Research Article: 2022 Vol: 25 Issue: 2S

The effect of audit committee characteristics on the financial performance in the UAE

Shouq Abdelqadir Aqeel Abdelrahman Al Ali, Business Department, Higher Colleges of Technology, UAE

Soha Salem El Mokdad, Business Department, Higher Colleges of Technology, UAE

Ahmad Faisal Hayek, Business Department, Higher Colleges of Technology, UAE

Citation Information: Abdelrahman Al Ali, S.A.A., El Mokdad, S.S., & Hayek, A.F. (2022). The effect of audit committee characteristics on the financial performance in the UAE. Journal of Entrepreneurship Education, 25(S2).

Abstract

This paper studies the effect of the audit committee characteristics on Etisalat Group's financial performance over the period 2015-2017. The objective of the study is to evaluate the impact of the audit committee characteristics (Independence of the audit committee, Expertise of the audit committee, Size of the audit committee, and frequent meetings of the audit committee) on the financial performance (Return on Assets (ROA), Return on Equity (ROE), and Profit) of Etisalat Group. This study employs a quantitative research method by implementing a correlation research design. Panel regression techniques of data analysis and Correlation coefficient were used in the analysis of data collected. The findings of this study should be of interest for managers to make appropriate decisions about audit committee characteristics and corporate governance to improve the performance of the company, and to help them understand the relationship and the effect of the audit committee characteristics on the financial performance. First, this is a cross-sectional study, where it used data from 2015-2017 only from secondary resources, this short-term study may not represent the way a company operates a business, therefore, future research could extend the study to include the data for many years. Second, this study uses only one population in the United Arab Emirates, which is Etisalat Group, part of the telecommunication sector. Third, as this study used only secondary data, future research should focus on obtaining a response from the company itself to validate the findings of the current study. Lastly, data collected in this study were divided into three categories, independent variables (Independence of audit committee, size of audit committee, expertise of audit committee, and the frequent meetings of the audit committee), dependent variables (Return on assets (ROA), Return on equity (ROE), and profit), and control variables (Firm size, Firm age, and Firm leverage), these three variables were studied and analysed using statistical methods (Correlation matrix, regression analysis, and the Multi-collinearity/Variance Inflation Factor test (VIF test)). Based on the analysis and the results, the frequent meetings of the audit committee have a positive impact on the financial performance of Etisalat Group.

Keywords

Audit Committee, Audit, Financial Performance.

Background of the Study

As one of the key steering committees of the Company's board of directors, the Audit Committee oversees and controls financial information of firms (Kenton, Variance Inflation Factor, 2018), internal control systems, risk management systems, and the internal and external audit functions (Australian Institute of Company Directors, 2014). It also maintains contact with the financial director and the company's personnel. The Audit Committee plays a key role in helping the board meet its supervisory responsibilities in areas such as financial information, internal control systems, risk management systems, and internal and external audit functions.

The primary role of the audit committee includes; monitoring the official announcements related to the integrity of the company's financial statements and reviewing the judgments of important financial reports included, reviewing The internal control and risk management system of the company, Monitor and reviewing the effectiveness of the company's internal audit function, recommend the Board of Directors for the appointment of an external auditor, request shareholder approval of the general meeting, and approve the terms of the external auditor's remuneration and contract. Auditors ensure that the financial information presented complies with the accounting standards. The Audit Committee is an important element of governance and operates under the delegated authority of the Board (Financial Reporting Council, 2012). This research will examine one of the most important sectors in the UAE, which is the Telecommunication sector. Telecommunications in the United Arab Emirates is under the control and supervision of the Telecommunications Regulatory Authority (TRA) which was established under UAE Federal Law (Telecommunications Regulatory Authority, 2014-2018). The UAE's telecommunications have become an ever-evolving industry that is characterized by opportunities arising from new challenges in an increasingly digitized world. UAE’s telecommunication sector is served by two operators, Emirates Telecommunications Corporation which is known as Etisalat, and Emirates Integrated Telecommunication Company PJSC which is known as Du. Etisalat has been leading this industry for nearly 30 years until du came around in 2007 and started the competition (Smith, 2015). Etisalat Group is Emirates Telecommunication Group Company PJSC headquartered in Abu Dhabi. It is one of the largest telecommunication providers in the GCC. Etisalat was founded in 1976 to launch the first mobile network in the Middle East (Etisalat, 2019). Etisalat is one of the most profitable telecommunication groups in the world, with a market cap of 152 billion AED, AED 51.7 billion net revenue, and net profit of 8.4 billion AED for 2017 (Etisalat, 2017-2019).

The audit committee is one of the main steering committees of the company's board of directors overseeing financial information and disclosure (Kenton, Audit Committee, 2018). The Audit Committee maintains communication with the CFO and the company's control officers and oversees financial information, monitors accounting policies, supervises external auditors, adheres to regulations, and discusses risk management policies with the administration (Kenton, Audit Committee, 2018; Turley & Zaman, 2004). The significance of this study is to evaluate the effects of the audit committee characteristics on Etisalat’s financial performance.

Research Objectives

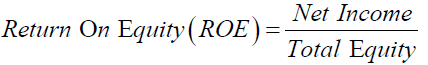

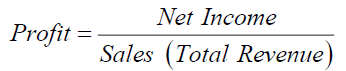

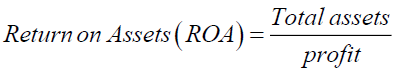

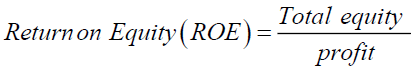

The main objective of the study is to evaluate the effect of the audit committee characteristics (the Independence of the Audit Committee, the Expertise of the Audit Committee, the Size of the Audit Committee, the Frequent Meetings of the Audit Committee) on the financial performance of Etisalat Group (Return on Assets (ROA), Return on Equity (ROE), and Profit).

