Research Article: 2019 Vol: 23 Issue: 6

The Effect of Debt Ratios on Earnings per Share Comparative Study between Arab Bank and Housing Bank 2005 - 2018

Shireen Mahmoud Alali, Ajloun National University

Abstract

The study aimed to identify the effect of Debt ratios, and total assets on the earnings per share in Arab Bank and Housing Bank, and to examine if there statistically significant differences in the Debt ratios and earnings per share between Arab Bank and Housing Bank. The descriptive and analytical approach was followed. The study reached conclusions that there is a convergence ratio between the Arab Bank and the Housing Bank, which was slightly higher than in the Arab Bank. The study, showed that there is no statistically significant differences in Debt ratios between Arab Bank and Housing Bank. There is no statistically significant effect of Debt on earnings per share in Jordanian Banks. The results also indicated that the average earnings per share was in favor of Arab Bank. The study showed that the percentage of profitability of shares in both Banks decreased during the study period. The results indicated that there are statistically significant differences in the profitability of the shares of Arab Bank and Housing Bank. In light of the results, the study recommended Banks to study the risks of Debt and the feasibility study of leverage in achieving the appropriate return and risk reduction. The study also recommended investors to invest in Banks with larger assets to increase earnings per share and reduce investment risks.

Keywords

Debt Ratio, Earnings per Share, Total Assets.

Introduction

The company's financing decision is one of the most important financial decisions made by companies in different fields and activities. The concept of capital structure and its practical contents is very important for managers regardless of the field they work in. The capital structure formula is the result of the interrelationship between the tax benefits obtained by the company due to the high volume of debt and the risk of Bankruptcy. The capital structure formula prefer the use of financing through the issuance of shares, and its effect on the profitability of the company, where the issue of balancing the capital structure between loans and shareholders' equity is common for many companies (Awwal, 2013).

The relationship between Debt and earnings per share is an important financial issue that requires the attention and study of financial managers in financial companies, especially Banks. This importance showed by the role of borrowing funds in these companies development, especially if these funds are invested in investment fields rationally, as sound financial and administrative decisions lead to the integrity of the financial structure. Which achieves profitability consistent with liquidity, followed by solid financial position and financial ability to repay liabilities without the need to borrow from others with interest rates that outweigh the company's growth (Fatoki & Olweny, 2017).

Venugopal & Srivastava (2012) indicated that financial leverage is the process of using third-party funds at fixed financial costs. These funds may be represented in loans or preference shares, as both have a fixed financial cost and the Bank is obliged to pay; i.e. leverage related to the Bank's financing structure. On the external sources of financing, the degree of leverage increases, then leverage becomes beneficial and effective if the bank can invest borrowed funds at a rate of return that exceeds the borrowing funds cost. In addition, if the Bank fails to do so, it will be exposed to greater risks and greater loss, which means losing the advantage of leveraging the company's financing structure.

Financial leverage is desirable if the return on assets exceeds the cost of loans or interest. Therefore, the higher the leverage degree, the higher the return on equity rate on the assumption of improving economic conditions as it depends on the prevailing conditions. In addition, when the economic conditions are good, the profit margin will be high and vice versa (Enekwe et al., 2014).

Problem of the Study

The Banking sector is one of the main sectors in the economy, which most economic sectors are based, as well as it is an attractive institution for investors in financial markets. Therefore, the low earnings per share are one of the serious issues facing Banks and investors in the stock market. Many studies showed various factors that play a role in earnings per share, but they vary from one environment to another and from one country to another. Abu-Rub (2019) showed that there is a statistically significant effect of the financial ratios derived on the earnings per share at the Jordanian commercial Banks. Study of Al-Subaihi et al. (2018) showed that there is a positive and statistically significant relationship between leverage and earnings per share in Abu Dhabi Securities Exchange. While Barakat & Samhan (2014) showed that, there is a weak and inverse relationship between the leverage and the shares' value.

Due to earnings per share are often influenced by factors outside the financial domain such as political and economic factors, the problem of the current study is the clarity of the most influential factors in the earnings per share at Amman Stock Exchange, as well as the ambiguity of the Debt role in the profitability of shares of Jordanian Banks.

