Research Article: 2021 Vol: 25 Issue: 5

The Green Products Strategy and Financial Performance: A Case of Firms Listed on the Johannesburg Stock Exchange

Obey Dzomonda, Department of Research Administration and Development, University of Limpopo, South Africa

Abstract

This study assessed the link between the green products strategy and financial performance of firms listed on the Johannesburg Stock Exchange. The current study adopted a quantitative research method informed by a positivism research philosophy. The population of the study was all firms listed on the Johannesburg Stock Exchange. The sample consisted of 16 firms listed on the FTSE/JSE Responsible Investment Top 30 Index operating operate in Environmentally Sensitive Industries such as mining, energy, manufacturing as well as health and pharmaceuticals. Panel data spanning from 2011-2018 was used. Data was analysed using panel regression. Particularly, the feasible generalised least squares was used. Interestingly, the relationship between the green strategy and financial performance (EPS) was found to be significant at 10% significance level. To that effect, the alternative hypothesis stating that there is a significant positive relationship between the green strategy and the EPS of firms listed on the JSE was supported. This confirms that stakeholders such as customers, suppliers and investors are now preferring firms which excel in green initiatives. The novelty of this study is that it generated new empirical findings which can add value to the body of knowledge Recommendations are made for managers of listed firms to build a strong case for sustainability where the green strategy is incorporated into the main strategy of the business to align the business for financial benefits associated with the green revolution.

Keywords

Eco Design, Eco Labelling, Financial Performance; Green Packaging; Green Products; Strategy.

Introduction

It has become pertinent for businesses to adopt the green business strategy which enables them to be sustainable entities. The green business revolution calls for businesses to adapt their products or services to cater for the environment. This is a strategic issue which means businesses should have a clear plan on how to leverage on this innovative concept. The green business strategy can be implemented by leveraging on the manufacturing and sale of green products. Green products are defined as environmentally friendly products which are produced with biodegradable features (Mukonza & Swarts, 2020). The green products and services innovation strategy can be an effective tool to appeal to environmentally sensitive consumers (Xue et al., 2019). Green oriented customers are a unique set of customers with new needs never served in the market before. The eco-consumerism has seen most consumers in both developed and developing countries becoming aware of their health needs and the need for environmental stewardship from concerned firms (Ali et al., 2020). South African consumers have also recently started considering environmental products seriously (Maiziriri, 2020). These customers are willing to pay a premium for green oriented products which meet their health requirements while also contributing towards environmental protection. Hence, new markets and customers are emerging for such products globally, creating additional revenue streams for firms that choose to pursue such avenues (Miroshnychenko et al., 2017).

The empirical findings about the relationship between green products and services innovation and financial performance are inconclusive. For example, Miroshnychenko et al. (2017) reported a positive relationship between green practices and financial performance while other studies report a negative relationship (Orzan et al., 2018; Seo et al., 2016). Besides the inconclusiveness of existing empirical findings, the impact of investing in green products to enhance financial performance remain unexplored in South Africa in the context of listed firms. Presently, a study by Maziriri (2020) investigated green marketing among South African Small and Medium Enterprises. Another study by Mukonza & Swarts (2020) also investigated green marketing strategies on performance of two retailers in South Africa. Thus, the major objective of this study is to examine the relationship between green products/services innovation and financial performance of listed firms. Essentially, the current study focused on listed firms because they have slack financial resources which they can invest towards the green strategy concept. This view is supported by the Slack Resources Hypothesis. The novelty of this study is that it generated new empirical findings which can add value to the body of knowledge. Practically, the findings of this study are expected to help the managers of listed firms to raise awareness about green products to their different stakeholders.

Literature Review

Legitimacy Theory

Dowling & Pfefeer (1975) define legitimacy as the way the society perceives an organisation as desirable or appropriate as determined by how it conduct business. For legitimacy to exist, there should be congruence between the values of the firm and that of the society. Any disparity between the two may result in conflicts between the two systems, which may create unfavourable operating conditions for the business. It follows that the expectations of the society are deep rooted in the social contract which, in most cases, is very delicate. The delicacy of the social contract emanates from the fact that social needs and expectations are not static but evolve over time. This entails that firms’ activities and behaviour should always adjust to cater for the new social contract. Any breach of the social contract carries negative implications for the firm, which are difficult to resolve in the short run. This means the firm should operate within the norms and belief systems of the society less it risks business failure. Firms should also take certain actions to justify their existence. Such actions include; adhering and respecting the society’s values and belief systems that in turn award the firm endorsement and positive publicity, which is essential for business sustainability. Noteworthy, it is imperative for a firm to keep itself abreast with changing society values, norms and beliefs as well as stakeholder needs so as to maintain a positive image and legitimacy (Ching & Gerab, 2017; Wei et al., 2017).

