Research Article: 2019 Vol: 23 Issue: 4

The Effect of Managerial Overconfidence On Accruals-Based and Real-Activities Earnings Management: Evidence from Egypt

Ahmed M. Zaher, Zagazig University

Abstract

This study aims at investigating the effect of managerial overconfidence on earnings management (both accruals and real activities). A sample of 125 companies is drawn from Egyptian-listed companies’ qualified population for a period from 2012 to 2017 producing 750 year-firm observations. The trade-off model developed by Zang (2012) after adjusting it in order to fit the Egyptian environment and incorporate managerial overconfidence as independent variable is used to investigate the effect of managerial overconfidence on earnings management. The findings of this study indicate that managerial overconfidence positively affects both accruals earnings management and real-activities earnings management. Moreover, Egyptian managers jointly use both types of earnings management.

Keywords

Accruals Earnings Management, Real-Activities Earnings Management, Managerial Overconfidence, Earnings Management Types’ Trade-Off.

Introduction

An important question being addressed, and yet its answer is not well understood is “what causes firms to behave the way they do” (Graham et al., 2013). The previous question could be answered if we knew how managers make decisions. The current study attempts to provide a behavioral explanation for earnings management (EM) in Egypt proposing managerial overconfidence as an explanatory variable.

Agency theory views a firm as a sequence of contractual relationships with conflicting interests of parties are brought in to equilibrium (Jensen & Meckling, 1976). Through these contractual relations, the owners (principal) delegate decision-taking authority to managers (agents), this, in turn, puts managers in front of many decisions relating to the design of corporate policies, including the role of assessing future unknowns (Demand, cash flows, competition) and use these projections as inputs to design corporate policies (Ben-David et al., 2007). When assessing future unknowns, managers are affected by biases e.g. overconfidence bias.

The term overconfidence might seem difficult to define or even to assess, as overconfidence is non-observable and occurs simultaneously with other types of psychological phenomena in a mixture called sentiment (Ferreira, 2017). At its core seems to be the belief that people tend to be optimistic in the circumstances of uncertainty (Margolin, 2012). However, the behavioral corporate finance literature draws a distinction between optimism and overconfidence. Optimism is defined as a subjective overvaluation of the probability of favorable forthcoming events, while overconfidence relates to an underestimation of the risk or variance of forthcoming events (De long et al., 1990; Goel & Thakor, 2008; Fairchild, 2009). Furthermore, overconfident people e.g. managers- overestimate their abilities, believing that they know more than they actually do, and suffer from an illusion of control, believing that they exert more control over results than they in fact do. Moreover, they neglect their competitors’ strategic countermoves (Paredes, 2005)

Ma (2008) defined overconfidence as “an artificially inflated estimate or prediction of a past event or future outcome’’ (Ma, 2008), and is supported by three cognitive factors, differential attention, above than average effect, and the illusion of control. Also, Ackert and Deaves (2010) defined overconfidence as “the tendency for people to overestimate their knowledge, abilities, and the precision of their information, or to be overly sanguine of the future and their ability to control it’’(Ackert & Deaves, 2010). Moore and Schatz (2017) identified three faces (types) of overconfidence: overestimation, overplacement and overprecision. “Overestimation is thinking that you are better than you are, overplacement is the exaggerated belief that you are better than others, overprecision is the excessive faith that you know the truth” (Moore & Schatz, 2017). However, in accounting literature, the definition of managerial overconfidence is usually a combination of all three forms (Kim, 2016).

Goel & Thakor (2008) and Gervais et al. (2011) document that cost reduction motivates companies to prefer overconfident managers, as it will be less costly for companies to motivate them to take on risky projects. However, overconfident CEOs overestimate their capabilities, and as a consequence under-invest in information production, overconfidence that exceeds an optimal level can result in undesirable impacts to firm performance.

Hribar & Yang (2015) provided evidence that overconfidence increases the probability of issuing point estimates relative to range or open-ended forecasts. They also show that overconfidence is positively related to the use of income-increasing abnormal accruals subsequent to a forecast. Taken together, increasing the probability of missing management forecast and higher EM, could be regarded as an increased optimistic bias, as a result of overconfidence.

EM is primarily achieved through:

1. Accruals earnings management (AEM) which involves the within-GAAP manipulation of accruals through the discretionary choices of accruals accounting, e.g., depreciation rates, inventory valuation methods, and bad debt provisions. Therefore, AEM does not influence the firm’s underlying economics, but involves the change in the accounting presentation of these economics (El Diri, 2018).

2. Real earnings management (REM) involves economic decisions like accelerating sales through more lenient credit terms and higher discounts to the clients (Cohen and Zarowin, 2010), overproduction to decrease the fixed cost per unit and ultimately the unit cost and the cost of sales (Chi et al. 2011).

3. Classification shifting of non-recurring income statement items.

Companies trade off AEM and REM activities according to their relative costs, and therefore AEM and REM are commonly perceived as substitutes (Cohen et al. 2008; Bartov & Cohen 2009; Baber et al. 2011; Zang 2012). The costs of AEM include stakeholder scrutiny, audit quality, and accounting flexibility (Zang, 2012). Analysts also influence AEM behavior and encourage switching to real activities once their expectations fail (Bartov & Cohen 2009). On the other hand, the costs of REM contain the competitive status in the industry, financial health, institutional ownership, and the tax consequences of manipulation (Zang 2012).

