Research Article: 2019 Vol: 23 Issue: 5

The Effects of Sustainability Disclosure on the Quality of Financial Reports in Saudi Business Environment

Alaa Mohamad Malo-Alain, Al-Balqa Applied University

Magdy Melegy Abdul Hakim Melegy, Benha University

Mahmoud Ragab Yassein Ghoneim, Benha University

Abstract

The research aimed to measure the effect of accounting disclosure of sustainable development on the quality of financial reports for selected companies listed on the Saudi Stock Exchange. The independent variable is represented by the accounting disclosure about the sustainable development which includes quality and quantity of disclosure. The dependent variable is represented by the quality of financial report quality (QFR), which has been measured through discretionary accruals, accounting conservatism and asymmetry of information. The study adopted content analysis methodology to examine the financial reports of (153) company listed on the Saudi Stock Exchange during the year 2018. Our research concluded that there is a significant and negative correlation between the accounting disclosure of sustainable development and both discretionary accruals and information asymmetry, this found result can be explained by the fact that increasing disclosure of sustainability leads to a decrease in the value of discretionary accruals and information asymmetry. Moreover, our research concluded that there is a positive and significant correlation between accounting disclosure of sustainable development and accounting conservatism, this found result can be explained by the fact that increasing disclosure of sustainability leads to a increase in the value of accounting conservatism.

Keywords

Accounting Disclosure, Sustainable Development, Quality of Discretionary Accruals, Information Asymmetry, Accounting Conservatism.

Introduction

Sustainable development practices have occupied prominent interests by researchers and professional bodies, and that was due to the financial crises and world climate changes happened recently.

Indeed, UN Summit on Sustainable Development, (2015) addressed the importance of promoting economic growth and social and environmental sustainable practices. Many companies no longer rely solely on the philosophy of maximizing economic profit. Rather, it tended to disclose financial and non-financial information in order to provide stakeholders about the performance information (economic, social, environmental and corporate governance) to properly assess its performance and determine the fair value of the investment in stocks and its ability to deal with risks, which will contribute to improve the reputation and image of the company in the community and ultimately ensures sustainability of profitability and competitive advantage (Silivia et al., 2014; Prayage et al., 2015).

Moneva & Llena, (2000) and Reverte (2009) indicated that several professional bodies around the world recommended to include social and environmental information in the company annual report as it can be beneficial for different parties associated with company. Also, those parties not only provided trends of profits but the approaches to attain such profits, Dragomir & Cristina (2009). The disclosure about the sustainable development through the annual reports or through the complementary reports overcomes the weaknesses of traditional financial report (Martínez-Ferrero et al., 2013) therefore; there is an indigence need to study the association effect between them.

In this context, the current study aims to examine the relation between disclosure about the sustainable development and quality of financial reports of the companies listed in the Saudi Stock Exchange. In spite of great importance of financial report for managers, shareholders and creditors, one of the weak points of that report is that it doesn’t provide information about the issues which have great importance at the present time and which are related to the social and environmental aspects of activities of the company. So, several companies face criticism about its social and environmental effects despite financial or technological progress (Reverte, 2009). The community’s interest to the social and environmental issues has been increased; and ultimately, a proper disclosure for such issues is needed (Frias-Aceituno et al., 2012).

At the level of Saudi environment, the accounting disclosure about sustainable development did not get enough attention from governing bodies, and till now no accounting standard was issued so far which can regulates it.

In fact, there is no agreed measure upon for the quality of financial report (Dechow et al., 2010) as the accounting studies contained various measures such as: discretionary accruals, accounting Conservatism and weak internal control system (Choi & Pae, 2011; Martinez-Ferrero et al., 2013). Also, high quality of financial report is considered to be a very important tool to reduce the problem of information asymmetry (Chen et al., 2011). Therefore, researchers relied on three different methods to express the quality of financial report which are: discretionary accruals, accounting conservatism and information asymmetry.

