Research Article: 2018 Vol: 22 Issue: 5

The Impact of Income Smoothing on Tax Profit: An Applied Study to a Sample of International Companies

Qassim Mohammed Abdullah Al Baaj, University of Al Qadisiyah

Salim Awad Hadi Al-Zabari, University of Baghdad

Abbas Alwan Shareef Al Marshedi, Babylon Technical Institute

Abstract

During economic turbulence, companies are under pressure that makes them turn to account department in attempt to control the frustrations by changing the financial information to their desired level. When the management oversees that the targeted level cannot be managed from the initial planning, they result to decree the figure in earning. This type of management practice to change the accounting records is called income smoothing. When other conditions are identical, the management usually prefers smoothed income than genuine income that fluctuate greatly. Smoothed income allows the firms to evade discounting in the capital market that brings undesirable consequences with the stakeholders. Income smoothing or earning management can be classified into real discretion and technical accounting policy. In real discretion, the management achieves the targeted number of figures by changing transactions between the firm and stakeholders. Technical accounting policy allows the management to change the accounting estimates or accounting policies. In this paper, the concept of income smoothing will be analyzed, and the term "big baths" used to leeway information presented in the financial statements will be shown. The researchers consider that firms in japan, companies in the Tehran stock exchange in Iran and American banks all engage in smoothing income using accounting policy. This will provide a platform to show biased accounting introduced by the management and learn the ways to remove this bias by linking the knowledge to financial analysis. The purpose of the research is to show the true situation from the biased results in firms, a basic step to enterprise value assessment and financial ratio analysis.

Keywords

Big Baths, Smooth Income, Magic Accounting.

Introduction

Scholars and researchers have dedicated considerable efforts in defining ‘income smoothing’. For Ronen and Yaari (2008), income smoothing is a form of earnings management and is defined as the dampening of fluctuations in reported earnings over time. In other words, management is inclined to take actions to increase earnings when earnings are relatively low and to decrease earnings when earnings are relatively high. Most papers distributed regarding the matter spotlight on breaking down the variables that prompt smoothing or differentiation regardless of whether this wonder does without a doubt exist in various divisions or not. The global writing, ships away at the connection between showcase returns and the level of pay smoothing in business incorporate those of Michelson et al., (1995:1999); Stall et al. (1996); Wan and Kamil (2000); Iñiguez and Poveda (2004). In this paper, the authors ponder the impact of income smoothing on tax profit of some selected international companies.

Literature Review

Ronen and Yaari (2008) point out that there are two sorts of smoothing: genuine and fake. Genuine smoothing includes settling on generation and speculation choices that lessen pay changeability. Interestingly, fake smoothing is accomplished through bookkeeping rehearses. Michelson et al. (1995) played out a long-run exact examination amongst smoothing and stock benefit, utilizing U.S. organizations' stock data as their example. They arranged the organizations as smoothers and non-smoothers in view of the business variety coefficient versus the income variety coefficient. Utilizing geometric arrangement of profits as a reason for estimation, they demonstrated that the non-smoother test had bigger normal pay than the smoother test. Notwithstanding, the month to month normal salary utilized as a part of their examination was not balanced for hazard or market (ordinary returns). There additionally was a distinction in size and hazard between the two examples: the smoothing bunch was bigger and had a littler beta than the non-smoothing gathering, despite the fact that there was no factual proof to help this result.

Stall et al. (1996) considered the Finnish market to check whether irregular return, as got from income divulgences, was diverse between organizations that do and do not demonstrate smoothing conduct, in light of the variety coefficient technique. The outcomes demonstrated that smoothers had a tendency to be greater than non-smoothers, and the previous likewise had littler betas than their partners. When talking about irregular returns, the non-smoothers demonstrated better market execution against fluctuation of wage when contrasted with smoothers.

Even more as of late, Michelson et al. (2001) returned to their investigation of 1995 to check whether the bookkeeping execution measures are identified with pay smoothing, however this time utilizing unusual returns. The consequences of this strategy depend on the aggregation of anomalous returns utilizing number-crunching arrangement. The outcomes demonstrated that smoothers have an altogether higher anomalous return than non-smoothers. The smoothers, as per the market estimation of fluid resources, were greater than non-smoothers.

