Research Article: 2022 Vol: 28 Issue: 1S

The Effectiveness of Fiscal Policy in Targeting Inflation in Jordan

Salah Turki Ateiwi Alrawashdeh, Al Balqa Applied University

Ali Abdel Fattah Hamdan Zyadat, Al Balqa Applied University

Ahmad Mahmoud Marzouq Abkal, Central Bank of Jordan

Citation Information: Alrawashdeh, S.T.A., Hamdan Zyadat, A.A.F., & Marzouq Abkal, A.M. (2022). The effectiveness of fiscal policy in targeting inflation in Jordan. Academy of Entrepreneurship Journal, 28(S1), 1-12.

Abstract

The present studyexplored the impact of the fiscal policy on inflation in Jordan. The researchers adopted an analytical approach to explore the impact of direct and indirect taxes on the consumer price index in Jordan. They carried out time series analysis for the period (1992 – 2000). The model includes the following variables: 1)-the consumer price index (dependent variable). 2)- Direct taxes, indirect taxes, import price index, and real GDP (independent variables). The researchers concluded that the direct taxes have negative significant impact on the consumer price index. They found that there is a significant and positive effect for indirect taxes, the import price index, and the real GDP on the consumer price index. They recommend analyzing the financial policy of the Central Bank in a periodical manner to explore the impact of the tools of the financial policy on the consumer price index (i.e. inflation).

Keywords

Fiscal Policy, Inflation, Direct Taxes, Indirect Taxes.

Introduction

Inflation is a major challenge that face countries when applying various economic policies. It’s considered so especially when trying to address the negative impacts of inflation through implementing the fiscal policy that is consistent with the existent economic situation and requirements.

One of the most important objectives of fiscal policy is represented in achieving high and sustainable economic growth rates. The fiscal policy also aims to achieve low and stable inflation rates (Asandului et al., 2021).

Inflation is one of the important economic problems that are faced by developing and developed countries. The causes and effects of inflation differ from one country to another. Due to having different causes, the economic and social effects of inflation differ from one country to another. Due to having different causes, the impacts of inflation on the applied fiscal and monetary policy inflation differ from one country to another (Mustafa, 2020).

Inflation is a significant economic concept. There isn’t any agreement among economists about the definition of the term (inflation). Inflation may be defined as the continuous rise in the general level of prices. It may refer to the rise of the prices of most of the goods and services (Al-Dosky et al., 2011).

Al-Shorbagy (2006) suggest that the high inflation rate leads to having a decrease in the real value of long-term returns. The high inflation rate leads to increasing taxes. Thus, it leads to incurring loss that affects the real value of cash balances. The high rate of inflation leads to a decrease in the real value of the bank deposit of individuals and business enterprises. It leads to a decrease in the real value of the monetary reserves of banks. That leads to a reduction in financial depth.

Economic inflation has several negative impacts on economy. Such effects include: the ones shown below (Mustafa, 2020):

Inflation has negative effects on the distribution of real income: Such distribution refers to the total quantities of goods and services that individuals obtain based on their monetary income.

Inflation affects the purchasing power of money: That result in the continuous increase of prices and poor confidence in the national currency. That encourages people to buy products, foreign currencies, and real estate.

Inflation affects the balance of payments: As a result of the increase in inflation rates, the competitiveness of national goods in global markets declines. That leads to having a decline in the volume of exports. It leadsto having an increase in the demand for imported products that have relatively low prices in comparison to the process of the alternative local products.

Inflation affects the wealth distribution: Inflation forces individuals to sell their properties, such as: the real estate due to having continuous increase in prices. It forces individuals to do that to maintain their level of consumption that they are used to. The ones who acquire ownership for properties in the light of having high inflation rates shall lose the real value of their wealth. That’s attributed to having higher prices and lower purchasing power for the income.

