Research Article: 2023 Vol: 27 Issue: 4

The Effect of Accounting Conservatism on Firm Characteristics: An Applied study on the Egyptian Listed Companies After Arabic Spring Revolution

Mohamed Abd EL-Fattah, Arab Academy for Science, Technology and Maritime Transport

Amr Yousef, Arab Academy for Science, Technology and Maritime Transport

Ahmed Sakr, Arab Academy for Science, Technology and Maritime Transport

Karim Elfaham, Arab Academy for Science, Technology and Maritime Transport

Citation Information: EL-Fattah, M.A., Yousef, A., Sakr, A., & Elfaham, K. (2023). The effect of accounting conservatism on firm characteristics: an applied study on the egyptian listed companies after arabic spring revolution. Academy of Accounting and Financial Studies Journal, 27(3), 1-21.

Abstract

The empirical study of accounting conservatism has received significant interest from scholars in recent years because it improves investors' ability to assess business performance by reducing the information asymmetry that exists between investors and management. In order to do this, this paper used two control variables, firm size and age, to examine the impact of accounting conservatism measured by (Asymmetric Timeliness (AT), Asymmetric Accrual to Cash-flow (AACF), and the Market-to-Book on firm characteristics (Investment Efficiency, Liquidity, Firm Leverage and Firm Growth). Accordingly, secondary data (panel data) are collected from Egyptian companies listed on Egyptian stock exchange according to EGX 100 after excluding the financial institutions and banks during the period from 2012 to 2021. The Generalized Least Squares (GLS) method for regression analysis was conducted for the panel data used for this research. In addition, the fixed versus random effect models had been fitted, and the Hausman test had been used to select the suitable method of fixed versus random models. Finally, the results fully support the relationship between accounting conservatism and firm leverage, while the relationship between accounting conservatism and liquidity is partially supported. On the other hand, the results did not support the relationship between accounting conservatism and investment efficiency as well as the relationship between accounting conservatism and firm growth.

Keywords

Accounting Conservatism, Firm, Characteristics, Firm Size, Firm Age, Leverage, Investment Efficiency, Liquidity, Firm Growth.

Introduction

Over the last period researchers had put a great attention on the empirical research of accounting conservatism topic (Wang et al., 2008). Accounting conservatism helps investors to evaluate the firm performance in a better way as it reduces the asymmetry of information that occurs between investors and managers (García Lara et al., 2014). Accounting conservatism can be defined as the tendency of accountants to require a higher degree of verification to recognize the profits and lose in the financial statements (Kim & Zhang, 2016).

The current paper focuses on investment efficiency because the decision of investment helps company to compete in the market and several institutions, as World Bank and central banks all over the world is focusing of investment in their countries. This is because the level of investment affects the economy of the country and helps it in development, rebuilding, and further expansion because investment opens many doors to other countries for exchange. Investments have two types: fixed investments and monetary investments, both of which aid in the business growth. Fixed investment is a form of investment in which investors buy machinery, plants, or buildings. While monetary is a form of investment that involves purchasing stocks and bonds. A bad investment decision can lead to a company's demise and bankrupt. As a result, companies should concentrate on factors that increase their investment, and one of these factors is accounting conservatism, which increases future profitability and investment efficiency (Virlics, 2013).

Firm characteristics can be defined as the managerial and demographic variables of the firm that represents the internal environment of the firm. Firm characteristics can include many dimensions such as firm size, firm leverage, liquidity, investment and sales growth (Egbunike & Okerekeoti, 2018). Moreover, Kogan & Tian (2012) saw that firm characteristics consists of 27 dimensions that can be collected under seven groups: firm size, investment, financial distress (firm leverage), prior returns, earnings, external financing and other dimensions (as liquidity and turnover). The current paper focuses only on four dimensions of firm characteristics (Investment efficiency, Liquidity, Firm leverage and Firm growth), as it was proved that accounting conservatism is linked only to these four dimensions.

Therefore, this paper aims to investigate the effect of accounting conservatism (Asymmetric Timeliness Measure (AT), Asymmetric Accrual to Cash-flow Measure (AACF) and the Market-to-Book (or Book-to-Market) ratio) on firm characteristics (Firm leverage, Investment efficiency, Liquidity and firm growth) through two control variables; firm size and age in Egyptian companies listed on Egyptian stock exchange during the period from 2012 to 2021.

Problem Statement

After the rapid revolution that happened lately on many countries, the economic growth of these countries has affected and faced many crises and challenges. Egypt is trying to make its economy recover and recall its development. Any economic development and recovery requires a stock market recovers its value in addition the value of development of organizations, which will affect the stock market development (Helpman, 2009). Accordingly, the firm characteristics should be developed, in order to achieve this development, there is some factors affect these characteristics such as accounting conservation with its dimensions (Asymmetric Timeliness Measure (AT), Asymmetric Accrual to Cash-flow Measure (AACF), and the Market-to-Book (or Book-to-Market) ratio). Accordingly, accounting conservatism is linked to four firm characteristics (Investment efficiency, Liquidity, Firm leverage, and Firm Growth).

Firstly, it is important to refer that accounting conservatism chooses a procedure that does not negatively reflect the company's profits and assets at a higher value than their actual value, in which increases the firm's investment opportunity. Secondly, it is expected that accounting conservatism has a positive relationship with liquidity, as accounting conservatism increases the likelihood of future profitability as well as increases firm cash flow. Finally, because conservatism reduces information asymmetry, which increases firm leverage, the relationship between accounting conservatism and firm leverage is assumed to be negative.

Literature Review

In this section, the literature that researched the research variables and the study of the relationship between them will be presented.

The Effect of Accounting Conservatism on Investment Efficiency

Balakrishnan et al. (2016) clarified the relationship between accounting conservatism and firm investment levels during the 2007-2008 financial crisis. Using quarterly data from non-financial firms obtained from Compustat. Choosing two time periods: before and after the financial crisis (1 July 2006-30 June 2007), (1 July 2007-30 June 2008). The sample size was 23,120 quarter data points. Results explained that accounting conservatism had a positive influence in reducing under-investment during financial crisis. The study of (Balakrishnan et al., 2016) focused only on two years, which represents a very short period of time that could not help in reaching generalized results.

Lara et al. (2016) also investigated the impact of accounting conservatism on firm investment efficiency. During 1990-2007, the study used COMPUSTAT to collect data on extract accounting, while CRSP was used to collect data on extract stock market for US companies. The firm-year sample size was 41,851. According to the findings, accounting conservatism had a negative impact on both under and overinvestment. Accounting conservatism, on the other hand, had a positive impact on future firm profitability. This study tested its relationship among US companies by that it focused only on developed countries and neglecting the developing countries and the difference that could happen in results between the developed and developing ones.

Furthermore, Yasir (2018) determined how accounting conservatism affects firm investment efficiency in Pakistan. To prove study hypothesis, study collected data from Karachi Stock Exchange (KSE100) index, for annual reports from 1998 to 2015. Finally, the study observed that accounting conservatism had significant influence on investment, but this significant effect had negative impact on investment efficiency. In this study, the focus on accounting conservatism was as a whole, without examining different measurement of this conservatism.

