Review Article: 2022 Vol: 25 Issue: 2S

The First Steps in Reforming Public Financial Management through the Implementing the Government Financial Management Information System (GFMIS)

Ahmed H. Juhi Al Saedi, Governmental Accounting PhD Iraqi Ministry of Finance

Citation Information: Al Saedi, A.H.J. (2022). The first steps in reforming public financial management through the implementing the Government Financial Management Information System (GFMIS). Journal of Management Information and Decision Sciences, 25(S2), 1-14.

Keywords

GFMIS, Financial discipline and performance, Financial reports and statements, Decision making, Proper planning, Database, Government spending units, Digital technologies, Electronic connectivity, Human resources, Manual system, Organizational structure.

Abstract

This study deals with studying the government financial management information system and introducing it and its importance, and aims to demonstrate the effect of this system on the excellence of government financial performance in government institutions. This system helps in how to utilize financial resources efficiently through the quality of accounting information provided by this system through financial statements and reports, which reflects the possibility of predicting the financial policy of the country through government programs and activities, in addition to identifying weaknesses and addressing it quickly in order to avoid the occurrence of waste and loss of public money which leads to the possibility of using the financial resources available to the state effectively and efficiently. The full implementation of the GFMIS is an important tool in the hands of the public financial administration towards optimizing the use of available resources and towards implementing government programs and activities that support economic development through improving financial performance and providing useful information that helps in monitoring the operations of the government unit. In addition, a review and study of the status of the GFMIS, the stages it passed through, and the obstacles that delayed the implementation of the system, a study of the obstacles facing the Ministry of Finance and relevant government institutions in the post-start-up phase, and how to improve and successfully implement the government financial management information system (GFMIS) in government spending units from one side , and the Ministry of Finance from other side.

Introduction

Due to the spread of information and communication technology services in the world, which increased interest in the use of computers and information technology applications, which led to improving the quality of accounting information, which is the basis of the accounting system. For this reason, government institutions are trying to improve its financial performance and make efforts to develop the work of government financial management mechanisms to provide consolidated financial statements that contribute to supporting the base of government financial decisions, which contributes to enhancing financial and economic stability. Accordingly, international organizations, particularly the International Monetary Fund, have realized the importance of raising the efficiency and effectiveness of the government apparatus as a prerequisite for improving the government accounting system and the transparency of its operations, by devising a modern accounting approach that prepares and provides all useful accounting information for government spending units and for the purpose of reforming public financial management, which It helps to link the general principles of financial management with the results of the public budget represented in achieving financial discipline and specialized and operational efficiency. In spite of the importance that the public budget constitutes in developing countries, including Iraq, the failure of financial management and presented the approved methods in preparing, planning, implementing and monitoring the public budget items that contributed significantly to misallocation of financial resources and slow implementation of investment projects as well as administrative and financial corruption resulting from traditional management of managing the public money in the state. In this context, the new program of the Federal Government in Iraq in 2018 committed the Iraqi Ministry of Finance to the adoption of the Government Financial Management Information System (GFMIS) to be fully implemented during the three years of the government’s life, which was recommended by many international organizations as one of the most important tools for reforming the public financial management, but because of the resignation of the Iraqi government in 2019, this implementation of the program has been postponed to the new government that has been formed which will be the application of the GFMIS one of its most important priorities for reforming Iraqi financial management by showing its importance and its role in the exploitation of financial resources, accurate and fast information, improving control operations and not exceeding the financial allocations established in the budget, and providing an accurate historical database on the volume of public expenditures and revenues for all units of government spending. Where Iraqi academics, experts and specialists began to provide local and foreign studies and research and awareness towards the importance of adopting this comprehensive system by the new Iraqi government, including this study.

Problem Statement

In order to raise the level of services provided by the ministries and government departments and to improve the mechanisms of dealing with public money and preserve it from embezzlement and manipulation, and to obtain accurate and comprehensive information in a timely manner due to the high cost of this information, and the difficulty in coordination between the accounting information systems applied in the departments operating in the Ministry of Finance, financial departments, and sub-government units from exchanging financial information and reports. For the purpose of replacing the computerized systems currently used and not connected in all ministries and government spending units, where an effective system had to exist to link all ministries with each other, especially the financial side of it. Here the problem of the study emerged through the role of the GFMIS in raising the effectiveness of the government budget through preparation, approval, implementation and control, and the impact of the application of GFMIS in ministries and government departments in achieving excellence in financial performance, improving the level of transparency, disclosure and financial control and increasing the speed of electronic communication of the Ministry of Finance with other ministries and providing accurate and fast information and provide an accurate database on the volume of expenditures and revenues for all units of government spending, and thus the efficiency of financial management in general.

