Research Article: 2018 Vol: 22 Issue: 5

The Impact of Ownership Structure on Firm Performance: Evidence from Jordan

Ahmed Maqsad Mohammed, College of Administration and Economics, University of Babylon, Iraq

Abstract

The aim of this study is to investigate the relationship between ownership structure and firm performance for firms listed in the Jordanian stock exchange. The ownership concentration and owner’s identity which includes block holders, family ownership, institutional ownership and managerial ownership are taken as independent variables in our study. Whereas, Tobin’s Q, Return on Asset (ROA) and Return on Equity (ROE) are used as dependent variables. Pooled ordinary least square is used to test the hypothesis. The findings of the study have shown a great deal of agreement with agency theory. Results further revealed that Jordanian firms were following concentrated ownership, mostly family-based. The findings of this study have implications for researchers and policymakers in advancing the existing body of knowledge and formulating corporate policies.

Keywords

Ownership Structure, Firm Performance, Jordan.

Introduction

Corporate governance is a set of procedures and principals which control the corporation by determining the rights of stakeholders and to protect the interest stakeholders (Basheer, 2014). it is important to boost the confidence of the investor in the stock market and the issue arises from the separation of ownership from management. Hart (1995) stated that governance need arises due to the changing nature of the business environment and shareholders are unable to write comprehensive contracts entailing responsibilities, duties, compensation of the controlling group. In addition to this, he further pointed out that the governance performs two interconnected functions i.e. controlling/constraining and continuous learning. Fernando (2012) stated that “corporate governance deals with the ways in which suppliers of finance to corporations assure themselves of getting a return in their investment”. Having diverse nature of shareholders/owners (state-owned, institutional, concentrated families, diluted) and separation of ownership from management, minority shareholder may suffer expropriation by management or representative of large shareholders. As quoted by Adam Smith in his book titled Wealth of Nations. “The directors of such (joint-stock) companies, however, being the managers rather of other people’s money than of their own, it cannot well be expected, that they should watch over it with the same anxious vigilance with which the partners in a private company frequently watch over their own negligence and profusion, therefore, must always prevail, more or less, in the management of the affairs of such a company” (Naciri, 2008).

Corporate governance is a governing instrument which helps the firm in installing a governance mechanism which helps the stakeholders to align their objective to achieve organizational objectives (Stout & Blair, 2017). One of the issues which modern organizations are facing is a misalignment of interest between the chief controlling authority (Board of Director) and chief decisional authority (Chief Executive Officer). The board of director requires management to undertake wealth maximization practices without considering investment risks. On the other hand, the management also considers investment risks and the probability of default before undertaking any investment projects. This conflict of interest comes at a cost which is known as agency cost (Basheer, 2014; Tahir and Sabir, 2014; Kazan and Özdemir, 2014; Abiola et al., 2014; Hsu and Wen, 2015; Ali et al., 2016; Abobakr, 2017; Zhu and Chen, 2018; Aguilera & Judge, 2018). Board of directors performs two important functions such as monitor the actions of management and resources allocation. However, the role of BODs largely depends on ownership structure, for instance, the role of monitoring is more important in organizations where the shareholders are dispersed while the role of providing resources is central to BODs where concentrated ownership dominates. Agency problem (Conflict of interest between principle and agent) largely depends on ownership structure, dispersed owners with a little stake in the organization does not bother to strictly monitor the actions of managers. On the other hand, large investors having a greater stake in the organization are more interested to monitor management via representation in the board, but there arises another agency problem then between large and minority shareholders (Desender & Lafuente, 2009). Cheema et al. (2003) stated that majority shareholders having dominance overboard would reallocate organizational resource for their private benefits rather than distributing profit as dividend. They further added that to maintain majority control in the organization, they practice cross-shareholding, interlock directorship, holding companies, and pyramid structure is known as a principle-principle issue (Luo, 2007). Information discloser related to corporate is relatively less important among Chinese firms (Li et al., 2010). Few studies also concludes that the Working Capital Management positively effects the financial performance of firms by adding new variables of managers on how to develop the financial performance with working capital management (Mosbah et al., 2017; Malarvizhi et al., 2018; Le et al., 2018; Ahmed et al., 2018).

