Research Article: 2019 Vol: 23 Issue: 6

The Effect of Internal Control and Ethics Disclosure on Earnings Quality: Investor Perception-Based Analysis

Andre Ata Ujan, Universitas Katolik Indonesia Atma Jaya

Mukhlasin, Universitas Katolik Indonesia Atma Jaya

Abstract

The agency problem that arises from information asymmetry is the accuracy of financial reporting. The aspects needed to prepare complete and reliable financial reporting are a set of internal control functions and ethical practices that exist within the company. Internal control and voluntary disclosure of ethics show that financial reports are prepared with high quality. Quality of earnings based on the perspective of information is reflected in the investor's response to the announcement of financial statements. Internal control and ethics of voluntary disclosure in annual reporting signify that earnings are derived from the best processes and behaviors that affect investors in responding to information. Linear regression with 412 observational data on non-financial and banking companies listed on the Indonesia Stock Exchange for the period 2012-2015 proves that internal control and ethical disclosure signal the quality of earnings information for investors and reduce information asymmetry.

Keywords

Internal Control Disclosure, Ethics Disclosure, Earnings Quality, Earnings Response Coefficient.

Introduction

Financial statements designed to provide information about the financial position, financial performance, and cash flow of an entity that is useful for most users in making economic decisions. The information contained in financial statements that attract the attention of investors or prospective investors is the company's income that reflects its performance during the accounting period. Taking it from information perspective, quality income is reflected in the positive response from investors through the increase in stock prices. Information about profits that reaps the attention of investors or prospective investors is profit information that reflects the company's performance over the accounting period. In the information approach, earnings quality is analyzed using a short window around the announcement date of financial statements (before and after the announcement) to attest that changes in stock prices occur due to surprises on income information (Cornell & Landsman, 2003).

Financial statements that are generally prepared in accordance with general accounting principles, alternative methods, and accounting estimates chosen by management can produce accrual volatility (Watts & Zimmerman, 1986) which in turn can cause information asymmetry. Since shareholders are not able to effectively oversee company performance and, hence, lead them to the problem of accurately identifying the future of business prospect, a wide range of information asymmetry will benefit managers more than what they are entitled to while at the same time inflicting lost on the part of shareholders (Dye, 1988). In such conditions, management actually creates for themselves the opportunity to provide information that is selectively distorted and, therefore, brings itself into a moral danger (Scott, 2012). Thus, greater information asymmetry provides space for managers to manage accounting results in a fashion that support their own specific goals by using accounting policies. At this point, a mechanism that can effectively reduce information asymmetry is necessary to do. Such a mechanism is but voluntary disclosure for it can to reduce information asymmetry, on the one hand, and to encourage voluntary disclosure, on the other (Shin & Oh, 2017, Scott, 2012, Consoni et al., 2017).

Voluntary disclosure in annual reporting is a communication tool needed by stakeholders to stimulate and maintain transparency, accountability, and good corporate governance practices (Uyar & K?l?c¸ 2012). Maintaining such values can help reduce information gaps, increase credibility in financial reporting (Healy & Palepu, 1993), and contribute to understanding the role of accounting information in corporate financial valuation (Core, 2001). The purpose of internal control is to keep the operations running effectively and efficiently in order to preserve the reliability of financial reporting, and to prompt compliance with applicable laws and regulations. In so doing, the internal control mechanism is in practice directly related to the quality of financial statements. Disclosure of internal control information that reflects the transparency of financial statements can directly increase foreign investment (Agyei-Mensah, 2015). Internal control, however, will have an impact on quality financial reports insofar as it is performed in accordance with the rules of ethical behaviour in the company. Learning from literatures, Einhorn (2007) states that performing corporate voluntary disclosure is usually motivated by the desire of company management to inflate investor expectations about firm value, and thus maximize the price at which company shares are traded in the capital market. Meanwhile, ethical implementation in the company depends on the wisdom and ethical values shared by the management (Person, 2009).

