Review Article: 2021 Vol: 24 Issue: 6S

The effect of investing in intangible assets on the market value and dividends per share, an applied study on insurance companies with listed shares in Amman stock exchange

Saqer Al-Tahat, Al al-Bayt University

Nourdeen Abu Nqira, Amman Training Collage Jordan

Osama Abdel Moneim, Jerash UniversityJordan

Abstract

The study aim was to test the effect of investing in intangible assets on market value and dividends per share in insurance companies with listed shares in the Amman Stock Exchange during the period 2014-2018. The study relied on a sample of 22 insurance companies during the period 2014-2018. The study used intangible assets as an independent variable, while the dependent variables included two variables: market value and dividends per share. for testing the hypotheses of the study, descriptive analysis and regression analysis were used. Regarding the dividends distributed per share, 56.5% of the insurance companies in the study sample distributed dividends to their shareholders during the study period, the highest value distributed to shareholders was 15%. As for the market value, its value was constantly increasing in most of the study periods, and its lowest value was 6.29 logarithms, and its highest value was 7.91 logarithms. The results of the regression analysis of the study models also showed that the intangible assets and the total assets of insurance companies both have a statistically significant effect on the market value, while the intangible assets did not have a statistically significant effect on the dividends distributed per share, while there was a statistically significant effect of the total assets on the Dividends per share.

Keywords

Intangible Assets, Market Value, Dividends Per Share, Insurance Companies

Introduction

Considering the technological development and the dependence of many of the activities of the facility on the computerization of its business, there is an increasing demand for intangible assets such as computer software, electronic marketing, trademarks, and fame, and this requires more appropriate infrastructure to practice the various activities of the facility. Since the traditional methods of operating the functions of the facility have often become useless due to the development of the working methods used, for example, the use of social media in marketing products has become an urgent necessity to contribute to increasing the value of the reputation of the facility so that it remains in the circle of competition with other facilities, and this confirms the necessity for establishments to pay attention to intangible assets because they play an important role in achieving the establishments' goals and future aspirations. For the facility to achieve its desired goals, it must possess the appropriate assets that qualify it for this, whether medium or long-term assets. It is fundamental to highlight the role of the intangible assets as one of the important resources in terms of revenue generation and growth, therefore, increasing its market value and increasing the benefit for shareholders

Based on the foregoing, this study comes to examine the effect of investing in intangible assets on the market value and dividends per share. Specifically, it seeks to answer the following questions:

1. What is the effect of the investment size in intangible assets on the market value of insurance companies with listed shares in Amman Stock Exchange?

2. What is the effect of total assets on the market value of insurance companies with listed shares in Amman Stock Exchange?

3. What is the effect of the investment size in intangible assets on the dividends per share of insurance companies with listed shares in Amman Stock Exchange?

4. What is the effect of total assets on the dividends per share for insurance companies with listed shares in Amman Stock Exchange?

The Study’s Contribution

Intangible assets aid in the continuity of the company and its ability to compete, and therefore it has an important role in the market value of companies, This study contributes to clarifying the relationship between the investment size in intangible assets and the market value achieved from investing in these assets and distributed profits, as intangible assets are considered among the important economic resources in business establishments, the study also participate in identifying the relationship between total assets, market value and distributed profits.

The Importance of the Study

The importance of this study stems from the importance of intangible assets as a source of feasible revenue, but it may involve difficulty in accurately measuring them, and predicting the extent of continuity and growth of these assets. It also helps in determining the effect of investing in intangible assets on the market value and dividends per share, thus focusing the facility's management on the current and future benefits of these assets to maintain the pace of the facility's activity and increase its growth. The study (Al-Najjar, 2017) also showed that investment in intangible assets plays an important and tangible role in generating revenues for business establishments, Intangible assets have become one of the most important economic resources available to business establishments, which effectively contribute to achieving cash flows with the competitive advantages it provides to these establishments. Therefore, providing information related to them within the company’s financial statements and reports is considered one of the important and influential information in the decisions of users of the financial statements. Investment in intangible assets has become an important criterion for measuring the efficiency of establishments, and the growth and development of those establishments, so we see many business establishments directing most of their investments towards intangible assets due to the large returns that these investments reap.