Fiscal policy is an important tool to address the state of economic imbalance in developed and developing countries. It is an important tool due to the increasing impacts for inflation on the economic systems of the countries. Such impacts must be addressed in the countries that have an environment that contributes to increasing the inflationary pressures. The latter environment includes a group of factors and variables that contribute to increasing the inflationary pressures and forcing domestic price levels to rise (Wadih, 2017).

Fiscal policy is defined as the policy that is related to the management and use of public revenues and expenditures. It aims to meet the goals set by the government in the economic, social and political fields (Al-Khatib & Al-Shamiya, 2012).

Saad and Al-Tarwana (2016) suggest that fiscal policy carries out three functions. Those functions are: 1) improving the economic efficiency through reallocation of resources. 2) improving the income distribution, and 3) achieving economic stability. The achievement of a state of economic stability is affected mainly by the effectiveness of the public financial policy in achieving the main economic goals set by policy makers. The latter goals are related to achieving economic growth and a state of stability in the level of prices.

Based on all economic schools, fiscal policy is a tool for fostering economic activity and meet economic, social and political goals. It is a financial program of action that’s implemented by the government through the use of public revenues and expenditures and aims at a chieving a state of economic stability. It aims at achieving social justice, providing equal opportunities to the public through reducing the disparity between classes. It aims at achieving an equal distribution for income and wealth (Al-Dosky et al., 2011).

Fiscal policy can be defined as a set of rules that the government must comply with when determining the public expenditures and securing the resources needed to pay off these expenditures (Al-Daami, 2010).

Public revenues have become an important element of the fiscal policy. Fiscal policy has a significant impact on economic and social activities. It is a tool for preventing some unwanted activities. It is a tool for controlling investment, and public revenues, including taxes. Taxes are the most important financial resource for the budget. They are mandatory contributions made by one in exchange for getting the public services. They are either directly imposed on income (e.g. income tax), or indirectly imposed on the activities of individuals (e.g. taxes on imports, exports, and sales) (Allawi, 2016).

Based on the aforementioned information, the researchers believe that it’s important to explore the effectiveness of the fiscal policy -adopted by the Jordanian Ministry of Finance - in reducing the inflation level in Jordan.

Statement of the Problem

Inflation is one of the main problems that face facing the economic systems of countries. It requires using the tools of the fiscal policy. The use of such tools aims to achieve economic stability and reasonable growth rates in the main economic indicators, including the consumer price index (inflation). The tools of the fiscal policy include direct and indirect taxes. Therefore, the problem of the study is the following question: (What is the effectiveness of fiscal policy in in reducing the inflation level in Jordan?)

The Study’s Objectives and Questions

The current research explored the effectiveness of fiscal policy in in reducing the inflation level in Jordan. It aimed to answer those questions:

Q1: What is the appropriate standard model for identifying the relationship between the consumer price index (inflation) from one hand and direct and indirect taxes, import price index and real GDP from another hand?

Q2: What is the effectiveness of the fiscal policy in reducing consumer price index (inflation level)?

The study’s significance:

The significance of this research article arises from the following points:

This article explored the nature of the impact of tools of the financial policy on the consumer price index (inflation) in Jordan through analyzing the standard model of fiscal policy used in Jordan.

This article sheds a light on the effectiveness of the tools of the financial policy. It sheds a light on the need to make amendments to the direct and indirect tax rates in order to raise the effectiveness of fiscal policy and adjust deviation. Such amendments are made by the decision makers working in public bodies.

Definition of Terms

Fiscal policy: It is the set of tools that the government uses to foster economic activity to achieve a specific goal. Such tools include public spending tools and public revenue tools (Allawi, 2016).

Consumer price index (inflation): It is the amount of continuous increase in the general level of prices in a country which result from having excessive supplies in goods and services during a certain period of time (Doepke et al., 1999).

Direct taxes: They refer to taxes imposed on a one’s income and wealth. They are paid directly to the government. They can’t be changed. Taxes are positively associated with one’s income or wealth. That means that taxes increase with having an increase in income or wealth.