Ali Al-fadhel (2020) introduced in Jordan the relationship between accounting conservatism and firm investment decision efficiency. From 2013 to 2017, a sample of 87 Jordanian companies was used. The findings demonstrated that accounting conservatism had a significant positive effect. This study also focuses on accounting conservatism as a whole, without examining different measurement of the conservatism. Moreover, it focuses on Jordan as developing country only without testing any developed country.

Daryatno & Santioso (2020) reviewed how accounting conservatism, leverage, growth opportunities, and cash and liquidity affect corporate investment efficiency. Secondary data was gathered on manufacturing companies listed on the Indonesia Stock Exchange (IDX). The final sample included 168 companies from which data from 2014, 2015, and 2016 were collected. The results showed that none of the independent variables had a significant impact on corporate investment efficiency. The period of collected data is not big enough, accordingly, the study did not succeed in proving any link between the research variables.

From literature review, it was observed that accounting conservatism had a direct effect on investment efficiency of firms. Finally, based on the previous studies that were illustrated, it could be assumed that:

H1: There is a significant relationship between Accounting Conservatism and Investment Efficiency

The Effect of Accounting Conservatism on Liquidity

Maria (2017) investigated the link between accounting conservatism and banking liquidity in Russia. The study's data was collected from the top 100 banks in Russia, with a final sample size of 74 banks from 2011 to 2015. It was discovered that the relationship between accounting conservatism and instant liquidity ratio was negative and significant, as was the relationship between accounting conservatism and long-term liquidity ratio. The relationship between accounting conservatism and current liquidity ratio, on the other hand, was insignificant. Instant liquidity is measured by the ratio of a bank's highly liquid assets to its demand account liabilities. This study had targeted the banks (financial institution) as its case study and neglected the non-financial institutions that could have different results with the studied variables.

Harakeh (2017) represented the link between accounting conservatism and firm liquidity in UK and France. Data for listed firms in France and the United Kingdom was gathered from World Scope and DataStream between 2001 and 2008. The total number of firms was 1149, with a total sample size of 3,075 firm-year observations. The findings demonstrated a negative and statistically significant relationship between accounting conservatism and liquidity. The study of (Harakeh, 2017) had focused on two developed countries, while developing countries are not included, in which make the reached results are not able to be generalized.

Moreover, Kerr (2018) aimed to examine the linkage between accounting conservatism and liquidity. The study's sample was drawn from publicly traded companies in the United States between 1999 and 2012. The study used a total sample size of 617 firms from the National Association of Securities Dealers (NASDAQ) and the New York Stock Exchange. After analyzing the data, the author concluded that there is a negative relationship between firm liquidity and accounting conservatism in US firms. In this study, the focus was also on developed countries and not the developing ones, the comparison between developed and developing countries was also neglected.

Sejati & Jones (2019) also tested the association between accounting conservatism and liquidity in Malaysia. Data was gathered from the Compustat Global Industrial/Commercial (IC) file for Malaysian listed firms from 1988 to 2006. To test the study hypothesis, a sample size of 5,650 observations was chosen. The findings revealed an inverse relationship between accounting conservatism and firm liquidity in Malaysia. The study of (Sejati & Jones, 2019) had focused on an old period of time, otherwise, testing different periods of time including recent period helps in reaching comparative results and identify the current situation.

In addition to, Lobo et al. (2020) explained the relationship between accounting conservatism and liquidity. The sample used in the study to analyze the study hypothesis was obtained from the Compustat, CRSP, and SDC databases for listed firms from 1997 to 2014, yielding 59,365 valid observations out of 128,852 firm-years. In the study, descriptive statistics are used to analyze the sample. The findings revealed a negative and significant relationship between accounting conservatism and liquidity. This research also focuses on accounting conservatism as a whole, without examining different measurements of the conservatism.

According to previous research, the relationship between accounting conservatism and firm liquidity is negative and significant, implying that both move in the same direction, whether increasing or decreasing. Based on the preceding studies, it can assume that

H2: There is a significant relationship between Accounting Conservatism and Liquidity

The Effect of Accounting Conservatism on Firm Leverage

In Indonesia, Sugiarto & Fachrurrozie (2018) investigated the relationship between accounting conservatism and firm leverage. The study's samples were collected from listed firms on the Indonesia Stock Exchange (IDX), with approximately 143 companies included in the study between 2013 and 2016. In the study, IBM SPSS 23 was used to analyze the data. The study's findings clarified the association between firm leverage and accounting conservatism was positive and significant in Indonesia. This study has two gaps; first one is focusing only on a developing country, second one is the short period of time used in collecting data.

Moreover, Alves (2019) explained the firm leverage relation with accounting conservatism. Valid 390 observations were collected from a total of 749 firm-years for 26 companies using data from Annual Reports and Corporate Governance Reports of non-financial firms from 2002 to 2016. The findings revealed a positive and significant relationship between accounting conservatism and firm leverage. The study of (Alves, 2019) focused on testing accounting conservatism as a whole, without differentiate it into many measurements.

Jain et al. (2019) also looked into the relationship between accounting conservatism and firm leverage. The study sample targeted 4004 firms at Compustat between January 1995 and December 2017. The study excluded year 2008 from its analysis, and after data was examined, only 3993 firms were included for a total of 42,530 firm-year observations. The findings established a positive and significant relationship between conservatism and firm leverage. Accounting conservatism is calculated in this study through only one measurement, which neglects the different effects that may occur from the different measurements of accounting conservatism on firm leverage.

Lobo et al. (2020) provided an explanation of the relationship between accounting conservatism and firm leverage. The sample used in the study to analyze the study hypothesis was obtained from the Compustat, CRSP, and SDC databases for listed firms from 1997 to 2014, yielding 59,365 valid observations out of 128,852 firm-years. In the study, descriptive statistics are used to analyze the sample. The findings revealed a negative and statistically significant relationship between accounting conservatism and firm leverage. Also this study is well established, a small gap is identified. The study collected its data till year 2014 without considering the recent years.

Teymouri & Sadeghi (2020) established a link between accounting conservatism and firm leverage. Data was gathered from financial reports of companies listed on the Tehran Stock Exchange from 2011 to 2016. The study's final sample size was 137 businesses. The findings supported the positive and significant relationship between accounting conservatism and firm leverage after data analysis. Iran is chosen as a developing country to be the case study in the study of (Teymouri & Sadeghi, 2020), which represents a gap in this study as the developed countries were not studied.

Based on the previous studies that were illustrated, the third hypothesis of the study is assumed.

H3: There is a significant relationship between Accounting Conservatism and Firm Leverage

The Effect of Accounting Conservatism on Firm Growth

Ahmed & Duellman (2011) looked at the impact accounting conservatism has on managers' investment decisions, investment size, and firm growth via boosting profitability. A sample of US businesses reported in Compustat with data accessible from 1989 to 2001 was used to evaluate the forecasts. It was found that businesses with more careful accounting turned out to be much more lucrative than those with less cautious accounting up to three years in the future. Furthermore, the results indicated that firms with more meticulous accounting procedures charge for special items at noticeably lower rates and with distinctly smaller magnitudes than firms with less meticulous accounting procedures. Although this study had examined many variables to identify their relationships with each other, the study focuses only on a developed country.

