Research Article: 2019 Vol: 23 Issue: 2

The Impact of Board of Directors Characteristics on Banks Performance: Evidence from Jordan

Alaa Mohammad AlQudah, Yarmouk University, Irbid-Jordan

Mohammad Jamal Azzam, Yarmouk University, Irbid-Jordan

Mahmoud Mohammad Aleqab, Yarmouk University, Irbid-Jordan

Mohammad Ziad Shakhatreh, Yarmouk University, Irbid-Jordan

Abstract

The awareness of board of directors’ role in enhancing firms’ financial performance has increased noticeably over the last years. Previous studies, however, have covered a traditional set of characteristics (i.e. board independence, board size and board meetings), but few studies are conducted to explore the impact of a new set of characteristics (i.e. political connections, number of foreign members and busy directors) on banks’ performance within the context of emerging markets. This study was motivated to combine the new set of characteristics with the traditional ones to gauge the impact of them on financial performance. Employing an Ordinary Least Square (OLS) regression technique on a sample of 14 Jordanian banks listed at the Amman Stock Exchange between 2013 and 2017 revealed that the only variable that has a significant positive impact on financial performance is board size. Busy directors have not obtained the sufficient knowledge and experience or at least they lacked the required time to enhance performance. Politically connected directors as well as foreign members were a stumbling block in the way to positively improve performance. Board meetings and independence were found to be insignificantly associated with return on assets. In a nutshell, the Jordanian regulators need to devote more efforts to revise the suggested characteristics related to boards of directors; since the current composition of boards has been presented as a weak monitoring tool to fulfil principals’ goals through enhancing banks’ performance.

Keywords

Board of Directors, Political Connections, Foreign Members, Busy Directors, Financial Performance.

Introduction

The stability of a firm’s financial position is affected by various factors such as the opportunistic decisions that may be taken by managers to inflate their personal gains (Zona et al., 2018). These decisions emerged in the financial markets as a result of the establishment of corporations, where there is a real separation in tasks and responsibilities among a firm’s agents and principals (Fama, 1980; Schroeder et al., 2009). This non-traditional management position created a breach in shareholders expectations, since managers show exploitative behaviors to maximize their personal benefits instead of taking beneficial decisions that make shareholders pleased (Man & Wong, 2013). In such a situation, managers may affect a firm’s performance, earnings figures or any other element of financial statements to guarantee a regular seat in a firm board.

Shareholders therefore are in force to pay several costs known as “agency costs” to minimize the negative consequences of the bad decisions (at least form the principals point of view) that have been made by managers (Mallin, 2004). One good example of these costs is adopting Corporate Governance (CG) mechanisms that may enhance board of directors’ ability to solve this conflict of interests. Indeed, board of directors is seen as trustworthy representatives who secure a firm’s resources from being used as an exploitative bridge to increase managers’ bonuses or unseen rewards (Ciftci et al., 2019; Khalil & Ozkan, 2016). Therefore, a good emergence of CG structure linked with a real intention to facilitate the overall monitoring process is directly responsible to enhance firms’ performance in a way that ensures market stability and shareholders satisfaction. For example, polarizing independent directors to serve in a firm’s board motivates other directors to override any misleading or opportunistic decisions that may have unfavourable impact on financial performance (Chen & Zhang, 2014). The interests of independent members correspond with an agent’s expectations since they do not have any direct benefits of engaging in opportunistic decisions that may affect that performance.

Of equal importance, hiring members with a previous political connections may support a firm’s financial position to interlock with the local environment in a way that facilitate firm’s ability to obtain loans, for example, or to hinder greedy managers form exploiting resources to maximize their personal wealth (Gul & Zhang, 2016; Khwaja & Mian, 2005; Osazuwa et al., 2016). Furthermore, the presence of active owners (i.e. foreign owners) in a firm’s ownership map alongside with effective CG mechanisms is expected to enhance performance noticeably. Such investors are expected to pay more attentions and efforts to direct their investments to be grown in successful firms; therefore, they are aware and knowledgeable enough to protect their investments from being expropriated by opportunistic managers (Alnabsha et al., 2018; Carney et al., 2018; Hamdan, 2018).

Most of the previous studies (Lel, 2016; Mihai & Mihai, 2013; and Kim et al., 2010) that investigate the association between foreign members and firms' attributes have been conducted in contexts where the presence of foreign members in firms' boards as well as their ownership is relatively low. This suggests that the generalizability of findings, especially from a developed country context to a developing one, is very limited. This study, therefore, tries to fill this gap in the literature by investigating this association in the Jordanian context where foreigners reserve 35% of boards' seats (as reported in Table 2. Equally significant, foreigners own approximately 50% of the market value of firms' stocks in the Amman Stock Exchange (ASE 2019).

Although the area of the covered topic in this study is very common; the characteristics of the emerging markets such as Jordan are different in compare with other markets. For instance, the nepotism and favouritism are the most popular features that may play a noticeable role in constraining the effectiveness of activating the social and economic regulations; since such markets is located under the tribes’ umbrella (Rwashdeh, 2016). Additionally, the Jordanian economy has suffered from the Arab Spring (AS) consequences. Indeed, Jordan is surrounded by burning areas that experienced these local revolutions negatively since the Jordanian economy was basically relies on these countries to export the Jordanian products. This political condition has constrained the ability of Jordanian institutions to interlock with other markets to secure their needed resources that may support their continuity. Therefore, examining the role of politically connected members as knowledgeable and experienced members that may mitigate the stress between banks owners and their agents in terms of maximizing the benefits. Interestingly, these characteristics are expected to add to current literature by introducing new evidence regarding the effectiveness of CG mechanisms in enhancing banks performance within the Jordanian context.

Problem Statement

Financial improprieties discovered in well-known firms (i.e. Enron and WorldCom) opened the door for regulatory bodies to make a deep and quick revision of the accounting standards. Further, it was a motive to introduce effective monitoring tools such as CG principles to impede any opportunistic behaviour that can be adopted by a firm’s agents to attain individual benefits rather than achieve the classical goal of any firm which is maximizes agents’ wealth (Chen & Zhang, 2014; Mallin, 2011). In turn, this exploitative situation may affect firms’ financial performance in a way that may mislead financial statements’ users (Ciftci et al., 2019). As a result, CG is shown as one of the main paths that have a noticeable influence on financial performance since it is considered a cornerstone of firms’ monitoring tools.

