Research Article: 2021 Vol: 25 Issue: 4

The Effects of Corporate Governance on the Association Between Corporate International Diversification and Audit Quality: Evidence from Korea

Hyun Min Oh, Sunchon National University

Abstract

This study examines the association between corporate international diversification and audit quality and the extent to which the association is affected by corporate governance. Specifically, this paper investigates whether auditors put in additional hours in accordance with the level of corporate international diversification and charge for audit fees as a result of additional effort. In addition, this paper investigates the effects of corporate governance on the association between corporate international diversification and audit quality measure. This study uses the audit hours and audit fees as our audit quality measure and also use the corporate governance score of KCGS (Korean Corporate Governance Service) as corporate governance quality measure. The empirical results of this study are as follows. The relation between corporate international diversification and audit hours are statistically significant and positive on foreign sales ratio and foreign assets ratio, respectively. Also, the relation between corporate international diversification and audit fees are statistically significant and positive on foreign sales ratio and are statistically not significant and positive on foreign assets ratio, respectively. Thus, this paper concludes that the effects of corporate international diversification on audit hours and audit fees increases for firms with higher international diversification. More corporate international diversification increase audit hours and audit fees. The effects of corporate international diversification and corporate governance on audit quality were found to increase with good corporate governance. Thus, this paper concludes that the effects of corporate international diversification and corporate governance on audit hours and audit fees increase for firms with superior corporate governance. When corporate governance is good, more corporate international diversification increases audit hours and audit fees. The results show that corporate governance can be interpreted in terms of investment that enables sustainable growth by improving corporate image and brand value in relation to international diversification, audit hours and audit fees. This study contributes to accounting research as it directly tests the effects of corporate governance on the association between corporate international diversification and audit quality in Korea, providing empirical support that good corporate governance increases the audit hours and audit fees. In addition, this study is meaningful as it presents the empirical evidence that corporate governance presents not only cost in perspective of the capital market such as the increment in costs of capital, the reduction of corporate values, but also additional costs according to the increment in audit risk.

Keywords

Corporate International Diversification, Audit Quality, Audit Hours, Audit Fees, Corporate Governance.

Introduction

The purpose of this study is to analyze the effects of corporate governance on the relationship between corporate diversification and audit hours and audit fees. Specifically, this study empirically examines whether the auditor adds additional audit hours according to the level of international diversification, and whether additional audit fees are required accordingly. In addition, we analyze the effects of corporate governance on the relationship between international diversification, audit hours and audit fees, using the corporate governance rating of Korean corporate governance structure.

Diversification refers to a strategy to expand products and markets into new field. Geringer et al. (2000) classify the diversification into product diversification and international diversification. The expanding of business is product diversification, and the expanding of business activity market is international diversification. In addition, Cha et al. (2010) define international diversification as a strategy to expand the business area to different places or markets other than the country where the firm is located. International diversification may have a negative impact on firms due to factors such as currency risks, economic crises in each country, and changes in system and tax rate policies. On the other hand, it may have a positive impact on firm by increasing the growth and profitability of the new market and by reducing the volatility. In previous research, the effect of international diversification on corporate value appears mixed.

In summary, international diversification can lead to an increase in the inherent risks and control risks of the corporation, and may act as a factor in highly evaluating the audit risk and in lowering the audit risk. The complexity of the business environment due to international diversification increases the inherent risks, and the difficulty in managing the overseas business is the factor that increases the control risk. On the other hand, the decline in volatility across the firm due to volatility offsetting of diversified investments in many countries contribute to the risk reduction. If the international diversification raises the audit risk, the auditor will make an effort to reduce the audit risk of the firm to an acceptable level. In addition, the auditor will require additional remuneration for additional audit hours. Therefore, the higher the level of international diversification, the more audit hours and audit fees can be expected.

Conversely, if the audit risk is lowered due to international diversification, the auditor will reduce the audit risk of the firm and the auditor will lessen the effort. As a result, the higher the level of diversification of firms, the lower the audit hours and the audit fees. The impact of international diversification on audit hours and audit fees may be positive or negative. In this study, we try to analyze the effect of international diversification on audit hours and audit fees.

On the other hand, firms with good corporate governance and high quality of accounting information reduce the cost of capital, which is the required rate of return of shareholders, by reducing the information cost and the agency problem. Good corporate governance not only reduces information asymmetry between business and creditors, but also reduces the cost of other capital costs due to reverse selection. As a result, firms with good corporate governance have high ratings on corporate bonds and low interest cost on debt (Na et al., 2013).

In summary, even firms with a high level of international diversification can expect to be able to mitigate the effects of information risk and agent risk if their corporate governance is superior. The mitigation of information risk and agent problems leads to the reduction of audit risks, and even for companies with a high level of international diversification, the auditor may not be required to input additional audit hours and audit fees.

Another perspective on the impact of corporate governance on international diversification, audit hours and audit fees is from a governance perspective, not from an audit risk perspective. It is possible that firms with sound governance can increase audit hours and audit fees by selecting high quality auditors to maintain better governance (Son & Yoon, 2007; Choi & Yang, 2008; Park et al., 2013). firms with good corporate governance often have good financial health, and these companies are likely to require more thorough audits to maintain good ratings in the market and thus pay more audit fees (Choi & Yang, 2008). The results of analyzing the relationship between independence, diligence, and expertise and audit fees for Fortune 1000 companies are as follows. The more independent the board, the harder it is, the more professional it is, the higher the quality of audit to protect its reputation, legal liability and shareholder interests (Carcello et al., 2010).

This study examines the effects of corporate diversification on audit hours and audit fees on firms listed on the Korea Exchange from 2005 to 2013 using empirical data. We also analyze the effect of corporate governance on the level of international diversification, audit hours and audit fees.

In previous studies, international diversification was used as a proxy for the complexity of the business environment. However, this study differs from previous studies in that it examines the interrelationships between international diversification and control mechanisms by considering corporate governance in international diversification, audit hours and audit fees. We also analyze the existence of additional costs due to the increase in audit risk as well as the cost in the capital market, such as an increase in capital cost due to international diversification and a decrease in firm value. Even though there is an effect of reducing audit risk due to international diversification, there is a suggestion to auditors, audited firms and supervisory agencies that they are paying additional costs to maintain corporate governance.

The rest of this study is as follows. In Chapter ?, we review previous studies on international diversification, audit hours, audit fees, and corporate governance. Section ? explains the hypotheses and the research methods to verify them. Section IV presents empirical results, and Section VI presents the results and limitations of the study.

Background and Hypotheses Development

International Diversification

Previous research shows that the effects of corporate diversification on audit hours and audit fees may increase or decrease. First, in terms of increasing audit hours and audit fees, firms with international diversification are more likely to become more complicated and separated from information sources because of the complexity of the business environment. In addition, the risk of auditing may increase due to the risk of exchange rate fluctuations and the difficulty of management such as overseas branch management.

