Research Article: 2019 Vol: 23 Issue: 5

The Impact of Cost Stickiness on Audit Pricing

Jin Ho Kim, Sungkyunkwan University

Abstract

This study investigates the impact of the cost stickiness on audit pricing. The author finds that the company’s asymmetric cost behavior, cost stickiness, is one of the important determinants of the audit pricing. The test results exhibit that firm’s cost stickiness driven by empire building incentives is positively associated with the audit fees, and it has an incremental effect on the audit fees compared to “Future Expectation” group. It implicates that auditors recognize cost stickiness as audit risk, but they price cost stickiness discriminately according to the motives.

Keywords

Cost Stickiness, Audit Pricing, Cost Behavior

Introduction

Agency problem has been an important topic of audit researches. According to PCAOB Auditing Standards, when auditors assess of company’s audit risk, they should understand management's philosophy, operating style, and company environments. Because managers can affect financial reporting and internal control over the firm.

The purpose of this paper is to investigate whether agency problem proxied by firm’s asymmetric behavior, cost stickiness, has an impact on the audit pricing. It is hypothesized that audit pricing is determined by agency theory and a set of other factors identified in prior literature. If agency problem proxied by cost stickiness helps to explain audit pricing after controlling for well-known factors identified in previous literature, it can be said to be one of the determinants of audit pricing.

Prior literature has researched agency problem in the audit pricing (Gul & Tsui, 2001; 1998; Nikkinen & Sahlström, 2004). As previous researches noted that managers have a vital role in financial reporting and the firm’s business risk. For the reason, many researchers have focused on the agency problem. In this paper, the author suggests that asymmetric cost behavior as a proxy for agency problem, and conjectures that it has a positive relation with audit fees.

PCAOB Auditing Standards noted that as part of obtaining an understanding of the company, it examples an analyst report. Interestingly, its accuracy and coverage are related to cost stickiness. Weiss (2010) shows that firms with stickier cost behavior have less accurate analysts' earnings forecasts than firms with less sticky cost behavior, and it affects analyst coverage. The inaccuracy of analyst forecasts and its smaller coverage would affect auditor perceptions. Because auditors should spend more time to assess the client’s risk compared to firms with less stickier cost behavior due to relatively small and inaccurate information. In addition, Jung (2015) exhibits that cost stickiness driven by the agency problem is positively associated with discretionary revenue. The underlying notion of this paper is managers may attempt to conceal the inefficiency by managing earnings through discretionary revenues. If Sticky cost behavior driven by the agency problem increases discretionary revenues, it also affects auditor’s risk assessment procedure. Therefore, auditors could regard cost stickiness as higher audit risk. For those reasons, there is a possibility that cost stickiness driven by the agency problem is positively associated with audit fees.

The author investigates whether the cost stickiness driven by agency problem, “Empire Building”, can be a determinant of audit fees. If auditors identify the motivations for the cost stickiness, they will probably respond differently. Usually, the cost stickiness is induced by two incentives, the one is the manager’s bright view of future expectation, the other one is private incentives, “Empire Building”. The former one is based on rational judgment by managers, even if the firm’s profits are small, they do not cut costs in preparation for a better economy in the future. In this case, if the manager’s judgment is rational, auditors do not consider it as an audit risk. However, the latter case is different. “Empire Building” incentives can be an audit risk, and it will affect auditor perceptions. For these reasons, the author conjectures that there is a positive relation between cost stickiness driven by agency problem and the audit fees.

To identify the incentive of cost stickiness, the author employs the measure of growth opportunity, market to book ratio (Barclay, Smith, & Watts, 1995; Bevan & Danbolt, 2002; 2004; Booth, Aivazian, Demirguc Kunt, & Maksimovic, 2001; Rajan & Zingales, 1995) and sales growth (Kakani, 1999; Wald, 1999). Although the firm has a low growth opportunity and it does not cut the costs, which is more common in the “Empire Building” incentives. In this case, auditors could consider it as an audit risk compared to cost stickiness driven by the manager’s rational judgment in preparation for a better economy in the future.

The sample consists of firms from COMPUSTAT and AUDIT ANALYTICS. The sample period starts in 1999 due to the limitation of audit data and ends in 2016. Following prior literature, financial service companies are excluded.

Firm specific cost stickiness is measured by Weiss(2010). This paper deals only with the cost stickiness, not the anti-sticky case, so positive values are deleted from the sample. After deleting the positive values, it converted to absolute values for easier interpreting. To distinguish the motivations of cost stickiness, the author employs the growth opportunity such as market to book ratio (Barclay et al., 1995; Bevan & Danbolt, 2002; 2004; Booth et al., 2001; Rajan & Zingales, 1995) and sales growth (Kakani, 1999; Wald, 1999). Assuming that if the firm has a low growth opportunity, it has a higher possibility that its cost stickiness is based on the agency problem. Because high growth opportunity is essential if the cost stickiness is to prepare for the future business in a better economy.

At first, the author makes the indicator variable using the industry median value of market to book ratio which takes 1 if the firm’s market to book ratio is lower than the industry median and 0 otherwise. The first test is conducted using the total sample with an interaction term between stickiness and an indicator variable of growth opportunity. In the second test, the author separates the sample into two groups using a growth opportunity indicator variable.

