Research Article: 2022 Vol: 26 Issue: 6

The Impact of Business Intelligence Technologies on Activating Accounting Information Systems: A Survey Study on a Sample of Academicians in Some Iraqi Universities

Affaq Thanoon Ibrahem, Tikrit University

Asmaa Noaman Jasim, Tikrit University

Citation Information: Ibrahem, A.T., & Jasim, A.N. (2022). The impact of business intelligence technologies on activating accounting information systems: a survey study on a sample of academicians in some iraqi universities. Academy of Accounting and Financial Studies Journal, 26(6), 1-20.

Abstract

The research aimed to test the extent to which the use of business intelligence techniques contributed to the achievement of the effectiveness of accounting information systems. The research information were collected by preparing a questionnaire drafted to achieve that goal, and distributed to a group of academicians represented by teachers from accounting specialties (University of Mosul, University of Tikrit, Northern Technical University) during 2022, the number of valid forms for analysis was (68) forms. The descriptive analytical approach was adopted in the preparation of the research and the research arrived at several results, the most important of which is that the use of business intelligence techniques positively and morally affects the activation of accounting information systems, as the use of modern technologies including business intelligence techniques improves the effectiveness of accounting information systems through the speed of information processing and help accountants draw conclusions from huge information in a short time as well as extract predictive information from large information bases more easily for information users. This contributes to improving the quality of information published in financial reports and thus facilitates the process of making the right decisions, at the right time and appropriately for decision makers, whether at the administrative and executive level within enterprises or stakeholders more effectively. The research provides several recommendations, the most important of which is the need to keep abreast of technological developments using business intelligence techniques and to prepare qualified accountants for these technologies through workshops and training courses to obtain new knowledge.

Keywords

Business Intelligence Technologies, Accounting Information Systems, Large Data, Data Mining.

Introduction

The world today has, thanks to the tremendous technological changes, become a small global village, the information and knowledge society emerged and the strengths moved from material to information to live the era of information revolution, which made enterprises dependent on them thanks to their impact and growing pressures in their work to support their plans and control their operations, especially accounting information, which is a source of strength for the management of enterprises which led to an increase in the size of the information base in enterprises. As a result, business intelligence technologies emerged as inputs to improve and develop the performance of enterprises, which enhanced the ability of information systems in producing accounting information of a large scale as a result of the utilization of those techniques and methods provided by business intelligence.

The studies of (Rikhardsson & Yigitbasioglu, 2018; Wong & Venkatraman, 2015) emphasized that the implementation of business intelligence technologies as the technological aspect of an information system that stores and analyzes information to achieve the development of knowledge management and thus organize, arrange and store information in a way that facilitates access to them in an information base used by enterprises in their activities to improve operations and employ them in reducing cost, predicting the future, managing profits, detecting fraud, and then processing and presenting them in reports to support and improve the operations of enterprises at the tactical and strategic level that were the impetus for the application of these technologies.

From here, the research gap is manifested for research to shed light on the expected impact of business intelligence in activating accounting information systems in Iraqi facilities. After reviewing the introduction, the rest of the research will be divided into five sections. The first section deals with the methodological framework of the research, the second deals with the concept of accounting information systems and the activation of these systems, while the third section deals with the accounting importance of using business intelligence techniques, the fourth section discusses the results and testing hypotheses, and finally in the fifth section the conclusions and recommendations are reviewed.

Research Problem

In view of the enormous technological developments of recent times, the emergence of modern environmental concepts, insights and contemporary analysis to solve financial and administrative problems in enterprises. Enterprises must build and design accounting information systems capable of keeping abreast of these developments as one of the fundamental pillars of management's functioning, especially in a fierce competitive environment. Therefore, enterprises have sought to use new technologies such as business intelligence techniques that develop accounting information systems. Thus, the problem of research lies in the limited accounting information systems of the importance of their operationalization in accordance with modern technologies, including business intelligence techniques, by posing the following question:

"Is there an impact of using business intelligence techniques in activating accounting information systems?".

Research Importance

The importance of research stems from the importance of variables and the relationship between them that will be addressed, namely business intelligence techniques and the activation of accounting information systems. Therefore, it is important to seek to demonstrate the effectiveness of accounting information systems through business intelligence techniques by enhancing these systems and their ability to keep abreast of modern technological developments, especially in the context of an accelerating business environment and fierce competition.

Research Objective

In the light of what has been presented regarding the problem and importance of research, the main objective of this research is to identify the impact of business intelligence techniques on the functioning of accounting information systems. The main objective of this research is the following sub-objectives:

1. Providing a theoretical framework for what accounting information systems are and the effectiveness of their performance.

2. Identifying business intelligence and techniques.

3. Demonstrating the relationship of business intelligence techniques to the effectiveness of accounting information systems.

Research Hypothesis

The research is based on the following two main hypotheses:

1. First Main Hypothesis: There is a significant relationship between business intelligence techniques and the activation of accounting information systems.

2. Second Main Hypothesis: There is a significant impact of business intelligence techniques in activating accounting information systems.

Research Methodology

The research is based on the analytical descriptive methodology through the preparation and distribution of a questionnaire form because it is the most commonly used methodology in social studies, with the aim of achieving logical results that support the research hypothesis. Secondary sources were also used, including literature review related to research, academic letters and articles in specialized periodicals.

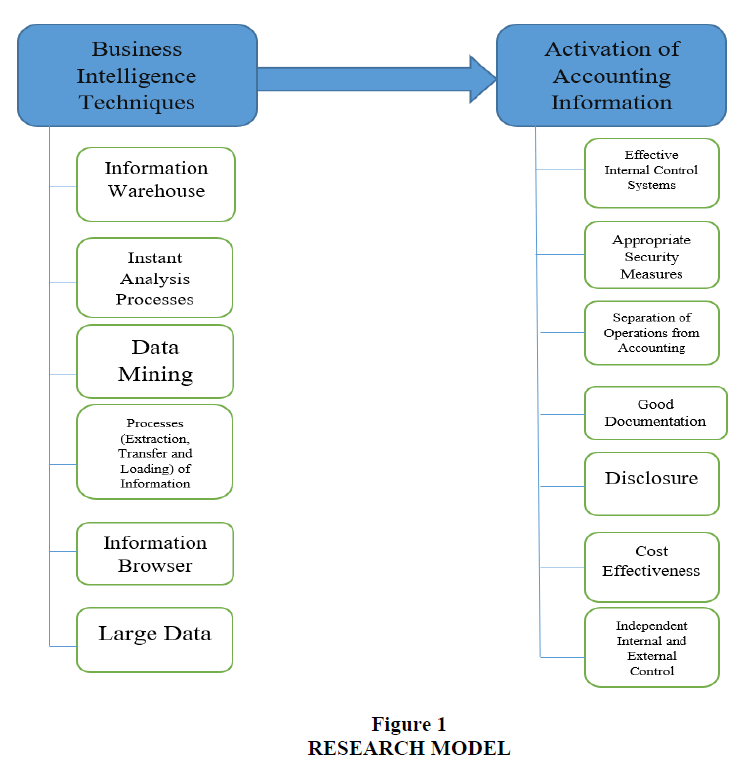

Research Model

Figure 1 illustrates the relationship between the research variables of the independent variable (Business Intelligence Techniques) and the dependent variable (Activation of Accounting Information Systems).