Francis et al. (2015) examined how female CEOs affect various business decisions, including funding, investing, and mergers and acquisitions, which affect the firm growth in the context of accounting conservatism. To test the gender effect on financial reporting conservatism, the primary design was used to compare the levels of conservatism for male and female CFO turnover firms between the pre-and post-transition periods. This technique was used besides testing the other research variables such as; firm size, firm leverage, firm growth, and research and development. As there are three different measures of conservatism that were used, which are (a market-value-based measure (CON-MTB), CON-ACCRUAL, and CON-SKEWNESS). The results found that there was a negative link between CON ACCRUAL and CON SKEWNESS since sales growth, which measures firm growth affects accruals like inventories and receivables, which in turn affect CON ACCRUAL and CON SKEWNESS. The data showed a positive correlation between sales growth and CON-MTB because rapid sales growth usually raises market expectations for future cash flows. Although the study of (Francis et al., 2015) had identified three measurements of accounting conservatism which represents a great implication of this study, the study focuses only on female CEOs by that the concluded results cannot be generalized.

Kang et al. (2017) aimed to look into whether a firm's maturity has an impact on how accounting conservatism is employed to obtain external loans in order to expand the firm or achieve firm growth. During a survey period that lasted from 1987 to 2008, the data was gathered. In order to calculate all of the variables included in the models, every company that is represented in COMPUSTAT North America was taken into account. The data supporting a favorable correlation between conservatism and debt maturity was discovered. Additionally, evidence of a relationship between conservative accounting and future growth across all debt classes was found; however, this relationship is more pronounced for long-term debt than for short-term debt, the latter of which is less agency risk susceptible. This research examined the relationship between accounting conservatism and firm growth through the role of firm maturity without measuring the direct relationship between the independent and dependent variable.

Ma et al. (2020) investigated whether a firm's decision to adopt accounting conservatism is significantly influenced by religion, a substantial informal institutional component. The sample period runs from 1971 until 2010. The firm-level data from Compustat and the Center for Research in Security Prices (CRSP) database. County-level information on religiosity is available from the American Religion Data Archive (ARDA). The valid sample has 124,984 firm years for Model (3) and 129,859 firm years for Model (4). Furthermore, the findings indicated that the baseline results are influenced by the local religious culture rather than a CEO's personal religious convictions. Last but not least, it was discovered that religion raises firms' ex ante and ex-post unconditional and conditional conservatism. This research focused on an old period of time, however, testing the recent period helps in reaching comparative results and identify the current situation

From the previous studies, the relationship between accounting conservatism and firm growth was positive and significant, which meant that both move in the same direction whether to increase or decrease. Based on the previous studies that were illustrated, the fourth hypothesis is assumed

H4: There is a significant relationship between Accounting Conservatism and Firm Growth Control Variables

This section introduces the control variables of the research, which are; firm age, and firm size.

Firm Age

In different countries and over different time periods, several studies looked at age as a control variable in the relationship between accounting conservatism and firm characteristics. The role of age as a control variable in the relationship between accounting conservatism and firm characteristics would be explained in this section.

Geimechi & Khodabakhshi (2015) reviewed the relationship between firm size, discretionary accruals, financial leverage, and accounting conservatism, with controlling variables; firm age and industry variables. Data on 121 companies was gathered from the Financial Statements of Tehran Stock Exchange-listed companies from 2009 to 2013. The findings demonstrated that firm age and discretionary accruals had insignificant effects on accounting conservatism, whereas financial leverage had a significant effect on it. In this study, accounting conservatism is measured by only one measurement, on the other hand, using different measurements of this conservatism will help in concluded different effects on the dependent variables.

Moreover, Lara et al. (2016) associated the influence of accounting conservatism on firm investment efficiency. The researchers had included various control variables, which were; firm size, firm age, information asymmetry, leverage, market-to-book ratio, depreciation method, the volatility of cash flow from operations, volatility of sales, volatility of investment, Z-Score, proportion of tangible assets, industry capital structure, operating cash flow to sales and dividend payout ratio and length of the operating cycle. Accounting data was extracted from Compustate, while stock market data was obtained from CRSP. The final sample included 41,626 firms from 1990 to 2007. The findings of the study revealed a strong relationship between conservatism and investment reduction, even for opaque investments (for example, research and development).

Firm Size

In different countries and over different time periods, several studies looked at firm size as a control variable in the relationship between accounting conservatism and firm characteristics. The role of firm size as a control variable in the relationship between accounting conservatism and firm characteristics would be explained in this section.

Thomas & Aryusmar (2020) represented the relationship between firm size and accounting conservatism in Indonesia. In order to test the study hypothesis, 24 companies from the Indonesia Stock Exchange (IDX) were chosen from a total of 45 public companies LQ45 in the period 2013-2018. In the sample analysis, Eviews10 is used. The results revealed a significant and direct relationship between firm size and accounting conservatism. This research examined only the relationship between accounting conservatism and firm size without considering any other variables that could play a significant role in this relationship.

Furthermore, Chipeta et al. (2021) claimed that accounting conservatism improved firm performance and total assets (Size). It used a large sample of African firms from 1982 to 2015 to study the relationship between accounting conservatism and firm performance. The final sample includes 1308 firms from thirteen African countries (12,908 firm-year observations) (Botswana, Egypt, Ghana, Ivory Coast, Kenya, Morocco, Namibia, Nigeria, South Africa, Tanzania, Tunisia, Zambia and Zimbabwe). Accounting conservatism had a positive impact on total assets, which measured the firm's size, according to the findings. The focus of this research was only on African countries, which consider a gap that did not include other countries that could have different results and effects.

Cui et al. (2021) investigated how accounting conservatism affected firm performance and firm size during the COVID-19 pandemic. The final sample includes 1,909 individual Chinese firms listed on the Shanghai and Shenzhen Stock Exchanges. According to the findings, firms that use more conditionally conservative reporting experience lower declines in stock return performance during the Covid-19 outbreak. Furthermore, the findings revealed that accounting conservatism has a positive impact on firm performance and firm size. Two main gaps are identified in this study, first gap is the study period as it only includes the period of corona virus, while the second gap is targeting a developed county (China).

Methodology

The measurements of research variables are adopted from previous literature. Looking for accounting conservatism, it is noticed that accounting conservatism measures are asymmetric timeliness measure, asymmetric accrual to cash-flow measure, the market-to-book (or book-to-market) ratio, the hidden reserves measure and the negative accruals measure (Wang et al., 2008; Wang et al., 2009; Lu, 2012; Khalifa & Ben Othman, 2015). Moreover, BELL?KL? & DA?TAN (2021) refers to accounting conservatism measures to be asymmetric timeliness measure, asymmetric accrual to cash-flow measure, the market-to-book ratio, and the negative accruals measure. The current study adopted three measures of accounting conservatism, which are; asymmetric timeliness measure, asymmetric accrual to cash-flow measure, and the market-to-book (or book-to-market) ratio, as the hidden reserves measure and the negative accruals measure are not suitable to be measured within the companies. Finally, according to the equations that use to calculate accounting conservatism measures they are presented in Tables 1-3, which are adopted from (Wang et al., 2008).

