Original Articles: 2017 Vol: 21 Issue: 1

The Effect of Ownership Structure on Market Valuation of Firms in India: Evidence from BSE-100 Index Companies

Nahila Nazir, Ansal University

Amarjeet Kaur Malhotra, Ansal University

Keywords

ownership structure, market valuation, market capitalisation, Price to Book Value, BSE, India

Introduction

The relevance of the conflict of interest between owners and managers, especially with regard to the likely effects for firm performance is shown in agency theory. According to (Jensen

& Meckling, 1976), this theory is dependent on assumptions like the absence of complete agreements and the opportunism of financial agents to justify the appearance of agency costs. These costs occur from efforts by the owner (the principal) to keep an eye on the actions of the manager (the agent) and create contractual bonuses for him, as well as by certain techniques of the manager to benefit himself over the of the shareholders, such as concentrating on the short term, insider trading, and resistance/amount of resistance to activities that are advantageous to the shareholders, including liquidations, divisions, and mergers (Jensen & Meckling, 1976; Stulz, 1988). One of the effective topics which have gained much importance in corporate governance is ownership structure. The relationship between ownership structure and firm performance has acquired significant attention. (Berle and Means 1932) are the pioneers to bring focus to the idea that with the improved diffuseness of the ownership structure, the firm performance deteriorates.

In India, the ownership and control structure of companies is marked by its high concentration (Srivastava 2001). In this scenario (Claessens, Djankov, & Lang, 2000; Lins, 2003) found that agency costs mainly occur from issues of interest between controlling and minority shareholders, which may lead to the expropriation of the wealth prosperity between the two.

National and international empirical studies have analysed the presence of a relationship between ownership structure and corporate performance. These studies are usually differentiated by their techniques generally, plus they present divergent results that lead to different interpretations. In this study impact of ownership structure on market valuation is one of the objectives. Ownership structure is an independent variable and market valuation a dependent variable and the parameters used to measure market valuation are market capitalisation, price to book value. Market capitalisation has been used as the basic valuation technique while checking the total worth of firms. PB is the ratio of market price of a company's shares over its assets expressed on the balance sheet. PB value shows how much an asset can fetch in the market compared to its book value. So again, in market valuation this study uses the basic market value components that can show the actual position of the business in an understandable form to the users of the information. Most of the earlier have ignored this factor and have used Tobin’s Q as proxy for market value which sometimes gets difficult to assess as in Tobin’s Q replacement value is difficult to trace.

The results of studies such as those by (Claessens, Djankov, and Lang 2002), (Fahlenbrach and Stulz 2009) and (Garcia- Meca and Sanchez-Ballesta 2011) found that there is a relationship between ownership structure and corporate business performance. However, other studies, such as those by (Demsetz and Lehn 1985), (Himmelberg, Hubbard, and Palia 1999) and (Demsetz and Villalonga 2001), found that the ownership and control structure can be an endogenous variable that depends upon corporate characteristics and does not affect company performance. While as (Dwivedi & Jain 2005) found no endogeneity in the variables. The aim and objective of this study is to test the impact of ownership structure on firm’s market valuation in Indian firms. This study investigates whether there is evidence to support the idea that variations in firms observed ownership structures result in systematic variations in observed firm performance in the context of Indian firms. The current study examines this hypothesis by assessing the impact of the structure of ownership on market valuation measured by market capitalisation and PB value of selected firms using data of BSE 100 Index from 2000-2014, covering all major sectors.

Literature Review

The review of literature for the impact of ownership structure on the firm's performance shows no arranged relationship, and provides strong argument on this issue among various studies in various countries from developed to developing countries. As mentioned earlier, this work can be traced back to the pioneering study of (Berle and Means 1932) that discussed the results about the separation between ownership and management in large companies in the United States, different studies have analysed the issue of interests between managers and shareholders to attempt to get its likely effect on firm performance. Most of the earlier empirical studies examined the insider ownership structure of the on-going companies, mainly the directors' and managerial ownership, and focused on the incentive (or alignment) effect and the entrenchment effect as designed by (Jensen and Meckling 1976), (Morck, Shleifer, and Vishny 1988), (Stulz 1988). However, studies such as those by (La Porta, Lopezde- Silanes, and Shleifer 1999), (Claessens, Djankov, and Lang 2000), and (Lins 2003) show that broadly dispersed ownership is a characteristic only of the Anglo-Saxon model. The analysis by (La Porta et al. 1999) whose sample included 691 companies from the 27 richest countries in the world (based on per capita income from 1993) showed proof of the predominance of high ownership concentration in companies that are usually under the control of families and the State. (Dwivedi

