Research Article: 2018 Vol: 21 Issue: 4

The Effect of Knowledge Management and Entrepreneurial Orientation on Organization Performance

Dr. Muhammad Imran Hanif, University of Putra Malaysia

Fareeha Malik, Bahauddin Zakariya University

Dr. Abu Bakar Abdul Hamid, University of Putra Malaysia

Abstract

The paper aims to examine the effect of knowledge management processes and international entrepreneurship orientations on organization performance. A questionnaire that targeted 220 respondents resulted in 203 useable ones with a response rate of 92.26 percent. To test the research hypothesis, a multiple regression analysis was conducted, in addition to descriptive statistics that provides a background about the respondents. Analysis highlighted that both knowledge management process and international entrepreneurship orientations have positive effect on organization performance in banks. It is the primary investigation that studied the effect of knowledge management process and entrepreneurial orientations on organization performance.

Keywords

Organization Performance, International Entrepreneurship, International Entrepreneurship Orientation, Knowledge Management, Knowledge Management Processes.

Introduction

In a present hypercompetitive environment where the world is becoming the Global village knowledge management processes and international entrepreneurship orientations have become the most engaging concept in management. Both are predominantly the common strategies for better organization performance (Al-Swidi & Mahmood, 2012; Jabeen et al., 2015). Knowledge is described as part of organization assets that leads organization towards better performance (Andreeva and Kianto, 2012; Obeidat et al., 2012). Effective organizations are required to have the capability to gain, store and share information for the achievement of competitive advantage. As different studies has proposed that organizations applying knowledge management are capable of bringing out superior performance. According to Gupta & Shaw (2007), for every type of organization, entrepreneurial orientations can act as a catalyst in moving them towards success.

In other words, for effective performance, organizations need people having the ability to bring innovation, ability to take risk, proactiveness and knowledge management capabilities (Hanif and Gul, 2016). The consultancy function of bank includes the creation and utilization of knowledge to meet the customer needs. Therefore, banks are considered appropriate in finding the effect of knowledge management processes and international entrepreneurship orientations on organization performance.

Effects of knowledge management process and innovation on firm performance have been discussed independently by some researchers. Still, there are numerous other reasons that make present study essential and unique. First, in its author were examining the impact of three entrepreneurial orientations, than just considering innovations impact on firm performance (Hanif and Shao, 2018). Secondly, it is useful as we have considered service sector to explore our studies relationship, because the significance of service sector is increasing gradually. Thirdly, most of the previous research studies have focused on consultancy sector; but we have conducted research in banking sector.

short, the present study has examined the impact of international entrepreneurship orientations and knowledge management process on firm performance in banking sector. Banks are considered knowledge abundant institutions that depend upon a lot of knowledge (Hanif and Irshad, 2018). Conversely, banks are able to make better decisions for their customers by utilizing more precise information.

Moreover, following research questions are addressed in the study.

Q1: Do knowledge management processes (knowledge acquisition, sharing and utilization) effect firm performance?

Q2: Do entrepreneurial orientations (innovativeness, proactiveness and risk taking behavior) effect firm performance?

The paper is structured like so: It starts with literature regarding knowledge management process and entrepreneurial orientation; and the link these two variables with firm performance. Followed by, methodology which includes study model, hypothesis, participants, data collection & analysis procedure. After that, tests of the proposed hypothesis in the data analysis section have been given. Finally, discussion, conclusion and areas related to future research are also addressed in the end.

Literature Review

Knowledge Management Process

Knowledge management is defined as a practice of producing, obtaining, distributing and utilizing knowledge for boosting organizational performance. According to Hanif et al. (2016), knowledge management includes three fundamental procedures that are knowledge acquisition, sharing and application. Organizations must make assure that they obtain, transfer and exploit knowledge in their operations; to make performance better (Ling et al., 2009).

