Research Article: 2022 Vol: 25 Issue: 1S

The impact of government expenditure on economic growth in Southeast European countries

Jehona Shkodra, University of Prishtina, Republic of Kosovo

Arjeta Krasniqi, University of Prishtina, Republic of Kosovo

Njomza Ahmeti, University of Prishtina, Republic of Kosovo

Citation Information: Shkodra, J., Krasniqi, A., & Ahmeti, N. (2022). The impact of government expenditure on economic growth in

Southeast European countries. Journal of Management Information and Decision Sciences, 25(S1), 1-7.

Abstract

Government expenditure on a country's economic growth is an important indicator for measuring sustainable economic development. Considering the importance of a country's economic development, as well as the impact of government expenditure on economic development, we have analyzed government expenditure for the period 2002-2019 in the countries of southeastern Europe (Bosnia, Kosovo, Northern Macedonia, Montenegro, Serbia and Albania).

As a dependent variable we have used economic growth while as independent variables the wages and salaries, goods and services, subsidies, social transfers and capital expenditures has been used. The purpose of this research is to examine the effect of government spending on economic growth in the context of Southeast European (SEE) countries. The analysis method used is the regression model between the variables, DW Test and VIF test for multicollonearity between the variables. The result shows that the beta coefficient of wages and salaries, social transfer, subsidies and capital interventions are positive, which means that the higher the investment in wages and salaries and social transfer, the higher would be the economic growth.

As a result, we conclude that our study supports the positive effect of government spending on economic growth.

Keywords

Economic growth; GDP; Southeast European countries; Government spending.

JEL Codes

E60; H60; H68

Introduction

The economic situation is an issue of great interest and is the focus of policy-making worldwide today. Defining economic development means what policies and directions a country follows towards achieving development and what development mentality they have achieved. Economic development is a process through which national income grows over a long period of time.

While economic growth is more an element that refers to the quantitative aspect or the creation of a production or service sector, economic growth is currently measured by the growth of national product and per capita income which are external economic elements that refer to numbers and statistics in order to define microeconomic and macroeconomic policies bringing effect on economic development. GDP is the most important economic indicator of national accounts, which represents the economic performance of a country in a given period. GDP is also an aggregate measure of the values of all final products and services produced in an economy. Therefore, it is important that GDP is measured to judge the state of an economy and its dynamics.

The impact of government spending on growth has been investigated extensively, generally with conflicting results. This holds true for total spending, the division between capital and consumption expenditures, and various components of government spending. The effects of government spending are also often found to differ between developed and developing nations.

Thus, a category of government expenditure such as road construction may have very different impacts on economic growth dependent upon a government’s effectiveness.

Keefer and Knack (2007) demonstrate that the level of public expenditure may be inversely related to its productivity due to the quality of government. Kutasi and Marton (2020) found negative impact, statistically significant on GDP growth from expenditures on social protection.

This paper reports the results of a study investigating the growth impact of government spending. The primary focus of the analysis is how government effectiveness affects the growth impact of government spending.

Literature Review

There is a lot of research by many authors on the impact of government spending on a country's economic growth. Many studies confirm that government spending has a positive impact on economic growth (Tang, 2009; Wahab, 2011; Ali et al. 2013; Attari & Javed, 2013; Al-Fawwaz, 2015; Kimaro et al., 2017; Leshoro, 2017; Lee et al., 2019; Nyasha & Odhiambo, 2019; Yasin, 2000), while others have found a negative impact (Hasnul, 2015; Ramash, 2004; Devarajan et al., 1996; Nurudeen & Usman, 2010; Sáez et al., 2017; Lupu et al., 2018; Okoye et al., 2019). Also some studies who concluded government spending have no significant impact on economic growth (Hasnul, 2015; Schaltegger & Torgler, 2006).

Research conducted for American countries by Mitchell (2005) shows that a large and growing government is not conducive to better economic performance. Indeed, downsizing the government would lead to greater revenue and improve America’s competitiveness.

The impact of government spending on economic growth depends on what the government spends money on and how well the institutional mechanism decides to manage spending. A paper conducted in India used a simple regression analysis on the model to determine the relationship between general government spending and the rate of GDP growth. From the results obtained the model shows that the square value R is 83% meaning that 83% of the change in the GDP growth rate is explained by all the independent variables, which are the total government expenditures, the coefficient of reform period and the crisis period coefficient as dummy variables and the growth rate of foreign direct investment (Seshaiah et al., 2018).

All the above variables explain that they positively and significantly affect the rate of GDP growth in addition to the rate of growth of foreign direct investment. The coefficient reflects when expenditures increase by 1 unit, the GDP growth rate increases by 1,134 units. Dummy period of the 1991 reform has had a positive and significant impact on the rate of GDP growth. The dummy of the crisis period shows a negative and significant sign, which means that after 2008 there was a negative impact on the level of GDP growth (Seshaiah et al., 2018).

