Review Article: 2023 Vol: 26 Issue: 6S

The Effects of Fintech Adoption on Banking Industry′s Performance: Literature Review

Hajar Mohammad Alhosseiny, Misr University for Science and Technology

Citation Information: Alhosseiny, H.M. (2023). The effects of fintech adoption on banking industry’s performance: literature review. Journal of Entrepreneurship Education, 26(S6), 1-10.

Abstract

Despite the fact that in most markets banks and other traditional financial institutions continue to be the main source of capital for businesses and households, new financial intermediaries have recently come onto the scene and gained popularity. The traditional business models of banking systems have been considerably influenced by the development of fintech (financial technology). In numerous financial domains, including credit, deposits, capital-raising, payments, and investments, financial technology is now prevalent. The objective of this study is to clarify the effects of Fintech adoption on the performance of the banking industry in the GCC countries. It is a qualitative secondary study depends on collecting existing data from different sources.

Keywords

Fintech, Banking Performance, GCC Countries.

Introduction

In terms of globalization and sophisticated technology, the idea of FinTech has been successful, bringing advantages and challenges to the various facets of finance. In addition to being seen as an emerging field that has offered to save costs and increase performance in each firm in which it is involved, financial technology (FinTech) has gained recognition for its innovative methodologies. FinTech can be viewed from a variety of angles, particularly when it comes to money and, more especially, the banking sector (Abbas & Shaheen, 2021).

The discovery of firms using innovation in budgetary arrangements, such as banking, financial installment, and personal budget management, will change this. Using these associations, FinTech businesses hope to draw customers with services and products that are simpler, more efficient, and computerized than those that are currently offered (Abbas & Shaheen, 2021).

FinTech refers to businesses that use cutting-edge and creative technologies into their budgetary administrations. The different segments can increase the effectiveness of their budgetary framework through financial innovation (Abbas & Shaheen, 2021). At its core, the growth of this industry can be linked to technological solutions to the shortcomings of traditional banks and other traditional providers of financial services (AlHares, et al., 2022).

Customers can choose from a wide range of modern and innovative financial services and products thanks to fintech companies. Peer-to-peer lending and mobile payments are only two examples of the new financial services that FinTech service providers have created while disrupting the traditional financial services provided by existing banks. By doing this, they compete with banks in similar market segments and businesses, but they engage with a bigger clientele and offer financial services that are simple to use and affordable. FinTech businesses have developed into a strong competitive force in the banking industry due to the benefits they offer to customers (AlHares et al., 2022).

The ways that FinTech companies affect the financial stability of banks must be taken into account. It's probable that increased competition may worsen banks' financial soundness, but it's also plausible that it will improve it (AlHares et al., 2022).

A substantial amount of research has been done on the subject of how market competition impacts the stability of bank. However, it is unknown whether or to what extent these newcomers have an impact on the financial stability of banks in the Gulf Cooperation Council (GCC) nations.

The objective of this study is to clarify the effects of Fintech adoption on the performance of the banking industry in the GCC countries through reviewing the literature.

Fintech and Bank performance

Fintech has a significant impact on the financing industry, but many wonder if this impact will provide a threat to or an opportunity for the banking sector. The banking sector needs to be able to keep up with the current wave of technological progress. This is due to the possibility of banks going out of business if they cannot compete with Fintech companies (Alsmadi et al., 2023).

One of the threats for the domestic banking sector is the growth of Fintech. The majority of big bank respondents thought that fintech will be a serious threat during the next five years (Alsmadi et al., 2023).

It is hypothesized that people's rising preference for using digital transactions as a means of transacting benefits the existence of Fintech.

One the one hand, numerous studies have lauded fintech for its potential to improve financial services by raising the level of customer satisfaction and streamlining business processes, making transactions more affordable, secure, and comfortable (Nguyen et al., 2022).

On the other side, the growth of fintech could have an impact on the banking industry, as suggested by the consumer hypothesis and the disruptive innovation hypothesis. According to the first theory, current financial institutions' incumbent services can be replaced by fintech-provided services if they can meet similar consumer expectations. The disruptive innovation theory states that new market entrants that use novel technology to offer more readily available and affordable services face intense competition from established players (Nguyen et al., 2022).

According to several studies, commercial banks may have difficulties as a result of the expansion of information technology because these institutions take longer to adapt to new technologies. Because fintech credit is less strictly regulated and has superior technological advantages, traditional institutions have lost market share to it. When compared to conventional credit institutions, FinTech’s process loan applications are more quickly and without increasing credit risks (Nguyen et al., 2022).