The Concept of Accounting Information Systems

Accounting Information Systems (AIS) is one of the most important pillars of enterprises, as these systems in enterprises collect and store information and convert it into information that help enterprises in making planning and monitoring decisions.

As the competitive environment has grown, accounting information systems have become the winning paper for establishing the existence of the enterprise in the light of the recent technological revolution in the world. Technology has demonstrated that the foundation for the stability of any enterprise is its efficient and effective system to keep pace with the world's economic perceptions and conditions. In order to give a clear concept of accounting information systems, more than one concept of accounting information systems can be illuminated as follows:

Iskandar (2015) considers that accounting information systems are a set of ready-made programs that are used to record and operate financial statements and then provide them as accounting information to beneficiaries whether they are internal or external parties.

Accounting information systems are defined by Fakeeh (2015) as computer-based systems for directly pursuing financial matters because they are systems which are responsible for storing information and processing accounting information used for decision-making both by the enterprise's management and by stakeholders.

The two researchers believe that accounting information systems are primarily computer-based systems by collecting, storing and processing financial information together with information technology resources and converting such information into information provided to all parties involved in the internal and external establishment in order to meet their need for such information and assist them in making decisions.

Effectiveness of Accounting Information Systems

In the light of the information and technology revolution that has become characteristic in today's environment, increased competition between enterprises seeks to use effective accounting information systems to provide accounting information that meets the needs of users of such information with the required accuracy and timeliness of good decision-making.

Chill (2010) explained that the effectiveness of accounting information systems is one that can achieve the goals it is intended for to provide accurate, appropriate, reliable and timely information that have a positive impact on different users' decisions.

Sajady et al. (2012) defined it as the extent to which accounting information systems contribute to providing information capable of meeting users' needs with high quality, efficiency and predictability in the future.

The researchers have previously felt that the effectiveness of accounting information systems is the accounting information possessed by the enterprise that is capable of achieving the enterprise's objectives in accordance with its mission and vision.

In order for accounting information systems to be effective, it is necessary to identify the indicators for measuring the effectiveness of accounting information (Abd El Samea, 2016):

1. Effective Internal Control Systems: The control process is to follow up the actual implementation and compare it with the planned performance to ensure that the actual performance was carried out in accordance with the plans and policies established by the enterprise. Since accounting information has grown increasingly and become more complex and dependent on modern technology, it is imperative that business enterprises ensure adequate control over their accounting information systems.

2. Appropriate Security Procedures: The existence of appropriate security procedures within the enterprise will increase the effectiveness of accounting information systems These procedures include all transaction cycles from information entry and processing to outputs, as well as the protection of information from any risks to it, such as theft, loss, damage or risks of incorrect use, whether intentional or unintentional, and the establishment of standards and procedures to prevent access to information for unauthorized persons.

3. Separation of Operations from Accounting: The enterprise must maintain the accounting information systems section by separating accountants involved in processing transactions from fund-raising procedures to ensure that accounts are not manipulated as well as maintaining business registration documents as well as controlling the periodic recording of all information entry and checking of records.

4. Good Documentation: Documentation is an important factor for judging the effectiveness of accounting information systems. Good documentation of information gives it reliability that helps the management of the enterprise to perform its activities properly, as well as good documentation is the basis for the preparation of financial lists and reports used by management and stakeholders and helps them in making good decisions.

5. Disclosure: Disclosure is intended to disseminate understandably and reliably financial and non-financial information that help users to meet their needs whether users are inside or outside the facility and help them to read future expectations as well as enhance users' confidence in this information and reduce the degree of uncertainty of the decision maker to help decide more effectively.

6. Cost Effectiveness: Accounting information systems can lead to cost effectiveness because effective accounting information systems help to determine the extra cost and these costs can be reduced by the enterprise's management.

7. Independent Internal and External Control: Information systems provide financial reports to the administrative levels within the establishment that help the establishment to effectively control the work within it in order to ensure the actual implementation of the objectives of the enterprise are achieved at the lowest cost and the best efficiency and effectiveness. External control is carried out by the independent accountants of the enterprise.

The two researchers agree with these indicators as the basis for measuring the effectiveness of accounting information systems.

Factors Affecting Accounting Information Systems

In the light of developments in information systems, the efficiency and effectiveness of these systems require the attention of enterprises, as well as taking into account the factors affecting them, which may be: (Romney et al., 2012).

1. Enterprise Culture: means a set of features, characteristics and components of traditions, values and beliefs, interacting among them and individuals working within the enterprise constitute a lifestyle within the enterprise. Since the enterprise culture affects accounting information systems, accounting information systems with its functions within the enterprise reflect the enterprise culture by controlling the flow of information within the facility, for example, access to information is easier and more widely pressed for further decentralization.

2. Strategy: The art of business management and policies used in the enterprise to achieve its objectives, so there are many opportunities to invest in information technology for the development of accounting information systems that enhance the support of the strategic position adopted in the implementation of the enterprise's strategy as well as the role of accounting information systems in assisting the enterprise to adopt and maintain a specific strategic position, thus it works on achieving compatibility of activities within the enterprise that requires the collection and linking of each activity's own information, whether financial or non-financial.

3. Information Technology: Information technology is a fundamental pillar of accounting information systems' services, they also affect the design and development of these systems and the nature of the services provided at the facility that information technology tools provide the possibility to operate information and produce accounting information with greater accuracy and speed, leading to the highest degree of complementarity and coherence of activities within the enterprise and thus add value to the facility and provide high-quality, low-cost and timely product services.

Characteristics of Accounting Information System

There is a range of features that are available in accounting information systems that make it an important, dynamic, accurate, efficient and effective information system in the facility. The most important features are: (Abd El Samea, 2016; Hassan, 2018; Mohammed, 2016; Ramli, 2011):

1. The accounting information systems of the enterprise must be of high accuracy, speed and utilization to the possible extent of modern technology in the storage and processing of information for the production of accounting information.

