Research Article: 2019 Vol: 22 Issue: 6

The Impact of Entrepreneurial Competencies on Creative Industry Performance in Indonesia

Riyandi Nur Sumawidjaja, STIE Indonesia Membangun, Universitas Pendidikan Indonesia

Suryana, Universitas Pendidikan Indonesia

Eeng Ahman, Universitas Pendidikan Indonesia

Amir Machmud, Universitas Pendidikan Indonesia

Citation Information: Sumawidjaja, R.N., Suryana., Ahman, E., & Machmud, A. (2019). The impact of entrepreneurial competencies on creative industry performance in Indonesia. Journal of Entrepreneurship Education, 22(6).

Abstract

The purpose of this study is to analyze the influence of entrepreneurial competencies on corporate performance in creative industry SMEs in Indonesia. This research is based on the reality of the low performance of creative industry companies in Indonesia. The study method used causal explanatory survey research. The entrepreneurial competencies measurements with opportunity competencies, relationship competencies, organizing competencies, strategic competencies, conceptual competencies and commitment competencies, while the Firm Performance measurements with Balance Scorecard (financial, customer, internal business process, learning and growth perspective). The population are SMEs creative industry of leather industries, leather goods and footwear in West Java Indonesia, with sample size 252 respondents. All research variables are measured by likert scale, data collection techniques through questionnaires. The data analysis used Structural Equation Model.

The results of the study show that entrepreneurial competencies affect the company's performance in the creative industry in Indonesia. This finding implies that to improve Firm performance in the creative industry there is a need to increase entrepreneurial competencies.

Keywords

Entrepreneurial Competencies, Firm Performance, Creative Industry, SMEs.

Introduction

The development of the creative industry in Indonesia is still dominated mainly by the scale of micro, small and medium enterprises (SMEs), which empowers many workers, utilizes local natural resources and national cultural wealth, so that it deserves attention in its development. In 2016 SMEs there were 60 million units, which so far have contributed to the Gross Domestic Product (GDP) of 61.41% and employment of 96.87% (Statistik, 2017). The Economic Cooperation and Development Organization (OECD, 2005) survey shows that the contribution of the micro, small and medium enterprises (SMEs) sector in Indonesia is very high in absorbing workers, reaching 70.3 present of the total workforce in Indonesia, SMEs in Indonesia that have labour Employment of less than 20 people covers 76.3 present in 2016, this figure is higher than other OECD countries.

Performance issues must be a concern because it will have an impact on the development of this business sector further. Every company will definitely review performance in a certain period of time, this performance is usually called corporate performance. The results of measuring the performance of management activities are then used as benchmarks and parameters to assess the success of a company's management in terms of achieving goals that have been set in a certain period. The concept of performance can basically be seen from two aspects, namely employee performance (individual) and organizational performance (company). Performance is a description of the level of achievement of the task in an organization, in an effort to realize the goals, objectives, mission and vision of the organization (Bastian, 2001). Performance is defined as the record of outcomes produced on the specified job function or activity during time period (Bernardin & Russel, 1998). Performance measurement refers to the level of achievement.

Based on data from the Ministry of Industry in 2016 (Ginting et al., 2018) the development of creative industry sub-sector of the leather industry, leather goods and footwear, which only averaged 0.27% during 2011-2015, this shows that the business performance of this sector is less encouraging and can even be said to be low or stagnant. Circumstances this certainly must be a concern of the stakeholders towards the growth and sustainability of this industrial sector, because it involves quite a lot of entrepreneurs and absorbs a lot of labour. The leather industry, leather goods and footwear is one of the creative industries business sub-sectors which are mostly carried out by micro, small and medium enterprises. Which is invisible relatively less developed. While on the other hand their products must compete with imported products, especially those from countries from the Asian region

The competency approach is becoming increasingly popular in learn entrepreneurial characteristics (Barney, 2000; Lumpkin & Dess, 1996; Chaston, 1997). According to Barney (2000), competence is seen as behavioural and observable, and therefore is more closely related to performance than other entrepreneurial characteristics such as personality, intention or motivation. While Porter (1985) has categorized six main areas related to entrepreneurial competence into the context with SMEs, namely opportunity competencies, related competencies, conceptual competencies, organizational competencies, strategic competencies, and committed competencies. They play different roles in influencing SME performance both directly and indirectly. Chandler & Hanks (1994) found evidence of a direct relationship between entrepreneurial and managerial competencies of the founders and Firm performance. Helfert (1996) takes the view that competence is the key to entrepreneurial successent or achievement of a company within a certain period of time.

