Research Article: 2021 Vol: 25 Issue: 3S

The Impact of Monetary Policies on the Monetary Stability of Iraq and Address the Problems of Inflation in the Past Three Decade

Hameed Hasan Khalaf, TIKRIT University

Ahmed Rashid Ajrash Almuain, TIKRIT University

Raad Mohammed Nada, TIKRIT University

Keywords

Monetary Policies, Monetary Stability, Problems of Inflation

Abstract

The theme of monetary policy and its role in achieving stability and economic growth has been a subject of great controversy over the past three decades, especially after the many tools of these policies and the creation of modern monetary instruments that increased the channels of monetary policy to economic activity. The monetary policies of the effective economic policies facing the phenomenon of inflation considering that these policies are an essential part of the components and components of the general economic policy, which exercise its role by influencing the volume of money supply in accordance with the prevailing economic conditions in order to absorb excess cash or supply the economy With a new cash flow. After the transformation of the system towards a market economy and relying on the forces of supply and demand in the management of the economy, the Iraqi Central Bank since 2003 through its monetary tools to secure this transformation and activate the mechanisms of market economy through a set of technical and legislative procedures, in addition to rely on indirect monetary instruments And modernization of direct monetary instruments under the new phase. The present study is a study of monetary policies and their role in the monetary stability of Iraq as well as the treatment of inflation in the past three decades.

Introduction

The monetary policy in Iraq faces great challenges in achieving stability in line with the nature of the post-invasion phase of the Iraqi regime, on the one hand, and the dynamism of economic and social reconstruction and construction programs on the other (Abdullah, 1994; Al-Zamil & Al-Rifai, 2002; Allen et al., 2006). The price trends experienced by the Iraqi economy since the nineties of the last century until 2003 have left an annual average of about 50% to reflect a structural problem that has become entrenched in the components and entrances of the Iraqi economy, which is still suffering from the imbalance between the services and distribution sectors that are still working In favor of marginal service activities or low productivity, but a fundamental change took place on the path of inflationary phenomenon during the period 2003 to 2009, in the case of the relative decline in price trends, which indicates the success of the Central Bank in the fight against inflation and achieve Monetary stability of the country (Al-Humaidi & Khalaf, 1997; Al-Rafiqi, 2007; Abdulsattar, 2020; Ahmed & Al-Irhayim, 2021).

Research Problem

Inflation is one of the most important problems that represent a major challenge to macroeconomic policies as well as partial, especially in the absence of a clear economic strategy in Iraq and the survival of the economy subject to the discretion of decision makers and the pressures of international organizations, which requires the formulation of a tight monetary policy to reduce, inflationary pressures and achieve internal and external monetary stability

Research Hypothesis

The research proceeds from the hypothesis that monetary policy in Iraq has achieved relative success in raising and stabilizing the value of the Iraqi dinar using its traditional tools.

Research Objective

The purpose of the study is to study the nature of the work of monetary policy and discuss the main monetary tools used by the monetary authority to achieve its objectives while the practical side of the study tries to identify the most important changes in the monetary policy in Iraq after 2003 and to show the extent of internal monetary stability (stability of the general level of prices) And external monetary stability (stability of the currency exchange rate) in the country.

Research Structure

The first discussed the nature of the work of monetary policy and the most important tools, while the second section devoted to study the evolution of monetary policy in Iraq, while the third topic dealt with the main conclusions and recommendations of the study.

The First Topic: The Concept of Monetary Policy and its Tools

Monetary policy is one of the most important pillars of the general economic policy in the country. The interest in this policy has been increasing as the financial crisis and the economic instability in the world have intensified. The development of the philosophy of monetary policy has been linked to the development of modern economic ideas and theories, especially monetary ones, after the middle of the last century (Al Suwaidi, 2004).

