Research Article: 2019 Vol: 23 Issue: 6

The Effect of Liquidity, Profitability and Solvability to the Financial Distress of Manucatured Companies Listed On the Indonesia Stock Exchange (IDX) Period of Year 2015-2017

Rusli Moch, Universitas Negeri Jakarta

Rida Prihatni, Universitas Negeri Jakarta

Agung Dharmawan Buchdadi, Universitas Negeri Jakarta

Abstract

This study aims to examine the effect of liquidity as measured by Current Ratio and Working Capital to Total Assets, profitability as measured by Return On Equity and Return On Assets, and solvency as measured by Debt Asset Ratio, Debt Equity Ratio, and Time Interest Earned in predicting financial distress at manufacturing companies listed on the Indonesia Stock Exchange for the period 2015-2017. The populations in this study were all manufacturing companies listed on the Stock Exchange in 2015 to 2017. While the sample of this study was determined by the nonprobability sampling method so that 101 samples were obtained. The type of data used is secondary data obtained from the Indonesia capital market directory and www.idx.co.id. The statistical methods used for hypothesis testing are the Likelihood Statistic Test (simultaneous) and the z statistical test (partial) obtained from multiple logistic regression analysis with Financial distress (Y) as the dependent variable. This study uses Altman discriminant analyst with version 4 (four) variables to determine the Z-Score value as a prediction classification of companies experiencing financial distress, in vulnerable areas, or healthy. The results of the research partially showed CR liquidity, WCTA had a significant negative effect, ROA profitability, ROE had a significant negative effect and DAR solvency, DER had a significant positive effect on financial distress of manufacturing companies listed on the Indonesia Stock Exchange in the 2015-2017 period. The other ratio is TIE which has no significant effect on financial distress.

Keywords

Liquidity, Profitability, Solvency, Financial Distress, Z-Score.

Introduction

The development of a dynamic world economy requires good company management. The company must always support to maintain and improve its performance in every sector in anticipation of tighter business competition. Indonesia is a medium developing country, along with this development, growth in this country also causes very tight competition in every line of business in every company, be it service companies, trade companies or manufacturing companies.

In 2008 the economy in Indonesia experienced a situation where the economic situation at that time was less conducive. The situation occurred because of the impact of the American global crisis in 2008. As a result, many companies whose health levels were disrupted were experiencing financial difficulties so they could not pay off financial obligations that were due and were eventually declared bankrupt. In addition, the average company bears a high operational cost burden that is greater than the profits. This further worsened the economic conditions in Indonesia because with the number of companies closed, more workers became unemployed, so the crime rate was even higher. This event is a periodic event, such as 1997-1998, 2008-2009, and estimates for 2018-2019. Investors in Indonesia experience various events related to financial distress. Therefore research on this matter still needs to be done to maintain the validity of ratios that indicate financial difficulties.

Seeing these conditions, the company is expected to be able to quickly and appropriately make decisions and take action to improve the situation and conditions so that they will not be protracted and eventually failure of the company will lead to bankruptcy. The main reason for the lack and incapability of the company to pay its obligations is actually due to the negligence of the company's management in running its business. Another reason is that previously the management did not calculate the financial ratios provided so they did not know that the actual condition of the company was no longer able to because the value of debt was higher than the value of current assets or short-term debt (Kasmir, 2012).

Some companies experienced financial difficulties until it was declared bankrupt, such as: Humpuss Sea Transport Pte. Ltd, PT. Telekomunikasi Indonesia, PT. Merpati Nusantara Airlines, Mobile-8 Telecom, Tbk, PT. Citra Maharlika Nusantara Corpora Tbk, PT. Dwi Aneka Jaya Kemasindo Tbk. The condition of financial difficulties was also experienced by companies in various sectors of the textile and garment sub-sector. The concern of business players is increasing because they are burdened with various tariff and levy increases, the price of fuel oil (BBM), electricity tariffs, telephone tariffs, transport tariffs, and raw material prices have proven to add to the burden of expenditure. This situation is worsened by the rush of imported textiles and textile products ASEAN, namely the China Free Trade Area is proven to hit this business sector (http://cetak.kompas.com). This concern is reasonable because Chinese products are increasingly rampant in Indonesia. The production capacity of the textile industry in China is more than 10 times the production capacity of the Indonesian textile industry. In comparison, China's textile production capacity is estimated at 62 million tons per year, while Indonesia is only 6.2 million tons per year. Most companies in the manufacturing industry experienced a downward trend in net income and even suffered losses. This shows that the company cannot generate profits. In addition the company is also experiencing financial difficulties to pay debts that are past due, thus experiencing bankruptcy (Table 1).

