Research Article: 2021 Vol: 25 Issue: 2

The Impact of Capital Structure on Profitability of Ethiopian Construction Companies: Evidence from Large Tax Pay Organizations

Meyad Diriba Abdi, Wolkite University

Kefiyalew Belachew Bayu, Wolkite University

Abstract

The choice of fund sources to finance an organization’s operation and investment activities is one of the major activities organization managers have to decide. This decision of managers in financing their firm’s operation and investment could involve; issuance of debt, raising of new capital through issuance of additional shares of equity, or retaining of capital from earnings generated from operations; and selection from among them largely depend on the effect they have on the organizations’ profitability. The main essence of the study is to examine the impact of capital structure on Ethiopian Construction Companies Profitability, evidence from large tax pay organizations. This thesis shade a new light for Ethiopian capital structure studies and the importance of giving a thorough thought for different maturity level of debt in studies of capital structure. The data collected for this paper is limited on ten years financial statement of selected construction Companies. This is because there is a problem to get accurate financial information and also it is difficulty on data collection from companies itself. So, the researcher wants to study on this sector by sampling ten large tax pay construction companies to have the actual data and to ease of generalization based on their availability of data for the researcher. The researcher found quantitative research approach appropriate. This is because quantitative approach is an inquiry that grounded in the assumption that features of social environment constitute an objective reality that is relatively constant across time and setting. Accordingly the result of the study shows that Return on equity and short term debt ratio have statically significant positive effect on the profitability of construction companies in Ethiopia.

Keywords

Capital Structure, Construction Companies of Ethiopia, Financial Performance, Return on Equity.

Introduction

The choice of fund sources to finance an organization’s operation and investment activities is one of the major activities organization managers have to decide. This decision of managers in financing their firm’s operation and investment could involve; issuance of debt, raising of new capital through issuance of additional shares of equity, or retaining of capital from earnings generated from operations; and selection from among them largely depend on the effect they have on the organizations’ profitability. The issue of capital structure, mix of debt and equity, decision has begun first in the literature was in 1958 when Professor Franco Modigliani and Merton Miller published their Article on the relationship between capital structure and firms’ value (hereafter MM theorem). In this earlier study, the authors concluded that under very restrictive assumptions of perfect capital market, investors’ homogeneous expectations, tax free economy and no transaction costs, capital structure is irrelevant for organization’s profitability. This is because, the increasing benefit from cheaper debt could exactly offset by increasing financial risk; hence the effect on profitability is constant. Back to then, a debate intensified on the result of MM theorem and many researchers engaged in the area; as a result of these, various attempt and theories developed on relation between capital structure decision and Profitability.

Again, in 1963 Modigliani & Miller, took the pioneer to study this relationship by admitting an existence of corporate tax in their analysis and they found organization could be benefited from the cheaper debt than it costs for financial risk so that better to finance an organization by debt as much as possible. Whereas Jensen & Meckling, (1976) in their Agency cost model suggest that there is an optimal capital structure which leads the organization to have a better Profitability and it requires maintaining this optimal position. The determination of this position will involve the tradeoff among the effects of corporate and personal taxes, bankruptcy costs and agency costs. The other important theory was the Pecking order theory by Myers & Majluf, (1984) which states no optimal capital structure for an organization exists rather there is a hierarchy preference with respect to the financing of their investments. This resulted from existence of asymmetric information between the managers and investors.

Beside the theoretical development, many researchers conduct an empirical study to examine the effect of capital structure on firms’ profitability. And their results indicate there is a relationship between capital structure and profitability. Though many researches done in the area, most of them conducted in developed countries where capital markets are well developed or in transitional countries markets are emerged in which the companies have greater opportunity to raise new capital easily from these markets and enables them to maintain or restructure their capital structure, results also shows an impact on profitability. But in countries where the case is different, less or no money market and capital market is well established, like Ethiopia, less effort is exerted to study the effect. Additionally, from few researches conducted in the country most of them focused on determinants of capital structure based on data from financial institutions taking the total debt level for the measurement of capital structure. The purpose of this study is to look in to the impact of capital structure on Ethiopia Construction Companies profitability; Evidence from large tax pay organizations by capturing different debt level and fill the knowledge gap.

Statements of the Problem

An issue of financing a business operation and investment is the utmost consideration given from the time of its initial establishment to the entire life of the business. In raising the fund for use, business managers encounter different sources to choose. A source can be a fund raised from owners of the business (or stockholders) as equity and on the other hand they have an option to use debt through issuance of debt securities or borrowing loan extended by financial institutions. Yet the extent at what quantity firms should use debt in their financing of assets is left to business managers to decide.

The choice to the mix of debt and equity in capital structure has been investigated in theory and empirical evidences have been found as to the existence of relationship between capital structure and firm’s profitability Modigliani & Miller, (1963); Myers & Majluf, (1984); Rajan & Zingales, (1995); Sunder & Myers, (1999); Abor (2005); Luper & Isaac, (2012); Daniel (2011); Weldemikael (2012) and others.

Their relationship theoretically begins from the incentives debt has a tax advantage over equity since interest payment is tax deductible (Modigliani & Miller, 1963) but not dividends distributed to owners. This tax benefit the debt brings to business firms motivate managers to employ more debt in their financing and such dependency on debt after some extent can cause the business to be risky. Consequently, owners of the business, whom they have residual claim over the assets, demands high required rate of return for additional risk they bear; as a result, an effort for raising new capital will be more expensive and leads the overall cost of financing to be high then finally it forced the firms’ value to decrease.

The results found from empirical studies show a mixed result both a positive effect Berger (2002), Chowdhury & Chowdhury, (2010); Ahmed et al. (2012); Abiodun (2012); Aburub (2012); and also a negative effect Chin Ai Fu (1997); Frank & Goyal (2007); Memon et al. (2010), Adekunle & Sunday, (2010); Pratheepkanth (2011) and Keshtkar et al. (2012) on firms’ profitability. Moreover, these studies largely used a total debt level as a measure for capital structure but the level of debt is important in determining the profitability. For example R. Zeitun & Tian, (2007) found that short term debt is significantly and positively related to profitability despite long term and total debt negatively related to profitability.

Even though several studies conducted in this area, most of them done in countries there are more developed or emerged money and capital market existed. In these countries companies have an opportunity to adjust their capital structure by generating new capital easily through issuance of new shares and/or new debt securities from the market. But in countries where there is less developed or no capital market established; such as Ethiopia, business organization faced difficulty to raise new capital other than from restricted line of credit extended from depository institution which challenges managers to maintain their capital structure; besides, there are few researches conducted in this area in Ethiopia which largely focused on determinants of capital structure Daniel (2011), Weldemikael (2012) and others. Therefore, this situation creates a greater interest to the researcher and encouraged her to study the impact of capital structure on Ethiopian Construction Companies Profitability, evidence from large tax pay organizations.

Objectives of the Study

General objectives

The main essence of the study is to examine the impact of capital structure on Ethiopian Construction Companies Profitability, evidence from large tax pay organizations.

Specific objectives

Further, the researcher attempted to achieve the following specific objectives;

1. Determine the extent Ethiopian Construction Companies relied on debt;

2. Examine the impact of different maturity level of debt on profitability;

3. Investigate company size’s and asset tangibility’s impact on profitability

Significance of the Study

Although numerous studies conducted in developed and recently in developing nations in the area of capital structure, there are few studies done in Ethiopia. Despite these few studies, to the extent of the researcher knowledge no single study was conducted to examine the impact of capital structure on profitability in which debt maturity choice is considered rather those few studies almost all of them are focused on determining factors of capital structure. Therefore, this thesis shade a new light for Ethiopian capital structure studies and the importance of giving a thorough thought for different maturity level of debt in studies of capital structure. Finally, the result of this study could be used as an input for interested researchers in the field to understand how important are the reverse effect of capital structure on profitability and the maturity level of debt to capital structure studies.

