Research Article: 2021 Vol: 25 Issue: 5

The Impact of Terrorist Attacks on the Readability of 10-K Reports

Camellia Sodki, Sungkyunkwan University

Kyung Hyun Lee, University of Pennsylvania

Abstract

Concerns about the complexity of corporate disclosures have been raised by investors and regulators alike as financial statements are becoming incomprehensible to ordinary investors. This study examines the relationship between exogenous shocks such as terrorist attacks on the readability of narrative disclosures in 10-K reports. Using a large US sample from 1994 to 2016, we find that attack proximity is significantly negatively associated with the readability of narrative disclosures in 10-K reports. We also find that this association is less pronounced for firms with more experienced CEOs. In addition, we find evidence suggesting that managers use voluntary disclosures to mitigate the reduced informational environment of the firm following terrorist attacks. Further analysis shows that the association is robust to the use of alternative readability measures and alternative specification of attack proximity measure. We also document that the economic magnitude of the effect is larger when the distance between the firms and attack sites is shorter. Parallel assumption test results alleviate the concerns that our findings are due to reverse causality or model misspecification. Overall, findings from our study suggest that exogenous shocks outside of the firms’ control such as terrorist attacks matter for the readability of corporate disclosures.

Keywords

Corporate Disclosure, 10-K Reports, Readability, Terrorist Attacks, Exogenous Shocks.

Introduction

Firms use financial statements to disclose accounting information, discuss their financial results and future outlook. However, for the information to be beneficial, a reader must be able to analyze and comprehend the written text (Bonsall et al., 2017). Recently, Tesla’s earnings gathered the attention of investors and journalists. The Financial Times reported on the 28th of April 2021 that the disclosure of Tesla’s sales of $101m worth of Bitcoin in the first quarter of 2021 was inserted as a discrete image. This made it very difficult for investors to not only quickly search and find information in the document, but also to estimate the company’s value.

Recently, the readability of corporate disclosures started receiving considerable research interest in the accounting and finance literature, as investors and regulators raised concerns about the effectiveness of these disclosures in communicating information to ordinary shareholders. Studies show that individual firm characteristics such as size, age, geographic operating segments, culture, business strategy, and managerial ability are associated with readability (Li, 2008; Kumar, 2014; Lim et al., 2018; Hasan, 2020). Additionally, poor readability scores are related to fraud (Blanco & Dhole, 2017), poor performance (Li, 2008), earnings management (Lo, Ramos, & Rogo, 2017). Given the negative consequences of poor readability of 10-K reports, it is important to identify factors that influence readability. While there is a burgeoning literature on internal factors that affect the readability of corporate disclosures, there is little evidence on the impact of exogenous shocks. The question of how exogenous shocks outside of the company’s control are associated to readability is important, and is the focus of this paper.

According to the Global Terrorism Database (GTD) (https://www.start.umd.edu/gtd/), the threat of terrorism has intensified over the last years. While there is a rich literature examining the impact of terrorist attacks on the macroeconomic level, it is only recently that firm-specific impact became the center of academic research. This study is motivated by the importance of 10-K mandatory disclosures on one hand, and the growing concerns regarding the threat of terrorism on the other. We investigate whether, and to what extent, proximity to terrorist attacks is associated with the readability of the narrative disclosures in 10-K reports.

According to the ‘management obfuscation hypothesis’, managers obfuscate their firm’s real financial performance through more complex and less transparent disclosures in order to defer unfavorable capital market impacts. Li (2008) shows that less readable financial reports are produced to communicate losses. In the context of terrorist attacks which have a complex impact on the microeconomic level, managers could issue more complex 10-K reports to mask the negative effect of the attacks on one hand, or they might need to write longer and more complex sentences to explain the situation fully to investors, as proposed by Bloomfield (2008), on the other. Additionally, high-skilled managers may issue less readable annual reports to hide their compensation and perquisites, and to extract private benefits (Hasan & Habib, 2017). Dai et al., (2020) find that CEOs of firms near terrorist attack sites receive a terrorist attack premium which is equal to an average pay increase of 12% relative to CEOs in non-affected firms. The ‘rent extraction’ hypothesis suggest that those CEOs have greater incentive to hide their actions through less readable 10-K, since they can extract personal gain through the ‘terrorist attack premium’. In all three cases, we expect a positive relation between financial statement complexity and terrorist attacks. If this is the case, we would then need to determine whether the financial statement complexity reflects an intentional choice by managers or not. To do so, we examine if managers in firms close to terrorist attack sites manage their informational environment by using alternative disclosure channels, thereby mitigating the effect of increased disclosure complexity after the attacks. According to Guay et al. (2016), if the complexity of the financial statements is not intentional, managers will use alternative disclosure channels to improve the information environment. In this case, we expect a positive relation between terrorist attacks and voluntary disclosure.

In contrast to the above conjecture, an alternative argument is that terrorist attacks might lead to an increase in demand for information about the firm, and the need to provide more readable financial statements to mitigate the noisiness of performance measure. In this case, terrorist attacks would lead to an improvement in the readability of 10-K reports.

In this study, we examine a sample of terrorist attacks that occurred in the US from 1994 to 2016. We identify affected firms by calculating the distance between their headquarters and the terrorist attack location. We use a difference-in-difference approach where our attack proximity variable equals one for firms located near an attack site and zero otherwise, conditioning on no prior event within the last three years. We use the Gunning-Fog index (Lim et al., 2018; Li, 2008; Lo et al., 2017), as a readability measure. We document that attack proximity is significantly negatively associated with the readability of 10-K reports. We also find that this association remains robust after controlling for other firm-level variables. We show that attack proximity is positively related to more frequent 8-K fillings. These findings suggest that managers react to the informational problems created by terrorist attack by increasing their voluntary disclosure subsequently. It also alleviates concerns that managers are intentionally making financial

statements more complex. We also find that the relationship we uncover is weaker for firms with more experienced CEOs. Further analysis reveals that our results are robust to multiple readability measures and alternative distance cutoffs.

