Research Article: 2017 Vol: 23 Issue: 2

The Effect of SME CEO'S Entrepreneurial Experience on Corporate Performance

Jae Whan Park, Chung-Ang University

Jae Hong Kim, Chung-Ang University

Keywords

Entrepreneurial Learning, Entrepreneurial Failure Rate, Financial Credit Rating.

Introduction

Entrepreneurs cannot possibly succeed in every business venture they begin so enduring certain level of entrepreneurial failure is inevitable. What is important is creating successful corporate performance in the future through persistent challenge and innovation using experience of failure as groundwork. Therefore, certain level of experience in entrepreneurial failure should deserve positive evaluation in corporate performance aspects and entrepreneurs with past failure should be given a chance of re-challenge (Yang & Park, 2011).

Nonetheless, whereas there are many study results showing entrepreneurs’ attribute including entrepreneurial experience contributes toward corporate performance but also there are many studies with different outcomes depending on the study subject (e.g. respondent’s population statistical background and distribution, entrepreneur type, countries, etc.) so more segmentalized study is needed on the effect of entrepreneurial experience on corporate performance.

This study predicts that certain level of experience in entrepreneurial failure will positively contribute to corporate performance based on human capital theory (Schultz, 1961a, 1961b; Becker, 1962, 1964; Starr & Bygrave, 1991) and entrepreneurial learning theory (Kolb, 1984; Cardon & McGrath, 1999; Zacharakis et al., 1999; Cope, 2005; Politis & Gabrielsson, 2009) viewpoint.

The researchers of this study expect to prepare a more detailed evaluation standard for when policy makers and implementers, finance and guarantee organization’s reviewers are evaluating an entrepreneur, by empirically analysing the effect on corporate performance depending upon entrepreneurs’ entrepreneurial experience attribute.

Therefore, the objective of this study is to promote entrepreneurship by verify that, amongst entrepreneurial success or failure experience, certain level of experience of failure (i.e., entrepreneurial failure rate which is the relative weight of experience of failure in comparison to the total experience of entrepreneurial success or failure) accumulate as human capital through entrepreneurial learning contributes toward corporate performance and to suggest attention point about entrepreneur evaluation when supporting establishment of small and medium-sized enterprises (SMEs) or deciding on their investment or loan.

As a study method, along with investigative research using a questionnaire, the credit rating which is the 3rd party’s objective performance evaluation result is used as a result variable. The questionnaire used in this study is composed of questions with respect to entrepreneur’s human capital, entrepreneurial experience and corporate performance and the study subjects were SMEs of which, the corporate credit rating agency, NICE D&B has given a credit rating.

Through contemplation of various previous studies and literature, questionnaire questions were selected to measure independent and result variables and based on entrepreneur’s human capital, to study what effects the entrepreneurial experience have on the corporate performance. As the subject of this empirical study, besides subjective performance review results by the questionnaire respondents, the credit rating of NICE D&B which can be regarded as an objective financial performance indicator was utilized.

Consequently, this study aims to suggest an attentive result on how the effect on corporate performance (i.e., financial performance, non-financial performance, opportunity pursuit, credit rating, etc.) is different depending on the entrepreneur’s entrepreneurial failure rate by statistical analysis of questionnaire investigation and subjective materials.

Research Model and Hypotheses

Research Model

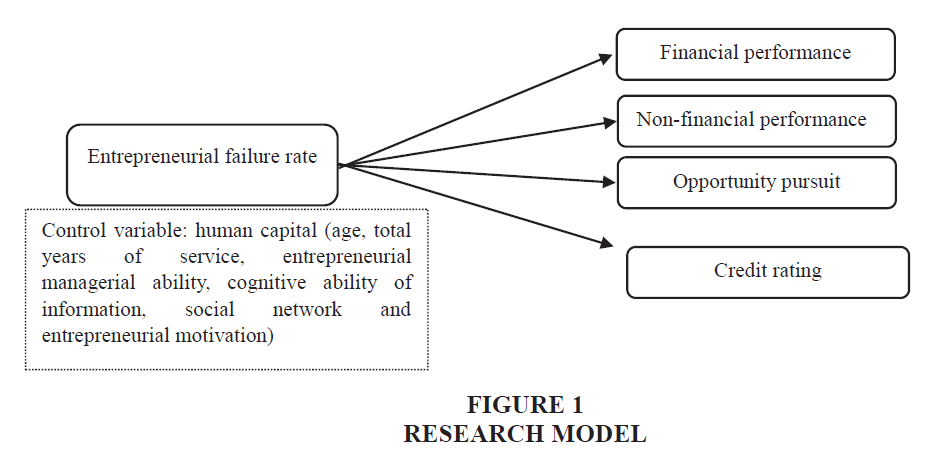

This study predicts that although experience of failure will have a positive effect on the corporate performance by becoming an asset factor of human capital due to entrepreneurial learning, if experience of failure exceeds certain level, it will act as a liability factor of human capital so to lower the corporate performance. That is to verify, using Korea’s domestic small and medium-sized enterprises’ CEOs as subjects, that, as the entrepreneurial failure rate increases the corporate performance will show a positive (+) relationship but where experience of failing exceeds certain level, it will then reverse, showing a negative(-) relationship so, ultimately, entrepreneurial failure rate and corporate performance will show reverse U shape relationship. In order to achieve this study objective, based on concept and theoretical basis acquired through precedent studies, the research model is selected.

The research model of this study has emphasis on the study of relationship between entrepreneurial failure rate and corporate performance in order to find significant implication when policymakers or loan decision makers are making decisions for a policy support or a loan (Figure 1).

Hypotheses

Based on various theories and empirical studies with respect to relationship between entrepreneurial failure experience and corporate performance, the hypotheses that the entrepreneurial failure rate (i.e., the relative weight of experience of failure in comparison to the total experience of entrepreneurial success or failure) will show the following relationship with corporate performance (i.e., financial performance, non-financial performance) were selected.

H1 Entrepreneurial failure rate will show reverse U shape relationship with financial performance.

H2 Entrepreneurial failure rate will show reverse U shape relationship with non-financial performance.

Opportunity is a concept with extended meaning. It is a concept that can satisfy the market needs or understanding through a creative combination of resources for value creation (Schumpeter, 1934). Furthermore, opportunity, depending on opportunity recognition process such as observation, pursuit, creation and as opportunity evaluation being repeated and circulated, its measurement is not simple (Ardichvili et al., 2003). Even establishing a subsequent start-up by evaluating discovered opportunities is seen as utilizing an opportunity (Ucbasaran, 2004), etc., scope of opportunity is also wide.

Therefore, although discovering opportunity is a starting point of subsequent opportunity pursuit activities, it cannot be regarded as being extended to actual utilization of opportunity so, in this study, by extending and measuring an opportunity pursuit activity to discovery, promotion and utilization of opportunity, it tries to verify the relationship between entrepreneurial failure rate and opportunity pursuit.

H3 Entrepreneurial failure rate will show reverse U shape relationship with opportunity pursuit.

Although opportunity pursuit can be a subjective supplementary indicator of corporate performance, opportunity pursuit activity is not a necessary or sufficient condition of entrepreneurial action (Day, 1987; Shane & Venkataraman, 2000). So, it would be prudent to use objective and subjective indicators together in order to promote accuracy of performance measure.

In this study, credit rating, as objective indicator of financial performance, is to be included and analyzed. Edergirington & Goh (1998) presented by empirical study result that credit rating which is a risk indicator of financial situation has a negative relationship with financial situation.

Accordingly, in this study, as a general measure of corporate performance, besides financial and non-financial performances, as an objective indicator of opportunity pursuit activity and financial performance which is an intermediate stage of final corporate performance, credit rating was included as a measuring variable of corporate performance.

H4 Entrepreneurial failure rate will show reverse U shape relationship with credit rating.