Scope of the Study

The study is delimited to the impact of capital structure on the profitability of Ethiopian Construction companies, which covers only large tax pay construction companies in Ethiopia. Among 119 large taxes pay construction companies the researcher analyzed large tax pay construction companies. The data collected for this paper is limited on ten years financial statement of selected construction Companies. This is because there is a problem to get accurate financial information and also it is difficulty on data collection from companies itself. So, the researcher wants to study on this sector by sampling ten large tax pay construction companies to have the actual data and to ease of generalization based on their availability of data for the researcher.

Theoretical Review of Literature

Prior to Modigliani & Miller (1958), conventional perspectives believed that using financial leverage increases company’s value. Accordingly, there is optimized capital structure that minimizes capital cost (Gupta et al. 2011). This first view of capital structure is usually called the traditional approach. And it is largely relies on a number of simplifying assumption that do not exist in reality. Some of them are no tax exist, companies have only two choice to finance either through perpetual of debt or ordinary equity shares, no earnings and dividend payment growth and also the business risk associated with company unchanged overtime . Considering these assumptions, traditional approach arrived at a conclusion that companies should use the combination of debt and equity finance that minimizes its overall cost of capital in order to maximize the wealth of its shareholders (Denzil & Antony, 2007). However, by the year 1958 Modigliani & Miller affirm that, in consideration of perfect capital market the capital structure does not have influence on the market value of the company rather the benefit of using debts will compensate by the decrease of companies stock. As a result, they argued in the efficient market the debt-equity choice is irrelevant to the value of the firm, known latter as irrelevance theory (Gupta et al. 2011). In supporting of their argument, they stated also the market value of a company depends on its expected performance and commercial risk so that the market value of a company and its cost of capital are independent. But they came to this conclusion based on the assumption outlined in traditional approach and extra assumption of capital markets was perfect which was central to their model (Denzil & Antony, 2007).

Five years later from their prior paper, Modigliani & Miller, (1963) reviewed their position and incorporated the corporate taxes benefits of the debt. From then on, it is considered that the cost of debt would be smaller than equity, because the government would be indirectly subsidizing the expenses with interests (Carvaliho & Edison, 2007). Therefore, they argued that due to tax deductibility of interest payments the appropriate capital structure for a firm is composed entirely of debt (Modigliani & Miller, 1963) since firm value will increase with higher financial leverage (Gupta et al. 2011) however, the increasing debt results in an increased probability of bankruptcy to occur. Hence, the optimal capital structure reached when the marginal cost of bankruptcy is equal to be marginal benefit from tax sheltering provided by the increase debt ratio (Boodhoo, 2009). Further Miller (1977), extends the 1963 model by integrating the effect of personal taxes in to their model. This Miller’s complex model considers the relationship between equity available for investors to invest in. According to his model, the higher interest rate on debt borrowed will cancel out the tax benefits of the additional debt, leaving the average cost of capital unchanged. As with their first model the Miller’s model also did not take bankruptcy cost into account. Consequently, the result was similar to their first model (Denzil & Antony, 2007). Following the path-breaking work of Modigliani & Miller, (1958,1963) on capital structure, the following conflicting theories of capital structure have been developed: Trade-off (static trade-off theory and agency cost theory) and pecking order.

Trade-off theory

Trade off-theory assumes that there are benefits and costs associated with the use of debt as against equity and firms thus chose an optimal capital structure that trades off the marginal benefits and costs of debt. In the beginning, the theory was limited to the tradeoff between the tax advantages of debt against the bankruptcy costs. Then it was extended to include benefits and costs associated with the use of debt in mitigating the conflicts among the agent groups associated firm (i.e. managers, equity-holders and debt-holders). Both dimension of the theory discussed in the following two sections.

Static trade-off theory

The original version of the trade-off theory grew out of the debate over the Modigliani & Miller theorem. A corporate income tax which was added to their original irrelevance proposition (Modigliani & Miller, 1963) created a benefit for debt in that it served to shield earnings from taxes. As per their proposition there is no offsetting cost of debt, implying a 100% debt financing. This benefit resulted from the reality in which debt has tax advantage to a company since interest payments reduce the firm’s taxable income while dividends and share repurchase do not (Lewellen & Lewellen, 2006).

Agency cost theory

The agency theory was initially developed by Berle & Means, (1932) who argued that due to a continuous dilution of equity ownership of large corporation ownership and control become more and more separated (Boodho, 2009). Their argument has contributed its part to the capital structure decision, till Jensen & Meckling, (1976) wrote their paper titled “Theory of the firm: managerial behavior, agency cost and ownership structure.” In their paper, Jensen & Meckling, (1976) define Agency relationship: Agency relationship is a contract under which one or more persons (the principal[s]) engage another person (the agent) to perform some service on their behalf which involves delegating some decision making authority to the agent. Based on this definition and reality, principals (here there on shareholders) are the owners of a company, and the task of its Agents (here there on directors or managements) are merely to ensure that shareholders’ interest maximized or run the company in a way which maximizes long term return of shareholders and company’s profit and cash flow.

Pecking order theory

The pecking order theory was initiated by the work of Myers (1984), and Myers & Majluf, (1984). This theory states that due to asymmetric information occur in between managements (insiders) and investors (outsiders) in which there are situations management would have more information about companies’ value and investment opportunities whereas investors might not. In such occasion if management will go for future investment opportunities through issuance of new shares of equity, rational investors might considers the management actions as if it is because of management perception that the market overvalued their stock and as if they are trying to take advantage of it; so that, investors would underprice the stock then it will dilute value and control from existing shareholders to the new one, sometime the dilution from issuance of new shares may be beyond the benefits of the new project. As a result, as a way to avoid such dilution of value, management could pass over positive net present value investment opportunities or they will try to use another financing arrangement.

Review of Empirical Studies

Similar to the theoretical results of the issue different results have been found in the empirical researches of this field. These differences clearly shown between the researches held in developed nations who have well established markets, in which companies could gain an efficient access to raise capital, and in developing nations where their markets are emerged or not developed enough for capital access and as well for restructuring their capital composition. Furthermore, the residing difference not only restricted to the market situation of respected countries but also observed within same level of market situations as researches indicated both the direct and inverse relation between the capital structure and financial performance had. In this section of the literature review, the researcher tried to show researches conducted in developed countries with a highlight comparison to those done on developing ones and further tried to depict the mixed results found in different researches. Then, the review goes to studies which used different levels of debt as a measure for the capital structure to see their impact on performance. Finally, it ends up by summaries of researches on the study area from Ethiopia.

Empirical review from developed nations

Despite there are enormous researches done using data from developed countries available, the researcher use only seven of them which are considered enough to create awareness for the audiences. Besides, from among these seven researches the first two are cross sectional (data taken from different countries) and the remaining done within individual country. The first among well-known and referenced researches conducted from developed nations is the paper done by Rajan & Zingales, (1995) which entitled “What do we know about Capital structure?” This study investigated determinants of capital structure choice using data from public firms in the major industrialized countries named as G-7 (United States[USA], Japan, Germany, France, Italy, United Kingdom [UK] and Canada) with an objective to examine whether capital structure outside USA is related to factors similar to those appearing to influence the capital structure of USA firms. In this study the researchers took “Profitability” as one factors to see its relation with capital structure; accordingly they have found that profitability is negatively correlated with capital structure in US, Japan, Italy and Canada, while in the UK it is more positively correlated, since the dominant source of external finance in UK is equity. Whereas, there are no relationship found in Germany and France. As their result clearly indicated the relationship between capital structure and profitability a substitute for performance vary among countries of developed countries.