Perceived legitimacy creates long term relationships between a firm and its stakeholders (Ching & Gerab, 2017). As such, stakeholders tend to favour or associate with businesses they perceive as legitimate (Maleka et al., 2017). It follows therefore, that businesses should behave responsibly in order to improve their legitimacy from the perspective of key stakeholders and the society. Burlea & Popa (2013) submit that firms have to prove their legitimacy by respecting and adhering to society’s values and expectations lest they risk business failure or lawsuits. The same study further alludes that firms can disclose and report on how they are dealing with social and environmental challenges to improve their legitimacy rating by the society. The legitimacy behaviour of firms is shaped by its management and pressure from the society for firms to account for their actions and damages to the environment and the social sphere (Burlea & Popa, 2013). Firms should endeavour to continuously engage their stakeholders to avoid conflicts which can consequently reduce the firm’s legitimacy (Whelan & Fink, 2016).

The legitimacy theory remains one of the widely adopted theories in studies related to environmental sustainability. Moreover, unlike other theories, the legitimacy theory clearly outlines some innovative strategies that firms can use to gain trust from their stakeholders. To this end, most companies are involved in voluntary disclosures as an application of the Legitimacy theory. Such voluntary environmental disclosures are linked to enhanced environmental performance and superior corporate image. This makes the Legitimacy theory an important theory for this study. This theory has been used by a plethora of studies to explain what motivates firms to invest in sustainability initiatives and generally as a strategic tool for a firm to maintain key relations and gain a positive image from the society. One compelling idea derived from the legitimacy theory is that the society has a bearing on the demise or success of a firm. Hence, firms ought to act and operate within the legitimacy dictates prescribed by the society if they are to enhance their legitimacy (Reisig & Bain, 2016; Ching & Gerab, 2017; Maleka et al., 2017). The next section discusses the concept of sustainable development.

The Green Products Strategy

The concept refers to the production of biodegradables which can add value to the environment rather than destroying it. Green products are designed to eliminate inefficiencies from the source and eliminate reliance on end of pipe strategies to environmental protection (Eneizan & Wahab, 2016). This is triggered by the emergence of green customers globally (Ali et al., 2020). Essentially, green products and services innovation positively influence other areas such as energy efficiency, water efficiency, waste and carbon emission reduction (Eneizan & Wahab, 2016). With high levels of environmental damage caused by excessive pollution and carbon emissions, leveraging on the green products and services innovation strategy enables businesses to minimise environmental damage. More importantly, green products and services innovation may increase the green sales of the firm by attracting environmentally acclimatised customers. Green products and services innovation include eco design, products innovation, use of green packaging, enhanced product quality and eco-labelling, among others.

Eco Design

Eco design describes the processes put in place by a firm to design products that are environmentally friendly. It can also be defined as a strategy to cut resource overuse at the preliminary stages of the product design (Mendoza et al., 2017). It is characterised by life cycle thinking from the primary stages of product conceptualisation, and it helps in resource efficiency. This is because eco design is an operational strategy (De Pauw et al., 2014). As such, eco design is regarded as the cornerstone of the circular economy (European Environmental Bureau, 2015). Due to rising pressure for environmental protection, pundits of sustainability argue that measures to eliminate possible toxins on the environment should start at the designing phase of the product (Vanalle et al., 2017). This entails designing products that are biodegradable, hence, minimising environmental damage. On that note, De Pauw, Kandachar & Karana (2015) are of the view that eco designers can learn much from mimicking natural systems and biological processes. The proponents of this view name it biomimicry. It helps eco product designers to give a product unique features that do not only excel in environmental sustainability, but that can also give the firm an unmatched competitive advantage. Nature inspired design is premised on the idea that waste should be converted into something of economic value through sustainable strategies. Essentially, nature inspired designs are successful when designers infuse their designs with materials which easily decompose and become part of the environmental regeneration nutrients (Tempelman et al., 2015). Biomimicry tends to bear fruits when a holistic approach is followed and everyone in the firm participates (De Pauw et al., 2014; De Pauw et al., 2015). Mendoza et al. (2017) underscore that the design stage can help eliminate 80% of environmental damage if well executed as is required in eco designing.