Indirect Taxes: They refer to the tasks imposed on the one who consumes goods and services. They are paid indirectly to the government. This tax can be easily transferred to another person. The higher the amount of tax, the lower the demand for goods and services and vice versa.

Import Price Index: It refers to the number of imported units that the country obtains for exporting one unit to the outside world. It can be calculated through dividing the index of the quantity of imports by the index of the quantity of exports.

Real GDP: It refers to the economic output that is adjusted for the effects of inflation. Thus, it is an indicator that’s more accurate than the long-term national economic performance.

The Limits of the Study

The study’s limits are shown below:

Spatial limits: This article targets the financial policy applied by the Jordanian government (specifically by the Ministry of Finance).

Time limits: Standard analysis was conducted. It targets the period (1992-2000).

Previous Studies

The researchers reviewed the following studies:

Asandului et al. (2021) analyzed the asymmetric effects of fiscal policy on inflation. They explored the effects of the economic activity on 12 post-communist European countries that have membership in the European Union. They explored the asymmetric effects on inflation and economic activity through using a Pooled Mean Group (PMG) estimator. Based on the results, on the long run, the fiscal policy instrument negatively affects both inflation and economic activity. On the short term, the effects are not significant. A Nonlinear Autoregressive Distributed Lag (NARDL) model was estimated individually for each country.

Victor et al. (2021) investigated the inflation–unemployment dynamics during the recession and COVID-19 crisis in India and the United Kingdom (UK). Through using a generalized additive model (GAM), they found the recession had given way to stagflation in India. In contrast, in the United Kingdom (UK), it has led to a more severe recession on the short term. During the downturn, policy initiatives aggravate the recession and eventually turn to stagflation in India due to inflation caused by the weak supply side. However, in the UK, the policy initiatives during this downturn pushed the economy into a deeper recession due to reduced demand.

Mostafa (2020) explored the impact of inflation on economic performance and economic growth rates in Egypt during the period (1961-2018). Based on the standard model, he found that a one-way causal relationship exists between inflation rates and the rate of economic growth. They found that the exports and imports of goods and services don’t have any significant impact on the rate of economic growth. They found that inflation has a significant negative impact on the rates of economic growth.

Wadih (2017) explored the effectiveness of fiscal policy in Algeria in reducing the inflation level during the period (1990-2009). He found that Algeria has been suffering from inflation and other economic problems and imbalances. He found that such economic problems negatively affect the economic system of Algeria. He found that the Algerian government took several measures to make economic reforms. He found that the economic problems used spending, revenue, prices and wages policies to reduce the inflation levels.

Abu Azoum et al. (2016) examined the evolution of the domestic price movement in the Libya during the period (2010-2014). They explored the degree to which the monetary and fiscal policies are effective in achieving stability in price levels. They adopted a descriptive analytical historical approach. They found that the Libyan economy witnessed a continuous rise in price levels during the period (2010-2014). Such continuous rise is attributed to several reasons. They found that the Libyan government took several austerity measured that led to having a decrease in the public spending rates. However, such measures weren’t effective for reducing the inflation levels. They weren’t effective for achieving stability in domestic price levels. That indicates that the problem of inflation is not the only problem that has been facing the Libyan economy. In fact, the Libyan economy has been negatively affected by the political unrest, military operations and the high rates of financial and administrative corruption

Mohamedin et al. (2016) explored the effects of monetary and fiscal policies on inflation in Sudan. They used the method of ordinary least squares and the autoregressive moving averages. They used the inflation model. They concluded that money supply, budget deficit and exchange rate has a significant impact on inflation. They concluded that there is a significant relationship between inflation from one hand and money supply, budget deficit and exchange from another hand.

Allawi (2016) explored the role of fiscal policy in reducing the inflation level in the Iraqi economy during the period (1996-2011). Based on the standard analysis, he found that there are weaknesses in the tools of the financial policy (i.e. public expenditures and public debt). Such weaknesses led to having an increase in the inflation rates. The high inflation is attributed to tax revenues-related reasons. The researcher found that there is a need to activate the role of the tools of the financial policy in reducing the intensity of inflation.