The other well-known paper similar with the former is the study undertaken by Chen and Hammes (2003) which used data from seven OECD countries (specifically US, UK, Canada, Denmark, Italy, Sweden and Germany) to analyze factors influencing firm’s leverage. Similar to the Rajan & Zingales, (1995) they took profitability as one factor of leverage; however, they have found a negative relation in all countries with a strong relation in Denmark and Sweden whereas a weak relation in US and Germany. As a result they concluded high performer companies exhibit lower debt.

Beyond the cross sectional researches, there are efforts to study by taking from a single countries. For instance an empirical research on Swiss companies to examine determinants of capital structure using a panel data from 106 companies for the period of ten years indicated profitability to be negatively related with leverage (Gaud et al. 2003). Similarly a study by Reimoo (2008) on UK’s 173 non-financial listed companies for a period of ten years from 1998 to 2007 also revealed same result which indicates a negative association in between profitability and leverage. Han-suck song’s (2009) study on the Swedish 6000 companies for nine year time span arrived at the same conclusion with above researchers. Above all, these researches reach to the conclusion that the relation between capital structure and performance supports the pecking order theory of capital structure.

Although all the above studies on data from developed countries shows a negative relation in between the two variables, the mixed result found in the two studies of Frank and Goyal (in the year 2007 and 2009) draw some attention. Their former research which titled as “Capital structure decisions; which factor are reliably important?” Examined the relative importance of many factors in the leverage decisions of publicly traded American firm for over half century using data from U.S firms on composted CRSP revealed a negative correlation between the two variables (profitability and leverage). However, on their latter research named “profits and capital structure”, they argued towards the wrong impression about Trade of theory held by other authors because of the difference in its theoretical and empirical results. As a result they tried to support their argument by taking data from the US compustat CRSP then they have found that more profitable firms tend to issue more debt and repurchase equity or in other words less profitable firms tend to do the reverse which in short a positive relation between them. As a summary, it is obvious that researches gave much favor to a result of negative relation and pecking order theory as it is tried to describe above but it couldn’t be conclusive to say the two variables to have a complete inverse relation since there could be moments they too have direct relation as seen in the works of (Frank & Goyal, 2007).

Empirical review from transitional and developing nations

In similar way studies from the developing nations also have similar features with that of developed nations despite their level of development. These studies mostly favored the inverse relationship of the studied variables. To support this idea with some researches we can observe beginning from the cross-country study conducted by (Booth et al., 2001). They examined the financial structures of firms by a sample of ten developing countries particularly India, Pakistan, Thailand, Malaysia, Turkey, Zimbabwe, Mexico, Brazil, Jordan and Korea. They primarily focused on answering a question “Do corporate leverage decision differ significantly between developing and developed countries?” As their finding indicated no significant difference as per the decision was found but they have found profitability to have a significant and negative relation with leverage decision except for Zimbabwe. Moreover, their consistent result in both the countries and pooled data is that the more profitable the firm, the lower the debt level regardless of how it is measured. As a result, their finding is consistent with pecking order hypothesis which suggest there is an existence of significant information asymmetries and also gave a hint for costly external financing to be avoided by firms. The study by Bauer (2004) on Czech Republic firms also revealed a negative correlation between leverage and performance supporting pecking order theory as their part of examining determinants of capital structure.

Additionally, several studies seeking to knew whether capital structure has an impact on performance also reaches to the same conclusion. Among them, a study evidenced from 100 firms in national stock exchange of India (Gupta et al., 2011), study evidenced from 77 nonfinancial Bangladesh’s four most leading sector firms (Chowdhury & Chowdhury, 2010), study evidenced from 30 listed companies traded in Colombo stock exchange Sri Lanka (Pratheepkanth, 2011), and studies evidenced from non-financial firms listed on the Nigerian stock exchange by Adenkule & Sunday (2010), and by Ossuji & Odita, (2012) stating firms’ capital structure has a negative impact on financial performance; in other word companies that have good performance would likely to have low debt.

However, a study on 40 Mauritanian listed firms differ slightly from above studies as the result shows firm’s performance tends to be negatively related to a certain range of leverage. But beyond this range the benefit from the tax deductibility of interest expense derived from an increase in the debt ratio to be more than offset by the increase in cost related to financial distress and bankruptcy; therefore it will have a direct relation (Boodho, 2009). Lastly, in contrast to all studies discussed previously, Abu Rub (2011) has found a positive correlation between firm performance and capital structure for 28 listed companies in Palestine stock exchange.

Empirical review on studies using debt maturity level

Once finalizing the review of studies to highlight a comparison between the developed and developing nations in prior section, the researcher is interested to look at what will be the relation different maturity level of debt has with financial performance from prior research findings if any deviation could be observed unlike the total debt value. As the researcher tried to review some empirical studies which use different maturity level of debt as a measure of leverage, there are differences in results as to their relationship with performance. To strengthen this argument the researcher discussed and presented review of research findings below. When start the broad discussion, I found the study entitled “Determinants of capital structure in developing countries”. This paper investigated the capital structure decision of firms in developing countries using firm level survey data for 25 countries of 11,125 firms from five regions: Africa, East Asia and Pacific, Latin America and Caribbean, Middle East and North Africa and South Asia with main focus on small and private firms. In this cross countries study, the researchers tried to look the relationship between debt maturity levels with performance on different categories of firms (small, medium and large) and among private and public companies. Their result shows, total debt and long term debt have a significant and negative relationship with performance on small, medium and large firms; whereas, short term debt has insignificant and negative relation on small and large firms but not for medium firms. On the other hand, all of them have been found to have insignificant relationship with performance however all are significant and negative on private firms (Bas et al. 2009). From this cross-country study we can understand there are situations as to which maturity level of debt should not be overlooked while studying the effect of capital structure on performance. Similar to the cross-country study discussed above, there are findings from single countries which suggest the same.

For instance, one study on 70 Brazilian companies by Carvalho & Edson, (2007) tried to examine the influence of capital structure regarding the factor profitability; under which they have tried to verify the relationship among the rates of return (measures of performance) related to the composition of capital: short term debt, long term debt and equity. Their finding revealed an inverse relationship with long term financing but a direct relation for short term financing which indicates maturity level of debt to be borrowed has its own part in determining performances of companies. The other study by Ahmed et al. (2012) also examined the capital structure effects on 58 Malaysians’ consumer and industrial sector listed companies in which they differentiated the short term debt, long term debt and total debt effects considering they will have different risk and return profiles, and to observe how the change in debt level affect firms’ performance. Unlike Carvalho & Edson, they found long term debt to have a significant and positive relation with return on assets (ROA), but short term debt has a significant and negative relation with ROA; however, both of them have an inverse relation with return on equity (ROE) of another measure of performance which magnifies consideration of maturity level is still in need. Abor (2005) also investigated the issue by taking all listed Ghanaians’ firms. He finds a significant and positive relation between short term debt and profitability suggesting that profitable firms use more short-debt to finance their operation and short term debt is an important source of financing for Ghanaian firms representing 85% of total debt financing.

However, long term debt is negatively correlated with profitability. Likely, Ellili & Farouk, (2011), on their examination of the issue for 33 firms listed on Abu Dhabi stock exchange, find long term debt negatively correlated with profitability and positively correlated with short term debt. Following this result, they concluded that more profitable companies may use short term debt in financing their operating activities and use the long term debts in financing their investments. Although all the above mentioned studies put a variation in between different debt maturity level, the next two researches clearly shown it is not always the case to have various relation with performance. The first one conducted by Keshtkar et al. (2012) which entitled as “Determinants of corporate capital structure under different debt maturities; evidence from Iran” Investigated factors of capital structure considering different debt maturities in that they have found performance and total debt inversely related.