& Jain 2005) provide evidence that a higher percentage of overseas shareholding is associated with increase in market value of the company, while as Indian institutional shareholders' association is not statistically significant. A poor positive relationship is also found between board size and firm value. Directors' shareholding has a non-linear negative relationship with firm value, while the public shareholding has a linear negative association. Endogeneity in the parameters was not found.

(Gugler et al. 2008) found the market value of the stocks held by directors and officials captured the alignment effect, since it also positively affected Tobin's Q and the ratio of firm's return on investment to its cost of capital; in addition, managerial shareholdings revealed a negative relationship with both indicators, thus taking the entrenchment impact. (Azofra and Santamaria 2011) indicated that the higher the separation between the largest shareholder's cash flow and voting rights, the smaller the business's return on assets, so when there is absolutely no divorce between ownership and control, the relationship between the controlling shareholders' holding and the bank's profitability is not monotonic. Finally, the simultaneous determination of variables can also skew the variables of the estimated models also. According to (Borsch-Supan and Koke 2002), the direction of causality between the ownership structure and company performance is not yet determined. An increased ownership concentration can increase firm value due to better monitoring of the management, preventing the expropriation of shareholder wealth by the managers. However, well-performing companies could catch the attention of new investors and therefore change the business's ownership structure. Simultaneity can be mitigated with several instruments as shown in the studies by (Drakos and Bekiris 2010). (Drakos and Bekiris 2010) found that inside directors' shareholdings and the deposition of stocks by investors who owned or operated more than 1% of the shares and who didn't participate in senior management positively affected Tobin's Q.

(Morck et al., 1988), taking percentage of shares by the board of directors of the company as a way of measuring ownership concentration and having both Tobin's Q and accounting profit as measure of performance for 500 fortune companies and using piece-wise linear regression, found a positive relationship between Tobin's Q and board ownership ranging from 0% to 5%, a negative relation for board ownership ranging from 5% to 25%, and again a positive relation for the said ownership above 25%. The interpretation of such a non-monotonic relationship is--firms having a lesser level of ownership concentration can be taken over easily and therefore managers of such companies take action to increase the shareholders' value as anti-takeover strategy, because takeover may cause loss of jobs for them. At moderate degree of concentration of holding, managers are less worried about takeovers, as they think that takeover attempts won’t get succeed, but at an increased level again, incentive effect of better performance contributes to positive relation.

(Al Mutari, 2011) analyzed 80 firms listed on Kuwait Stock Exchange in a 9 year time period from 2000-2008. The results from his study revealed that the “type” of shareholders influences on firms' value, while public and individual ownership have a negative and significant impact on the firms' value. (Demsetz & Villalonga, 2001) examined the relation between the ownership structure and the performance (average Tobin's Q for five years 1976-80) of the firms. By using Ordinary Least Squares (OLS) and Two-stage Least Squares (2 SLS) regression model, no significant systematic relation between ownership structure and firm performance was found. According to their results, "The market driving forces plays a role in creating suitable ownership structures for firms, and which eliminates any predictable relationship between empirically determined ownership structures and firm rates of return. Welch (2003), by applying the model of (Demsetz & Villalonga, 2001), analysed the relationship between ownership structure and firm performance of Australian listed companies. Her OLS results claim that ownership of shares by the top management is significant in describing the performance assessed by accounting rate of return, however, not significant if performance is assessed by Tobin's Q.

This article seeks to study whether the ownership and control structure influences corporate market value.

Hypothesis

H01: There is no impact of ownership structure on market capitalisation.

H1: There exists significant impact of ownership structure on market capitalisation.

H02: There is no impact of ownership structure on price to book value.

H2: There exists significant impact of ownership structure on price to book value.