Saad and Al-Tarwana (2016) explored the impact of the discretionary fiscal policy on economic growth in Jordan during the period (1976-2011).They found that a long-term equilibrium relationship exists between economic growth rates and discretionary fiscal policy variables.

Otto & Ukpere (2015) investigated the impact of fiscal policy on inflation. They used the data obtained from the Central Bank of Nigeria. Such data targets a period consisting from 32 years. The researchers used an ordinary least squares regression analysis. They found that the fiscal policy impacts don’t have any significant impact on inflation in Nigeria. They found that inflation in Nigeria is affected by the scarcity of goods, corruption, and multiple taxation. They found that inflation in Nigeria is affected by the high cost of borrowing and infrastructural deficits.

Cottarelli and Jaramille (2012) explored the short and long-term relationships between fiscal policy and economic growth in developed countries. They found that countries should reduce the debt-to-output ratio. The latter ratio negatively affects long-term growth. The researchers found that the correction of public financial conditions is likely to have a negative impact on growth rates on the short term.

Al-Dosky et al. (2011) explored the effect of the fiscal and monetary policies on inflation in Iraq during the period (2003-2010). They found that the fiscal and monetary policies are effective in reducing the inflation rate in the Iraqi economy. They found that the fiscal policy affects the inflation rates (level General prices) during the targeted period. They found that the monetary policy affects the reduction of inflation during the targeted period. So, the impact of the two policies on inflation was measured and analyzed. From here, the research concluded that the constraint of fiscal policy on monetary policy is large through the money supply, which is determined by total public spending by (95-97%) of oil revenues. In addition, the monetary policy's constraint on fiscal policy is significant through the exchange rate, constituting public spending.

Giordano et al. (2008) explored the effects of fiscal policy on GDP, inflation and long-term interest rate in Italy. They used the SVAR model during the period (1982-2004). They concluded that in the event of a shock of one percentage in the government spending variable, its impact on economic activity will be significant and strong by 6.0% after three quarters of the subsequent period, and with regard to the impact on the inflation variable, it was positive, small and short-term. The rest of the variables, it was positive.

El-Shorbagy (2006) explored the impact of inflation on the performance of the financial sector in six countries in the Mediterranean region during the period (1988-2003). They explored such impact through using cross-sectional time-series data method by applying fixed-effects models with the presence of fixed effects for each of the country and time periods. Based on the analysis, they found that there is a negative significant for inflation on the performance of both the banking sector and the stock market in the sampled countries during the mentioned period. They found that there is a strong negative impact for inflation on the performance of the financial sector in the event that the prevailing inflation rates are greater than the critical rate of inflation, which was estimated at about 8%. They found that the performance of the financial sector will not decline as long as the rate of inflation is low.

Commentary on the Studies Listed Above

Based on the studies listed above, there are several variables that affect inflation, such as: the fiscal and monetary policies that are adopted by the government. The fiscal policy includes several elements, such as: the direct and indirect taxes and GDP rates. Based on the studies listed above, fiscal policy affects the inflation rates in the state. Most of the studies listed above used simple models to test the relationships between dependent and independent variables.

The present study is characterized by the fact that it aimed to explore the effectiveness of fiscal policy in reducing the consumer price index (inflation) in Jordan. It is highly needed due to having several external and internal factors that negatively affect the Jordanian economy. Those factors negatively affect the effectiveness of the tools of the fiscal policy.

Methodology

The researchers adopted ananalytical approach. They used the standard analysis for exploring the impact of direct and indirect taxes on the consumer price index in Jordan. They used time series analysis. They targeted the period (1992–2000). They adopted a model ARDL.

