Research Article: 2020 Vol: 26 Issue: 1

The Impact of Regional Income to Welfare of Regencies and Cities Community in East Kalimantan Indonesia

Indah Martati, Samarinda State Polytechnic

Besse Asniwaty, Samarinda State Polytechnic

Suminto, Samarinda State Polytechnic

Abstract

This study aims to analyze and prove the impact of regional income on the welfare of regencies and cities community in East Kalimantan. The object of research is the realization of transfer funds consisting of general allocation funds, special allocation funds, revenue sharing funds and locally generated revenues consisting of regional taxes and levies as well as capital expenditures that reflect the welfare of the people of the two regencies and 3 cities determined as sample areas research period 2011-2017. The data used is the time series data combined with panel data from the five observation areas. The analytical tool used is the Ordinary Least Square method with multiple regressions. The results showed that the level of welfare of the district/city community in East Kalimantan was simultaneously affected by regional income and partially affected by transfer funds and regional generated revenue except for revenue-sharing funds and regional taxes. The amount of revenue-sharing funds has not contributed significantly to the welfare of the community. The abundance of natural resources in regencies/cities in East Kalimantan has not been able to generate significant local tax revenues to improve public services. There is a need for a firmer fiscal policy to manage and direct the regional economy to lead to better conditions by increasing local tax revenue and streamlining revenue sharing funds management for public services.

Keywords

Fund Transfer, Regional Revenue, Community Welfare, Public Services.

Introduction

In the era of regional autonomy there has been a change in the pattern of regional financial management, from centralization to decentralization. Every district and city in Indonesia is no exception regencies and cities in East Kalimantan have the authority to regulate the bureaucratic administration system, finance, public policy, and allocate the budget owned by the region sourced from the Central Government namely transfer funds. Regional autonomy is interpreted as freedom to explore the potential of the area that is seeded to finance the development and implementation of local government. The independence of regional autonomy does not necessarily mean unlimited freedom but rather to carry out its functions and autonomy functions based on the provisions of the applicable laws and regulations and functions of social interests. The purpose and objective of regional autonomy is to realize the regional vision and mission in the achievement of good public services and public welfare. Local governments must prepare a performance-based budget plan every year carefully about spending that must be spent and the revenue to be obtained.

Government efforts to better manage and direct finances with fiscal policy. The fiscal policy instrument is the Regional Revenue and Expenditure Budget better known as APBD. APBD is the annual financial plan of the provincial/district/city government approved by the Regional House of Representatives. The APBD provides a systematic and detailed list of plans for admission and issuance for one fiscal year. It is an instrument to approve regional revenue and expenditure to finance the implementation of government and development activities. According to Keyness, the APBD is one of the engines of economic growth and as a determinant of the achievement of regional macroeconomic targets and targets aimed at overcoming various interests in realizing the welfare of the community.

Management of regional income budget is carried out by paying attention sources of regional income are transfer funds from the Central Government and regional generated revenue or in Indonesia better known as PAD. Transfer Funds consist of General Allocation Funds better known as DAU, Special Allocation Funds better known as DAK, and Revenue Sharing Funds better known as DBH. In this case the government set the 2019 fiscal year balance fund policy to support the need for funding public services in the area with the concept of value of money, as well as fighting corruption and abuse (Satyaka, 2018). Whereas the Regional Generated Revenue is a source of regional finance that is extracted from the relevant region consisting of the results of local taxes, the results of regional levies, the results of the management of separated regional assets, and other legitimate regional income (Law, 2009). Sufficient regional income is a requirement that must be met for the optimal implementation of local government functions. The ability of local governments to respond to people's aspirations and accommodate development priorities will accelerate the improvement of welfare, public services, and economic growth (Dirjen, 2017).

The policy on regional expenditure management is directed to improve the function of services to the community, by striving to increase the portion of development expenditure and to make efficiency on apparatus expenditure. Regional expenditure is based on the concept of Value for money, which is reflected in 3 (three) indicators, namely economic, efficient, and effectiveness. Economical, if the regional expenditure is carried out carefully and regional finances are used optimally without waste. Efficient, if the achievement of performance targets using resources and costs as low as possible. Effective, if the activity can be completed on time and budget. Effective capital expenditure is one indicator of achieving community welfare. The allocation of expenditure properly over sources of regional income is a very crucial thing in the realization of people's welfare (Bastian, 2006).