Subsequent to Zang (2012) study, it is not appropriate to investigate one type of EM without considering the other type. Managers throughout the year focus on REM as it depends on their decisions. But, after year end, and before issuing the report, they might shift to use more AEM to achieve their targets. Then the relation between these two types could be viewed as a sequential relationship.

Costs and benefits of both types of EM restrict managers choices between these two types, therefore managers make a conscious selection about how to meet earnings goals by considering relevant costs and benefits of each type, consistent with the findings of Abernathy et al. (2014), who show that managers, when faced with constrained EM tactics, shift to use other form of EM.

Accordingly, the main research question of the current study can be stated as follows: “What is the relation of managerial overconfidence with earnings management?” (Both AEM and REM).

This study contributes to the existing literature by investigating the effect of managerial overconfidence on EM in Egypt as an emerging market, while considering the trade-off possibility between REM and AEM. The results of this study indicate that managerial overconfidence positively affects both AEM and REM. Moreover, Egyptian managers jointly use both types of EM. The result of this study may help users to partially understand why firms’ acts the way they do. The remainder of this paper is organized as follows: section 2 presents literature review and hypotheses development. Section 3 discusses research method. Section 4 reports empirical findings. Section 5 presents the results. Finally section 6 provides discussion and conclusion.

Literature Review and Hypotheses Development

Hirbar & Yang (2015) predict that overconfidence affects CEOs’ choices to adopt EM strategies to manipulate reported income in two ways. First, if an overconfident executive issues too optimistic forecasts, these optimistic forecasts provide incentives for CEO’s to adopt income increasing strategies to try to meet or beat these forecasts. In other words, future returns of firms’ projects are overestimated by overconfident CEO’s. Therefore, they are more likely to overestimate the likelihood and size of positive shocks and underestimate negative shocks to forthcoming cash flows from current projects (Ahmed & Duellman, 2013). Therefore, overconfident managers are more likely to use EM strategies to meet these estimates.

Second, Miller & Ross (1975) argue that confidence influences the attribution of causality. CEO’s who anticipate that their conduct should create success are more likely to attribute failure to luck, and success good outcomes to expertise. In this way, if an overconfident CEO was to face shortfall in income, he would attribute this shortfall to luck, and be more willing to make it up by adopting income increasing strategies, trusting that he/she will be able to compensate for any shortfall in the following time period.

Hirbar & Yang (2015) results support the previous arguments, as their results showed positive association between managerial overconfidence and the use of income increasing accruals. Also, Hsieh et al. (2014) find that overconfident CEOs are more likely to be involved in EM activities. Specifically, overconfident CEO’s are more likely to use income-increasing strategies through AEM in the form of discretionary accruals. Also, they are more likely to use real activities EM through abnormally high operating cash flows and abnormally low discretionary expenses. Moreover, Berry-Stölzle et al. (2018) find that CEO overconfidence is negatively correlated with loss reserves, in a way that overconfident CEO will be more likely to decrease loss reserves, which is another evidence about the positive relation between overconfidence and income increasing EM. Also, Chang et al. (2018) provides evidence that managerial overconfidence is positively associated with the accrual- based EM.

In contrast, Hsieh et al. (2014) find that after Sarbanes Oxley Act (SOX), overconfident CEOs tendency to manage to profit targets decreases. Also, Dal Magro et al. (2018) concludes that overconfidence has a negative relation with EM, suggesting that non-overconfident managers believe with less intensity in their capabilities, and so as to assure that organizational outcomes that satisfy the expectations of firm followers, e.g. analysts, they opportunistically practice the EM in order to increase organizational results.

Chae & Ryu (2016), unlike previous studies, provides evidence from Korea on a negative correlation between managerial overconfidence and REM, and justify this result by family ownership, as most of the Korean firms are family firms that put emphasis on long-term value. They tend to avoid REM while seeking to redeem performance deterioration resulting from their wrong decisions. This justification is supported by Li & Hung (2013), as their results show a positive relation between overconfidence and EM behaviors. Also, family control negatively moderates the positive relation between managerial overconfidence and EM.

Two main hypotheses can be formulated as follows

H1 Managerial overconfidence is not related to real earnings management.

H2 Managerial overconfidence is not related to accruals earnings management.

Method

Sample Selection

The population of the study includes all Egyptian corporations listed on the Egyptian stock exchange, which amounts to 224 companies as of October 1, 2018. Excluded are the banking sector (11 companies), financial services sector (37 companies), companies listed subsequent to 2010 to ensure data availability (25 companies), firms with inactive share trading price (5 companies) as share trading price will be used in measuring accounting conservatism, and companies that use US Dollar as their functional currency (6 companies). This ends up with 140 companies “qualified population”.

A sample of 125 companies is drawn from this qualified population for a period from 2012 to 2017. Table 1 shows a summary of qualified population and the sample composition.

| Table 1 Qualified Population and Sample Composition | |||

| Qualified population | number of companies in sample | % in sample | |

| Sector | Number of companies qualified | ||

| Basic resources, Utilities, Oil and gas | 11 | 10 | 0.080 |

| Chemicals | 7 | 7 | 0.056 |

| Construction and materials | 20 | 19 | 0.152 |

| Food and beverage | 23 | 21 | 0.168 |

| Healthcare and pharmaceuticals | 12 | 10 | 0.08 |

| Industrial goods and services and automobiles | 15 | 13 | 0.104 |

| Personal and household products | 9 | 8 | 0.064 |

| Real estate | 24 | 19 | 0.152 |

| Retail | 4 | 4 | 0.032 |

| Telecommunications, Technology, Media | 6 | 5 | 0.040 |

| Travel and leisure | 9 | 9 | 0.072 |

| Total | 140 | 125 | 1 |

The study data are hand-collected from Egyptian stock exchange, Egyptian Financial Supervisory Authority, and Egypt for Information Dissemination EGID.