Study Objectives

This study aims to identify the following:

A. Explaining the extent of GFMIS implementation in government departments and ministries.

B. Explain the effect of the effectiveness of the implementation of the GFMIS, and explain its role in the advancement and excellence of government performance through:

1. Bring speed, accuracy, clarity and transparency in all stages of government financial work.

2. The electronic linking process between all the ministries and departments affiliated to the system with the Ministry of Finance.

3. Raising the efficiency of implementing financial claims payment procedures.

4. Improving the quality of financial and accounting data.

5. Quality of cash planning management operations.

6. Raising the level of accuracy in government budget estimates, preparation and implementation.

C. The use of the GFMIS leads to the implementation of a performance oversight system in all government spending units and efficient decision-making.

D. Study the obstacles and challenges that have delayed the implementation of the GFMIS system.

E. Study how the implementation of the GFMIS in the Ministry of Finance will improve through improving the mechanisms and procedures of public funds and how to enhance the level of services provided to various government institutions.

Significance of the Study

The importance of the study is highlighted in the lack of studies, references and research that touched on the issue of applying the government financial management information system (GFMIS) to the financial performance of the modernity of these systems and software. The importance of the GFMIS has become dependent on government ministries when making decisions, as the public budget is responsible for spending and revenue collection in the Ministry of Finance and directing the public budget. To improve the planning process, take decisions and raise information between ministries and government departments faster, which increases the level of efficiency and effectiveness of financial procedures and increase the control capacity, which leads to the importance of providing an integrated financial system, which financial information is interconnected between the Ministry of Finance and government spending units.

Hypothesis

Based on the problem, importance, and objectives of the study, a major hypothesis can be formulated that the implementation of the GFMIS leads to the enhancement and improvement of the level of financial performance and financial control as it affects the efficiency of public financial management, in government ministries and government spending units by providing government financial information that helps in the planning and decisions making, thus raising the effectiveness of government budget efficiency through the role of that financial information provided by the GFMIS at the stage of preparing, implementing and controlling the public budget.

The Importance of Using Modern Technologies to Improve Government Financial Management

In general, providing data in a timely and comprehensive manner provides more options for designing public policies, and enhancing the ability of decision and policy makers to prepare accurate expectations for government resources. It is common to rely on the previous financial statements as a starting point when planning government budgets, and then make some adjustments to them based on growth, income and spending expectations to determine expected revenues, which is one of the levels that are reflected in the planning of unrealizable public budgets, as this is clearly demonstrated in the big difference between government budgets and final accounts. Consequently, relying on a third party when preparing budgets, especially with regard to the aspects of expenditures and revenues, is by expanding the reliance on modern digital technologies to collect and analyse financial data. Where the third party (the electronic financial system) provides a secure and integrated information environment for financial management operations in a manner that allows a rapid transfer of information between ministries and government departments, and to ensure an integrated environment in which information is available in a timely and accurate manner to all the competent parties on the different geographical locations and the functions that they occupy, which provides a direct impact to raise the level of efficiency and effectiveness of the financial procedures that are implemented during the various stages of preparing and implementing the public budget and controlling it.

Challenges of Applying Modern Technologies in Government Finance

There is no doubt that the application of modern technologies in planning, preparing, implementing and monitoring government budgets in addition to providing government services, as it must be at the forefront of the priorities of the new government in Iraq, especially as this approach is no longer a choice but has become a reality that must be taken into consideration by virtue of the technical revolution that invaded the world. The degree of response to this electronic transformation varies from one country to another, and the degree of response depends on the degree of development of institutional, legislative and even political frameworks to accept this transformation, in addition to another matter on a large aspect of importance, which is the extent of the ability of human and governmental cadres to cope with this transformation and deal with the means modern technology in preparing, implementing and monitoring the government budget. The transition to using modern technical means to provide government services and bear a high cost is required to use the infrastructure of government institutions, including communication networks, equipment, rehabilitation and training for government cadres, as well as comprehensive and progressive awareness programs that are appropriate for all administrative and financial levels to reduce the consequences of non-response of some government employees and officials to use modern technologies in providing government services and financial linkage between all government institutions through an integrated system for managing government financial information, for fear of losing some of the advantages provided by the application of traditional systems. The requirements for governments ’success in applying modern technologies are not limited to providing government services, providing information systems, qualified cadres, and organizational and institutional preparations within the government only, but it requires providing an appropriate degree of awareness among users of government services of the importance and benefits of obtaining services electronically, which is known as digital financial inclusion. Despite the importance of the shift towards a non-paper environment to ensure the success of the transition to electronic management of government finance, some government institutions may find a major challenge due to the nature of its work, such as engineering, procurement, and credit departments whose work is related to the existence of paper contracts, where electronic copies cannot be relied on, before the work becomes available with the mechanism of electronic signature and electronic documentation of contracts, which requires changes in the legal framework regulating the work of these departments and the legal framework regulating contractual transactions in general. This transformation requires a coordinated and strategic planning of policies for the use of digital technologies in all areas and at all levels of administration, and the challenges associated with digital government programs come in public strategies for public sector reform, as this requires the existence of an organizational maturity of the public sector and a consistency between rules, structures and risk management models with the strategic vision of the digital government.