Our study makes a contribution to both the readability literature and the terrorism related literature by documenting a negative and significant relation between them. Although prior studies show that terrorist attacks are associated with more negatively biased earnings forecasts (Chen et al, 2020), influence the sentiment and forecasts of sell-side equity analysts (Cuculiza et al., 2021) and non-GAAP earnings disclosure (Chen, 2019), the extent to which they are associated with the readability of narrative disclosures is new to the literature. Our study thus complements the prior literature that documents how various exogenous shocks help explain corporate disclosure (Houston et al., 2019; Li et al., 2018; Dyer et al., 2016; Irani & Oesch, 2013).

The rest of the paper is organized as follows: Section 2 develops our hypotheses and predictions. Section 3 describes data, methodology, and variable construction. Section 4 reports our key empirical findings. Section 5 concludes.

Background and Hypothesis Development

Readability of the Narrative Disclosures in 10-K Reports

Publicly traded firms prepare 10-K fillings which are the main source of information for capital market participants, regulators, and policy makers. Given that stakeholders rely on the narratives in 10-K reports to interpret fundamental accounting information and that the readability of the narrative disclosures has important implications for communicating value-relevant information effectively (Loughran & McDonald, 2014), firms filing 10-K reports should be particularly cautious in their choice of language and text when preparing them. Textual analysis is used in finance and accounting research to examine the readability of corporate 10-K reports. Research examining the consequences of 10-K reports’ readability shows that it is positively associated with earnings persistence (Li, 2008), analyst coverage, accuracy of forecasts (Lehavy, Li, & Merkley, 2011), credit rating (Bonsall & Miller, 2017), managerial ability (Hasan, 2020) and investment efficiency (Biddle, Hilary, & Verdi, 2009). It is also negatively associated with the innovation-oriented prospector strategy (Lim et al., 2018). Loughran and McDonald (2011) show that less readability reflects poor corporate information environment.

An emerging body of literature relates corporate disclosure to exogenous events. Houston et al. (2019) exploit three legal events that generate exogenous variations in firms' litigation risk and find that they affect the firm’s voluntary disclosure practices. Humphery-Jenner et al. (2020) find that readability worsens after firms experience an SCA (Securities class action lawsuits). Dyer et al. (2016) suggest that complexity of financial statement trend documented by Li (2008) is primarily due to changes in regulation. Irani & Oesch (2013) exploits exogenous reductions in coverage resulting from brokerage house mergers, and find that it causes managers to adopt less informative disclosure policies. Finally, following the recognition of the Inevitable Disclosure Doctrine by US state courts which generates variations in the proprietary costs of disclosure Li et al. (2018) find that firms respond by reducing the level of disclosure regarding their customers’ identities. Overall, these studies provide important insights into exogenous and firm level determinants of the readability of corporate disclosures and their implication on the firm.

Terrorist Attacks

Terrorist attacks are potentially life-threatening events. Terrorism risk is an example of a low–probability exogenous event with extreme negative consequences. As Dai et al. (2020) state, a terrorist attack allows to draw causal inferences because it is a “clean, sharp, and specific event that forms an unexpected unambiguous” negative change of a certain environment. Prior studies document that terrorist attacks can negatively affect macroeconomic conditions and the performance of financial markets (e.g, Abadie & Gardeazabal, 2003; Blomberg et al., 2004). Only recently have studies shifted their focus to microeconomic effects, linking terrorist attacks to acquisitions (Nguyen et al., 2020); CEO compensation (Dai et al., 2020); IPO sentiment (Chen et al., 2020); change in flows to mutual funds (Wang & Young, 2020). Han et al. (2021) also find evidence that firms are less likely to fire their CEOs in the event of a terrorist attack and that the turnover performance sensitivity weakens as well. Kim et al. (2021) document an association between terrorist attacks and capital structure.

In the disclosure literature, Chen (2019) demonstrate that affected firms are less likely to report non-GAAP earnings. Chen et al. (2020) document that firms located in the metropolitan areas attacked issue more negatively biased earnings forecasts. These studies constitute one of few work connecting terrorist attacks to corporate disclosure. Motivated by these earlier findings, we aim to examine another unexplored site to corporate disclosure: the readability of 10-K filings.

