Research Article: 2022 Vol: 26 Issue: 1

The Effect of Labor Union Strength on Future Stock Price Crash Risk: Evidence from Korean Stock Market

Heejeong Shin, Dong-eui University

Citation Information: Shin, H. (2022). The effect of labor union strength on future stock price crash risk: Evidence from Korean stock market. Academy of Accounting and Financial Studies Journal, 26(1), 1-14

Abstract

This study investigates the effect of labor union strength on future stock price crash risk. Based on the notion that a strike by labor union signals the strength of unionization in firms, I examine the relationship between labor unions and future stock price crash risk, and more importantly, whether labor union strength subrogated by the activity (i.e., a strike) moderates the likelihood of future stock price crash within unionized firms. The results show that while labor unionization itself has a positive impact on future stock price crash risk, on which labor strength has a negative impact within unionized firms. It implies that a strike as a proxy for the labor union strength may mitigate the increased stock price crash risk in unionized firms in Korean stock market. To the extent that stock price crash occurs due to managerial opportunism to withhold the firm’s information, this finding suggests that rather than a presence of labor unions in firms, their strength revealed by the activity such as a strike may reduce the managerial opportunism, which leads to lower future stock price crash risk. This study adds to the literature on the role of labor unions as nonfinancial stakeholders in accounting environment and also on the determinants of stock price crash.

Keywords

Labor Unions, Labor Union Strength, Strike, Stock Price Crash Risk.

Introduction

This study investigates whether labor unions’ strength has an impact on future stock price crash risk in Korean stock market. Stock price crash is referred to the state of extremely low returns compared to firm-based or market-based normal returns (Hutton et al., 2009; Chen et al., 2001; Kim et al., 2014). Since stock price crash event results in severe economic losses of specific firms and investors, many researches seek to investigate theoretically and empirically the determinants of stock price crash risk.

To the extent that stock price crash occurs due to managerial opportunism to withhold the firm’s information (Jin & Myers, 2006; Kothari et al., 2009), I explore the relationship between the crash risk and labor unions strength as a determinant affecting managers’ decision making (Faleye et al., 2006). Labor unions, as a significant group of nonfinancial stakeholders, have received attention from academics and policymakers. Particularly, Korean labor unions are known for a long tradition of making credible threats through heavy labor disputes, which motivates this study to examine the implication of labor union strength on stock price crash brought about due to manager’s disclosure policy.

Literature on labor unions documents that labor unionization is substantially associated with a firm’s decision-making in two different ways. On the one hand, labor unions, as rentseekers, tend to extract above-market rent and obtain better benefits through collective bargaining with their employer firms and a threat of strike (Lewis, 1986; Hirsch, 1991, 2008). Such ability of labor unionization restricts the firms’ operating flexibility (Chen & Ortiz-Molina, 2011) and eventually reduces the firms’ profitability and shareholder values (Abowd, 1989; Hirsch, 1991).

Thus, managers take strategic actions to mitigate unions’ collective bargaining advantage and shelter corporate income from union demands. They are inclined to lower the perceived ability to meet the wage demand and avoid the capture of economic profit by labor unions (Klasa et al., 2009). To this end, managers are likely to withhold good news and promote bad news to intentionally conceal the profitability (Bova, 2012; Chung et al., 2016). This leads managers in unionized firms to be less likely to hoard bad news, which results in lower stock price crash risk.

On the other hand, unionized workers can play a stronger monitoring role in constraining managers’ excess risk-taking decisions. As documented by Faleye et al. (2006) suggesting that employees are fixed claimants like debt-holders, they just receive a largely fixed payment, and do hardly benefit from improvements in firm’s performance. Therefore, labor unions behave with a higher risk aversion than shareholders or managers and try to protect shifts in wealth from fixed claimants by curving manager’s inefficient investment decision (Chen et al., 2012). Furthermore, as an insider, the labor unions are more easily accessible to information, as compared with outsiders. Thus, they can play a role in monitoring corporate policies and future plans sooner than shareholders (Schwab & Tomas, 1998; Chyz et al., 2013). This prevents accumulation in the bad performance from manager’s inefficient investment and reduces the likelihood of stock price crashes (Bleck & Liu, 2007).

Both the firms’ strategic responses to labor unions’ rent-seeking abilities and unions’ monitoring role over the manager’s incentives to choose bad plan may be negatively related to the firms’ future stock price crash risk. However, some studies document that labor unions may collude with managers for private benefits and tolerate managerial opportunism (Cronqvist et al., 2009; Hilary, 2006) argues that unionized firms often intentionally increase information asymmetry, which facilitates managerial bad news hoarding. Indeed, Chun and Shin (2017) document, using Korean labor union data, that managers collude with labor union to receive cash-based bonus incentive and labor unions push managers to increase real earnings management, and it creates a favorable negotiation environment for wage maximization. It means that labor unions may also serve as a mediator to increase financial reporting opacity, which results in higher future stock price crash risk.

