Research Article: 2021 Vol: 25 Issue: 5

The Effectiveness of the International Transfers Pricing Methods in Preventing Tax Avoidance in Developing Economy Evidence from Ghana

Mohammed Issah, University of Professional Studies

Samuel Antwi, University of Professional Studies

Zingteng Amatus, Jirapa Audit Service, Upper West Region

Abstract

This study examines the effectiveness of international transfer pricing methods in the prevention of tax avoidance by multinationals in Ghana. Primary data was collected from 45 respondents comprising of 15 staff of the transfer pricing unit, 15 staff of the tax unit of tax multinationals and 15 multinationals using questionnaires and interviews. The responses were analyzed using a logistic regression model and descriptive statistics. To test the logistic regression model and evaluate the fitness of the model, the study adopted the Hosmer and Lemeshow test among several statistical methods (The pseudo R2, scale Deviance, Pearson goodness of fit chi-square test and information criteria among others). To ensure that tax officials and multinationals apply the right and effective transfer pricing method, the study found that government will have to train and retain staff of transfer pricing unit, the staff of the large taxpayers, Multinational Enterprises (MNE’s) and specialists, beef up the less than 20 staff in the transfer pricing unit, provide more financial and material resources. Ghana Revenue Authority (GRA) will also have to conduct a frequent audit using modernize audit policy and strategies, and provide a comparability database for transfer pricing in consultation with and support of other major stakeholders, as well as getting a specialist to support complex and prolonged audits of transfer pricing transactions. The study also concluded that difference in income tax among countries, import and export duties, interest and participation of local partners, restriction on profit and dividend repatriation, exchange rate risk, the political risk of nationalization of foreign companies and the relationship with the host government at a time are important variables/factors that MNE's consider when formulating transfer pricing policies and in deciding which transfer pricing method to adopt.

Keywords

Transfer Pricing, Tax Avoidance, Multinational Enterprises, Logistic Regression.

Introduction

The issue of Transfer pricing has in the recent past being the main problem for both tax administrators and Multinational Enterprises (MNEs) global as it’s among the several tax reduction scheme employed by MNE’s (Mulyani, 2010; Ernst & Young, 2006; Addo et al., 2017; Amidu et al., 2019). Less developed countries are in the fixed because, whiles technology transfer is required from MNEs, they do not have the requisite resources and capabilities for transfer pricing audits and monitoring to detect abuses (Mulyani, 2010; Amidu et al., 2019).

Over 60 per cent of global trade and business activities are transacted through Multinational Enterprises and 70 per cent of these transactions are between related parties (GRA 2013 TP Regimes; Osei 2010). Multinational Enterprises, alongside other enterprises, accounted for most of developing countries’ trade with the international community. There is, therefore, the risk of revenue losses through transfer pricing manipulations (Osei 2010; Amidu et al., 2019; Addo et al., 2017).

Development aid received annually by the developing countries is far lesser than the revenue lost from the transfer pricing abuse by these multinationals. Osei (2010) noted that over $400 billion in capital moved out of developing countries to developed countries annually through transfer pricing abuses. Transfer Pricing manipulations have enormous effects on the economies of both developed and developing countries. It reduces government tax revenue, leading to over-taxation of the population and borrowings by the government, with its attendance debt burden on the country. (Sikka & Willmott, 2010; Nakyea, 2012, Addo et al., 2017). Transfer Pricing Manipulation also has the potential of distorting a country's balance of Payments thereby threatening the independence of developing countries, including Ghana, given the sophisticated and complex nature and size of Multinational Enterprises (MNE's). There is also dislocation of international production and employment. Transfer pricing enables MNE's to minimize tax payments through the exportation of capital to more favourable locations. As MNEs principal objective is to minimize tax and maximize their group profits, they set up subsidiaries and branches in locations where the tax burden is less and production is most profitable, therefore affecting the level of investment a country gets (Sikka & Willmott, 2010; Nakyea, 2012, Amidu et al., 2019).

As 60 per cent of all international and world business is accounted for by MNEs (Osei 2010, p.609 citing Owens, 2006) there is the need for countries across the globe to subject these increases in cross-border trade to scrutinize to prevent transfer pricing abuses (Ernst & Young, 2006). These MNEs operates in the various sectors of the developing economy including Mining, Oil & Gas, Manufacturing and Services etc they charged for related parties’ services such as technical and management fee and royalties as part of the contractual arrangement between the group members. Goods and raw materials extracted are also either exported to associates in other jurisdiction either in their raw form or in the form of the finished product. This situation always leads to MNEs putting in place an abusive transfer pricing scheme in its pricing of the products for them to maximize their global profit at the expenses of Ghana’s tax revenue (GRA, 2013 TP Regimes). How these abusive prices determination in most cases are difficult to ascertain because of inadequate human and materials resources.

Multinational Enterprises use transfer pricing strategies to predict their level of profit to enable them to meet shareholders’ expectation (Action Aid, 2011). They also used transfer pricing tools to move incomes and returns from high tax jurisdictions to low tax jurisdictions (Action Aid, 2011; Sikka &Willmott, 2010). Jurisdictions with low or no tax rates are called “tax havens” and as such several MNEs have an establishment in these countries with low effective tax rate with aim of moving a larger portion of group profit to these areas (Action Aid, 2011; Gravelle, 2009; Amidu, Coffie, Acquah, 2019). For instance, the Cayman Islands which is reported to be a country with a low tax rate (Tax Haven) has the number of registered companies in the country as double its population. It is reported that one building alone hosts the headquarters of over 18,000 businesses and establishments among which are some of the mega Multinational Enterprises.