Connection between terrorist attacks and the readability of 10-K reports

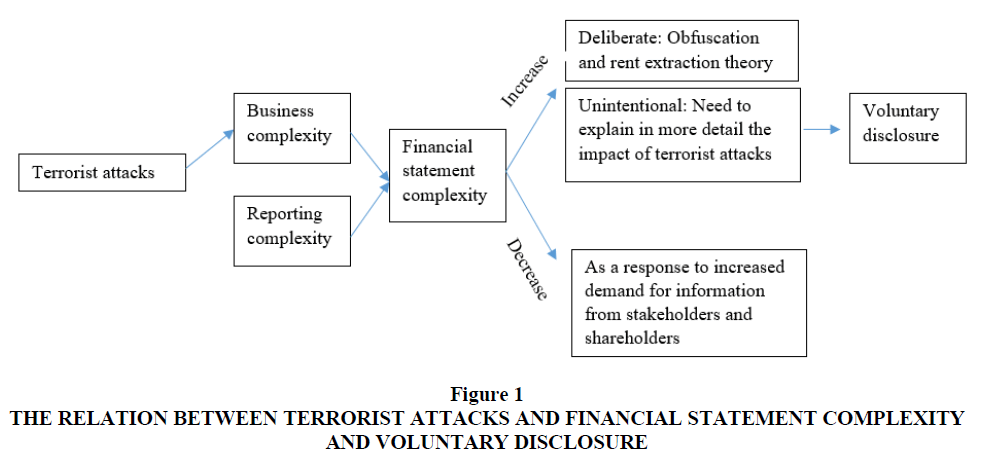

We develop two non-mutually exclusive arguments for the association between attack proximity and the readability of 10-K reports. According to Guay et al. (2016), financial statement complexity stems from either business complexity or reporting complexity. Terrorist attacks would lead to more complex financial statements as they negatively affect firms’ business operation, labor etc. However, an alternative hypothesis is that affected firms might have to answer to additional external demand for information from different stakeholders and shareholders, leading to more readable 10-K reports.

The differentiating feature of our study is that we also examine how financial report complexity stemming from proximity to terrorist attack sites relates to the frequency of voluntary disclosure. Under the managerial obfuscation and the rent extraction theory, managers may intentionally choose to produce more complex financial statements when the benefits from doing so exceed the costs. They might intentionally increase financial statement complexity to obfuscate terrorist attack-induced poor performance. Dai et al. (2020) find that CEOs receive higher compensation in the aftermath of terrorist attacks. This provides an incentive to reduce readability of mandatory disclosures to extract personal gain from the firm. The informational hypothesis poses that managers of affected firms might need to explain in more details and in lengthy documents the impact of the attacks on their firms, reducing the readability of 10-K reports. Guay et al. (2016) argue that if managers deliberately issue more complex financial statements to obfuscate information, then it seems improbable that they would use other disclosure channels to increase the quality of the information environment. However, if the complexity of financial disclosure in unintentional, as it is difficult to precisely predict when and where the readers will struggle to comprehend a specific financial statement, then managers might compensate with more voluntary disclosure.

This figure 1 illustrates our predictions concerning terrorist attacks and their effect on the complexity of financial statements, and voluntary disclosure. Therefore, based on the above discussion, given the competing arguments regarding the association of attack proximity with 10-K readability, we develop the following non-directional hypothesis:

Figure 1 The Relation Between Terrorist Attacks and Financial Statement Complexity and Voluntary Disclosure

H1: Terrorist attacks are associated with the readability of 10-K reports

As noted above, if the readability of 10-K decreases unintentionally, the managers would have incentives to improve the firm’s informational environment through an increase in the frequency of voluntary disclosure following the attacks. However, if the managers deliberately obfuscate 10-K reports, then they would have no incentive to issue more voluntary disclosures. Thus, we propose the second hypothesis as follow:

H2: Terrorist attacks are associated with the frequency of 8-K reports.

Finally, we explore the impact of managers’ individual attributes on the relation we uncover. The upper echelons theory posits that top managers' characteristics will affect the way the firm is managed, Hambrick & Mason (1984). Xu et al., (2018) argue that the increased business acumen and firm-specific knowledge gained through experience, leads executive to develop better communications skills and therefore have a positive impact on the readability of 10-K reports. In case of a negative association between attack proximity and the readability of 10-K reports, we expect the effect to be weaker for firms with a more-experienced CEO. To examine this possibility, we propose our third hypothesis as follow:

H3: The impact of terrorist attacks on the readability of 10-K reports is less pronounced for firms with more experienced CEOs.

Data Construction and Methodology

We build our dataset from multiple sources. First we obtain data on terrorist attacks from the Global Terrorism Database GTD (http://www.start.umd.edu/gtd/). It is an open-source database compiled by the National Consortium for the Study of Terrorism and Responses to Terrorism (START), at the University of Maryland, with more than 170,000 terrorist incidents available to date. We download information on the event date, latitude and longitude coordinates of each terrorist attack in the U.S, over the period between 1994 and 2016. Second, we collect accounting information from Compustat, readability and sentiment data from WRDS SEC Analytics Suite, and CEO data from Execucomp. To construct the attack proximity variable, we use handcollected historical latitude and longitude information on the location of the firm’s headquarters, from 1994 to 2016, provided by Young Han (Andy) Kim.

We calculate the attack proximity measure following the procedure in Vincenty (1975). We use a measure of geographic proximity which is based on the physical distance between firm headquarters, and the coordinates of where the terrorist attacks took place. We follow Dai et al. (2020), and define Attack proximity variable as a dummy variable that takes the value of one for local firms that are located 100 miles away from the attack site, for each firm year, and zero otherwise, conditioning on no prior events within the last three years.

As a result, we have a unique dataset of US listed companies, combining attack proximity, accounting and readability data from 1994 to 2016. Following Hasan (2020) we use ordinary least-squares regressions with robust standard errors and within-firm clustering. We include firm-level control variables, industry and year fixed effects. We exclude firms operating in the Utilities and Financial industries (SIC codes 49, 60–69). As it is standard in the literature to mitigate the effect of outliers, we winsorize all the continuous variables at the top and bottom 1% level. Our sample includes 37,648 firm year observations. We present the descriptive statistics in Table 1 for the variables included in our models.