2. Accounting information systems should be economical, i.e. the cost of producing accounting information should not exceed its benefits.

3. The accounting information systems respond to the request for information when needed on a continuous basis through a state-of-the-art information bank and updated periodically and continuously according to the recent changes in the facility.

4. Providing information to assist the management in achieving its planning function, whether short, medium or long-term, for the future work of the enterprise by providing adequate and accurate information on the results of the implementation of these plans by comparing what is actual with what was planned in advance and presented to the management of the publisher in a detailed and analytical report that meets the needs of the decision maker.

5. Accounting information systems must provide communication channels to facilitate the flow of information into and out of the enterprise, as well as harmonize the enterprise's information systems with other systems to provide information according to the circumstances of the users of the information.

6. There should be simplicity, clarity and understanding of the flow of information from its sources in an orderly and non-duplicate manner for any previously operated information, as well as the flow of information between the various decision-making centers in the enterprise.

7. Relative flexibility by providing information capable of meeting stakeholders' needs and appropriate for making investment decisions. There is also sufficient flexibility to develop and update them to suit changes in the enterprise as a whole.

8. Accounting information systems should have a self-service upon request, i.e. the beneficiary can automatically access information without the need for human interaction with the service provider such as server and network storage. It is a service sold upon request and usually calculated per minute, hour or megabyte.

9. Widespread network access and beneficiaries' access through standard devices such as mobile phones, laptops, etc.

Quality of Accounting Information Systems

The quality of accounting information is a criterion by which the extent to which accounting information achieves its objectives efficiently and effectively can be judged, as accounting information is the cornerstone of the various planning, control and decision-making processes of the enterprise's management, as well as the reliance of stakeholders on it in making their investment decisions.

Due to the quality of accounting information, it has several different definitions because of the different quality depending on the different viewpoint and purpose of the users of this information, it is defined by (Jasim & shaban, 2021) as the extent to which the information disclosed in the financial reports of the enterprise has basic qualitative characteristics (relevance, genuine representation) and enhancement characteristics (comparability, verifiability, timeliness and understandability) in order to meet the needs and requirements of the stakeholders and to assist them in assessing the financial situation of the enterprise and the results of its business and performance and thus making appropriate decisions towards the enterprise.

Awwad (2020) defined the quality of accounting information as appropriate, credible and reliable accounting information through which the results of the business and the real financial position of the enterprise are presented, and the preparation of such information conforms to generally accepted accounting standards.

Cheung et al. (2010) defined the quality of accounting information as the extent to which information achieves its objectives, which can be measured by a set of qualitative characteristics that enable it to meet stakeholders' needs for appropriate decision-making.

Abadi defined the quality of accounting information as the credibility of the accounting information, which is free from manipulation, misinformation and misrepresentation, and the benefit to users, and which is prepared in accordance with a set of standards to help achieve the objective of its use.

The quality of accounting information can be measured to the extent that it is effective to achieve the enterprise's objectives or decision makers, or through its efficiency, which is demonstrated through the achievement of its objectives with the lowest possible resources and costs. The quality of the information is determined by the predictive capacity it exhibits after obtaining results, the less uncertain the higher the quality of the information. The process of evaluating the level of effectiveness and efficiency of accounting information systems requires specific criteria for measuring these levels through two basic criteria: (Amirouche & Qitaf, 2017; Foud et al., 2019).

1. Efficiency Criterion: means the optimal use of available enterprise resources for the purpose of achieving the best added values, i.e. achieving the objectives set by the management of the enterprise at the lowest cost and at the lowest level of resources used without compromising the objectives. Efficiency is measured by the ratio of systems' outputs to their inputs or utility to cost ratio. The lower ratio indicates the efficiency of the accounting information systems, in other words, fewer resources have been used and more beneficial than their actual cost, without compromising the objectives sought.

2. Effectiveness Criterion: Accounting information systems are effective when achieving their objective of providing necessary, reliable and appropriate quality, time and cost information for good decision-making and the effectiveness of accounting information systems can be measured through the objectives achieved in relation to the planned objectives, the greater the ratio indicates the effectiveness of accounting information systems. Some researchers also measure it through cost-benefit analysis, value-added or user satisfaction about the ease with which accounting information systems are handled and utilized.

The Concept of Business Intelligence

Business Intelligence is the state of integration between modern technology applications and information systems as (Hua et al., 2012) defined it as the solutions resulting from the application of information technology to recover inconsistent information for classification, interpretation, integration, and reformulation as usable knowledge by employing it as analytical mechanisms. Hajredini (2014) added that it was the collection of predictive statistical information (information exploration or so-called predictive analysis) and others, because through information stored in different periods, predictions for the future can be made and the purpose of this technology is to enable easy access to it (information for operational needs), and its management is as effective as possible, turning into information and through this information the future can be predicted in order to make a decision with easier and faster actions and as a result of performance to improve the enterprise as market activity flows or improve well-being and social realization.

It is also defined by (Al Tayeb, 2016: 62) as an information system that combines information storage with information analysis and knowledge management tools. This system operates in phases such as phase one by compiling information on the enterprise's activities such as marketing, sale and activities of post-sale services as well as the behavior of customers, suppliers' systems. After the compilation phase comes the second phase, namely, the organizing, arrangement, classification and storage of such information in an accessible manner in the information base. The third is then processed and presented in reports, and in the final phase, the results of applying these techniques can be used to improve the enterprise's operations.

From an accounting business perspective, business intelligence is defined as the recruitment of tools and software to control biases in accounting processes with a personal opinion of the accounting process and to achieve efficiency in information operations, to extract accurate, high-value and quality real-time information related to the business area itself (Shehad et al., 2011). Its technology is one of the most important and cutting-edge solutions for information processing, information production and handling of large information that contributes to the flow of accounting information and high-quality knowledge management that helps support management decisions. Hence, the research view is compatible with both the study of (Aly et al., 2021; Wixom & Watson, 2010) that business intelligence is a technique that contains three basic elements:

1. The technology element which collects, stores and distributes information to achieve basic functions of broad business intelligence procedures.

2. Human capacities for information recovery and distribution as knowledge production, acquisition and decision-making information.

3. An element that supports specific business processes that usefully acquire new information or knowledge for the growth of business values.

Advantages of Business Intelligence

There are several advantages of business intelligence that can be summarized as follows:

1. Facilitating the Decision-Making Process: It is a key advantage of business intelligence by enabling the enterprise to make smart decisions through the accuracy of the information it provides in a timely manner, to decide on the dealings with the most profitable enterprises (Hajredini, 2014).

