Research Article: 2021 Vol: 24 Issue: 5

The impact of the adoption of data analytics on gathering audit evidence: A case of KPMG Zimbabwe

Wadesango Newman, University of Limpopo

Fadzai Muzvuwe, Midlands State University

Malatji Stephen, Tshwane University of Technology

Citation Information: Newman, W., Muzvuwe, F., & Stephen, M. (2021). The impact of the adoption of data analytics on gathering audit evidence: A case of KPMG Zimbabwe. Journal of Management Information and Decision Sciences, 24(5), 1-15.

Abstract

The aim of this research, on the KPMG Zimbabwe external audit and assurance department, is to understand the impact of adopting data analytics on gathering audit evidence. The study purposes to disclose how auditors perceive the utility of big data and data analytics to support auditing procedures and gathering audit evidence. The topic was triggered by the crescent awareness of accounts, audit firms, standard setters, and academics. The paper adopted a mixed methodology research. Data collected through questionnaires was analysed quantitatively using descriptive statistics specifically measures of central tendency (mode) and measures of frequency (percent) were used and an overall assessment through regression analysis was made. Data collected through interviews was analysed using qualitative coding and analysis. The research discovered that adoption of data analytics has a positive effect on gathering audit evidence and this was supported by other scholars who were reviewed in chapter two. Recommendation was given for KPMG to fully adopt data analytics as solutions to challenges faced when using data analytics were proffered.

Keywords

Data analytics; Audit evidence; KPMG Zimbabwe.

Introduction

The audit profession is about giving the users of financial statements reasonable assurance that financial information is free from material misstatements due to fraud or error, especially potential investors and analysts, thus the expectations of the profession to deliver on its mandate rise. For audit firms to meet these higher expectations they need to be effective and efficient in carrying out their work. According to Vanbutsele (2017) big data analytics is the future of the auditing profession bearing in mind the volume and complexity of data transactions that are being processed by companies (clients) therefore it is vital to come up with data analytics which might improve audit efficiency and effectiveness in carrying out audit procedures. The monetary policy pronouncements were announced in January and September 2019, there was an increase in transactions increasing the amount of data processed by businesses. According to a report issued by The Herald in February 2020, POTRAZ reported that mobile money transactions for the financial services sector grew by 108percent in the last quarter of 2019.

All Big 4 firms have announced efforts in the data analytics field (Deloitte, 2013; PWC, 2018; KPMG, 2018). In addition, International Auditing and Assurance Standards Board (IAASB) is developing the Data Analytics Working Group (DAWG) with the aim to inform stakeholders about the IAASB’s ongoing work to explore effective and appropriate use of technology, with a focus on data analytics, in the audit of financial statements.

Data analytics are increasingly dominating the financial reporting process. A study by Deloitte (2013) noted that finance and accounting divisions are increasingly investing in analytics. Furthermore, other accounting firms are working to invest in technological tools that will advance the use of data analytics in financial statement audits. (Davenport & Harris 2017) appear to agree that adoption of data analytics is important as clients are now producing big data. Liddy (2015) elucidates and supports the fact that data & analytics can develop risk assessment procedures in auditing of which risk assessment is deemed vital in auditing. (Byrnes, et al., 2014) add that an improvement in audit efficiency, procedures and audit quality is expected if data analytics are implemented.

Additionally, Earley (2015) added that the adoption of data analytics will allow more transactions to be tested, giving a better result than a result obtained when a sample is used. This is supported by a study which was done by Earley (2015) which states that data & analytics will potentially bring a lot of transformation to the audit sector, improving the results and audit evidence as sample based methods will no longer be used. Akhtar (2016) adds that it is important and necessary for audit firms to keep on investing in data analytics as this will help to produce more assurance and relevance to the audit profession.

Alles (2015) also states that there is need to invest in data analytics for firms to remain competitive in the future. ICAEW, 2017 supports Alles (2015) as they point out that it is important that the auditing and financial reporting sectors invest in understanding and developing data & analytics technology as this benefits their respective sectors. Additionally, Alles (2015) states that, that auditors may promptly embrace big data as a way of increasing the effectiveness and credibility of their work. After receiving harsh criticism under the Enron and WorldCom’ scandals and the financial crisis, auditors feel some pressure to adopt big data and data analytics as a way to ensure additional credibility about their work.