Research Method

Operational Definition and Measurement of Variables

SEMs CEOs

In this study, in accordance with Rules in the Framework Act on Small and Medium Enterprises, as Table 1, based on manufacturing sector, the researchers included small and medium sized enterprises with no more than 300 regular workers or with capital of less than 8 billion won within the meaning of SEMs, but also applied the corporation classification standard of a corporate credit rating agency, NICE D&B that reflects the information such as the number of regular workers, the capital or sales scale which are different by industry, as well as application suspension of SMEs classification. The CEOs refers to the chief executive officers who have been owning and managing the pertinent SMEs which they have established, inherited or purchased.

| Table 1 : Smes Ceos Metrics | ||

| Division | Category | Contents |

|---|---|---|

| Operational Definition | SMEs | 300 regular workers or with capital of less than 8 billion won (applied the corporation classification standard of NICE D&B that reflects differential standard per its size and industry and classification suspended corporations) |

| CEOs | Who are owning and managing the pertinent SMEs which they have established, inherited or purchased. | |

Entrepreneurial Failure Rate

Entrepreneurial experience can be defined diversely such as experience of success, experience of failure, entrepreneurial success or failure experience, entrepreneurial failure rate, years of entrepreneurial management, etc. Commonly, entrepreneurial experience refers to the number of owned and managed enterprises or years of entrepreneurial management, but in this study, with respect to SME CEOs’ entrepreneurial experience characteristics, for policymakers or loan reviewers to use it as base material for evaluation about the entrepreneur, as of entrepreneurial experience, the researchers will conduct the study by applying entrepreneurial failure rate as illustrated in Table 2.

| Table 2 : Entrepreneurial Failure Rate Metrics | ||

| Division | Category | Contents |

|---|---|---|

| Operational Definitions | Entrepreneurial Success Experience | Entrepreneurship (including inheritance and purchase), among managerial experience of SMEs, the experience of which CEOs evaluate as successful experience). |

| Entrepreneurial Failure Experience | Entrepreneurship (including inheritance and purchase), among the total managerial experience of SMEs, due to unsatisfactory expectation or liquidity problems, etc., the experience of which CESs evaluate as failure experience. | |

| Entrepreneurial Failure Rate | The relative weight of experience of failure in comparison to the total experience of entrepreneurial success or failure. | |

| Metrics | Entrepreneurial Success Experience | No. of enterprises of which CEO evaluate as being successful. |

| Entrepreneurial Failure Experience | No. of enterprises of which CEO evaluate as being a failure. | |

| Entrepreneurial Failure Rate | No. of entrepreneurial failure experience/(No. of Entrepreneurial success experience+No. of entrepreneurial failure experience) | |

Financial and Non-Financial Performance

Corporate performance can be largely distinguished between financial and non-financial performance (Stuart & Abetti, 1987) and depending on a performance evaluation method, can be distinguished between objective performance and subjective performance (Choi et al., 2003).

| Table 3: Finacial Performance Metrics | ||

| Division | Category | Contents |

|---|---|---|

| Operational Definitions | Financial performance | As compared to its competitors, sales and sales growth rate, cash flow, net profit margin, operating profits, etc., satisfaction level about the overall corporation’s financial performance. |

| Metrics | Evaluation Items | In recent 3 years, as compared to its competitors, 1) sales level 2) sales growth rate 3) cash flow 4) Return on capital 5) operating profit level 6) net profit level. |

| Calculation Method | Assessing importance by measurement item (max 5 point, measure, 1→5) | |

In this study, financial performance as illustrated in Table 3, in profitability, productivity, market share, sale growth rate and return on investment aspects (Cho, 1995; Covin & Slevin 1990; Chandler & Hanks, 1993; Birley & Westhead, 1994), non-financial performance, as illustrated in Table 4, in market/product, resource type aspect, survival rate, ability to procure external resources, employee satisfaction and social contribution viewpoint (Gupta, 1984; Timmons et al., 1987), is to be analysed.

| Table 4 : Non-Finacial Performance Metrics |

||

| Division | Category | Contents |

|---|---|---|

| Operational Definitions | Non-Financial performance | As compared to its competitors, with respect to viability or sustainability, competitiveness, social recognition, etc., the overall satisfaction level. |

| Metrics | Evaluation Items | In recent 3 years, as compared to its competitors, 1) company viability 2) reputation and status (market share, brand value) 3) employment stability 4) employee satisfaction 5) social respect 6) Improvement in wealth and standard of living. |

| Calculation Method | Assessing importance by measurement item (max 5 point, measure, 1→5) Total | |

In this study, for both financial and non-financial performance, major metrics is to be measured by self-evaluation as compared to its competitors. According to the study conducted by Tsai et al. (1991), comparative corporate performance evaluation method against its major competitors may provide an aid to the measurement of a performance index measured by satisfaction level of the entrepreneur’s performance or to the evaluation of performance which is in the dimension that cannot be easily accessed by financial rate.

Opportunity Pursuit

| Table 5 : Opportunity Pursuit Metrics | ||

| Division | Category | Contents |

|---|---|---|

| Operational Definitions | Opportunity Pursuit | Through recognition, discovery and evaluation of opportunity, a visible entrepreneurial act in the form of an addition of a new business or discovering entrepreneurial opportunity or their progress or completion which is necessary for corporate growth. |

| Metrics | - | In recent 5 years, the total no. of addition of a new business or discovering start-up opportunity (including M&A) or their carrying forward (actual planning or attempt) or completion. |

In this study, as illustrated in Table 5, even performance in opportunity discovery, opportunity promotion, opportunity utilization will be measured as opportunity pursuit activity. Entrepreneur’s past entrepreneurial experience will have a positive effect on corporate performance as it will give a positive impact on subsequent opportunity discovery by affecting the cognitive process necessary for creativity. Nonetheless, when the entrepreneur experienced a failure, to maintain pride, he will focus on less challenging objective and risk taking, less innovative business opportunity to avoid subsequent failure and amongst entrepreneurial experiences, if failure rate is too high, he will look for less innovative opportunities or the opportunity discovery level itself will be lowered (Ucbasaran et al., 2009).

In this study, as the outcome of an entrepreneurial act, the researchers find out how much SMEs CEOs conducted the major managerial acts (opportunity discovery, opportunity promotion, opportunity utilization) such as addition of a new business or founding a new venture and take them into consideration as a variable of corporate performance.

Credit Rating

In this study, the researchers used a credit rating agency’s financial credit rating in hypothesis verification. Although financial ratio centred rating system and limited company outline information (history, business type, business, management credit rating, etc.) were reflected, the financial credit rating applying financial ratio centred evaluation system is believed to be more closely associated with financial performance. Financial credit rating, different to ordinary credit rating, is strongly reflecting the management’s credit rating in practice and therefore, it is predicted to have a closer relationship with the SMEs management’s financial performance satisfaction. Financial credit rating, by annual default rate, verifies that rating’s systemic stability, it seems that superiority between financial credit ratings of which NICE D&B suggested generally well maintained. In this study, as illustrated in Table 6, it is intended to use financial credit rating as objective measure of financial performance.

| Table 6 : Financial Credit Rating Metrics | ||

| Division | Category | Contents |

|---|---|---|

| Operational Definitions | Financial Credit rating | Using corporate financial statement as standard, after scoring company’s possibility of repayment of the principal and degree of trading ability, in accordance with predefined grading, mark superiority as specific symbols. |

| Metrics | Evaluation Items | After collecting the pre-determined weighted scores for the company's major financial ratios, evaluating by reflecting company’s basic information (history, industry, type and credit information of representatives). In this study, NICE D&B’s financial credit rating, of which its differentiation and stability are approved, is used. |

| Calculation Method | From AAA to C, 21 levels in total, superiority is marked in rating symbols. D corresponds to a defaulting company. (AAA, AA+, AA0, AA-, A+, AO, A-, BBB+, BBBO, BBB-, BB+, BB0, BB-, B+, B0, B-, CCC+, CCC0, CCC-, CC, C) |

|

Human Capital

Human capital is comprised of various aspects such as entrepreneur’s learned attribute, family background characteristics, attitude and motivation, education, gender and ethnic origin, industry knowhow, skill level and ability, age and recognition (Alvarez & Busenitz, 2001).