Research Hypothesis

H1: Audit committee characteristics have an impact on a company’s financial performance.

Scope of the Study

This study studies the effect of the audit committee characteristics on the financial performance of Etisalat Group (Etisalat Group, 2015). However, the study is limited to one company under the Telecommunication Sector in the UAE (Etisalat Group, 2015). The study covers a short period of three years (3) years (2015-2017).

This study examined the four attributed of the audit committee characteristics (the independence of the audit committee, the expertise of the audit committee, the size of the audit committee, and the frequent meetings of the audit committee), while the concept of performance covered only the financial performance (Return on Assets (ROA), Return on Equity (ROE) and Profit).

Significance of the Study

The audit committee is one of the main steering committees of the company's board of directors overseeing financial information and disclosure (Kenton, Audit Committee, 2018). The Audit Committee maintains communication with the CFO and the company's control officers and oversees financial information, monitors accounting policies, supervise external auditors, adhere to regulations, and discuss risk management policies with the administration (Kenton, Audit Committee, 2018). The significance of this study is to evaluate the effects of the audit committee characteristics on Etisalat’s financial performance.

Literature Review

This section reviews and presents relevant and related literature on audit committee characteristics and firm performance, empirical studies on audit committee and performance. It also discusses the theories of corporate governance about audit committee functions.

Previous Studies

Committee Effectiveness and Performance of Saudi Arabia Listed Companies, this study was conducted by Yahya Ali Al-Matari, Dr. Abdullah Kaid Al-Swidi, and Dr. Faudziah Hanim Bt Fadzil. This study examines the nature of the audit committee and the relationship between the Saudi stock market (TADAWL) in 2010 and internal corporate governance mechanisms related to the performance of listed Saudi companies, excluding financial companies. The statistical results of the study showed a positive effect of the Audit Committee on the measurement of corporate performance and the internal audit of the proposed variable of Tobin’s Q and ROA.

Although it was found that the effect of the degree of amendment of the audit committee on the results of ROA internal audit activities was found to be significantly positive, the effect of the same variable Tobin’s Q study is not supported. However, the audit committee, the meetings of the audit committee, the activities of the audit committee, and the independence of the main internal audit and audit committee meetings are all considered to be trivially involved (Al-Matari et al., 2012).

Al Mansouri et al. (2009) the research was aimed to estimate the impact of compliance of corporate governance by the company over the return on assets of the companies listed at Bursa Malaysia. The authors have used the secondary data of 45 companies listed at Bursa Malaysia. The authors have applied regression analysis to identify the impact of significant variables on the return on assets of the company. The regression analysis has shown that the frequency of board meetings, risk management committee members, foreign shareholders, and audit committee qualification regarding accounting and finance has a major impact on the return on assets. These variables are successful in explaining the relation up to 57 % variation in the returns on assets.

In another study conducted by Ahmad Almansour et al. (2016), the researcher mentioned in his research that Dividend stability is considered as important to enhance the confidence of investors and, to determine the stability in dividends financial performance of the company’s matters and operating cash flow has a major role. In addition to that, the researcher mentioned that governance, board size, ownership structure, and CEO duality are considered as very important determinants of dividend payout. The data of 150 companies were operating in the non-financial sector of the Pakistan stock exchange was collected from the annual reports of those companies. Proportionate sampling was conducted to include all the sectors. After ensuring the normality of data, regression was applied to the variables that were chosen based on the literature review. The results highlighted that all the variables i.e. board size, CEO duality, ownership structure, and operating cash flow, have a significant impact on the dividend payout. The findings of the study also supported agency theory and added operating cash flow in the agency theory which was the main contribution and significance of the study.

Another study was conducted by Khalil et al. (2018). The researchers mentioned that In the last decade several companies have revalued their assets. The companies revalue their assets by showing that they want to present a true and fair value of their assets as identified by the international reporting standards. As prescribed in the standards, the purpose of any accounting policy is to give true and fair value of the company to make it more sustainable. Because depiction of true and fair view of the company enhances confidence of the investors, which ultimately keep the company sustainable especially in the case of entrepreneurial ventures. In order to meet the objective of identification of management motives behind the revaluation of assets, primarily literature was reviewed which highlighted certain factors. In order to explore other hidden motives, exploratory study was conducted. The purpose of conducting qualitative research was to identify any other factor which has not yet been covered. For the purpose data was collected from seven professions; including academicians, entrepreneurs, chartered accountants, and finance heads. The findings revealed that revaluation is done primarily for the improvement of financial position to satisfy the investors so that more funds may be generated. The study suggested a quantitative study on the identified constructs and also suggested the entrepreneurs, policy makers, and governments to revalue the assets appropriately to get maximum benefits of revaluation for the sustainability of the companies.

Khan et al. (2020) in their research mentioned that in the corporate world the internal audit function of an organization is established and used to provide an unbiased and objective review of the organization's processes and activities. When organizations consider that their internal audit services are either costly or are inefficient they prefer to outsource. An organization might want to outsource its internal audit function to an outsourced service provider to acquire better services from the function. They might outsource it because they want to have a better quality of the auditor they are unable to run the function in-house. When an organization will outsource its internal audit function, it will have an impact on its processes and activities either in a constructive or else in a destructive way. However, this is not the end there are several other motives for which the organizations may wish to outsource internal audit services. The study is an attempt to highlight and reveal the motives of the organizations behind outsourcing their internal audit services according to the existing literature. The findings highlighted those areas which are not very common; hence the findings of the study open the horizons for future research to analyze empirically (Khan, 2018).