Literature Review And Hypothesis Development

There are several theories that are concerned with accounting disclosure; for instance, according to agency theory there is asymmetry of information between the parties inside the market as the companies adopt “disclosure” to reduce that problem, but this theory has been criticized because it focuses on economic considerations and doesn’t take into account the potential use of environmental and social information (Cormier et al., 2005). Therefore, two theories emerged to explain the disclosure about the information of sustainable development. The two theories are: Legitimacy Theory and Stakeholders Theory. According to the legitimacy theory, the company will exceed the limits of economic objectives to include the social and environmental objectives to meet the expectations of community and all concerned parties, and that is to assure the continuity and development of the company (Archel et al., 2009). As far as the stakeholder’s theory is concerned, the ability of the company to create sustainable wealth depends on its relation with different parties associated to the company (Post et al., 2002). As a result, the disclosure about the information of sustainable development can be considered as a tool to meet the needs of those parties.

At the level of accounting literature, several studies made efforts to analyze the relation between the disclosure about sustainable development and the quality of financial reports. In this context, Jennifer et al. (2015) endeavor to examine the relation between the quality of financial reports and the quality of information of social responsibility through a study of 747 registered international companies in 25 countries during the period 2002 to 2010. The study concluded that there is positive correlation between the quality of financial reports and the quality of accounting disclosure about the practices of sustainable development. Also, the companies, which maintain the high level of quality of discretionary accruals or decrease the practices of profit management, are characterized by the quality of its accounting profits and thus the quality of its financial reports and such companies are very much ready for disclosure about the practices of sustainable development.

Choi & Pae (2011) analyzed the relation between the work ethics and the quality of financial report and found that the companies which have high level of ethical commitment are having less motives to practice the earning management and they are more conservative in declaring profits and more accurate in the expectation of future cash flows. So, the ethical commitment is associated with high quality of financial report as well as it is related to the practices of sustainable development. Beside to that, Chih et al. (2008) concluded that the social responsibility and sustainable development increases the transparency and decreases boosting the profit and hiding the losses and that is by reducing the probabilities of practicing earning management.

In Arabian environment, some studies agreed with the previous results, Al-Sayed (2009) found that the disclosure about the social and environmental performance lead to improve the performance of Saudi Companies while Ahmed (2013) and Moshapit (2016) concluded that the disclosure about the report of sustainability has positive impact on sustainability of performance of Egyptian Companies. In the same context, Ahmed, (2016) found that the disclosure about the social responsibility, under adoption of good governance practices, leads to increase the firms value.

Concerning to the quality of financial report Verrecchia, (1990) explained that the companies, which have high quality financial information, have motives to provide more information such as information of social responsibility. Francis et al. (2005) found that there is an integration relationship between the quality of profits as an indicator for the quality of financial report and optional financial disclosure. In addition, the disclosure about the information of sustainable development decreases the asymmetry of information. As a result, the companies with low profits have fewer motives for optional disclosure because the investors look to them as less credible Francis et al., (2008). In this context, Salewski & Zülch (2012) found that the practices of social responsibility are associated positively with the earning management and negatively with the accounting conservatism. Consequently, it is associated with the lower quality of financial report. In consistent with that, Prior et al. (2008) found the positive effect of practices of social responsibility on the deceptive behavior.

Based on the different viewpoints among researchers, there is lack of agreement concerning to the relationship between the disclosure about sustainable development and the quality of financial report. Therefore, this relationship might take the shape of "integration relationship" as the companies which enjoy high quality financial information, have motives to disclose all types of information such as the information of sustainable development. On the other hand, it can be "alternatives relationship" as the companies of low quality financial report resort to the information of sustainable development as a procedure to compensate the deficiency in the quality of financial information. In addition to above, Yip et al. (2011) found a negative relationship between social responsibility and profit management in petrol industries, whereas there was a positive relationship in food industries. Those results indicate to the existence of an impact for political and ethical considerations.