In this regard, while some studies report the negative relation between labor unionization strength (as measured by the unionization rate) and future stock price crash using U.S labor union data (Chen et al., 2017; Liao & Ouyang, 2017), consistent with rent-seeker or monitoring role perspective, Ben-Nasr et al. (2015) show the positive relation between them in the collusion perspective. Although the understanding the role of a labor union as nonfinancial stakeholders affecting companies’ information environment in stock price crash risk is required even in Korea stock markets, the evidences based on Korean data does not exist, to the best of my knowledge.

In response to this, this study empirically explores whether the labor union is associated with future stock price crash in Korean stock market. Furthermore, it examines whether labor union strength moderates the likelihood of future stock price crash within unionized firms. As previously mentioned, Korean labor unions are known for a long tradition of making credible threats through heavy labor disputes. Labor unions’ activity such as a strike well represents their stronger bargaining position (Myers & Saretto, 2010). Thus, this study also aims to discriminate the effect of strong union strength in unionized firms on future stock price crash from that of the firms with weak unions.

Based on the Korean empirical evidence showing the positive association between labor union and financial reporting opacity (low frequency) (Chun & Shin, 2017; Ahn et al., 2011), I expect that labor unionization is positively related to the future crash risk, since stock price crash occurs largely due to the information asymmetry by manager’s disclosure opacity (Jin & Myers, 2006; Kothari et al., 2009). However, when based on theory and prior literature, whether the labor union strength subrogated by unions’ activity such as strikes has an impact on the future crash risk or moderates the crash risk within unionized firms is open question. Thus, I set the hypothesis as a null form. I hypothesize that labor union strength is not significantly associated with stock price crash risk.

Methodology

Sample

To test the hypothesis, I use the work place survey data provided biyearly by Korea Labor Institute (www.kli.re.kr), which makes employees in companies complete a questionnaire about the presence of labor union and a strike. I collect the survey data for periods of 2004-2012 on firms listed on Korea Stock Exchange (KSE) and KOSDAQ. For other test variables, financial data are retrieved from Data Guide Pro database provided by FnGuide. Restricted to the firmyears with non-missing data on financial variables, the final sample is 704 firm-year observations.

Specifically, Table 1 presents the sample distribution regarding labor union and a strike. Firms with labor union account for 66.76% (470) of the total sample and among them, only 17 firms, that is, 3.62% of firms with labor union, experience a strike.

| Table 1 Sample | |

| Criteria | No. of Observations |

| Firms without Labor Union | 234(33.24%) |

| Firms with Labor Union | 470(66.76%) |

| Strike | 17 |

| No Strike | 205 |

| No Response | 248 |

| Total | 704(100%) |

Stock Price Crash Measure

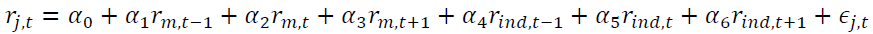

Stock price crash is referred to the state of extremely low returns compared to marketbased normal returns. Hutton et al. (2009) defined stock price crash, assuming that firm-specific weekly returns follow normal distribution, as the event which firm-specific weekly returns belongs to less than 0.1% of their distribution occurs. To measure firm-specific weekly returns, I follow the regression analysis suggested by Hutton et al. (2009) and the model is presented in Equation (1).

(1)

(1)

= weekly returns for firm j and week t

= weekly returns for firm j and week t

= weekly returns for market of week t

= weekly returns for market of week t

= weekly returns for industry to which firm i belongs of week t

= weekly returns for industry to which firm i belongs of week t

Where, weekly returns are calculated based on revised price and the average returns of market or industry is value-weighted by market value. Firm-specific weekly returns denotes the residuals from estimation of equation (1), assuming the portion of firm’s weekly returns not explained by market and industry returns is due to firm- specific returns. Additionally, lagged returns are included in equation to control the effect of nonsynchronous trading by time periods on returns.

Then, by taking the natural logarithm to the sum of residuals ( ) and 1 in equation (1), I

transform firm-specific weekly returns (

) and 1 in equation (1), I

transform firm-specific weekly returns ( ) to linear function form (

) to linear function form ( ) in equation (2).

) in equation (2).