Another investigation that should be stated is that of Iñiguez and Poveda (2004) concerning smoothing in the Spanish market. They did this through a long-run think about (10 years) of the relationship of wage smoothing, chance and unusual return. Utilizing coefficients of variety, they acquired outcomes demonstrating a conduct example of profits and beta identified with the level of smoothing (variety of gaining in this examination were balanced discretionarily). Their experimental proof proposes that smoothers acquire better returns in the capital market than non-smoothers do. In connection to orderly hazard, smoothers introduce fewer hazards. Therefore, they reasoned that the Spanish capital market does not process data on wage smoothing productively by allowing the diminishment of precise danger of stocks and enhancing their arrival through administration of income.

The connection between wage smoothing and firm esteem is an intriguing subject, on which there have been exact examinations for the American, Finnish and Spanish markets. In addition, there are some inadequate investigations regarding the matter that show how the market esteems and respond to the act of wage smoothing. In this paper, we add to this writing by breaking down the impacts of wage smoothing on the Brazilian market.

Hypotheses

The present paper is based on the following hypotheses:

H0 There exists no connection between income smoothing and the income tax of the company's selected Tehran stock exchange.

H1 There exists Connection between income smoothing and the income tax of the company's selected Tehran stock exchange.

Theoretical Framework

Income Smoothing Meaning

The term income smoothing refers to changing of expenses and revenue for the purpose of presenting deceitful imprint that a firm has stable earnings. Guillaume & Pierre (2016), advocates that income smoothing being one of the incentive accounting involves adjusting and manipulating fluctuations about some heights of earnings for the business. When it comes to the earning management there are two sentiments that entail. The first prevails and regards the earning management as false while in the second scenario the stakeholders determine such doings as management using their preferences Chhabra (2016).

Reason for Income Smoothing

Zachary and Hambrecht (2015) examine the link between management fraud and income smoothing to see whether the two are associated with equity or not. According to them, the company may employ the "big bath” process to increase the accrued setbacks, in which the main idea is to show a bigger loss in the current period and then followed by a bigger margin of profit in the next period. This mainly is done by factoring in future expenses into the current period instead of the correct next period. The result of this process, income smoothing, is that it reduces earnings quality because net income does not truly show the economic operation of the business for given period of time. The main purpose is to balance income variability above some years by changing income of a bad year with that of a good year. In the same way, income variability may be changed by shifting losses or expenses from time to time. For example, a business can reduce discretionary costs in the current financial year to advance current time earning which will result in the coming year that discretionary cost will be expanded. Businesses make use of the following accounts; bad debts written off, warranty costs, sales returns, allowances, and pension expenses. This is in order to encounter quarterly earnings approximate and occasionally increases losses in the coming year. Glaum et al. (2018) say that the Union Carbide Corporation applied false accounting procedures for investment, tax and credits which increased their profits without necessarily adding the cash termed as “magic accounting”. According to Gaganis and Pasiouras (2016) in their research on smoothing income, they claim that those firms showing a steady growth rate usually mislead the markets. He came up with idea supported by unusual observations and approximating risk methods. This holds that there exists a relationship between the risk and income variance to affect the interpretation of the stakeholders on the firm's risk.

Ethical Approach to Income Smoothing

According to the international accounting standards, the process of income smoothing is not legal as it uses false accounting procedures and interpretations to stabilize fluctuations in net income (Acharya & Lambrecht, 2015). When businesses do income smoothing, there is no correct information to determine their actual earnings formerly to avoid taxes. Income smoothing being a topic discussed for many years raising the topic of whether it's ethical or not. As (Guillaume & Pierre, 2016) says, most of the people hold that manipulating incomes reduces the important aspects of financial reports and more so the accounting principles. (Acharya & Lambrecht, 2015) calls for the modification to improve the financial statements transparency in order for the interested to look at the actual numbers for their decision making.