According to Alsamdi, Alrawashdeh, Al-Gasaymeh, Al-Malameh, & Al_hazimeh (2023), the use of digital channels for financial transactions has increased. Smartphone apps were innovative five years ago, but they are now widely used. hence, Fintech has a fantastic opportunity here. Banks that don't make changes promptly run the risk of falling behind. In addition, they found that fintech can offer a range of services that conventional banks cannot. Peer-to-peer (P2P) lending reduces the time and effort involved in applying for and paying loans. Instead of physically visiting the company, customers can request for credit online. Moreover, Public access to loan funds is another aspect of financial inclusion, and fintech promotes this by connecting people who have money to lend (lenders) with those who need it (borrowers) via the internet.

Another crucial element that receives a lot of assistance from Fintech is microfinance. Banking sector can offer microloans more successfully with the use of Fintech. Because of mobile banking, people who have access to smartphones can raise microloans for their small companies and home renovations via Fintech applications provided by banks. However, having a smartphone is not required in order to participate in fintech (Alsmadi et al., 2023).

Fintech would therefore be suited for nations where a sizable portion of the population lacks the knowledge, skills, and cellphones needed to use Fintech applications. In reality, agency banking supports these individuals and makes it easier for them to raise microloans for both personal and professional purposes.

Additionally, fintech lending is more capable of refinancing and responds more elastically to demand-side shocks. Fintech significantly reduces the long-term and distinctive advantages of commercial banks in terms of payment settlement by enabling mobile payments at substantially lower prices. Moreover, cloud computing supports payments more effectively and can store and manage client data more effectively (Nguyen et al., 2022).

According to Temelkov (2018), the existence of P2P lending Fintech would not cause the demise of traditional financial institutions (banks). This is so that the two financial institutions can work together and support one another through channeling.

In the ideal situation, Fintech is not a threat; in fact, it can present banks with an opportunity to grow their business and increase their market share in the financial sector.

The need for cooperation between banking and Fintech was recognized by Sgro et al. (2019), who asserted that both organizations share the same objective of enhancing financial inclusion. Financial technology may be combined with powerful bank expertise and resources, as well as the flexibility of Fintech enterprises themselves. The most important thing is that the local economy runs more smoothly, openly, and quickly. They also noted that in order to appeal to the general public, especially young people, banks must increase the speed of their banking services and devise fresh, creative ways to run effective (Alsmadi et al., 2023).

In order to work with the Fintech revolution, banks must first have the confidence to build a strong digital infrastructure. This infrastructure is necessary for extending the connectivity to previously inaccessible places. To prevent inhibiting technological advancement, banks should also improve the quality of their staff (HR) (Alsmadi et al., 2023).

Fintech companies, for instance, should focus on areas of customer safety and comfort in addition to being more flexible with banking by frequently providing training and education in digital technology (Alsmadi et al., 2023).

According to Thakor (2020), who highlighted the link between Fintech and banking industry performance, the banking sector has enhanced its operations as a result of technological innovation. Additionally, Wonglimpiyarat (2017) thought that the use of Fintech in the banking sector had greatly raised the customer satisfaction rate over the previous several decades. Navaretti et al. (2018) conducted study on the relationship between Fintech and banking sector performance and found that there is a considerable positive correlation between the two factors. Banks are able to shorten the amount of time it takes to conduct a transaction thanks to the use of Fintech.

Relevantly, Kaur & Dogra (2019) suggested that because banks have always been linked to Fintech, banking financial services could expand. In contrast, Siek & Sutanto (2019) suggested that, despite improving bank performance, Fintech actually damages the banking sector from a financial and market share viewpoint.

Similar thinking was expressed by Navaretti et al. (2018), who claimed that while the development of fintech enables small enterprises to provide financial services to the general public, it also slows the growth of the banking sector's consumer base. According to Thakor (2020), consumers must fulfil a specific set of eligibility requirements in order to use banking services. Contrarily, simply using their own mobile devices, private Fintech companies let users open accounts using their identity cards and biometric verification. In this approach, consumers favor the services of private Fintech companies over those of banks due to convenience.

In light of these circumstances, it is evident that fintech companies generally have the ability to influence bank performance in either direction.

