Research Article: 2021 Vol: 24 Issue: 6

The impact of competitiveness and sustainability of financial performance on funeral assurance companies: a case study of vineyard assurance company

Wadesango Newman, University of Limpopo

Charles. C. Mahwahwa, Midlands State University

Stephen Malatji, Tshwane University of Technology

Citation Information: Newman, W., Mahwahwa, C. C., & Malatji, S. (2021). The impact of competitiveness and sustainability of financial performance on funeral assurance companies: a case study of vineyard assurance company. Journal of Management Information and Decision Sciences, 24(6), 1-8.

Abstract

The purpose of this study was to identify the innovative competitive strategies that management accounting practices at Vineyard Funeral Assurance (Private) Limited Company can provide while creating a competitive environment in the funeral assurance industry. This was achieved by evaluating the impact of competitiveness and sustainability of financial performance of funeral assurance companies with a special reference to Vineyard Assurance Company. Vineyard Funeral Assurance (Private) Limited Company was established in early 2000s as Life Care Management (Private) Limited when it was a funeral services provider not an assurance company being registered in terms of the Companies Act. The study sought to find Vineyard’s strategies on the impact of competitiveness and sustainability of financial performance in the industry it operates on. The results showed that management accounting techniques play an important function in creating a sustainable competitive advantage for an organisation.

Keywords

Impact; Competitiveness; Sustainability; Financial performance; Funeral assurance companies.

Background of the Study

Vineyard Funeral Assurance (Private) Limited Company was established in early 2000s as Life Care Management (Private) Limited when it was a funeral services provider not an assurance company being registered in terms of the Companies Act. The company was then registered in 2003 as an assurer in terms of the Insurance and Pensions Commission Act, then the company name was changed to Vineyard Funeral Assurance (Private) Limited Company. Vineyard Funeral Assurance (Private) Limited Company is one of the companies that were required to re-register by Insurance and Pension Commission in 2010 following promulgation of new US$ capital requirements. It is governed by Board of Directors comprising of directors, non-executive directors and executive directors.

Today’s fast changing economic environment requires every organisation to try and continuously assess its performance. Weetman (2010), pointed that, for survival organisations need to take steps to expand by accessing new markets, improving on production and product ranges, pricing their products more competitively, satisfying existing and new customers and developing new marketing strategies. Chapman (2005) noted that companies must constantly look for suitable tools and techniques to investigate the operational environment in which they operate from, get market information, product costs, analyse customer needs, forecast and assess organisational performance, while ensuring competitive advantage in product activities.

The Insurance Institute of Zimbabwe President Chomi Makina once noted that “There is a big knock for funeral assurers because you find that banks and life insurers are also conducting funeral insurance and it means that the cake which we were partaking of is getting smaller”. Addressing the 2018 Zimbabwe Funeral Assurance and Service Conference, the then Insurance and Pension Commission commissioner Tendai Karonga noted that one of the challenges currently bedevilling the funeral assurance industry is the existence of unregistered entities. Such unregistered, not only have unfair competitive edge over registered players in terms of regulatory costs, but also pose risk to their policyholders. As Zimbabweans view funeral assurance as a vehicle to provide a dignified funeral to their loved ones, unscrupulous and dishonest fraudsters see it as a money-spinning opportunity.

According to IPEC, there is an emergence of oligopoly in the Funeral Assurance sector as the country’s top four players dominated 90% or 17 million of the business during the first four months of 2019. With 17 million of Net Premium Interest [NPI] concentrated in the hands of the top four players Nyaradzo, Moonlight, First Funeral and Doves, the other seven players only controlled 2 million in NPI. Oligopoly is a market form in which an industry is dominated by a small number of sellers or oligopolists.

The depressed economic environment has led to low disposable incomes since companies are closing down, retrenching and downsizing. This has resulted in low uptake of insurance products, premium debtors and an increase in lapse ratios. The outcome of the management process, from strategic planning to implementation of the plan will lead to measuring performance. According to Noreen et al. (2012), the term corporate performance refers to the end result of management process of attainment of the organisational goals. Crosson and Needles (2011) opined that performance is the organisation’s ability to achieve its goal by using resources in an economic, efficient and effective way. In strategic management, the measurement of company performance can be diverse. Company performance can be classified into categories of measurement like, operational performance and financial performance. According to Drury, the operational performance takes into account such things as, market share, product quality and marketing effectiveness. Financial performance can further be extended to market-based financial performance and accountingbased financial performance whereas financially the concept of corporate performance is always linked to financial aspects like profit, return on assets (ROA) and economic value addition (EVA).