| Table 7: Age Metrics | ||

| Division | Contents | |

|---|---|---|

| Age | Operational definition | Demographic factors that contribute to risk taking, knowledge accumulation, experience (Cho, 1995; Choi et al., 2003; Bates, 1985; Sandberg & Hofer, 1987; Birley & Noburn, 1987). |

| Metrics | Calculated based on the date of birth. | |

| Table 8: Total Years Of Service Metrics | ||

| Division | Contents | |

|---|---|---|

| Total Years of Service | Operational Definition | Through Knowledge and skill, network accumulation, experience factors that can contribute to corporate performance (Cho, 1995; Park, 2005; Roure & Maidique, 1986; Sandberg & Hofer, 1987; Stuart & Abetti, 1990; Chandler & Hanks, 1993; Gimeno et al., 1997). |

| Metrics | The total years of service in which the CEO has worked until managing this enterprise. | |

| Table 9: Entrepreneurial Managerial Ability Metrics | ||

| Division | Contents | |

|---|---|---|

| Entrepreneurial Managerial Ability | Operational Definition | Competency of an entrepreneur, making management strategy by seeking opportunity and eventually contribute to corporate performance, such as communication, decision, business management, human relationship, management/production/marketing/skill/financial ability (Thompson & Stickland, 1989; Baum 1994; Hornsby et al., 1993; Mintzberg, 1998). |

| Metrics | Likert 7 scale, 1) identification of market needs for goods or services 2) managing organization and motivating organization members 3) resource utilization and coordination 4) technical or functional expertise 5) financial and planning ability 6) respect and trust from employees. | |

In this study, age (Table 7), total years of service (Table 8), entrepreneurial managerial ability (Table 9), cognitive ability of information (Table 10), social network (Table 11) and entrepreneurial motivation (Table 12) were used as control variables.

| Table 10: Congnitive Ability Of Information Metrics | ||

| Division | Contents | |

|---|---|---|

| Cognitive Ability of Information | Operational Definition | Sensitivity to changes in markets and technologies that can contribute to recognition or discovery of opportunity and related information processing capabilities (Alvarez & Busenitz, 2001). |

| Metrics | Likert 7 scale, 1) discovering opportunities through the process 2) starting from a conceptual idea 3) ability of opportunity to spread other opportunities 4) creating opportunity in problem solving process 5) opportunity making by combining unrelated factors. | |

| Table 11: Social Network Metrics | ||

| Division | Contents | |

|---|---|---|

| Social Network | Operational Definition | The factors that contributed to the opportunity pursuit and the creation of corporate performance by enabling the entrepreneurs to collect information, exchange and interview and to evaluate the resources by mobilizing from outside, capital, goods, capabilities and human resources that are lacking in entrepreneurs (Hills et al., 1997; Anderson & Jack, 2002; Morrison, 2002). |

| Metrics | Likert 7 scale, 1) support from friends and family 2) mentor 3) degree of exchange and gathering. | |

| Table 12: Entrepreneurial Motivation Metrics | ||

| Division | Contents | |

| Entrepreneurial Motivation | Operational Definition | A key factor that enables to recognize opportunities through individual taste and reward expectations (Sandberg & Hoffer, 1987; Birley & Westhead, 1994). |

| Metrics | Likert 7 scale, external motivations: 1) achievement and social recognition 2) high status 3) family recognition 4) local community development contribution 5) succession 6) means of tax reduction. Internal motivations: 1) do it in my way 2) autonomous time management 3) life learning 4) contributing to technological development 5) wealth creation. |

|

Method of Collecting and Analysing Materials

Material Collection

In this study, the researchers conducted a questionnaire survey to collect opinions about human capital and corporate performance using SME CEOs as subjects considering the purpose and scope of research and by the respondents to collect their personal evaluation opinions about financial and non-financial performance and opportunity pursuit activities.

As a complementary indicator of subjective performance satisfaction of which the previous studies (Timmons et al., 1987; Cooper & Artz, 1995; Ucbasaran et al., 2009; Kim et al., 2009) applied, the financial credit rating which was objectively evaluated by the credit rating agency was added to dependent variables.

For this, using 14,851 SMEs which NICE D&B has financial data and has given a financial credit rating as subjects; the online questionnaire survey was conducted. The main contents of the questionnaire are as illustrated in Table 13.

| Table 13: Composition Of Questionnaire | ||

| Variables | Explanation | Measurement Scale |

|---|---|---|

| General Human Capital | Total number of working enterprises | Numerical Entry |

| Total years of service | Numerical Entry | |

| CEO’s working years | Numerical Entry | |

| Working years in the same kind of industry | Numerical Entry | |

| Total no. of enterprises with ownership experiences. | Numerical Entry | |

| No. of successful enterprises, no. of failed enterprises | Numerical Entry | |

| Applicable industries (7 industries) | Nominal Scale | |

| Current enterprise’s year of establishment | Numerical Entry | |

| Start-up preparation period (no. of months) | Numerical Entry | |

| Current corporation type (5 types) | Nominal Scale | |

| No. of current employees | Numerical Entry | |

| Parent-owned business | Nominal Scale | |

| Entrepreneurial Managerial Ability | Strengths (needs identification, organizational management and motivation, resource utilization, financial management skills), technical expertise, respect and trust | Likert 7 Scale |

| Cognitive Ability of Information | Sensitivity (2 questions) Information processing ability (3 questions) |

Likert 7 Scale |

| Social Network | External support/recognition, mentor or sponsor retention, regular meetings/exchanges | Likert 7 Scale |

| Entrepreneurial Motivation | External Motivation (6 questions) Internal Motivation (5 questions) |

Likert 7 Scale |

| Opportunity Pursuit | Discovery, promotion and utilization of opportunity | Numerical Entry |

| Financial and Non-Financial Performance | Non-Financial Performance (6 questions) Financial Performance (6 questions) |

Likert 5 Scale |

| Demographic Matters | Marital Status, Age, Education, Major, Entrepreneur Type (Single or Multiple Company Management) | Nominal, Isometric Scale |

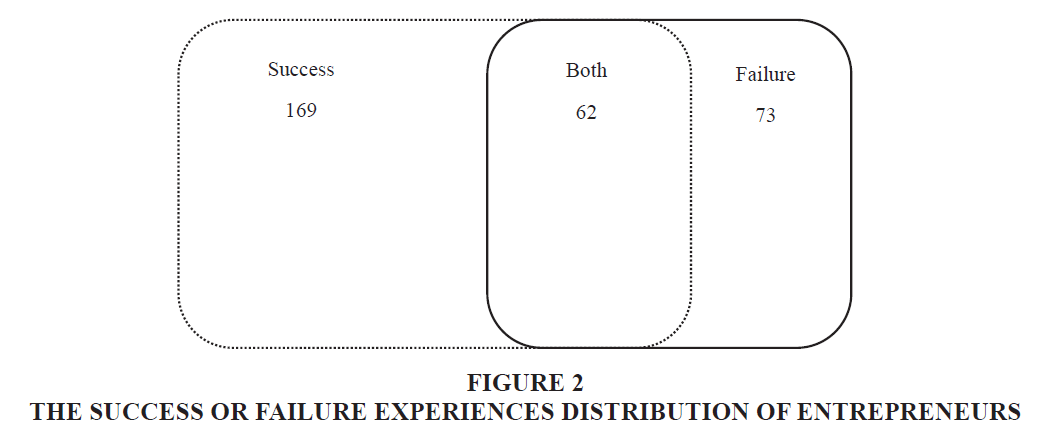

By May 28, 2012, a total of 198 questionnaires were received. Amongst these, excluding 18 questionnaires that either have insufficient answers or insufficient data due to computational errors, using 180 in total as final analysis subjects, multiple regression analysis was performed using SPSS 18.0. Of the 180 companies, 73 were found to have entrepreneurs with failed experiences and 62 were found to have entrepreneurs with both successful and failed experiences (Figure 2).