According to a study done in the GCC countries, banks are the organizations that are most wary about competition from FinTech firms. It can be argued that any business that makes use of innovative technology to provide previously bank-only services, like lending, payments, or investments, has the potential to one day compete with traditional banks and, as a result, have an impact on how well banks perform their duties. Despite how closely related the financial industry and information technology have become, very few studies have looked at how technology is used in financial services and the connection between the performance of banks and the growth of FinTech startups (AlHares et al., 2022).

Global and Arab investments in FinTech:

Global investment in FinTech reached $98 billion across 2,456 transactions in the first half of 2021, far exceeding the total investment in 2020 of $121.5 billion across 3,520 transactions. According to KPMG's Pulse of Fintech, a semi-annual analysis on fintech investment trends, global FinTech funding across mergers and acquisitions, private equity, and venture capital increased to a new high in the first part of 2021. Comparing the second half of 2021 to prior periods, it is anticipated that overall investment in FinTech will remain high. Due to the rise in electronic attacks around the world, it is anticipated that as the number of digital transactions rises, so will the demand for new B2B and banking service models, electronic control systems, and cybersecurity. Global investment in cybersecurity also reached a significant amount in the first half of 2021, increasing from $2.2 billion in 2020 to more than $3.7 billion. Fintech investments in Europe, the Middle East, and Africa totaled $39.1 billion in the first half of 2021 (Rahman, Rahiman, Meero, & Amin, 2022).

The Status of FinTech in GCC Countries

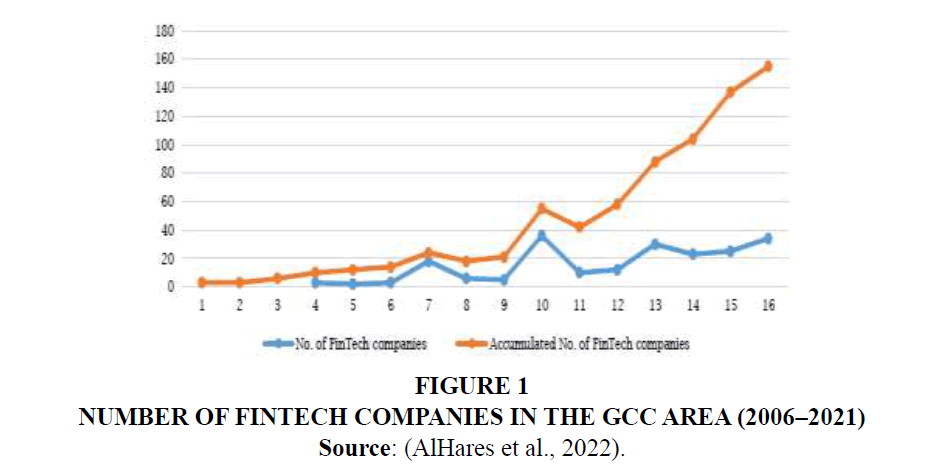

Companies that use FinTech to offer financial services have grown in importance in both developed and developing countries. From $11 billion in 2010 to $220 billion in 2021, the total amount invested globally in FinTech increased. It is vital to remember that more than half of the top 100 cities in the world for financial technology are situated in developing nations Figure 1. (AlHares et al., 2022).

1-Kuwait

As a wealthy Middle Eastern nation with highly educated citizens and a cutting-edge technology infrastructure, Kuwait has a much more tech-savvy populace than many other developing nations (Rabaa'i, 2022).

It also has one of the highest rates of internet and mobile penetration globally. However, Kuwait needs to improve its economic attractiveness and competitiveness in order to compete with its GCC neighbors like Bahrain and the UAE. The result was the introduction of Kuwait Vision 2035 by the Kuwaiti government. By digitalizing the economy and diversifying away from oil, which now accounts for 90% of the country's national production, this strategy seeks to increase Kuwait's competitive standards (Rabaa'i, 2022).