In addition to that, firm characteristics are measured by four variables, which are; Investment Efficiency, Liquidity, Firm leverage, and Firm Growth, where the equations of each variable are adopted from (Egbunike & Okerekeoti, 2018). Finally, the equations of control variables are adopted from (Chi et al., 2009; Kravet, 2014; Shahzad et al., 2019). The following Table 1 shows the equations used in measuring the research variables.

| Table 1 Research Variables Operationalization |

|||

|---|---|---|---|

| Research Variable | Definition | Measurement | References |

| Accounting Conservatism – Independent Variable | Wang et al., 2008 | ||

| Basu’s Asymmetric Timeliness Measure (AT) | The promptness with which accounting recognizes economic events is well known. The level of conservatism in a firm increases with increasing asymmetric timeliness. |  Where: EPSit: Earnings per share for firm i year t Pit: Opening stock market price for firm i year t |

|

| Asymmetric Accrual to Cash-flow Measure (AACF) | The non-stock market equivalent of the AT measure is the AACF measure. | ACCt: Accruals measured as Δ inventory + Δ Debtors + Δ other current assets – Δ Creditors – Δ Other current liabilities – Depreciation. | |

| The Market-to-Book (or Book-to-Market) ratio | The book-to-market ratio is a ratio that assesses a company's value by contrasting its book value and market value. | BTMt,i: Book-to-Market (BTM) ratio of firm i, at the end of year t. | |

| Firm Characteristics – Dependent Variable | |||

| Liquidity | the proportion of the company's ability to use the money it has on hand to its advantage and make a profit. | Net credit facilities / Total assets. | Egbunike & Okerekeoti, 2018 |

| Investment Efficiency | the suitability of investing the company's available cash, which it obtained from deposits, in order to meet the requirements of credited loans and advances | Net credit facilities / Total deposits | |

| Firm Growth | measured as a high rate of increase in gross profit, increasing sales, solid cash flow, and higher rate of customer retention | Dividing the difference between the current period value and the previous period value with the previous period value | |

| Firm leverage | calculated as the ratio of debt to equity at the time (t) | Measured as percentage of total debt to total assets Total debts /total equity |

|

| Firm Age and Firm Size – Control Variables | |||

| Firm Age | Is the age of the firm since being listed (measured in years) | It represents an indicator variable, which equals to 1 if the number of years since data first became available for the firm is in the bottom quartile, but otherwise equals 0. | Chi et al. (2009) Kravet (2014) |

| Firm Size | Measured as the natural logarithm of total assets in the period (t) | The total assets owned by the firm, measured as the natural logarithm of total assets | |

A quantitative data was used by collecting a secondary data (panel data) collected from Egyptian companies listed on Egyptian stock exchange according to EGX 100 after excluding the financial institutions and banks during the period from 2012 to 2021. After collecting data for the 100 most profitable companies in the Egyptian Stock Exchange, the size of the research sample was 71 valid companies.

The collected data targeted the period from 2012 to 2021. The researcher targets year 2012 to be the first year of investigation of the current study, as it is the year that follows the Arab spring and the Egyptian revolution. Accordingly, it is a suitable period to be studied because the situation started to be a little stable than the year before. Moreover, 2012 is selected to investigate the effect of revolution on the Egyptian companies. Looking for year 2021, it is selected because it represents the last year that financial information are available about the selected companies.

After collecting the data from the Egyptian stock market about the most active 100 companies in Egypt, it is noticed that those companies belongs to 16 sectors (Banks, Basic Resources, Building Materials, Contracting and Construction Engineering, Education Services, Food, Beverages and Tobacco, Health Care and Pharmaceuticals, Industrial Goods , Services and Automobiles, IT , Media and Communication Services, Non-bank financial services, Paper and Packaging, Real Estate, Shipping and Transportation Services, Textile and Durables, Trade and Distributors and Travel and Leisure).

As this research aims to study only the non-financial sector, the organizations relates to the financial sector (banks and non-bank financial services) are excluded from the study sample, with total number 20 organization. In addition to that another 9 companies that do not belong to the financial sector are excluded because they are not considered as the most active companies during the 10 years period. Therefore, the final number that included in the analysis is 71 companies Table 2.

| Table 2 Companies Details |

||

|---|---|---|

| Sector Number | Sector Name | Number of Companies |

| 1. | Banks | 7 |

| 2. | Basic Resources | 2 |

| 3. | Building Materials | 10 |

| 4. | Contracting and Construction Engineering | 3 |

| 5. | Education Services | 3 |

| 6. | Food, Beverages and Tobacco | 2 |

| 7. | Health Care and Pharmaceuticals | 4 |

| 8. | Industrial Goods , Services and Automobiles | 5 |

| 9. | IT , Media and Communication Services | 5 |

| 10. | Non-bank financial services | 13 |

| 11. | Paper and Packaging | 1 |

| 12. | Real Estate | 28 |

| 13. | Shipping and Transportation Services | 4 |

| 14. | Textile and Durables | 4 |

| 15. | Trade and Distributors | 4 |

| 16. | Travel and Leisure | 5 |

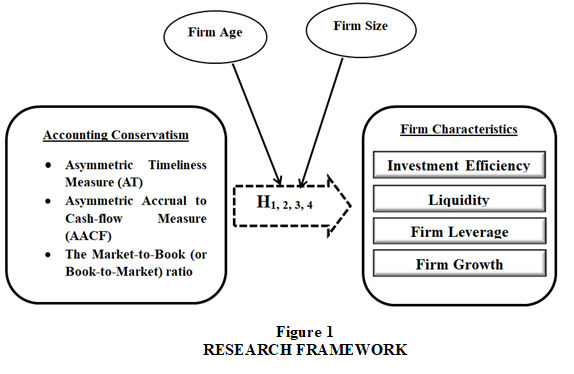

Figure 1 presents the research framework, where the independent variable is accounting conservatism and the dependent variable is firm characteristics. Accounting conservatism includes Asymmetric Timeliness Measure (AT), Asymmetric Accrual to Cash-flow Measure (AACF) and the Market-to-Book (or Book-to-Market) ratio. Firm characteristics include Liquidity, Investment efficiency, Firm leverage, and Firm Growth.

Independent Variable: Accounting Conservatism (Asymmetric Timeliness Measure (AT), Asymmetric Accrual to Cash-flow Measure (AACF) and the Market-to-Book (or Book-to-Market) ratio).

Dependent Variable: Firm Characteristics (Liquidity, Investment efficiency, Firm leverage, and Firm Growth).

Control Variable: Firm Age, and Firm size.

According to the research framework, the research hypotheses could be stated as follows:

H1: There is a significant relationship between Accounting Conservatism and Investment Efficiency.

H2: There is a significant relationship between Accounting Conservatism and Liquidity.

H3: There is a significant relationship between Accounting Conservatism and Firm Leverage.

H4: There is a significant relationship between Accounting Conservatism and Firm Growth.

Results and Findings

The statistical packages of SPSS and EViews had been used to find out the research finding using varieties of the statistical techniques. The Generalized Least Squares (GLS) method for regression analysis was conducted for the panel data used for this research. In addition, the fixed versus random effect models had been fitted, and the Hausman test had been used to select the suitable method of fixed versus random models. The usage of GLS had been determined after testing the data understudy for the Ordinary Least Squares (OLS) method.