| Table 1Data of Manufacturing Company Profit / Loss | ||||

| Sl. No. | Company Code | Net Income in IDR Thousands | ||

| 2015 | 2016 | 2017 | ||

| 1 | ALMI | -53.613.906 | -99.931.854 | 6.446.456 |

| 2 | ALTO | -26.500.566 | -26.500.566 | -62.849.582 |

| 2 | BAJA | -9.349.901 | 34.393.355 | -22.984.762 |

| 3 | BRNA | -7.159.572 | 12.664.977 | -178.283.422 |

| 4 | ETWA | -224.231.055 | -68.488.774 | 45.028.000 |

| 5 | HDTX | -355.659.019 | -393.567.637 | -847.049.209 |

| 6 | IKAI | -108.888.289 | -145.359.282 | -43.578.020 |

| 7 | IMAS | -22.489.431 | -312.881.006 | -64.296.811 |

| 8 | JKSW | -23.096.658 | -2.895.182 | -3.925.259 |

| 9 | JPRS | -21.989.705 | -19.268.949 | -14.894.192 |

| 10 | KBRI | -155.746.631 | -102.760.679 | -125.704.262 |

| 11 | KIAS | -144.635.000 | -252.499.000 | -85.300.977 |

| 12 | MBTO | -14.056.550 | 8.813.611 | -24.690.826 |

| 13 | MYTX | -263.871.000 | -356.491.000 | -286.485.000 |

| 14 | PSDN | -42.619.830 | -36.662.178 | 8.813.611 |

| 15 | RMBA | -1.638.538.000 | -2.085.811.000 | -480.063.000 |

| 16 | SIAP | -36.848.228 | -25.245.748 | -10.584.364 |

| 17 | SSTM | -10.460.601 | -14.582.624 | -23.709.834 |

| 18 | LPIN | -18.173.655 | -64.037.460 | 38.301.528 |

| 19 | SMCB | 19.488.000 | -284.584.000 | -758.045.000 |

Based on the income statement data it can be seen that companies experiencing financial distresss are ALMI in 2015-2016, ALTO in 2015-2017, ETWA Tbk 2015-2016, HDTX in 2015-2017, and IKAI in 2015-2017, IMAS in 2015-2017, JKSW in 2015-2017, JPRS in 2015-2017, Indonesian Embassy in 2015-2017, KIAS in 2015-2017, MYTX in 2015-2017, PSDN in 2015-2016, RMBA in 2015-2017, READY for 2015-2017, SSTM 2015-2017, LPIN 2015-2016, and SMCB 2016-2017. Besides experiencing a negative operating profit for two consecutive years. These companies also experience problems with profitability, liquidity and leverage ratios. Companies that experience financial distress are generally negative profitability ratios. Meanwhile, the liquidity ratios of companies experiencing financial distress are generally below 1, which means the company's current assets cannot cover the company's current debt. The leverage ratio of companies experiencing financial distress is generally greater than 1, meaning that the amount of corporate debt is greater than the total assets of the company. Agustini & Wirawati, 2018 states that the company's financial distress conditions can be demonstrated through the Interest Coverage Ratio (ICR). Claessens & Fan (2003) in (Agustini & Wirawati, 2018) defines companies that are in financial distress are companies that have an Interest Coverage Ratio (ICR) of less than 1. ICR is the ratio between earnings before interest and taxes on interest expense.

Financial difficulties if not handled properly can force the owner to increase the deposit of funds in the company or even volunteer to close the company. Therefore, the financial aspects of the company play an important role that really needs to be observed by the company's risk bearers. Through good financial management the company is expected to be able to improve its financial performance in every economic condition. Planning is the key to success for financial managers in carrying out its functions. Strengths and weaknesses of a company can be known through the previous year's financial statements. Financial statements are basically the final results of the accounting process that can be used to communicate with parties with an interest in the financial condition and results of operations of the company (Afriyeni, 2008).

Sometimes there are conditions where a company is unable or unable to pay all or part of its debt or obligations which are due at the time of collection. Or often companies do not have sufficient funds for all these obligations. The company's inability to pay its obligations, especially short-term debt is caused by several factors. First, it could be because the company does not currently have funds at all. Or secondly, the company may have funds, but at maturity the company does not have sufficient funds in cash (Kasmir, 2012).

There are several financial ratios that can be used to assess the health condition of a company as follow:

Liquidity ratios are ratios used to measure a company's ability to meet its short-term obligations that are past due. Liquidity ratios commonly used in various studies are the current ratio and Working Capital to Total Assets (WCTA). Current ratio is a ratio that shows a company's ability to meet its short-term obligations using its current assets. Working Capital to Total Assets is a ratio that measures or compares working capital (current assets-current liabilities) with total assets, or bias is also referred to as a ratio to measure the liquidity of a company's assets relative to its total capitalist (Kasmir, 2013).

While profitability is a ratio that is used to assess the ability of companies to look for profit (Kasmir, 2013). The profitability ratios commonly used in various studies are Return On Equity (ROE) and Return On Assets (ROA) (Chou & Buchdadi, 2018). ROA is a ratio to show the results (return) on the amount of assets used in the company, while ROE shows the efficiency of using their own capital. The higher the two profitability ratios, the better (Kasmir, 2012).

Solvency is used to measure a company's ability to measure the extent to which a company's assets are financed with debt. If a finance company uses more debt, this risks there will be difficulties in payment in the future due to debt greater than the assets owned. The company's inability to meet its debt to creditors when due can cause financial distress . The ratio used in this study is Debt to Total Assets where this ratio is used to measure how much the company's assets are financed by both short-term and long-term debt Debt to Equity Ratio (DER) This ratio is used as a measure of a company's ability to pay off its obligations. Times Interest Earned (TIE ratio) is used as a company's ability to pay or cover future interest expenses (Kasmir, 2012).

There are several previous studies which show different results of research on several variables of the ratio of financial liquidity, profitability, and solvency to the prediction of financial distress, namely among others: Widardjo & Setyawan's research in 2009 in Andre O (2013). In his research that the liquidity ratio represented by the current ratio has no effect on financial distress. Other studies related to liquidity ratios (Widhiari & Merkusiwati, 2015; Antikasari & Djuminah (2017) state that liquidity ratios (current ratios) affect financial distress, which means that the more liquid a company is, the more companies will avoid the threat financial distress. Meanwhile, research conducted by (Sopian & Putri, 2017; Kariani & Budiasih, 2017; Dewi & Dana, 2017; Murni, 2018) state that the liquidity ratio (current ratio) has no effect on financial distress.

Ongesa, (2014) in Kusumaningrum, (2018) in his research showed that the liquidity ratio (WCTA) was found to have no significant effect on the occurrence of Financial Distress conditions. This finding is also support by the current research that using linear regression of liquidity ratio on financial distress (Murni, 2018). However, The results of other studies by Rahmawati & Basuki (2015); Hapsari (2012) show that the Working Capital to Total Asset (WCTA) variable has an influence but is not significant to the occurrence of Financial Distress. But these results contradict the research conducted by Anisa & Suhermin (2016); Nugroho & Mawardi (2012) which shows that the Working Capital to Total Asset variable has a significant positive effect on Financial Distress.

Research conducted by Simanjuntak et al. (2017) states that the profitability financial ratio as measured by ROA has no effect on financial distress. This is in line with research conducted by Rohmadini (2018), which is the profitability ratio measured by ROA & ROE has no effect on financial distress. But different results in a study conducted by Maulida (2018), that the profitability ratio (ROA, ROE) shows that the ratio has a significant negative effect on financial distress. Moreover, Pranowo et al (2010) also found that profitability ratio have no significant impact on the status of corporate financial distress.