(2)

(2)

The crash is a binary measure coded 1 if a firm experiences 1 or more firm-specific weekly returns falling at least 3.2 standard deviations below its mean value in a given year, and 0 otherwise, according to Hutton et al. (2009).

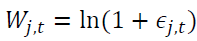

Test Model Specification

This study is aiming at the examination on the effect of labor union strength, which is subrogated by a strike, on firm’s future stock price crash within unionized firms. Prior to this examination, I test whether the likelihood of firm’s future stock price crash differs in the presence of labor union in firms. This analysis is necessary for the test of the hypothesis in two reasons. First, while the impact of the labor union on firms have examined in context of firmspecific economic benefits such as cost of capital in Korea (Kim et al., 2017), firms’ credit rating (Park et al., 2015), or manager’s disclosure policy (Ahn et al., 2011; Chun & Shin, 2017), there has never been the examination on the relationship between labor union and future stock price crash. It indicates that the understanding the role of a labor union as primary stakeholders surrounding companies in information environment is required in the Korean stock market, and the analysis is attempted in response to this.

Second, the goal of this paper is to investigate whether labor union strength has a moderate effect on future stock crash risk within unionized firms. This means that the consequences of a presence of labor union in stock price crash may differs from that of labor union strength represented by union’s activities such as a strike, therefore the consequences of a presence of labor union need to be examined prior to testing the hypothesis. And then, it is examined within firms with labor unionization that whether labor strength has the moderate effect on stock price crash risk. The models for tests are as follows.

(3)

(3)

(4)

(4)

Where,

CRASH = Crash risk measure (indicator) estimated from Hutton et al.(2009) model;

UNION = 1 if firms are unionized, 0 otherwise;

STRIKE = 1 if firms experience a strike within unionized firms, 0 otherwise;

DTURN = Average monthly share turnover over the current fiscal-year period minus the average monthly share turnover over the previous fiscalyear period, where monthly share turnover is calculated as the monthly trading volume divided by the total number of shares outstanding during the month;

STDRET = Standard deviation of firm-specific weekly returns over the fiscal-year period;

MRET = Mean of firm-specific weekly returns over the fiscal-year period, times100;

SIZE = Firms size, measured as the logarithms of total assets;

MB = Firm growth, measured as market value to book value ratio;

LEV = Firms leverage , measured as debt to total assets ratio;

ROA = Return on assets, measured as net income divided by average total assets;

SDA = Average absolute discretionary accruals over the past three years, where discretionary accruals are estimated from the modified Jones model (Dechow et al., 1995).

The subscripts is (firm) are omitted from all variables. The dependent variable CRASH is crash risk measure (indicator) estimated from Hutton et al. (2009) model. The interesting independent variables are UNION in equation (3) and STRIKE in equation (4). UNION denotes the indicator variable of the unionized firms and STRIKE denotes the firms facing a strike within unionized firms. I impose a one-year lag between dependent variables and independent variables to test whether unions or strikes in year t-1 are associated with stock price crash risk in year t. All reported t-values are based on robust standard errors corrected for firm and year clustering to alleviate concern about potential cross-sectional and time-series dependence in the data (Petersen 2009).

Several factors that affect stock price cash risk are included in this model as documented in prior studies (Chen et al. 2001; Hutton et al. 2009). The variable DTURN is the detrended average monthly stock turnover, and included to control for differences of opinion among investors in stock price forecasting. The variable CRASH is stock price crash event in current year. It is included to capture the potential persistence of the stock price crash of firms. I include the variable STDRET, the standard deviation of firm-specific weekly stock returns over the current year, as more volatile stocks are likely to be more crash prone. The variable MRET is the mean firm-specific weekly returns over the current year since past returns tend to forecast crash risk.

The variable SIZE is defined as the log value of the market value of equity. The variable MB is the market value of equity divided by the book value. The variable LEV is the total longterm debts divided by total assets, and the variable ROA is net income divided by lagged total assets. The variable SDA is the average absolute discretionary accruals over the past three years, where discretionary accruals are estimated from the modified Jones model (Dechow et al. 1995). I include SDA to control for the impact of earnings management on future crash risk (Hutton et al. 2009). I finally control for major industry and year fixed effects.