Bashir & Asad, (2018) conducted research with the purpose to examine the relationship of corporate governance (CG) tools (board size, board meetings) with performance (ROA) of listed textile firms on the Pakistan stock exchange. Leverage (FLEV) has been accommodated as a moderator in the study, data has been collected concerning 30 textile firms from the period 2015 to 2017 and multiple regression technique has been employed in the research to assess the relation among corporate governance and firm performance. The study found that both board size (BS) and board meetings (BM) have a significant impact on the textile firm’s performance, moreover, the moderating effect of leverage was found to be significant on the relationship between BM and performance of textile, but insignificant on the relationship of board size and performance. This study provides helpful information for regulators as well as management of textile firms to enhance policies relating to corporate governance ahead.

Another study was conducted by Abdul Kemi Idris Zubair under the title “Evaluation of the impact of audit committees on performance of listed deposit”. The objectives of this study are to assess the impact of the components of the audit committee (size, independence, conferences, and financial experience) on asset performance, net interest margin, Tobin Q, and compliance with standards investors of financial institutions and deposit banks Trust in Nigeria. The study uses qualitative and quantitative research methods that use correlation studies and survey design. Panel Kendall's coincidence counting method of regression and data analysis was used for the analysis. This study shows that there is a significant positive relationship between the components of the audit committee (size, independence, meetings, and financial experience) and the performance of deposit banks listed in Nigeria, and the role of the audit committee has a very positive impact of trust. In particular, the attendance of auditors, who are specialists in the accounting and finance fields, has improved financial performance during the accounting period, which means that the performance of the members is greatly improved due to the increase in the members' audit committee. As the number of independent non-standing director’s increases, financial performance improves significantly. The findings also show that the higher the frequency of the audit committee meetings, the greater the financial performance and the higher the frequency of committee meetings, the better the financial performance (Zubair, 2016).

A third study was conducted by Rateb Mohammad Alqatamin under the title “Audit Committee Effectiveness and Company Performance: Evidence from Jordan” to examine the impact of the nature of the audit committee on company performance. Research shows that the size, independence, and gender diversity of the audit committee have a significant positive relationship with company performance, while the experience and frequency of meetings are negligible. The results of this study can help managers and the board in making appropriate decisions about the nature of audit committees and corporate governance mechanisms to improve company performance. The relationship between the nature of the audit committee and company performance is ambiguous. This study contributes to the literature by confirming the role of the audit committee on the performance of the company, suggesting that the performance depends on the characteristics of the audit committee (Alqatamin, 2018).

Audit Committee in the UAE

Corporate Governance is a system used to direct and control an organization. It includes laws, policies, procedures, practices, standards, principles, relationships, and responsibilities that can influence the direction and control of the organization as well as the stakeholders of the organization (Al-Baidhani, 2014; Alkhuzaie & Asad, 2018). Corporate governance helps the board of directors and the management handles the difficulties of operating a business more effectively. The current state of corporate governance differs from country to country. Many people view the United States as a reference point for corporate governance standards, but discipline is a mobile goal that is constantly evolving and subject to many internal disputes.

In the United Arab Emirates (UAE), the Securities and Commodities Authorities (SCA) have introduced a new corporate governance code that applies to all companies and institutions in which securities are quoted in the market. All companies of this type had to comply with corporate governance regulations by April 30, 2010. The corporate governance legislation does not apply to government agencies regulated by the central bank or foreign companies (Bainbridge, 2011). Many corporate governance requirements apply to private companies listed on the Abu Dhabi Stock Exchange (ADX) and the Dubai Financial Market (DFM), as well as the requirements of the bank's regulated financial institutions, and the Central Bank of the United Arab Emirates (Central Bank) (Williams, 2018).

The main provisions of the Corporate Governance Code are as follows:

1. A third of the directors should be independent directors, and most of them must be non-executive directors. The position of the president and general manager must be filled by others (Bainbridge, 2011).

2. Board meetings should be held at least every two months (Bainbridge, 2011).

3. The Board of Directors must establish the Audit Committee and the Nominating and Compensation Committee. The committee shall consist of at least three non-standing directors, two of whom shall be independent directors and the chairman of the board shall not be a member of such committee. At least one of the auditors must be a financial and accounting expert (Bainbridge, 2011).

4. A compliance officer should be appointed by the board (Bainbridge, 2011).

5. The board should establish a rigorous internal control system for risk management tools and procedures, implementation of the Corporate Governance Code, compliance with local laws and regulations, internal procedures, and compliance and review of financial statements. Financial information declarations are used in drafting financial reports (Bainbridge, 2011).

6. All listed companies must submit an annual report on corporate governance practices to SCA. The governance report contains all the information on the SCA approved form, in particular the details of the internal governance system, any violations that occurred during the fiscal year (together with the reasons for such violations in the same future); Summary of board composition including the level of remuneration; And details on the remuneration of senior management (Bainbridge, 2011).

In Conclusion, this study shows that the role of forming an audit committee was brought to the United Arab Emirates (UAE) by the Securities and Commodities Authorities (SCA) as one of the Corporate Governance Code to help companies in the UAE operate more efficiently, by forming an audit committee with at least three members.

Characteristics of Audit Committee

Independence of Audit Committee

The existence of an independent auditor can reduce the economic difficulties of the company by collecting the opinions of the company. By doing so, the independence of the audit committee can help an external auditor maintain assets without being affected by the director (Wakaba, 2014). Based on other research about the Audit committee effectiveness as reflected from the UAE, the independence of the members of the audit committee is the most important characteristic of the audit committee (Qasim, 2018).