Methods Used to Smooth Income

An Article written by Geoffrey Singles, and Muja Glow, Vice President and Principal at Charles River Associates respectively, Singles and Glow showed that to get around management and auditor detach accounting procedures and the companies began "channel stuffing" in this the company vessels products in surplus of a client's requirements towards the closing stage of an accounting period to inflate revenues. Chhabra (2016) says that smoothing income can be applied with no inquiries from the stakeholders hence the management does not disclose any information. The application of both the smooth of income and "big bath" is commonly referred to creative accounting or earnings management. The practice of income smoothing which stretches over a length of time is common whereas the phenomenon of “big baths” is based on the nonrecurring characteristic of transactions. This shows that income smoothing and “big bath" are two different methods as far as the extent of application is factored out. For example, company Z speculates that it may fail the stock markets, it forecast for the current period and the management increases their loss to R50000 from R20000. They will do this by for example writing off an R15000 as outmoded asset and increase their depreciation to an additional of R15000. This enables the company to indicate a profit of R30000 in the coming financial Year which in turn shows investors and clients that the company is doing well.

One of the methods that can be used to identify earning management is to contrast the reported profit for a company with the cash flow. If the profit earned is fine but exist a net cash flow then the company is employing creative accounting (Collins et al., 2016). In case the company contains an ever-cumulating profit, cash flow at all-time cannot be noted, hence the company results to book entries to manipulate and increase profits. (Gaganis & Pasiouras, 2016) points out that the firm’s smooth profits so as to decrease its volatility, it can serve as a reminder to the bad debt holders for the company that earnings have reduced volatility hence portrays a decreased risk and also the company’s owners feel confident that there are stable earnings hence improved relationships among the investors, management, and the employees. According to (Capkun, 2016), application of smoothing may enable the company to benefit from the government subsidies and tax holiday. All this reason ns for smoothing concerned with reducing the volatility of earnings increase the stock's price and value of the company's stock and the aspects related to financing. The book of entry is the main tool for smoothing income can be used differently to achieve smoothing effect. Acharya & Lambrecht (2015) advocate that depreciation, over and under the provision in book entry, allowance book of entry to include uncollected allowances, loans, and warranty obligations is the main areas for smoothing income. Bora & Saha (2016) did a research on the income smoothing and advocated a framework to determine the income smoothing manner he criticized other research's for making use of one variable to determine income smoothing. He says "businesses use the joint effects of accounting variables in order to reduce income variables to the minimal". He used income and sale variable and concluded that income smoothing emerges from the alternating difference between sales and expenses.

Gaganis & Pasiouras (2016) proposed that leeway from accounting procedures results to income smoothing done to minimize income fluctuations instead of reducing or increasing reported income. They did a test on firms with a smooth income and also the results of aimed factors toward income smoothing. The two did a research to determine the relationship between income smoothing, the stock price and the return on investment. They used 500 companies as samples and determined information on net income, assets, stock price equity, for a period of eight years between 2000 and 2008. The result of their research showed that there existed a negative significant between the income smoothing and return on investment.

Capkun (2016) in their study, quoted Francis et al. (2008) by advocating that earnings quality affects financial information disclosure. They explored on the matter to check whether business social obligations related to earning management and they found that the relationship is determined by the firm's ethical background, laws and political factors.

Methodology

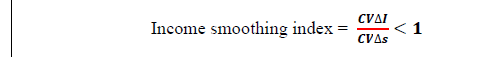

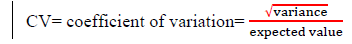

Eckels’ Coefficient of Variation

Bora & Saha (2016). Proposes that in order to determine the income smoothing the coefficient of variation by Eckel's is best to be applied. The techniques vary from real smoothing and artificial smoothing methods. Eckel's Model provides a base for measuring income smoothing. The model shows or is based on the fact that costs and revenue are linear over a period hence they are directly related. The model proposes that to show the connection between revenues and profit, the coefficient of variation in sales and profits should be used.

