Research Article: 2023 Vol: 27 Issue: 5S

The Impact of Cloud Accounting on Auditing Practice

Dr. Marwan Mahmoud Said Nafoukh, IFFM-CFO

Citation Information: Nafoukh, A.M.S. (2023). The impact of cloud accounting on auditing practice. Academy of Accounting and Financial Studies Journal, 27(S5), 1-14.

Abstract

Determine the impact of cloud accounting on auditing practice by presenting the concept of cloud accounting by clarifying cloud computing and the essence of auditing and practices from planning and documentation in order to issue a report on financial statement by adopting a descriptive and analytical approach in this research by collecting previous literature and linking it to standards and professional reports Practices on cloud accounting and information technology and their impact on audit practice. Cloud accounting allows work in any place without a specific location improving operational performance in terms of facilitating the completion of accurate accounting operations through the cloud, and this phenomenon had a clear impact on auditing and its practices, so continuous auditing electronic auditing and digital auditing, the cloud has become a place for the completion of operations and dialogue between employees or clients , which has an impact on the audit strategy and the audit planning process, as well as dispensing on documents for confirmation as it is a self service for customers and here its effect is clear on audit evidence in order to reduce the gap of expectations And the analysis processes related to audit and internal control risks in order to issue report on the financial statements,, as major audit firms have their own cloud to Provide cloud accounting and audit services. Finally, supported the quality of auditing and speed work completion and lowest cost Accordingly, the academic study of this professional topic should be expanded and field studies should be conducted to cover the lack of research and continue to support organizations in order to issue standards for the cloud as well as laws in order to keep pace with the massive reliance on accounting and cloud auditing, especially in the time of the pandemic and enhance of scientific, practical and continuous learning due to the tremendous development of digital transformation that we are facing.

Keywords

Cloud Accounting, Auditing Practice, Financial Statement, Digital Auditing.

Introduction

Pandemic changed work remotely and reliance on technology have become very important which are applications provided as online services. Hardware and software required and data storage are all located in the data center of cloud service providers (Ruan, 2013). Cloud computing application specifically designed to transfer accounting information systems into an environment for processing and distributing financial information by a cloud service provider. However due to the unique characteristics and critical importance of AIS in addition to the risks of cloud computing cloud accounting may face additional risks (Dimitri & Matei, 2015).

Some presented cloud accounting is the application of cloud computing that transfers accounting information systems for organizations from the site to the remote servers of cloud service providers. Some cloud accounting studies use a conceptual approach to analyze the adoption of cloud accounting for enterprises where the advantages of using cloud accounting are mainly discussed Some studies have highlighted some potential risks with other cloud computing applications. Cloud accounting also provides a device for the And about the nature of auditing computerized systems (Dimitri & Matei, 2015).

This study is aim to find the impact of cloud accounting on audit practice by obtaining high quality evidence and improve audit quality of professional judgment exercised by financial statements auditors.

Research Problem

Cloud accounting is a completely new model that serves the accounting profession relied on the latest studies and technical reports of practitioners because of the lack of studies in this regard (Dimitriu & Matei, 2015). The internal of set a to subject is profession audit perhaps restrictions and factors external and one of them is cloud accounting.

The Importance of Research

The importance of this research lies in the fact that it deals with one of the latest topics that dealt with linking several vital topics namely the use of cloud accounting by institutions including auditors and its impact on the auditing practice of facilities and in the audit process for auditing companies in the world and Jordan in particular as the audit sector is one of the important in establishing confidence in financial sector.

Research Design

This study is qualitative determined and an analysis has been conducted by collecting previous literature on various areas of information technology, how these technologies are transformed into the accounting profession in general and the way accountants perform their tasks. The aim is to provide qualitative evidence of the interaction between accountants and information technology by reviewing numerous literature, standards, reports, professional technical bulletins and publications of practitioners to support our discussions and also provide the basis for our conclusion.

Objectives of the Research

The research aims to determine the impact of cloud accounting on the practice of auditing by the hypothesis of the impact of cloud accounting on the practice of auditing and supporting. It in the practice of auditing by companies that use accounting which is an interpretive framework for the phenomenon around the world and how it should be understood and studied and strengthened practical and professional views:

1.This research seeks to demonstrate the importance of using cloud accounting in the audit process.

2.Learn about the conceptual framework of cloud accounting and development.

3.Learn about the conceptual framework of auditing practice.

4.The impact of companies using cloud accounting on auditing.

Previous Studies

Previous studies about accounting information systems cloud computing or and technology have been presented the reason for that is the essence of cloud computing we derive the impact on the practice of the auditing profession that provided us with a report on cloud accounting data in this dynamic and evolving environment.

Study artificial of adoption the with auditing of quality the tagged 2015 Anbar work auditing all out carries that program electronic an prepare to aims research intelligence and papers work documenting samples of size the selecting through planning hwit starting the of performance the evaluating report a and report draft a obtaining with ending hypothesis the on based work supervisory.

