Research Article: 2022 Vol: 26 Issue: 2

The Effect of Financial Flexibility on Reducing Financial Fragility: An Analytical Study of a Sample of Commercial Banks Listed in the Iraq Stock Exchange through 2004 To 2019

Rafiaa Ibrahim AL-Hamdani, University of Mosul

Abd ALjalil A. Omran, University of Mosul

Citation Information: AL-Hamdani, R.I., & Omran, A.A. (2022). The effect of financial flexibility on reducing financial fragility: an analytical study of a sample of commercial banks listed in the iraq stock exchange through 2004 to 2019. Academy of Accounting and Financial Studies Journal, 26(2), 1-11.

Abstract

The current study aims at testing the effect of financial flexibility upon reducing financial fragility in a sample of commercial banks, specifically (9) commercial ones listed on the Iraqi Stock Exchange from 2004 to 2019. The debt-to-equity ratio was determined as an indicator for measuring financial flexibility, And the Texas indicator for measuring financial fragility. The descriptive and analytical approach was used in the financial description and statistical analysis in the practical side of the data and information contained in the financial reports and statements of the sample studied. It also used ready-made software, including Excel (2010) and (SPSS.V.22), to test the hypothesis, Answer the question related to the study problem and reach the goals. The research also reached a set of results, The most important of which is, Financial flexibility affects the reduction of financial fragility, And the research presented a set of recommendations, Including, The need to work on finding a flexible financing structure that meets the financial needs of the bank, And takes into account the return and risk on the one hand, And the deadlines of financial obligations on the one other hand.

Keywords

Financial Flexibility, Financial Fragility, Texas Index.

Introduction

The Iraqi banking sector undergoes several issues, Most notably the instability of the financial system in Iraq and the weak role of the Iraqi stock market, In addition to the negative impression prevailing on banks in Iraqi society. This was confirmed by some studies that indicated only (10%) of the Iraqi population have bank accounts (Al-Taie & Al-Jubouri, 2017). World Bank reports indicate that the Iraqi banking sector is slowly improving due to the limited services provided by this sector in particular and the weak role of the stock market in general. Because of the importance of the role played by banks in supporting financial systems, let us move towards studying the causes of fragility in this section and researching the extent to which banks listed in the Iraqi Stock Exchange can employ financial flexibility to reduce financial fragility (Hussain et al., 2020).

Research Problem

The problem of the study stems from the following main question:

1-Does financial flexibility have an impact on reducing financial fragility?Some sub-questions of the study can also be raised:

a. What are the levels of financial flexibility in the banks?

b. What is the extent of financial fragility faced by the investigated banks?

Research Hypotheses

For answering the questions posed in the research problem and reaching the research objectives, the study started from the following hypotheses:

a. The investigated banks suffer from high financial fragility.

b. There is a statistically significant effect of financial flexibility in reducing financial fragility.

Research Importance

The study is of importance due to the significance of the sample investigated, Because the bank sector is one of the important pillars of the financial systems in general, The other aspect of the importance of the study it focused on modern concepts that need multiple studies to enrich them and show their importance, And the most important aspect of this study is an attempt to develop treatments for the risks of financial fragility on banks and ways to employ financial flexibility to reduce them.

Research Objectives

There are several objectives that the research seeks to achieve, including:

1. Measuring the degree of financial flexibility enjoyed by the investigated banks.

2. Measuring the degree of financial fragility experienced by the investigated banks.

3. Determining the most prominent indicators of financial fragility.

4. Choosing the extent of the impact of financial flexibility to reduce fragility in the investigated banks.

Research Limitations

1. Spatial limits: A group of banks listed in the Iraq Stock Exchange were selected.

2. Temporal limits: a study that covered a period of (16) years, Spanning from (2004) to (2019).

The reason for choosing this period is due to the novelty of the time period and the availability of financial statements and statements on the official website of the Iraq Stock Exchange.

Research Method

The descriptive approach was used in presenting concepts and the theoretical aspect of the research, and the analytical and quantitative approach in analyzing data using financial ratios and models to calculate financial flexibility and financial fragility. The statistical methods and programs (SPSS.V.22) were used to test the effect between the research variables. The following Figure 1 represents the relationship between the research variables.