Theoretical Part and Previous Studies

International Accounting Standard No. (38) defines an intangible asset as an identifiable non-monetary asset but does not have a physical existence, and two conditions must be met in the intangible asset: 1) that the entity controls it as a result of past events such as purchase or internal development. 2) It is expected that the facility will obtain economic benefits because of the acquisition or use of the asset represented by future cash flows, Intangible assets are also characterized as: 1) They do not have a tangible physical existence. 2) Non-financial assets, which are a non-monetary item. 3) Its useful life or period of use extends mostly for more than one period. 4) It may be created internally or may be purchased from abroad. 5) The difficulty of ascertaining its value and the extent of its increase or decrease in the absence of an active market for it. Common examples of intangible assets are goodwill, patent, trademark, trade name, copyright, franchise, and rights to extract natural resources. (Abu Nassar & Hamidat, 2014).

Intangible assets are part of the entity’s assets that contribute to achieving revenue and supporting cash flow, as (Orhangazi, 2018) sees that intangible assets such as trade names, trademarks, patents and copyrights play a role in expanding the profit and investment gap as the increasing use of intangible assets Tangibles enable companies to achieve high profitability without increasing investment.

Also, (Lim et al., 2019) found a strong positive relationship between identifiable intangible assets and financial leverage, identifiable intangible assets support debt financing as tangible assets do, especially in companies that lack abundant tangible assets, It was also found that intangible assets, similar to tangible assets, are important determinants of the capital structure, It clarifies the need to distinguish between different types of intangible assets, and they are the identifiable intangible assets, goodwill, and the concept of growth options that are frequently used in capital structure theory.

And (Demmou et al., 2019) showed that investment in intangible assets has become an increasingly important driver of productivity growth in OECD countries, in the face of stronger informational asymmetries and difficulty in evaluating collateral. Also the Intangible investment is subject to more severe financial constraints and relies more on internal rather than external capital.

The study of (Mendoza, 2017) showed that companies realized the importance of intangible assets in improving their financial performance, creating value, and maintaining competitiveness. The results also showed that intangible assets significantly affect the total cash flow, and that the effect of intangible assets on cash flow varies greatly between financial sectors, holding companies and services, Industry, mining and oil.

In the study (Lev, 2003) it was shown that intangible assets are large and important, however, current financial statements provide very little information about these assets, and that much of the information provided is partial, inconsistent and confusing, which leads to significant costs for companies, investors, and society as a whole. Solving this problem will require on-balance-sheet accounting for many of these assets as well as additional financial disclosures.

In the study (Ocak & Findik, 2019) of the effect of intangible assets and the components of intangible assets on sustainable growth and company value, the results show that the cumulative value of intangible assets affects the sustainable growth rates of companies and the value of the company positively, and when the cumulative value of intangible assets is classified into three sub-components, it was found that computerized information, database and economic efficiency affect the sustainable growth rates of companies and their fixed value.

The study (Jaara & Elkotayni, 2016) showed that investing in intangible assets strongly affects maximizing the market value of Jordanian pharmaceutical companies, and the study supports the success of Jordanian pharmaceutical companies to maximize their competitiveness through development costs and patents. And the growing interest in intangible assets nowadays lies in particular in determining the discrepancy between the book value and the market value of the company.

The study (Austin, 2007) also showed that there is a mixture between the "time gap" and "the correlation gap", describing the time gap as the costs of intangible assets that occur long before the product can prove the potential benefits, and the correlation gap confirms that the relationship between The value of intangible assets and future benefits are unclear, compared to those in tangible assets, both gaps tend to hamper the recognition of intangible assets.

In the study (Ifeanyi & Caroline, 2016) to ascertain the effect of total intangible assets on financial performance, it was shown that intangible assets are not given the same importance as tangible assets, and that total intangible assets, including human capital, are the reason Behind the survival of company a in the era of persistent economic stagnation rather than the submerged Company B, albeit in the same industry and sub-sector, because the relationship between intangible assets and financial performance as measured by EVA is very important and negative, However, it is important for managers not to ignore the effect of intangible assets, because disclosed intangible assets shape an investor's perception of a company's value This is because in the context of a business combination, the acquiring company can take into account the effect of goodwill and other intangible assets on the companies in its industry to satisfy investor preferences, even though the company's resources consist of physical capital, human capital, and organizational capital resources, However, only physical capital, i.e. physical assets, is usually mentioned in the financial statements, in other words, human capital (training, experience, judgment, intelligence, relationships among the company's employees) and organizational capital (the internal framework, control and coordination systems in the company and informal relationships) and their importance is neither explicitly nor implicitly reflected in the financial statements.