Knowledge acquisition has become the vital topic for any organization in the world. It is the first step in knowledge management process. Knowledge is becoming a crucial resource for the enhancement of firm performance (Du Plessis, 2007). Knowledge can be acquired from within and outside of the organization (Easterby-Smith et al., 2011). In order to survive in competitive environment organizations are depending more on knowledge acquisition. Effective knowledge acquisition process helps to deliver unique products in order to create value for customers and also helps in gaining and sustaining competitive advantage (Schulze & Hoegl, 2006, Hanif and Gul, 2016). Those organizations that take part in implementation of knowledge acquisition process can perform financially, operationally and socially better than others; not implementing it.

Knowledge sharing is the way to increase the value of knowledge through disseminating. It can be characterized as the procedure that support dissemination of information and helps to make the work environment knowledge intensive. In knowledge intensive environment, knowledgeable employees get the fundamental learning from various sources in a way that prompts upgrade execution and helps in completing workers task effectively. It is crucial for banks to possess suitable knowledge management control system; that supports bankers to share their knowledge in a manner which will not only minimize surplus knowledge but also minimize worker turnover. Banks are able to generate large amount of knowledge by encouraging employees to share knowledge within the workplace and by increasing workers ability to develop new ideas and opportunities (Hanif et al., 2018). Also knowledge sharing helps employees to generate more ideas by being influenced from others ideas. This process results in generation of more feasible and workable ideas.

Knowledge application is concerned with utilizing knowledge in business functions to carry out action which results in unique product and services; also results in creation of value for client. Hanif et al. (2018) found that knowledge application is the sum of societal, technical and operational perspective because each one has vital role in knowledge application. But, it ignores technological perspective; contrary to that, technology is taken as a strategic weapon and it provides essential help in operational and strategic business processes.

International Entrepreneurial Orientations

Entrepreneurial Orientations are defined as multidimensional construct that extends beyond local boundaries and is proposed to generate value for organizations. But this definition give rise to confusion about exactly what is international entrepreneurship (Hanif and Irshad, 2018). Finally the thought prevailed that sum of three dimensions innovativeness, risk-seeking and proactiveness helps to generate an international entrepreneurial orientation; which is the essential part of the concept of international entrepreneurship (Coviello and Jones, 2004). In opposition to that, Hanif and Gul (2016) stated entrepreneurial orientations as a combination of procedures, approaches, styles, strategies and choice makings which keep up entrepreneurial opportunities.

Innovativeness is described as entrepreneurial orientation, which expresses organization ability to encourage new ideas and support innovative activities in the process of providing new products and services. In entrepreneurial individuals, innovativeness is a personality trait that distinguishes innovative people from others because of high degree of openness toward new ideas (Anderson, 2000). Hanif and Shao (2018), and Lumpkin and Dess (1996) were the first people who have focused on concept of innovation. Innovation is merely the dimension which is applicable in all type of organizations Covin & Miles (1999). Even without the existence of any other entrepreneurial orientation, the presence of innovation is unquestionably needed to demonstrate organization like an entrepreneurial organization.

Risk taking is the valuable component of entrepreneurial orientations. According to literature entrepreneurs have greater risk taking propensity in comparison to other individuals in similar society. Covin & Miles (1999) showed that risk involves the chances of loss at a specific time; contrary to that Kropp (2008) defined risk taking as being intentional to do vague practices. For example; investing large amount of investment in one market, borrowing at high interest rate and creating low net spread rate etc. The firm ability to expect higher return depends upon its ability to take risk which is stated by approved principle of finance that is “the higher the risk; the higher the return”.

Proactiveness is the ability to predict future needs and demands and developing products and services in order to fulfill future needs and demands (Lumpkin and Dess, 1996). In other words, it can be described as exploiting opportunities and introducing new product in the market before competitors (Covin & Miles, 1999). It can be defined as two sides of the coin, at one side proactiveness provide opportunities; on the other side it can exploit those opportunities for meeting customer needs.