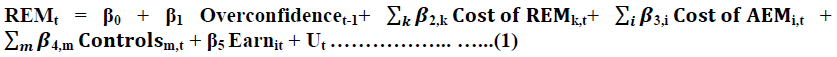

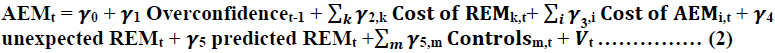

Models

To examine the relation between managerial overconfidence and EM, taking into consideration the trade-off between REM and AEM, this study follows Zang (2012)1 model after modifying it to suit the Egyptian environment (Boghdady, 2019b) and incorporating the independent variable of this study (managerial overconfidence).

Definition of Models Variables

Table 2 introduces the operational definitions of the two models variables. Different measures of overconfidence are used in the literature. These measures can be classified into: (first) option-based measures2, and (second) investment-based measures (Campbell et al., 2011; Schrand and Zechman, 2012; Hirshleifer et al., 2012; Hribar and Yang, 2015; Ahmed and Duellman, 2013). This study uses investment-based measures, because of the availability of data required to apply these measures in the Egyptian environment.

| Table 2 Operational Definitions |

|

| Dependent variable: | |

| AEMt | AEM as measured by discretionary accruals adopting the modified Jones model (1995) using industry-year regression. TACCit/ Ait-1 = β0(1/Ait-1) + β1 [(?REVit - ?RECit) / Ait-1] + β2 (PPEit/ Ait-1) + ?t Where: • TACCit: Total accruals (Net income before extra-ordinary items minus operating cash flows). • Ait-1 : Total assets of firm i at the beginning of the year. • ?REVit : Change in revenues for the firm i during period t. • ?RECit : Change in receivables for the firm i during period t. • PPEit : Total property plant & equipment at the end of year t. |

| REMt | REM measured using the Roychowdhury model (2006), composed of three sub-models; abnormal operating cash flow, abnormal discretionary expenses and abnormal production costs. Aggregate REM is the sum of Abnormal Operating Cash Flow multiplied by (-1) and Abnormal Discretionary Expense multiplied by (–1) for non-manufacturing firms and adding abnormal production cost for manufacturing firms. The abnormal operating cash flow is estimated as the residuals from the following industry year regression: CFOit /Ait-1 = α1t [1/Ait-1] + α2 [Salesit/Ait-1] + α3 [? Salesit/Ait-1] + εit Where, CFO is cash flow from operations, At is total assets at the end of year t, salesit is the net sales during the year and ? Salesit is the change in net sales from year t-1 to t. The abnormal production costs are measured as the estimated residual from the following regression Prodit/Ait-1 = α1t [1/Ait-1] + α2[ Salesit/Ait-1] + α3 [? Salesit/Ait-1] + α4 [? Salesi, t-1/Ait-1] + εit Where, Prodit is the sum of cost of goods sold in year t plus the change in inventory from year t-1 to t, Ait-1 is total assets of firm i at the end of year t-1 , salesit is the net sales during the year and ? Salesit is the change in net sales from year t-1 to t. The abnormal discretionary expenses are measured as the estimated residual from the following regression DisExpit/Ait-1= α1t [1/Ait-1] + α2 [Salesit-1/Ait-1] + εit Where, DisExpit is the sum of advertising expense and selling, general, and administrative expenses in year t and, Ait-1 is total assets of firm i at the end of year t-1, salesit-1 is the net sales during the yeart-1. |

| Independent variable: | |

| Overcont-1 | Managerial overconfidence in year t-1, employing Overconfidence investment-based measure, following Schrand and Zechman (2012.8): equals one if the firm’s capital expenditures deflated by lagged total assets are greater than the industry median of that year, zero otherwise. |

| Cost of REM | |

| MSt-1 | Market share at the beginning of the year, measured as the percentage of a company’s sales to the total sales of its industry. |

| Instt-1 | the percentage of institutional ownership at the beginning of year t |

| Cost of AEM | |

| SAFt | Size of audit firm, indicator variable equals 1 if the company’s auditor is one of the big 4, zero otherwise. |

| Tenuret | Audit tenure, indicator variable equals 1 if the number of years the auditor has audited the client is above the sample median of 17 years, zero otherwise. |

| NOAt-1 | Net operating assets a proxy for the extent of AEM in previous periods, measured as shareholders equity minus cash and marketable securities plus total debt at the beginning of the year all divided by lagged total assets. |

| OCt-1 | The natural log of the operating cycle at the beginning of the year measured as the days receivables plus the days inventory less the days payable |

| Control variables: | |

| MTBt | Market value of equity divided by book value of equity |

| LEVt | Total debt divided by total assets |

| CFOt-1 | Cash flow from operations in year t scaled by total assets at the beginning of year t |

| ROAt-1 | (ROA) Net income divided by total assets |

| SIZEt | The natural log of total assets at the end of year t |

| Control variable unique to REM | |

| Earnt | pre managed earnings to control for the goal of managing earnings upward, measured as earnings before extraordinary items minus discretionary accruals and production costs plus discretionary expenditures scaled by lagged total assets |

| Control variable unique to AEM | |

| predicted REM | predicted value of real earning management from the first equation to control for the extent of income increasing earnings management activities |