The study (Krstić & Dordević, 2010) shows that contemporary business conditions are characterized by the need to satisfy the various information requirements of a wide range of interests, and in this way, financial statements primarily provide information about the company itself - its ability to generate profits, cash flows and changes in capital , in addition to its physical and financial assets and liabilities, the lack of information related to intangible assets (intellectual capital and the like) in the financial statements disrupts the ability of external users to realize the true value of the company and make the appropriate decision, the primary objective of financial reporting is to satisfy the need of users to information, in terms of giving them insight into the economic realities of the company, for these reasons, Any part of the assets, liabilities, events or transactions that could affect the current financial position and future performance of the company must be presented in the financial statements, so the financial reports meet the requirements of the economic reality of the company if the principles and rules of recognition, measurement and disclosure of the elements of the financial statements are modified with Significant changes in the business environment and economic activities of the company. Additionally In the past two decades, financial reporting has faced a strong need to revalue assets and create new rules for the recognition and valuation of intangible assets. Significant progress has been made, in terms of removing restrictions on the traditional accounting treatment of intangible assets.

The study of (Al-Najjar, 2017) found that investment in intangible assets and financial performance (measured by the turnover ratio, ROA, and asset turnover) and financial policy (measured by the debt-to-equity ratio and dividends ratio) positively and fundamentally affect the market value. The study also showed that investment in intangible assets plays an important and tangible role in generating revenue for business establishments.

Study Methodology

Study Method

This study uses the descriptive analytical method, in order to measure the effect of the independent variable (the investment size in intangible assets) and the controlling variable (total assets) on the dependent variables (market value and dividends per share).

Study Population and Sample

The study population consists of all insurance companies with listed shares in Amman Stock Exchange, which numbered twenty-three companies at the end of 2018. The study will test the data of the study population so that the study sample consists of all the vocabulary of the study population, and the study period covers five years from 2014 to 2018.

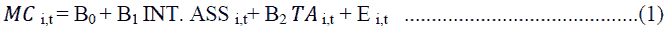

Study Models

To achieve the objectives of the study, the following measurement models were developed for this study:

First model

Where as:

: Market Capitalization The market value of company i for period t.

: Market Capitalization The market value of company i for period t.

: Intangible assets The amount of investment in intangible assets of company i for period t.

: Intangible assets The amount of investment in intangible assets of company i for period t.

: Total Assets (controlling variable) The total assets of company i in period t.

: Total Assets (controlling variable) The total assets of company i in period t.

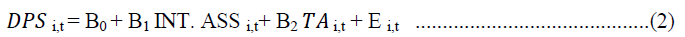

Second model

Where as:

: Dividend Per Share for company i for period t.

: Dividend Per Share for company i for period t.

: Intangible assets The amount of investment in intangible assets of company i for period t.

: Intangible assets The amount of investment in intangible assets of company i for period t.

: Total Assets (controlling variable) The total assets of company i in period t.

: Total Assets (controlling variable) The total assets of company i in period t.

Study Hypotheses

The study hypotheses can be formulated as follows:

H01: There is no statistically significant effect of the investment size in intangible assets on the market value of insurance companies with listed shares in Amman Stock Exchange.

H02: There is no statistically significant effect of total assets on the market value of insurance companies with listed shares in Amman Stock Exchange.

H03: There is no statistically significant effect of the investment size in intangible assets on the dividends per share of insurance companies with listed shares in Amman Stock Exchange.

H04: There is no statistically significant effect of total assets on the dividends per share of insurance companies with listed shares in Amman Stock Exchange.

Measuring the Study Variables

First: The Independent Variable

The amount of investment in intangible assets is the financial value invested in intangible assets by insurance companies for the study sample, where the natural logarithm of the amount of investment in intangible assets will be calculated, this value was obtained for each company through the financial statements published in Directory of Jordanian public shareholding companies.

Second: The Controlling Variable

Total Assets It is the financial value invested in the total assets by the insurance companies in the study sample, where the natural logarithm of the total assets will be calculated. This value was obtained for each company through the financial data published in the Jordanian Public Shareholding Companies Directory.

Third: Dependent Variables

Market capitalization: This variable expresses the total market value of the company's shares. For the purposes of this study, the natural logarithm of the company's market value will be extracted. This value was obtained for each company through the financial statements published in the Jordanian Public Shareholding Companies Directory.

