Research Article: 2021 Vol: 24 Issue: 1S

The Impact of Technological-Personal-Environmental (TPE) Factors on Server-Based Electronic Money Users in Indonesia

Femmy Effendy, Universitas Pendidikan Indonesia

Ratih Hurriyati, Universitas Pendidikan Indonesia

H Disman, Universitas Pendidikan Indonesia

Mokh. Adib Sultan, Universitas Pendidikan Indonesia

Lila Setiyani, STMIK ROSMA Karawang

Ramayani Yusuf, Politeknik Piksi Ganesha Bandung

Citation Information: Effendy, F., Hurriyati, R., Disman, H., Sultan, M.A., Setiyani, L., & Yusuf, R. (2021). The impact of Technological- Personal-Environmental (TPE) factors on server-based electronic money users in Indonesia. Journal of Management Information and Decision Sciences, 24(S1).

Keywords

Server-Based Electronic Money, TPE, TAM, UTAUT2, IDT, TBM, Innovation Resistance Theory

Abstract

This study is to analyze the decision factors to use application Server-Based Electronic Money (SBEM) by developing a model based on the technology, personal, and environment framework (TPE framework), including perceived usefulness, perceived ease of use, hedonic motivation, compatibility, perceived of application quality, social influence and tradition. The study is data obtained directly or primary data by surveying respondents, measured by a semantic differential scale. The sample obtained is 143 current active users. The data analysis technique used in this research is PLS, a multivariate statistical method that can simultaneously handle multiple response variables and explanatory variables. The results indicated that the TPE factors, including perceived usefulness, perceived ease of use, hedonic motivation had positive and significant effects on perceived benefit. Perceived application quality and compatibility had a positive and significant impact on initial trust. Social influence had no affected intention to use the application. Tradition had a negative and significant effect as a barrier factor on intention to adopt it. This study shows that personal and technological are essential factors that influence the decision to use Electronic Money, so making an application that fits the user's needs is the most important thing. Application developers expect to provide education on technology to potential users to be easy to apply.

Introduction

The development of digital technology innovations has recently been widely used by the public, leading to an increase and shift in the use of cash transactions to non-cash transactions and increasing physical activities to mobile-based transaction activities. The pattern of economic transactions has shifted from conventional methods to digital platforms. Modern technology as a non-cash payment instrument, both domestically and internationally, is accompanied by various innovations that lead to more efficient, safe, fast, and convenient usage. The impact of technological developments in the latest payment system is the emergence of a payment instrument known as Electronic Money (EM). Electronic money emerged to answer the need for micropayment instruments expected to process payments quickly at a relatively low cost. This value of money saved, this instrument placed on a particular media that can be accessed promptly off-line, safely and cheap. Electronic money as an alternative to non-cash payment instruments shows that there is considerable potential to reduce the rate of growth in the use of cash. Electronic money offers faster and more convenient transactions than cash, especially for small value transactions. Electronic money transactions can be carried out more quickly and cheaply and ensure the security and speed of transactions, both for consumers and merchants. In addition, the emergence of the Cashless society, which is a term that refers to people who in transactions no longer use physical money, but through the transfer of financial information digitally (Humbani & Wiese, 2019) also starting in Indonesia. In this Cashless Society, in daily transactions, people do not use real money but digital money. Implementing a cashless payment system for people who follow the cashless society style renews the conventional cash payment system that is already known. Usually, people exchange money in a cash payment system, either coins or paper money or checks to get certain goods and services. The cashless payment system is made through fintech applications, such as electronic wallets or e-wallets or debit and credit cards (Milian, Spinola & Carvalho 2019). The development of electronic money, especially in digital payment transactions, is progressing very rapidly because electronic money can solve various financial needs of the community that conventional banks have not accommodated. Some sectors like traditional banks, which the presence of electronic money can solve. According to data from Bank Indonesia seen from the storage media, electronic money itself in Indonesia is divided into two types, namely, card-based (chip) and server-based electronic money. Some examples of card-based electronic money include Flazz (Bank BCA), E-money (Bank Mandiri), Tap cash (Bank BNI), Brizzi (Bank BRI), etc. While server-based electronic money, (SBEM) also known as digital wallet or e-wallet, in Indonesia, there are OVO, GoPay, ShopePay, LinkAja, Sakuku from Bank BCA, and others.

The previous study has been considerable discussing the acceptance of payment system using digital technology based on some technological acceptance theories such us Technology Acceptance Model (TAM) from the (Davis et al., 1989; Bailey et al., 2017; Li, Liu & Ji, 2014; Nugraheni, Hadisoewono & Noranita, 2020), Unified Theory of Acceptance and Use of Technology 2 Model (UTAUT2) from the (Venkatesh et al., 2012; Brohi et al., 2018; Gharaibeh, Arshad & Gharaibh, 2018; Li et al., 2014; Widodo, Irawan & Sukmono 2019, 2012). Most of study focused only on the personal side. Therefore, this research tries to complement existing a study by analysis uses an integrative approach of the TPE (Technological-Personal- Environmental) framework. The framework is considered a very suitable framework for explaining the phenomenon in technology acceptance from the technological, personal, and environmental sides. From that study we apply to adopt server-based electronic by combining several models that are considered to be able to answer research questions regarding the adoption of the current use of SBEM. Beside TAM and UTAUT2,Innovation Diffusion Theory (IDT) from Roger 1983 and Trust Building Model (TBM) from (McKight et al., 2002) where compatibility and perceived application quality are considered to play a role in user trust and confidence in the applications (Mcknight, Choudhury & Kacmar, 2002; Moti & Walia, 2020; Williams et al., 2017). Innovation Resistance Theory (IRT) from Ram and Seth assuming the obstacles that may occur when technology changes existing traditions, such as research (Laukkanen et al., 2007; Lian & Yen, 2013; Moorthy et al., 2017).

