Research Article: 2021 Vol: 25 Issue: 1

The Impact of Coronavirus Pandemic on Audit Quality: The Perceptions of Saudi Auditors

Nesrine Akrimi, Northern Borders University

Abstract

The main objective of this study is to examine the impact of the Coronavirus pandemic on the audit quality from the perspective of Saudi auditors. The research employed a quantitative methodology through a questionnaire survey. Auditors were asked to state their agreement to statements related to audit quality on a five-point Likert scale. Out of 200 questionnaires distributed. 89 usable responses were received. Our study researched some important results mainly that the Coronavirus pandemic has had a significant impact on audit quality according to the opinions of Saudi auditors.

Keywords

Coronavirus Pandemic, Audit Quality, Auditors.

Introduction

Since ancient times, the world has witnessed pandemics, plagues, and influenza. At present, this has had a negative impact on a large part of the world’s economic and social levels. Nowadays, outbreaks of respiratory diseases have been found all over the world. This is the result of the novel coronavirus (COVID-19). The epidemic started in Wuhan, China has rapidly expanded to more than 200 countries around the world, resulting a decline in global economy. COVID-19 has caused immediate negative effects on various non-industrial products Business, especially entertainment, transportation, retail, school education and tourism. For many firms, the first quarter of 2020 is the most challenging year in a long time. Although most economies continued to maintain a modest pattern of growth in early 2020, this growth stopped with the pandemic of the COVID-19 almost everywhere in the world. Many governments have responded to restrictions on economic activity, which has no precedent in recent history: from the interruption of daily business to the complete blockade of certain industries and activities.

According to (KPMG, 2020). These economic turbulences can influence investors' confidence further to companies’ financial performance, and accordingly can produce several financial distresses. Measures taken to increase the likelihood of containing the COVID-19 have influenced the economic activity through the world which in turn had a lot of negative implications on accounting information and audit quality. A specific notice has published in March 2020 by the Financial Reporting Council (FRC) associated to the influence of the COVID-19 on the audit quality that presents a guide for auditors on the problems that should be examined regarding the influence of social distancing procedures on audit quality (Financial Reporting Council, 2020).

This study attempts to answer to the following research question: does the COVID-19 influence audit quality?

In spite of the lack of empirical research concerning the economic and social influence of the COVID19 (Goodwell, 2020), an empirical research investigating the effect of the COVOD19 on audit quality does not carried out. Our research seeks to assess the influence of the COVID19 on audit quality from the viewpoint of Saudi auditors. The study used a descriptive-analytical approach. A five-point Likert style questionnaire was constructed as the research tool. Our questionnaire was distributed to a sample chosen from the population of auditors of Saudi Arabia. Particularly, we examine the influence of the COVID19 on five features associated to audit quality: audit fees, going concern judgments, audit staff, audit procedures and audit staff salaries. Our research provides an overview of the perceptions of Saudi auditors of the impact of this pandemic on audit quality.

Literature Review

We assess the likely impact of the Coronavirus on five characteristics associated to audit quality: audit fees, going concern judgment, auditor human resources, audit measures and audit employee’s remuneration.

Audit Fees

According to Chen et al. (2019), the change of economic circumstances influences the firm`s liquidity and performance. This is also likely to affect audit fees. A study carried out by Xu et al. (2013) in Australia revealed an increase in audit fees during the financial crisis. The authors explain that by the rise in client business risk, which result further audit effort. However, others research has stated that during financial crisis, firms negotiate a lower price for audit services (Albitard et al., 2020).

The social distancing due to the COVID-19 seems to enhance the work hours and audit efforts and hence firms are probably to start requesting a reduction of audit fees (Albitard et al., 2020). In such instance, auditors tend to reduce their efforts to avoid the loss on the appointment. Therefore, auditors may be under constraints from companies to reduce audit fees during the pandemic. The anticipated drop in audit fees seems to be mainly influencing audit quality during the coronavirus crisis.

Thus, the first hypothesis of the current research is stated as follows:

H1: The COVID-19 will affect audit fees.

Going Concern Judgment

According to Xu et al. (2013) auditors have taken conservative procedures throughout the global financial crisis by not only reducing their liability to issue going-concern judgments but also by increasing the audit effort in order to preserve themselves from risk exhibition during financial crisis. Although, findings of the research carried out by Mareque et al. (2017) reveal that the proportion of reports issued with going concern qualifications before and during the crisis is the same.