Green Packaging

The issue of packaging has generated much debate recently. There is evidence that plastics generate approximately 70% of environmental pollution (Yildiz & Sezen, 2019). As such firms need to rethink their packaging to suit the green requirements (Franklin Associates, 2014). Hsu et al. (2016) define green packaging as applying environmental sensitivity in the packaging of a product. In this definition, other scholars deduce that green packaging also involves using packages that are compliant to the quality standards as set out by environmental regulators (Franklin Associates, 2014). There is an agreement among researchers that green packaging consists of using biodegradable material, cutting out excess material on the package and using alternative packages (Maziriri, 2020). Nevertheless, green packaging should not compromise the perceived quality of the product, ease of use and its compatibility for distribution purposes. This entails that firms should take all these factors into consideration before adopting the packaging.

Eco Labelling

In this study, eco labelling is defined as initiatives put together by a firm to communicate its environmental responsibility. This is done by putting information related to green practices on the firm’s products. Such information is intended to educate customers on the benefits of green behaviour as well as organic ingredients contained in the product. As such, eco-labelling has become one of the crucial tools of green marketing (Testa et al., 2015). Eco-labels are meant to guide customers on their purchase decision making. It follows that customers perceive firms that effectively label their products transparent as compared to those that do not. On that note, customers usually trust green products with international green certification. This assures them that the information provided on eco labels is authentic. Eco labelling backed by international environmental certification assures customers that the firm is not into greenwashing, a concept that has led most green customers not to be easily convinced by eco labels. Fears are that marketers preach what they do not practise in reality. As such, firms should ensure that the information provided on eco labels is legitimate to avoid possible lawsuits (Testa et al., 2015; Delmas & Lessem, 2017; Hameed & Waris, 2018).

For the above green product and services innovation strategy to work, the entire internal processes should be transformed to support the new strategy. Trying to implement the green product and services innovation strategy without aligning it to internal processes can lead to outright failure of the initiative. To that effect, green processes should be in place to help eliminate any inefficiency from inputs to the outputs. Moreover, the firm’s buildings, warehouses and its logistics should signal to customers that the firm is seriously involved in green revolution not green washing. When all the above are in order, it becomes a well-coordinated system that guarantees the firm success from its green investments (Eneizan & Wahab, 2016).

Hypothesis Development

Relationship between Green Products Strategy and Financial Performance

Green innovation in terms of green product designs allows a firm to renew its value proposition in the market resulting in a favourable position (Xue et al., 2019). According to Chen et al. (2016), green products can help firms to avoid costs associated with environmental penalties. In addition, green products can also open new markets for the firm by appealing to environmentally sensitized customers. For firms that consider growing, this can be a cost effective and sustainable expansion strategy. This is because green products present a new opportunity for firms to expand into new markets that have never been tapped before. Hence, a firm is able to broaden its future revenue streams leading to enhanced financial performance.

Green products development can be a sustainable mechanism for firms to cut costs (Kushwaha & Sharma, 2015). There is a consensus among studies from different industries that green product development initiatives such as eco-design, eco-labelling, product innovation and recyclable products result in enhanced financial performance (Lin et al., 2013; Dangelico & Pontrandolfo, 2015; Kushwaha & Sharma, 2015).

Ar (2012) adopted a survey method to assess the effect of green product innovation on profitability. The study adopted a questionnaire to collect data from 140 firms in Turkey. It emerged that green product innovation was positively related to financial performance. Moreover, the study established that firms can gain superior competitive advantage by investing in green products and services innovation.

Cheng et al. (2014) analysed the effect of eco-innovation and performance of Taiwanese firms. The study findings indicated that eco-product designs positively influence the performance of firms. Cheng et al. (2014) argued that innovation supports the recent green business models which are ideal in current markets characterised by green oriented customers. Furthermore, with the vastness of information and interactive platforms such as social media, customers are now easily accessing product and different company brand reviews. This means that a firm with negative reviews in terms of its product and services inability to meet the customers’ green expectations is dropped right immediately.

Chen et al. (2018) proved that green initiatives were positively related to profitability by assessing green initiatives of firms in different regions. Even though the effect varied from one region to another, a positive relationship was established between green products innovation and profitability. Additionally, the study noted that the positive financial returns of green initiatives are usually realized in the long run. In the long, the firm could have recovered all the costs incurred in purchasing new machines, new technology and new product designs. These tend to strain the firm’s cash flows in the short run.

In supporting the positive relationship hypothesis, Przychodzen & Przychodzen (2015) reported that green products allow firms to earn higher profits which allows them to fund their growth. A similar study conducted in Brazil confirmed that green products positively influence financial performance.