Firm Performance

Performance is defined as the extent of accomplishment of tasks associated to work. Lumpkin and Dess (1996) displayed that organizations can achieve higher performance, when workers become successful in accomplishing their objectives related to job. Because employee job objectives basically determine firm performance (Hanif and Gul, 2016). Likewise, Kropp (2004) has given perspective that numerous researchers used the term performance to assess put in and output competence. Organizational Performance is basically the ability of the organization to achieve its targets by proficiently utilizing its resources. Various Scholars have recommended various performance evaluation tools. According to Hanif and Irshad (2018), Balance Scorecard is the best instrument to measure the performance of the organization and to enhance the strategies or methodologies of the business. Performance measurement systems must be utilized to remain aware of the performance; and to control the dubious occasions by enhancing its corporate procedures.

Methodology

Study Model

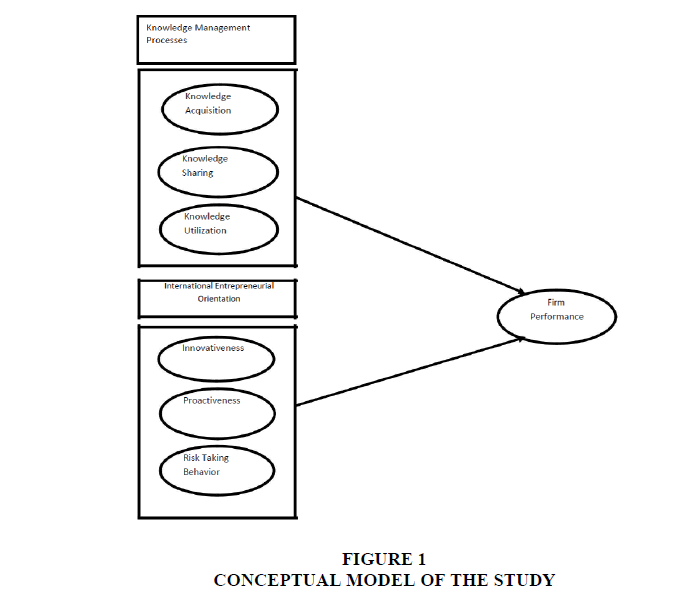

The basics of present research are documented on the basis of previous available literature. In fact, this research utilized variables that are recognizable in the knowledge management and entrepreneurial orientation journalism. Figure 1 presents a conceptual model of study that highlights the cause variables: knowledge processes; entrepreneurial orientations, and effect variable firm performance and also the anticipated relationship between both independent and dependent variable.

Operational Definitions

The present study includes two cause variables (KM processes and entrepreneurial orientation) and one effect variable (firm performance). Additional, knowledge management processes contain knowledge acquisition/creation, knowledge transfer/sharing and knowledge utilization/application, while entrepreneurial orientations contain innovativeness, risk taking and proactiveness. Knowledge acquisition is known as a practice with which the organization increases its knowledge asset (Figure 1).

This can be accomplished by placing new individuals, developing research and development department which are committed to acquiring up-to-the-minute knowledge and hiring human resource having intentions to learn latest skills. Hence, knowledge acquisition is evaluated with six questions that were adapted from Bader et al. (2016).

Knowledge sharing includes exchanging information both inside and outside of the firm. It has been evaluated through five questions in present research that were taken from (Bader et al., 2016). Knowledge application can be referred to as adopting dominant practice than competitors, discovering related knowledge and using it. Knowledge utilization is evaluated by five questions adopted from Bader et al. (2016).

Innovativeness is described as a process of converting an idea into physical product or services that create value for customer and for which the customer is willing to pay. Innovativeness is evaluated by three questions adopted from Hean et al. (2007). Proactiveness involves sensing market opportunities and developing product or service in advance for meeting future needs. Proactiveness is studied by two questions adopted from Hean et al. (2007) and Hanif and Shao (2018). Risk taking includes doing business or activity which involves the chance of loss. It involves making decision to do something which involves the chances of both loss as well as opportunity. Risk taking is studied by three questions adopted from Hean et al. (2007).

Firm performance refers to organization ability to fulfill task according to desired goals. It refers to the degree to which firm can accomplish its desired outcomes. It is measured by using four questions adapted from Hean et al. (2007).