Table 1 presents descriptive statistics of the variables used in the regressions. The mean (median) Fog Index is 19.994(19.953), which is close to that of prior studies (e.g. Xu et al., 2018). The mean of attack proximity is 0.076, with a standard deviation of 0.265. The descriptive statistics for the control variables are in line with prior studies.

| Table 1 Descriptive Statistics | ||||

| Mean | Median | Standard deviation | Observations | |

| Attack proximity | 0.076 | 0.000 | 0.265 | 37,648 |

| Fog index | 19.994 | 19.953 | 0.986 | 37,648 |

| Log File size | 7.510 | 7.315 | 1.484 | 37,648 |

| Kincaid Index | 15.815 | 15.783 | 0.958 | 37,648 |

| Flesch Index | 25.301 | 25.087 | 3.842 | 37,648 |

| Smog index | 17.383 | 17.361 | 0.696 | 37,648 |

| ROE | -0.098 | 0.049 | 1.449 | 37,648 |

| Size | 5.295 | 5.327 | 2.019 | 37,648 |

| MTB | 3.151 | 2.081 | 7.397 | 37,648 |

| Log firm Age | 2.195 | 2.303 | 0.693 | 37,648 |

| Spec | -0.029 | 0.000 | 0.108 | 37,648 |

| Earnings volatility | 0.238 | 0.059 | 0.985 | 37,648 |

| Nbseg_LN | 0.183 | 0.000 | 0.367 | 37,648 |

| Ngseg_LN | 0.322 | 0.000 | 0.566 | 37,648 |

| Delaware | 0.003 | 0.000 | 0.052 | 37,648 |

| Harvard negative tone | 4.042 | 4.055 | 0.600 | 37,876 |

| ROA | -0.202 | 0.012 | 0.996 | 37,876 |

| Sd_roa | 0.338 | 0.077 | 1.471 | 37,876 |

| Loss | 0.456 | 0.000 | 0.498 | 37,876 |

| VolDisct | 8.781 | 8.000 | 7.352 | 75,482 |

| Leverage | 0.322 | 0.179 | 0.632 | 75,482 |

| Tenure | 8.007 | 6.000 | 7.484 | 12,134 |

| Duality | 0.479 | 0.000 | 0.500 | 12,134 |

| Share_5 | 0.731 | 1.000 | 0.444 | 12,134 |

Empirical Results

Attack proximity and the Readability of 10-K Reports

We test whether attack proximity is associated with the readability of 10-K reports by estimating the following regression model (to test H1).

FOGit+1 =α0+β1Attack proximity it+ β2ROE it +β3Size it +β4MTB it +β5Firm age it + β6Spec it + β7Earnings volatility it + β8Nbseg_LN it + β9Ngseg_LN it + β11Delware it + IND_FE+ YEAR_FE+ ε it (1)

FOG Index, our dependent variable, is a proxy for 10-K readability obtained from WRDS SEC Analytics Suite. Following Li (2008), the FOG index is estimated as (words-per-sentence + percent-of-complex-words) ∗0.4 where words with three syllables or more are classified as complex words. A higher (lower) value of FOG index is designed to indicate that the 10-K report is less (more) readable since it requires more (less) number of years of formal schooling to understand the text. Our variable of primary interest is Attack proximity. We include a number of control variables that prior research finds to be associated with readability scores (Li, 2008; Lim et al., 2018; Hasan 2020). ROE is a measure of firm profitability, calculated as the net income scaled by common equity. SIZE is Natural logarithm of total assets. MTB is the market-to-book ratio calculated as the market value of the firm divided by its book value. Firm age is the natural log of the number of years since a firm’s IPO date. SPEC is measured as special items divided by total assets; Earnings volatility is the standard deviation of operating earnings (EBIT/TA) over the prior five years; NBSEG_LN is the natural log of the number of business segments; NGSEG_LN is the natural log of the number of geographic segments. Following Lim et al (2018), we also add a binary variable equal to one for firms incorporated in Delaware. We expect firms with higher earnings volatility, larger and growth firms, and firms with more complex business operations (proxied by the number of business and geographic segments), to have less readable 10-K reports. Conversely, older and profitable firms and firms with more negative special items are likely to issue more readable 10-K reports. We control for industry and year effects and cluster standard errors at the firm level. The results of the analysis are reported in Table 2.

| Table 2 The Effect of Terrorist Attacks on the Readability of 10-K Reports | |||||||