The next variable is the solvency ratio, in a study conducted by Simanjuntak et al. (2017) that solvency measured by DAR is a significant effect on the company's financial distress. This condition is in accordance with research conducted by Muhtar & Aswan (2017) that DAR has a significant effect on financial distress. Unlike the case with the results of research by Banjarnahor, (2018) that DAR has no effect on financial distress. DER has a significant effect on the company's financial distress. This is reinforced by the results of research by Rohmadini (2018) DER has a significant effect on financial distress. Then the results of research conducted by Andre (2013) that the leverage ratio (DER) has a positive and significant relationship in predicting financial distress. In a study conducted by Ginting (2017) DER had a significant negative relationship to the occurrence of financial distress in property and real estate companies. The difference in the results of research by Nukmaningtyas and Worokinasih (2018) research on companies in various industry sectors for the 2013-2016 period that the DER solvency ratio did not significantly influence the company's financial distress. The same thing from the results of research conducted by Ruslinawati (2017) that DER has no effect on the company's financial distress.

Based on the background of the problems that have been described and there are gaps or differences in the results of previous research with theory, the authors feel the need to do research to examine the possibility of bankruptcy of companies, the authors raise the title "The effect of liquidity, profitability and solvability to the financial distress of manucatured companies listed on the Indonesia stock exchange (IDX) period of year 2015-2017”.

Literature Review

Financial statements: According to IAI (2017) in (Curry & Banjarnahor, 2018), financial statements are part of the financial reporting process which is a means of communicating financial information to parties interested in the company. Complete financial statements usually include a balance sheet, income statement, statement of changes in financial position (which can be presented in various ways such as cash flow statement or cash flow statement), records and an integral part of financial statements. According to Kasmir (2012), in a simple sense, financial statements are reports that show the company's financial condition at this time or in a certain period. The purpose of financial statements that show the current conditions are the latest conditions or the financial condition of the company at a certain date (for the balance sheet) and a certain period (for the income statement).

In practice, financial statements generally consist of five (5) types, namely (Kasmir, 2012):

a. Balance sheet is a report that shows a company's financial position on a certain date. The financial position in question is the position of the amount and type of assets, liabilities and equity of a company. According to Van Home in Kasmir (2012), the balance sheet is a summary of the company's financial position on a certain date that shows total assets with total liabilities plus total owner's equity.

b. Income Statement (income statement): The income statement is a financial statement that describes the company's operating results within a certain period. According to Van Home in Kasmir (2012), which is a summary of the company's income and expenses for a certain period, ending with a profit or loss for that period.

c. Statement of Changes in Equity: The statement of changes in equity is a report that contains the amount and type of capital held at this time. Then this report also explains the changes in capital and the causes of capital changes in the company.

d. Cash flow statement: The cash flow statement is a report that shows all aspects related to company activities, both those that have a direct or indirect effect on cash.

e. Notes to the Financial Statements: Is a report that provides information if there are financial statements that require certain explanations.

Financial Statement Analyst

Analysis of financial statements is a process to determine the financial position of a company at this time. The results of the analysis will provide information about the weaknesses and strengths of a Kasmir company (2012). Before the process of analyzing the financial statements of a company, it is necessary to have an appropriate method and technical analysis so that the results of the analysis can be maximized.

Analytical methods in practice consist of two types of analytical methods commonly used, among others (Kasmir, 2012).

a. Vertical analysis is an analysis carried out on only one financial statement period. The analysis is carried out between the posts that exist in one period.

b. Horizontal Analysis is an analysis of financial statements which is done by comparing financial statements for several periods.

Financial Ratio Analysis

Financial ratio analysis can reveal important relationships and be the basis of comparison in finding conditions and trends that are difficult to detect by studying each component that makes up the ratio. Like other analysis tools, the ratio is most useful for future orientation (Subrahmanyam & Wild, 2012).

Financial Ratios as Predictors of Financial Distress

The usual financial ratios and are often used in several studies to measure the health of a company related to the failure rate:

1. Likuiditas: Liquidity ratio is a ratio that illustrates the ability of companies to meet short-term obligations (Fred Weston) in Kasmir (2012). Company liquidity as a financial distress predictor measured by Kasmir (2012):

a. Current ratio, It is a ratio to measure a company's ability to pay short-term liabilities or debt that are due immediately when billed.

b. Working Capital to Total Assets, It is a ratio that measures or compares working capital (current assets - current debt) with total assets, or bias is also referred to as a ratio to measure the liquidity of a company's assets relative to its total capitalist.

2. Profitability: Namely the ratio to measure the company's ability to generate profits (Masamah, 2010). The company's profitability as a financial distress predictor is measured by Kasmir (2012):

a. Return on Equity It is a ratio to measure net income after tax with own capital. This ratio shows the efficiency of the use of own capital. The higher this ratio, the better.

b. Return on assets, Is a ratio to show the results (return) on the amount of assets used in the company.

3. Solvency: Namely the ratio used to measure the extent of company activity financed by receivables (Kasmir, 2014).

a. Debt to Total Asset Ratio (DAR): Namely the debt ratio used to measure the ratio between total debt to total assets of Kashmir (2015).

b. Debt to Equity Ratio (DER): Namely comparing the total liabilities (liabilities) with equity (equity). In this case the debt must not be greater than capital so that the company's burden does not increase. A low ratio means the company's condition is getting better because the portion of debt to capital is getting smaller (Kasmir, 2014).

c. Times Interest Earned Ratio (TIE): This ratio is used to measure the company's ability to pay interest expenses in the future. This ratio compares earnings before tax and interest against Interest Costs in accordance with accounting principles. The following is the formula for Times Interest Earned Ratio (Kasmir, 2014).