The Concept and Objectives of the Government Financial Management Information System (GFMIS)

The Concept of A Government Financial Information Management System (GFMIS):

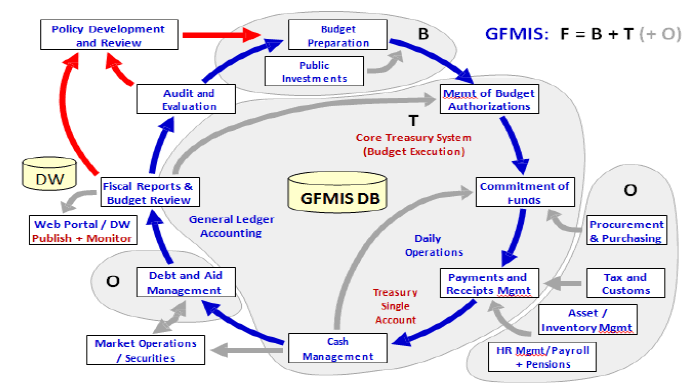

It is a ready-made software specialized in the field of public finance and government accounting, consisting of applications and subsystems that are adaptable and adaptive to serve multiple functions that include all fields of work such as payments, receipts, purchases and preparing the annual budget. Where it is automated through all the processes of the traditional system to prepare, implement and monitor government budgets, so that it is done electronically within the framework of an integrated accounting system for all government spending units. This system enables the government to plan, implement and monitor the public budget and facilitate the disclosure of information, as Figure 1 illustrates the core functions of the GFMIS and its interrelationships.

Figure 1: Illustrates the Core Gfmis Functions and Their Interrelationships

Source: World Bank data.

Note: For the purposes of this report, GFMIS (F) is defined narrowly to include mainly core budget preparation (B) and treasury/budget execution (T) systems, complemented by other (O) modules in some cases. Arrows are used to indicate the linkages between core modules (blue), the interfaces with other systems (gray), and the links with policy development and review processes (red). The core FMIS functions and their contributions to PFM practices are more fully explained in Dener, Watkins, and Dorotinsky, 2011. GFMIS DB = Government financial management information system database; DW = data warehouse; HR = human resources.

Where the accounting information and its quality play an important role in the management of ministries and government departments, and that one of the most important reasons for the development of accounting, in general, is to provide accurate information in a timely manner to make decisions, whether for management or the parties interested in this information, as the GFMIS is one of the most important systems that have been applied In the field of government accounting and public finance. Working to automate all financial and accounting work procedures, and replacing manual and paper methods with advanced computerized methods as it worked to unify financial systems and procedures by providing a comprehensive financial database that supports the management and making of financial decisions at the appropriate time, as financial information flows between ministries, government departments and Ministry of Finance. That is why the GFMIS is defined as an integrated computerized system that computes the entire documentary financial cycle from budget preparation, implementation, and financial reporting to ensure transparency and accountability, as this system connects all government institutions to support the decision-making process.

The Objectives of the GFMIS

The goal of the presence of the accounting information system is to produce accurate reports in a standardized and appropriate time, and to help decision makers in issuing its rational decisions with high efficiency, as the implementation of the GFMIS was found to achieve the following goals:

1. Save time and effort by simplifying financial procedures and processes.

2. Ensuring accuracy, integrity and transparency throughout all stages of the system's operation.

3. Strengthening financial monitoring, oversight and accountability.

4. Adherence to the deadlines for issuing periodic reports.

5. Implementing the state’s public budget within the limits of available allocations and determinants of providing cash.

6. Organizing banking operations, programming it, and providing reports on the collected revenues.

7. Achieving financial sustainability through managing cash to be more efficiently and effectively.

8. Electronic linking between all ministries, government departments and the Ministry of Finance.

9. Facilitate the preservation and retrieval of financial and accounting information and data.

10. Providing accurate statistical information to help the decision maker in drawing future policies and plans and taking appropriate executive decisions.

11. Achieving financial discipline and compliance and limiting errors in implementing financial procedures by not exceeding the financial allocations included in the budget and the limits of disbursement in the financial flows plan.

12. Integration between government electronic systems.

13. Monitor government spending in all sectors of the country.

14. Increased capacity to properly plan of government cash flows.

15. Assisting ministries and governmental institutions in unifying the financial and accounting procedures and electronic linking between all ministries and government spending units with the Ministry of Finance.