Empirical Findings

Descriptive Statistics

Table 3 presents the descriptive for the variables, while Table 4 presents the proportions for dummy variables.

| Table 3 Descriptive Statistics | ||||

| Variable | Mean | Std. dev. | Min. | Max. |

| REMit | 0.001 | 0.117 | -0.248 | 0.239 |

| AEMit | -0.0003 | 0.074 | -0.146 | 0.154 |

| MSit-1 | 0.069 | 0.125 | 0.001 | 0.481 |

| INSTit-1 | 0.572 | 0.305 | 0 | 0.964 |

| NOAit-1 | 0.896 | 0.108 | 0.640 | 0.998 |

| OCit-1 | 2.237 | 0.459 | 1.243 | 3.123 |

| MTBit-1 | 1.114 | 0.847 | 0.054 | 3.307 |

| LEVit-1 | 0.425 | 0.233 | 0.063 | 0.878 |

| CFOit-1 | 0.054 | 0.108 | -0.135 | 0.321 |

| ROAit-1 | 0.048 | 0.077 | -0.111 | 0.199 |

| SIZEit | 8.777 | 0.589 | 7.780 | 9.901 |

| EARNit | 0.050 | 0.105 | -0.165 | 0.258 |

| Table 4 Proportions of Dummy Variables | |||

| OVERCONit-1 | SAFit | TENUREit | |

| Proportion of 1 | 0.518024 | 0.3484646 | 0.411215 |

| Proportion of 0 | 0.481976 | 0.6515354 | 0.588785 |

Correlation Matrix

Pearson correlation is used to test the correlations among all variables of the study models. The correlation results mainly are used to get some initial insights into the data and provide an indication about the multi-collinearity problem. However, multi-collinearity problem will be investigated later using variance inflation factor. Correlation coefficients are calculated for the models as presented in Table 5.

| Table 5 Pearson Correlations for Model 1 | |||||||||

| Correlation | AOCFit | ADEit | APCit | REMit | AEMit | OVERCONit-1 | MSit-1 | INSTit-1 | SAFit |

| AOCFit | 1.000 | ||||||||

| ----- | |||||||||

| ADEit | -0.172 | 1.000 | |||||||

| 0.000 | ----- | ||||||||

| APCit | 0.445 | 0.191 | 1.000 | ||||||

| 0.000 | 0.000 | ----- | |||||||

| REMit | 0.813 | 0.245 | 0.838 | 1.000 | |||||

| 0.000 | 0.000 | 0.000 | ----- | ||||||

| AEMit | 0.527 | -0.053 | 0.090 | 0.368 | 1.000 | ||||

| 0.000 | 0.146 | 0.037 | 0.000 | ----- | |||||

| OVERCONit-1 | 0.064 | -0.009 | -0.028 | 0.027 | 0.136 | 1.000 | |||

| 0.081 | 0.798 | 0.515 | 0.464 | 0.000 | ----- | ||||

| MSit-1 | -0.049 | 0.017 | -0.085 | -0.043 | -0.014 | 0.169 | 1.000 | ||

| 0.183 | 0.635 | 0.051 | 0.238 | 0.712 | 0.000 | ----- | |||

| INSTit-1 | -0.055 | -0.130 | -0.102 | -0.112 | -0.008 | 0.091 | 0.267 | 1.000 | |

| 0.133 | 0.000 | 0.018 | 0.002 | 0.831 | 0.013 | 0.000 | ----- | ||

| SAFit | 0.135 | -0.122 | -0.002 | 0.055 | 0.067 | 0.027 | 0.103 | 0.184 | 1.000 |

| 0.000 | 0.001 | 0.971 | 0.135 | 0.068 | 0.462 | 0.005 | 0.000 | ----- | |

| TENUREit | -0.095 | 0.102 | 0.041 | -0.017 | -0.026 | 0.019 | 0.208 | 0.117 | -0.124 |

| 0.009 | 0.005 | 0.339 | 0.643 | 0.485 | 0.598 | 0.000 | 0.001 | 0.001 | |

| NOAit-1 | 0.329 | -0.127 | 0.153 | 0.250 | 0.140 | -0.035 | -0.06 | -0.087 | 0.158 |

| 0.000 | 0.001 | 0.000 | 0.000 | 0.000 | 0.342 | 0.099 | 0.017 | 0.000 | |

| Ocit-1 | 0.078 | -0.063 | 0.049 | 0.049 | 0.019 | -0.050 | -0.205 | -0.189 | 0.042 |

| 0.033 | 0.087 | 0.258 | 0.177 | 0.607 | 0.168 | 0.000 | 0.000 | 0.249 | |

| MTBit-1 | -0.133 | 0.12 | -0.109 | -0.107 | 0.000 | -0.007 | -0.034 | 0.026 | 0.010 |

| 0.000 | 0.001 | 0.012 | 0.003 | 0.993 | 0.842 | 0.347 | 0.481 | 0.792 | |

| LEVit-1 | 0.242 | -0.196 | 0.205 | 0.192 | -0.089 | -0.012 | -0.028 | 0.245 | 0.023 |

