Research Article: 2022 Vol: 25 Issue: 5S

The impact of tax decisions on entrepreneur turnover

Xue Chang, University of Nottingham Ningbo China

Citation Information: Chang, X. (2022). The impact of tax decisions on entrepreneur turnover. Journal of Management Information and Decision Sciences, 25(S5), 1-20.

Abstract

With market competition has increased in recent years, CEO turnover has become more frequent and becoming an important area in business management and corporate governance. Entrepreneur turnover is a series issues in board decision making because the company's strategy will be repositioned. This paper analyzes the impact of corporate tax avoidance on corporate governance. This paper selects Chinese A-share market from 2010 to 2019 as a sample, and combines theoretical analysis and empirical research to explore the impact of corporate tax avoidance on CEO turnover, and further analyzes the relationship under different ownerships. We find that there is a negative relationship between tax rates and forced CEO turnover. Listed companies with lower tax rates will cause social concern, leading to public doubts and inspections by tax authorities, which will further damage the company’s reputation. CEO turnover is the quick and easy way to respond the public accusations. We also find that state-owned enterprises undertake more social responsibilities than non-state-owned enterprises. The main contributions of this paper are as follows: On the theoretical perspective, this paper conduct systematic research on corporate tax avoidance and CEO turnover and analyze the relationship under different ownerships. In terms of practice, this paper puts forward relevant policy recommendations for the long-term development for enterprises and social responsibilities.

Keywords

Corporate Governance; Decision Making; Corporate Tax Avoidance; CEO Turnover; Corporate Social Responsibility.

Introduction

This paper is based on two theories: agency theory and corporate social responsibility theory. The reason why we choose to join the corporate social responsibility theory is that the agency theory mainly focuses on the relationship between shareholders and managers, and cannot fully explain the relationship between tax avoidance and corporate governance. Corporate responsibility theory can better explain the link between the company and all stakeholders (such as government agencies, political groups, customers and the public) (Annuar et al. 2014).

Like tax avoidance, corporate social responsibility lacks a clear definition. According to Waller & Lanis (2009) the social responsibility theory states the existence of an implicit contract between the corporations and society, and this contract is based on expectations of several groups in the society. Another important aspect of social corporate responsibility is that organizations seek legitimacy from various stakeholders within the society. The way to obtain legitimacy is to conduct operations in a socially responsible manner, which is determined by the stakeholders of corporations. The greater the influence and power of the reference groups, the more willing the organization to make changes to legitimatize itself to the relevant groups.

Agency theory is provided by Jensen & Meckling (1976). The separation of ownership and control due to the goal of the shareholders and managers is inconsistent. Shareholders are aimed at after-tax profits and managers pursue avoid risks (Desai & Dharmapala, 2009). In order to reduce agency cost, companies often choose equity incentive compensation (Jensen & Meckling, 1976).

In order to better understand Chinese companies, we must pay attention to the background of Chinese companies (Spicer et al., 2000). State-owned enterprises account for approximately 80% of Chinese stock market (Economist, 2012). The selection and appointment of state-owned enterprises executives are mainly based on the "internal labor market" formed by the government officials, which has led to different taxation attitudes between SOEs and non-SOEs. Most scholars believe that the degree of tax avoidance in SOE is less than that of non-SOEs.

Literature Review

Corporate Tax Avoidance

In recent years, many researchers have paid attention to tax avoidance. Graham et al. (2012) review literatures of the three top accounting journals (Accounting Review, Journal of Accounting and Economics, Journal of Accounting Research) and find an upward trend on tax avoidance literatures. Many literatures have analyzed the motivations and consequences of tax avoidance (Desai & Dharmapala, 2007). We define tax avoidance broadly as covering any matter that reduces the company’s tax payment compared to pre-tax income (Dyreng et al., 2008). We do not measure tax aggressiveness, tax risk, tax evasion, or tax sheltering. Previous researches have shown substantial variation in effective tax rates. Tax strategy is affected by many factors, such as: board composition, company structure and management compensation. Among many factors, the influence of executives is the most important. Kim et al. (2011) finds that managers can manipulate income and hide negative information through complex tax techniques. Crocker & Slemrod (2005) find that if the marginal benefits of tax avoidance are greater than the marginal costs, managers will take all measures to reduce the tax expenses. Companies that use after-tax incentive compensation have lower effective tax rates than companies that use pre-tax performance incentives compensation (Gaertner, 2014; Powers et al., 2016). The consequences of tax avoidance can be analyzed through the cost of equity, enterprises value, investors’ attitude, management reputation, and leverage and so on (Graham et al., 2014).

The CEO Turnover

CEO turnover has always been considered as an important factor of the change of enterprise strategy, because CEO is the decision-maker and implementer of enterprise strategy. In recent years, CEO turnover has become a core issue in the field of strategy, organization, finance and leadership. According to the previous literatures, the main factors that affect CEO turnover are company performance, industry competitiveness, board composition, insider ownership, and so on. CEO turnover is an important part of corporate governance. Board has the responsibility to replace the inappropriate CEOs if they cannot meet the requirement of shareholders (Weisbach, 1988). Cumming et al. (2011) proposes that compared with state-owned companies, corporate fraud in non-SOEs is more likely to lead to CEO turnover in China. Fee et al. (2013) shows that effectively distinguishing between forced and non-forced CEO turnover can reduce bias in the test, which can analyze the relationship between tax and CEO turnover robustly. Because forcing the CEO to leave is a deliberate action taken by the board, which means that the company plans to change direction, strategy, and leadership. In developed countries, CEO turnover has been widely analyzed. However, in countries with weak legal systems and underdeveloped financial systems, the determinants of CEO turnover remain unclear. It is rare to analyze the effect of tax rate on CEO turnover in China. Our research also complements the existing literatures on CEO turnover (Cheng & Warfield, 2005).

Relevant Research on the Relationship between Corporate Tax Avoidance and CEO Turnover

Although the CEO is not a tax expert and cannot directly influence the company's tax policies, the CEO is the ultimate decision-maker, whose position is higher than that of the tax director and CFO (Cazier et al., 2015). CEOs have a greater impact on effective tax rates than CFOs (Desai & Dharmapala, 2006; Feldstein, 1999). The CEO can use "tone at the top" to indirectly influence the tax policies (Hambrick & Mason, 1982). They hold that the decision-making is affected by the CEO personal characteristics, and has been confirmed by a large number of studies (Chyz, 2013; Dyreng et al., 2010; Olsen & Stekelberg, 2016; Rego & Wilson, 2012; Laguir et al., 2015). They believe that the CEO has a significant impact on corporate tax rates (Dyreng et al., 2017). CEOs can adjust the company's annual budget to avoid taxes. The decision to hire or dismiss a tax director is part of the CEO's tax planning. The CEO can also instruct the CFO or tax directors to avoid tax by changing the compensation plan. Therefore, the CEO has the intention and ability to influence the company's tax strategy. Chyz et al. (2019) find that there is a positive relationship between tax avoidance and CEO overconfidence. Koester et al. (2017) finds that executives with more resources are more effective in participating tax avoidance. Chyz & Gaertner (2018) analyses CEO turnover in the United States from 1993 to 2006. They find that there is a relationship between the tax rates and forced CEO turnover. When the tax rate deviates from the industry average, the CEO is more likely to be replaced.