The Expertise of the Audit Committee

Based on research that was conducted on the financial performance in listed companies at the Nairobi securities exchange, the audit committee experience has a positive impact on the company's performance (Wakaba, 2014). The study has shown that having an experienced auditor reduces the likelihood of financial errors and improves the company's performance. It reduces the cost of debt as well as the possibility of fraud. In addition, the vast experience of audit members is related to more knowledge of quality monitoring and auditing. Auditing is essential to improving the company's performance (Wakaba, 2014).

Frequent Meetings of Audit Committee

Based on Etisalat’s report, The Audit Committee held six meetings in 2015:

| Dates of Audit Committee Meetings | |||||

| 25-1 | 19-2 | 16-4 | 26-7 | 25-10 | 13-12 |

Based on Etisalat’s report, The Audit Committee held seven meetings in 2016:

| Dates of Audit Committee Meetings | ||||||

| 25-1 | 14-2 | 7-3 | 24-4 | 26-7 | 23-10 | 12-12 |

Based on Etisalat’s report, The Audit Committee held seven meetings in 2017:

| Dates of Audit Committee Meetings | |||||||

| 23-1 | 14-2 | 6-3 | 24-4 | 24-7 | 2-10 | 22-10 | 10-12 |

Based on a study that was conducted on Chinese listed companies, the result was that the frequency of audit committee meetings is negatively related to the share of shares owned by major shareholders. It also showed that the meeting of the audit committee reported that the reported real estate company had less private property. In addition, the share of shares owned by majority shareholders has a negative relationship with the audit committee meeting of state enterprises (Yin, 2012;Zgarni et al., 2018).

Based on another study that was conducted in Oman, it argued that the number of audit committee meetings will determine the degree and level of audit committee activity and the commitment to company performance. In addition, regular audit committee meetings can improve your financial accounting practices, which can lead to a company's overall performance (Badhabi, 2017).

Size of Audit Committee

A study showed that as the size of the audit committee grows, the company's performance is expected to decrease due to the pressure to follow the opinions of other members without considering the problems and disputes of free users. However, because of the large expertise of large audit committees, large audit committees can claim to protect and control accounting and financial processes (Wakaba, 2014). Based on the Securities and Commodities Authorities (SCA) new corporate governance code, and as mentioned in 7.1. Audit Committee in the UAE, The Board of Directors must establish the Audit Committee and the Nominating and Compensation Committee. The committee shall consist of at least three non-standing directors, two of whom shall be independent directors and the chairman of the board shall not be a member of such committee. At least one of the auditors must be a financial and accounting expert (Bainbridge, 2011). Another study concluded that the size of the audit committee is the least important factor (Qasim, 2018).

Based on Etisalat’s report, there are four members of the Committee, Chairman Essa Abdulfattah Kazim Al Mulla, Sheikh Ahmed Mohd Sultan Bin Suroor Al Dhahiri, Khalid Abdulwahid Hassan Alrustamani, and Salim Sultan Al Dhaheri an External member of the audit committee (Etisalat Group, 2017).

According to the studies above, there are four characteristics an audit committee must have to perform effectively, which are Independence of the audit committee, Experience of the audit committee, frequently of meetings of the audit committee, and size of the audit committee. The roles and responsibilities of the audit committee differ from a country to another, but they all have similar goals.

Financial Performance

Financial performance analysis is the process of determining the operational and financial characteristics of a company based on its financial and financial statements. The purpose of analyzing the financial performance is to determine the efficiency and performance of the company's operations as reflected in its financial records and reports. Analysts want to measure liquidity, profitability, and other indicators that the business is performing in a rational and normal way. Ensure sufficient returns for shareholders who can at least maintain market value (Bhunia et al., 2011).

To evaluate and determine the stability and health of Etisalat’s financial performance, we can use their balance sheet and compare their assets with their liabilities. Based on Etisalat’s 4th quarter of 2018 consolidated statement of financial position, they own (assets) 124,211,981 AED’000, and owe (liabilities) 67,789,080 AED’000, which puts them in a good financial position (Etisalat Group, 2017; Etisalat Group, 2018). There are 4 ratios to measure the financial performance of a company, which are:

1. Liquidity ratios

2. Efficiency ratios

3. Profitability ratios, and

4. Leverage ratios

Profitability ratios help assess your financial success potential and compare your company with other companies in the same industry. It consists of three important ratios: Net profit margin, return on assets and X measures how much a company earns. Return on assets helps knowing how well management is using the company's various resources. Finally, return on equity measure how well your business is performing in relation to shareholder investments.

| 2015 | 2016 | 2017 |

| 0.1391 | 0.1506 | 0.1463 |

| 2015 | 2016 | 2017 |

| 0.0644 | 0.0687 | 0.0658 |

| 2015 | 2016 | 2017 |

| 0.1597 | 0.1608 | 0.1634 |

In Conclusion, to evaluate the financial performance of Etisalat, it is necessary to calculate their ROA, ROE, and profit.

The Link between Audit Committee Characteristics and Company’s Financial Performance

Many researchers have examined the link between Audit committee characteristics and a company’s financial performance. As a result of a research that was conducted in the Department of Accounting, Covenant University, Ota, Ogun State, Nigeria, certain measures of the efficiency of the audit committee (e.g. independence of the audit committee, the financial experience of the audit committee, and size of the board) have shown a positive coefficient and a significant impact on the company's financial performance. As a result, the audit committee meeting had a significant positive relationship with employee return on equity (ROI), but generally, the size of the audit committee and audit committee meetings did not add value to the financial performance of the company in Nigeria (Aanu et al., 2014).

Another study had concluded that the independence of the audit committee has a significant impact on the financial performance of Nigerian banks. The study also concluded that the size and frequent meetings and experiences of the audit committee had a significant positive impact on the financial performance of the deposit bank during that period (Zubair, 2016).