Conversely, some studies cite that the green products innovation strategy can negatively affect the firm’s profitability (Rexhäuser & Rammer, 2014). A significant amount of investment is required in new technology and process before implementing the design and production of green products and services. This may lead to significant cash outflows which might take long to recover.

Other studies are of the view that green products and services innovation strategies such as green packaging and eco-labelling can make the final price of the product unreasonably high. For instance, Orzan et al. (2018) analysed the effect of behaviour and attitudes of Romanian consumers towards green packaging. The study found that consumers may be discouraged from buying highly priced green products and continue buying less priced environmentally unfriendly products. This negatively impacts on the financial performance of the firm. Similarly, Seo et al. (2016) assessed attitudes of customers towards green products. The findings showed that that green products increase the cost of production which is later passed on to customers in form of higher prices. This may drive away customers leading the business to run losses.

The author of this study is of the conviction that firms can benefit immensely by investing in green products. This is because several stakeholders such as customers, suppliers and investors prefer brands which excel in the green initiatives. This means investors are prepared to pay a premium on shares for firms which excel in green issues because they anticipate that the business will continue to operate as a going concern into the foreseeable future. Performing well in terms of green products and services can also enable a business to score a positive rating from its customers which enhances its market value. Based on this, the following hypothesis is proposed:

Ha: There is a significant positive relationship between the green products innovation strategy and the earnings per share of firms listed on the JSE.

Methods and Materials

The study area of this study was all FTSE/JSE listed firms. The researcher opted for a quantitative research approach and used a case study research design. This is because the researcher intended to collect data from several listed firms. The longitudinal design was adopted where the researcher collected panel data from 2011-2018. The reason for considering this period was that integrated financial reporting was introduced in 2010 in South Africa. Hence, relevant data was obtainable from 2011 and beyond (Leigh, 2017). All firms listed on the JSE were considered as the population of this study. The choice to consider JSE listed firms was that these are critically scrutinised in terms of sustainability engagement and reporting (JSE, 2019).

Sample Description

The sample consisted of 16 firms listed on the FTSE/JSE Responsible Investment Index. These firms were observed for a period of 8 years from 2011-2018 which resulted in 128 observations. These firms operate in Environmentally Sensitive Industries (ESI) such as mining, energy, manufacturing as well as health and pharmaceuticals. The FTSE/JSE Responsible Investment Index is an index formed by the partnership between the JSE and the FTSE Russell in June 2015 in a bid to promote sustainable behaviour among listed firms. The firms on the FTSE/JSE Responsible Investment Index have been actively involved in sustainability practices (JSE, 2019). Additionally, they have satisfied the reporting requirements for both the FTSE and the JSE. This assisted the researcher to access all the data required to test the hypotheses of the study. This addressed the issue of missing data which usually causes problems in research (Putz, 2017).

Data Collection

This study utilised secondary data, which is annual financial statements of firms listed on the JSE. The data provided by these firms is critically audited to enhance transparency (Amacha & Dastane, 2017). Secondary data is widely used in studies linking environmental sustainability to financial performance (Amacha & Dastane, 2017; Boakye, 2018). Financial performance data such as Tobin’s Q, liquidity and firm size was collected from integrated annual financial statements on the firm’s websites and the McGregor database. Quantitative content analysis was used to collect data related to stakeholder engagement. The research used a dichotomous scale ranging from 0 and 1 for objectivity (Mans-Kemp, 2014). During data collection, a score of 0 was allocated when the variable was not reported and a score of 1 was allocated when the variable was reported in the financial year following similar studies (Galant & Cadez, 2017). Data was analysed using Panel regression analysis model. The Fixed and Random effects models were used to analyse data. The Hausman test was used to evaluate the appropriate model to use between the fixed effects and the random effect model depending on the data set provided (Pedace, 2013).

Measurement of Variables

Dependant variable (Financial Performance)

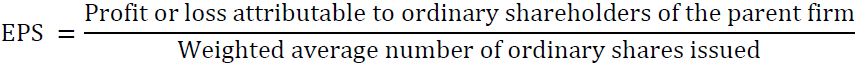

This study used earnings per share (EPS) to measure financial performance. EPS reflects the value of a firm’s shares. EPS was adopted for this study because firms listed on the JSE are required to publish their EPS. More importantly, EPS is used for strategic decisions such as stock valuations and possibilities of considering another firm for possible joint ventures or mergers. EPS is also relatively easy to calculate. Most firms use EPS because investors easily understand it. Ideally, EPS has an influence on the share price of the firm. As such, EPS stands as a key ratio useful in financial reporting (Mans-Kemp, 2014; Madugba & Okafor, 2016; Samiloglu et al., 2017).