Additionally, it is the same for short term and long term debt as total level. The second one evidenced from manufacturing companies of Nigeria and reached to the conclusion capital structure and performance is insignificantly and negatively correlated. Moreover, all, short term, long term and total debt level are not major determinants of firms’ performance (Luper & Isaac, 2012). Therefore, as we have seen in the above discussion to one way or another, it is important to know the impact of each maturity level of debt beside the total amount and level of debt since it may have a significant impact on performance which requires a critical decision on structuring their capital mix.

Empirical review from Ethiopia

As the researcher tried to configure out in the above discussion, the empirical results regarding the relationship between capital structure and financial performance are controversial. Likewise, the case seems similar in Ethiopia also, as some states there is a negative relation, some other concluded a positive relation but other claims no significant relationship found at all. However, it is better to know that all studies, to the extent of my knowledge, were focused on determining factors of capital structure rather examining the effect of capital structure on financial performance. As a result, the researcher is restricted to review these studies only since they are the only options which can provide us a hint towards their relationship. One study evidenced from Ethiopian small scale manufacturing cooperatives by Daniel (2011) investigated the determinants of capital structure and attempt to test the validity of dominant capital structure theories to these cooperatives. For this study the researcher used 13 small scale manufacturing cooperatives for time span of five year as a sample. Using their audited financial statements for analysis, the study found an inverse correlation with profitability which supported pecking order theory though the result was insignificant. Based on his finding he concluded profitability influences firms to maintain low leverage even if it was insignificant. Another study by Netsanet (2012) examined empirically the issue by taking evidence from 11 large construction companies residing in Addis Ababa city.

This study after analyzing annual financial reports of these 11 companies, found a significant and negative relationship between profitability of the large construction companies and their level of leverage which again supported pecking order theory as Daniel concluded. Additionally, Weldemikael’s (2012) research result also agreed with these previous studies as he also concluded profitability has negative relation with leverage and it supported pecking order theory by taking and analyzing financial statements of eight commercial banks of Ethiopia. On the other side, a research evidenced from Ethiopian insurance industry contradicted with above studies in such a way that it finds a significant and positive correlation with total debt ratio and support Trade-off theory unlike the previous reviewed three studies. As a result, it rejects the hypothesis claiming profitability is inversely related with capital structure (Bayeh, 2011).

Furthermore, a research conducted by Amanuel (2011) is completely different. His study used 12 manufacturing share companies of Addis Ababa city, to understand the relevance of theoretical internal (firm level) factors determining capital structure in these share companies. Based on analysis of their audited financial reports it has concluded profitability has no any statistically significant relation with total debt. Concerning the relationship between debt maturity level and performance, I have found only two studies, Bayeh’s (2011) and Amanuel’s (2012) researches. By taking Long term debt leaving short term debt, Bayeh found profitability a negative relation with long term debt indicating an increase in profit would lead to decrease in leverage. Note that total debt has a positive relation with profitability as depicted above. Whereas, Amanuel used both the short term and long term debt as a measure for maturity level and he found short term debt positively and long term debt negatively and significantly correlated with profitability unlike the insignificant relationship of total debt level.

To summarize the discussion, we can see that there is no any conclusive decision as to mixture of debt and equity in a company’s capital composition in Ethiopia and as well whether to use more short term debt or long term debt financing sources within the capital restriction environment based on prior studies. Therefore, it requires additional studies to be done especially to sectors which were not covered in prior studies like the Ethiopian Construction Companies.

Summary on Review of Related Literature

The literatures focus on factors affecting profitability of on other developed countries firms rather than on construction companies. Even these fewer literatures are also concerning on other countries construction companies. In addition it does not show the impact of capital structure on profitability of construction companies. So as compared to other firm’s literature, the existing literatures concerning construction companies on the impact of capital structure on profitability of construction companies is not enough. This shows that the research conducted in the topic of the impact of capital structure on profitability of construction companies is very limited in Ethiopia, even though a lots of construction companies are emerging continuously.

Therefore, this study would help to acquire information about the impact of capital structure on profitability of construction companies in Ethiopia. Regarding to empirical evidences the impact of capital structure on profitability of construction companies focused on internal factors such, firm size, liquidity, capital structure and working capital management. The results found by the researchers mentioned above in the empirical shown fluctuates based on to the country in which the research is conducted regarding some variables. Previous studies conducted on the topic of the impact of capital structure on profitability of construction companies were focused only on other countries. Therefore, this study filled the above stated gaps by studying the impact of capital structure on profitability of construction companies in Ethiopian context.

Research Methodology

Research Design

An eligibility of research approach primarily based on objectives and purposes which the study tried to achieve and a research problem to be answered. As the researcher tried to state the objectives and problems in the introduction chapter of this thesis, the study exert effort to examine the impact of capital structure on profitability of selected Ethiopian construction Companies, with large tax pay companies with determining which giant capital structure theory is followed. Consistent to this, the researcher found quantitative research approach appropriate. This is because quantitative approach is an inquiry that grounded in the assumption that features of social environment constitute an objective reality that is relatively constant across time and setting (Gall et al., 1996) as cited in (Manning & Mcmurray, 2010).

When they continued further, the dominant methodology of this is to describe and explain features of this reality by collecting numerical data on observable behavior of samples and by subjecting these data to statistical analysis, which is this study required. Moreover, quantitative researches test theories deductively from existing knowledge, through developing hypothesized relationships and proposed outcome. And to arrive at this point this research approach employs a review of the existing literature to deductively develop theories and hypotheses to be tested and requires translating of the research problem to specific variables (Yesigat, 2009). As Yesigat further noted quantitative research approaches tests the theoretically established relationship between variables using sample data with the intention of statistically generalizing for the population under investigation.

Accordingly, this study reviewed literature extensively and discussed it in the previous chapter regarding the theoretical relationship between capital structure and financial performance along with empirical studies on the area. Based on this discussion the study developed hypothesis to be tested from the residing theories and translated the research problem into variables which are measurable. In such a way the study took profitability as dependent variable, leverage which consist the total debt level and different maturity level (short term and long term) as independent variables and lastly company size, management efficiency and asset tangibility which are found in the literature to impact profitability taken as a control variables. Then it tested dominant capital structure theories, trade off and pecking order, to identify which theory could be supported in Ethiopia using data from 10 sample large tax pay Construction companies.

Target Population, Sampling Technique, Data Source and Type

Target population

Population refers to all the members of a real or hypothetical set of people, events or objects to which we wish to generalize the results of our research. The target populations of this study are Ethiopian Large Tax Pay Construction Companies. The population of this study included all private construction companies in Ethiopia which are 119 in number.

Sampling technique

To make the study manageable with time and cost constraint the random sampling methods were employed. Moreover, the random sampling method gives equal chance for all respondents being chosen in the sample. The criterion for companies to be included in the study required companies to have a ten year audited financial statements particularly balances sheet and profit and loss statements covering a period from 2009 to 2018 inclusive.

Therefore, from the total 8 sampled companies, there would be 80 observations which are sufficient for undertaking a regression analysis. These financial statements were obtained from each sampled individual companies. This is because no other means available to reach such data legally.

The sample size for the study is determined by using the sample size determination table developed by Yamen, (1967) with precision level of ± 7% is used. The sample covers only Large Tax Pay Construction companies in Ethiopia. Among 119 Large Tax Pay construction companies the researcher analyzed only 8 grade one construction companies.