A study Jamil & Othman artificial using of possibility het identify to aimed study The public Jordanian in audit internal of quality the controlling in techniques intelligence companies shareholding public all included community study The companies shareholding leaders the managers, financial epresentingr respondents )188( of composed was sample The internal and accounting in employees and managers audit internal departments accounting ofin departments audit.

Nwakoby et al. 2015 study titled ICT a Magical Medicine for Accounting Practice in Nigeria. The paper examined the application of ICT in the efficiency and acceleration of the accounting process and how these technologies ensured the efficiency of completing accounting work. The survey method was adopted and the questionnaire was the main source of data collection and from the results obtained it was found that the application of ICT has a positive impact on the efficiency of accounting practice specifically in the areas of ensuring the timely completion of accounting work in Nigeria. Hence the authors encourage accountants and accounting firms to integrate ICT into all aspects of accounting practices for effectiveness.

Dandago & Rufai (2014) Study on Information Technology and Accounting Information System in the Nigerian Banking Industry. In this paper the authors argued through the authors findings that the use of information technology can improve performance by reducing operational cost facilitating transactions and relevant in simplifying issues and in providing quality information and therefore recommend that Nigerian banks invest more in IT tools in order to deliver services and profitability efficiently his finding is consistent with the arguments of Murthy in their study entitled Applying Information Technology in Management Accounting Decision Making. This study also indicates that IT has a significant impact on operational costs and reveals that IT can improve the efficiency of the accounting department leading to an effortless timely and accurate result.

Study of Ebenezer et al. (2014) a study titled accounting in the Cloud How Cloud Computing Can Transform Companies. The study shows that cloud computing can still be successfully applied for accounting purposes. Although cloud accounting may not look very different from desktop accounting but in practice cloud computing has a lot of ways that can enhance accounting. The objective of the accounting information system is to collect and store data on transactions and events appropriately process this data into useful information for the purpose of making decisions and ensure that adequate controls are in place to protect the assets of the organization. Therefore due to the availability of cloud computing accountants now have the opportunity to navigate with everything they do the easy-to-access realtime cloud computing gives way to continuous reporting and possibly continuous auditing as some evidence is provided before.

Al-Khasawneh & Futa study (2013) The objective of the study is the role of digital auditing in achieving competitive advantages in audit companies in the Hashemite Kingdom of Jordan through the testing a set of hypotheses that dealt with the role of digital auditing in achieving the dimensions of competitive advantage in audit offices. The study showed the obstacles that limit the benefit of the use of electronic audit.

Study Sacer & Oluic (2013) in their study entitled Information Technology and Quality of Accounting Information Systems in Croatian Medium and Large Enterprises revealed through the findings that information technology affects the way the accounting information system works and contributes to the preparation processing and delivery of accounting information. It contributes significantly to the accuracy timeliness and quality of accounting reports.

Lim (2013) in a study titled The Impact of Information Technology on Accounting Systems. When we talk about technology important to demystify the concept to make it easier to use technology may be in the form of hardware physical devices through which accountants enter data process data and obtain information in the form of reports or software software installed in devices to enable accountants to perform their tasks effectively and efficiently. Today accountants rely on both hardware and software technology to carry out key accounting tasks and ensure timely reporting, and this has also helped create highly sophisticated technologies that are deployed for the collection processing and storage of financial information.

Christauskas & Miseviciene (2012) shows characteristics of the advantages of cloud computing Reduces expenses on and software network management and comprehensive information technology Adding new software is very simple. The web browser is all needed to access accounting and users will have the same version of the software and offer real-time backup that results in less data loss prepare the financial statement anywhere without necessarily being in an office where the accounting software package has been installed on the desktop. This mobility opportunity would allow accountants to benefit from the timely exchange of information enhancing the speed of decision making. Moreover financial statements can be stored at a relatively lower cost without the need to invest in infrastructure and its maintenance costs.

Today accountants are exploiting emerging technologies to help them complete their tasks more effectively efficiently accurately in a timely manner or simply from the arched clay tablets of Sumerian scribes by adding 19thcentury machines to 20thcentury calculators and computers. However all these technological developments have been just proposals compared to the current cutting-edge technology that is reshaping the accounting profession in general and accountants in particular are currently changing ways of communicating and collaborating with the stakeholders they work with and for the sake forming new technologically driven business patterns and redefining their knowledge to deal with new demands ACCA 2012.

Accounting and Technology

In practice, accountants are involved in either the preparation and submission of previously prepared financial statements or audits to ensure that they reflect a true and fair view of the economic reality being measured and presented. Note that either of these activities requires different processes that accountants have to go through in order to provide the information required for internal and external use. The argument here is that accountants, using figures and financial statements, describe the health of the organization as a whole or different parts of the organization. Accounting and percentage figures tell the story of a business, just like a thousand-word picture (Imhanzenobe, 2020) accountants analyze revenue and profits/losses; providing other owners and users with the information required to make informed decisions overtime. This information forms the basis of the company's year-end financial report and legal filing reports.