In addition, (Vanbutsele, 2017) emphasizes that auditing profession is facing challenges due to rise of big data which can be reduced by adoption of data analytics. All these authors, scholars and researchers above seem to be agreeing that the adoption of data analytics has an impact on audit efficiency and gathering sufficient appropriate audit evidence.

Other schools of thoughts however differ from the above arguments. Financial Reporting Council, 2017 states that audit firms and teams feel pressure to promote the use of audit data analytic techniques on audits to meet audit committee expectations and to achieve efficiencies. This may result in overemphasis of data analytics as they might not be prevalent as to what the market expects. Bender (2017) adds that the application of data analytics is still new and audit firms need time to fine-tune its use, but it however does not make it bad for use by the audit firms.

Researchers on data analytics have focused more on effects of adoption of data analytics, factors influencing the adoption and use of Data Analytics and Computer Aided Audit Techniques. A study by (Mansour, 2016) focusing on the use of technology in auditing, he noted that there are significant factors which are leading to use of CAATs by external auditors such as the need for auditors to work independently on data without dependence on the client. Mohammad et al. (2017) support the study by Mansour (2016) as they closely look at factors affecting adoption of CAATs among external auditors. Results show that among other factors the size of the firm might contribute to the adoption of data analytics (Rosli et al., 2013).

Research Objectives

To analyse the impact of data analytics on audit procedure and gathering audit evidence.

Research Methodology

The study adopted a mixed methodology research using descriptive research design. The target population of this research was KPMG employees in the audit department (Table 1). The researchers used stratified random sampling for questionnaires in order to achieve the main objective of the study which was to determine the effect of adoption of data analytics on gathering audit evidence. For interviews, the researchers used convenience (non-probability) sampling technique because auditors spend most of their time at clients. The researchers used interviews and questionnaires as data collection methods to efficiently collect information on the effect of adopting data analytics on gathering audit evidence.

| Table 1 Population and Sample Size | |||

| Population Identity | Target Population | Sample Size | Interviews |

| Audit Partners | 5 | 20% | |

| Audit Managers | 5 | 100% | 3 |

| Audit Supervisors | 3 | 33% | |

| Audit Seniors | 20 | 50% | |

| Audit Associates | 40 | 35.7% | |

| Total | 73 | 43.84% | 4 |

The researcher used measures of central tendency and measures of frequency under descriptive statistics for data analysis.

Results and Discussion

Impact of Data Analytics on Audit Procedures and Audit Evidence

The research problem was centred on data analytics and audit evidence. The questionnaires were designed to ascertain the impact of data analytics on audit procedures and audit evidence.