GFMIS Vision and Mission

The vision and mission of the GFMIS is through the deployment of an integrated government financial system whose mission is to assist the Ministry of Finance mainly in transforming fiscal policy and public financial management to be more efficient, effective, innovative, and results-oriented to manage financial operations for all government departments to ensure the following:

A. The integrity, evaluation, transparency and efficiency of all financial and accounting transactions.

B. Update financial information constantly.

C. Use a unified and integrated financial database that helps to manage public money efficiently and effectively.

D. Improving the budget cycle in order to enhance the effectiveness of government performance and provide quality service to citizens.

E. Simultaneous and subsequent audits are applied to resource allocation processes in the public budget.

GFMIS Application Features and Benefits

The system contains a number of features that can be summarized as follows:

A. One integrated system used by all state institutions that participate in the public budget.

B. An integrated system for all financial managers for use in all financial and accounting operations.

C. Financial and accounting operations are controlled and settled by the GFMIS only.

D. Providing a database that helps increase the efficiency of financial management.

E. Exchanging financial reports accurately, easily and quickly.

F. Apply the principle of transparency in the financial statements.

G. Activating the principle of financial control.

H. Make the right decisions at the right time.

I. Achieving financial sustainability through managing cash flow more efficiently and effectively.

J. Executing the public budget in accordance with its allocations, by ensuring that it is within the spending limits and determinants of availability of cash liquidity.

K. Connect all government institutions to support the decision-making process.

L. Quick access to the cash position of the government

M. An increase in the ability to access to the economic performance information.

N. Improving financial planning in the medium term.

The Organizational Structure of the GFMIS

The organizational structure of the government financial management information system GFMIS consists of the following:

A. Information Technology Department: The beating core of the GFMIS, which guarantees its continuity and effectiveness, is divided into three parts:

1. Infrastructure and Networks Division: It works to solve the problems of networks and the main devices through which the system is implemented and the backup copies of the GFMIS are raised.

2. Development and Data Transfer Department: It is responsible for developing reports from the system, developing application interfaces with other systems, and transferring and refining data from old systems to the GFMIS.

3. Support Center: This center is responsible for receiving complaints, inquiries from users, following up and resolving it.

B. Operations Department: It is subdivided into the following departments:

C. Change Management Department: this section is concerned with the process of moving and switching from old systems to desirable position, as it branches from the following: Training, communication and alignment of operations.

D. GFMIS Application Project Management Office: This office coordinates all GFMIS departments and government ministries.

GFMIS Components

Among the systems and applications of the government financial management information system are as follows:

A. Applications of preparing the public budget: These applications are concerned with preparing the draft of the state budget, starting from the stage of entering a proposal for the opinion of the competent authority and ending with the stage of issuing and approving the public budget and transferring financial allocations to the applications of the general ledger for implementation.

B. General ledger applications: These applications are concerned with the general ledger record and the introduction of the necessary budgetary adjustments governed by public budget changes (transfers - additions) in addition to the introduction of exchange registers and registration adjustments in government spending units at the level of separation / article / type / detail type, according to the accounting tab.

C. The commitment registers system: It is concerned with the introduction of commitment registers for future commitments of unspecified value and in accordance with the requirements of the administrative authority of the accounting unit, and this is implemented within the applications of the general ledger and according to the balances of financial allocations in the public budget.

D. Cash flow application: This application is concerned with the expected cash flow in the accounting unit, both revenue and expense, to develop a sound cash concept that contributes to sound cash management.

E. The application of the unified treasury account system and electronic payment and collection: It is concerned with managing the public treasury account in which all government payments and receipts are made through the electronic payment and collection process in the accounting units.

F. Accounts receivable applications: Specializes in entering and managing receipts from all sides and dealing with clients.

G. Accounts Payable Applications: It is concerned with managing and entering payments operations and dealing with suppliers.

H. Cash management applications: It is concerned with dealing with bank reconciliations and following up the payment and collection movement implemented.

I. The employees' wages system: It is concerned with calculating and paying the salaries of employees and calculating the entitlements and deductions due to the issuance of the net salaries of employees.

J. Inventory management system: It is concerned with managing inventory in government units in order to achieve proper inventory rates.

K. Procurement management system: concerned with the management of purchases, starting with the purchase order and ending with the issuance of the sales order.

L. Debt management system: It is concerned with managing loans, external and internal government debt and servicing public debt (interest and installments).

M. Grant management system: It is concerned with the management and classification of grants, its uses and requirements.

N. Revenue management system (taxes and fees): It is concerned with managing customs and tax duties revenues of all kinds.