In Nepal, the effect of a different component of government spending on economic growth is examined and the empirical result shows that there is a positive relationship between economic growth as a dependent variable and factors such as agricultural, non-agricultural sector, industry and service as independent variables. Meanwhile, expenditures and inflation are negatively related to economic growth. High levels of government spending have the potential to increase employment, profitability and investment in aggregate demand. Thus, government spending can contribute positively to economic growth (Gupta, 2018).

There are also those who found a middle ground where government spending is assumed to have a positive impact on economic growth up to a certain threshold, above which the impact of government spending on economic growth turns negative (Nyasha & Odhiambo, 2019).

However, some authors show that general government spending promotes economic growth, but economic growth does not increase government spending. Therefore, there is a one-way link between government spending and economic growth (Jiranyakul, 2007).

According to Ricardian, the effect of government spending, whether financed by government debt or tax revenue, on economic growth is neutral. In other words, this relationship between government spending and economic growth does not exist. The main reason behind this neutral effect of government spending on economic growth is consumer expectations for tax increases in the future. If consumers expect tax increases in the future, they will increase their savings by reducing current consumption, which in turn neutralizes the mechanism of influence of government spending (Alqadi & Ismail, 2019).

Wagner's law has another view that disagrees with Ricardian. Wagner argues that there is a relationship between government spending and economic growth, but the impact goes from economic growth to government spending. In other words, Wagner's Law assumes that the increase in government spending is a result of economic growth (Alqadi & Ismail, 2019).

Some empirical studies have used the Wagner's Law hypothesis to establish the relationship between public spending growth and GDP growth, while other studies have found that Wagner's Law has no effect in all countries. For example, Ram (1986) tested Wagner's Law for 63 countries and found limited results. He found that Wagner's law relies on the structure of the economy for rich countries, but not for poor countries (Alrasheedy et al., 2018).

Government spending can also indirectly contribute to economic growth by increasing the marginal productivity of government factors and production supply factors. Government spending on research and development, for example, provides higher productivity in the interaction between physical factors and human capital. Similarly, other components of government spending related to the enforcement of property rights and the maintenance of public order can exert an increasingly positive indirect effect by contributing to better use of existing capital and working assets (Maingi, 2017).

From these studies we can conclude that most of them support the positive effect of government spending on economic growth. However, the results obtained for government spending on economic growth are subject to a number of different factors, including the selection of samples from different countries, the level of development of countries, timelines, variables included in the model, the methodology used, and so on.

Methodology

The objective of the research is to examine the effect of government expenditure in economic growth in context to SEE countries (Bosnia, Kosovo, Northern Macedonia, Montenegro, Serbia and Albania) for 18 years during period 2002-2019. The data source for each country is collected from the OECD stats, Eurostat’s, World Bank, and International Monetary Fund.

As a dependent variable we have used economic growth while as independent variables we have wages and salaries, goods and services, subsidies, social transfers and capital expenditures.

The analysis method is the regression model between the variables, DW Test and VIF test for multicollonearity between the variables.

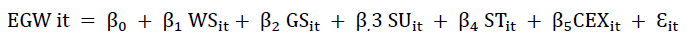

Model Layout

Where: EGW: Economic Growth; WS: Wages and salaries; GS: Goods and services; SU: Subsidies; ST: Social transfers; CEX: Capital expenditures.

Correlation Analysis

This analysis is used to know what strength of connection we have between the factors. The Pearson corrections coefficients have been used to present the bivariate between the variables and the results are presented in Table 1.

| Table 1 Pearson’s Correlations Matrix Of Dependent And Independent Variables |

||||||

|---|---|---|---|---|---|---|

| EGW | Wages and salaries | Goods and services | Subsidies | Social transfers | Capital expenditures | |

| EGW | 1 | |||||

| Wages and salaries |

0.996** | 1 | ||||

| Goods and services |

-0.572 | 0.965 | 1 | |||

| Subsidies | 0.977* | 0.975 | 0.978** | 1 | ||

| Social transfers | 0.997** | 0.992 | 0.972 | 0.976* | 1 | |

| Capital expenditures | 0.519 | 0.894 | 0.811 | 0.873 | 0.889 | 1 |

Note: *correlation is significant at the 5% level, **correlation is significant at the 10% level

The values of the correlation coefficient for categories: wages and salaries, subsidies and social transfers are highest positive and significant correlation coefficient, which show that economic growth is positively related to these coefficients and results that in each of their government spending plays a very important role for the economic development of their countries.

Economic growth is negatively related to goods and services and this means that higher spending on goods and services will result in lower economic growth.