Thus, the preceding discussion and an extensive literature on the effect of accounting disclosure of sustainable development on the quality of financial reports lead to the following three main hypotheses:

H1: There is a significant and negative correlation between the accounting disclosure of sustainable development and discretionary accruals.

H2: There is a positive and significant correlation between accounting disclosure of sustainable development and accounting conservatism.

H3: There is a significant and negative correlation between accounting disclosure of sustainable development and information asymmetry.

Methodology

Sample and Data

The population of our research consists of 176 registered company in the Saudi Stock Exchange Market (SSEM) based on their market capitalization during 31 December 2018 distributed to 15 sectors. The researchers adopted purposive sampling technique; therefore, the research sample consisted of 153 company representing 86.9% of total population, which have complete data about the research variables. Quantitative research method through regression analyses has been adopted to measure the various relationships between variables. The data were collected independently from the main and supplementary annual reports, besides to the provisionary announcements of SSEM database.

Research Variables

The variables of the research are:

Independent Variable

Independent variable is represented by the accounting disclosure for sustainable development and includes:

a. Quantity of disclosure which has been measured based on number of paragraphs of sustainability disclosed in the annual report of the company.

b. Quality of disclosure which has been measured through building an indicator for disclosure comprised of 40 criterions distributed between 5 groups. This indicator has been adopted based on the following studies (Ahmed, 2016, Ronald & Dennis, 2010).

Dependent Variable

Dependent variable is represented by the Financial Report Quality (FRQ), therefore, researchers have relied on the following three different methods for measuring it.

Earning Management

The Modified Jones Model (Jones, 1991) is widely used to measure the earning management. This model relies on calculation of discretionary accruals as an indicator to manage the profits (Brian et al., 2015) and which can be calculated through following steps:

a. Determining Total Accruals (TA)

b. Regression Model for variables affecting Total Accruals (TA)

c. Determining Nondiscretionary Accruals

d. Estimation of Discretionary Accruals (DA)

Discretionary accruals (DA) were estimated through the difference between each of total accruals and non-discretionary accruals as following:

DAit = TAit - NDAit

DAt was used as an indicator for earning management as the positive value of discretionary accruals indicates to the exiting of earning management practice of the company in order to increase the income, while the negative value indicates to the exiting of earning management in order to decrease the income. If the value of discretionary accruals is equal to zero or near to zero, it indicates to non-existence of earning management.

Accounting Conservatism

The most used standard in the accounting studies to measure the level of accounting conservatism in the financial statements (Beaver & Rtan, 2000; Xie, 2015) is Market to Book Ratio (MTB) which will be calculated as:

Cons=BV÷MV

BV: book value of company’s shares at the end of the year.

MV: market value of company’s shares at the end of the year.

Indeed, researchers relied on the previous model based on the availability of data in the Saudi environment and ease of calculation, and it is a comprehensive measure where it reflects the cumulative impact of accounting conservatism from the date of incorporation of the company to the date of measurement, as well as it links the elements of financial position with market variables.

Information Asymmetry

The information asymmetry can be calculated through the following equation (Jennifer et al., (2015) :

Information Asymmetry=EPS-median of forecasted EPS ÷ Share Price

a. EPS: Earning per share.

b. EPS: Median Forecasts of Analysts about the earning per share.

c. Share Prices

Regression Model

This model aims to examine the effect of accounting disclosure of sustainable development (independent variable) on the quality of financial reports (dependent variable). Also, the model includes some control variables such as: size of the company, return on assets, financial leverage, and rate of sales growth, quality of corporate governance and the nature of company activity. This model can be designed through following equation:

Where:

QFR: Quality of financial reports

ESD: Quantity of Disclosure

QSD: Quality of Disclosure

CG: Corporate Governance

FSIZE: Size of Company

ROA: Return on Assets

LEV: Financial Leverage

SG: Rate of Sales Growth

INDU: Nature of Company’s Activity

Results And Discussion

Descriptive Analysis

Table 1 provides descriptive statistics for the sample. The statistics shows a decreasing trend in level of accounting disclosure about sustainability in the Saudi business environment, where the average accounting disclosure for both variables (ESD) and (QSD) was about 45.13%, 40.78% respectively. Indeed, this is indicating that accounting disclosure is still voluntary for some companies, which requires more attention from the bodies responsible for organising Saudi stock market in light of the growing interest in sustainable development practices .Concerning to earning management practices, the lowest value of the DA was about 102374 and the highest value was 8254763. Most of the research sample companies practicing earning management in order to increase profits where the average value of the DA was positive 1286641.25. As depicted in Table 1 the tendency of the research sample to follow conservative accounting policies (CONS), where the average accounting conservatism were about 5.3419. Pertaining to information asymmetry, the average value registered a decreasing trend 0.2956. This is indicating that increasing the level of accounting disclosure about sustainability development may lead to minimise the information asymmetry.

| Table 1: Descriptive Analysis | |||||||||

| Part 1: Continuous Variables | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Var. | N | Minimum | Maximum | Mean | Std. Deviation | ||||

| ESD | 156 | 0.18 | 0.82 | 0.4513 | 0.19541 | ||||

| QSD | 156 | 0.16 | 0.69 | 0.4078 | 0.15497 | ||||

| DAT | 141 | 102374.00 | 8254763.00 | 1286641.25 | 816113.06 | ||||

| CONS | 156 | 0.01 | 9.88 | 5.3419 | 2.85957 | ||||

| INFAS | 146 | 0.10 | 0.68 | 0.2956 | 0.11317 | ||||

| CG | 156 | 1.00 | 6.00 | 3.8718 | 1.16241 | ||||

| SIZE | 156 | 1.95 | 12.45 | 7.3714 | 2.63145 | ||||

| ROA | 143 | 0.01 | 0.68 | 0.3214 | 0.13445 | ||||

| LEV | 156 | 1.07 | 10.98 | 5.5657 | 2.83175 | ||||

| SG | 156 | 0.01 | 0.51 | 0.2474 | 0.11689 | ||||

| Part 2: Dummy Variables | |||||||||

| Var. | 0 | 1 | |||||||

| INDU | 76 | 48.72 % | 80 | 51.28 % | |||||

Table 1 also shows an increasing trends to CG quality where the average value was about 3.8718, followed by SIZE; ROA; LEV with values 7.3714; 3214; 5.5657; respectively. Concerning to SG there was an increasing trend reached an average of 274.2%, while the average industrial companies among the sample companies reached 51.28%.

Correlation

We perform a bivariate analysis to establish any relationships between the research variables. Table 2 presents the calculations of a pairwise correlations (Pearson correlation) matrix together with their level of significance, the results obtained indicating to a weak significant correlation between the disclosure of sustainable development and the discretionary accruals, as the coefficient correlation registered for (ESD) and (QSD) the values -0.141; -0.273 respectively. In additions, there was a negative significance correlation between disclosure about sustainable development and information asymmetry as the coefficient correlation registered for (ESD) and (QSD) the values -0.141; -0.273 respectively -0.0615 ; -0.0769 respectively. The results also indicate a strong positive correlation between the disclosure of sustainable development and the accounting conservatism, where the coefficient correlation registered for (ESD) and (QSD) the values 0.766; 0.870 respectively, reflecting the tendency of companies providing sustainable development information to expand the use of the accounting conservatism when preparing their financial reports.