Financial Distress

Definition of financial distress according to Plat Plat (2002) in Fahmi (2012) financial distress as a stage of decline in financial conditions that occurred before the bankruptcy or liquidation experienced by a company. Meanwhile, according to Foster (1986), financial distress is defined as follows "Financial distress is used to mean server liquidity problems that cannot be resolved without a resizable resolution of the entity's operations or structure". The increasingly globalized economy causes increasingly fierce competition between companies, not only in one country but also with companies in other countries.

This increasingly fierce competition requires companies to always strengthen management so that they will be able to compete with other companies. The inability to anticipate global developments by strengthening management fundamentals will result in a reduction in the volume of business which ultimately results in bankruptcy of the company (Darsono & Ashari, 2005) in Yuliastari & Wirakusuma (2014). Andre O (2013), revealed that financial distress can be described from two extreme points, namely short-term liquidity problems to insolvable. Short-term financial difficulties are usually short-term, but can develop into severe. Indicators of financial difficulties can be seen from the analysis of cash flow, analysis of corporate strategies, and financial statements of the company.

This financial distress information can be used as an early warning for bankruptcy so that management can take action quickly to prevent problems before bankruptcy, where bankruptcy of a company is characterized by financial distress, which is a situation where companies are weak in generating profits or companies tend to experience deficits (Ramadhani & Lukviarman, 2009). Financial distress occurs before the company goes bankrupt, where there is an unhealthy financial condition of the company. Financial distress prediction models need to be developed, because by knowing the company's financial distress conditions early it is expected that the company can take actions to anticipate what leads to bankruptcy.

Financial Distress Indicator Darsono & Ashari (2005) in Helgawati (2017) explained that there are several indicators used as guidelines to assess or measure financial distress that will be suffered by the company, these indicators include:

a. Current cash flow information and cash flows for the coming period. Cash flow provides an overview of the sources and uses of the company's cash.

b. Analysis of the company's position and strategy compared to competitors. This information provides an overview of the company's position in business competition which refers to the company's ability to sell products or services to generate cash.

c. Corporate bankruptcy assessment is a formula that was coined by Edward Altman called the Altman Z-Score formula.

The model to predict whether a company experiences financial distress or not is the most effective and has proven its reliability, namely the Altman model. According to Altman in Sawir (2005), there are five ratios that can be combined to see the difference between companies that are healthy or will have bankruptcy problems. This ratio is known as the ratio of five variables.

The ratio of the five variables used in the Altman Z-Score (Rice, 2015). Analysis calculation is as follows. Then Altman makes what he calls a four-variable version, which is:

X1 = (Current Assets − Current Liabilities) / Total Assets

X2 = Retained Earnings / Total Assets

X3 = Earnings Before Interest and Taxes / Total Assets

X4 = Book Value of Equity / Total Liabilities

Z-Score bankruptcy model :

Z = 6.56X1 + 3.26X2 + 6.72X3 + 1.05X4

Zones of discriminations :

Z > 2.6 -“Safe” Zone

1.1 < Z < 2. 6 -“Grey” Zone

Z < 1.1 -“Distress” Zone.”

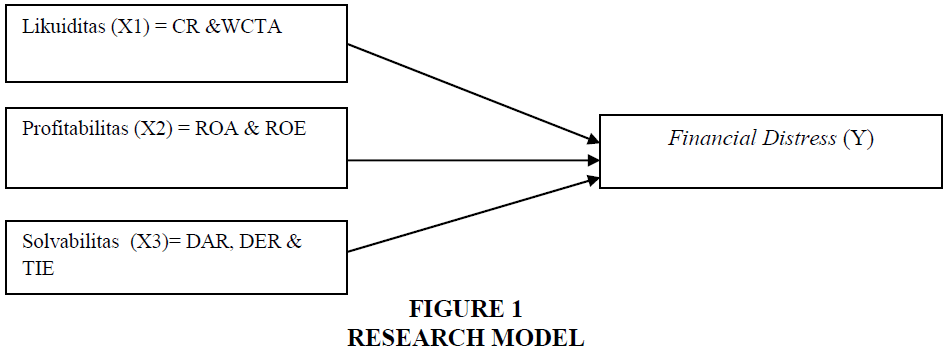

This model can be used for public and private companies, and for manufacturing and service companies. The Z-Score created by Altman has proven its reliability and has survived to the present. It can be concluded that the higher the liquidity ratio and the profitability ratio of a company, the better the development of the company and the impact on the company's good financial condition, so that the impact of financial distress is smaller. Then concluded the effect of liquidity and profitability on financial distress of textile and garment companies is the opposite direction or negative (Figure 1).

Hypothesis

The null hypothesis (H0) and the alternative hypothesis (Ha) as for the Ha and H0 in this study are:

a) Simultaneously

H0 : p value > 0,05 There is no significant effect of the current liquidity ratio and Working Capital to Total Assets, the profitability ratio of ROE and ROA, and the solvency ratio of DAR, DER, TIE to financial distress.

Ha : p value ≤ 0,05 There is a significant influence of the liquidity ratio of the current ratio and Working Capital to Total assets, the profitability ratio of ROE and ROA, and the solvency ratio of DAR, DER, TIE to financial distress.

b) Partially

H01 : p value > 0,05 There is no significant effect of the liquidity ratio (current ratio) on the company's financial distress.

Ha1 : p value ≤ 0,05 There is a significant effect of the liquidity ratio (current ratio) on the company's financial distress.

H02 : p value > 0,05 There is no significant effect of the liquidity ratio (Working Capital to Total Assets) on the company's financial distress.

Ha2 : p value ≤ 0,05 There is a significant effect of the liquidity ratio (Working Capital to Total Assets) on the company's financial distress.

H03 : p value > 0,05 There is no significant effect of profitability ratio (ROE) on the company's financial distress.

Ha3 : p value ≤ 0,05 There is a significant effect of the profitability ratio (ROE) on the company's financial distress.

H04 : p value > 0,05 There is no significant effect of profitability ratios (ROA) on the company's financial distress.

Ha4 : p value ≤ 0,05 There is a significant effect of profitability (ROA) on the company's financial distress.

H05 : p value > 0,05 There is no significant effect of the solvency ratio (DAR) on the company's financial distress.