Data Collection, Research Methodology And Variables Used In The Study

The study uses the BSE 100 Index companies provided by the Bombay Stock Exchange as the sample. The list consists of 100 companies. All the data used is secondary in nature. We collect and derive market valuation aspects i.e., market capitalisation and PB value ratio and ownership structure measures such as promoters, non-promoters, non-promoters institutional and non-promoter non institutional shareholding data from ‘Prowess’ data base of the Centre for Monitoring Indian Economy (CMIE) for the period of 15 years starting from 2000-2014

Methodology

In the research study the secondary data of different variables related to ownership structure and firm market valuation in the BSE 100-Index is used. The data is collected from the different source as mentioned in above section.

The descriptive analysis of the variables is done and represented. In descriptive analysis of the variables, the measure of central tendency mean and distribution are estimated.

Data used in this study is panel data. Panel data is data that involves measurements of many individual units over a period of time, i.e., the same cross-sectional unit is surveyed over time. In short, panel data has the space and time dimensions. In the study the time series data of different variables related to ownership structure, firm’s market valuation of the companies in the Index BSE-100 is used. Hence the nature of the data is panel. Panel data regression model is used to get the effect of ownership structure on firm’s market valuation.

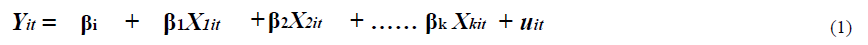

In order to analyse the panel data, the fixed and random effect model is applied in the study. The panel data regression model can be represented as:

The subscript i indicate the cross-sections considered in the study and t represents the time series behaviour of the variables. The choice of fixed effect model and random effect model depends on the results of f test as well as Hausman test.

Variables Used in the Study

Firm Performance (Market Valuation)

Market value depends upon the valuations or multiples accorded by shareholders to companies, such as price-to-sales, price-to-earnings, enterprise value, market capitalization and so on and so forth. The higher the valuation, the greater is the market value. Market value can fluctuate over periods of time and is significantly affected by the business cycle. A perennial query that affected the earlier research studies regarding ownership and performance is really in respect to the selection of way of measuring performance. Should it be accounting rate of return or EPS or market-based return or others? (Demsetz and Lehn 1985) applied accounting rate of return, while (Demsetz and Villalonga 2001) used Tobin’s Q as proxy for the market-based performance. Previously researchers assessed firm performance sometimes by accounting rate of return or Tobin’s Q. A number of studies applied both equally. Both measures possess shortcomings. In this study market capitalisation and PB value are used to measure the market valuation of the firms.

Ownership Structure

(Demsetz 1983) and (Demsetz and Lehn 1985), and the like have noted that endogeneity of ownership structure must be accounted for whenever analyzing the impact ownership structure has on firm profitability. The work by (Demsetz and Villalonga 2001) is inspired by the necessity to re-examine the relationship between ownership structure and firm performance considering not just the endogenity issue but in addition various other dimensions of ownership structures. Particularly these people suggest the portion of shares possessed by outside shareholders as well as by management needs to be assessed individually since they reflect various categories of individuals who may have different interests. But we have taken ownership structure as an independent variable because no endogenity was found in Indian scenario by (Dwivedi & Jain 2005). We model ownership structure, first, as an exogenous variable and, second, we examine different measures of ownership structure: (a) promoters holding, (b) non-promoters holding, subdivided into: (c) non-promoters institutional holding, and (d) non-promoters non institutional holding.

Empirical Results

Market Capitalization

In the study a frequency distribution of the companies is done on the basis of market capitalization. The frequency distribution is shown below in The results indicate that 22 percent of firms in BSE 100 Index are having average market capitalization more than Rs.15000 cr., 12 percent of the firms are having average market capitalization in the range of Rs.10000-15000 cr., 17 percent of the firms are found to have average market capitalization of Rs.5000-10000 cr., 41 percent of firms are found to have average market capitalization in the range of Rs.1000-5000 cr. and 8 percent of the firms are having the market capitalization less than Rs.1000 cr.