The Asian financial crisis and corporate frauds like Enron and world.com lead the world to a new era of corporate governance. Counties around the world have started focusing on the development of codes of corporate governance. Corporate governance literature from developed countries such as USA and UK reported that concentrated ownership acts as a solution for issues in internal governance. However, the developing countries such as Jordan where the codes of corporate governance are well documented but not well implemented. Moreover, ownership structure is highly concentrated and the relationship between ownership structure and firm performance is ambiguous. The ownership structure is usually categorized into two categories ownership concentration which is basically the percentage of ownership to total shareholdings and identity of shareholders (holding companies, financial institutions, family, and directors) which characterized as block holes i.e. they are holding 5 percent or more stakes in the company.

Jordan is a country where the code of corporate governance is developing roots, the ownership structure is highly concentrated, and the majority of the firms are controlled by the family. In such a country, the impact of ownership concentration on firm performance is an interesting area of the study and how corporate governance influences corporate policies is still an unknown phenomenon. To present a comprehensive and generalized conclusion, this study is using three different measurements of firm’s performance which are Tobin’s Q, ROA (firm growth), ROE (firm profitability).

The role of the audit committee in corporate governance is the subject of increasing public and regulatory interest. The audit committee is a sub-group of the full board. The audit committee gives the correspondence between the full board, insider auditor, outsider auditor, the executive officers, and fund executives. Jensen and Mackling (1976) displayed a method of reasoning for the presence of the board audit committee that managers take the chance to act against shareholders' benefits when the agency cost increase. Contractual connections in the middle of shareholders and managers decrease agency costs. In any case, these agreements must be along these lines observed.

The development of an audit committee emerges from the need to screen these agreements. Audit committee serve as trustees in a governance system decreases information asymmetry in the middle of internal and external and in this manner, mitigates agency issues. Beasley et al. (2005) likewise trusted that a successful audit committee has qualified individuals with authority and assets to ensure shareholders by safeguarding dependence on financial reporting, inward controls, and hazard management, however, its oversight part. The independent of audit committees from the management play an important role in organizations because they have good reputations to transform transparency, support the board of directors, and prevent inadequate activity and oversight function of financial reporting.

The business environment in Jordanian been seen in a few quarters as not very helpful for investors; both intro and inter. The commonness of fraud, over the earnings management and other financial wrongdoings in the nation, has decreased the level of certainty rested in these financial statements and in the capacity of these remarks to perform their essential capacities. In light of the expense of fakes to the business and the guilty party, it is critical to creating strategies to avert or distinguish business fraud and investigating the danger elements connected with the business.

The respectability of the financial related reporting system is being scrutinized, the trustworthiness of the auditor is in uncertainty and an organization control structure is at risk to be blamed in perspective of the absence of auditor flexibility and oversight from the board. DeFond and Francis (2005) claim that the result of the corporate shock has restored the importance of self-ruling audits and their linkage to the checking part of corporate governance. Fulfilling quality financial reporting depends upon the part that the outside audit plays in supporting the way of financial reporting of referred to organizations.

Numerous and inevitable changes in the governance and evaluating system keep on emphasizing the key part of the audit committee in viable stewardship. Audit committee serves the premiums of stakeholders and investors through their autonomous oversight of the yearly corporate reporting process, incorporating the organization's correlation with the outside auditor. Therefore, the present study is being carried out in Jordan where audit committee implementation is in early stages and provides an interesting insight for researchers.

Literature Review

Management accountability, resources allocation, directing and terminating the underperforming management, improving financial/non-financial performance, transparency, shareholder activism, minority investor protection, building a long-term relationship with the stakeholders, and encouraging innovation are main objectives of corporate governance (Okpiliya et al., 2016; Mahmoud, 2016; Rauf, 2016; Zou et al., 2017; Syadullah, 2018; Njiku and Nyamsogoro, 2018; Aguilera & Judge, 2018). Similarly, O'Shea (2005) said that corporate governance has six basic pillars common in almost all countries:

1. Board composition (executive/non-executive/independent).

2. Duality of power between CEO and Chairman.

3. Timely disclosure of corporate information, which may affect the stock price.

4. Nominee committee for the appointment of suitable directors.

5. Comprehensive and understandable corporate reports.

6. Sound internal control system.

Corporate governance controls are posited to be related to information asymmetry in high growth firms by the agency theory (Cai et al., 2015). Putting it another way, as management controls the affairs of the company, hence, they have more information about business operations than shareholders. Rathnayake and Sun (2017) claimed that the probabilities of agency conflict are quite high in high growth firms, therefore, the requirement of stringent corporate controls are more likely to be practised in high growth firms. CG not only improves the efficiency of allocating scarce resource among different economic units at the firm level but also enhance the economic growth of the country as well (Sobhan, 2003). As the representatives of shareholders, BOD ensures the governance practices, oversee, review, and counsel the management to achieve the organizational long-term objectives (Naciri, 2008). However, if the large investors dominate the board then the small investors will hesitate to invest. Similarly, Investor Opinion Survey on Corporate Governance conducted by Mckinsey also supported the idea that an investor is ready to pay premium prices for the shares of the company if it is well managed. Board is the most important component in the governance of any company. However, researchers are not agreeing whether the size (number of directors) or the composition (inside/outside directors) of the board is important and shareholder’s right protection largely depends on the composition of the board. Furthermore, they stated that corporate governance reforms hardly improved minority shareholder’s right protection for the family-owned firms in Pakistan (Cheema et al., 2003). Similarly, the corporate governance mechanisms play important roles in Malaysia in influencing the financing and investment decisions. It is obvious because corporations in Malaysia are highly concentrated in terms of family ownership and state ownership which may increase the probability of agency conflict (Ararat et al., 2016).

Some of the studies like Dalton et al. (1998) and Wagner (1998) found that size is the most important element while others Barnhart et al. (1994) and Barnhart & Rosenstein (1998) found that composition is more important. Large investors having a greater stake in the organization are more interested to monitor management via representation in the board, but there arises another agency problem then between large and minority shareholders (Desender & Lafuente, 2009). Cheema et al. (2003) stated that majority shareholders having dominance overboard would reallocate organizational resource for their private benefits rather than distributing profit as dividend. They further added that to maintain majority control in the organization, they practice cross-shareholding, interlock directorship, holding companies, and pyramid structure is known as a principle-principle issue (Luo, 2007). Information discloser related to corporate is relatively less important among Chinese firms (Li et al., 2010). Family firms have a greater tendency to supervise management as the family wealth is closely linked to net present value projects. Many empirical studies present the positive influence of family ownership on firm performance (Wang & Shailer, 2017). On the other hand, Negative effects between family ownership and firm performance are reported by Fattoum-Guedri et al. (2017), Haron et al. (2017), and Shen et al. (2018). This finding shows that family firms are more risk averse and the tendency to mergers or other opportunities for expansion owing to their concern for the family bequest.

The number of shares held by the top three shareholders measures the concentrated ownership structure. He, furthermore, said that a company is widely held if none of the individual having more than 10% ownership strike in it. Tobin’s Q ratio, Return on Assets (ROA), Return on Equity (ROE), and return on sales is used to measure the asset’s turnover efficiency under different ownership structure (Boubakria et al., 2005; Barontini & Caprio, 2006).

The study of Bohren and Odegaard (2001) found an inverse and significant relationship between ownership structure and firms’ performance, whereas, the rest corporate elements namely board characteristics, financial policy, and security design, were insignificant when proxy of Tobin’s Q is used as firm performance. Relevant corporate governance structure mechanism variables such as board size, board composition, CEO duality, multiple directorship, ownership concentration, and managerial shareholdings were studied by Hanifa and Hudaib (2006) in order to determine its relationships with firms’ performance measurements namely Return on Assets (ROA) and Tobin’s Q. They noted only for both board size and ownership concentrated have a positive relationship with the firm’s performance.

Previous studies investigated the relationship between corporate governance and firm performance and concludes that the ownership structure is one of the most significant factors of corporate governance which affect the firm performance (Rathnayake & Sun, 2017) This study extends the prior studies in this area by considering the combined effect of corporate governance factors such as ownership structure and identity of ownership on firm performance. Specifically, we are studying the impact of ownership structure on three performance indicators.