| Panel A: Main regression | |||||||

| Fog Index t+1 | |||||||

| Dependent variable: | Exp sign | (1) | (2) | (3) | |||

| Attack proximity t | + | 0.051*** | 0.029* | ||||

| 3.06 | 1.8 | ||||||

| Before t-3 | 0.006 | ||||||

| 0.22 | |||||||

| Before t-2 | 0.013 | ||||||

| 0.45 | |||||||

| Before t-1 | -0.012 | ||||||

| -0.42 | |||||||

| Current t | 0.061* | ||||||

| 1.85 | |||||||

| After t+1 | 0.056* | ||||||

| 1.86 | |||||||

| After t+2 | 0.028 | ||||||

| 1.11 | |||||||

| After t+3 | 0.016 | ||||||

| 0.64 | |||||||

| ROE t | - | -0.008** | -0.006 | ||||

| -2.09 | -1.11 | ||||||

| Size t | + | 0.090*** | 0.087*** | ||||

| 13.35 | 10.17 | ||||||

| MTB t | + | -0.001 | 0 | ||||

| -1.31 | 0.02 | ||||||

| Firm age t | - | -0.151*** | -0.111*** | ||||

| -10.12 | -3.56 | ||||||

| Spec t | - | -0.205*** | -0.232*** | ||||

| -4.2 | -3.31 | ||||||

| Earnings volatility t | + | 0.008 | 0.007 | ||||

| 0.8 | 0.47 | ||||||

| Nbseg_LN t | + | -0.029 | -0.013 | ||||

| -0.91 | -0.33 | ||||||

| Ngseg_LN t | + | -0.035* | -0.027 | ||||

| -1.84 | -1.14 | ||||||

| Delaware t | +/- | -0.18 | -0.229 | ||||

| -0.73 | -0.79 | ||||||

| Constant | 19.556*** | 19.314*** | 19.630*** | ||||

| 180.33 | 182.62 | 69.51 | |||||

| Industry FE | Yes | Yes | Yes | ||||

| Year FE | Yes | Yes | Yes | ||||

| Observations | 37648 | 37648 | 20882 | ||||

| Adj. R-squared | 0.169 | 0.204 | 0.182 | ||||

| Panel B: Alternative distance measures | |||||||

| Fog Index t+1 | |||||||

| Distance measure | 50 miles | 25 miles | 10 miles | ||||

| Attack proximity t | 0.033** | 0.033** | 0.042* | ||||

| 2.09 | 2.11 | 1.82 | |||||

| ROE t | -0.008** | -0.008** | -0.008** | ||||

| -2.09 | -2.08 | -2.08 | |||||

| Size t | 0.090*** | 0.090*** | 0.090*** | ||||

| 13.35 | 13.35 | 13.35 | |||||

| MTB t | -0.001 | -0.001 | -0.001 | ||||

| -1.33 | -1.34 | -1.33 | |||||

| Firm age t | -0.151*** | -0.151*** | -0.151*** | ||||

| -10.13 | -10.15 | -10.16 | |||||

| Spec t | -0.205*** | -0.205*** | -0.206*** | ||||

| -4.2 | -4.21 | -4.21 | |||||

| Earnings volatility t | 0.008 | 0.008 | 0.008 | ||||

| 0.8 | 0.8 | 0.8 | |||||

| Nbseg_LN t | -0.029 | -0.029 | -0.029 | ||||

| -0.9 | -0.9 | -0.91 | |||||

| Ngseg_LN t | -0.035* | -0.035* | -0.035* | ||||

| -1.85 | -1.86 | -1.85 | |||||

| Delaware t | -0.18 | -0.18 | -0.179 | ||||

| -0.74 | -0.73 | -0.73 | |||||

| Constant | 19.314*** | 19.315*** | 19.316*** | ||||

| 182.6 | 182.75 | 182.85 | |||||

| Industry FE | Yes | Yes | Yes | ||||

| Year FE | Yes | Yes | Yes | ||||

| Observations | 37648 | 37648 | 37648 | ||||

| Adj. R-squared | 0.204 | 0.204 | 0.204 | ||||

Table 2 reports the difference-in-differences estimates of the impact of terrorist attacks on the readability of 10-K reports of affected firms. We perform univariate analysis to provide preliminary insights on the association between the FOG index and attack proximity. In Column 1 of Panel A, using Fog index as a proxy of financial report complexity (inverse readability measure), we find that the coefficient on attack proximity is positive and statistically significant at the 1% level. This indicates that firms near attack sites exhibit less readable 10-Ks. Column 2 reports the main regression results after including our set of control variables. We find that the coefficients on attack proximity remains positive and statistically significant at the 10% level. The control variables' coefficients are broadly in line with those of (Li, 2008). For example, large firms are associated with less readable 10-K reports. However, well established (firm age) and profitable (ROE) firms and those with special items (Spec) are associated with more readable narrative disclosures. Number of geographic segments (Ngseg_LN) are significantly and negatively associated with FOG as per Li (2008).

We perform a placebo test to examine whether our results are robust or arise mechanically, perhaps due to some methodological flaws. Our goal is to examine whether the change to the readability of the 10-K reports we document is related to any pre-existing shocks that are unrelated to the attacks. Following Klasa et al. (2018), we add lead- lag attack proximity variables to our main regression. Before t-1~t-3 is equal to one for local firms which will experience an attack one to three years into the future. Current dummy variable equals one if the attack occurred in the current year. After t+1~t+3 equal one if the attack occurred one, two or three years ago. We find in Column 3 that the coefficients on Before t-1~t-3 are statistically insignificant, while those on Current and After t+1 are positive and significant. These results show that the reduction in the readability of the 10-K reports happens only after the attack events, but not before. Hence, reverse causality or a violation of the parallel trends assumption do not explain our key results.

In Panel B, as a robustness check, we test whether our results persist when using alternative distance measures. Following the literature on terrorist attacks, we have used so far 100 miles to define local firms, (Dai et al., 2020). We then use three alternative distances as cutoff to define attack proximity (e.g., 50 miles, 25 miles or 10 miles as cutoffs, respectively) to ensure that our results are not due to the specific choice of 100 miles. We rerun our main regression and find that our results remain unchanged. In particular, we find that the effect we document in the overall sample is amplified as the distance between the firms’ HQ and attack sites shortens. Overall, our results lend support to our first hypothesis H1.