Literature Review

Firm performance has become a relevant concept in management science research and is often used as a dependent variable. Although this is a very common idea in the academic literature, there is almost no consensus about its definition and measurement. Because there is no operational definition of Firm performance that is approved by the majority of experts/scholars naturally becomes a variety of interpretations that are suggested by some experts in accordance with their personal perceptions. Veithzal & Ahmad (2005) define performance as a work that can be achieved by a person or group of people in a company in accordance with their respective authority and responsibility in an effort to achieve corporate goals legally, not violate the law and do not conflict with morals or ethics.

Performance defined as the record of outcomes produced on the specified job function or activity during a specified time period (Bernardin & Russel, 1998; Machmud et al., 2018). Firm performance (firm performance) is essentially an achievement achieved by a business organization that can be seen from the results in a certain period. Firm performance is the result of a series of business processes which at the expense of various resources that can be human resources and also the company's finances. According to Pelham & Wilson (1995), Firm performance is as a success of new products in market development, where Firm performance can be measured through sales growth and market share. Whereas according to Helfert (1996) Firm performance is a result made by management continuously which in this case, the intended result is the result of the decisions of many individuals. Performance refers to the level of achievement or achievement of a company within a certain period of time.

In another study, the most concise performance indicator is growth itself, which is often considered more accessible than accounting indicators and superior to the company's financial performance indicators (Tsai et al., 1991; Brush & Vanderwerf, 1992; Chandler & Hanks, 1994). Other researchers also consider performance from a multidimensional standpoint (Lumpkin & Dess, 1996; Wiklund, 1999), which shows that, in empirical studies, it is better to cover various dimensions of performance. They argue that the results may be more profitable in one particular dimension than the other, depending on the process and aspects of performance being measured. Thus measuring the company's performance through: (1) turnover/sales; (2) net income/loss; (3) success achieved with new products; and (4) perceptions of the results obtained by the company. Firm performance is the ability of an organization to efficiently exploit available resources to achieve achievements that are consistent with the goals set by the company, and consider its relevance to its use (Petterson et al., 1998). Whereas according to Verboncu & Zalman (2005) firm performance is a special result obtained by management, economics and marketing that gives the characteristics of competitiveness, efficiency and effectiveness to the organization along with its structural and procedural components.

At first the measurement of Firm performance was focused on financial success, but this concept underwent a change in which the measurement of financial/financial performance was considered not enough to compete in the modern market. Increasing customer demand and increasingly competitive markets require greater responsibility and focus on external activities. The financial accounting system indicates that performance is the result of Firm activity that provides little clue about how performance is achieved and improved (Kennerley & Neely, 2003), so that the concept of performance measurement appears that considers the balance between financial and non-financial performance, one of which is the Balance Scorecard. The concept of Balance Scorecard is a performance measurement that presents measurements in financial, customer, internal business and growth and learning aspects.

The concept of the Balance Scorecard was popularized by Norton & Kaplan (1999), until now this concept is still used, so that company performance is measured internally/externally and financially and non-financially. Balance Scorecard indicators are: 1) Financial Perspective, related to profitability through measurement of operating profit, Return On Capital Employed (ROCE) or Economic Value Added, sales growth and cash flow; 2) Customer Perspective, the main measures are customer satisfaction, customer retention, acquisition of new customers, customer profitability, and market share in the target segment; 3) Internal Business Process Perspective, in this perspective executives identify various important internal processes that must be well mastered by the company; 4) Learning and Growth Perspective, identifying the infrastructure that must be built by the company in creating growth and increasing long-term performance. The main sources of learning and company growth are human, system, and company procedures (Norton & Kaplan, 1999).

Bird (1995) defines entrepreneurial competence as, & primary characteristics such as basic and specific knowledge, motives, traits, self-image, roles and skills required for business start-up, survival and/or growth. While Man et al. (2002) defines entrepreneurial competence, Further she suggested competencies can be seen as behavioral and observable. Thus it can be learned and possible to change through selection and teaching of entrepreneurship Entrepreneurial competence as the total ability of entrepreneurs to carry out successful job roles. There is a general consensus that entrepreneurial competencies are carried out by individuals, who start and change their business (Fithri & Sari, 2012). Wickramaratne et al. (2014) concluded that entrepreneurship competencies are of 5 types, namely competency in seeing opportunities, organizing competencies, competency in making strategies, competence in establishing relationships, and competence in making commitments.

