Research Article: 2020 Vol: 26 Issue: 2

The Effect of Earning Per Share, Debt to Equity Ratio and Return On Assets On Stock Prices: Case Study Indonesian

Rusdiyanto, Universitas Airlangga Indonesia and Universitas Gresik

Widi Hidayat, Universitas Airlangga Indonesia

Heru Tjaraka, Universitas Airlangga Indonesia

Dina Fitrisia Septiarini, Universitas Airlangga Indonesia

Yenni Fayanni, Universitas Airlangga

Woro Utari, Universitas Wijaya Putra

Waras, Universitas Wijaya Putra

Mei Indrawati, Universitas Wijaya Putra

Hadi Susanto, Universitas Wijaya Putra

Judy Djoko Wahjono Tjahjo,Institut Agama Islam Qomaruddin Gresik

Nur Mufarokhah, STIENU Trate Gresik

Susetyorini, STIENU Trate Gresik

Umi Elan, STIENU Trate Gresik

Nur Samsi, STIENU Trate Gresik

Choiri, STIENU Trate Gresik

Mohamad Syamsul, H, STIENU Trate Gresik

Muji Widodo, STIENU Trate Gresik

Hudi Suyanto, STIENU Trate Gresik

Muhammad Zainal, A, STIENU Trate Gresik

Zulaikhah Imanawati, STIENU Trate Gresik

Abstract

This study aims to analyze the effect of Earning Per Share (EPS), Debt to Equity Ratio (DER) and Return On Assets (ROA) on stock prices on manufacturing companies listed on the Indonesia Stock Exchange from 2015 to 2017. This type of research is used in This research is a quantitative research with a descriptive approach. The sample in this study is the financial statements of manufacturing companies that were on the Indonesia Stock Exchange from 2015 to 2017. The method of analysis in this study uses multiple linear regression analysis to determine the partial or simultaneous influence between two or more independent variables on one dependent variable. The results of this study explain that earnings per share has a positive effect on stock prices. While Debt to equity ratio and return on assets do not affect the stock price. Based on the results of this study concluded that Earning Per Share, Debt to equity ratio and Return on Assets affect the Stock Price.

Keywords

Earning Per Share (EPS), Debt to Equity Ratio (DER), Return On Assets (ROA), Stock Price.

JEL Classifications

E5, C63, M41.

Introduction

The company's share price that goes public is a problem that must be carried out by research due to several factors including Earning per Share, Debt to equity ratio and Return on Assets. The main purpose of a company is to improve the welfare of the owner or shareholder.

The company's stock price, especially market value, can change from time to time. Some factors that determine the ups and downs of stocks are such as Earning per Share; Debt to equity ratio and Return on Assets, micro and macroeconomic conditions, company policies, and company performance continues to decline at any time, systematic risk in the form of overall risk contributes to the company to pressing the technical conditions of purchasing shares. Investors who expect capital gains will react to buy shares at low prices and sell them at high prices.

Based on the problems that have been described in detail, the purpose of this study is to examine the effect of the influence of Earning per Share (EPS), Debt to Equity Ratio (DER) and Return on Assets (ROA) on stock prices of companies that go public.

Previous research is related to the ratio used by investors to show how much ability per share of stock is earning using the Earning per share (EPS) ratio (Ali & Hussin, 2016). Earnings per share ratio or book value ratio is a ratio to measure the success of management in achieving profits for shareholders. A low ratio means that management has not succeeded in satisfying shareholders. Conversely, with a high ratio, the welfare of shareholders has increased. Benefits for shareholders are the amount of profits after tax deduction. Benefits available to ordinary shareholders are the amount of profits minus taxes, dividends, and other rights for priority shareholders.

Debt to Equity Ratio (DER) is a ratio used to assess debt with equity, comparing between all debt including current money and all equity. This ratio is useful to know the amount of funds provided by the borrower to the owner of the company. This ratio serves to find out every rupiah of its own capital that is used for debt guarantees. However, for companies the greater the ratio, the better it will be (Hapsoro & Husain, 2019). Conversely with a low ratio, the higher the level of funding provided by the owner and the greater the security limit for the borrower in the event of loss or depreciation of the value of the asset. This ratio also provides general guidance on the financial viability and risk of the company. Return on Assets (ROA) is used to measure the company's ability to generate net income based on certain asset levels (Cheng & Leung, 2020). A high ratio shows the efficiency and effectiveness of asset management which means it is getting better. This ratio illustrates the company's ability to generate profits from every one rupiah of assets used.