Normality Testing for the Research Variables

Normality is one assumption that must be verified for the OLS regression analysis. If the data is normally distributed, the researcher could use parametric analysis such as Ordinary Least Squares Regression. Therefore, it could be claimed that the normality of data should be verified as a preliminary step for inferential analysis, as it determines whether the researcher could use parametric or non-parametric tests to respond to the research hypotheses. Formal test of exact normality assumption could use Kolmogorov-Smirnov test and Shapiro-Wilk test. It assumes the data to be normal, if the P-value is greater than 0.05. As the data set under study did not show an exact normal distribution, the informal test of normality is used to examine the approximate normality of data distribution. The results show the informal testing of normality assumption for the research variables, the informal test is used to detect the approximate normality for the sample of 150 observations or more, where it could be shown that the skewness and kurtosis values are all not at the acceptance level of ±3, which means that the data under study are not normally distributed.

Testing the Research Hypotheses

This section shows the results for the effect of Accounting Conservatism measurements; Basu’s Asymmetric Timeliness, Asymmetric Accrual to Cash-flow, and Book-to-Market (BTM) ratio on Firm Characteristics, measured by Liquidity, Investment Efficiency, Firm leverage, and Firm Growth.

Testing the Effect on Investment Efficiency

Table 3 shows the GLS simple regression result for the effect of Accounting Conservatism on Investment Efficiency in the presence of the Control Variables; Firm Age, and Firm Size. It could be observed that:

| Table 3 Gls Pooled Regression For The Effect On Investment Efficiency With Control Variables |

||||

|---|---|---|---|---|

| Dependent Variable: Investment Efficiency | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | -3.558114 | 0.256936 | -13.84823 | 0.0000 |

| Basu’s Asymmetric Timeliness | 0.042184 | 0.069801 | 0.604346 | 0.5458 |

| Asymmetric Accrual to Cash-flow | -0.017959 | 0.080923 | -0.221930 | 0.8244 |

| Book-to-Market (BTM) ratio | -0.015691 | 0.013502 | -1.162127 | 0.2456 |

| Firm Age | 0.470037 | 0.088132 | 5.333307 | 0.0000 |

| Firm Size | 0.205510 | 0.025494 | 8.060975 | 0.0000 |

| R-squared | 0.128700 | |||

| Adjusted R-squared | 0.122512 | |||

| F-statistic | 20.79769 | |||

| Prob(F-statistic) | 0.000000 | |||

1. There is an insignificant effect of Basu’s Asymmetric Timeliness on Investment Efficiency, as the corresponding P-value is 0.9721 (P-value > 0.05).

2. There is an insignificant effect of Asymmetric Accrual to Cash-flow on Investment Efficiency, as the corresponding P-value is 0.4702 (P-value > 0.05).

3. There is an insignificant effect of Book-to-Market (BTM) ratio on Investment Efficiency, as the corresponding P-value is 0.4135 (P-value > 0.05).

4. There is a significant positive effect of Firm Age on Investment Efficiency as the corresponding P-value is 0.000 (P-value < 0.05) with a coefficient of 0.470037 (β > 0).

5. There is a significant positive effect of Firm Size on Investment Efficiency as the corresponding P-value is 0.000 (P-value < 0.05) with a coefficient of 0.205510 (β > 0).

Also, the R Square is 0.128700, which means that 12.87% of the variation of the Liquidity can be explained by this model. The regression equation is estimated as follows:

Investment Efficiency = -3.558114 + 0.042184*Basu’s Asymmetric Timeliness - 0.017959*Asymmetric Accrual to Cash-flow - 0.015691*Book-to-Market (BTM) ratio + 0.470037*Firm Age + 0.205510*Firm Size

Using the fixed versus random effect, as indicated in Table 4, the P-value for the Hausman test is 0.8678, showing that the random effect, rather than the fixed effect, is the significant impact in the data set.

| Table 4 Hausman Test For Fixed Versus Random Effect On Investment Efficiency With Control Variables |

|||||

|---|---|---|---|---|---|

| Variable | Fixed Effect | Random Effect | Hausman Test | ||

| Coefficient | Prob. | Coefficient | Prob. | ||

| C | -1.866158 | 0.0001 | -2.409973 | 0.0000 | 0.1289 |

| Basu’s Asymmetric Timeliness | -0.013995 | 0.7670 | -0.011422 | 0.8077 | |

| Asymmetric Accrual to Cash-flow | -0.023595 | 0.7405 | -0.026411 | 0.7026 | |

| Book-to-Market (BTM) ratio | -0.017632 | 0.0709 | -0.017306 | 0.0729 | |

| Firm Age | 0.502470 | 0.0194 | 0.484686 | 0.0025 | |

| Firm Size | 0.001007 | 0.9823 | 0.068509 | 0.0734 | |

The above result means that regarding Investment Efficiency, the first hypothesis H1 “There is a significant relationship between Accounting Conservatism and Investment Efficiency” is not supported.

Testing the Effect on Liquidity

Table 5 shows the GLS simple regression result for the effect of Accounting Conservatism on Liquidity in the presence of the Control Variables; Firm Age, and Firm Size. It could be observed that:

| Table 5 Gls Pooled Regression For The Effect On Liquidity With Control Variables |

||||

|---|---|---|---|---|

| Dependent Variable: Liquidity | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | 1.288785 | 0.156509 | 8.234556 | 0.0000 |

| Basu’s Asymmetric Timeliness | 0.029628 | 0.042518 | 0.696827 | 0.4861 |

| Asymmetric Accrual to Cash-flow | 0.249597 | 0.049293 | 5.063552 | 0.0000 |

| Book-to-Market (BTM) ratio | 0.002768 | 0.008225 | 0.336582 | 0.7365 |

| Firm Age | -0.115155 | 0.053685 | -2.145030 | 0.0323 |

| Firm Size | -0.122659 | 0.015530 | -7.898427 | 0.0000 |

| R-squared | 0.120037 | |||

| Adjusted R-squared | 0.113787 | |||

| F-statistic | 19.20674 | |||

| Prob(F-statistic) | 0.000000 | |||

1. There is an insignificant effect of Basu’s Asymmetric Timeliness on Liquidity, as the corresponding P-value is 0.4861 (P-value > 0.05).

2. There is a significant positive effect of Asymmetric Accrual to Cash-flow on Liquidity, as the corresponding P-value is 0.000 (P-value < 0.05) with a coefficient of 0.249597 (β > 0).

3. There is an insignificant effect of Book-to-Market (BTM) ratio on Liquidity, as the corresponding P-value is 0.7365 (P-value > 0.05).

4. There is a significant negative effect of Firm Age on Liquidity as the corresponding P-value is 0.0323 (P-value < 0.05) with a coefficient of -0.115155 (β < 0).

5. There is a significant positive effect of Firm Size on Liquidity as the corresponding P-value is 0.000 (P-value < 0.05) with a coefficient of -0.122659 (β < 0).

Also, the R Square is 0.120037, which means that 12% of the variation of the Liquidity can be explained by this model. The regression equation is estimated as follows:

Liquidity = 1.288785 + 0.029628*Basu’s Asymmetric Timeliness + 0.249597*Asymmetric Accrual to Cash-flow + 0.002768*Book-to-Market (BTM) ratio - 0.115155*Firm Age - 0.122659*Firm Size

Using the fixed vs random effect, as indicated in Table 6, the P-value for the Hausman test is 0.0288, showing that the fixed effect, rather than the random effect, is the significant effect in the data set. The relationship between the variables may change over time, according to the data.