The Effect of Terrorist Attacks on Voluntary Disclosure

So far, we have documented that terrorist attacks lead to less readable 10-K reports. In this section, we attempt to test whether the worsening of readability measures is deliberate or unintentional. To do so, we follow the argument proposed in Guay et al (2016) that if complex financial statements reflect an intentional choice by managers to obfuscate and hide information from investors, then the managers have no incentive to voluntarily disclose additional information. Therefore, the sign of the relation between attack proximity and the frequency of voluntary disclosure depends on whether the complexity is deliberate or unintentional. We follow Guay et al., (2016), and regress volDisct (proxied by the frequency of 8-K fillings) on attack proximity and a set of control variables. Firm and year fixed effect as well as clustering of standard errors on firm level are in place. The results are reported in Table 3.

| Table 3 The Effect of Terrorist Attacks on Voluntary Disclosure | |

| Dependent variable | VolDisc8K t+1 |

| Attack proximity t | 0.125* |

| 1.91 | |

| Size t | 0.714*** |

| 11.86 | |

| ROA t | -0.123*** |

| -4.63 | |

| Book leverage t | -0.115* |

| -1.78 | |

| MTB t | 0.003 |

| 1.3 | |

| Spec t | -0.579*** |

| -3.25 | |

| Loss t | 0.381*** |

| 5.76 | |

| Constant | -2.110*** |

| -5.99 | |

| Firm FE | Yes |

| Year FE | Yes |

| Observations | 75482 |

| Adj. R-squared | 0.629 |

VolDisct it+1 =α0+β1 Attack proximity it + β2Size it +β3ROA it +β4Book Leverage it +β5MTB it + β6Spec it + β7Loss it + + FIRM_FE+ YEAR_FE +ε it (2)

The coefficient on attack proximity is positive and statistically significant at the 5% level, which indicates that managers of firms near terrorist attack sites increase their voluntary disclosure, therefore confirming our second hypothesis, H2. Our evidence suggests that increased complexity of 10-K reports following the attacks is unintentional, and that managers of firms near the attack site increase the frequency of their voluntary disclosure in order to mitigate the worsening informational environment of the firm.

Additional Analysis

Alternative readability measures

We compute a battery of alternative readability measures to evaluate the robustness of our main findings, given the ongoing debate over the comparative merits of readability measures (Loughran & McDonald, 2014). We therefore do not limit our study to a specific measure. Following Xu et al., (2018) and Caglio et al., (2020), we adopt four alternative measures of readability: the Flesch Reading Ease (FLESCH Index), where a higher value signifies greater readability, the-Flesh-Kincaid Grade Level (KINCAID Index), SMOG index, and the length of an annual report (LENGTH) where a higher value indicates lower readability. The results are reported in Table 4.

| Table 4 Alternative Measures of Readability | ||||

| Dependent variable | File Size t+1 | Kincaid t+1 | Flesh t+1 | Smog Index t+1 |

| Attack proximity t | 0.017* | 0.031** | -0.139*** | 0.020* |

| 1.81 | 2.04 | -2.66 | 1.79 | |

| ROE t | -0.005** | -0.011*** | 0.018 | -0.006** |

| -2.05 | -3.16 | 1.41 | -2.26 | |

| Size t | 0.162*** | 0.113*** | -0.611*** | 0.064*** |

| 47.36 | 17.99 | -23.67 | 13.36 | |

| MTB t | 0.001** | 0 | -0.010*** | -0.001 |

| 2.38 | -0.05 | -3.53 | -1.39 | |

| Firm age t | -0.052*** | -0.194*** | 0.908*** | -0.112*** |

| -6.95 | -14.18 | 16.6 | -10.52 | |

| Spec t | -0.299*** | -0.244*** | 0.367** | -0.151*** |

| -8.8 | -5.48 | 2.16 | -4.38 | |

| Earnings volatility t | 0.034*** | 0.005 | 0.042 | 0.006 |

| 5.24 | 0.6 | 1.1 | 0.88 | |

| Nbseg_LN t | 0.096*** | -0.044 | 0.042 | -0.024 |

| 5.7 | -1.54 | 0.37 | -1.03 | |

| Ngseg_LN t | 0.059*** | 0.002 | -0.161** | -0.025* |

| 5.99 | 0.09 | -2.3 | -1.84 | |

| Delaware t | 0.031 | -0.14 | 0.696 | -0.124 |

| 0.23 | -0.74 | 0.79 | -0.72 | |

| Constant | 8.619*** | 15.079*** | 28.157*** | 16.914*** |

| 35.94 | 154.78 | 73.31 | 216.52 | |

| Industry FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Observations | 37648 | 37648 | 37648 | 37648 |

| Adj. R-squared | 0.855 | 0.284 | 0.399 | 0.208 |

The results are consistent with our main table, that proximity to terrorist attacks leads to lower readability of 10-K reports. We therefore find supporting evidence that our main conclusions remain unchanged and robust to the use of alternative measures of readability.

Cross sectional analysis: the impact of CEO experience

In the last section of this study, we examine the impact of CEO experience on the relationship between attack proximity and the readability of 10-K reports. More experienced CEOs are better communicators and are able to clearly convey information about the firm. Studies have shown the impact of CEO characteristics on the readability of 10-K fillings, (Kim & Chung, 2014; Chen, 2019). We test our third hypothesis that the reduction in the readability of 10-K fillings is weaker for firms with more experienced CEOs.