Literature Review

Server-Based Electronic Money (SBEM)

The definition of electronic money refers to the definition issued by the Bank for International Settlements, which defines electronic money as "stored value or prepaid products in which a record of the funds or value available to a consumer stored on an electronic device in the consumer's possession" (stored value product), or prepaid where a certain amount of money stored in an electronic media owned by someone) (Hidayati, 2006). Electronic money is defined as a means of payment in electronic form where the value of the money is stored in certain electronic media (Bank Indonesia). According to Bank Indonesia Regulation No.16/8/PBI/2014, based on the place where the value of electronic money funds is stored, it is also divided into 2 (two) types, namely:

a) Card or chip-based electronic money; Where the value of electronic money funds is recorded on electronic media managed by the issuer, it is also recorded on electronic media managed by the holder. This recording system occurs in card or chip-based electronic money and allows transactions to be carried out offline.

b) Server-based electronic money; The value of the holder's funds is stored in the issuer's database and in carrying out transactions, it will require media in the form of a user gadget to send the required password number and transaction value and receive a token number to make transactions. This kind of recording system occurs in server-based electronic money and can only be done online.

TPE (Technological Personal Environment)

The TPE framework is a framework adapted from a TOE (Technological Organizational Environment), which is usually used as a benchmark for acceptance of technology in organizations. Because the TOE is more focused on the organizational context, so that the framework is considered unsuitable for technology acceptance on the individual side, a TPE framework has been designed that can provide a better explanation of the acceptance of technology for an individual. The TPE framework is divided into three categories: technology (external and internal variables), personal (individual traits), and environment (related to social circumstances and availability of support related to the object under investigation) (Hunafa, Hidayanto & Sandhyaduhita, 2018).

Technology Acceptance Model (TAM)

The Technology Acceptance Model in the future, referred to as TAM, is one of the adaptation theories of TRA (Theory of Reasoned Action), which was previously introduced by (Ajzen & Fishbein, 1980) and proposed by (Davis, 1989). TRA is a theory that explains that individuals carry out behavior with the will or intention to carry out related activities to be carried out on their own accord. TAM describes a causal relationship between a belief (the benefits of an information system and its ease of use) and the behavior, needs, and information system users. TAM seeks to explain and estimate an information system's user acceptance. In TAM using TRA because it is used to know the relationship between perceived usefulness and perceived ease of user interests in IT (Information Technology). TAM is a theory that explains how people perceive technology. The user's perception will have an influence on their interest in using IT. Technology Acceptance Model (TAM) model is the model most often used (Nabila et al., 2018), TAM is one of the behavioral theories technology utilization (Davis, 1989) which develops a framework of thinking about the intention to use information technology. TAM focuses on attitudes towards using information technology by users by creating it based on perceived usefulness and perceived ease of use of technology. TAM is one of the many research models that are influential in technology acceptance studies. The technology in this research is technology in the financial sector, namely fintech. TAM is widely used to predict user acceptance and usage based on perceived usefulness by considering the ease of using information technology. Some previous research using TAM for adoption technology such us study by (Al-Rahmi et al., 2019; Bailey et al., 2017; Chuang, Liu & Kao, 2016; Jin, Seong & Khin, 2019; de Luna et al., 2019) The Technology Acceptance Model (TAM). Perceived Ease in Use, Perceived Usefulness, Perceived in Risk, and Trust have significant effect on consumer interest in transacting over the internet (Nugroho, 2016). (Bailey et al., 2017a; Chuang et al., 2016), perceived usefulness has a significantly positive effect on attitudes toward using. Perceived ease of use has huge positive impact on how people feel about using it or attitudes toward using. Attitudes toward on using have a significantly positive effect on behavioral intention to use and actual use. (Chaniotakis & Lymperopoulos, 2008) The TAM uses a variable designated as ‘perceived usefulness’. However, this is usually measured with a scale that was developed for organizational users. The present study therefore adopted a new latent variable called ‘perceived benefits’ for inclusion in the proposed model. Perceived benefit found to be the most important variable affecting the attitude and as well as consumer intent to use Internet banking services This finding is consistent with basic marketing principles, according to which consumers select products and services based on the utility they expect to gain. Convenience refers to flexibility in time and location, Given that mobile devices are one of the important channels of use, convenience through mobile devices determines the level of perceived usefulness. Perceived benefit variable has a significant effect on the intention to use a digital wallet and the intention to use it greatly affects the actual use of a digital wallet. Based on the above, it can be hypothesized that:

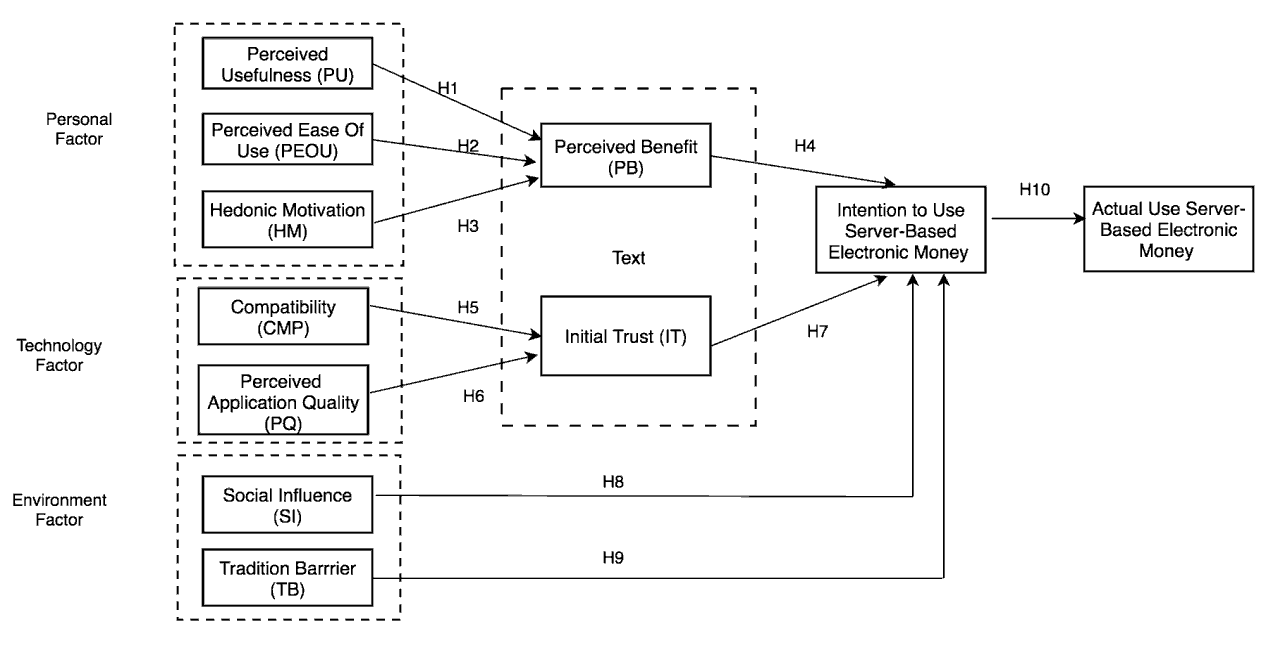

H1: Perceived usefulness have a significant effect on Perceived of Benefit

H2: Perceived ease of use have a significant effect on using Perceived of Benefit

H4: Perceived of Benefit have significant effect on Intention to Use SBEM

H10: Intention to Use EM has significant effect on Actual Use SBEM

The Unified Theory of Acceptance and Use of Technology 2 (UTAUT2)

The addition of the Hedonic motivation and social influence factors are considered important to see environmental impacts and additional factors from the personal side or personal intention to use, so this research was also developed with the addition of the use of the Unified Theory of Acceptance and Use of Technology 2 (UTAUT2) from the (Venkatesh et al., 2012). According to (Karsen et al., 2019), hedonic motivation is also used in several studies related to technology adoption (Hunafa et al., 2018; Yen & Wu, 2016) Social influence is also a factor influencing intention to use and actual use e-wallet (George, 2018; Kwateng et al., 2019). Research conducted by (Koenig-Lewis et al. 2015) wants to prove that enjoyment and social influence affect the intention to use to adopt the use of mobile payments. (Karsen, Chandra & Juwitasary 2019) hedonic Motivation It is also used in several studies related to technology adoption, (Hunafa et al., 2018; Megadewandanu, Suyoto & Pranowo 2017; Yen & Wu, 2016), social influence is also a factor in influencing e-wallet intention to use (George, 2018; Kwateng, Atiemo & Appiah, 2019). Based on the above, it can be hypothesized that:

H3: Hedonic Motivation have a significant effect on Perceived of Benefit

H8: Social Influence have a significant effect on intention to use SBEM

Innovation Diffusion Theory (IDT)

Previous research has shown that IDT is the most critical characteristic of innovation in explaining the level of innovation adoption (Al-Rahmi et al., 2019; Gumilang & Hidayatullah, 2018; Jamshidi & Kazemi, 2019; Lou & Li 2017). There are characteristics of IDT as perceived by individuals, which help explain their different adoption rates (Turan, Tunç & Zehir 2015), Variable factors, namely, relative advantage, compatibility, complexity, trialability, observability, in this study Relative advantage and Compatability are considered essential significant effect to behaviour intention. and will be added by referring to research conducted by (Al-Rahmi et al., 2019; Chen, Chen & Chen, 2019; Lubis & Irawan, 2020; Williams et al., 2017), compatibility has a significant effect on intention/intention to use mobile payments, this is because the applications offered are considered to have conformity with what consumers want, consumers feel that mobile payments are considered suitable for the conditions of the current technological era, besides that the features of mobile payment applications are considered fully able to assist daily activities -days in making payments that require practicality in transactions (Effendy et al., n.d.) Empirical support was found for compatibility having a significant positive influence on trust and on consumers’ intentions to use m-payment services (Williams et al., 2017). Based on the above, it can be hypothesized that:

H5: Compatibility have a significant effect on Initial Trust

Trust Building Model (TBM)

Three factors that build consumer trust in vendors in information systems according to the TBM-Trust building model developed by (McKnight et al., 2002; McKnight & Chervany, 2006) are, structural assurance (i.e., consumer perceptions of the security website environment), perceptions of the reputation of the vendor's website, and the perception of website quality. These three factors significantly affect consumer confidence in website vendors. Quality and reputation of the website are the strongest factors that vendors can use to build consumer trust to overcome the negative perceptions that people often have about the security of the website environment (Mcknight et al., 2002). The quality of the online fashion store website is essential in influencing consumers to transact with the website. Consumers judge products based on virtual appearances, so consumer perceptions of a website will represent the quality of vendors and the products they sell. The higher the quality of a website, the higher the trust of consumers to transact with the website (Pujastuti, Winarno & Sudarmawan, 2015) Based on the above, it can be hypothesized that:

H6: Perceptions of application quality have a significant effect on Initial Trust