These low tax rate countries do not carry out any major operations yet they report heavy profits from which the tax payable is either low or no corporate tax are levied as compared to countries with high tax rate where most of the business operations are undertaken Action Aid, (2011). Thus MNEs used transfer mispricing, to avoid payment of tax thereby crippling the economic and financial base of countries, of which developing countries such as Ghana suffer the most.

Developing countries however face several limitations such as the absence of comprehensive transfer pricing legislation, limited resources of local tax authorities, limited availability of comparable data and limited skills of tax authorities to effectively and successfully conduct transfer pricing audits (Heggmair et al., 2013, Addo et al., 2017). Tax officials will therefore require a detailed understanding of the regulations (L.I 2188, 2012) and the methods therein to assess which is appropriate for each transaction and how to effectively apply them. Also, the tax authorities require training in the area of specialized Transfer Pricing audits (Pricewaterhouse Coopers, (Pwc), 2011) as they increase their transfer pricing audit efforts, to ensure that transfer prices abuses among related parties are minimized as the level of cross-border related party transactions increases. Developed countries such as the US and others are making serious progress in the fight against transfer mispricing and profit shifting among related parties. They have developed extensive and sophisticated transfer pricing regulations, effective transfer pricing audit mechanism, and a well-trained and resources public (Tax official) and judiciary system that support enforcement of tax regulations (Action Aid,2011; Osei, 2010).

The study is different from other previous studies in the area of international transfer pricing methods effectiveness in the prevention of tax avoidance by Multinationals in Ghana in terms of arm’s length principle and methodologies. It is against this background that the researcher seeks to evaluate the effectiveness of the international transfers pricing methods in Transfer Pricing Regulations 2012 (LI 2188) in preventing tax avoidance by Multinational Enterprises in Ghana. The Regulation requires taxpayers to demonstrate that all transactions between them and their related entities are carried out at arm’s length.

The main objective of the study is to evaluate the effectiveness of the international Transfers pricing methods in preventing tax avoidance by Multinational Enterprises (MNE’s) in Ghana. Specifically, the study seeks to:

1. Examine the capacity of the Ghana Revenue Authority in implementing the Transfer Pricing Regulation.

2. Examine the determinants of an effective transfer pricing method from the tax practitioners and tax authority’s perspectives.

Hypotheses Development

Determinants of the Effectiveness of Transfer Pricing Method. The functionality of the transaction

The first point to selecting a transfer pricing method is the functional analysis of the transaction in respect of which method is selected (UN, 2013, OECD, 2010, Feinschreiber, 2004). Each of the transfer pricing methods demands an in-depth analysis taking into consideration the type of method that is questioned. By doing functional analysis intra-group transactions are identify and study to form the basis for comparability and for determining any possible adjustments to the comparables where need be, including checking the accuracy of the method selected and over time, to consider the adaptation of the policy if the functions, risks or assets have been modified. The major components of functional analysis are the Functions performed, Risks undertaken and Assets used or contributed (UN, 2013, GRA,2013, OECD, 2014& Feinschreiber, 2004).

The industry in which the transactions occurs (industry-specific), the transactions contract terms, the business strategies and economic circumstances are guiding principles in the analysis of the function of a transaction (OECD,2010).

By performing functional analysis complex or limited operations are identify thereby leading to high profit or lower profit depending on the complexity or limited nature of the transactions.

H1: Ceteris paribus, if transaction functionality is easily identifiable, the more likely it is that the method selected will be effective.

Comparability

Comparability is the central point to the application of the arm's length principle. When determining whether the terms of controlled transactions meet an arm's length principle, such terms must be compared with comparable unrelated transactions. The issue here is whether the controlled transaction that is being compared with the uncontrolled transaction is comparable. To be comparable means no differences (if any) between the situations being compared could materially affect the condition being examined in the method (price, margin) or that adjustment can easily be done to remove any effects in the difference. If the difference cannot be adjusted then the transactions are not comparable.

H2: Transactions that have arm’s length comparables available, the more likely than the method being selected will be effective.

KNOWLEDGE = 1, if GRA staff have the required knowledge and skill to analyze transaction, or otherwise.

The ability of staff of the revenue collecting agencies to identify transfer pricing risk through general audit and flag them with the transfer pricing unit depends on the sufficiency of knowledge acquired Readhead, (2016). Knowledge is acquired through training locally and internationally with the support of international partners. Thus, all staff of the large tax payer's unit should receive basic training on transfer pricing to be able to detect transfer mispricing through the application of transfer pricing methods. Equally, the staff of multinationals needs training on the various transfers pricing methods and when each method is applicable.

H3: if GRA and MNE’S staff have the required knowledge and skills to analyze transaction, the more likely it will be that the right and effective transfer pricing method will be adopted.

Experience

The ability to easily detect transfer pricing transactions and mispricing are influenced by the level of experience one have in a particular area. Where the GRA tax auditors are encouraged to specialize in various industries and rotated based on a clear policy, it will enable them to build a technical understanding of the various sectors thus helping them to detect transfer pricing methods misapplication easily and timely. It is noted that effective risk identification is an essential prerequisite for cost effective audit (OECD, 2012).