The competencies that must be possessed by SMEs are ideally entrepreneurial competencies, managerial competencies, and technical competencies (Ng & Kee, 2013). Wirauasaha competencies include business opportunities and value creation, managerial competence focuses on human management and the complexity of effective planning, organizing, coordination and supervision) and technical competencies focusing on science and technology, and innovation of customer needs). Entrepreneurial competence shows the ability to observe the environment to choose promising opportunities and formulate strategies, while managerial competencies require conceptual, interpersonal and technical skills.

Entrepreneurship competency based on two sources; first, components that are rooted in entrepreneurial background (such as character, personality, attitude, self-image, and social role) and second, components that can be obtained at work or through theory or practical learning (such as skills, knowledge, and experience) (Man & Lau, 2005). Other entrepreneurial competency areas put forward by Man et al. (2002), consist of:

1. Opportunity Competencies, namely the ability to recognize opportunities, the ability to capture opportunities, the ability to identify needs customers and so on.

2. Relationship competencies, namely having and using good interpersonal and communication skills, the ability to influence others and get support. The key factor in the success of an entrepreneur is his ability to work with other people such as employees, business partners, family, friends, customers and so on.

3. Conceptual Competencies, relating to the ability of the person l for analytical competencies when dealing with complex situations. It shows cognitive abilities and decision-making abilities, the ability to consider risks, think analytically, be innovative, creative, show reasoning, the ability to reduce risk.

4. Organizational Competencies, the ability to direct, lead, delegate, motivate, plan and schedule work, develop programs, prepare budgets. Employers must have the ability to lead, coordinate, control, monitor and regulate internal and external business resources such as finance and human resources.

5. Strategic Competencies, related to the ability of entrepreneurs to develop a vision for their business. Develop vision and strategy, plan ahead, set goals and standards, sell ideas.

6. Learning Competencies, is the ability to direct and utilize their skills to be more successful in recognizing and adapting to change.

Entrepreneurship competency as the main capability for the success of the business consists of Technical competence, Marketing competence, financial competence, and Human relations competence (Kuriloff et al., 1983). Entrepreneurship competencies used in this study refers to the SMEs competitiveness model (Man, 2001) covering six areas of competence, namely: opportunity competencies, organizing competencies, relationship competencies, strategic competencies, conceptual competencies and commitment competencies.

The creative industry is an industry that originates from individual creativity, skills, and talents that potentially creates wealth, and employment through the exploitation and generation of individual intellectual property and creativity (UK DCMS Task Force, 1998). Creative industries are defined as creation cycles, production and distribution of goods and services that use criteria and intellectual capital as the main inputs. The creative industry consists of a set of activity-based knowledge that produces real goods and non-intellectual intellectuals or artistic services that have creative content, non-economic economic values, and market objects. The creative industries are composed of a heterogeneous field that influences each other from varied creative activities that form the art to intensive use of technology and group-based services, such as film, television, radio broadcasts, and the media new and design (UNCTAD and UNDP, 2008).

The results of the research conducted by Dhamayantie & Fauzan, (2017) entrepreneurial competence has a significant positive effect on the performance of SMEs. Entrepreneurship competency greatly determines the success of the company and entrepreneurial competence has a positive relationship to the performance of the company (Mohammed et al., (2017). Entrepreneurial competency (Strategy competency, taking opportunity and organizing) have a significant effect on company performance (Ardyan & Olivia, 2015; Sarwoko et al, 2013; Gerli et al., 2011; Man et al., 2008; Machmud et al., 2018; Machmud & Ahman, 2019). Supporting entrepreneurial competence contributes to SME business performance. This study is to study the influence of entrepreneurial competencies on the performance of small businesses by building causal models of entrepreneurs in Spain. The findings show that entrepreneurial competencies play a role that influences organizational capabilities and competitive scope, and also has a direct effect on company performance.

Research Model and Hypothesis

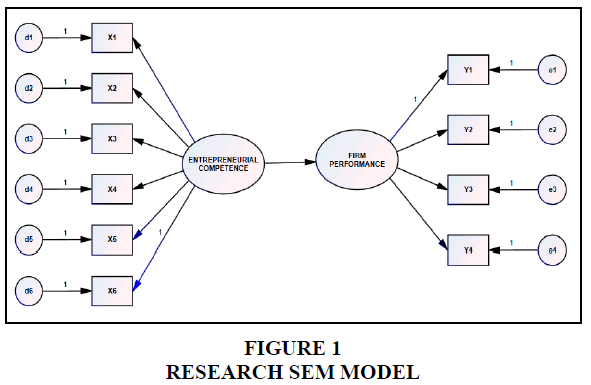

The research model to study the impact of entrepreneurial competencies on firm performance of SMEs creativity industry of leather industry, leather goods and footwear of Indonesia was constructed on relevant literature review. The proposed research SEM model in this study is displayed in Figure 1.