Data And Methodology

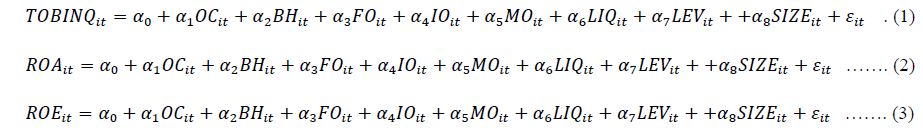

The aim of this study is to investigate the relationship between ownership structure and firm performance, the data is collected from the annual accounts of 90 listed companies from 2013 to 2016. The current study has employed the panel data methodology, panel data involves the pooling of observation into time series and cross-section units. Panel data analysis allows greater variability, less collinearity, higher speed of adjustment, larger sample size, considers the heterogeneity of cross-sections, a higher degree of freedom, and better efficiency compared to time-series (Din et al., 2017). To measure the impact of ownership structure on firm performance the following models are used:

Where, TOBINQ, ROA, ROE are used to measure the firm performance and being used as dependent variables, whereas OC (Ownership Concentration: ratio of sum of all share held by block holders by total shares), BH (Bollock Holder; Dummy variable 1: if there are a block holder and 0 otherwise), FO ( dummy variable: if family is a block holder 1 and 0 other wise), IO (dummy variable: if institution is a block holder 1 and 0 other wise), MO (dummy variable: if manager is a block holder 1 and 0 other wise) are being used as independent variables in above three equations . Liquidity (LIQ), Leverage (LEV) ad firm size (SIZE ) are being used as control variables.

Results And Discussion

Bivariate correlation analysis is also applied to check for the possibility of multicollinearity. The correlation Table 1 shows that Tobin’s Q is negatively correlated with ownership concentration, block holder, family ownership and managerial ownership at (p<0.000).Whereas it is positively correlated with institutional ownership at (p<0.010), and board independence at (p<0.005). As none of the correlation coefficient is greater than 0.8%, providing reasonable ground to believe that data is free from multicollinearity issue.

| Table1 Correlation Analysis |

|||||||||||

| TOBIN’S Q | ROA | ROE | OC | BH | FO | IO | MO | SIZE | PROF | LE V | |

| TOBIN’S Q | 1 | ||||||||||

| ROA | 0.5079* | 1 | |||||||||

| ROE | 0.2766** | 0.2354* | 1 | ||||||||

| OC | -0.3027*** | -0.1127 | 0.1860 | 1 | |||||||

| BH | -0.0037** | 0.1059** | -0.0117* | -0.2914* | 1 | ||||||

| FO | -0.0033** | 0.2043* | -0.0711* | -0.1492* | 1 | 1 | |||||

| IO | 0.2454*** | 0.1442** | -0.2745* | -0.001* | 0.0100 | -0.1200 | 1 | ||||

| MO | -0.2343** | 0.1342* | -0.2341* | 0.0213** | 0.1120* | -0.3110 | 0.3451* | 1 | |||

| SIZE | 0.3132* | 0.1432* | 0.1234* | 0.0312** | 0.3110* | 0.1120 | 0.1345* | 0.2311 | 1 | ||

| PROF | 0.3423* | 0.4321* | 0.2341* | 0.3312** | 0.5210* | 0.3220 | 0.3245* | 0.1321 | 0.2341 | 1 | |

| LEV | 0.3312** | 0.5210* | 0.3220 | 0.3245* | 0.1321 | 0.1120 | 0.1345* | -0.0711* | -0.1492* | 0.0213* | 1 |

Note: ***, **, and *denote statistical significance the 0.01%, 0.05% and 0.10% level respectively.