| Table 2: Correlation Matrix Between Variables | |||||||||||

| ESD | QSD | DAT | CONS | INFAS | CG | SIZE | ROA | LEV | SG | INDU | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ESD | 1 | ||||||||||

| QSD | 0.722** | 1 | |||||||||

| DAT | -0.141- | -0.273** | 1 | ||||||||

| CONS | 0.766** | 0.870** | -0.259** | 1 | |||||||

| INFAS | -0.615** | -0.769** | 0.235** | -0.860** | 1 | ||||||

| CG | 0.692** | 0.831** | -0.184* | 0.887** | -0.730** | 1 | |||||

| SIZE | 0.769** | 0.850** | -0.206* | 0.921** | -0.778** | 0.868** | 1 | ||||

| ROA | 0.556** | 0.813** | -0.244** | 0.833** | -0.645** | 0.803** | 0.778** | 1 | |||

| LEV | -0.706** | -0.902** | 0.256** | -0.937** | 0.808** | -0.883** | -0.875** | -0.836** | 1 | ||

| SG | 0.776** | 0.832** | -0.191* | 0.916** | -0.783** | 0.826** | 0.893** | 0.831** | -0.874** | 1 | |

| INDU | -0.029 | 0.142 | -0.060 | -0.015 | -0.043 | 0.003 | -0.058 | 0.147 | -0.140 | -0.040 | 1 |

** * indicates significance levels at (0.01) (0.05) respectively.

Multicollinearity

Normal distribution was verified using both Kolmogorov-Sminov and the Shapiro-Wilk test. The results showed that P-Value more than 0.05 indicating there is normal distribution. Multicollinearity has been applied for independent variables; as a result, a VIF greater than 10 is an indicator of multicollinearity. For this research, all variables were less than 10, which imply no multicollinearity exists in the regressions used.

Regression Models

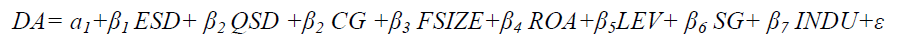

Results regression 1

The first hypothesis tested is stated as follows:

H1: There is a significant and negative correlation between the accounting disclosure of sustainable development and discretionary accruals.

This hypothesis is tested using the following regression:

Where:

DA: Discretionary accruals

ESD: Quantity of Disclosure

QSD: Quality of Disclosure

CG: Corporate Governance

FSIZE: Size of Company

ROA: Return on Assets

LEV: Financial Leverage

SG: Rate of Sales Growth

INDU: Nature of Company’s Activity

Hence, Table 3 summarizes the multiple regression analyses for the first hypothesis. As shown in Table 3 the multiple regression models is statistically significant at 0.013 with an adjusted R-squared of 44.0 percent. B value for ESD and QSD for sustainability disclosure was negative at -0.921 and -0.821 respectively. This found result can be explained by the fact that increasing disclosure of sustainability leads to a decrease in the value of discretionary accruals. T. test shows significance level less than 0.05 for both ESD and QSD, These results are in line with the results that Choi et al. (2013) found. Our results are depicts a significance relationship, Thus, our findings do support Hypothesis 1.

| Table 3: Regression Models | |||||||||

| Model 1 | Model 2 | Model 3 | |||||||

|---|---|---|---|---|---|---|---|---|---|

| B | t | Sig. | B | t | Sig. | B | t | Sig. | |

| (Constant) | 0.236 | 0.711 | 0.478 | 4.227 | 4.497 | 0.000 | 0.298 | 3.770 | 0.000 |