| 0.000 | 0.000 | 0.000 | 0.000 | 0.015 | 0.751 | 0.439 | 0.000 | 0.530 | |

| CFOit-1 | -0.685 | 0.135 | -0.32 | -0.557 | -0.487 | 0.033 | 0.180 | 0.153 | -0.014 |

| 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.363 | 0.000 | 0.000 | 0.701 | |

| ROAit | -0.351 | 0.199 | -0.302 | -0.317 | 0.181 | 0.100 | 0.136 | 0.032 | 0.042 |

| 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.006 | 0.000 | 0.383 | 0.250 | |

| SIZEit | -0.089 | 0.061 | -0.083 | -0.073 | 0.029 | 0.133 | 0.511 | 0.460 | 0.342 |

| 0.015 | 0.096 | 0.056 | 0.046 | 0.435 | 0.000 | 0.000 | 0.000 | 0.000 | |

| EARNit | -0.230 | 0.247 | -0.510 | -0.322 | -0.062 | 0.032 | 0.108 | -0.007 | 0.076 |

| 0.000 | 0.000 | 0.000 | 0.000 | 0.089 | 0.385 | 0.003 | 0.838 | 0.036 | |

| TENUREit | NOAit-1 | Ocit-1 | MTBit-1 | LEVit-1 | CFOit-1 | ROAit+1 | SIZEit | EARNit | |

| TENUREit | 1.000 | ||||||||

| ----- | |||||||||

| NOAit | -0.179 | 1.000 | |||||||

| 0.000 | ----- | ||||||||

| Ocit | -0.140 | 0.199 | 1.000 | ||||||

| 0.000 | 0.000 | ----- | |||||||

| MTBit | 0.079 | -0.028 | -0.112 | 1.000 | |||||

| 0.030 | 0.438 | 0.002 | ----- | ||||||

| LEVit | 0.050 | 0.007 | -0.022 | -0.166 | 1.000 | ||||

| 0.173 | 0.857 | 0.557 | 0.000 | ----- | |||||

| CFOit | 0.106 | -0.403 | -0.209 | 0.154 | -0.206 | 1.000 | |||

| 0.004 | 0.000 | 0.000 | 0.000 | 0.000 | ----- | ||||

| ROAit+1 | 0.08 | -0.247 | -0.169 | 0.22 | -0.513 | 0.512 | 1.000 | ||

| 0.028 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ----- | |||

| SIZEit | 0.156 | 0.012 | -0.07 | 0.001 | 0.063 | 0.213 | 0.165 | 1.000 | |

| 0.000 | 0.747 | 0.057 | 0.971 | 0.085 | 0.000 | 0.000 | ----- | ||

| EARNit | 0.019 | -0.154 | -0.143 | 0.224 | -0.405 | 0.478 | 0.706 | 0.130 | 1.000 |

| 0.596 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ----- | |

With regard to AEM, there is a positive correlation between (AEM) and each of abnormal operating cash flow (AOCF), abnormal production cost (APC) and REM, suggesting that firms depend on both types of EM.

Overconfidence is positively correlated with each of abnormal operating cash flow (AOCF) and AEM, suggesting that overconfident managers rely on these two methods in

managing earnings. Also, overconfidence is positively correlated with market share (MS), institutional ownership (INST), return on assets (ROA) and size of the firm (SIZE), suggesting that large firms with a high market share and high institutional ownership and achieve high return on assets are managed by overconfident executives.

Regression Models Validation

The validation tests for the models of this study (i.e. linearity, normality, multicollinearity, Heteroscedasticity and autocorrelation) are tested (Tables 6 & 7). The VIF value for all variables are less than 10, which indicates that multicollinearity problem is not present, Except for the AEM model where there is collinearity between CFOit-1 and predicted REM estimated from REM model. Therefore, the predicted REM is removed from the regression model to avoid multicollinearity problem, as mentioned by Ayyangar (2007). A solution to this problem is to remove one of the highly correlated variables. The overall conclusion is AEM model will be estimated using random effects (RE) model, while REM model will be estimated using firm fixed effects (FFE) model with clustered robust standard errors are used to correct for autocorrelation(Hoechle, 2007; Ayaanger, 2007).

| Table 6 Models Validation Results | |||

| Study models | Test value | Significance | |

| Breusch-Pagan lagrangian multiplier test To select Pooled OLS or RE | REM | 156.76 | 0.000 |