Breusch-Pagan Lagrangian Multiplier (LM) test is applied to check the suitability of pooled and fixed effect model and the results of the test var (u)=0, and Probability>1.00, as pvalue is greater than 5%, suggesting that pooled OLS is the most efficient and appropriate test for this dataset. The results of the first equation reported that all the independent variables are collectively explaining the behaviour of the dependent variable by 74.7%. Results of the first and third equation are quite similar and indicate that the ownership concentration, bollock holders, family ownership and managerial ownership are negatively and significantly associated with firm performance. The results of this study are in-line with the findings of Fattoum-Guedri et al. (2017); Haron et al. (2017); and Shen et al. (2018), these studies also found a significant and negative relationship between concentrated ownership and firm performance. Whereas, institutional ownership showed positive but insignificant relationship with firm performance. The results of the study highlight the fact that in Jordanian firm the results are providing more support to the argument of resource-based view which advocates dispersed ownership as a source of wellresourced management.

| Table 2 Ols Regression |

|||

| Equation | (1) | (2) | (3) |

| -0.923*** | -0.031*** | - 0.723*** | |

| (0.029) | (0.029) | (0.139) | |

| - 0.258*** | 0.299*** | - 0.732*** | |

| (0.018) | (0.020) | (0.121) | |

| -0.277** | 0.182** | -0.437** | |

| (0.003) | (0.003) | (0.052) | |

| 0.128 | - 0.600* | - 0.527** | |

| (0.277) | (0.062) | (0.137) | |

| -0.148** | 0.882** | -0.478** | |

| (0.226) | (0.229) | (0.346) | |

| 0.676* | 0.624* | 0.584 | |

| (0.177) | (0.170) | (0.126) | |

| 0.784** | 0.574** | - 0.452** | |

| (0.026) | (0.026) | (01026) | |

| -0.232*** | -0.222* | -0.231 | |

| (0.006) | (0.066) | (0.573) | |

| 0.659 | 0.661 | 0.538 | |

| Adjusted | 0.747 | 0.746 | 0.554 |

| F-statistic | 21.553 | 19.334 | 19.023 |

| Prob. (F-Statistics) | 0.000 | 0.000 | 0.000 |

| S.E of Regression. | 0.089 | 0.090 | 0.088 |

| Number of firms | 58 | 58 | 58 |

Note: ***, **, and * denote statistical significance the 0.01, 0.05 and 0.10 level respectively.

In the second equation, the regression results indicate that the ownership concentration, bollock holders, and family ownership are positively but significantly associated with firm performance. Whereas, institutional ownership and managerial ownership showed a negative and significant relationship with firm performance. Which indicate that the Jordanian firm which is characterized by concentrated ownership in hands of families believes in asset growth. Overall the results of the study have shown a great deal of agreement with agency theory and resourcebased view theory

Conclusion

It is important to examine the effects of corporate governance factors ownership concentration and firm performance set specifically, to investigate ownership concentration as a function of internal governance and identity as a function of excessive control, family ownership, government and state ownership, managerial ownership, and other control variables are used in the study. Such findings can have both, practical relevance in guiding corporate financing and investment decisions and theoretical relevance in providing new evidence on the application of existing capital structure and investment theories. The results of the study of three model used in our study showed that overall in Jordanian firm the ownership concentration is in a negative relationship with firm performance. Meanwhile, the Jordanian family-controlled firm believes in asset growth the earning per share and there is evidence in the literature that study the firms are under expansion process.

The findings of this study have both, practical relevance in guiding corporate financing and investment decisions and theoretical relevance in providing new evidence on the application of existing capital structure and investment theories. Managerial ownership serves as a robust monitoring tool over the strategic decision of the firm, which eventually results in the minimization of agency costs. In addition, it also reduces the opportunistic activities of management which provides the general.

References

- Abiola, I.D.O.W.U., & Olausi, A.S. (2014). The impact of credit risk management on the commercial banks performance in Nigeria. International Journal of Management and Sustainability, 3(5), 295-306.

- Abobakr, M.G. (2017). Corporate governance and banks performance: Evidence from Egypt. Asian Economic and Financial Review, 7(12), 1326-1343.

- Aguilera, R.V., Judge, W.Q., & Terjesen, S.A. (2018). Corporate governance deviance. Academy of Management Review, 43(1), 87-109.

- Ahmed, A., Rehan, R., Chhapra, I.U., & Supro, S. (2018). Interest rate and financial performance of banks in Pakistan. International Journal of Applied Economics, Finance and Accounting, 2(1), 1-7.