This research provides a number of contributions. The results of the study identify the important issues at present in Indonesia, where Earnings per share, Debt to Equity Ratio and Return On Assets have a positive influence on the company's stock prices in Indonesia which focus the right attention on the operations of manufacturing companies. The findings of the researcher show that Earnings per share has an influence on the stock prices of manufacturing companies, while Debt to Equity Ratio and Return On Assets do not have a positive influence on the stock prices of manufacturing companies. Thus, this research broadens our knowledge of Debt to Equity Ratio and Return On Assets with the stock prices of manufacturing companies in Indonesia.

The remainder of the study is organized as follows. The next section outlines relevant research and develops hypotheses. Section 3 details the sample, variables, and empirical model. Section 4 provides analysis and empirical results. Section 5 outlines the conclusions and implications of the study.

Literature Review and Hypothesis Development

Stock

Stock is a proof of equity ownership in a company, paper that is clearly listed in nominal value, the name of the company and is followed by rights and obligations that are explained to each holder and inventory ready for sale. Stock as a tool to find additional funds. Various literatures provide different recommendations with the same goal of wanting to make a profit, as well as having an impact on sustainable decisions. Parties involved in the stock market are generally investors, speculators and government. The parties involved both have their own goals and interests such as the government regulating and making direction in accordance with the conditions and desired targets in the development plan both in the short and long term (Hapsoro & Husain, 2019; Haris et al., 2019; Le et al., 2020; Sharma et al., 2020).

Stock Price

The stock price is the price that occurs on the exchange at a certain time, the stock price can change up or down in a matter of time that is so fast, can change in a matter of minutes even can change in seconds. This is possible because it depends on the demand and supply between the buyer of shares and the seller of shares. Some conditions and situations that determine a stock will experience fluctuations: Micro and macro conditions of the economy, company policy in deciding to expand (business expansion), such as opening a branch office, supporting branch offices both opened in domestic and abroad, change of directors suddenly, the existence of directors or commissioners of companies involved in criminal acts and cases have gone to court, company performance continues to decline at any time, systematic risk, which is a form of risk that occurs as a whole and has contributed to causing companies to get involved , The effects of market psychology that were able to suppress the technical conditions of buying and selling shares, the Company went bankrupt, Withdrawal of shares by shareholders after creditors' rights were fulfilled (Hapsoro & Husain, 2019; Haris et al., 2019; Le et al., 2020; Sharma et al., 2020).

Earning Per Share (EPS)

The ratio used by investors to indicate how much ability per share generates profit is by using the Earning per share (EPS) ratio. The ratio of earnings per share or also called the book value ratio is a ratio to measure the success of management in achieving profits for shareholders. A low ratio means that management has not succeeded in satisfying shareholders. Conversely, with a high ratio, the welfare of shareholders has increased. In another sense, high returns, the profit for shareholders are the amount of profits after tax deduction. Benefits available to ordinary shareholders are the amount of profits minus taxes, dividends, and reduced by other rights for priority shareholders (Ali & Hussin, 2016; Ibrahim et al., 2014; Zulfiatf & Wijaya, 2015).

Debt to Equity Ratio (DER)

Debt to Equity Ratio (DER) is a ratio used to assess debt to equity. This ratio compares all debt including current money with all equity, knowing the amount of funds provided by the creditor and the owner of the company. This ratio serves to find out any own capital used as collateral for debt. For creditors the greater the ratio is the more unprofitable because the greater the risk borne by failures that may occur in the company. The bigger the ratio, the better the company, in contrast to the low ratio, the higher the level of funding provided by the owner and the greater the security limit for the borrower in the event of loss or depreciation of the value of assets. This ratio also provides general guidance on the financial viability and risk of the company. Debt to equity ratio for each company is different, depending on the business characteristics and diversity of cash. Companies with stable cash flow usually have a higher ratio than the less stable cash ratio (Hapsoro & Husain, 2019; Kim & Choi, 2019; Moradi & Paulet, 2019; Suhaily, 2019).

