Research Article: 2022 Vol: 26 Issue: 1

The Impact of Corporate Social Responsibility on Firm Value of Manufacturing Companies Listed on the Idx: The Role of Institutional and Managerial Ownership as Moderating Variables

Agung Dharmawan Buchdadi, State University of Jakarta, Indonesia

Rosa Salsa Bila, State University of Jakarta, Indonesia

Suherman, State University of Jakarta, Indonesia

Adam Zechariah, State University of Jakarta, Indonesia

M. Edo Suryawan Siregar, State University of Jakarta, Indonesia

Herni Kurniawati, Universitas Tarumanegara, Indonesia

Citation Information: Buchdadi, A.D., Bila, R.S., Suherman, Zechariah, A., Siregar, M.E.S., & Kurniawati, H. (2022). The impact of corporate social responsibility on firm value of manufacturing companies listed on the idx: the role of institutional and managerial ownership as moderating variables. Academy of Accounting and Financial Studies Journal, 26(1), 1-09.

Abstract

This study aims to determine the effect of corporate social responsibility (CSR) on firm value, with institutional ownership and managerial ownership as moderating variables. The sample of this research is 33 manufacturing companies (198 observations) listed on the Indonesia Stock Exchange (IDX) in 2014-2019 in a row. The model used in this study is in the form of balanced panel data with a random effects model approach. The results of this study indicate that CSR does not have a significant effect on firm value. Institutional ownership cannot moderate the effect of CSR on firm value. However, managerial ownership can significantly moderate the effect of CSR on firm value.

Keywords

Corporate Social Responsibility, Institutional Ownership, Managerial Ownership, Company Value.

Introduction

Factors other than finance that can affect the value of the company, one of which is Corporate Social Responsibility (CSR). CSR is often interpreted as the pillar of business ethics, which means that companies not only have economic and legal responsibilities, but also have responsibilities to other interested parties (stakeholders) whose scope exceeds economic and legal obligations. This social responsibility refers to all forms of commitment from the company to realize a better quality of life for related stakeholders. The implementation of CSR can also be one way to optimize the value of the company.

However, conflicts of interest that occurs between managers and shareholders or commonly referred to as agency problems will arise in the process of implementing CSR. This happens because managers prioritize personal interests, which can lead to increased costs for the company so that it will trigger a decrease in company profits and affect stock prices so that it can reduce the value of the company.

Agency problem can be solved by having share ownership by management. With the shares owned by managerial parties, it is expected that managers will take steps according to the wishes of the principals because managers will be moved to maximize their performance so as to increase the value of the company. In addition, agency problems can also be overcome by implementing supervisory actions in an industry carried out by institutional investors, which are useful for motivating managers to be more focused on increasing company value.

This study on CSR is very interesting, considering that CSR activities are constantly associated with the green movement program which has been very attractive discussed for the past few years, both nationally and internationally, which will certainly affect the community's paradigm of a company approximately. However, previous research on the effect of CSR shows inconsistent results. Research by Nahda & Harjito (2011), Retno & Prihatinah (2012), Fiona (2017) and Buchanan et al. (2018) reveals that the disclosure of corporate social responsibility has a positive effect on firm value. However, research from Putri et al. (2016) and Kusuma & Juniarti (2016) found that CSR has no effect on firm value.

In addition, research by Buchanan et al (2018) reveals that institutional ownership as a moderating variable has a significant effect on the relationship between CSR and firm value. These results contradict research by Fiona (2017) and Suryonugroho (2016), the results of the study show that institutional ownership cannot moderate the relationship of CSR to firm value.

Then the research that has been done by Fiona (2017) states that managerial ownership can moderate the relationship between corporate social responsibility and firm value. However, it is different from the results of research conducted by Indarti & Setiawan (2016) where managerial ownership cannot moderate the relationship between CSR and firm value.

Based on the above background and differences in the results from previous studies, it is the basis for researchers to make these problems the basis of this research. Therefore, the purpose of this study is to determine the effect of corporate social responsibility on firm value, and to determine the effect of institutional ownership and institutional ownership in moderating the relationship.

Theoretical Framework and Hypothesis Development

The effect of corporate social responsibility on firm value

In line with the development of the public concern to environment, the importance of corporate social responsibility is gradually increasing. Furthermore, the influence of companies in social sector more increasingly significant (Shin, 2015). The company can expect to experience sustainable growth through the trust placed in it by society. If the company carries out trust-based company activities, then the company can maintain good relations with various stakeholders which will improve economic performance. Investors are also aware of the importance of socially responsible investment, which involves investing in companies with outstanding CSR performance (Cho et al., 2019).