1 This section covers the following main headings:

2 The standard model: It includes dependent and independent variables. The dependent variables is the consumer price index. The independent variables include: the direct taxes, indirect taxes, the import price index, and real GDP.

3 Testing the inactivity of the model variables: The researchers carried out the extended Dickey-Fuller test as one of the unit root tests to detect the inactivity of the time series of the model variables.

4 Estimation of the ARDL model.

Results

Results Related to the First Question

Q1: What is the appropriate standard model for identifying the relationship between the consumer price index (inflation) from one hand and direct and indirect taxes, import price index and real GDP from another hand?

Based on the economic theories and models, the researcher found that the consumer price index is affected by multiple factors. Therefore, the standard models that link the consumer price index and other variables must differ. Regarding the impact of direct and indirect taxes on inflation. Thus, the mathematical relationship between the variables mentioned in the following equation (1.1) can be written:

CPI = f (DT, IT, IPI,RGDP) (1.1)

Whereas,

Consumer Price Index.

Direct Taxes.

Indirect Taxes.

Imports Price Index.

REAL GROSS Domestic Product (GDP).

Based on the above information, the model can be written in equation (1.1) in the form of a multiple linear regression equation as in the following equation (2.1):

This equation presents the parameters of the independent variables. It presents the segment of the function. It presents the error term.

The Model Variables Static Test

Time-series stillness is an important issue in the field of time-series analysis in particular, and in the field of econometrics in general, as assuming the static variables and conducting appropriate tests will lead those studies to reach results that may be false (Al-Majali, 2008).

The inactivity of the time series can be detected by the unit root test (Extended Dickey Fuller test) Augmented Dickey Fuller (ADF). The time-series inactivity of the variable is judged by the ADF test based on the probability value associated with the t-statistic used in the test. If the probability is greater than 5%, it means that the time series of the variable is not stationary (Gujarati, 2004). The degree of inactivity of the time series of the variable is indicated by I(0) if it is stationary at the level, while it is indicated by I(1) if it is stationary at the first difference. Table (1) presents the results of the unit root test (the Extended Dickey-Fuller test) for the targeted variables at the level and at the first difference. It includes t-statistic values that arecalculated through both tests.

Table 1 show that the variables of the study’s model are not static at the level, and they are all static at the first difference. Thus, the ARDL model can be estimated.

| Table 1 The Results of the Unit Root Test ADF for the Variables in the Study’s Model | ||||

| Variable | Intercept | Decision | ||

| Prob. | t-Statistic | |||

| CPI | 0.422 | -1.696 | Failed to Reject Ho | |

| DT | 0.9652 | 0.166 | Failed to Reject Ho | |

| IT | 0.9997 | 1.946 | Failed to Reject Ho | |

| IPI | 0.8373 | -0.674 | Failed to Reject Ho | |

| RGDP | 0.8417 | -0.657 | Failed to Reject Ho | |

| Unit Root Tests at First Difference | ||||

| Ho: First Difference of Variable Has A Unit Root | ||||

| Variable | Decision | Intercept | ||

| Prob. | t-Statistic | |||

| CPI | I(1) | Reject Ho | 0.0001 | 5.402- |

| DT | I(1) | Reject Ho | 0.0026 | -4.26 |

| IT | I(1) | Reject Ho | 0.0083 | -3.778 |

| IPI | I(1) | Reject Ho | 0.0006 | -4.842 |

| RGDP | I(1) | Reject Ho | 0.0011 | -4.592 |

Estimation of the ARDL model over the short and long term.