In this study EPS was calculated as follows;

Independent variable (Green products Strategy)

The green products strategy was the independent variable in this study. It was measured using products, green packaging, enhanced product quality, green labelling and eco design.

Dependent variable; Y: Financial performance

Dependent variable 1; Y: EPS

Independent variable; X: Green products strategy

Independent variable 1; X1: Green products strategy

Panel regression model

Yit=α+X1it+X2it+X3it + ε

Where y=financial performance; x1= green products strategy; x2= firm size; x3=Liquidity; + ε = error term; α= constant

Control variables

It is important to determine if other underlying factors have an influence on the dependent variable (Maleka et al., 2017). Hence, these factors should be tested prior to the independent variable to provide an alternate explanation for the findings. Control variables such as firm size and liquidity were used following similar studies (Jayeola, 2015). This is because the size of the firm and liquidity have an effect on the overall financial performance of a firm (Marashdeh, 2014; AlShahrani & Tu, 2016). In this study, market capitalisation was used to measure the size of the firm while liquidity was measured by compiling values from the current ratio of firms which were evaluated.

Results and Discussion

Descriptive Statistics

Table 1 present descriptive statistics of key variables. The total number of observations was 128 derived from 16 firms observed for 8 years. Considering green products and services, a mean of 1.144531 was observed with a standard deviation of 1.457438, with a minimum value of 0 and a maximum value of 3. The mean for liquidity was 1.425118 and the standard deviation was 0.9830142. The minimum value for liquidity was 0 and the maximum value was 6.8176. Considering firm size, the mean score was 9297.23 and the standard deviation was 47711.28. The minimum value was 0 and the maximum value was 428668.

| Table 1 Descriptive Statistics | |||||

| Variable | Obs | Mean | Std. Dev. | Min | Max |

| Green products and services | 128 | 1.144531 | 1.457438 | 0 | 3 |

| Liquidity | 128 | 1,425118 | 0,9830142 | 0 | 6,8176 |

| Firm size | 128 | 9297,23 | 47711,28 | 0 | 428668 |

Correlation Analysis

Table 2 shows correlation analysis results among the key variables of the study. The green strategy was found to be negatively correlated with EPS Q (-0.2118) and liquidity (-0.032) respectively. On the other hand, a possitive correlation (0.0255) was established between the green strategy and firm size.

| Table 2 Correlation Analysis | ||||

| Variables | EPS | GreenP strategy | liquidity | Firm size |

| EPS | 1 | |||

| GreenP strategy | -0.2118 | 1 | ||

| Liquidity | -0.032 | 0.034 | 1 | |

| Firm size | 0.122 | 0,0255 | 0.0222 | 1 |

Relationship Between the Green Products Strategy and Financial Performance

Table 3 present findings on of the Feasible generalised least squares model on EPS. It was found that the green products strategy positively and significantly predicts financial performance particularly EPS (166.2; p<0.073). The relationship was significant at the 10% significance level. To that effect, the hypothesis that there is a significant positive relationship between the green products strategy and the EPS of firms listed on the JSE is accepted. This confirms that stakeholders such as customers, suppliers and investors are now preferring firms which excel in green initiatives. As such, investors are prepared to pay a premium on shares for firms which excel in green issues because they anticipate that the business will continue to operate as a going concern into the foreseeable future. Performing well in terms of green products and services can also enable a business to score a positive rating from its customers which enhances its market value and EPS. The findings of the current study are corroborated by a plethora of studies conducted outside South Africa.