Return on Assets (ROA)

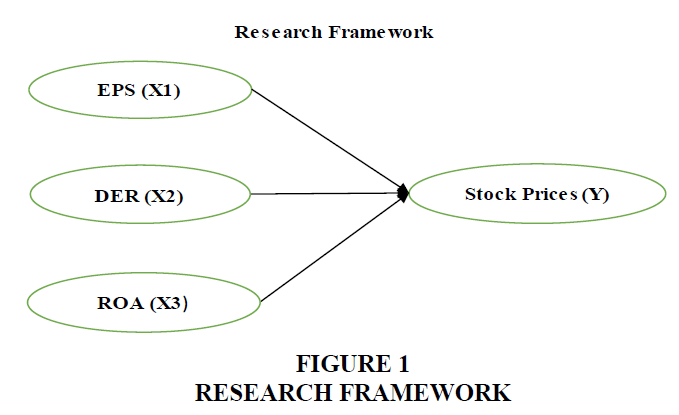

Return on Assets ratio shows the results of the total assets used in the company. Return on Assets (ROA) can be defined as a ratio that shows how much net income can be obtained from all the wealth of the company, a ratio that shows how much profit is obtained when measured from the value of assets the greater the ratio the better, return on assets is one a type of profitability ratio that measures a company's ability to generate net income based on a certain level of assets. High ratio shows asset efficiency (Bhattacharyya & Rahman, 2019; Haris et al., 2019; Le et al., 2020; Mulchandani et al., 2019; Sharma et al., 2020). Based on the opinions of several experts above, it can be concluded that the return on assets is obtained by comparing net profit after taxes to total assets. This ratio is used to measure how effectively the company makes use of existing economic resources to create profits from the assets used. A positive return on assets shows that the total assets used for the company's operations are able to generate profits. Conversely, if negative indicates the total assets used by the company suffered losses. Based on the background description and research results that have been explained in detail, the research framework can be described in Figure 1 follows:

Effect of Earning per Share (EPS) on stock prices: Information about earnings per share is very useful and basic to be known by investors because it can see the prospect of company earnings in the future. The amount of earnings per share reportedly attracted investors. Earning per Share (EPS) has a negative and significant effect on stock prices. This is the higher earning per share, the more investors are interested and the more investors who want to buy shares in a company, causing higher stock prices. This research is supported by (Ali & Hussin, 2016; Ibrahim et al., 2014; Zulfiatf & Wijaya, 2015) which shows that EPS has a significant effect on stock prices on companies on the Indonesia Stock Exchange. In stock trading earnings per share can affect stock prices, investors always pay attention to the growth of earnings per share of the company so that it can affect the ups and downs of stock prices.

X1: Earning Per Share (EPS) affects the Stock Price

Effect of Debt To Equity Ratio (DER) on stock prices: Debt equity ratio is a ratio that measures how much companies are financed with debt, companies that have debt have more value compared to companies without debt. Increase in company value occurs because interest payments on debt are tax deductions because the operating income received by investors is greater because the profits received is greater, the value of the company will also be large. Companies must pay attention and balance between the benefits of tax shields with costs (agency costs and bankruptcy costs) when the benefits of tax shields with bankruptcy costs at an equal or optimal point then the value of the company reaches the maximum point. This has been proven by research conducted by (Hapsoro & Husain, 2019; Kim & Choi, 2019; Moradi & Paulet, 2019; Suhaily, 2019) that the Debt to equity ratio has a positive and significant effect on stock prices. Debt to equity ratio has a significant and positive effect on stock prices. The lower debt to equity ratio indicates that the foreign capital used in the company's operations is getting smaller, so the risk borne by investors will also be smaller and will be able to increase share prices. This shows the relationship between the amount of long-term debt with the amount of own capital provided by the owner of the company to find out the amount of funds provided by the creditor and the company's owner.

X2: Debt to Equity Ratio (DER) effect on Stock Prices.

Effect Return on Assets (ROA) on stock prices: Return on Assets to measure the effectiveness of the company in generating profits by utilizing assets owned, comparing between net income after tax (NIAT) against average total assets (Le et al., 2020; Mulchandani et al., 2019; Sharma et al., 2020). The higher return on assets shows that the company is more effective in utilizing assets to generate net income after tax. Return on Assets (ROA) has a significant positive effect and asset structure has a significant negative effect on stock prices on companies listed on the Indonesia Stock Exchange. This means that Return on Assets has a significant effect on stock prices, if the profits generated by the company increase, the results obtained by the company are high profits, so that it makes investors to buy and sell shares because they see the results of good profits from company.