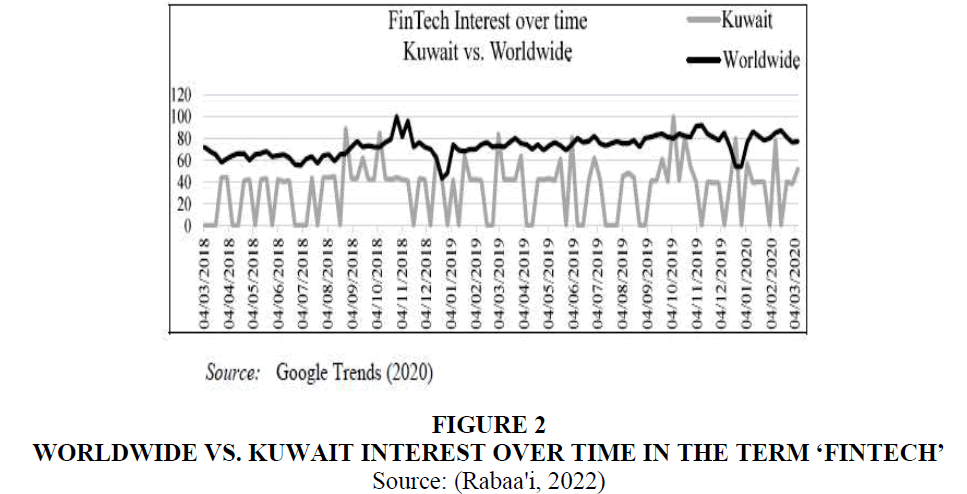

Developing a new dynamic ecosystem of various public sector organizations, private companies, and FinTech entrepreneurs. As a result, the CBK introduced its "FinTech regulatory sandbox" in 2018, allowing Kuwaiti business owners to test cutting-edge software products and services in a secure environment. Since FinTech is still in its infancy, Kuwait should pay special attention to it. Figure 2 depicts Google Trends' global versus Kuwaiti interest over time for the phrase "FinTech," from 4 March 2018 to 4 March 2020 (Rabaa'i, 2022).

According to a KFAS (Kuwait Foundation for the Advancement of Sciences) survey on FinTech and the future of financial services, more than 50% of Kuwaitis between the ages of 15 and 39 are comfortable accepting technology advancements. Moreover, almost. In comparison to 33% for the Middle East area and 54% globally, 70% of people who are between the ages of 15 and 24 have a banking relationship. Digitally literate, expecting on-demand services, turning to the internet first, and unafraid to switch to a better platform, Kuwait's young population is not averse to change (Rabaa'i, 2022).

Kuwait's youthful generation's expectations of financial institutions, such banks, have drastically changed as a result of their preference for digital services that complement other products they use and meet their demands with the least amount of friction. They are seeking a digital solution that would support their e-commerce needs by enabling quick account opening, access to loyalty programs, incentives, and discounts, prudent savings plans, and dependable mobile payment solutions (Rabaa'i, 2022).

Furthermore, KFAS's (2019) study highlighted a number of intriguing statistical findings related to the willingness and acceptance of FinTech products and services, such as: mobile penetration stands at 146.6% - it is noticeably higher than most developed countries and the world average of 64.5%; ownership of smartphones is also high at 99.7% of households; mobile network infrastructure is well-developed and 100% of land area and population is covered; and 4G LT is available in 100% of the population and coverage is 100% of the land area (Rabaa'i, 2022).

In fact, due to its influence on consumer spending across the GCC, Kuwait is one of the most intriguing markets in the Middle East and North Africa area.

Kuwait is among the best rates of new technology adoption and highest income per user for IT companies while being a small market (Rabaa'i, 2022).

To adhere to what were described as "global best practices," the CBK presented a set of FinTech efforts to "renovate and modernize the IT infrastructure" of Kuwait's current financial systems. These programs comprise (Rabaa'i, 2022):

1. The Kuwait National Payment System (KNPS), which uses a number of secure gateways to improve the payment system.

2. The infrastructure for digital currency, which intends to create the required infrastructure for the projected issuance of digital currencies and Digital Kuwaiti Dinars (KD).

3. The government's electronic banking system, which is already operational and is being pushed out to all government agencies, intends to increase efficiency by phasing out manual procedures and carrying out all government transactions electronically.

4. The introduction of a regulatory sandbox framework with the goal of giving FinTechs a monitored and secure environment in which to test new goods and services

Banks and financial services are crucial to Kuwait's economy given the Kuwait 2035 Vision objectives to diversify the country's income away from oil and to develop it into a commercial, cultural, and financial hub in the region (Rabaa'i, 2022).

In Kuwait, Companies offering Shared Automated Banking Services (KNET) in Kuwait give financial technology firms access to the necessary infrastructure to receive electronic payment services for their offered goods and services, such as the electronic payment gateway (Magdy Rezk & Halim, 2022).