The author finds that cost stickiness driven by “Empire Building” incentives is positively associated with audit fees, and it has an incremental impact on the audit fees. It implicates that auditors may distinguish the motivations of cost stickiness and they reflect that to the audit pricing. In the robustness check, the author finds supporting evidence, the results of the test are consistent with the previous test.

This paper contributes to the studies of cost stickiness and audit pricing. It complements the aspect of agency problems in existing audit literature. Gul & Tsui (1998, 2001) investigate whether agency theory provides a general framework explaining audit fees across accounting and economic environments. The results of Gul & Tsui (2001) show that audit fees are affected by agency costs, and Nikkinen & Sahlström (2004) confirm that a negative relationship exists between audit fees and agency costs internationally. This research also extends the cost stickiness literature, by investigating whether the auditor perceives differently according to the motive of the stickiness, the auditor considers it as a risk factor.

The rest of the paper is structured as follows: the next section discusses the prior literature and presents the research hypotheses. In this section, the author discusses several scenarios underlying the expectation of both a negative association and a positive association. After that, the author discusses the data and research methods, present the results, and provide a conclusion for the paper.

Literature Review and Hypothesis Development

Since Simunic (1980) developed an audit fee model, following audit pricing researches have adopted this framework with modifications to the independent variables in the different audit environments (Firth, 1985; Francis, 1984; Johnson et al., 1995; Palmrose, 1986; Simon et al.,1986). Early studies have focused on audit firm characteristics, such as firm size, auditor specialty, market share, and audit environments.

Francis (1984) exhibits that audit firm size is positively related to audit fees in the Australian market. Big eight audit firms have significantly higher audit prices than non-big eight firms. Firth (1985) and Simon (1986) document that company size is one of the most important factors in explaining audit fees and the complexity of audit is also an important factor to determine audit fees. Johnson (1995)’s findings imply that the Big 5 provides quality-differentiated audit services in some segments of the New Zealand audit market. Collectively, firm size, receivables, inventories, business complexity, and auditor size are well-known factors in the model. In this study, the author provides another explanation for audit pricing which is based on the asymmetric cost behavior and agency problem.

Gul & Tsui (2001) demonstrates that audit fees are closely related to agency costs, and Nikkinen & Sahls Sahlström (2004) confirm that a negative relationship exists between audit fees and agency costs internationally. In line with the previous studies (Gul & Tsui, 2001; 1998; Nikkinen & Sahlström, 2004), the author looks at the effect of agency problems proxied by cost stickiness on the audit pricing as an extension of existing research.

Generally, motivations for asymmetric cost behavior can be explained by two aspects of managerial incentives. The first one is based on the manager’s rational judgment to prepare the future in a better economy. The second one is based on the agency problem, “Empire Building”. The second one suggests that managerial opportunistic incentive induces asymmetric cost behavior, cost stickiness. Managers do not want to cut down the cost level in spite of the unfavorable situation in the company by pursuing private interests (Anderson et al., 2003; Anderson et al., 2007). In the second case, it could be perceived as an audit risk to the auditors.

According to PCAOB auditing standards, audit risk is a function of the three risk components: inherent risk, control risk, and detection risk. The higher the former two risks, the more audit efforts will be required to reduce the detection risk, and it will affect audit pricing. Especially, control risk and detection risk are closely related to the agency problem. Therefore, the premise upon that cost stickiness can capture agency problem, it could help to explain audit pricing.

A positive relation between the cost stickiness driven by managerial private incentives, “Empire Building”, and audit risk is expected for two reasons. Firstly, according to Jung (2015), there is a positive association between cost stickiness driven by the manager’s private incentives, “Empire Building” and earnings management. The underlying notion of his research is “Empire Building” managers will try to conceal the cost inefficiency by manipulating earnings. Those managers have a higher possibility of earnings management, in doing so it could increase audit risk. Healy (1985) suggests that accruals such as account receivable and inventory are vulnerable to management manipulation. Defond & Jiambalvo (1994) demonstrate that discretionary accruals and timing of sales are a measure of management manipulations of earnings. In this context, “Empire Building” managers will try to conceal their cost inefficiency by earnings management, if auditors distinguish the motivations of cost stickiness, they will perceive it as an audit risk. For the reason, the author hypothesizes that cost stickiness induced by the manager’s private incentives, “Empire Building”, is positively associated with audit risk, and it will affect audit pricing. On the other hand, if auditors notice that cost stickiness driven by rational future expectations, they do not consider it as an audit risk. Therefore, the author hypothesizes that there is no relation between cost stickiness driven by the manager’s rational judgment to prepare future business in a better economy and audit pricing.

Hypotheses

H1 The cost stickiness is positively related to the audit fees in the “Empire Building” group.

H2 The cost stickiness is not related to the audit fees in the “Future Expectation” group.

Research Design and Sample Selection

Sample Selection

The sample is taken from the Compustat and Audit Analytics. It includes all firms in the industrial field, and the period is 1999 to 2016. After the dropping of missing values, 23,877 firm years are included.