Panel Data Model Selection

The data collected in the research study is panel data because the data of selected variables are collected for 100 firms in BSE 100 Index for the period of 2000-2014. Hence the panel regression model is applied to analyse the impact of ownership structure on the firms on the market valuation. In panel data regression model two popular tests are available, fixed effect model and random effect model. The fixed effect model assumes that the firms are heterogeneous in nature. However the random effect model is applied to get generalized results assuming that firms in the sample are randomly selected. Statistically f-test and Hausman test is used to identify the most suitable panel regression model to be applied in the study. The results of f-test and Hausman test are shown below Table 5.

The results of F-test indicate that the probability value of f-statistic is less than 5% level of significance. Hence with 95% of confidence level it can be concluded that the fixed effect model is significantly better than pooled regression model. However, the Hausman test indicates that the probability value is not less than 5% level of significance in any variable used in study i.e., promoters holding, non-promoters holding, non-promoters institutional and non-promoters non institutional. Hence the null hypothesis that the effects are random cannot be accepted in any variable in study and it can be further concluded that random effect model is suitable to apply for analysis.

Panel Data Regression Model

In order to analyse the impact of ownership in the selected companies on market capitalization of the firms, the random effect model is applied. In the analysis the market capitalization is considered as dependent variable however the different types of ownership structures are considered as independent variables. The random effect model is applied with market capitalization as dependent variable and ownership structures in the firms as independent variable. The result of the panel regression model is shown below in table 6.

The results indicate that the probability value of t-statistic in case of non-promoters holding and non-promoters non-institutional holding is found to be significant. Hence it can be concluded that the non-promoters holding (in case taken as separate variable) and non-promoters non institutional holding have a significant impact on market capitalization of the firm. In case of promoters holding and non-promoters institutional holding no effect is found on market capitalization of the firm.

PB Ratio

In the study a frequency distribution of the companies is done on the basis of price to book value. The frequency distribution is shown below in table 1.

| Table 1: Frequency distribution of firm’s w.r.t averageMarket capitalization for the period 2000-2014 | ||

| Average Market capitalization | Frequency | Percentage |

|---|---|---|

| less than 1000 cr. | 8 | 8.00% |

| 1000-5000 cr. | 41 | 41.00% |

| 5000-10000 cr. | 17 | 17.00% |

| 10000-15000 cr. | 12 | 12.00% |

| more than 15000 cr. | 22 | 22.00% |

| Total | 100 | 100.00% |

The results indicate that 3percent of firms in BSE 100 Index are having average Price to Book value more than (20 times), 3percent of the firms are having average Price to Book value in the range of (15-20 times), 15percent of the firms are found to have average Price to Book value of (10-15 times), 38percent of firms are found to have average Price to Book value in the range of (5-10 times) and 41 percent of the firms are having the Price to Book value less than (5 times).

Panel Data Model Selection

Statistically f-test and Hausman test is used to identify the most suitable panel regression model to be applied in the study. The results of f-test and Hausman test are shown below Table 2.

| Table 2:F-test and hausman test for model selection w.r.t market Capitalisation | ||||

| Dependent Variable | Independent variable | f test(p value) | Hausman test(p value) | Panel data regression model to be applied |

|---|---|---|---|---|

| Market Capitalisation | Promoters holding | 26.56(.000) | 1.02(.310) | Random Effect Model |

| Non promoters holding | 26.00(.000) | 3.55(.059) | Random Effect Model | |

| Non promotersInstitutional | 25.22(.000) | .229(.631) | Random Effect Model | |

| Non promoters noninstitutional | 25.45(.000) | .00011(.991) | Random Effect Model | |

The results of F-test indicate that the probability value of f-statistic is less than 5% level of significance. Hence with 95% of confidence level it can be concluded that the fixed effect model is significantly better than pooled regression model. However, the Hausman test indicates that the probability value is less than 5% level of significance in case of non-promoters institutional holding and in case of promoters holding, non-promoters holding and non-promoters non institutional the probability value is not less than 5% level of significance. Hence the null hypothesis that the effects are random can be accepted in case non promoters institutional holding, hence it can be concluded that fixed effect model is suitable to apply for analysis.

Further in case of promoters holding, non-promoters holding and non-promoters non institutional holding, random effect model is suitable to apply for analysis.