Previous literature in this stand of research shows a discrepancy in the obtained results regarding the effectiveness of CG mechanisms in enhancing firms’ performance. Some researchers claimed that this disharmony in these results may be linked to the fact that previous intensive studies focused on a specific set of CG mechanisms (Man & Wong, 2013). To fill this gap in preceding literature and to gauge the monitoring roles of CG mechanisms on financial performance, this study focuses on a non-traditional category of CG variables such as political connections, the number of external seats occupied by board members and the number of foreign members in firms’ boards.

Significance of the Study

The Jordanian financial market is classified as an emerging economy; where weak protection rights, unstable economy and the political conditions played a key role in the several financial failures. A good example of such failures is linked to Petra bank scandal in 1989 where the top management was charged by embezzlement and fraudulence. These charges appeared as a reaction of bad shaping of the bank’s board structure.

Furthermore, the Jordanian market witnessed several financial problems related, for example, to Jordan Phosphate Mines firm where the CEO took advantage of his position to manipulate the financial figures and further, his exploitative behaviors exceed to reach the fraud area. Therefore, this study tries to examine the effect of board of directors’ characteristics on financial performance of banks listed at Amman Stock Exchange (ASE) by focusing on a new set of board’s features. Hence, this study aims to answer the following question:

1. What is the association between board of directors’ characteristics (i.e. foreign members, political connections, busy directors, board independence, board size, and board meetings) and banks performance?

Literature Review And Hypotheses Development

The reviewed literature in the following section introduced blurred areas regarding the effects of CG mechanisms as a clear monitoring road map that may enhance firms’ performance. This crashing area may be connected to several shortages, for instance, some studies tried to cover several markets concomitantly, ignoring by that the effects of the legal and social conditions of each market and this may distort mechanisms monitoring role. (Uribe-Bohorquez et al., 2018) argue that each market has uniqueness in terms of its institutional settings that may play a remarkable role in shaping the expected role of such mechanisms in supporting the effectiveness of CGC. Additionally, some studies such as Zhou et al. (2018) and Tulung & Ramdani (2018) focused on a few variables without considering the impact of other variables that may have an influential role in some contexts rather than others. With respect to periods length, some studies such as Hamdan (2018); Torchia & Calabrò (2016) and Ciftci et al. (2019) have covered short period (for example one year) and this short period is not efficient and enough to catch the real impact of CG effectiveness, since such issue needs longer period to be reflected accurately (Chen & Zhang, 2014).

Board Independence and Firms Performance

One of the key mechanisms that may reduce the issue of agency problem is the independent members (Fama, 1980; Fama & Jensen, 1983). Indeed, the argument behind this positive position of such members is the absence of any direct or indirect benefits that may affect financial performance (Man & Wong, 2013). In effect, they are expected to be trustworthy directors to act on behalf of a firm’s agents in a way that guarantees a stable financial position of their firms (Chen & Zhang, 2014; Khalil & Ozkan, 2016). In line with this optimistic behavior of such members, agency theory expects a distinguished role of independent members in enhancing firms’ performance and protecting minority interests (Fama & Jensen, 1983). Indeed, independent members were found to be committed and experienced in acting as delegate members to enhance performance based on an international sample (Uribe-Bohorquez et al., 2018). Furthermore, Tulung & Ramdani (2018) stated that the independent commissioners acted as keen and knowledgeable directors in making decisions that enhance financial performance in Indonesia.

Contrariwise, some studies refuted the perspective of agency theory by documenting a poor role of such members in enhancing firms’ performance. For example, the presence of independent members in a board structure as well as increasing their number is still not serving firms’ performance in Greece (Zhou et al., 2018). Furthermore, Conyon & He (2017) revealed that independent members failed to carry out their duties efficiently since they were unable to enhance performance using an international sample between 2007 and 2014. Likewise, the hypothesis of enhancing firms’ performance by appointing independent members was rejected by Ciftci et al. (2019), as a result of documenting a negative association between financial performance and independent members.

In a nutshell, this opposite position deviates to go beyond agency theory perspective in a way in which the institutional theory standpoints seem to be appropriate to explain the extracted results. In this case, firms adopted CG recommendations to legitimize their presence in stock markets, or to show their firms as committed firms in terms of activating the new regulations such as CG code.

However, since the obtained conclusions regarding the impact of independent members on firms’ financial performance vary from one context to another as a result of the institutional settings and other social factors, this study adopts the following hypothesis:

H1: There is a significant positive relationship between firms' financial performance and board independence in Jordan's listed banks.

Board Size and Firms’ Performance

The impact of board size on firms’ performance is still ambiguous, since previous investigations still show mixed findings regarding this issue. Actually, determining the size of a firm’s board, in general, is not applicable since each context has a unique set of characteristics that may play a noticeable role in supporting or hindering the success of CG codes (Chen & Zhang, 2014; Corbetta & Salvato, 2004). Regardless of the board’s size, it is very important to guarantee the presence of adequate number of directors who are professional enough to achieve firms’ goals (Noor & Fadzil, 2013).

In this vein, agency theory supports grand boards in monitoring managers’ activities, since such boards are expected to hire experienced, professional and specialized directors (Torchia & Calabrò, 2016; Tulung & Ramdani, 2018). Hence, grand boards may enhance financial performance and restrain any opportunistic decisions that affect shareholders’ wealth (Rubino et al., 2017). In line with this argument, Singh et al. (2018) found that, larger boards were more cohesive and effective in enhancing firms’ performance compared with smaller boards. Additionally, a positive link is documented between board size and financial performance within the Turkish context (Ciftci et al., 2019). Likewise, large boards showed more competence and experience in enhancing firms’ value (Mohapatra, 2017).

In contrary to the previous argument, small boards are presented as knowledgeable and well-informed boards in directing firm's activities that affect its performance. The fact is that such boards have smooth channels of communications that can help them to discuss firms’ issues easily (Alabdullah et al., 2014). Consistent with this view, larger boards are found to have a weak supervision tool in enhancing firms’ performance within the Malaysian context (Zabri et al., 2016). Furthermore, larger boards were less experienced in making beneficial decisions that can affect firms’ performance positively (Conyon & He, 2017). The results reported by Abdulsamad et al. (2018) have confirmed the fact that smaller boards were more qualified and competent in organizing firms operations, since a negative correlation is documented between boards’ size and financial performance.