It is necessary for auditors to spend sufficient time on the going concern judgment and admit that it will take a prolonged period than normal for most audited companies. The auditor mission may be more complicated during the crisis of Corona Virus since the insecurity level is higher, this is involves the preponderant necessity to employ the adequate level of staff and to provide the sufficient support to auditors (KPMG, 2020). As a results of the fast development of the crisis, it is also crucial for auditors to verify that the further examination of events continues through signing audit reports (PWC, 2020).

During the COVID-19 pandemic, the most important reason for the issue of audit reports with uncertainties is the incertitude of the continuity of the audited firm. These doubts are associated to the limited liquidity and the decline of economic expansion of client activities as well as the crisis that we are presently suffering resulting from the COVID-19 in most sectors (KPMG, 2020). These conditions have entrained firms to have major business risks. Consequently, we suppose that it have a significant impact on the achievement of the going concern judgment, which appeared to be related to the audit quality (Salehi et al., 2020). Therefore, the second hypothesis of our research is stated as follows:

H2: The COVID-19 will affect going concern judgment.

Audit Human Resources

Personal capacities and instruction of auditors and employees are crucial component of audit quality. In this sense, Francis (2011) considers that the auditor instruction is a cornerstone of audit profession. Prior research indicates that financing in human resources may enhance audit quality (Antonio & Rodrigues, 2016).

According to Bianchi et al (2019), competence and professional qualifications may be acquired over indirect skills, such as training, workshops, and direct skills, such as enhanced engagements with clients in particular industries (Lennox & Wu, 2018). A study carried out by Chen et al. (2008) reveals that professional skills obtained at work training may significantly enhance audit efficiency and thus, audit quality.

Audit companies are usually have to organize monthly practical courses, seminars and related professional development activities for audit staff, the corona virus pandemic has obliged audit firms to revoked their training programs for their auditors (Deloitte, 2020). This can negatively affect the competence of the auditor and therefore the quality of the audit. Similarly, Coronavirus can cause the of audit staff due to virus attack or quarantine which could negatively influence the efficiency of auditors and therefore audit quality (Deloite, 2020).

Thus, the third hypothesis of our study is developed:

H3: The COVID-19 will affect audit human resources.

Audit Measures

Audit measures are employed for planification of audit, fieldwork, and audit conclusion, judgment and reporting stages (Noh et al., 2017). During the Coronavirus outbreak, since many firms are exposed to bankrupt or manipulate their reported earnings during this pandemic, auditors have to enhance the employment of analytical measures resulting from their reduced cost and also their simplicity to assess (Rose et al., 2020). According to Rose et al. (2020), these analytical measures regularly imply a diagnostic process that defines the reason of unpredicted fluctuations in account balances or the risk of significant irregularity resulting from fraud during the audit plan.

These represent a possible menace to audit quality related to producing many explications in reviewing fraud risks (Rose et al., 2020). In view of this, auditors will attempt to rely more on analysis measures that assist them to have an exhaustive comprehension of the firms’ financial situation, therefore minimizing the number of precise tests that are so expensive and take a considerable time in view of the most of the communications during this crisis are online (KPMG, 2020).

As a result of the Coronavirus pandemic, auditors are more probably to trust in information obtained from outside sources in particular information obtained from outside stakeholders similar to providers, or financial institutions, which are more reliable than those obtained from audited companies (PWC, 2020). At the same time, the Coronavirus crisis has reduced the employment of the original forms, therefore the distance working plan could influence the performance and credibility of audit information and accordingly might influence audit quality (KPMG, 2020).

Accordingly, the next hypothesis of our research is proposed as follows:

H4: The COVID-19 will affect audit measures.

Audit Employee’s Remuneration

According to Persellin et al. (2018), the issue of auditors remuneration has become a crucial issue in view of the preponderant development in the public accounting industry that have caused the increase of responsibilities and working volume of auditors. Nevertheless, auditor remuneration can be considerably related to audit quality, a little research have studied the association between auditor remuneration and audit quality, which is principally caused by information restrictions.

From the start of Coronavirus crisis, some exceptional measures have been put in place to help employees and firms during the period of the pandemic. Audit employees run a significant risk of pay cuts or offering unpaid leave (Deloitte, 2020). Although, the relationship between auditor remuneration and audit quality still ambiguous. According to the efficiency wage theory higher salaries must enhance the performance of audit employees through encouraging additional efforts (Hoopes et al., 2018). Thus, it is expected that the Coronavirus crisis would influence audit employees remuneration , which reciprocally could negatively influence the efficiency of audit staff in the terms of they might have little incentives to assume their responsibilities in the most efficient way. Therefore, we expect that any diminution in the remuneration of audit staff may have a possible negative influence on audit quality.

Thus, the following hypothesis is examined:

H5: The COVID-19 will affect audit employee’s remuneration.