O. Implementation of the monitoring and review system: It is concerned with electronic monitoring and review operations.

P. Application: It is a program to implement a set of operations.

Q. System: It is a program for the process of exchanging information between more than one party.

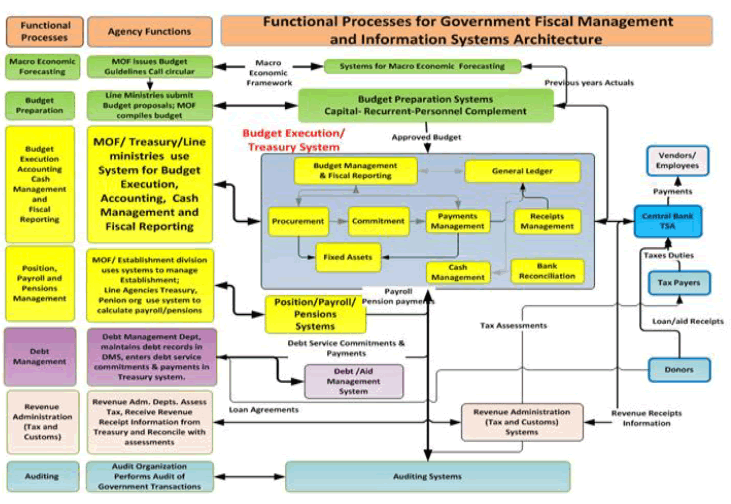

The Scope, Work Cycle and Coverage of the GFMIS

Understanding the GFMIS depends on knowing the scope of government coverage and its various sectors, to know how the government is in the process of financing and the methods currently in place, because the new government accounting thought that the GFMIS pays attention to supplying consolidated information. It requires determining the scope of coverage of the units included in the GFMIS and stating what government units are the collection of financial information is possible and feasible, and which government spending units can be included in the GFMIS. The scope of work of the GFMIS system depends on the centralization, whereby all operations and transactions related to the state budget are poured into a central system in the Ministry of Finance directly linked to the consolidated treasury account and the central bank, in addition to the components mentioned in the GFMIS, the scope of work of the system includes the following items:

The process of preparing, implementing and following up the general budget, government revenues, general accounts, cash management, governmental procurement, government payments and follow up the implementation of investment projects according to the schedule.

The automated work cycle in the GFMIS is at the level of ministries and government sectors and its relationships as targeted by the accounting units and budget bodies as shown in Figure 2.

As the system increases the central oversight functions in the Ministry of Finance to monitor spending and revenues accrued by the ministries and the ability of government spending units to carry out their tasks assigned to them, which leads to improved financial planning in the medium term.

The Accounting Rules Adopted by the GFMIS

The accounting rules related to the flows registers and balances in the GFMIS are designed in a manner that is compatible with government accounting rules, with the aim of ensuring that the data generated by this system is in accordance with the accepted standards currently in place to prepare economic statistics, and it's as follows:

A. The type of accounting system: the double entry system is used to record flows, where each register leads to an effect of equal value on both the creditor and debtor sides, the debtor is (an increase in assets and a decrease in liabilities) while the creditor is (a decrease in assets and an increase in liabilities or an increase in value added).Revenues that represent an increase in the added value are recorded as a creditor and in return, the expenses indicate a decrease in the net value and are recorded as a debit register, while the balance sheet is the collection of data (the assets and liabilities of the government unit), and represents the basic equation for the balance sheet (the sum of the assets equals the sum of the liabilities plus the value net) and the use of double entry ensures that matching is maintained correctly.

B. Time of flows: The balances recorded in the balance sheet are affected by the timing of the flows, and the problem in determining the timing of transactions is the presence of a long period between the start of work and its final completion. For example, the process of buying goods starts with signing a contract between the seller and the buyer, the production and shipping process from the seller’s place to the place of the buyer, preparing and sending the invoice, and agreeing to pay, and there may be interest paid on late payment, expiry of the discount period for immediate payment, signing the payment check and sending it to the buyer and receiving the seller for the check and depositing it in the bank, and finally the bank pays the buyer the value of the check.

In view of the problems mentioned above, the government financial system resorted to paying alternative accounting principles, which are as follows:

A. Accrual basis

B. Modified accrual basis

C. Commitment basis

D. Cash basis

The GFMIS guide relies on the above four principles for recording transactions and economic events. Where the GFMIS focuses primarily on the accrual basis to determine the time to record flows, because the time of recording the flows corresponds to the events creating the actual resource flows, and the accrual basis is the best accounting basis according to the GFMIS because it provides accurate, clear information and discloses all the operations practiced by government units, as all the authors of statistics prefer to record transactions on an accrual basis because it provides comprehensive data on the operations and economic events of the government unit. In addition to that it is considered a comprehensive accounting model for all resource flows and is recorded, including internal transactions and other economic flows, it also provides oversight and provides honest information on transparency as it gives a clear picture of the overall performance of government units, and contributes to the design and preparation of financial statements and reports that show the reality of the financial situation for the government unit.