The problem of the current study is determined by answering the following questions:

1. What is the effect of Debt ratios on earnings per share at Arab Bank and Housing Bank?

2. Is there an effect for total assets on earnings per share at Arab Bank and Housing Bank?

3. Are there statistically significant differences in the Debt ratios between the Arab Bank and the Housing Bank?

4. Are there statistically significant differences in the earnings per share between the Arab Bank and the Housing Bank?

Objectives of the study

The current study aims to achieve the following objectives:

1. Identifying the effect of Debt ratios on earnings per share at Arab Bank and Housing Bank.

2. Recognizing the effect of total assets on earnings per share at Arab Bank and Housing Bank.

3. Identifying if there statistically significant differences in the Debt ratios and earnings per share between Arab Bank and Housing Bank.

4. Comparing the effect of Debt ratios on earnings per share at Arab Bank and Housing Bank.

Related Literature

It can be noted that Debt is the use of fixed cost financing, which is the degree or percentage of increase in profits as a result of using the funds of others (borrowing) in the company's operations to finance needs. In addition, it is the driving force behind the fluctuations of the stock, which is affected by the company's cash flows as well as generates a little diversity at the market level and greater diversity at the company level if the fluctuation of cash flows is higher (Sojeva, 2015).

Whereas Debt ratios considered as one of the main monitoring tools that help in assessing the company's financial structure at a certain date, in terms of its dependence degree on the funding sources, whether internal or external. The term financial leverage is often used to describe Debt ratios, where the higher the debt ratio, the greater the effect of leverage on the company's profits (Henry et al., 2012). In addition earnings per share refers to the dividend earned by the shareholder on each share he held at the company (Bank) (Khan et al., 2014).

There are many studies examined the relationship between the Debt ratios and earnings per share, including: Study done by Abu-Rub (2019) aimed to know the Effect of Financial Ratios Derived from Operating Cash Flow on Earnings per Share at Jordanian Commercial Banks Listed on Amman Stock Exchange, during the Period (2013-2017). The study showed that there is a statistically significant effect of the financial ratios derived from the operating cash flows on the earnings per share at the Jordanian commercial Banks.

The study of Aziz & Abbas (2019) aimed to examine the relationship between the financing method by different debts and the performance of companies in many sectors of Pakistan. The study result showed that debt financing has a negative, while it also has significant effect on the company's performance in Pakistan.

Whereas, the study of Al-Subaihi et al. (2018) aimed to identify the basic concepts of Debt and its relationship to return and risk, as well as the extent of its effect on earnings per share at many joint stock companies in the Abu Dhabi Securities Exchange for the period (2010-2015). The study result showed that there is a positive and statistically significant relationship between leverage and earnings per share in Abu Dhabi Securities Exchange.

In addition, the study of Ma’sh (2016) aimed to clarify the effect of leverage on the Earnings per Shares at companies listed on the Qatar Exchange for many companies during the period (2010-2015). The study results showed that there is a statistically significant correlation between the long-term debt ratios on Owners’ equity as well as the ratio of total debt to total assets and Earnings per Shares. The results also showed that shareholders' profits are increased by increasing leverage which results in fluctuations in profits.

The study of Korkmaz (2016) aimed to examine the relationship between debt ratios and profitability of companies engaged in manufacturing industry listed on the Istanbul Stock Exchange in Turkey for the period (1994-2015). The study results showed that actual growth and return on equity affect the new borrowing variables positively, while the current earnings per share adversely affect the new borrowing variables according to the investment.

Another study done by Ulzanah & Murtaqi (2015) sought to know the effect of earnings per share and debt to equity ratio on profitability, which is referred to as return on assets, for companies included in the (LQ45) Index through the period (2009-2013). The study results showed that earnings per share, debt to equity ratio and current ratio have a significant effect on profitability, as well as a positive effect on earnings per share.

However, the study done by Al-Sayeh (2014) aimed to identify the basic concepts of financial leverage and its effect on earnings per share and up to financial risks with an attempt to give the ideal picture of the capital structure. The study results showed that the leverage, which is measured by the Debt ratio, has an effect on the earnings per share from the realized profits, where it explained (7.30%), which is a strong and positive relationship.