2. Reducing Time: That is, reducing the time to provide the information demanded by management and users and improve the performance and efficiency of people and businesses of the enterprise by delivering the information as quickly as possible (Rouhani et al., 2018).

3. Increasing Productivity: With business intelligence, important factors can be identified for the safety of decisions that result in the profitability of the enterprise, based on which the enterprise avoids the risks that lead to its loss and then bankruptcy.

4. Cost Reduction: The adoption of business intelligence technologies leads to the achievement of the objectives of the enterprise in reducing costs through its handling of information and facilitating their receiving and analysis of information with high accuracy and delivering them to beneficiaries by participating in the use of devices through various networks of large businesses when human intervention is costly or in situations where no human expert is available (Ahmed, 2020; Azevedo et al., 2022).

5. Preparing Regular and Competitive Reports: In order to have an efficient and effective management, periodic reports must be systematized for the sections of the enterprise and their preparation needs cost and time, which has created business intelligence to place the enterprises of the competition department on their reports, accurate statistics, predictions of the future and sales as a measure to place them in a competitive situation.

Criticisms of the Use of Business Intelligence

There are difficulties in applying business intelligence methods that are regarded as criticism (Ahmed, 2020; Hajredini, 2014):

1. Difficulty in applying business intelligence with the high relative cost of purchasing and operating the system.

2. Lack of specialized staff in the field of communications technology and application of business intelligence.

3. Difficulty in qualifying and training a specialized staff to be able to apply business intelligence and deal with network technology.

4. The problem of systems breach and access to information.

5. Specific rules and legislation for accessing information that need to be understood by specialists along with the rapid increase of technological development and progress.

Business Intelligence Techniques

Many studies emphasized that the term business intelligence is used to express methods and techniques that transform big information into meaningful business information through information exploration and is concerned with the effective use of regulatory practices and technological processes to create a knowledge base that supports the enterprise by integrating and exchanging information (Olbrich et al., 2012; Wong & Venkatraman, 2015).

Technologies continue to shape the future of business intelligence. Business intelligence tools use pre-stored information that may or may not be stored in the information warehouse. Tools and business intelligence techniques enable the conversion of raw information into clear and understandable information that helps the enterprise make better decisions and communicate credible information that in turn helps to grow and increase revenue. These techniques include information warehouse, instant analysis processes, information exploration, processes (extraction, transfer, load), dashboard (information browser), and big information (Leite et al., 2019; AL-Zamili, 2016).

Hence, enterprises are starting to adopt technologies that can help them sustain with the rapid development of information technology and provide timely predictions and rapid information access. The following is a brief review of business intelligence techniques:

1. Information Warehouse: an important technology and tool for business intelligence, which is a set of design tools and techniques applied to users' specific needs and information bases to retrieve information from different systems and convert it from systems for reporting and permit the import of information from an old system to a new system to reduce the cost required by the conversion of information from the two systems to the information warehouse (Preisler & Jeronimo, 2022).

2. Instant Analysis Processes: A technique that helps extract information as a second stage as there may be differences in business processes, information bases, types and relationships with other information systems. This is where the importance of this technology comes in analyzing and identifying relationships compatible with information sources to create and generate quick reports that are used to predict and obtain accurate results for the requirements of detecting internal and external factors of the facility (Wong & Venkatraman, 2015).

3. Information Exploration: This technology emerged when solutions for investing the surplus and important resources in its information bases, which is "Information", emerged and it refers to developing relationships between the information stored on its information bases. With advanced analysis systems such as instant processing system and in-depth analysis of all information taking into account all possibilities that can be measured and obtained through the beneficiary's experience in reading and harnessing visible information with advanced analysis techniques together to be the result of knowledge discovery resulting in the facility's great revenues (AlShoura, 2020). Naveen (2009) pointed out that the process of information mining and extraction of hidden predictive information from large information bases is a new and powerful technology and has great potential to help enterprises focus on the most important information in their information repositories as information mining tools predict future trends and behaviors, allowing facilities to make them proactive in discovering knowledge and making decisions (Al-Zamili, 2016: 41).

Operations (Extraction, Transfer, and Loading) of Information (ETL): The extraction of information in an automated way necessitates extracting it from its sources and converting it from unstructured information to an organized format through three stages as follows:

a. Extraction Stage: This stage includes accessing to information originating from different and inconsistent sources, these sources are often distributed across several platforms and can be part of the customer information system.

b. Conversion Stage: This stage converts the extracted information and can be considered as the most complex stage in this technique. The conversion stage converts the information to the same information warehouse schema on which it will be uploaded. The conversion stage is usually performed by traditional programming languages.

c. Loading Stage: The loading stage pushes the converted information and loads the information from the warehouse with the collected and filtered information to the requirements of the business intelligence system to be able to extract information in different formats from sources and convert them into similar formats, and then load them into the appropriate information. The warehouse has traditionally made the ETL process the most expensive aspect of the business intelligence system in some cases, the business intelligence system may contain specified but separate information (Namdarian, 2013).

d. Information Panel (Information Browser): This business intelligence technology varies according to the goal desired by the establishment. Information display techniques are, in different ways, one of the important technologies for the success of business intelligence tasks and for communicating its outputs represented by information to its users, including information boards for workers' cards and business scorecards as it provides an opportunity for users to enhance their cognitive abilities (Rikhardsson & Yigitbasioglu, 2018). In order to suit the desired goal, reports are prepared, which are the most applied at the accounting level to display the content and analysis of management information in a flexible way that can be monitored with actual information and reworded approximately for reliance on it. While the balanced scorecard was a form of reviewing business results for the performance of facilities and was considered one of the latest types of reports to measure performance and continuous development (Nespeca & Chiucchi, 2018).

e. Big data: The emergence of large information technology has led to a change in information warehouses, which until recently were the focus of decision support technologies. The diversity and complexity of information and the growing need to keep information under control, which made the information warehouse unable to keep up with progress, led to the development of a new model, large information along with the information warehouse (Sharda & Ramesh, 2020: 654), which is an evolutionary step towards a better use of collective unstructured information from multiple sources that can enhance current and future business intelligence solutions. The relationship between business intelligence and large information can be described as one of the potential goals of information analysis, an enterprise cannot get business intelligence without analyzing large information. On the other hand, large information analysis can be used to achieve different goals, not just business intelligence, as large information is the source of extending the existing analytical set of information bases due to its size and dynamics (Bußian et al., 2016).