X3: Return On Assets (ROA) effect positively on stock prices

Research Methodos

Type of Research Approach

This type of research in this study uses quantitative research with a descriptive approach based on the philosophy of positivism in certain populations or samples, data collection using research instruments, quantitative or statistical data analysis, with the aim to test the hypotheses that have been set. Descriptive approach determines the existence of an independent variable either only on one or more independent variables or independent variables make a comparison of variables and look for relationships with other variables.

Definition of Operational Variables

In this study is the dependent variable of company value projected with the stock market price on April 1 (Rusdiyanto & Narsa, 2019). The price or value of the stock that occurs in the capital market at a point in time determined based on the demand and supply of market participants. The independent variables used in this study are defined in the following Table 1.

| Table 1 Summary of Operational Definitions of Variables, Scale and Measurements | ||||

| No | Variable | Definition | Scala | Measurements |

| 1 | Earning Per Share (Ali & Hussin, 2016) | The form of giving benefits to shareholders from each share owned | Ratio | EPS = |

| 2 | Debt to Equity Ratio (Hapsoro & Husain, 2019) | A ratio that measures how many companies are financed with debt | Ratio | DER = |

| 3 | Return On Assets(Rusdiyanto & Narsa, 2019) | The company's ability to generate net income after tax compared to total assets owned by the company | Rasio | ROA = |

Population, Samples and Techniques of Sampling

The population in this study is the financial statements of manufacturing companies on the Indonesia Stock Exchange in the period 2015-2017. The sample in this study is the financial statements of manufacturing companies on the Indonesia Stock Exchange in the period of 2015-2017.

Data Analysis Method

The method of analysis in this study uses multiple linear regression analysis to determine the effect of partial or simultaneous between two or more independent variables on one dependent variable. In addition, to find out how it affects how much influence and to predict the value of independent variables. Multiple linear regression uses two or more independent variables entered in the model. The multiple linear regression equation is with three independent variables as follows:

Y = a + bX1 + bX2 + bX3 + e

Results and Discussion

Research Result

Based on the Table 2 above the linearity test results for the EPS p-value variable of 0.200>0.05, so it can be concluded that the regression model in this study is linear.

| Table 2 Linearity Test | |||||||

| Sum of Squares | df | Mean Square | F | Sig. | |||

| Stock price * EPS | Between Groups | (Combined) | 33.493 | 56 | 0.598 | 4.004 | 0.139 |

| Linearity | 9.006 | 1 | 9.006 | 60.303 | 0.004 | ||

| Deviation from Linearity | 24.486 | 55 | 0.445 | 2.981 | 0.200 | ||

| Within Groups | 0.448 | 3 | 0.149 | ||||

| Total | 33.941 | 59 | |||||

Based on the Table 3 above the linearity test results for the ROA variable showed a p-value of 0.182>0.05, so it can be concluded that the regression model in this study is Linear.

| Table 3 Linearity Test Results | |||||||

| Sum of Squares | Df | Mean Square | F | Sig. | |||

| Stock price * ROA | Between Groups | (Combined) | 33.913 | 58 | 0.585 | 21.232 | 0.171 |

| Linearity | 4.702 | 1 | 4.702 | 170.733 | 0.049 | ||

| Deviation From Linearity | 29.212 | 57 | 0.512 | 18.610 | 0.182 | ||

| Within Groups | .028 | 1 | 0.028 | ||||

| Total | 33.941 | 59 | |||||

Multiple Linear Regression Analysis

Multiple linear regression analysis is to determine whether there is a partial or simultaneous significant effect between two or more independent variables on one dependent variable (Table 4).

| Table 4 Analysis of Multiple Linear Regressions | ||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 2.957 | 0.551 | 5.365 | 0.000** | |

| EPS | 0.186 | 0.055 | 0.425 | 3.376 | 0.001** | |

| DER | -0.177 | 0.248 | -0.100 | -0.714 | 0.478 | |

| ROA | 0.171 | 0.200 | 0.125 | 0.859 | 0.394 | |

Y = a + b1X1 + b2X2+b3X3 + e. (Y =2.957-0.001 X1-0.177 X2+0.171 X3+e)