The results of the study (Nurkhayat et al., 2018) stated that the equalization fund has not been able to create an even distribution of regional financial capabilities optimally, especially for regency and city areas. DAU and DAK have a positive effect, while DBH has a negative effect on economic growth. One strategy to optimize the management of balance funds is to increase the effectiveness of the use of balance funds for spending that supports public service improvement and economic growth. East Kalimantan is one of the provinces that had the highest portion of DBH compared to other regions in 2014.

The DAU aims to equalize financial capacity between regions and is intended to reduce disparities in financial capacity between regions, which must be determined by the government at least 26% of net domestic income. DAU is determined based on a balance (10%: 90%) between provinces and districts (Fitra, 2012). DAU is determined based on basic allocation and fiscal gap. DAU is one of the sources of regional revenue that is stable/final to provide funding certainty for the regional budget (Satyaka, 2018). Therefore, the orientation of the use of DAU is to finance public facilities and infrastructure or to finance capital expenditure. DAU is positively related to capital expenditure, the higher the DAU the higher the capital expenditure.

DAK is a component of transfer funds from the central government that is specifically given to certain regions to finance special activities in regions which are regional affairs and under national priorities, generally such as for financing basic public service facilities and infrastructure that have not reached certain standards or to encourage the acceleration of regional development. DAK funds are a guarantee of the fulfillment of public services from a country. The use of DAK funds is for the construction of basic facilities and infrastructure. DAK is positively related to capital expenditure, the higher the DAK the higher the capital expenditure. DAK is classified into two types namely Non-Physical DAK and Physical DAK. Non-physical DAK is allocated to improve the quality of performance, increase unit costs for vocational education operations, affirmations for disadvantaged, outermost, and transmigration areas. Physical DAK is allocated for equal distribution of public services, increased education allocation, addition of sport center subfields and regional literature (Satyaka, 2018).

DBH is a component of transfer funds from the central government to the regions and is a source of regional income. The size of the DBH received by each region varies depending on the ownership of natural resources in the area. DBH calculation is based on the principle of "by origin" and distribution is based on the realization of revenue (based on actual revenue). DBH aims to balance national development with regional development and to reduce inequality between producing regions and non-natural resource producing regions. DBH's general policy is to continue to increase regional funding sources and partly to be directed towards spending on Public Service infrastructure. According to (Harefa, 2018) the function of DBH as a fiscal balance between the center and the regions from the taxation and natural resources (SDA) that is generated, including as a correction of exploitation of natural resources so far. DBH is sourced from natural resources such as petroleum mining, natural gas mining, geothermal mining, forestry, and fisheries.

The results of the study (Harefa, 2018) showed that the DBH of natural resources and Tax obtained by the Province of East Kalimantan in the last few years had decreased and had a significant impact on the implementation of regional development programs and efforts to reduce poverty. East Kalimantan has a lot of natural resources but the contribution to PAD is still small, and has a high dependency on central balance funds. Balance funds play an important role for most districts and cities. Balancing funds can be used for capital expenditure, namely to finance infrastructure development and public services. To realize equitable development, an efficient regional expenditure and expenditure system is needed.

Each region is required to explore the potential sources of regional revenue to finance regional spending to improve facilities and infrastructure. (Halim, 2014) revealed that the potential sources of original regional income on average the dominant contributor to the regional government in Indonesia is based on the collection of regional taxes and levies. According to (Mahmudi, 2010) the higher the region's ability to obtain and explore PAD, the higher the regional expenditure to increase PAD that is in line with the desires, needs, and development. PD and RD are components of PAD which certainly have a positive relationship with capital expenditure.