Saudi Arabia

The largest GCC country, Saudi Arabia, has undergone significant change in such a short period of time. Numerous causes have contributed to these alterations. The Kingdom of Saudi Arabia is undergoing significant economic development transmogrification, according to the findings of the report "FinTech: Middle East and Africa 2021" published by The FinTech Times. These transmogrifications are centered around Saudi Vision 2030, the country's long-term national economic development strategy. Some elements, like its financial services industry and digital transmogrification in general, have been given priority as a result of this. The Financial Sector Development Program (FSDP), one of its earliest delivery initiatives, aimed to develop Saudi Arabia's financial services sector into one that was not only solid but also innovative and distinctive (AlHares et al., 2022).

Due to this, the Saudi Arabian Monetary Authority (SAMA) established the FinTech Saudi catalyst, which was unveiled in 2018. Accelerating the growth and maturity of the FinTech sector in the Kingdom of Saudi Arabia is its main goal. Not only is it expanding Saudi Arabia's FinTech ecosystem and furthering the digitization of financial services, but it is also hastening financial inclusion for the country's unbanked and underbanked populations. After doing research, SAMA and a number of other organizations, working with the World Bank Group and the G20 Global Partnership for Financial Inclusion (GPFI), came to the conclusion that the youth, women, and SMEs are the three categories that most urgently need aid and support so as to promote financial inclusion through the use of digital and other regulatory incentives (AlHares et al., 2022)

The presence of a national payments’ operator operating under the Saudi Arabian Monetary Agency, the "Saudi Central Bank," operating under the presence of appropriate regulations and instructions to develop such technologies, was one of the most notable components of the infrastructure promoting financial technology solutions in Saudi Arabia (Magdy Rezk & Halim, 2022).

Bahrain

The Kingdom of Bahrain is one of the forerunners in the field of financial technology investment, as the country is currently home to resurrected financial technology projects that offer the banking industry a variety of banking services in response to the growing demand for them through the provision of biometric ATMs dispersed throughout the country (Rahman, Rahiman, Meero, & Amin, 2022).

In this regard, the Central Bank of Bahrain Governor issued Resolution No. (43) of 2017 establishing the experimental environment for financial technology, and in May 2017, the Bank released a final paper on the "Experimental Regulatory Environment". The document includes creating a framework for using and developing financial technology industry in an organized manner, according to the bank's website. Additionally, the bank's board of directors decided to create a division with expertise in financial technology and innovation (Rahman, Rahiman, Meero, & Amin, 2022).

The vast majority of Bahrain's 120 or so fintech businesses work in the payment and cryptocurrency industries. The research also highlights additional information, such as the Central Bank of Bahrain's (CBB) establishment of new regulatory policies and regulations pertaining to open banking, crowdfunding, crypto-assets, digital financial advising, and the electronic know-your-customer (e-KYC) framework. More than 19 distinct startups as well as accelerators are also a part of the ecosystem in the Kingdom. The government may be seen assisting with investment in terms of help that goes beyond only the law, which in the MEA as a whole Bahrain has been leading much in terms of a more regulated approach on matters like open banking. In the island nation, there are currently about eight different investing entities actively investing in a range of FinTech firms (AlHares et al., 2022).

UAE

In the Middle East, the FinTech sector is growing at an alarming rate. It is expected that more than (800) FinTech companies operating in a variety of sectors, including payments, insuretech, and cyber security, will raise more than $2 billion in venture capital funding to support their growth by the year 2022, according to a statement made by the UAE lender Mashreq on February 1 that cited data from the Middle East Institute. The UAE Digital Economy Strategy aims to increase the digital economy's current 10% share of the country's gross domestic product to roughly 20% over the course of the following ten years (AlHares et al., 2022).

In the UAE, one of the most significant factors supporting financial technology companies in the field of electronic payment in the UAE is the development of the telecom sector's infrastructure, which is supported by the widespread use of smart phone devices, the simplicity and rapidity of accessing the Internet, the availability of cloud computing, and the presence of start-up support bodies (Magdy Rezk & Halim, 2022).