Based on the previous framework, it is suspected that CSR has a positive and significant effect on firm value. This is reinforced by the results of research by Fiona (2017) which states that CSR has a positive and significant effect on firm value. This can happen because investors are more interested in companies that have a good image in the community because the better the company's image, the higher consumer loyalty, thus forming the trust of investors and will have an impact on stock prices so that it will increase the value of the company.

H1: Corporate social responsibility has a positive and significant effect on firm value

The effect of institutional ownership in moderating the effect of social responsibility on firm value

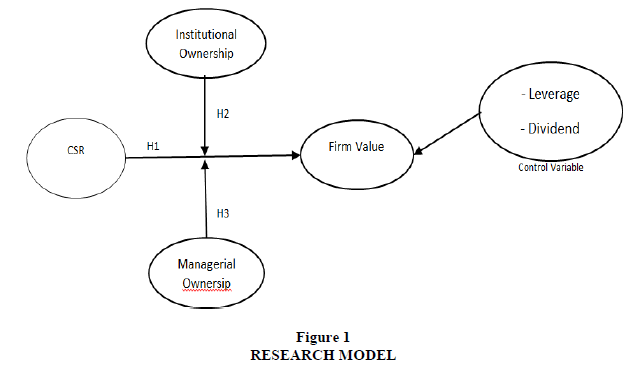

Institutional ownership is share ownership owned by an institution or organization. Institutional ownership can make the value of the company increase, by utilizing information and can resolve agency conflicts, because with the increase in institutional ownership, all company activities will be supervised by the institution or organization. The supervisory function carried out by institutional ownership can encourage management to carry out CSR activities which will have an impact on company value (Damayanti & Suartana, 2014). Research by Buchanan et al (2018) proves that institutional ownership as a moderating variable has a significant positive effect on the relationship between CSR and firm value.(Figure 1)

H2: Institutional ownership moderates the relationship of corporate social responsibility to firm value

The effect of managerial ownership in moderating the effect of corporate social responsibility on firm value

To overcome the problem of agency costs, it can be overcome by increasing managerial ownership. This step is carried out by providing an opportunity for managers to be involved in the ownership of company shares which aims to equalize the interests of shareholders. Increased managerial ownership makes it easier to link the interests of internal parties with external shareholders, and leads to better decision making and aims to increase company value. This shows that managerial ownership encourages companies to carry out CSR activities so as to increase the value of the company. This is in accordance with research by Fiona (2017) and Widyaningsih (2018) which explain that managerial ownership can moderate the relationship between corporate social responsibility and firm value.

H3: Managerial ownership moderates the relationship of corporate social responsibility to firm value

Research Methodology

Research Variable

The dependent variable used in this study is firm value, the independent variable used is CSR, the moderating variable used is institutional ownership and managerial ownership, and the control variables used are leverage and dividend policy in Table 1.

| Table 1 Variable Operationalization |

||

|---|---|---|

| Variable(Proxy) | Draft | Indicator |

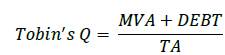

| The value of the company (Tobin's Q) |

Tobin's Q as the ratio of the value of equity plus the market value of the company's debt divided by the replacement value of the company's assets. |  |

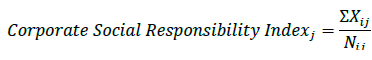

| Corporate Social Responsibility (CSR) |

CSR disclosure index by adding up the items disclosed by the company divided by 79 Global Reporting Initiative (GRI) items |  |

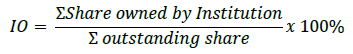

| Institutional Ownership (IO) | Shows the percentage of share ownership owned by the institution |  |

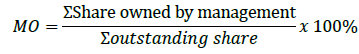

| Managerial Ownership (MO) | Shows the percentage of share ownership owned by the management (commissioners and directors) |  |

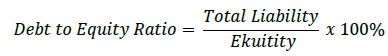

| Leverage (DER) | The ratio that compares the total debt with the total capital owned by the company |  |

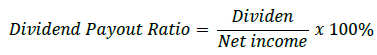

| Dividend Policy (DPR) | Shows the percentage of net profit paid out as cash dividends |  |

Sample

The population used in this study are manufacturing companies listed on the Indonesia Stock Exchange (IDX) during the 2014-2019 period. Used purposive sampling method to select the sample, which is a method of determining the sample selected according to predetermined criteria, taking into account things that are in accordance with the research objectives so that the sample obtained is representative in Table 2.