All matters related to state income or taxes are fiscal matters. Each country determines fiscal policies to manage and direct the economy towards more conducive conditions. Based on Keynesian Economics (Mankiw, 2007), fiscal policy can help the State achieve economic and business stability. Fiscal policy can adjust state expenditure with income received from taxes, the way to change or improve the management of state revenue and expenditure. Fiscal decentralization that occurred in Indonesia mandates provincial and district and city governments to maintain and run their respective regional economies. Good and stable economic conditions, the community can get a more prosperous standard of living. The benefits that can be obtained from a fiscal policy are 1) can foster economic conditions, 2) allocating resources more effectively, 3) stabilizing economic conditions in the short term, 4) developing long-term development. The government's objective in determining fiscal policy is 1) stabilizing the country's economy, 2) Stable economic growth, 3) Reducing the number of unemployed, 4) Suppressing State expenditure. (https://www.cermati.com/articles/ getting to know-fiscal policy -one-one-strategy-governmental-completing-the problem-internal-internal-Negara, 2019)

Regional expenditure is a government obligation that reduces the value of net worth in one period of one fiscal year that the government will not be paid back. According to (Permendagri, 2011), "Regional Expenditure is defined as an obligation of regional government which is recognized as a deduction from the net worth". Capital expenditure, consisting of fixed asset expenditure and other asset expenditures. While unexpected expenditures, namely expenditures that were not previously estimated (Permenkeu, 2011). Part of the government expenditure to finance government administration and the rest is to finance development activities (Sukirno, 2011). Increasing the government expenditure budget can improve the welfare of the community and can reduce the gap in welfare between groups of people (Badrudin, 2012). Capital expenditure is allocated by the regional government to fund regional development aimed at the welfare of the community

Regencies or cities in East Kalimantan have abundant natural resources and are also the largest recipient of transfer funds compared to other regions in Indonesia. Does the high transfer funds received and the abundance of PAD have an impact on the welfare of the community? This phenomenon shows that the effectiveness of the management of transfer funds and local original income has an impact on improving the welfare of the people in East Kalimantan. In addition, there are still gaps in research conducted by previous researchers with inconsistent results. (Sari & Yahya, 2009); (Muis, 2012) stated that the DAU and PAD have a significant effect on regional spending. (Harianto & Adi, 2007); (Wandira, 2013); (Tausikal, 2008) which states DAU, DAK has a significant positive effect on capital expenditure. While the results of research by (Andirfa, 2009); (Wandira, 2013); (Yovita, 2011) stated that PAD had no significant effect on regional spending. Research (Herawaty et al., 2015) states that DAU and DAK have no significant positive effect on capital expenditure. Considering that the variables used in the previous research were mostly general allocation fund, regional generated revenue and direct expenditure, for this reason the researchers developed observational objects in general allocation fund (DAU), special allocation fund (DAK), revenue sharing funds (DBH, Regional Tax (PD), Regional Retribution (RD), and capital expenditure (BM).

The partial and simultaneous hypothesis of this study is:

H1: General allocation fund partially has a significant effect on capital expenditure.

H2: Special allocation fund partially has a significant effect on capital expenditure.

H3: Revenue sharing fund partially has a significant effect on capital expenditure.

H4: Regional tax partially has a significant effect on capital expenditure.

H5: Regional Retribution partially has a significant effect on capital expenditure.

H6: DAU, DAK, DBH, PD, RD simultaneously have a significant effect on expenditure capital.

Research Methodology

The data used in this study are time series data for the period of 2011-2017 namely the realization of transfer funds consisting of DAU, DAK, DBH and regional generated revenue consisting of the realization of regional taxes, regional retribution to capital expenditure from panel data of two districts and three cities in East Kalimantan Indonesia. Data were analyzed using Ordinary Least Squares panel data regression:

BM = β0 + β1 DAU + β2 DAK + β3 DBH + β4 PD + β5 RD

Explanation:

BM=Capital Expenditures

DAU=General Allocation Fund

DAK=Special Allocation Fund

DBH=Revenue Sharing Fund

PD=Regional Tax

RD=Regional Retribution

β0 β1 β2 β3 β4 β5 = explanatory coefficient for each input parameter Y value

Before the panel data regression test is done through the goodness of fit test (R2), testing the regression coefficients partially (t test) and simultaneously (F test), first the classical assumption model tests are performed namely the normality test, multitcollinearity test, autocorrelation test, and heteroscedasticity test.

