Research Article: 2021 Vol: 25 Issue: 3S

The Impact of Financial Risk on Corporate Credit Risk

Saad Sabbar Nasif, College of ARTS, Tikrit Uneversity

Ahmed Nawar Naseef, Al-Imam University College

Ibrahem Ali Kurdi, College of Administration and Economics, University Tikrit

Keywords

Special Risks, General Risks, Primary Lending Rate Risk, Risks of the Facilitation Period, Credit Risk, Information Exchange Risks

Abstract

The practical growth of the banks has meant that risk has become a concern and that the banks face a wide range of different banking risk levels and this is why managing potential risks has become critical to help banks survive and ensure their continuity on banking markets as well as where banks and banks are establishments of the nature of their businesses. In particular, the credit risk faces revenues and threats in its different forms and is one of the most significant factors in credit risk that it faces and is the product of transactions in banking, with customers, institutions and both. Advanced allows the Bank to reliably define and helps to forecast their future. Based on that, several recent and modern studies have explored frameworks for managing banking credit risk management and how investments and financial decisions are to be taken on foundations and the rules of today's structures and to maintain good monitoring and administrative processes to ensure banks are able to more clearly recognize these risks. The purpose of this report is to analyze the internal rating system used by Merkez Al-Madina Automotive Trading Company (MAATC), the entity where the curricular internship was developed. To this end, an economic-financial analysis is carried out using the financial ratios model for a client company and the explanatory variables that are used for rating the rating are analyzed. This study draws conclusions about the management of credit risk, its importance and the process that financial institutions should follow in order to reduce the probability of default on their customer portfolios.

Introduction

The current economic recession, coupled with the loss of confidence in the markets, has resulted in greater pressure on financial institutions to grant credit. On the one hand, there are social pressures to help the progressive impoverishment of a large part of the population, which has led to a greater demand for credit products. On the other hand, financial market regulators have imposed stricter policies for the allocation of financing amounts, as is the case of the Basel Accord developed by the European Union, which, among other measures, restricts the minimum capital requirements to 8% banks need to have in the form of reserves (Elsadig et al., 2014), and it obliges financial institutions to implement more stringent internal credit risk control systems. Financial institutions find themselves in a controversial situation as they intend to maximize profits and obtain greater market shares, but on the other hand they face the fear of reaching a high level of default by customers and being penalized by regulatory authorities. The external rating systems were developed by entities external to the banks and allow checking the credibility of companies, states or debt securities, being restricted to large and internationally known companies. However, the overwhelming majority of customers of financial institutions are individuals or small and medium-sized companies whose credit risk rating is not covered by external rating entities. With regard to private customers, the problem is easily overcome because the analysis of the risk profile is made in a much simpler way, making inquiries into the customer's profile and taking into account the financial information provided by the same (Hayder et al., 2020).

The main question arises regarding the granting of credit to client companies. In these cases, it is necessary to study in depth the entire reality of the company so that the bank's error is thus minimal, that is, minimizing the margin of default. In this way, a good analysis of the reality of a company is essential for financial institutions to guarantee the credits financed. Thus, internal rating systems were developed using the economic and financial analysis of companies as a basis. This analysis is usually done through the model of financial ratios that allow ascertaining the reality of the company over a period. Through financial ratios, analysts are able to compare the economic and financial situation of a company between periods, but also between competing companies or other sectors of activity, since the results obtained in the ratios are quantifiable and standardized (Azhar & Ammr, 2017).

In addition to the quantitative analysis, the internal rating systems also presuppose the analysis of qualitative factors, that is, non-financial variables that can alter the analyst's opinion. These variables include the macroeconomic and political analysis of the country in which the company operates, analysis of the company's sector of activity or analysis of the history of the company and its shareholders/managers.

To conclude, a weighting is developed, internal to each financial institution, on the qualitative and quantitative factors to assign a rating classification. Through this classification, companies are considered to be good or bad customers, and consequently the requested financing amount is or is not allocated. In this way, this final master's report aims to verify the importance of economic and financial analysis of companies for the attribution of a rating (Barik et al., 2021; Zhang et al., 2021; Hamad et al., 2021; Khalaf et al., 2020; Thivagar et al., 2020; Antony et al., 2020; Layth et al., 2018; Ibrahim et al., 2020; Hashim, 2016).