| ESD | -0.921 | -0.085 | 0.032 | 0.147 | 1.612 | 0.023 | -0.005 | 0.713 | 0.037 |

| QSD | -0.821 | -1.496 | 0.037 | 0.011 | 0.010 | 0.031 | -0.065 | -0.718 | 0.024 |

| CG | 0.012 | 1.300 | 0.196 | 0.164 | 1.215 | 0.226 | -0.007 | -0.601 | 0.549 |

| SIZE | 0.009 | 0.037 | 0.970 | 0.203 | 3.112 | 0.002 | -0.008 | -1.536 | 0.127 |

| ROA | -0.358 | -1.071 | 0.286 | 0.906 | 0.905 | 0.367 | 0.261 | 3.097 | 0.002 |

| LEV | 0.006 | 0.912 | 0.363 | -0.463 | -6.787 | 0.000 | 0.023 | 3.958 | 0.000 |

| SG | 0.011 | 1.032 | 0.304 | 4.593 | 3.072 | 0.003 | -0.397 | -3.135 | 0.002 |

| INDU | 0.046 | 0.774 | 0.440 | -0.363 | -2.553 | 0.012 | 0.011 | 0.892 | 0.374 |

| Adjusted R Square R Square |

0. 44 0.462 |

0.432 0.456 |

0.693 0.710 |

||||||

| F Sig. |

1.799 0.013 |

0.189 0.000 |

40.794 0.000 |

||||||

Thus, the first regression model could be drafted as follows:

DA = 0.236-0.921(ESD) -0.821(QSD) + 0.012 (CG) + 0.009 FSIZE- 0.358 (ROA) +0.006(LEV) + 0.11 (SG) + 0.046 (INDU) +ε

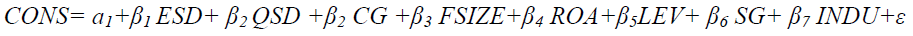

Results regression 2

The second hypothesis tested is stated as follows:

H2: There is a positive and significant correlation between accounting disclosure of sustainable development and accounting conservatism.

This hypothesis is tested using the following regression:

Where,

CONS: Accounting conservatism

ESD: Quantity of Disclosure

QSD: Quality of Disclosure

CG: Corporate Governance

FSIZE: Size of Company

ROA: Return on Assets

LEV: Financial Leverage

SG: Rate of Sales Growth

INDU: Nature of Company’s Activity

As shown in Table 3 the multiple regression models is statistically significant at 0.00 with an adjusted R-squared of 43.0 percent. B value for ESD and QSD for sustainability disclosure was positive at 0.147 and 0.011 respectively. This found result can be explained by the fact that increasing disclosure of sustainability leads to an increase in the value of accounting conservatism. T. test shows significance level less than 0.05 for both ESD and QSD, These results are in line with the results that Ogundare (2013) found. Our results are depicts a significance relationship, Thus, our findings do support Hypothesis 2.

Thus, the second regression model could be drafted as follows:

CONS=4.277+0.147(ESD) +0.011(QSD) +0.164(CG) +0.203 FSIZE +0.906 (ROA)-0.463(LEV) +4.593 (SG) -0.363 (INDU) +ε

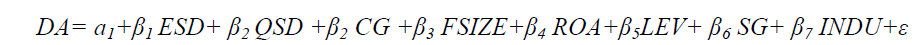

Results Regression 3

The third hypothesis tested is stated as follows:

H3: There is a significant and negative correlation between accounting disclosure of sustainable development and information asymmetry.

This hypothesis is tested using the following regression:

Where,

INFAS: Information Asymmetry

ESD: Quantity of Disclosure

QSD: Quality of Disclosure

CG: Corporate Governance

FSIZE: Size of Company

ROA: Return on Assets

LEV: Financial Leverage

SG: Rate of Sales Growth

INDU: Nature of Company’s Activity

As shown in Table 3 the multiple regression models is statistically significant at 0.00 with an adjusted R-squared of 69.0 percent. B value for ESD and QSD for sustainability disclosure was negative at -0.005 and -0.065 respectively. This found result can be explained by the fact that increasing disclosure of sustainability leads to a decrease in the value of information asymmetry. T. test shows significance level less than 0.05 for both ESD and QSD, These results are in line with the results that Fuhrmann et al., (2017) found. Our results are depicts a significance relationship, Thus, our findings do support Hypothesis 3.

Thus, the third regression model could be drafted as follows:

INFAS = 0.298 - 0.005 (ESD) - 0.065(QSD) - 0.007 (CG) -0.008 FSIZE +0.261 (ROA) +0.023(LEV) - 0.397 (SG) - 0.11 (INDU) +ε

Conclusion

Accounting disclosure of sustainable development has become one of the most prominent topics in accounting literature; this is due to the fact that the importance of accounting disclosure about sustainable development increases dramatically. Also, it moves gradually to a typical and mandatory form. Therefore, our findings will have a benefit to firm’s legislators to understand the effect of that disclosure on decision making, enhancing the quality of financial reports.