Research Hypothesis

Paying taxes is an important way for enterprises to undertake social responsibility. Hanlon & Slemrod (2009) find that company will be labeled as "poor corporate citizen" when the tax rate is too low, which will result in the increase of political and reputation costs. Stakeholders highly apprise companies that have made greater contributions to society. Companies that pay more taxes deliver excellent performance information to the market. In turn, companies will face stricter inspections by the tax authorities, media and even customers resist, which will affect the market value of the company. Based on the above analysis, we put forward the first hypothesis.

H1A: The possibility of forcing CEO turnover increases when the effective tax rates related to peer companies are low.

From the perspective of reducing agency costs and CEOs’ personal interests, CEOs are more willing to avoid taxes. Failure to participate in tax avoidance may result in the CEO being unable to achieve the after-tax profit target and increase the possibility of dismissal. This leads to our second hypothesis:

H1B: The possibility of forcing CEO turnover increases when the effective tax rates related to peer companies are high.

From the view of managers, CEOs in state-owned enterprises are often administrative appointments which bear a lot of administrative responsibilities, while CEOs of non-state-owned enterprises are agents elected by the board of directors. The differences make them have different attitudes towards corporate tax avoidance.

Based on the above analysis, this paper puts forward the second hypothesis

H2: Compared with non-state-owned enterprises, tax avoidance in state-owned enterprises has a more significant impact on forced CEO turnover.

Methodology

Data and Sample

Our sample is companies listed on both the Shanghai Stock Exchange (SHSE) and the Shenzhen Stock Exchange (SZSE) from 2010 to 2019. The main reason for the sample period begins from 2010 is that China has implemented the new enterprise income tax law since 2008. The revision of the new income tax law has reduced the maximum enterprise income tax rate from 33% to 25%. Therefore, it is expected that the implementation of this policy in 2008 will significantly affect the tax avoidance of enterprises (Frank et al., 2009; Freeman et al., 2004). In addition, the global financial crisis started in 2008 has a partial impact on China's economy, leading to the fluctuation of national policy. In short, in order to avoid the impact of the new income tax law and the global financial crisis, this paper takes 2010 as the starting year of the research sample. The sample period ends in 2018, because 2018 data is the latest research data available in this paper.

Next, the samples are screened as follows steps: (1) remove the samples whose pre-tax accounting profit is less than or equal to zero; (2) remove the abnormal samples whose income tax expense is less than or greater than pre-tax accounting profit; (3) delete the abnormal samples whose debt cost is less than or greater than one; (4) exclude firms with incomplete information on the key variables; (5) delete the listed companies in the financial industry, because the accounting standards in the financial industry are quite different from those of other industries, and the relevant indicators are not comparable; (6) We delete companies marked as ST or * ST because of irregularities and negative profits for two or three consecutive years. (7) Excluding the samples with abnormal actual income tax rate (the actual income tax rate is less than 0 and greater than 1). The research data comes from CSMAR database. In addition, all variables are winsorized at the 1% and 99% level. In 2010-2019, there are 11,000 firm-year observations.

There are 1,701 CEO turnovers during the sample period. In Table 1, there are 12 reasons for CEO turnover, which provided by CSMAR database. Change of job is taking up highest percentage, which accounting for 28.81% of the turnover. The second one is contract expiration, which represents 27.81%, and the third is Personal reasons (12.17%). Only 0.76% falls in the dismissal category. We reclassify reasons on job changes, resignations, personal reasons, and reasons not given (Firth et al., 2006). Other turnover rates are classified as normal with one exception: if the CEO is less than 60 years old and stated reason is retirement, we classify this turnover as forced (Huson et al., 2004).

| Table 1 Reasons For Ceo Turnover Presented In Csmar Database |

||

|---|---|---|

| Reasons | Freq. | Percent |

| Change of job | 490 | 28.81% |

| Retirement | 46 | 2.70% |

| Contract expiration | 473 | 27.81% |

| Change in controlling shareholders | 3 | 0.18% |

| Resignation | 160 | 9.41% |

| Dismissal | 13 | 0.76% |

| Health | 34 | 2.00% |

| Personal reasons | 207 | 12.17% |

| Corporate governance reform | 94 | 5.53% |

| Legal disputes | 4 | 0.24% |

| Completion of acting duties | 76 | 4.47% |

| No reason given | 101 | 5.94% |

| Total | 1701 | 100.00% |

Table 2 summarizes the reasons for CEOs forced and normal turnover and the corresponding frequency. By reexamining 958 cases through a search for CEO resume, 432 cases are not forced. We can see those 241 cases remaining as board chairman or vice chairman and 191 cases are promoted (186 CEOs promote as chairman or vice chairman; 5 CEOs became government officials). We classify the remaining 526 cases as forced turnover. These included 78 CEOs who accepted new positions ranked lower than CEO position and 448 cases without any traceable destination information. In conclusion, 1154 normal turnover events which accounted for 67.84% of the total and 516 cases as forced turnover (32.16%).

| Table 2 Classification Of Ceo Turnover |

||

|---|---|---|

| Reasons for turnover | No of observations | Frequency (%) |

| Normal turnover | 1154 | 67.84% |

| Retirement | 38 | 2.23% |

| Contract expiration | 473 | 27.81% |

| Change in controlling shareholders | 3 | 0.18% |

| Health | 34 | 2.00% |

| Corporate governance reform | 94 | 5.53% |

| Legal disputes | 4 | 0.24% |

| Completion of acting duties | 76 | 4.47% |

| Important government position taken up | 5 | 0.29% |

| Remaining as board chairman or vice chairman | 241 | 14.17% |

| Promoted to board chairman or vice chairman | 186 | 10.93% |

| Forced turnover | 547 | 32.16% |

| New position ranked lower than CEO position | 78 | 4.59% |

| retirement ageless than 60 | 8 | 0.47% |

| Dismissed | 13 | 0.76% |

| Information unavailable | 448 | 26.34% |

| Total number of observations | 1701 | 100.00% |

Measures

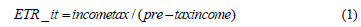

According to Hanlon & Heitzman (2010), they find that there are many approaches to measure tax avoidance to ensure the robustness of research conclusions. In this paper, we use four measures from the balance sheet dimension and cash flow statement dimension: effective tax rate (ETR), cash effective tax rate (CASH_ETR), book tax difference (BTD), and discretionary book-tax difference (DDBTD). They are the core variables in the study of tax avoidance, and have been used in many literatures (Li et al., 2019). They conclude that a higher ETR or cash-ETR indicates lower tax aggressiveness, while a higher BTD and DDBTD indicates higher tax avoidance.

ETR

ETR (Effective Tax Rate) as the simplest measure used by many scholars (Bertrand & Schoar, 2003; Lanis & Richardson, 2012; 2013). Lower ETR reflects lower tax expenditure caused by tax avoidance (Blaylock et al., 2012).

CASH-ETR

Our second measure is Cash-ETR which reflects firms’ actual cash tax payments for a given level of pre-tax income (Hoi et al., 2013; Chyz, 2013; Richardson & Lanis, 2007).

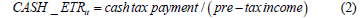

BTD

Book-tax difference (BTD) refers to the difference between book accounting profit and the taxable income declared to the tax authority, which was proposed by Plesko (2003). The larger the BTD, the greater the difference between the accounting profit and the taxable income (Desai & Dharmapala, 2006).