Business Intelligence from an Accounting Perspective

The components of electronic operating accounting systems are no different from manual operation. In all cases, there must be a documentary group, a book set, an accounting manual, and financial lists and reports. In addition, the use of business intelligence applications has an impact on the quality of the various types of regular information and the high probability of accounting system inputs by influencing the flexibility of identification, measurement and information entry and operation methods, and by reducing the errors achieved thanks to accuracy in calculations, the ability to automatically collect and store information and the ability to keep complete records through the presence of multiple-use information bases.

As for the operations of accounting systems information, business intelligence applications can have a significant impact on achieving the quality of operations through a variety of accounting tools for information conversion operations resulting from the plurality of analysis and interpretation of these information, in order to meet the needs of internal and external users.

Business intelligence applications have a decisive impact on the quality of the performance of accounting systems through the qualitative impact on the quality of information generated by accounting systems, in terms of achieving the qualitative characteristics of information that came from the international accounting rooting councils in order to serve the processes of making, decision-making and information management flow between the internal and external environment of contemporary business organizations (Beggar et al., 2011: 22).

There are many factors related to the effectiveness of accounting information systems using business intelligence, which is to reduce the cost through the use of devices and information through the use of various networks and increase coordination between departments, and it contributes to achieving the effectiveness of accounting information systems through the ability to access all information (Ahmed, 2020).

The accounting function has responded to these developments and reacted to them on the basis that accounting systems are one of the most important sources for obtaining quantitative information in various projects, and in many cases, they are even considered the oldest and most developed information systems. The American Accounting Association stated in its report on accounting theory that: "Accounting is essentially information systems, and in a more specific way it is an application of the general theory of information, so that the effectiveness of economic processes is achieved."

Abdel Moneim (2022) pointed out that a new term has emerged from (Amnesty International), which is a specialized term and is a type of business intelligence, which means a set of techniques used to extract and analyze information about accounting applications, enterprise resource planning and one traditional BI (Business Intelligence) solutions is to extract information through an information warehouse simply through accounting intelligence to provide information in real time.

The Relationship of Business Intelligence Technologies to the Effectiveness of Accounting Information Systems

The speed of technological progress that the world is witnessing today is the biggest challenge for enterprises, as these enterprises have been forced to keep abreast of technological developments so that they can survive in the market and gain a competitive advantage, and the need to qualify accountants in enterprises to deal with advanced information systems in light of technological developments through undergoing training courses to deal with business intelligence techniques in collecting, storing, analyzing and providing enterprise information in the form of information that help to make decisions.

The two researchers expect that the ability of business intelligence technologies to quickly analyze huge amounts of information allow providing actionable information that can help increase the effectiveness and efficiency of accounting information systems through the following:

1. Information warehouse technology for business intelligence helps in storing enterprise information, as such information is a real and invaluable wealth if used by enterprises by studying, analyzing and then presenting it to decision makers in enterprises in a way that enables them to identify the performance of those enterprises and draw long-term strategies, which contributes to enhancing the effectiveness of accounting information systems through which enterprises can follow up on the implementation of their actual performance and compare it with the planned performance to ensure that it was carried out as planned.

2. The technology of instant analysis operations of business intelligence contributes to helping accountants draw conclusions from huge information at any time, enabling them to create different and varied reports according to the needs of decision makers, whether they are inside or outside the facility. This will enhance the effectiveness and efficiency of accounting information systems through information entry and processing to the outputs, as well as providing security measures to protect information from theft, loss or the risks of using modern technologies in the information analysis process.

3. The process of information mining for business intelligence helps to extract predictive information from large information bases located in enterprises and helps them focus on the most important information in their information warehouses, i.e. predicting valuable information or deducing it according to some actual information, and this will contribute to the activation of accounting information systems by providing information of predictive value for future variables.

4. Information extraction technology provides business intelligence to extract information in an automated way and convert it from unstructured information to an organized format, aimed at making information easily available to users, and this will contribute to enhancing the activation of accounting information systems through the availability of wide access to the network and enabling beneficiaries to access it through standard devices and mechanisms such as mobile phones, laptops, and others.

5. The information display technology for business intelligence contributes to the delivery of outputs represented by information to all decision-makers, which contributes to the activation of accounting information systems more efficiently and effectively by providing reliable information capable of meeting the needs of decision-makers and convenient for making decisions in a timely manner.

6. Large information technology provides a competitive advantage to enterprises if they use it well and benefit from it because it helps facilitate the process of making the right decisions as quickly as possible at the administrative and executive level within enterprises, relying on the available information, as well as facilitating the drawing up of future expansion plans and recognizing weaknesses in current accounting information systems and improving them. This will enhance the rationalization of decision-making based on information extracted by accounting information systems more effectively.

Community and Sample Research

The research community is represented by academicians within accounting disciplines exclusively in Iraqi universities, and a sample was identified, including the University of Mosul, Tikrit University and the Northern Technical University, as the questionnaire forms were distributed via the internet, and within the social media and media websites of the accounting department at the two universities in question, and (68) valid forms for analysis were received.

Description of the Study Tool and Measurement of Variables

The questionnaire form included a set of phrases to measure the two research variables, as this form was formulated with the aim of measuring those variables, represented by the first variable, which is the independent variable that reflects business intelligence techniques, and it had (7) phrases in the questionnaire form and its phrase was formulated based on the study of (Ahmed, 2020; Tamandeh, 2016). As for the dependent variable represented by the activation of accounting information systems, it had (14) phrases, and these phrases were formulated based on the study of (Abd El Samea, 2016; Tamandeh, 2016), whereas the dependent variable represented by the activation of accounting information systems, had (14) phrases, and these phrases were formulated based on the study of (Abd El Samea, 2016; Fakeeh, 2015). Table 1 shows the sequence of questionnaire statements for each of the research variables.

| Table 1 Research Variables and Phrase Numbers in the Questionnaire form | |||

| Study Variables | No. | Sequence | |

| Independent | (BI) | 7 | 1-7 |

| Dependent | (AIS) | 14 | 8-21 |

| Total | 21 | 1-21 | |

Demographic Analysis of the Researched Individuals

With regard to the distribution of sample members according to demographic variables, Table 2 shows the distribution of sample members according to their personal demographic characteristics.

| Table 2 Distribution of Sample Members According to Demographic Variables | |||

| Category | No. | Rate % | |

| Academic Achievement | Master | 53 | 77.9 |

| PhD | 15 | 22.1 | |

| Scientific Title | Assistant Teacher | 24 | 35.3 |

| Teacher | 27 | 39.7 | |

| Assistant Professor | 13 | 19.1 | |

| Professor | 4 | 5.9 | |

| Years of Experience | From 1 to 5 | 12 | 17.6 |

| From 6 to 10 | 21 | 30.9 | |

| From 11 to 15 | 14 | 20.6 | |

| 16 and above | 21 | 30.9 | |

Table 2 shows that:

1. Academic Achievement: The number of respondents who hold a Master's Degree is (53) single and a PhD (15) single out of the total sample size (N=68), this supports the objectivity of the response to the sample members due to the presence of participation equivalent to approximately 22% of PhD holders.