Data source and type

The data sample was collected from the Ministry of urban Development, Housing and construction. The data includes selected construction companies from the year 2009 to 2018. To achieve the purpose of the study, the researcher depends solely on secondary data taken from companies annual audit reports. The data characterized as panel data, which capture both the cross section and time series dimensions. Baltagi et al. (1994) cited in Chen and Hammes (2003) described the advantages of panel as a way to increase number describer of data points and degree of freedom, and to reduce co-linearity among explanatory variables that lead to improve the efficiency of econometric estimates. They noted additionally, it can also control for individual heterogeneity due to hidden factors that if neglected in time series or cross sectional estimation which leads to biased result. By this rational the researcher chooses to use panel data type.

Method of Data Analysis

The panel data collected from companies audited financial statements analyzed by using “E-views version 8.0.” statistical package. Using this statistical package, the researcher has undertaken various statistical analysis methods in order to test the proposed hypothesis. First, the study employed a descriptive statistics of variables to provide the researcher and audience in picturing the situation and to present relevant information (Malhotra, 1997 cited in Bayeh, 2011). Then it conducted Pearson’s correlation matrix test to identify the relationship of each variable among them and with dependent variables, and various specification tests has been done to check for assumptions of classical linear regression model: heteroscedasticity, autocorrelation, multicolinearity, and normality are held along with a test for either a fixed effect or random effect model is appropriate for the study. Finally, the study used multiple regression models to test the influence of capital structure on Ethiopian Construction companies’ profitability by applying Ordinary least square (OLS) regression method with a rational that it can minimize the error between the estimated point on the line and the actual observed points of the estimated regression line giving the best fit (San & Heng, 2011).

The impact of each explanatory variable on leverage was assessed in terms of the statistical significance of the coefficients ‘βs’. Using a 1%, 5%, and 10% level of significance, an estimated coefficient was considered to be statistically significant: at 1%, if p-value <0.01, at 5%, if p-value <0.05 and at 10%, if p-value <0.1. It is conventional to use a 5% significance level, but 10% and 1% are also commonly used (Brooks, 2008). The signs in the model reveal the expected relationship between the dependent variable, and independent variables. Lastly, all results presented through tables and graphs.

Method Specification from Empirical Review

Leverage (debt ratio)

The static trade-off theory predicts that higher level of debt usage, due to its benefits of tax deductibility of interest payments, will favor companies’ profitability up to a certain range where this tax advantage eventually disappear as a result of the bankruptcy risk and financial distress aroused from excessive utilization of debt (Scott, 1977). Consequently, to avoid this risk of bankruptcy companies would try to maintain an optimum mix of debt and equity at the point the marginal benefit of debt and marginal benefit of equity equals. Accordingly, static trade off theory says there is a positive effect of inclusion of debt in capital structure on profitability. Likewise, the agency cost theory also predicts that higher leverage is expected to lower agency costs, reduce inefficiency and thereby lead to improvement in companies’ profitability. Berger (2002) argues that increasing the leverage ratio should result in lower agency costs of outside equity and improve company profitability, all else held constant. From this contribution, it is expected that leverage to have a positive or direct impact on profitability. On the other hand, pecking order theory says that due to asymmetric information occur in between insiders and outsiders, in which there are situations management would have more information about companies’ value and investment opportunities whereas investors might not (Myers & Majluf, 1984). In such occasion if management will go for future investment opportunities through external financing, rational investors might consider the management actions as if it is because the management perceived the company is overvalued and as if they are trying to take advantage of it; so that, investors would underprice the company. So that, to avoid such situations management could pass over good investment opportunities that would affect companies’ profitability unfavorably and further the management will finance their operation in the order as follows: first they will go for internal fund, if this source is exhausted and they have found external financing necessary, they will address their finance deficit using safest debt then to risky one and as a last resort they could use new issuance of equity.

Therefore, unlike the previous two theories, pecking order theory forward debt to have a negative impact on profitability. As is clearly shown above there is controversy in the relation between leverage and profitabilityin various capital structure theories. Besides, many empirical researches done in testing for these theories to support by data from different countries. Among these many empirical researches most of them favor pecking order theory suggesting a negative relationship between the two variables. For instance, study by Booth et al. (2001); Gaud et al. (2003); Bauer (2004); Attaullah & Hjazi, (2004); Han-suck song (2005); Reimoo (2008); Abor (2008); Sen & Oruc, (2008); Ellili & Farouk, (2011) supported pecking order theory by their data. Similarly, most studies in Ethiopia in the area also support this theory like study by Daniel (2011); Weldemikael (2012) and Netsanet (2012) are some of them. Therefore, based on this the first hypothesis to be tested regarding total level of debt stated as

Hypothesis 1: There is a significant negative impact of Leverage ratio on Ethiopian Large Tax Pay Construction companies’ profitability.

Short term debt ratio

Similar to the manner for the variable leverage and as part of it, the above theories explained theoretically the relationship between short term debt ratio variable with the Profitability. Rather than going for their theoretical relationship again the researcher focused on the empirical researches. The results of these researches indicated mostly a positive relationship in between these two variables which supported a Trade-off theory of capital structure. Carvaliho & Edison, (2007) found a positive impact and they suggested for this to occur is the instability of economy to arouse for a need of short run fund to finance their working capital which are the type of resources supposedly offered with relative abundance and easiness by financial institution. Abor (2005) also found a positive relation with profitability which he indicated that short term debts are less expensive in which increasing short term debt with a relatively low interest rate will lead to an increase in profitability level. Additionally, Ellili & Farouk (2011) supported this and justified that more profitable companies used short term debt in financing their operating activities. The only study by Amanuel (2012) using short term debt as variable for leverage in Ethiopia also supported the positive relationship. From this it is expected a positive impact of short term debt on profitability and to support Trade off theory; so that, the second hypothesis stated as follows

Hypothesis 2: There is a significant positive effect of short term debt on Ethiopian Construction companies’ profitability

Long term debt ratio

Concerning Long term debt as variable for leverage, different studies revealed that it has a negative impact on profitability and support pecking order theory, which to indicate that highly profitable companies use internal fund in financing their long term investment rather than borrowing a long term debt. This is supported from studies by Carvaliho & Edison, (2007); Bas et al. (2009); Abor (2005); Keshtkar et al. (2012); Bayeh (2011) and Amanuel (2012) from Ethiopia’s case. Based on these, long term debt is expected to have a negative impact on profitability which would support Pecking order theory. Consequently, the third hypothesis would be as follows

Hypothesis 3: There is a significant negative effect of long term debt on Ethiopian Construction Companies’ Profitability.

Company size

The size of the company affects favorably its profitability in many ways. First, large companies can exploit economies of scale and scope, and thus being more efficient compared to small firms. Second, larger firms have a greater access to long term capital from financial institutions than smaller companies but smaller companies tend to either borrow short by means of bank loans or raising capital from owners. Lastly, large companies would have greater power than smaller companies to compete in highly competitive market. However, it may have unfavorable consequence if any suffer from inefficiencies as a company grows in size which would lead the company to inferior profitability. As a result of this relationship with profitability the researcher believed it to have an effect on profitability of Ethiopian Large Tax Pay Construction Companies and included it as control variable. Similarly, Abor (+) (2005); Memon et al. (-) (2010); Ahmed et al. (+) (2012); Adekunle & Sunday, (+) (2010) and Osuji & Odita, (+) (2012) added company size in their study as control variable and found it to have a significant effect. Considering its impact on profitability and from existing literature, it is expected to have a positive effect and the fourth hypothesis stated as

Hypothesis 4: There is a significant positive effect of companies’ size on Ethiopian Large Tax pay Construction Companies.