Finally, the study of Barakat & Samhan (2014) aimed to analyse and study the effect of the financial structure, leverage and profitability on the industrial company's value as a long-term strategic analysis helps the analyst to predict the future value of the company in addition to the external environment. The study results showed that there is a weak and inverse relationship between the leverage and the shares' value. The study also reached that there is no statistically significant relationship between the leverage and the company's value. The study results also showed that there is a direct and statistically significant relationship between the return on equity and the capital structure, and the dependent variable of the stock market price.

Methodology

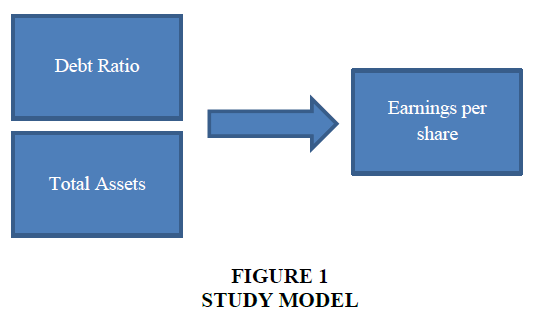

The study rely on the descriptive analytical method, which was used to describe the study variables' reality at the Jordanian commercial Banks in Figure 1. In addition, the study relied on Analytical approach to identify the effect of debt ratios on earnings per share comparative: study between Arab Bank and Housing Bank as the following:

1. Descriptive analytical method: to review the main literature related to the subject of the study with some analysis and comparisons whenever possible.

2. Methodology of the field study: came to cover the applied side of the study, which we try to test the validity of hypotheses and answer their questions.

Hypothesis

The current study seeks to test the following hypotheses:

H1: There is no statistically significant effect at (α≤ 0.05) between the Debt on the earnings per share at Arab Bank and Housing Bank.

H2: There is no statistically significant effect at (α≤ 0.05) between the total assets on the earnings per share at Arab Bank and Housing Bank.

H3: There is no statistically significant differences at (α≤ 0.05) in Debt ratio between Arab Bank and Housing Bank.

H4: There is no statistically significant differences at (α≤ 0.05) in the earnings per share between Arab Bank and Housing Bank.

The Population and Sample of the Study

The study population includes all 13 commercial Banks listed on the Amman Stock Exchange (http://www.cbj.gov.jo) in Table 1:

| Table 1 The Population of the Study | ||

| Date of Establishment | Commercial Banks in Jordan | |

| 1 | 1930 | Arab Bank |

| 2 | 1956 | Jordanian National Bank |

| 3 | 1960 | Bank of Jordan |

| 4 | 1960 | Amman-Cairo Bank |

| 5 | 1974 | Housing Bank for Commerce and Funding |

| 6 | 1977 | Kuwait-Jordan Bank |

| 7 | 1978 | Arab-Jordanian Investment Bank |

| 8 | 1989 | Bank of Arab Banking corp. |

| 9 | 1989 | Jordanian Bank for Investment and Funding |

| 10 | 1991 | Union Bank for Deposit and investment |

| 11 | 1965 | Industrial Development Bank |

| 12 | 1983 | Bayt Al-Mal for Deposit and Investment |

| 13 | 1978 | Jordanian-Islamic Bank |

Where two Banks, Housing Bank and Arab Bank were selected as the sample of the study.

Statistical Methods Used in the Study

Descriptive methods: such as percentages, arithmetic averages and standard deviation of study variables.

Regression test: to determine the effect of independent variables on the dependent variable.

Statistical Data Processing

The financial statements have been collected, which related to the effect of debt ratios on earnings per share study between Arab Bank and Housing Bank for the period (2005-2018), from the financial statements of these two Banks in Jordan. Statistical analysis was conducted using (SPSS) to test the study's hypotheses, where it was based on the arithmetic mean and regression test.