| Table 3 Model 1 FGLS regression -EPS | ||||||

| Cross sectional time series FGLS regression | ||||||

| Coefficients: generalized least squares | ||||||

| Panels: | heteroskedastic | |||||

| Correlation: no autocorrelation | ||||||

| Estimated covariances | = | 1 | Number of obs = | 128 | ||

| Estimated autocorrelation | = | 0 | Number of groups= | 16 | ||

| Estimated coefficients | = | 11 | Time periods= | 8 | ||

| Wald chi2 (10)= | 131.93 | |||||

| Prob >chi2= | 0.0000 | |||||

| EPS | Coef. | Std.Err. | z | P>|z| | [95% confi. | Interval] |

| GreenProd | 166.2241 | 92.61029 | 1.79 | 0.073 | -15.28871 | 347.737 |

| Liquidity | 559.4661 | 141.5768 | 3.95 | 0.000 | 281.9807 | 836.9516 |

| Firm size | 0.4827396 | 0.707116 | 6.83 | 0.000 | 0.3441475 | 0.6213317 |

| __cons | -983.9288 | 1506.284 | -0.65 | 0.514 | -3936.191 | 1968.333 |

For example, Xue et al. (2019) argue that green innovation in terms of green product designs allows a firm to renew its value proposition in the market resulting in a favourable position. According to Chen et al. (2016), green products can help firms to avoid costs associated with environmental penalties. In addition, green products can also open new markets for the firm by appealing to environmentally sensitized customers. For firms that consider growing, this can be a cost effective and sustainable expansion strategy. This is because green products present a new opportunity for firms to expand into new markets that have never been tapped before. Hence, a firm is able to broaden its future revenue streams leading to enhanced financial performance. Green products development can be a sustainable mechanism for firms to cut costs (Cheng et al., 2014; Kushwaha & Sharma, 2015). There is a consensus among studies from different industries that green product development initiatives such as eco-design, eco-labelling, product innovation and recyclable products result in enhanced financial performance (Lin et al., 2013; Dangelico & Pontrandolfo, 2015; Kushwaha & Sharma, 2015).

Ar (2012) adopted a survey method to assess the effect of green product innovation on profitability. The study adopted a questionnaire to collect data from 140 firms in Turkey. It emerged that green product innovation was positively related to financial performance. Moreover, the study established that firms can gain superior competitive advantage by investing in green products and services innovation. Cheng et al. (2014) analysed the effect of eco-innovation and performance of Taiwanese firms. The study findings indicated that eco-product designs positively influence the performance of firms. Cheng et al. (2014) argued that innovation supports the recent green business models which are ideal in current markets characterised by green oriented customers. Furthermore, with the vastness of information and interactive platforms such as social media, customers are now easily accessing product and different company brand reviews. This means that a firm with negative reviews in terms of its product and services inability to meet the customers’ green expectations is dropped right immediately.

Chen et al. (2018) proved that green initiatives were positively related to profitability by assessing green initiatives of firms in different regions. Even though the effect varied from one region to another, a positive relationship was established between green products innovation and profitability. Additionally, the study noted that the positive financial returns of green initiatives are usually realized in the long run. In the long, the firm could have recovered all the costs incurred in purchasing new machines, new technology and new product designs. These tend to strain the firm’s cash flows in the short run. In supporting the positive relationship hypothesis, Przychodzen & Przychodzen (2015) reported that green products allow firms to earn higher profits which allows them to fund their growth. A similar study conducted in Brazil confirmed that green products positively influence financial performance.

Conclusion

This study assessed the link between the green products strategy and financial performance (EPS) of firms listed on the JSE, particularly the FTSE/JSE Responsible Investment Index. The current study adopted a quantitative research method informed by a positivism research philosophy. The population of the study was all firms listed on the Johannesburg Stock Exchange. The sample consisted of 16 firms listed on the FTSE/JSE Responsible Investment Top 30 Index. Panel data spanning from 2011-2018 was used. Data was analysed using panel regression. Particularly, the feasible generalised least squares was used. Interestingly, the relationship between the green strategy and financial performance (EPS) was found to be significant at 10% significance level. To that effect, the alternative hypothesis stating that there is a significant positive relationship between the green strategy and the EPS of firms listed on the JSE was supported. This confirms that stakeholders such as customers, suppliers and investors are now preferring firms which excel in green initiatives. As such, investors are prepared to pay a premium on shares for firms which excel in green issues because they anticipate that the business will continue to operate as a going concern into the foreseeable future. The limitations of this study include that this study was limited to 16 firms considered to operate in Environmentally Sensitive Industries (ESI) such as mining, energy, manufacturing as well as health and pharmaceuticals. Nevertheless, the findings of the study contribute new empirical evidence to the body of knowledge. The findings can also help managers of listed companies to design internal environmental policies which promote the green strategy and green business models. The author of this study suggest that further research can investigate the moderating role of industry type on the link between other environmental sustainability variables and financial performance. Recommendations are made for managers of listed firms to build a strong case for sustainability where the green strategy is incorporated into the main strategy of the business to align the business for financial benefits associated with the green revolution.

References

- Ali, Q., Salman, A., Parveen, S., & Zaini, Z. (2020). Green Behavior and Financial Performance: Impact on the Malaysian Fashion Industry. SAGE Open, 10(3), 2158244020953179.

- Alshahrani, S., & Tu, Z. (2016). The impact of organisational factors on financial performance- Building a theoretical model. International Journal of Management Science and Business Admin, 2(7), 51-52.