We augment the model specification in regression (1) with CEO tenure variable, its interaction term with attack proximity and additional controls related to CEO characteristics (binary variables equal to one if the CEO is also Chairman, ‘Duality’ or if the CEO’s share ownership is above 5%, ‘Share_5’). The results are in Table 5.

| Table 5 Cross-Sectionel Tests: The Impact of CEO Experience | ||||||

| Fog Index t+1 | Flesh t+1 | |||||

| Dependent variable | 100 miles | 50 miles | 25 miles | 100 miles | 50 miles | 25 miles |

| Attack proximity t | 0.03 | 0.095** | 0.082* | -0.152 | -0.371*** | -0.415*** |

| 0.68 | 2.24 | 1.85 | -1.18 | -3.02 | -3.25 | |

| Attack*Tenure t | -0.001 | -0.008** | -0.006 | 0.012 | 0.033*** | 0.026** |

| -0.23 | -2.03 | -1.48 | 0.93 | 2.84 | 2.25 | |

| Tenure t | 0.001 | 0.001 | 0.001 | -0.001 | -0.003 | -0.002 |

| 0.21 | 0.42 | 0.35 | -0.12 | -0.29 | -0.24 | |

| ROE t | -0.015 | -0.015 | -0.015 | 0.04 | 0.039 | 0.039 |

| -1.39 | -1.37 | -1.37 | 1.26 | 1.23 | 1.23 | |

| Size t | 0.048*** | 0.048*** | 0.048*** | -0.271*** | -0.270*** | -0.270*** |

| 3.22 | 3.2 | 3.21 | -5.13 | -5.12 | -5.13 | |

| MTB t | -0.002 | -0.002 | -0.002 | -0.008 | -0.008 | -0.008 |

| -1.42 | -1.44 | -1.44 | -1.52 | -1.5 | -1.48 | |

| Firm age t | -0.032 | -0.031 | -0.032 | 0.478*** | 0.477*** | 0.478*** |

| -1 | -0.98 | -1 | 4.32 | 4.31 | 4.33 | |

| Spec t | -0.302*** | -0.301*** | -0.304*** | 0.902** | 0.899** | 0.909** |

| -2.66 | -2.65 | -2.68 | 2.44 | 2.43 | 2.46 | |

| Earnings volatility t | 0.137* | 0.134 | 0.136* | -0.394 | -0.385 | -0.391 |

| 1.69 | 1.64 | 1.69 | -1.39 | -1.34 | -1.39 | |

| Nbseg_LN t | 0.078 | 0.078 | 0.078 | -0.391** | -0.393** | -0.393** |

| 1.48 | 1.49 | 1.49 | -2.22 | -2.23 | -2.23 | |

| Ngseg_LN t | -0.021 | -0.021 | -0.021 | -0.067 | -0.067 | -0.064 |

| -0.69 | -0.7 | -0.71 | -0.67 | -0.66 | -0.64 | |

| Delaware t | 0.172 | 0.171 | 0.174 | -1.716* | -1.711* | -1.729* |

| 0.6 | 0.59 | 0.61 | -1.8 | -1.77 | -1.82 | |

| Duality t | 0.027 | 0.027 | 0.027 | -0.006 | -0.008 | -0.007 |

| 0.83 | 0.85 | 0.84 | -0.05 | -0.07 | -0.06 | |

| Share_5 t | -0.088*** | -0.088*** | -0.088*** | 0.221** | 0.222** | 0.222** |

| -2.81 | -2.82 | -2.82 | 1.99 | 2 | 2.01 | |

| Constant | 19.857*** | 19.853*** | 19.856*** | 23.975*** | 23.991*** | 23.989*** |

| 141.2 | 141.08 | 141.4 | 48.07 | 48.09 | 48.17 | |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 12134 | 12134 | 12134 | 12134 | 12134 | 12134 |

| Adj. R-squared | 0.189 | 0.19 | 0.19 | 0.377 | 0.377 | 0.377 |

| Wald t test p value | 0.028 | 0.067 | 0.003 | 0.001 | ||

We find when using Fog index as a measure of readability that the coefficient on the interaction term is negative but statistically insignificant for firms within 100 miles. However, it regains statistical significance when local firms are defined within 50 miles of the attack sites. As an additional test, we use Flesch index instead and find coherent results. For firms closest to the attack sites (within 50 miles and 25 miles), the readability of 10-K reports reduces but to the extent that the CEO has more experience, the effect is weaker. P values of the wald t test refute the null hypothesis that Attack Proximity*tenure+ Attack Proximity=0, therefore confirming H3.

Conclusion

The readability of financial reports is found to cause substantial economic consequences for the firm. In contrast with previous studies which focus on firm level characteristics that have an impact on readability, this study examines the effect of exogenous shocks such as terrorist attacks on the readability of 10-K reports. Consistent with our hypothesis, we find that attack proximity is significantly associated with less readable narrative disclosures in 10-K reports. Through a range of sensitivity analyses, we establish that the association between attack proximity and the readability of 10-K reports is robust to the use of alternative readability measures and attack proximity distances. We also find that this association is less pronounced for firms with more experienced CEOs. Additionally, we find evidence suggesting that managers mitigate the reduction of readability by improving the informational environment of the firm through more frequent voluntary disclosures.

Our study contributes to the growing literature on the determinants of the readability of corporate disclosures by identifying the role of extreme negative events such as terrorist attacks. Our findings can help market participants and investors to better understand and interpret the information disclosed by firms.

Acknowledgement

We thank Young Han (Andy) Kim for providing the hand collected longitude and latitude data of the location of the firms’ Headquarters.

References

- Abadie, A., & Gardeazabal, J. (2003). The economic costs of conflict: A case study of the Basque Country. American Economic Review, 93(1), 113-132.

- Biddle, G.C., Hilary, G., & Verdi, R.S. (2009). How does financial reporting quality relate to investment efficiency?. Journal of Accounting and Economics, 48(2-3), 112-131.

- Blanco, B., & Dhole, S. (2017). Financial statement comparability, readability and accounting fraud. AFAANZ Conference, Working Paper.

- Blomberg, S.B., Hess, G.D., & Orphanides, A. (2004). The macroeconomic consequences of terrorism. Journal of Monetary Economics, 51(5), 1007-1032.