First: Short-Term Model Estimation (Error Correction Model)

When estimating the error correction model according to the ARDL methodology, attention is focused on three criteria. Those criteria are shown below Table 2:

| Table 2 The Results of the Error Correction Model Estimation OF The Study’s Model | |||||

| Prob. | t-Statistics | Coefficient | |||

| 0 | -6.77 | -1.4 | ECM | ||

| R2=90 % D.W = 2.4 | |||||

| Diagnostics Tests | |||||

| Decision | Sig. | Prob. | Null Hypothesis | Test | |

| H0 | |||||

| Failed to Reject H0 | 5% | 0.659 | No Heteroskedasticity | Breusch-Pagan-Godfrey | |

| Failed to Reject H0 | 0.162 | No | Breusch-Godfrey LM Test | ||

| Serial Correlation | |||||

| Failed to Reject H0 | 0.949 | Residuals are Normally Distributed | Histogram – Normality Test | ||

1 The nature and significance of the influence of the independent variables on the dependent variable in the short term.

2 Negative and statistical significance of the error correction coefficient.

3 Aspects related to the quality of the model and its freedom from standard problems.

ECM Error Correction Factor and Bounds Test

Based on the results of the estimation, the error correction coefficient is negative and statistically significant at a significance level of 5%. The value of the coefficient reached (-1.4) and the probability associated with it (0.00). Based on this result, the deviation of the value of the dependent variable in the model from the equilibrium value corrects with time, approximately seven months. The results of the FBounds test showed that the value of F-Statistic reached (6.528). That means that the standard value is greater than the upper limit at the level of significance (1%). These results also prove that there is a a long-term relationship between the independent variables and the dependent variable in the study’s model.

Estimated Quality and Free From Standard Problems

The quality of the model can be judged by the significance of the estimated parameters and the value of the coefficient of determination (R2). Based on the results of the analysis, the majority of the estimated parameters are statistically significant at the level of significance of 5%. The significance of the parameters includes that the relationship between the independent variables and the dependent variable is not by chance and that it is statistically significant.

The value of the coefficient of determination in the model estimation is (09%). That means that 90% of the changes in the dependent variable can be attributed to the independent variables in the study’s model. Significant probability values and high coefficient of determination values reflect the quality of the model. Based on these results, it can be said that the model is good. The results show that the estimation is free from standard problems. That was determiend based on the decision to (accept) the null hypothesis that there are no problems. Perhaps, the quality of the model and its absence of standard problems supports the adoption of the standard results contained in the analysis on the relationship between the variables in question.

Second: The Long-Term Model Assessment

The long-term study model can be formulated in the following equation (3.1), followed by estimating each of them according to the ARDL methodology in Table (3).

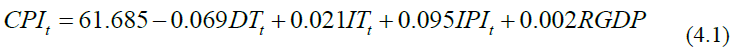

Based on the results presented in Table 3, the model can be rewritten as in equation (4.1).

| Table 3 Results of the ARDL Model Estimation For The Study Model | |||

| Prob. | t-Statistics | Coefficient | Variable |

| 0.0002 | -5.413 | -0.069 | DT |

| 0.0007 | 4.503 | 0.021 | IT |

| 0.0001 | 5.704 | 0.095 | IPI |

| 0.0035 | 3.624 | 0.002 | RGDP |

| 0 | 11.097 | 61.685 | C |

Before starting to analyze the results contained in Table 3 on the impact of the independent variables in question on the consumer price index, it should be noted that all the parameters in the study model are statistically significant.

Q2: What is the effectiveness of the fiscal policy in reducing consumer price index (inflation level)?

Based on the previous analytical tables, the results showed that the impact of direct taxes on the consumer price index is negative and significant. The value of the parameter associated with direct taxes was (-0.069). The associated probability value is (0.0002). It’s statistically significant at the statistical significance level of 1%. This result is expected and logical, as direct taxes mainly affect those with high incomes and those with low marginal propensity to consume, which reduces the impact on high consumption or demand, and thus increases prices and inflation in the economy.

The results show that the impact of indirect taxes on the consumer price index is positive and significant. The value of the parameter associated with indirect taxes was (0.021), while the probability associated with it was (0.0007), which is significant at the significance level of 1%. This result is attributed to the fact that indirect taxes mainly affect the segment of consumers with low incomes, which affects the domestic demand for goods and services and thus controls the inflation rate in the economy.