Kim et al. (2012) reported that the domestic business sector is performing a disclosure on sectoral earnings or assets. However, we did not disclose detailed information on geographic or country earnings or assets for the overseas business sector, so that the accuracy of earnings estimates of financial analysts decreased as the firm diversified internationally.

On the other hand, Denis et al. (2002) found that international diversification increases the flexibility to cope with changes in the business environment that companies face. Goldberg & Heflin (1995) argue that individual benefits from diversified investments in various countries offset volatility of each other, thereby reducing the volatility of the firm’s overall earnings, leading to a reduction in capital cost. Hermalim & Katz (2003) argued that a highly performing business sector is likely to reduce its cost of equity by properly supporting poorly performing businesses and, consequently, by lowering the risk of the entire enterprise.

Since the auditor requires more conservative accounting for the business activities of the new markets that the company has pioneered, investors are more likely to appreciate the benefits of their overseas business.

In other words, when the auditor recognizes the information in the operating segment of a new market, the entity requires the entity to perform conservative accounting, which recognizes the revenue early and recognizes the costs early, until uncertainty is removed and stable (Bodnar et al., 2003). This may reduce audit risk. In summary, the impact of international diversification on audit hours and audit fees may increase or decrease. Thus, we hypothesize as follows:

H1: The level of international diversification does not affect audit hours.

H2: The level of international diversification does not affect audit fees.

Corporate Governance, Audit Hours and Audit Fees

There are two competitive hypotheses for the effect of good corporate governance on audit fees or audit hours. One is that audit fees and audit hours for firms with good governance can be further reduced because auditors can expect their audit services to be lessened by better governance benefits, including audits. The other is that firms with good governance may increase audit fees and audit hours because the auditor's audit service is meaningful as a cost to achieve better governance.

The former refers to the auditor's 'audit risk perspective' and the latter to the superior corporate governance perspective'. While the former may be an approach from the perspective of auditor's risk, the latter suggests that a firm with a good governance structure, in addition to its internal governance structure for its better governance, as well as its external governance structure, it may be related to the tendency to appoint auditors.

The audit risk perspective is that under the imperfect competitive market, information risks from information asymmetries can lead to audit risks and that audit hours and audit fees can increase if audit risks increase.

Jee & Moon (2006) analyzed whether the increase in auditor's audit risk due to corporate failure affects auditor input hours and whether audit input hours affects conservative accounting treatment.

As a result of the analysis, it was argued that the auditor 's audit hours increased as the risk of litigation increased, and that the increase in the audit hours due to the litigation risk strengthened the audit firm' s conservativeness.

The auditor can be interpreted as trying to maintain the proper audit quality in view of the risk of litigation that may arise later, and the risk that the auditor's reputation will be compromised by the lawsuit.

The corporate governance viewpoint sees the auditor's audit service as a cost to achieve better governance and sees it as part of a continuing effort to maintain confidence in the market. The more sound corporate governance, the higher the audit fees and audit hours by appointing a high quality auditor in order to have better governance (Son & Yoon, 2007; Choi & Yang, 2008; Park et al., 2013).

A firm with good governance is more likely to have good financial soundness, and a firm will require more thorough audits to maintain good ratings in the market and will pay higher audit fees (Choi & Yang, 2008). In sum, the effect of corporate governance on the relationship between international diversification and audit hours and audit fees may be strengthened in the positive direction or weakened in the negative direction. Thus, we hypothesize as follows:

H3: Corporate governance does not affect the relationship between international diversification and audit hours.

H4: Corporate governance does not affect the relationship between international diversification and audit fees.

Research Design

Regression Models

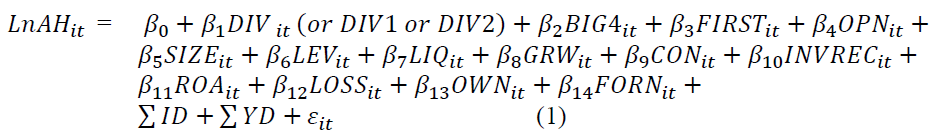

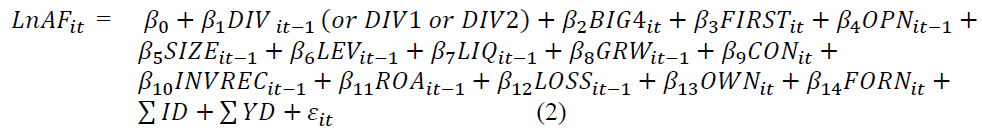

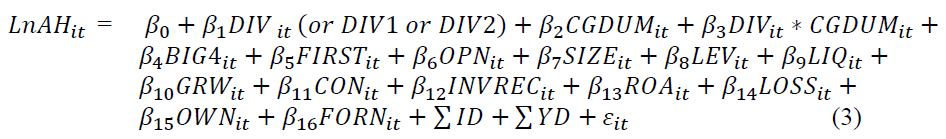

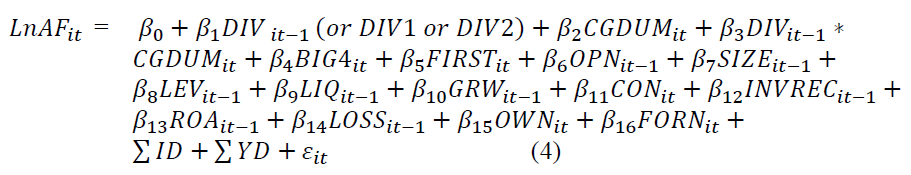

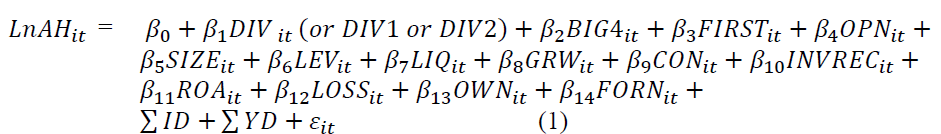

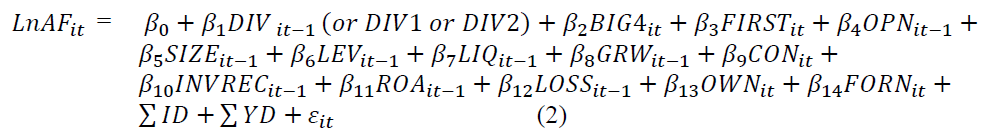

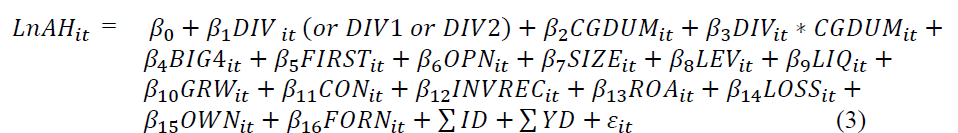

The purpose of this study is to investigate the effects of international diversification on audit fees and audit hours of auditors. In addition, we examine the effect of corporate governance on the relationship between international diversification, audit hours and audit fees. In order to verify the hypothesis of the research, the model set in this study is from Eq. (1) to Eq. (4).