The conclusion that can draw from the previous arguments is that determining a specific number of directors to serve in firms’ boards is still negotiable, since mixed findings are confirmed. To enrich the literature, the current study carries out this investigation within the emerging market (Jordan). Thus, the following hypothesis regarding board size is formulated:

H2: There is a significant positive relationship between firms' financial performance and board size in Jordan's listed banks

Board Meetings and Firms’ Performance

The productiveness of any board is not restricted to a specific set of characteristics such as independence, board size or busy directors. Indeed, the frequency of holding regular meetings can express board effectiveness to enhance a firm’s performance (Paul, 2017; Sahu & Manna, 2013). However, using the regulatory of carrying out systematic meetings as an index of board activism may not appear constructive, unless the attendance of such meetings is associated with active participation in discussing firms’ issues. In general, previous studies present mixed findings regarding the impact of board meetings on financial performance.

For instance, Sail et al. (2018) failed to support the theoretical framework that introduces active boards as a delegate and qualified representative to take actions on behalf of a firm’s principals to enhance its performance. Aryani et al. (2017) documented a negative correlation between ROA and the frequency of holding regular meetings by a board. Moreover, the Malaysian context introduces evidence that the CG requirements in terms of board meetings need more consideration, since active boards showed a weak impact on firms’ performance (Abdulsamad et al., 2018). In contrast, boards with regular meetings showed a reasonable awareness regarding their operational decisions to enhance financial performance in India (Gurusamy, 2017). Meanwhile, active boards were more experienced in dealing with board discussions compared with non-active boards (Ntim & Osei, 2011).Similarly, Francis et al. (2012) found a positive and significant impact on firms’ performance caused by increasing the number of board meetings.

To sum up, rareness in previous studies regarding board meetings effect on financial performance is seen obviously. Most of the previous findings refute the theoretical framework that presents board meetings as an effective tool to enhance performance. This conclusion can be linked directly to their ineffective attendance to such meetings. Therefore, this study adopts the following hypothesis:

H3: There is a significant negative relationship between firms' financial performance and board meetings in Jordan's listed banks.

Busy Directors and Firms’ Performance

The effect of concurrent seats on financial performance can be discussed based on several vantage-points. Agency theory claims that, overworked directors may suffer from lacking time to carry out their duties effectively in a way that maximizes principals’ wealth (Baccouche & Omri, 2014; Sharma & Iselin, 2012). Likewise, busy directors, occasionally, tend to shrink or neglect their monitoring roles, which in turn may negatively affect performance (Rubino et al., 2017). Indeed, overworked directors were less active in attending board meetings as a result of their interlock duties in various firms (Jiraporn et al., 2009). Interestingly, family firms’ context supports agency theory perspective by documenting a negative correlation between firms' performance and busy CEOs (Pandey et al., 2015). In addition, Hamdan (2018) found that busy directors had a noticeable effect in reducing the overall boards’ effectiveness in enhancing the performance of Saudi listed firms.

On the contrary, the resource dependency theory introduces busy directors as an effective tool for firms to contact with other firms and communities to enhance their performance (Hillman & Dalziel, 2003). Under this perspective, overworked directors may have the opportunity to gain more experience and knowledge to run their firms effectively (Daily et al., 2003). Such concurrent appointments of boards’ members may create the fundamental channels with firms’ environment to secure firms survival (Hamdan, 2018; Pfeffer & Salancik, 2003). A case that supports this perspective is shown by Rubino et al. (2017) who found a positive effect of serving in several boards concurrently on firms’ financial performance. Additionally, Zona et al. (2018) reported similar results using data from the Italian financial market.

To summarize, in exploring the effect of the concurrent seats of directors, two perspectives were employed. The first stand shows a negative impact of such directors on firms’ performance as well as the monitoring behavior of the whole board. In contrast, the resource dependency theory hypothesizes a beneficial role of the interlock appointments on managers monitoring tasks that in turn enhances performance. Based on the previous summary, the following hypothesis regarding busy directors is formulated:

H4: There is a significant positive relationship between firms' financial performance and busy directors in Jordan's listed banks.

Political Connections and Firms’ performance

The background and experience of a board’s members can improve board effectiveness to enhance financial performance, for instance, political connections (Osazuwa et al., 2016). A politically connected director is defined as a board member who has served in a governmental position. However, such a characteristic has several costs and benefits. Indeed, hiring an outside director who had a political tie may enhance a firm’s ability to obtain a favorable treatment to take loans from commercial banks or local governments (Khwaja & Mian, 2005; Lee et al., 2013). It also supports the resource dependency theory which claims that, firms with several connections with its environment may help firms to survive and thus, guarantee a smooth flow of external resources such as loans (Pfeffer & Gerald, 1978). Furthermore, political tie may affect the process of enacting laws such as tax laws in a way that can gain a reduction in their taxable income (Agrawal & Knoeber, 2001; Francis et al., 2012).

In line with this optimistic perspective, Hung et al. (2017) found that the benefits of hiring directors were in line with shareholders’ expectations since the chains banks’ performance was higher compared with non-tied banks with local governments. Furthermore, serving under the governmental umbrella during the regime of President Mubarak has enhanced firms’ performance which created a political tie with the presidential family. Additionally, this political connection was a secured source for such firms to obtain governmental loans (Dang et al., 2018). In addition, motivating directors by a political promotion was found to positively affect firms’ performance in China (Cao et al., 2018). Interestingly, firms with family power connected with political connections were more stable and performed better than non-politically firms in Bangladesh (Muttakin et al., 2015).

In contrast, preferring outside directors who had been politically tied with governments may increase the gap between a firm’s agents and principals (Zhang et al., 2014). The argument behind this is that politician directors may respond to governments' pressure in a way that maximizes their wealth rather than achieving the classical goal of corporations (Gul & Zhang, 2016).

For instance, the presence of a director with political background within the solar energy firms in China has reduced their financial performance (Zhang et al., 2014). Unexpectedly, serving as a Chinese politician has undermined board efficiency to enhance performance and refuted the perspective introduced by resources dependency theory in which such directors are expected to create valid channels with the local environment to secure firms’ continuity as successful firms (Gul & Zhang, 2016). Shen et al. (2015) aimed to explore to what extent firms need political connections to enhance CG structure in their firms in a way that may increase firms' value. The implied results showed that the presence of political directors has reduced CG effectiveness and this led to minimize performance and other financial figures.

In a nutshell, the effect of political connections on firms’ performance is still ambiguous since the previous studies showed inconsistency in conclusions. Therefore, to enrich literature by new evidence, this study aims to shed light on the effect of politically connected members on banks’ performance in Jordan. Hence, the following hypothesis regarding political connections is formulated:

H5: There is a significant negative relationship between firms' financial performance and political connections in Jordan's listed banks.