Asset tangibility

Asset tangibility is also considered to be the major factor of a company’s profitability. Mackie (1990) as cited in Osuji & Odita, (2012) argues that a company with high fraction of plant and equipment (tangible assets) has the asset base made debt choice more likely and influence the company profitability. Since tangible assets are used as collateral, company which possesses more investment on these assets would have lower borrowing cost to improve profitability. Supporting this, Akintoye (2008) argues that companies retaining large investments in tangible assets will have smaller costs of financial distress that lead to better profitability than companies that relies on intangible assets (as cited in Adekunle & Sunday, 2010). However, if there is an inefficient use of these fixed assets, it could leave companies in difficulty (Memon et al. 2009). Relying on this argument, asset tangibility used as a control variable believing that it also has an effect on profitability of Ethiopian Construction companies. It has also been used as control variable in the studies by Memon et al. (2009); Adekunle & Sunday, (2010) and Osuji & Odita, (2012). The effect of asset tangibility is expected to be positive; hence, the fifth hypothesis to be tested is

Hypothesis 5: There is a significant positive impact of Asset tangibility on Ethiopian Construction company’s profitability.

Variable Description

This study consists six variables: dependent variable profitability; three different independent variables of capital structure: Leverage ratio, Short term debt ratio, and Long term debt ratio; and three control variables: Company size and Asset tangibility. All these variables are measured based on book value as it provides an easy and accurate way to calculate ratios (Shah & Hijazi, 2004). Book value measures preferred since book values are related to values of these variables already in place while market value depends on present value of growth opportunities (Myer 1984, cited in Daniel, 2012). Besides, it is complicated and difficult to find their market value in countries like Ethiopia where there is no proper established capital markets; so that, no other option left for the researcher to choose other than book value measure.

Dependent Variable

Profitability

In the field of finance, various financial ratios; such as return on assets (RoA), return on equity (RoE) and return on investment (RoI) could be used as a proxy measure of companies’ financial performance but in this study the researcher has used only RoE as a proxy measure of profitability because it is more effectively and widely acceptable measure in the existing Academy of Accounting and Financial Studies Journal Volume 25, Issue 2, 2021 17 1528-2635-25-2-680 literature. RoE measure the amount of income generated from equity financing of assets employed by dividing profit (earning) before tax (EBT) by total owners’ equity of a company. Here, RoE calculated by utilizing Earning before tax instead of earning before tax and interest since interest expenses are not presented separately in Ethiopian Construction companies’ profit and loss statements. Therefore,

RoE=(Earnings before Tax (EBT))/(Total owners’ Equity)

A high percentage of RoE indicate better performance while low percentage represents the reverse. Chin Ai Fu (1997), Abor (2005), Carvaliho and Edison (2007), Abu rub (2012), Ahmed et al. (2012) and Osuji and Odita (2012) also used RoE to measure performance.

Independent variables

In this study, capital structure issued as independent variable using three different level of debt to assets ratios to measure leverage. First, it takes the total level of debt of companies for computing leverage ratio. Then decomposing the total debt level into short term debt and long term debt, it computed the short term debt ratio and long term debt ratios respectively to have a better understanding whether there is an effect of different maturity level of debt on Ethiopian Large Tax Pay Construction companies’ Profitability.

Leverage

Debt ratio (Dr)

Leverage measured by Debt ratio total liabilities (short term liabilities and long term liabilities) by total assets used as one of the independent variables to represent capital structure. This ratio reveals that how much percentage of the total assets is financed by debt financing and also viewed as a proxy for what is left for owners in case of liquidation. This ratio stated as

Dr=(Total Liabilities)/(Total Assets)

Debt ratio is more familiar as a measure for Leverage in empirical researches of capital structure studies. Among those Rajan & Zingales, (1995); Booth et al. (2001); Gaud et al. (2003); Reimoo (2008); Daniel (2011); Bayeh (2011) and Netsanet (2012) used it to measure leverage.

Short term debt ratio (SDr)

Short term debt ratio also indicates what portion of the total assets of a company is financed using from short term matured debt. And this measured as;

SDr=(Current Liabilities)/(Total Assets)

Note: Short term liability is defined for this study as liabilities which are paid within less than one year or one operating cycle. This ratio also introduced in study of Bas et al. (2009); Luper & Isaac (2012); Ellili & Farouk, (2011) and Amanuel (2012).

Long term debt ratio (LDr)

Similarly, Long term debt ratio depicts how much of total assets are financed by using long term debt financing means. And it is measured;

LDr=(Long term Liabilities)/(Total assets)

Note: Long term liability is defined for this study as liabilities which will mature beyond one year or one operating cycle. Long term debt ratio also captured to measure maturity level of leverage in the studies of Bas et al. (2009), Luper & Isaac, (2012), Ellili & Farouk, (2011), Bayeh (2011) and Amanuel (2012).

Control variables

In addition to the above independent variables, the researcher took three variables, which are found in the literature to have an influence on companies’ financial performance, namely, Company size, Asset Tangibility, and Efficiency of management, as control variables in this study.

Company size (SZ)

As companies’ financial performance factor, company size included as a control variable. And to achieve the normal distribution and linearity Size of a company measured by natural logarithm of total assets.

SZ=(Natural Logarithm )/(Total assets)

Nguyen & Ramachandran, (2006); Shah & Hijazi, (2004); Adenkule & Sunday, (2010); Daniel (2011); Bayeh (2011) and Osuji & Odita, (2012) similarly used natural logarithm of total assets to measure company size.

Asset tangibility (Tang)

Asset tangibility has been found in most literature of capital structure that affects company’s performance and included as a control variable which is measured by dividing Net fixed assets to Total assets. This is written as;

Tang=(Fixed Assets)/(Total Assets)

It has also been used by Chen & Hammes, (2003); Han-suk Song (2005); Zeitun & Tian (2007); Daniel (2011); W/Mikael (2012) and Amanuel (2012).

Data Presentation, Analysis and Interpretation

This chapter presents the empirical test results based on panel data regression on multiple linear regressions to test the outcomes of the analysis for eight construction companies in Ethiopia from the period of 2009 to 2018. The collected panel data from the sample companies audited financial statements was analyzed by using E-views software package of version 8. Using this statistical package, the researcher undertook various statistical analysis methods in order to test the proposed hypothesis. In this study, the descriptive statistics was used to show the basic features of the data (mean, maximum, minimum and standard deviation)for all study variables and it provide a simple summary about the sample and the measures which indicate the variable used in the study. Therefore, this chapter provides the results from the analysis of data and its interpretation. The first section deals with descriptive analysis of the data and variation for the dependent variables and repressors for panel data variables for the study; the second section discusses the correlation analysis between dependent and independent variables, the third section deals panel data models with testing the models and; the forth section presents the regression analysis, result and discussion.

Descriptive Statistics

The dependent variable used in the study is profitability which was measured by return on equity (determined by the ratio of earning after tax to total owner’s equity). The explanatory variables of the study are debt ratio which includes long term debt ratio and short term debt ratio and tangibility. The total observation of the study was 80 from data of 8 private construction companies for the period of ten years (2009 to 2018). The overall descriptive statistics that were computed in the study include mean, median, maximum, minimum and standard deviation of all study variables. Each result of the descriptive statistics was summarized and presented in Table 1. As indicated in the Table 1 above, all variables consisted of 90 observations. The descriptive statistics for profitability (financial performance) which was measured by ROE indicates that Ethiopian private construction companies, on average, earned a positive after tax profit over the last ten years. For the sample of the study, the mean of ROE was 10.52% with a minimum of 0% and a maximum of 26.42% which indicates that, on average, the sampled Ethiopian construction companies earned 10.52 cents of profit after tax for a single birr invested by its owners (shareholders). The minimum (negative profit or the loss) was recorded during the establishment year of one of the samples construction companies which is inevitable for any company during its beginning of operation.

| Table 1 Summary of Descriptive Statistics for ROE | |

| ROE | |

| Mean | 0.105298 |

| Median | 0.100509 |

| Maximum | 0.264255 |

| Minimum | 0.000000 |

| Std. Dev. | 0.075191 |

| Observations | 80 |

| Source: Output of E-views 8 of the panel data | |

The figure looks high, but it was due to the fact that the ratio of Owners equity was small compared to the amount of loss. Furthermore, the standard deviation for ROE was also 7.51% which indicates the profitability variation between the selected contractors of Ethiopian construction companies. The variation (standard deviation) looks high which reveals that the data are somehow far from the mean value. This is due to the extreme values (very large negative losses ratio and high profit value ratios) included in to the data. Parallel with this reality, Brooks (2008) stated that low standard deviation shows that data are very close to the mean, whereas high standard deviation shows data are spread out over a large range of values.