Hansen et al. (2009) opined that, the allocation of scarce by the company depends on the information within the business environment and the information is the source that triggers operational activities. This information must accurate, relevant and reliable to enable managers to formulate and implement organisational strategies for competitive advantage, compete well in the market place through effective decision making. Atkinson et al. (2012) noted that companies have always relied on management accounting reports for decision making, the traditional management accounting tools support internal information for application by management which is not very useful for strategic purposes in the present day competitive business environment. Bhimani (2006) stated that, strategic management accounting is outward looking, scans the internal and external business environment for effective business macro-economic environment for effective business decision making. Strategic management accounting enables management accounting more strategic and focuses on a company’s performance against that of its competitors and provides and analyses financial and business information, products and cost structures of the organisation comparing with competitors, with some monitoring over some time from where decisions in pricing may be undertaken (Shim & Siegel, 2017). This process is when information about the customer is gathered, and cost reductions opportunities are also discovered through strategic cost analysis, comparing accounting emphasis with strategic positioning with market analysis ending up with strategic evaluation of the present status.

Research Methodology

This study used the mixed method design which combines qualitative and quantitative approach to collect and analyse data. Furthermore, the study employed the explanatory method, which contains quantitative data collection followed by qualitative data collection. This method was used in order to obtain a clearer picture from quantitative data to provide better understanding and explanation of the study. To explore in depth, the quantitative data, the researchers gathered quantitative data, the researcher then collected qualitative data from participants who could help explain the results. The study sample size was 50 respondents from a population of 101.

Results

Different Strategies Formulated and Implemented by Funeral Assurance Companies

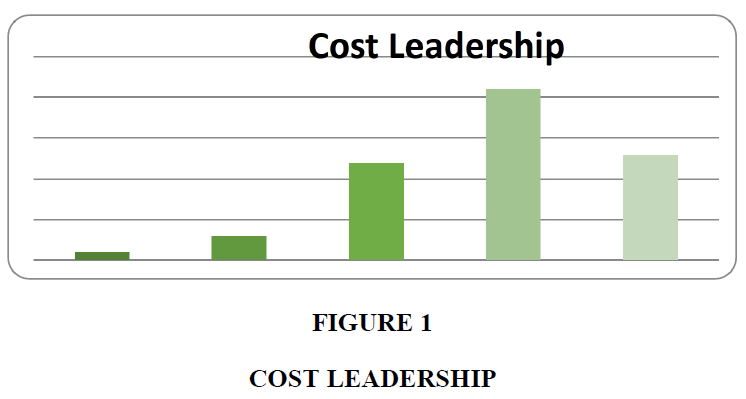

Cost leadership strategy

On the question of whether Vineyard employs cost leadership or not, of the 50 respondents who participated 4 respondents felt there was a cost leadership strategy at Vineyard, 12 were not sure and 44 disagreed. This position is depicted below (Figure 1).

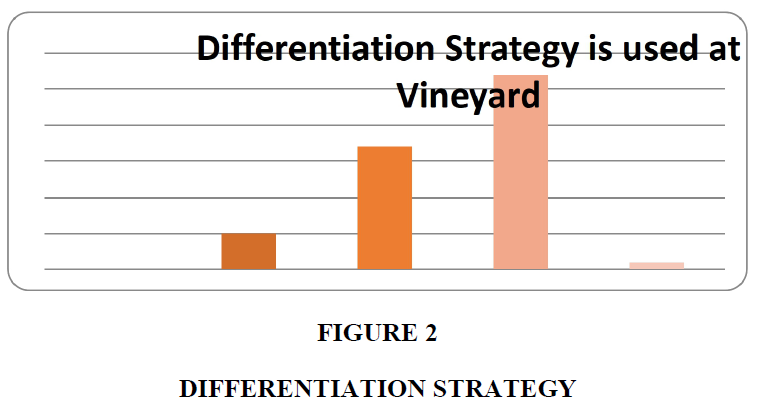

As appearing in the chart above 5 of the respondents felt there was differentiation strategy at Vineyard, 17 were not sure and a total 28 respondents were of the opinion that there was not differentiation strategy at Vineyard (Figure 2).