| AEM | 13.60 | 0.000 | |

| Hausman test To choose between RE and FFE | REM | 21.81 | 0.058 |

| AEM | 19.89 | 0.133 | |

| Ramsey’s RESET for linearity | REM | 0.4 | 0.754 |

| AEM | 2.42 | 0.065 | |

| skewness/kurtosis normality test | REM | 3.47 | 0.176 |

| AEM | 2.66 | 0.265 | |

| Breusch-Pagan / Cook-Weisberg test | REM | 1.53 | 0.217 |

| AEM | 1.42 | 0.234 | |

| autocorrelation test | REM | 9.091 | 0.003 |

| AEM | 0.349 | 0.556 | |

| Table 7 Variance Inflation Factor | ||

| Variable | Models by dependent variable | |

| REM | AEM | |

| VIF | VIF | |

| OVERCON it-1 | 1.05 | 1.2 |

| MS it-1 | 1.52 | 1.86 |

| INST it-1 | 1.42 | 1.73 |

| SAF it | 1.22 | 1.92 |

| TENURE it | 1.12 | 1.3 |

| NOA it-1 | 1.21 | 1.51 |

| OC it-1 | 1.16 | 1.58 |

| MTB it-1 | 1.13 | 1.1 |

| LEV it-1 | 1.53 | 2.35 |

| CFO it-1 | 1.55 | 28.87 |

| ROA it-1 | 2.37 | 1.89 |

| SIZE it | 1.9 | 1.98 |

| EARN it | 1.96 | |

| Predicted REM | 26.01 | |

| Unexpected REM | 1.04 | |

Results

REM Model

Table 8 reports the results of REM model. The model is significant as the Wald chi2 test statistic equals 14.50 with a probability less than 0.001, the explanatory power of the model (R2) equals 10.21%. The model shows that managerial overconfidence positively affects aggregate REM with a coefficient of (0.015) and a probability of (0.048). With regard to control variables, return on assets and size positively affect REM with a coefficients of (0.130 and 0.101 respectively) and probabilities (0.029 and 0.016 respectively), which indicate that large firms with high return on assets are more engaged in REM. Pre-managed earnings result is not consistent with Zang (2012) who found a negative relation between pre-managed earnings and REM.

| Table 8 Results of Rem and AEM Models | ||||

| Dep. Variable | REM | AEM | ||

| Indep. Variables | Coeff. | Significance | Coeff. | Significance |

| Constant | -0.942 | 0.012 | -0.072 | 0.166 |

| OVERCONit-1 | 0.015 | 0.048 | 0.015 | 0.001 |

| Cost of REM | ||||

| MSit-1 | 0.191 | 0.065 | 0.049 | 0.054 |

| INSTit-1 | -0.068 | 0.205 | 0.017 | 0.076 |

| Cost of AEM | ||||

| SAFit | 0.033 | 0.275 | -0.006 | 0.297 |

| TENUREit | -0.007 | 0.646 | -0.006 | 0.257 |

| NOAit-1 | 0.087 | 0.115 | -0.005 | 0.847 |

| OCit-1 | -0.003 | 0.534 | -0.005 | 0.420 |

| Other control variables | ||||

| MTBit-1 | 0.002 | 0.335 | 0.006 | 0.046 |

| LEVit-1 | 0.035 | 0.086 | -0.015 | 0.202 |

| CFOit-1 | -0.497 | 0.000 | -0.733 | 0.000 |

| ROAit-1 | 0.130 | 0.029 | 0.689 | 0.000 |

| SIZEit | 0.101 | 0.016 | 0.009 | 0.129 |

| EARNit | -0.042 | 0.420 | ||

| Unexpected REM | -0.002 | 0.326 | ||

| N | 709* | 708* | ||

| R-squared | 0.1021 | 0.5477 | ||

| Wald chi2 | 14.50 | 869.55 | ||

| Prob.( Wald chi2) | 0.000 | 0.000 | ||

With regard to cash flow from operations (CFO), it negatively affects REM with a coefficient of (-0.497) and a probability less than 0.001, which indicates that firms with higher cash flow from operation are engaged less in REM.

Finally, all other variables do not affect REN, as their probabilities are higher than 0.05. However, the market share is positively related to REM with a coefficient of (0.191) and a probability of (0.065), this result is consistent with Zang (2012) and indicates that firms with higher market share engage in higher level of REM. Also, leverage is marginally positively related to aggregate REM with a coefficient of (0.035) and a probability of (0.086).

AEM Model

Table 8 reports the results of AEM management model. The model is significant as the Wald chi2 test statistic equals 869.55 with a probability less than 0.001, the explanatory power of the model (R2) equal 54.77%. The model shows that managerial overconfidence positively affects AEM with a coefficient of (0.015) and a probability of (0.001).

With regard to control variables, market-to-book ratio and return on assets positively affect AEM with coefficients of (0.006 and 0.689 respectively) and probabilities of (0.046 and 0.000 respectively), which indicates that firms with high market to book ratio and return on assets are engaged more in AEM.

Finally, all other variables do not effect AEM as their probabilities are higher than 0.05. However, market share and institutional ownership are positively related to AEM with coefficients of (0.049 and 0.017, respectively) and probabilities of (0.054 and 0.076 respectively).

With regard to the tradeoff between REM and AEM, Zang (2012) argue that a negative relation between AEM and the unexpected amount of REM is an indication of a substitutive relation or sequential decisions are being made about the use of the two EM approaches.

However, in the AEM model, the unexpected REM is not significant, suggesting managers in Egyptian firms might use both types of EM jointly to reach the target levels of earnings. This result is consistent with Boghdady (2019a) who finds a positive relation between both types of EM, indicating no tradeoff between both types, and argues that poor corporate governance and weak investor protection in Egypt might be the cause of the use of both types (Boghdady, 2019a).

Discussion and Conclusion

The results indicate that managerial overconfidence positively affects REM, indicating rejection of hypothesis (H1) stating that “Managerial overconfidence is not related to real earnings management”. It could be concluded that overconfident managers are more likely to be involved in upward real activities earnings management. This result is consistent with the findings of Habib et al. (2012) and Chang et al. (2018) who report that overconfident managers use REM more than less confident managers. However, this result is inconsistent with Chae and Ryu (2016) who report a negative relation between managerial overconfidence and REM.