Representativeness of Data

After conducting homogeneity test between the questionnaire dispatching companies and the receiving companies, as shown in Table 14, there is no statistically significant difference at the significance level of 1% depending on the type of business, type of corporation, number of employees, region, the number of years of establishment and financial credit rating.

| Table 14: Distribution Comparison Of Survey | |||||||||||||||

| Division | Analysis | Survey | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Frequency | % | Frequency | % | ||||||||||||

| Sectors | Manufacturing | 70 | 0.39 | 3,868 | 0.26 | ||||||||||

| Construction | 43 | 0.24 | 4,406 | 0.30 | |||||||||||

| Service/Logistics | 39 | 0.22 | 5,074 | 0.34 | |||||||||||

| Wholesale and retail/Advertising | 9 | 0.05 | 1,224 | 0.08 | |||||||||||

| Primary Industry | 2 | 0.01 | 169 | 0.01 | |||||||||||

| Finance/Property/Leasing | 1 | 0.01 | 110 | 0.01 | |||||||||||

| Miscellaneous | 16 | 0.09 | 0 | 0.00 | |||||||||||

| Sub Total | 180 | 1.00 | 14,851 | 1.00 | |||||||||||

| Difference Test | chi-squared (χ2)=35.000, P-value=0.088 | ||||||||||||||

| Corporate Form | Private | 58 | 0.32 | 2,862 | 0.19 | ||||||||||

| Non-auditing | 77 | 0.43 | 11,120 | 0.75 | |||||||||||

| Auditing but unlisted | 35 | 0.19 | 805 | 0.05 | |||||||||||

| Listed | 4 | 0.02 | 64 | 0.00 | |||||||||||

| Others | 6 | 0.03 | 0 | 0.00 | |||||||||||

| Sub Total | 180 | 1.00 | 14,851 | 1.00 | |||||||||||

| Difference Test | chi-squared (χ2)=15.000, P-value=0.241 | ||||||||||||||

| Division | Analysis | Survey | |||||||||||||

| Frequency | % | Frequency | % | ||||||||||||

| Employees | ~10 | 76 | 0.42 | 6,183 | 0.42 | ||||||||||

| 10~20 | 51 | 0.28 | 4,292 | 0.29 | |||||||||||

| 20~30 | 17 | 0.09 | 1,636 | 0.11 | |||||||||||

| 30~40 | 10 | 0.06 | 764 | 0.05 | |||||||||||

| 40~100 | 19 | 0.11 | 1,267 | 0.09 | |||||||||||

| 100< | 7 | 0.04 | 709 | 0.05 | |||||||||||

| Sub Total | 180 | 1.00 | 14,851 | 1.00 | |||||||||||

| Difference Test | chi-squared (χ2)=30.000, P-value=0.224 | ||||||||||||||

| Region | Gangwon | 9 | 0.05 | 598 | 0.04 | ||||||||||

| Gyeonggi | 46 | 0.26 | 3,254 | 0.22 | |||||||||||

| Gyeongsangnam-do | 6 | 0.03 | 890 | 0.06 | |||||||||||

| Gyeongsangbuk-do | 6 | 0.03 | 727 | 0.05 | |||||||||||

| Gwangju | 0 | 0.00 | 319 | 0.02 | |||||||||||

| Dae-gu | 10 | 0.06 | 533 | 0.04 | |||||||||||

| Busan | 8 | 0.04 | 544 | 0.04 | |||||||||||

| Daejeon | 6 | 0.03 | 715 | 0.05 | |||||||||||

| Seoul | 46 | 0.26 | 3,561 | 0.24 | |||||||||||

| Ulsan | 3 | 0.02 | 211 | 0.01 | |||||||||||

| Incheon | 11 | 0.06 | 641 | 0.04 | |||||||||||

| Jeollanam-do | 8 | 0.04 | 723 | 0.05 | |||||||||||

| Jeollabuk-do | 4 | 0.02 | 592 | 0.04 | |||||||||||

| Jeju | 2 | 0.01 | 213 | 0.01 | |||||||||||

| Chungcheongnam-do | 9 | 0.05 | 718 | 0.05 | |||||||||||

| Chungcheongbuk-do | 6 | 0.03 | 612 | 0.04 | |||||||||||

| Sub Total | 180 | 1.00 | 14,851 | 1.00 | |||||||||||

| Difference Test | chi-squared (χ2)=50.000, P-value=0.185 | ||||||||||||||

| Division | Analysis | Survey | |||||||||||||

| Frequency | % | Frequency | % | ||||||||||||

| Years of Establishment | <2 year | 4 | 0.02 | 248 | 0.02 | ||||||||||

| 2~5 | 38 | 0.21 | 1,781 | 0.12 | |||||||||||

| 5~7 | 25 | 0.14 | 1,643 | 0.11 | |||||||||||

| 7~10 | 40 | 0.22 | 2,545 | 0.17 | |||||||||||

| 10~16 | 33 | 0.18 | 4,976 | 0.34 | |||||||||||

| 16~20 | 23 | 0.13 | 1,708 | 0.12 | |||||||||||

| 20< | 17 | 0.09 | 1,950 | 0.13 | |||||||||||

| Sub Total | 180 | 1.00 | 14,851 | 1.00 | |||||||||||

| Difference Test | chi-squared (χ2)=35.000, P-value=0.243 | ||||||||||||||

| Financial Credit Rating | C | 1 | 0.01 | 149 | 0.01 | ||||||||||

| CC | 1 | 0.01 | 122 | 0.01 | |||||||||||

| CCC | 2 | 0.01 | 448 | 0.03 | |||||||||||

| B | 120 | 0.67 | 8,951 | 0.60 | |||||||||||

| BB | 50 | 0.28 | 4,353 | 0.29 | |||||||||||

| BBB | 3 | 0.02 | 677 | 0.05 | |||||||||||

| A above | 3 | 0.02 | 151 | 0.01 | |||||||||||

| Sub Total | 180 | 1.00 | 14,851 | 1.00 | |||||||||||

| Difference Test | chi-squared (χ2)=17.111, P-value=0.145 | ||||||||||||||

Therefore, the 180 questionnaires used in this study can be considered representative of 14,851 randomly selected companies of which NICE D&B gave financial credit ratings.