Next, the issue of credit risk management is analyzed. In this paper, the concepts of rating and scoring are mentioned and the process to be followed by credit institutions in their rating systems is systematized. Finally, the empirical study is carried out. For this, MAATC is used based on the analysis period between 2017-2019. Based on this information, a careful economic and financial analysis is made, calculating the financial ratios discussed above, and qualitative variables are evaluated and a rating score is assigned.

Literature Review

Economic-Financial and Risk Analysis of the MAATC

With the case study presented in this section, it is intended to apply in practice the themes mentioned in the literature and fit them with the tasks carried out in the internship at Commercial Bank of Iraq, Iraq. The focus of this case study is the economic and financial analysis of the target company according to the method of financial ratios and credit risk assessment with the aim of assigning a rating.

Description of the Case Study

The present case study aims to present an example of the main task carried out during the curricular internship. To this end, an assessment is made of the economic and financial situation of a MAATC client company, classifying it according to a credit rating. The name of this company is fictitious in order to ensure professional confidentiality between MAATC and its customers. The company on which the analysis is carried out is called “MAATC” and focuses its activity on the automotive sector.

This assessment is based on the internal method used by the bank to assess the risk inherent in the financing of its customers. This method is based on an economic-financial analysis based on the use of financial ratios. According to the results obtained with this analysis, a rating is assigned to the client and it is through this rating that the decision is made to assign or not the financing amounts requested by the company.

Methodology and Data

For the analysis of financing to client companies or potential clients, MAATC prepares credit reports that allow the company to be classified as having a high or low risk of default. These credit reports, as mentioned in point 2.5.2, are divided into two parts depending on the amount of financing requested by the client. When credit exposure is less than $ 150,000, MAATC uses a synthetic credit allocation model giving only relevance to the economic and financial information that the company has made available. On the other hand, when the financing amount exceeds $ 150,000, MAATC prepares credit reports using a rating assignment model (Almuaali et al., 2020).

In this case study, the company to be analyzed has a credit exposure of more than $ 150,000, so it is given a rating in order to classify it in terms of the risk of default.

The data presented throughout this case study were collected during the internship at MAATC. The information provided by the company “MAATC” used in this report is for the 2016-2019 period.

The preparation of this credit report is based on the following points:

• Collection of information provided by the company “MAATC”;

• Collection of information in the MAATC internal database about the company's credit history, if you are already a bank customer;

• Collection of information in the Merkez Al-Madina Automotive Trading Companydatabase on the responsibilities that the company has towards financial institutions;

• Collection of information provided by the MAATC on the evolution of the market, especially of the brands that are marketed by the company “MAATC”;

• Collection of information about the commercial relationship that the company “MAATC” has with MAATC;

• Qualitative analysis - analysis of the sector of activity, the positioning of the company in the sector, the history of the company and the history of its shareholders/partners;

• Economic and financial analysis for the company “MAATC” - quantitative analysis;

• Assignment of rating classification according to an internal MAATC table based on determining variables.

Presentation of the Company and the Sector

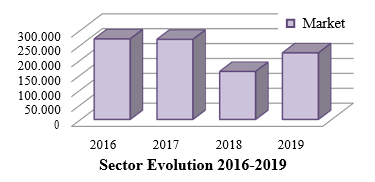

The company “MAATC” operates in the automotive distribution and repair sector, representing the brands of the Volkswagen group, both in private and commercial vehicles. Having started its activity in the 70's, it is a national reference in this sector (Almuaali ET AL., 2020). According to data provided by ACAP, the automotive sector was one of the most affected by the global financial crisis. During the 2016-2019 periods, this market showed successive decreases, having improved only in 2018 Figure 1 shows the evolution of the sector for the period 2016-2019.

Figure 1: Evolution of The Automotive Sector for The Period 2016-2019

(Amounts expressed in Units of vehicles sold)

Table 1 shows the percentage of customers that the company “MAATC” managed to attract to Iraq community, by car brand.