DDBTD

Discretionary book-tax difference (DDBTD) are the residuals from the following model (7) (Desai & Dharmapala, 2006; Sikka, 2010). DDBTD can more accurately measure and reflect the tax avoidance behaviour. DDBTD can be calculated from the model (3) . is total accruals profit scaled by total assets; ui is the average value of the residual for firm i over the sample period; and εi,t is the deviation in year t from firm i’s average residual ui. The residual from this regression (DDBTD) can be used as a measure of tax avoidance. DDBTD represents the part of the BTD that cannot be explained by accrued profit.

. is total accruals profit scaled by total assets; ui is the average value of the residual for firm i over the sample period; and εi,t is the deviation in year t from firm i’s average residual ui. The residual from this regression (DDBTD) can be used as a measure of tax avoidance. DDBTD represents the part of the BTD that cannot be explained by accrued profit.

Model and Variables

In order to test whether tax avoidance will affect the probability of forced CEO turnover, this paper uses Linear probability models (LPM) to test hypothesis (Chang & Wong, 2009):

We estimate the model (4) and give the results of ETR, cash ETR, BTD and DDBTD respectively (Table 3). Control variables can be divided into two aspects. We use (Duality structure and CEO’s tenure) variables to control the characteristics of CEOs (Kang & Shivdasani, 1995). We control firm characteristics through capital structure, corporate size, and companies' ownership. We also control for three firm characteristics: capital structure, size, leverage, and the ownership of the largest shareholders (Armstrong et al., 2012). We use the accounting performance indicator (ROA) to measure profitability. The dummy variable (State) indicates that whether a listed firm is controlled by state or private shareholders. We calculated industry-adjusted returns (AR) as the firm’s industry-adjusted annual stock return (including dividends) (Hubbard et al., 2017).

| Table 3 Variable Definitions |

||

|---|---|---|

| Variables | Variables Name | Definition |

| Explained Variables | ETR | ETR equals tax expenditure to pre-tax income |

| CASH_ETR | CASH_ETR means cash tax payment to pretax income | |

| BTD | Book-tax difference (BTD) means that the total differences between book and taxable incomes. | |

| DDBTD | DDBTD means a measure of unexplained total book-tax differences | |

| Explanatory Variables | TO_FORCE | TO_FORCE is a dummy variable that equals 1 if there was a forced turnover and 0 otherwise. |

| Control Variables | STATE | If a firm has a greater percentage of state shares, State takes the value of 1, and 0 otherwise. |

| TENURE | Tenure indicates that the number of years that a CEO has served in a listed firm. | |

| SIZE | Size means the size of a listed firm, measured as the natural logarithm of the book value of total assets. | |

| AR | Firm’s industry-adjusted annual stock return (including dividends) | |

| DUALITY | Duality is used to measure whether the CEO is concurrently as a chairman. It is a dummy variable. The value 1 if the CEO and the Chairman of the Board of Directors are the same person and 0 otherwise. | |

| LEV | Leverage is defined as total liabilities divided by total assets. | |

| ROA | ROA=after tax profit/ total assets | |

Empirical Results

Descriptive Statistics

Table 4 presents descriptive statistics. We can see that the average length of tenure is 5.286 years. Duality is not a common feature of the corporate governance structure in listed companies; only 27.2% of the CEOs are also serving as the chairman of the board. The average size of listed companies is 22.13. The average leverage is 0.392, indicating that the total liabilities account for one third of the total assets. The average ROA for all listed firms is 6.2%. Among the four taxable avoidance variables, the average values of ETR and Cash-ETR are 17.1% and 52.3% respectively. And the average of BTD and DDBTD are 0.7% and 0.5% respectively.

| Table 4 Describe Statistics |

||||||

|---|---|---|---|---|---|---|

| Variables | Number | Mean | Standard Deviation | Minimum | Median | Maximum |

| Panel A: Control variables | ||||||

| STATE | 11000 | 0.338 | 0.473 | 0 | 0 | 1 |

| TENURE | 11000 | 5.286 | 2.837 | 0 | 4.984 | 21.19 |

| SIZE | 11000 | 22.13 | 1.254 | 19.99 | 21.95 | 25.74 |

| AR | 11000 | 0.0630 | 0.523 | -1.437 | -0.0210 | 16.95 |

| LEV | 11000 | 0.392 | 0.198 | 0.0510 | 0.382 | 0.818 |

| ROA | 11000 | 0.0620 | 0.0380 | 0.00900 | 0.0530 | 0.193 |

| DUALITY | 11000 | 0.272 | 0.445 | 0 | 0 | 1 |

| Panel B: Performance variables | ||||||

| TO FORCE | 11000 | 0.0270 | 0.163 | 0 | 0 | 1 |

| ETR | 11000 | 0.171 | 0.0710 | -0.0110 | 0.158 | 0.365 |

| CASH_ ETR | 11000 | 0.523 | 0.222 | -0.00500 | 0.503 | 0.990 |

| BTD | 11000 | 0.00700 | 0.0270 | -0.0580 | 0.00300 | 0.102 |

| DDBTD | 11000 | 0.00500 | 0.0270 | -0.0660 | 0.00300 | 0.0920 |

Variable definitions

ETR equals tax expenditure to pre-tax income. CASH_ETR means cash tax payment to pretax income. Book-tax difference (BTD) means that the total differences between book and taxable incomes. DDBTD means a measure of unexplained total book-tax differences. TO_FORCE is a dummy variable that equals 1 if there was a forced turnover and 0 otherwise. STATE presents a firm has a greater percentage of state shares, State takes the value of 1, and 0 otherwise. Tenure indicates that the number of years that a CEO has served in a listed firm. SIZE means the size of a listed firm, measured as the natural logarithm of the book value of total assets. AR presents firm’s industry-adjusted annual stock return (including dividends). DUALITY is used to measure whether the CEO is concurrently as a chairman or not. It is a dummy variable. The value of concurrent is 1, otherwise it is 0. LEV is defined as total liabilities divided by total assets. ROA equals after tax profit divided total assets.

Correlations

In order to test the relationship between variables initially, the Pearson correlation coefficient between the main variables is shown in Table 5. In the Table 5, "*, **, ***" indicate the significance levels at 10%, 5%, and 1%, respectively. It can be seen from the table above:

| Table 5 Pearson Correlation Coefficients |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| VARIABLES | STATE | TENURE | SIZE | AR | LEV | ROA | DUALITY | TO FORCE | ETR | CASH_ETR | BTD | DDBTD |

| STATE | 1 | |||||||||||

| TENURE | 0.100*** | 1 | ||||||||||

| SIZE | 0.359*** | 0.038*** | 1 | |||||||||

| AR | -0.011 | 0.001 | -0.034*** | 1 | ||||||||

| LEV | 0.293*** | 0.022** | 0.554*** | 0.051*** | 1 | |||||||

| ROA | -0.102*** | 0.004 | -0.121*** | 0.044*** | -0.347*** | 1 | ||||||

| DUALITY | -0.286*** | 0.011 | -0.193*** | 0.021** | -0.148*** | 0.030*** | 1 | |||||

| TO FORCE | 0.049*** | -0.118*** | 0.056*** | -0.002 | 0.037*** | 0.002 | -0.025*** | 1 | ||||

| ETR | 0.130*** | 0.018* | 0.200*** | -0.022** | 0.226*** | -0.138*** | -0.074*** | -0.024** | 1 | |||

| CASH_ETR | 0.103*** | 0.041*** | 0.129*** | -0.046*** | 0.220*** | -0.285*** | -0.066*** | -0.039*** | 0.295*** | 1 | ||

| BTD | 0.020** | -0.002 | -0.053*** | 0.006 | -0.114*** | 0.297*** | -0.016* | 0.043*** | -0.496*** | -0.286*** | 1 | |

| DDBTD | 0.030*** | -0.008 | -0.027*** | 0.011 | -0.094*** | 0.215*** | -0.01 | 0.037*** | -0.392*** | -0.212*** | 0.788*** | 1 |

The correlation coefficient between the effective tax rate (ETR) and forced CEO turnover (TO_FORCE) is -0.024 the correlation coefficient between cash-ETR and TO_FORCE is -0.039, and the correlation coefficient between BTD (DDBTD) and TO_FORCE is 0.043 and 0.037, respectively and significant at the 1% level. This indicates that the higher tax rate, the lower level of tax avoidance and the CEO is unlikely to be fired, which is consistent with the hypothesis 1A.