Theoretical Background

Reviewing Previous Studies

Among similar studies, there is a study by Yahaya et al. (2015) that used the empirical method “case study” To examine the performance of the Islamic Bank in Nigeria. The study assumed a positive relationship between several variables, including financial flexibility with profitability and growth. The study found acceptance of the previous assumption in light of the results of the tests it conducted. As for study by (Al-Amri, 2018) tested the impact relationship between financial flexibility and financial recovery in Iraqi banks, According to the descriptive and analytical approach, And concluded that there is an impact relationship between financial flexibility and financial recovery in the surveyed banks. As for the study by (Al-Taie & Al-Jubouri, 2017), It followed the analytical and quantitative approach to test the relationship between financial flexibility and banking fragility in a number of Iraqi commercial banks. This study reached a number of results, including the existence of a significant statistically significant effect of financial flexibility in reducing banking fragility.

Financial Flexibility

The Concept of Financial Flexibility

Financial flexibility represents the company ability to respond effectively to unexpected financial shocks or future investment opportunities. It is the main driver of financial management decisions in choosing the capital structure (Bancel et al., 2010). Financial flexibility refers to the company ability and speed to mobilize the financial resources necessary for its reactive, Preventive and exploitative actions under the conditions of an unstable environment (Al-Ghaliby & Al-Zubaidi, 2017). The concept of financial flexibility focuses on the company ability to respond to financial needs and the ability to adjust the timing of needs to overcome unexpected crises and exploit unexpected profitable investment opportunities (Ibrahim & Abdul Sattar, 2019).

Sources of Financial flexibility

Theoretically, companies have various sources of financial flexibility, which will determine their ability to face crises and respond to unexpected shocks effectively. In this context, three basic financial flexibility and measurement tools can be adopted:

1. Cash assets: They are cash and equivalent cash “securities” and short-term investments that are announced in the balance sheet. The cash management of the company is able to pay its operational obligations and avoid financial hardship if enough cash assets are kept, As well as achieving another goal, which is not to lose investment opportunities due to the freezing of funds and non-exploitation (Al-Tai & Al-Jubouri, 2017).

2. The ability to borrow: It is the company ability to obtain new loans with low risk and cost and an appropriate expected return, where the value of the liquidated assets is estimated as collateral for the company total debts. The exhaustion of this hypothetical ability means the possibility of entering into financial hardship in the future (Balali, 2019).

3. Net cash flow: Maintaining cash assets out of prevention or speculation depends on the nature of the investment in the company, which seeks to achieve high returns to bear the fluctuations in investment risks and cash flows significantly (Balali, 2019). Cash flow is defined as a statement of the company cash flows that is divided on the basis of operating activity into outflows and inflows. Cash flow provides information on credit standing, solvency and ability to finance working capital needs. Through this flow it is possible to assess the quality of income generated by each activity (Al-Ta’i & Al-Jubouri, 2017).

Companies can be financially flexible and avoid the financial risks resulting from investment and secure adequate funding for these opportunities from several sources, including:

1. Maintaining the ability to borrow and issue bonds at least in the short term.

2. Maintaining high cash levels by recovering net cash flows.

3. The possibility of selling assets that do not affect the operating and investment needs.

4. Reducing dividends and increasing the return on equity (Ibrahim & Abdul Sattar, 2019).

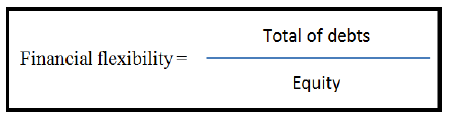

Measuring Financial Flexibility

There are many studies that dealt with the measure of financial flexibility, But the most consistent with our study are (Bancel et al, 2010), (Alawi, 2019), and (Al-Amri, 2018), Which indicated using the debt-to-equity ratio as an indicator to measure financial flexibility, Which reflects the company financing policy and the extent of its reliance on borrowing to finance its current activities.

Financial Fragility

The Concept of Financial Fragility

Financial fragility is the instability that arises from an imbalance in the financial structure of the company, which makes it constantly vulnerable to financial fluctuations. The higher the sensitivity of the financial structure, the smaller the financial shock is sufficient to cause a significant change in the company financial behavior (Sordi & Verceli, 2003). Financial fragility can be defined as a state of imbalance, which can be likened to a stick bending under pressure and ready to bounce back, until the pressure reaches a certain point that causes it to break. The case of pressure is represented by a decline in profit rates, which leads to a decline in activity and estimates become more pessimistic about future profitability. Cash inflows become directed towards debt service, and eventually collapse and bankruptcy occur (Schroeder, 2016). As for the banking sector, it is the situation resulting from excessive bad lending, which results in a high probability of default, which gives way to financial instability due to the decline in returns. Losses accumulate and over time lead to bankruptcy (Loayza & Ranciere, 2005).