GFMIS Development and Implementation Phases

A. Preparing the accounts tree: which includes all the main and subsidiary accounts related to revenues and expenditures, it is identical in content to the quality of the main revenues in each unit of the budgeted units and according to the nature of each.

B. Preparing a procedures guide documenting all the financial and accounting processes, procedures and its sequence for each government unit listed in the budget, at the main and sub levels, and setting up a mechanism to integrate all financial transactions into a unified total account in the Ministry of Finance and the unified treasury account and the central bank.

C. Link all financial operations to each other to reflect the related transactions in the total accounts automatically.

D. Providing Terminals link units, with each budget unit, and loading the unified application on each of them.

E. Preparing training programs and workshops for a number of employees concerned with government spending units and budget units, to train them in the stages of applying the system and analyzing its outputs.

F. Begin applying the system with selected government spending units listed in the budget.

G. Prepare the necessary experimental tests in parallel with the traditional manual system, and match it for a period of no less than one fiscal year, to indicate the extent of conformity of the final account prepared by the traditional manual methods with that extracted from the GFMIS.

H. Generalizing the use of the system based on the results of the extracted tests.

Difficulties of Applying the GFMIS

The results of implementing the GFMIS are usually disappointing, sometimes there are excessive expectations about what the system can achieve, the system can lead to better spending control and better decision-making and management, yet it won't be able to change an environment characterized by informal rules and non-compliance the regulations and directives that currently used and cannot replace internal controls in poorly managed countries. If the government administration in these countries is not serious and does not want to implement the new system, it is possible that the application of the system will face great and many difficulties, and among these difficulties are as follows:

A. When preparing for the system project and purifying information, the availability and provision of information and data from various budget institutions is one of the difficulties for those working on the system.

B. When implementing the system, the appropriate employees should be chosen in terms of the qualifications of working on the system and the desire of government spending units to provide the right people (the end user) for this task, due to the difficulty in using the interfaces system.

C. The need for technical support and training courses for GFMIS project staff to ensure that staff working on the system switch from manual procedures to computerized procedures.

D. The necessity of issuing legal controls, instructions, and legislation from the Prime Minister or the House of Representatives to compel all ministries, governorates, and government spending units to implement the GFMIS.

E. The need for a sound and good plan to implement the system through strong good management of the system project and the provision of all human, physical and financial resources to implement it.

F. Weak information technology infrastructure at the central and decentralized level used in implementing the GFMIS in all government spending units, and the lack of a strong network for the system to be linked between the Ministry of Finance and all accounting units.

G. The absence of a link between the electronic payment and collection system with the GFMIS, as the failure to activate the payment system and link it with the electronic payment system, in which the accounting units (government spending units) can issue electronic payment orders without making sure of the availability of financial allocations that allow spending or not.

Conditions for Successful Implementation of the GFMIS in Government Spending Units

The Ministry of Finance should coordinate with the company implementing the GFMIS to develop a plan to publish the partial application (horizontal method) of the GFMIS to all government spending units as a first stage, and the most important implementation steps are the following:

A. Feeding the system with spending controls in accordance with the general budget regulations, accounts and financial allocations approved in the state’s general budget, as the system monitors spending limits and adheres to financial allocations approved in the public budget.

B. Training employees of government spending units on responsibilities, applications and interfaces to be activated as follows:

1. Training employees to insert financial allocations and allocations transfer within the public budget of government spending units.

2. Training staff to prepare or enhance a plan for cash flows.

3. Training staff to enter correlation registers.

4. Training employees within government spending units to enter all financial operations.

5. Training staff in audit and analysis.

6. Training staff on all GFMIS outputs.

C. Delivery of government tunnel units employees who have been trained with mobile devices loaded with security and confidentiality systems, financial applications for the GFMIS, USB modems and connection lines for data transmission between the accounting units with the main center in the Ministry of Finance.

D. The employees of the General Budget Department of the State transfer the financial allocations to government agencies and institutions planned to be activated electronically from the (PSB) system in accordance with the applications of Oracle version 11 to the general ledger program according to the applications of Oracle version 12.

E. Budget officials in government spending units distribute financial allocations to its units, according to the administrative and qualitative accounting tabulation that currently used in those units.

F. Government spending units officials prepare a cash flow plan for its account units in light of the remaining financial allocations within the account units from the date of activation.