Ha5 : p value ≤ 0,05 There is a significant influence of solvency (DAR) on the company's financial distress.

H06 : p value > 0,05 There is no significant effect of the solvency ratio (DER) on the company's financial distress.

Ha6 : p value ≤ 0,05 There is a significant effect of solvency (DER) on the company's financial distress.

H07 : p value > 0,05 There is no significant effect of the solvency ratio (TIE) on the company's financial distress.

Ha7 : p value ≤ 0,05 There is a significant effect of solvency (TIE) on the company's financial distress.

Research Objects and Methods

The object in this study is the object of population research because it is a generalization consisting of objects and subjects that have certain qualities and characteristics applied by researchers to draw conclusions (Sugiyono, 2012).

According to Sugiyono (2013), the research method is defined as a scientific way to obtain valid data with the aim that it can be found, developed, and proven to a certain knowledge so that in turn it can be used to understand, solve, and anticipate problems. This research is an associative descriptive research. According to Sugiyono (2007), descriptive research is research conducted to determine the value of an independent variable, either one or more variables without making comparisons or connecting one variable with another variable. While the associative method according to Sugiyono (2007) is a study that aims to determine the relationship between two or more variables. In this research, a theory can be built that can serve to explain, predict, and control a phenomenon.

Categorizing for proof of analysis between variables using logistic regression. Logistic regression is used in this study because it does not have an assumption of normality over the independent variables in the model so that limitations that arise such as data normality can be ignored.. The company code number for experiencing financial distress uses number 1 and non-financial distress uses number 0. That is, if the resulting equation value approaches number 1, it means that the probability of a company to obtain financial distress is large. Meanwhile, if the value generated is close to 0, it means that the possibility of companies for non-financial distress is small (Tables 2 & 3).

| Table 2 Variable Operations | ||||

| No | Variable | Concept | Indicator | Scale |

| 1 | Liquidy Ration (X1) | The ratio used to describe the ability of the company to meet short-term obligations (Kasmir, 2012) |

Current ratio (current ratio), with the formula: current assets / current leabilities (Kasmir, 2012) Working Capital to Tottal Asset, with the formula: working capital / total assets (Kasmir, 2012) |

Ratio Ratio |

| 2 | Profitability Ratio (X2) | Ratios that can be used to measure a company's ability to look for profits or profits (Kasmir, 2008: 196) |

ROE formula: EAIT / Equity (Kasmir, 2012: 199) ROA formula: EAIT / total assets (Chou & Buchdadi, 2018) |

Ratio Ratio |

| 3 | Ratio Solvency (X3) |

This ratio measures the ability of companies to pay debts when a company is liquidated (Masamah, 2010) | DAR formula: Debt / Asset DER formula: Debt / Equity TIE formula: EBIT / Interest (Kasmir, 2014) |

Ratio Ratio Ratio |

| 4 | Financial Distress (Y) | Financial distress is the stage of a decline in the company's financial condition that occurred before the bankruptcy or liquidation of the company Plat Plat (2002) in Fahmi (2012) | Altman Z-Score Z = 6.56X1 + 3.26X2 + 6.72X3 + 1.05X4 Zones of discriminations: Z> 2.6 - "Safe" Zone 1.1 <Z <2. 6 - "Gray" Zone Z <1.1 - "Distress" Zone. " Charles (89) in Sawir (2005) |

Ratio |

| Table 3 Manufacturing Companies Listed on the Indonesia Stock Exchange in 2015 - 2017 | ||

| No | Criteria | Total |

| 1 | Manufacturing companies listed successively on the IDX in 2015 - 2017 | 143 x 3 = 429 |

| 2 | Does not have complete financial statements for 2015-2017 | (37) |

| 3 | Companies whose financial year book is not December 31 | (42) |

| 4 | Companies that report finance in units of dollars | (47) |

| number of samples | 303 | |

Data analysis methods used to determine the effect of liquidity and profitability on financial distress for manufacturing companies is:

Data Analysis Method

The stages of the data analysis method used to determine the magnitude of the influence of financial ratios on the company's financial distress are as follows:

Descriptive Analysis

Used to discuss quantitative data. This analysis is done by calculating financial ratios and Z-Score consisting of:

a. Liquidity Ratio

X1 = Current Ratio and Working Capital to Total Asset

b. Profitability Ratio

X2 = Return On Equity ( ROE ) and Return On Asset (ROA)

c. Solvency Ratio

X3 = Debt to Asset Ratio(DAR,) Debt to Equity Ratio(DER) and Time Interest Earned (TIE)

d. Altman Z-Score discriminant analysis to predict financial distress (Y)

Z = 6,56 X1 + 3,26 X2 + 6,72 X3 + 1,05X4

Z > 2,6 : health condition

1,1<Z<2,6 : grey condition

Z < 1,1 : financial distress condition (Kamaludin & Indriani, 2012:59).

Determination Coefficient

The coefficient of determination is used to assess the ability of the variable X (independent variable) to influence the variable Y (the dependent variable). The coefficient of determination in logistic regression is Mc Fadden R Square.

Results and Discussion

Financial distress prediction models from processing results can be seen in the following Table 4:

| Table 4 Logistic Regression Coefficient Value | |||||||||||

| Model 1 | Model 2 | Model 3 | Model 4 | ||||||||

| V | Coef. | Prob. | V | Coef. | Prob. | V | Coef. | Prob. | V | Coef. | Prob. |