H4: if GRA staff are experienced in TP method applications, the more likely it is that an effective transfer pricing method will be adopted.

Resources

The prevention of transfer pricing abuses to a large extent depends on the material, financial and human resource level of the various Revenue Authorities, as having a good transfer pricing Regulation is not the only panacea to Transfer pricing problems. Authorities in developed countries have the resources to scrutinize corporate tax policy (Sikka & Willmolt, 2010.) as compared to developing countries including Ghana who lack adequate financial resources to be able to combat and Audit the sophisticated transactions of Multinationals or hire expert labour to scrutinize corporate practices more closely and aggressively check transfer pricing abuses. (Irish 1986, Heggmair et al (2013); Sikka & willmolt, 2010).

H5: if GRA resources (human and financials) allocation to TP Activity is adequate, the more likely it is that transfer pricing abuses will be minimized.3.6.2

Methodology

Research Design and Data Set

Thus, the study adopted the mixed methods which combine numeric and narrative properties was employed to obtaining statistical quantitative results using a questionnaire with follow up interview to explore and get other qualitative information about MNEs behaviour that could not be obtained through the use of the questionnaire.

The study population includes the staff of Ghana Revenue Authority, Tax practitioners, Firms and Multinational Enterprises. The target populations are the Transfer pricing unit of the GRA, the tax unit of the Tax practitioners and the Tax and Finance unit of the Multinationals. This is due to the assumption that they have the requisite knowledge to enable the researcher to meet the research objectives. It is also to ensure that staff of the population studied during the period whose work has no link with transfer pricing are excluded from the study.

The purposive sampling technique, (a non probability sampling technique), was used to select staff of the Ghana Revenue Authority (GRA) and respondents from the tax practitioners. A convenient sampling technique on the other hand will be used to select the respondents from the MNEs. This is because MNEs would not normally and easily grant interviews on sensitive issues like transfer pricing without prior personal contacts (Saunders, et al., 2009).

A sample size of 50 respondents was selected from a population because the area of study required persons/respondents with skills and knowledge in transfer pricing. The 50 was made up of 15 staff of the transfer pricing unit of the large taxpayer unit of the Ghana Revenue Authority (GRA), 15 staff (tax unit) from the selected tax practitioners firms, 20 staff (tax and finance unit) and 10 (2 from each MNE) MNEs.

The research instruments employed in this study is a set of structured and unstructured questionnaire. This was followed by semi structured interviews with the Managing Director or the Finance Director of MNE's and the Tax managers of the tax practitioners/consultants to clarify, corroborate information obtained from staff through the structured questionnaires and find other qualitative information that could not be obtained through the questionnaires. All items were considered as approximately equal attitude value to which participants responded with degree or intensity of agreement and disagreement.

Structured questionnaires were given to two staff of the finance/tax unit of the MNE'S and the tax unit of the tax practitioners/consultants to answer for collection later by the researcher because of their expertise in dealing with transfer pricing on behalf of their organizations and clients. The researcher's contact details were made available to the respondents to enable them to clarify any questions or issues relating to the study.

The questionnaires were collected one week after they were delivered. A reminder was sent to respondents two days before the collection date.

Data Analysis and Statistical Model

The data was collected from the staff of the Ghana Revenue Authority, selected tax practitioner firms and MNEs. The data collected was organized in two stages. The data was organised and subsequently coded and entered into the Statistical Package for Social Sciences (SPSS), 20.0 versions to facilitate data analysis and description.

Both descriptive and inferential statistics were computed during the analysis of the data using both SPSS and Microsoft Excel. The descriptive aspect employed frequency tables whilst the inferential aspect of the analysis employed the logistics regression model. The objective of the logistic regression is to correctly estimates the category of outcome for individual cases using the closest model that includes the predictor variables that are useful in predicting the response variable Antwi et al, (2014). In this study, the probability of a transfer price method being effective is influenced by Staff Knowledge of TP Methods, Experience on TP methods application, Resources assigned to TP audit, Availability of comparables, and Frequency of TP Audit by the tax auditors among others.

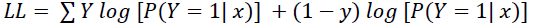

To this end, the logistic regression in this study uses the maximum likelihood estimation techniques to estimate the coefficients. This method yields the values of α and β which maximize the probability of obtaining the observed set of data by constructing a likelihood function which expresses the probability of the observed data as a function of the unknown parameters α and β,

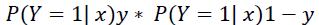

Thus, the likelihood function for a given value of the Predictor X in a univariate case is given by:

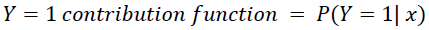

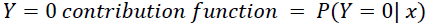

When

When

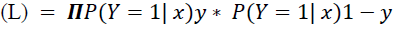

However, the likelihood function of data is the product of the individual contributions thus Likelihood function

Taking the natural Logarithm of the likelihood function gives the log likelihood function as

The log likelihood function is differentiated in respect of α and β and equated to zero to get the values of the parameters that maximize the log likelihood function. The resultant equation is solved using the iteration method to get the values of α and β which are referred to as the maximum likelihood estimates.

Once the model fit the given set of data, its adequacy was determined using the goodness of fit test and examination of influential observations. A model is considered fit when the difference between the observed and fitted values are small and if there is no systematic contribution of differences to the error structure of the model (Antwi et al., 2014).

