Research Article: 2020 Vol: 24 Issue: 1

The Effect of Internal Audit on Accounting Information Technology in the Public Joint Stock Pharmaceutical Industries in Jordan

Ayman Saleh Mustafa Harb, Zarqa University

Abstract

This study aims to find out the effect of internal audit in public joint stock pharmaceutical industries sector of technology. This study found that there is a statistically significant effect of the internal audit on information technology of public joint stock pharmaceutical industries sector. There is also a statistically significant effect of the internal audit on the efficiency of reliance on information of public joint stock pharmaceutical industries sector. One of the most important recommendations of the researcher was to oblige all sectors to activate the role of internal audit in each sector.

Keywords

Internal Audit, Accounting Information Technology, Pharmaceutical Industries.

Introduction

Many sectors in oversight and internal audit attach importance to produce reliable accounting information, through accounting information technology. Randal & Elder & Beasley (2019) defined internal audit as the guarantor of the accuracy of accounting and financial information provided by financial services and accounting departments.

The internal audit is based on the management and effectiveness of the information system, from the input, processing and production of information to third party beneficiaries. The internal audit system is based on the communication between the external auditor, the financial services and accounting departments in verifying the authenticity of the accounting information system and the financial performance of the company.

Importance of Study

This study is concerned with the role of internal audit on technology of public joint stock pharmaceutical industries sector to rely on the effectiveness and efficiency of accounting information.

Study Objectives

The objective of this study is to determine the effect of internal audit on technology and efficiency of relying on accounting information in the public joint stock pharmaceutical industries sector.

Problem of the Study

Internal Audit has an effect in role of efficiency and reliability of information technology in the public joint stock pharmaceutical industries sector through following questions:

1. What is the effect of internal audit on accounting information technology in the public joint stock pharmaceutical industries sector?

2. What is the effect of internal audit on the efficiency of reliance on accounting information in the in the public joint stock pharmaceutical industries sector?

Study Hypotheses

H01: There is no statistically significant effect of the internal audit effect on accounting information technology in the public joint stock pharmaceutical industries sector.

H02: There is no statistically significant effect of the internal audit effect on the Efficiency of relying on accounting information in the public joint stock pharmaceutical industries sector.

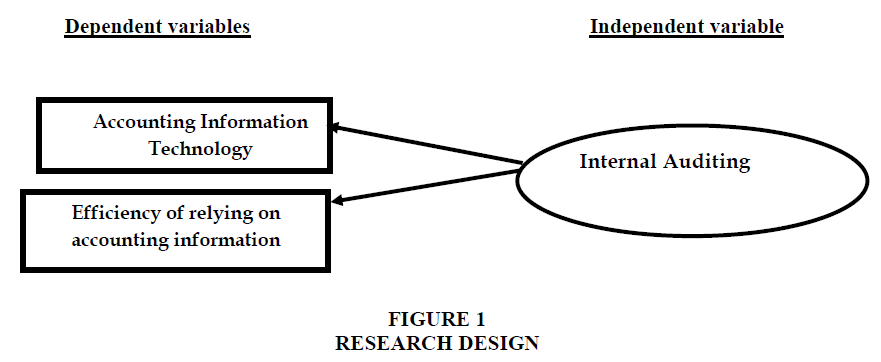

There are three variables are:

1. Internal audit.

2. Accounting Information Technology.

3. Efficiency of relying on accounting information (Figure 1).

Literature Review

The study (Rotich, 2015) aimed at the degree of reliance on accounting information, and one of the most important results was that the internal audit has a role in the production of accounting information. (Kanakriyah, 2017) concluded that the role of internal audit in the integrity of information and the degree of contribution to the quality of accounting information.. (Sifile& Innocent, 2014) aimed at a relationship between functional performance and technology-supported operational techniques in raising the efficiency of audits. A study of (Alrefaee, 2013) indicated the role of accounting information systems in achieving internal audit efficiency. (Al-Chahadah, Soda & Al Omari, 2018) supports the relationship between the fundamental developments of internal audit in developing the reliability of the quality of accounting information technology for banks. (Kamil, 2017) aimed to the audit profession contribution to the development of information technology and reduce the audit gap, address the negative effects and reduce the risk of audit and make it more effective and positive. (Adebisi, 2018) concluded that there is a relationship of control and audit in the statement of weakness and frauds in the security systems in accounting information. (Shaqqour, 2017) found that number of persons in audit community effect on internal audit.