Platform-as-Service (PaaS), and Infrastructure as a Service (IaaS). This means that cloud computing users will be able to reduce costs by eliminating physical infrastructures, and tasks can be performed from any part of the world. Thus, we can boldly say that future accountants may be able to perform accounting functions on the cloud without being limited by physical structures.

We expect that the accountants and the organizations they work with and/or for will exploit a cloud as a result of the opportunities that come with them. Accounting systems were among the first to become available online, joined by a growing group of “commercial software” (ACCA, 2013).

1.Accountants and big data

2.Accountants and artificial intelligence

3.Accountants and cybersecurity

4.Accountants and Virtual Reality (VR)

Accountants can explore these technologies to provide users of accounting information with a touch closer to the economic reality measured by reported figures. Special reports on virtual reality and augmented reality can be prepared to make it easier for users to understand what it is, what is why, and what will be for the entity submitting the report.

Cloud Accounting

Cloud accounting is a cloud computing application with the specific purpose of processing and presenting financial data and information and transferring the installation, processing and storage of data from AIS from local servers to remote servers of cloud service providers (Dimitriu & Matei, 2015). From another point of view, cloud accounting is the transfer of the accounting information system to a cloud environment, and it is able to access it. For the traditional public service information system, computer systems, data storage systems, and software applications are physically present and installed within the workplace. For cloud accounting service providers, such as Xero), they mainly use a public cloud deployment model, providing a SaaS service model, which means that cloud accounting service providers own, manage, and operate cloud accounting infrastructures Dimitriu & Matei (2014) and infrastructures, including servers, data storage systems, network components, and software applications, are located in the premises and under Cloud accounting providers sell, mainly using a subscription form (e.g., such as Xero, Saasu, MYOB Live, or Account One) to companies or consumers who allow them to use, enter, and process applications for their financial transactions, while user interfaces are managed by service providers. On the part of users, they do not need to install any accounting software or applications on their computer systems within their workplaces, as financial data storage and backup systems are located in the data center of service providers and under their control. Similar to other cloud computing applications, users only need computers, laptops, tablets, or smartphones with Internet access to access cloud accounting, including data entry, data processing, reporting generation, and data storage.

Cloud accounting provides some benefits for businesses, such as on-site flexibility, lower IT maintenance costs and ease of sharing financial information with customers (Dimitriu & Matei, 2014b, 2014c; Prichici & Ionescu, 2015). Current cloud accounting studies mainly use a theoretical approach to discuss the potential benefits and barriers to using cloud accounting (Arsenie-Samoil, 2011).

The studies also discuss risks in cloud accounting, such as the integrity of sensitive financial data, data privacy, unauthorized access, and loss of control over financial data, as well as internet outages These studies are the theory to discuss potential risks and concerns about the use of cloud computing. However, it does not conduct empirical studies to investigate actual risks when using cloud computing in a business environment.

Auditing

Most of the definitions related to auditing relied on its objectives. AAA defined it as a regular and systematic process for collecting and evaluating evidence and evidence related to the results of the organization's economic activities and events, objectively, to determine the compatibility and conformity between these results and the criteria of a decision, while informing the beneficiaries of the results of the audit process through the report.

Cloud Audit of cloud Accounting Information Systems

In the current contract the evolution of information technology has changed how store and process all types of data including business and accounting transaction information Some of these companies have maintained their information systems including accounting to other organizations capable of managing computing resources which are called service organizations. The resort of customer companies to the undertaking aims to obtain better transaction operating systems and achieve improvement technological development and cost savings these risks do not come without risks and these risks include non-compliance with contracts loss of technical knowledge and risks related to Cloud auditing and auditing are similar in general. Both are subject to the same problems related to conflicts of interest the independence of the auditor, the need for professional auditing practices adequate technical training and the efficiency of the auditor and the issuance of audit reports that clearly confirm the results evidence and documents based on opinions. The educational curriculum of the American Institute of Chartered Accountants (AICPA) has issued the educational curriculum framework that includes recommendations for the qualification elements necessary to practice auditing electronic accounting information systems they are as follows Evaluate and divide. IT risks Building models simulating and using electronic table programs Using databases and information search engines electronically. Control of email privacy of websites Control in general the fields of engineering of various electronic systems. Through our presentation of the previous qualification curricula it is clear that the qualification of the auditor in the field of information technology does not lack the importance of his qualification in the field of accounting and auditing Planning and performing the audit process. The effects of the use of information technology on the audit process can be explained by influencing the planning of the audit process with regard to the timing of the parts of the audit process and influencing some of the characteristics of internal control which in turn already exist in manual auditing. The possibility that some employees and others can easily change accounting data and computer programs from other sites.