Research Design

To distinguish the motivations of cost stickiness, the sample set is separated into two groups by growth opportunity. Following the studies (Gul & Tsui, 2001; 1998), market to book ratio is used for estimating growth opportunities. Specifically, the sample is decomposed by the median value of the MTB (yearly industry median). If the firm’s MTB is lower than the industry median, the author assumes that a firm’s stickiness is from the manager’s private incentives not preparing the future business. Cost stickiness is measured by the method of Weiss (2010).

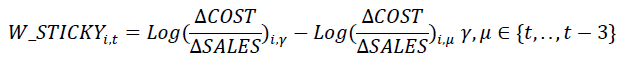

where gamma is the most recent of the last four quarters with a decrease in sales and mu is the most recent of the last four quarters with an increase in sales, SALEi,t = SALEi,t- SALEi,t-1 (Compustat #2), COSTi,t = (SALEi,t - EARNINGSi,t) - (SALEi,t-1 - EARNINGSi,t-1), and earnings is income before extraordinary items (Compustat #8). Weiss (2010) defines the difference between the cost increase rate in the most recent quarter of the increase in sales and the cost decrease rate in the most recent quarter of decline in sales directly at the individual firm level, which is defined as cost stickiness. If costs are sticky, the suggested measure has a negative value. A lower value of sticky means more sticky cost behavior. The positive (anti sticky case) values are excluded from the sample. For easier interpretation, absolute values are used in the tests.

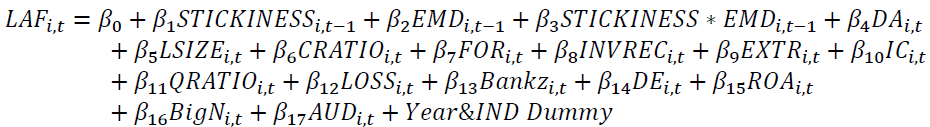

Model 1:

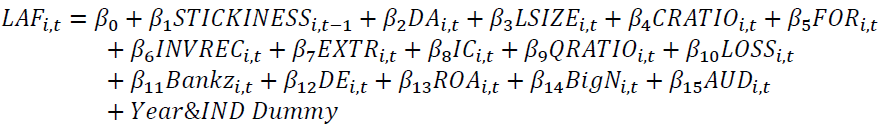

Model 2:

Where:

LAF : Logarithm of audit fees;

STICKINESS : Stickiness is estimated by Weiss(2010) stickiness. The positive(anti sticky case) values are excluded from the sample. After deleting the positive values, I converted negative values to positive values for easier interpreting. A higher value means higher stickiness;

EMD: If the firm’s MTB is under industry median, then 1 and 0 otherwise;

STICKINESS*EMD: Interaction of stickiness and growth opportunity;

DA : Absolute value of discretionary accruals measured by modified Jones 1991 (Dechow et al., 1995);

LSIZE : Logarithm of total assets;

CRATIO: Ratio of current assets to total assets;

FOR: Percentage of total assets held in foreign countries.

INVREC: Total inventories plus total receivables divided by total assets;

EXTR : If the firm has extraordinary items, then 1 and 0 otherwise;

IC : Material Weakness exists(auopic=2), then 1 and 0 otherwise;

QRATIO: Ratio of quick assets to current liabilities;

LOSS : Negative income, then 1 and 0 otherwise;

Bankz: Bankruptcy risk of Zmijewski (1984), -4.803-3.599*(ni/at)+5.406*(lt/at)-0.1*(act/lct);

DE: Ratio of long-term debt to average assets;

ROA: Ratio of income before extraordinary item to average total assets;

BigN : Compustat code au, if au=4 to 7, then 1 and 0 otherwise;

AUD: If the auditor is changed, then 1 and 0 otherwise.

LAF is the natural log of audit fees. STICKINESS is the cost stickiness proxied by Weiss (2010). The positive (anti sticky case) values are excluded from the sample. After deleting the positive values, the author converted negative values to positive values for easier interpreting. A higher value means higher stickiness. EMD is the indicator variable, if the firm’s market to book ratio is under yearly industry median, then 1 and 0 otherwise. Variable of interest is the following interaction term, STICKINESS*EMD. In the “Empire Building” group, the positive relation between audit fees and cost stickiness is expected. Although the firm’s growth opportunity is low, maintaining or not cutting down the cost is sufficient to assume that the manager pursues private interests. If the auditors recognize the motivation of cost stickiness, they will perceive it differently. Therefore, that relation will disappear or weaken in the “Future Expectation” group. Because its cost inefficiency has a certain reason for preparing the future business. The coefficient for the absolute value of discretionary accrual is expected to be positive (Gul et al., 2003). Log of total assets (LSIZE) is used as a proxy for auditee size. As Simunic (1980) document that auditor lawsuits frequently involve a problem with asset valuation. Therefore, the coefficient for Size is predicted to be positive. The complexity of audit is measured by CRATIO, FOR, INVREC and EXTR (Seetharaman et al., 2002; Simunic, 1980). The auditor’s effort should increase with increasing complexity, so all of the complexity variables will be positive. Financially distressed firms are often involved with auditor litigation (Palmrose, 1997). The following five variables are intended to control the financial condition. The ratio of quick assets to current liabilities (QRATIO), the presence of a loss(LOSS), bankruptcy score (Bankz), long term debt to total assets (DE), and the return on assets (ROA). The coefficient of QRATIO and ROA should be negative, conversely, the others’ coefficients should be positive.