The results also showed that the impact of the import price index on the consumer price index is positive and significant. The value of the parameter associated with the import price index was (0.095), while the probability associated with it was (0.0001), which is significant at the significance level of 1%. This may be due to the fact that the prices of imports contribute to a part of the inflation in consumer prices and this is what is sometimes called imported inflation, as controlling imports contributes to reducing inflation.

The results also showed that the effect of the real GDP on the consumer price index is positive and significant. The value of the parameter associated with the real GDP is (0.002). The probability associated with it is (0.0000). It is significant at the significance level of 1%. The growth of the gross domestic product (GDP) affects the inflation rates. The fall of GDP leads to a drop in production and investment.

Conclusion

Through designing a standard model, the researchers explored the impact of fiscal policy on inflation in Jordan. The dependent variables are the consumer price index. The independent variables include: the direct taxes, indirect taxes, the import price index, and real GDP. The targeted period is represented in the following period (1992-2000).

Based on the data analysis, there isn’t any statistically significant impact for direct taxes on the consumer price index. Based on the data analysis, indirect taxes have a positive statistically significant impact on consumer price. Whereas, indirect taxes mainly affect the segment of low-income consumers. The researcher concluded that there is a significant and positive effect of the import price index in addition to the real GDP on the consumer price index. To sum up, they found that there is a significant and positive effect for indirect taxes, the import price index, and the real GDP on the consumer price index.

Recommendations

Based on the results, the researchers recommend analyzing the financial policy of the Central Bank in a periodical manner to explore the impact of the tools of the financial policy on the consumer price index (i.e. inflation).

References

Abu Azoum, A., Muhammad, S., & Abu Al-Qasim, S. (2016). The impact of fiscal and monetary policies on inflation in the Libyan economy during the period 2010-2014. Conference on the Economic and Financial Crisis in the Libyan Economy: Challenges and Reform Policies. Sebha University, Libya.

Al-Khatib, K., & Al-Shamiya, A. (2012). Foundations of Public Finance, Jordan: Dar Wael for Publishing and Distribution.

Al-Daami, A.K. (2010). Monetary and financial policies and the performance of the stock market, 1st edition. dar safaa for printing and publishing, Amman.

Al-Dosky, A., Al-Waeli, S., & Hussein, A.R. (2011). The impact of fiscal and monetary policies on inflation in the Iraqi economy for the period 2003-2010, analysis and measurement. Tikrit Journal of Administration and Economics Sciences, 7(23), 97-115.

Allawi, S. (2016). The role of fiscal policy in addressing the phenomenon of inflation in the Iraqi economy for the period (1996 - 2011). Journal of Baghdad College of Economic Sciences, (48).

Cottarelli, C., & Laura, J. (2012). Walking hand in hand: Fiscal policy and growth in advanced economies, IMF Working Paper, WP/12/137.

Doepke, M., Lehnert, A., & Sellgren, W. (1999). Macroeconomics, Chicago, Illinois.

Gujarati, D.N. (2004). Basic econometrics. 4th Edition, McGraw-Hill Companies.

Majali, A. (2008). The optimal policy to control inflation, an unpublished Ph.D. thesis, College of Business Administration, University of Jordan, Amman-Jordan.

Mostafa, I.M. (2020). The relationship between inflation rates and the rate of economic growth - applying to the Egyptian situation during the period 1961-2018. Journal of the Faculty of Economics and Political Science, 21(3), 105-130.

Wadih, K. (2017). Fiscal policy and its role in addressing inflation, a case study of Algeria 1990-2015. Master's thesis, Larbi Ben M'hidi University -Oum El Bouaghi - Algeria.

Pandemic: Inflation Unemployment Comparison between the UK and India. Economies, 9(73).

Saad, A., & Al-Tarawneh, S. (2016). Discretionary fiscal policy and its impact on economic growth in Jordan during the period 1976-2011. The Jordanian Journal of Economic Sciences, 3(2).