Research Methodology

The community and sample of the study consists of all sectors of the in the public joint stock pharmaceutical industries sector in Jordan until (30/06/2019) in Table 1.

| Table 1 The Stady Population |

| 1-Jordanian Pharmaceutical Manufacturing Co. PLC (JPM) |

| 2- Hayat Pharmaceutical Industries Co (HPIC) |

| 3- International Silica Industries Co. (ISIC) |

| 4- Middle East Pharmaceutical And Chemical industries & Medical Appliances P.L.C |

| 5- Arab Pesticides and Veterinary Drugs Manufacturing Company |

| 6- Arab Center For Pharmaceutical & Chemical Industries Co ACPC |

| 7-Arab International Food Factories and Investment Co. |

| 8- Jordan Industrial Resources Co. Ltd. (JIRCO) |

| 9- Philadelphia Pharmaceuticals Co. |

The analysis unit is the 180 individuals working in the pharmaceutical industries sector (N = 180). The questionnaires will be distributed to individuals working in the public joint stock companies in Jordan who are limited to:

1. Director, Assistant Director and Head of the Department of Pharmaceutical Industries.

2. Chief Financial Officer and Accountants.

3. Internal Auditor.

4. Information Technology Officer

Data Collection Methods

The data were collected from public joint stock pharmaceutical industries sector in Jordan, as:

1. Secondary sources of information available from books, references and annual financial reports.

2. Primary sources: - It consists of a questionnaire to be distributed to individuals working in the public joint stock pharmaceutical industries sector in Jordan.

Number of distributed questionnaires = 180

Number of non-responders = (30)

Number of answered questionnaires = (30)

Number of answered questionnaires = 150

It is clear that the percentage of response is equal to (150 ÷ 180 = 83.333%).

Statistical Methods

To analysis of the study data, the researcher adopted on:

1. Descriptive statistics: are arithmetic mean, standard deviation and percentage.

2. Inferential statistics are (T- Test) and multiple regression analysis.

3. Use of statistical analysis (SPSS).

Results and Discussion

There was agreement between the studies (Rotich, 2015) with the researcher's study in relying on accounting information in internal audits, as well as agreement between the study (Kanakriyah, 2017) and the researcher's study on the impact of internal audit on the validity of accounting information.

Relying on technology for auditing reduces the financial risks that all industrial sectors can face in the future. Where it represents of the stability of the field of internal auditing and areas of accounting information technology and the efficiency of relying on accounting information in Table 2.

| Table 2 The Method of Cronbach's Alpha for Internal Consistency | |||

| No. | Area | NO Of Questions | Cronbach's Alpha Value |

| 1 | Internal Audit (Independent Variable) | 7 | 0.775 |

| 2 | Accounting Information Technology - First dependent variable | 7 | 0.891 |

| 3 | Efficiency of relying on accounting information (second dependent variable) | 7 | 0.714 |

| Total | 21 | 0.905 | |

It has reached a value the value of Cronbach's Alpha was (0.775) for the internal audit of the independent variable, and (0.891) for accounting information technology for the first dependent variable, and (0.714) for the efficiency of relying on accounting information for the second dependent variable and (0.905) for total score of the questionnaire. All of these values are appropriate and sufficient for the purposes of this research, as all are considered high because they are close to the correct one, which is the largest value that may be reached by questionnaire.

Analysis of Variables

Analysis of the independent variable (Internal Auditing)

The researcher analyzed the mean values, standard deviations and relative importance of each of the study variables where the researcher used the taxonomic scale to describe the values of the estimated averages, this means the effect of some values (less than (2.33) means low effect, and (2.33 - 3.67) mean medium effect, and (3.67 - 5.00) means high effect in Tables 3-5.