1.Structured and continuous performance Separate records.

2.Update accounts and files instantly and at the same time can lead to the conversion or cancellation of intermediary activities (cancellation of mediation) in several sectors such as finance art health and literacy (Swan, 2015) personal insurance (Von Gunten & Mainelli, 2014) corporate auditing and accounting Smith (2018) In order to achieve these goals auditors need an good understanding of customer business IT infrastructure IT systems related to financial reporting and controls in place.

Supervising and Reviewing the Audit Work

The senior consultant at Deloitte Canada confirms that an audit is an opinion provided on the financial statements of companies based on predetermined accounting guidelines However after Scandals like Enron in 2001 the global audit industry has lost its core assets trust (Spoke, 2015). This is highlighted by the literature showing that trust in auditing has been undermined by scandals and is still in the process of recovery and in response to rebuilding this trust new regulations and accounting and auditing standards have been imposed increasing complexity and increasing the cost of oversight and reporting activities for companies.

Documenting the Audit Evidence to support the Opinion

Today, blockchain technology allows businesses to conduct digital interactions or record in a transparent, secure, auditable, efficient, and highly interruptive manner and these features can not only reduce accounting, auditing, and compliance costs, but also change and facilitate the work of auditors (Spoke, 2015).

Obviously this technology can allow more efficient access to data and financial audit completion.

In fact, that any asset or document that can be recorded, referenced, or packaged with ledger input helps to simplify the work of auditors and accounting professionals reducing manual work Drane (2016) and at the same time helps ensure that transactions are fully tracked.

Checking the Nature of the Procedures and the size of the Audit Process

Large international audit firms themselves expect the cost and time required to conduct the to decrease significantly Alison and Taizak. It therefore seems reasonable to expect a significant increase in the conversion of financial audit services into commodities Anderson 2017 decrease in audit costs. Those companies most notably Big Four blockchain technology to boost operation and drive growth Alarcon (2018 KPMG LLP and Microsoft) reported a partnership to create a series of innovative workspaces and other initiatives dedicated to the development of use cases of blockchain technology applications (Alarcon & Ng, 2018).

PwC has also created the Global Blockchain Team and created the Experience Blockchain Lab which works in co-construction with industry experts. Blockchain is also expected to reduce reliance on auditing to test financial transactions that provide third party automated (Spoke, 2015). This could eventually lead to the abolition of monitoring and auditing activities or at least a radical redefinition of those professions. For example access to reviewers and regulators can be granted providing a single source of truth and allowing for realtime review (MacManus, 2017).

Another example is the confirmation process that can be deleted from the auditor review process the emphasis on balances receivable and accounts payable in particular. In fact once the data is uploaded and approved by the blockchain, confirmation of information and transaction details is broadcast to the entire network, providing real-time verification of money transfer from another party, making audit confirmation no longer necessary (Smith, 2018). However, although blockchain technology offers many different features As of today although many blockchain projects have been created and some of them are well established such as Bitcoin and Ethereum there are still problems with interoperability between blockchain infrastructure. Moreover the issue of blockchain compatibility with enterprise information systems such as ERP which often includes a variety of functional modules such as accounting control procurement logistics warehousing manufacturing project management quality management etc is currently being addressed by many ERP vendors and technology companiesThese systems are widely used in the best use of blockchain is achieved (Kacina et al., 2017).

In terms of Timing of Audit Procedures

Another key issue is blockchain expansion Scalability is the ability of a system to continue to function well when it changes in size or size typically to a larger size or larger size, in the context of blockchain a scalability problem arises when the number of participants increases over time. Scalability has several components: latency, which is transaction confirmation time (Croman, 2016). Moreover, 13% of transactions on the public blockchain exceed 20 minutes, and 25 percent can exceed an hour (Harris, 2018). Size and storage are other components of scaling importance that need to work on In fact by design the ledger has a blockchain on all transactions since the configuration block. Thus as the number of users and transactions increases the size of the ledger also increases.

In terms of Scope of Audit Procedures

Bandwidth is also important because transactions need to be migrated across the network before being validated through a consensus algorithm. In fact, when the number of users increases and therefore the number of transactions increases, it is necessary to improve the connection to the network. Good network connectivity and large storage capacity require efficient log management leading to centralization, increased costs (Harris, 2018) and more power consumption. The last component of scalability is the transfer rate at which indicates the maximum rate at which the network can function properly (i.e., send, receive, and validate transactions). Due to the design of the blockchain infrastructure, the number of transactions sent, received and verified over the network is small in relation to other existing and centralized infrastructures. With Bitcoin, for example, the maximum rate is around 7 transactions per second. This issue is mainly related to public blockchain and is already managed for private blockchains that some infrastructures can already handle thousands of transactions per second.