Where, LnAH it = audit hours, the natural log of audit hours for firm i in year t; LnAFit = audit fees, the natural log of audit fees for firm i in year t; DIV it-1 (it) = international diversification level for firm i in year t; DIV1 it-1 (it) = international sales ratio (international sales divided by total sales); DIV2 it-1 (it) = international assets ratio (international asset divided by total asset); CG it = corporate governance, the total corporate governance (TCG) scores which are data from the KCGS (Korean Corporate Governance Service) for firm i in year t; CGDUM it = corporate governance indicator variable, an indicator variable equals to 1 if the firm has greater than total corporate governance (TCG) scores, 0 otherwise; BIG4 it = BIG4 affiliated audit firm indicator variable, l if the firm audited by a Big 4 auditor, and 0 otherwise for firm i in year t; FIRST it = initial firm, l if the firm is the initial audit firm, and 0 otherwise for firm i in year t; OPN it-1 (it) = audit opinion, 1 if an audit opinion is not unqualified opinion, and 0 otherwise for firm i in year t-1(t); SIZE it-1 (it) = frim size, the natural log of lagged total assets for firm i in year t-1(t); LEV it-1 (it) = leverage, total debt divided by total assets for firm i in year t-1(t); LIQ it-1 (it) = current ratio, current assets divided by current liabilities for firm i in year t-1(t); GRW it-1 (it) = growth rate, one-year growth rate in sales for firm i in year t-1(t); CON it = firm with consolidated financial statement, l if the firm reported consolidated financial statements, and 0 otherwise for firm i in year t-1(t); INVREC it-1 (it) = proportion of inventory plus accounts receivable to total assets, inventory plus accounts receivable divided by total assets for firm i in year t-1(t); ROA it-1 (it) = profitability, pretax income divided by total assets for firm i in year t-1(t); LOSS it-1 (it) = loss firm indicator variable , l if the firm reported negative net income, and 0 otherwise for firm i in year t-1(t); OWN it = the largest shareholders ownership for firm i in year t; FORN it = the foreign ownership for firm i in year t; ID it = industry dummy; YD it = year dummy; ??it = residuals, the estimated error in the mode

In the previous study, the variables that are known to affect audit hours and audit fees were set as control variables. The common explanatory variables considered in the model are BIG4, FIRST, OPN, SIZE, LIQ, LEV, GRW, CON, INVREC, ROA, LOSS, OWN, FORN. The industry dummy variable (ΣID) and the year dummy variable (ΣYD) were included in the model to control industry characteristics and year characteristics.

According to previous studies, audit hours and audit fees may vary depending on the size of the auditor. If the size of the auditor (BIG4) is large, the audit hour input will be increased to maintain the auditor's reputation (Park et al., 2013; Palmrose, 1989; Lee et al., 2012). Therefore, BIG4 is expected to be positive for LnAF and LnAH, respectively.

The results of this study suggest that there is a initial audit discount due to intense competition. Therefore, FIRST is added as a control variable. On the other hand, in the case of initial audit, audit hours is expected to increase as opposed to audit fees. This is because additional hours will be required to identify the audited company (Park et al., 2010). OPN, which represents the audit opinion, is a company that received an unqualified audit opinion and is highly likely to have an audit risk, so it is expected to have a positive relationship with LnAF and LnAH (Palmrose, 1986; Kwon & Ki, 2011).The size of the audited company (SIZE) and the complexity of business (CON) are important factors that determine audit input (Palmrose, 1989; Lee et al., 2012). The size (SIZE) and the complexity of business (CON) of the audited company are expected to be positive for LnAF and LnAH respectively. The debt-to-equity ratio (LEV) and the liquidity ratio (LIQ) were added to the control variables as variables related to the firm's financial health. This is also related to the auditor's audit risk. LIQ is a variable related to long-term financial health, and LIQ is a variable related to short-term financial health (Kwon & Ki, 2011). LEV is expected to be positive for LnAF and LnAH, and LIQ is expected to be negative for LnAF and LnAH.

GRW was added to the control variable as a variable indicating sales growth rate. The company with high sales growth is expected to have a positive relationship with LnAF and LnAH because of the high possibility of earnings management (Park et al., 2013; Lee et al., 2012). As the amount of inventories and accounts receivable increases, audit hours and audit fees are expected to increase due to inquiry procedures and due diligence. In order to control this effect, we add INVREC to the control variable as the share of inventory and accounts receivable in total assets.

A positive relationship is predicted for LnAF and LnAH, as there is a possibility that the audit firm's earnings will be adjusted if the ROA is low or loss occurs (LOSS) (Lee et al., 2012; Blankley et al., 2012). To control the ownership structure, the majority shareholder ownership (OWN) and foreign investor ownership (FORN) were added to the control variables.

The results of this study are as follows. First, the negative relationship of LnAF and LnAH is found when the the major shareholder ratio is high, and the positive relationship is found between LnAF and LnAH when the foreign investor ratio is high (Park and Park, 2007). We did not predict the direction of major shareholder ownership (OWN), LnAF and LnAH, and the relationship between foreign investors' ownership (FORN) and LnAF and LnAH is positive.

Sample Selection

Information on financial data was collected in the Data-Guide, and information on audit fees, audit hours and audit opinions was collected from the TS-2000 database. The proportion of exports to sales in relation to international diversification was collected from KIS-VALUE. Each variable was winsorized to a value equal to or less than 1% or 99% of the distribution. The final sample is firm-year 4,672.