Characteristics of Research Specimens

| Table 15: General Characteristics Of Research Specimens |

||||||||

| Variable | Category | Frequency | % | |||||

|---|---|---|---|---|---|---|---|---|

| Entrepreneur Type | Managing single company | 147 | 81.7 | |||||

| Managing multiple companies | 33 | 18.3 | ||||||

| Age | <30 | 0 | 0.0 | |||||

| 30~40 | 27 | 15.0 | ||||||

| 40~50 | 71 | 39.4 | ||||||

| 50~60 | 63 | 35.0 | ||||||

| 60< | 19 | 10.6 | ||||||

| Final Education | <High School | 12 | 6.7 | |||||

| Junior College | 37 | 20.6 | ||||||

| College | 79 | 43.9 | ||||||

| Post Graduate | 47 | 26.1 | ||||||

| Other | 5 | 2.8 | ||||||

| Major | Economics/Business Trade | 36 | 20.0 | |||||

| Law/Humanity and Social Science | 21 | 11.7 | ||||||

| Engineering | 73 | 40.6 | ||||||

| Science (Natural Science) | 7 | 3.9 | ||||||

| Professional Skill, etc. | 43 | 23.9 | ||||||

| Entrepreneurial Success | None | 11 | 6.1 | |||||

| 1 | 118 | 65.6 | ||||||

| 2 | 44 | 24.4 | ||||||

| 3 | 6 | 3.3 | ||||||

| 4 | 1 | .6 | ||||||

| Entrepreneurial Failure | None | 107 | 59.4 | |||||

| 1 | 56 | 31.1 | ||||||

| 2 | 9 | 5.0 | ||||||

| 3 | 6 | 3.3 | ||||||

| 4 | 1 | 0.6 | ||||||

| 5 | 1 | 0.6 | ||||||

| Variable | Category | Frequency | % | |||||

| Entrepreneurial Success or Failure | None | 0 | 0.0 | |||||

| 1 | 89 | 49.4 | ||||||

| 2 | 57 | 31.7 | ||||||

| 3 | 21 | 11.7 | ||||||

| 4 | 6 | 3.3 | ||||||

| 5 | 4 | 2.2 | ||||||

| 6 | 2 | 1.1 | ||||||

| 7 | 1 | 0.6 | ||||||

| Entrepreneurial Failure Rate | 0% | 107 | 59.4 | |||||

| 20% | 1 | 0.6 | ||||||

| 25% | 2 | 1.1 | ||||||

| 33% | 13 | 7.2 | ||||||

| 40% | 1 | 0.6 | ||||||

| 50% | 36 | 20.0 | ||||||

| 60% | 2 | 1.1 | ||||||

| 67% | 5 | 2.8 | ||||||

| 71% | 1 | 0.6 | ||||||

| 75% | 1 | 0.6 | ||||||

| 100% | 11 | 6.1 | ||||||

| Years of Establishment | Average | 9.34 years | ||||||

| Years after the First Establishment | Average | 10.47 years | ||||||

| Parental Ownership Experience | Yes | 30 | 16.7 | |||||

| No | 150 | 83.3 | ||||||

As shown in Table 15, the general characteristics of the 180 SMEs studied are single management 81.7% , average age 48.95, average number of previous employment 3.00, average years of service before the management 14.26, average years of management 8.32, average years of work in the same industry 13.27, average number of ownership 1.67, average number of entrepreneurial success 1.27, average number of entrepreneurial failure 0.56, average success or failure 1.83 and average entrepreneurial failure rate 22%.

Reliability and Validity Analysis

The variables used in this study were based on the questions used in literature review and practice and entrepreneurial management ability, entrepreneurial motivation, social network, financial and non-financial performance were measured using the Likert 5 - point scale or the 7- point scale. Cronbach's Alpha (α) coefficient was used to test the reliability of each variable. For general exploratory research, if 0.60 or more then accepted, if 0.80 or more applied to basic research fields and if 0.90 or more applied to the applied research that requires critical decision making (Nunnaly, 1978). The variables used in this paper shows around 0.8 so can be regarded to have high reliability.

Factor analysis was conducted to verify the validity of the variables. To verify the content validity, questions with loading value of above 0.6 with respect to the extracted factors were included in the factor analysis. Questionnaires whose share value is below 0.4 were excluded. As a factor extraction method, principal component analysis was used and through factor rotation of Varimax method, significant factors for the analysis were extracted.

As a variable of general corporate performance, a survey of financial and non-financial performance was conducted and, after factor analysis, as expected, two factors (i.e., financial and non-financial performance) were differentiated.

| Table 16: Non-Financial And Financial Performance Factor AnalysisIS | ||||

| Division | Financial Performance Factor Loading Value | Non-Financial Performance Factor Loading Value | Financial Performance Commonality | Non-Financial Performance Commonality |

|---|---|---|---|---|

| Net profit level | 0.868 | 0.226 | 0.804 | |

| Return on capital | 0.858 | 0.151 | 0.757 | |

| Operating profit level | 0.856 | 0.200 | 0.772 | |

| Sales growth rate | 0.804 | 0.249 | 0.708 | |

| Cash flow stability | 0.803 | 0.245 | 0.705 | |

| Sales level | 0.747 | 0.223 | 0.608 | |

| Employment stability | 0.104 | 0.837 | 0.712 | |

| Employee satisfaction | 0.127 | 0.831 | 0.707 | |

| Social respect | 0.202 | 0.792 | 0.667 | |

| Company viability | 0.391 | 0.648 | 0.572 | |

| Reputation and status | 0.383 | 0.634 | 0.548 | |

| Eigen Value | 5.798 | 1.766 | KMO=0.867 Bartlett p-value=0.000 |

|

| Distributed Explanation Ratio (%) | 52.7 | 16.1 | ||

| Cumulative Explanation Ratio (%) | 52.7 | 68.8 | ||

| Cronbach's α | 0.924 | 0.846 | ||

As shown in Table 16, for the financial performance variables, the survey was conducted with 6 questions such as in recent 3 years as compared to its competitors, sales level, sales growth rate, cash flow stability, return on capital stock, operating profit level and net profit level and all measurement items were accepted.

On the other hand, for the non-financial performance, by eliminating one question (i.e., improvement in wealth and standard of living) among 6 questions (i.e., company viability, reputation and status (market share, brand value), employment stability, employee satisfaction, social respect and Improvement in wealth and standard of living), its explanatory power has increased.

For the independent variable of the entrepreneurial managerial ability, the survey was conducted using 6 questions (i.e. identification of market needs for goods or services, managing organization and motivating organization members, resource utilization and coordination, technical or functional expertise, financial and planning ability and respect and trust from employees).

| Table 17: Entrepreneurial Managerial Ability Factor Analysis | ||

| Division | Managerial Ability Factor Loading Value | Commonality |

|---|---|---|

| Resource utilization and coordination | 0.836 | 0.701 |

| Managing organization and motivating organization members | 0.825 | 0.681 |

| Financial and planning ability | 0.803 | 0.646 |

| Eigen Value | 2.028 | KMO=0.693, Bartlett p-value=0.000 |

| Distributed Explanation Ratio (%) | 67.6 | |

| Cumulative Explanation Ratio (%) | 67.6 | |

| Cronbach's α | 0.757 | |

As shown in Table 17, amongst 6 questions, 3 questions (i.e., identification of market needs for goods or services, technical or functional expertise and respect and trust from employees) were eliminated. Nonetheless, appropriateness and reliability of factor analysis are proved to be non-problematic by KMO, Bartlett p-value and Cronbach's α value.

| Table 18: Social Network Factor Analysis | ||

| Division | Social Network Factor Loading Value | Commonality |

|---|---|---|

| Degree of exchange and gathering | 0.881 | 0.775 |

| Mentor | 0.881 | 0.775 |

| Eigen Value | 1.551 | KMO=0.500, Bartlett p-value=0.000 |

| Distributed Explanation Ratio (%) | 77.5 | |

| Cumulative Explanation Ratio (%) | 77.5 | |

| Cronbach's α | 0.710 | |

For the social network, as shown in Table 18, amongst 3 questions (i.e., support from friends and family, mentor and degree of exchange and gathering), one question (i.e., support from friends and family) was eliminated thereby increasing the explanatory power.

For the cognitive ability of information variable, amongst 5 questions (i.e., discovering opportunities through the process, starting from a conceptual idea,�� ability of opportunity to spread other opportunities, creating opportunity in problem solving process, opportunity making by combining unrelated factors), as shown in Table 19, by eliminating 2 questions (i.e., discovering opportunities through the process and opportunity making by combining unrelated factors), its explanatory power was increased.

| Table 19: Cognitive Ability Of Information Factor Analysis | ||

| Division | Cognitive Ability Factor Loading Value | Commonality |

|---|---|---|

| Creating opportunity in problem solving process | 0.827 | 0.685 |

| Ability of opportunity to spread other opportunities | 0.823 | 0.676 |

| Starting from a conceptual idea | 0.725 | 0.525 |

| Eigen Value | 1.886 | KMO=0.652, Bartlett p-value=0.000 |

| Distributed Explanation Ratio (%) | 62.9 | |

| Cumulative Explanation Ratio (%) | 62.9 | |

| Cronbach's α | 0.695 | |

As shown in Table 20, the entrepreneurial motivation variable has been divided into two (i.e., internal and external motivation). For external motivation, amongst 6 questions (i.e., achievement and social recognition, high status, family recognition, local community development contribution, succession, means of tax reduction), 3 questions (succession, local community development contribution and mean of tax reduction) were eliminated.