The Results of the Study First, Debt Ratio

Table 2 shows the Debt ratio during the period (2005-2018):

| Table 2 The Debt Ration During the Period (2005-2018) | ||||||

| Arab Bank | Housing Bank | |||||

| Year | Total Obligations |

Total assets | Debt ratio (%) |

Total Obligations |

Total assets | Debt Ratio (%) |

| 2005 | 14,956,174,000 | 16,815,804,000 | 88.941 | 2,801,219,864 | 3,196,252,968 | 87.641 |

| 2006 | 15,346,190,000 | 18,440,138,000 | 83.222 | 3,261,251,574 | 4,096,450,307 | 79.612 |

| 2007 | 17,672,037,000 | 21,220,031,000 | 83.28 | 4,129,777,729 | 5,020,071,766 | 82.265 |

| 2008 | 19,171,048,000 | 22,751,002,000 | 84.265 | 4,519,566,069 | 5,430,579,044 | 83.224 |

| 2009 | 19,298,285,000 | 23,099,491,000 | 83.544 | 5,123,864,965 | 6,090,337,737 | 84.131 |

| 2010 | 19,532,813,000 | 23,319,408,000 | 83.762 | 5,655,732,177 | 6,679,660,443 | 84.671 |

| 2011 | 20,107,961,000 | 23,921,485,000 | 84.058 | 5,889,334,069 | 6,937,969,687 | 84.886 |

| 2012 | 20,036,905,000 | 23,912,416,000 | 83.793 | 6,044,962,647 | 7,091,627,609 | 85.241 |

| 2013 | 20,582,958,000 | 24,538,372,000 | 83.881 | 6,169,994,828 | 7,227,090,355 | 85.373 |

| 2014 | 22,301,883,000 | 25,859,777,000 | 86.242 | 6,556,531,338 | 7,594,929,467 | 86.328 |

| 2015 | 22,341,021,000 | 25,859,162,000 | 86.395 | 6,883,358,473 | 7,922,698,728 | 86.881 |

| 2016 | 20,753,491,000 | 24,254,246,000 | 85.566 | 6,760,174,653 | 7,820,225,195 | 86.445 |

| 2017 | 20,811,663,000 | 24,361,572,000 | 85.428 | 7,028,963,806 | 8,145,194,167 | 86.296 |

| 2018 | 21,874,715,000 | 25,545,338,000 | 85.631 | 7,219,944,027 | 8,300,037,601 | 86.987 |

| Total | 19,627,653,143 | 23,135,588,714 | %84.85771429 | 5,574,619,730 | 6,539,508,934 | %85 |

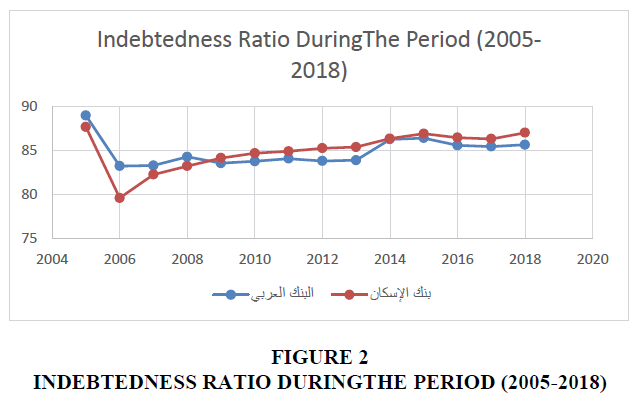

Table 2 & Figure 2 shows that the average of Debt ratio reached (84.858%), while Debt ratio in Housing Bank reached (85%) during the study period. Table 2 also shows that there is a fluctuating decrease in the Debt ratio during the study period in both Banks, where the arithmetic average of the Arab Bank's Debt ratio was (84.8577%), while the arithmetic average of Housing Bank was (85%), which indicate that there is presence of a close ratio in the Debt ratio at the two banks.

Second, Earnings per Share

Table 3 shows the Earnings per share during the period (2005-2018):