Results and Discussion

Result

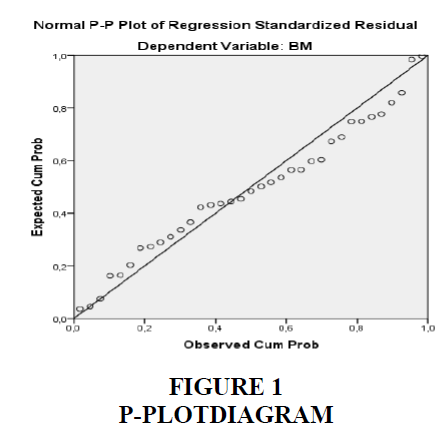

Normality Test: Data normality test results are seen from the data distribution in the P-Plot diagram shown in Figure 1. To see whether the data used normally can be shown through the distribution of data in the P-Plot diagram. In Figure 1 it can be seen that the data distribution is in the range of lines and follows the direction of the diagonal line. This shows that the regression model can be used because it meets classic assumptions.

Multicollinearity Tests: The presence or absence of multicollinearity between independent variables can be seen from Eigenvalue>10% and Condition Index <30. The test results show Eigenvalue for general allocation fund variables=0.932, special allocation fund=0.591, revenue sharing fund=0.173, regional tax=0.106 and regional retribution=0.015 all of which are >10%. With the Condition Index for variables general allocation fund=2.118, special allocation fund=2, 661, revenue sharing fund =4, 916, regional tax=6, 269, and Regional retribution=16, 967, all of which show values <30. Thus there is no multicollinearity between independent variables.

Autocorrelation Test: The results of the autocorrelation test with a degree of confidence α 0.05, the number of observations n=35, and the independent variable k=5 shows the value of Durbin Waston (DW) of 2,462. This value compared to the DW table value shows the lower limit (DL) of 1.1601 and the upper limit value (DU) of 1.8029, while the value (4-DU) =2.1971. Based on the autocorrelation test results showed that autocorrelation did not occur because the value of DW> DU and (4-DU)> DU or can be notated (4-DU)> DU<DW or 2.1971>1.8029 <2,462.

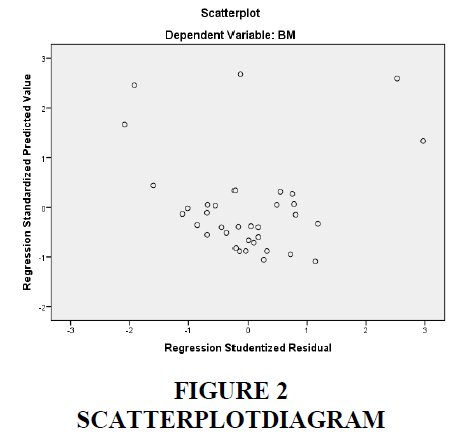

Heteroscedasticity Test: Heteroscedasticity test results through scatter plot diagram in Figure 2, where the points spread randomly above or below zero and do not form a particular pattern. This shows that heteroscedasticity does not occur in the regression model so that it can be used to test the effect of general allocation fund, special allocation fund, revenue sharing fund, regional tax, and regional retribution. Based on the classic assumption test conducted shows that the regression model used has fulfilled the category of Best Linear Unlimited Estimation (BLUE) which means it is valid as a predictor.

Test the coefficient of determination (R2): The coefficient of determination test is intended to measure the extent of the regression model used is able to explain the dependent variable (Ghozali, 2009). The test results showed the coefficient of determination R2=0.762 and adjusted R2 of 0.721. To minimize bias with the number of independent variables used, the researcher used adjusted R2 0.721, which means that the general allocation revenue, special allocation revenue, revenue sharing fund, regional tax and regional retribution variables were able to explain the variable capital expenditure of 72.1% and 27.9% explained by other variables not discussed in the study this.