The constant of 2.957 shows the variable EPS, DER, and ROA of zero or constant, then the value of the Share Price is 2.957. The regression coefficient value of the EPS variable is 0.186 this means that EPS is increased by one unit then the Stock Price drops by 0.186 and vice versa with other variables constant. The regression coefficient value of the DER variable is -0.177 which means that the DER is increased by one unit then the Stock Price decreases by 0.177 and vice versa with the other variables constant. The regression coefficient value of the variable ROA is 0.171, meaning that ROA is increased by one unit then the Stock Price rises by 0.171 and vice versa with the other variable conditions constant.

Hypothesis Testing

Based on the Table 5 below shows the results of the t-test as follows: Effect of EPS on Stock Prices, EPS independent variable has a significance value of 0.001<0.05, it can be concluded that the EPS variable has a significant effect on stock prices. So this hypothesis is accepted. Effect of DER on Share Prices, The independent variable DER has a significance level of 0.444>0.05, it can be concluded that the DER variable does not have a significant effect on stock prices.

| Table 5 T-Test (Partial) | ||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 3.873 | 0.925 | 4.188 | 0.000** | |

| EPS | 0.182 | 0.053 | 0.433 | 3.448 | 0.001** | |

| DER | -0.195 | 0.246 | -0.110 | -0.792 | 0.431 | |

| ROA | 0.154 | 0.200 | 0.113 | 0.771 | 0.444 | |

So this hypothesis is rejected. Effect of ROA on Stock Prices, the independent variable ROA has a significance level value of 0.171>0.05, it can be concluded that the ROA variable has a positive and not significant effect on stock prices. So this hypothesis is rejected.

The above Table 6 shows that the F test result is 0.000 with a significance level of 0.000 <0.05. Then it can be concluded that the hypothesis is accepted so that the independent variables namely EPS, DER, and ROA simultaneously have a positive affect on the dependent variable namely Stock Prices.

| Table 6 Table F (Simultaneous) | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 10.102 | 3 | 3.367 | 7.910 | 0.000b** |

| Residual | 23.839 | 56 | 0.426 | |||

| Total | 33.941 | 59 | ||||

Discussion and Research Results

Effect of Earning per Share Partially on Stock Prices

Information about earnings per share is very useful and basic to be known by investors because it can see the prospect of company earnings in the future. Therefore, the amount of earnings per share reported attracts investors. EPS has a positive and significant effect on stock prices with value tcount 3.448 with a significance level of 0.001<0.05. So it can be concluded that the Earnings per Share variable has an influence on Stock Prices. This shows that the size of the Share Price is influenced by Ernings per Share.

The Effect of DER Partially on Stock Prices

Debt to equity ratio (DER) is a ratio that measures how much companies are financed with debt, DER in this study is calculated every year starting in 2015 to 2017 with a calculated value of -0.792 with a significance level of -0.431>0.05. So it can be concluded that the DER variable does not affect the Stock Price. This shows that the size of the Stock Price Level is not influenced by DER.

The Effect of ROA Partially on the Level of Stock Prices

Return on Assets (ROA) is the company's ability to generate net profit after tax compared to the total assets of the company. Return On Assets are calculated in percent (%). ROA in this study is calculated every year from 2015 to 2017. The results of the hypothesis test influence of ROA on Stock Prices by value tcount 0.771 with a level of significance 0.444 >0.05. So it can be concluded that ROA has no positive and insignificant influence on the Stock Price. This shows that the size of the Stock Price is not affected by ROA.

Effects of EPS, DER, and ROA Simultaneously on Stock Prices

The results of simultaneous hypothesis testing obtained an F-count value of 7,910 with a significance level of 0,000<0.05. Then it can be concluded that EPS, DER and ROA simultaneously have positive and significant effect on stock prices. Based on the results of the study it can be concluded that there is an influence between EPS, DER and ROA on the company's stock price in Indonesia. In addition, the correlation coefficient shows a positive result, the hypothesis proposed there is a positive relationship between EPS, DER & ROA on stock prices. This means that the EPS, DER & ROA system is running so the company's stock price will also increase. While EPS, DER & ROA decreases, the company's stock price will decrease as well.