| CR | -12.25 | 0.0001 | CR | -6.246 | 0.00 | CR | -13.840 | 0.0000 | CR | -12.65 | 0.000 |

| ROA | -63.40 | 0.0002 | ROA | -4.354 | 0.00 | ROA | -53.000 | 0.0001 | ROA | -5.756 | 0.000 |

| DAR | 20.85 | 0.0008 | DAR | 0.4436 | 0.00 | DAR | 14.013 | 0.0012 | DAR | 0.6072 | 0.000 |

| TIE | -0.077 | 0.182 | TIE | -0.22 | 0.00 | TIE | -0.068 | 0.2184 | TIE | -0.176 | 0.164 |

| C | 9.2215 | 0.0113 | C | 11.153 | 0.00 | C | -1.227 | 0.5643 | C | 5.5677 | 0.000 |

| M.R | 0.9114 | M.R | 0.7342 | M.R | 0.8854 | M.R | 0.76490 | ||||

| L.R | 366.64 | L.R | 295.35 | L.R | 356.17 | L.R | 3.076.891 | ||||

| Prob. | 0.0000 | Prob. | 0.0000 | Prob. | 0.0000 | Prob. | 0.0000 | ||||

This research following the previous research in examinig the financial distress using the logistic regression (Almilia & Herdinigtyas, 2005; Fitriyah & Hariyati, 2013; Kamaludin & Pribadi, 2011; Muflihah, 2017; Pasaribu, 2008; Restianti & Agustina, 2018). The probability of a company to experience financial distress and non-financial distress ranges from 0 to 1. If the resulting equation is close to 1, then the probability of a company to get financial distress is great. Meanwhile, if the value generated is close to 0, it means that the possibility of companies for non-financial distress is small.

The understanding of the logistic regression coefficient values are as follows:

1. The value of the logistic regression coefficient of model 1 CR is -12.24950 and model 2 is -6.245917 meaning that if the other independent variables are boarding, if the company is getting higher its CR, then the possibility of the company to experience financial distress is lower with the coefficient value of e-12.24950 e-6.245917 and vice versa. A negative sign on the value of the regression coefficient represents an unidirectional relationship between CR and financial distress. Based on the z statistic test results obtained the level of significance for CR variables in models 1 and 2 are 0.0001 and 0.0000 (p ≤ 0.05). Because this significance is less than 0.05, there is a significant negative effect of CR on financial distress. So according to the results of the CR logistic regression there is a significant difference in influence between companies experiencing financial distress and non financial distress. So, this findings supports the previous study on liquidity ratios, such as Pasaribu (2008); Widhiari & Merkusiwati (2015); and Antikasari & Djuminah (2017) that found the more liquid a company is, the more companies will avoid the threat financial distress.

Ha1 : accepted There is a significant effect of the liquidity ratio (current ratio) on the company's financial distress.

c. The value of the logistic regression coefficient of working capital or WCTA variable is -13.83655 in model 3 and -12.64736 in model 4 meaning that if the other independent variables are boarding, if the company is getting higher WCTA, then the possibility of the company to experience financial distress is getting smaller with the coefficient value e-13.83655 and e-12.64736 and vice versa. The negative sign on the value of the regression coefficient symbolizes the opposite relationship between WCTA and financial distress. Based on the z statistical test results obtained the level of significance for the WCTA variable is 0,000 in models 3 and 4 (p> 0.05). Because this significance is less than 0.05 this means that there is a significant effect of WCTA on financial distress. So according to the results of logistic regression, WCTA there is a significant difference in influence between companies that experience financial distress and non financial distress. Then, the findings is different with the previous studies that could not found the impact of WCTA on financial distress (Rahmawati & Basuki, (2015) and Hapsari (2012) as well as the study that noted the WCTA has a positive impact on the financial distress.

Ha2 : accepted, there is a significant effect of the liquidity ratio (Working Capital to Total Assets) on the company's financial distress.

d. The logistic regression coefficient value of the variable ROA is -63,40062 in model 1 and -53.00197 in model 2 meaning that if the other independent variables are boarding, if the company is getting higher its ROA, then the possibility of the company to experience financial distress is lower with e-63.40062 coefficient values and e-53.00197 and vice versa. A negative sign on the value of the regression coefficient represents an unidirectional relationship between ROA and financial distress. Based on the z statistic test results, the significance level for the ROA variable is 0.0002 and 0.0001 (p ≤ 0.05). Because this significance is less than 0.05, there is a significant negative effect of ROA on financial distress. So according to the results of logistic regression, ROA there is a significant difference in influence between companies that experience financial distress and non financial distress. Thus, this research support the argument of Maulida (2018); Nurcahyonob (2014), and Muflihah (2017) that the profitability ratio (ROA, ROE) shows that the ratio has a significant negative effect on financial distress

Ha3 : accepted, there is a significant effect of profitability (ROA) on the company's financinoal distress.

e. The logistic regression coefficient of the ROE variable is -4.354333 in model 2 and -5.756266 in model 4 meaning that if the other independent variables are kostan, if the company is getting higher ROE, then the possibility of the company to experience financial distress is lower with e-value coefficient 4.35433 and e-5.756266 and vice versa. A negative sign on the value of the regression coefficient represents an unidirectional relationship between ROE and financial distress. Based on the z statistic test results, the significance level for the ROE variable is 0.0000 in models 2 and 4 (p> 0.05). Because this significance is less than 0.05, there is a significant effect of ROE on financial distress. So according to the results of logistic regression, ROE there is a significant difference in influence between companies that experience financial distress and non financial distress. This finding is also supported the previous study in Indonesia that return on equity have an impact on financial distress in industrial sector (Restianti & Agustina, 2018).

Ha4 : accepted, there is a significant effect of the profitability ratio (ROE) on the company's financial distress.

f. The logistic regression coefficient value of the DAR variable is 20.85001 in model 1 and 14.01301 in model 3 meaning that if the other independent variables are boarding, if the company is getting higher DAR, then the possibility of the company to experience financial distress is higher with the coefficient values e20.85001 and e14 .01301 and vice versa. A positive sign on the value of the regression coefficient symbolizes a direct relationship between DAR and financial distress. Based on the z statistic test results, the significance level for the DAR variable is 0.0012 and 0.0008 (p <0.05). Because this significance is less than 0.05, there is a significant positive effect of DAR on financial distress. So according to the results of logistic regression, DAR there is a significant difference in influence between companies that experience financial distress and non financial distress. Thus finding confirms the previous research in Indonesia that a positive impact of leverage variable to financial distress of the firm (Moleong, 2016; Muflihah, 2017).