Hypotheses Development

To check the effect of both KM processes and entrepreneurial orientations on firm performance following hypothesis are considered:

H1a: Knowledge acquisition has positive effect on firm performance.

H1b: Knowledge sharing has positive effect on firm performance.

H1c: Knowledge utilization has positive effect on firm performance.

H2a: Innovativeness has positive effect on firm performance.

H2b: Proactiveness has positive effect on firm performance.

H2c: Risk taking has positive effect on firm performance.

Participants

The respondents of the study include the Bank employees and the sample was 202 employees because KM and entrepreneurial orientations plays a key function in banks in order to achieve and maintain their competitive advantage for superior firm performance. In banks, knowledge management processes and experience is the central part for banker’s work; while the entrepreneurial orientations in banks focus on amalgamation of innovative services which leads toward novel collaboration with customers. The sustained success of banks depends upon the knowledge of its bankers, which is utilized to provide solutions to its rising customers’ needs.

Data Analysis and Results

For investigating relationship of two predictor variables i.e. knowledge management process and entrepreneurial orientations, one criterion variable i.e. firm performance; five-points Likert scale is used which varies among strongly agree=1 to strongly disagree=5. Validity and reliability analysis are held; with the aim to explain uniqueness of sample descriptive analysis was used. Furthermore, for testing of research hypothesis multiple regression analysis was used.

Validity and Reliability Analysis

Validity analysis is described as the extent to which a set of measures precisely defines the concept. Whereas, reliability analysis measures the degree of uniformity among various dimensions of a variable it is calculated by cronbach’s alpha coefficient. Researchers have suggested that the value of cronbach’s alpha for all variables must be above 0.60. Table 1 shows the outcome of Cranach’s alpha of both variables IV and DV.

| Table 1 CRONBACH ALPHA OF KNOWLEDGE MANAGEMENT PROCESS, INTERNATIONAL ENTREPRENEURSHIP ORIENTATION AND FIRM PERFORMANCE |

||

| Variables | No. of items | Cronbachs' Alpha |

| Knowledge acquisition | 6 | 0.798 |

| Knowledge Sharing | 5 | 0.75 |

| Knowledge Utilization | 5 | 0.716 |

| Innovation | 3 | 0.655 |

| Proactiveness | 2 | 0.491 |

| Risk Taking | 3 | 0.635 |

| Firm Performance | 4 | 0.755 |

The results of cronbach’s alpha coefficient of all variables are above 0.60 except proactiveness, it means that the all measures except proactiveness are reliable. The questionnaire items were reviewed by instructor of Institute of Banking and Finance BZU Multan. So as to check the validity of instrument researcher has adopted previous scale used by other researcher too (Table 1).

Respondents Demographic Profile

Table 2 includes the statistic profile of respondents for present investigation. It demonstrated that in banks employees are commonly males, postgraduates, having 5 year experience, 63% of banks have 6-10 employees and about 3% of them are PhDs

| Table 2 ILLUSTRATION OF RESPONDENT DEMOGRAPHIC PROFILES |

||

| Category | Frequency | (%) |

| Gender | ||

| Male | 149 | 73.8 |

| Female | 53 | 26.2 |

| Total | 202 | 100 |

| Education Level | ||

| Undergraduate | 57 | 28.2 |

| Postgraduate | 139 | 68.8 |

| PhD | 6 | 3 |

| Total | 202 | 100 |

| Years of Experience | ||

| Less than 5 years | 122 | 60.4 |

| 6-10 years | 57 | 28.2 |

| For more than 10 years | 23 | 11.4 |

| Total | 202 | 100 |

| Number of Employees | ||

| 0-5 | 34 | 16.8 |

| 43379 | 63 | 31.2 |

| 42309 | 36 | 17.8 |

| 16-20 | 35 | 17.3 |

| 21-25 | 21 | 10.4 |

| 26-30 | 3 | 1.5 |

| 31-35 | 2 | 1 |

| More than 35 | 8 | 4 |

| Total | 202 | 100 |

Descriptive Analysis

To portray reactions and accordingly behavior of respondents to every question, mean and standard deviation was evaluated. As accessible in Table 3, results of data analysis have demonstrated that KM processes and entrepreneurial orientations are implemented to a huge degree in the banks. Table 4 highlights mean scores for the items of KM processes, entrepreneurial orientations and firm performance.