Several statistical methods have been developed to determine the fitness of a chosen model (The pseudo R2, scale Deviance, Pearson goodness of fit chi square test and information criteria among others), however, the study adopted the Hosmer and Lemeshow test which divides the range of probability values into groups based on covariate pattern and compared the observed and the expected counts within these groups using the chi square statistic test. The smaller, the expected and the observed counts, the smaller the overall variance and thus the test statistic value. Therefore, a large p value indicates a good fit.

The hypothesis of the model fitness was measured by Hosmer and Lemeshow test as follows:

H1: the model fits the data

H0: the model does not fit the data.

Results and Analysis

Logistic Regression Results

The computation of the crude odds ratio for risk factors, X, is given by the estimate Exp (B). The crude odds ratio of factor determines the influence it has on the choice of a particular transfer pricing method. The Wald's and log-likelihood ratio tests are also performed to ascertain the significant effect of the factors. A probability value of less than or equal to 0.050 was considered to be statistically significant. Hence the inclusion of that factor is important in determining the choice of a particular transfer pricing method Y= 0 or 1.

The parameters of the model were estimated using the maximum likelihood approach. The estimates for each independent variable are interpreted relative to the referenced category.

Determinants of Effective Transfer Pricing Methods

The Omnibus test of the model coefficient indicates how well the model performs, with predictors entered into the model. This is referred to as a "goodness of fit test”. From Table 1, the omnibus test results gave a highly significant value of 0.000 (the significant value must be less than 0.05) and a chi-square value of 6.875 with 6 degrees of freedom. Since our omnibus test is significant we can conclude that adding the predictors to the model has significantly increased our ability to predict determinants of effective TP methods.

| Table 1 Omnibus Tests of Model Coefficients | ||||

| Chi-square | Df | Sig. | ||

| Step 1 | Step | 6.875 | 6 | .000 |

| Block | 6.875 | 6 | .000 | |

| Model | 6.875 | 6 | .000 | |

The model summary provides information about the usefulness of the model. The Cox and Snell & Nagelkerke R-square values of 0.246 and 0.408 respectively indicated that the proportion of variation in the outcome variables being explained by the model is between 24.6% and 40.8% of the time. Also, the log-likelihood test is significant in Table 2.

| Table 2 Model Summary | |||

| Step | -2 Log likelihood | Cox & Snell R Square | Nagelkerke R Square |

| 1 | 10.521a | 0.246 | 0.408 |

From Table 3 above, the chi-square value for the Hosmer-Lemeshow test is 1.695 with a significant value of 0.792 which is greater than 0.05, indicating support for the model. This is a strong indication of a good model fit.

| Table 3 Hosmer and Lemeshow Test | |||

| Step | Chi-square | df | Sig. |

| 1 | 1.695 | 4 | 0.792 |

The Contingency Table 4 for Hosmer and Lemeshow Test simply shows the observed and expected values for each category of the outcome variable as used to calculate the Hosmer and Lemeshow chi-square. A better model fit is indicated by a smaller difference between the observed and predicted classification is evident in the Table 4. That is the insignificant differences remain between actual and expected values. This shows that the prediction is acceptable.

| Table 4 Contingency Table for Hosmer and Lemeshow Test | ||||||

| Effectiveness of the Methods= Yes | Effectiveness of the Methods= No | Total | ||||

| Observed | Expected | Observed | Expected | |||

| Step 1 | 1 | 2 | 2 | 0 | 0 | 2 |

| 2 | 2 | 2 | 0 | 0 | 2 | |

| 3 | 4 | 4.347 | 1 | 0.653 | 5 | |

| 4 | 2 | 1.306 | 0 | 0.694 | 2 | |

| 5 | 1 | 1 | 1 | 1 | 2 | |

| 6 | 0 | 0.347 | 2 | 1.653 | 2 | |

The classification Table 5 indicated how well the model can predict the correct category (market-based or cost-based) for each attribute. From table 5 above, the percentage of accuracy in classification (PAC) is 86.7%. This implies that the model correctly classified 86.7% of cases overall. That is 90.9% of the outcome yes of the variable effectiveness of the methods is predicted correctly while 75.0% of the outcome no of the variable effectiveness of the methods is predicted correctly by the fitted model.

| Table 5 Classification Table | ||||

| Observed | Predicted | |||

| Effectiveness of the Methods | Percentage Correct | |||

| Yes | No | |||

| Effectiveness of the Methods | Yes | 10 | 1 | 90.9 |

| No | 1 | 3 | 75 | |

| Overall Percentage | 86.7 | |||

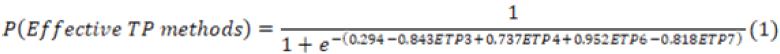

Table 6 gives information about the contribution or importance of each predictor variables. The test that is used here is known as the Wald test and the test statistic for each predictor variable is shown in the column labelled Wald. The significance of the Wald statistic for each independent variable indicates the overall determinants of an effective transfer pricing method from the tax practitioners and tax authority’s perspectives (P<0.05). The significance of the variables are assessed by the p value (represented in the table by “sig.”), the Wald’s statistic value or the odd ratios represented by

| Table 6 Determinants of an Effective Transfer Pricing Method from the Tax Practitioners and Tax Authority’s Perspectives | |||||||

| B | S.E. | Wald | df | Sig. | Exp(B) | ||

| Step 1a | Transaction functionality | 0.171 | 0.218 | 0.616 | 1 | 0.433 | 1.187 |