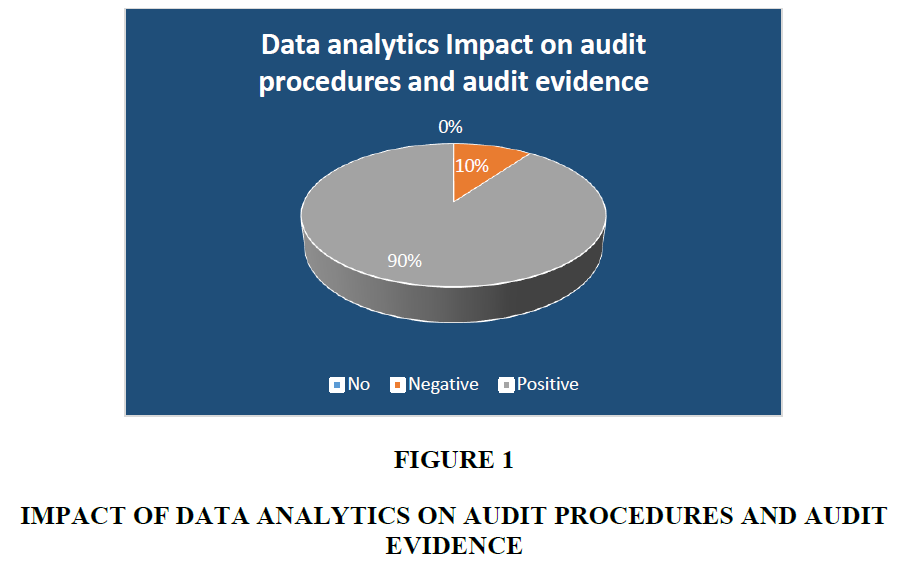

Figure 1 show results from respondents on the impact of data analytics on the audit procedures and audit evidence. Of the respondents, none responded highlighting that data analytics has no impact. 3(10%) negative and 27(90%) positive were the results from the respondents.

Implementation of Data Analytics Fully by KPMG

The main aim of this question was to assess if the firm (KPMG) needs to fully implement data analytics in audit processes and this assisted the researcher on coming up with recommendations. The results are tabulated below.

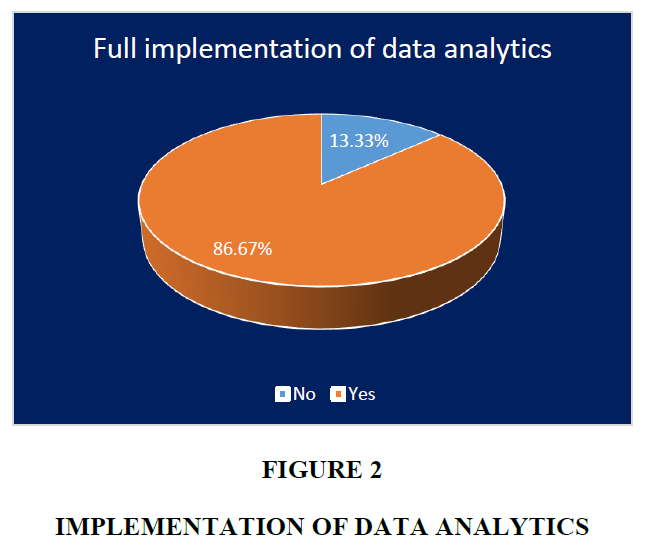

Figure 2 illustrates that 84% of the respondents highlighted that the firm (KPMG) needs to fully implement Data Analytics. The results obtained above can be supported by Ramlukan (2015) who highlighted that audit firms need to continuously invest in data analytics so that they can fully implement data analytics in all audit processes. In addition, Earley (2015) also supports that the firm needs to fully implement data analytics as that clients are now producing big data which needs the firm to fully implement data analytics in order to make auditing easy for auditors. The research by Gepp et al, (2018) concluded that audit firms need to fully implement data analytics so as to catch up with transformation of data into big data, thus supporting the findings of this study.

Importance of Data Analytics in Auditing

This section was key to ascertain the benefits of data analytics in auditing through assessing views from different people.

Improves audit effectiveness

The aim of the question was to find out more on effectiveness as one of the benefits of data analytics in auditing. The responses to the questionnaire are documented below.

Table 2 exhibits that 0/30(0%) strongly disagree, 0/30(0%) disagree, 2/30(6.67%) are neutral, 11/30(36.67%) agree and 17/32(56.67%) strongly agree that data analytics improves audit effectiveness. In total, 28/30(93.33%) agreed to the assertion that data analytics improves audit efficiency. Taking into consideration the mode statistical analysis it can be deduced that data analytics improves audit efficiency as many respondents above do agree to that.

| Table 2 Improves Audit Effectiveness | |||||

| Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree | |

| Increases effectiveness | 17 | 11 | 2 | 0 | 0 |

| Percentage response rate | 56.67% | 36.67% | 6.67% | 0% | 0% |

Improves audit efficiency

This question was also raised to ascertain benefit as perceived by the auditors (Table 3).