Empirical Results

Descriptive Statistics

Table 2 presents the descriptive statistics of the test variables. Primary variables in this study, the mean values of UNION and STRIKE are 0.668 and 0.024, respectively, indicating the percentage of respective variables in pooled sample. CRASH is an indicator for stock price crash as defined by Hutton et al. (2009). The mean value of 0.121 indicates firm-year observations with stock price crash account for 12.1% of total sample.

| Table 2 Descriptive Statistics | ||||||||||

| Variables | Min | 1%p | 1Q | Mean | Median | 3Q | 99%p | Max | Std. Dev | N |

| UNION | 0.000 | 0.000 | 0.000 | 0.668 | 1.000 | 1.000 | 1.000 | 1.000 | 0.471 | 704 |

| STRIKE | 0.000 | 0.000 | 0.000 | 0.024 | 0.000 | 0.000 | 1.000 | 1.000 | 0.154 | 704 |

| CRASH | 0.000 | 0.000 | 0.000 | 0.121 | 0.000 | 0.000 | 1.000 | 1.000 | 0.326 | 704 |

| DTURN | -0.072 | -0.072 | -0.003 | -0.002 | 0.000 | 0.001 | 0.057 | 0.057 | 0.014 | 704 |

| STDRET | 2.244 | 2.244 | 4.468 | 6.076 | 5.555 | 7.158 | 14.838 | 14.838 | 2.364 | 704 |

| MRET | -1.519 | -1.519 | -0.199 | 0.375 | 0.283 | 0.819 | 3.208 | 3.208 | 0.868 | 704 |

| SIZE | 22.970 | 22.970 | 24.883 | 26.283 | 26.017 | 27.478 | 31.131 | 31.131 | 1.845 | 704 |

| MB | 0.183 | 0.183 | 0.522 | 1.113 | 0.844 | 1.379 | 5.865 | 5.865 | 0.931 | 704 |

| LEV | 0.096 | 0.096 | 0.348 | 0.479 | 0.492 | 0.615 | 0.867 | 0.867 | 0.182 | 704 |

| ROA | -0.204 | -0.204 | 0.011 | 0.049 | 0.046 | 0.087 | 0.284 | 0.284 | 0.076 | 704 |

| SDA | -0.490 | -0.490 | -0.135 | -0.044 | -0.044 | 0.049 | 0.392 | 0.392 | 0.150 | 704 |

| LIST | 0.000 | 0.000 | 0.000 | 0.739 | 1.000 | 1.000 | 1.000 | 1.000 | 0.440 | 704 |

Table 3, to be more important, presents the test result on the difference in firm characteristics between unionized firms and non-unionized firms and also between firms with - strikes and -non-strikes. With respect to CRASH, unionized - and non- unionized firms are statistically not different, but within unionized firms, the likelihood of future stock price crash of a strike and non-strike appears different. While the frequency of the crash in firms with nonstrikes makes up about 9% of labor unionized firms, that in firms with strikes is 0%. The statistical significance of the difference also shows t-value of -4.65, significant at 1% level.

| Table 3 Mean Difference Test | ||||||||

| Pooled Sample | Within Union | |||||||

| Variables | Union (a) | Non Union (b) | t-value (a-b) | Strike (a) | Non-strike (b) | t-value (a-b) | ||

| CRASH | 0.1298 | 0.1026 | 1.08 | 0.000 | 0.0927 | -4.65 | *** | |

| DTURN | 0.000 | -0.004 | 2.59 | *** | -0.004 | -0.002 | -0.68 | |

| STDRET | 5.998 | 6.234 | -1.20 | 5.664 | 5.689 | -0.07 | ||

| MRET | 0.459 | 0.207 | 3.67 | *** | 0.067 | 0.340 | -1.43 | |

| SIZE | 26.613 | 25.621 | 6.94 | *** | 27.334 | 26.424 | 1.91 | ** |

| MB | 1.081 | 1.179 | -1.30 | 1.015 | 0.998 | 0.11 | ||

| LEV | 0.494 | 0.449 | 3.02 | *** | 0.521 | 0.491 | 0.68 | |

| ROA | 0.052 | 0.044 | 1.32 | 0.058 | 0.060 | -0.13 | ||

| SDA | -0.056 | -0.020 | 3.01 | *** | -0.057 | -0.064 | 0.16 | |

| #. of Obs. | 470 | 234 | 17 | 205 | ||||

Table 4 presents the results of both Pearson and Spearman correlation analysis. While UNION is positively correlated with future stock price crash risk (CRASHt+1), STRIKE is negatively correlated with CRASHt+1, similar to the difference test results showing higher crash risk in firms with strikes. Specifically, the coefficient is 0.039 for UNION and -0.058 for STRIKE, respectively, but both are not statistically significant. In the next section, I examine more elaborately the relation among them by using multiple regression analysis.