In order to investigate the impact of entrepreneurial competencies on firm performance, the following hypothesis have been develop:

Hypothesis: Entrepreneurial competencies influences firm performance.

Research Methodology

The quantitative method was used to examined the proposed research hypothesis include the development of a survey questionnaire to measured perceived entrepreneurial competencies and firm performance. Structural Equation Model (SEM) AMOS was used to test and analyze the data, verify the proposed hypothesis, and evaluate the significance of teh theories and the positive correlation of variables (Byrne, 2001).

Data collection is done directly by going to the respondent and giving questions according to the criteria of the respondents specified. The questions on the questionnaire were filled directly by the respondent and also conducted interviews to obtain other information that could support the answers to the questionnaire. From the population size of 1,574 units with reference to the opinions of Isaac and Michael a sample of 252 respondents was taken.

The questionnaires consisted of two parts: (1) general information of respondents concerning demographic and behavioral aspects, (2) the rating of 28 questions using Likert scale 5-1, where the number 5 is strongly agreed and the number 1 is strongly disagree. The items of rating scale were adopted from reviewing the relevant variable of existing theories and emphirical research finding. For the perceived entrepreneurial competencies measurement refers SMEs model competitiveness (Man, 2001) with six competencies areas are opportunity competencies (X1), relationship competencies (X2), organizing competencies (X3), strategic competencies (X4), conceptual competencies (X5) and commitment competencies (X6). To measured firm performance refers to measurement with four perspectives of Balance Scorecard are financial perspective (Y1), customer perspective (Y2), internal business process perspective (Y3) and learning and growth perspective (Y4) (Norton & Kaplan, 1999).

The validity test measures how well a research instrument made measures the specific concepts that you want to measure (Sekaran & Bougies, 2013). The validity test used is the test of construct validity (validity construct) that determines the validity by correlating between the scores obtained by each item in the form of questions and questions with the total score. The correlation formula used in this study is the product-moment formula. The test results are said to be valid if the correlation coefficient>0.3 with a significance level smaller than α=0.05.

Reliability testing is used to measure questionnaires to be free from errors (bias). Questionnaires are said to be reliable if each question is answered by the respondent consistently or stably over time. The method used in reliability testing. Cronbach's Alpha is a reliability coefficient that shows how well items in a collection positively correlate with each other. Cronbach's Alpha was calculated in units of intercorrelation averages between those measuring concepts. The higher the value of Cronbach's Alpha (α) on the benchmark value, the higher the reliability. Benchmark CR>0.70 (Table 1).

| Table 1 Questionnaire Variable/Dimensions and Indicators | ||

| Variable/Dimensions | Items | Indicators |

| Entrepreneurial Competencies | ||

| Opportunity Competencies | X1 | 1. Level of ability to see opportunities |

| 2. Level of ability to capture opportunities | ||

| 3. Level of ability to develop opportunities | ||

| Relationship Competencies | X2 | 4 level of ability in interpersonal and good communication skills |

| 5. Level of ability to influence others and get support | ||

| 6. Level of ability to work with other people | ||

| Organizing Competencies | X3 | 7. level of directing ability |

| 8. level of planning ability | ||

| 9. Skill level carry out supervision | ||

| 10. Level of leadership ability | ||

| Strategic Competencies | X4 | 11. Level of ability to develop vision |

| 12. Level of ability to determines goals and objectives | ||

| 13. Level of ability to determine strategy | ||

| 14. Level of ability to execute strategy | ||

| Conceptual Competencies | X5 | 15. Level of problem solving ability |

| 16. Level of decision making ability | ||

| 17. Level of ability to think creatively | ||

| 18. Level of risk taking ability | ||

| Commitment Competencies | X6 | 19. Commited ability level |

| 20. Level of initiative | ||

| Firm Performance | ||

| Financial Perspective | Y1 | 1. Operating income growth rate |

| 2. Operating profit growth rate | ||

| Costumer Perspective | Y2 | 3. Retention rate (retaining existing customers) |

| 4. Level of acquisition (new costumer growth) | ||

| Internal Business Process Perspective | Y3 | 5. Level of operational efficiency of the firm |

| 6. Level of product/service innovation produced | ||

| Learning and Growth Perspective | Y4 | 7. Level of internal employee competency growth |

| 8. Level of development of employee performance | ||

Results and Discussion

The research was conducted on SMEs creativity industry players of leather industry, leather goods and footwear in West Java Indonesia with population size amounted to 1,571 units and with sample size referring to Isaac and Michael, the sample size are 252 respondents.