2. Scientific Title: The number of respondents holding the title of Professor was (4) by (5.9%), the title of assistant professor (13) by (19.1%), the title of teacher (27) by (39.7%), and the title of assistant teacher (24) by (35.3%), out of the total sample size.

3. Years of Experience: The number of respondents from 1-5 years (12) by (17.6%), from 6-10 years (21) by (30.9%), from 11-15 years (14) by (20.6%), and from 16 years and over (21) by (30.9%), out of the total sample size. This indicates that the majority of the sample members have extensive academic experience.

Testing the Validity and Stability of the Study Tool

The stability of the questionnaire means the stability of the results of the questionnaire form and their unchanging significantly if they were redistributed to the sample members several times during certain time periods under the same conditions and terms. The two researchers verified the stability of the questionnaire form through the Cronbach's Alpha Coefficient as shown in Table 3.

| Table 3 Value of the Cronbach's Alpha Coefficients for the Study Variables | ||

| Variable | Cronbach's Alpha Coefficient | Validity Coefficient |

| (BI) Techniques | 0.821 | 0.906 |

| (AIS) Activation | 0.901 | 0.949 |

| Total | 0.902 | 0.950 |

Table 3 shows that the Cronbach's Alpha value ranged between (0.821 – 0.902), while the validity coefficient showed values exceeding (0.9), which indicates the validity of the questionnaire statements. These values are acceptable in a way that reflects the availability of reliability and confidence in the research variables and confirms their validity for the following stages of analysis.

Descriptive Analysis

Table 4 shows the arithmetic mean, standard deviation, relative importance and coefficient of variation for the study phrases and variables, which reflects the extent of agreement and disagreement about the research variables.

| Table 4 Descriptive Analysis of Research Phrases and Variables | ||||||

| Phrases and Variables | Arithmetic Mean | Standard Deviation | Relative Importance | Coefficient of Variation | Degree of Agreement | Sequence of Agreement |

| The processes of analyzing information according to modern technologies help to rationalize administrative decisions | 4.260 | 0.563 | 85.2% | 0.132 | High | 1 |

| Large-scale information processing operations help to improve the prediction of future variables | 4.280 | 0.595 | 85.6% | 0.139 | High | 2 |

| Access all existing information easily | 4.030 | 0.846 | 80.6% | 0.210 | High | 7 |

| Cost reduction through shared use of devices and information | 4.120 | 0.744 | 82.4% | 0.181 | High | 5 |

| Providing control through the ability to track the sources of financial statements | 4.250 | 0.608 | 85.0% | 0.143 | High | 3 |

| The ability to secure distributed processing of any modifications to the information | 3.940 | 0.790 | 78.8% | 0.201 | High | 6 |

| Their ability to participate in physical sources and networks | 4.160 | 0.704 | 83.2% | 0.169 | High | 4 |

| Total ("BI" technologies) | 4.149 | 0.486 | 83.0% | 0.117 | High | 2 |

| Comparable information contribute to the follow-up of the implementation of the actual performance of what is planned | 4.250 | 0.632 | 85.0% | 0.149 | High | 9 |

| The disclosed information are convenient and for its users | 4.260 | 0.589 | 85.2% | 0.138 | High | 2 |

| The need to provide a comprehensive protection plan that includes closing the ports of breach, access to accounting information and maintaining a backup copy that can be returned to when necessary | 4.400 | 0.650 | 88.0% | 0.148 | High | 7 |

| The need for internal control systems to protect the transfer of documents in the facility | 4.470 | 0.634 | 89.4% | 0.142 | High | 3 |

| The need to separate accounting tasks and functions related to information systems | 4.240 | 0.715 | 84.8% | 0.169 | High | 12 |

| The need to restrict employees who are authorized to access important and sensitive information in the facility. | 4.260 | 0.822 | 85.2% | 0.193 | High | 14 |

| Providing accurate and verifiable information | 4.351 | 0.641 | 87.1% | 0.147 | High | 5 |

| Providing information with a high degree of credibility and transparency | 4.260 | 0.745 | 85.2% | 0.175 | High | 13 |

| Disclosure of information of predictive value | 4.160 | 0.683 | 83.2% | 0.164 | High | 10 |

| Disclosure of accounting information allows confirming the expectations of the decision-maker | 4.220 | 0.709 | 84.4% | 0.168 | High | 11 |

| Achieving goals at the lowest possible cost compared to the achieved return | 4.320 | 0.558 | 86.4% | 0.129 | High | 1 |

| Providing relevant information in line with the requirements of rapid technological changes leads to lower cost | 4.250 | 0.608 | 85.0% | 0.143 | High | 4 |

| Providing a set of control procedures to ensure the correctness of information processing and thus ensure the correctness of the extracted information | 4.380 | 0.647 | 87.6% | 0.148 | High | 8 |

| The information contribute to providing better control procedures in detecting errors, especially in financial reports | 4.350 | 0.641 | 87.0% | 0.147 | High | 6 |

| Total (activation of "AIS") | 4.299 | 0.441 | 86.0% | 0.102 | High | 1 |

According to Table 4 of the descriptive analysis of research phrases and variables, the degree of agreement was measured in three categories: high (3.66-5), medium (2.33-3.67) and low (1-2.34), while two sequences of the degree of agreement were placed, the first according to the phrases of each variable, and the second sequence at the level of research variables. In the variant of business intelligence technologies, it was noted that the sentence: "Information analysis processes according to modern technologies help rationalize administrative decisions." was the highest in agreement and consistency in terms of the importance of the coefficient of difference that recorded the lowest level for this phrase compared to other phrases. Nevertheless, according to the variable of activation of accounting information systems, the sentence: "Achieving goals with the lowest possible cost compared to the achieved return." was the highest in compatibility and consistency in terms of relative importance and difference coefficient. However, and according to the research variables, the activation of (AIS) was the highest in compatibility and consistency, followed by the variable of (BI) technologies.

Testing the Normal Distribution of Information

In order to verify the assumption of a normal distribution of the information, the two researchers relied on calculating the value of the coefficient of skewness for all variables of the study, as the information approaches the normal distribution if the value of the coefficient of skewness is between (1 to -1), as shown in Table 5.

| Table 5 Normal Distribution Test | |

| Variables | Value of the Coefficient of Skewness |

| (BI) Techniques | 0.217 |

| (AIS) Activation | - 0.288 |

According to the results shown in Table (5), the information follow the normal distribution, but do not exceed (1) or (-1).