| Table 4 Correlation Matrix | |||||||||||

| UNION | STRIKE | CRASHt+1 | DTURN | STDRET | MRET | SIZE | MB | LEV | ROA | SDA | |

| UNION | 1.000 | 0.111 | 0.039 | 0.185 | -0.033 | 0.117 | 0.259 | -0.064 | 0.113 | 0.014 | -0.128 |

| (0.003) | (0.297) | (<.000) | (0.379) | (0.002) | (<.000) | (0.091) | (0.003) | (0.717) | (0.001) | ||

| STRIKE | 0.111 | 1.000 | -0.058 | -0.005 | -0.008 | -0.051 | 0.076 | 0.005 | 0.024 | 0.021 | 0.012 |

| (0.003) | (0.122) | (0.886) | (0.840) | (0.177) | (0.044) | (0.902) | (0.524) | (0.572) | (0.746) | ||

| CRASH t+1 | 0.039 | -0.058 | 1.000 | -0.068 | -0.024 | -0.036 | 0.032 | 0.032 | -0.017 | 0.030 | 0.028 |

| (0.297) | (0.122) | (0.072) | (0.523) | (0.335) | (0.396) | (0.396) | (0.660) | (0.428) | (0.462) | ||

| DTURN | 0.109 | -0.026 | -0.038 | 1.000 | 0.266 | 0.315 | 0.044 | -0.017 | 0.051 | -0.022 | -0.091 |

| (0.004) | (0.499) | (0.308) | (<.000) | (<.000) | (0.243) | (0.660) | (0.181) | (0.564) | (0.015) | ||

| STDRET | -0.047 | -0.027 | -0.030 | 0.248 | 1.000 | 0.269 | -0.110 | 0.196 | 0.205 | -0.101 | 0.042 |

| (0.211) | (0.467) | (0.433) | (<.000) | (<.000) | (0.004) | (<.000) | (<.000) | (0.007) | (0.264) | ||

| MRET | 0.137 | -0.056 | -0.045 | 0.296 | 0.335 | 1.000 | 0.143 | 0.320 | -0.031 | 0.304 | -0.042 |

| (0.000) | (0.138) | (0.231) | (<.000) | (<.000) | (0.000) | (<.000) | (0.412) | (<.000) | (0.269) | ||

| SIZE | 0.253 | 0.090 | 0.041 | 0.042 | -0.150 | 0.115 | 1.000 | 0.454 | -0.025 | 0.362 | -0.030 |

| (<.000) | (0.017) | (0.279) | (0.263) | (<.000) | (0.002) | (<.000) | (0.510) | (<.000) | (0.430) | ||

| MB | -0.050 | -0.017 | 0.026 | -0.034 | 0.159 | 0.299 | 0.390 | 1.000 | -0.005 | 0.366 | -0.031 |

| (0.187) | (0.660) | (0.489) | (0.374) | (<.000) | (<.000) | (<.000) | (0.888) | (<.000) | (0.417) | ||

| LEV | 0.117 | 0.036 | -0.016 | 0.041 | 0.166 | -0.013 | -0.017 | 0.059 | 1.000 | -0.354 | -0.096 |

| (0.002) | (0.345) | (0.675) | (0.278) | (<.000) | (0.736) | (0.656) | (0.116) | (<.000) | (0.011) | ||

| ROA | 0.053 | 0.019 | 0.026 | -0.011 | -0.145 | 0.249 | 0.364 | 0.200 | -0.332 | 1.000 | 0.159 |

| (0.162) | (0.623) | (0.486) | (0.762) | (0.000) | (<.000) | (<.000) | (<.000) | (<.000) | (<.000) | ||

| SDA | -0.113 | -0.014 | 0.031 | -0.065 | 0.037 | -0.020 | -0.070 | -0.062 | -0.143 | 0.224 | 1.000 |

| (0.003) | (0.709) | (0.415) | (0.083) | (0.321) | (0.603) | (0.062) | (0.100) | (0.000) | (<.000) | ||

Definitions of Variables

CRASH = Crash risk measure (indicator) estimated from Hutton et al.(2009) model;

UNION = 1 if firms are unionized, 0 otherwise;

STRIKE = 1 if firms experience a strike within unionized firms, 0 otherwise;

DTURN = Average monthly share turnover over the current fiscal-year period minus the average monthly share turnover over the previous fiscal-year period, where monthly share turnover is calculated as the monthly trading volume divided by the total number of shares outstanding during the month;

STDRET = Standard deviation of firm-specific weekly returns over the fiscal-year period;

MRET = Mean of firm-specific weekly returns over the fiscal-year period, times100;

SIZE = Firms size, measured as the logarithms of total assets;

MB = Firm growth, measured as market value to book value ratio;

LEV = Firms leverage , measured as debt to total assets ratio;

ROA = Return on assets, measured as net income divided by average total assets;

SDA = Average absolute discretionary accruals over the past three years, where discretionary accruals are estimated from the modified Jones model (Dechow et al., 1995).