First: The Concept of Monetary Policy

Monetary policy is defined as deliberate action by monetary authorities by controlling cash by expansion or contraction in order to achieve price stability in a fundamental way and to help maintain the stability of economic growth and employment. In what some know as a set of procedures and measures related to the organization of the process of cash issuance and control of credit in a way that can not separate the cash and credit in the impact of these measures and measures on price movements (Barik et al., 2021; Patro, 2021), while others refers to the affairs of cash and credit for the purpose of effects In the amount of money or means of payment available to suit the economic conditions by absorbing excess liquidity or injecting the economy with a new cash flow. The monetary authority usually seeks to control the volume of money supply for the purpose of achieving certain economic objectives. The central bank may reduce the money supply and raise interest rates in order to curb inflation rates or raise the exchange rate of the national currency or injection of the economy in cash doses in order to reduce interest rates and thus stimulate spending Investment and economic activity in the country. Monetary policy involves two types of decisions: decisions concerning the setting of the objectives that the state seeks to achieve. It is a political economic decision taken at the level of the government. It may also be taken at the level of the monetary authority if it is independent and decisions regarding the means of transferring monetary policy to achieve the objective (El-Sayed, n.d; El-Sayed, 1999; Hani, 2003; Habib, 2007).

Second: The Objectives of Monetary Policy

The preparation of an integrated strategy that defines the tools and objectives is necessary to build an effective monetary policy and to achieve the desired goals. To be a comprehensive monetary strategy must contain the following:

Operational Objectives

Due to the inability of the central bank to affect the final targets directly, operational objectives must be used in terms of growth rates of: monetary basis, short-term interest rates and exchange rate.

Intermediate Objectives

The intermediate objectives are to influence long-term interest rates and cash supply. By controlling these two objectives, the monetary authority can contribute to the achievement of the final objectives and thus achieve the desired effect and in accordance with the requirements of the economic situation.

Final Objectives

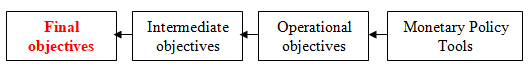

The ultimate objectives are to achieve an acceptable level of monetary and economic stability and to contribute to the achievement of appropriate growth rates in all economic sectors. The monetary policy aims at stabilizing the value of the currency and achieving justice in the distribution of incomes. These economic objectives are common objectives of all components of economic policy. Between monetary policy and other macro policies such as fiscal policy and trade policy the lack of harmony and cooperation between these policies would hamper the achievement of the final objectives of monetary policy. To illustrate the importance of operational and intermediate objectives, it is assumed that the central bank aims to achieve a growth rate of output of about 5% within a year. To achieve this goal, the supply of money (intermediate target) can be increased by 4% (Operational objective) by 5% For example; monetary policy is re-implemented in the following sequence: Figure 1

Monetary Policy Tools

Monetary policy instruments are divided into two types: monetary instruments, quantitative instruments and the most prominent quantitative instruments on money supply are:

Open Market Operations

Open market operations are one of the means of the central bank used to achieve an increase or decrease in the amount of cash reserves with commercial banks and the public, thus affecting the amount of credit granted by these banks. The central bank enters this market as a seller or buyer of these securities, The monetary reserves of commercial banks which affect the creation of credit according to the prevailing economic conditions of the recession Inflation and that central banks retain as much as appropriate government bonds for the purpose of this tool is one of the most effective tools in developed countries with well-developed financial markets.

Redemption Price

Commercial bank transactions may require more liquidity, and the central bank will have to deduct its holdings of government securities and treasury bills, get its cash value before maturity, and deduct a certain percentage of its value called the rebate rate. The central bank also direct loans to commercial banks when they face unanticipated excess orders from their depositors to withdraw their deposits, so that their liquidity is unable to meet them the central bank is rushing to provide support and cash cover to these troubled banks for a low interest rate. In light of this, the discount rate is defined as the price charged by the Central Bank for the re-deduction of commercial and government bills for commercial banks or for loans made by Commercial bank sharks.