(1)

(1)

Where,

ΔI=change in income

ΔS=change in sales

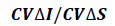

In income smoothing the management plays the vital role to control the economic transactions. Artificial smoothing, on the other hand, employs accounting manipulations done to smooth income. ECKEL method looks more on identifying the artificial one as it distorts the appearance of the economic reality. From him, real smoothing is as a result of the change in sales while a change in income advocate for the artificial smoothing. If a variation of the sales is more than that of income, the firm is said to be artificially smooth. This employs the coefficient of variation. The study examines incomes from business operations and after-tax income, due to the fact that the income smoothing index is calculated and tested apart. The income smoothing is measured in two ways; variability of income in relations cash flow (deviation), and correlation in changes in expenses and cash flows (color). If a business has more income smoothing there is less variability of incomes in relation to the cash flows and more negative or reduced correlation among expenses and cash flows. Evidence from the capital markets reveals that the emphases on the significance of earning by the companies unstable and make efforts to hide. There are two business ratios to determine firm's efficiency; return on equity and return on assets. Return on assets outlines after-tax earnings of assets showing the profitability of the firm. The ratio is determined by dividing the net profit after taxes by total assets of the firm. On the other side, the return on equity determines the return on the money put in the business by investors. Return on equity is determined by dividing the net income by stakeholder's equity; hence it is a key gauge to measure the performance of the management. The coefficient of variation shows the variation of sales and income. Any business is artificial smoothing if the formula holds:

(2)

(2)

Where,

ΔI =Income change

Δs=selling change

CV= coefficient of variation

?=income averag4

Š= selling average

Companies in Tehran Stock Exchange in Iran

For the purpose of determining smoothing act in the research, some companies in the Tehran stock exchange in Iran are selected following the criteria that 168 companies selected are profitable, availability of financial information, sell shares to the Tehran stock exchange and have opera rated for a minimum of ten years (Jalilvandet al., 2017). The use of the financial information in stock exchange for each firm in the sample in every year have variables which include the net sales NS, earnings E, average share price P and divided D.

Testing First hypotheses:

H0 There exists no connection between income smoothing and the income tax of the company's selected Tehran stock exchange.

H1 There exists Connection between income smoothing and the income tax of the company's selected Tehran stock exchange.

To test the first hypothesis, legit model advanced sort of linear regression is used from the Tehran stock exchange Table 1.

| Table 1 Likelihood Ratio Tests |

|||

| Model fitting criteria | Likelihood test | ||

| -2log like hood of reduced model | Chi-square | DF | sig |

| 5.545 | .0 | 0 | 0.0 |

| 228.733 | 223.187 | 162 | 0.001 |

From the logistics correlation test, it is evident that quantity of sig achieved is 0/001and a confidence interval of 0/95 that rejected hypothesis H0. there exist a connection between tax income and income smoothing of the companies. From above fact that any increase in income expands tax and reduce liquidity, hence the companies smooth their income to minimize a reduction in liquidity more so when they are in bad debts.

Testing Second Hypotheses

H0 There exists no relationship between return on equity and income smoothing for the companies.

H1 There exists no connection between income smoothing and the income tax of the company's selected Tehran stock exchange.

The Table 2 shows the connection between income smoothing and returns on equity

| Table 2 Income Smoothing And Returns On Equity |

||||

| Effect | Model fitting criteria | Likelihood test | ||

| -2log like hood of reduced model | Chi-square | DF | Sig | |

| Intercept | 0.000 | 0.000 | 0 | 0.0 |

| Return on equity | 154.421 | 154.421 | 122 | 0.025 |

From the logistic correlation test, Sig achieved is 0/025 and a confidence interval of 0/95 which accepted hypothesis H1 and rejected hypothesis H0. There is a connection between income smoothing and the return on equity for the selected companies.

From the above example on companies from Tehran, the hypothesis test shows that there exists a relationship between income smoothing and tax income. There is a connection between income smoothing and tax income. It is also evident that from above example that the tax income is more on non-income smoothing companies and less in income smoothing companies

Use of Reserve Accounts by Japanese Forms

Using the reserve accounts, the authors will examine income smoothing by Japanese firms. Income smoothing using reserve accounts is accompanied and showed by the capital intensity, operating deviations, tax, size, and securities and earning variability. Various reserve accounts are mandated by the Japanese laws and generally accepted accounting principles. It is an unusual expectation of the regulations to expand the management positions for income smoothing. The rules on the reserved accounts are lost and depend on the managerial decisions and their flexibility in finding reserves for a given period hence are prone to smoothing.