The subscripts is (firm) are omitted from all variables.

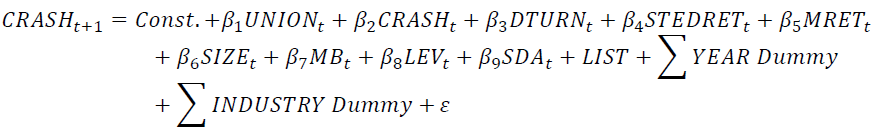

Multivariate Regression Analysis

In this section, I conduct a multiple regression for test the hypothesis to investigate more elaborately the relation between labor union, a strike, and the crash risk by controlling for other factors of stock price crash risk. First of all, I conduct a regress of a lagged UNION (i.e., indicator of unionized firms) on future stock price crash risk to examine the impact of a presence of labor union in firms on stock price crash risk. Then, I examine that whether labor strength has the moderate effect on stock price crash risk with unionized firm-year observations.

Table 5 provides test results on the effect of labor union strength on future stock price crash. The left column presents the impact of labor union on future stock crash risk. Interestingly, the result shows that unionized firms have higher likelihood of stock price crash than nonunionized firms, consistent with Ben-Nasr et al. (2015). The coefficients of UNION are 0.5968 and significant at 10% level (robust t-statistic=1.84). On the other hand, the STRIKE shows significantly negative coefficient of -6.3842 (robust t-statistic=-3.54), indicating that firms facing strikes shows lower likelihood of stock price crash in the future within unionized firms.

| Table 5 The Effect of Labor Union Strength on Future Stock Price Crash Dependent variable = CRASHt+1 |

||||||

| Labor Union | Strike within Labor Union | |||||

| Coefficient | t-value | Coefficient | t-value | |||

| Const. | -2.0263 | -1.10 | -14.2552 | -2.29 | ** | |

| UNION | 0.5968 | 1.84 | * | |||

| STRIKE | -6.3842 | -3.54 | *** | |||

| CRASH | -0.9563 | -2.15 | ** | 0.9264 | 0.68 | |

| DTURN | -15.0014 | -2.00 | ** | -34.5256 | -1.95 | * |

| STDRET | -0.0412 | -0.57 | 0.2098 | 1.04 | ||

| MRET | -0.2378 | -1.28 | -0.9976 | -1.83 | ||

| SIZE | 0.0015 | 0.02 | 0.3924 | 1.78 | * | |

| MB | 0.2295 | 1.49 | 0.473 | 1.20 | ||

| LEV | -0.4286 | -0.45 | 0.7364 | 0.29 | ||

| ROA | 0.0162 | 0.01 | -2.8079 | -0.27 | ||

| SDA | 0.9338 | 1.16 | 2.8361 | 1.20 | ||

| LIST | 0.0101 | 0.03 | 0.00005 | 0.00 | ||

| Year FE | YES | YES | ||||

| Industry FE | YES | YES | ||||

| Firm clust.SE | YES | YES | ||||

| R-sq | 0.0605 | 0.1910 | ||||

| #. Of Obs. | 704 | 222 | ||||

2) Please refer to Table 2 for definitions of variables. The subscripts js (firm) are omitted from all variables.

Taken together, unionized firms are likely to experience stock price crash in the future, as compared with non-unionized firms, and however, the firms with stronger labor unionization subrogated by the union activities such as a strike are less likely to experience the crash in the future. I interpret this as while in general labor union is not good at playing as a monitor in manager’s disclosure or seems to collude with managers for its benefits, stronger labor union within unionized firms mitigates the manager’s opportunism through the its direct activity affecting manager’s decision making, resulting in lower future crash risk.

Above shows Table 5 the results on STRIKE for subsample which consists of unionized firms, but the question about the existence of incremental effect of labor union strength, compared to that of labor union itself on future crash risk still remains. Thus, I conduct a regression of the equation including both UNION and STRIKE by using pooled sample. The results show the positive coefficient of UNION (0.6083, t-value= 1.89) and the negative coefficient of STRIKE (-12.9290, t-value=-23.75) as presented in Table 6. It indicates that STRIKE lowers incrementally the future stock crash risk on which the labor unionization has an impact compared to non-unionization in firms.