The correlation coefficient between the STATE and the effective tax rate (ETR) and CASH_ETR is 0.13 and 0.103 respectively, and is significant at the level of 1%. This indicates that the effective tax rate in state-owned enterprises is higher than that of non-state-owned enterprises which is consistent with hypothesis 2.

In order to ensure multi-collinearity is not a problem, we calculate the variance inflation factors (VIF) for each independent variable. All the VIFs do not exceed 2, which suggest that our models are not prone to multi-collinearity problems. After descriptive statistical analysis and Pearson correlation coefficient test, we have a preliminary understanding of the relationship between tax rates and forced CEO turnover. In order to test the correctness of the hypothesis in this paper, we will regression analysis.

Table 5 reports Pearson correlation coefficients for the full sample. Forced CEO Turnover is measured as year t+1, while all other variables as measured at t. *, **, *** Denote statistical significance at the 10 percent, 5 percent, and 1 percent levels, respectively, for one-tailed tests examining forced turnover quintiles, and two-tailed otherwise.

Variable Definitions

ETR equals tax expenditure to pre-tax income. CASH_ETR means cash tax payment to pretax income. Book-tax difference (BTD) means that the total differences between book and taxable incomes. DDBTD means a measure of unexplained total book-tax differences. TO_FORCE is a dummy variable that equals 1 if there was a forced turnover and 0 otherwise. STATE presents a firm has a greater percentage of state shares, State takes the value of 1, and 0 otherwise. Tenure indicates that the number of years that a CEO has served in a listed firm. SIZE means the size of a listed firm, measured as the natural logarithm of the book value of total assets. AR presents firm’s industry-adjusted annual stock return (including dividends). DUALITY presents 1 if the CEO and the Chairman of the Board of Directors are the same person and 0 otherwise. LEV is defined as total liabilities divided by total assets. ROA equals after tax profit divided total assets.

Regression Analysis

In order to test hypothesis, we will carry out LPM regression. Table 6 shows the regression results. The regression coefficient between the effective tax rate (ETR) and forced CEO turnover (TO_FORCE) is -0.1298, between CASH_ETR and TO_FORCE is -0.0367, between BTD (DDBTD) and TO_FORCE is 0.2422 (0.2357) and significantly above the 1% level. This indicates that the lower the effective tax rate (cash effective tax rates), the higher the degree of corporate tax avoidance and the higher likely forced CEO turnover, which verify the Hypothesis 1A. According to Chyz & Gaertner (2018), I also conduct the linear Probability Model with year fixed effects control for the effect of market-wide macroeconomic fluctuations and time trend on CEO turnover decisions, the result is consistent with Hypothesis 1A.

| Table 6 Lpm In Full Sample |

||||

|---|---|---|---|---|

| FULL SAMPLE | 1 | 2 | 3 | 4 |

| TO_FORCE | TO_FORCE | TO_FORCE | TO_FORCE | |

| STATE | 0.0107 | 0.0114 | 0.0115 | 0.0119 |

| -0.6448 | -0.6878 | -0.6882 | -0.7132 | |

| TENURE | -0.0176*** | -0.0176*** | -0.0176*** | -0.0177*** |

| (-6.3830) | (-6.3762) | (-6.3799) | (-6.3921) | |

| SIZE | 0.0210*** | 0.0193*** | 0.0213*** | 0.0214*** |

| -3.5542 | -3.1971 | -3.6436 | -3.6496 | |

| AR | -0.0016 | -0.0018 | -0.0012 | -0.0012 |

| (-0.5409) | (-0.6053) | (-0.3929) | (-0.4090) | |

| LEV | -0.0354* | -0.0335* | -0.0354* | -0.0352* |

| (-1.7702) | (-1.6652) | (-1.7835) | (-1.7654) | |

| ROA | 0.1383* | 0.0718 | 0.1115 | 0.1410* |

| -1.6946 | -0.7943 | -1.33 | -1.7522 | |

| DUALITY | 0.0277*** | 0.0274*** | 0.0279*** | 0.0279*** |

| -3.8023 | -3.7483 | -3.8436 | (3.8467 | |

| ETR | -0.1298*** | |||

| (-3.6580) | ||||

| CASH_ETR | -0.0367** | |||

| (-2.5172) | ||||

| BTD | 0.2422*** | |||

| -2.6327 | ||||

| DDBTD | 0.2357** | |||

| -2.4282 | ||||

| _cons | -0.3411*** | -0.3047** | -0.3732*** | -0.3749*** |

| (-2.7059) | (-2.3459) | (-3.0227) | (-3.0355) | |

| Year | Yes | Yes | Yes | Yes |

| N | 10695 | 10695 | 10695 | 10695 |

| adj. R2 | 0.022 | 0.022 | 0.022 | 0.022 |

| F | 10.8687 | 10.7843 | 10.9043 | 10.7655 |

The empirical test in Table 6 confirms the relationship between corporate tax avoidance and forced CEO turnover. In China, state-owned enterprises occupy an important part of listed companies. It is necessary to distinguish the nature of property rights to explore the difference between state-owned enterprises and non-state-owned enterprises. Therefore, an empirical test of hypothesis 2 is carried out. Table 7 shows that in state-owned enterprises, the effective tax rate (ETR) and CASH-ETR is negatively correlated with and TO_FORCE, and is significant at the 1% level, BTD (DDBTD) is significantly positively correlated with TO_FORCE and significant at the 1 % level. Compared with SOEs, Table 8 shows that the relationship between tax rates and forced CEO turnover is not significant in non-state-owned enterprises, which is consistent with Hypothesis 2. Table 7 shows that the lower the effective tax rate of the state-owned enterprise group, the higher the degree of corporate tax avoidance, and the greater the possibility of mandatory changes to the CEO (Jenter & Kanaan, 2015; Karpoff & Lott, 1993).

Table 6 reports results for our main tests examining the effect of taxes on forced CEO turnover using a Linear Probability Model. Regression coefficients and standard errors are reported side-by-side. Forced CEO Turnover is measured as year t+1, while all other variables as measured at t. *, **, *** Denote statistical significance at the 10 percent, 5 percent, and 1 percent levels, respectively, for one-tailed tests examining forced turnover quintiles, and two-tailed otherwise.

Variable Definitions

ETR equals tax expenditure to pre-tax income. CASH_ETR means cash tax payment to pretax income. Book-tax difference (BTD) means that the total differences between book and taxable incomes. DDBTD means a measure of unexplained total book-tax differences. TO_FORCE is a dummy variable that equals 1 if there was a forced turnover and 0 otherwise. STATE presents a firm has a greater percentage of state shares, State takes the value of 1, and 0 otherwise. Tenure indicates that the number of years that a CEO has served in a listed firm. SIZE means the size of a listed firm, measured as the natural logarithm of the book value of total assets. AR presents firm’s industry-adjusted annual stock return (including dividends). DUALITY presents 1 if the CEO and the Chairman of the Board of Directors are the same person, and 0 otherwise. LEV is defined as total liabilities divided by total assets. ROA equals after tax profit divided total assets.