Summary

This literature review concludes that there are four characteristics of an audit committee (independence of audit committee, which is the most important factor of audit committee characteristics, experience of audit committee which always affects the financial performance positively if it was used correctly, size of the audit committee, which should consist of at least three members, and frequent meetings of the audit committee, which does not affect the financial performance of companies, several numbers of studies have been conducted to establish the relationship between the meetings of the Audit Committee and the financial performance of the company, but each study has a different result which makes the results inconsistent). Also, the Securities and Commodities Authorities (SCA) in the United Arab Emirates (UAE) have introduced the audit committee as part of the Corporate Governance Code to help companies in the UAE operate more efficiently. Furthermore, to know the impact of the audit committee on the financial performance of Etisalat, we need to calculate their return on assets, return on equity, and profit, which can be gathered easily from Etisalat’s annual reports-financial statements. Finally, this section concludes that only three of these characteristics may impact the financial performance of any company, which is the independence of the audit committee, expertise of the audit committee, and size of the audit committee, while the number of meetings of the audit committee showed no consistent impact on the financial performance of any company.

Research Methodology

This section presents the research plan and description, Sample design, Period of the study, Research type, Methods and techniques in research design, and data sources.

Background

Based on a project submitted to the University of Nairobi by Margaret Atino Mutuku Kasyoki, under the title “The effects of board characteristics on the financial performance of listed commercial and service firms at Nairobi Securities Exchange”, the Dependent variables used were Return on Assets (ROA), Independent variables were the audit committee independence, the audit committee size, the audit committee frequent meetings, and the audit committee expertise, and Control Variables (firm size, firm age, and leverage) (Kasyoki, 2016).

Another study was published by Sciedu Press, used Return on assets (ROA) as a dependent variable, the audit committee expertise, the audit committee size, the audit committee independence, and the audit committee frequent meetings as the independent variable and control variables like company size, industry type, leverage ratio, and dividend ratio (Alqatamin, 2018).

A third study used return on assets (ROA) and Tobin’s Q (TQ) to measure the firm performance (dependent variables), and Audit committee independence, Shareholdings held by the audit committee, Audit committee meeting with the chief internal auditor, Audit Committee Reviews of IA Programs and Plans, Audit Committee Reviews of the Result of IA Activities and pursue the implementation of the corrective measures as independent variables, and Firm Size, leverage/Debt proportion as control variables (Al-Matari et al., 2012; Samoei & Rono, 2016).

Sample Design

To achieve the objectives of the study, quantitative data have been studied from the annual report of Etisalat Group 2015 to 2017 to collect information and measure their financial performance (Return on assets, return on equity, Profit) and evaluate the impact of the audit committee characteristics (independence, expertise, size, frequent meetings). The objective of this sample design is to assess the relationship between the theoretical Variables.

Research Type

To study whether the characteristics of the audit committee affects the financial performance of Etisalat Group, quantitative research have been done to study Etisalat Group annual reports of 2015-2017 to calculate and study the impact on the dependent variables and independent variables.

Period of Study

The period of this study comprises three years of Etisalat Group’s financial performance from 2015 to 2017. Etisalat Group is a Telecommunication Company that provides a variety of products and services for customers in the United Arab Emirates and other countries.

The Return on Assets (ROA) and the characteristics of the audit committee. This study assumes a relationship between audit committee characteristics and the financial performance of a firm. This study adopts secondary sources of data collected from Etisalat Group’s website.

Methods and Techniques in Research Design and Data Sources

Data Collection

The data was obtained using secondary data sources. Most of the data come from Etisalat Group’s annual reports of 2015, 2016, and 2017 to examine the link between Audit committee characteristics and Etisalat’s financial performance, and measure their financial performance. The method of data collection for these involves statements of financial positions and income statements of the period 2015-2017, while the audit committee characteristics are non-financial statements.

Correlation Analysis: Correlation analysis is a statistical measure of the extent to which two or more variables fluctuates together (Rouse, 2016). A "correlation coefficient" is used to analyze the relationship between variables; this coefficient is calculated as a quantitative or qualitative variable (Suárez, 2015). Based on the Investopedia Web site, the correlation coefficient is a statistical measure that calculates the strength of the relationship between the relative movements of two variables. Values vary between -1.0 and 1.0 and a calculated number greater than 1.0 or less than -1.0 means that there is an error in the correlation measurement, furthermore, a correlation of -1.0 indicates a perfect negative correlation, whereas a correlation of 1.0 indicates a perfect positive correlation, A correlation of 0.0 indicates no relationship between the movements of two variables (Chen, 2019; Gerimo, 2018; Fernando, 2019).

Regression Analysis: Regression analysis is the relationship between two variables. The tables below show the result of the relationship between audit committee frequent meetings and each other variable. Appendix

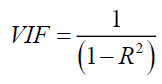

Multi-Collinearity Test: Based on the Investopedia Web site: Variance Inflation Factor (VIF) is a measure of the amount of multi-collinearity in a set of multiple regression parameters, multiple regression analysis is used to test the impact of multiple variables on a particular result ( Kenton, Profitability Ratios, 2018). When there is a linear relationship or correlation between one or more variables or independent inputs, Multicollinearity exists and it creates a problem in multiple regression analysis because input affects each other when multiple lines exist. It is not independent and it is difficult to prove how much it affects. In a regression model, a combination of independent variables and dependent variables or results (Kenton, Profitability Ratios, 2018;Sharma, 2018; DeZoort et al., 2002).

Relating to the correlation analysis matrix, a multicollinearity test was applied because a high correlation was found between the variables.

Data Analysis

Secondary data from Etisalat Group annual reports were reviewed and studied for statistical analysis. Excel software has been used to identify the Independence variables, dependence variables, and control variables.