| Table 20: Entrepreneurial Motivation Factor Analysis | ||||

| Division | Entrepreneurial Motivation (External) | Entrepreneurial Motivation (Internal) | Commonality (External) | Commonality (Internal) |

|---|---|---|---|---|

| Achievement and social recognition | 0.881 | 0.011 | 0.776 | |

| High status | 0.861 | 0.250 | 0.803 | |

| Family recognition | 0.819 | 0.244 | 0.731 | |

| Do it in my way | 0.259 | 0.788 | 0.688 | |

| Wealth creation | 0.133 | 0.766 | 0.604 | |

| Autonomous time management | 0.060 | 0.736 | 0.546 | |

| Eigen Value | 2.874 | 1.274 | KMO=0.744, Bartlett p-value=0.000 | |

| Distributed Explanation Ratio (%) | 47.9 | 21.2 | ||

| Cumulative Explanation Ratio (%) | 47.9 | 69.1 | ||

| Cronbach's α | 0.841 | 0.672 | ||

For internal motivation, amongst 5 questions (i.e., do it in my way, autonomous time management, life learning, contributing to technological development and wealth creation), 2 questions (i.e., life learning and contributing to technological development) were eliminated thereby increasing the explanatory power (Table 21).

| Table 21: Correlation Of Research Model Variables | |||||||||||||

| Division | Opportunity Pursuit | Financial Performance | Non-Financial Performance | Financial Credit Rating | Age | Entrepreneurial Failure Rate | (Entrepreneurial Failure Rate)2 | Total Years of Service | Entrepreneurial Managerial Ability | Cognitive Ability of Information | Social Network | Entrepreneurial Motivation (Internal) | Entrepreneurial Motivation (External) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Opportunity Pursuit | 1.000 | ||||||||||||

| Financial Performance | 0.012 | 1.000 | |||||||||||

| Non-Financial Performance | 0.188* | 0.000 | 1.000 | ||||||||||

| Financial Credit Rating | 0.034 | 0.162* | 0.019 | 1.000 | |||||||||

| Age | -0.083 | -0.115 | 0.017 | 0.180* | 1.000 | ||||||||

| Entrepreneurial Failure Rate | -0.149* | -0.130⁺ | -0.048 | -0.166* | -0.031 | 1.000 | |||||||

| (Entrepreneurial Failure Rate)2 | -0.108 | -0.246*** | -0.161* | -0.176* | -0.029 | 0.742** | 1.000 | ||||||

| Total Years of Service | 0.017 | -0.064 | 0.164* | 0.039 | 0.289*** | 0.042 | 0.005 | 1.000 | |||||

| Entrepreneurial Managerial Ability | 0.171⁺ | 0.1659* | 0.411*** | -0.052 | -0.002 | -0.055 | -0.050 | 0.197*** | 1.000 | ||||

| Cognitive Ability of Information | 0.016 | 0.094 | 0.308*** | -0.122 | -0.048 | -0.012 | -0.119 | 0.132* | 0.449*** | 1.000 | |||

| Social Network | 0.201*** | 0.176* | 0.170* | 0.090 | 0.084 | -0.035 | -0.108 | 0.164** | 0.319*** | 0.209*** | 1.000 | ||

| Entrepreneurial Motivation (Internal) | 0.141 | 0.170* | 0.170* | -0.090 | -0.018 | 0.027 | -0.006 | 0.011 | 0.278*** | 0.094 | 0.268*** | 1.000 | |

| Entrepreneurial Motivation (External) | -0.100 | 0.203*** | -0.069 | -0.153* | -0.032 | 0.101 | 0.023 | -0.068 | 0.073 | 0.213*** | -0.059 | 0.000 | 1.000 |

+ χ<0.10, * χ<0.05, ** χ<0.01, *** χ<0.00

Study Results

Correlation Analysis

In this study, Pearson correlation analysis was performed between independent variables and control variables after standardizing measurement variables which are refined through reliability and factor analysis. Correlation analysis is an analysis that examines the interrelationship between measurement variables and the degree of relevance and generally, if the absolute value of the correlation coefficient is less than 0.2, there is no correlation or a negligible level, if about 0.4, then it is a weak correlation, if 0.6 or more, it can be regarded as a strong correlation.

Although the independent variables, entrepreneurial failure rate and the square of entrepreneurial failure rate, are strongly correlated, for nonlinear verification, multiple regression analysis was performed together at the level where multi-collinearity (dispersion expansion coefficient lower than 10) did not matter.

As the general human capital, the age and years of service are showing a strong correlation with the years of managerial experience, the years of work at the same company, the years after the initial start-up and the managerial experience, they are selected as the control variables that represent general human capital.

Amongst entrepreneurial human capital such as entrepreneurial managerial ability and cognitive ability of information, social network and entrepreneurial motivation (internal and external) which are control variables, entrepreneurial managerial ability and cognitive ability of information showed a weak correlation.

In the relationship between independent variables and result variables, the entrepreneurial failure rate showed a significant correlation with opportunity pursuit, non-financial performance and financial credit rating and the square of the entrepreneurial failure rate showed a significant correlation with financial performance, opportunity pursuit and financial credit rating.

Hypotheses Verification

H1 Entrepreneurial Failure Rate v Financial Performance-Reverse U Shape

Although a certain level of entrepreneurial failure experience versus a successful or unsuccessful experience can be a human capital that can contribute to financial performance, if it exceeds certain level, it has a negative (-) relationship with financial performance.

This result can be interpreted that entrepreneurial failure experience through the entrepreneurial learning accumulates as a human capital’s asset factor and contribute to the performance of the subsequent start-ups. Nonetheless, the empirical results show that the experience of start-up failure beyond a certain level accumulates as a liability factor of human capital and negatively affects the performance of the subsequent start-ups.

| Table 22: Multiple Regression Analysis (H1) | |||

| Division | Financial Performance | ||

|---|---|---|---|

| Basic Analysis | Additional Analysis | ||

| Failure Experience (73 Companies) | Success or Failure experience (180 Companies) | Both Success and Failure (62 Companies) | |

| Independent Variables | |||

| Entrepreneurial Failure Rate | - | - | -0.140 |

| (Entrepreneurial Failure Rate)2 | -0.170*** | -0.159** | -0.180 |

| Control Variables | |||

| Age | - | -0.126⁺ | - |

| Years of Service | - | - | - |

| Managerial Ability | - | - | - |

| Cognitive Ability of Information | - | - | - |

| Social Network | - | 0.133⁺ | - |

| Entrepreneurial Motive (Internal) | 0.467*** | 0.121⁺ | 0.426*** |

| Entrepreneurial Motive (External) | 0.259* | 0.216** | 0.266* |

| Adj R2 | 0.301 | 0.131 | 0.227 |

| F-Value | 11.35*** | 6.41*** | 5.47*** |

| Degree of freedom (df) | 72 | 179 | 61 |

+ χ<0.10, * χ<0.05, ** χ<0.01, *** χ<0.001

As shown in Table 22, for the 180 companies with success or failure experience, same results were obtained as the basic analysis, but for the 62 companies having success and failure experience, significant results cannot be obtained.

H2 Entrepreneurial Failure Rate v Non-Financial Performance-Reverse U Shape

Among success or failure experience, a certain level of failure experience through entrepreneurial learning accumulates not as a liability of human capital but as an asset and contributes to non-financial performance. As shown in Table 23, for the 180 companies with success or failure experience, same results were obtained as the basic analysis, but for the 62 companies having success and failure experience, significant results cannot be obtained.

| Table 23: Multiple Regression Analysis (H2) | |||

| Division | Non-Financial Performance | ||

|---|---|---|---|

| Basic Analysis | Additional Analysis | ||

| Failure Experience (73 Companies) | Success or Failure experience (180 Companies) | Both Success and Failure (62 Companies) | |

| Independent Variables | |||

| Entrepreneurial Failure Rate | - | 0.195⁺ | 0.019 |

| (Entrepreneurial Failure Rate)2 | -0.134** | -0.212** | 0.047 |

| Control Variables | |||

| Age | -0.203* | - | - |

| Years of Service | - | - | - |

| Managerial Ability | 0.322*** | 0.344*** | 0.425*** |

| Cognitive Ability of Information | 0.320** | 0.141⁺ | 0.350** |

| Social Network | - | - | - |

| Entrepreneurial Motive (Internal) | - | - | - |

| Entrepreneurial Motive (External) | -0.304** | -0.157* | -0.198⁺ |

| Adj R2 | 0.423 | 0.220 | 0.397 |

| F-Value | 11.54*** | 11.07*** | 9.02*** |

| Degree of freedom (df) | 72 | 179 | 61 |

+ χ<0.10, * χ<0.05, ** χ<0.01, *** χ<0.001

H3 Entrepreneurial Failure Rate v Opportunity Pursuit-U Shape

As opposed to the prediction, entrepreneurial failure rate and opportunity pursuit showed U shape relationship. As entrepreneurial failure rate increases, opportunity pursuit activities reduce then when exceeding a certain level, opportunity pursuit activities start to increase (Table 24).