Quality of income reflects how much financial statements are beneficial to users. Income quality is important to study because there are accounting cases that occured in large companies in the world such as Enron, WorldCom and UK telecommunications, even the last case in Indonesia at PT NSP Finance has caused a decline in investor confidence in the company's financial statements. In addition, it is necessary to conduct research that reviews additional information that can increase investor confidence in the quality of financial statements. However, additional information needs to be examined in order to be sure which of them can arouse investor confidence in financial statements that describe internal processes and ethical rules and which ones that can reduce opportunistic behavior. Extensive research that specifically examines internal control and ethical disclosure needs to be conducted to provide more reliable information about the issues. One important aspect in providing complete and reliable information which is considered seriously by the financial community is the necessity of having a strict set of internal controls (Elliot & Elliot, 2013). Previous research shows that the relationship between internal control and earnings quality is not conclusive. Ji et al (2016) found disclosure of weaknesses in Internal Control had a negative impact on corporate accounting conservatism. Meanwhile, Hong & Lee (2015) found that internal material control weaknesses over financial reporting resulted in an increase in information asymmetry which in turn caused unreliable and/or opaque financial reporting. The later would drive the fall of stock prices. From investor perspective point of view, Ashbaugh-Skaife et al. (2008) proved that market responded negatively to the disclosure of internal control weaknesses. Meanwhile Doyle et al. (2007) found that there are no significant differences in the quality of accruals between companies operating under strict internal control and those which are likely to avoid though internal control.

As with the internal disclosure of controls, prior research on ethical disclosures yielded inconsistent results. Choi & Pae (2011) found that firms with higher level of ethical commitment tend to have higher earnings quality. Such finding is affirmed by fewer earnings management, more conservative earnings report, and more accurate future cash flow prediction. Meanwhile, Labelle et al. (2010) documented that corporate moral or ethical development is related to financial reporting quality which is proxied by earnings management. These results are supported by Pae & Choi (2011) who test ethical commitment to capital costs and confirmed by Persons (2009) in his study of fraudulent finance. Choi and Jung (2008) in their research on ethics and firm value come to the same conclusion as they emphasize the influence of ethics on firm value. However, it is important to note that company's commitment to business ethics can only be effective if implemented correctly. A review of business ethics studies by Loe et al. (2000) and Stevens (2008) found that the existence of a code of ethics does not always lead to ethical business decisions.

It must be noted that research about the relation of internal control disclosure and ethical disclosure towards earnings quality in the perspective of investors are really rare. This paper seeks to address research gap about the relationship between internal control disclosure and ethical disclosure, on the one hand, and earnings quality in the perspective of investors, on the other.

Hypothesis Development

Managers in the firms with internal control weaknesses are unable to make reliable accrual estimates necessary to produce high-quality earnings and other financial information. Such condition creates opportunity for managers to make biased accrual estimates and intentionally misstate earnings and other financial information to achieve self-serving interests (Ashbaugh-Skaife et al., 2008). In another perspective, Weng et al. (2015) state that firms with internal control weaknesses likely have poorer-quality information, and investors of such internal control weaknesses firms tend to face larger information asymmetry than those of other firms. Voluntary internal control disclosure can distinguish them from other low-quality companies. It is often said that giving internal control attributes, for example, voluntary disclosures in annual reports, can bring many benefits to the company, such as improving the company's image, attracting potential investors, reducing capital costs, reducing stock volatility, creating an understanding of its products or services, and improving relationships with various stakeholders (Singh & Van der Zahn, 2008). From the stand point of signaling perspective, voluntary internal control disclosure can be a very effective means for companies to signal their superior quality due to internal control significance for future wealth creation (Whiting & Miller, 2008).

Hypothesis 1: Internal control disclosure has a positive effect on earnings quality

Relying on good-management theory, the corporate ethical environment has, reciprocally, positive relationship to the quality of corporate governance (Pae & Choi 2011). High-quality corporate governance then leads to better management and provision of high-quality information, which reduces agency problems and firm-specific risk, and promotes ethical commitments (Jamali et al., 2008; Money & Schepers, 2007). According to the signalling theory, companies that are committed to implementing ethical financial reporting can be indicated from their commitment to form a committee that serves to oversee ethics and corporate governance (Persons, 2009) and to encourage companies to improve their positive image, reputation and credibility by expressing voluntary ethical practices in the company. Huang et al. (2008) stated that efforts to consistently practice ethical financial reporting will be rewarded in the form of enhanced firm value. The assumption built into this frame of mind is that the level of corporate ethics disclosure reflects how ethical a firm is in practice.

Hypothesis 2: Ethical disclosure has a positive effect on earnings quality

Research Methodology

The population and sample in this study are companies listed on the Indonesian stock exchange except financial companies for the period 2012-2015. Observed data in this study are the annual financial statements of audited companies listed on the Indonesia Stock Exchange which are downloaded from www.idx.co.id and the company's stock price data is obtained from https://finance.yahoo.com. In addition, the company also has at least 1 internal disclosure control indicator and 1 indicator of ethical disclosure, complete data and presented in rupiah currency. The samples studied were 412 data observation.