Assess Audit Risk

There are important types of risks for example credentials can be hacked or stolen and there are concerns that they may be vulnerable to programming errors as the case of the decentralized autonomous organization or DAO platform which lost $50 million in 2016 or systems vulnerabilities such as the Volkrapylat behind the Bitcoin exchange scandal Mt Gox in 2014. This also applies to smart contracts. They are independent programs that once started automatically execute predefined terms encrypted within the blockchain that work just like any conditional statement of the “if – then” type if that condition is fulfilled then such a result works. No form or human intervention is needed to process those transactions 3% of all smart contracts are fatally flawed recent study has revealed.

In addition to these technical challenges the biggest barrier to blockchain adoption today as PwC and Deloitte reported in their reports PwC Deloitte (2018) is regulatory uncertainty. Although many territories have begun to study and discuss issues Price Waterhouse. Coopers 2018 especially with regard to financial services the regulatory environment remains unstable. Overall there are currently insufficient standards and controls to ensure that the systems work as intended (Alarcon & Ng, 2018).

Report Cloud Accounting

Cloud audit deals with audit reports in terms of the physical location of data storage on resources at its processors. These services as well as how to access and audit the accounting information system in the cloud in terms of basic principles to describe the credibility and reliability of the system. In the cloud it is unlikely that validators will be granted universal and total access to the cloud due to the confusion and potential confusion of the cloud service and the emphasis on reasonable solutions from the data of other customer companies maintained on the same cloud infrastructure resources in light of the protection and confidentiality of that data Complicating for auditors regulatory professional organizations such as the American Institute of Chartered Accountants AICPA the Canadian Institute of Chartered Accountants CICA and the Information Systems Audit Association ISACA are still developing cloud auditing requirements despite advances in cloud accounting services globally (Nicolaou et al., 2012).

For example AICPA identified the required elements when auditing the service organizations and processors that hosted the customer's company'operations through the SAS70 standard used to establish the effectiveness of the internal controls of those organizations and the processors and without any customer company conducting a review of its operations. Where a certified independent service auditor conducts an audit and issues a report that can be shared with the audit teams of the service organization customer companies. Although auditors reports according to the SAS70 standard provide evidence of all aspects of processing accounting and financial reports cloud accounting service providers have recently untruly described these reports as comprehensive certifications for governance security and privacy in their organizations (Mohamed, 2017).

Therefore the concept of cloud auditing has emerged as an inevitable result of dealing with these risks and challenges according to the latest accounting work in the cloud computing environment. Cloud audit addressed challenges related to data auditing cloud accounting services granting permission and the right to access them at any time and from anywhere. Raising work performance and efficiency by enhancing the flexibility of accounting and auditing professions through real time interaction allowing companies benefiting from cloud changing working conditions 15 (Corkern et al., 2015).

Here the benefits of cloud auditing are evident in its contribution to addressing fundamental issues in accordance with the standards of service organizations cloud accounting service provider by obliging them to describe these issues such as to protect data from theft and manipulation data loss of control in the cloud and how to recurs information after a disaster (Lin, 2010). Cloud audit also ensures the responsibility of managing cloud accounting providers for its services and thus addresses the experience transfer problems of customer companies regarding how to maintain their database management systems deal with operating system issues and keep up with critical software updates. These companies may resort to shift critical control to cloud service equipment (Nicolaou et al., 2012). One of the risks faced by cloud auditing in front of this environment is the weakness of the development of auditing standards to some extent that there is the lack of clear guidance for external auditors regarding how to test customer operations in the cloud SOC standards only provide general directions for the accreditation of an independent auditor on the certification service provided by the customer (Nicolaou et al., 2012).

Accounting and Auditing in Deloitte

Providing technical accounting and auditing support the accounting and auditing primarily helps employees in delivering quality work to customers main focus is on providing technical support for accounting and auditing auditing practices. In addition provide accounting advice and training to clients. The accounting and auditing department consists of three main areas accounting which assists audit clients and non-auditors in making key accounting technical. From the above we conclude that auditing and auditing in the Fourth Industrial Revolution need the continuous development of skills investments and the adoption of the latest tools which enhances the experience of both the auditor and the customer in their advancement to the future. With quality and efficiency at the basis of the approach standards can be constantly raised and deliver greater value through continuous adaptation and flexibility in obtaining the opportunities offered by technology.

Director of Audit and Audit Business at Deloitte Kakoullis in a report Companies today operate in a dynamic fast moving digitally feasible and highly competitive global economy he wrote. To respond organizations must constantly adapt as well as auditors by integrating innovative technologies to address and identify emerging risks constantly in ever transition markets to invigorate the audit process to enhance quality and accelerate insights into the work of emerging techniques to significantly improve audit quality. The ability to quickly analyze huge of complex data at a rate once conceivable is to allow auditors to streamline processes and enhance quality. Auditors can now see a more complete picture and quickly identify unusual transactions or underlying patterns and be better guided by risk assessment procedures. The technology transforms the audit experience into its ability to identify risks and establish responsive audit procedures. Early risk identification is critical for auditing and with new digital tools the auditor is able to quickly examine a wide range of publicly available financial statements to detect potential risks.