Table 7 reports results for our main tests examining the effect of taxes on forced CEO turnover using a Linear Probability Model in SOEs. Regression coefficients and standard errors are reported side-by-side. Forced CEO Turnover is measured as year t+1, while all other variables as measured at t. *, **, *** Denote statistical significance at the 10 percent, 5 percent, and 1 percent levels, respectively, for one-tailed tests examining forced turnover quintiles, and two-tailed otherwise.

| Table 7 Lpm In Soes |

||||

|---|---|---|---|---|

| SOE | 1 | 2 | 3 | 4 |

| TO_FORCE | TO_FORCE | TO_FORCE | TO_FORCE | |

| TENURE | -0.0231*** | -0.0236*** | -0.0233*** | -0.0235*** |

| (-5.4514) | (-5.5295) | (-5.4425) | (-5.4430) | |

| SIZE | 0.0297*** | 0.0260** | 0.0321*** | 0.0325*** |

| -2.6038 | -2.2673 | -2.7939 | -2.857 | |

| AR | 0.0036 | 0.0034 | 0.004 | 0.004 |

| -0.4069 | -0.38 | -0.4488 | -0.4442 | |

| LEV | -0.0998* | -0.1052** | -0.0986* | -0.1021** |

| (-1.9424) | (-2.0556) | (-1.9426) | (-2.0074) | |

| ROA | -0.0326 | -0.4247** | -0.134 | -0.0617 |

| (-0.2063) | (-2.2235) | (-0.8417) | (-0.3971) | |

| DUALITY | 0.0182 | 0.0154 | 0.0186 | 0.0174 |

| -1.1771 | -1.0173 | -1.2397 | -1.1574 | |

| ETR | -0.3752*** | |||

| (-5.4373) | ||||

| CASH_ETR | -0.1615*** | |||

| (-5.4374) | ||||

| BTD | 0.8919*** | |||

| -4.2166 | ||||

| DDBTD | 1.0125*** | |||

| -4.4485 | ||||

| _cons | -0.4058 | -0.2715 | -0.5325** | -0.5437** |

| (-1.6419) | (-1.0898) | (-2.1440) | (-2.2069) | |

| Year | Yes | Yes | Yes | Yes |

| N | 3615 | 3615 | 3615 | 3615 |

| adj. R2 | 0.044 | 0.047 | 0.043 | 0.045 |

| F | 6.4493 | 6.6244 | 6.4755 | 6.5498 |

Variable Definitions

ETR equals tax expenditure to pre-tax income. CASH_ETR means cash tax payment to pretax income. Book-tax difference (BTD) means that the total differences between book and taxable incomes. DDBTD means a measure of unexplained total book-tax differences. TO_FORCE is a dummy variable that equals 1 if there was a forced turnover and 0 otherwise. STATE presents a firm has a greater percentage of state shares, State takes the value of 1, and 0 otherwise. Tenure indicates that the number of years that a CEO has served in a listed firm. SIZE means the size of a listed firm, measured as the natural logarithm of the book value of total assets. AR presents firm’s industry-adjusted annual stock return (including dividends). DUALITY presents 1 if the CEO and the Chairman of the Board of Directors are the same person, and 0 otherwise. LEV is defined as total liabilities divided by total assets. ROA equals after tax profit divided total assets.

Table 8 reports results for our main tests examining the effect of taxes on forced CEO turnover using a Linear Probability Model in Non-SOEs. Regression coefficients and standard errors are reported side-by-side. Forced CEO Turnover is measured as year t+1, while all other variables as measured at t. *, **, *** Denote statistical significance at the 10 percent, 5 percent, and 1 percent levels, respectively, for one-tailed tests examining forced turnover quintiles, and two-tailed otherwise.

| Table 8 Lpm In Non-Soes |

||||

|---|---|---|---|---|

| NON-SOEs | 1 | 2 | 3 | 4 |

| TO_FORCE | TO_FORCE | TO_FORCE | TO_FORCE | |

| TENURE | -0.0118*** | -0.0120*** | -0.0118*** | -0.0118*** |

| (-3.3687) | (-3.4036) | (-3.3649) | (-3.3640) | |

| SIZE | 0.0183*** | 0.0200*** | 0.0183*** | 0.0182*** |

| (2.6039) | (2.7841) | (2.6064) | (2.5999) | |

| AR | -0.0042 | -0.0037 | -0.0042 | -0.0043 |

| (-1.2467) | (-1.1106) | (-1.2611) | (-1.2795) | |

| LEV | 0.0021 | -0.0003 | 0.0022 | 0.0017 |

| (0.1003) | (-0.0143) | (0.1088) | (0.0842) | |

| ROA | 0.1902* | 0.2668*** | 0.1892* | 0.2008** |

| (1.9498) | (2.5888) | (1.8687) | (2.0642) | |

| DUALITY | 0.0325*** | 0.0328*** | 0.0325*** | 0.0324*** |

| (3.8368) | (3.8695) | (3.8342) | (3.8241) | |

| ETR | 0.0187 | |||

| (0.4845) | ||||

| CASH_ETR | 0.0279* | |||

| (1.711) | ||||

| BTD | -0.0162 | |||

| (-0.1649) | ||||

| DDBTD | -0.0906 | |||

| (-0.9075) | ||||

| _cons | -0.3566** | -0.4059*** | -0.3531** | -0.3502** |

| (-2.3910) | (-2.6519) | (-2.4089) | (-2.3988) | |

| Year | Yes | Yes | Yes | Yes |

| N | 7080 | 7080 | 7080 | 7080 |

| adj. R2 | 0.014 | 0.015 | 0.014 | 0.014 |

| F | 5.6732 | 5.6339 | 5.6632 | 5.6177 |

Variable definitions

ETR equals tax expenditure to pre-tax income. CASH_ETR means cash tax payment to pretax income. Book-tax difference (BTD) means that the total differences between book and taxable incomes. DDBTD means a measure of unexplained total book-tax differences. TO_FORCE is a dummy variable that equals 1 if there was a forced turnover and 0 otherwise. STATE presents a firm has a greater percentage of state shares, State takes the value of 1, and 0 otherwise. Tenure indicates that the number of years that a CEO has served in a listed firm. SIZE means the size of a listed firm, measured as the natural logarithm of the book value of total assets. AR presents firm’s industry-adjusted annual stock return (including dividends). DUALITY presents 1 if the CEO and the Chairman of the Board of Directors are the same person and 0 otherwise. LEV is defined as total liabilities divided by total assets. ROA equals after tax profit divided total assets.

Robustness

In this subsection, we perform a series of additional tests to ensure the robustness of our results.