- Bloomfield, R. (2008). Discussion of annual report readability, current earnings, and earnings persistence. Journal of Accounting and Economics, 45(2-3), 248-252.

- Bonsall IV, S.B., Leone, A.J., Miller, B.P., & Rennekamp, K. (2017). A plain English measure of financial reporting readability. Journal of Accounting and Economics, 63(2-3), 329-357.

- Caglio, A., Melloni, G., & Perego, P. (2020). Informational content and assurance of textual disclosures: Evidence on integrated reporting. European Accounting Review, 29(1), 55-83.

- Chen, W., Wu, H., & Zhang, L. (2020). Terrorist Attacks, Managerial Sentiment, and Corporate Disclosures. The Accounting Review.

- Chen, X. (2019). Managerial sentiment and non-GAAP earnings disclosure: evidence from terrorist attacks. Asia-Pacific Journal of Accounting & Economics, 1-19.

- Chen, Y., Goyal, A., Veeraraghavan, M., & Zolotoy, L. (2020). Terrorist attacks, investor sentiment, and the pricing of initial public offerings. Journal of Corporate Finance, 65, 101780.

- Cuculiza, C., Antoniou, C., Kumar, A., & Maligkris, A. (2021). Terrorist attacks, analyst sentiment, and earnings forecasts. Management Science, 67(4), 2579-2608.

- Dai, Y., Rau, P.R., Stouraitis, A., & Tan, W. (2020). An ill wind? Terrorist attacks and CEO compensation. Journal of Financial Economics, 135(2), 379-398.

- Dyer, T., Lang, M.H., & Stice-Lawrence, L. (2016). The ever-expanding 10-k: Why are 10-ks getting so much longer (and does it matter). Available at SSRN, 2741682.

- Guay, W., Samuels, D., & Taylor, D. (2016). Guiding through the fog: Financial statement complexity and voluntary disclosure. Journal of Accounting and Economics, 62(2-3), 234-269.

- Habib, A., & Hasan, M.M. (2017). Managerial ability, investment efficiency and stock price crash risk. Research in International Business and Finance, 42, 262-274.

- Hambrick, D.C., & Mason, P.A. (1984). Upper echelons: The organization as a reflection of its top managers. Academy of Management Review, 9(2), 193-206.

- Han, J.H., Kim, Y.H., & Sodki, C. (2021). The impact of terrorist attacks on CEO turnover. Working paper.

- Hasan, M.M. (2020). Readability of narrative disclosures in 10-K reports: does managerial ability matter?. European Accounting Review, 29(1), 147-168.

- Houston, J.F., Lin, C., Liu, S., & Wei, L. (2019). Litigation risk and voluntary disclosure: Evidence from legal changes. The Accounting Review, 94(5), 247-272.

- Irani, R.M., & Oesch, D. (2013). Monitoring and corporate disclosure: Evidence from a natural experiment. Journal of Financial Economics, 109(2), 398-418.

- Kim, Y.H., Sodki, C., & Song, K.R. (2021). Terrorist attacks and Capital structure. Working paper.

- Kim, Y.H., & Chung, S.G. (2014). Are Female CFOs Better at Improving Readability of the Annual Reports?. Sung Gon, Are Female CFOs Better at Improving Readability of the Annual Reports.

- Klasa, S., Ortiz-Molina, H., Serfling, M., & Srinivasan, S. (2018). Protection of trade secrets and capital structure decisions. Journal of Financial Economics, 128(2), 266-286.

- Kumar, G. (2014). Determinants of readability of financial reports of US-listed Asian companies. Asian Journal of Finance & Accounting, 6(2), 1.

- Lehavy, R., Li, F., & Merkley, K. (2011). The effect of annual report readability on analyst following and the properties of their earnings forecasts. The Accounting Review, 86(3), 1087-1115.

- Li, F. (2008). Annual report readability, current earnings, and earnings persistence. Journal of Accounting and Economics, 45(2-3), 221-247.

- Li, Y., Lin, Y., & Zhang, L. (2018). Trade secrets law and corporate disclosure: Causal evidence on the proprietary cost hypothesis. Journal of Accounting Research, 56(1), 265-308.

- Lim, E.K., Chalmers, K., & Hanlon, D. (2018). The influence of business strategy on annual report readability. Journal of Accounting and Public Policy, 37(1), 65-81.

- Lo, K., Ramos, F., & Rogo, R. (2017). Earnings management and annual report readability. Journal of Accounting and Economics, 63(1), 1-25.

- Loughran, T., & McDonald, B. (2011). When is a liability not a liability? Textual analysis, dictionaries, and 10?Ks. The Journal of finance, 66(1), 35-65.

- Loughran, T., & McDonald, B. (2014). Measuring readability in financial disclosures. The Journal of Finance, 69(4), 1643-1671.

- Nguyen, T., Petmezas, D., & Karampatsas, N. (2020). Does Safety Uncertainty Affect Acquisitions?. Available at SSRN 3250400.

- Powell, J. (2021). Tesla and the obscure earnings JPEG. Financial Time. Retrieved May 20, 2021, from https://www.ft.com/content/8014e86f-c06d-4175-ad63-f459d7cd9929

- Vincenty, T. (1975). Direct and inverse solutions of geodesics on the ellipsoid with application of nested equations. Survey Review, 23(176), 88-93.

- Wang, A.Y., & Young, M. (2020). Terrorist attacks and investor risk preference: Evidence from mutual fund flows. Journal of Financial Economics, 137(2), 491-514.

- Xu, Q., Fernando, G.D., & Tam, K. (2018). Executive age and the readability of financial reports. Advances in Accounting, 43, 70-81.