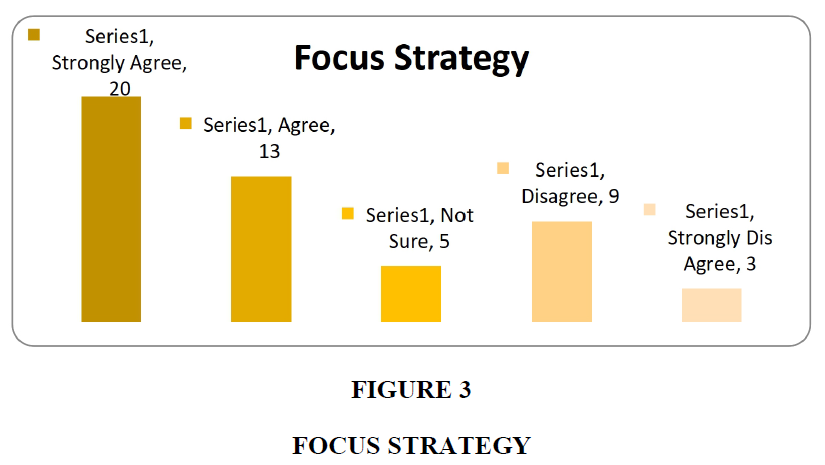

Focus strategy

On focus strategy a total 33 respondents were in agreement that the company uses a focus strategy and 12 of the respondents disagreed, while 5 were not sure. The chart below shows this pattern of responses (Figure 3).

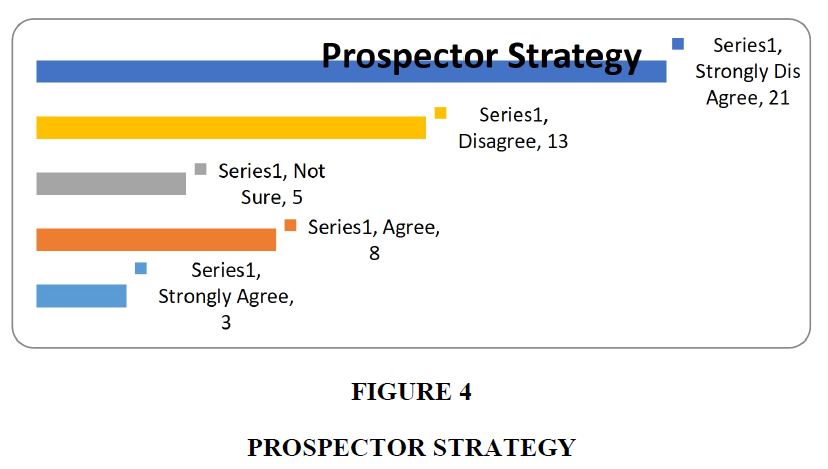

The prospector strategy

This strategy is where a company continues to apply innovation by seeking and exploiting research and development for new products and new opportunities in the market. On this strategy, 11 respondents felt the company is engaged in the prospector strategy, 5 were not sure and 44 disagreed. This is shown in the graph below (Figure 4).

Defender strategy

The defender Strategy is characterised by the search for stability and is focused on limited product lines directed towards a narrow segment of the market. The responses to this question are shown on the chart below (Figure 5).

A total 27 respondents thought that the company uses a defender strategy, 18 disagreed that the company uses a defender strategy and 5 were not sure.

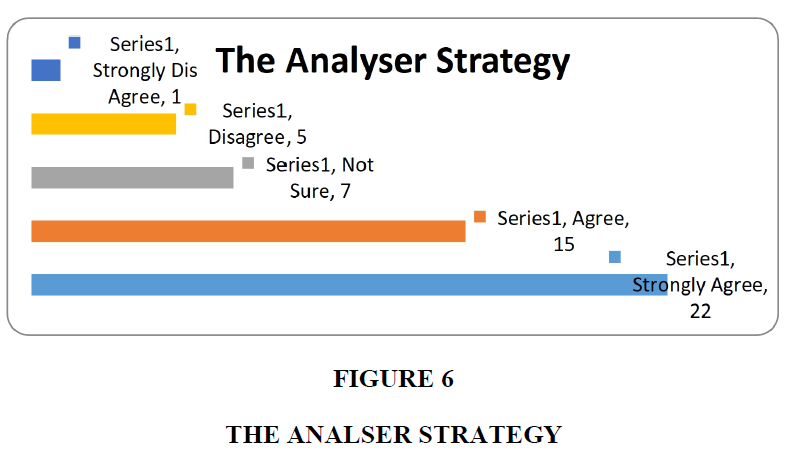

The analser strategy

The chart below shows the pattern of responses to this question (Figure 6).