Hypotheses of Financial Fragility

There are three perspectives explaining financial fragility:

1. The hypothesis of government guarantees and moral risks in the banking industry: It confirms the first view, which has received the most attention and acceptance, among the rest of the other hypotheses. Financial fragility arises from the low fear of banks of falling into financial problems or crises due to the financial aid provided by governments or central banks in the event of banks failure, which means that they do not face the full risks of their investments alone. Therefore, they are excessively motivated to invest their money in high-risk investments or provide loans with low collateral on a large scale, And this excessive risk is the root cause of financial fragility. The justification of governments in their intervention to restore stability to troubled banks because of the role they play in providing the economy with liquidity. The failure of one of the banks motivates depositors in other banks to withdraw their deposits for fear that the effects of the crisis will be transmitted to the rest of the banks. (Allen et al, 2015 ).

2. The original sin hypothesis: The second opinion in explaining financial fragility is that the incompleteness of financial markets leads to the inability of companies to use the local currency for external borrowing, or even long-term internal borrowing, due to future fears of currency mismatch. Companies are forced to borrow in foreign currencies to secure their investment needs, which generate returns in local currency, or resort to financing their long-term investments by borrowing short-term. The previous mismatch does not necessarily result from lack of companies to the required insight, to match the structure of assets and liabilities, but rather the incompleteness of financial markets is the most important cause of financial fragility (Vankatesh & Hiremath, 2020).

3. The hypothesis of the commitment problem: The third point of view in explaining financial fragility seeks to focus on the difference in financial transactions from other ones, As they are accompanied by a financial commitment at later periods of time, Which may result in the emergence of problems of non-payment and implementation of the commitment, For various reasons, Including changing prices exchanges that are outside the will of the borrower, or the absence of legal institutions that provide sufficient speed to retrieve loan guarantees in the event of default. The value of the guarantee was more than the value of the loan, but if the value of the guarantees is less than the value of the loan, the lenders do not benefit from it, and hence financial fragility arises (Eichengreen & Hausmann, 1999).

Causes of Financial Fragility

Many studies cite the financial crisis that occurred in 2008 or the so-called (the mortgage crisis), which erupted due to the excessive trading of financial derivatives, in an escalating manner, Which led to a decrease in the actual value of real estate with lower levels of the financial guarantees encumbered by it, To extend its effects after that. To the rest of the financial sectors in the United States, and then moved across the border to the rest of the world. The bursting of the real estate bubble is due to a banking crisis (Mohieddin, 2000). Hence, we can mention some of the reasons for financial fragility, which are as follows:

External causes of financial fragility: A group of reasons that affect the financial position of the company and are outside its control and do not bear responsibility for its occurrence, and affect the financial environment in general, among which we mention:

The tendency of countries to liberalize their financial systems, Or to lift restrictions on the movement of capital, which we mention from some of its negative effects:

1. Ease of transmission of crises across borders.

2. National capital flight risks under the pretext of investment or trading.

3. The risk of accumulating liquidity due to the free movement of funds.

4. Risks of debt globalization: For example, Some Arab countries have converted their foreign debts to some developing countries into securities that are traded in the international financial markets, which eventually lead to the emergence of a new type of risk similar to the financial risks that led to the mortgage crisis in the United States (Khaldi & Hazerchi, 2019).

The fragility of the financial markets due to the excessive issuance of new securities, which are often evaluated by investors as false. They are issued due to the lack of sufficient liquidity to pay the financial obligations of the issuer.

The fiscal and monetary policies that governments follow to influence the levels of activity and competition, including currency exchange rates, Setting interest Rates, and control and supervision controls for central banks (Rossi, 1999).

The internal causes of financial fragility: A group of reasons related to the financial position of companies, and their financing and investment policies, Which determine the degree of their tolerance for financial risks, Including:

1. The low quality of banking services makes it less attractive to new depositors, so the current depositors withdraw their deposits, which reduces liquidity at banks, Which negatively affects the decline in profits (Sordi& Verceli, 2003).