The variables of the study are considered attributes of the audit committee, the independent variables (audit committee independence, audit committee expertise, audit committee size audit committee frequent meetings). On the other hand, the dependent variables are the financial performance variable (return on assets (ROA), return on equity (ROE), profit), and finally, control variables, which are firm size, firm age, and firm leverage.

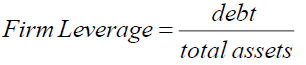

Based on Table 1, Independence Variables, Etisalat Group increased the number of meetings every year, from 6 meetings in 2015 to 8 meetings in 2017 with an average of 7 meetings, while the number of the independent member of the audit committee stayed the same throughout the years 2015-2017, same as the audit committee size and audit committee expertise. Table 2, Dependence Variables, shows that the Return on Asset (ROA) increased by 4.295% from 2015 to 2016, and decreased by 2.894% in 2017 with a maximum point of 0.068 in 2016 and a minimum point of 0.064 in 2015. As of the Return on Equity (ROE), the rate increased from 2015 to 2016 then decreased in 2017 with an average of 0.14, a maximum point of 0.15 in 2016, and a minimum point of 0.13 in 2015, while the profit kept on increasing every year with an average of 0.16. Table 3, Control Variables shows a significant decline in the firm size from 128,265,000,000 to 122,546,000,000 in 2015- 2016, then a significant increase in 2017 to 128,284,000,000 with an average of 126,365,000,000. Etisalat Group's leverage keeps on increasing every year, which means their debts are getting higher than their assets every year, the average number of their leverage is - 0.3403.

| Table 1 Independence Variables | |||

| 2015 | 2016 | 2017 | |

| Independence of AC | 3 | 3 | 3 |

| Expertise of ac | 1 | 1 | 1 |

| Size of AC | 4 | 4 | 4 |

| Frequent meetings | 6 | 7 | 8 |

| Table 2 Dependence Variables | |||

| 2015 | 2016 | 2017 | |

| ROA | 0.064421315 | 0.068717053 | 0.065822706 |

| ROE | 0.139166316 | 0.150603595 | 0.14633301 |

| Profit | 0.159712 | 0.160829 | 0.163434 |

| Table 3 Top 5 Market Orientation Actions Ranked by Respondents | |

| Market Orientation Actions | Rank |

| Adopt innovation orientation, not the customer orientation | 1 |

| Be idea-driven, not market-driven | 2 |

| Gather market information through informal networking, not through formalized market research | 3 |

| Focus on interactive marketing methods and word-of-mouth | 4 |

| Focus on bottom-up targeting, not the traditional top-down (segmentation, targeting and positioning) | 5 |

Based on Table 4, Correlation Analysis Matrix, the Independence, Expertise, and Size of Audit committee fail in the correlation test because the variables are consistent over the years 2015-2017, therefore, these characteristics can’t go under the VIF test because they do not correlate. This also means that these three characteristics won’t show a significant impact on the financial performance of Etisalat Group. Multicollinearity usually occurs when there is a high correlation between two or more variables ( Stephanie, 2015); Multicollinearity Test (VIF) is applied in Table 5.

| T able 4 Correlation Analysis Matrix | ||||||||||

| AC Independence | AC Expertise |

AC Size |

AC Meetings |

ROA | ROE | Profit | Firm Size | Firm Age | Firm Leverage | |

| Independence of AC |

1 | |||||||||

| Expertise of AC |

#DIV/0! | 1 | ||||||||

| Size of AC | #DIV/0! | #DIV/0! | 1 | |||||||

| Meetings of AC |

#DIV/0! | #DIV/0! | #DIV/0! | 1 | ||||||

| ROA | #DIV/0! | #DIV/0! | #DIV/0! | 0.320 | 1 | |||||

| ROE | #DIV/0! | #DIV/0! | #DIV/0! | 0.620 | 0.942 | 1 | ||||

| Profit | #DIV/0! | #DIV/0! | #DIV/0! | 0.974 | 0.099 | 0.428 | 1 | |||

| Firm Size | #DIV/0! | #DIV/0! | #DIV/0! | 0.003 | - 0.947 |

- 0.783 |

0.228 | 1 | ||

| Firm Age | #DIV/0! | #DIV/0! | #DIV/0! | 1 | 0.320 | 0.620 | 0.974 | 0.003 | 1 | |

| Firm Leverage | #DIV/0! | #DIV/0! | #DIV/0! | -1 | - 0.311 |

- 0.612 |

-0.977 | - 0.013 |

-1 | 1 |

| Table 5 VIF Test | ||

| Variables | VIF | 1/VIF |

| ROA | 1.113965094 | 0.897694196 |

| ROE | 1.624488885 | 0.615578235 |

| Profit | 19.77016671 | 0.050581263 |

| Firm Size | 1.000008251 | 0.999991749 |

| Firm Leverage | 10459.55903 | 9.56063E-05 |

| Mean VIF | 2096.613532 | |

Based on the VIF test in Table 5, Return on Asset (ROA), Return on Equity (ROE), and the Firm Size VIF results are moderately correlated because the values are between 1-5. On the other hand, Etisalat Groups Profit is above 10 which are considered a high correlation (Stephanie, Variance Inflation Factor, 2015). As a result of studying only 3 years of Etisalat Group financial performance, the VIF test of profit is high; studying more years may result in a much lower VIF result.

Analytical Methods

This study focuses on long-term relationships with dependent variables so that all explanatory variables are considered in the model. The dependent variables were studied by collecting the financial information of Etisalat Group to calculate the Return on Assets (ROA), Return on Equity (ROE) and Profit, where:

On the other hand, the independent variables were studies by gathering information from Etisalat Group Corporate Governance annual reports to study the Audit Committee characteristics of Etisalat Group. Based on their Corporate Governance reports, Etisalat Group has 3 independent members, 1 expertise, and 4 members in the Audit Committee through the period of the study, while the number of Audit Committee meetings increased.