| Arm’s length comparable availability | -0.274 | 0.170 | 2.601 | 1 | 0.107 | 0.760 | |

| GRA’s staff knowledge and skill in analyzing TP transactions | -0.843 | 0.200 | 17.693 | 1 | 0.000 | 0.430 | |

| GRA’s staff experience in TP method applications | 0.737 | 0.242 | 9.293 | 1 | 0.002 | 2.091 | |

| GRA’s resources allocation to TP Activity | 0.036 | 0.239 | 0.023 | 1 | 0.880 | 1.037 | |

| Frequency of TP Audit | 0.952 | 0.214 | 19.861 | 1 | 0.000 | 2.591 | |

| MNEs Knowledge in TP laws and application | -0.818 | 0.190 | 18.606 | 1 | 0.000 | 0.441 | |

| Constant | 0.294 | 1.688 | 0.030 | 1 | 0.862 | 1.342 | |

From the table, column five (5) determines the significant predictor variables at a 0.05 level of significance. The four significant variables are GRA’s staff knowledge and skill in analyzing TP transactions (ETP3); GRA’s staff experience in TP method applications (ETP4); Frequency of TP Audit (ETP 6) and MNEs Knowledge in TP laws and application (ETP 7). Thus, the logistic function is given by the equation below:

From Table 7, the omnibus test results gave a highly significant value of 0.006 (the significant value must be less than 0.05) and a chi-square value of 9.08 with 5 degrees of freedom. Since the omnibus test is significant it can be concluded that adding the predictors to the model has significantly increased the ability to predict indicators of Tax Officials Capacity to implement the transfer pricing regulations.

| Table 7 Omnibus Tests of Model Coefficients | ||||

| Chi-square | Df | Sig. | ||

| Step 1 | Step | 9.08 | 5 | 0.006 |

| Block | 9.08 | 5 | 0.006 | |

| Model | 9.08 | 5 | 0.006 | |

The model summary provides information about the usefulness of the model. The Cox and Snell and Nagelkerke R-square values of 0.132 and 0.178 respectively indicated that the proportion of variation in the outcome variables being explained by the model is between 13.2% and 17.8% of the time. Also, the log-likelihood test is significant in Table 8.

| Table 8 Model Summary | |||

| Step | -2 Log likelihood | Cox & Snell R Square | Nagelkerke R Square |

| 1 | 18.070a | 0.132 | 0.178 |

From Table 9 above, the chi-square value for the Hosmer-Lemeshow test is 5.715 with a significant value of 0.335 which is greater than 0.05, indicating support for the model. This is a strong indication of a good model fit.

| Table 9 Hosmer and Lemeshow Test | |||

| Step | Chi-square | Df | Sig. |

| 1 | 5.715 | 5 | 0.335 |

The Contingency Table 10 for Hosmer and Lemeshow Test simply shows the observed and expected values for each category of the outcome variable as used to calculate the Hosmer and Lemeshow chi-square. A better model fit is indicated by a smaller difference between the observed and predicted classification is evident in the table above. That is the insignificant differences remain between actual and expected values. This shows that the prediction is acceptable.

| Table 10 Contingency Table for Hosmer and Lemeshow Test | ||||||

| Good Working Conditions = Yes | Good Working Conditions = No | Total | ||||

| Observed | Expected | Observed | Expected | |||

| Step 1 | 1 | 1 | 1.41 | 1 | 0.59 | 2 |

| 2 | 1 | 1 | 1 | 1 | 2 | |

| 3 | 2 | 1.482 | 1 | 1.518 | 3 | |

| 4 | 0 | 0.754 | 2 | 1.246 | 2 | |

| 5 | 1 | 0.699 | 1 | 1.301 | 2 | |

From Table 11 above, the percentage of accuracy in classification (PAC) is 60%. This implies that the model correctly classified 60% of cases overall. That is 16.7% of the outcome yes of the variable good working conditions is predicted correctly while 88.9% of the outcome no of the variable good working conditions is predicted correctly by the fitted model.

| Table 11 Classification Table | ||||

| Observed | Predicted | |||

| Good Working Conditions | Percentage Correct | |||

| Yes | No | |||

| Good Working Conditions | Yes | 1 | 5 | 16.7 |

| No | 1 | 8 | 88.9 | |

| Overall Percentage | 60 | |||

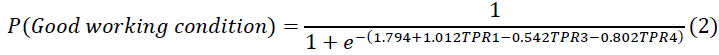

Table 12 gives information about the contribution or importance of each predictor variables. The test that is used here is known as the Wald test and the test statistic for each predictor variable is shown in the column labelled Wald. The significance of the Wald statistic for each independent variable indicates the overall Tax Officials Capacity to implement the Transfer pricing regulations (P<0.05). The significance of the variables are assessed by the p value (represented in the table by “sig.”), the Wald’s statistic value or the odd ratios represented by

| Table 12 Tax Officials Capacity to Implement the Transfer Pricing Regulations | |||||||

| B | S.E. | Wald | df | Sig. | Exp(B) | ||

| Step 1a | Provided with adequate funds, materials office accommodation for TP jobs | 1.012 | 0.276 | 13.468 | 1 | 0.000 | 2.750 |

| Educations level adequate for my job | -0.445 | 0.248 | 3.224 | 1 | 0.073 | 0.641 | |

| Have Adequate training for my job | 0.542 | 0.310 | 3.056 | 1 | 0.020 | 1.719 | |