| Table 3 OVERALL MEAN AND SD OF STUDY’S VARIABLE |

||

| Kind of Variable | Mean | Standard Deviation |

| Predictor Variable | ||

| Knowledge Management Process | ||

| KA | 2.2129 | 0.7357 |

| KS | 2.1743 | 0.75213 |

| KU | 2.2594 | 0.72732 |

| International EO | ||

| limo | 2.3284 | 0.82958 |

| Pro | 2.349 | 0.894 |

| RT | 2.3746 | 0.80762 |

| Dependent Variable | ||

| Finn Performance | 2.0483 | 0.79909 |

| Table 4 MEAN SCORES FOR THE ITEMS OF KM PROCESSES |

||

| Item | Mean | SD |

| Knowledge Acquisition | ||

| KA1 | 2.0891 | 0.92612 |

| KA2 | 2.1535 | 0.98305 |

| KA3 | 2.3119 | 1.00583 |

| KA4 | 2.1782 | 1.11432 |

| KA5 | 2.3614 | 0.97383 |

| KA6 | 2.1832 | 1.22621 |

| Knowledge Sharing | ||

| KS1 | 2.1931 | 1.03055 |

| KS2 | 2.0297 | 1.0410 |

| KS3 | 2.1535 | 1.03242 |

| KS4 | 2.2970 | 1.05136 |

| KS5 | 2.1980 | 1.15917 |

| Knowledge Utilization | ||

| K1_71 | 2.4356 | 1.02618 |

| K1_72 | 2.3911 | 1.03689 |

| KU3 | 2.1584 | 0.99983 |

| KU4 | 2.1592 | 1.08836 |

| KU5 | 2.1535 | 1.17232 |

| Innovativeness | ||

| INNO1 | 2.2129 | 1.15867 |

| INNO2 | 2.3069 | 1.07659 |

| INNO3 | 2.4653 | 0.99315 |

| Proactiveness | ||

| PRO1 | 2.297 | 1.0177 |

| PRO2 | 2.401 | 1.17291 |

| Risk Taking | ||

| RT1 | 2.5099 | 1.10287 |

| RT2 | 2.3168 | 1.17291 |

| RT3 | 2.297 | 1.04186 |

| Firm performance | ||

| FP1 | 2.0693 | 0.96462 |

| FP2 | 2 | 0.97736 |

| FP3 | 2.0891 | 1.18531 |

| FP4 | 2.0347 | 1.06682 |

Results of Testing Hypothesis

research is conducted to find the effect of knowledge management processes and international entrepreneurship orientations on firm performance. Multiple regression technique was utilized for testing the current study hypothesis.

Hypothesis 1: Table 5 shows that both Knowledge acquisition and Firm Performance (FP) are positively correlated in banking sector (R=0.816), that means both predictor and criterion variable changes in similar way. Similarly, knowledge Sharing is positively related to FP (R=0.745). Also knowledge application is positively correlated with FP (R=0.747). Value for R2 shows a percentage of change in firm performance variable due to 3 processes of knowledge management. The highest variability of firm performance has been explained by the knowledge acquisition from knowledge management process. Also knowledge acquisition has highest F value 0.665 which is significant and thus the hypothesis 1-3 is accepted. B was 0.886, 0.792 and 0.820; correspondingly, representing that knowledge acquisition is strongest predictor for firm performance in Multan banks, as compared to other processes of knowledge management.