2. Weak explanatory capabilities of banks, and weak governance systems that relieve management of financial problems or crises faced by banks.

3. NS. Excessive low-guaranty loans in compared to high quality loans, which increases the risk of default.

4. Excessive speculation and financing fake projects, which absorb liquidity and ultimately lead to financial crises, and then sell assets at low prices to meet debt obligations.

5. Extensive use of short-term loans, which increases the risk of low liquidity and multiple ability to repay (Schroeder, 2016).

Financial Fragility Measurement

The measurement of financial fragility is of interest in many studies in which different models were used, according to the main indicators of each system, On the basis of which periods of instability are evaluated, According to certain determinants. Therefore, We chose the most suitable model for the study sample:

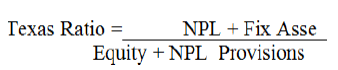

Texas Index

This indicator is used to study the safety of commercial banks, and the possibility of financial hardship that warns of financial fragility leading to bankruptcy and liquidation. This indicator was built based on the ratio of non-producing assets (non-productive loans + fixed assets) to provisions for doubtful debts + equity, according to the following equation:

Where:

NPL: Non-Producing Loans.

Equity: Equity.

NPL provisions: provision for doubtful debts.

Fix Asset: Fixed assets.

The value of this indicator is (the correct one), and the results of this indicator being higher than this value indicate the financial fragility of the studied bank (Al-Hamawi, 2016).

The Practical Side

Financial description of the research variables

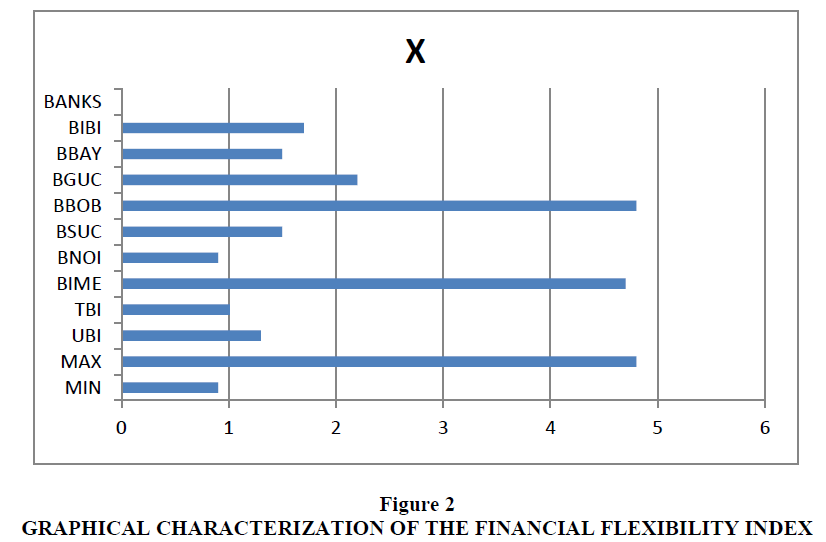

1-Analysis of the results of the Financial Flexibility Index (X)Table 1 show the statistical description of the data of the financial flexibility index (debt-equity ratio) for the study sample banks for the period (2004-2019), as the highest value (4.8) was in the Bank of Baghdad, And the lowest value (0.9) was in the National Bank.

| Table 1 Financial Characterization of the Financial Flexibility Index for Commercial Banks Study Sample for the Period (2004-2019) | |||||||||||

| BANKS | BIBI | BBAY | BGUC | BBOB | BSUC | BNOI | BIME | TBI | UBI | MAX | MIN |

| X | 1.7 | 1.5 | 2.2 | 4.8 | 1.5 | 0.9 | 4.7 | 1.01 | 1.3 | 4.8 | 0.9 |

The data in the table can be illustrated graphically through Figure 2:

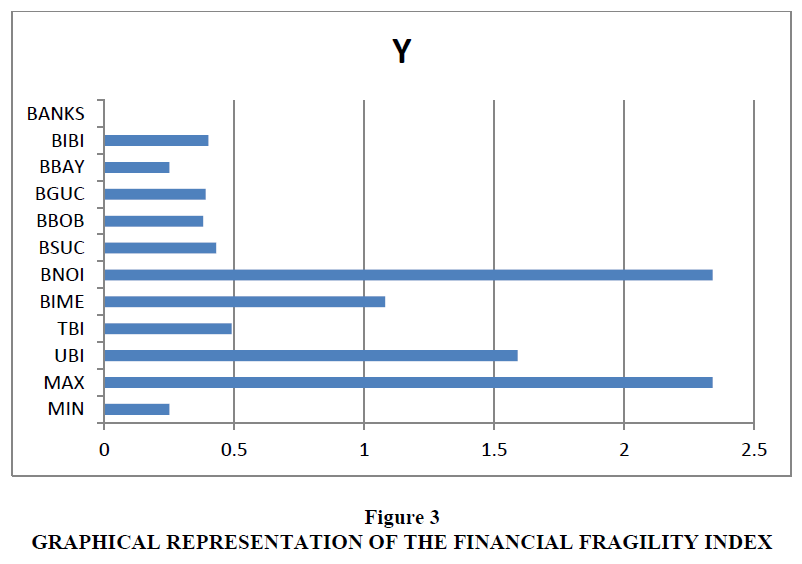

Analysis of Texas Fragility Index Results

In this part, the results of the statistical analysis of the approved variable (financial fragility), after using Texas indicator as a tool for measuring financial fragility in the surveyed banks, were discussed. (2004-2019), Where the highest value was (2.34) in the National Bank, and the lowest value was (0.25) in the Bank of Babel in Table 2.

| Table 2 Statistical Description of the Financial Fragility Index | |||||||||||

| BANKS | BIBI | BBAY | BGUC | BBOB | BSUC | BNOI | BIME | TBI | UBI | MAX | MIN |

| Y | 0.48 | 0.25 | 0.39 | 0.38 | 0.43 | 2.34 | 1.08 | 0.49 | 1.59 | 2.34 | 0.25 |

Figure 3 represents the graphic description of the financial fragility index for the study sample:

Statistical Analysis and Testing Hypothesis

The first hypothesis (the studied banks suffer from high financial fragility. In order to analyze this hypothesis, the One-Sample T-Test was used. Table 3 shows the descriptive statistics of the research sample, Where the column (N) shows the number of observations of the research sample, Which is (144). The arithmetic mean of the sample means was (0.8253), The standard deviation (0.93543), And the mean standard error (0.7795).

| Table 3 Descriptive Statistics for the Financial Fragility Variable | ||||

| N | Mean | Std. Deviation | Std. Error Mean | |

| Fragility | 144 | .8253 | .93543 | .07795 |

Table 4 shows the results of the One-Sample T-Test, As the value of (t) is (-2.241), the degree of freedom (N-1) is (143), And the level of morale of the test is (0.027).

| Table 4 Testing the Average Differences in Financial Fragility in Banks, the Research Sample | ||||||

| Test Value = 1 | ||||||

| t | df | Sig. (2-tailed) | Mean Difference | 95% Confidence Interval of the Difference | ||

| Lower | Upper | |||||

| Fragility | -2.241- | 143 | .027 | -.17472- | -.3288- | -.0206- |

Based on the previous analysis, the hypothesis was proven incorrect, Indicating that the banks do not suffer from high financial fragility, Because the arithmetic mean of the sample in Table 4 is equal to (0.82) which is less than the standard value of the fragility index of (1). Also, The (P-Value) was (0.027), which is less than (0.05).

The second hypothesis (there is a significant, statistically significant effect of financial flexibility in reducing financial fragility).

To test the hypothesis, Pearson's test was used to test the correlation between financial flexibility (X) and financial fragility (Y). Table 5 shows the correlation between the two variables. The value of the correlation coefficient was (-0.234), and the level of significance of the relationship was (0.002), Which is less than (0.05). This indicates a weak inverse correlation between the two variables, that is, The increase in financial flexibility is accepted by the decrease in financial fragility in the surveyed banks.