The above result means that regarding Liquidity, the second hypothesis H2 “There is a significant relationship between Accounting Conservatism and Liquidity” is partially supported.

| Table 6 Hausman Test For Fixed Versus Random Effect On Liquidity With Control Variables |

|||||

|---|---|---|---|---|---|

| Variable | Fixed Effect | Random Effect | Hausman Test | ||

| Coefficient | Prob. | Coefficient | Prob. | ||

| C | 0.477386 | 0.0165 | 0.626187 | 0.0009 | 0.0288 |

| Basu’s Asymmetric Timeliness | -0.012591 | 0.5264 | -0.011359 | 0.5666 | |

| Asymmetric Accrual to Cash-flow | 0.009759 | 0.7447 | 0.021187 | 0.4743 | |

| Book-to-Market (BTM) ratio | 0.001867 | 0.6490 | 0.001756 | 0.6672 | |

| Firm Age | -0.070706 | 0.4333 | -0.078597 | 0.3178 | |

| Firm Size | -0.011754 | 0.5382 | -0.029112 | 0.1008 | |

Testing the Effect on Firm leverage

Table 7 shows the GLS simple regression result for the effect of Accounting Conservatism on Firm Leverage in the presence of the Control Variables; Firm Age, and Firm Size. It could be observed that:

| Table 7 Gls Pooled Regression For The Effect On Firm Leverage With Control Variables |

||||

|---|---|---|---|---|

| Dependent Variable: Firm Leverage | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | -0.547189 | 0.212026 | -2.580767 | 0.0101 |

| Basu’s Asymmetric Timeliness | 0.307307 | 0.057600 | 5.335144 | 0.0000 |

| Asymmetric Accrual to Cash-flow | -0.157585 | 0.066778 | -2.359840 | 0.0186 |

| Book-to-Market (BTM) ratio | 0.039431 | 0.011142 | 3.538942 | 0.0004 |

| Firm Age | -0.067860 | 0.072727 | -0.933068 | 0.3511 |

| Firm Size | 0.112773 | 0.021038 | 5.360423 | 0.0000 |

| R-squared | 0.121756 | |||

| Adjusted R-squared | 0.115518 | |||

| F-statistic | 19.51986 | |||

| Prob(F-statistic) | 0.000000 | |||

1. There is a significant positive effect of Basu’s Asymmetric Timeliness on Firm Leverage as the corresponding P-value is 0.000 (P-value < 0.05) with a coefficient of 0.307307 (β > 0).

2. There is a significant negative effect of Asymmetric Accrual to Cash-flow on Firm Leverage as the corresponding P-value is 0.0186 (P-value < 0.05) with a coefficient of -0.157585 (β < 0).

3. There is a significant positive effect of Book-to-Market (BTM) ratio on Firm Leverage as the corresponding P-value is 0.0004 (P-value < 0.05) with a coefficient of 0.039431 (β > 0).

4. There is an insignificant effect of Firm Age on Firm Leverage as the corresponding P-value is 0.3511 (P-value > 0.05).

5. There is a significant positive effect of Firm Size on Firm Leverage as the corresponding P-value is 0.000 (P-value < 0.05) with a coefficient of 0.112773 (β > 0).

Also, the R Square is 0.121756, which means that 12.18% of the variation of the Firm Leverage can be explained by this model. The regression equation is estimated as follows:

Firm Leverage = -0.547189 + 0.307307*Basu’s Asymmetric Timeliness – 0.157585*Asymmetric Accrual to Cash-flow + 0.039431*Book-to-Market (BTM) ratio - 0.067860*Firm Age + 0.112773*Firm Size

Using the fixed versus random effect, as indicated in Table 8, the P-value for the Hausman test is 0.4454, showing that the random effect, rather than the fixed effect, is the significant impact in the data set.

| Table 8 Hausman Test For Fixed Versus Random Effect On Firm Leverage With Control Variables |

|||||

|---|---|---|---|---|---|

| Variable | Fixed Effect | Random Effect | Hausman Test | ||

| Coefficient | Prob. | Coefficient | Prob. | ||

| C | -0.538473 | 0.2334 | -0.471228 | 0.1676 | 0.4454 |

| Basu’s Asymmetric Timeliness | 0.288721 | 0.0000 | 0.289223 | 0.0000 | |

| Asymmetric Accrual to Cash-flow | -0.143711 | 0.0353 | -0.143051 | 0.0281 | |

| Book-to-Market (BTM) ratio | 0.023247 | 0.0129 | 0.024755 | 0.0070 | |

| Firm Age | 0.246872 | 0.2291 | 0.055873 | 0.6785 | |

| Firm Size | 0.060596 | 0.1632 | 0.083720 | 0.0129 | |

The above result means that regarding Firm leverage, the third hypothesis H3 “There is a significant relationship between Accounting Conservatism and Firm leverage” is fully supported.

Testing the Effect on Firm Growth

Table 9 shows the GLS simple regression result for the effect of Accounting Conservatism on Firm Growth in the presence of the Control Variables; Firm Age, and Firm Size. It could be observed that:

| Table 9 Gls Pooled Regression For The Effect On Firm Growth With Control Variables |

||||

|---|---|---|---|---|

| Dependent Variable: Firm Growth | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | 0.106340 | 0.241676 | 0.440009 | 0.6601 |

| Basu’s Asymmetric Timeliness | 0.119750 | 0.065656 | 1.823919 | 0.0686 |

| Asymmetric Accrual to Cash-flow | -0.078561 | 0.076116 | -1.032124 | 0.3024 |

| Book-to-Market (BTM) ratio | -0.008468 | 0.012700 | -0.666809 | 0.5051 |

| Firm Age | 0.058256 | 0.082898 | 0.702748 | 0.4824 |

| Firm Size | 0.080847 | 0.023980 | 3.371427 | 0.0008 |

| R-squared | 0.054135 | |||

| Adjusted R-squared | 0.044424 | |||

| F-statistic | 5.574554 | |||

| Prob(F-statistic) | 0.000052 | |||

1. There is an insignificant effect of Basu’s Asymmetric Timeliness on Firm Growth as the corresponding P-value is 0.0686 (P-value > 0.05).

2. There is an insignificant effect of Asymmetric Accrual to Cash-flow on Firm Growth, as the corresponding P-value is 0.3024 (P-value > 0.05).

3. There is an insignificant effect of Book-to-Market (BTM) ratio on Firm Growth as the corresponding P-value is 0.5051 (P-value > 0.05).

4. There is an insignificant effect of Firm Age on Firm Growth as the corresponding P-value is 0.4824 (P-value > 0.05).

5. There is a significant negative effect of Firm Size on Firm Growth as the corresponding P-value is 0.0008 (P-value < 0.05) with a coefficient of 0.0880847 (β < 0).