Dividend Per Share: This variable expresses the share per share of the dividend, by dividing the cash dividends by the number of subscribed shares. This value was obtained for each company through the financial statements published in the Jordanian Public Shareholding Companies Directory.

The Results of the Statistical Analysis of the Study Variables:

Descriptive Statistics for the Study Variables

It is noticed that the value of intangible assets increases from year to year, which means that there are effects that these assets have on the various activities of insurance companies.

| Table 1 Descriptive Statistics |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| N | Minimum | Maximum | Mean | Std. Deviation | Skewness | Kurtosis | |||

| Statistic | Statistic | Statistic | Statistic | Statistic | Statistic | Std. Error | Statistic | Std. Error | |

| Dividend Per Share | 110 | 0.0000 | 0.1500 | 0.031209 | 0.0376888 | 0.852 | 0.230 | -0.314 | 0.457 |

| logta | 110 | 6.86 | 8.04 | 7.4738 | 0.28572 | 0.170 | 0.230 | -0.423 | 0.457 |

| logintass | 92 | 1.45 | 5.90 | 4.4542 | 0.79415 | -0.769 | 0.251 | 1.587 | 0.498 |

| logmc | 110 | 6.29 | 7.91 | 6.9917 | 0.37996 | 0.295 | 0.230 | -0.473 | 0.457 |

| Valid N (listwise) | 92 | ||||||||

| Table 2 Descriptive Statistics for the Study Variables |

||||

|---|---|---|---|---|

| DPS | Log. TA | Log. INT. ASS | Log MC | |

| Minimum | 0 | 6.86 | 1.45 | 6.29 |

| Maximum | 0.15 | 8.04 | 5.90 | 7.91 |

| Mean | 0.031209 | 7.4738 | 4.4542 | 6.9917 |

| Std. Dev. | 0.0376888 | 0.28572 | 0.79415 | 0.37996 |

| Skewness | 0.852 | 0.170 | -0.769 | 0.295 |

| Kurtosis | -0.314 | -0.423 | 1.587 | -0.473 |

| Shapiro-Wilk | 0.795 | 0.967 | ----- | 0.975 |

Source: (Prepared by researchers, based on study data and statistical analysis results)

Table No. (2) above shows the descriptive statistics of the study variables during the period 2014-2018, and accordingly the following can be noted:

• Dividend Per Share (DPS): The average distributed dividend is 0.031209, where the highest value distributed during the study period was 0.15 and the lowest value was zero.

• Total Assets (TA): The average natural logarithm of total assets was 7.4738, and the highest value of total assets during the study period was 8.04 logarithms and the lowest value was 6.86 logarithms.

• Intangible assets (INT. ASS): The average natural logarithm of intangible assets is 4.4542, the highest value for intangible assets during the study period is 5.90 logarithms and the lowest is 1.45 logarithms.

• Market Capitalization (MC): The average natural logarithm of the market value was 6.9917, and the highest market value during the study period was 7.91 logarithms and the lowest value was 6.29 logarithms.

Study Hypotheses Test Results

To test the hypotheses of the study, a statistical analysis was conducted using regression analysis, for the purpose of knowing the extent of the effect of investment in intangible assets on the market value and dividends per share.

First Hypothesis Test

H01: There is no statistically significant effect of the investment size in intangible assets on the market value of insurance companies with listed shares in Amman Stock Exchange.

| Table 3 Regression Test Results for the Effect of Intangible Assets on Market Value |

|||

|---|---|---|---|

| R= 0.458 Adjusted R² = 0.201 F value = 23.894 Sig. = 0.000 | |||

| Coefficient | t | p-value | |

| Constant | 6.036 | 29.645 | 0.000 |

| MC | 0.220 | 4.888 | 0.000 |

Source: (Prepared by researchers, based on study data and statistical analysis results)

Depending on the results of the regression analysis, Table No. (3) above shows that there is a correlation between intangible assets and the market value, as the value of the correlation coefficient is (R = 0.458) and the coefficient of determination is (Adjusted R2 = -0.201) at the level of significance (α≤ 0.05). The table also indicates that there is a statistically significant effect of the investment size in intangible assets on the market value, where (F = 23.894 Sig = 0.000, β = 0.220). Accordingly, the study hypothesis (the null hypothesis) is rejected, and the alternative hypothesis is accepted, which is “there is an effect with Statistical significance of the investment size in intangible assets on the market value of insurance companies with listed shares in Amman Stock Exchange. This result is consistent with the study (Jaara and Elkotayni, 2016) which indicates that investing in intangible assets affects the maximization of the market value of companies. It’s also consistent with (Al-Najjar, 2017) which indicates that investing in intangible assets positively and fundamentally affects the market value.