G. Upload the final accounts for the period from the beginning of the fiscal year to the date of activation on the (General Ledger) system, sometimes while loading the expenses through financing programs, it is discovered that many government spending units spend it excess of the permitted financial allocations, the matter that leads to referring to the General Budget Department electronically, to make many adjustments, transfers and additions electronically to amend some items, types and chapters of spending in the budgets of government spending units, so that the system can accept uploading the expenses of these units after making additions and transfers by the General Budget Department.

H. Once the allocation process is completed, expenses are loading and carried over to the general ledger system and the cash flow plan is prepared, and then the actual operation of the system is carried out for all government spending units after making all amendments and additions for review and posting electronically.

I. Activating all the main functions of the government financial management information system, including (general ledger program, receipts and payments, cash flows and purchases), with integration with other systems such as the system of automating salaries and wages (Pay Roll), the electronic payment system (E. Payment), in order to reach an integrated model and can be circulated to all ministries and government spending units.

To effectively implement GFMIS, the following conditions must be generally met:

1. GFMIS should be seen as a broader reform process, as this system addresses weaknesses in risk management systems, which requires manual procedures to be reformed before GFMIS is implemented.

2. Adequate workforce, financial resources, and capacity development required to implement the system, where the government must be able to closely supervise program developers and enterprise resource planning.

3. A phased implementation strategy should be identified in terms of functions and the number of entities of government spending units involved in implementing the system.

Results

A. The implementation of the GFMIS in the Ministry of Finance and all government institutions will contribute effectively to a holistic development of the preparation of the public budget, as the system facilitates the process of existing estimates and expenditures and this will make it easy to prepare the budget for the coming years, as the system will provide data on actual spending, which contributes to supporting the decentralization system through preparing budgets for government departments.

B. The use of the government financial management information system in the financial departments of ministries and government departments, which leads to the speedy preparation of financial reports, saving time and effort, improving the decision-making process and raising the level of financial performance in a high degree.

C. The use of the government financial management information system in the financial accounting departments of ministries and government departments, which will achieve a guarantee of the accuracy and transparency of data, the preservation and retrieval of information, financial and accounting data, upgrading the level of internal and external oversight of spending documents and raising the level of financial performance with a high degree.

D. The use of the GFMIS in customer services departments in ministries and government departments, which leads to facilitating the process of tracking customer financial transactions, according to the documentary cycle currently used, indicating the level of achievement in their transactions, improving the payment process for customer receivables without delay and obstacles and raising the level of financial performance.

E. The GFMIS is more modern and largely compatible with the requirements of the control system, as it has created a set of variables related to preparing the public budget according to all classifications, so that the GFMIS can apply the accrual basis as an accounting basis instead of the current accounting principles, and also pay attention to government accounting outputs to ensure the development of performance government financial.

F. GFMIS contributes to improving the financial performance of government units by providing useful financial information that helps auditors monitor follow up the operations of government spending units first Powel.

G. The GFMIS consolidated all financial information for the accounting units in ministries and government departments in the general ledger record, and reflected all financial transactions in the unified treasury account.

H. The GFMIS app removes duplicate financial transactions, makes them consistent and available in a systematic and disciplined manner.

I. The GFMIS assists the Ministry of Finance to improve public money management mechanisms and procedures, and is a key tool for efficient and effective reform of public financial management.

J. The GFMIS helps provide accurate financial data for preparing financial plans and cash flow plans by linking the payments system and the receipts system with the cash management system so that these plans are updated directly with actual expense balances and revenues by preparing the cash flow plan automatically by using the system.

Recommendations

Based on what was mentioned in the content of the study above and the results reached, the author proposes some recommendations that I deems appropriate in order to increase awareness of the importance of implementing the government financial management information system GFMIS, and in particular encouraging the new Iraqi government on the need to apply this system because of its clear effects of the reform of public financial management in Iraq, which are as follows:

A. The author recommends that departments and governments should pay more attention to GFMIS applications, as it has multiple functions for wider planning, oversight and decision-making.

B. The author recommends the necessity of increasing the administration's awareness and interest in implementing the GFMIS, as it provides speed, accuracy, and saves time and effort.

C. The author recommends the necessity of developing the internet networks, the database, developing and providing the computerized devices used in ministries and government spending units that applied the GFMIS, to improve its performance level and give the required speed in line with the development of the accounting environment and serves management in the areas of planning and oversight.

D. The author recommends that government departments should pay attention to the data and information provided by the system, in order for these departments to be able to control its expenditures and discover deviations before it occur and address it.

E. Increasing studies and research and interest by researchers, experts and specialists as well as by increasing awareness campaigns, to push towards encouraging governments, including Iraq, to implement the GFMIS, because of the efficiency of this system in its work and its outputs benefit on all the joints of the financial state through financial control, reducing costs Operational, decision-making and the quality of financial information in addition to the optimal use of financial resources, financial allocations within the public budget and improving the efficiency of government institutions.