Companies using this strategy look out for, analyse and copy new ideas of the established companies. Responses to this question were as follows, 37 felt the company uses the analyser strategy, 7 were not sure and the rest 6 disagreed. This is shown in the graph above.

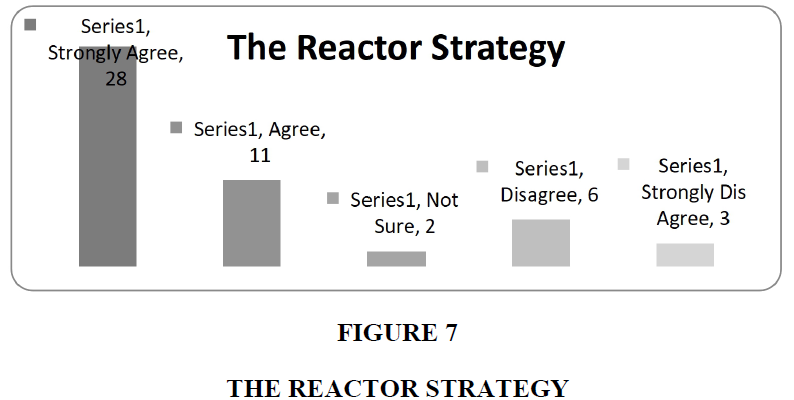

The reactor strategy

The reactor strategy is where a company react to the environmental changes and adjust when they are compelled to do so by the environmental pressures. To this end the responses received were that 39 respondents felt that the company uses the reactor strategy, 9 respondents disagreed and 2 were not sure. The chart below highlights the responses to this question (Figure 7).

Factors That Influence Strategic Management Accounting Adoption

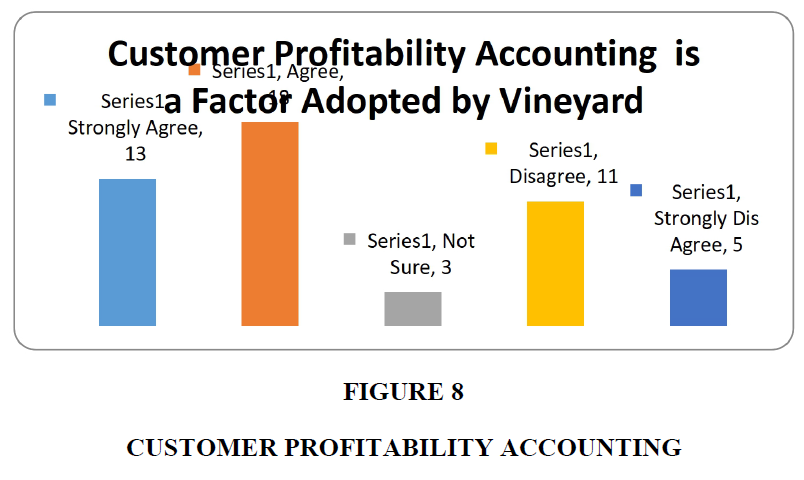

Customer profitability accounting

Customer profitability accounting enables an organisation to analyse income earned from customers and expenses incurred to earn the income. To this question 31 respondents felt that the company uses this type of strategy, 16 respondents disagreed and 3 were not sure. The graph below shows the responses that were gathered (Figure 8).