The impact of auditor size (BigN) on audit fees has been mixed in the prior literature (Francis & Stokes, 1986; Gul, 1999; Palmrose, 1986), the author does not expect its sign of coefficients.

Empiricial Analysis

Table 1 shows descriptive statistics for the variable used in the tests. All variables have 23,877 observations. The mean value of LAF is 12.633 in the “Empire Building” group. “Future Expectation” group has a 13.866 mean value. The discretionary accrual’s mean value of “Empire Building” is larger than the “Future Expectation” group’s, conversely, its firm size is smaller in the “Empire Building” group. Notably, LOSS, Bankz, DE, and AUD are lager in the suspected group, “Empire Building”. It means that “Empire Building” group is financially distressed, and they change the auditor frequently.

| Table 1 Descriptive Statistic | ||||||

| “Empire Building” group (n=11,451) | “Future Expectation” group (n=12,426) | Difference in | ||||

| Variables | Mean | Median | Mean | Median | Mean | Medians |

| LAF | 12.633 | 12.567 | 13.866 | 13.942 | -1.233*** | -1.375*** |

| Stickiness | 0.945 | 0.524 | 0.901 | 0.493 | 0.044*** | 0.031*** |

| DA | 0.684 | 0.117 | 0.454 | 0.095 | 0.23*** | 0.022*** |

| LSIZE | 4.587 | 4.71 | 6.811 | 6.99 | -2.224*** | -2.28*** |

| CRATIO | 0.537 | 0.555 | 0.461 | 0.45 | 0.076*** | 0.105*** |

| FOR | 0.071 | 0 | 0.071 | 0 | 0 | 0*** |

| INVREC | 0.325 | 0.304 | 0.242 | 0.219 | 0.083*** | 0.085*** |

| EXTR | 0.012 | 0 | 0.014 | 0 | -0.002 | 0 |

| IC | 0.032 | 0 | 0.029 | 0 | 0.003 | 0 |

| QRATIO | 2.115 | 1.285 | 2.076 | 1.328 | 0.039 | -0.043*** |

| LOSS | 0.446 | 0 | 0.281 | 0 | 0.165*** | 0*** |

| Bankz | 9.096 | -2.251 | -2.31 | -2.159 | 11.406*** | -0.092** |

| DE | 0.21 | 0.074 | 0.188 | 0.164 | 0.022** | -0.09*** |

| ROA | -0.316 | 0.011 | 0.027 | 0.042 | -0.343*** | -0.031*** |

| BigN | 0.526 | 1 | 0.823 | 1 | -0.297*** | 0*** |

| AUD | 0.101 | 0 | 0.059 | 0 | 0.042*** | 0*** |

Table 2 provides a correlation matrix for the variables. Consistent with the preceding literature, the correlation coefficients of most control variables are significant in the expected sign.

| Table 2 Pairwise Pearsons Correlation | ||||||||||||||||

| a | b | c | d | e | f | g | h | i | j | k | l | m | n | o | p | |

| a | 1.00 | |||||||||||||||

| b | -0.08*** | 1.00 | ||||||||||||||

| c | -0.06*** | 0.02*** | 1.00 | |||||||||||||

| d | 0.87*** | -0.13*** | -0.11*** | 1.00 | ||||||||||||

| e | -0.28*** | -0.01 | 0.04*** | -0.43*** | 1.00 | |||||||||||

| f | 0.10*** | -0.01 | 0.00 | 0.08*** | 0.00 | 1.00 | ||||||||||

| g | -0.17*** | -0.15*** | -0.02** | -0.24*** | 0.61*** | 0.01 | 1.00 | |||||||||

| h | 0.00 | 0.01 | -0.01 | 0.02*** | -0.03*** | -0.02*** | -0.01 | 1.00 | ||||||||

| i | 0.11*** | 0.01 | -0.00 | 0.03*** | 0.00 | 0.01* | 0.00 | -0.00 | 1.00 | |||||||

| j | -0.12*** | 0.05*** | 0.01 | -0.10*** | 0.21*** | 0.00 | -0.12*** | -0.02*** | -0.01* | 1.00 | ||||||

| k | -0.26*** | 0.20*** | 0.05*** | -0.38*** | 0.13*** | -0.03*** | -0.01* | -0.00 | 0.04*** | 0.03*** | 1.00 | |||||

| l | -0.06*** | 0.01* | 0.30*** | -0.11*** | 0.01** | -0.00 | -0.02*** | -0.00 | -0.00 | -0.02*** | 0.03*** | 1.00 | ||||

| m | 0.02*** | 0.03*** | 0.02*** | 0.00 | -0.10*** | -0.01 | -0.06*** | 0.01 | -0.00 | -0.05*** | 0.03*** | 0.22*** | 1.00 | |||

| n | 0.07*** | -0.03*** | -0.20*** | 0.12*** | -0.02*** | 0.01 | -0.00 | 0.00 | 0.00 | 0.02*** | -0.10*** | -0.19*** | -0.07*** | 1.00 | ||

| o | 0.55*** | -0.07*** | -0.06*** | 0.58*** | -0.20*** | -0.03*** | -0.17*** | 0.01 | 0.02*** | -0.04*** | -0.21*** | -0.04*** | 0.01 | 0.07*** | 1.00 | |

| p | -0.12*** | 0.03*** | -0.01 | -0.11*** | 0.04*** | -0.02** | 0.04*** | 0.01 | 0.03*** | -0.00 | 0.06*** | -0.01 | -0.01* | -0.00 | -0.14*** | 1.00 |

a:LAF b:STICKINESS c:DA d:LSIZE e:CRATIO f:FOR g:INVREC h:EXTR i:IC j:QRATIO k:Loss l:Bankz m:DE n:ROA o:BigN p:AUD