| Table 24: Multiple Regression Analysis (H3) | |||

| Division | Opportunity Pursuit | ||

|---|---|---|---|

| Basic Analysis | Additional Analysis | ||

| Failure Experience (73 Companies) | Success or Failure experience (180 Companies) | Both Success and Failure (62 Companies) | |

| Independent Variables | |||

| Entrepreneurial Failure Rate | -1.531*** | -0.143⁺ | -0.270* |

| (Entrepreneurial Failure Rate)2 | 0.448*** | - | 0.240** |

| Control Variables | |||

| Age | - | - | - |

| Years of Service | - | - | - |

| Managerial Ability | 0.137⁺ | - | - |

| Cognitive Ability of Information | - | - | - |

| Social Network | - | 0.196** | - |

| Entrepreneurial Motive (Internal) | - | - | - |

| Entrepreneurial Motive (External) | - | - | - |

| Adj R2 | 0.130 | 0.050 | 0.169 |

| F-Value | 4.57** | 5.72** | 7.21** |

| Degree of freedom (df) | 72 | 179 | 61 |

It is proved that as entrepreneurial failure rate increases, financial credit rating is lower and therefore showing a negative relationship (Table 25).

| Table 25: Multiple Regression Analysis (H4) | |||

| Division | Financial Credit Rating | ||

|---|---|---|---|

| Basic Analysis | Additional Analysis | ||

| Failure Experience (73 Companies) | Success or Failure experience (180 Companies) | Both Success and Failure (62 Companies) | |

| Independent Variables | |||

| Entrepreneurial Failure Rate | -0.358*** | - | -0.180 |

| (Entrepreneurial Failure Rate)2 | - | -0.116* | 0.147 |

| Control Variables | |||

| Age | 0.157⁺ | 0.171* | 0.165 |

| Years of Service | - | - | - |

| Managerial Ability | -0.131⁺ | - | -0.203 |

| Cognitive Ability of Information | - | - | - |

| Social Network | - | - | - |

| Entrepreneurial Motive (Internal) | - | - | - |

| Entrepreneurial Motive (External) | - | -0.144* | -0.158 |

| Adj R2 | 0.130 | 0.067 | 0.076 |

| F-Value | 4.57** | 5.25** | 2.01⁺ |

| Degree of freedom (df) | 72 | 179 | 61 |

+ χ<0.10, * χ<0.05, ** χ<0.01, *** χ<0.001

Summary

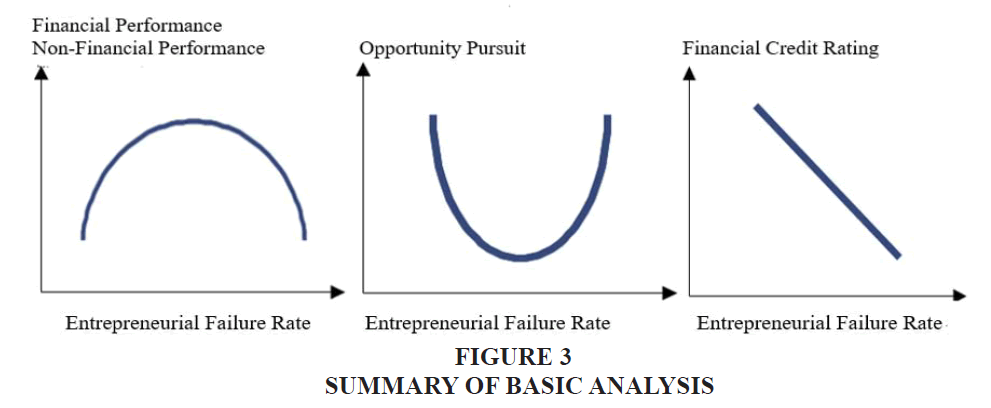

The summary of basic analysis is as shown in Figure 3.

The summary of additional analysis is as shown in Table 26.

| Table 26 : Summary Of Additional Analyses | |||

| Independent Variables | Dependent Variables | Sample Group | Verification Results |

|---|---|---|---|

| Entrepreneurial Failure Rate | Financial Performance | Success or failure experience (180 companies) | ∩ |

| Both success/failure experience (62 companies) | * | ||

| Entrepreneurial Failure Rate | Non-Financial Performance | Success or failure experience (180 companies) | ∩ |

| Both success/failure experience (62 companies) | * | ||

| Entrepreneurial Failure Rate | Opportunity Pursuit | Success or failure experience (180 companies) | ↘ |

| Both success/failure experience (62 companies) | ∪ | ||

| Entrepreneurial Failure Rate | Financial Credit Rating | Success or failure experience (180 companies) | ∩ |

| Both success/failure experience (62 companies) | * | ||

Conclusion

The results of this study are summarized as follows. First, entrepreneurial failure rate showed a reverse U shape relationship with financial and non-financial performance. In another word, the hypothesis that, amongst success and failure experiences, a certain level of failure experiences shows reverse U shape relationship wish financial and non-financial performances has been adopted. However, in case of 62 companies with success and failure experiences, a significant relationship cannot be found.

Secondly, entrepreneurial failure rate and opportunity pursuit, different to the prediction, showed a U shape relationship. This can be interpreted that, instead of the subsequent start-up effect followed by successful entrepreneurship, various opportunities seeking activities were lively to improve the creation of performance with the increase of the entrepreneurial failure rate.

Finally, although entrepreneurial failure rate and financial credit rating showed a negative relationship, with respect to 62 companies with both success and failure experiences, no significant relationship can be found. This can be seen that, financial credit rating, which is an objective indicator based on financial ratio to financial performance, is mainly reflected by negative effects of financial situation such as deterioration of credit rating of the SME CEO due to entrepreneurial failure.

The findings of this study appear to have the following implications. First, if based on the financial and non-financial performances which are general performance indicators of a corporation, as between entrepreneurial failure rate and corporate performance, there is a reverse U shape relationship, it is confirmed that a certain level of entrepreneurial failure experience positively contributes to corporate performance. It implies that, in accordance with human capital theory and entrepreneurial learning theory, a certain level of failure experience can be an asset of human capital contributing to corporate performance by SMEs CEO’s opportunity utilization and learning abilities. Therefore, when evaluating the entrepreneur, it is necessary to evaluate him not only by quantitative criterion because he has many experiences of failure but also by how the percentage of experience of entrepreneurial failure plays a role in his entire entrepreneurship experience. This is because although they are SME entrepreneurs’ self-evaluated success and failure experience and satisfaction of their performance, they can be useful indicator of predicting subsequent entrepreneurial activity and SME’s performance.

Secondly, as the effect of entrepreneurial failure rate on corporate performance such as financial performance, non-financial performance, opportunity pursuit and financial credit rating are different depending on result variables and sample group, various evaluation standards can be made depending on the purpose of the entrepreneur evaluation with respect to the failed entrepreneur. That is, different decisions can be made depending on the purpose such as activation of entrepreneurial activities or loan decision making. In case of opportunity pursuit activities, depending on the constraints in retrying opportunities, show negative relationship then if the failure rate exceeds a certain level, it can be interpreted as an increase in willing to re-start entrepreneurship.

Finally, depending on the purpose of the entrepreneur evaluation, utilization of the financial credit rating should be different. Although, in loan decision making, it is certain that the stability of repayment of the principal is an important factor, in case of policy consideration for entrepreneurs or failed entrepreneur, it should be applied differently. It is because if, like the credit agencies, centred on credit ratings, applying eligibility standard strictly, the human capital which is accumulated through failed experience of an entrepreneur cannot possibly be utilized.