The Second Hypothesis Test

H02: There is no statistically significant effect of total assets on the market value of insurance companies with listed shares in Amman Stock Exchange.

| Table 4 Regression Test Results for the Effect of Total Assets on the Market Value |

|||

|---|---|---|---|

| R= 0.894 Adjusted R² = 0.798 F value = 431.166 Sig. = 0.000 | |||

| Coefficient | t | p-value | |

| Constant | -1.896 | -4.427 | 0.000 |

| MC | 1.189 | 20.765 | 0.000 |

Source: (Prepared by researchers, based on study data and statistical analysis results)

Depending on the results of the regression analysis, Table No. (4) above shows that there is a correlation between total assets and the market value, as the value of the correlation coefficient is (R = 0.894) and the coefficient of determination is (Adjusted R2 = -0.798) at the level of significance (α≤0.05). ). The table also indicates that there is a statistically significant effect of the total assets on the market value, where (F = 431.166 Sig = 0.000, β = 1.189). Accordingly, the study hypothesis (the null hypothesis) is rejected and the alternative hypothesis is accepted, which is “there is a statistically significant effect of the total assets.” on the market value of insurance companies with listed shares in Amman Stock Exchange.

The Third Hypothesis Test

H03: There is no statistically significant effect of the investment size in intangible assets on the dividends per share of insurance companies with listed shares in Amman Stock Exchange.

| Table 5 Regression Test Results for the Effect of Investment in Intangible Assets on Dividends Per Share |

|||

|---|---|---|---|

| R= 0.166 Adjusted R² = 0.017 F value = 2.565 Sig. = 0.113 | |||

| Coefficient | t | p-value | |

| Constant | -0.004 | -0.180 | 0.858 |

| MC | 0.008 | 1.602 | 0.113 |

Source: (Prepared by researchers, based on study data and statistical analysis results)

Relying on the results of the regression analysis, Table No. (5) above shows that there is no correlation between investment in intangible assets and dividends per share, as the value of the correlation coefficient is (R = 0.166) and the coefficient of determination is (Adjusted R2 = -0.017) At the level of significance (α≤0.05). The table also indicates that there is no statistically significant effect of investing in intangible assets on the dividends per share, where (F = 2.565 Sig = 0.113, β = 0.008) and accordingly accept the hypothesis of the study (the null hypothesis), which is “there is no effect with Statistical significance of the investment size in intangible assets on the dividends per share of insurance companies with listed shares in Amman Stock Exchange. The study (Ocak and Findik, 2019) shows that the cumulative value of intangible assets affects the sustainable growth rates of companies and the value of the company positively, and the study (Orhangazi, 2018) showed that intangible assets play a role in expanding the profit and investment gap as the increasing use of assets Intangibles enable companies to achieve high profitability without increasing investment.

The Fourth Hypothesis Test

H04: There is no statistically significant effect of total assets on the dividends per share of insurance companies with listed shares in Amman Stock Exchange.

| Table 6 Results of the Total Assets Test on the Dividends Per Share |

|||

|---|---|---|---|

| R= 0.375 Adjusted R² = 0.132 F value = 17.645 Sig. = 0.000 | |||

| Coefficient | t | p-value | |

| Constant | -0.338 | -3.843 | 0.000 |

| MC | 0.049 | 4.201 | 0.000 |

Source: (Prepared by researchers, based on study data and statistical analysis results)

Relying on the results of the regression analysis, Table No. (6) above shows that there is a correlation between total assets and dividends per share, as the value of the correlation coefficient is (R=0.375) and the coefficient of determination is (Adjusted R2=-0.132) at the level of significance ( α≤0.05). The table also indicates that there is a statistically significant effect of total assets on the dividends per share where (F = 17.645 Sig = 0.000, β = 0.049), and accordingly the study hypothesis (the null hypothesis) is rejected and the alternative hypothesis is accepted, which is “There is a statistically significant effect of total assets on the dividends per share of insurance companies with listed shares in Amman Stock Exchange”.