Ha5 : accepted, there is a significant effect of solvency (DAR) on the company's financial distress.

g. The logistic regression coefficient value of the DER variable is 0.443600 in model 2 and 0.607183 in model 4 meaning that if the other independent variables are boarding, if the company is getting higher the DER, then the possibility of the company to experience financial distress is higher with the coefficient value of e0.443600 and e0.607183 and vice versa. A positive sign on the value of the regression coefficient symbolizes the same or direct relationship between DER and financial distress. Based on the z statistic test results, the significance level for the DER variable was 0.0000 in both models (p> 0.05). Because this significance is less than 0.05, there is a significant effect of DER on financial distress. So according to the results of logistic regression, DER there is a significant difference in influence between companies that experience financial distress and non-financial distress.

Ha6 : accepted, there is a significant effect of solvency (DER) on the company's financial distress.

h. The value of the logistic regression coefficient of the TIE variable is -0.219977 meaning that if the other independent variables are boarding, if the company is getting a higher TIE, then the possibility of the company to experience financial distress is lower with the coefficient value of e-0.219977 and vice versa. A negative sign on the value of the regression coefficient represents an unidirectional relationship between TIE and financial distress. Based on the z statistical test results obtained the level of significance for the TIE variable is 0.0000 (p> 0.05). Therefore this significance is less than 0.05. But this condition only occurs in one model only for the other three models the significance is greater than 0.05 then there is no significant effect of TIE on financial distress. So according to the results of logistic regression, TIE there is no significant difference in influence between companies that experience financial distress and non financial distress.

Ha7 : rejected, there is no significant effect of solvency (TIE) on the company's financial distress.

Conclusion

Based on research, that has been done the conclusions that can be drawn in this study that liquidity ratio, profitability ratio, and solvency ratio could be a proxy in determining the financial distress of the company. This research also provides the robustness of the variables as the determinant of the financial distress as this is one of the first research utilising the log it regression.

The implication of this study is could be used to the goverment of Indonesia, also the investor, to emphasize the importance of liquidity ratio, profitability ratio, and solvency ratio in montioring and evaluating the performance of the company especially regarding the financial distress condition of the companies.

References

- Afriyeni, E. (2008). Financial performance appraisal using ratio analysis. Journal of ekonomi dan bisnis oktober 2008, 3(2), 109-118.

- Agustini, N.W., & Wirawati, N.G., (2019). Effect of financial ratios on financial distress of retail companies listed on the Indonesia stock exchange (IDX). E-Journal of Accounting, Udayana University, 26(1), 251-280.

- Almilia, L.S., & Herdinigtyas, W. (2005). Camel ratio analysis to prediction of problematic conditions in banking institutions in the 2000-2002 periods. Journal of Economics and Business, 7(2), 131–147.

- Altman, E., Hartzell, J., & Peck, M (1995). Emerging markets of corporate bonds: A scoring system. New York: Wiley and Sons.

- Altman, E.I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance, 23(4).

- Andre, O. (2013). The effect of profitability, liquidity and leverage in predicting financial distress: Empirical study of various companies listed on BEI. Jurnal Akuntansi, 1(1).

- Anisa, V.D., & Suhermin, S. (2016). Bankruptcy variable analysis of financial distress with Altman's Z-Score method. Jurnal Ilmu & Riset Manajemen, 5(5).

- Antikasari, T.W., & Djuminah, D. (2017). Predicting financial distress with binary logit regression company telecommunications. Journal of Finance and Banking, 21(2), 265-275.

- Chou, T.K., & Buchdadi, A.D. (2018). Executive compensation, good corporate governance, ownership structure, and firm performance: A study of listed banks in Indonesia. Journal of Business and Retail Management Research, 12(3), 79-91.

- Claessens, S., & Fan, J.P.H. (2003). Corporate governance in Asia: A Survey. International Review of Finance, 3(2), 71-103.

- Curry, K., & Banjarnahor, E. (2018). Financial distress in go public property sector companies in Indonesia. Prosiding Seminar Nasional Pakar 2018 Buku II.

- Darsono., & Ashari. (2005). Practical Guidelines for Understanding Financial Statements. Andi Pratita Trikarsa Mulia: Yogyakarta. Fachrudin. (2008). Corporate and Personal Financial Difficulties. Usu press: Medan.

- Dewi, N.K.T.S., & Dana, M.I. (2016). The effect of growth opportunity, liquidity, non-debt tax shield and fixed asset ratio on capital structure. E-Jurnal Manajemen Unud, 6(2), 772-780.

- Fahmi, I. (2012). Financial Statement Analysis. CV Alfabeta: Bandung.

- Fitriyah, I., & Hariyati. (2013). Pengaruh Rasio Keuangan Terhadap Financial Distress pada Perusahaan Propoerti dan Real Estate. Jurnal Ilmu Manajemen, 1(3), 760–773.

- Foster, G. (1986). Financial Statement Analysis ( Second Edition ) . Prentice-Hall International Edition: Singapore.

- Ginting, M.C., (2017). Effect of current ratio and debt to equity ratio (DER) on financial distress in property & real estate companies on the Indonesia stock exchange. Management Journal , 3 (2), 37-44.

- Hapsari, E.I. (2012). The strength of financial ratios in predicting the financial distress of manufacturing companies on the IDX. Journal of Management Dynamics , 3(2), 101-109.

- Helgawati, M. (2017). The effect of implementation of corporate governance, company sizes and leverage of financial difficulty, financial distress: Study of CGPI Participating Companies Listed on BEI 2011-2014. Thesis (S1) thesis, Faculty of Economics and Business Unpas Bandung.

- Kamaludin, & Pribadi, K.A. (2011). Financial distress prediction in manufacturing industry case using logistic regression model. Jurnal Ilmiah STIE MDP, 1(1), 11-23.

- Kamaludin., & Indriani, R. (2012). Financial Management Basic Concepts and their Application ( Revised Edition ) . CV Mandar Maju: Bandung.

- Kariani, N.P.E.K.K., & Budiasih, I.G.A.N. (2017). Firm size as moderating effect of liquidity, leverage, and operating capacity in financial distress. E-Journal of Udayana University Accounting, 20(3), 2187-2216.