Our research investigated the effect of accounting disclosure of sustainable development on the quality of financial reports for selected companies listed on the SSE, therefore, testing possible relationships between the independent variable represented by the accounting disclosure for sustainable development which includes quality and quantity of disclosure, and the dependent variables represented by the quality of financial report (QFR), which has been measured through various methods. Our results showed a reduction in the level of accounting disclosure for sustainable development in the Saudi environment, as the average disclosure for the selected sample was about 45.13%. This may be due to the fact that the disclosure of sustainable development practices is still optional, besides to lack of accounting standards regulating the practices, and insufficient awareness among many companies about the culture of sustainable development.

In additions, our research concluded that there is a significant and negative correlation between the accounting disclosure of sustainable development and both discretionary accruals and information asymmetry. This found result can be explained by the fact that increasing disclosure of sustainability leads to a decrease in the value of discretionary accruals and information asymmetry, these results are in line with the results that (Choi et al., 2013; Jennifer et al., 2015; Ahmad, 2016; Moser & Martin, 2012; Francis et al, 2008; Fuhrmann et al., 2017) found. Moreover, our research concluded that there is a positive and significant correlation between accounting disclosure of sustainable development and accounting conservatism. This found result can be explained by the fact that increasing disclosure of sustainability leads to a increase in the value of accounting conservatism, these results are consistent with the results that Ogundare (2013) found.

As all studies have limitations, a few caveats are in order. Our research limitations can be concluded in the size of the study sample, methods used in measuring variables; for instance, the quality of financial reports had been measured based on three methods i.e. accounting conservatism, earning management and information asymmetry.

References

- Ahmed, A. (2013). Analyzing the realizing of financial statements prepares for development and governance practice on the sustainable development by applying on the registered Egyptian companies. Journal of Auditing & Accounting, 1(1), 193-248.

- Ahmed, T. (2016). The impact of relation between governance and disclosure on social responsibilities and its reflection on companies? value: A Case of Egyptian Companies. Journal of Intellectual Accounting, 2(1), 1-48.

- Al-Sayed, M. (2009). Studying the importance of social & environmental responsibilities to support companies? governance by applying on Saudi companies. Science Journal for Financing and Commerce, 1(2), 443-497.

- Archel, P., Husillos, J., Larrinaga, C., & Spence, C. (2009). Social disclosure, legitimacy theory and the role of the state. Accounting, Auditing and Accountability Journal, 22(8), 1284-307.

- Beaver, W., & Ryan, S. (2000). Biases and lags in book value and their effects on the ability of the book-to-market raito to predict book return on equity. Journal of Accounting Research, 38, 127-148.

- Chen, F., Hope, O.K., Li, Q., & Wang, X. (2011). Financial reporting quality and investment efficiency of private firms in emerging markets. The Accounting Review, 86(4), 1255-1288.

- Chih, H.L., Shen, C.H., & Kang, F.C. (2008). Corporate social responsibility, investor protection, and earnings management: Some international evidence. Journal of Business Ethics, 79(1), 179-198.

- Choi, T.H., & Pae, J. (2011). Business ethics and financial reporting quality: Evidence from Korea. Journal of Business Ethics, 103(3), 403-427.

- Choi, B., Lee, D., & Park, Y. (2013). Corporate social resposibility corporate governance and earnings quality: Evidence from Korea. Corporate Governance: An International Review, 21(5), 447-467.

- Cormier, D., Magnan, M., & Van Velthoven, B. (2005). Environmental disclosure quality in large German companies: Economic incentives, public pressures or institutional conditions. European Accounting Review, 14(1), 111-122.