| Table 3 The Earnings Per Share During the Period (2005-2018) | ||||||

| Arab Bank | Housing Bank | |||||

| Year | Total Obligations |

Total assets |

Earnings Per share (%) |

Total Obligations |

Total assets |

Earnings per Share (%) |

| 2005 | 200,092,000 | 176,000,000 | 1.137 | 74,051,778 | 100,000,000 | 0.741 |

| 2006 | 263,277,000 | 356,000,000 | 0.74 | 94,705,866 | 250,000,000 | 0.379 |

| 2007 | 334,656,000 | 356,000,000 | 0.94 | 111,463,294 | 250,000,000 | 0.446 |

| 2008 | 360,174,000 | 534,000,000 | 0.674 | 101,322,745 | 252,000,000 | 0.402 |

| 2009 | 250,039,000 | 534,000,000 | 0.468 | 66,562,510 | 252,000,000 | 0.264 |

| 2010 | 145,085,000 | 534,000,000 | 0.272 | 88,437,238 | 252,000,000 | 0.351 |

| 2011 | 263,001,000 | 534,000,000 | 0.493 | 100,002,298 | 252,000,000 | 0.397 |

| 2012 | 261,341,000 | 534,000,000 | 0.489 | 104,488,612 | 252,000,000 | 0.415 |

| 2013 | 346,226,000 | 534,000,000 | 0.648 | 106,926,629 | 252,000,000 | 0.424 |

| 2014 | 217,844,000 | 569,600,000 | 0.382 | 123,917,229 | 252,000,000 | 0.492 |

| 2015 | 154,019,000 | 640,800,000 | 0.24 | 124,728,034 | 252,000,000 | 0.495 |

| 2016 | 212,414,000 | 640,800,000 | 0.331 | 131,012,613 | 252,000,000 | 0.52 |

| 2017 | 195,025,000 | 640,800,000 | 0.304 | 125,204,267 | 315,000,000 | 0.397 |

| 2018 | 433,514,000 | 640,800,000 | 0.677 | 94,526,738 | 315,000,000 | 0.3 |

| ????? | 259,764,786 | 516,057,143 | 0.556785714 | 103,382,132 | 249,857,143 | 0.430214 |

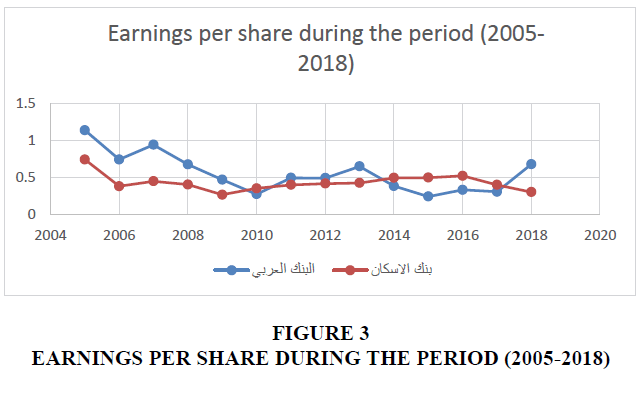

Table 3 & Figure 3 shows that the average of Earnings per share was in favor of the Arab Bank, where it reached (0.556785714), while Earnings per share in Housing Bank reached (0.430214) during the study period. Table 3 also shows that there is a fluctuating decrease in Earnings per share ratio during the study period in both Banks, where the arithmetic average of the Arab Bank's Earnings per share was (%4.5585655.0), while the arithmetic average of Housing Bank was (4.0440.0), which indicate that there is presence of a close ratio in Earnings per share ratio at the two banks.

Hypothesis Test

The first hypothesis

H1: There is no statistically significant effect at (α< 0.05) between the Debt on the earnings per share at Arab Bank and Housing Bank.

To test the hypothesis, a multiple regression test was used to know if there is a statistically significant effect at (α≤ 0.05) for the Debt on the earnings per share at Arab Bank and Housing Bank where Table 4 shows the test results.

| Table 4 Regression Analysis of the Relationship Between the Debt Ratio and Earnings per Share at Arab Bank and Housing Bank | |||||||

| Contrast Source | Total Squares | DF | Average Total Squares | R | R2 | F | Sig. |

| SSR | 0.047 | 1 | 0.047 | ||||

| SSE | 1.132 | 26 | 0.044 | 4..00 | 4.404 | 1.070 | 4.4.. |

| SST | 1.179 | 27 | |||||

b. Predictors: (Constant), Debt

Table 4 shows the effect of the Debt on the earnings per share at Arab Bank and Housing Bank. The results of statistical analysis showed no statistically significant effect, where the total squares due to the regression SSR (0.047) at the significance level (α ≤0.05). In addition, the calculated value of (F) was (1.052), which is less than its tabular value (4.17), and at a statistical significance level (0.311) which is higher than the specified value (0.05). Thus, we accept the nil hypothesis and reject the alternative hypothesis. This means there is no statistically significant effect at (α< 0.05) between the Debt on the earnings per share at Arab Bank and Housing Bank.