Monitoring and Collaboration across the Cloud

Besides automation cloud technology is also leading the audit revolution. By including tools in the audit process and using cloud technology as a secure digital input for information sharing auditors can monitor audit progress from the center and improve communication and accuracy of data exchange with their customers. This creates greater transparency and enables auditors and clients to proactively identify and address potential issues. In addition the cloud speeds up the audit process by providing the auditor with immediate access to resources anywhere around the world. Continuous investment in the cloud is critical to driving the profession forward Auditors must be ready to evolve.

This rapid development and implementation of realtime automated audit not only reimagines the profession as we know it but also pushes for the need for new perhaps as we integrate technology deeper into our environment the skills we seek in graduate and lateral employment will continually evolve. The review in the Fourth Industrial Revolution requires the continuous development of skills and investments and the adoption of the latest tools enhancing the experience of both the auditor and the client in our advancement to the future. With quality and efficiency at the foundation of our approach we can continually raise auditing standards and deliver greater value but only by staying adaptive and flexible in the opportunities that technology offers in another report on Deloitte'audit techniques.

It is a real world built into everything we do. They have handled huge amounts of data gained efficiency anticipated risk and continue to progress Business insight. Technology is at the core of our audit and access to auditors. With it teams manage data perform advanced analytics and reveal insights. Our technology not only handles big data sets but also integrates tools for auditors Procedure Optical character recognition natural language processing machine learning Analyzes Trends Regression Risks Anomalies Automation Processes routine cognitive tasks Data collection structured and unstructured Deloitte. Connect is an intuitive cloud based customer portal. It improves efficiency quality transparency and trust between teams throughout the process and helps reduce the administrative burden on work Easy. Document sharing data sharing real time visibility scheduling.