| Have a good understanding of the transfer pricing regulations | -0.802 | 0.500 | 2.639 | 1 | 0.004 | 0.444 | |

| Have adequate Time Allocated for TP Jobs | -0.371 | 0.275 | 1.816 | 1 | 0.178 | 0.690 | |

| Earned an adequate Salary to support my family | 0.362 | 0.366 | 0.977 | 1 | 0.323 | 1.436 | |

| Constant | 1.794 | 3.517 | 0.260 | 1 | 0.610 | 0.166 | |

From the table, column five (5) determines the significant predictor variables at a 0.05 level of significance. The three significant variables are Provided with adequate funds, materials office accommodation for TP jobs (TPR1); Have Adequate training for my job (TPR3) and Have Good understanding of the transfer pricing regulations (TPR4). Thus, the logistic function is given by the equation below:

From Table 13, the omnibus test results gave a highly significant value of 0.000 and a chi-square value of 8.962 with 5 degrees of freedom. Since our omnibus test is significant we can conclude that adding the predictors to the model has significantly increased our ability to predict indicators of Tax Consultants Capacity to implement the transfer pricing regulations.

| Table 13 Omnibus Tests of Model Coefficients | ||||

| Chi-square | df | Sig. | ||

| Step 1 | Step | 8.962 | 5 | 0.000 |

| Block | 8.962 | 5 | 0.000 | |

| Model | 8.962 | 5 | 0.000 | |

The model summary provides information about the usefulness of the model. The Cox and Snell and Nagelkerke R-square values of 0.454 and 0.662 respectively indicated that the proportion of variation in the outcome variables being explained by the model is between 45.4% and 66.2% of the time. Also, the log-likelihood test is significant in Table 14.

| Table 14 Model Summary | |||

| Step | -2 Log likelihood | Cox & Snell R Square | Nagelkerke R Square |

| 1 | 8.318a | 0.454 | 0.662 |

From Table 15 above, the chi-square value for the Hosmer-Lemeshow test is 11.186 with a significant value of 0.191 which is greater than 0.05, indicating support for the model. This is a strong indication of a good model fit.

| Table 15 Hosmer and Lemeshow Test | |||

| Step | Chi-square | Df | Sig. |

| 1 | 11.186 | 5 | .191 |

The Contingency Table 16 for Hosmer and Lemeshow Test simply shows the observed and expected values for each category of the outcome variable as used to calculate the Hosmer and Lemeshow chi-square. A better model fit is indicated by a smaller difference between the observed and predicted classification is evident in the table above. That is the insignificant differences remain between actual and expected values. This shows that the prediction is acceptable.

| Table 16 Contingency Table for Hosmer and Lemeshow Test | ||||||

| Good Working Conditions = Yes | Good Working Conditions = No | Total | ||||

| Observed | Expected | Observed | Expected | |||

| Step 1 | 1 | 1 | 1 | 0 | 0 | 1 |

| 2 | 3 | 3 | 3 | 3 | 6 | |

| 3 | 0 | 0 | 2 | 2 | 2 | |

| 4 | 0 | 0 | 1 | 1 | 1 | |

| 5 | 0 | 0 | 5 | 5 | 5 | |

From Table 17 above, the percentage of accuracy in classification (PAC) is 80%. This implies that the model correctly classified 80% of cases overall. That is 100% of the outcome yes of the variable good working conditions is predicted correctly while 72.7% of the outcome no of the variable good working conditions is predicted correctly by the fitted model.

| Table 17 Classification Table | ||||

| Observed | Predicted | |||

| Good Working Conditions | Percentage Correct | |||

| Yes | No | |||

| Good Working Conditions | Yes | 4 | 0 | 100 |

| No | 3 | 8 | 72.7 | |

| Overall Percentage | 80 | |||

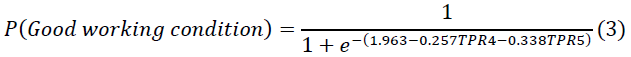

Table 18 gives information about the contribution or importance of each predictor variables. The test that is used here is known as the Wald test and the test statistic for each predictor variable is shown in the column labelled Wald. The significance of the Wald statistic for each independent variable indicates the overall Tax Consultants Capacity to implement the Transfer pricing regulations (P<0.05). The significance of the variables are assessed by the p value (represented in the table by “sig.”), the Wald’s statistic value or the odd ratios represented by

| Table 18 Tax Consultants View on GRA Capacity to Implement the Transfer Pricing Regulations | |||||||

| B | S.E. | Wald | df | Sig. | Exp(B) | ||

| Step 1a | Provided with adequate funds, materials office accommodation for TP jobs | 0.022 | 0.129 | 0.028 | 1 | 0.867 | 1.022 |

| Educations level adequate for my job | 0.019 | 0.117 | 0.025 | 1 | 0.873 | 1.019 | |

| Have Adequate training for my job | -0.094 | 0.130 | 0.527 | 1 | 0.468 | 0.910 | |

| Have a good understanding of the transfer pricing regulations | -0.257 | 0.113 | 5.144 | 1 | 0.023 | 0.774 | |

| Have adequate Time Allocated for TP Jobs | -0.338 | 0.130 | 6.805 | 1 | 0.009 | 0.713 | |

| Earned an adequate Salary to support my family | 0.087 | 0.123 | 0.502 | 1 | 0.479 | 1.091 | |

| Constant | 1.963 | 0.750 | 6.844 | 1 | 0.009 | 7.121 | |

From the table, column five (5) determines the significant predictor variables at a 0.05 level of significance. The two significant variables are Have a Good understanding of the transfer pricing regulations (TPR 4) and Have adequate Time Allocated for TP Jobs (TPR 5). Thus, the logistic function is given by the equation below:

Discussion, Conclusion and Future Research

We conclude by first discussing our findings concerning our research objectives that motivated our research, subsequently, we considered the implications of our studies.