| Table 2 Sample Selection |

|

|---|---|

| Sample Criteria | Number of Companies |

| Manufacturing companies that have gone public and are listed consecutively on the Indonesia Stock Exchange (IDX) for the 2014-2019 period | 135 |

| Manufacturing companies that did not issue financial reports for six consecutive years in the 2014-2019 period | (13) |

| Manufacturing companies that do not issue financial statements in rupiah | (30) |

| Manufacturing companies that do not provide and display the complete data and information needed by researchers regarding the variables in this study | (51) |

| Samples that have data outliers | (8) |

| Total Sample Used | 33 |

| Number of Observations (33 companies x 6 years) | 198 |

Research Methods

In this study, the approach in calculating panel data regression analysis used was the random effect model (REM). REM is an estimation of panel data using residuals that are thought to have a relationship between time and individuals. This model is assumed to have different intercepts, but the intercepts are random or stochastic. The advantage of using REM is that it can eliminate heteroscedasticity. Another name for this model is the Error Component Model (ECM) or the Generalized Least Square (GLS) technique. In addition, this study also uses moderated regression analysis (MRA). This method is used because in this study a moderator variable is used, so that the panel data regression equation for the moderator variable is to use MRA.

Results and Discussion

Descriptive Statistics

Descriptive statistics are statistics that provide a description or description of data, which is intended to describe the sample under study in accordance with how it is, without the need to conduct analysis and draw conclusions that apply to the public in Table 3.

| Table 3 Descriptive Statistics |

||||||

|---|---|---|---|---|---|---|

| Statistics | Tobin's Q | CSR | IO | MO | DER | DPR |

| mean | 1.039312 | 0.346695 | 0.617329 | 0.068735 | 1.128670 | 0.171312 |

| median | 0.900045 | 0.316456 | 0.654174 | 0.022130 | 0.894847 | 0.024152 |

| Maximum | 4.442219 | 0.645570 | 0.980011 | 0.380094 | 6.340638 | 0.840504 |

| Minimum | 0.056971 | 0.113924 | 0.019475 | 0.000030 | 0.040291 | 0.000000 |

| Std. Dev. | 0.695618 | 0.150281 | 0.224877 | 0.098435 | 1.066309 | 0.213956 |

| Observations | 198 | 198 | 198 | 198 | 198 | 198 |

Multicollinearity Test

The multicollinearity test aims to see whether in the regression model there is a correlation or relationship between independent variables. If there is no correlation or relationship between the independent variables, it can be said that the regression model is good in Table 4.

| Table 4 Multicollinearity Test |

|||||

|---|---|---|---|---|---|

| Correlation (Probability) |

CSR | IO | MO | DER | DPR |

| CSR | 1,000 | ||||

| ----- | |||||

| IO | -0.147 | 1,000 | |||

| (0.039) ** | ----- | ||||

| MO | -0.111 | -0.448 | 1,000 | ||

| (0.120) | (0.000) *** | ----- | |||

| DER | -0.024 | 0.026 | -0.164 | 1,000 | |

| (0.738) | (0.714) | (0.021) ** | ----- | ||

| DPR | 0.188 | 0.084 | -0.170 | -0.085 | 1,000 |

| (0.008) *** | (0.239) | (0.017) ** | (0.232) | ----- | |

| **: significant at <0.05 (5%) ***: significant at value < 0.01 (1%) |

|||||

The Table 4 above shows the results of the multicollinearity test for this research variable. If between variables there is a correlation coefficient value of more than 0.8, then the independent variable has multicollinearity. From these results, there is no correlation coefficient value between variables that is more than 0.8. So it can be said there is no correlation between the independent variables used in this study.

Regression Results

The effect of corporate social responsibility on firm value

Based on Table 5, it is known that in model 2 the CSR coefficient value is 3.124 with a CSR probability value of 0.077 (significant at 10%), which means that CSR has a significant positive effect on firm value. This can happen because CSR is used as a useful corporate strategy to provide a good corporate image, which not only focuses on profit aspects but also environmental and social aspects to external parties. Companies can maximize shareholder capital, company reputation, and long-term viability of the company by implementing CSR. The results of this study are in line with research by (Dianawati & Fuadati, 2016; Dewi & Sanica, 2019).