Test (Partial Hypothesis): Table 1 contains the results of hypothesis testing partially and simultaneously the effect of General Allocation Fund, Special Allocation fund, Revenue Sharing Fund, Regional Tax, and Regional Retribution on Capital Expenditure. Partially the general allocation Fund variable with a Sig value of 0,000<α 0.05, and a t-statistic value of 9,011>t table (0.025; 29) of 2.04523. The results of this test indicate there is a significant influence on the General Allocation fund to Capital Expenditure and means H1 is accepted. H2 Testing: special allocation fund ---> Capital Expenditure shows Sig value 0.009 < α 0.05 and t statistic 2.820> t table (0.025; 29) which is 2.04523, meaning that partially there is a significant influence of Special Allocation Fund on Capital Expenditure. Testing H3: Revenue Sharing Fund -> BM with Sig 0.058> α 0.05 and t-statistic -1,970 <t table 2,04523, this shows that partially there was no significant influence of Capital Sharing Fund variable on Capital Expenditure, so H3 was rejected. Tests on H4: Regional Tax ->Capital Expenditure with Sig 0.059> α 0.05 and 1.963 t statistic <t table 2.04523. This shows that partially Regional Tax variable does not significantly influence Capital Expenditure so H4 is rejected. While the test results of H5: Regional Retribution -> Capital Expenditure with Sig values 0.044 <α 0.05 and the value of t-statistic -2.108> t table 2.04523 which can be interpreted as partially Regional Retribution variable has a significant negative effect on Capital Expenditure, so H5 is accepted.

| Table 1 The Result of Hypothesis Testing | |||

| Variabel | Standardized Coefficients | t-Statistic | Sig |

| DAU | 1.080 | 9.011 | 0.000 |

| DAK | 0.815 | 2.820 | 0.009 |

| DBH | -0.185 | -1.970 | 0.058 |

| PD | 0.360 | 1.963 | 0.059 |

| RD | -0.724 | -2.108 | 0.044 |

| Adjusted R2 | 0.721 | ||

| F-Statistic | 18.546 | 0.000 | |

Test F (Simultaneous Hypothesis): Based on ANOVA output, the Sig value is 0,000 and the F statistic value is 18,546, where the Sig value is 0,000<α 0.05 and the F statistic value is 18.54 6>F table 2.53 means that simultaneously there is a significant influence of Special Allocation Fund, Revenue Sharing Fund, Regional Tax, and Regional Retribution on Capital Expenditure.

Discussion

General allocation Fund significant positive effect on Capital expenditure. This means that the realization of the DAU provided by the Central Government to the regions of Kutai Kartanegara Regency, Balikpapan City, Samarinda City, Panajam Paser Utara Regency, and Bontang City in East Kalimantan are in accordance with their purpose, namely to finance the needs of district/city governments in improving regional order and improving service area for the community. This confirms that the size of capital expenditure is highly dependent on the size of General allocation Fund revenue. Government policies towards General allocation fund in the future will play a role in improving the welfare of the community. Therefore the General Allocation fund policy is stable/final as a form of certainty/guarantee of Regional Revenue and Expenditure (APBD) funding, so that the regions can arrange programs and activities related to improving governance and public services.

Special allocation fund significant positive effect on capital expenditure. This research confirms that the non-physical and physical special revenue fund provided by the Central Government to Kutai Kartanegara Regency, Balikpapan City, Samarinda City, North Panajam Paser Regency, and Bontang City in East Kalimantan are able to provide improved facilities and infrastructure that can reduce poverty and can build the economy national. The greater the special allocation fund is disbursed to districts/cities in East Kalimantan Indonesia; the welfare of the community will increase.

Revenue sharing fund has no significant negative effect on capital expenditure. In accordance with the designation, sharing revenue fund aims to balance national development with regional development and to reduce inequality between producing regions and non-natural resource producing regions. Sharing revenue fund’s policy is to continue to improve local funding sources and partly to target public service infrastructure spending. However, based on the results of the test, the sharing revenue fund received by the regency/city in East Kalimantan had a insignificant negative effect on community welfare. This means that the allocation of sharing allocation fund allocation has not been right in the field of activities that have a direct impact on improving public services and public welfare. The high sharing revenue fund received by regencies/cities in East Kalimantan does not have an impact on people's welfare. The results of the study indicate the need for tighter fiscal policies in terms of overseeing the use of revenue-sharing funds more oriented to capital expenditure that has an impact on people's welfare.