Discussion of Findings

The result from the analysis shows that both tax officials and Multinationals have adequate facilities for the performance of their job. However, the majority of the tax consultants disagree with the statement that the tax official and staff of MNE's are provided adequate facilities to perform their work. This difference in opinion is since staffs' general do not want to speak badly about their employer and themselves. Both staff at the transfer pricing unit and MNEs indicated that they have the required level of education to commensurate the job they do. They however indicated that more training is required as it is an essential part of the efficient implementation and detection of transfer mispricing.

Even though, the tax practitioners agreed that their level of education (Tax officials and MNE's) is adequate for them to do their job. They however revealed that both the tax officials and MNE's do not have the needed training to effectively perform their work or job, as most of the tax practitioners responded that their training level on transfer pricing is not adequate to effectively perform transfer pricing duties. This confirmed what an interview with a tax manager from one of the tax consulting firm said. 'GRA may be a handicap in the application and full implementation of regulations due to inadequate staffing and training (less than 20 staff in the transfer pricing unit), materials resources, and the question of independence. Multinationals also need training on transfer pricing, in general, to help identify transfer pricing transactions to enable them to do proper filling'.

The head of the transfer pricing unit has this to say on training staff, MNE, judges and consultants have undergone some training in TP, however since training is a process they are still on as most of them still do not have on the job/practical training on how transfer pricing audit is done. The study also revealed that to be able to select the right or effective method on a transfer pricing transaction the number of resources allocated will be key. Thus, all the respondents see the number of resources allocated to the unit to be important determinants. This is since the frequency of transfers pricing audit to a large extent is also dependent on the availability of the resources. Also, the selection of an effective TP method depends on experiences gained in the audit of similar companies and transactions as this would be brought to bear on the subsequent audit. Both the tax officials and MNE's also revealed that there is difficulty in determining the arm's length price for transfer pricing transaction as the majority of the respondents agreed with the assertion. This is due to a combination of factors including the non availability of comparables, inadequate resources (materials and human) as a result tax officials find it difficult to get the best method to price related parties transactions.

The analyses also show that the main problem is obtaining information to applying the arm's length principle. This is since developing countries including Ghana have less organized players, thus finding comparable data is always difficult. Even if the comparables data are found its quality could be compromised and may also be incomplete making it difficult to analyze and interpret as resources are not adequate. Data relied on upon transfer pricing analysis are mainly from the developed countries.

This difficulty in assessing and using reliable data implies that Ghana will be unable to effectively apply transfer pricing methods that would have the characteristics of a reliable comparable’s. This could deny Ghana the right revenue and create uncertainty in the business environment. This non availability of data to the tax authorities and multinationals could result to dispute between the tax authorities and the multinationals as each might take an entrenched position. As tax negotiations and disputes resolution are also based on compromise, the non availability of comparable data will cast doubt on the skills, experience and governance framework based on which the negotiation should start. This could extend the time required to settle disputes.

As a result of the non availability of comparable data currently, the transfer pricing unit focuses its audit on few companies in the areas of interest calculation and management fees, leaving out product pricing since it depends on comparable data availability (Head TP unit Interview report, July 2016).

The ability of staff of the revenue collecting agencies to identify transfer pricing risk through general audit and flag them with the transfer pricing unit depends on the sufficiency of knowledge acquire (Read head, 2016). Thus, knowledge could be acquired through training locally and internationally with the support of international partners. Equally the experience one has in the job is important in choosing or applying any effective transfer pricing method for a transaction. The experience could be gotten through job rotations, enlargement or enrichment.

The tax officials equally revealed that multinationals are always unwilling to reveal their actual transfer pricing transaction. This is due to inadequate education and training of multinationals, non enforcement of the law through transfer price audit as a result of the smaller number of staff at the unit. To improve tax compliance, the head of the transfer pricing unit noted that, continuous education, enforcement of the law through transfer price and general tax audit and refresher training for the MNE'S, Tax consultants (Tax practitioners) and the judiciary would help (interview report of the head of transfer pricing unit).

Conclusion

This study provides a comprehensive analysis of the effectiveness of international transfer pricing methods in preventing tax abuses by multinationals in Ghana. It provides first hand information on the determinants for selecting or applying the right or effective method that will curb transfer mispricing by multinationals thereby preventing any disagreement between the tax officials and the MNEs.

Firstly, the study revealed the need for government to provide more financial and materials resources, the need for GRA to beef up the staff strength in the transfer pricing unit, offer training to all staff of the large taxpayer unit, MNEs and others relevant bodies to promote and increased compliance to the regulations.

Secondly, the study further revealed that transaction functionality, availability of arm's length comparables, tax official knowledge and experience, resource (human, financial, and materials) allocation to the unit, the frequency of transfer pricing audit that officials undertake, the knowledge of the multinationals are key determinants for selecting or applying the right or effective method that will curb transfer mispricing by multinationals thereby preventing any disagreement between the tax officials and the MNE's.