Panel A of Table 1 is the distribution of the sample by year. There is no significant difference in the number of samples by year, Panel B of Table 1 shows the distribution by industry. The proportion of coke and chemical materials (12.14%) is high and the proportion of publishing, broadcasting (1.18%) is small. Panel C of Table 1 shows the average of international diversification in the PC, Medical industries accounts for 8.45% of sales and 62% of assets, which is the highest level of international diversification. In the publishing, broadcasting industries, the sales ratio is 0.04% and the asset ratio is 0.38%, which is the lowest level of international diversification.

| Table 1 Distributions of International Diversification Over the Sample Period | ||||||||

| Panel A: Distribution across fiscal years | ||||||||

| Year | N | (%) | (%) | |||||

| 2005 | 486 | 10.40 | 10.40 | |||||

| 2006 | 501 | 10.72 | 21.13 | |||||

| 2007 | 516 | 11.04 | 32.17 | |||||

| 2008 | 520 | 11.13 | 43.30 | |||||

| 2009 | 528 | 11.30 | 54.60 | |||||

| 2010 | 527 | 11.28 | 65.88 | |||||

| 2011 | 487 | 10.42 | 76.31 | |||||

| 2012 | 555 | 11.88 | 88.18 | |||||

| 2013 | 552 | 11.82 | 100.00 | |||||

| Total | 4,672 | 100.00 | 100.00 | |||||

| Panel B: Industry distribution | ||||||||

| Industry | N | (%) | ||||||

| Food, Beverage | 229 | 4.90 | ||||||

| Fiber, Clothes, Leathers | 201 | 4.30 | ||||||

| Timber, Pulp, Furniture | 211 | 4.52 | ||||||

| Cokes, Chemical | 567 | 12.14 | ||||||

| Medical Manufacturing | 264 | 5.65 | ||||||

| Rubber & Plastic | 132 | 2.83 | ||||||

| Non-Metallic | 159 | 3.40 | ||||||

| Metallic | 395 | 8.45 | ||||||

| Pc, Medical | 314 | 6.72 | ||||||

| Machine & Electronic | 347 | 7.43 | ||||||

| Other Transportation | 311 | 6.66 | ||||||

| Construction | 284 | 6.08 | ||||||

| Retail & Whole Sales | 364 | 7.79 | ||||||

| Transportation Service | 163 | 3.49 | ||||||

| Publishing, Broadcating | 55 | 1.18 | ||||||

| Professional Services | 334 | 7.15 | ||||||

| Other | 342 | 7.32 | ||||||

| Total | 4,672 | 100.00 | ||||||

| Panel C: international diversification ratio across industry | ||||||||

| Industry | N | international sales ratio (%) | international asset ratio (%) | |||||

| Food, Beverage | 229 | 0.61 | 8.46 | |||||

| Fiber, Clothes, Leathers | 201 | 2.33 | 36.97 | |||||

| Timber, Pulp, Furniture | 211 | 0.66 | 13.30 | |||||

| Cokes, Chemical | 567 | 2.42 | 35.27 | |||||

| Medical Manufacturing | 264 | 0.86 | 8.51 | |||||

| Rubber & Plastic | 132 | 2.80 | 29.11 | |||||

| Non Metallic | 159 | 0.56 | 7.12 | |||||

| Metallic | 395 | 2.29 | 28.81 | |||||

| Pc, Medical | 314 | 8.45 | 62.00 | |||||

| Machine & Electronic | 347 | 4.32 | 36.05 | |||||

| Other Transportation | 311 | 4.31 | 42.46 | |||||

| Construction | 284 | 0.29 | 6.96 | |||||

| Retail & Whole Sales | 364 | 4.53 | 28.92 | |||||

| Transportation Service | 163 | 1.10 | 33.05 | |||||

| Publishing, Broadcating | 55 | 0.04 | 0.38 | |||||

| Professional Services | 334 | 1.46 | 19.07 | |||||

| Other | 342 | 1.11 | 12.03 | |||||

| Total | 4,672 | 2.56 | 26.61 | |||||

Empirical Results

Descriptive Statistics

Table 2 is descriptive statistics of the main variables considered in the model formulas (1) - (4). The mean of LnAH is 6.998 and the median is 6.880. The mean LnAF was 11.414 and the median was 11.277. International diversification level (DIV) is 0.266 for international sales and 0.026 for international assets. The level of international diversification measured by asset ratio is low compared to the diversification level measured by the sales ratio. The average and median of CG, which indicates corporate governance quality, are 110.436 and 105, respectively, suggesting that overall corporate governance can be improved.

| Table 2 Descriptive Statistics | |||||||

| Full samples (N=4,672) | |||||||

| Variable | Mean | Std. Dev. | Min | 25th pecentile | Median | 75th pecentile | Max |

| LnAH | 6.998 | 0.783 | 5.298 | 6.461 | 6.880 | 7.409 | 9.201 |

| LnAF | 11.414 | 0.749 | 9.903 | 10.915 | 11.277 | 11.813 | 13.459 |

| DIV1 it | 0.266 | 0.304 | 0.000 | 0.000 | 0.115 | 0.501 | 0.996 |

| DIV1 it-1 | 0.263 | 0.303 | 0.000 | 0.000 | 0.112 | 0.497 | 0.996 |

| DIV2 it | 0.026 | 0.061 | 0.000 | 0.000 | 0.000 | 0.025 | 1.000 |

| DIV2 it-1 | 0.025 | 0.059 | 0.000 | 0.000 | 0.000 | 0.025 | 1.000 |

| CG | 110.436 | 26.200 | 0.000 | 94.000 | 105.000 | 121.000 | 252.000 |

| CGDUM | 0.388 | 0.487 | 0.000 | 0.000 | 0.000 | 1.000 | 1.000 |

| BIG4 | 0.718 | 0.450 | 0.000 | 0.000 | 1.000 | 1.000 | 1.000 |

| FIRST | 0.167 | 0.373 | 0.000 | 0.000 | 0.000 | 0.000 | 1.000 |

| OPN | 0.002 | 0.044 | 0.000 | 0.000 | 0.000 | 0.000 | 1.000 |

| SIZE | 19.894 | 1.572 | 17.093 | 18.713 | 19.643 | 20.809 | 24.108 |

| LEV | 0.526 | 0.247 | 0.000 | 0.329 | 0.537 | 0.709 | 0.926 |

| LIQ | 0.787 | 0.092 | 0.100 | 0.817 | 0.817 | 0.817 | 0.817 |

| GRW | 0.458 | 1.773 | 0.015 | 0.015 | 0.050 | 0.173 | 11.569 |

| CON | 0.711 | 0.454 | 0.000 | 0.000 | 1.000 | 1.000 | 1.000 |

| INVREC | 0.532 | 0.812 | 0.361 | 0.361 | 0.361 | 0.451 | 8.240 |

| ROA | 0.080 | 0.340 | 0.006 | 0.006 | 0.031 | 0.070 | 5.531 |

| LOSS | 0.217 | 0.412 | 0.000 | 0.000 | 0.000 | 0.000 | 1.000 |

| OWN | 0.426 | 0.163 | 0.019 | 0.311 | 0.426 | 0.530 | 0.820 |

| FORN | 0.109 | 0.154 | 0.000 | 0.006 | 0.039 | 0.154 | 0.892 |

Correlation Analysis

Table 3 shows the Pearson correlation coefficients between the variables used in the analysis. The correlation between the audit hour (LnAH) and the audit fee (LnAF) is 0.862, indicating a positive value. Audit hour (LnAH) and international diversification (DIV1) have a positive correlation to test Hypothesis 1 of this study. The correlation between audit fees (LnAF) and international diversification (DIV1) is positive to test the hypothesis 2. Audit hour (LnAH) and audit fees (LnAF) have a positive correlation with CGDUM, which means corporate governance quality.