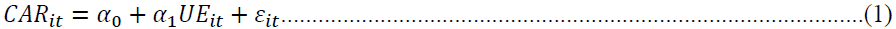

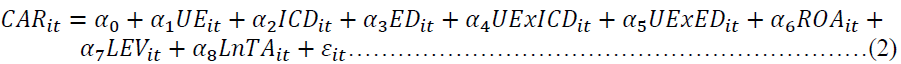

Based on the research objectives, the analytical tool used to test the hypothesis is the ordinary least square, which is described in two research models as follows:

First equation is a proxy of stock price or market reaction on unexpected earning. CAR is Cumulative Abnormal Return and UE is Unexpected Earnings. Earnings quality is measured based on the Earnings Response Coefficient (ERC) sourced from the regression coefficient (α1 of equation 1. The internal control disclosure variable is measured by the measurement which is applied by Wang et al. (2013). The internal control disclosure index (ICD) includes internal environment, risk evaluation, control activities, information & communication, internal supervision, internal control defects, internal assessment, and external assessment.

Ethical Commitment Index is used to measure the level of ethical disclosure (ED). This measurement refers to 11 indicators from Choi and Jung (2008) which includes: Top corporate managers regularly emphasize the importance of business ethics. Those managers anchor ethical behaviour on the formal business philosophy and then adopt ethical principles to be the norms of the company. The company is equipped with a system of discipline and a set of code of ethics; and anybody who violates such norms will be sentenced accordingly. To help enforce ethical norms in company, employees assume the right to report ethical violation behaviours through anonymous channels. Besides allocating most of its profit on generosity, company regularly organizes ethics training or workshop, aiming at institutionalizing ethical principles and improving employees’ ethical behaviour in doing business. A company characterized by strong ethical commitment also has an independent ethics and supervisory department serving to develop open communications among employees through which ethical problems are discussed transparently and sought to be solved fairly. Such companies are even completed with an independent Ethics Committee that serves to evaluate ethical practices in the company. Thus, true commitment to ethical values must be concretely realized in employees’ daily life.

Results and Discussion

The value of unstandardized residual model in this model of research, after being tested using one sample Kolmogorov Smirnov, reveals a test statistic of 0.037 with asymp. Sig. (2-tailed) of 0.185; this means that the model in this study is normally distributed. The Durbin Watson value of 2,046 lain between du and 4-dl, indicates that there is no connection between the data or no auto correlation. UE variables are excluded from the research model to avoid multicollinearity. The test results show that after the UE is removed from the analysis, the Variance Inflation Factor value is less than 10 (see table). It can be stated that in this research model there is no strong relationships between independent variables (multicollinearity).

The results of Glejser test for 412 observations shows that the significance value (p-value) for all independent variables with absolute residuals as independent variables was greater than 5%. This indicates that there is no variance or the diversity of errors is affected by other factors.

The results of multiple linear regression testing are presented in Table 1. The adjusted R square value of 0.306 means that the independent variables in this study are able to explain the CAR value of 30.6% while 69.4% is influenced by variables other than ICD, ED, UExICD, UExED, ROA, LEV and LnTA. The calculated F value of 26.925 with a significance of 0.000 proves that the model in this study is fit with the data or it can be stated that there are independent variables that influence the dependent variable.

| Table 1 Regression Result: Impact Internal Control and Ethics Disclosure on Earnings Response Coefficient | |||||