Panel Data Regression Model

To analyse the impact of ownership in the selected companies on PB ratio of the firms, the fixed effect model and random effect model is applied. In the analysis the PB ratio is considered as dependent variable however the different types of ownership structures are considered as independent variables. The fixed effect model is applied with PB ratio as dependent variable and non-promoters holding as ownership structure in the firms as independent variable. However, random effect model is applied in case of promoters holding, non-promoter institutional holding and non-promoters non institutional holding. The result of the panel regression model is shown below in table 3 .

| Table 3: Panel data analysis showing impact of ownership structure on Market capitalization |

||||||

| Panel regression model | Independent variable |

Regression coefficients | T statistics |

F statistics | R square |

|

|---|---|---|---|---|---|---|

| (p value) | (p value) | |||||

| Random Effect Model | Promoters Holding | Intercept Alpha |

17973.28 | 3.759 (.0002) |

.6280 (0.4282) |

.047% |

| Beta | -63.93 | -.792 (0.428) |

||||

| Random Effect Model | Non Promoters Holding |

Alpha | 333435 | 7.138 (0.000) |

24.426 (0.0000) |

1.72% |

| Beta | -343.71 | -4.946 (.0000) |

||||

| Random Effect Model | Non Promoters Institutional Holding |

Alpha | 14364.63 | 4.171 (0.000) |

.2357 (.6273) |

.0169% |

| Beta | 32.708 | .4853 (0.6275) |

||||

| Random Effect Model | Non Promoters Non Institutional Holding |

Alpha | 29969.10 | 9.086 (0.000) |

76.63 (0.000) |

5.2% |

| Beta | -583.72 | -8.749 (0.000) |

||||

| Table 4: Frequency distribution of firms’ w.r.t average Price to Book value for the period 2000-2014 | ||

| Average PB ratio | Frequency | Percentage |

|---|---|---|

| less than 5 times | 41 | 41.00% |

| 5 - 10 times | 38 | 38.00% |

| 10 - 15 times | 15 | 15.00% |

| 15 - 20 times | 3 | 3.00% |

| more than 20 times | 3 | 3.00% |

| Total | 100 | 100.00% |

| Table 5 : F-test and hausman test for model selection w. R t. Pb ratio | ||||

| DependentVariable | Independentvariable | f test(p value) | Hausmantest(p value) | Panel data regression model tobe applied |

|---|---|---|---|---|

| PB ratio | Promoters holding | 32.19(.000) | .417(.517) | Random EffectModel |

| Non promotersholding | 11.83(.000) | .3896(.532) | Random EffectModel | |

| Non promotersInstitutional holding | 12.24 (.000) |

6.22 (.0126) |

Fixed EffectModel | |

| Non promoters noninstitutionalholding | 11.98 (.000) |

.337 (.561) |

Random EffectModel | |

The results indicate that the probability value of t-statistic in case of non-promoters institutional holding and non-promoters non-institutional holding is found to be significant. Hence it can be concluded that the non-promoters institutional holding and non-promoters non institutional holding have a significant impact on PB ratio of the firm. In case of promoters holding and non-promoters holding (in case taken as separate variable) no effect is found on PB ratio of the firm.

| Table 6: Panel data analysis showing impact of ownership structure on pb Ratio | ||||||

| Panel regression model |

Independent variable |

Regression coefficients | T statistics |

F statistics |

R square |

|

|---|---|---|---|---|---|---|

| (p value) | (p value) | |||||

| Random Effect Model |

Promoters Holding |

Intercept Alpha |

3.108 | 4.694 (.0000) |

2.877 (0.090) |

.214% |

| Beta | .0183 | 1.694 (0.0903) |

||||

| Random Effect Model |

Non Promoters Holding |

Alpha | 4.545 | 5.247 (0.000) |

.4459 (0.5043) |

.032% |

| Beta | -.0094 | -.667 (.504) |

||||

| Fixed Effect Model |

Non Promoters Institutional Holding |

Alpha | 2.313 | 5.282 (0.000) |

12.124 (.000) |

4.837% |

| Beta | .0630 | 4.140 (0.000) |

||||

| Random Effect Model |

Non Promoters Non Institutional Holding |

Alpha | 5.759 | 10.152 (0.000) |

22.217 (0.000) |

1.56% |

| Beta | -.067 | -4.711 (0.000) |

||||

Conclusion

Market value doesn’t remain same all the time for any firm, it keeps on changing as per the performance and other governance aspects. In this study, it is observed that different measures of ownership as well as firm performance have different effects on each other.