Logit

We also conduct logit model to support hypothesis, which shows in Table 9. The result is consistent with LPM model.

| Table 9 Robustness Tests |

||||

|---|---|---|---|---|

| VARIABLES | ETR | CASH_ETR | BTD | DDBTD |

| (1) Controlling for earning management | -0.1526*** | -0.0492*** | 0.2309** | 0.2285** |

| (-3.7863) | (-3.0113) | (2.2104) | (2.1989) | |

| (2) Controlling for information quality | -0.2262*** | -0.0777*** | 0.3566*** | 0.3714*** |

| (-4.3889) | (-3.8524) | (2.5991) | (2.7777) | |

| (3) Controlling for management ability | -0.1320*** | -0.0354** | 0.1930** | 0.1811* |

| (-3.4865) | (-2.3207) | (1.9638) | (1.7747) | |

| (4) Full model | -0.2277*** | -0.0728*** | 0.3143** | 0.3345** |

| (-4.3824) | (-3.4716) | (2.1881) | (2.4161) | |

| (5) Estimating using Logit instead of OLS-FULL SAMPLE | -1.0075*** | -3.0814*** | 12.9581*** | 13.6437*** |

| (-4.7224) | (-3.9937) | (2.7206) | (2.8353) | |

| (6) Estimating using Logit instead of OLS-SOEs SAMPLE | -17.9064*** | -6.9399*** | 31.6770*** | 35.3557*** |

| (-4.8327) | (-4.9872) | (3.9692) | (4.385) | |

| (7) Estimating using Logit instead of OLS-NON-SOEs SAMPLE | -5.8901* | -0.5823 | 2.3245 | -0.6353 |

| (-1.7370) | (-0.5690) | (0.3636) | (-0.0992) | |

*, **, *** Denote statistical significance at the 10 percent, 5 percent, and 1 percent levels, respectively, for one-tailed tests examining H1 and H2, and two tailed otherwise. This table reports coefficients and standard errors for our variables of interest for a series of robustness tests. In the Table 9, we estimate several variations of our main results, but for brevity, only report the coefficients on ETR, CASH_ETR, BTD, and DDBTD. Full estimation results are available from the authors upon request. Robustness tests are estimated in ten groupings, (1) to (7): (1) controls for earning management by adding ABSDA; (2) controls for information quality by adding OPAQUE; (3) controls for management ability by adding MA_SCORE; (4) takes the base model and adds all variables used in (1), (2), and (3); (5) uses LOGIT to estimate instead of the Linear Probability Model; (6) uses LOGIT to estimate SOEs; (7) uses LOGIT to estimate non-SOEs.

Changes of tax rates after forced CEO turnover

If low taxes played a role in the CEO’s firing, then we expect these trends to be reversed under new management. There is a positive relationship between ETR (CASH_ETR) and TO_FORCE. The results showed in Table 10, which shows that tax rates increase following forced turnover.

| Table 10 Changes Of Tax Rates After Forced Ceo Turnover |

||||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| L_ETR | L_CASH-ETR | L_BTD | L_DDBTD | |

| TO_ | 0.0069* | 0.0246** | -0.0019 | -0.0003 |

| -1.7315 | -2.156 | (-1.0279) | (-0.1805) | |

| STATE | 0.0098 | -0.0067 | -0.0005 | -0.0023 |

| -0.6486 | (-0.1502) | (-0.1005) | (-0.4048) | |

| TENURE | 0.0019** | 0.0045 | -0.0004 | -0.0004 |

| -2.1588 | -1.635 | (-1.0863) | (-0.8619) | |

| SIZE | 0.0004 | -0.0221* | 0.0044*** | 0.0031** |

| -0.0943 | (-1.7563) | -2.6232 | -2.0427 | |

| AR | 0.0019 | 0.0221*** | 0 | -0.0002 |

| -1.6394 | -5.258 | -0.0386 | (-0.3228) | |

| LEV | 0.0227 | 0.0973** | -0.0173*** | -0.0116* |

| -1.5997 | -2.0645 | (-2.6054) | (-1.7497) | |

| ROA | -0.0186 | -0.8015*** | 0.0256 | 0.0163 |

| (-0.4072) | (-5.2415) | -1.0307 | -0.6055 | |

| DUALITY | 0.0019 | -0.01 | -0.0003 | -0.0003 |

| -0.5568 | (-0.8947) | (-0.2065) | (-0.1783) | |

| _cons | 0.1373 | 0.9372*** | -0.0852** | -0.0600* |

| -1.6327 | -3.4538 | (-2.3821) | (-1.8613) | |

| Year | Yes | Yes | Yes | Yes |

| N | 4478 | 4478 | 4478 | 4478 |

| adj. R2 | 0.008 | 0.046 | 0.132 | 0.099 |

| F | 2.0282 | 8.3209 | 24.8909 | 19.0775 |

Table 10 reports ETR, CASH_ETR, BTD and DDBTD for firms experiencing forced turnover. Forced CEO Turnover is measured as year t+1, while all other variables as measured at t. *, **, *** Denote statistical significance at the 10 percent, 5 percent, and 1 percent levels, respectively, for one-tailed tests examining forced turnover quintiles, and two-tailed otherwise.

Variable Definitions

ETR equals tax expenditure to pre-tax income. CASH_ETR means cash tax payment to pretax income. Book-tax difference (BTD) means that the total differences between book and taxable incomes. DDBTD means a measure of unexplained total book-tax differences. TO_FORCE is a dummy variable that equals 1 if there was a forced turnover and 0 otherwise. STATE presents a firm has a greater percentage of state shares, State takes the value of 1, and 0 otherwise. Tenure indicates that the number of years that a CEO has served in a listed firm. SIZE means the size of a listed firm, measured as the natural logarithm of the book value of total assets. AR presents firm’s industry-adjusted annual stock return (including dividends). DUALITY presents 1 if the CEO and the Chairman of the Board of Directors are the same person, and 0 otherwise. LEV is defined as total liabilities divided by total assets. ROA equals after tax profit divided total assets.

Falsification Tests

To ensure primary results are not spurious or the result of correlated omitted factors generally inherent to CEO turnover, we conduct a falsification test. Specifically, we re-estimate our main tests after substituting Unforced CEO Turnover for Forced CEO Turnover. According to Table 2, we obtain 1,154 normal CEO turnover cases, which unlikely to be the result of organizational stress or crisis that drives board action to deliberately change its leader or firm strategy (Fee et al., 2013). The results of our falsification test (reported in Table 11) are supportive of our hypotheses, as UNFORCED CEO turnover are not significant positively related tax indicators.

| Table 11 Falsification Test |

||||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| L_UNFORCED | L_UNFORCED | L_UNFORCED | L_UNFORCED | |

| STATE | -0.0298 | -0.0294 | -0.0294 | -0.0299 |

| (-0.9138) | (-0.9018) | (-0.9003) | (-0.9137) | |

| TENURE | -0.0345*** | -0.0345*** | -0.0345*** | -0.0345*** |

| (-9.5848) | (-9.5886) | (-9.5881) | (-9.5822) | |

| SIZE | 0.0406*** | 0.0407*** | 0.0406*** | 0.0408*** |

| -5.1558 | -5.1379 | -5.1494 | -5.171 | |

| AR | -0.0076* | -0.0075* | -0.0075* | -0.0074* |

| (-1.7271) | (-1.7070) | (-1.7235) | (-1.7013) | |

| LEV | -0.0328 | -0.0332 | -0.0332 | -0.0322 |

| (-1.0483) | (-1.0583) | (-1.0596) | (-1.0295) | |

| ROA | 0.0045 | 0.0198 | 0.0215 | -0.0121 |

| -0.0422 | -0.1598 | -0.1897 | (-0.1102) | |

| DUALITY | -0.0656*** | -0.0657*** | -0.0657*** | -0.0655*** |

| (-5.6541) | (-5.6524) | (-5.6556) | (-5.6363) | |

| ETR | -0.0238 | |||

| (-0.4681) | ||||

| CASH_ETR | 0.0023 | |||

| -0.1101 | ||||

| BTD | -0.029 | |||

| (-0.2183) | ||||

| DDBTD | 0.138 | |||

| -0.8947 | ||||

| _cons | -0.6422*** | -0.6509*** | -0.6464*** | -0.6513*** |

| (-3.8747) | (-3.8599) | (-3.9021) | (-3.9299) | |

| Year | Yes | Yes | Yes | Yes |

| N | 10695 | 10695 | 10695 | 10695 |

| adj. R2 | 0.04 | 0.04 | 0.04 | 0.04 |

| F | 31.8288 | 31.8529 | 31.8545 | 31.8211 |

Table 11 reports results for our falsification tests examining the effect of taxes on unforced CEO turnover using a Linear Probability Model. Regression coefficients and standard errors are reported side-by-side. Forced CEO Turnover is measured as year t+1, while all other variables as measured at t. *, **, *** Denote statistical significance at the 10 percent, 5 percent, and 1 percent levels, respectively, for one-tailed tests examining forced turnover quintiles, and two-tailed otherwise.