| Table 5 RESULTS OF STUDY MODEL |

|||||||

| Variable | R | R2 | F | Significance (f) | B | T | Significance (t) |

| KA | 0.816 | 0.665 | 397.606 | 0.000 | 0.886 | 19.94 | 0.000 |

| KS | 0.745 | 0.556 | 250.126 | 0.000 | 0.792 | 15.815 | 0.000 |

| KU | 0.747 | 0.555 | 251.955 | 0.000 | 0.82 | 15.873 | 0.000 |

Hypothesis 2: Table 6 shows that international entrepreneurship orientations and Firm Performance (FP) are positively correlated in banking sector. As, Innovativeness is positively linked with FP (R=0.646) similarly, proactiveness is positively linked with firm performance (R=0.597). Also, risk taking is positively associated with FP (R=0.635); the value for R2 shows percentage of change in firm performance variable due to 3 orientations of international entrepreneurship. The highest variability of firm performance has been explained by the Innovativeness from international entrepreneurship orientation. Also Innovativeness has highest F value 0.665 which is significant and thus the hypothesis 4-6 is accepted. B was 0.623, 0.534 and 0.629; correspondingly, representing that risk taking is powerful indicator for firm performance in Multan banks, followed by innovativeness and proactiveness.

| Table 6 RESULT OF PRESENT MODEL |

|||||||

| Variable | R | R2 | F | Significance (f) | B | T | Significance (t) |

| Innovativeness | 0.646 | 0.418 | 143.568 | 0.000 | 0.623 | 4.661 | 0.000 |

| Proactiveness | 0.597 | 0.353 | 110.757 | 0.000 | 0.534 | 10.524 | 0.000 |

| Risk Taking | 0.635 | 0.401 | 135.48 | 0.000 | 0.629 | 11.64 | 0.000 |

Discussions

The purpose of present study was to explore the effect of both KM processes and IE orientations on Firm performance in Multan banks. First of all, KM processes are discussed; results indicate that each KM process has positive effect on firm performance.

Results demonstrated that placing capable employees inside the bank is a superior source of obtaining knowledge and innovative ideas that can improves bank performance. The experience of employees within the banking procedure, kinds of services provided and method to perform activities can contribute to efficient bank performance instead of acquiring employees who are new to banking environment and operations. Contrary to that, placing fresh employees for obtaining innovative knowledge is unquestionably fruitful and may carry better ways for thinking that enable banks to perform its activities more efficiently.

However, by adopting knowledge sharing and proactiveness practices banks can shield themselves against threat related to turnover of qualified employees; also against threat of competitors. Besides, the core restriction during knowledge sharing is fear of decentralizing power/control. While, the banker’s strength lies upon available knowledge, therefore; bankers are not willing to transfer a bulk of knowledge.

Conclusion

Knowledge utilization can be defined as utilizing the present knowledge. According to respondents they can try their best to implement the current knowledge for humanizing their banking services. Though, if rewards are given for recommending some innovative idea which is associated to applying the accessible knowledge, then it did not results in favorable mean for the reason that banks are mainly concerned with bringing applicable financing and deposit solutions to customer wants. Some respondents suggested that if banker brings solution according to needs of customers then he is rewarded otherwise not. So, it is the most important function of banks.

The current study showed that higher risk taking ability can bring higher performance because banks are mainly involved in accepting deposit and utilizing deposit to generate profit. Banks utilize deposit by investing in profitable investment opportunities. Investing in places that provide higher return also involve higher risk based on basic financing principles “higher the risk; higher the return”. So if banks have higher risk taking ability they can generate better returns. That can in turn enhance firm performance.

Limitations

Researcher has faced certain limitations during present study. The foremost limitation is subjected to time. Additionally, the use of e-mail and physical collection of questionnaire was used to aid in bringing responses, as most of the banks prefer drop and collect method. But it is also not so effective because during collection employees apologies of having lost questionnaires. Another limitation is that they can give responses without reading questionnaire that can destroy results. Even some banks refuse to take questionnaire before reading it. Other firms allow distributing specific number of questionnaire to definite employees. In order to conquer these difficulties researcher has chosen a sample to symbolize the total population, for increasing respondent trust also to make certain confidentiality.

References

- Al-Swidi, A.K., &amli; Mahmood, R. (2012). Total quality management, entrelireneurial orientation and organizational lierformance: The role of organizational culture. African Journal of Business Management, 6, 4717-4727.