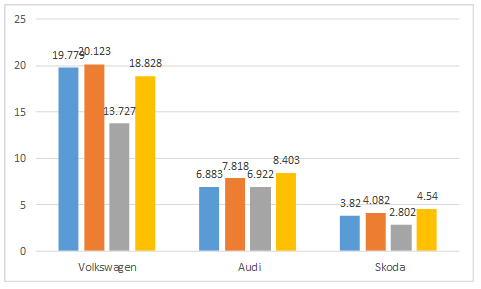

However, despite the drop in sales volumes, the three brands sold by the company improved their market positioning for the period between 2016 and 2019. Despite the results illustrated above, there was a slight increase in terms of market share, as illustrated in Figure-2. During this period the company has used the bank's services to finance its exploration activity. The credit report that is made in the following points refers to the request for renewal of existing financing and allocation of new amounts. Table 2 shows the credit exposure that the company “MAATC” intends to have with the financing request made.

| Table 1 Percentage of Customers of the Company “Maatc” Who are Also Customers of BSCP |

|||

|---|---|---|---|

| Percentage of Customers | |||

| Total 2016 | Total 2017 | Hom variation | |

| Company " MAATC" | 39.80% | 34.80% | -5.00% |

| Total Audi | 21.20% | 18.00% | -3.20% |

| Company " MAATC" | 37.30% | 35.80% | -1.50% |

| Total Skoda | 36.50% | 30.60% | -5.90% |

| Company " MAATC" | 34.00% | 28.50% | -5.50% |

| Total Volkswagen | 21.90% | 25.50% | -3.60% |

Table 2 shows that the company “MAATC” has a commercial relationship with Iraq automobile sector above the average of other client companies, in the three brands it sells. For example, in 2019 and for the Audi brand, the company “MAATC” managed to get 34.8% of its customers to finance themselves with Iraq automobile sector. For the average of Automobile client companies, the percentage of sales financed by the bank is only 18%.

Economic -Financial Analysis of the Company “MAATC”

At this point, the analysis of a request for renewal and an increase in the amounts of credit to finance the company's operating activity is simulated. To this end, an analysis is made of the evolution of the company's activity for the period 2017-2019 and the main financial ratios are analyzed.

The company made available to Iraq automobile industry its management reports for the years 2017, 2018 and 2019 and the balance sheet for the month of September 2019, whose information is inserted in the bank's internal analysis model. In order to guarantee the privacy of Iraq automobile industry credit risk reports, the internal model used in the treatment of information and in the calculation of financial ratios is not provided (Khalaf et al., 2020). Only tables that are taken from that model and that contain the necessary information to carry out the economic and financial analysis of the company “MAATC” are provided.

In the model used by the Iraq automobile industry, the analysis of the evolution of the company's activity is divided between economic analysis and financial analysis, being subdivided into four points: Activity results, in the perspective of economic analysis, and Assets, Liabilities and Equity for financial analysis. The financial ratios model is also used to detail this analysis. Thus, the main financial ratios and other indicators that express the economic and financial situation of the company “MAATC” are calculated. Table 2 shows the summary table of the calculated ratios.

| Table 2 Ratios Used By the Iraq Automobile Industry in the Economic and Financial Analysis |

||||

|---|---|---|---|---|

| Ratios | Provisional 31/08/2016 | 30-04-2019 | 30-04-2018 | 30-04-2017 |

| General | ||||

| Financial autonomy | 40.70% | 43.40% | 50.90% | 39.90% |

| Weight of Assets in Liabilities (Total Assets/Total Liabilities) | 168.60% | 176.50% | 203.50% | 166.50% |

| Solvency | 68.60% | 76.50% | 103.50% | 66.50% |

| Weight of Equity in Liabilities of MLP9 (Equity/MLP liabilities) | 1.6 | 1.6 | 6.4 | 4.6 |

| Net Working Fund (Current Assets - Current Liabilities) | 2.277.485.7 | 4.364.397.2 | 3.608.364.7 | 2.022.997.8 |

| Reduced Liquidity | 0.8 | 0.9 | 0.6 | 0.5 |

| Weight of Fixed Assets in MLP Liabilities (Fixed Assets/Liabilities MLP) | 2 | 1.3 | 3.4 | 3.6 |