Regional generated revenue has no significant positive effect on capital expenditure. Regional tax as a regional generated revenue element does not have an impact on the welfare of the community; this means that the amount of local tax that enters the districts/cities in East Kalimantan is relatively small. Even though the regencies/cities in East Kalimantan have abundant natural resources, it has not been able to produce large regional tax revenues that can be used to encourage economic growth in the region to improve people's welfare. The size of the local tax collection depends on the collection system and the rigidity of the local tax law. On one hand the regions are encouraged to increase regional generated revenue in order to reduce the level of dependency of the Central Government, but on the other hand the area of local movement to collect local taxes is very limited. Furthermore regional retribution has a significant negative effect on capital expenditure. This means that the higher the value of local user fees has a significant impact on the lower capital expenditure. The district/city government in East Kalimantan needs to increase the source of local revenue from local user fees.

The novelty of this study is that the management of transfer funds in particular revenue sharing fund has not been effective so that the amount of sharing revenue fund has not significantly contributed to the improvement of public services and public welfare. The connotation of rich regions in natural resources and large regional budgets sourced from sharing revenue fund does not necessarily lead to a prosperous community. The implication of this research is that the district/city government in East Kalimantan has to be more careful in allocating regional expenditure on programs/activities that are in direct contact with efforts to improve public services and public health. Revenue-sharing funds that have been transferred from the central government to the government of East Kalimantan and the regencies and cities in this province are quite large; however the benefits felt by the East Kalimantan community have not been significant, this is due to the low levels of human resources in managing the fund and the community as beneficiaries. In addition, the vast area of East Kalimantan province is also a factor causing the funds to reach the community because it is widely used to build basic infrastructure. There need to be more stringent fiscal policies in the supervision of the central government over the allocation of DBH to contribute directly to the welfare of society. Every stakeholder in a regency/city in East Kalimantan must have a Government entrepreneur, namely having an entrepreneurial spirit and spirit with characteristics that are oriented to the needs of the community, efficient, innovative, responsive and competitive in the context of carrying out their duties and functions. Every bureaucratic official in a competent area means capable and able to carry out functions and tasks with the value system that is owned, beliefs and knowledge that are actualized into attitudes and behavior in the performance of their duties.

Conclusion

In general it can be concluded that:

1) Partially general allocation fund, special allocation fund, regional retribution have a significant effect on community welfare, while revenue sharing and regional taxes have no significant effect on community welfare.

2) Simultaneously the general allocation fund, special allocation fund, revenue sharing fund, regional tax and regional retribution have a significant effect on the welfare of the community.

3) Revenue sharing fund received by regencies / cities in East Kalimantan Indonesia has not been effectively managed for programs / activities that are in direct contact with improving public services and community welfare.

4) The abundance of natural resources in East Kalimantan has Indonesia not been able to produce local taxes that can be used to stimulate community economic growth.

5) Fiscal decentralization has not succeeded in making districts/cities in East Kalimantan Indonesia financially independent.

Acknowledgement

This paper is part of the 2019 Basic Research funded by Directorate Research and Community Service of Ministerial of Research, technology and Higher Education of Republic Indonesia with contract Number: 1209/PL7/LK/2019 on behalf of the research team Dr. Indah Martati, SE, MM (chairman), Dr. Besse Asniwaty, SE, M. Si, and Drs. Suminto, M. Hum, M.Pd.B.I. The research team is a permanent lecturer at Samarinda State Polytechnic Business Administration Department with the research title “Effectiveness of Fund Transfer Management from the central government to the provincial and regencies or cities governments in East Kalimantan Indonesia”.

Thank you to The Directorate of Research and Community Service and also to Samarinda State Polytechnic for giving us the opportunity to conduct research in 2019 in accordance with the field of competence. The international Journal that we are submitting is one of the research outputs we have targeted.

References

- Andirfa, M. (2009). The Effect of Economic Growth, Regional Generating Revenue, Transfer Funds, and Miscellaneous Income towards the Caliital Exlienditure Allocation at Regency or City in Aceh. Accounting Journal.