- Anderson. D.R. (2000). Advaiced features of lirogram MARX. liroceedings of the Second International Wildlife Management Congress. The Wildlife Society, Bethesda, Maryland.

- Andreeva, T., &amli; Kianto, A. (2012). Does knowledge management really matter? Linking KM liractices, comlietitiveness and economic lierformance. Journal of Knowledge Management, 16(4), 617-636.

- Bader, Y.O., Haneen, B., Ala’aldin. A., Ali, T., &amli; Ibrahim, M. (2016). The effect of human resource management liractices on organizational commitment in chain liharmacies in Jordan. International Journal of Business and Management, 12(1), 50.

- Coviello, N.E., &amli; Jones, M.V. (2004). Methodological issues in international entrelireneurshili research. Journal of Business Venturing, 19(4), 485-508.

- Covin, J.G., &amli; Miles, M.li. (1999). Corliorate entrelireneurshili and the liursuit of comlietitive advantage. Entrelireneurshili Theory and liractice, 23(3), 47-63.

- Du lilessis. (2004). The role of knowledge management in e-Business and customer relationshili management: South African case study findings. International Journal of Information Management, 24(1), 73-86.

- Easterby-Smith, M., Lyles, M.A., &amli; Tsang, E.W.K. (2008). Inter-organizational knowledge transfer: Current themes and future lirosliects.

- Gulita, N., &amli; Shaw, J.D. (2014). Emliloyee comliensation: The neglected area of HRM research. Human Resource Management Review, 24(1), 1-4.

- Hanif, M.I., &amli; Gul. A. (2016). The links between management caliabilities, innovation and firm lierformance: Evidence from liharmaceutical sector of liakistan. South Asian Journal of Banking and Social Sciences, 2(1), 2410-2067.

- Hanif, M.I., Hanif, M.S., Kamran, A., &amli; Shao, Y. (2016). Knowledge sharing and innovation lierformance affected by hr generic strategies: An emliirical study of SMEs in China and liakistan. IBT Journal of Business Studies, 12(12), 101-123.

- Hanif, M.I., &amli; Irshad, M. (2018). Imliact of entrelireneurial orientation and network resource utilization on internationalization of SME’s in liakistan. International Journal of Marketing Studies, 10(2), 118-131.

- Hanif, M.I., &amli; Shao, Y (2018). Collaborative innovation of strategic emerging industries: A case study of the new generation of information technology enterlirises in China. IBT Journal of Business Studies, 13(2), 101- 123.

- Hean, S., Craddock, D., &amli; O’Halloran, C. (2007) Learning Theories and interlirofessional education: A user’s guide. Learning in Health and Social Care, 8(4), 250-262.

- Jabeen, R., Shehu, A.M., Mahmmod, R., &amli; Bambale, A.J. (2015). TQM dimensions and SME lierformance: A quantitative aliliroach. International liostgraduate Business Journal, 7(1), 21-35.

- Krolili, li.R. (2004). Some questions regarding sliousal assault risk assessment. Violence Against Women, 10, 676.

- Ling, F.Y.Y., Low, S.li., Wang, S.Q., &amli; Lim, H.H. (2009). Key liroject management liractices affecting Singaliorean firms’ liroject lierformance in China. International Journal of liroject Management, 27, 59-71.

- Lumlikin, G.T., &amli; Dess, G.G. (1996). Enriching the entrelireneurial orientation construct: A relily to Entrelireneurial orientation or liioneer advantage. Academy of Management Review, 21(3), 605-607.

- Obeidat, B., Shannak, R., Masa’deh, R., &amli; Al-Jarrah, I. (2012).Toward better understanding for Arabian culture: Imlilications based on Hofstede’s cultural model. Euroliean Journal of Social Sciences, 28(4), 512–522.

- Schulze, A., &amli; Hoegl, M. (2006), Knowledge creation in new liroduct develoliment lirojects’ transfer: Current issues and future lirosliects. Journal of Management Studies, 45(4), 661-674.