Legal Reserve

The legislation regulating the work of banks in most countries states that each commercial bank shall maintain a certain percentage of its deposits in the form of credit with the Central Bank. This percentage represents the minimum amount to be held against bank deposits. The central bank reserves the power to change this ratio as a reduction or reduction in accordance with prevailing economic conditions, in order to allow commercial banks to extend credit and expand deposits. The ability of the Commercial Bank to provide credit and loans is not limited to the amount of cash deposits obtained, i.e., the liquidity required to meet its obligations by its depositors. It is also determined by the Commercial Bank's obligation to deposit a percentage of the balances and accounts of individuals and projects in accounts with the Central Bank, Affects Commercial bank's ability to expand credit. If the central bank finds that the commercial banks' credit has exceeded the desired level, and then decides to combat the resulting inflationary signs, it raises the legal reserve ratio, forcing commercial banks to reduce the volume of loans granted to their clients and vice versa in case of recession or Economic downturn. It is worth mentioning that the legal reserve ratio is one of the most widely used instruments by developing countries because there are no efficient financial markets in these countries that enable the central bank to follow a policy which gains a comparative advantage, the open market. The central influence on the structure of commercial bank funds without affecting the interest rate. The qualitative instruments are aimed at controlling the volume of cash Credit in the Credit and Certain Sectors of the Economy the central banks usually use the credit ceiling policy to limit the ability of commercial banks to grant credit by a certain amount and for a certain period. Another tool is literary persuasion. The idea of literary persuasion is that the central bank has an important place for the banking system as a whole. The central bank relies on this method to explain the economic condition of monetary institutions in general and commercial banks in particular and to convince them of appropriate monetary policy. Central to persuade commercial banks to finance certain sectors.

It should be noted that this analysis may not apply to developing countries for a number of reasons,

- Most developing countries are weak, small, small and concentrated in specific regions with short-term financing. Commercial financing (without long-term financing) Productive financing.

- These countries are characterized by undervalued and limited financial and monetary markets, which leads to the ineffective policy of re-discounting and open market policy, which depends on large and sophisticated financial and monetary markets.

- The banking habits of the public have not evolved sufficiently since most of the transactions are done on the basis that the settlement of transactions is through paper money and not the basis of direct cash payment in deposit money. The ratio of money supply to GDP is generally low in developed countries compared to developing countries.

- Commercial banks in developing countries are characterized by maintaining large cash reserves characterized by unpredictability of demand for deposits due to the instability of political and economic systems, which weakens the central bank's intervention in influencing money supply and thus weak monetary policy effectiveness.

The Second Topic: Monetary Policy and Economic Reform in Iraq

The circumstances of the war and the economic siege that Iraq has suffered during the last three decades have contributed to the increase in the rates of the twentieth century, a negative role in the Iraqi economy, inflation, unemployment, weak domestic savings and low wage purchasing power, as well as the low exchange rate of the local currency against foreign currencies. To distort and distort the economic structure and imbalance and the result of a major shift in the Iraqi economy and its orientation towards the market economy since then Yeh the first quarter of 2003 has necessitated a major shift in monetary policy in Iraq to keep up with the new trends of the Iraqi economy and in order to stand on monetary policy in the experience of Iraq during the period 2003-2009 should be addressed to the following themes:

First: The Framework of Monetary Policy in Iraq

As a result of the economic reform programs, the monetary authority in Iraq has developed a set of foundations aimed at enhancing stability. The rules have taken many measures in monetary and economic terms to create an economic environment based on supply and demand mechanism. The main goal of the CBI is to achieve and maintain the price level stability And work to find a competitive financial system based on the market economy and accordingly the central bank also Promote sustainable growth, work and prosperity. We can identify the most important actions taken to achieve this as follows:

1- Independence of the Central Bank of Iraq: Law 56 of 2004 granted the Iraqi Bank the right to independence in its decision. The Central Bank of Iraq has become independent and does not receive instructions even from government agencies. The law also prohibits the Central Bank from lending to the government or any state- Except for the purchase of government securities in the framework of open market operations.