H7: Initial Trust have a significant effect on intention to use SBEM

Innovation Resistance Theory

As technology-based and emerging products are certainly not easy to accept, barriers or barriers to acceptance will inevitably occur. The measurement of barriers is based on the theory of innovation resistance. This theory uses innovation characteristics, user characteristics, and marketing mechanisms to understand why users cannot accept innovation. Previous studies regarding the behavior and intentions of older adults’ regarding electronic commerce and online shopping are from a ‘‘drivers’’ perspective. Research from the ‘‘barriers’’ perspective is rare (Molesworth & Suortti, 2002; Moorthy et al., 2017) According to the empirical findings, the value barrier is the most significant barrier to mobile banking adoption among both mature and younger consumers. However, aging appears to be related especially to the risk and image barriers (Laukkanen et al., 2007). Based on the same theory, (Lian & Yen, 2014) compare the perceptions of different age groups of users regarding mobile banking. They found that users under 55 consider Usage and value to be a barrier to mobile banking. Users who are more than 55 years old assume Usage, value, risk, tradition, and image as obstacles. In 2008, studied subjects aged 18-65 years and divided the “non-adopters” of an innovation (Internet banking) into three groups and those “procrastinators, opponents, and rejecters. They found that procrastinators did not have significant barriers that caused them to resist innovation. On the other hand, opponents find risk, tradition, and image to be obstacles to internet banking adoption. Finally, resisters had higher resistance than the two groups discussed above, with risk and tradition being the most critical. Finally, (Jamshidi & Kazemi, 2019; Jansukpum & Kettem, 2016; Kaur et al., 2020; Leong et al., 2020; Lian & Yen, 2013; Sadiq et al., 2021; Yu & Chantatub, 2016) also show that Usage, value, risk, tradition, and image barrier has a significant effect on older perceptions consumers regarding adoption technology. Based on the above, it can be hypothesized that:

H9: Tradition have a negative and significant effect on intention to use EMBS

Based on the above theoretical background, the conceptual framework in this study are as Figure 1 follows

Methodology

The data used in this study are data obtained directly or primary data by conducting a survey of respondents, namely by distributing questionnaires measured by semantic differential or semantic differential scales. Semantic Differential (SD) introduced and mainly developed by US psychologist Charles E. Osgood (1916–1991), is a type of semantic rating scale that measures the connotative meaning of concepts such as terms, objects, events, activities, ideas, etc. Cognitive attribution of respondents to the selected concept at a multidimensional level. Unlike other rating scales, SD is universal and measures associations, motivation, emotions, attitudes, and can be used for almost every concept (Ploder & Eder, 2015). The study population was the Jabodetabek community of various ages and occupations with the criteria they had been and actively used electronic money until the time the questionnaire was distributed. Samples were taken using non-probability sampling and purposive sampling, this form of sampling that focuses on candidates who have certain traits or characteristics in common (Etikan, 2016). The sample obtained is 143 current electronic money active users. Data collection techniques in this study using library data and questionnaires. Library research is used to search from literature, documents, articles, journals, books, and other tools to support secondary research data. The way of sampling and understanding of its traits or characteristics will make it possible to generalize these traits or characteristics to population elements. The data collection technique was done by distributing questionnaires. The questionnaire is the process of collecting data by giving or distributing some questions to respondents to obtain responses to the questions given. In this study, the scale used is the Differential Semantic scale; there are five; the scale used contains a series of bipolar (two-pole) characteristics such as Difficult-Easy, Unfriendly-Friendly, and so on, which are arranged on one cotynomic line where the answers are very positive. Is in the far right position and very negative answers are in the far left position, or vice versa (Ploder & Eder 2015). The data analysis technique carried out in this study using PLS, a multivariate statistical technique that can handle multiple response variables and explanatory variables at the same time is the partial least square. As this approach is more robust or invulnerable, this analysis is a strong alternative to the approach of multiple regression analysis and principal component regression. Robust means that the model parameters do not change much when new samples are taken from the total population (Sobti, 2019). Partial Less Square is a statistical strategy that can accommodate multiple independent variables, even when they occur. According to Wold, PLS is an effective form of study since it is not based on certain assumptions or circumstances, such as normality and multi-collinearity checks. The approach has its own benefits, among others: the data does not have to be a normal multivariate distribution. Also metrics with a scale of data types, ordinal, intervals, and ratios can be used.

Results and Discussion

Profile of Respondents

Data collection was applied during February to Mei the primary week of 2021. Questionnaires made within the variety of Google Form were distributed to the Electronic money user. The testing method using SEM PLS. The results of the collected samples total 145 sample, there have been two samples that weren't used, in order that the sample data that would be processed were 143 samples, with a complete of 36 questionnaires distributed directly

Validity and Reliability

Because the measurements in this study were modified and/or narrowed from previous studies, validity and reliability were tested. The acceptable threshold for the cut of value reliability (CR) is >0.7 and for the average variance extracted (AVE) is >0.5. In addition, Nunnally (1978) shows that the minimum threshold for Cronbach is 0.5 or 0.6, therefore the threshold for Cronbach alpha in this study is >0.6. In Table 1 Shows Cronbach alpha value >0.05, so that all research instruments are considered valid and composite reliability values >0.7 are all considered reliable.

| Table 1 Validity and Reliability |

||||||

|---|---|---|---|---|---|---|

| Cronbach's Alpha | Rho_A | Composite Reliability | Average Variance Extracted (AVE) | Factor Loading | R2 | |

| PU | 0.802 | 0.831 | 0.884 | 0.718 | 0.738-0.906 | N/A |

| PEOU | 0.904 | 0.905 | 0.933 | 0.777 | 0.828-0.914 | N/A |

| HM | 0.919 | 0.925 | 0.961 | 0.925 | 0.958-0.965 | N/A |

| CMP | 0.882 | 0.883 | 0.927 | 0.809 | 0.822-0.903 | N/A |

| PQ | 0.821 | 0.892 | 0.891 | 0.734 | 0.722-0.914 | N/A |

| SI | 0.825 | 0.851 | 0.895 | 0.74 | 0.787-0.901 | N/A |

| TB | 0.893 | 0.993 | 0.931 | 0.819 | 0.792-0.963 | N/A |

| PB | 0.933 | 0.934 | 0.949 | 0.788 | 0.872-0.917 | 0.79 |

| IT | 0.903 | 0.908 | 0.932 | 0.775 | 0.867-0.899 | 0.61 |

| IU | 0.896 | 0.896 | 0.936 | 0.829 | 0.881-0.917 | 0,523 |

| UB | 0.876 | 0.877 | 0.924 | 0.802 | 0.881-0.907 | 0,777 |

Discriminant Validity

Table 2 shows the discriminant validity among the constructs used. Because the diagonal value is greater than other related values, the construct shows acceptable discriminant validity. Discriminant validity refers to the degree of discrepancy between attributes that should not be measured by the measuring instrument and theoretical concepts about the variable. Discriminant validity can also be calculated by comparing square root of Average Variance Extracted (AVE) values. If the value of √AVE is higher than the correlation value among latent variables, then discriminant validity can be considered achieved. Discriminant validity can be said to be achieved if the AVE value is greater than 0.5.