Table 3 presents the results of the main test for the relation between cost stickiness and audit fees. Consistent with prior studies, the coefficients of most variables are significant in the expected direction. Column (1) reports the test results of model 1. Cost stickiness is positively related to audit pricing, but insignificant. However, the interaction of stickiness and empire building indicator’s coefficient is positive and significant. It implicates that cost stickiness driven by agency problems could affect audit pricing. The author assumes that managers try to conceal her/his firm’s cost inefficiency by earnings management in the "Empire Building" group, in doing so it could affect audit pricing. The author admits that it is difficult to distinguish the motivation of cost stickiness. It occurs mainly for two reasons, managerial private incentives and preparing for the future business in a better economy. The idea of using growth opportunity to distinguish the motivation is based on that point. If the firm has a low growth opportunity, there is a lower possibility that cost stickiness is from the manager’s rational judgment of preparing a future business. The author assumes that if the firm exhibits sticky cost despite the low growth opportunity of the firm, it is due to its pursuit of private profits. In this context, the predicted sign of interaction term is positive, and the test result supports the hypothesis 1. From the column (4) to column (9), it reports the test results of the models with cost stickiness using COGS and XSGA respectively. It also supports hypothesis 1. The coefficient of the absolute value of discretionary accruals is positive but insignificant in the column (1). The rest of the results, column (2) to column (9), are also insignificant. One of the well-known factors, size is positively associated with audit fees in all columns corresponding with prior studies (Simunic, 1980). The variables that complexity of audit such as CRATIO, FOR, INVREC and EXTR(Seetharaman et al., 2002; Simunic, 1980), are positively and significantly associated with audit fees as previous studies in the almost columns. In line with the (Palmrose, 1997), proxies for financial conditions such as QRATIO, LOSS, Bankz, DE, and ROA have predicted directions in the almost columns. It implicates that auditors charge higher audit fees to financially distressed firms. In this study, auditor size (BigN) is positively related to audit fees. That is, large audit firms charge higher audit fees because they reflect their greater expertise, skills, and seniority. Interestingly, the coefficient of AUD is different between column (2) and (3). In the “Empire Building” group, AUD is positively associated with audit fees, conversely, it is negative in the “Future Expectation” group. A possible scenario is “Empire Building” group is financially distressed (Table 1), so auditors charge higher audit fees when they engage in the audit contract. In addition, it could be interpreted that the “Empire Building” group tries to opinion shopping in the market, to conceal their inefficiency or internal control weaknesses.

| Table 3 Results of Regression Model 1 | ||||||||||

| Sticky-COST | Sticky-COGS | Sticky-XSGA | ||||||||

| Pred. | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

| sign | LAF Full sample |

LAF E-group |

LAF F-group |

LAF Full sample |

LAF E-group |

LAF F-group |

LAF Full sample |

LAF E-group |

LAF F-group |

|

| STICKINESS | ? | 0.006 | 0.026*** | 0.013*** | -0.019 | 0.017 | -0.010 | -0.025** | 0.003 | -0.027** |

| (1.18) | (5.99) | (2.70) | (-1.55) | (1.51) | (-0.86) | (-2.13) | (0.23) | (-2.34) | ||

| EMD | ? | -0.095*** | -0.092*** | -0.186*** | ||||||

| (-8.60) | (-4.44) | (-5.42) | ||||||||

| STICKINESS*EMD | + | 0.031*** | 0.046*** | 0.036** | ||||||

| (4.58) | (2.78) | (2.02) | ||||||||

| DA | + | 0.002 | 0.000 | 0.000 | -0.001 | 0.001 | -0.007 | -0.008 | -0.010 | -0.008 |

| (1.58) | (0.11) | (0.09) | (-0.14) | (0.40) | (-1.20) | (-1.17) | (-0.82) | (-1.00) | ||

| LSIZE | + | 0.522*** | 0.482*** | 0.555*** | 0.549*** | 0.500*** | 0.583*** | 0.556*** | 0.526*** | 0.564*** |

| (164.01) | (101.23) | (142.60) | (97.28) | (58.78) | (76.34) | (70.97) | (39.53) | (55.24) | ||

| CRATIO | + | 0.289*** | 0.380*** | 0.295*** | 0.426*** | 0.473*** | 0.372*** | 0.620*** | 0.459*** | 0.778*** |

| (4.81) | (8.56) | (6.76) | (4.99) | (5.96) | (3.86) | (6.59) | (3.49) | (5.83) | ||

| FOR | + | 0.011 | -0.027* | 0.072*** | 0.000 | -0.026 | 0.049* | -0.012 | -0.086** | 0.070** |

| (0.96) | (-1.68) | (4.65) | (0.02) | (-0.92) | (1.77) | (-0.40) | (-1.97) | (2.41) | ||