Also, the R Square is 0.025269, which means that 2.53% of the variation of the Firm Growth can be explained by this model. The regression equation is estimated as follows:

Firm Growth = 0.106340 + 0.119750*Basu’s Asymmetric Timeliness - 0.078561*Asymmetric Accrual to Cash-flow - 0.008468*Book-to-Market (BTM) ratio + 0.058256*Firm Age + 0.080847*Firm Size

Using the fixed versus random effect as shown in Table 10, it could be observed that the P-value for the Hausman test is 0.0683, implying that the random effect is the significant effect in the data understudy rather than the fixed effect.

| Table 10 Hausman Test For Fixed Versus Random Effect On Firm Growth With Control Variables |

|||||

|---|---|---|---|---|---|

| Variable | Fixed Effect | Random Effect | Hausman Test | ||

| Coefficient | Prob. | Coefficient | Prob. | ||

| C | 0.152096 | 0.8130 | 0.021539 | 0.9524 | 0.0683 |

| Basu’s Asymmetric Timeliness | 0.102629 | 0.1110 | 0.110673 | 0.0768 | |

| Asymmetric Accrual to Cash-flow | -0.123586 | 0.2030 | -0.111235 | 0.1949 | |

| Book-to-Market (BTM) ratio | 0.001077 | 0.9354 | -0.001075 | 0.9322 | |

| Firm Age | -0.713271 | 0.0148 | -0.057092 | 0.6677 | |

| Firm Size | 0.205136 | 0.0010 | 0.112114 | 0.0019 | |

The above result means that regarding Firm Growth, the fourth hypothesis H4 “There is a significant relationship between Accounting Conservatism and Firm Growth” is not supported.

By measuring the variables identified from the literature review and conducting GLS simple regression analysis using SPSS and Amos, the empirical study to test the research hypotheses was provided. It is important to refer that the analyzed data includes the period from 2012 till 2021, which means that the results of the analysis may be affected by the main events happened through the prior period (Arab spring and the Egyptian revolution). Table 11 provides an overview of the analysis results.

| Table 11 Summary Of Research Hypotheses |

||

|---|---|---|

| Hypothesis | Description | Results |

| H1 | There is a significant positive effect of Accounting Conservatism on Investment Efficiency | Not Supported |

| H2 | There is a significant positive effect of Accounting Conservatism on Liquidity | Partially Supported |

| H3 | There is a significant positive effect of Accounting Conservatism on Firm leverage | Fully Supported |

| H4 | There is a significant positive effect of Accounting Conservatism on Firm Growth | Not Supported |

Research Discussion

In this section the achievement of the research objectives and hypotheses is identified.

H1: There is a significant relationship between Accounting Conservatism and Investment Efficiency. The GLS simple regression analysis of the effect of Accounting Conservatism on Investment Efficiency in the presence of the control variables proved insignificant effects of Basu’s Asymmetric Timeliness, Asymmetric Accrual to Cash-flow and Book-to-Market (BTM) ratio on investment efficiency. The above result means that the first hypothesis is not supported. From the above concluded results, it is noticed that the results are consistent with (Lara et al., 2016; Yasir, 2018; Daryatno & Santioso, 2020). On the other hand, the results are inconsistent with (Balakrishnan et al., 2016; Ali Al-fadhel, 2020).

H2: There is a significant relationship between Accounting Conservatism and Liquidity. The GLS simple regression analysis of the effect of Accounting Conservatism on liquidity in the presence of the control variables proved insignificant effects of Basu’s Asymmetric Timeliness, and Book-to-Market (BTM) ratio on liquidity. On the other hand, Asymmetric Accrual to Cash-flow has a significant effect on Liquidity. The above result showed that the second hypothesis is partially supported. The results are inconsistent with (Maria, 2017; Harakeh, 2017; Kerr, 2018; Sejati & Jones, 2019; Lobo et al., 2020).

H3: There is a significant relationship between Accounting Conservatism and Firm leverage. The GLS simple regression analysis of the effect of Accounting Conservatism on firm leverage in the presence of the control variables proved positive significant effects of Basu’s Asymmetric Timeliness, and Book-to-Market (BTM) ratio on leverage, while an negative significant impact of Asymmetric Accrual to Cash-flow on leverage is proved. The above result showed that the third hypothesis is fully supported. From the above concluded results, it is noticed that the results are consistent with (Sugiarto & Fachrurrozie, 2018; Alves, 2019; Jain et al., 2019; Teymouri & Sadeghi, 2020) while the results are inconsistent with (Lobo et al., 2020).

H4: There is a significant relationship between Accounting Conservatism and Firm Growth. The GLS simple regression analysis of the effect of Accounting Conservatism on firm growth in the presence of the control variables proved insignificant effects of Basu’s Asymmetric Timeliness, Asymmetric Accrual to Cash-flow and Book-to-Market (BTM) ratio on firm growth. The above result means that the fourth hypothesis is not supported. From the above concluded results, it is noticed that the results are consistent with Francis et al., 2015, while the results are inconsistent with (Ahmed & Duellman, 2011; Kang et al., 2017; Ma et al., 2020).

The contributions of this research are confirmed following the completion of data collecting and analysis. Academic and practical contributions are two different types of contributions made by the current research. The academic contribution is that the researcher takes into account the academic implications as the influence of accounting conservatism on firm characteristics (firm leverage, investment efficiency, liquidity, and firm growth) was examined through the control variables firm age and firm size, as there aren't many studies that have looked at this relationship in Egypt, particularly during the years following the revolution.

Another academic contribution is evaluating the effect of accounting conservatism measures (Asymmetric Timeliness Measure, Asymmetric Accrual to Cash-flow Measure, and the Market-to-Book ratio) on other dimensions, as previous studies used to study accounting conservatism as a whole without investigating the separate effect of each measure.

The practical contribution of this study represented helping the decision makers to know the effect of accounting conservatism on different firm characteristics while identifying the changes that could happen from the existence of other variables (control variables).

The results of the study help the managers and owners of the companies to know more about accounting conservatism and its influence on firm characteristics (firm leverage, investment efficiency, liquidity, and firm growth). Additionally, the study helps them to understand the effect that could be done by firm age and firm size on the relationship between accounting conservatism and firm characteristics. Finally, the study also helps them to identify the effect of main events and issues that happened nationally or globally.

Conclusion

Recommendations and Limitations

Based on the data and analysis presented by the paper, a number of recommendations were made by the paper to decision-makers in Egyptian companies, to ensure the levels of liquidity, investment efficiency, firm leverage, and firm growth in them as well as other recommendations is provided to future research.

Practical Recommendations

These recommendations are that:

1. The necessity of activating the mechanisms of corporate governance and control over small-sized companies to ensure that companies adhere to a level of accounting conservatism to ensure the transparency and credibility of such reports.

2. Work to increase the awareness of users of accounting information about the quality of accounting profits because of their important impact on increasing the quality of accounting information that will help in making rational decisions.

3. Studying the extent to which accounting profits enjoy high quality by using another measure of profit quality. The quality of profits varies according to the measurement method used (such as the ability to predict, the appropriate timing, and the absence of profit management practices).

4. The competent authorities shall oblige all companies to adopt accounting conservatism practices when preparing financial reports, in order to protect the rights of shareholders and related parties.

5. The need for the competent bodies to publish a special and comprehensive content of accounting conservatism and the advantages it enjoys to increase awareness and knowledge of accountants, members of the board of directors and account keepers, due to their more interest in accounting conservatism policies when preparing financial reports.

6. Ensure that accounting conservatism is used within reasonable limits and not exaggerated, in order to avoid distorting accounting information so as not to lose its ability to predict future flows.

7. Urging small companies in which governance mechanisms are weak to adhere to the application of accounting conservatism policies in order to guarantee the transparency and credibility of their financial reports.

8. The necessity of activating risk management mechanisms within companies to allow them to identify and measure the risks that they may face, which allows facing cases of uncertainty about future events.