| Table 5 Regression Results |

||||

|---|---|---|---|---|

| Variable | [Model 1] [BRAKE] |

[Model 2] [BRAKE] |

[Model 3] [BRAKE] |

[Models 4] [BRAKE] |

| Intercept | 0.668 | -0.277 | 0.562 | -0.063 |

| (0.106) | (0.680) | (0.156) | (0.923) | |

| CSR | 0.964 | 3,124 | 1.067 | 2,552 |

| (0.405) | (0.077)* | (0.339) | (0.140) | |

| IO | - | 1,124 | - | 0.756 |

| - | (0.084)* | - | (0.233) | |

| CSR*IO | - | -2.401 | - | -1,690 |

| - | (0.137) | - | (0.285) | |

| MO | - | - | 3,621 | 5,336 |

| - | - | (0.0004) *** | (0.001) *** | |

| CSR*MO | - | - | -13,809 | -13,204 |

| - | - | (0.0048) *** | (0.009) *** | |

| DER | 0.004 | 0.007 | 0.008 | 0.009 |

| (0.923) | (0.859) | (0.828) | (0.818) | |

| DPR | 0.192 | 0.194 | 0.114 | 0.118 |

| (0.294) | (0.289) | (0.520) | (0.505) | |

| Adjusted R-Squared | 0.696 | 0.829 | 0.842 | 0.841 |

| Prob (F-Statistics) | 0.000 | 0.000 | 0.000 | 0.000 |

| Observation | 198 | 198 | 198 | 198 |

| *, *** signify significant at the 10% and 1% levels Source: Data processed by researchers using Eviews 10 |

||||

However, in other models, CSR has no significant effect on firm value. This may be due to the low CSR disclosure in the company's annual report when viewed from the results of descriptive statistics which show the average CSR disclosure in the financial statements is only 0.3467 or about 27 items disclosed from the 79 indicators. Putri et al. (2016) and Kusuma & Juniarti (2016) stated that investors are only oriented to short-term profits, while CSR is more oriented to long-term performance.

The results of this study are in line with research by Fiona (2017), Dewi & Sanica (2019), and Karina & Setiadi (2020) that corporate social responsibility has a significant influence on firm value. This means that the hypothesis (H1) which states that CSR has a positive and significant influence on firm value can be fulfilled.

Institutional ownership moderates the effect of corporate social responsibility on firm value

Based on table 5, It is noted that the institutional ownership variable cannot moderate the impact of corporate social responsibility on the company value in both model 2 and model 4. This can happen because companies with institutional ownership do not necessarily receive strict and professional supervision of the implementation of CSR from the owner's institution so that institutional ownership cannot moderate the relationship between CSR and the value of the company.

The results of this study are in line with research conducted by Fiona (2017) and Suryonugroho (2016) which shows that institutional ownership cannot moderate the relationship between corporate social responsibility and firm value. Institutional investors tend to compromise or side with management and ignore the interests of corporate social responsibility and tend to focus on profits that will increase their wealth. This means that the hypothesis (H2) which states that institutional ownership can moderate the relationship between CSR and firm value is rejected or cannot be fulfilled.

Managerial ownership moderates the effect of corporate social responsibility on firm value

Based on table 5, it can be seen that the moderating variable CSR*MO has a probability value of 0.0048 and 0.009 in model 3 and model 4, which indicates that this variable has a significant effect. With this it can be concluded that managerial ownership can moderate the effect of CSR on firm value. This shows that the higher the level of interaction between managerial ownership and CSR, the higher the firm value. Companies with high management share ownership will encourage the implementation of corporate social responsibility more optimally, so that the value of the company will increase.

Research which states that managerial ownership can moderate the relationship between corporate social responsibility and firm value is in line with research conducted by Fiona (2017) and Widyaningsih (2018) which states that managerial ownership encourages companies to increase CSR activities so as to increase firm value. So it can be concluded that the hypothesis (H3) in this study is accepted, with the result that managerial ownership is able to moderate the relationship between CSR and firm value.

Conclusion

The purpose of this study was to determine the effect of corporate social responsibility on firm value and the effect of institutional ownership and institutional ownership in moderating the relationship. Corporate social responsibility generally does not have a significant effect on firm value. Institutional ownership generally cannot moderate the effect of CSR on firm value. Companies with institutional ownership do not necessarily receive strict and professional supervision by the owner's institution in order to increase the value of the company. Managerial ownership can moderate the relationship of CSR to firm value. Companies with high management share ownership will encourage the implementation of corporate social responsibility more optimally, so that the value of the company will increase.

Further research can use the dependent variable with other proxies such as price earning ratio (PER) and price to book value (PBV). The results obtained are more varied. In addition, further research can add other independent variables that strengthen or weaken firm value such as firm size. Finally, further research can expand the research sample, not only in the manufacturing sector but also in other sectors such as the financial sector.

References

Damayanti, T.I.N., & Suartana, I.W. (2014). The Effect of Managerial Ownership and Institutional Ownership on Firm Value. E-Journal of Accounting, 9(3), 575-590.

Shin, K. (2015). Corporate Social Responsibility. Springerbriefs In Business, 1-21.

Widyaningsih, D. (2018). Managerial ownership, institutional ownership, independent commissioners, and audit committee on firm value with CSR disclosure as the moderating variable and firm size as the control variable. Accounting and Tax Journal, 19(1), 38-52.

Karina, D.R.M., & Setiadi, I. (2020). The effect of CSR on firm value with GCG as moderating. Journal of Accounting Research Mercu Buana, 6(1), 37-49.