2- Liberalization of the financial sector, especially the interest rate: In 2004, the Central Bank announced the abandonment of the determination of the rate of interest paid or paid by banks and financial institutions intermediary to customers and the Central Bank allowed foreign banks to operate within Iraq, where work in Iraq many foreign banks.

3- Update most of the bank payments: The system means adjustments over time and issued the total settlements on more than half a trillion Iraqi dinars per day more than 100 transactions, although this system reduces the uncertainties in banking and manipulation.

4- Issuing regulations: Issuing regulations that enable banks to expand their operations outside the balance sheet to achieve high competitive capabilities, access to financial resources at different times, reduce investment risks and partial shift from the interest base to profit within the budget in terms of accepting deposits and granting credit. To the so-called "Base Base" operations required by diversification.

5- Restructuring the Rafidain and Rashid banks financially and administratively in order to promote the sector where a memorandum of understanding was signed between the Central Bank and the Ministry of Finance in this regard.

6- Modernizing the Central Bank of Iraq and restructuring its organizational structure in accordance with the objectives of monetary policy and the freedom of foreign transfer was launched through the abolition of the Department of Foreign Exchange Control and the establishment of an office to combat money laundering, crime and terrorism.

7- Rescheduling the internal public debt in the interest of the Central Bank of Iraq to the Ministry of Finance resulting from overdraft account and treasury receipts issued by the Ministry of Finance and owned by the Central Bank of Iraq, which accumulated during the nineties because of the phenomenon of funding.

Second: The role of Monetary Policy in Achieving Monetary Stability

The monetary policy under the Central Bank of Iraq Law No. 56 of 2004 adopted a monetary framework that was corrected in accordance with the objectives adopted, which were designed to stabilize domestic prices and maintain a stable financial system that promotes sustainable development and provides jobs and prosperity in Iraq by influencing the levels Liquidity and control of the direction of the cash functions of the Central Bank of Iraq as follows:

Open Market Operations and Permanent Facilities

Some of the articles of the law of the Central Bank may, in order to achieve its objectives, complete open market operations with licensed commercial banks and licensed financial intermediaries and provide permanent facilities for commercial banks.

- Buy or sell directly (immediate and for long) or on the basis of repurchase agreements or other similar financial instruments and securities issued by the Central Bank of Iraq or by the Government bearing market returns.

- Buying or selling (immediate and long) foreign exchange.

- Discounting of remittances or promissory notes.

- Granting of loans secured by mortgage guarantees

- Accepting interest bearing deposits from banks

Legal Rreserve Requirements

In accordance with the provisions of the law and for the purpose of implementing monetary policy in Iraq, the Central Bank and through its regulations require banks to keep reserves in the form of cash holdings or deposits with the Central Bank of Iraq banks may not overdraft on reserve accounts at any time and the levels of reserve These are the same reserve levels for all banks for each category of liabilities that can be compensated, and in the case of a bank default Anvaz minimum required reserves of the Central Bank may impose a fine by a certain benefit.

The Last Resort to Borrow

According to some provisions of the law and in exceptional circumstances, the CBI can play the role of lender as a last resort to the licensed bank and provide this support by granting financial assistance to the bank or for its benefit for a period not exceeding three months and renewable by the CBI on the basis of a program that defines procedures related to the bank, And this obligation to grant the loan can be achieved only in two cases:

Initial Case: If the bank is solvent and able to provide additional collateral and the request for financial assistance is based on the need to improve liquidity.

The Second Case: Such assistance is necessary to maintain the stability of the financial system and the issuance of the Minister of Finance written guarantee to the Central Bank of Iraq on behalf of the government believes in repayment of the loan. Indicators indicate that in the period 2003 to 2009 that monetary policies in Iraq have achieved remarkable success in improving the value of the Iraqi dinar during that period.