Control Variables were gathered by applying some ratios, were:

Firm Size = Number of EtisalatGrouptotal assets

To calculate the VIF, a correlation matrix has been conducted to estimate the variables that affect the financial performance and remove the ones that do not show any impact, As a result, the frequent meetings of the audit the committee showed a high correlation. Furthermore, a regression table is formed to see the effect of the frequent meetings of the audit committee on the financial performance (return on assets (ROA), return on equity (ROE), and profit) and to help us calculate the VIF by taking the R Square of each output.

Diagnosis Test

This study used panel data estimation technique, this technique has many advantages over time- series data, based on a research that was conducted by Cheng Hsiao, the panel data contains more degrees of freedom and sample variability than the cross-sectional data, which can be viewed as time-series data, typically a panel with T=1 or a panel with N=1. It improves the efficiency of econometric estimates; he also mentioned that Panel data improved the ability to capture the complexity of human behavior over one section or time-series data (Hsiao, 2007; Glen, 2015).

Summary

The study explores the impact of the Audit committee characteristics on the financial performance of Etisalat Group. Based on the findings, the Independence of the Audit Committee, Expertise, and Size does not impact the financial performance of Etisalat Group significantly. Based on the correlation matrix table results, these characteristics had consistent values, therefore, they were not discussed as they do not contribute to affect the financial performance, and don’t show a result in the correlation test, therefore, a VIF test can’t be done. On the other hand, the frequent meeting of Etisalat Group’s Audit Committee shows a significant impact on their financial performance ( Etisalat Group, 2016). As a result of increasing the number of meetings every year, Etisalat Group's profit increases by 1% every year (Etisalat Group, 2016).

Findings

Based on this study, the Frequent Meetings of the Etisalat Group Audit Committee show a positive and a significant impact on the financial performance of Etisalat Group, that due to an increase of the number of meetings every year, while the Audit Committee independence, expertise, and size held a consistent variable, therefore, it doesn’t influence financial performance.

Empirically, the findings of (Aanu et al., 2014) are in line with this study's results, as he mentioned the frequent meetings of the audit committee added value to the financial performance. On the other hand, the findings of (Zubair, 2016) are against this study results as they concluded that the independence of the audit committee, the size of the audit committee, the frequent meetings of the audit committee, and experiences of the audit committee have a significant impact on their financial performance.

The results of the literature review indicate that each characteristic of the audit committee affects the financial performance differently depending on the change of the variable every year, which makes the results inconsistent.

Discussion

As mentioned earlier in the literature review section, the main objective of this study is to answer the following question: Does the Audit Committee Characteristics affect the financial performance of the Etisalat Group in the UAE? The findings indicated that the Audit Committee Independence, Expertise, and Size have no impact on the financial performance of Etisalat Group, On-the-other-hand, the Frequent Meetings of the Audit Committee show a positive and significant impact on the financial performance of Etisalat Group. Furthermore, the regression results show and explain the effect of the frequent meetings of the audit committee on the Return on Assets (ROA), Return on Equity (ROE), Profit, Firm Size, Firm Age, and Firm Leverage. The regression results indicate that there is a positive association between the frequent meeting and the variables.

The main reason why the Audit Committee Independence, Expertise, and Size did not show any impact on Etisalat Group’s financial statements is that the value of each component did not change over the years 2015- 2017, which caused an error in the correlation matrix test, therefore, no impact is shown. On the other hand, the frequent meetings of the audit committee shows a positive impact on the financial performance as the number of meetings increased by 1 meeting every year through the period 2015-2017, therefore, the correlation matrix analysis showed results between -1 and 1 for all the components selected to be compared with the Frequent meetings (Return on Assets (ROA), Return on Equity (ROE), Profit, Firm Size, Firm Age, and Firm Leverage), which allowed us to develop a regression analysis matrix for all the components, and finally run the results in a Multicollinearity Test to test the frequent meetings of the audit committee on the Return on assets, return on equity, profit, firm size, firm age, and firm leverage.

As mentioned earlier in the methodology section- Data analysis, the Independence, Expertise, and Size of Audit committee fail in the correlation test because the variables are consistent over the years 2015- 2017, therefore, these characteristics can’t go under the VIF test because they do not correlate. This also means that these three characteristics won’t show a significant impact on the financial performance of Etisalat Group, 2016. Multicollinearity usually occurs when there is a high correlation between two or more variables; Multicollinearity Test (VIF) is applied. Return on Asset (ROA), Return on Equity (ROE), and the Firm Size VIF results are moderately correlated because the values are between 1-5. On the other hand, Etisalat Groups Profit is above 10 which are considered a high correlation.

Research Strengths

1. Data was collected efficiently from secondary resources, which provides more detailed information to study and multiple methods for gathering the data.

2. The company selected (Etisalat Group) provided all the information needed on their website, which helped us save time in collecting and analyzing data.

3. This study enhances the understanding of the audit committee characteristics and their impact on financial performance.

Research Limitations and Constraints

The findings of this research have to be seen in the light of some limitations, firstly, there are many ways to measure the financial performance of a firm, but this study covers the Return on Assets (ROA), Return on Equity (ROE), and profit, increasing the number of dependent variables may give a broader picture of the situation. The second limitation concerns that corporate governance has many mechanisms, but this study is limited to one only, which is the four characteristics of the audit committee. Thirdly, insufficient sample size of the statistical measurement, the data studied was based on a short period, which did not fit the standard categories for the VIF test or the regression analysis test results of the p-value. It is important to have a sufficient sample size to conclude a valid research result, and the larger the sample is, the more precise the results will be. Moreover, Lack of previous research studies on the topic in UAE companies. It was hard to collect information about the audit committee characteristics application in the United Arab Emirates due to the lack of researches published online.