F. The necessity of implementing the GFMIS in the non-profit government units for the purpose of achieving transparency and financial discipline, by unifying the financial reports in all government units.

G. All government units should work to fully use and implement the GFMIS as a tool to improve financial performance, and then achieve the overall goals of the country through rationalizing government spending, expanding revenue and thus social welfare for all will be achieved.

H. The necessity of updating the concept of the accounting unit, by shifting the financial allocations from being earmarked for achieving ambiguous, unknown and sometimes unhelpful purposes to allocating these funds to implement specific activities, programs and clear and explicit goals and thus the accounting unit becomes a group of activities and programs for which financial allocations are allocated.

I. The necessity of resorting to replacing the accounting reports and records currently in place in most government spending units to the adoption of accounting reports and records that are compatible with the GFMIS, which are more accurate and rapid financial reports than the paper reports that currently used.

J. The implementation of the GFMIS in government units will be more expressive and clear about the financial position and performance of the government and about all operations carried out by government spending units during the ending fiscal year and some expected future operations, in a manner that helps provide useful information that meets the largest possible number of needs of different users, especially auditors for the purpose of tracking government unit operations and assessing its financial performance.

K. The necessity of relying on digital technologies to complete government transactions, as it has become a necessity imposed by global and regional developments and the weak performance of paper reports currently used and its inaccuracy, which does not provide to the central government with adequate financial information on the financial situation in all government institutions.

L. The necessity of choosing the employees working on the GFMIS carefully and according to the required qualifications and those who have technical expertise in this field, and providing training courses on the system to ensure that the end users are using the system correctly in their daily routine tasks.

M. The necessity of providing the necessary infrastructure for the successful implementation of the system in all government units and accounting units at the central and decentralized level by extending the electronic link lines between the main center of the information system in the Ministry of Finance and government spending units in all state institutions.

N. The necessity of formulating a clear government strategic plan for the implementation of the government financial management information system, through which the subsystems of the GFMIS are activated in stages that take into account the technical capabilities of human resources in all government spending units and the extent of their ability to gradually shift from the manual system to prepare, implement and control the state budget to the electronic system for all administrative and financial transactions within the accounting units, I suggest that the first stage include activating the subsystems that help achieve financial discipline for the public budget. The second stage includes activating the subsystems that help in proper and good planning and allocating resources to all sectors of the state, while the third stage includes activating the subsystems that help to provide services efficiently and effectively and measuring the performance of public services.

O. A legal instrument must be issued by the House of Representatives or the Prime Minister to compel ministries, governorates, and all government institutions to implement and work on the GFMIS system.

P. The need to create a strong organizational structure for managing the GFMIS project within the Ministry of Finance

References

Al-Mousawi, A.S.K. (2017). The government's financial statistics system in enhancing the effectiveness of oversight in centrally funded units. Journal of Financial and Accounting Studies, twelveth(41- Fourth ), 183-206.

Al-Shazly, A.S. (2019). The role of financial technologies in improving government financial management: an economic study. Arab Monetary Fund Journal , 53.

Al-Tohma, H.H. (2019). What does the implementation of the Financial Information Management System in Iraq mean? Baghdad.

Aziz, W.A. (2017). The effect of applying the government financial information system on the efficiency of public financial performance in Egypt. Egypt-Cairo.

Hamdan, M.B. (2016). The role of government financial management information system in raising the effectiveness of the government budgeting. International Journal of Business and Social Science , 7(6), 244-261.

Dener, C., & Saw, Y.M. (2013). Financial management information systems and open budget data: Do governments report on where the money goes? Washington, DC. World Bank.

Farhood, on the morning of Barzan al. (2013). "The Role of the Pillars of Governance in the Efficiency of the Public Budget Preparation, Dhi Qar University Scientific Journal 0.2 (8). 96-123.

Zapata, M. (2014). Financial management in the family and non-family in the industry in Mexico, Journal of accounting and taxation, 2, 49-57.

Shannak, R.O. (2015). Government financial management information system: The case of government of Jordan. International conference of Talal Abo Ghazaleh / University of Business. Manama- Kingdom of Bahrain: University of Business.

International Monetary Fund. (2012). Data quality assessment framework for government finance statistics. Washington, DC: IMF.

World Bank FMIS Database (1984-2013), updated July 2013.

Received: 30-Dec-2021, Manuscript No. JMIDS-21-6206; Editor assigned: 02-Jan-2022, PreQC No. JMIDS-21-6206 (PQ); Reviewed: 15-Jan-2022, QC No. JMIDS-21-6206; Revised: 23-Jan-2022, Manuscript No. JMIDS-21-6206 (R); Published: 30-Jan-2022