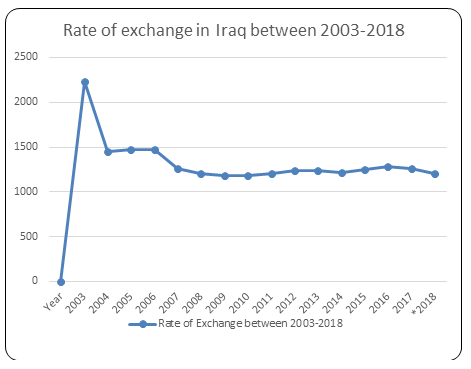

From Figure (2), it is notes that the Iraqi dinar exchange rate improved by 25% in the period, 2003-2004 and then improved by 2% in the period, 2008-2009 and then was a qualitative improvement until 2006 and then a qualitative decline in 2017-2018, according to statistics of the Central Bank of Iraq. The following are the inflation rates in 2003 and 2009 as the sample for the study, as follows:

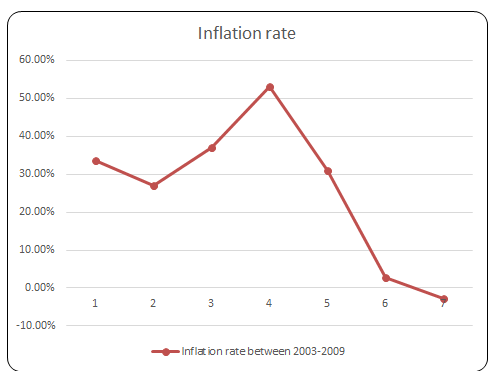

Despite the improvement in the exchange rate of the Iraqi dinar, however, we find in Figure (3) that inflation rates reached high levels of inflation, where the rate of inflation in 2006 to 53% and that this new trend in inflationary phenomenon can be attributed to two factors:

First, is supply bottlenecks in the real sector (supply shock), which mainly focused on the fuel sector and its negative impact on transportation costs and production costs.

Second, the increase in the total expenditure on goods and services in the economy, which was the result of the increase in government spending of the consumer nature in addition to the increase in salaries and wages, where we note that the proportion of the output amounted to about 60% of the annual budgets for the years 2005-2008, Has greatly improved the inflation risk resulting from the overall expenditure ratios due to the lack of productive sectors, especially in the field of industrial and agricultural activity, And increased inflationary hedge Qat individuals in foreign currency as a stable value of stocks and a means to protect the wealth of these factors impose a row of instability on the demand transport function Å de dinar, which means directed towards individuals dollarization increasingly in generating trade-off between retaining dinar or the dollar. Imam of these events the Central Bank of Iraq began to implement a tight monetary policy by the end of 2006 to address the phenomenon of inflation is growing, and based on this policy on the interest rate and exchange rate as tools. As the interest rate signal helped monetary policy to achieve its goal of converting the Iraqi dinar into an attractive currency and a strong stabilizer in the face of inflationary expectations, in two directions:

The first is to ensure that the value of the Iraqi dinar is stabilized by reference to nominal interest with positive effect on real interest as a protection for the nominal stabilizer referred to above to ensure that the inflationary expectations of the public remain constant and generate a tendency by providing positive returns on savings deposits with banks, With a value and an encouraging return to financial stability.

The second trend is that the phenomenon of dollarization is continuously narrowing and its promise to cause hyperinflation by relying on the role of interest rate signals adopted by the Central Bank within the mechanisms of monetary transition and its importance in containing the rebound phenomena in the level of the inflationary expectations of the public. This is the basis for the interest rate signal to prevent the growth of the phenomenon of dollarization so the cash market took its obvious path to restore the cash balance.