Foreign Members and Firms’ Performance

The diversity of ownership map in a firm can play a noticeable impact on overall monitoring process (Yavas & Erdogan, 2017). Two perspectives, however, discuss this impact. On the one hand, the supporting perspective claims that foreign owners have superior knowledge and experience in controlling a firm’s activities, which in turn may enhance performance (Mallin, 2004; Wang, 2014). For example, Phung & Mishra (2016) and Yavas & Erdogan (2017) found a positive correlation between firms’ performance and foreign ownership as foreigners who were found to be more creative and knowledgeable compared with other owners in Vietnam and Turkey, respectively.

On the other hand, the opponents claimed that, the distance of international owners may constrain their ability to monitor firm’s activities as a result of the difficulty of accessing and monitoring reporting process (Alzoubi, 2016).

Indeed, even with the noticeable increase of foreign ownership percentage within the Japanese market, their impact on firms’ performance was insignificant (Nakano & Nguyen, 2013). Likewise, the Chinese market provides evidence in which foreigners were less active in enhancing performance (Jiang, 2007). In addition, D?ani? (2012) failed to find a competitive monitoring role of foreigners compared with domestic investors.

To sum up, the role of foreign investors in enhancing firms’ performance needs more investigations, since prior studies introduced several points of view. Based on the previous summary, the following hypothesis regarding foreign directors is formulated:

H6: There is a significant positive relationship between firms' financial performance and foreign members in Jordan's listed banks.

Research Methodology

Research Sample

This study takes a positivist research position in which a set of secondary data has been collected from banks’ annual reports. The sample of this study covers all listed banks at the ASE between 2013 and 2017 covered by that a group of fifteen banks. Indeed, the Jordanian market has suffered from the negative consequences of the Arab Spring which started approximately in 2012; and thus this study covers this period. The non-financial sectors have been excluded from the main population since these sectors have different operational activities and further, adhering to CG code requirements is still under the general rule “Comply or Explain”. Indeed, the rationale behind this selection is to obtain consistency in the covered sample since each sector has a specific singularity in regulations. To achieve the main goal of this study, the data were collected manually through scanning the annual reports published by Jordan Securities Commission (JSC), because these reports contain both financial and non-financial data (CG information).

Variables Measurements

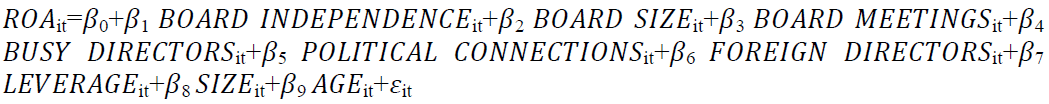

Prior studies show various measurements of a firm’s financial performance because a general agreement in terms of a specific measurement is not available. In effect, the most commonly used measurement is Return on Assets (ROA). Hence, this study employs the ROA to gauge firms’ performance. A set of CG variables has been selected to provide new evidence from a developing country context about the impact of board of directors’ characteristics on firms’ performance. Board independence (BOARD INDEPENDENCE) is estimated through dividing the number of independent members over the board size. Board size (BOARD SIZE) is calculated by the total number of members serving in a bank’s board. Board meeting (BOARD MEETING) is measured by the number of annual meetings held by a bank’ board. With regard to busy directors (BUSY DIRECTORS), it has been defined as the percentage of board members who concurrently serve in three or more firms to the board size. Political connections (POLITICAL CONNECTIONS) are measured as the percentage of board members who had a previous political seat in the Jordanian government to the board size. Finally, the percentage of board members who have a foreign nationality to the board size is defined as foreigner directors (FOREIGN DIRECTORS).

Consistent with prior studies, and to capture the effects of banks specific characteristics, a set of control variables is used. Bank size (SIZE) is considered by calculating the natural logarithm of bank assets. Leverage (LEVERAGE) is calculated by dividing the total debt over a bank’s total assets. Bank age (AGE) is calculated by taking the natural logarithm of the time length of banks shares listed in the ASE. Table 1 summarizes the study variables and their measurements.

| Table 1: Summary Of Variables And Their Measurements | |||

| Description | Variable name | Measurement | Exp. sign |

| Dependent variable: | |||

| ROA | Return on assets | Net income divided by total assets. | |

| Independent variables: | |||

| BOARDINDEPENDENCE | Board independence | The percentage of independent directors to the total number of directors. | + |

| BOARDSIZE | Board size | The total number of members serves in a bank’s board. | + |

| BOARD MEETINGS | Board meetings | The number of annual meetings held by a bank’s board. | _ |

| BUSYDIRECTORS | Busy directors | The percentage of board members who concurrently serve in three or more firms to the board size. | + |

| POLITICAL CONNECTIONS | Political connections | The percentage of board members who had a previous political seat in the Jordanian government to the board size. | _ |

| FOREIGN DIRECTORS | Foreign directors | The percentage of board members who have a foreign nationality to the board size. | + |

| Control variables: | |||

| LEVERAGE | Leverage | The ratio of total debt to total assets. | _ |

| SIZE | Bank size | The natural logarithm of bank assets. | + |

| AGE | Bank age | The natural logarithm of the time length of banks shares listed at the ASE. | + |

In order to extract valid findings to test the developed hypotheses, this study employs the multiple regression technique by adopting the following regression model:

Results

Descriptive Statistics

Table 2 shows that the mean of the Return on Assets (ROA) is 1.224% with a median of 1.203%. It seems that the mean of ROA in listed banks at the ASE has increased over time, especially some of the previous studies in Jordan, like (Tomar & Bino, 2012), reveal that the mean value of ROA is around 86%. This result may indicate that banks restore investors' confidence regarding their operations especially in the aftermath of the global financial crisis that occurred in 2008, which in turn enhances their financial performance with the passage of time.

| Table 2: Descriptive Statistics For The Dependent, Independent, And Control Variables | |||||

| Variables | Minimum | Maximum | Mean | Median | SD |

| ROA | 0.240 | 2.047 | 1.224 | 1.203 | 0.447 |

| BOARD INDPENDENCE | 0.000 | 0.727 | 0.376 | 0.363 | 0.144 |

| BOARD SIZE | 7.000 | 13.00 | 11.28 | 11.00 | 1.495 |

| BOARD MEETING | 6.000 | 14.00 | 7.871 | 7.000 | 2.091 |

| BUSY DIRECTORS | 0.181 | 0.818 | 0.471 | 0.458 | 0.132 |

| POLITICAL CONNECTIONS | 0.000 | 0.545 | 0.287 | 0.285 | 0.171 |

| FOREIGN DIRECTORS | 0.000 | 0.666 | 0.351 | 0.374 | 0.227 |

| LEVERAGE | 0.755 | 0.984 | 0.870 | 0.867 | 0.034 |

| SIZE (in millions) | 950.0 | 2590 | 398.0 | 223.0 | 612.0 |

| AGE | 16.00 | 43.00 | 33.83 | 36.00 | 6.775 |

Notes: This Table illustrates the descriptive statistics for the dependent, independent, and control variables of listed banks at the ASE from 2013 to 2017.