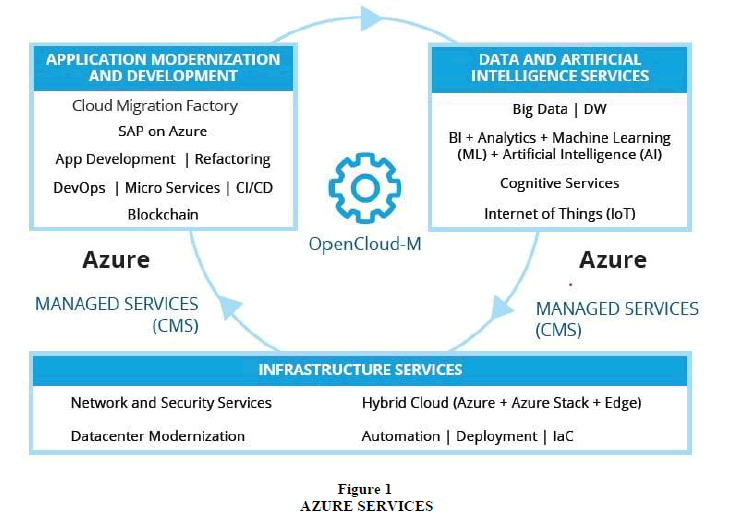

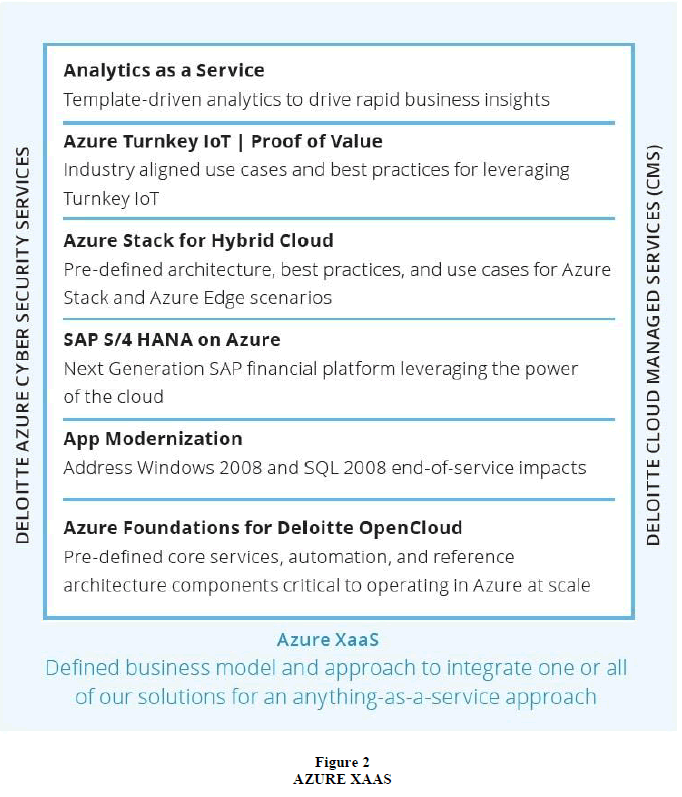

Practice Deloitte Azure Audit Software

To practice and improve the implementation of the audit program and to transform work and take advantage of the value and benefits that Deloitte Azure services offer at every step of the journey to the cloud Deloitte brings the right mix of end-to-end certified talent, technical relationships and potential within the facility. By working together the program can help you solve the biggest challenges of the facility speed up the time and make the facility possible a reality Deloitte. Azura capabilities aim to achieve consistent endtoend global capabilities into reliable solutions to help quickly innovate and transform the facility on the Azure platform. Experienced practitioners can help you navigate digital transformation such as DevOpsmicroservices the Internet of Things. Internet of Things artificial intelligence machine learning big data analytics and the hybrid cloud that leverages Azure services According to the shape Figure 1 and Figure 2.

Results and Recommendations

The study included the practice of cloud accounting and its impact on the practice of auditing. The use of cloud accounting has affected financial and accounting systems and internal control controls in business facilities which resulted in the mandatory access to cloud audit and the emergence of professional standards that guide and guide ways to deal with these systems when auditing accounts in the cloud accounting house. The electronic audit process helps improve the efficiency and effectiveness of the external audit process and complete the external audit tasks with less time and at a lower cost which contributes to supporting the audit strategy. The risk of auditing reduces the potential for a significant change in the practice of auditing that is widely recognized in the financial sector due to this global phenomenon while the level of awareness in sectors remains low. The expectation that intermediary activities will be eliminated the abolition of mediation or the transformation of these activities in all sectors of the economy is especially evident in the audit and control professions. This provides opportunities for auditors to redesign best practices. And update the rules and procedures Identifying new standards for the profession that can be coded within the framework of transactions or even innovation using new value added services While possibilities have been widely discussed scientific studies on their impact on business processes and professional practices remain rare (Weber et al., 2016). Thus based on the results we recommend the following Auditors should develop and develop technological skills in order to embrace and promote cloud computing technology. The need to establish introductory and training courses on adopting cloud audit practices in the context of cloud accounting services and reducing the risks of technological technology on the business of customer companies.

Conclusion

The need to introduce the latest audit work including cloud audit vocabulary in the audit and control subjects and accounting information systems for what they represent for the audit profession in the work wishing to benefit from the technological capabilities and services of service organizations in the fields of accounting and auditing should not ignore the potential risks involved in adopting those services, and should resort to the cloud auditor to provide them with the necessary assurances and guarantees. As part of the future work proposal other researchers can develop work at the academic level conducting field studies to support professional and practical.

References

Alarcon, A.J., & Ng, C. (2018). Blockchain and the future of accounting. Pennsylvania CPA Journal.

Indexed at, Google Scholar, Cross Ref

Al-Khasawneh, A.L., & Futa, S.M. (2013). The relationship between job stress and nurses performance in the Jordanian hospitals: A case study in King Abdullah the Founder Hospital. Asian Journal of Business Management, 5(2), 267-275.

Indexed at, Google Scholar, Cross Ref

Arsenie-Samoil, M.D. (2011). Cloud Accounting. Ovidius University Annals, Economic Sciences Series, 2, 782-87.

Indexed at, Google Scholar, Cross Ref

Association of Certified Chartered Accountants (ACCA) (2013). Technology Trends: Their Impact on the Global Accountancy Profession.

Indexed at, Google Scholar, Cross Ref

Christauskas, C., & Miseviciene, R. (2012). Cloud - Computing Based Accounting for Small to Medium Sized Business, Journal of Inzinerine Ekonomika- Engineering Economics, 23(1), 14-21.

Indexed at, Google Scholar, Cross Ref

Croman, K., Decker, C., Eyal, I. ACCA, (2012). 100 drivers of change for the global accountancy profession, White paper, Association of Chartered Certified Accountants. Available at: www.accaglobal.com

Indexed at, Google Scholar, Cross Ref

Corkern, S., Kimmel, S., & Morehead, B. (2015). Accountants Need to Be Prepared for The Big Question: Should I Move to The Cloud?”, International Journal of Management & Information Systems, 19(1), 13-20.

Indexed at, Google Scholar, Cross Ref

Gencer, A., Juels, A., Kosba, A., Miller, A., Saxena, P., Shi, E., Sirer, E., Song, D., & Wattenhofer, R. (2016). On scaling decentralized blockchains (a position paper). Financial Cryptography and Data Security, 106-125.

Indexed at, Google Scholar, Cross Ref

Dandago, K.I., Rufai, A.S. (2014). Information Technology and Accounting Information System in the Nigerian Banking Industry. Asian Economic and Financial Review, 4(5), 655-670.

Deloitte. (2018). Breaking blockchain open. Deloitte ’s 2018 global blockchain survey.