The results indicate that managerial overconfidence positively affects AEM, then, hypothesis (H2) stating that “Managerial overconfidence is not related to accruals earnings management” cannot be rejected. Therefore, it could be concluded that overconfident managers are more likely to be involved in AEM. Thus, they tend to use discretionary accruals to increase current year reported profits. This result is consistent with the findings of Hsieh et al. (2014), Berry-Stölzle et al. (2018) and Chang et al. (2018) who reported that managerial overconfidence positively affects AEM. However, this result is inconsistent with Habib et al. (2012) who reported that overconfident managers use less AEM. Also, the result is inconsistent with those of Dal Margo et al. (2018), how reported that lower overconfidence has a positive impact on EM.

The findings and interpretations of the current study are subject to certain limitations. First, this study findings are likely to be conditional on the ability of AEM Jones model to appropriately isolate the discretionary accruals component, as the literature indicates that accruals models lack power due to the likelihood of misclassifying the discretionary and non-discretionary accruals. Second, a limitation concerns the measurement of managerial overconfidence adopted in this study which is confined to investment based measure, due to inapplicability of other measures in the Egyptian environment, therefore the results are reliable to the extent to which this measure captures managerial overconfidence. Third, a limitation concerns the period of this study, which is confined to the period from 2012 to 2017, due to the usage of investment-based overconfidence measure which might be inappropriate to apply in periods of decreasing gross domestic product, period of Egyptian revolution.

The current study investigated the effect of managerial overconfidence on EM, however, a multitude of research area still exists. Further research is needed to investigate the effect of managers risk attitude on these decisions. Also, the effect of corporate governance mechanisms in mitigating bad effect of managerial overconfidence is needed. These study findings suggest a joint use of accruals and real activities EM in Egypt. Further evidence on the costs and constraints of both types of EM and joint use of them in Egypt is needed. Another area for research is to investigate the effect of managerial overconfidence on firm’s corporate social responsibility and cost stickiness. As well as investigating the determinants of managerial overconfidence and its collective consequences.

End Notes

1. Zang (2012) identified four types of costs for real activities manipulation. The first is a firm’s market leader status in the industry at the beginning of the year. The second type concerns firms’ financial health, measured using a modified version of Altman’s Z-score (Altman, 2000). The third type captures the influence of institutional ownership on real activities earnings management. The last type of REM cost is the marginal tax rate. Of the four types of costs, this study uses only two costs: market leader status measured by market share at the beginning of the year, and institutional ownership measured by the percentage of institutional ownership at the beginning of the year. I exclude financial health due to the inapplicability of Altman’s Z-score in the Egyptian environment, I also exclude marginal tax rate, as for, law 91 per year 2005 and its amendments, tax rate applies to Egyptian corporations is fixed at 22.5%.

2. The option-based measure developed by Malmendier and Tate (2005), depends upon overconfident CEOs being more likely to delay exercising options, as they argue that overconfident CEOs overestimate the returns from their investment projects and hence overestimate the increase of their firms’ value.

References

- Abernathy, J.L., Beyer, B., & Rapley, E.T. (2014). Earnings management constraints and classification shifting. Journal of Business Finance and Accounting, 41(5-6), 600-626.

- Ackert, L.F., & Deaves, R. (2010). Behavioural finance: psychology, decision making, and markets. South-Western Cengage Learning, Mason.

- Ahmed, A.S., & Duellman, S. (2013). Managerial overconfidence and accounting conservatism. Journal of Accounting Research, 51(1), 1-30.

- Altman, E.I. (2000). Predicting financial distress of companies: Revisiting the Z-score and ZETA models. Stern School of Business, New York University, 9-12.

- Ayyangar, L. (2007). Skewness, multicollinearity, heteroskedasticity-you name it, cost data have it! solutions to violations of assumptions of ordinary least squares regression models using SAS®. SAS Global Forum 2007.

- Baber, W.R., Kang, S.H., & Li, Y. (2011). Modeling discretionary accrual reversal and the balance sheet as an earnings management constraint. The Accounting Review, 86(4), 1189-1212.

- Baddeley, M. (2017). Investment: Theories and Analyses. Macmillan International Higher Education.

- Bartov, E., & Cohen, D.A. (2009). The “numbers game” in the pre-and post-Sarbanes-Oxley eras. Journal of Accounting, Auditing & Finance, 24(4), 505-534.

- Ben-David, I., Graham, J.R., & Harvey, C.R. (2007). Managerial overconfidence and corporate policies (No. w13711). National Bureau of Economic Research.

- Ben-David, I., Graham, J.R., & Harvey, C.R. (2013). Managerial miscalibration. The Quarterly Journal of Economics, 128(4), 1547-1584.

- Berry-Stölzle, T.R., Eastman, E.M., & Xu, J. (2018). CEO overconfidence and earnings management: Evidence from property-liability insurers' loss reserves. North American Actuarial Journal, 1-25.

- Boghdady, A.B.A. (2019a). The impact of corporate governance mechanisms on real and accruals earnings management in the state-owned versus privately-owned companies: Empirical evidence from Egypt. Ph.D. Thesis, faculty of commerce, Zagazig University.

- Boghdady, A.B.A. (2019b). The impact of ownership type on the relationship between corporate governance and earnings management: An empirical study. Corporate Ownership & Control, 16(4), 31-44.