- Kasmir. (2008). Analisis Laporan Keuangan. PT. Raja Grafindo Persada: Jakarta.

- Kasmir. (2012). Analisis Laporan Keuangan edisi 5. PT Raja Grafindo Persada: Jakarta.

- Kasmir. (2014). Analisis Laporan Keuangan edisi 7. PT Raja Grafindo Persada: Jakarta.

- Kusumaningrum, R.H. (2018). Analysis of WCTS, RETA, EBITTA, MVETL, STA on predictions of the company's financial distress conditions. Journal of Diponegoro University business economics.

- Masamah (2010). Financial statement analyst. IBA University: Palembang.

- Maulida, I.S., Moehaditoyo, S.H., & Nugroho, M. (2018). Analysis of financial ratios to predict financial distress in manufacturing companies listed on the Indonesia Stock Exchange 2014-2016. JIABI , 2(1).

- Moleong, L.C. (2016). The impact of real interest rate and leverage on financial distress. MODUS, 30(1), 71-86.

- Muflihah, I.Z. (2017). Financial distress analysis of manufactur firm in Indoensia using logic regression. Majalah Ekonomi, 22(2), 254-269

- Muhtar, M., & Aswan, A. (2017). Influence of financial performance against the occurrence of financial distress conditions in telecommunications companies in Indonesia. Journal of Business Management and Information Hasanudin University, 13(3).

- Murni, M. (2018). Factors analysis on financial distres of listed manufactur companies during 2010-2014 in Indonesia. Jurnal AKuntansi Dan Bisnis, 4(1), 74-83.

- Nugroho, M.I.D., & Mawardi, W. (2012). Analysis of financial distress prediction using the modified Altman Z-Score model. Jurnal Manajemen Fakultas Ekonomika dan Bisnis, Universitas Diponegoro: Semarang. 1(1).

- Nukmaningtyas, F., & Worokinasih, S. (2018). The influence of profitability, liquidity, laveerage, and cash flow ratio, to predict financial distress : Study of Various Industrial Sector Companies Listed on Indonesia Stock Exchange Period 2013-2016. Journal of Business Administration , 61(2).

- Nurcahyono, K.S. (2014). Analysis of financial ratios to predict the financial distress conditions. Management Analysis Journal, 1(3), 1-6.

- Ongesa, T.N., Nyamweya, B.O., Abdi, A.M., Njeru, F., & George, G.E. (2014). An assessment of financial literacy on loan repayment in Ngara, Nairobi County. Research Journal of Finance and Accounting, 5(12), 181-192.

- Pasaribu, R.B.F. (2008). USE of binary logit for financial distress prediction of companies listed in jakarta stock exchange : Case Study of Industry Industry Issuers). Journal o f Economy, Business, a nd Venture Accounting, 11(2), 153-172.

- Pranowo, K., Achsani, N.A., Manurung, A.H., & Nuryartono, N. (2010). Determinant of corporate financial distress in an emerging market economy?: Empirical evidence from the indonesian stock exchange 2004-2008. International Research Journal of Finance and Economics, (52), 81-90.

- Rahmawati, A.I.E., & Hadiprajitno, P.B. (2015). Analysis of financial ratios to financial conditions distress in that manufacturing company listed in Indonesia stock exchange, 2008-2013. Diponegoro Journal of Accounting, 4(2), 1-11.

- Ramadhani, U.S., & Lukviarman, S. (2009). Comparison of bankruptcy prediction analysis using the first Altman model, revised Altman, and Altman modification with company size and age as explanatory variables: Study of manufacturing companies listed on the Indonesia Stock Exchange. Journal of Business Strategy. 13(1), 15-28.

- Restianti, T., & Agustina, L. (2018). The effect of financial ratios on financial distress conditions in sub industrial sector company. Accounting Analysis Journal, 7(1), 25-33.

- Rice. (2015). Altman Z-Score?: Detecting financial distress. Jurnal Wira Ekonomi Mikroskil, 5(2), 111-120.

- Rohmadini, A., Saifi, M., & Darmawan, A., (2018). Effect of profitabilias, liquidity, and leverage on financial distress: Study of food & beverage companies listed on the Indonesia stock exchange period 2013-2016. Journal of Business Administration , 61(2).

- Sawir. (2005). Financial Performance Analysis and Corporate Financial Planning. Gramedia Main Library: Jakarta.

- Simanjuntak, C. (2017). Effect of financial ratios on financial distress: Study of transportation companies listed on the indonesia stock exchange for the 2011-2015 Period. e-Proceeding of Management , 4(2).

- Sopian, D., & Rahayu, W.P. (2017). the effect of financial ratios and size of companies to financial distress: Empirical study in food and beverage companies in Indonesia stock exchange. Competitive, 1(2), 1-13.

- Subrahmanyam, K.R., & Wild, J.J. (2012). Financial Statement Analysis. Salemba Empat: Jakarta.

- Subramanyam, K.R., & Wild, J.J. (2010). Financial Statement Analysis. Issue 10, Book 2 In Translation of Yanti, D. Salemba Empat: Jakarta.

- Subramanyam, K.R., Wild, J.J., & Halsey, R.F. (2005). Financial Statement Analysis, Issue 8 In Translation Bachtiar, Y.S., and Harahap, S.N. Salemba Empat: Jakarta.

- Sugiyono (2007). Administrative Research Methods. ALFABETA: Bandung.

- Sugiyono (2012). Business Research Methods. ALFABETA: Bandung.

- Sugiyono (2013). Qualitative Quantitative Research Methods and R&D. ALFABETA: Bandung.

- Widhiari, N.L.M.A., & Merkusiwati, N.K.L.A. (2015). The effect of liquidity, leverage, operating capacity, and sales growth ratio on financial distress. E-Jurnal Akuntansi Universitas Udayana, 12(2), 456-469.

- Yuliastari, E.C., & Wirakusuma, M.G. (2014). Financial distress analysis with the altman. Springate, Zmijewski Z-Score Method. Bali: Udayana University.