| INVREC | + | 0.223*** | -0.052 | 0.382*** | 0.136 | -0.180** | 0.338*** | -0.055 | -0.072 | -0.100 |

| (3.33) | (-1.07) | (6.68) | (1.40) | (-2.03) | (2.93) | (-0.58) | (-0.56) | (-0.70) | ||

| EXTR | + | 0.177*** | 0.216*** | 0.153*** | 0.202*** | 0.356*** | -0.002 | 0.595*** | 0.503** | 0.609*** |

| (4.88) | (3.94) | (3.23) | (2.73) | (3.45) | (-0.03) | (4.53) | (2.43) | (2.92) | ||

| IC | + | 0.458*** | 0.520*** | 0.388*** | 0.422*** | 0.465*** | 0.371*** | 0.414*** | 0.531*** | 0.305*** |

| (17.97) | (14.14) | (11.07) | (7.64) | (6.08) | (4.57) | (5.35) | (5.02) | (2.87) | ||

| QRATIO | - | -0.016** | -0.029*** | 0.004 | -0.022** | -0.036*** | 0.012** | -0.036*** | -0.021*** | -0.023* |

| (-2.37) | (-8.81) | (1.06) | (-2.21) | (-7.11) | (2.29) | (-4.59) | (-2.74) | (-1.84) | ||

| Loss | + | 0.236*** | 0.219*** | 0.216*** | 0.237*** | 0.207*** | 0.125*** | 0.246*** | 0.234*** | 0.194*** |

| (25.36) | (18.82) | (15.28) | (13.97) | (9.87) | (4.26) | (8.59) | (6.09) | (4.33) | ||

| Bankz | + | 0.000*** | 0.000*** | 0.088*** | 0.000*** | 0.000*** | 0.138*** | 0.017** | 0.024*** | 0.106*** |

| (5.10) | (3.98) | (6.51) | (4.12) | (3.00) | (10.38) | (1.97) | (2.66) | (4.66) | ||

| DE | + | 0.033** | 0.027** | -0.298*** | 0.014** | 0.015*** | -0.555*** | 0.010 | -0.096 | -0.418*** |

| (2.06) | (2.18) | (-4.27) | (2.42) | (3.11) | (-5.88) | (0.14) | (-1.10) | (-2.76) | ||

| ROA | - | -0.008** | -0.013*** | 0.325*** | -0.026*** | -0.019*** | 0.166** | -0.034 | 0.094 | 0.115 |

| (-2.02) | (-4.47) | (6.67) | (-3.36) | (-3.09) | (2.00) | (-0.58) | (0.84) | (1.17) | ||

| BigN | ? | 0.327*** | 0.394*** | 0.224*** | 0.286*** | 0.372*** | 0.171*** | 0.254*** | 0.287*** | 0.165*** |

| (30.41) | (28.75) | (12.95) | (14.22) | (14.42) | (5.18) | (8.50) | (7.00) | (3.34) | ||

| AUD | ? | -0.006 | 0.038* | -0.049* | -0.012 | 0.008 | -0.029 | -0.010 | 0.042 | -0.094 |

| (-0.37) | (1.94) | (-1.84) | (-0.40) | (0.20) | (-0.58) | (-0.21) | (0.67) | (-1.33) | ||

| Ind & Year dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | |

| Firm & Year clustered standard errors | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | |

| Observations | 23877 | 11451 | 12426 | 6200 | 3102 | 3098 | 2816 | 1260 | 1556 | |

| Adjusted R2 | 0.849 | 0.801 | 0.847 | 0.856 | 0.806 | 0.857 | 0.865 | 0.803 | 0.855 | |

Sensitivity Tests

In this section, following prior literature, sales growth is used for the proxy for growth opportunity (Kakani, 1999; Wald, 1999) to explore the idea that cost stickiness induced by manager’s private incentives is a risk factor for auditors. In the same context, the author expects the positive relation between cost stickiness driven by private incentives and audit fees. Table 4 reports the test results of using an alternative growth opportunity variable, sales growth. As we can see in Table 4, the test results are consistent with previous tests using market to book ratio as a growth opportunity in the column (1) to (3). The significance level of the interaction term is weak compared to the previous test(significance at the 5% level), but still, the direction is positive and significant. However, the rest of the test results, column (4) and column (7) lost its significance. The test results partially support hypothesis 1 in the Sticky-COST column.

| Table 4 Results of Regression Model 2 | ||||||||||

| Sticky-COST | Sticky-COGS | Sticky-XSGA | ||||||||

| Pred. | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

| sign | LAF Full sample |

LAF E-group |

LAF F-group |

LAF Full sample |

LAF E-group |

LAF F-group |

LAF Full sample |

LAF E-group |

LAF F-group |

|

| STICKINESS | ? | 0.013*** | 0.030*** | 0.012** | 0.002 | -0.004 | 0.007 | -0.018* | 0.003 | -0.020 |

| (2.67) | (6.83) | (2.38) | (0.15) | (-0.35) | (0.52) | (-1.70) | (0.21) | (-1.60) | ||