Variable Definitions

ETR equals tax expenditure to pre-tax income. CASH_ETR means cash tax payment to pretax income. Book-tax difference (BTD) means that the total differences between book and taxable incomes. DDBTD means a measure of unexplained total book-tax differences. TO_FORCE is a dummy variable that equals 1 if there was a forced turnover and 0 otherwise. STATE presents a firm has a greater percentage of state shares, State takes the value of 1, and 0 otherwise. Tenure indicates that the number of years that a CEO has served in a listed firm. SIZE means the size of a listed firm, measured as the natural logarithm of the book value of total assets. AR presents firm’s industry-adjusted annual stock return (including dividends). DUALITY presents 1 if the CEO and the Chairman of the Board of Directors are the same person, and 0 otherwise. LEV is defined as total liabilities divided by total assets. ROA equals after tax profit divided total assets.

Contributions and Limitations

Our research expands the research perspective through investigates the impact of tax outcomes on forced CEO turnover from different theories, which helps to understand corporate tax avoidance from a more complete perspective and enrich the existing literature. Firstly, we document the important relationship between tax outcomes and forced CEO turnover. Many researchers question the role of CEOs in tax planning because they are not tax experts and do not know the details of tax strategy. This paper studies the role of CEO in corporate tax planning. Secondly, we provide a new perspective on forced CEO turnover. CEO turnover is a hot issue in the current research, but the existing literatures focus on the impact of corporate performance on CEO turnover. There are few researches analyses the relationship between tax avoidance and forced CEO turnover. Thirdly, we enrich the existing literature on tax avoidance. There are many researchers investigate the reasons and impacts of tax avoidance since the literature published by Hanlon & Heitzman (2010). However, few of them analyses on tax avoidance from corporate social responsibility theory. We also analyze the relationship under different ownerships, which provides a new perspective for corporate tax avoidance and CEO turnover. This paper also helps board of directors to effectively evaluate the manager’s ability and competence as the tax is an important responsibility of managers.

Conclusion

Due to time, energy, research capabilities and data availability, the research still has the limitations. This article chooses control variables mainly from the company level. The increase in operating income and the rate of return on the stock market are mostly indicators commonly used in the research of the US capital market. Taking into account the maturity of the Chinese capital market, these indicators are easy to be affected by other factors. When selecting control variables in subsequent research, more consideration should be given to the development of the Chinese capital market, and more explanatory control variables should be selected.

References

Annuar, H.A., Salihu, I.A., & Obid, S.N.S. (2014). Corporate ownership, governance and tax avoidance: An interactive effects.Procedia-Social and Behavioral Sciences,164, 150-160.

Indexed at, Google Scholar, Cross Ref

Armstrong, C.S., Blouin, J.L., & Larcker, D.F. (2012). The incentives for tax planning.Journal of Accounting and Economics,53(1-2), 391-411.

Indexed at, Google Scholar, Cross Ref

Bertrand, M., & Schoar, A. (2003). Managing with style: The effect of managers on firm policies.The Quarterly Journal of Economics,118(4), 1169-1208.

Indexed at, Google Scholar, Cross Ref

Blaylock, B., Shevlin, T., & Wilson, R.J. (2012). Tax avoidance, large positive temporary book-tax differences, and earnings persistence.The Accounting Review,87(1), 91-120.

Indexed at, Google Scholar, Cross Ref

Cazier, R., Rego, S., Tian, X., & Wilson, R. (2015). The impact of increased disclosure requirements and the standardization of accounting practices on earnings management through the reserve for income taxes.Review of Accounting Studies,20(1), 436-469.

Indexed at, Google Scholar, Cross Ref

Chang, E.C., & Wong, S.M. (2009). Governance with multiple objectives: Evidence from top executive turnover in China.Journal of Corporate Finance,15(2), 230-244.

Indexed at, Google Scholar, Cross Ref

Cheng, Q., & Warfield, T.D. (2005). Equity incentives and earnings management.The Accounting Review,80(2), 441-476.

Indexed at, Google Scholar, Cross Ref

Chyz, J.A. (2013). Personally tax aggressive executives and corporate tax sheltering.Journal of Accounting and Economics,56(2-3), 311-328.

Indexed at, Google Scholar, Cross Ref

Chyz, J.A., & Gaertner, F.B. (2018). Can paying “too much” or “too little” tax contribute to forced CEO turnover?.The Accounting Review,93(1), 103-130.

Indexed at, Google Scholar, Cross Ref

Chyz, J.A., Gaertner, F.B., Kausar, A., & Watson, L. (2019). Overconfidence and corporate tax policy.Review of Accounting Studies,24(3), 1114-1145.

Crocker, K.J., & Slemrod, J. (2005). Corporate tax evasion with agency costs.Journal of Public Economics,89(9-10), 1593-1610.

Indexed at, Google Scholar, Cross Ref

Cumming, D.J., Hou, W., & Lee, E. (2011).Corporate fraud, CEO turnover, and state ownership in China. Working Paper.

Desai, M.A., & Dharmapala, D. (2006). Corporate tax avoidance and high-powered incentives.Journal of Financial Economics,79(1), 145-179.

Indexed at, Google Scholar, Cross Ref

Desai, M.A., & Dharmapala, D. (2007). Taxation and corporate governance: An economic approach.Available at SSRN 983563.

Desai, M.A., & Dharmapala, D. (2009). Taxes, institutions and foreign diversification opportunities.Journal of Public Economics,93(5-6), 703-714.

Indexed at, Google Scholar, Cross Ref

Dyreng, S.D., Hanlon, M., & Maydew, E.L. (2008). Long-Run Corporate Tax Avoidance. The Accounting Review, 83, 61-82.

Indexed at, Google Scholar, Cross Ref

Dyreng, S.D., Hanlon, M., & Maydew, E.L. (2010). The effects of executives on corporate tax avoidance.The Accounting Review,85(4), 1163-1189.

Indexed at, Google Scholar, Cross Ref

Dyreng, S.D., Hanlon, M., Maydew, E.L., & Thornock, J.R. (2017). Changes in corporate effective tax rates over the past 25 years.Journal of Financial Economics,124(3), 441-463.

Indexed at, Google Scholar, Cross Ref

Economist. (2012). Edging toward capitalism. The Economist.

Fee, C.E., Hadlock, C.J., & Pierce, J.R. (2013). Managers with and without style: Evidence using exogenous variation.The Review of Financial Studies,26(3), 567-601.