- Campbell, T.C., Gallmeyer, M., Johnson, S.A., Rutherford, J., & Stanley, B.W. (2011). CEO optimism and forced turnover. Journal of Financial Economics, 101(3), 695-712.

- Chae, S.J., & Ryu, H.Y. (2016). Managerial overconfidence and real earnings management: Evidence from Korea. International Information Institute (Tokyo). Information, 19(11A), 5065.

- Chang, S.L., Hwang, L.J., Li, C.A., & Jhou, C.T. (2018). Managerial overconfidence and earnings management. International Journal of Organizational Innovation (Online), 10(3), 189-205.

- Chi, W., Lisic, L.L., & Pevzner, M. (2011). Is enhanced audit quality associated with greater real earnings management?. Accounting Horizons, 25(2), 315-335.

- Cohen, D.A., & Zarowin, P. (2010). Accrual-based and real earnings management activities around seasoned equity offerings. Journal of accounting & Economics, 50(1), 2-19.

- Cohen, D.A., Dey, A., & Lys, T.Z. (2008). Real and accrual-based earnings management in the pre-and post-Sarbanes-Oxley periods. The Accounting Review, 83(3), 757-787.

- Dal Magro, C.B., Gorla, M.C., & Klann, R.C. (2018). Overconfident chief executive officer and earnings management practice. Scientific Editorial Board, 17(50).52-67.

- De Long, J.B., Shleifer, A., Summers, L.H., & Waldmann, R.J. (1990). Noise trader risk in financial markets. Journal of Political Economy, 98(4), 703-738.

- Dechow, P.M., Sloan, R.G., & Sweeney, A.P. (1995). Detecting earnings management. The Accounting Review, 70(2), 193-225.

- El Diri, M. (2018). Definitions, activities, and measurement of earnings management. In Introduction to earnings management (pp. 5-44). Springer, Cham.

- Fairchild, R. (2009). Managerial overconfidence, moral hazard problems, and excessive life cycle debt sensitivity. Investment Management and Financial Innovations, 6(3), 35-42.

- Ferreira, M.P. (2017). Overconfidence in finance: Overview and Trends. In Handbook of Investors' Behavior During Financial Crises (pp. 101-112). Academic Press.

- Gervais, S., Heaton, J.B., & Odean, T. (2011). Overconfidence, compensation contracts, and capital budgeting. The Journal of Finance, 66(5), 1735-1777.

- Goel, A.M., & Thakor, A.V. (2008). Overconfidence, CEO selection, and corporate governance. The Journal of Finance, 63(6), 2737-2784.

- Graham, J.R., Harvey, C.R., & Puri, M. (2013). Managerial attitudes and corporate actions. Journal of Financial Economics, 109(1), 103-121.

- Habib, A., Hossain, M., & Cahan, S. (2012). Managerial overconfidence, earnings management and the global financial crisis. In AFAANZ 2012 Conference Proceedings. Wiley-Blackwell Publishing Asia.

- Hirshleifer, D., Low, A., & Teoh, S.H. (2012). Are overconfident CEOs better innovators? The Journal of Finance, 67(4), 1457-1498.

- Hoechle, D. (2007). Robust standard errors for panel regressions with cross-sectional dependence. Stata Journal 7(3), 281-312.

- Hribar, P., & Yang, H. (2015). CEO overconfidence and management forecasting. Contemporary Accounting Research, 33(1), 204-227.

- Hsieh, T.S., Bedard, J.C., & Johnstone, K.M. (2014). CEO overconfidence and earnings management during shifting regulatory regimes. Journal of Business Finance and Accounting, 41(9-10), 1243-1268.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Kim, H.J. (2016). The Impact of Managerial Overconfidence and Ability on Auditor Going-Concern Decisions and Auditor Termination. working paper. Available at: http://w.batteninstitute.com/uploadedFiles/Kim.pdf.

- Li, I.C., & Hung, J.H. (2013). The moderating effects of family control on the relation between managerial overconfidence and earnings management. Review of Pacific Basin Financial Markets and Policies, 16(02), 1350010.

- Ma, Nirvana (2008). Overconfidence its theory and implications in dispute resolution. ADR Bulletin, 10(4). Retrieved from http://epublications.bond.edu.au/adr/vol10/iss4/4

- Malmendier, U., & Tate, G. (2005). CEO overconfidence and corporate investment. The Journal of Finance, 60(6), 2661-2700.

- Margolin, M. (2012). Managerial overconfidence and education insights from dual process theory. Master Thesis, University of Mannheim

- Miller, D.T., & Ross, M. (1975). Self-serving biases in the attribution of causality: Fact or fiction? Psychological bulletin, 82(2), 213.

- Moore, D.A., & Schatz, D. (2017). The three faces of overconfidence. Social and Personality Psychology Compass, 11(8), e12331.

- Paredes, T.A. (2005). Too much pay, too much deference: Behavioral corporate finance, CEOs, and corporate governance. Fla. St. UL Rev., 32(2), 673-762.

- Roychowdhury, S. (2006). Earnings management through real activities manipulation. Journal of Accounting and Economics, 42(3), 335-370.

- Schrand, C.M., & Zechman, S.L. (2012). Executive overconfidence and the slippery slope to financial misreporting. Journal of Accounting and Economics, 53(1), 311-329.

- Zang, A.Y. (2012). Evidence on the trade-off between real activities manipulation and accrual-based earnings management. The Accounting Review, 87(2), 675-703.