| Profitability | ||||

| Cash Flow=Self-financing | 237.564.7 | 322.100.2 | 494.638.6 | 526.711.2 |

| Asset Coverage (Cash Flow/Total Assets) | 1.80% | 2.60% | 4.40% | 4.50% |

| Sales Coverage (Cash Flow/Sales) | 1.70% | 1.40% | 1.90% | 2.00% |

| Equity Coverage (Cash Flow/Equity) | 4.30% | 6.00% | 8.60% | 11.30% |

| ROE | 1.40% | 0.30% | 0.90% | 3.70% |

| ROA | 0.60% | 0.10% | 0.50% | 1.50% |

| Gross Margin (as a percentage of Sales) | 8.90% | 11.40% | 10.70% | 10.10% |

| Asset Rotation | 104.00% | 183.90% | 232.30% | 224.30% |

| Bank financing | ||||

| Weight of Financial Debts in Liabilities (Financial Debts/Total Liabilities) | 50.70% | 47.10% | 16.20% | 18.50% |

| Short-Term Financial Debts (CP Financial Debts/ Current Liabilities) | 15.60% | 0.10% | 0.00% | 4.70% |

| Financial Debts in MLP (Financial Debts MLP/MLP liabilities) | 100.00% | 100.00% | 100.00% | 100.00% |

| Weight of Financial Debts in Equity (Debts Financial/Equity) | 73.90% | 61.50% | 15.70% | 27.90% |

| Average Permanence of Stocks (in days) | 96.3 | 83.2 | 86.1 | 77.2 |

| Average Receipt Term (in days) | 43.3 | 30.2 | 27.6 | 32.3 |

| Average Payment Term (in days) | 86.4 | 55.4 | 59.5 | 73.8 |

| Average Time to Maturity (PME+PMR - PMP) | 53.1 | 58 | 54.2 | 35.8 |

| Pay-back (in years)=Debt Recovery Period | 17 | 10.3 | 1.8 | 2.5 |

Activity Results

The results of the activity are analyzed from an economic point of view, that is, an analysis is made of the main items of the Income Statement that justify the profits/losses of the company's activity.

Table 2 shows a decrease of 12.9% in the company's sales volume in the period 2017-2019, which is related to the fall in the activity sector. However, the percentage of Gross Margin increased from 10.1% to 11.4% due to the reduction in Costs of Goods Sold. According to the accounting data for September 2019, the company is expected to register an 18.5% drop in sales in the year (Almuaali et al., 2020).

The negative impact of the volume of sales is offset by the increase in the sales margin and the reduction in the structure of fixed operating costs, with the result that the Operating Result shows successive increases in the period 2017-2019.

Regarding Financial Charges, they registered an increase over the period of analysis, being that they absorb almost entirely the company's operating component; in 2019, the operating profit was $ 445,582.6 compared to $ 435,090.9 of financial expenses. This factor, combined with the decrease in the extraordinary component, translates into a decrease in Net Income (-90% over the period 2017-2019).

Consequently, the Financial Profitability of the company “MAATC” also decreases in the period of analysis, with an R.O.E. of 0.3% in 2019 compared to 3.7% in 2017. The result of this ratio expresses the reduction in the rate of return for shareholders in 2019 compared to 2017. This fact is mainly due to the crisis in the activity sector that limits the growth of the companies that are part of it. (Zhang et al., 2021) Finally, it is important to mention the amount that the company manages to generate for its financing. In the internal model of Iraq automobile industry this is called Cash Flow and is equivalent to the Auto Financing. Due to the drop in the Net Result, the Cash Flows generated by the company between 2017-2019 had a decrease of 39%, which negatively influences the Debt Recovery Period ratio (Barik et al., 2021) referred to as Pay-back in the internal model of Iraq automobile industry). This ratio suggests in 2019 a period of 10.3 years that the company needs to meet its debts, compared to the 2.5 years presented in 2017. Note that a value greater than 10 years reflects a greater probability that the company will non-compliance. However, the ratio should be assessed over a period and not in a specific year, in order to exclude situations that may distort the result. Thus, it is important to mention that the company “MAATC” had significantly low Pay-back values, close to 2 years, in 2017 and 2018.