Audit hour (LnAH) and audit fees (LnAF) are significantly positive with auditor size (BIG4). The larger the size of the auditor, the greater the audit hour and audit fees (Chang et al., 2011). Audit hour (LnAH) and audit fee (LnAF) are in a negative relation with the initial audit (FIRST). It can be understood that the initial audit shows a payout discount. Audit hour (LnAH) and audit fee (LnAF) are significantly positive with firm size (SIZE). The larger the size of the audited company, the greater the audit hour and audit fees. In addition, we can conclude that audit firms have a significant positive correlation with auditor hour and audit fees (Chang et al., 2011). Audit hour (LnAH) shows a significant positive relationship with OPN, LEV, GRW, CON, INVREC, ROA, and FORN, and shows a significant negative correlation with LIQ, LOSS, and OWN. Audit fees (LnAF) also show similar results.

| Table 3 Pearson Correlations | ||||||||

| PANEL A: Full samples (N=2,584) | ||||||||

| Variables | LnAH | LnAF | DIV1 | DIV1 t-1 | DIV2 | DIV2 t-1 | CGDUM | BIG4 |

| LnAF | 0.862 | |||||||

| DIV1 | -0.110 | -0.099 | ||||||

| DIV1 t-1 | -0.091 | -0.088 | 0.825 | |||||

| DIV2 | 0.373 | 0.427 | -0.019 | -0.034 | ||||

| DIV2 t-1 | -0.062 | -0.045 | 0.627 | 0.512 | 0.036 | |||

| CGDUM | -0.051 | -0.037 | 0.512 | 0.628 | 0.021 | 0.817 | ||

| BIG4 | 0.425 | 0.373 | -0.007 | -0.009 | 0.233 | -0.006 | 0.000 | |

| FIRST | -0.033 | -0.066 | 0.026 | 0.018 | 0.009 | 0.017 | 0.018 | -0.023 |

| OPN | 0.030 | 0.024 | -0.069 | -0.034 | -0.025 | 0.001 | 0.003 | -0.016 |

| SIZE | 0.679 | 0.698 | -0.120 | -0.112 | 0.429 | -0.005 | -0.040 | 0.356 |

| LEV | 0.256 | 0.275 | -0.050 | -0.022 | 0.017 | -0.037 | -0.026 | 0.111 |

| LIQ | -0.057 | -0.057 | 0.005 | 0.004 | 0.016 | -0.003 | -0.008 | -0.037 |

| GRW | 0.070 | 0.095 | 0.015 | -0.024 | 0.068 | 0.000 | -0.023 | 0.036 |

| CON | 0.376 | 0.359 | -0.018 | -0.004 | 0.103 | -0.031 | -0.023 | 0.149 |

| INVREC | 0.097 | 0.118 | 0.012 | -0.012 | 0.081 | 0.005 | -0.015 | 0.040 |

| ROA | 0.096 | 0.125 | 0.014 | -0.004 | 0.098 | 0.004 | -0.008 | 0.062 |

| LOSS | -0.021 | -0.048 | -0.016 | -0.009 | -0.154 | 0.000 | 0.006 | -0.063 |

| OWN | -0.119 | -0.152 | -0.095 | -0.058 | -0.148 | -0.101 | -0.058 | 0.034 |

| FORN | 0.296 | 0.342 | -0.047 | -0.047 | 0.292 | 0.065 | 0.035 | 0.232 |

| Variables | FIRST | OPN | SIZE | LEV | LIQ | GRW | CON | INVREC |

| OPN | -0.020 | |||||||

| SIZE | -0.041 | 0.013 | ||||||

| LEV | -0.035 | 0.022 | 0.052 | |||||

| LIQ | -0.004 | -0.016 | -0.046 | -0.149 | ||||

| GRW | -0.003 | -0.012 | -0.157 | 0.120 | 0.013 | |||

| CON | -0.044 | 0.017 | 0.379 | 0.204 | 0.025 | 0.024 | ||

| INVREC | 0.019 | -0.009 | -0.170 | 0.117 | 0.029 | 0.621 | 0.034 | |

| ROA | -0.005 | -0.015 | -0.140 | 0.062 | 0.043 | 0.595 | 0.014 | 0.772 |

| LOSS | -0.002 | 0.084 | -0.070 | 0.099 | -0.212 | -0.076 | -0.017 | -0.048 |

| OWN | 0.007 | -0.045 | -0.046 | -0.051 | -0.005 | 0.003 | -0.055 | -0.018 |

| FORN | -0.030 | -0.001 | 0.344 | -0.071 | 0.048 | 0.082 | 0.170 | 0.089 |

| Variables | ROA | LOSS | OWN | |||||

| LOSS | -0.177 | |||||||

| OWN | 0.006 | -0.053 | ||||||

| FORN | 0.169 | -0.090 | -0.056 | |||||

***, **, * denote significance at the 1%, 5%, and 10% levels, respectively (two-tailed).

Multivariate Results

Table 4 shows the regression analysis of Hypothesis 1. International diversification and audit hours showed positive direction in asset ratio (DIV1) and sales ratio (DIV2), respectively, and statistically significant. It can be understood that additional audit hours are being spent on the increased audit risk due to the international diversification of the company. The F value of the audit hour decision model appears to be statistically significant, suggesting that the setting of the study model is appropriate. The explanatory power of the model is about 61%. Across models, R2 values range from approximately 46.14 to 58.27 percent. Additionally, the F-statistic is significant, suggesting that our use of the regression model is appropriate.