| Coefficient | t value | p value | Tolerance | VIF | |

| Constant | -0.060 | -1.585 | 0.114 | ||

| ICD | 0.004 | 0.125 | 0.901 | 0.699 | 1.430 |

| ED | -0.016 | -1.438 | 0.151 | 0.693 | 1.442 |

| UExICD | 0.021 | 4.583 | 0.000 | 0.446 | 2.240 |

| UExED | 0.047 | 4.188 | 0.000 | 0.446 | 2.242 |

| ROA | 0.050 | 3.391 | 0.001 | 0.760 | 1.315 |

| LEV | 0.003 | 1.067 | 0.287 | 0.795 | 1.258 |

| LnTA | 0.002 | 1.835 | 0.067 | 0.893 | 1.120 |

| Additional Information | |||||

| Adjusted R Square | 0.306 | ||||

| F value | 26.925 | ||||

| P value | 0.000 | ||||

| Durbin Watson | 2.046 | ||||

| One Sample KS Unstandardized Residual | |||||

| Test Statistic | 0.037 | ||||

| Asymp. Sig. (2-tailed) | 0.185 | ||||

| N | 412 | ||||

The t value of UExICD variable is 4.583 with the p-value 0,000 and regression coefficient of 0.000 prove that hypothesis 1 in this study is accepted because the p-value is less than 5% and the regression coefficient shows a positive direction. It can be concluded that the ICD strengthens the relationship between the UE and CAR. In other words the ICD strengthens investor perceptions of the quality of earnings information. ICD variable shows t value 0.125 with p value of 0.901. This means that the ICD has no effect on CAR. This indicates that internal disclosure does not directly affect investor response but the ICD moderates’ relations between the UE and CAR. This result is in line with that of Weng et al. (2015) emphasizing that enforcing and maintaining effective internal control over financial reporting is essential for reliability and transparency. Hong & Lee (2015) really support this result. Examining the association between weak internal control and the occurrence of stock price crashes, Hong and Lee found that serious weakness of internal control over financial reporting has increased information asymmetry. And unreliable and/or opaque financial reporting occurred due to such weakness which is in turn results in stock price crashes. In the context of conservatism, Ji et al. (2016) find that there is a complementary relationship between accounting conservatism and demand for additives to internal control reporting guarantees on the ground that additional guarantees from internal control reporting can help to reduce the negative impact of internal control weakness on accounting conservatism.

Table 1 presents the EDt t value -1.438 with p value 0.151 and regression coefficient -0.034. These results indicate that for investors, ED is not a signal so that it will respond negatively. This is contrary to the view that voluntary disclosure actually indicates managers’ motivation and desire to show the good performance they have sought for. However, this study proves that ethics disclosure has an effect on earnings quality. This can be seen in Table 1 with the regression coefficient UExED 0.047, t count 4.188 and p value 0.000 which means that UExED has a positive and significant effect on CAR. Based on such results, investors would come to the conclusion that in relation to earnings quality, ED is a positive signal. From the perspective of information asymmetry, the results of the study reveal that ethical disclosure reduces information asymmetry. Such reduction brings with it conservative management that in effect is likely to lead quality financial reports come across with investors’ desire.

The results of this study are supported by Choi & Pae (2011) which proves that the company's commitment to business ethics influences the quality of financial statements. Companies with a higher level of ethical commitment engage in fewer earnings management and in so doing are able to recognize economic bad news in a timely manner. Those companies are even can predict cash flow more accurately than companies with a lower level of ethical commitment. Person (2009) also succeeded in proving that companies that voluntarily provide further details of ethical disclosure are never involved in committing fraudulent financial reports. Lai et al. (2018) indirectly confirm Person’s position as they stated that auditors who have to deal with many clients are likely to slip and get stuck in unethical behaviour and because of that they are, ethically, required to improve and exercise high-quality audit skill.

Conclusion

The sample in this study was 412 observation data. Samples were taken from non-financial companies listed on the Indonesia Stock Exchange for the period of 2012 to 2015. Testing using multiple linear regressions proves that internal control disclosure influences the quality of financial information based on investor perceptions. The variables of ethical disclosure in this study also have a positive effect on investors' perceptions of the quality of company earnings information.

This study merely examines the effect of internal disclosure of controls and ethical disclosures on investor perceptions of the quality of corporate earnings rather than investor perceptions of financial statement disclosures. Further testing of investor perceptions of voluntary disclosures, therefore, needs to be done. The theoretical contribution of this research is related to signal theory stating that viewing from the investors’ perception, true commitment to perform internal control and ethical disclosure is a positive signal that can help to reduce information asymmetry. In relation to the quality of financial statement information, management should perform internal control and ethical disclosures. For regulators, the results of this study must be seen as evidence that reflects an urgent need for regulations serving to govern disclosures which are directly related to financial reporting, specifically, internal control and ethical disclosures.

References

- Agyei-Mensah, B.K. (2015). The determinants of financial ratio disclosures and quality: Evidence from an emerging market. International Journal of Accounting and Financial Reporting, 5(1), 188-211.

- Ashbaugh-Skaife, H., Collins, D.W., Kinney, W.R., & LaFond, R. (2008). The effect of SOX internal control deficiencies and their remediation on accrual quality. The Accounting Review, 83(1), 217-250.

- Choi, T.H., & Pae, J. (2011). Business ethics and financial reporting quality: Evidence from Korea. Journal of Business Ethics, 103(3), 403-427.

- Choi, T.H., & Jung, J. (2008). Ethical commitment, financial performance, and valuation: An empirical investigation of Korean companies. Journal of Business Ethics, 81, 447-463.

- Consoni, S., Colauto, R.D., & Franco de Lima, G.A.S. (2017). Voluntary disclosure and its relationship with earnings management: Evidence from the Brazilian capital market. R. Cont. Fin. – USP, São Paulo, 28(74), 249-263.