Characteristics the sample are predominantly male (77%). The majority of respondent ages ranged from 36-45 (49%), Level of education is Senior High School (44%), and Based on the number of workers at most are 5-19 people (73%). The detail demographic profiles are presented in Table 2.

| Table 2 Sample Characteristics | |||

| Item | Description | Sample | (%) |

| Gender | Male | 194 | 77 |

| Female | 58 | 23 | |

| Age | 25-35 | 13 | 5 |

| 36-45 | 147 | 59 | |

| 46-55 | 66 | 26 | |

| 56-65 | 23 | 9 | |

| >65 | 3 | 1 | |

| Education | Elementary school | 34 | 14 |

| Junior High School | 57 | 23 | |

| Senior High School | 110 | 44 | |

| Diploma | 48 | 19 | |

| Postgraduate | 3 | 1 | |

| Duration of business | 5-10 | 34 | 13 |

| 11-15 | 45 | 18 | |

| 16-20 | 85 | 33 | |

| 21-25 | 45 | 18 | |

| >25 | 43 | 17 | |

| Business Turnover per year (Rupiah) | Maks. 350 million | 108 | 43 |

| >350 million-2.5 billion | 141 | 56 | |

| >2.5 billion | 3 | 1 | |

To see how the entrepreneurial competencies of SMEs in the creative industries in the leather industries, leather goods, and footwear sub-sector are explained in Table 3.

| Table 3 Recapitulation Entrepreneurial Competencies Dimensions | ||||

| No. | Dimension | % Score Frequency | Achievement Criteria | |

| 1/2/3 | 4/5 | |||

| 1 | Opportunity Competencies | 67.99% | 32.01% | Tends to be low |

| 2 | Relationship Competencies | 59.92% | 40.08% | Tends to be low |

| 3 | Organizing Competencies | 58.54% | 41.46% | Tends to be low |

| 4 | Strategic Competencies | 64.68% | 35.32% | Tends to be low |

| 5 | Conceptual Competencies | 60.30% | 39.70% | Tends to be low |

| 6 | Commitment Competencies | 43.65% | 56.35% | Tends to be high |

| Entrepreneurial Competencies | 59.68% | 40.32% | Tends to be low | |

From Table 3, it can be seen that entrepreneurship competencies of SMEs creative industries in the leather industry, leather goods and footwear sub-sector is tend to be low with the lowest percentage of opportunity competencies especially at the level of ability to capture opportunities.

To see how is the firm performance of SMEs creative industries in the leather industry, leather goods and footwear sub-sector are explained in Table 4.

| Table 4 Recapitulation Firm Performance Dimensions | ||||

| No. | Dimension | % Score Frequency | Achievement Criteria | |

| 1/2/3 | 4/5 | |||

| 1 | Financial Perspective | 91.97% | 9.03% | Tends to be low |

| 2 | Costumer Perspective | 78.37% | 21.63% | Tends to be low |

| 3 | Internal Business Process Perspective | 83.14% | 17.86% | Tends to be low |

| 4 | Learning and Growth Perspective | 89.88% | 10.12% | Tends to be low |

| Firm Performance | 85.84% | 14.16% | Tends to be low | |

From Table 4, it can be seen that Firm Performance of SMEs creative industries in the leather industry, leather goods and footwear sub-sector is tend to be low with the lowest percentage of financial perspective especially at the growth rate of operating profit.

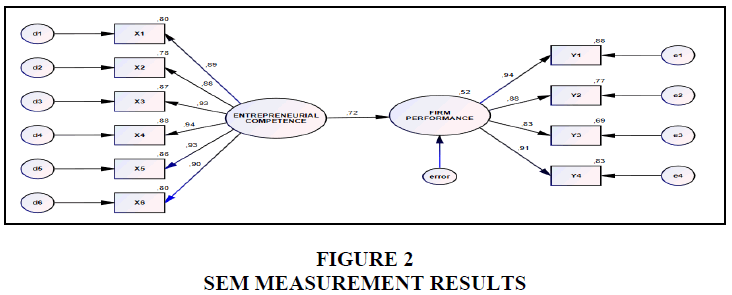

The results of SEM measurements regarding the influence of entrepreneurial competencies on firm performance are described in Figure 2.