Supposing random walk expectations of earnings E, the earnings previously on reserve accounts, EBR, we calculate the measure of income smoothing, IS, by contrasting the entire value of the one-year variance in earnings before delivery on the reserve account CEBR with the total value of the year difference in earnings CE. Those firms with the negative CEBR have a greater incentive to smooth income for the purpose of lowering the difference among the two EBRS:

(3)

(3)

Where,

IS= proxy of income smoothing

EBR=earnings before ÷ provisions on reserve account

E=NET INCOME

ASSETS= beginning of year total assets

The similar model is outlined by Moses, 1987 and Hermann in determining the income smoothing. When the value of IS, positive represents income smoothing because the total values for CEBR lower the total value of CE. The firm size is the first factor to determine smoothing of income. The larger the firm the bigger the public profiles hence a greater determination to maintain their standings. In terms of taxes, the firm with greater tax liabilities is more likely to smooth incomes a shown in Japan's progressive tax system, the capital intensity represented by the proposition of fixed assets to total assets. Those firms that have large investments in physical capital incur income smoothing using the changes in depreciation technique. For the purpose of examining the results of capital intensity on income smoothing, the net physical fixed assets deflated by the firm's total assets it owns are included.

On the side of operating activity deviation, the managers of the firms have an increased motive to smooth income when the working results deviate from anticipated working results. The firms in Japan are likely to look at the sales growth as the main aim hence sales are used to measure any change in operating activities. The deviation in this case is determined by measuring the total value of the deviations in sales deflated by former year sales which is expected associate positively with income smoothing. Japanese firms are the largest shareholders of the banks hence the banks monitor the firms accounting practices making more difficult for the firms to smooth incomes. This effect shows the debt to equity ratio.

(Guillaume & Pierre, 2016) finds that those firms that are more profitable have the probability to make use of income increasing options accruals. These firms with more profitability may find it necessarily to smooth income to show a continued future development and its growth. Return on assets is calculated as a ratio of net income to all the assets and is used to measure profitability. According to (Acharya & Lambrecht, 2015). depreciation expenses are a mean of smoothing incomes. The firms may find it necessary to use the reserve accounts in order to smooth income using depreciation expenses. To determine if there is a connection between the depreciation and the income smoothing, the changes in depreciation and expenses reincluded over one-year period followed by the former sales per year.

Commercial Banks in America

Income smoothing practices: evidence from banks operating. Using 278 commercial banks as a sample in organization for economic cooperation and development countries, it is evident that a number of banks smooth incomes deliberately either by selling trade securities or using loan loss provisions and they use more of income smoothing than the artificial smoothing. According to banks intensity to smooth also depends on the exposure to practical and beneficial constraints. The presence of insured creditors, a height of capitalization and the formation of regulatory equity capital are the main motivators for the banks to smooth their earnings. Income smoothing allows financial institutions to consolidate their money bases and to abide by the regulations and laws. Most of the studies show that income smoothing in Americans' banks is interested to show the connection between net income and provisions policy. He further factors out the need acquire finance from external sources and more so the concern for the post of a manager as the explanatory factor of smoothing incomes in America. The main determinant of the income smoothing in banks are the level of in debtless, nature of control, the size of the bank and listing or level of the bank. Guillaume & Pierre (2016) showed that supervision and regulation of banks affect income smoothing by handling loan loss provisions of the bank.

The net income is a component of capital adequacy ratio can also be manipulated by selling securities or by overseeing loan loss provisions. The financial institutions with a solvency ratio under the minimum are exposed to the controller interference. Collins (2014) proved that could capitalize their loans loss provision or the securities in order to smooth the results.

Individuals in America

Each citizen in the United States is provided with the incentive to save for the future. He says that the two pillars of the individual retirement system are not to be included in taxation system and the income smoothing. The merit of smoothing is as a result of tax progressivity. The interest and the growth rate affect individual hence influence the tax benefit of income smoothing. When a person has a positive interest, his objective is to minimize the value to be taxed. Interest brings investment income that top up smoothing bracket for lower income earners. Income growth and the interest of a person moves the smoothing accrues in an opposite road. The income level and the parameters determine the net effect hence the smoothing effect reduces with interest and also increases with income growth. The effect of smoothing is also larger wit high-income earners as they save more and the interest on bigger savings to up fixed smoothing ground for the lower income earners thus bringing an obstacle to the worker from presenting false labor income.