| EMD | ? | 0.059*** | 0.047*** | 0.058** | ||||||

| (6.37) | (2.96) | (2.37) | ||||||||

| STICKINESS*EMD | + | 0.017** | -0.004 | 0.019 | ||||||

| (2.54) | (-0.29) | (1.39) | ||||||||

| DA | + | 0.002 | 0.002 | 0.002 | -0.002 | 0.002 | -0.014** | 0.000 | -0.040*** | 0.011 |

| (1.35) | (0.92) | (0.84) | (-0.43) | (0.27) | (-2.11) | (0.02) | (-2.85) | (1.56) | ||

| LSIZE | + | 0.527*** | 0.527*** | 0.528*** | 0.558*** | 0.555*** | 0.567*** | 0.567*** | 0.581*** | 0.559*** |

| (189.51) | (137.15) | (131.67) | (111.82) | (84.74) | (74.52) | (79.77) | (61.21) | (50.30) | ||

| CRATIO | + | 0.339*** | 0.328*** | 0.425*** | 0.497*** | 0.423*** | 0.664*** | 0.700*** | 0.696*** | 0.714*** |

| (5.89) | (4.95) | (9.96) | (5.80) | (3.91) | (6.51) | (7.63) | (5.41) | (5.33) | ||

| FOR | + | 0.012 | 0.011 | 0.014 | 0.006 | -0.027 | 0.031 | -0.050* | -0.027 | -0.075** |

| (1.26) | (0.76) | (1.03) | (0.32) | (-1.04) | (1.26) | (-1.94) | (-0.69) | (-2.25) | ||

| INVREC | + | 0.194*** | 0.243*** | 0.069 | 0.124 | 0.148 | 0.081 | -0.170* | -0.170 | -0.154 |

| (3.06) | (3.38) | (1.31) | (1.27) | (1.20) | (0.70) | (-1.78) | (-1.26) | (-1.10) | ||

| EXTR | + | 0.175*** | 0.187*** | 0.157*** | 0.218*** | 0.209** | 0.228** | 0.585*** | 0.491*** | 0.676*** |

| (4.86) | (3.74) | (3.10) | (3.14) | (2.24) | (2.24) | (4.38) | (2.61) | (4.32) | ||

| IC | + | 0.445*** | 0.466*** | 0.409*** | 0.395*** | 0.424*** | 0.332*** | 0.399*** | 0.425*** | 0.362*** |

| (18.01) | (14.64) | (10.39) | (7.44) | (6.61) | (3.60) | (5.40) | (4.52) | (2.77) | ||

| QRATIO | - | -0.017** | -0.014** | -0.027*** | -0.022** | -0.019 | -0.028*** | -0.039*** | -0.033*** | -0.037*** |

| (-2.45) | (-1.97) | (-7.06) | (-2.15) | (-1.58) | (-3.12) | (-5.50) | (-4.34) | (-3.18) | ||

| Loss | + | 0.210*** | 0.195*** | 0.220*** | 0.212*** | 0.193*** | 0.176*** | 0.201*** | 0.173*** | 0.196*** |

| (22.73) | (16.66) | (15.50) | (12.41) | (8.97) | (5.41) | (7.05) | (4.82) | (4.25) | ||

| Bankz | + | 0.000*** | 0.000*** | 0.000** | 0.000*** | 0.000 | 0.001*** | 0.019** | 0.043*** | 0.019** |

| (5.19) | (4.84) | (2.26) | (4.18) | (0.97) | (4.01) | (2.20) | (4.52) | (2.39) | ||

| DE | + | 0.029** | 0.024** | 0.083*** | 0.012** | 0.016 | 0.075 | -0.087 | -0.237*** | -0.085 |

| (2.15) | (2.01) | (4.45) | (2.07) | (1.10) | (1.09) | (-1.27) | (-2.72) | (-0.90) | ||

| ROA | - | -0.008** | -0.008* | -0.007 | -0.027*** | -0.025*** | -0.215*** | -0.002 | -0.054 | 0.053 |

| (-2.06) | (-1.76) | (-0.94) | (-3.36) | (-3.22) | (-3.58) | (-0.04) | (-0.56) | (0.60) | ||

| BigN | ? | 0.308*** | 0.315*** | 0.297*** | 0.255*** | 0.253*** | 0.252*** | 0.265*** | 0.253*** | 0.283*** |

| (28.89) | (21.42) | (19.26) | (12.84) | (9.35) | (8.49) | (8.57) | (5.93) | (5.98) | ||

| AUD | ? | -0.025 | 0.015 | -0.069*** | -0.008 | 0.047 | -0.056 | -0.028 | -0.060 | 0.005 |

| (-1.59) | (0.73) | (-2.99) | (-0.27) | (1.11) | (-1.31) | (-0.63) | (-0.92) | (0.08) | ||

| Ind & Year dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | |

| Firm & Year clustered standard errors | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | |

| Observations | 27020 | 14200 | 12820 | 7135 | 3885 | 3250 | 3130 | 1605 | 1525 | |

| Adjusted R2 | 0.840 | 0.851 | 0.826 | 0.847 | 0.859 | 0.833 | 0.855 | 0.868 | 0.841 | |

Conclusion

In this study, the author explores the idea that auditors perceive cost stickiness differently depending on the motivations, and in doing so it could affect audit pricing. As prior literature finds that agency problem increases the audit risk, test results are corresponding with them. This paper contributes to the studies of cost stickiness and audit pricing. It complements to the aspect of agency problem in existing audit literature (Gul & Tsui, 2001; 1998; Nikkinen & Sahlström, 2004). This research also extends the cost stickiness literature, by investigating whether the auditor perceives cost stickiness differently depending on the motivations of the stickiness. The author finds supporting evidence that the auditor considers cost stickiness driven by the manager’s private incentives as a risk factor to audit pricing.