| Table 4 The Effect of International Diversification on Audit Hours (H1) | ||||

| Variables | Independent Variable DIV1 | Independent Variable DIV2 | ||

| Coefficient | t-value | Coefficient | t-value | |

| INTERCEPT | 0.134 | 0.98 | 0.177 | 1.30 |

| DIV1 | 0.414 | 3.49 | ||

| DIV2 | 0.064 | 2.64 | ||

| BIG4 | 0.287 | 16.60 | 0.290 | 16.74 |

| FIRST | 0.044 | 2.28 | 0.045 | 2.32 |

| OPN | 0.228 | 1.25 | 0.207 | 1.13 |

| SIZE | 0.303 | 52.85 | 0.300 | 52.37 |

| LEV | 0.753 | 12.34 | 0.745 | 12.19 |

| LIQ | -0.025 | -0.31 | -0.019 | -0.23 |

| GRW | 0.111 | 8.91 | 0.110 | 8.86 |

| CON | 0.074 | 4.16 | 0.075 | 4.23 |

| INVREC | 0.080 | 6.80 | 0.080 | 6.80 |

| ROA | 0.201 | 3.12 | 0.197 | 3.06 |

| LOSS | 0.034 | 1.81 | 0.035 | 1.88 |

| OWN | -0.004 | -9.54 | -0.004 | -9.44 |

| FORN | 0.002 | 3.11 | 0.002 | 3.07 |

| Year dummy | Included | Included | ||

| Industry dummy | Included | Included | ||

| F-VALUE | 329.27 | 328.66 | ||

| ADJ R-SQ | 61.17% | 61.12% | ||

***, **, * denote significance at the 1%, 5%, and 10% levels, respectively (two-tailed).

Table 5 shows the regression analysis of hypothesis 2. The effect of international diversification on audit fees is shown to increase in asset ratio (DIV1) and sales ratio (DIV2). Statistical significance was only supported by (DIV1) on asset ratio and partially supported hypothesis 2. It can be understood that audit duties are required for an increased audit risk due to the international diversification of companies. The F-value of the audit-financing decision model is statistically significant, suggesting that the setting of the research model is appropriate. The explanatory power of the model is 53% for the asset weighted model and 52% for the sales weighted model. This means that the higher the level of international diversification, the more complex the business environment and the more complex accounting information. The increased possibility of separation from the source of information suggests that the quality of accounting information is likely to be weak. In addition, it can be seen that an increase in audit risk due to exchange rate fluctuations and difficulties in business management leads to an increase in audit fees and audit time.

| Table 5 The Effect of International Diversification on Audit Fees (H2) | ||||

| Variables | Independent Variable DIV1 | Independent Variable DIV2 | ||

| Coefficient | t-value | Coefficient | t-value | |

| INTERCEPT | 6.134 | 53.27 | 0.177 | 1.30 |

| DIV1 | 0.355 | 3.30 | ||

| DIV2 | 0.064 | 2.64 | ||

| BIG4 | 0.241 | 13.30 | 0.290 | 16.74 |

| FIRST | -0.055 | -2.67 | 0.045 | 2.32 |

| OPN | -0.013 | -0.06 | 0.207 | 1.13 |

| SIZE | 0.246 | 43.07 | 0.300 | 52.37 |

| LEV | 0.005 | 12.34 | 0.745 | 12.19 |

| LIQ | -0.019 | -0.31 | -0.019 | -0.23 |

| GRW | 0.001 | 8.91 | 0.110 | 8.86 |

| CON | 0.177 | 4.16 | 0.075 | 4.23 |

| INVREC | 0.041 | 6.80 | 0.080 | 6.80 |

| ROA | 0.843 | 3.12 | 0.197 | 3.06 |

| LOSS | 0.032 | 1.81 | 0.035 | 1.88 |

| OWN | -0.005 | -9.54 | -0.004 | -9.44 |

| FORN | 0.005 | 3.11 | 0.002 | 3.07 |

| Year dummy | Included | Included | ||

| Industry dummy | Included | Included | ||

| F-VALUE | 234.07 | 214.09 | ||

| ADJ R-SQ | 53.27% | 52.02% | ||

***, **, * denote significance at the 1%, 5%, and 10% levels, respectively (two-tailed).

Table 6 shows the regression analysis of hypothesis 3. The effect of corporate governance on the relationship between international diversification and audit hour reinforced auditing hour in the direction of positive (+) direction. However, statistical significance was only supported by DIV2, which partially supported hypothesis 3. Corporate governance implies increasing audit hour in relation to international diversification and audit hour. The effect of corporate governance on international diversification and audit hour can be seen to be consistent with the viewpoint of corporate governance rather than the auditor 's audit risk perspective. A firm with a good governance structure has a differentiated auditing demand in order to build a better corporate governance structure. In order to meet the different auditing demands of a corporation seeking superior governance, it is necessary to increase the input of audit hour, which is an economic resource of the auditor (Kim and Kim, 2012).

| Table 6 The Effects of Corporate Governance on the Association Between Corporate International Diversification and Audit Hours (H3) | ||||

| Variables | Independent Variable DIV1 | Independent Variable DIV2 | ||

| Coefficient | t-value | Coefficient | t-value | |

| INTERCEPT | 0.373 | 2.63 | 0.518 | 3.64 |

| DIV1 | 0.375 | 2.80 | ||

| CGDUM | 0.099 | 5.35 | ||

| CGDUM*DIV1 | 0.224 | 0.86 | ||

| DIV2 | -0.023 | -0.77 | ||

| CGDUM | 0.043 | 2.06 | ||

| CGDUM*DIV2 | 0.258 | 5.38 | ||

| BIG4 | 0.281 | 16.26 | 0.287 | 16.62 |

| FIRST | 0.044 | 2.30 | 0.046 | 2.37 |

| OPN | 0.253 | 1.39 | 0.257* | 1.42 |

| SIZE | 0.289 | 46.71 | 0.282 | 45.30 |

| LEV | 0.759 | 12.48 | 0.753 | 12.39 |

| LIQ | -0.033 | -0.41 | -0.023 | -0.29 |

| GRW | 0.107 | 8.58 | 0.104 | 8.44 |

| CON | 0.083 | 4.69 | 0.089 | 5.01 |

| INVREC | 0.075 | 6.37 | 0.071 | 6.06 |

| ROA | 0.197 | 3.05 | 0.199 | 3.11 |

| LOSS | 0.045 | 2.45 | 0.047 | 2.55 |

| OWN | -0.004 | -8.52 | -0.004 | -8.30 |

| FORN | 0.001 | 2.48 | 0.001 | 2.59 |

| Year dummy | Included | Included | ||

| Industry dummy | Included | Included | ||

| F-VALUE | 305.66 | 308.33 | ||

| ADJ R-SQ | 61.45% | 61.87% | ||

***, **, * denote significance at the 1%, 5%, and 10% levels, respectively (two-tailed).

Table 7 shows the regression analysis of Hypothesis 4. The effects of corporate governance on the relationship between international diversification and audit fees are reinforced by positive direction of audit fees, supporting Hypothesis 4. This implies that corporate governance plays a role in increasing audit fees in the relationship between corporate diversification and audit fees. The effect of corporate governance on international diversification and audit fees can be seen to be consistent with the viewpoint of corporate governance rather than the auditor 's audit risk perspective. This is because companies with good governance have differentiated auditing needs to build better governance structures. Audit fees can be seen to be paid to auditors with high audit quality (Park et al., 2013; Choi and Yang, 2008). In spite of the fact that audit risks such as inherent and control risks can be reduced by establishing an excellent corporate governance structure in Korea's capital market, it was found that audit hours and audit fees were increased. This means that firms with superior corporate governance are more interested in building credibility in the capital market. This is an empirical result showing that companies with excellent corporate governance make efforts to improve the quality of financial statements by increasing audit hours and audit fees at Korean text.