Indexed at, Google Scholar, Cross Ref

Feldstein, M. (1999). Tax avoidance and the deadweight loss of the income tax.Review of Economics and Statistics,81(4), 674-680.

Indexed at, Google Scholar, Cross Ref

Firth, M., Fung, P.M., & Rui, O.M. (2006). Firm performance, governance structure, and top management turnover in a transitional economy.Journal of Management Studies,43(6), 1289-1330.

Indexed at, Google Scholar, Cross Ref

Frank, M.M., Lynch, L.J., & Rego, S.O. (2009). Tax reporting aggressiveness and its relation to aggressive financial reporting.The Accounting Review,84(2), 467-496.

Indexed at, Google Scholar, Cross Ref

Freeman, R.E., Wicks, A.C., & Parmar, B. (2004). Stakeholder theory and “the corporate objective revisited.Organization Science,15(3), 364-369.

Indexed at, Google Scholar, Cross Ref

Gaertner, F.B. (2014). CEO after-tax compensation incentives and corporate tax avoidance.Contemporary Accounting Research,31(4), 1077-1102.

Indexed at, Google Scholar, Cross Ref

Graham, J.R., Hanlon, M., Shevlin, T., & Shroff, N. (2014). Incentives for tax planning and avoidance: Evidence from the field.The Accounting Review,89(3), 991-1023.

Indexed at, Google Scholar, Cross Ref

Graham, J.R., Raedy, J.S., & Shackelford, D.A. (2012). Research in accounting for income taxes.Journal of Accounting and Economics,53(1-2), 412-434.

Indexed at, Google Scholar, Cross Ref

Hambrick, D.C., & Mason, P.A. (1982). The Organization as a Reflection of Its Top Managers. Academy of Management Proceedings,9, 12-16.

Indexed at, Google Scholar, Cross Ref

Hanlon, M., & Heitzman, S. (2010). A review of tax research.Journal of Accounting and Economics,50(2-3), 127-178.

Indexed at, Google Scholar, Cross Ref

Hanlon, M., & Slemrod, J. (2009). What does tax aggressiveness signal? Evidence from stock price reactions to news about tax shelter involvement.Journal of Public Economics,93(1-2), 126-141.

Indexed at, Google Scholar, Cross Ref

Hoi, C.K., Wu, Q., & Zhang, H. (2013). Is corporate social responsibility (CSR) associated with tax avoidance? Evidence from irresponsible CSR activities.The Accounting Review,88(6), 2025-2059.

Indexed at , Google Scholar, Cross Ref

Hubbard, T.D., Christensen, D.M., & Graffin, S.D. (2017). Higher highs and lower lows: The role of corporate social responsibility in CEO dismissal.Strategic Management Journal,38(11), 2255-2265.

Indexed at, Google Scholar, Cross Ref

Huson, M.R., Malatesta, P.H., & Parrino, R. (2004). Managerial succession and firm performance.Journal of Financial Economics,74(2), 237-275.

Indexed at, Google Scholar, Cross Ref

Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure.Journal of Financial Economics,3(4), 305-360.

Indexed at, Google Scholar, Cross Ref

Jenter, D., & Kanaan, F. (2015). CEO turnover and relative performance evaluation.The Journal of Finance,70(5), 2155-2184.

Indexed at, Google Scholar, Cross Ref

Kang, J.K., & Shivdasani, A. (1995). Firm performance, corporate governance, and top executive turnover in Japan.Journal of Financial Economics,38(1), 29-58.

Indexed at, Google Scholar, Cross Ref

Karpoff, J.M., & Lott Jr, J.R. (1993). The reputational penalty firms bear from committing criminal fraud.The Journal of Law and Economics,36(2), 757-802.

Indexed at, Google Scholar, Cross Ref

Kim, J.B., Li, Y., & Zhang, L. (2011). Corporate tax avoidance and stock price crash risk: Firm-level analysis.Journal of Financial Economics,100(3), 639-662.

Indexed at, Google Scholar, Cross Ref

Koester, A., Shevlin, T., & Wangerin, D. (2017). The role of managerial ability in corporate tax avoidance.Management Science,63(10), 3285-3310.

Indexed at, Google Scholar, Cross Ref

Laguir, I., Staglianò, R., & Elbaz, J. (2015). Does corporate social responsibility affect corporate tax aggressiveness?.Journal of Cleaner Production,107, 662-675.

Indexed at, Google Scholar, Cross Ref

Lanis, R., & Richardson, G. (2012). Corporate social responsibility and tax aggressiveness: An empirical analysis.Journal of Accounting and Public Policy,31(1), 86-108.

Indexed at, Google Scholar, Cross Ref

Lanis, R., & Richardson, G. (2013). Corporate social responsibility and tax aggressiveness: a test of legitimacy theory.Accounting, Auditing & Accountability Journal, 26(1), 75-100.

Indexed at, Google Scholar, Cross Ref

Li, W., Pittman, J.A., & Wang, Z.T. (2019). The determinants and consequences of tax audits: Some evidence from China.The Journal of the American Taxation Association,41(1), 91-122.

Indexed at, Google Scholar, Cross Ref

Olsen, K.J., & Stekelberg, J. (2016). CEO narcissism and corporate tax sheltering.The Journal of the American Taxation Association,38(1), 1-22.

Indexed at, Google Scholar, Cross Ref

Plesko, G.A. (2003). An evaluation of alternative measures of corporate tax rates.Journal of Accounting and Economics,35(2), 201-226.

Indexed at, Google Scholar, Cross Ref

Powers, K., Robinson, J.R., & Stomberg, B. (2016). How do CEO incentives affect corporate tax planning and financial reporting of income taxes?.Review of Accounting Studies,21(2), 672-710.

Indexed at, Google Scholar, Cross Ref

Rego, S.O., & Wilson, R. (2012). Equity risk incentives and corporate tax aggressiveness.Journal of Accounting Research,50(3), 775-810.

Indexed at, Google Scholar, Cross Ref

Richardson, G., & Lanis, R. (2007). Determinants of the variability in corporate effective tax rates and tax reform: Evidence from Australia.Journal of Accounting and Public Policy,26(6), 689-704.

Indexed at, Google Scholar, Cross Ref

Sikka, P. (2010). Smoke and mirrors: Corporate social responsibility and tax avoidance. Accounting Forum, 34(3), 153-168.

Indexed at, Google Scholar, Cross Ref

Spicer, A., McDermott, G.A., & Kogut, B. (2000). Entrepreneurship and privatization in Central Europe: The tenuous balance between destruction and creation.Academy of Management Review,25(3), 630-649.

Indexed at, Google Scholar, Cross Ref

Waller, D.S., & Lanis, R. (2009). Corporate social responsibility (CSR) disclosure of advertising agencies: an exploratory analysis of six holding companies' annual reports.Journal of Advertising,38(1), 109-122.

Indexed at, Google Scholar, Cross Ref

Weisbach, M.S. (1988). Outside directors and CEO turnover.Journal of Financial Economics,20, 431-460.

Indexed at, Google Scholar, Cross Ref

Received: 11-Feb-2022, Manuscript No. JMIDS-22-11235; Editor assigned: 15-Feb-2022, PreQC No. JMIDS-22-11235(PQ); Reviewed: 01-Mar-2022, QC No. JMIDS-22-11235; Revised: 21-Mar-2022, Manuscript No. JMIDS-22-11235 (R); Published: 24-Mar-2022