Second Hypothesis

H2: There is no statistically significant effect at (α≤ 0.05) between the total assets on the earnings per share at Arab Bank and Housing Bank.

To test the hypothesis, a multiple regression test was used to know if there is a statistically significant effect at (α≤0.05) for the total assets on the earnings per share at Arab Bank and Housing Bank where Table 5 shows the test results.

| Table 5 Regression Analysis of the Relationship Between the Total Assets and Earnings Per Share at Arab Bank and Housing Bank | |||||||

| Contrast Source | Total Squares | DF | Average Total Squares | R | R2 | F | Sig. |

| SSR | 1.67927E+17 | 1 | 1.67927E+17 | ||||

| SSE | 9.76269E+16 | 26 | 3.75488E+15 | 4.505 | 4.840 | 00.500 | 4.444 |

| SST | 2.65554E+17 | 27 | |||||

b. Predictors: (Constant): Assets-Total

Table 5 shows the effect of the total assets on the earnings per share at Arab Bank and Housing Bank. The results of statistical analysis showed a statistically significant effect, where the value of the correlation coefficient between independent variables and the dependent variable (R) reaches (0.795), while the coefficient of determination (R2) was (0.632). Therefore, the independent variable total assets was able to explain (63.2%) of the changes in the dependent variable earnings per share, indicating a suitable explanatory ability to measure the effect of the independent variable on the dependent variable. In addition, the calculated value of (F) was (44.722), which is higher than its tabular value (4.17), and at a statistical significance level (0.00) which is less than the specified value (0.05). Thus, we accept the alternative hypothesis and reject the nil hypothesis. This means there is statistically significant effect at (α< 0.05) for the total assets on the earnings per share at Arab Bank and Housing Bank.

Third Hypothesis

H3: There is no statistically significant differences at (α< 0.05) in Debt ratio between Arab Bank and Housing Bank.

To test the hypothesis, (ONE WAY ANOVA) test was used to know if there is a statistically significant differences at (α≤ 0.05) in Debt ratio between Arab Bank and Housing Bank, where Table 6 shows the test results.

| Table 6 One Way Anova test for Debt | |||||

| Contrast Source | total squares | DF | Average squares | F | Sig. |

| Between Groups | 4.139 | 1 | 4.139 | ||

| Inside Groups | 94.278 | 26 | 3.626 | 4.038 | 4.846 |

| Total | 94.417 | 27 | |||

Table 6 shows that there is no statistically significant differences at (α≤ 0.05) in Debt ratio between Arab Bank and Housing Bank, where the value of (F) was (0.038) at a statistical significance level (0.846) which is higher than the specified value (0.05).

Fourth Hypothesis

H4: There is no statistically significant differences at (α< 0.05) in earnings per share between Arab Bank and Housing Bank.

To test the hypothesis, (ONE WAY ANOVA) test was used to know if there is a statistically significant differences at (α≤0.05) in earnings per share between Arab Bank and Housing Bank, where Table 7 shows the test results.

| Table 7 One Way Anova Test for Earnings Per Share | |||||

| Contrast Source | total squares | DF | Average squares | F | Sig. |

| Between Groups | 4.112 | 1 | 4.112 | ||

| Inside Groups | 1.067 | 26 | 4.041 | 2.733 | 4.110 |

| Total | 1.179 | 27 | |||

Table 7 shows that there is no statistically significant differences at (α≤ 0.05) in earnings per share between Arab Bank and Housing Bank, where the value of (F) was (2.733) at a statistical significance level (0.110) which is higher than the specified value (0.05).

The Debt ratio at Arab Bank and Housing Bank is close; where in Housing Bank was slightly higher than at Arab Bank. In addition, the study showed no statistically significant differences at (α≤ 0.05) in the Debt ratios between Arab Bank and Housing Bank, where the researcher attributes this result to the convergence of the two banks in the nature of the tasks and are one of the most important banks in Jordan.

The study also showed that there is no statistically significant effect of Debt on earnings per share at Arab Bank and Housing Bank. This result is consistent with the study of Barakat & Samhan (2014), which showed that there is no statistically significant relationship between leverage and company value. Whereas, it differs with the study of Ma'sh (2016), which found a statistically significant relationship between the ratio of long-term debt on equity as well as the ratio of total debt to total assets and earnings per share. It also differ with the study of Al-Subaihi et al. (2018), which found a positive and statistically significant relationship between leverage degrees and earnings per share in Abu Dhabi Securities Exchange, where the researcher attributes this difference in that the study of Al-Subaihi et al. (2018) talked about the Debt related to leverage, which is usually used in high-yield investments.