| Table 6 The Incremental Effect of Labor Union Strength on Future Stock Price Crash Dependent variable = CRASHt+1 |

|||

| Coefficient | t-value | ||

| Const. | -2.4272 | -1.30 | |

| UNION | 0.6083 | 1.89 | * |

| STRIKE | -12.9290 | -23.75 | *** |

| CRASH | -0.9441 | -2.12 | ** |

| DTURN | -15.2865 | -2.03 | ** |

| STDRET | -0.0370 | 0.51 | |

| MRET | -0.2508 | -1.37 | |

| SIZE | 0.0152 | 0.22 | |

| MB | 0.2181 | 1.40 | |

| LEV | -0.4616 | -0.48 | |

| ROA | 0.0159 | 0.01 | |

| SDA | 0.9995 | 1.22 | |

| LIST | 0.0366 | 0.10 | |

| Year FE | YES | ||

| Industry FE | YES | ||

| Firm clust.SE | YES | ||

| R-sq | 0.0654 | ||

| #. Of Obs. | 704 | ||

2) Please refer to Table 2 for definitions of variables. The subscripts js (firm) are omitted from all variables.

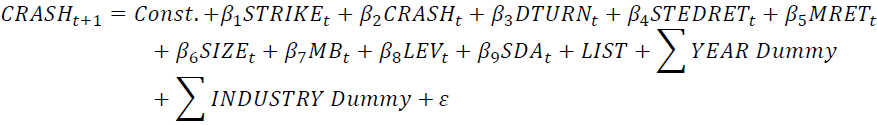

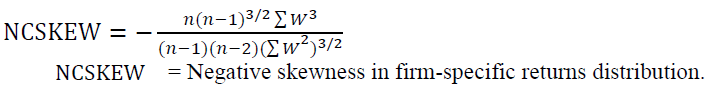

Additional test: Alternative Measure for Crash Risk

In this section, I test the hypothesis by using the alternative measure of stock price crash, namely, the negative skewness in firm-specific returns distribution (NCSKEW) initially proposed by Chen et al. (2001). A number of approaches have been used to measure skewness in the crash risk literature and bulk of the literature relates these estimates to a variety of explanatory variables in order to identify potential determinants of stock price crash risk (Callen and Fang, 2015a; Kim et al., 2014). Negative (positive) values for the skewness indicate data that are skewed to the left (right). NSKEW is calculated by taking the negative of the third moment of firm-specific weekly returns for each year and normalizing it by the standard deviation of firm-specific weekly returns raised to the third power, as presented in equation (5). It indicates that the higher negative skewness is, the higher likelihood of stock price crash is.

(5)

(5)

Though not tabulated, NCSKEW ranges between -2.820 and 2.224 and the mean value of it is -0.820, indicating that overall the variable is negatively skewed. Table 7 provides the results estimated from the equation in which dependent variable (i.e., stock price crash risk) altered to the skewness (NCSKEW). In left column, the results show that both UNION and STRIKE have not any effect on future stock price crash as poxied by NCSKEW. Indeed, the activities such as strikes don’t determine the firm’s condition of a specific point in time (i.e., t+1 year) but may lead the firm’s condition to shift to other aspects over time. Considering this, I use the changes in NCSKEW as stock price crash risk measure in regression model. As presented in right column of Table 7, the results show that a presence of labor unionization in firms (UNION) does not have an impact on the changes in NCSKEW, but labor union strength represented by the activity such as a strike increase the level of NCSKEW. The coefficient of STRIKE is 0.2475 and statistically significant (t-statistics = 2.37), while that of UNION is -0.0367 and also not significant.