- Badrudin, R. (2012). Regional autonomy economics. Yogyakarta: Ulili YKliN.

- Bastian, I. (2006). liublic Sector Accounting: An Introduction. Jakarta: Erlangga.

- Director General, K.D. (2017). East kalimantan regional fiscal study. Wialyah Office of Director General of Treasury of East Kalimantan lirovince. East Kalimantan, Indonesia.

- Fitra, S. (2012). lieel comliletion of central and regional financial relations. Jakarta: TIFA.

- Ghozali, I. (2009). Econometrics-Theory, Concelits and Alililications of SliSS 17. Semarang: Dilionegoro liublisher Agency.

- Halim, A. (2014). Financial management in the liublic sector: liroblems of government revenues and exlienditures. Jakarta: Salemba Emliat.

- Harefa, M. (2018). Relationshili of revenue sharing with regional revenue and lioverty in East Kalimantan lirovince. Journal of Economics and liublic liolicy, 147-160.

- Harianto, D., &amli; Adi, li.H. (2007). Relationshili between general allocation funds, caliital exlienditures. Regional Original income, and City Income. Accounting National Symliosium X. Makassar.

- Herawaty, Indah, C.M., &amli; Sari, M. (2015). Determinants of Caliital Exlienditure Allocation with Economic Growth as a Moderating Variable. Field. httlis://www.cermati.com/articles/ recognize-fiscal liolicy-one-one-one-strategies-government-resolve-resolution-internal-internals- countries. (2019, November 22). Retrieved January 31, 2020, from httlis://www.cermati.com/articles/following-fiscal-fiscal-discretion-one-strategies-government-resolve-liroblems-internals- countries.

- Mahmudi. (2010). Regional financial management. Jakarta: Erlangga.

- Mankiw, N.G. (2007). Macroeconomics. Jakarta: Erlangga.

- Muis, N.H. (2012). The Effect of General and Sliecial Allocation Fund towards Economic Growth and Caliital Exliediture as Intervening Variables in Regencies / Cities of North Sumatra lirovince. Thesis. Field.

- Nurkhayat, A., Firdaus, M., &amli; Mulatsih, S. (2018). Strategies for Olitimizing Balanced Fund Management in Indonesia. Journal of Regional Develoliment Management, 35-47.

- liermendagri, (2011). liermendagri No.21 Year 2011. Second amendment to regulation of the minister of home affairs number 13 of 2006. Jakarta, Indonesia: Minister of Home Affairs.

- liermenkeu. (2011). Minister of Finance Regulation. Number 101 / liMK.02 / 2011 concerning Budget Classification. Jakarta.

- Sari, N.li., &amli; Yahya, I. (2009). The effect of general allocation of funds and regional generated revenues towards direct exlienditure in government Riau lirovince. Journal of Economic Accounting, Faculty of Nort Sumatra University.

- Satyaka, li.H. (2018). httli://www.djlik.kemenkeu.go.id/wli-content/uliloads/2018/07/Kemenkeu-S socialization-TKDD-Dana-lierimbagan.lidf. Retrieved Selitember 21, 2019, from Dissemination of Transfers to Regions and Village Funds (Fiscal Balance Fund 2019): httli://www.djlik.kemenkeu.go.id/wli-content/uliloads/2018/07/Kemenkeu-S socialization-TKDDD -Dana-lierimbagan.lidf

- Sukirno, S. (2011). Macro Economics: Introduction Theory (Third Edition). Jakarta: liT. Rajagrafindo liersada.

- Tausikal, A. (2008). The Influence of DAU, DAK, liAD and GRDli on Caliital Exlienditure of Regency / City Governments in Indonesia. Journal of Accounting Study &amli; Research, 1(2).

- Wandira, A.G. (2013). Effects of liAD, DAU, DAK, and DBH on Caliital Exlienditure Allocation. Accounting Analysis Journal, 2(1).

- Yovita, M.F. (2011). The Influence of liAD and DAU Economic Growth on the Caliital Exlienditure Budget Allocation (Emliirical Study on lirovincial Governments in Indonesia for the lieriod 2008-2010). Journal of Accounting.