References

- Anderson, M.C., Banker, R.D., & Janakiraman, S.N. (2003). Are selling, general, and administrative costs "sticky"? Journal of Accounting Research, 41(1), 47-63.

- Anderson, M., Banker, R., Huang, R., & Janakiraman, S. (2007). Cost behavior and fundamental analysis of SG&A costs. Journal of Accounting, Auditing & Finance, 22(1), 1-28.

- Barclay, M.J., Smith, C.W., & Watts, R.L. (1995). The determinants of corporate leverage and dividend policies. Journal of Applied Corporate Finance, 7(4), 4-19.

- Bevan, A.A., & Danbolt, J. (2002). Capital structure and its determinants in the UK-a decompositional analysis. Applied Financial Economics, 12(3), 159-170.

- Bevan, A.A., & Danbolt, J.O. (2004). Testing for inconsistencies in the estimation of UK capital structure determinants. Applied Financial Economics, 14(1), 55-66.

- Booth, L., Aivazian, V., Demirguc Kunt, A., & Maksimovic, V. (2001). Capital structures in developing countries. The Journal of Finance, 56(1), 87-130.

- Dechow, P.M., Sloan, R.G., & Sweeney, A.P. (1995). Detecting earnings management. The Accounting Review, 193-225.

- DeFond, M.L., & Jiambalvo, J. (1994). Debt covenant violation and manipulation of accruals. Journal of Accounting and Economics, 17(1-2), 145-176.

- Firth, M. (1985). An analysis of audit fees and their determinants in New-Zealand. Auditing-a Journal of Practice & Theory, 4(2), 23-37.

- Francis, J.R. (1984). The effect of audit firm size on audit prices: A study of the Australian market. Journal of Accounting and Economics, 6(2), 133-151.

- Francis, J.R., & Stokes, D.J. (1986). Audit prices, product differentiation, and scale economies: Further evidence from the Australian market. Journal of Accounting Research, 383-393.

- Gul, F.A. (1999). Audit prices, product differentiation and economic equilibrium. Auditing: a Journal of Practice & Theory, 18(1), 90-100.

- Gul, F.A., & Tsui, J.S. (2001). Free cash flow, debt monitoring, and audit pricing: Further evidence on the role of director equity ownership. Auditing-a Journal of Practice & Theory, 20(2), 71-84.

- Gul, F.A., & Tsui, J. S. L. (1998). A test of the free cash flow and debt monitoring hypotheses: Evidence from audit pricing. Journal of Accounting and Economics, 24(2), 219-237.

- Gul, F.A., Chen, C.J., & Tsui, J.S. (2003). Discretionary accounting accruals, managers' incentives, and audit fees. Contemporary Accounting Research, 20(3), 441-464.

- Healy, P.M. (1985). The effect of bonus schemes on accounting decisions. Journal of Accounting and Economics, 7(1-3), 85-107.

- Johnson, E.N., Walker, K.B., & Westergaard, E. (1995). Supplier concentration and pricing of audit services in New Zealand. Auditing-a Journal of Practice & Theory, 14(2), 74.

- Jung, S.H. (2015). Cost stickiness and discretionary revenues. Korean Management Review, 44(4), 1183-27.

- Kakani, R.K. (1999). The determinants of capital structure an econometric analysis. Finance India, 13, 51-70.

- Nikkinen, J., & Sahlström, P. (2004). Does agency theory provide a general framework for audit pricing? International Journal of Auditing, 8(3), 253-262.

- Palmrose, Z.V. (1986). Audit fees and auditor size: Further evidence. Journal of Accounting Research, 97-110.

- Palmrose, Z.V. (1997). Who got sued? Journal of Accountancy, 183(3), 67.

- Rajan, R.G., & Zingales, L. (1995). What do we know about capital structure? Some evidence from international data. The Journal of Finance, 50(5), 1421-1460.

- Seetharaman, A., Gul, F.A., & Lynn, S.G. (2002). Litigation risk and audit fees: Evidence from UK firms cross-listed on US markets. Journal of Accounting and Economics, 33(1), 91-115.

- Simon, D., Ramanan, R., & Dugar, A. (1986). The market for audit services in India: An empirical examination. International Journal of Accounting, 21(1), 285-95.

- Simunic, D.A. (1980). The pricing of audit services: Theory and evidence. Journal of Accounting Research, 161-190.

- Wald, J.K. (1999). How firm characteristics affect capital structure: an international comparison. Journal of Financial Research, 22(2), 161-187.

- Weiss, D. (2010). Cost behavior and analysts’ earnings forecasts. The Accounting Review, 85(4), 1441-1471.

- Zmijewski, M.E. (1984). Methodological issues related to the estimation of financial distress prediction models. Journal of Accounting Research, 59-82.