| Table 2 Diskriminan Validity Fornell-Larcker Criterion |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| CMP | HM | IU | PB | PEOU | PQ | PU | RPT | SI | TB | UB | |

| CMP | 0.899 | ||||||||||

| HM | 0.719 | 0.962 | |||||||||

| IU | 0.72 | 0.673 | 0.91 | ||||||||

| PB | 0.8 | 0.782 | 0.67 | 0.888 | |||||||

| PEOU | 0.727 | 0.661 | 0.686 | 0.809 | 0.882 | ||||||

| IT | 0.747 | 0.717 | 0.689 | 0.806 | 0.712 | 0,880 | |||||

| PU | 0.693 | 0.623 | 0.656 | 0.794 | 0.833 | 0.754 | 0.85 | ||||

| PQ | 0.755 | 0.62 | 0.667 | 0.704 | 0.644 | 0.717 | 0.7 | 0.86 | |||

| SI | 0.396 | 0.533 | 0.399 | 0.425 | 0.323 | 0.526 | 0.43 | 0.4 | 0.86 | ||

| TB | -0.15 | -0.14 | -0.21 | -0.15 | -0.2 | -0.04 | -0.14 | -0.13 | -0 | 0.905 | |

| UB | 0.702 | 0.686 | 0.882 | 0.725 | 0.675 | 0.695 | 0.68 | 0.64 | 0.464 | -0.2 | 0.9 |

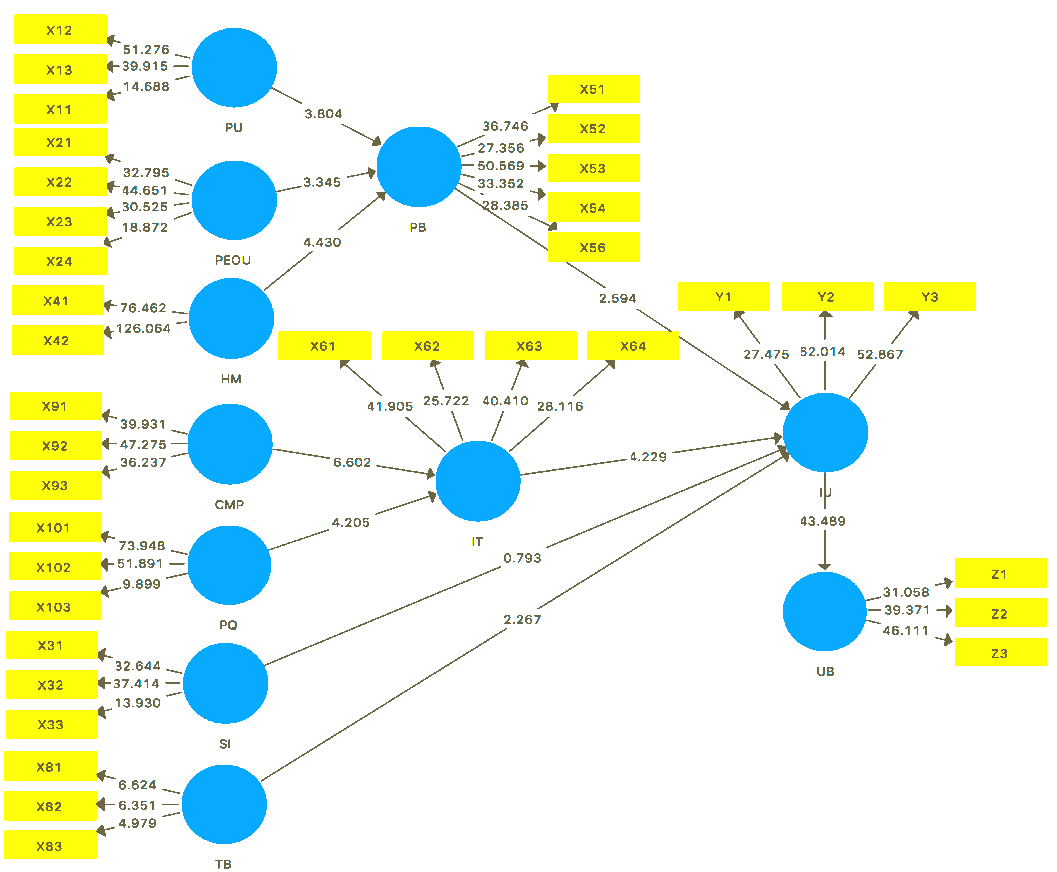

Hypothesis Test To test the proposed hypothesis, two partial partial squares (PLS) models (Ringle, & Karjaluoto et al., 2019) were analyzed to verify the research hypothesis. The results of the hypothesis test are illustrated in Table 3 and Figure 2, P<0.05 (influential and significant)