| Table 3 Standard Deviations for the Indepent Variable (Internal Audit) Items and Total Mean | ||||||

| No. | Areas | Mean | Std. Deviation | Relative Importance | Level | Grade |

| 1 | The industrial company has an internal audit department | 3.65 | 1.13 | 72.6 | Average | 1 |

| 4 | The internal auditor does not experience any effects when performing its tasks | 3.64 | 1.20 | 72.5 | Average | 2 |

| 6 | The internal auditor is concerned with the application of internal audit standards | 3.63 | 1.22 | 72.3 | Average | 2 |

| 5 | The internal auditor performs his business honestly and efficiently | 3.41 | 1.26 | 68.1 | Average | 4 |

| 2 | Management is concerned with the internal audit systems in place | 3.31 | 1.33 | 66.3 | Average | 5 |

| 3 | Periodic financial reports are prepared for management | 3.12 | 1.35 | 62.3 | Average | 6 |

| 7 | The internal auditor is interested in taking periodic samples of the auditing | 3.02 | 1.20 | 60.9 | Average | 7 |

| Internal Auditing | 3.39 | 0.81 | 67.8 | Average | ||

| Table 4 The Means and Standard Deniations for the First Dependent Variable (Accounting Informatin Technology) Items and Totlal mean Calculated | ||||||

| No. | Item | Mean | Std. Deviation | Relative Importance | Level | Grade |

| 1 | The employee uses the password for the private device | 3.14 | 1.26 | 62.6 | Average | 5 |

| 2 | Enter the employee information for the system | 3.06 | 1.33 | 61.3 | Average | 7 |

| 3 | Company information is stored periodically | 3.46 | 1.28 | 69.6 | Average | 2 |

| 4 | Restrictions are placed on modifying information | 3.35 | 1.32 | 67.2 | Average | 3 |

| 5 | The industrial company establishes a system to protect against information manipulation | 3.31 | 1.09 | 66.0 | Average | 4 |

| 6 | Technology systems achieve accuracy in storing information | 3.71 | 1.21 | 74.1 | High | 1 |

| 7 | Information is referenced when you need it at high speed | 3.09 | 1.07 | 61.6 | Average | 6 |

| Accounting Information Technology | 3.30 | 0.96 | 66.0 | Average | ||

| Table 5 The Means and Standard Deniations for the Second Dependent Variable (Efficiency of Relying on Accounting Information) Items and Totlal mean Calculated | ||||||

| No. | Item | Mean | Std. Deviation | Relative Importance | Level | Grade |

| 1 | Documentation and development of procedures to control the documentation policy in the industrial company | 3.14 | 1.36 | 62.6 | Average | 6 |

| 2 | Control the access to information systems | 3.28 | 1.32 | 65.5 | Average | 4 |

| 3 | Provides general information about the users of the systems | 3.29 | 1.33 | 64.2 | Average | 5 |

| 4 | Identify security controls against unknown source information | 3.02 | 1.31 | 60.6 | Average | 7 |

| 5 | Limit private or confidential information available to employees | 3.62 | 0.90 | 72.7 | Average | 1 |

| 6 | Protection of information from intrusions of computers | 3.53 | 1.16 | 70.7 | Average | 2 |

| 7 | The industrial company uses a contingency plan in case of sudden malfunction | 3.45 | 1.08 | 69.1 | Average | 3 |

| Efficiency of relying on accounting information | 3.33 | 0.74 | 66.6 | Average | ||

There is the highest mean is (3.65) with an average agreement degree, and the lowest mean is (3.02) with a average agreement degree. The total mean score is (3.39) for overall Internal Auditing fields with an average agreement degree.

Analysis of the First Dependent Variable (Accounting Information Technology)

There is the highest mean is (3.71) with the highest agreement degree, and the lowest mean is (3.06) with an average agreement degree. The total mean score is (3.30) for overall accounting information technology fields with an average agreement degree.

Analysis of the second dependent variable (Efficiency of relying on accounting information)

There is the highest mean is (3.62) with an average agreement degree, and the lowest mean is (3.02) with a average agreement degree. The total mean score is (3.33) for overall Efficiency of relying on accounting information fields with a average agreement degree.

Hypotheses Testing

H01: There is no statistically significant effect of the internal audit effect on accounting information technology in the public joint stock pharmaceutical industries sector.

H02: There is no statistically significant effect of the internal audit effect on the efficiency of relying on accounting information in the public joint stock pharmaceutical industries sector.