9. The limits of flexibility available in the application of hedge accounting provided by the financial accounting system must be exploited in order to provide a real financial position for companies and not to mislead other relevant parties.

Theoretical Recommendations

The current study aims to investigate the relationship between accounting conservatism (Asymmetric Timeliness Measure, Asymmetric Accrual to Cash-flow Measure and the Market-to-Book ratio) and firm characteristics (Firm leverage, Investment efficiency, Liquidity and firm growth) considering firm age and firm size as two control variables. Thus, the study suggests investigate more dimensions of accounting conservatism. Moreover, investigate more variables that could be affected by accounting conservatism.

Regarding the future recommendations, this research makes this study in Egypt as a developing country, so this study recommends for future studies to examine the same factors in developed country to see if the same results will be concluded on those countries or no. Additionally, the researcher suggests conducting comparisons between developed and developing nations.

Furthermore, the researcher examined this aim in a certain period of time and on a particular sample so the researcher recommends for the future researches to examine the same relation but in a longer period of time and also suggest to examine it on a larger sample size to reach more generalized results.

Research Limitations

This paper faced some limits during its preparation. The first limit is the selected country, as the current research focuses only on Egypt as a developing country. Accordingly, it is suggested to future research making comparative studies between developed and developing countries. Another limitation is related to the timing and the sample together, as the study focuses on a sample of companies located in Egypt only through the period after the Egyptian revolution. This research did not include periods before the revolution because data are not available, in addition to that the market had face a shock during the revolution as the nature of the companies had face significant changes.

References

Ali Al-fadhel, M.M. (2020). The Correlation between Accounting Conservatism and the Efficiency of Investment Decisions in View of Managerial Ownership: A Field Study of Jordanian Environment.AAU Journal of Business and Law,3(1), 2.

Alves, S. (2019). Ownership Concentration and Accounting Conservatism: Portuguese Evidence.Journal of Business & Economic Policy,6(8), 82-90.

Balakrishnan, K., Watts, R., & Zuo, L. (2016). The effect of accounting conservatism on corporate investment during the global financial crisis. Journal of Business Finance & Accounting, 43(5-6), 513-542.

Indexed at, Google Scholar, Cross Ref

Chipeta, C., Aftab, N., & Machokoto, M. (2021). The implications of financial conservatism for African firms.Finance Research Letters, 101926.

Indexed at, Google Scholar, Cross Ref

Cui, L., Kent, P., Kim, S., & Li, S. (2021). Accounting conservatism and firm performance during the COVID?19 pandemic.Accounting & Finance.

Indexed at, Google Scholar, Cross Ref

Daryatno, A.B., & Santioso, L. (2020). The Influence of Accounting Conservatism, Leverage, Growth Opportunities, Cash and Liquidity on Corporate Investment Among Manufacturing Companies Listed on Indonesia Stock Exchange.

Indexed at, Google Scholar, Cross Ref

Egbunike, C.F., & Okerekeoti, C.U. (2018). Macroeconomic factors, firm characteristics and financial performance. Asian Journal of Accounting Research.

Indexed at, Google Scholar, Cross Ref

García Lara, J.M., Garcia Osma, B., & Penalva, F. (2014). Information consequences of accounting conservatism. European Accounting Review, 23(2), 173-198.

Indexed at, Google Scholar, Cross Ref

Geimechi, G., & Khodabakhshi, N. (2015). Factors affecting the level of accounting conservatism in the financial statements of the listed companies in Tehran stock exchange.International Journal of Accounting Research,42(1839), 1-6.

Harakeh, M. (2017).Information Asymmetry, Accounting Standards, and Accounting Conservatism. The University of Manchester (United Kingdom).

Helpman, E. (2009).The mystery of economic growth. Harvard University Press.

Indexed at, Google Scholar, Cross Ref

Jain, A., Jain, C., & Robin, A. (2019). Does accounting conservatism deter short sellers?Review of Quantitative Finance and Accounting, 1-26.

Indexed at, Google Scholar, Cross Ref

Kerr, R. (2018). The Impact of Private Securities Lawsuits on Accounting Conservatism and the Moderating Influence of Corporate Governance.

Indexed at, Google Scholar, Cross Ref

Kim, J.B., & Zhang, L. (2016). Accounting conservatism and stock price crash risk: Firm?level evidence. Contemporary Accounting Research, 33(1), 412-441.

Indexed at, Google Scholar, Cross Ref

Kogan, L., & Tian, M.H. (2012). Firm characteristics and empirical factor models: A data-mining experiment. FRB International Finance discussion paper, (1070).

Indexed at, Google Scholar, Cross Ref

Lara, J.M.G., Osma, B.G., & Penalva, F. (2016). Accounting conservatism and firm investment efficiency.Journal of Accounting and Economics,61(1), 221-238.

Indexed at, Google Scholar, Cross Ref

Lobo, G.J., Robin, A., & Wu, K. (2020). .Review of Quantitative Finance and Accounting,54(2), 699-733.

Maria, K. (2017). Relationship Between Accounting Conservatism and Solvency and Liquidity Levels: Evidence from the Russian Banking Sector.

Indexed at, Google Scholar, Cross Ref

Ramalingegowda, S., & Yu, Y. (2021). The role of accounting conservatism in capital structure adjustments. Journal of Accounting, Auditing & Finance, 36(2), 223-248.

Indexed at, Google Scholar, Cross Ref

Sejati, Y.A., & Jones, C.R. (2019). The Impact of Malaysian Code on Corporate Governance and Political Connections on Accounting Conservatism.Journal of Accounting and Finance,19(3).

Indexed at, Google Scholar, Cross Ref

Sugiarto, H.V.S., & Fachrurrozie, F. (2018). The determinant of accounting conservatism on manufacturing companies in Indonesia.Accounting Analysis Journal,7(1), 1-9.

Indexed at, Google Scholar, Cross Ref

Teymouri, M.R., & Sadeghi, M. (2020). Investigating the Effect of Firm Characteristics on Accounting Conservatism and the Effect of Accounting Conservatism on Financial Governance.Archives of Pharmacy Practice,1, 124.

Thomas, G.N., & Aryusmar, L.I. (2020). The effect of effective tax rates, leverage, litigation costs, company size, institutional ownership, public ownership and the effectiveness of audit committees in accounting conservatism at public companies LQ45.Journal of Talent Development and Excellence, 85-91.

Virlics, A. (2013). Investment decision making and risk.Procedia Economics and Finance,6, 169-177.

Indexed at, Google Scholar, Cross Ref

Wang, R.Z., Ó Hogartaigh, C., & van Zijl, T. (2008). Measures of accounting conservatism: A construct validity perspective.Journal of Accounting Literature, Forthcoming.

Yasir, M. (2018).Accounting conservatism and firm investment efficiency(Doctoral dissertation, MS thesis submitted to Capital University of Science and Technology, Islamabad).

Received: 16-Jan-2023, Manuscript No. AAFSJ-23-13135; Editor assigned: 18-Jan-2023, PreQC No. AAFSJ-23-13135(PQ); Reviewed: 01-Feb-2023, QC No. AAFSJ-23-13135; Revised: 02-Mar-2023, Manuscript No. AAFSJ-23-13135(R); Published: 09-Mar-2023