The study concludes that in the case of non-promoters holding and non-promoters non institutional holding, there exists a significant impact on market capitalization of firms. In case of promoters holding and non-promoters institutional holding no effect is found on market capitalization of firms. Furthermore, it is found that the non-promoters institutional holding and non-promoters non institutional holding have a significant impact on PB ratio of the firm. In case of promoters holding and non-promoters holding no effect is found on PB ratio of the firm. Non-promoters non-institutional holding i.e., retail holding is also having significant effect on market valuation of firms; the reason could be the sensitivity of stock markets to various economic factors at global level. The other way of looking at our results is that investors in India can influence market. Also, there is no strong evidence that there is a relationship between both the institutional ownership and firm performance except when performance is measured by PB Value for the Indian BSE 100-Index firms, due to the insignificancy for t-test, and therefore this is consistent with (Sanchez & Garcia, 2007), and Lee (2008) studies. This conclusion can be due to many reasons such as; the institutional ownership is considered double-edged sword; it has its own advantages and disadvantages. Therefore, their existence and influence could affect practically the types and risk level of investment decisions taken by the management which in return will affect the firm’s performance as a whole. Retail investors also have significant effect on market value. The reason possibly could be that retail investors mostly follow the footsteps of institutional investors.

The literature on international corporate governance tells us much about ownership structure but the message in the information is far from clear or complete. Much more work remains to be done. Suggestions for further research include the development and estimation of a generalized non-linear model specification and a proper study on impact of ownership structure on dividend policy, operating efficiency can be done.

References

- Azofra, V., & Santamaria, M. (2011). Ownership, control, and pyramids in Spanish commercial banks. Journal of

- Borsch-Supan, A., & Koke, J. (2002). An applied econometricians’ view of empirical corporate governance studies.

- Claessens, S., Djankov, S., & Lang, L. H. P. (2000). The separation of ownership and control in East Asian

- Claessens, S., Djankov, S., Fan, J. P. H., & Lang, L. H. P. (2002). Disentangling the incentive and entrenchment effects of large shareholdings. The Journal of Finance, 57 (6), 2741-2771.

- Demsetz, H. & Lehn, K. (1985). The Structure of Corporate Ownership: Causes and Consequences. Journal ofPolitical Economy, 93(6), 1155-1177.

- Demsetz, H. & Villalonga, B. (2001). Ownership Structure and Corporate Performance. Journal of Corporate Finance, 7(3), 209-233.

- Drakos, A. A., & Bekiris, F. V. (2010). Corporate performance, managerial ownership and endogeneity: a simultaneous equations analysis for the Athens stock exchange. Research in International Business and Finance, 24 (1), 24-38.

- Dwivedi, N. and Jain, A. K. (2005). Corporate Governance and Performance of Indian Firms: The Effect of Board Size and Ownership. Employee Responsibilities and Rights Journal, 17, (3). DOI: 10.1007/s10672-005-6939-5

- Garcia-Meca, E., & Sanchez-Ballesta, J. P. (2011). Firm value and ownership structure in Spanish capital market.Corporate Governance, 11 (1), 41-53.

- Gugler, K., Mueller, D. C., & Yurtoglu, B. B. (2008). Insider ownership, ownership concentration and investment performance: an international comparison. Journal of Corporate Finance, 14 (5), 688-705.

- Himmelberg, C. P., Hubbard, R. G., & Palia, D. (1999). Understanding the determinants of managerial ownership and link between ownership and firm performance. Journal of Financial Economics, 53 (3), 353-384.

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3 (4), 305-360.

- La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (1999). Corporate ownership around the world. The Journal of Finance, 54 (2), 471-517.

- Lins, K. V. (2003). Equity ownership and firm value in emerging market. Journal of Financial and Quantitative Analysis, 38 (1), 159-184.

- Srivastava, A. (2011). Ownership Structure and Corporate Performance: Evidence from India.International Journal of Humanities and Social Science, l (1).

- Stulz, R. M. (1988). Managerial control of voting rights: financing policies and market of corporate control. Journal of Financial Economics, 20 (1), 25-54.