Conclusion

The most important results of this study were as follows:

1. There is an effect of internal audit on accounting information technology in the public joint stock pharmaceutical industries sector. (F) Value (67.86) at significance (0.000), there was a positive statistically significant relationship at a significant level (P≤0.05), where the value of the relationship between the variables (0.653) (Tables 6 and 7).

| Table 6 Test the Accuracy of Results of Simple Linear Regression Analysis for the Intrenal Auditing Effects on Accounting Informaation Technology | ||||||||

| Independent variable | r | R2 | f | Sig f | β0 | β | t | Sig t |

| Internal Audit | 0.653 | 0.428 | 67.86 | *0.000 | 0.658 | 0.782 | 8.24 | *0.000 |

| Table 7 Test the Accuracy of Results of Simple Linear Regression Analysis for the Internal Auditing Effects on Efficiency of Relying on Accounting Information | ||||||||

| Independent variable | r | R2 | f | Sig f | β0 | β | t | Sig t |

| Internal Audit | 0.633 | 0.395 | 60.06 | *0.000 | 1.379 | 0.576 | 7.78 | *0.000 |

2. The values of the coefficient (β) show the impact of internal auditing on accounting information technology in the in the public joint stock pharmaceutical industries sector in the regression model reached, where the value of this impact is (0.782).

3. The value of (R2) indicates the variance of the dependent variable, which can be predicted by the independent variable which is (42.8%). With this result, the null hypothesis was rejected and the alternative hypothesis were accepted, there is an impact of internal audit on accounting information technology.

4. There is a effect of internal audit on efficiency of relying on accounting information in the public joint stock pharmaceutical industries sector. (F) Value (60.06) at significance (0.000), there was a positive statistically significant relationship at a significant level (P≤0.05), where the value of the relationship between the variables (0.576).

5. The values of the coefficient (β) show the impact of internal auditing on efficiency of relying on accounting information in the in the public joint stock pharmaceutical industries sector in the regression model reached, where the value of this impact is (0.576).

6. The value of (R2) indicates the variance of the dependent variable, which can be predicted by the independent variable which is (39.5%). With this result, the null hypothesis was rejected and the alternative hypothesis were accepted, there is an impact of internal audit on efficiency of relying on accounting information.

Recommendations

The most important recommendations of the researcher are the following:

1. Should be a maintaining the level of internal auditing in the pharmaceutical industries companies and working to develop it in parallel with the development of international auditing standards, because it has a positive impact on the level of accounting information.

2. It's important to keep going development of internal auditing and linking it with the development of accounting information technology, will give more confidence for decision makers, shareholders, and internal and external users of financial statements, thus helping to right decision making in a timely, and then will help to put a right accounting policies for companies that will reflect positively on the state's economy directly.

3. Commit all sectors in Jordan to activate the role of internal audit.

4. Enhancing the role of internal audit through academic studies.

5. Linking future research in third parties sectors other than the pharmaceutical industry in the internal audit.

References

- Adebisi, O.Y. (2018). The impact of internal control system on manufacturing industries: A case study of evans medical PLC. Retrieved from: https://www.academia.edu/37585111/THE_IMPACT_OF_INTERNAL_ CONTROL_SYSTEM_ON_MANUFACTURING_INDUSTRIES_A_CASE_STUDY_OF_EVANS_MEDICAL_PLC).

- Al-Chahadah, A.R., Soda, M.Z., & Omari, R.A. (2018). The impact of the internal audit on the quality of accounting information in the jordanian commercial banks. International Journal of Economics and Finance, 10(9), 157-167.

- Al-Refaee, K., & Siam, A. (2013). The effect of using information technology on increasing the efficiency of internal auditing systems in Islamic banks operating in Jordan. Research Journal of Finance and Accounting, 4(9), 110-117.

- Kamil, O.A., & Nashat, N.M. (2017). The impact of information technology on the auditing profession-analytical study. International Review of Management and Business Research, 6(4), 1330-1342.

- Kanakriyah, R. (2017). The impact of accounting information systems on the banks success: Evidence from Jordan. Research Journal of Finance and Accounting, 8(17), 1-15.

- Elder, R.J., & Beasley, M.S. (2019). Auditing And Assurance Services (16th Edition)., Michigan State University, North Carolina State University, The American University in Cairo, USA.

- Rotich, G. (2015). Role of internal audit function in promoting effective corporate governance of commercial banks in Kenya. International Journal of Business & Law Research 3(1), 2360-8986.

- Shaqqour, O.F. (2017). The corporate governance mechanisms and the internal audit quality. International Journal of Managerial Studies and Research (IJMSR), 5(2), 82-90.