| Table 3 Hypothesis Testing Result |

||||

|---|---|---|---|---|

| T Statistics (|O/STDEV|) | P Values | Significant | Conclusion | |

| PU -> PB | 3,976 | 0,000 | Significant | H1: Supported |

| PEOU -> PB | 3,341 | 0,001 | Significant | H2: Supported |

| HM -> PB | 4,635 | 0,000 | Significant | H3: Supported |

| PB -> IU | 2,483 | 0,013 | Significant | H4: Supported |

| CMP -> PQ | 6,534 | 0,000 | Significant | H5: Supported |

| PQ -> IT | 4,411 | 0,000 | Significant | H6: Supported |

| IT -> IU | 4,062 | 0,000 | Significant | H7: Supported |

| SI -> IU | 0,773 | 0,440 | Not Significant | H8: Not Supported |

| TB -> IU | 2,499 | 0,013 | Significant | H9: Supported |

| IU -> UB | 43,798 | 0,000 | Significant | H10: Supported |

H1 and H2, PU and PEOU has a positive impact on Perceived of benefit. According to hypothesis testing, resulted supported. H4, PB has a positive impact on intention to use using SBEM. According to hypothesis testing, resulted supported. This testing result is consistent with the underlying assumptions of TAM where (Bailey et al., 2017; Chuang et al., 2016), perceived usefulness has a significantly positive effect on attitudes toward using. Perceived ease of use has a significantly positive effect on attitudes toward using. Attitudes toward on using have a significantly positive effect on behavioral intention to use (Bailey et al., 2017; Sombat, Chaiyasoonthorn & Chaveesuk, 2018), customers may feel the solution is useful if it is making benefit and affected performance. This result suggests that customers are willing to use SBEM services because this service provided advantage compare to existing solutions, namely cash transaction SBEM are offering a product that are useful for everyone. With this, we can conclude that because the respondents perceive the SBEM are useful, they feel that using this kind services as an appealing idea, and therefore, are worth to try.

H8, SI have no impact to behavior intention according to hypothesis testing, resulted not supported the results of this research are not prove as research conducted by (DeLone et al., 2019; George, 2018; Kwateng et al., 2019), which state that SI has a positive impact on intention to use using mobile banking, results of this study also not same as the research conducted by (Koenig-Lewis et al., 2015), social influence have no affect the intention to use to adopt the use of SBEM because users in the present era aware of the usefulness and effectiveness and are not just following other people, but also because of the awareness of the benefits they will get, SI factor is not compelling enough to influence people to intend to use something that is widely done. H3, HM have positive impact to behavior intention according to hypothesis testing, resulted supported, results of this research are the same as research conducted by (DeLone et al., 2019; George, 2018; Kwateng et al., 2019), which state that HM has a positive impact on intention to use using EM. As far as hedonic motivation goes, the results indicate that users felt enjoyable, delighted, excited and benefit by using SBEM. They were pleased using these systems and they have feeling of being electrified or being thrilled, add-ons, etc. Although most of the sample consist of not youth excitement while using these systems hedonic motivation is high. H10: Intention to use SBEM have a positive and significant effect on actual use EMBS, the same research results were also carried out by (Gupta & Arora, 2019).

H5 and H6, CMP and PQ has a positive impact on intention to use using SBEM. According to hypothesis testing, resulted supported the results of the study proved that the compatibility and quality of the website greatly influenced trust and intention in using in the platform. The results show that the four characteristics of the payment platform, namely, mobility, adaptability, security, and reputation, are useful for increasing customer trust and intention (Chandra, Srivastava & Theng, 2010; Shao et al., 2019).

H7, COMPT has a not impact on intention to use using SBEM. According to hypothesis testing, resulted not supported The results of the study contradicting referring to research conducted by (Chen & Adams, 2005; Liu & Yi, 2017; M D Williams et al. 2017) that state variable factors, namely, relative advantage, compatibility, complexity, trialability, observability, Relative advantage and Compatability are considered essential significant effect to behaviour intention.

H9, TRD has a negative impact on intention to use using SBEM. According to hypothesis testing, resulted supported. The results of the study proved that find tradition to be obstacles to EMBS adoption. (Jamshidi & Kazemi, 2019; Jansukpum & Kettem, 2016; Kaur et al., 2020; Leong et al., 2020; Lian & Yen, 2013a, 2013b; Sadiq et al., 2021; Yu & Chantatub, 2016) also show that Usage, value, risk, tradition, and image barrier has a significant effect on older perceptions consumers regarding adoption technology

Conclusion

This study analyzes the effect of technological, personal, and environmental factors in SBEM acceptance to consumers in Indonesia. After the data analysis, it proves that the personal factors including PU, PEOU, HM formulated fully have positive effect on consumer's perceived benefit. The technological factors including CNMP, PQ also formulated fully have a positive effect on consumer's Initial Trust. Environmental factors from SI variable have no effect on behavior intention. In addition, it also proves that the personal factor and technological factors formulated fully have positive effect to consumer's intention to use EMBS. In terms of theoretical implications, this study complements existing studies by including the TPE framework perspective. The framework divides the factors used in this study into technological, personal, and environmental categories. TPE framework makes this study easier to explain the interrelationship between the factors being used and becomes a more comprehensive model for better understanding the phenomenon of electronic money acceptance. In addition, this study helps explain Indonesian consumer behavior in SBEM acceptance as one of the countries with a propensity or tradition habit to use cash as the most preferred payment method. From the practical point of view, this research indirectly provides understanding to the organizations that develop SBEM services in Indonesia to help them increase user intentions to adopt their services. Knowing factors that significantly influence users' intentions to use SBEM (either directly or indirectly) can help the organization determine their future SBEM development strategies. This research is conducted in Indonesia so the sample only represents the behavior of consumers in Indonesia. Other limitations, this study also does not include several factors that are considered important by some previous studies in the context of SBEM such as personal innovativeness, risk, expectation (Ryu, 2018; Gerlach & Lutz 2019; Turan, Tunç & Zehir 2015b). Hence, the future study may conduct the research across countries, to give a better understanding of the acceptance behaviour of SBEM technology from different respondent perspective. In addition, further research can also examine other factors that are considered important in the context of SBEM with the aim of obtaining more comprehensive understanding of the phenomenon in SBEM acceptance.

Acknowledgement

The author would like to thank all those who have provided assistance in this research. All inputs will be taken into consideration to expand the research in the future by looking at other aspects outside of this research.