- Core, J.E., (2001). Firm’s disclosure and their cost of capital: a discussion of a review of the empirical disclosure literature. Journal of Accounting and Economics, 31, 441–456.

- Cornell, B., & Landsman, W.R. (2003). Accounting Valuation: Is earning Quality an Issue? Financial Analysis Journal. November/December

- Doyle, J., Ge, W., & McVay, S. (2007). Determinants of weaknesses in internal control over financial reporting. Journal of Accounting and Economics, 44(1/2), 193-223.

- Dye, R. (1988). Earnings management in an over lapping generations model. Journal of Accounting Research, 26,195-235.

- Einhorn E. (2007). Voluntary disclosure under uncertainty about the reporting objective. Journal of Accounting and Economics, 43(2-3), 245-274.

- Elliot, B., & Elliot, J. (2013). Financial Accounting and Reporting, (16th Edition). Pearson Higher Education, NJ.

- Healy, P.M., & Palepu, K.G. (1993). The effect of firms' financial disclosure strategies on stock prices. Accounting Horizons, 7(1), 1-11.

- Hong, S., & Lee, J. (2015). Internal control weakness and stock price crash risk. The Journal of Applied Business Research, 31(4), 1289-1294.

- Huang, P., Louwers, T.J., Moffitt, J.S., & Zhang, Y. (2008). Ethical management, corporate governance, and abnormal accruals. Journal of Business Ethics, 83, 469-487.

- Jamali, D., Sahieddine, A.M., & Rabbath, M. (2008). Corporate governance and corporate social responsibility synergies and interrelationships. Corporate Governance: An International Review, 16, 443-459.

- Ji, X., Lu, W., & Qu, W. (2016). Internal control weakness and accounting conservatism in China. Managerial Auditing Journal, 31(6/7), 688-726.

- Labelle, R., Gargouri, R.M., & Francoeur, C. (2010). Ethics, diversity management, and financial reporting quality. Journal of Business Ethics, 93(2), 335–353.

- Lai, K.M.Y., Sasmita, A., Gul, F.A., Foo, Y.B., & Hutchinson. (2018). Busy auditors, ethical behavior, and discretionary accruals quality in Malaysia. Journal Business Ethics, 150, 1187-1198.

- Loe, T.W., Ferrel, L., & Mansfield, P. (2000). A review of empirical studies assessing ethical decision making in business. Journal of Business Ethics, 25, 185-204.

- Money, K., & Schepers, H. (2007). Are CSR and corporate governance converging? A view from boardroom directors and company secretaries in FTSE100 companies in the UK. Journal of General Management, 33(2), 1-11.

- Pae, J., & Choi, T.H. (2011). Corporate governance, commitment to business ethics, and firm valuation: Evidence from the Korean stock market. Journal of Business Ethics, 100, 323-348.

- Persons, O.S. (2009). Audit committee characteristics and earlier voluntary ethics disclosure among fraud and no-fraud firms. International Journal of Disclosure and Governance, 6(4), 284-297.

- Scott, W.R. (2012). Financial accounting theory (6th Edition). Toronto: Pearson

- Shin, H., & Oh, H. (2017). The effect of accruals quality on the association between voluntary disclosure and information asymmetry in Korea. The Journal of Applied Business Research, 33(1), 223-236.

- Singh, I., & Van der Zahn, M. (2008). Determinants of intellectual capital disclosure in prospectuses of initial public offerings. Accounting and Business Research, 38(5), 409-431.

- Stevens, B. (2008). Corporate ethical codes: Effective instruments for influencing behaviour. Journal of Business Ethics, 78, 601-609

- Uyar, A., & Kilic, M. (2012). Influence of corporate attributes on forward-looking information disclosure in publicly traded Turkish corporations. Procedia-Social and Behavioral Sciences, 62, 244-252

- Wang, J.L., Song, L., & Yao, S.J., (2013). The determinants of corporate social responsibility disclosure: Evidence from China. The Journal of Applied Business Research, 29(6), 1833-1848.

- Watts, R.L., & Zimmerman, J.L. (1986). Positive Accounting Theory. Prentice-Hall International Edition.

- Weng, T.C., Chi, H.Y., & Chen, G.Z. (2015). Internal control weakness and information quality. Journal of Applied Finance & Banking, 5(5), 135-169.

- Whiting, R.H., & Miller, J.C. (2008). Voluntary disclosure of intellectual capital in New Zealand annual reports and the hidden value. Journal of Human Resource Costing & Accounting, 12(1), 26-50.