Lastly, the results also show that multinational decision making processes are influenced by their parent companies. There is, therefore, the likelihood that export oriented MNEs would use abusive transfer prices to move profits out from Ghana to achieve their organizational objectives. These empirical results are consistent with theoretical predictions.

Future Extension of this Research

Future research can investigate transfer pricing abuses in the extractive industry, as the oil and mining sector alone constitutes 66% of Ghana export. Despite this significant contribution, there are allegations of potential tax abuses that suggest tax revenue from the extractive sector could be higher.

Future research could also be conducted on the relationship between companies within the free zone area and their affiliates outside the free zone area either in Ghana or outside Ghana. This is since the MNEs located in the free zone area pay less corporate taxes less as compared to multinationals located outside the free Zone area as most of the MNEs export their products/services to the outside world.

References

- Accessed at http://www.drtp.ca/wpcontent/uploads/2015/02/Ghana_Transfer_pricing_regulations_ 2012L.I2188.pdf

- Accessed at www.mofep.gov.gh/sites/default/files/budget/2012_Budget_Speech.pdf

- Action Aid. (2011). Multinational enterprises must stop profit shifting and pay their corporate income taxes. Accessed http://www.actionaid.org/ghana/2011/12/multinational-enterprises-must-stop-profit-shifting-and-pay-their-corporate-income-tax.

- Addo, E.B., Salia, H., & Ali-Nakyea, A. (2017). Transfer pricing abuse: the Ghanaian perspective and the role of the accountant in tax compliance. Journal Akuntansi and Bussiness Research, 5(2), 83-91.

- Amidu, M., Coffie, W., & Acquah, P. (2019). Transfer pricing, earnings management and tax avoidance of firms in Ghana. Journal of Financial Crime.

- and Regulatory Changes. Accessed at

- Christian Aid. (2009). False profits: robbing the poor to keep the rich tax-free. A Christian Aid Report, Accessed at https://www.christianaid.org.uk/Images/false-profits.pdf

- Cuthill, M. (2002). Exploratory research: citizen participation, local government and sustainable development in Australia. Sustainable development, 10(2), 79-89.

- Drumm, H.J. (1983). Transfer pricing in the international firm. Management International Review, 32-43.

- Ernst & Young, L. (2013). Transfer pricing global reference guide, (February). Available at: http://www.ey.com/GL/en/Services/Tax/International-Tax/Transfer-Pricing-and-Tax-Effective-Supply-Chain-Management/2013-Transfer-pricing-global-reference-guide---Japan

- Ernst & Young. (2006). Global Transfer Pricing Surveys: Tax Authority Interviews: Perspectives, Interpretations,

- Feinschreiber, R. (2004). Transfer pricing methods: An applications guide. John Wiley & Sons.

- Ghana Revenue Authority. (2013). Practice Note on Transfer Pricing Regulations 2012 (L.I 2188): Methodologies and related issues.

- Heggmair, M., Bandoehlke, N., & Nakyea, A. (2013). International Transfer Pricing in Developing Countries: Ghana Rising. International Transfer Pricing Journal, 20(6).

- https://astro.temple.edu/~rmudambi/Teaching/BA804/FF_10/EY_GlobalTPSurvey3_Sep2006.pdf

- MOFEP (2012). Budget Statement of Ghana. Clause 85.

- Mulyani, Y. (2010). Factors influencing transfer pricing compliance: An Indonesian perspective. Unpublished PhD Thesis, University of New South Wales, Australia.

- Nakyea, A. (2012). Transfer pricing-The comfort or pain of the Multinationals. WTS-CITG, Unpublished.

- OECD, (2008). Guidelines for Multinational Enterprises. Accessed at OECD website at www.oecd.org/daf/investment/guidelines

- OECD, (2010). OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations 2010: (Serbian version), SFS, Belgrade. DOI: http://dx.doi.org/10.1787/9788691513702-sr

- OECD. (2012). Dealing Effectively with the Challenges of Transfer Pricing, OECD Publishing. http://dx.doi.org/10.1787/9789264169463-en

- Osei, E.K. (2010). Transfer Pricing in Comparative Perspective and the need for Reforms in Ghana. Transnat'l L. & Contemp. Probs, 19, 599.

- Patel, M. (1981). A Note on Transfer Pricing by Transnational Corporations. Indian Economic Review, 16(1/2), 139-152.

- Pricewaterhouse Coopers. (2011). International transfer pricing 2011. Accessed at https://www.pwc.com/gx/en/international-transfer-pricing/assets/itp-2011.pdf

- Readhead, A. (2016). Transfer Pricing in the Extractive Sector in Tanzania. Natural Resource Governance Institute.

- Saunders, M., Lewis, P., & Thornhill, A. (2009). Research methods for business students (5th edn).

- Sikka, P., & Willmott, H. (2010). The dark side of transfer pricing: Its role in tax avoidance and wealth retentiveness. Critical Perspectives on Accounting, 21(4), 342-356.

- Taylor, V.A. (2011). The Transfer Price Conundrum. International Business & Economics Research Journal (IBER), 5(11).

- United Nations. (2013). Practical Manual on Transfer Pricing for Developing Countries. New York, United Nations. Retrieved from http://www.un.org/esa/ffd/documents/UN_Manual_TransferPricing.pdf