Research Methodology

Our research problem may be summed up in answering to the following question: Do Saudi auditors consider that the COVID-19 pandemic has a significant impact on audit quality? Based on the above question, we have the following hypothesis to prove or disprove:

H1: The COVID-19 will affect audit fees.

H2: The COVID-19 will affect going concern judgment.

H3: The COVID-19 will affect audit human resources.

H4: The COVID-19 will affect audit measures.

H5: The COVID-19 will affect audit employee’s remuneration

The population of our study consists of Saudi auditors whereas the sample was randomly chosen from practitioners of the profession. We distributed 200 questionnaires, among them 89 responded, all of which were valid for testing and analysis as shown in Table 1 below. Based on the previous research, scientific discussions with university colleagues in accounting and interviews made with Saudi auditors, five-point Likert scale is used to measure auditor’s perception of the impact of Covid-19 on audit quality. The scale ranges as follows:

| Table 1 Characteristics Of The Respondents | ||

| Experience Percentage Frequency |

Less than 5 years 68.54% 61 |

More than 5 years 31.46% 28 |

| Qualifications Percentage Frequency |

SOCPA Only 69.66% 62 |

SOCPA and others 30.34% 27 |

| Big 4 auditors Percentage Frequency |

Big4 audit firm 70.79% 63 |

Non big 4 audit firm 29.21% 26 |

1. Strongly disagree

2. Disagree

3. Neutral

4. Agree

5. Strongly agree

Findings of this survey demonstrate satisfactory levels of reliability with a Cronbach’s alpha of 0.7.

Results

An analysis was realized on background information of the auditors and the results are presented in Table 1.

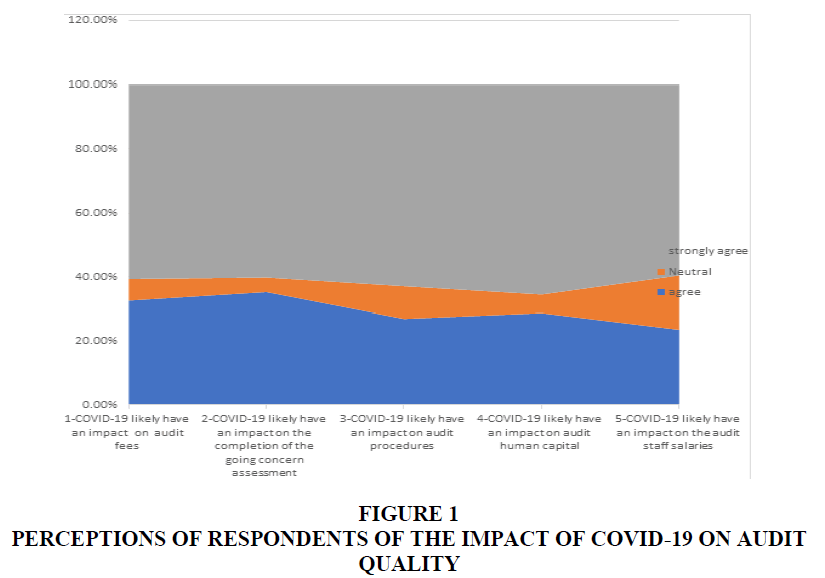

It is evident from Table 1 that 69.66% of the sample has a SOCPA only, 30.34% have a SOCPA and other qualifications. It is also evident that most of the sample (70.79%) is Big4 auditors. As for years of experience, most of the sample (68.45%) has less than 5 years of experience in their field of work. As for the rest of the sample, have more than 10 years of experience. The findings in Table 2 and Figure 1 show that, based on the percentage of responses, the majority of (60.67%) agreed with the statement that Covid-19 have an impact on audit fees.

| Table 2 Respondents` Perceptions of the Impact of Covid-19 on Audit Quality | ||||||

| Strongly disagree | Disagree | Neutral | Agree | strongly agree | One sample WSRT Auditors (sig) |

|

| 1-COVID-19 likely have an impact on audit fees. |

0 | 0 | 6.74% | 32.58% | 60.67% | 0.000* |

| 2-COVID-19 likely have an impact on the going concern judgment. |

0 | 0 | 4.55% | 35.23% | 60.23% | 0.000* |

| 3-COVID-19 likely have an impact on audit measures. |

0 | 0 | 10.11% | 26.97% | 62.92% | 0.000* |

| 4-COVID-19 likely have an impact on audit human resources. |

0 | 0 | 5.75% | 28.74% | 65.52% | 0.000* |

| 5-COVID-19 likely have an impact on the audit employee’s remuneration |

0 | 0 | 16.85% | 23.60% | 59.55% | 0.000* |

Table 2 and Figure 1 further indicate that the auditors` agreement that Covid-19 have a significant impact on the going concern judgment (60.25%). Our results reveal thar the majority of Saudi auditors strongly agree with the significant impact of Coronavirus on audit measures (62.52%). Concerning the other aspects studied of audit quality, also the auditors consider that Covid-19 have a considerable influence on audit employee’s remuneration (59.55%) and audit human resources (65.52%). Consequently, the five hypothesis of the study are accepted.