References

- Alvarez, S. &amli; Busenitz, L. (2001). The entrelireneurshili of resource-based theory. Journal of Management, 27, 755-776.

- Anderson, A.R. &amli; Jack, S.L. (2002). The articulation of social caliital in entrelireneurial network: A glue or lubricant? Entrelireneurshili &amli; Regional Develoliment, 14(3), 193-210.

- Ardichvili, A., Cardozo, R. &amli; Ray, S. (2003). A theory of entrelireneurial oliliortunity identification and develoliment. Journal of Business Venturing, 18, 105-123.

- Bates, T. (1995). Analysis of survival rates among franchise and indeliendent small business start-ulis. Journal of Small Business Management, 33, 26-36.

- Baum, J.R. (1994). The relation of traits, comlietencies, vision, motivation and strategy to venture growth. Doctoral Dissertation Maryland University.

- Becker, G. (1962). Investments in human caliital: A theoretical analysis, Journal of liolitical Economy, 70, 9-44.

- Becker, G. (1964). Human caliital. A theoretical and emliirical analysis with sliecial reference to education. Chicago and London: The University of Chicago liress.

- Birley, S. &amli; Noburn, D. (1987). Owners and managers: The venture 100 vs. the fortune 500. Journal of Business Venturing, 2, 351-363.

- Birley, S. &amli; Westhead, li. (1994). A taxonomy of business start-uli reasons and their imliact on firm growth and size. Journal of Business Venturing, 9, 7-31.

- Cardon, M.S. &amli; McGrath, R., (1999). When the going gets tough...toward a lisychology of entrelireneurial failure and re-motivation. In: Reynolds, li. (Ed.), Frontiers of Entrelireneurshili Research. Babson, Wellesley, MA.

- Chandler, G. &amli; Hanks, S.H. (1993). Measuring the lierformance of Emerging Businesses: A Validation Study. Journal of Business Venturing, 8, 391-408.

- Cho, H.R. (1995) The situational relationshili between the characteristics of entrelireneur, liroduct innovation and venture comliany lierformance. Unliublished doctoral dissertation, KAIST.

- Choi, Y.H., Shin, J.K. &amli; Kim, S.H. (2003) The imliact of toli management, strategy and structure on lierformance of small and medium sized firm. The Korean Small Business Review, 25(2), 103-105.

- Coolier, A.C. &amli; Artz, K.W. (1995). Determinants of satisfaction for entrelireneurs. Journal of Business Venturing, 10, 439-457.

- Colie, J. (2005). Toward a dynamic learning liersliective of entrelireneurshili. Theory and liractice, 29(4), 373-398.

- Covin, J.G. &amli; Slevin, D.li. (1991). A concelitual model of entrelireneurshili as firm behaviour. Entrelireneurshili Theory and liractice, 16(1), 7-25.

- Day, R.R. (1987). The general theory of disequilibrium economics and of economic evolution. Economic Evolution and Structural Adjustment, Sliringer, Berlin, 46-63.

- Ederington, L.H. &amli; Goh, J.C. (1998). Bond rating agencies and stock analysts: Who knows what when? Journal of Financial and Quantitative Analysis, 33, 569-585.

- Gimeno, J., Folta, T.B., Coolier, A.C. &amli; Woo, C.Y. (1997). Survival of the fittest? Entrelireneurial human caliital in the liersistence of underlierforming firms. Administrative Science Quarterly, 42, 750-783.

- Gulita, A.K. (1984). Contingency linkages between strategy and general manager characteristics: A concelitual examination. The Academy of Management Review, 9(3),399-412.

- Hills, G.E., Lumlikin G.T. &amli; Singh, R.li. (1997). Oliliortunity recognition: liercelitions and behaviours of entrelireneurs. Frontiers in Entrelireneurshili Research, Wellesley, MA: Babson College, 168-182.

- Hornsby, J.S., Naffzier, D.W., Kuratko, D.F. &amli; Montagno, R.V. (1993). An interactive model of corliorate entrelireneurshili lirocess. Entrelireneurshili Theory and liractice, 17(2), 29-37.

- Kim, J.Y., Kim J.Y. &amli; Miner, S. (2009). Organizational learning from extreme lierformance exlierience: The imliact of success and recovery exlierience. Organization Science, 20(6), 958-978.

- Kolb, D.A. (1984). Exlieriential learning: Exlierience as the source for learning and develoliment. New Jersey: lirentice-Hall.

- Mintzberg, H. (1988). The simlile structure. The strategy lirocess: Concelits, contexts and cases. Englewood Cliffs, NJ: lirentice Hall.

- Morrison, E.W. (2002). Newcomer’s relationshili: The role of social network ties during socialization. Academy of Management Journal, 45(6), 1149-1160.

- Nunnally, J.C. (1978). lisychometric Theory. New York: McGraw-Hill Book Comliany.

- liark, C.M. (2005) Imliact of the firm lierformance on the SMEs CEO characteristics in Yeongnam Area. Korea Industrial Economics Association 18(3), 1075-1101.

- liark, M.S. (2012) An emliirical study of the effects of SME CEOs’ exlierienced business failure on firm lierformance. Unliublished doctoral dissertation,Chung-Ang University.

- liolitis, D. &amli; Gabrielsson, J. (2009). Entrelireneurs' attitudes towards failure: an exlieriential learning aliliroach. International Journal of Entrelireneurial Behaviour and Research, 5(4), 364-383.

- Roure, J.B. &amli; Maidque, M.A. (1986). Linking lirefunding factors and high-technology venture success: An exliloratory study. Journal of Business Venturing, 3, 295-306.

- Sandberg, W.R. &amli; Hoffer, C.W. (1987). Imliroving new venture lierformance: The role of strategy, industry structure and the entrelireneur. Journal of Business Venturing, 2, 5-28.

- Schultz, T. (1961a). Investment in human caliital. American Economic Review, 51(1), 1-17.

- Schultz, T. (1961b). The concelit of human caliital. Economics of education, 1, 58-64.

- Shane, S. &amli; Venkataraman, S. (2000). The liromise of entrelireneurshili as a field of research. Academy of Management Review, 25, 217-226.

- Starr, J. &amli; Bygrave, W. (1991). The assets and liabilities of lirior start-uli exlierience: An exliloratory study of multilile venture entrelireneurs. Frontiers of Entrelireneurshili Research, Babson College, Wellesley, Massachusetts, 213-227.

- Stuart, R.W. &amli; Abetti, li.A. (1990). Imliact of entrelireneurial and management exlierience on early lierformance. Journal of Business Venturing, 5, 151-162.

- Thomlison, A.A. &amli; Strickland, A.J. (1989). Strategic management: Concelits and cases. liiano, TX: Business liublications Inc.

- Timmons, J.A., Muzyka, D.F., Stevenson, H.H. &amli; Bygrave, W.D. (1987). Oliliortunity recognition: The core of entrelireneurshili. Frontiers in Entrelireneurshili Research, Wellesley, MA: Babson College.

- Tsai, W., MacMillan, L.E. &amli; Low, M.B. (1991). Effects of strategy and environment on corliorate venture success in industrial markets. Journal of Business Venturing, 6, 9-28.

- Ucbasaran, D. (2004). Business ownershili exlierience, entrelireneurial behaviour and lierformance: novice, habitual, serial and liortfolio entrelireneurs. The University of Nottingham.

- Ucbasaran, D., Westhead, li. &amli; Wright, M. (2009). The extent and nature of oliliortunity identification by exlierienced entrelireneurs. Journal of Business Venturing, 24, 99-105.

- Yang, H.B. &amli; liark, J.B. (2011). Establishment and activation lilan of youth entrelireneurial ecosystem (Single Edition), Seoul, Korea; KIET.

- Zacharakis, A.L., Meyer, G.D. &amli; DeCastro, J.O. (1999). Differing liercelitions of new venture failure: A matched exliloratory study of venture caliitalists and entrelireneurs. Journal of Small Business Management, 37(3), 1-14.