- Amacha, E., & Dastane, O. (2017). Sustainability Practices as Determinants of Financial Performance: A Case of Malaysian Corporations. The Journal of Asian Finance, Economics and Business, 4(2), 55-68.

- Ar, I.M. (2012). The impact of green product innovation on firm performance and competitive capability: the moderating role of managerial environmental concern. Procedia-Social and Behavioral Sciences, 62, 854-864.

- Boakye, D.J. (2018). The Relationship between Environmental Management Quality and Financial Performance of AIM listed Firms. Doctoral thesis, Bournemouth University.

- Burlea, A.S., & Popa, I. (2013). Legitimacy theory. In Encyclopedia of Corporate Social Responsibility (pp. 1579-1584). Springer Berlin Heidelberg.

- Chen, F., Ngniatedema, T., & Li, S. (2018). A cross-country comparison of green initiatives, green performance and financial performance. Management Decision, 56(5), 1008-1032.

- Chen, P.H., Ong, C.F., & Hsu, S.C. (2016). Understanding the relationships between environmental management practices and financial performances of multinational construction firms. Journal of cleaner production, 139, 750-760.

- Cheng, C.C., Yang, C.L., & Sheu, C. (2014). The link between eco-innovation and business performance: A Taiwanese industry context. Journal of Cleaner Production, 64, 81–90.

- Ching, H.Y., & Gerab, F. (2017). Sustainability reports in Brazil through the lens of signaling, legitimacy and stakeholder theories. Social Responsibility Journal, 13(1), 95-110.

- Dangelico, R.M., & Pontrandolfo, P. (2015). Being “green and competitive”: the impact of environmental actions and collaborations on firm performance. Business Strategy Environment, 24, 413-430.

- De Pauw, I.C., Karana, E., Kandachar, P., & Poppelaars, F. (2014). Comparing Biomimicry and Cradle to Cradle with Ecodesign: a case study of student design projects. Journal of Cleaner Production, 78, 174- 183.

- De Pauw, I.C., Kandachar, P., & Karana, E. (2015). Assessing sustainability in nature?inspired design. International Journal of Sustainable Engineering, 8(1), 5-13.

- Delmas, M.A., & Lessem, N. (2017). Eco-premiumoreco-penalty? Eco-labels and quality in the organic wine market. Business & Society, 56(2), 318-356.

- Dowling, J., & Pfeffer, J. (1975). Organizational legitimacy: Social values and organizational behavior. Pacific Sociological Review, 18(1):122-136.

- Eneizan, B.M., & Wahab, K.A. (2016). Effects of green marketing strategy on the financial and non-financial performance of firms: A conceptual paper. Arabian Journal of Business Management Review, 6(5), 1-7.

- European Environmental Bureau, (2015). Delivering resource?efficient products: How eco design can drive a circular economy in Europe. Brussels: European Environmental Bureau (EEB). [Online]. Available: https://eeb.org/work-areas/resource-efficiency/circular-economy/. Accessed on 19 August 2019.

- Franklin Associates, (2014). Impact of Plastics Packaging on Life Cycle Energy Consumption & Greenhouse Gas Emissions in the United States and Canada – Substitution Analysis. Report prepared for the American Chemistry council (ACC) and the Canadian Plastics Industry Association (CPIA). [Online]. Available: https://plastics.americanchemistry.com/EducationResources/Publications/Impact-of-Plastics-Packaging.pdf. Accessed on 16 July 2019.

- Frenken, K., & Faber, A. (2009). Introduction: Evolutionary methodologies for analyzing environmental innovations and the implications for environmental policy. Technological Forecasting and Social Change, 76, 449-452.

- Galant, A., & Cadez, S. (2017). Corporate social responsibility and financial performance relationship: a review of measurement approaches. Economic research-Ekonomska istra?ivanja, 30(1), 676-693.

- Hameed, D., & Waris, I. (2018). Eco labels and eco conscious consumer behavior: The mediating effect of green trust and environmental concern. Journal of Management Sciences, 5(2), 86-105.

- Jayeola, O. (2015). The impact of environmental sustainability practice on the financial performance of SMEs: A study of some selected SMEs in Sussex. International Journal of Business Management and Economic Research, 6(4), 214-230.

- Kushwaha, G.S., & Sharma, N.K. (2015). Green initiatives: a step towards sustainable development and firm’s performance in the automobile industry. Journal of Cleaner Production, 121, 116-129.