It can be concluded that, at the level of the results analyzed, the company “MAATC” is in a situation of activity breakdown in 2019 resulting largely from the crisis in the sector in which it operates. Analyzing historically (for the period 2017-2019), the company has operating resources that allow it to generate profits and Cash Flows in order to comply with its obligations.

Active

The analysis of the Assets is reflected in an assessment of its evolution, of the most significant items and of the ratios that suggest the efficiency in the use by the company of its assets (Elsadig & Najat, 2014).

It is possible to check the evolution of the Assets and break it down into percentage terms. The analysis is made only for the period between 2017-2019 because the figures presented for 2019 are provisional, not reflecting the entire period.

Over the period between 2017-2019 the value of the assets of the company “MAATC” grew by 6%, rising to 12,458,611.7 $ in 2019. This last year, is made up mainly of the items of Stocks in 37%, Tangible Fixed Assets in 21% and Customers w/c by 15%.

Stocks showed an irregular evolution over the three years of analysis, standing at 4,659,335.6 $ in 2019, reflecting an Average Permanence ratio of 83 days, compared to 86 days in 2018 and 77 days in 2017.

Tangible fixed assets are mostly comprised of Buildings and Other Constructions, which means that the company has fixed resources that can be used in the long term.

In relation to Customers with a decrease of approximately 19% between 2017 and 2019, having the value of $ 1,896,752.9 in the last year, which represents an Average Payment Term of 30 days, compared to 28 days in 2018 and 32 days in 2017. The value of this ratio is not very high, as the company takes about a month to receive from its customers, which means that it is efficient in its collection or has good negotiating power with its customers (Thivagar et al., 2020).

It is also important to mention the Rotation of Asset and Return on Asset ratios. As noted with Financial Profitability, Economic Profitability also decreased in the period under review. Between 2017 and 2019, the R.O.A. (Return on Assets) decreased from 1.5% to 0.1%, which means that the company is obtaining less profitability with the investment it makes, a fact that stems from the constant drop in operating profitability.

The Rotation of Assets ratio also decreased from 224% in 2017 to 184% in 2019, incorporating the decrease seen in the volume of Sales. However, the value presented in 2019 is a good indicator as it reflects the continuity of high results in the three years, which can translate into an efficient use of assets by the company.

Thus, it can be concluded that despite the decrease in ratios, the company "MAATC" presents a good economic situation in relation to its assets, with an efficient use of assets that translate into a positive profitability (Antony et al., 2020).

Passive: Regarding Liabilities, the analysis that is made is based on its evolution and the most significant items, as well as on the main ratios that reflect the company's liquidity. The analysis is made only for the period between 2017-2019 because the figures presented for 2019 are provisional, not reflecting the entire period.

Results shows that the value of the Liabilities remained between 2017 and 2019, however there was a decrease in the year 2018. Looking at the year 2019, it appears that the Liabilities are mainly made up of the items of Suppliers c/c by 49% and Debts to Credit Institutions by 47%.

Debts to Credit Institutions increased from 1,304,733.8 $ in 2017 to 3,323,802.9 $ in 2019. Due to the crisis in the activity sector, the company “MAATC” had a greater need to finance itself with financial institutions to close the business activity breaks. It should be noted that a large part of the debts that the company has with financial institutions are MLP debts, which can translate into a good management by the company because by taking out debt in the long term it takes pressure off the treasury management that is done on a short term.

Suppliers c/c have a value of $ 3,480,201.1 in 2017, reflecting a decrease of 23% in the analysis period, with 18% being recorded between 2018 and 2019), which represents an Average Payment Term of 55 days, compared to 60 days in 2018 and 74 days in 2017. Not being a very high value, approximately two months, and this ratio should be taken into account as it may indicate difficulties of the company in meeting its commitments. However, the decreasing result of the ratio over the three years suggests an effort on the part of the company to comply with its obligations towards its suppliers.

When analyzing Liabilities, reference should be made to the liquidity ratio. In the case of the internal model of Iraq automobile industry, only reduced liquidity is calculated. Results shows that the company “MAATC” had a positive evolution in terms of liquidity between 2017 and 2019, presenting a result of 0.9 in the last year, which suggests an improvement in management that allows it to have greater capacity to satisfy its short-term debts, using only current assets.