Conclusions and Recommendations

Based on the results of the analysis and the findings of the study, a set of conclusions and recommendations were reached:

First: Conclusions

- The developing countries are characterized by weak and few banking systems. Their financial and monetary markets are characterized by lack of regulation and limited size. In addition to the lack of development of banking habits among the public, these characteristics lead to discouraging the effectiveness of quantitative monetary policy instruments. Countries.

- The survival of monetary policy is unable to achieve the desired price stability in the Iraqi economy because the latter suffers from real structural imbalances in the field of industry and investment and local markets such as the labor market and the market of goods and services. In order to address these imbalances to coordinate and activate and share other macroeconomic policies fiscal policy, Investment policy and production policy.

- As a result of developments in the Iraqi economy through the adoption of policies of transition to a market economy, this prompted monetary authorities in Iraq to change the framework of monetary policy by granting the Central Bank independence in decision-making and in line with the objectives of the general economic policy of the country.

- The monetary policy during the period 2003-2009 achieved relative success by increasing the real value of 39%, due mainly to the intervention of the bank to the Iraqi dinar through the introduction of large amounts of foreign exchange through the auction of foreign currency.

- A shift in the role of the Central Bank of Iraq from the role of specific policy of commercial banks for lending and deposits and interest rates to the role of observer of the movements of lending and deposits and interest rates, as the Central Bank granted commercial banks the freedom to determine interest rates in accordance with the economic situation of the country to achieve profits for these banks after the legislation Banking Law.

- The monetary policy in Iraq could not restrain inflation until 2006, where the rate of inflation to nearly 53%, but the procedures followed by the monetary authorities at the end of 2006 led to the rate of inflation to close to 2.8 in 2008, which indicates success Monetary policy adopted in containing the inflationary phenomenon through the use of operational instruments (interest rate, exchange rate) in achieving the ultimate objectives of monetary authority and curb inflation.

Second: Recommendations

- The Iraqi economy suffers from structural imbalances in the economic infrastructure. In order to address these imbalances, it is necessary to combine macroeconomic policy efforts with monetary policy in order to introduce sectoral economic reforms in the sector of industry, agriculture, services, extractive industries and transformation through a comprehensive economic plan.

- Monetary policy should strive to maintain the exchange rate of the Iraqi dinar high against foreign currencies through currency auctions because the stability of the exchange rate is one of the important foundations to attract foreign investment and accelerate the growth and economic development in the country.

- Monetary policy should work to control the large monetary bloc by achieving a balanced balance between the monetary bloc and Iraqi GDP to reach the balance of the real and monetary sectors.

- The monetary authority should work on the development of financial and monetary markets in order to implement and assimilate its indirect measures to control the movement of economic variables, especially the general level of prices

- The need for the participation of the Central Bank of Iraq in the formulation, preparation, financing and implementation of economic plans that work to achieve real economic reforms in the three main markets of the money market and the market for goods and services and the labor market if these markets are the most important climates conducive to create a large-scale economic movement in which economic stability Incubator Growth and economic development is not inflation targeting.

References

- Abdullah, A.J. (1994). Money and Banking. Open University, Libya.

- Al-Zamil, K., & Al-Rifai, W. (2002.).Principles of Macroeconomics. Dar Wael.

- Allen, M., Baumgartner, U., & Rajan R. (2006). Inflation targeting and the IMF. International Monetary Fund.

- Al-Humaidi, A.R., & Khalaf, A.R. (1997). Money, banks and financial markets. Dar Al-Khuraiji for publication and distribution, Riyadh.

- Al-Rafiqi, I.M., (2007). Public liquidity and effectiveness of monetary policy in control.

- Abdulsattar A.H., Al-Obeid, A.S., & Al-Taiy, E.H. (2020). “Synchronization phenomena investigation of a new nonlinear dynamical system 4d by gardano’s and lyapunov’s methods”. Computers, Materials & Continua, 66(3), 3311-3327.