Seventh: Testing the Hypotheses of the Relationship between Variables

One main hypothesis for testing the relationship between variables was formulated as follows:

The First Main Hypothesis: There is a significant relationship between business intelligence technologies and the activation of accounting information systems. To test this hypothesis, the Pearson correlation coefficient between the research variables was calculated as shown in Table 6.

| Table 6 Coefficient of Correlation Between Research Variables | ||

| Variables | Pearson Correlation Coefficient | (AIS) Activation |

| (BI) Techniques | Coefficient of Correlation Value | 0.445 |

| Significance | 0.000 | |

Table 6 shows that there is a positive significant correlation between business intelligence technologies and the activation of accounting information systems. This result is consistent with the study of (Tamandeh, 2016), which confirmed that business intelligence technologies have a positive correlation in the effectiveness of accounting information systems, in addition to the study of (Ahmed, 2020), which confirmed that the application of large information and information warehouse, analytical processing, and information mining provide a deeper understanding of their customers and their requirements and this helps in making appropriate decisions in a more effective way based on the information provided by information bases which increase efficiency that leads to the development of accounting systems and their treatments in the Egyptian business environment. This shows that business intelligence technologies contribute to the activation of accounting information systems. Based on the above results, the first main hypothesis is accepted.

Testing the Hypotheses of the Impact

One main hypothesis for testing the impact of the independent variable on the dependent one was formulated as follows:

The Second Main Hypothesis: There is a significant impact of business intelligence technologies in the activation of accounting information systems.

To test this hypothesis, a simple linear regression equation was prepared to estimate the level of activation of accounting information systems in terms of business intelligence techniques for the purpose of determining the extent of the latter's influence on the activation of accounting information systems, and Table 7 shows this impact.

| Table 7 Regression Equation of the Impact of (BI) Techniques in the Activation of (AIS) | |||||

| Variables | Regression Coefficient (β) | (T) Value (Sig.) | (F) Value (Sig.) | (R2) | (R2) Modified |

| (BI) Techniques | 0.445 | 4.038 (0.000) |

16.302 (0.000) |

0.198 | 0.186 |

It is clear from Table 7 above that:

1. The significance of the regression model is proved, where the value of (F) = (16.302), which is significant at the level of significance (0.05).

2. The significance of the regression coefficients of the variable business intelligence techniques and the fixed limit is proved, where the value of (T) for business intelligence techniques (4.038) reached a significant level (0.05), and this significance indicates the presence of the impact.

3. The beta (β) value of positive (0.445) indicates that the impact of business intelligence technologies is positive in the activation of accounting information systems, that is, the wider the scope of adoption and use of business intelligence technologies, this led to an increase in the level of activation of accounting information systems.

4. The value of the determination coefficient (R2) = (0.198), which indicates that the business intelligence variable explains 19.8% of the changes that occur in the levels of activation of accounting information systems.

These results confirm the validity of the second sub-hypothesis, related to the existence of a significant impact of business intelligence technologies in activating accounting information systems, and this is consistent with the results arrived at in the study of (Tamandeh, 2016), in terms of reflecting the success of adopting business intelligence technologies in activating accounting information systems. This indicates that business intelligence technologies have a significant positive impact and are important in the activation of accounting information systems. The use of modern technologies, including business intelligence technologies, improves the effectiveness of accounting information systems through the speed of information processing and helping accountants to draw conclusions from huge information in a short time, as well as extracting predictive information from large information bases more easily for information users. This contributes to improving the quality of information published in financial reports and thus facilitating the process of making correct, timely and appropriate decisions for decision makers, both at the administrative and executive levels within enterprises or stakeholders more effectively.

Conclusions

1. The adoption of the application of business intelligence technologies enhances the effectiveness and efficiency of accounting information systems through information entry and processing to the outputs, as well as providing security measures to protect information from theft, loss or the risks of using modern technologies in the information analysis process.

2. The adoption of business intelligence technologies achieves a competitive advantage for enterprises by providing high-quality, accurate, low-cost and timely information.

3. The application of business intelligence techniques helps to extract predictive information from large information bases located in enterprises, which contributes to the activation of accounting information systems by providing information of predictive value for future variables.

4. The research results showed a significant and positive correlation between business intelligence technologies with accounting information systems at a significant level (0.05). This indicates that business intelligence technologies contribute to the activation of accounting information systems.

5. The results of the statistical analysis proved that business intelligence technologies have a significant impact on the activation of accounting information systems, where the signal of the regression coefficient (β) of (0.445) was positive, which indicates that the use of modern technologies, including business intelligence technologies, improves the effectiveness of accounting information systems through the speed of information processing and helping accountants draw conclusions from huge information in a short time, as well as extracting predictive information from large information bases more easily for information users. This contributes to improving the quality of information published in financial reports and thus facilitating the process of making correct decisions in a timely and appropriate manner for decision-makers, both at the administrative and executive levels within enterprises and stakeholders more effectively.

Recommendations

1. The need to keep abreast of technological developments using business intelligence techniques and prepare qualified accountants for these techniques through workshops and training courses to gain new knowledge.

2. The need for enterprises to increase their investments in business intelligence technologies and work to keep abreast of the latest technological developments in order to increase the activation of their accounting information systems.

References

Abd El Samea, Y.G.E.R. (2016). Proposed Framework for The Integration of IT Governance and Trust Services' Principles as A Platform to Increase The Effectiveness of Accounting information systems. (Master Thesis), Mansoura University, Egypt.

Abdel Moneim, Y.T. (2022). Digital Transformation and its Impact on Accounting Information Systems. Paper presented at the Fifth Scientific Conference of the Department of Accounting and Auditing, Alexandria, Egypt.

Ahmed, G.W. (2020). The role of business intelligence technologies in developing accounting processes and their relationship to big data. Scientific Journal of Research and Business Studies, 34(1), 75-95.

AlShoura, R.K. (2020). The Impact of the Fundamental Qualitative Characteristics of Accounting Information in the Application of the Effectiveness of Business Intelligence- A Case Study on” FINCA” Jordan Microfinance Loan. (Master Thesis), Zarqa University, Jordan.

Aly, M.R.Z., Matar, S.F., Youssef, E.S.A.E.H., & Hayder, M.M.I.H. (2021). The Impact of Business Intelligence on Organization Agility The Mediating Role of Absorptive Capacity “An Empirical Study on Joint Venture Banks in Alexandria”. Trade and Finance, 41(4), 49-136.