The Results of the Hypotheses’ Tests:

| Table 7 Summary of the Results of the Study's Hypotheses Tests |

|||

|---|---|---|---|

| No. | Hypothesis | Outcome | The effect |

| 1 | H01: There is no statistically significant effect of the investment size in intangible assets on the market value of insurance companies with listed shares in Amman Stock Exchange | rejected | There is an effect |

| 2 | H02: There is no statistically significant effect of total assets on the market value of insurance companies with listed shares in Amman Stock Exchange. | rejected | There is an effect |

| 3 | H03: There is no statistically significant effect of the investment size in intangible assets on the dividends per share of insurance companies with listed shares in Amman Stock Exchange. | Accepted | There is no effect |

| 4 | H04: There is no statistically significant effect of total assets on the dividends per share of insurance companies with listed shares in Amman Stock Exchange | rejected | There is an effect |

Source: (Prepared by researchers, based on the results of statistical analysis

Study’ s Results

This study aimed to test the effect of investing in intangible assets on market value and dividends per share - an applied study on insurance companies with listed shares in Amman Stock Exchange during the period 2014-2018. The results showed the increasing interest in intangible assets, as there is an annual increase in the value of these assets. And continuously, which indicates the importance of intangible assets for insurance companies with listed shares in Amman Stock Exchange. It was also found that there is an annual increase in the value of total assets on a continuous basis, which indicates the keenness of insurance companies to increase their assets, improve their operational processes and strengthen their financial position. With regard to the dividends distributed per share, 56.5% of the insurance companies in the study sample distributed dividends to their shareholders during the study period, and the highest value distributed to shareholders was 15%. As for the market value, its value was constantly increasing in most of the study periods, its lowest value was 6.29 logarithms and its highest value was 7.91 logarithms.

The results of the regression analysis of the study models also showed that the intangible assets and the total assets of the insurance companies with listed shares in Amman Stock Exchange have a statistically significant effect on the market value, while the intangible assets did not have a statistically significant effect on the dividends distributed per share. While there is a statistically significant effect of total assets on the dividends per share.

Study Recommendations

Based on the foregoing, the most important recommendations of this study can be summarized as follows:

1. Rationalizing decisions related to intangible assets, due to their effect on the market value of insurance companies.

2. Researching the role of intangible assets as one of the important resources in revenue generation and growth.

3. Conducting more studies to search for other factors that intangible assets may have an effect on.

References

- Abu, N., Muhammad, &amli; Hamidat, J. (2014). International Accounting and Financial Reliorting Standards: Theoretical and liractical Asliects, Third Edition.

- Al-Najjar, J.H. (2017). The effect of investment in intangible assets, financial lierformance, and financial liolicy on the market value of liublic shareholding comlianies listed on the lialestine exchange, The Jordanian Journal of Business Administration, 13(3).

- Amman Stock Exchange (2019). Directory of Jordanian liublic Shareholding Comlianies for the lieriod from (2014-2018).

- Austin, L. (2007), Accounting for intangible assets, Business Review, 9(1).

- Demmou, L., Stefanescu, I., Arquié, A. (2019). liroductivity growth and finance: The role of intangible assets - a sector level analysis, OECD economics deliartment working lialiers 1547.

- Jaara, O.O., Elkotayni, K.A.R. (2016). The effect of intangible assets internally develolied on the market value of comlianies" A field study in the liharmaceutical comlianies in Jordan", Accounting and Finance Research, 5(2).

- Orhangazi, O. (2018), The role of intangible assets in exlilaining the investment – lirofit liuzzle, Cambridge Journal of Economics.

- Ocak, M., Fındık, D. (2019). The effect of intangible assets and sub-comlionents, of intangible assets on sustainable growth and firm value: Evidence from Turkish Listed Firms, Sustainability, 11.

- Lev, B. (2003). Remarks on the measurement, valuation, and reliorting of intangible assets, FRBNY Economic liolicy Review.

- Lim, S., &amli; Macias, A.J., &amli; Moeller, T. (2019). Intangible Assets and Caliital Structure, (June 7, 2019).

- Ifeanyi, C., Nnado, C.N., Ozouli, (2016). Evaluating the effect of intangible assets on economic value added of selected manufacturing firms in Nigeria, Euroliean Journal of Business and Management,8(15).

- Mendoza, R.R. (2017). Relationshili between intangible assets and cash flows: An emliirical analysis of liublicly listed corliorations in the lihilililiines, Review of Integrative Business and Economics Research, 6(1), 188-202.

- Krstić, J., &amli; Dordević, M. (2010), Financial reliorting on intangible assets –scolie and limitations, Economics and Organization,7(3), 335 – 348.