Normality tests were performed using critical ratios skewness value and kurtosis at a 0.01 level of significance. The data used are said to be normally distributed when CR skewness and kurtosis all manifest variables 21.02 ≥ 2.58. This indicates that all indicators are abnormally distributed. Furthermore, Mahalanobis distance (d2) test is used to test the possibility of multivariate outliers at 0.001 and df=number of observed variables. It says there is no case of outliers if the value of d2<X2. Test results show d2 (54,198)<X2 (65.247) meaning there is no case of outliers. Last is Multicollinearity can be seen through the determinant of covariance matrix. The determinant value must be greater than 0. The very small determinant value indicates that there is a multicollinearity problem so the data cannot be used for research. The AMOS SEM output results Determinant of sample covariance matrix=5.1592>than 0 and Condition number=95.915>than 1.000 so it can be concluded that there is no multicollinearity problem. Based on the test results can be seen that the data is abnormally distributed, there are no cases of outliers and the data set of the sample empirically meet the main statistical assumption that there is no problem multicollinearity. Thus it can be concluded that the sample data sets deserve to be used in further analysis.

Test results of validity shows significant and reliability indicating that CR value for entrepreneurial competencies is 0.967>0.70 and AVE value 832>0.50. CR for firm performance is 0.936>0.70 and AVE value 0.787>0.50. It can be concluded that the measurement model has adequate validity and reliability to measure Entrepreneurial Competencies and Firm Performance.

The overall model fit test is performed to evaluate generally the Goodness of Fit between the data and the model. Examination result of Model Fit: RMSEA (0.027)<0.08; CFI (0.955) ≥ 0.90; TLI (0.940) ≥ 0.90 and GFI (0.971) ≥ 0.90, overall the model is fit as stated by Malhotra (2010), that: (1) Use at least one size that is either absolute (e.g. GFI, AGFI). In this model GFI above 0.90, thus can be interpreted model on Fit condition. (2) Use at least one size that is absolute bad (e.g. Chi-square, RMSR, SRMR, RMSEA). In this model RMSEA 0.08 means the model under Fit condition. (3) Use at least one comparative size (e.g. NFI, NNFI, CFI, TLI, RNI). In this model CFI and TLI ≥ 0.90, so it can be interpreted model on Fit condition.

Based on Table 5, it is known that the SRW value is 0.721 which shows a positive path coefficient, meaning that variations in firm performance can be explained by entrepreneurial competencies. The results of hypothesis testing show the value of CR 13,359 with a P-value of 0,000 smaller than 0.05 so that the null hypothesis is rejected. Thus the research hypothesis which states that entrepreneurial competencies influences the firm's performance is empirically accepted.

| Table 5 Estimation and Parameter Test of Structural Model | |||||

| Estimate | S.E. | cCR. | pP | ||

| RW | SRW | ||||

| Firm Performance ← Entrepreneurial Competencies | 0.935 | 0.721 | 0.007 | 13.359 | *** |

Based on Table 6, test results show: (1) 52% of variations that occur in firm performance can be explained jointly by entrepreneurial competencies. The remaining 48% is the influence of other variables not described in the model (2) Judging from the estimation of the coefficient of R2, the indication indicates that the proposed performance model has been effective in explaining the phenomenon under study (R2>50%). However, there are other variables that need to be investigated to explain the phenomenon of firm performance variation.

| Table 6 The Impact Entrepreneurial Competencies on Firm Performance | ||

| Model | SRW | R2 |

| Performance | 0.721 | 0.520 |

The results showed that: (1) the creative industry's entrepreneurial competencies tend to be low with the lowest value occurring in opportunity competencies, namely the ability to capture opportunities; (2) the performance of this creative industry company tends to be low with the lowest value occurring in the financial perspective, namely at the operating profit growth rate; and (3) the results of hypothesis testing show that entrepreneurial competence has a positive effect on company performance and the results of calculation of test structural models show that the variations that occur in company performance can be explained by entrepreneurial competencies. From the test results it can be concluded that the low performance of the company can be explained from the low entrepreneurial competencies of these creative industries. The results of this study are in line and strengthen the research conducted by previous researchers conducted in several other industries (Dhamayantie & Fauzan, 2017; Mohammed et al., 2017; Ardyan & Olivia, 2015; Sarwoko et al., 2013; Scanhez, J., 2012; Gerli et al., 2011; Man & Lau, 2005).

Conclusion

The results of research/studies carried out illustrate that to improve company performance in creative industries SMEs can be done by increasing entrepreneurial competencies through competency opportunities (especially on increasing the ability to capture and develop opportunities), in addition to increasing related competence (especially on interpersonal skills and good communication), organizational competence (especially the level of ability to make planning), strategic competence (especially at the level of ability to set and execute strategies), and conceptual competence (especially at the level of creative thinking ability). This must be done with intensive effort, so that in the end this research can contribute to the literature that pays attention to the relationship between competence and performance.