References

- Mugahed, A.W., Yahaya, N., Aldraiweesh, A.A., Alamri, M.M., Aljarboa, N.A., Alturki, U.,… & Aljeraiwi, A.A. (2019). “Integrating technology acceptance model with innovation diffusion theory: An Empirical Investigation on Students’ Intention to Use E-Learning Systems.” IEEE Access, 7, 26797–809.

- Anthony, B.A., Pentina, I., Mishra, A.S., & Mimoun, M.S.B. (2017). “Mobile payments adoption by US Consumers: An extended TAM.” International Journal of Retail and Distribution Management, 45(6), 626–40.

- Brohi, I.A., Ali, N.I., Shah, A., Aziz, M.B.S.A., & Tamrin, M.I.B.M. (2018). “Near field communication enabled mobile payments: Preliminary Study.”

- Shalini, C., Srivastava, C.S., & Theng, Y.L. (2010). “Evaluating the role of trust in consumer adoption of mobile payment systems: An empirical analysis.” Communications of the Association for Information Systems.

- Jim, C.J., & Adams, C. (2005). “User acceptance of mobile payments: A theoretical model for mobile payments.” Proceedings of the International Conference on Electronic Business (ICEB) (January 2005), 619–24.

- Chuan, C.W., Chen, C.W., & Chen, W.K. (2019). “Drivers of mobile payment acceptance in China: An empirical investigation.” Information (Switzerland,) 10(12),1–20.

- Li-Min, C., Liu, C.C., & Kao, H.K. (2016). “The adoption of fintech service: TAM Perspective.” International Journal of Management and Administrative Sciences (IJMAS), 3(7), 1–15.

- Fred, D. (1989). “Perceived usefulness, perceived ease of use, and user acceptance of information technology.” MIS Quarterly, Management Information Systems, 13(3),319–39.

- DeLone, W.H., & McLean, E.R. (2003). The DeLone and McLean model of information systems success: A ten-year update. Journal of Management Information Systems, 19(4), 9–30.

- Femmy, E., Hurriyati, R., Disman, D., & Hendrayati, H. (n.d.). “Are compatibility and app reputation determinants of consumer behavior to use mobile payments? Do compatibility and reputation determine consumer behavior when using cellular payments ?”, 1–9.

- Ilker, E. (2016). “Comparison of convenience sampling and purposive sampling.” American Journal of Theoretical and Applied Statistics.

- Ajimon, G. (2018). “Determinants of behavioral intention to use mobile wallets-a conceptual model,” 5(5), 52–62.

- Johannes, G.M., & Lutz, J.K.T. (2019). “Evidence on usage behavior and future adoption intention of fintechs and digital,” 13(2), 83–105.

- Gharaibeh, M.K., Arshad, M.R.M., & Gharaibh, N.K. (2018). “Using the UTAUT2 model to determine factors affecting adoption of mobile banking services: A qualitative approach.”

- Ilham, G., & Hidayatullah, D.S. (2018). “Pengaruh relative advantage, complexity, compatibilty, subjective Norm, and perceived behavioral control of online entrepreneurial intentions in business school graduates in bandung (case study at the bandung institute of technology's business school of management and." E-Proceeding of Management, 5(1), 360–69.

- Kanishk, G., & Arora, N. (2019). “Investigating consumer intention to accept mobile payment systems through unified theory of acceptance model: An indian perspective.” South Asian Journal of Business Studies, 9(1), 88–114.

- Hidayati, S. (2006). Kajian operasional e-money. Bank Indonesia.

- Humbani, M., & Wiese, M. (2019). “An integrated framework for the adoption and continuance intention to use mobile payment apps.” International Journal of Bank Marketing.

- Khalila, H., Hidayanto, A.N., & Sandhyaduhita, P. (2018). “Investigating mobile payment acceptance using Technological-Personal-Environmental (TPE) framework: A case of Indonesia.” 2017 International Conference on Advanced Computer Science and Information Systems, ICACSIS, 159–65.

- Jamshidi, D., & Kazemi, F. (2019). “Innovation diffusion theory and customers’ behavioral intention for islamic credit card: Implications for awareness and satisfaction.”

- Kanjana, J., & Kettem, S. (2016). “Applying innovation resistance theory to understand consumer resistance of using online travel in Thailand.” Proceedings - 14th International Symposium on Distributed Computing and Applications for Business, Engineering and Science, DCABES,139–42.

- Jin, C.C., Seong, L.C., &. Khin, A.A. (2019). “Factors affecting the consumer acceptance towards fintech products and services in Malaysia,” International Journal of Asian Studies, 9(1),59-6.

- Heikki, K., Shaikh, A.A., Leppäniemi, M., & Luomala, R. (2019). “Examining consumers’ usage intention of contactless payment systems.” International Journal of Bank Marketing, 38(2), 332–51.

- Marisa, K., Chandra, Y.U., & Juwitasary, H. (2019). “Technological factors of mobile payment: A systematic literature review.” Procedia Computer Science, 157,489–98.

- Puneet, K., Dhir, A., Singh, N., Sahu, G., & Almotairi, N. (2020). “An innovation resistance theory perspective on mobile payment solutions.” Journal of Retailing and Consumer Services, 55, 102059.

- Lewis, K.N., Marquet, M., Palmer, A., & Zhao, A.L. (2015). “Enjoyment and social influence: Predicting mobile payment adoption.” The Service Industries Journal, 35 (10).

- Tommi, L., Sinkkonen, S., Marke, K., & Laukkanen, P. (2007). “Innovation resistance among mature consumers.” Journal of Consumer Marketing, 24.

- Leong, L.Y., Hew, T.S., Ooi, K.B., & Wei, J. (2020). “Predicting mobile wallet resistance: A two-staged structural equation modeling-artificial neural network approach.” International Journal of Information Management, 51.

- Li, J., Liu, J.L., & Ji, H.Y. (2014). “Empirical study of influence factors of adaption intention of mobile payment based on TAM model in China.” International Journal of u- and e- Service, Science and Technology, 7, 1, 119-132.