- Ali, K., Khan, Z., Khan, N., Alsubaie, A.H.I., Subhan, F., & Kanadil, M. (2016). Performance evaluation of UK acquiring companies in the pre and post-acquisitions periods. Asian Journal of Economics and Empirical Research, 3(2), 130-138.

- Ararat, M., Black, B.S., & Yurtoglu, B.B. (2016). The effect of corporate governance on firm market value and profitability: time-series evidence from turkey. Emerging Markets Review, 30, 113-132.

- Asteriou, D., & Hall, S.G. (2015). Applied econometrics. Palgrave Macmillan.

- Barnhart, S.W., & Rosenstein, S., (1998). Board composition, managerial ownership, and firm performance: An empirical analysis. Financial Review, 33(1).

- Barnhart, S.W., Marr, M.W., & Rosenstein, S. (1994). Firm performance and board composition: Some new evidence. Managerial and Decision Economics, 15(4), 329-340.

- Basheer, M.F. (2014). Impact of corporate governance on corporate cash holdings: An empirical study of firms in manufacturing industry of Pakistan. International Journal of Innovation and Applied Studies, 7(4), 1371.

- Beasley, M.S., Clune, R., & Hermanson, D.R. (2005). Enterprise risk management: An empirical analysis of factors associated with the extent of implementation. Journal of Accounting and Public Policy, 24(6), 521-531.

- Bøhren, Ø., & Ødegaard, B.A. (2004). Governance and performance revisited. Retrieved from http://www1.uis.no/ ansatt/odegaard/publications/governance_performance/performancepaper_jul_2005.pdf

- Cai, J., Liu, Y., Qian, Y., & Yu, M. (2015). Information asymmetry and corporate governance. Quarterly Journal of Finance, 5(3).

- Cheema, A., Bari, F., & Siddique, O. (2003). Corporate governance in Pakistan: Ownership, control and the law. In F. Sobhan, & W. Werner (Eds.), A Comparative Analysis of Corporate Governance in South Asia: Charting a Roadmap for Bangladesh (pp. 1-311). Dhaka: Bangladesh Enterprise Institute.

- Dalton, D.R., Daily, C.M., Ellstrand, A.E., & Johnson, J.L. (1998). Meta?analytic reviews of board composition, leadership structure, and financial performance. Strategic Management Journal, 19(3), 269-290.

- DeFond, M.L., & Francis, J.R. (2005). Audit research after sarbanes?oxley. AUDITING: A Journal of Practice & Theory: Supplement, 24(1), 5-30.

- Desender, K.A., & Lafuente, E., (2009). The relationship between enterprise risk management and external audit fees: Are they complements or substitutes? Jalilvand & Malliaris (eds.), Risk Management and Corporate Governance. Routledge.

- Din, S.M.U., Abu-bakar, A., & Regupathi, A. (2017). Does insurance promotes economic growth: A comparative study of developed and emerging/developing economies. Cogent Economics & Finance, 5(1).

- Fattoum-Guedri, A., Guedri, Z., & Delmar, F. (2017). Multiple blockholder structures and family firm performance. Entrepreneurship Theory and Practice, 42(2), 231-251.

- Fernando, A. (2012). Corporate governance principles, policies and practices, (Second Edition). New Dehli, UP, India: Dorling Kindersley.

- Haniffa, R., & Hudaib, M. (2006). Corporate governance structure and performance of Malaysian listed companies. Journal of Business Finance & Accounting, 33(7-8), 1034-1062.

- Haron, N.H., Zam, Z.M., & Abdullah, N.A.I.N. (2017). Family ownership, firm performance and capital structure: Malaysian evidence. Advanced Science Letters, 23(11), 10688-10691.

- Hart, O. (1995). Corporate Governance: Some theory And Implications. The Economic Journal, 105(430), 678-689.

- Hsu, M.F., & Wen, S.Y. (2015). The influence of corporate governance in Chinese companies on discretionary accruals and real earnings management. Asian Economic and Financial Review, 5(3), 391-406.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Kazan, H., & Özdemir, Ö. (2014). Financial performance assessment of large scale conglomerates via topsis and critic methods. International Journal of Management and Sustainability, 3(4), 203-224.