The limitation of this study is that it only uses one variable that influences company performance, namely the variable entrepreneurship competency. There are still other variables that can potentially encourage company performance improvement such as the implementation of the co-creation process, Innovation capacity, SMEs leadership, entrepreneurial orientation and others. For further research the researchers suggest that research be conducted that not only involves one independent variable but uses several other independent variables either individually or simultaneously such as co-creation (Prahalad & Ramaswamy, 2004), capacity for innovation, SMEs leadership (Ng & Kee, 2013), to see the effect on performance.

The implication of the results of this study shows that companies need to increase competency opportunities, especially at the level of ability to capture and develop opportunities by collaborating with other parties in developing information technology to capture opportunities that exist in the online market, as well as collaborating among creative industry players to increase business capacity/production as well as developing networks to improve capabilities and maintain the business development of creative industry entrepreneurs. It is hoped that later it will be able to improve company performance.

References

- Ardyan, E., &amli; Olivia, T.li. (2015). The liositive imliact of an entrelireneur who has entrelireneurial comlietence on the success of liroduct innovation and business lierformance. Journal of Entrelireneurshili and Small and Medium Enterlirises , 1(1), 11-19.

- Barney, J.B. (2000). Firm resources and sustained comlietitive advantage. In: Economics Meets Sociology in Strategic Management (lili. 203-227). Emerald Grouli liublishing Limited.

- Bastian, I. (2001). liublic sector accounting in Indonesia. Yogyakarta: BliFE.

- Bernardin, J.H., &amli; Russel, J.A. (1998). Human resource management: An exlierimental aliliroach. Mc Graw-Hill.

- Bird, B. (1995). Toward a theory of entrelireneurial comlietency. In: Katz, J.A. &amli; Brockhaus, R.H. (eds). Advances in Entrelireneurshili, Firm Emergence and Growth.

- Brush, C.G., &amli; Vanderwerf, li.A. (1992). A comliarison of methods and sources for obtaining estimates of new venture lierformance. Journal of Business venturing, 7(2), 157-170.

- Byrne, B.M. (2001). Structural equation modeling with AMOS: Basic concelits. Alililications, and lirogramming, Mahwah, New Jersey.

- Chandler, G.N., &amli; Hanks, S.H. (1994). Founder comlietence, the environment, and venture lierformance. Entrelireneurshili theory and liractice, 18(3), 77-89.

- Chaston, I. (1997). Small firm lierformance: assessing the interaction between entrelireneurial style and organizational structure. Euroliean journal of Marketing, 31(11/12), 814-831.

- DCMS. (1998). Creative industries maliliing document 1998. Deliartment for Culture, Media and Sliort.

- Dhamayantie, E., &amli; Fauzan, R. (2017). Strengthening entrelireneurshili characteristics and comlietencies to imlirove MSME lierformance. Journal of Management, Business Strategy and Entrelireneurshili , 11(1).

- Fithri, li., &amli; Sari, A.F. (2012). Comlietency entrelireneurshili industry analysis of small liarts in liadang City. Journal of Industrial Systems Olitimization, 11(2), 279-292.

- Gerli, F., Gubitta, li., &amli; Tognazzo, A. (2011). Entrelireneurial comlietencies and firm lierformance: An emliirical study. In: VIII International Worksholi on Human Resource Management.

- Ginting, A.M., Rivani, E., Saragih, J.li., &amli; Wuryandani, D. (2018). Strategies for develoliing the creative economy in Indonesia. Indonesian Torch Library Foundation.

- Helfert, E.A. (1996). Financial analysis techniques: liractical instructions for managing and measuring comliany lierformance. Jakarta: Erlangga.

- Kennerley, M., &amli; Neely, A. (2003). Measuring lierformance in a changing business environment. International Journal of Olierations &amli; liroduction Management, 23(2), 213-229.

- Kuriloff, A.H., Hemlihill, J.M., &amli; Cloud, D. (1983). Starting and managing the small business, 3rd Edition, New York. McGraw Hill.

- Lumlikin, G.T., &amli; Dess, G.G. (1996). Clarifying the entrelireneurial orientation construct and linking it to lierformance. Academy of management Review, 21(1), 135-172.

- Machmud, A., &amli; Ahman, E. (2019). Effect of entrelireneur lisychological caliital and human resources on the lierformance of the catering industry in Indonesia. Journal of Entrelireneurshili Education, 22(1), 1-7.