Results

In the isolation of gatherings, we found that all in all our speculation is affirmed. The outcomes in Table 3 demonstrate that the normal betas of the gathering organizations that smooth was essentially lower than those of the gathering of non-smoothers (0.583 Vs. 0.913). For restores, the outcomes demonstrate that the annualized advertise balanced anomalous return of smoothers was fundamentally higher than those of non-smoothers (9.69% Vs. just 5.83%). The distinctions in the methods for these gatherings was affirmed by parametric and nonparametric tests, demonstrating there is a measurably noteworthy contrast in execution in the Brazilian market between organizations that smooth and those that don't. Smoothers have deliberate measures to bring down hazard and higher return. The outcomes are reported in Table 4 beneath.

| Table 3 Descriptive Statistics |

||||||

| Type | N | Min. | Max. | Mean | Stand. Dev. | |

| Smoothers | Beta Variable | 64 | 0.1 | 1.5 | 0.583 | 0.37 |

| AR% | 64 | -98.5 | 921.9 | 253.1 | 202.64 | |

| AMR% | 64 | -2.1 | 27.17 | 9.69 | 8.9 | |

| Non-smoothers | Beta Variable | 83 | -0.2 | 2.9 | 1.195 | 0.449 |

| *AR% | 83 | -222.3 | 448.1 | 136.4 | 222.07 | |

| ***AMR% | 83 | -18.64 | 22.09 | 5.36 | 13.34 | |

| *AR= Abnormal Return; **AMAR= Annual Mean Return | ||||||

| Table 4 Parametric And Non-Parametric Results |

||||||||||

| Test | Mann-Whitney Test | |||||||||

| Variables | M0 | M1 | T | Sig.(bilat) | R0 | R1 | Mann-Whitney | Wilcoxon W | Z | Sig.(bilat) |

| AR | 136.4 | 253.1 | 2.848 | 0.025 | ||||||

| AMAR | 5.36 | 6.69 | 2.985 | 0.014 | ||||||

| Beta | 118.8 | 101.5 | 520.1 | 767.1 | -2.432 | 0.01 | ||||

| M0: Non-Smothers Mean; M1: Smoothers Mean; R0: average ranking non-smoothers; R1: Average ranking of smothers. | ||||||||||

Evidence of the factual importance of the distinction in normal returns between the two gatherings would demonstrate that an offer exchanging technique of taking a long position in smoothers and short in non-smoothers would be beneficial, guaranteeing a measurably critical irregular return.

Conclusions, Implications, And Recommendations

Conclusions

After examining the link between the income smoothing and the value of earnings in the sample companies, the researchers have reached the following conclusions:

1. Many of the companies are involved in the practice more by manipulating financial statements. It is also evident that income smoothing is also associated high extents of sales and earnings.

2. Earnings play a vital role in determining variables for stock returns, which are lower for smoothing firms.

3. Companies’ managements resort to income smoothing practices to increase their utility and for the job security. In the actual sense, the change and flexibility in reporting the financial reports are not actually dishonest as any manager has the obligation and option to determine his accounting procedures.

4. The study concludes that the published financial statements do not necessarily portray a real state of affair of corporate performance and position on account of availability of alternatives in suggested accounting practices.

5. There are two types of income smoothing. Natural smoothing, intentional smoothing or designed smoothing. Designed smoothing also named management smoothing and it is divided to two types:

• Real smoothing that named the transactional or economic smoothing.

• Artificial smoothing or accounting smoothing. Income smoothing purposes included increase in company shareholder value, reduction of corporate risk, raise funds, data transfer to market, improve relationships with employees, suppliers of raw mate, tax incentives, contractual incentives, reduce the risk of deportation and dismissals.

Implications

• The study opens the door to future applications of income smoothing practices to other sectors (industrial or agricultural sectors) for Middle East countries and other emerging markets.

• They study opens the door to conduct income smoothing practices for measuring tax income to international financial institutions register in the Stock Exchange Markets.