| Table 5 Significance Test of the Correlation Between Financial Flexibility and Financial Fragility | |||

| Fragility | Flexibility | ||

| Pearson Correlation | Fragility | 1.000 | -.234- |

| Flexibility | -.234- | 1.000 | |

| Sig. (1-tailed) | Fragility | . | .002 |

| Flexibility | .002 | . | |

| N | Fragility | 144 | 144 |

| Flexibility | 144 | 144 | |

Table 6 presents the values of the parameters of the correlation between financial flexibility and financial fragility, As the value of the correlation coefficient in column (R) is (0.234), And the value of the interpretation coefficient in (R2) is (0.48). These values, In addition to the results of Table 5, Indicate the existence of an inverse correlation between the two variables at the level of significance (0.002).

| Table 6 Parameters of the Correlation Between Financial Flexibility and Financial Fragility | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | .234a | .055 | .048 | .91271 |

Table 7 shows the results of a significant test of the linear relationship between financial flexibility and financial fragility, As the calculated (F) value (8.210), which is greater than the tabular (F) (3.84), Shows the level of test significance (0.005) which is less than (0.05). This indicates that there is a significant relationship with statistical significance between the two variables.

| Table 7 Testing the Significance of the Linear Relationship Between Financial Flexibility and Financial Fragility | ||||||

| Model | Sum of Squares | Df | Mean Square | F | Sig. | |

| 1 | Regression | 6.840 | 1 | 6.840 | 8.210 | .005b |

| Residual | 118.291 | 142 | .833 | |||

| Total | 125.130 | 143 | ||||

Table 8 shows a summary of the linear relationship between financial flexibility and financial fragility, As the two parameters of the regression line equation (β0, β1) appear in the second column, Which can be formulated statistically as follows:

| Table 8 A Brief Model of the Linear Relationship Between Financial Flexibility and Financial Fragility | ||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 1.068 | .114 | 9.375 | .000 | |

| Flexibility | -.110- | .038 | -.234- | -2.865- | .005 | |

Y= 1.07+0.11 *X

Based on the results of the analysis of the correlation and the linear relationship between financial flexibility and financial fragility, The hypothesis was proven (there is a significant and statistically significant effect of financial flexibility to reduce financial fragility).

Conclusion

1. The results of the financial analysis show that the National Bank achieved the highest rate according to the financial fragility index and the lowest rate according to the financial flexibility index.

2. The results of the financial analysis show that the Bank of Baghdad has the highest rate in the financial flexibility index and a low rate in the financial fragility index compared to the absolute value of this indicator, which is (1%).

3. The results showed the incorrectness of the second hypothesis, which indicates that the study sample banks suffer from high financial fragility. It was found that the banks that suffer from financial fragility are (Middle East Bank, National Bank, The United Bank), while the rest of the banks do not suffer from financial fragility.

4. The results of the statistical analysis showed the validity of the second hypothesis (there is a significant and statistically significant effect of financial flexibility to reduce financial fragility).

5. As the annual reports of some banks showed that some of their branches achieved financial losses, due to the mismanagement of these branches or the limitations of their banking products or services, in addition to the high rate of non-performing loans.

Recommendations

1. The necessity of adopting Texas index by commercial banks to test the stability of their financial position and to enhance the rates achieved for this indicator.

2. The necessity for the bank to follow an appropriate mechanism to examine the financial situation of the borrowers, and the financial feasibility of the projects on which loans are drawn, in order to avoid the borrowers' default.

3. The necessity for the National Bank to reconsider the assessment of its financial position, as it achieved the highest rate in the financial fragility of Texas index approved in the study among the banks. 4.The need to work on finding an appropriate financing structure that takes into account the balance between return and risk, on the one hand, and the terms of cash flows (incoming and outgoing), on the other hand.

References

Al-Taie, Y.H.S., & Al-Jubouri, H.J.O. (2017). Financial flexibility and its impact on reducing the fragility of the banking system (analytical study of a sample of Iraqi private banks). Al-Ghari Journal of Economic and Administrative Sciences, 14(3).

Eichengreen, B., & Husman, R. (1999). Exchange rates and financial fragility.

Ibrahim, A.F.M., & Abdul Sattar, E.A. (2019). The impact of working capital management efficiency and financial flexibility in the sustainable growth gap: an applied study in a sample of industrial companies listed on the Iraqi Stock Exchange, research published in the Journal of Baghdad College of Economic Sciences, 57.

Mohieddin, A. (2000). The Asian Debt Crisis, Roots, Mechanisms and Lessons. First edition, Dar Al-Shorouk, Cairo, Egypt.