- Woei, L.J., & Yen, D.C. (2013). “To buy or not to buy experience goods online: Perspective of innovation adoption barriers.” Computers in Human Behavior, 29(3), 665–72.

- Woei, L.J., & Yen, D.C. (2014). “Online shopping drivers and barriers for older adults: Age and gender differences.” Computers in Human Behavior, 37,133–43.

- Liu, P., & Yi, S. (2017). “The effects of extend compatibility and use context on NFC mobile payment adoption intention.” Advances in Human Factors and System Interactions.

- Antonio T.L.F., & Li, E.Y. (2017). “Integrating innovation diffusion theory and the technology acceptance model: The adoption of blockchain technology from business managers’ perspective.” Proceedings of the International Conference on Electronic Business (ICEB), 299–302.

- Lubis, A.W., & Irawan, A.J. (2020). “Understanding the determinants of customer adoption and intention to recommend electronic money in mobile payments: The case of gopay in Indonesia.”

- Ramos, L.I., Cabanillas, F.L., Fernández, J.S., & Leiva, F.M. (2019). “Mobile payment is not all the same: The adoption of mobile payment systems depending on the technology applied.” Technological Forecasting and Social Change, 146, 931–44.

- Mcknight, D., Choudhury, V., & Kacmar, C. (2002). “The impact of initial consumer trust on intentions to transact with a website: A trust building model.” The Journal of Strategic Information Systems, 11, 297–323.

- Simon, M., Suyoto, S., & Pranowo, P. (2017). “Exploring mobile wallet adoption in Indonesia using UTAUT2: An approach from consumer perspective.” Proceedings - 2016 2nd International Conference on Science and Technology-Computer, ICST, 11–16.

- Eduardo, M.Z., Spinola, M.M., & Carvalho, M. (2019). “Fintechs: A literature review and research agenda.” Electronic Commerce Research and Applications, 34.

- Mike, M., & Jukka-Petteri, S. (2002). “Buying cars online: The adoption of the web for high-involvement, high-cost purchases.” Journal of Consumer Behaviour, 2,155–68.

- Moorthy, K., Ling, C.S., Fatt, Y.W., Yee, C.M., Yin, E.C.K., Yee, K.S., … & Wei, L.K. (2017). “Barriers of mobile commerce adoption intention: Perceptions of generation X in Malaysia.”

- Moti, D.B., & Walia, N. (2020). “The effects of compatibility, social influence, and perceived ease of use on perceived usefulness of mobile payment services.”

- Muthia, N., Purwandari, N.B.A., Chalid, D.A., Wibowo, S.S., & Solichah, I. (2018). “Financial technology acceptance factors of electronic wallet and digital cash in Indonesia.” 2018 International Conference on Information Technology Systems and Innovation, ICITSI 2018 – Proceedings, 284–89.

- Nugraheni, D.M.K., Hadisoewono, A., & Noranita, B. (2020). “Continuance Intention to Use (CIU) on Technology Acceptance Model (TAM) for m-Payment (Case Study: TIX ID).”

- Ari, N.Y. (2016). “The effect of perceived ease of use, perceive of usefulness, perceive risk and trust towards behavior intention in transaction by internet.” Business and Entrepreneurial Review, 9(1),79.

- Kwateng, K.S,. Atiemo, K.A.O., & Appiah, C. (2019). “Acceptance and use of mobile banking: An application of UTAUT2.” Journal of Enterprise Information Management, 32(1),118–51.

- Andrea, P., & Eder. (2015). “Semantic differential,” (2nd Edition). In International Encyclopedia of the Social & Behavioral Sciences.

- Eli, P., Winarno, W.W., & Sudarmawan, S. (2015). “The influence of e-commerce fashion online stores on consumer confidence.” Creative Information Technology Journal, 1(2),139.

- Hyun-Sun, R. (2018). “Understanding benefit and risk framework of fintech adoption: Comparison of early adopters and late adopters.” Proceedings of the 51st Hawaii International Conference on System Sciences, 3864–73.

- Sadiq, M., Adil, M., & Paul, J. (2021). “An innovation resistance theory perspective on purchase of eco-friendly cosmetics.”

- Shao, Z., Zhang, L., Li, X., & Guo, Y. (2019). “Antecedents of trust and continuance intention in mobile payment platforms: The moderating effect of gender.” Electronic Commerce Research and Applications,33.

- Neharika, S. (2019). “Impact of demonetization on diffusion of mobile payment service in India: Antecedents of behavioral intention and adoption using extended UTAUT model.” Journal of Advances in Management Research, 16(4), 472–97.

- Sombat, P., Chaiyasoonthorn, W., & Chaveesuk, S. (2018). “The acceptance model of hospital information systems in Thailand: A conceptual framework extending TAM”. 89–94 in 2018 5th International Conference on Industrial Engineering and Applications, ICIEA.

- Aygül, T., Tunç, A.O., & Zehir, C. (2015). “A theoretical model proposal: Personal innovativeness and user involvement as antecedents of unified theory of acceptance and use of technology.” Procedia - Social and Behavioral Sciences, 210, 43–51.

- Widodo, M., Irawan, M.I., & Sukmono, R.A. (2019). “Extending UTAUT2 to explore digital wallet adoption in Indonesia.” 878–83.

- Williams, M.D., Roderick, S., Davies, G.H., & Clement, M. (2017). Risk, Trust, and Compatibility as Antecedents of Mobile Payment Adoption. aisel.aisnet.org.

- Michael, W.D., Davies, G.H., Roderick, S., & Clement, M. (2017). “Risk, trust, and compatibility as antecedents of mobile payment adoption.” AMCIS 2017 - America’s Conference on Information Systems: A Tradition of Innovation 2017-Augus(1989),1–10.

- Shen, Y.Y., & Wu, F.S. (2016). “Predicting the adoption of mobile financial services: The impacts of perceived mobility and personal habit.” Computers in Human Behavior, 65,31–42.