The statistics also show that the mean (median) value recorded for independent directors (BOARDINDPENDENCE) is approximately 38% (36%). The minimum number of independent directors serving in some banks' boards, however, is zero as indicated in Table 2. Thus, these banks contradict the governance requirements in Jordan that at least one third of a bank's directors must be independent. The policy-makers therefore could give more attention to this issue by means of applying penalties on banks that violate these requirements.

The average size of banks' boards (BOARDSIZE) was around eleven directors. This is comparable with previous studies in several different contexts where the number of a board's directors ranges from eight to eleven (Chiu et al., 2012; Ghosh et al., 2010; Osazuwa et al., 2016; Zalata & Roberts, 2016).Unlike board independence, banks were fully compliant with the governance requirements that the size of a board should be between 5 and 13 directors. Likewise, banks have met at least six times yearly, as required by the Corporate Governance Code (CGC), and the mean value recorded for board meetings (BOARDMEETING) was around eight.

ROA: Return on Assets measured by dividing net income over a bank’s assets.

BOARD INDPENDENCE: The number of independent members divided by the board size.

BOARD SIZE: The total number of members serving in a bank’s board.

BOARD MEETING: The number of annual meetings held by a bank’s board.

BUSY DIRECTORS: The percentage of board members who concurrently serve in three or more firms to the board size.

POLITICAL CONNECTIONS: The percentage of board members who had a previous political seat in the Jordanian government to the board size.

FOREIGN DIRECTORS: The percentage of board members who have a foreign nationality to the board size.

LEV: Total debt divided by total assets.

Size: The total assets of a bank.

AGE: The time length of banks shares listed in the ASE.

Approximately half of banks’ directors are busy (BUSY DIRECTORS) as the mean value recorded for them is 47.1%. This result is consistent with a study conducted by Jaafar & El-Shawa (2009) who reveal that the percentage of busy directors in Jordan’s listed firms is 46. The mean value of directors who have political connections (POLITICAL CONNECTIONS) is 28% and, more importantly, this percentage is reached around 55 in some banks. It seems that the mean of those directors in Jordanian banks is relatively high, even when compared with previous studies in developing countries. Foreign directors (FOREIGN DIRECTORS) also recorded high presence in banks’ boards as the mean of them is 35%. This high percentage may be based on the reasoning that Jordan’s government removes all barriers to the percentage that foreigners can hold in any firm listed in the ASE (JSC, 2018). In relation to the control variables, the statistics show that the mean of leverage (LEVERAGE), bank size (SIZE), and bank age (AGE) is 87%, $398 million, and 34 years respectively.

Regression Results

Before performing regression analysis, different assumptions must be met. The first is no multicollinearity between a study’s variables. Pearson correlations coefficients are used in the current study to check this assumption as reported in Table 3. The highest correlation is 67.4% between foreign directors and board meetings. This negative correlation is expected as foreigners are not always available as local directors to attend a board’s meetings. Overall, multicollinearity is not considered a threat to the regression’s findings because none of the correlations hits 70% as recommended by the vast majority of literature. This study also checks other assumptions namely, normality, no serial correlation, and homoscedasticity using several different statistical techniques (i.e. The Breusch-Pagan test, Durbin-Watson statistics, and the extent of skewness and kurtosis). The conclusion was that the current study meets regression assumptions.

| Table 3: Correlation Matrix Of Pearson Coefficients | ||||||||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | ||

| BOARD INDPENDENCE | (1) | 1.000 | ||||||||

| BOARD SIZE | (2) | -0.304* | 1.000 | |||||||

| BOARD MEETING | (3) | 0.013 | -0.224 | 1.000 | ||||||

| BUSY DIRECTORS | (4) | 0.142 | 0.115 | -0.067 | 1.000 | |||||

| POLITICAL CONNECTIONS | (5) | -0.360* | -0.103 | 0.227 | 0.310* | 1.000 | ||||

| FOREIGN DIRECTORS | (6) | -0.232 | 0.582* | -0.674* | 0.209 | -0.353* | 1.000 | |||

| LEVERAGE | (7) | 0.238* | -0.246* | 0.247* | -0.067 | -0.132 | -0.036 | 1.000 | ||

| SIZE | (8) | 0.385* | 0.136 | -0.285* | 0.290* | 0.187 | 0.247* | 0.029 | 1.000 | |

| AGE | (9) | 0.088 | -0.237 | -0.636* | -0.122 | -0.278* | 0.416* | -0.186 | 0.186 | 1.000 |

Notes: This Table illustrates Pearson correlations coefficients of listed banks at the ASE from 2013 to 2017.The symbol (*) denotes significance at 5% in two-tailed test. All variables are defined previously in Table two.

Table 4 reports the results of OLS regression. Board independence (BOARD INDPENDENCE) is found to be positively but insignificantly associated with an increased level of financial performance. This result suggests that banks should increase the number of independent directors; especially the current study finds that some banks do not have any independent director serving in their boards. Equally significant, banks have a relatively low percentage of board independence compared with other firms form different industries at the ASE. For example, board independence in manufacturing firms is 64% (Abu Haija, 2012). Together, these are the potential reasons that lie behind the ineffective role of independent directors in enhancing banks’ financial performance.

| Table 4: Results Of The Association Between The Board Attributes And Roa | ||||

| Hypothesis | Variable | Predicted Sign | Coefficients | Results |

| H1 | BOARD INDPENDENCE | + | 0.672 | Not accepted |

| H2 | BOARD SIZE | + | 0.353*** | Accepted |

| H3 | BOARD MEETING | - | -0.028 | Not accepted |

| H4 | BUSY DIRECTORS | + | -0.060* | Not accepted |

| H5 | POLITICAL CONNECTIONS | - | -1.312*** | Accepted |

| H6 | FOREIGN DIRECTORS | + | -0.091** | Not accepted |

| - | LEVERAGE | - | -1.068 | - |

| - | SIZE | + | 0.119 | - |

| - | AGE | + | 2.034*** | - |

| Adjusted R2 | 46.99 | |||

| P-value | 0.000 | |||

Notes: This Table presents the results of OLS regression for the association between the board attributes, control variables and ROA. The sample comprises of listed banks at the ASE from 2013 to 2017. The dependent variable is return on assets (ROA). Independent and control variables are defined previously in Table two. The symbols (*), (**) and (***) denote significance at 10%, 5% and 1%, respectively, in two-tailed test.