| Table 7 The Effects of Corporate Governance on the Association Between Corporate International Diversification and Audit Fees (H4) | ||||

| Variables | Independent Variable DIV1 | Independent Variable DIV2 | ||

| Coefficient | t-value | Coefficient | t-value | |

| INTERCEPT | 6.573 | 56.17 | 6.789 | 56.28 |

| DIV1 | 0.229 | 1.97 | ||

| CGDUM | 0.227 | 12.23 | ||

| CGDUM*DIV1 | 0.742 | 2.92 | ||

| DIV2 | -0.071 | -2.22 | ||

| CGDUM | 0.168 | 7.57 | ||

| CGDUM*DIV2 | 0.296 | 5.79 | ||

| BIG4 | 0.217 | 12.15 | 0.223 | 12.32 |

| FIRST | -0.054 | -2.68 | -0.055 | -2.72 |

| OPN | -0.024 | -0.12 | -0.035 | -0.17 |

| SIZE | 0.218 | 36.89 | 0.208 | 34.06 |

| LEV | 0.006 | 2.04 | 0.005 | 1.65 |

| LIQ | -0.022 | -5.35 | -0.022 | -5.20 |

| GRW | 0.001 | 2.31 | 0.001 | 2.19 |

| CON | 0.188 | 10.57 | 0.198 | 11.01 |

| INVREC | 0.033 | 3.42 | 0.034 | 3.60 |

| ROA | 0.778 | 16.38 | 0.775 | 16.06 |

| LOSS | 0.061 | 3.28 | 0.064 | 3.36 |

| OWN | -0.004 | -9.57 | -0.005 | -9.48 |

| FORN | 0.004 | 6.65 | 0.004 | 6.54 |

| Year dummy | Included | Included | ||

| Industry dummy | Included | Included | ||

| F-VALUE | 232.05 | 215.38 | ||

| ADJ R-SQ | 55.21% | 54.24% | ||

***, **, * denote significance at the 1%, 5%, and 10% levels, respectively (two-tailed).

Conclusion

This study analyzed the effect of international diversification of audited company on audit hour and audit fees. In addition, we examined the effect of corporate governance on the relationship between audit diversification, audit hour and audit fees, using the score of KCGS (Korean Corporate Governance Service) as a measure of corporate governance.

In this study, two perspectives on the effect of international diversification on audit hours and audit fees are presented and verified. One is the view that the international diversification of the company raises the audit risk and increases the audit hours and the audit fee. The other is the view that the international diversification of the company reduces the audit risk and reduces the audit hours and audit fees.

Two perspectives on the effects of corporate governance on the relationship between international diversification and audit hours and audit fees were also presented and verified. One is that corporate governance reduces audit hours and audit fees by lowering audit risk. Another is to increase audit hours and audit fees in terms of corporate governance to maintain good corporate governance.

On the other hand, in terms of corporate governance, firms with good corporate governance require conservative audits to maintain market confidence, which can lead to increases in audit hours and audit fees.

This study analyzed 4,672 business - year data from 2005 to 2013. As a result, audit hours and audit fees increased as the level of corporate diversification increased. The impact of corporate governance on the relationship between international diversification and audit hours and audit fees has strengthened the positive direction. Even if international diversification lowers audit risks, companies with good corporate governance are concerned about the quality of financial reporting in order to maintain market confidence. As a result of continuous efforts to relieve the information asymmetry and ensure the reliability of the audit report, the auditor is paid more audit fees and additional audit hours is taken.

This study is different from the previous studies in that it examines the effects of corporate governance on the relationship between international diversification and audit hours and audit fees at Korean text. The results show that there may be additional costs due to the increase of audit risk as well as capital market related costs such as increase of capital cost due to international diversification of corporate governance, decrease of firm value. Even though there is an effect of reduction of audit risk due to international diversification, there is a suggestion to stakeholders such as auditors, audited companies and supervisory authorities that they are paying additional costs to maintain market confidence. In other words, corporate governance can be interpreted in terms of investment that enables sustainable growth by improving corporate image and brand value in relation to international diversification, audit hours and audit fees. In addition, we analyzed the effects of corporate governance on international diversification by using the score of KCGS (Korean Corporate Governance Service). KCGS' corporate governance evaluation score data complies with international standards, which is distinct from subjective corporate governance measures. This study shows that companies with excellent corporate governance make more efforts to build trust in the capital market even if they pay additional audit fees.

The limitations of this study are as follows: First, there may be a problem of omitted variables that may further affect audit fees and audit hours. Second, due to difficulties in data collection, various substitutes for international diversification and corporate governance were not available. Future research using various measures of international diversification and corporate governance will be expected in the future.

Appendix 1. Variable Definitions for H1, H2, H3 AND H4

Dependent Variables

LnAH it = Audit hours, the natural log of audit hours for firm i in year t

LnAF it = Audit fees, the natural log of audit fees for firm i in year t

Explanatory Variables

DIV it-1 (it) = international diversification level for firm i in year t-1 (t)

DIV1 it-1 (it) = international sales ratio, international sales divided by total sales for firm i in year t-1 (t)

DIV2 it-1 (it) = international assets ratio, international asset divided by total asset for firm i in year t-1 (t)

DIV it-1 (it)* = Interaction variables between DIV and CGDUM for firm i in year t-1 (t)

CGDUM

DIV1 it-1 (it)* = Interaction variables between DIV1 and CGDUM for firm i in year t-1 (t)

CGDUM

DIV2 it-1 (it)* = Interaction variables between DIV2 and CGDUM for firm i in year t-1 (t)

CGDUM

Control variables

CG it Corporate Governance, the total corporate governance (TCG) scores which are data from the Korea Corporate Governance Service (KCGS)

CGDUM it for firm i in year t corporate governance indicator variable, an indicator variable equals to

BIG4 it 1 if the firm has greater than total corporate governance (TCG) scores, 0 otherwise

FIRST it Big 4 affiliated audit firm indicator variable, l if the firm audited by a

OPN it-1 (it) Big 4 auditor, and 0 otherwise for firm i in year t

SIZE it-1 (it) Initial audit, l if the firm is the initial audit firm, and 0 otherwise for firm i in year t;

LEV it-1 (it) audit opinion, 1 if an audit opinion is not unqualified opinion, and 0

LIQ it-1 (it) otherwise for firm i in year t-1(t);

GRW it-1 (it) firm size, the natural log of lagged total assets for firm i in year t-1(t);

CON it leverage, total debt divided by total assets for firm i in year t-1(t);

current ratio, current assets divided by current liabilities for firm i in year t-

INVREC it-1 (it) 1(t);

growth rate, one-year growth rate in sales for firm i in year t-1(t);

ROA it-1 (it) firm with consolidated financial statement, l if the firm reported

LOSS it-1 (it) consolidated financial statements, and 0 otherwise for firm i in year t-1(t);

OWN it proportion of inventory plus accounts receivable to total assets,

FORN it inventory plus accounts receivable divided by total assets for firm i in

YD year t-1(t);

ID profitability, pretax income divided by total assets for firm i in year t-1(t); loss firm indicator variable, l if the firm reported negative net income, and 0 otherwise for firm i in year t-1(t); ownership for the firm in year t foreign ownership for the firm in year t year dummy industry dummy.