It can be concluded that the company “MAATC”, despite the reinforcement in the use of credit, is in a favorable situation because the indicators suggest signs of a good capacity to satisfy its debts, and a responsible management in the reduction of treasury risk short term.

Equity: Finally, the analysis that is made to Equity is based on its evolution and on the Financial Autonomy and Solvency ratios, which measure the company's ability to generate its own means to meet its commitments. This analysis is also done based on the information for the period between 2017-2019, since the figures presented for 2019 are provisional, not reflecting the entire period.

Results Obtained and Rating Assignment

After the economic-financial analysis carried out in the previous point, other factors inherent to the company are considered, in order to be able to assign a credit rating that allows taking a correct position when financing.

The internal model used by Iraq automobile industry is based on the attribution of a rating note that allows the company to be classified as "MAATC" between high risk or low credit risk customers. This rating system is based on the economic and financial analysis carried out on the company and on factors that influence the company's relationship with the bank (qualitative information).

For rating the rating, an internal rating scale is used which varies between 1 - very high risk - and 9 - low risk level. This scale is also used to score the relevant credit assignment factors that are used by Iraq automobile industry. The calculation of the company's final rating is done through a weighting attributed to each factor.

The qualitative information that Iraq automobile industry considers relevant in the attribution of credit refers to the sector of activity, the management/shareholders of the company and the access that the company has to credit, partly applying the 6 C's methodology.

Regarding the first factor, the sector of activity in which the company operates is analyzed, taking into account the company's market share. These are analyzed in point 5.3 of this work.

Regarding the company's management/shareholders, the experience and knowledge of the business that the company's management team presents is analyzed, as well as it is verified, with the Merkez Al-Madina Automotive Trading Company database, whether the main shareholders present a financial solvency profile. The company “MAATC”, as mentioned in the previous discussion, is a national reference in the sector in which it is inserted due to its long history and presents, according to information provided by the company, the same Chairman of the Board of Directors since its foundation, which allows having a management body led by someone recognized in the sector and with knowledge of the business. It should be noted that the Chairman of the Board of Directors is one of the main shareholders of the company and that, according to data from Merkez Al-Madina Automotive Trading Company, he presents incidents with Merkez Al-Madina Automotive Trading Company as guarantor.

Regarding the quantitative information, that is, the indicators taken from the economic-financial analysis, Iraq automobile industry attributes as factors of decision of the rating level the ratios of financial profitability, pay-back, solvency and financial autonomy, as well as the result presented by the company and its ability to generate resources (Cash Flows). Thus, taking into account the analysis made and the qualitative information that is used in the internal system of Iraq automobile industry, it is concluded:

The company is part of a sector that is in a crisis situation; at least it is difficult to maintain demand levels. However, the company “MAATC” sells three brands that have good market shares, with Volkswagen in 2019 being in 2nd place for the most sold brands and Audi and Skoda among the 15 most sold brands in Iraq.

• The company presents a management board with knowledge of the business. There is only a caveat for the incident of the Chairman of the Board of Directors with Merkez Al-Madina Automotive Trading Company, not a very worrying situation because it is a condition as guarantor.

• The company holds several credits with financial institutions, using several banks to finance themselves. This means that the company frequently uses external financing to support its exploration activity. This is not a very favorable position for the company in the current market conjecture because, on the one hand it fits into a sector in crisis and will have greater needs for new financing, and on the other because there is a shortage of liquidity and access to credit is more difficult.

• The Net Result, despite presenting itself in positive territory, registered a decrease in the period between 2017-2019, with Financial Charges having a great weight in the constitution of the company's profit. The R.O.E. records low values in the analysis period, which suggests a low financial return.

• Cash Flows generated by the company are positive but show a decrease between 2017-2019, which negatively influences the Pay-back ratio. Currently, the company is more likely to default, so its self-financing capacity is considered limited.

• Finally, the company has an acceptable Equity for the levels of indebtedness, registering reasonable values of Financial Autonomy and Solvency that suggest a positive treasury.