Indexed at, Google Scholar, Cross Ref

Dimitriu, O., & Matei, M. (2014). A New Paradigm for Accounting through Cloud Computing, Procedia Economics and Finance, 15, 840-846.

Indexed at, Google Scholar, Cross Ref

Dimitriu, O., & Matei, M. (2014b). The Expansion of Accounting to the Cloud. SEA- Practical Application of Science, 4, 237-240.

Dimitriu, O., & Matei, M. (2014c). Cloud accounting: A new player in the economic context. [Paper presented at the 2014 International Conference Communication, Context, Interdisciplinarity].

Indexed at, Google Scholar, Cross Ref

Dimitriu, O., & Matei, M. (2015). Cloud Accounting: A New Business Model in a Challenging Context. Procedia Economics and Finance, 32, 665-671.

Indexed at, Google Scholar, Cross Ref

Drane, J. (2016). Wait, blockchains need audited?

Indexed at, Google Scholar, Cross Ref

Ebenezer, E.S., Omane-Antwi, K.B., & Kyei, M.E. (2014). Accounting in the Cloud: How Cloud Computing Can Transform Businesses (The Ghanaian Perspective). Proceedings of the Second International Conference on Global Business, Economics, Finance and Social Sciences.

Indexed at, Google Scholar, Cross Ref

Harris, C. (2018). The risks and dangers of relying on blockchain technology in underdeveloped countries. IEEE/IFIP Network Operations and Management Symposium.

Indexed at, Google Scholar, Cross Ref

Imhanzenobe, J.O. (2020). Managers financial practices and financial sustainability of Nigerian manufacturing companies: Which ratios matter most?. Cogent Economics and Finance, 8(1), 1724241.

Indexed at, Google Scholar, Cross Ref

Kacina, J., Harler, M., & Rajnic, M. (2017). Sophia TX whitepaper, the blockchain for business.

Indexed at, Google Scholar, Cross Ref

Lim, F.P.C. (2013). Impact of information technology on accounting systems. Asia-Pasific Jornal of Multimedia Services Convergent with Art, Humanities and Sociology, 3(2), 93-106.

Indexed at, Google Scholar, Cross Ref

Lin, P. (2010). SaaS: What Accountants Need to Know, The CPA Journal, 80(6), 68-73.

Indexed at, Google Scholar, Cross Ref

MacManus, E. (2017). The audit of the future. The Journal of the Global Accounting Alliance.

Indexed at, Google Scholar, Cross Ref

Mohamed, H. H. (2017). The Role and Responsibility of the External Auditor towards the Cloud Computing (An Empirical Study). MSc, Faculty of Commerce and Business Administration, Helwan University, Egypt.

Indexed at, Google Scholar, Cross Ref

Nicolaou, C. A., Nicolaou, A. I., & Nicolaou, G. D. (2012). Auditing in the cloud: Challenges and opportunities. The CPA Journal, 82(1), 66.

Indexed at, Google Scholar, Cross Ref

Nwakoby, N.P., Ezejiofor, R.A., Okoye, J.F. (2015). Information Communication Technology (ICT): A Panacea for Accounting Practice in Nigeria. European Journal of Business, Economics and Accountancy, 3(7), 24-32.

Prichici, C., & Ionescu, B.S. (2015). Cloud Accounting–A New Paradigm of Accounting Policies. SEA-Practical Application of Science, 7, 489-496.

Ruan, K. (2013). Cybercrime and Cloud Forensics: Applications for Investigation Processes. Hershey, PA: Information Science Reference.

Indexed at, Google Scholar, Cross Ref

Sacer, I.M., Oluic, A. (2013). Information Technology and Accounting Information Systems Quality in Croatian Middle and Large Companies. Journal of Information and Organizational Sciences, 37(2), 117-126.

Smith, S. (2018). Blockchain augmented audit – Benefits and challenges for accounting professionals. Journal of Theorical Accounting Research, 14(1), 117-137.

Indexed at, Google Scholar, Cross Ref

Spoke, M. (2015). How blockchain tech will change auditing for good.

Swan, M. (2015). Bitcoin and blockchain explained: not just cryptocurrencies, economics, and markets, applications in art, health, and literacy.

Von Gunten, C., & Mainelli, M. (2014). Chain of a lifetime: How blockchain technology might transform personal insurance. Long Finance.

Weber, I., Xu, X., Riveret, R., Governatori, G., Ponomarev, A., & Mendling, J. (2016). Untrusted business monitoring and execution using blockchain, CSIRO, nicta: 9291.

Indexed at, Google Scholar, Cross Ref

Received: 31-May-2023 Manuscript No. AAFSJ-23-13648; Editor assigned: 02-Jun-2023, PreQC No. AAFSJ-23-13648(PQ); Reviewed: 16-Jun-2023, QC No. AAFSJ-23-13648; Revised: 20-Jul-2023, Manuscript No. AAFSJ-23-13648(R); Published: 27-Jul-2023