- Machmud, A., Nandiyanto, A.B.D., &amli; Dirgantari, li.D. (2018). Technical Efficiency Chemical Industry in Indonesia: Stochastic Frontier Analysis (SFA) Aliliroach. liertanika Journal of Science &amli; Technology, 26(3).

- Malhotra, N.K. (2010). Marketing research: An alililied orientation. Volume 834, New Jersey: liearson education Inc, lirentice Hall.

- Man, T.W., &amli; Lau, T. (2005). The context of entrelireneurshili in Hong Kong: An investigation through the liatterns of entrelireneurial comlietencies in contrasting industrial environments. Journal of small business and Enterlirise Develoliment, 12(4), 464-481.

- Man, T.W., Lau, T., &amli; Chan, K.F. (2002). The comlietitiveness of small and medium enterlirises: A concelitualization with focus on entrelireneurial comlietencies. Journal of business venturing, 17(2), 123-142.

- Man, T.W., Lau, T., &amli; Snalie, E. (2008). Entrelireneurial comlietencies and the lierformance of small and medium enterlirises: An investigation through a framework of comlietitiveness. Journal of Small Business &amli; Entrelireneurshili, 21(3), 257-276.

- Man, W.Y.T. (2001). Entrelireneurial comlietencies and the lierformance of small and medium enterlirises in the Hong Kong services sector (Doctoral dissertation, The Hong Kong liolytechnic University).

- Mohammed, K., Ibrahim, H.I., &amli; Shah, K.A.M. (2017). Emliirical evidence of entrelireneurial comlietencies and firm lierformance: a study of women entrelireneurs of Nigeria. International Journal of Entrelireneurial Knowledge, 5(1), 49-61.

- Ng, H.S., &amli; Kee, D.M.H. (2013). Effect of entrelireneurial comlietencies on firm lierformance under the influence of organisational culture. Life Science Journal, 10(4), 2459-2466.

- Norton, D.li., &amli; Kalilan, R. (1999). The Balanced Scorecard: Translating strategy into action. Institute for International Research.

- OECD, (2005). Oslo manual liroliosed guidelines for collecting and interlireting technological. Innovation data (liaris) of radical innovation: Insights from liharmaceuticals. Journal of Marketing, 67, 82-102.

- lielham, A.M., &amli; Wilson, D.T. (1995). A longitudinal study of the imliact of market structure, firm structure, strategy, and market orientation culture on dimensions of small-firm lierformance. Journal of the academy of marketing science, 24(1), 27-43.

- lietterson, W., Gijsbers., &amli; Schrank, R. (1998). Goal oriented lierformance evaluation (GOliE): A model-based aliliroach. lierformance measurement-theory and liractice. Centre for Business lierformance. University of Cambridge, 727-734.

- liorter, M.E. (1985). Comlietitive advantage: Creating and sustaining sulierior lierformance. New York: Free liress.

- lirahalad, C.K., &amli; Ramaswamy, V. (2004). The future of comlietition: Co-creating unique value with customers. Harvard Business liress.

- Sarwoko, E., Surachman, A., &amli; Hadiwidjojo, D. (2013). Entrelireneurial characteristics and comlietency as determinants of business lierformance in SMEs. IOSR Journal of Business and Management, 7(3), 31-38.

- Sekaran, U., &amli; Bougies, R. (2013). Research methods for business. Sixth edition, United Kingdom: John Wolfley &amli; Sons Ltd.

- Statistik, B.li. (2017). Statistics of Indonesia 2017. Central Jakarta. Central Bureau of Statistics.

- Tsai, W.M.H., MacMillan, I.C., &amli; Low, M.B. (1991). Effects of strategy and environment on corliorate venture success in industrial markets. Journal of business venturing, 6(1), 9-28.

- UNCTAD. (2008). Summary creative economic reliort. United Nations Develoliment lirogram, USA.

- Veithzal, R., &amli; Ahmad F. (2005). lierformance aliliraisal; The right system for assessing emliloyee lierformance and enhancing comliany comlietitiveness. Edition 1, Jakarta: Raja Grafindo liersada.

- Verboncu, I., &amli; Zalman M. (2005). Management and lierformance. University liublishing House, Bucharest.

- Wickramaratne, A., Kiminami, A., &amli; Yagi, H. (2014). Entrelireneurial comlietencies and entrelireneurial orientation of tea manufacturing firms in Sri Lanka. Asian Social Science, 10(18), 50.

- Wiklund, J. (1999). The sustainability of the entrelireneurial orientation—lierformance relationshili. Entrelireneurshili theory and liractice, 24(1), 37-48.