This study proposes that board size may be linked with improvements to a board’s ability to control managers, thus enhancing performance. The results of Table 4 support this proposition and show a positive and significant association between board size (BOARD SIZE) and ROA (coefficient=0.353 and p<0.01). This result is consistent with the view in the literature that large boards confer benefits to banks as they comprise more experienced directors than a bank with a small board. Then, they have the ability to allocate their responsibilities to a larger number of directors who are most likely having the time and skills to detect and follow the problematic decisions and activities taken by a bank’s managers.

While the number of directors serving in a bank’s board is more positively linked to an improvement in financial performance, the number of their meetings does not play a vital role in this improvement. Indeed, the results show a negative but insignificant relationship between board meetings (BOARD MEETING) and ROA. A possible justification of this result is that it is not the number of meetings per se that is associated with a high level of ROA, but rather the effective participation and relevant decisions taken by banks’ directors in those meetings. Furthermore, a bank’s board may conduct more meetings, as noted earlier, to meet the CGC requirements even when there are no valuable and critical issues need to be discussed.

Discussion

The current study predicts that the presence of directors with many seats in other firms’ boards has a positive impact on ROA. Inconsistent with this prediction, Table 4 reveals that there is a negative and significant association between busy directors (BUSY DIRECTORS) and ROA (coefficient=-0.060 and p<0.01).This suggests that banks in which a board comprises a high percentage of busy directors have a lower level of financial performance. This result, however, is in line with some of previous studies, like Méndez et al. (2015) and Sharma & Iselin (2012), that those directors become too busy to perform their responsibilities as a result of their involvement with different boards. In this case, busy directors are detrimental to banks (i.e. decrease financial performance and increase managerial-discretion).

There is some controversy in previous studies about whether or not directors with political connections can exert more pressure on management choices and enhance its use of banks' resources. This study, however, hypothesizes a negative association between political connections (POLITICAL CONNECTIONS) and ROA. The results of Table 4 support this hypothesis and show a negative and significant association (coefficient=-0.075 and p<0.01). This implies that banks where directors have low level of political ties with governmental authorities report good financial performance compared with other banks. The reason that may stand behind this conclusion is that the politically connected directors lack experience in financial issues as well as in preparing financial statements. This conclusion is also supported by the findings of some of previous studies such as Osazuwa et al. (2016). Then, those directors are less likely to ask banks’ management for more information pertaining questionable financial activities, which in turn may impede them to make a dispassionate assessment of those activities.

Surprisingly, foreign directors (FOREIGN DIRECTORS) are found to be negatively and significantly associated with ROA (coefficient=-0.091 and p<0.05).Such a result is quite unexpected as foreign directors are predicted to play a pivotal role in enhancing banks’ financial performance. One possible explanation of this association is that foreign investors (as foreign directors represent foreign ownership) are concerned with long-term earnings. Thus, they are not interested in motivating managers’ decisions that lead to increase current period’s earnings compared with those that are expected to maximize future periods’ earnings. This argument is supported extensively in prior literature (Bahadori & Hajalizadeh, 2016; Bardhan et al., 2014; Sakaki et al., 2017).

Table 4 also reports the results of control variables. Bank age (AGE) is positively associated with ROA. This indicates that older banks are more able than new banks to generate profits that may be due to their experience in the market as well as the large number of customers they have. Leverage (LEVERAGE) and bank size (SIZE) are found to be insignificantly associated with ROA.

Conclusion

Firms’ financial performance is highly affected by how their board of directors are structured and composed. Such composition may play a pivotal role in enhancing the monitoring of managers’ decisions and choices. This is because there is a general belief that a high quality board (i.e. with more independent directors and financial experts serving in the board) are positively associated with higher levels of financial performance. The current study, therefore, examined the potential link between the structure of boards of listed banks at the ASE and their level of financial performance. This is done by performing multiple regression on secondary data that are collected manually from banks’ annual reports in the period 2013 to 2017.

The reported results reveal that, inconsistent with this study’s proposition, banks where board independence is largely observed do not disclose high financial performance (measured by ROA). The relatively low percentage of board independence in some banks, however, may stand behind this conclusion. While board meetings are found to be insignificantly associated with ROA, large boards play a vital role in increasing banks’ performance. Thus, large boards are more beneficial to banks, compared with small boards; as they most likely include more directors with different backgrounds as well as experiences. Directors who serve in several different boards (at least three) are not observed to confer benefits to banks, but rather they are detrimental to them. Shortage of time that those directors have to monitor managers, as a result of serving in various boards, may lead managers to hold excessive power to handle bank’s daily operations. Thus they have the opportunity to take decisions to manipulate earnings to increase their own compensation regardless of whether or not it leads to negative consequences on banks’ financial performance, especially in the future.

Likewise, directors with political connections are found to be associated with lower levels of ROA. Based on this result, this study argues that those directors are less interested in controlling managers most likely because they lack the required financial skills to do that. Indeed, most of them are not sitting in a bank’s board as in their personal capacity, but rather as a representative of governmental institutions. Foreign directors are not found as an effective controlling mechanism as it has a significant negative association with ROA. This finding is inconsistent with the current study’s predictions as well as with the majority of previous studies in several different contexts. Overall, the findings of this study provide some recommendations to banks such as increasing the number of independent directors in their boards, picking up directors with experience in financial issues, and motivating effective participation in board meetings. This study also recommends policy-makers in Jordan to put more restrictions on the number of seats that a director can hold in other firms’ boards. Future studies are recommended to investigate the impact of CG mechanisms on firm’s performance using more recent data; especially that the JSC issued a mandatory governance code in 2017 and to be implemented from January 1st, 2018. Additionally, future studies are recommended to cover more characteristics that cover audit committee and remunerations and nomination committee using for example an index to estimate CG adoption in Jordan.