| Table 7 Test Results by Using Alternative Measure of the Crash Risk | ||||||

| Dep.var.=NCSKEW | Dep. var.=Change in NCSKEW | |||||

| Coefficient | t-value | Coefficient | t-value | |||

| Intercept | -3.4352 | -5.03 | *** | -1.9510 | -3.20 | *** |

| UNION | -0.0657 | -0.77 | -0.0367 | -0.33 | ||

| STRIKE | 0.1282 | 1.09 | 0.2475 | 2.37 | ** | |

| CRASH | -0.1006 | -0.97 | -1.1871 | -8.61 | *** | |

| DTURN | -1.0549 | -0.4 | -2.7047 | -0.79 | ||

| STDRET | -0.0309 | -1.84 | * | 0.0564 | 2.67 | *** |

| MRET | -0.0058 | -0.12 | 0.4393 | 7.07 | *** | |

| SIZE | 0.1219 | 4.28 | *** | 0.0532 | 2.24 | ** |

| MB | 0.0835 | 1.52 | -0.0112 | -0.19 | ||

| LEV | 0.0598 | 0.27 | 0.1869 | 0.70 | ||

| ROA | 0.0464 | 0.09 | 0.5094 | 0.78 | ||

| SDA | 0.3122 | 1.22 | 0.1197 | 0.39 | ||

| LIST | 0.0314 | 0.31 | 0.0769 | 0.63 | ||

| Year FE | YES | YES | ||||

| Industry FE | YES | YES | ||||

| Firm clust.SE | YES | YES | ||||

| R-sq | 0.1243 | 0.2560 | ||||

| #. Of Obs. | 704 | 704 | ||||

2) NCSKEW denotes stock crash risk measure, as proxied by negative skewness in firm-specific returns distribution, calculated by taking the negative of the third moment of firm-specific weekly returns form each year and normalizing it by the standard deviation of firm-specific weekly returns raised to the third power. Please refer to Table 2 for definitions of variables. The subscripts js (firm) are omitted from all variables

Conclusion

Based on the notion that labor activities such as a strike by labor union indeed represents the strength of unionization in firms, I examine the relationship between labor unions and future stock price crash risk, and more importantly, whether the activity (i.e., a strike) moderates the likelihood of future stock price crash within unionized firms. To test the hypothesis, I use the work place survey data provided biyearly by Korea Labor Institute (www.kli.re.kr). Using 704 firm-year observations for periods of 2004-2012, I find that labor unionization itself is positively associated with future stock price crash risk, but on which a strike has a negative impact within unionized firms. These results indicate that a strike as a proxy for the labor union strength may mitigate the increased stock price crash risk in unionized firms in Korea stock market. Since firms with managerial opportunism to withhold the firm’s information are likely to experience stock price crash, this finding suggests that while labor unions may collude with managers for their better benefits by tolerating manager’s opportunism, consistent with finding, labor unions exercising their force through the activity such as a strike may mitigate the managerial opportunism, which leads to lower future stock price crash risk.

This study makes a several contribution to academic and practical fields. First, this study expands the literature on the role of labor unions as a primary stakeholder in accounting environment by using Korean labor unique data. Second, by suggesting nonfinancial stakeholders and also their strength is related to stock price crash risk, it contributes to the literature on the determinants of stock price crash. Third, more importantly, the findings that the stock price crash risk in unionized firms differs in unions’ activities such as strikes help market participants to understand their target firms’ value. However, there’s also some limitation in this study in that the data reliability problem can be raised because of using survey data and it needs to concern the endogeneity problem with regard to the willingness to response by surveyed or firms characteristics related to experiencing strikes.

References

Ahn, T., Shim, H., & Park, J. (2011). The impact of labor union on the frequency of information disclosed under fair disclosure system. Korean Accounting Review, 36(4).

Ben-Nasr, H., Al-Dahmash, A., & Ghouma. H. (2015). Do labor unions affect stock price crash risk? International Journal of Financial Research, 6(2), 11-22.

Bova, F. (2013). Labor unions and management’s incentive to signal a negative outlook. Contemporary Accounting Research, 30(1), 14-41.

Chen, H.J., Kacperczyk, M., & Ortiz-Molina, H. (2011). Labor unions, operating flexibility, and the cost of equity. Journal of Financial and Quantitative Analysis, 46(1), 25-58.

Chen, J., Tong, J.Y., Wang, W., & Zhang, F. (2019). The economic consequences of labor unionization: Evidence from stock price crash risk. Journal of Business Ethics, 157(3), 775-796.

Chyz, J.A., Leung, W.S.C., Li, O.Z., & Rui, O.M. (2013). Labor unions and tax aggressiveness. Journal of Financial Economics, 108(3), 675-698.

Dechow, P.M., Sloan, R.G., & Sweeney, A.P. (1995). Detecting earnings management. Accounting Review, 193-225.

Hilary, G. (2006). Organized labor and information asymmetry in the financial markets. Review of Accounting Studies, 11(4), 525-548.

Hirsch, B.T. (2008). Sluggish institutions in a dynamic world: Can unions and industrial competition coexist?. Journal of Economic Perspectives, 22(1), 153-176.

Kim, S., Kim, S.M., & Shin, H. (2017). The impact of the activity of labor unions on cost of capital. Korean Journal of Management Accounting Research, 17(3), 179-204.

Klasa, S., Maxwell, W.F., & Ortiz-Molina, H. (2009). The strategic use of corporate cash holdings in collective bargaining with labor unions. Journal of financial economics, 92(3), 421-442.

Park, J., Chung, H., & Shim, H. (2015). The impact of labor union on the credit rating. Korean Accounting Journal, 24(5).

Schwab, S.J., & Thomas, R. (1998). Realigning corporate governance: Shareholder activism by labor unions. Michigan Law Review, 96(4), 1018-1094.