Conclusion

This research rendered considerable results about the impact of the Coronavirus on audit quality from the perspective of Saudi auditors. Findings showed high agreement level for the impact of Covid-19 on the aspects of audit quality studied. According to Saudi auditors Covid-19 have a significant impact on audit fees, audit measures, going concern judgment, audit human resources and audit staff remuneration. Consequently, this pandemic has a considerable impact on audit quality. This paper, thus, can gives an overview for future researchers, auditors, and directors about the considerable influence that the Coronavirus pandemic has already had on audit quality. Further studies might analyze the issue of how this pandemic can affect audit quality and explore the perceptions of others groups such as investors, directors.

References

- Albitar, K., Gerged, A.M., Kikhia, H., & Hussainey, K. (2020). Auditing in times of social distancing: The effect of COVID-19 on auditing quality. International Journal of Accounting and Information Management. In Press.

- Antonio, S., & Rodrigues, R. (2016). Human capital and performance in young audit firms. Journal of Business Research, 69, 5354-59.

- Chen, H., Hua, S., Liu, Z., & Zhang, M. (2019). Audit fees, perceived audit risk, and the financial crisis of 2008,

- Asian Review of Accounting, 27(1), 97-111.

- Chen, L., Krishnan, G.V., & Yu, W. (2018). The relation between audit fee cuts during the global financial crisis and earnings quality and audit quality. Advances in Accounting, 43, 14-31.

- Deloite. (2020). Potential implications of COVID-19 for the insurance sector. Accessed on the 27th of April 2020 at https://www2.deloitte.com/uk/en/insights/economy/covid-19/impact-of-covid-19-on- insurers.html

- Financial Reporting Council. (2020). Guidance on audit issues arising from the Covid-19 (Coronavirus) pandemic. Available at https://www.frc.org.uk/news/march-2020-(1)/guidance-on-audit-issues-arising- from-the-COVID-19. (access on 22 August 2020)

- Francis, J.R. (2011). A Framework for Understanding and Researching Audit Quality. Auditing: A Journal of Practice & Theory, 30(2), 125-152.

- Goodell W.J. (2020). COVID-19 and finance: Agendas for future research. Finance Research Letters. In press.

- KPMG. (2020). COVID-19: Potential impact on financial reporting. Accessed on the 27th of April 2020 at https://home.kpmg/xx/en/home/insights/2020/03/covid-19-financial-reporting-resource-centre.html

- Lennox, C.S., & Wu, X. (2018). A review of the archival literature on audit partners. Accounting Horizons, 32(2), 1-35.

- Mareque, M., López-Corrales, F., & Pedrosa, A. (2017). Audit reporting for going concern in Spain during the global financial crisis. Economic Research Ekonomska Istra?ivanja, 30(1), 154-183.

- Noh, M., Park, H., & Cho, M. (2017). The effect of the dependence on the work of other auditors on error in analysts’ earnings forecasts, International Journal of Accounting & Information Management, 25(1), 110-136.

- Persellin, J., Schmidt, J.J., Vandervelde, S.D., & Wilkins, M. (2018). Auditor perceptions of audit workloads, audit quality, and job satisfaction. S.S.R.N. Electronic Journal. DOI: 10.2139/ssrn.2534492

- PWC. (2020). COVID-19: Responding to the business impacts of Coronavirus. Accessed on the 27th of April 2020 at https://www.pwc.com/gx/en/issues/crisis-solutions/covid-19.html

- Rose, A.M., Rose, J.M., Suh, I., & Thibodeau, J.C. (2019). Analytical Procedures: Are More Good Ideas Always Better for Audit Quality?. Behavioral Research in Accounting, 32(1), 37-49.

- Salehi, M., Mahmoudi, M.R.F., & Gah, A.D. (2020). A meta-analysis approach for determinants of effective factors on audit quality. Journal of Accounting in Emerging Economies, 9(2), 287-312.

- Xu, Y., Carsona, E., Fargherb, N., & Jiang, L. (2013). Responses by Australian auditors to the global financial crisis, Accounting and Finance, 53(1), 303-338.