References

- Abdulsamad, A.O., Yusoff, W.F.W., & Lasyoud, A.A. (2018). The influence of the board of directors’ characteristics on firm performance: Evidence from Malaysian public listed companies. Corporate Governance and Sustainability Review, 2(1), 6-13.

- Abu Haija, A. (2012). The application of fair value accounting and corporate governance and their relationship to financial statements manipulation. Unpublished Doctoral Thesis, University Utara Malaysia.

- Agrawal, A., & Knoeber, C.R. (2001). Do some outside directors play a political role? The Journal of Law and Economics, 44(1), 179-198.

- Alabdullah, T.T.Y., Yahya, S., & Ramayah, T. (2014). Corporate governance mechanisms and Jordanian companies' financial performance. Asian Social Science, 10(22), 247-262.

- Alnabsha, A., Abdou, H.A., Ntim, C.G., & Elamer, A.A. (2018). Corporate boards, ownership structures and corporate disclosures: Evidence from a developing country. Journal of Applied Accounting Research, 19(1), 20-41.

- Aryani, Y.A., Setiawan, D., & Rahmawati, I.P. (2017). Board meeting and firm performance. Proceedings of International Conference on Economics 2017, 438-444.

- Baccouche, S., & Omri, A. (2014). Multiple directorships of board members and earnings management: An empirical evidence from French listed companies. Journal of Economic and Financial Modelling, 2(1), 13-23.

- Bahadori, M., & Hajalizadeh, M. (2016). Institutional ownership, CEO characteristics and the probability of fraud occurrence in firms. Academic Journal of Accounting and Economic Researches, 5(3).

- Bardhan, I., Lin, S., & Wu, S.L. (2014). The quality of internal control over financial reporting in family firms. Accounting Horizons, 29(1), 41-60.

- Cao, X., Lemmon, M., Pan, X., Qian, M., & Tian, G. (2018). Political promotion, CEO incentives, and the relationship between pay and performance. Management Science.

- Carney, M., Estrin, S., Liang, Z., & Shapiro, D. (2018). National institutional systems, foreign ownership and firm performance: The case of understudied countries. Journal of World Business.

- Chen, J.J., & Zhang, H. (2014). The impact of the corporate governance code on earnings management-Evidence from Chinese listed companies. European Financial Management, 20(3), 596-632.

- Chiu, P.C., Teoh, S.H., & Tian, F. (2012). Board interlocks and earnings management contagion. The Accounting Review, 88(3), 915-944.

- Ciftci, I., Tatoglu, E., Wood, G., Demirbag, M., & Zaim, S. (2019). Corporate governance and firm performance in emerging markets: Evidence from Turkey. International Business Review, 28(1), 90-103.

- Conyon, M.J., & He, L. (2017). Firm performance and boardroom gender diversity: A quantile regression approach. Journal of Business Research, 79, 198-211.

- Corbetta, G., & Salvato, C. (2004). Self-serving or self-actualizing? Models of man and agency costs in different types of family firms: A commentary on “comparing the agency costs of family and non-family firms: Conceptual issues and exploratory evidence”. Entrepreneurship Theory and Practice, 28(4), 355-362.

- Daily, C.M., Dalton, D.R., & Cannella Jr, A.A. (2003). Corporate governance: Decades of dialogue and data. Academy of Management Review, 28(3), 371-382.

- Dang, V.Q., So, E.P., & Yan, I.K. (2018). The value of political connection: Evidence from the 2011 Egyptian revolution. International Review of Economics & Finance, 56, 238-257.

- D?ani?, A. (2012). Concentration of ownership and corporate performance: Evidence from the Zagreb Stock Exchange. Financial Theory and Practice, 36(1), 29-52.

- Fama, E.F. (1980). Agency problems and the theory of the firm. Journal of Political Economy, 88(2), 288-307.

- Fama, E.F., & Jensen, M.C. (1983). Separation of ownership and control. The Journal of Law and Economics, 26(2), 301-325.

- Francis, B.B., Hasan, I., & Wu, Q. (2012). Do corporate boards affect firm performance? New evidence from the financial crisis. International Journal of Productivity and Performance Management, 66(6), 724-741.

- Ghosh, A., Marra, A., & Moon, D. (2010). Corporate boards, audit committees, and earnings management: Pre-and post-SOX evidence. Journal of Business Finance & Accounting, 37(9-10), 1145-1176.

- Gul, F.A., & Zhang, L. (2016). Ethnicity, politics and firm performance: Evidence from Malaysia. Pacific-Basin Finance Journal, 40, 115-129.

- Gurusamy, P. (2017). Board characteristics, audit committee and ownership structure influence on firm performance of manufacturing firms in India. International Journal of Business and Economics Research, 6, 73-87.

- Hamdan, A. (2018). Board interlocking and firm performance: The role of foreign ownership in Saudi Arabia. International Journal of Managerial Finance, 14(3), 266-281.

- Hillman, A.J., & Dalziel, T. (2003). Boards of directors and firm performance: Integrating agency and resource dependence perspectives. Academy of Management Review, 28(3), 383-396.

- Hung, C.H.D., Jiang, Y., Liu, F.H., Tu, H., & Wang, S. (2017). Bank political connections and performance in China. Journal of Financial Stability, 32, 57-69.

- Jaafar, A., & El-Shawa, M. (2009). Ownership concentration, board characteristics and performance: Evidence from Jordan accounting in emerging economies (pp.73-95). Emerald Group Publishing Limited.

- Jiang, J. (2007). A study on the relationship between foreign ownership and the performance of Chinese listed companies. Bangkok, China: Bangkok University.

- Jiraporn, P., Singh, M., & Lee, C.I. (2009). Ineffective corporate governance: Director busyness and board committee memberships. Journal of Banking & Finance, 33(5), 819-828.

- JSC, J.S.C. (2018). Retrieved from www.jsc.jo

- Khalil, M., & Ozkan, A. (2016). Board independence, audit quality and earnings management: Evidence from Egypt. Journal of Emerging Market Finance, 15(1), 84-118.

- Khwaja, A.I., & Mian, A. (2005). Do lenders favor politically connected firms? Rent provision in an emerging financial market. The Quarterly Journal of Economics, 120(4), 1371-1411.

- Kim, I.J., Eppler-Kim, J., Kim, W.S., & Byun, S.J. (2010). Foreign investors and corporate governance in Korea. Pacific-Basin Finance Journal, 18(4), 390-402.

- Lee, H.A., Gomez, E.T., & Yacob, S. (2013). Ethnicity, economy, and affirmative action in Malaysia. Affirmative Action, Ethnicity, and Conflict, 67-94.