- Ahmed, M.A., & Al-Irhayim, Y.F. (2021). "An overview for assessing a number of systems for estimating age and gender of speakers." Tikrit Journal of Pure Science, 26(1), 101-107.

- Al Suwaidi, S. (2004). Said Money and Banks, Markets.

- Barik, R.K., Patra, S.S., Kumari, P., Mohanty, S.N., & Hamad, A.A. (2021). A new energy aware task consolidation scheme for geospatial big data application in mist computing environment. In2021 8th International Conference on Computing for Sustainable Global Development (INDIACom)(48-52). IEEE.

- Barik, R.K., Patra, S.S., Patro, R., Mohanty, S.N., & Hamad, A.A. (2021). GeoBD2: Geospatial big data deduplication scheme in fog assisted cloud computing environment. In2021 8th International Conference on Computing for Sustainable Global Development (INDIACom)(35-41). IEEE.

- El-Sayed, A., & Abdel, M., & Alissa, N.S.E-D. (1999). Money, banks and financial markets. Dar Hamid, Jordan.

- El-Sayed, A., & Abdel, M. (1999). Economics of Money and Banks, Academy of Publishing, Jordan.

- Hani, H.B. (2003). Economics of money and banks. Al-Kindi House, Jordan.

- Habib, M. (2007). Brief in political economy. University of Damascus, Syria.

- Issa, S.S., Khalaf, H.H., & Ahmed, R.A., & Essia, R.A. (2018). Effectiveness of inflation targeting based monetary policy. Opción, 34(16), 1032-1057

- Jagdish, L. (2009). Monetary economics (5th edition). Routledge, New York, USA.

- Khalaf, O.I., Ajesh, F., & Hamad, A.A., Nguyen, G.N., & Le, D.-N. (2020). “Efficient dual-cooperative bait detection scheme for collaborative attackers on mobile ad-hoc networks. "IEEE ACCESS, 8, 227962-227969.

- Khalaf, H.H. (2018). The impact of electronic money on the effectiveness of monetary policy. Academy of Entrepreneurship Journal, 24(3), 1-16.

- Muthanna, M.M., Khalaf, H.H., & Omar, A. (2021). Monetary policy responses to the global financial crisis: What did emerging economies do differently?. Academy Of Entrepreneurship Journal, 27(5).

- Milton, S., & Qrley, A. (1993). Contemporary economics, (7th edition). Worth Publisher, New York. USA.

- Nooruldeen, A.N., & Azher, A.M. (2021). "Dynamical Approach in studying GJR-GARCH (Q, P) Models with Application." Tikrit Journal of Pure Science, 26(2), 145-156.

- Sabri, J.M. (2020). "Simulation study of back surface and electron transport layers on Sb2Se3 solar Cell." Tikrit Journal of Pure Science, 25(6), 103-113.

- Seerwan, S.N. (2020). "Estimation the Variogram Function Indicator which represent the Transmissivity Coefficient in the groundwater." Tikrit Journal of Pure Science, 25(5), 110-118.

- Saeed, S. (n.d). Money and banking. Qatar University, Qatar.

- Taylor, J.B. (2014). “Inflation targeting in emerging markets: The global experience.” Speech at the Conference on Fourteen Years of Inflation Targeting in South Africa and the Challenge of a Changing Mandate, South African Reserve Bank, Pretoria, December 19.

- Yaseen, H.M., Faris, S.A., & Othman, K.Z. (2020). "Fabrication of small size wind turbine and studying its characterization." Tikrit Journal of Pure Science, 25(4), 75-79.

- Zaydan, B.M., Nazar, K.H., & Zeyad, M.A. (2020). "A modified three-term conjugate gradient method for large–scale optimization." Tikrit Journal of Pure Science, 25(3), 116-120.

- Zhang, G., Guo, Z., Cheng, Q., Sanz, I., & Hamad, A.A. (2021). Multi-level integrated health management model for empty nest elderly people's to strengthen their lives. Aggression and Violent Behavior, 101542.