As indicated in the Table 2, the main independent variable of the study, debt ratio which was measured by total debt to total assets, has a minimum value and maximum value of 0.45 and 0.79 respectively (which was rounded to two decimal places) and average value of 0.6396. This indicates that, on average, 63.96% of the total assets are financed by debt with short-term liability domination. The average standard deviation of DR from its mean value is 7.8% which indicates that the data of the companies on DR are close to the DR mean value. The descriptive statistics for short term debt ratio indicates that Ethiopian construction companies under the study period have a mean short term debt ratio of 137.9% showing the ratio of current liability to total asset written premium in Table 3.

| Table 2 Summary of Descriptive Statistics for Debt Ratio | |

| Dr | |

| Mean | 0.639206 |

| Median | 0.636909 |

| Maximum | 0.786909 |

| Minimum | 0.451243 |

| Std. Dev. | 0.078894 |

| Observations | 80 |

| Source: Output of E-views 8 of the panel data | |

| Table 3 Summary of Descriptive Statistics for Short Term Debt Ratio | |

| SDR | |

| Mean | 1.379099 |

| Median | 0.869577 |

| Maximum | 139.155 |

| Minimum | -143.6149 |

| Std. Dev. | 27.04599 |

| Observations | 80 |

| Source: Output of E-views 8 of the panel data. | |

This indicates that, on average a one birr change in current liability will produce birr 1.379 changes in total asset. SDR for sampled construction companies also ranged from -143.6149 to 139.1550. This shows that the high degree of operating leverage the Degree of current liability shows highest fluctuating trend than other variables. It is found that the tendency of operating profit too enormous with higher written premium. SDR had the highest standard deviation (27.04599) which indicates that Construction Company has, the more its profits will vary with a given percent change in gross. Another explanatory variable of the study was Company size. It was measured by natural logarithm of book value of total assets of each company in Table 4.

| Table 4 Summary of Descriptive Statistics for Company Size | |

| Sz | |

| Mean | 19.47682 |

| Median | 19.52491 |

| Maximum | 20.93531 |

| Minimum | 16.96121 |

| Std. Dev. | 0.911346 |

| Observations | 80 |

| Source: Output of E-views 8 of the panel data. | |

Its descriptive statistics indicate that it has a mean value of birr 288,440,676.88 which is antilog of the natural logarithm of 19.48, with a minimum and maximum value for the sampled construction companies in the study period ofbirr 23,207,823.4424 and birr 1,242,013,880.68 (antilog of the natural logarithm of16.96 and 20.94), respectively. The standard deviation of the Company size of the Ethiopian Construction companies was also birr 2.4843 (the antilog of natural logarithm of 0.91). Another important explanatory variable is long term debt ratio. As shown in Table 5 above, long term debt ratio (LDR) has a mean value of 0.22 and standard deviation of 0.06. The long term debt ratio computed by the ratio of long term liability to total asset written premium. This indicates that, on average, 22% percent of the long term liability collected from the customers was ceded for the total asset purpose. Compared to the other variables, long term debt ratio has low standard deviation. This probably due to the fact that construction companies cannot cede above 30% of their gross written premium to total asset since National Bank’s regulation prevent them to do so. The ideal ratio (percentage), as per National bank’s regulation, is 20-30%.

| Table 5 Summary of Descriptive Statistics for Long Term Debt Ratio | |

| LDR | |

| Mean | 0.223543 |

| Median | 0.227341 |

| Maximum | 0.359388 |

| Minimum | 0.06427 |

| Std. Dev. | 0.061781 |

| Observations | 80 |

| Source: Output of E-views 8 of the panel data | |

The minimum and maximum value of total asset dependence ratios were 6.18% and 35.94%, respectively. The minimum ratio of premium ceded shows high level of retention and vice versa. The Table 6 also shows descriptive statistics for fixed asset/total asset ratio that was measured by the ratio of incurred claims to net earned premium. fixed asset/total asset ratio for the sampled construction companies in Ethiopia over the past 10 years was 0.649 (or 65%)which implies that for every birr earned as net premium, 65 cents would be paid out for fixed asset/total asset ratio incurred. In the other way speaking, 65% of net earned premium on average, paid for loss incurred per year by Ethiopian construction companies. The minimum and maximum fixed asset/total asset ratio that was recorded during the study period was 34% and 109%, respectively. The 109% loss ratio indicates that the company (the company with this value) incurred claim above the net earned premium which also shows negative profit (loss) for the company on its main operation. The table also presents 0.123 (or 12.3%) standard deviation for claim ratio for the period of the study.

| Table 6 Summary of Descriptive Statistics for Tangibility | |

| Tang | |

| Mean | 0.649173 |

| Median | 0.663377 |

| Maximum | 1.087682 |

| Minimum | 0.341619 |

| Std. Dev. | 0.12292 |

| Observations | 80 |

| Source: Output of E-views 8 of the panel data. | |

Classical Linear Regression Model (CLRM)

To a given econometrics model be reliable and valid, the assumptions of Classical Linear Regression Model (CLRM) should be satisfied. As Brooks (2008) noted the data validity of the regressed result of the research is maintained through the classical linear regression model CLRM assumptions in order to pinpointing the model misspecification and correcting them so as to augment the research quality. The diagnostic test is made in order to make sure that the classical linear regression model assumption is violated or not. Under this section, the basic CLRM assumptions which include Homoscedasticity, no autocorrelation, Normality and no multi-collinearity and their diagnostic tests have been presented and discussed in details. Furthermore, model specification test was also done to check whether the model is properly defined or not.

Heteroscedasticity

Ordinary least squares assumes that all observations are equally reliable (i.e., the error variance is constant). To this opposite, heteroscedasticity is a systematic pattern in the errors where the variances of the errors are not constant. On the other hand, heteroscedasticity test is a test that made in order to check whether these error terms’ variance is constant (homoscedastic) or not (heteroscedastic). In order to achieve this, the Breusch-Paga Godfrey test was used as it is one of the most popular tests of homoscedasticity. The result of the test indicates that the variance of the error term is constant since the p-value is slightly greater than 0.05. In this regard, it is possible to conclude that the variance of the residuals is homoscedastic. The result of Breusch-Pagan-Godfreytest for heteroscedasticityis presented in the following Table 7.

| Table 7 Heteroskedasticity Test: Breusch-Pagan-Godfrey | |||

| F-statistic | 1.88155 | Prob. F(8,81) | 0.0742 |

| Obs*R-squared | 14.10393 | Prob. Chi-Square(8) | 0.0791 |

| Scaled explained SS | 16.455 | Prob. Chi-Square(8) | 0.0363 |

| Source: Output of E-views 8 of the panel data. | |||

1. Ho: homoscedasticity

2. Ha: unrestricted heteroskedasticity

Autocorrelation

The assumption of no autocorrelation between the disturbances states that given any two X values, Xi and Xj (i ≠ j), the correlation between any two ui and uj(i ≠ j), is zero (Brooks, 2008). According to Brooks (2008) it is assumed that the errors are uncorrelated with one another (i.e there is no pattern in the errors). But, if there are patterns in the residuals from a model, they are autocorrelated. The autocorrelation might be positive or negative autocorrelation. In the presence of autocorrelation, the coefficient estimates derived by using OLS are still unbiased, but they are inefficient, meaning that the standard errors are biased. Furthermore, the R square is likely to be inflated if the autocorrelation is positive (Brooks, 2008). Breusch-Godfrey test of autocorrelation was used in this study. Breusch-Godfrey tests allow examination of the relationship between error term and several of its lagged values at the same time. It was used because it is general test fourth order autocorrelation. The hypothesis for the autocorrelation test was formulated as follow:

1. H0: There is no autocorrelation problem in the model.

2. H1: There is autocorrelation problem in the model.

3. α=0.05

4. Decision Rule: Reject H0 if p-value less than significance level. Otherwise, do not reject H0.

As indicated in the Table 8 above, the p-values of both F-statistic and Chi-Square are greater than 0.05 and the null hypothesis of no autocorrelation problem in the model could not be rejected even at 10% level of significance. Therefore, there is no evidence of autocorrelation in this study.

| Table 8 Autocorrelation Test | |||

| F-statistic | 1.19103 | Prob. F(2,79) | 0.309 |

| Obs*R-squared | 2.63431 | Prob. Chi-Square(2) | 0.268 |

| Source: Output of E-views 8 of the panel data. | |||

Normality test

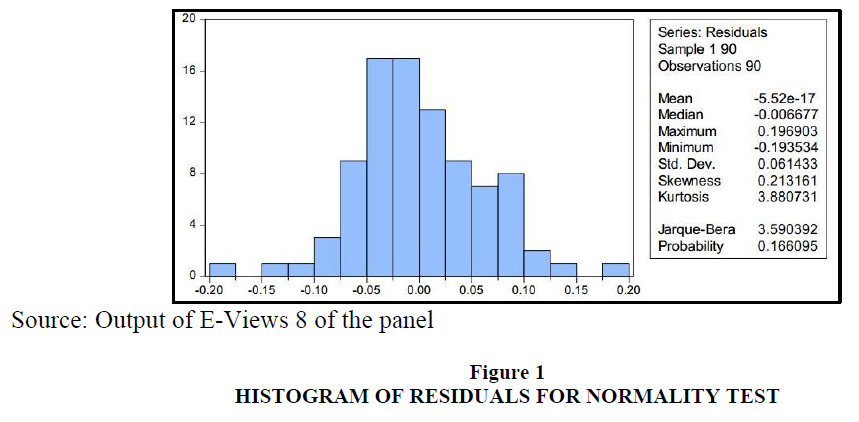

Normality is the assumption that the distribution of residuals is normal (Brooks, 2008).This assumption is very important in hypothesis testing since the violation of the assumption would affect the reliability of hypothesis testing. A normal distribution is symmetrical (bell shaped) with skewness of 0 and kurtosis of 3. However, in the data, there are extreme values (outliers) that could affect the normality of the distribution and its corresponding residual values. In this study, the researcher has observed two very extreme values and the inclusion of these observations has significant effect on normality and probably on other assumptions. Had these observation been included, the normality assumption would have been violated with negatively skewed and Leptokurtic (high kurtosis) shape of histogram. However, when these values are knocked out through the use of dummy4 variables, the residuals are normally distributed. Thus, the researcher has used two dummy variables for the two extreme negative ROE observations that were recorded for one company over two year of its operation. Then, the two common tests of normality (i.e. histogram of residuals; and the Jarque-Bera test) were used in this study. Histogram of residuals is used to learn about the shape of the probability density function of the residual whereas the Jarque-Bera test deals with the skewness and kurtosis of the residuals since skewness and kurtosis are the main ingredients of the normality test.

As indicated in the Figure 1 and Table above, the value of skewness is close to zero (0) and the value of Kurtosis is close to 3. Furthermore, the null hypothesis of normality is failed to be rejected since the P-value is greater than 0.05. Thus, the residuals are normally distributed and statistical inference made on this assumption could be reliable as far as the normality assumption of the CLRM is concerned

Multi-collinearity test Multi-colinearity indicates the degree of correlation among the explanatory variables. The best regression models are those in which the explanatory variables each correlate highly with the dependent (outcome) variable but correlate, at most, only minimally with each other (Brooks, 2008). It is stated that however, strong relationship among/between independent variables can exist due to one of the following reasons: 1) one variable is a constant multiple of another 2) Logs are used inappropriately, and 3) One variable is a linear function of two or more other variables.

According to Kennedy (2008) as it is cited in Gemechis (2017), the multicollinearity problem exists when the correlation coefficient among the variables are greater than 0.70. As shown in Table 9, there is no multicollinearity problem among the explanatory variables and the correlations among the independent variables are considerably weak with the maximum of 0.42. Thus, the researcher concludes that there is no evidence for presence of multicollinearity problem in this study model.

| Table 9 Correlation Matrix for Variables | ||||||

| ROE | DR | SDR | LDR | SZ | Tang | |

| ROE | 1 | - | - | - | - | - |

| DR | -0.1 | 1 | - | - | - | - |

| SDR | -0.04 | 0.0008 | 1 | - | - | - |

| LDR | -0.24 | 0.05 | -0.33 | 1 | - | - |

| SZ | 0.26 | -0.06 | -0.13 | -0.03 | 1 | - |

| Tang | 0.42 | 0.02 | 0.13 | -0.34 | -0.05 | 1 |

| Source: Output of E-views 8of the panel data, 2020 | ||||||

Fixed Effect Regression Analysis of ROE

ROE regression table demonstrates the relationship between dependent variable (ROE) and five independent variables. As it is observed from the Table 10, r-square and the adjusted rsquare shows a values 0.976 and 0.967 respectively, which means 96.7% variation on ROE were explained by independent variables Debt Ratio, Short Term Debt Ratio, Long Term Debt Ratio, Firm Size and Tangibility collectively. The independent variables Debt Ratio, Short Term Debt Ratio, Long Term Debt Ratio and Tangibility probability values were less than 0.01, which indicates their significance at 1% significance level. Firm size (total asset) was not significant independent variables to explain ROE, because of their probability value 0.4913. From the regression model the probability values of f-statistic tells us the overall significance of all independent variables altogether. Accordingly, the probability values of f-statistic was 0.0000 which was smaller than 0.01, therefore, we can say that all the independent variables jointly in the model significantly affect dependent variable, ROE, at 1% significance level.

| Table 10 Regression Analysis of ROE | ||||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. | ||

| C | 34.67905 | 5.160225 | 6.720453 | 0 | ||

| DR | -0.959163 | 0.16622 | -5.770434 | 0.0000* | ||

| SDR | -1.396148 | 0.325864 | -4.284454 | 0.0001* | ||

| LDR | -28.98811 | 5.497736 | -5.272735 | 0.0000* | ||

| SIZE | -1.07E-11 | 1.55E-11 | -0.693665 | 0.4913 | ||

| TANG | 0.303651 | 0.080976 | 3.749876 | 0.0005* | ||

| CBE11DUM | -23.96256 | 3.517774 | -6.811852 | 0 | ||

| Effects Specification | ||||||

| Cross-section fixed (dummy variables) | ||||||

| R-squared | 0.976191 | Mean dependent var | 23.4583 | |||

| Adjusted R- squared |

0.967073 | S.D. dependent var | 14.1462 | |||

| S.E. of regression |

2.566959 | Akaike info criterion | 4.95957 | |||

| Sum squared resid |

309.6962 | Schwarz criterion | 5.58993 | |||

| Log likelihood | -144.666 | Hannan-Quinn criter. | 5.20866 | |||

| F-statistic | 107.0582 | Durbin-Watson stat | 1.91849 | |||

| Prob(F-statistic) | 0 | |||||

| * denote significance level at 1%, | ||||||