The results also indicated that the average earnings per share were in favor of Arab Bank. The study showed that the earnings per share in both banks decreased during the study period, where the results indicated that there are statistically significant differences in earnings per share at Arab Bank and Housing Bank. The researcher attributes this result to the fact that Arab Bank's assets and investments are higher than the assets and investments in the Housing Bank, which gives it the ability to achieve higher returns for shareholders. In this regard, the study concluded that there is a statistically significant effect for total earnings on earnings per share at Arab Bank and Housing Bank, which confirms that the earnings ratio of Arab Bank shares exceeds the profit rate of Housing Bank shares. This result is consistent with the results of Abu-Rub (2019) study, which showed a statistically significant effect for financial ratios derived from operating cash flows on earnings per share at Jordanian commercial banks.

Conclusion

The study recommends that Banks should study the risk of Debt and the feasibility study of leverage in achieving the appropriate return and risk reduction. The study also recommends investors to invest in banks with larger assets to increase earnings per share and reduce investment risks. In addition, recommends conducting studies related to the factors related to earnings per share, especially in the cost of capital and capital structure in banks.

References

- Abu-Rub, L. (2019). The Effect of Financial Ratios Derived from Operating Cash.

- Al-Sayeh, Q. (2014). Attempting to measure the effect of leverage on dividends.

- Al-Subaihi, F., Abd-AlKadhem, M. & Salema, L. (2018). Debt and its effect on earnings per share and risk of joint stock companies in Abu Dhabi Securities Exchange for the period 2010-2015. Journal of Ceyhan University, Erbil(2), 220-247.

- Awwal, A. (2013). Application of Capital Structure in Creating Value for the Growth of Firms in Nigeria. European Journal of Business and Management, 5(31), 16-25.

- Aziz, S., & Abbas, U. (2019). Effect of Debt Financing on Firm Performance: A Study on Non-Financial Sector of Pakistan. Open Journal of Economics and Commerce, 2(1), 8-15.

- Barakat, A., & Samhan, H. (2014). The effect of financial structure, financial leverage, and profitability on value of shares of industrial companies: Applied study on a sample of Saudi Industrial Companies. Delhi Business Review, 15(2), 9.

- Enekwe, C.I., Agu, C.I., & Nnagbogu, E.K. (2014). The effect of financial leverage on financial performance: Evidence of quoted pharmaceutical companies in Nigeria. Journal of Economics and Finance, 5(3), 17-25.

- Fatoki, O.I., & Olweny, T. (2017). Effect of Earnings per Shares on Capital Structure Choice of Listed Non-Financial Firms in Nigeria. European Scientific Journal, 13(34), 230- 241.

- Henry, E., Robinson, T.R., & van Greuning, J.H. (2012). Financial analysis techniques. Financial Reporting & Analysis, 327-385.

- Khan, T.R., Islam, M., Choudhury, T.T., & Adnan, A.M. (2014). How earning per share (EPS) affects on share price and firm value. European Journal of Business and Management, 6(17), 97-101.

- Korkmaz, Ö. (2016). The Effects of Profitability Ratios on Debt Ratio: The Sample of the BIST Manufacturing Industry. Financial Studies, 20(2).

- Ma’sh, H. (2016). Attempt to measure the effect of leverage on equity returns: the status of the Qatar Exchange during the period (2010-2015). MA Thesis, kasdi merbah university Ouargla, Algeria.

- Sojeva, D. (2015). Economic and legal advantages to business financing through the issuance of bonds. Munich Personal RePEc Archive.

- Ulzanah, A.A., & Murtaqi, I. (2015). The Effect of Earnings Per Share, Debt To Equity Ratio, and Current Ratio Towards the Profitability of Companies Listed in Lq45 From 2009 To 2013. Journal of Business and Management, 4(1), 18-27.

- Venugopal, S., & Srivastava, A. (2012). Moving the Fulcrum: A primer on public climate financing instruments used to leverage private capital. World Resources Institute, Working Paper.