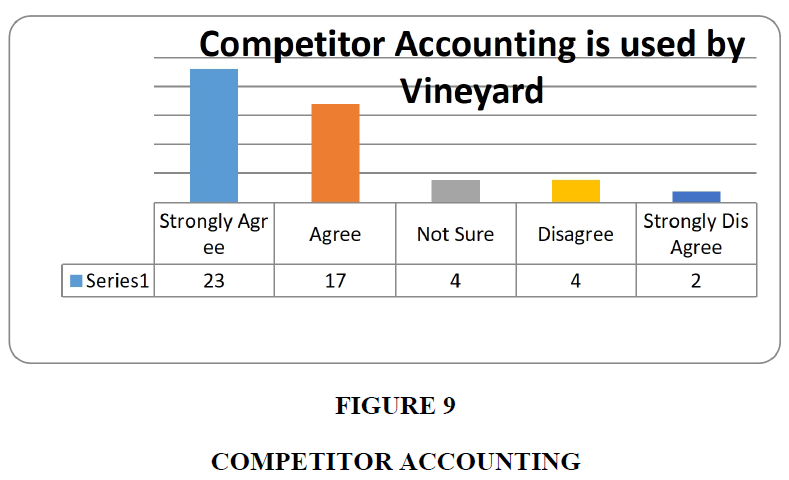

Competitor accounting

In response to this question, 40 responses indicate that the company analysis competitors, 6 disagreed and 4 disagreed. Competitor accounting provide a platform for a company to build competitiveness against competitors (Figure 9).

Measures of Effectiveness of Strategies in Creating Sustainable Competitive Advantage

Use of efficiency of performance measurement

Measurement of efficiency indicate how well the management of the organisation utilise all the resources available to them. Responses to this question are indicated below.

Discussion

Caplan (2016) stated that companies with cost leadership strategy must have excellent systems of cost control and should continually plan for cost reduction in order to remain the cost leaders in the market. The responses received that Vineyard does not employ cost leadership strategies; this is so because 68% of the respondents disagreed with the statement on cost leadership only 8% were in agreement. This means that the respondents see Vineyard not being able to compete effectively on price, by offering its products at lower prices than their rivals. It is recommend Vineyard establish a resting units (caskets/coffins) manufacturing business unit to compete on pricing instead of outsourcing as is the current position. In a similar study, Wadesango et al. (2019) found that the resting unit and fuel costs constitute the major cost components in honouring claims. On differentiation strategy, again 56% of respondents felt that Vineyard did not use the differentiation strategy. Differentiation strategy means making a product different from rival products in a way that customers can recognise it. According to Wadesango et al. (2019), this is a bit difficult in the funeral assurance industry but recommend Vineyard to consider introducing insurance riders like general medical aid benefits tied to their major policy products. On the use of the prospector strategy respondents felt that Vineyard does not use this strategy. However it emerged that Vineyard uses the defender strategy. Vineyard also used the analyser and reactor strategies.

Conclusion

This study discussed results from the findings. The findings were mainly on the opinion of respondents on the impact of competitiveness and sustainability of financial performance on funeral assurance companies focusing mainly on Vineyard Assurance Company. The study concludes that the respondents see Vineyard not being able to compete effectively on price, by offering its products at lower prices than their rivals. The study recommends Vineyard to establish a resting units (caskets/coffins) manufacturing business unit to compete on pricing instead of outsourcing as is the current position. The resting unit and fuel costs constitute the major cost components in honouring claims. On the use of the prospector strategy respondents felt that Vineyard does not use this strategy this was so because 68% rejected the idea. However, respondents felt that Vineyard uses the defender strategy. They also felt that Vineyard also used the analyser and reactor strategies.

References

- Atkinson, A. A., Kaplan, S. R., Matsumura, E. M., & Young, S. M. (2012). Management Accounting: Information for Decision-making and Strategy Execution. 6 editions. Pearson.

- Bhimani, A. (2006). Contemporary issues in Management Accounting. Oxford University Press.

- Caplan, D. (2016). Management Accounting, Concepts and Techniques. New York State University.

- Chapman, C. S. (2005). Controlling Strategy Management, Accounting, and Performance Measurement. Oxford University Press.

- Crosson, V. S., & Needles, E. B. (2011). Managerial Accounting, Ninth Edition. Cengage Learning.

- Hansen, D. R., Mowen, M. M., & Guan, L. (2009). Cost Management, Accounting & Control, Sixth Edition. Cengage Learning.

- Noreen, W. E., Brewer, C. P., & Garrison, H. R. (2012). Managerial Accounting for Managers, Second Edition, McGraw-Hill.

- Shim, K. J., & Siegel, G. J. (2008). Theory and Problems of Managerial Accounting, 2edition. McGraw-Hill.

- Wadesango, N., Tinarwo, N., Sitcha, L., Machingambi, S. (2019). The impact of cash flow management on the profitability and sustainability of small to medium sized enterprises. International Journal of Entrepreneurship, 23, 1-19.

- Weetman, P. (2010). Management Accounting, Second Edition. Pearson.