According to the conclusions drawn in each of these factors, it is possible to calculate the rating of the company “MAATC”. Table 3 shows the rating assigned to each of the areas assessed. Subsequently, these values are weighted and added to achieve the client's final rating. The different weightings attributed to each of the areas are defined in a corporate standard and are used internally by the entire Santander Group, so it can only be said that they vary between 10% and 25%.

| Table 3 Iraq Automotive Industry Internal Rating for "Maatc" |

||

|---|---|---|

| Area | Rating assignment by analysis | Note |

| Product/Demand/Market | Evolution of the market where the company operates; evolution of the brands represented by the company | 4 |

| Shareholders/Partners | Constitution of the company's capital and its management board and shareholder credibility | 5 |

| Access to Credit | Liabilities to Merkez Al-Madina Automotive Trading Company | 5 |

| Results/Profitability | Net Result, with special emphasis on ROE. | 4 |

| Resource Generation | Company treasury (emphasis on Cash Flows and Pay-back ratio) | 5 |

| Solvency | Financial Autonomy and Solvency Ratios | 6 |

| Rating Iraq Automobile Industry | 4.8 | |

This rating notation means that the company “MAATC” is above the average of the internal rating of the Iraq automobile industry, with credit being acceptable, but with some caveats, particularly with regard to qualitative factors. As the amount of financing required by the company “MAATC” is more than $ 2,000,000, this proposal will have to be submitted by analysts to the Board, which will then submit it to the Local Executive Committee for final decision making. It should be noted that the existing commercial relationship between the company and Iraq Automobile Industry is also a determining factor in the final decision on the amount to be financed. Thus, according to the rating classification and the good business relationship the company has with Iraq Automobile Industry, it is expected that the amount requested will be fully financed (Mahdi et al., 2018).

Conclusions

With the macroeconomic changes felt since 2017, it is increasingly important for financial institutions to develop and apply stricter credit allocation systems. On the other hand, customers, when access to finance is more difficult, are obliged to provide more financial information to banks, and in the case of companies this information needs to be of quality and credible. The economic-financial analysis based on financial ratios is thus essential for an easier and comparable assessment of the company's reality. Taking into account the information taken from the company's financial reports, credit analysts are able, through internal systems, to assign a rating classification in order to decide whether or not to allocate the required financing amount. Following the analytical study carried out at MAATC, this report allows us to conclude on the model used by the bank to analyze the capacity that client companies have to fulfill their obligations. At the level of the economic-financial analysis based on the ratios, it is suggested that the calculation of four more ratios that I consider to be important to verify the company's ability to generate resources to face its debts be incorporated into the analysis. These ratios are referred to in point 5.6, being the main remedy for the non-inclusion of the financial charges coverage ratio, which is one of the most relevant for credit assignment, as it is an indicator that suggests whether the level of activity that the company produces it is enough to cover your debts. Regarding the qualitative variables used in the rating classification, some changes are also suggested. The bank should cover its analysis not only to the company's sector of activity but also to the country's macroeconomic and political situation, as well as paying special attention to the policies that regulate the financial markets. In a financial crisis scenario, it is essential that the bank be more rigorous in the analysis carried out, so it should incorporate all the ratios that allow it to be more restricted in the financing they grant and all the non-financial information that may distort the rating to be attributed. However, and excluding the suggestions made, it can be concluded that the model used by MAATC in the allocation of credit to its customers fits with the theoretical component. The ratios used in the analysis make it possible to assess the financial situation of companies and determine whether they have liquidity to meet their obligations. By carrying out an analysis over a period, MAATC analysts are able to compare results and analyze the company's evolution between years of activity, which allows them to have a better perception of the macroeconomic impacts on the company's results.

This research work allowed me to deepen my knowledge in the area of economic-financial analysis to companies, whose themes I had covered throughout my degree and master's. In relation to credit risk, it was possible to learn about the credit allocation system that is used by most financial institutions in Iraq.

References

- Elsadig, A., & Najat, M. (2014). Factors affecting risk management practices and financial performance of Iraqi private banks. Middle East Journal of Scientific Research, 22, 971-977. 10.5829/idosi.mejsr.2014.22.07.21610.

- Hayder, A., Jing, Z., Mustafa, S., Meriem, S., & Sinan, H. (2020). The financial technology (fintech) and cybersecurity. International Journal of Research in Business and Social Science, 9(2147- 4478), 123-133. 10.20525/ijrbs.v9i6.914.