Regression Analysis

Regression coefficients represent the increase in the dependent variable as a result of the one-unit increase in the independent variable that accompanies this coefficient. In this case we have analyzed what is the impact of the increase in government spending on economic growth or the dependent variable for the countries included in the model, presented in Table 2.

| Table 2 Regression analysis |

|||||||

|---|---|---|---|---|---|---|---|

| Model | B | t | Sig | Collinearity Statistics | F | Sig | |

| Tolerance | VIF | ||||||

| Constant | 0.088 | 0.281 | 0.809 | 72.412 | 0.000 | ||

| WS | 0.399 | 7.816 | 0.000 | 0.759 | 1.842 | ||

| GS | -0.062 | -1.046 | 0.247 | 0.329 | 2.549 | ||

| SU | 0.015 | 5.512 | 0.098 | 0.799 | 4.132 | ||

| ST | 0.337 | 1.337 | 0.047 | 0.591 | 4.395 | ||

| CEX | 0.032 | 0.492 | 0.072 | 0.158 | 1.033 | ||

Source: Prepared by the authors

During the processing of data in Table 3 through regresion analysis, including all the given states in an econometric model we have obtained indication that R as a 0.984 and adjusted R2 as 0.961, which are high and explain that 96.1 percent of the variation in economic growth is explained by the variation in the predictors like wages and salaries, goods and services, subsidies, social transfers and capital expenditures of all the country. The value of 1.389 in Dubin-Watson test implies that there is autocorrelation between the variables.

| Table 3 Model summary |

||

|---|---|---|

| R | R2 | Dubin-Watson |

| 0.984 | 0.961 | 1.389 |

Source: Prepared by the authors

It also implies that regression result is highly significant with an f = 72.412, respectively all of them have the value p<0.00. So, in term of variation explained and significant the regression equation is excellent.

Moreover, the result shows that the beta coefficient of wages and salaries, social transfer, subsidies and capital interventions are positive, which means that the higher the investment in wages and salaries and social transfer, the higher would be the economic growth. Similarly, the finding shows that the higher the investment in subsidies and capital interventions the higher would be economic growth while goods and services have a negative impact on economic growth. Among the predictor, total wages and salaries, subsidies, social transfer and capital expenditure are significant i.e. its p-value is less than 0.05.

Based on the coefficient output, collineraity statistics, obtained VIF (Variance Inflation Factors) values for all the independent variable are less than 5, which implies that there is no multicollinearity.

Conclusions

The econometric analysis conducted from the data collected on government expenditures made in six countries (Bosnia, Kosovo, northern Macedonia, Montenegro, Serbia and Albania) shows that the categories of government expenditures Wages and Salaries; Subsidies; Social Transfers and Capital expenditures significantly affect the economic growth of the respective countries, while only expenditures on goods and services have an inverse ratio to economic growth therefore these countries should be careful and review the budget allocation for this category. The results obtained from the variables included in the model as well as the methodology used we can conclude that our study supports the positive effect of government spending on economic growth.

References

Alqadi, M., & Ismail, S. (2019). Government Spending and Economic Growth: Contemporary Literature Review.Journal of Global economics,7(4), 1-4.

Alrasheedy, A., Authority, S. A. M., & Alrazyeg, R. (2018). SAMA Working Paper.

Hasnul, A. G. (2015). The effects of government expenditure on economic growth: the case of Malaysia. Retrieved form https://mpra.ub.uni-muenchen.de/id/eprint/71254

Kimaro, E. L., Keong, C. C., & Sea, L. L. (2017). Government expenditure, efficiency and economic growth: a panel analysis of Sub Saharan African low income countries.African Journal of Economic Review,5(2), 34-54.

Leshoro, T. L. (2017). An empirical analysis of disaggregated government expenditure and economic growth in South Africa. Working Paper. Retrieved from http://hdl.handle.net/10500/22644

Mitchell, D. J. (2005). The impact of government spending on economic growth.The Heritage Foundation,1813, 1-18.

Nyasha, S., & Odhiambo, N. M. (2019). The impact of public expenditure on economic growth: a review of international literature.Folia Oeconomica Stetinensia,19(2), 81-101.

Okoye, L. U., Omankhanlen, A. E., Okoh, J. I., Urhie, E., & Ahmed, A. (2019). Government expenditure and economic growth: The case of Nigeria. Proceedings of SOCIOINT 2019- 6th International Conference on Education, Social Sciences and Humanities (pp.1184-94).

Sáez, M. P., Álvarez-García, S., & Rodríguez, D. C. (2017). Government expenditure and economic growth in the European Union countries: New evidence.Bulletin of Geography. Socio-Economic Series,36(36), 127-133.

Yasin, M. (2011). Public spending and economic growth: empirical investigation of Sub-Saharan Africa.Southwestern Economic Review,30, 59-68.