- Le, H.L., Vu, K.T., Le, T.B.N., Du, N.K., & Tran, M. (2018). Impact of working capital management on financial performance: The case of Vietnam. International Journal of Applied Economics, Finance and Accounting, 3(1), 15-20.

- Li, S., Fetscherin, M., Alon, H., Lattemann, C., & Yeh, K., (2010). Corporate social responsibility in emerging markets: The importance of the governance environment. Management International Review, 50(5) (2010), 635-654.

- Luo, Y. (2007). Global Dimensions of Corporate Governance, (Paperback Edition). Blackwell Publishing, Malden, MA, USA

- Mahmoud, O. (2016). Managerial judgment versus financial techniques in strategic investment decisions: An empirical study on the Syrian coastal region firms. International Journal of Business, Economics and Management, 3(3), 31-43.

- Malarvizhi, C.A., Nahar, R., & Manzoor, S.R. (2018). The strategic performance of Bangladeshi private commercial banks on post implementation relationship marketing. International Journal of Emerging Trends in Social Sciences, 2(1), 28-33.

- Mosbah, A., Serief, S.R., & Wahab, K.A. (2017). Performance of family business in Malaysia. International Journal of Social Sciences Perspectives, 1(1), 20-26.

- Naciri, A. (2008). Corporate governance around the world. New York: Routledge.

- Njiku, A.R. & Nyamsogoro, G.D (2018). Determinants of technical efficiency of small scale sunflower oil processing firms in Tanzania: One stage stochastic frontier approach. Asian Journal of Economics and Empirical Research, 5(1), 79-86.

- Okpiliya, F.I., Osah, C., Okwakpam, I., & Ekong, A. (2016). Spatial variability in the distribution of migrants and indigenous labor force among oil companies in ogba/ndoni/egbema local government area of rivers state. Humanities and Social Sciences Letters, 4(4), 84-95.

- O'Shea, N. (2005). Corporate governance how we've got where we are and what's next. Accountancy Ireland, 37, 33-37.

- Rathnayake, D.N., & Sun, G. (2017). Corporate ownership, governance and performance: Evidence from Asian countries. Research Journal of Finance and Accounting, 8(15), 28-36.

- Rauf, A.L.A. (2016). Risk and return: Comparative study of active sukuk markets of Nasdaq HSBC amanah sukuk and nasdaq Dubai listed sukuk. Global Journal of Social Sciences Studies, 2(2), 104-111.

- Shen, N., Au, K., & Yi, L. (2018). Diversification strategy, ownership structure, and financial crisis: Performance of chinese private firms. Asia Pacific Journal of Financial Studies, 47(1), 54-80.

- Sobhan, F. (2003). A comparative analysis of corporate governance in south Asia: Charting a roadmap for Bangladesh. Dhaka: Bangladesh Enterprise Institute.

- Stout, L.A., & Blair, M.M. (2017). A team production theory of corporate law. In Corporate Governance.

- Syadullah, M. (2018). ASEAN banking efficiency review facing financial services liberalization: The Indonesian perspective. Asian Development Policy Review, 6(2), 88-99.

- Tahir, S.H., & Sabir, H.M. (2014). Impact of family ownership on market value of a firm: A comparative analysis of family and non-family companies listed at Karachi stock exchange (Pakistan). International Journal of Management and Sustainability, 3(12), 673-683.

- Wagner, J.A.III, Stimpert, J.L., & Fubara, E.F. (1998). Board composition and organizational performance: Two studies of insider/outsider effects. Journal of Management Studies, 35, 655-677.

- Wang, K.T., & Shailer, G. (2017). Family ownership and financial performance relations in emerging markets. International Review of Economics & Finance, 51, 82-98.

- Zhu, C., & Chen, L. (2018). The impact of macroprudential supervision on the capital operation of commercial banks. Journal of Accounting, Business and Finance Research, 3(2), 56-63.

- Zou, L., Wilson, W., & Jia, S. (2017). Do qualified foreign institutional investors improve information efficiency: A Test of stock price synchronicity in china? Asian Economic and Financial Review, 7(5), 456-469.