• The study may enhance a better understanding of accounting practices in the international companies. The study reveals variations in different aspects among the international companies; this matter should be considered in separate studies across different areas.

Recommendations

1. The need for users of information and investors in the companies (the sample of the study) to understand the importance and impact of the phenomenon of income preparation and its determinants when adopting financial statements in their decisions.

2. Expanding the study of the reasons and motives for the use of non-income-generating companies to income-raising practices and to conduct surveys and interviews for accountants, financial managers, public administration, internal and external are auditing to determine the reasons for income preparation and the motives of corporate departments to do so.

3. The need to educate users of data and financial information about the importance of income and encourage companies to follow the behavior of income preparation to take their other investment decisions with some caution and away from absolute accuracy in the accuracy of accounts and representation.

Acknowlegement

I would like to show my warm thank to Mr. Abdullah Najim Abd Al Khanaifsawy who supported me at every bit and without whom it was impossible to accomplish the end task. His translation and guidelines have empowered me to positively finish this article.

References

- Acharya, V.V., & Lambrecht, B.M. (2015). A theory of income smoothing when insiders know more than outsiders. The Review of Financial Studies, 28(9), 2534-2574.

- Bin, K.W., & Kamil, K. (2000). Market perception of income smoothing practices: Malaysian evidence. Journal of Economics and Finance, 26(2), 132-146.

- Booth, G.G., Kallunki, J.P., & Martikainen, T. (1996). Post-announcement drift and income smoothing: Finnish evidence. Journal of Business Finance and Accounting, 23(8), 1197-1211.

- Bora, J., & Saha, A. (2016). Investigation on the presence of income smoothing among nse-listed companies. IUP Journal of Accounting Research & Audit Practices, 15(1), 55-72.

- Capkun, V., Collins, D., & Jeanjean, T. (2016). The effect of IAS/IFRS adoption on earnings management (smoothing): A closer look at competing explanations. Journal of Accounting and Public Policy, 35(4), 352-394.

- Chhabra, S. (2016). Earning management: A Study. Splint International Journal of Professionals, 3(11), 40-44.

- Collins, D.W., Hribar, P., & Tian, X.S. (2014). Cash flow asymmetry: Causes and implications for conditional conservatism research. Journal of Accounting and Economics, 58(2-3), 173-200.

- Gaganis, C., Hasan, I., & Pasiouras, F. (2016). Regulations, institutions and income smoothing by managing technical reserves: International evidence from the insurance industry. Omega, 59, 113-129.

- Glaum, M., Keller, T., & Street, D.L. (2018). Discretionary accounting choices: The case of IAS 19 pension accounting. Accounting and Business Research, 48(2), 139-170.

- Guay, W., Samuels, D., & Taylor, D. (2016). Guiding through the fog: Financial statement complexity and voluntary disclosure. Journal of Accounting and Economics, 62(2-3), 234-269.

- Guillaume, O., & Pierre, D. (2016). The convergence of US GAAP with IFRS: A comparative analysis of principles-based and rules-based accounting standards. Scholedge International Journal of Business Policy & Governance, 3(5), 63-72.

- Iñiguez, R., & Poveda, F. (2004). Long-run abnormal returns and income smoothing in the Spanish stock market. European Accounting Review, 13(1), 105-130.

- Jalilvand, A., Noroozabad, M.R., & Switzer, J. (2017). Informed and uninformed investors in Iran: Evidence from the Tehran Stock Exchange. Journal of Economics and Business.

- Michelson, S.E., Jordan-Wagner, J., & Wootton, C.W. (1995). A market based analysis of income smoothing. Journal of Business Finance and Accounting, 22(8), 1179-1193.

- Michelson, S.E., Jordan-Wagner, J., & Wootton, C.W. (1999). The relationship between the smoothing of reported income and risk-adjusted returns. Journal of Economics and Finance, 24(2), 141-159.

- Michelson, S.E., Jordan-Wagner, J., & Wooton, C.W. (2001). Accounting income smoothing and stockholder wealth. Journal of Applied Business Research, 10(3), 96-110.

- Ronen, J., & Yaari, V. (2008). Earning management: Emerging insights in theory, practice and research (First Edition). New York, USA: Springer Science, Business Media, LLC.