Indexed at, Google Scholar, Cross Ref

AL-Zamili, B.M.H. (2016). The Role of the Critical Success Factors in Business Intelligence Systems to Support the Accounting Information Systems for Internal Purposes-Field Study. (Master Thesis), Mansoura University, Egypt.

Amirouche, B., & Qitaf, L. (2017). The effectiveness and efficiency of the accounting information system in the organization -a theoretical study. Industrial Economics Journal, 1(12).

Awwad, K.L.G. (2020). Effect Ethics of The Internal Auditor on The Accounting Information Quality of banking _ a survey of the opinions of a sample of internal auditors in Iraqi banks. (Master Thesis), Tikrit University, Tikrit, Iraq.

Azevedo, J., Duarte, J., & Santos, M.F. (2022). Implementing a business intelligence cost accounting solution in a healthcare setting. Procedia Computer Science, 198, 329-334.

Indexed at, Google Scholar, Cross Ref

Bußian, A., Singer, K., Kopia, J., & Geldmacher, W. (2016). Perspectives On Big Data And Business Intelligence Technologies In The Context Of Audit Tasks. Paper presented at the Basiq International Conference on New Trends in Sustainable Business and Consumption, Konstanz, Germany.

Cheung, E., Evans, E., & Wright, S. (2010). An historical review of quality in financial reporting in Australia. Pacific Accounting Review, 22(2), 147-169.

Indexed at, Google Scholar, Cross Ref

Chill, E.T.E. (2010). The effectiveness of accounting information system in Iraqi private commercial banks: from the management perspective. (Master Thesis), Middle East University.

Fakeeh, K.A. (2015). The Practice and Prospects of Accounting Information Systems (AIS). Practice, 10(3), 16-22.

Indexed at, Google Scholar, Cross Ref

Fouda, S.A.S., Sayed, S.A.F., & Ghabbour, A.S.A.D. (2019). The Effect of The Efficiency and Effectiveness of Electronic Accounting Information Systems on Improving Performance Evaluation in Commercial Banks with A Field Study. Journal of Contemporary Commercial Studies, 5(6).

Hajredini, E. (2014). RËNDESIA E BI SISTEMEVE NË INSTITUCIONET E KOSOVËS. (Bachelor Degree), University for Business and Technology, Albania.

Hassan, Y.M.M.A. (2018). Role Of International Standards Of Auditing On Evaluating Computerized Accounting Information Systems in External Audit Firms In Sudan. (PhD Thesis), Sudan University of Science and Technology, Republic of Sudan.

Hua, J.S., Huang, S.M., & Yen, D.C. (2012). Architectural support for business intelligence: a push‐pull mechanism. Online Information Review, 36(1), 52-71.

Indexed at, Google Scholar, Cross Ref

Iskandar, D. (2015). Analysis of factors affecting the success of the application of accounting information system. International Journal of Scientific & Technology Research, 4(2), 155-162.

Jasim, A.N., & shaban, S.I. (2021). The role of narrative disclosure in improving the quality of information: An applied study in the Iraqi banking environment. Journal of Business Economics for Applied Research, 1(2), 253-273.

Mohammed, H.K. (2016). Rationalizing the Decision to Transform into Cloud - Computing Technology in the Light of Cost – Benefit Analysis - An applied Study. (Master Thesis), Mansoura University, Egypt.

Namdarian, I. (2013). The Use of Business Intelligence Components as a proficient tool in Monitoring the Operations and Cost Management in Agricultural Business Sector. Paper presented at the International Conference on Agriculture Informatics, Debrecen, Hungary.

Nespeca, A., & Chiucchi, M.S. (2018). The impact of business intelligence systems on management accounting systems: The consultant’s perspective. In Network, smart and open (pp. 283-297): Springer.

Indexed at, Google Scholar, Cross Ref

Olbrich, S., Poppelbuß, J., & Niehaves, B. (2012). Critical contextual success factors for business intelligence: A Delphi study on their relevance, variability, and controllability. Paper presented at the 45th Hawaii International Conference on System Sciences, Maui, HI, USA.

Indexed at, Google Scholar, Cross Ref

Preisler, F., & Jeronimo, L.D.R. (2022). Development of a business intelligence for asset management.

Ramli, F.H. (2011). Computerized Accounting Information Systems: A Contemporary Introduction for the Purposes of Rationalizing Administrative Decisions (1st Ed.). Republic of Sudan: Al-Abay for Publishing and Distribution.

Rikhardsson, P., & Yigitbasioglu, O. (2018). Business intelligence & analytics in management accounting research: Status and future focus. International Journal of Accounting Information Systems, 29, 37-58.

Indexed at, Google Scholar, Cross Ref

Romney, M., Steinbart, P., Mula, J., McNamara, R., & Tonkin, T. (2012). Accounting Information Systems Australasian Edition (11th ed.): Pearson Higher Education AU.

Rouhani, S., Ashrafi, A., Ravasan, A.Z., & Afshari, S. (2018). Business intelligence systems adoption model: an empirical investigation. Journal of Organizational and End User Computing (JOEUC), 30(2), 43-70.

Indexed at, Google Scholar, Cross Ref

Sajady, H., Dastgir, M., & Nejad, H.H. (2012). Evaluation of the effectiveness of accounting information systems. International Journal of Information Science and Management (IJISM), 6(2), 49-59.

Shehad, Q.A.R., Humaidan, A.N.A., & Ayouch, M.D. (2011). Business Intelligence Applications and Achieving the Integrative Concept of Accounting System Quality. Journal of Economics and Human Development, 2(1), 225-248.

Tamandeh, S.H. (2016). The effect of business intelligence on management accounting information system. European Online Journal of Natural and Social Sciences, 5(1), 190-199.

Wixom, B., & Watson, H. (2010). The BI-based organization. International Journal of Business Intelligence Research (IJBIR), 1(1), 13-28.

Indexed at, Google Scholar, Cross Ref

Wong, S., & Venkatraman, S. (2015). Financial accounting fraud detection using business intelligence. Asian Economic and Financial Review, 5(11), 1187-1207.

Indexed at, Google Scholar, Cross Ref

Received: 11-Oct-2022, Manuscript No. AAFSJ-22-12664; Editor assigned: 12-Oct-2022, PreQC No. AAFSJ-22-12664(PQ); Reviewed: 26-Oct-2022, QC No. AAFSJ-22-12664; Revised: 28-Oct-2022, Manuscript No. AAFSJ-22-12664(R); Published: 04-Nov-2022