- Azhar, A., & Ammr, K. (2017). Financial inclusion and economic development in Iraq. International Journal of Science and Research (IJSR), 6, 10.21275/ART20177491.

- Laith, A., Huda, A., & Al-obaidi, O. (2020). Enhancing risk management by using strategic auditing: A study of Iraqi Banks.

- Mahdi, J. (2018). The Impact of Credit Risk Management in Financial Market Indicators—Analytical Study in the Iraqi Market for Securities. Journal of Financial Risk Management, 07. 254-277. 10.4236/jfrm.2018.73017.

- Barik, R.K., Patra, S.S., Patro, R., Mohanty, S.N., & Hamad, A.A. (2021). GeoBD2: Geospatial Big Data Deduplication scheme in fog assisted cloud computing environment. In 2021 8th International Conference on Computing for Sustainable Global Development (INDIACom), 35-41, IEEE.

- Barik, R.K., Patra, S.S., Kumari, P., Mohanty, S.N., & Hamad, A.A. (2021). A new energy aware task consolidation scheme for geospatial big data application in mist computing environment. In 2021 8th International Conference on Computing for Sustainable Global Development (INDIACom), 48-52, IEEE.

- Zhang, G., Guo, Z., Cheng, Q., Sanz, I., & Hamad, A.A. (2021). Multi-level integrated health management model for empty nest elderly people's to strengthen their lives. Aggression and Violent Behavior, 101542.

- Hamad, A.A., Al-Obeidi, A.S., Al-Taiy, E.H., Khalaf, O.I., & Le, D. (2021). Synchronization phenomena investigation of a new nonlinear dynamical system 4d by gardano’s and lyapunov’s methods. Computers, Materials & Continua, 66(3), 3311-3327.

- Khalaf, O.I., Ajesh, F., Hamad, A.A., Nguyen, G.N., & Le, D.N. (2020). Efficient dual-cooperative bait detection scheme for collaborative attackers on mobile ad-hoc networks. IEEE Access, 8, 227962-227969.

- Thivagar, L.M., Hamad, A.A., & Ahmed, S.G. (2020). Conforming dynamics in the metric spaces. Journal of Information Science and Engineering, 36(2), 279-291.

- Maria Antony, L.T., & Abdullah Hamad, A. (2020). A theoretical implementation for a proposed hyper-complex chaotic system. Journal of Intelligent & Fuzzy Systems, 38(3), 2585-2590.

- Layth, K., Raj, S., Wilfred, M., & Fiona, B. (2018). Analyzing the critical risk factors associated with oil and gas pipeline projects in Iraq. International Journal of Critical Infrastructure Protection, 10, 1016/j.ijcip.2018.10.010.

- Ibrahim, K., Ahmed, F., & Ahmed, N. (2020). Enterprise risk management and performance of financial institutions in Iraq: The Mediating Effect of Information Technology Quality. Journal of Information Technology Management, 11, 10.22059/jitm.2019.74764.

- Noor Hashim, M. (2016). The impact of liquidity risk, credit risk and operational risk on the performance of Iraqi private banks. 10.13140/RG.2.2.36343.85923.

- Iman, M., Sharul, J., & Azam, A. (2019). The impact of financial engineering on the financial performance in Iraqi Banks, 2, 33-46.

- Velmurugan, R., & Arumugam, D. (2014). Determinants profitability in Indian automobile industry – using multiple regression analysis. International Journal of Innovative Research and Studies, 3, 992-1003.

- Sholarin, O. (2005). Risk Management and securitization of assets: The case of Iraq. 10.1057/9780230599352_8.

- Thivagar, M.L., & Hamad, A.A. (2019). Topological geometry analysis for complex dynamic systems based on adaptive control method. Periodicals of Engineering and Natural Sciences (PEN), 7(3), 1345-1353.

- Thivagar, M.L., Ahmed, M.A., Ramesh, V., & Hamad, A.A. (2020). Impact of non-linear electronic circuits and switch of chaotic dynamics. Periodicals of Engineering and Natural Sciences (PEN), 7(4), 2070-2091.

- Mahdi, T. (2018). The impact of credit risks on the part of commercial banks in lending to the real investment in Iraq, 10, 13140/RG.2.2.34493.51683.