Oman

Oman appears to be further along in the development of its FinTech ecosystem than the other GCC nations with which it shares a border. Despite this, the encouragement from the top that is being provided by Vision 2040 is causing a larger digital transformation and economic growth in sectors like fintech. The outbreak has also highlighted how important digitization is. One of the most connected countries in the world, more than 75 percent of the more than 5 million citizens have mobile connections. More than 95% of people use the Internet at least once each month, according to Hootsuite. Similar to the rest of the MEA, the Sultanate of Oman has a large proportion of people under the age of 29, with this group making up 63% of the entire population. Like its other GCC neighbors, Oman has a sizable population of people who identify as expatriates yet were born elsewhere. It is estimated that at least 1.7 million people belong to this group (AlHares et al., 2022). According to research conducted in 2020, P2P money transfers were reportedly used by 35 percent of Omanis who used fintech. Account aggregation came in second place with 30%, while robo-advisor came in third with 15%. The remaining four tied for fourth place, with linked house insurance, crowdfunding, linked health insurance, and linked vehicle insurance each controlling a 10% market share (AlHares et al., 2022).

Jordan

In Jordan, the development of communication networks and the presence of a sophisticated infrastructure for Electronic National Payment Systems Infrastructure, which are linked to one another, are the two most notable infrastructure components which promote the dissemination of financial technology solutions in the field of electronic payment. The enactment of the Electronic Crimes Law, the Cyber Security Law, and the acceptance of electronic payment systems for electronic signature in the Kingdom of Jordan all contribute to the favorable legislative climate that supports the development of digital payment technology. The systems, tools, and payment channels utilized in the field of electronic payment in the retail sector were prepared thanks to the availability of the guidelines and regulations required to control the activity of businesses operating in this sector (Magdy Rezk & Halim, 2022).

Conclusion

FinTech is an acronym of financial innovation that describes the expanding sector of financial services in the twenty-first century. The number of initiatives in FinTech firms and new enterprises has also greatly expanded, and this division is occurring with a high level of passion for the financial world, providing fertile ground to encourage innovative thinking and investigation. New technological developments have made it possible for several financial sectors to be more flexible, convenient, and quick.

This study conclusively shows that there is a link between the growth of FinTech businesses and the performance of the banking sector in the GCC countries.

Financial technology is being used by many people right now. Banks increasingly favor this method of funding, whether it be for credit, retail, or corporate endeavors. Infrastructure with cutting-edge applications and complex features, such as financial transactions and financial risk management, are necessary for the implementation of financial technology. Keeping these things in mind, financial technology has helped ushering in a new era for the global banking industry that has resulted in several advancements. By consistently developing and innovating the technology used for financial transactions, banks are utilizing financial technology to keep up with the shifting trends of the global marketplace.

Research Design/Methodology

This study is a qualitative secondary study depends on collecting existing data from different sources.

Declaration Of Conflicting Interests

The author declares that there is no conflict of interest.

References

AlHares, A., Dahkan, A., & Abu-Asi, T. (2022). The effect of financial technology on the sustainability of banks in the gulf cooperation council countries. Corporate Governance and Organizational Behavior Review, 6(4),359-373.

Alsmadi, A. A., Alrawashdeh, N., Al-Gasaymeh, A., Al-Malahmeh, H., & Al_hazimeh, A.M. (2023). Impact of business enablers on banking performance: A moderating role of Fintech. Banks and Bank Systems, 18(1), 14-25.

Kaur, J. and Dogra, M. (2019), “FinTech companies in India: a study of growth analysis”, Abhigyan, 37 (1), 21-31.

Magdy Rezk, W., & Halim, M.A.A. (2022). Financial technology (Fintech) in the Arab countries challenges and opportunities.L'Egypte Contemporaine,113(547), 437-466.

Nguyen, L., Tran, S., & Ho, T. (2022). Fintech credit, bank regulations and bank performance: a cross-country analysis. Asia-Pacific Journal of Business Administration, 14(4), 445-466.

Rabaa'i, A. (2022). FinTech in Kuwait: a survey study. Int. J. Business Information Systems, 1-50.

Siek, M., & Sutanto, A. (2019, August). Impact analysis of fintech on banking industry. In2019 international conference on information management and technology (ICIMTech)(Vol. 1, 356-361.

Temelkov, Z. (2018). Fintech firms opportunity or threat for banks? International Journal of Information,Business and Management , 10(1).

Thakor, A.V. (2020). Fintech and banking: What do we know?.Journal of Financial Intermediation,41, 100833.

Wonglimpiyarat, J. (2017). FinTech banking industry: a systemic approach.Foresight,19(6), 590-603.

Received: 07-Aug-2023, Manuscript No. AJEE-23-13864; Editor assigned: 09-Aug-2023, Pre QC No. AJEE-23-13864(PQ); Reviewed: 23-Aug-2023, QC No. AJEE-23-13864; Published: 30-Aug-2023