- Lel, U. (2016). The role of foreign institutional investors in restraining earnings management activities across countries. Journal of International Business Studies.

- Mallin, C. (2004). Corporate governance (Fourth Edition). Oxford.

- Mallin, C. (2011). Handbook on international corporate governance: Country analyses. Edward Elgar Publishing.

- Man, C.K., & Wong, B. (2013). Corporate governance and earnings management: A survey of literature.

- Méndez, C.F., Pathan, S., & García, R.A. (2015). Monitoring capabilities of busy and overlap directors: Evidence from Australia. Pacific-Basin Finance Journal, 35, 444-469.

- Mihai, I.O., & Mihai, C. (2013). The impact of foreign ownership on the performance of Romanian liste manufacturing companies. The International Journal of Management Science and Information Technology, 2(10), 106-122.

- Mohapatra, P. (2017). Board size and firm performance in India. Vilakshan: The XIMB Journal of Management, 14(1), 19-30.

- Muttakin, M.B., Monem, R.M., Khan, A., & Subramaniam, N. (2015). Family firms, firm performance and political connections: Evidence from Bangladesh. Journal of Contemporary Accounting & Economics, 11(3), 215-230.

- Nakano, M., & Nguyen, P. (2013). Foreign ownership and firm performance: evidence from Japan's electronics industry. Applied Financial Economics, 23(1), 41-50.

- Noor, M.A.M., & Fadzil, F.H. (2013). Board characteristics and performance from perspective of governance code in Malaysia. World Review of Business Research, 3(3), 191-206.

- Ntim, C.G., & Osei, K.A. (2011). The impact of corporate board meetings on corporate performance in South Africa. African Review of Economics and Finance, 2(2), 83-103.

- Osazuwa, N.P., Ahmad, A.C., & Che Adam, N. (2016). Financial performance in Nigerian quoted companies: The influence of political connection and governance mechanisms. International Journal of Economics and Financial Issues, 6(7S), 137-142.

- Pandey, R., Vithessonthi, C., & Mansi, M. (2015). Busy CEOs and the performance of family firms. Research in International Business and Finance, 33, 144-166.

- Paul, J. (2017). Board activity and firm performance. Indian Journal of Corporate Governance, 10(1), 44-57.

- Pfeffer, J., & Gerald, G.R. (1978). The external control of organizations: A resource dependence perspective: New York: Harper & Row.

- Pfeffer, J., & Salancik, G.R. (2003). The external control of organizations: A resource dependence perspective. Stanford University Press.

- Phung, D.N., & Mishra, A.V. (2016). Ownership structure and firm performance: Evidence from Vietnamese listed firms. Australian Economic Papers, 55(1), 63-98.

- Rubino, F.E., Tenuta, P., & Cambrea, D.R. (2017). Board characteristics effects on performance in family and non-family business: a multi-theoretical approach. Journal of Management & Governance, 21(3), 623-658.

- Sahu, T.N., & Manna, A. (2013). Impact of board composition and board meeting on firms' performance: A study of selected Indian companies. Vilakshan: The XIMB Journal of Management, 10(2), 99-112.

- Sakaki, H., Jackson, D., & Jory, S. (2017). Institutional ownership stability and real earnings management. Review of Quantitative Finance and Accounting, 49(1), 227-244.

- Saleem Salem Alzoubi, E. (2016). Ownership structure and earnings management: Evidence from Jordan. International Journal of Accounting & Information Management, 24(2), 135-161.

- Schroeder, R.G., Clark, M.W., & Cathey, J.M. (2009). Financial accounting theory and analysis: Text and cases. John Wiley & Sons.

- Sharma, V.D., & Iselin, E.R. (2012). The association between audit committee multiple-directorships, tenure, and financial misstatements. Auditing: A Journal of Practice & Theory, 31(3), 149-175.

- Shen, C.H., Lin, C.Y., & Wang, Y.C. (2015). Do strong corporate governance firms still require political connection, and vice versa? International Review of Economics & Finance, 39, 107-120.

- Sial, M., Zheng, C., Khuong, N., Khan, T., & Usman, M. (2018). Does firm performance influence corporate social responsibility reporting of Chinese listed companies? Sustainability, 10(7), 1-12.

- Singh, S., Tabassum, N., Darwish, T.K., & Batsakis, G. (2018). Corporate governance and Tobin's Q as a measure of organizational performance. British Journal of Management, 29(1), 171-190.

- Tomar, S., & Bino, A. (2012). Corporate governance and bank performance: Evidence from Jordanian banking industry. Jordan Journal of Business Administration, 8(2), 353-372.

- Torchia, M., & Calabrò, A. (2016). Board of directors and financial transparency and disclosure: Evidence from Italy. Corporate Governance, 16(3), 593-608.

- Tulung, J.E., & Ramdani, D. (2018). Independence, size and performance of the board: An emerging market research. Corporate Ownership & Control, 15(2).

- Uribe Bohorquez, M.V., Martínez Ferrero, J., & García Sánchez, I.M. (2018). Board independence and firm performance: The moderating effect of institutional context. Journal of Business Research, 88, 28-43.

- Wang, M. (2014). Which types of institutional investors constrain abnormal accruals? Corporate Governance: An International Review, 22(1), 43-67.

- Yavas, C.V., & Erdogan, S.B. (2017). The effect of foreign ownership on firm performance: Evidence from emerging market. Australian Academy of Accounting and Finance Review, 2(4), 363-371.

- Zabri, S.M., Ahmad, K., & Wah, K.K. (2016). Corporate governance practices and firm performance: Evidence from top 100 public listed companies in Malaysia. Procedia Economics and Finance, 35, 287-296.

- Zalata, A., & Roberts, C. (2016). Internal corporate governance and classification shifting practices: An analysis of UK corporate behavior. Journal of Accounting, Auditing & Finance, 31(1), 51-78.

- Zhang, H., Li, L., Zhou, D., & Zhou, P. (2014). Political connections, government subsidies and firm financial performance: Evidence from renewable energy manufacturing in China. Renewable Energy, 63, 330-336.

- Zhou, H., Owusu Ansah, S., & Maggina, A. (2018). Board of directors, audit committee, and firm performance: Evidence from Greece. Journal of International Accounting, Auditing and Taxation, 31, 20-36.

- Zona, F., Gomez Mejia, L.R., & Withers, M.C. (2018). Board interlocks and firm performance: Toward a combined agency–resource dependence perspective. Journal of Management, 44(2), 589-618.