The data analysis of the regression test of the financial performance was rejected as the p-value were lower than the alpha 0.05, which is another limitation in this study that could be addressed in future research, because of the regression analysis to ignore the null hypothesis, the p-value should be higher than alpha 0.05, gathering more data over a longer period may fix that issue. Another limitation is about the data analysis; the data were analyzed using self-effort only, which may lack analytical expertise to get a better data analysis. Another limitation is Methods and techniques in collecting data have limited the analysis of the results. A longer period of data and variables collected may support the study objectives. Finally, the Scope of discussion, lack of experience in conducting research may affect the efficiency of this study; each part of this study took a lot of time to understand and study before conducting it, which may affect the results.

Conclusion

This research studies the relationship between the characteristics of the Audit Committee (Independence of Audit Committee, Expertise of Audit Committee, Size of Audit Committee, and Frequent meetings of THE Audit Committee) on the financial performance of Etisalat Group (Return on assets (ROA), Return on Equity (ROE), and Profit). On the other hand, the study concludes that the frequent meetings of the audit committee have a positive impact on the financial performance of the company (Return on assets (ROA), Return on Equity (ROE), and Profit). The study also concludes that the other three components of the audit committee characteristics (Independence of Audit Committee, Expertise of Audit Committee, and the Size of Audit Committee) do not influence the financial performance of the company.

Recommendations

This study only captures one telecommunication company in the telecommunication sector, which is Etisalat Group, and it focuses on a short- time period viewpoint, future researches are recommended to cover all companies under the telecommunication sector (Etisalat Group and DU) for a long-time period, and make a comparison between them. Future research should consider adding more performance variables like earning per share, and return on capital. Secondly, Efforts should be made in choosing the right sample period of the study and the number of variables taken under each variable category (independence, dependence and control variables), the more variables you have, the better results you get. Moreover, A quantitative method is recommended to be conducted for a better understanding of the audit committee characteristics application, a better understanding will help conducting a better research and getting better results. Finally, having good statistical skills is required for better data analysis methods and techniques applications, statistical skills will help getting an effective result and build an accurate research structure.

References

Ahmad Almansour, A.A.Z., Asad, M., & Shahzad, I. (2016). Analysis of Corporate Governance Compliance And Its Impact Over Return On Assets Of Listed Companies In Malaysia. Science International, 28(3), 2935-2938.

Alkhuzaie, A.S., & Asad, M. (2018). Operating cashflow, corporate governance, and sustainable dividend payout. International Journal of Entrepreneurship, 22(4), 1-9.

Al-Matari, Y.A., Al-Swidi, A.K., & Fadzil, F.H.B. (2012). Audit committee effectiveness and performance of Saudi Arabia listed companies. Wulfenia Journal, 19(8), 169-188.

Australian Institute of Company Directors. (2014). Role of the Audit Committee.

Bainbridge, A., Kraishan, M., & Perrin, H. (2011). Corporate Governance for UAE Companies.

Bhunia, A., Mukhuti, S.S., & Roy, S.G. (2011). Financial performance analysis-A case study. Current Research Journal of Social Sciences, 3(3), 269-275.

Etisalat Group. (2015). Annual Report.

Etisalat Group. (2015). Corporate Governance Report 2015.

Etisalat Group. (2016). Annual Report 2016.

Etisalat Group. (2016). Corporate Governance 2016.

Etisalat Group. (2017). Annual Report 2017.

Etisalat Group. (2017). Corporate Governance 2017 Report.

Etisalat Group. (2017). Corporate Governance 2017.

Etisalat. (2017-2019). Fact Sheet.

Etisalat. (2019). Company Profile.

Fernando, J. (2019). Correlation Coefficient.

Gernimo, A. (2018). Telecom subscribers in UAE rise to 24 million: TRA.

Glen, S. (2015). Multicollinearity: Definition, causes, examples.

Hsiao, C. (2007). Panel data analysis—Advantages and challenges. Test, 16(1), 1-22.

Kasyoki, M.A. (2016). The Effects of Board Characteristics on Financial Performance of Listed Commercial and Service Firms at Nairobi Securities Exchange (Doctoral dissertation, University of Nairobi).

Kenton, W. (2018). Audit Committee.

Kenton, W. (2018). Profitability Ratios.

Kenton, W. (2018). Variance Inflation Factor.

Khan, U. (2018). Evolution of telecom industry inevitable.

Rouse, M. (2016). Correlation.

Samoei, R.K., & Rono, L. (2016). Audit committee size, experience and firm financial performance. Evidence Nairobi Securities Exchange, Kenya.

Sharma, A. (2018). TRA assigns 5G frequencies to Etisalat and du.

Stephanie. (2015). Variance Inflation Factor.

Suárez, H.R. (2015). What is a correlation? And data analysis tools.

Telecommunications Regulatory Authority. (2014-2018). Telecommunication Sector.

Wakaba, R. (2014). Effect of audit committee characteristics on financial performance of companies listed at the Nairobi securities exchange (Doctoral dissertation, University of Nairobi).

Williams, S. (2018). Corporate governance in the UAE.

Yin, F., Gao, S., Li, W., & Lv, H. (2012). Determinants of audit committee meeting frequency: evidence from Chinese listed companies. Managerial Auditing Journal.

Zubair, A. (2016). Evaluation of the impact of audit committees on performance of listed deposit money banks in Nigeria. Unpublished doctoral dissertation. Ahmuda Bello University, Zaria, Nigeria.