- Dechow, P.M., Ge, W., & Schrand, C. (2010). Understanding earnings quality: A review of proxies, their determinants and their consequences. Journal of Accounting and Economics, 50(2/3), 344-401.

- Dragomir, V., & Cristina, M. (2009). Corporate governance in the European Union: The implications for financial and narrative reporting. International Journal of Business and Economics, 9(1), 53-64.

- Francis, J., La Fond R., Olsson, P., & Schipper, K. (2005). The market pricing of accrual quality. Journal of Accounting and Economics, 39(2), 295-327.

- Francis, J., Nanda, D., & Olsson, P. (2008). Voluntary disclosure, earnings quality, and cost of capital. Journal of Accounting Research, 46(1), 53-99.

- rias-Aceituno, J.V., Rodriguez-Ariza, L., & Garcia-Sanchez, I. (2012). The role of the board in the dissemination of integrated corporate social reporting. Corporate Social Responsibility and Environmental Management.

- Fuhrmann, S., Ott, C., Looks, E., & Guenther, T. (2017). The contents of assurance Statements for sustainability reports and information asymmetry. Accounting and Business Research, 47(4), 369-400.

- Jennifer, M.F., David, R.C., & Isabel, G.S. (2015). The causal link between sustainable disclosure and information asymmetry: The moderating role of the stakeholder protection context. Corporate Social Responsibility and Environmental Management, 1-24.

- Jones, J. (1991). Earnings management during import relief investigations. Journal of Accounting Research, 29, 193-228.

- Moneva, J.M., & Llena, F. (2000). The environmental disclosures in the annual reports of large companies in Spain. European Accounting Review, 9(1), 7-29.

- Moshapit, H. (2016). The effect of disclosure on sustainable development on financial performance for economical units: Case study of Egyptian Banks. Journal of Intellectual Accounting, 2(1), 51-123.

- Ogundare, E. (2013). The impact of sustainability reporting on organizational performance: The Malaysia Experience. ASCENT International Conference Proceedings-Accounting and Business Management, 11-12.

- Post, J.E., Preston, L., & Sachs, S. (2002). Managing the extended enterprise: The new stakeholder view. California Management Review, 45(1), 6-29.

- Prayage, L.Y., Han, S.H., & Rho, J.J. (2015). Impact of environmental performance on firm value for sustainable investment: Evidence from Large US Firms. Business Strategy and the Environment, 1-19.

- Prior, D., Surroca, J., & Tribó, J.A. (2008). Are socially responsible managers really ethical? Exploring the relationship between earnings management and corporate social responsibility. Corporate Governance: An International Review, 16(3), 160-177.

- Reverte, C. (2009). Determinants of corporate social responsibility disclosure ratings by Spanish listed firms. Journal of Business Ethics, 88(2), 351-366.

- Ronald, P.G., & Dennis, M.P. (2010). Market reactions to the first-time issuance of corporate sustainability reports evidence that quality matters. Sustainability Accounting Management and Policy Journal, 1(1), 33-50.

- Salewski, M., & Zülch, H. (2012). The impact of corporate social responsibility (CSR) and financial reporting quality. Evidence from European Blue Chips. HHL Working Paper. No. 112. SSRN.

- Silivia, R., Beixin, L., Jeffers, A.E., & Degaetano, L.A. (2014). An overview of sustainability reporting practices. The CPA Journal, 68-71.

- United Nations Summit on Sustainable Development, (2015). United Nations Headquarters, New York.

- Verrecchia, R. (1990). Information quality and discretionary disclosure. Journal of Accounting & Economics, 12(4), 365-380.

- Xie, Y. (2015). Confusion over accounting conservatism: A critical review. Australian Accounting Review, 73(25), 204-216.

- Yip, E., Van Staden, C., & Cahan, S. (2011). Corporate social responsibility reporting and earnings management: The role of political costs. Australasian Accounting Business and Finance Journal, 5(3), 17-34.