- Leigh, G.R. (2017). Integrated Reporting: The South African Experience. [Online]. Available: https://www.cpajournal.com/2017/07/28/integrated-reporting-south-african-experience/. Accessed on 01 April 2018.

- Lin, R.J., Tan, K.H., & Geng, Y. (2013). Market demand, green product innovation, and firm performance: evidence from Vietnam motorcycle industry. Journal of Cleaner Production, 40, 101-107.

- Madugba, J.U., & Okafor, M.C. (2016). Impact of Corporate Social Responsibility on Financial Performance: Evidence from Listed Banks in Nigeria. Expert Journal of Finance, 4, 1-9.

- Maleka, T., Nyirenda, G., & Fakoya, M. (2017). The Relationship between Waste Management Expenditure and Waste Reduction Targets on Selected JSE Companies. Sustainability, 9(9), 1-20.

- Mans-Kemp, N. (2014). Corporate governance and the financial performance of selected Johannesburg Stock Exchange industries. Doctoral dissertation, Stellenbosch University.

- Marashdeh, Z.M.S. (2014). The effect of corporate governance on firm performance in Jordan (Doctoral dissertation, University of Central Lancashire).

- Maziriri, E.T. (2020). Green packaging and green advertising as precursors of competitive advantage and business performance among manufacturing small and medium enterprises in South Africa. Cogent Business & Management, 7(1), 1719586.

- Mendoza, J.M.F., Sharmina, M., Gallego?Schmid, A., Heyes, G., & Azapagic, A. (2017). Integrating backcasting and eco?design for the circular economy: The BECE framework. Journal of Industrial Ecology, 21(3), 526-544.

- Miroshnychenko, I., Barontini, R., & Testa, F. (2017). Green practices and financial performance: A global outlook. Journal of Cleaner Production, 147, 340-351.

- Mukonza, C., & Swarts, I. (2020). The influence of green marketing strategies on business performance and corporate image in the retail sector. Business Strategy and the Environment, 29(3), 838-845.

- Orzan, G., Cruceru, A., B?l?ceanu, C., & Chivu, R. G. (2018). Consumers’ Behavior Concerning Sustainable Packaging: An Exploratory Study on Romanian Consumers. Sustainability, 10(6), 1-11.

- Pedace, R. (2013). Econometrics for dummies. Hoboken, NJ: Wiley.

- Przychodzen, J., & Przychodzen, W. (2015). Relationships between eco-innovation and financial performance–evidence from publicly traded companies in Poland and Hungary.Journal of Cleaner Production, 90, 253-263.

- Reisig, M.D., & Bain, S.N. (2016). University legitimacy and student compliance with academic dishonesty codes: A partial test of the process-based model of self-regulation. Criminal Justice and Behavior, 43(1), 83-101.

- Rexhäuser, S., & Rammer, C. (2014). Environmental innovations and firm profitability: unmasking the Porter hypothesis. Environmental and Resource Economics, 57(1), 145-167.

- Samiloglu, F., Oztop, A.O., & Kahraman, Y.E. (2017). The Determinants of Firm Financial Performance: Evidence from Istanbul Stock Exchange (BIST). Journal of Economics and Finance, 8, 62-67.

- Tempelman, E., B. van der Grinten, B., Mul, E.J., & de Pauw. I. (2015). Nature inspired design handbook: A practical guide towards positive impact products. Delft, the Netherlands: Delft University of Technology.

- Vanalle, R.M., Ganga, G.M.D., Godinho Filho, M., & Lucato, W.C. (2017). Green supply chain management: An investigation of pressures, practices, and performance within the Brazilian automotive supply chain. Journal of Cleaner Production, 151, 250-259.

- Wei, Z., Shen, H., Zhou, K.Z., & Li, J.J. (2017). How does environmental corporate social responsibility matter in a dysfunctional institutional environment? Evidence from China. Journal of Business Ethics, 140(2), 209-223.

- Whelan, T., & Fink, C. (2016). The Comprehensive Business Case for Sustainability. [Online]. Available: http://everestenergy.nl/new/wp-content/uploads/HBR-Article-The-comprehensive-business-case-for-sustainability.pdf. Accessed on 1 July 2018.

- Xue, M., Boadu, F., & Xie, Y. (2019). The Penetration of Green Innovation on Firm Performance: Effects of Absorptive Capacity and Managerial Environmental Concern. Sustainability, 11(9), 1-24.

- Yildiz Ç.S., & Sezen, B. (2019). Effects of green supply chain management practices on sustainability performance. Journal of Manufacturing Technology Management, 30(1), 98-121.