References

- Blankley, A.I., Hurtt, D.N., & MacGregor, J.E. (2012). Abnormal audit fees and restatements. Auditing: A Journal of Practice & Theory, 31(1), 79-96. https://doi.org/10.2308/ajpt-10210.

- Bodnar, G.M., Hwang, L.S., & Weintrop, J. (2003). The value relevance of foreign income: an Australian, Canadian, and British comparison. Journal of International Financial Management & Accounting, 14(3), 171-193. https://doi.org/10.1111/1467-646x.00095.

- Carcello, J.V., Hermanson, D.R., Neal, T.L., & Riley Jr, R.A. (2002). Board characteristics and audit fees. Contemporary accounting research, 19(3), 365-384. https://doi.org/10.2139/ssrn.231582.

- Cha, S., Chung, J., & Yoo, Y. (2010). Corporate international diversification and cost of equity capital: Korean Evidence. Korean Management Review, 39, 157-175. [printed in Korean], http://www.riss.kr/search/detail/DetailView.do?p_mat_type=1a0202e37d52c72d&control_no=75f8a3099cd0c0e2ffe0bdc3ef48d419.

- Chang, S.J., Lee, M.G., & Cho, H.S. (2011). The Effect of Volatility of Earnings Management and Level of Income Smoothing on Audit Hours and Audit Fees. Study on Accounting, Taxation and Auditing, 53(2), 241-271, [printed in Korean], http://www.riss.kr/search/detail/DetailView.do?p_mat_type=1a0202e37d52c72d&control_no=1d0b3f9c04efdd45ffe0bdc3ef48d419.

- Choi, J.H., & Yang, H.S. (2008). An Examination on the Relationship between Corporate Governance, Audit Fees, and Audit Hours. Accounting Information Research, 26(1), 59-77, [printed in Korean], http://kiss.kstudy.com/thesis/thesis-view.asp?key=2679762.

- Denis, D.J., Denis, D.K., & Yost, K. (2002). Global diversification, industrial diversification, and firm value. Journal of Finance, 57(5), 1951-1979. https://doi.org/10.2139/ssrn.244721.

- Geringer, J.M., Tallman, S., & Olsen, D.M. (2000). Product and international diversification among Japanese multinational firms. Strategic Management Journal, 21(1), 51-80. https://doi.org/10.1002/(sici)1097-0266(200001)21:1<51: aid-smj77>3.0.co;2-k.

- Goldberg, S.R., & Heflin, F.L. (1995). The association between the level of international diversification and risk. Journal of International Financial Management & Accounting, 6(1), 1-25. https://doi.org/10.1111/j.1467-646x.1995.tb00047.x.

- Hermalim, B.E., & Katz, M.L. (2003). Retail Telecommunications Pricing in the Presence of External Effects. Traditional Telecommunications Networks—The International Handbook of Telecommunications Networks, 1, 180-231. https://doi.org/10.4337/9781781950630.00015.

- Jee, H.M., & Moon, S.H. (2006). The effect of litigation risk on audit hours and conservatism. Study on Accounting, Taxation & Auditing, 43, 311-336. [printed in Korean], http://www.riss.kr/search/detail/DetailView.do?p_mat_type=1a0202e37d52c72d&control_no=745664b8d9e7d3f9ffe0bdc3ef48d419.

- Kim, D.Y., & KIM, Y.I. (2012). A Study on Effects of Corporate Governance on Audit Fees and Audit Hours. Korean Corporation Management Review, 19(5), 247-265, [printed in Korean], http://kiss.kstudy.com/thesis/thesis-view.asp?key=3108957.

- Kim, M.I., An, H.T., & Kim, J.D. (2012). The impact of international diversification on value relevance of earnings. Korean Accounting Review, 37(4), 157-193. [printed in Korean], http://kiss.kstudy.com/thesis/thesis-view.asp?key=3117027.

- Kwon, S.Y., & Ki, Y.S. (2010). The Effect of accruals quality on the audit hour and audit fee. Korean Accounting Review, 36(4), 95-137.

- Lee, M.G., Chang, S.J., & Park, H.J. (2012). The effects of unfaithful disclosure on audit hours and audit fees. Korean Accounting Journal, 21(6), 1-30. [printed in Korean], http://kiss.kstudy.com/thesis/thesis-view.asp?key=3117009.

- Lee, M.G., Chang, S.J., & Cho, S.M. (2012). The Adoption of International Financial Reporting Standards (IFRS), Audit Hours and Audit Fees. Study on Accounting, Taxation and Auditing, 54(2), 473-504, [printed in Korean], http://www.riss.kr/search/detail/DetailView.do?p_mat_type=1a0202e37d52c72d&control_no=5d65a6feca169cf9ffe0bdc3ef48d419.

- Na, Y., Leem, W.B., & Kim, M.S. (2013). An Empirical Analysis on ESG Performance Information and Cost of Debt Capital. Accounting Information Research, 31(1), 453-487, [printed in Korean], http://kiss.kstudy.com/thesis/thesis-view.asp?key=3134953.

- Palmrose, Z.V. (1989). The relation of audit contract type to audit fees and hours. Accounting Review, 488-499. https://www.jstor.org/stable/247601.

- Park, J.I., Shin, J.Y., & Suh, C.W. (2013). The Effect of Corporate Governance on the Audit Fees and Audit Hours. Korean Acconting Association, 2, 273-314, [printed in Korean], http://riss.kr/search/detail/DetailView.do?p_mat_type=1a0202e37d52c72d&control_no=a80297f909377182ffe0bdc3ef48d419.

- Park, J., Kim, S., & Cho, E. (2010). A study on auditor changes and initial audit fee discount. Journal of Taxation and Accounting, 11(2), 103-132. [printed in Korean], http://kiss.kstudy.com/thesis/thesis-view.asp?key=3163156.

- Park, J.I., & Park, C.W. (2007). The effect of abnormal audit fees and audit quality on abnormal audit hours. Korean Taxation and Accounting, 10(3), 265-301. [printed in Korean], http://www.riss.kr/search/detail/DetailView.do?p_mat_type=1a0202e37d52c72d&control_no=f3009a74d8e9c5d4ffe0bdc3ef48d419.

- Sohn, P.S., & Yoon, H.D. (2007). The empirical study on the relation between corporate governance and audit fees. Korean Journal of Business Administration, 20(6), 2667-2686. [printed in Korean], http://scholar.dkyobobook.co.kr/searchDetail.laf?barcode=4010021485931.