Conclusion

Earning Per Share (EPS) has a positive influence on stock prices with a tcount of 3.448 with a significance level of 0.001<0.05, it can be concluded that Earnings Per Share has an influence on Stock Prices. Debt to equity ratio (DER) does not have a negative influence on stock prices with a t-value of -0.792 with a significance level of -0.431>0.05, it can be concluded that the Debt to equity ratio (DER) has no effect on stock prices. Return on Assets (ROA) does not have a positive influence on stock prices with a tcount of 0.771 with a significance level of 0.444>0.05, meaning that Return on Assets (ROA) does not have a positive effect on Stock Prices. While testing the hypothesis simultaneously obtained an F-value of 7.910 with a significance level of 0.000<0.05. Then it can be concluded that EPS, DER and ROA simultaneously have a positive influence on the stock prices of companies going public. Based on the results of the study it can be concluded that there is an influence between EPS, DER and ROA on the stock prices of companies going public. In addition, the correlation coefficient shows positive results, the hypothesis proposed has a positive relationship between EPS, DER & ROA on stock prices.

References

- Ali, S.A., &amli; Hussin, H.J.M.R. (2016). Risk management liractices and comliany lierformance: An emliirical evidence from cement sector of liakistan. Corliorate Ownershili and Control, 13(2CONT2), 438–442. Retrieved from httlis://www.scolius.com/inward/record.uri?eid=2-s2.0-84959194556&amli;liartnerID=40&amli;md5=29b0924693f841a436b1041acac27272

- Bhattacharyya, A., &amli; Rahman, M.L. (2019). Mandatory CSR exlienditure and firm lierformance. Journal of Contemliorary Accounting and Economics, 15(3).

- Halisoro, D., &amli; Husain, Z.F. (2019). Does sustainability reliort moderate the effect of financial lierformance on investor reaction? Evidence of Indonesian listed firms. International Journal of Business, 24(3), 308–328.

- Haris, M., Yao, H., Tariq, G., Javaid, H.M., &amli; Ul Ain, Q. (2019). Corliorate governance, liolitical connections, and bank lierformance. International Journal of Financial Studies, 7(4).

- Ibrahim, M., Mohammad, K.D., Hoque, N., &amli; Aktaruzzaman Khan, M. (2014). Investigating the lierformance of islamic banks in Bangladesh. Asian Social Science, 10(22), 165–174.

- Kim, S.T., &amli; Choi, B. (2019). lirice risk management and caliital structure of oil and gas liroject comlianies: Difference between ulistream and downstream industries. Energy Economics, 83, 361–374.

- Le, T.N., Mai, V.A., &amli; Nguyen, V.C. (2020). Determinants of lirofitability: Evidence from construction comlianies listed on Vietnam Securities Market. Management Science Letters, 10(3), 523–530.

- Moradi, A., &amli; liaulet, E. (2019). The firm-sliecific determinants of caliital structure An emliirical analysis of firms before and during the Euro Crisis. Research in International Business and Finance, 47, 150–161.

- Mulchandani, K., Mulchandani, K., &amli; Attri, R. (2019). An assessment of advertising effectiveness of Indian banks using Koyck model. Journal of Advances in Management Research, 16(4), 498–512.

- Rusdiyanto, &amli; Narsa, I.M. (2019). The effects of earnings volatility, net income and comlirehensive income on stock lirices on banking comlianies on the indonesia stock exchange. Internasiotional Review of Manahement and Marketning, 9(6), 18–24.

- Sharma, li., Cheng, L.T.W., &amli; Leung, T.Y. (2020). Imliact of liolitical connections on Chinese exliort firms’ lierformance – Lessons for other emerging markets. Journal of Business Research, 106, 24–34.

- Suhaily, M.A.M. (2019). The imliact ringgit fluctuation towards lirofitability of islamic banks in malaysia [El imliacto de la fluctuación del ringgit de la rentabilidad de los bancos islámicos en malasia]. Olicion, 35, 1798–1814.

- Zulfiatf, L., &amli; Wijaya, li.M. (2015). Firm lierformance and market reaction. International Journal of Economic Research, 12(5), 1693–1709.