Table 3 exhibits that 0/30(0%) strongly disagree, 0/30(0%) disagree, 1/30(3.33%) are neutral, 6/30(20%) agree and 23/30(76.67%) strongly agree that data analytics improves audit effectiveness. In total, 29/30(96.67%) agreed to that data analytics implementation in the firm will lead to an increase in audit effectiveness. Taking into consideration the mode statistical analysis it can be deduced that data analytics improves audit effectiveness as many respondents above do agree to that.

| Table 3 Improves Audit Effectiveness | |||||

| Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree | |

| Improves audit effectiveness | 23 | 6 | 1 | 0 | 0 |

| Percentage response rate | 76.67% | 20% | 3.33% | 0% | 0% |

Improved client service

The statement of the questionnaire sought to ascertain whether data analytics improves client service or not. The responses from the questionnaire are tabulated below.

Table 4 shows that 0/30(0%) strongly disagree, 0/30(0%) disagree, 7/30(23.33%) are neutral, 17/30(56.67%) agree and 6/30(20%) strongly agree that data analytics improves client service. In total, 23/30(76.67%) agreed to that data analytics implementation in the firm will lead to improve its relationship and service with clients. The mode statistical analysis was used to interpret that data analytics improves client service as many respondents above do agree to that.

| Table 4 Improved Client Service | |||||

| Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree | |

| Improves client service | 6 | 17 | 7 | 0 | 0 |

| Percentage response rate | 20% | 56.67% | 23.33% | 0% | 0% |

Challenges Faced When Using Data Analytics

Expertise of auditors

The questionnaire was designed to understand whether expertise of auditors is a challenge faced on implementation of data analytic tools.

Table 5 exhibits that majority of the respondents either agree or strongly agree that one of the challenges encountered when using data analytics is that auditors lack the relevant expertise. Research by Earley (2015) supports the above results as the research states that auditors are lagging behind when it comes to use of data analytics because they do not have the required skills to apply data analytics.

| Table 5 Expertise of Auditors | |||||

| Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree | |

| Expertise of auditors | 10 | 11 | 3 | 5 | 1 |

| Percentage response rate | 33.33% | 36.67% | 10% | 16.67% | 3.33% |

System breakdown

The question intended to ascertain whether system breakdown is a challenge that auditors face when using data analytics

Table 6 above outlines that 20/30(66.67%) of the respondents are in agreement that system break downs are a challenge when using data analytics. Using the modal statistical analysis, this highlights that majority of the respondents agreed that system breakdown is a challenge. However, 6/30(20%) were neutral and 4/30(13.33%) disagreed that this was a challenge which auditors face when using data analytics. Brown-Liburd et al. (2015) supported that this is a challenge. They highlighted that data analytical tools used by auditors might have breakdowns during the phase of an audit and this will cause auditors to take more time working on an engagement. Russom (2011) also added that problems with database software can be barriers to big data analytics.

| Table 6 System Breakdown | |||||

| Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree | |

| System breakdown | 11 | 9 | 6 | 4 | 0 |

| Percentage response | 36.67% | 30% | 20% | 13.33% | 0% |

Compatibility of hardware

The question intended to ascertain whether compatibility of hardware is a challenge that auditors face when using data analytics.

Table 7 above delineate that 4/30(13.33%) strongly disagree, 3/30(10%) agree, 2/30(6.67%) are neutral, 13/30(43.33%) agree and 8/30(26.67) strongly agree that compatibility of software is a challenge faced by auditors when using data analytic tools to gather audit evidence. From the findings above it can be noted that, many respondents fall under the modal class of agreeing that compatibility of hardware is a challenge encountered when using data analytics. The results above which states that compatibility of hardware is a challenge are supported by a research which was done by Mansour (2016), which indicated that some computers which are used by auditors are not compatible with data analytical tools as some computers might crash or slow down during audit thus affecting audit efficiency during audit procedures. In support of the above results Alles (2015) also indicate that some data analytical tools are not compatible with client`s hardware and this might affect the client`s hardware and all the blame will be put on auditors. Taking into consideration the results which were obtained from questionnaires and arguments by scholars it can be deduced that compatibility of hardware is a challenge encountered when using data analytics.

| Table 7 Compatibility of Software | |||||

| Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree | |

| Hardware compatibility | 8 | 13 | 2 | 3 | 4 |

| Percentage response rate | 26.67% | 43.33% | 6.67% | 10% | 13.33% |

Theft of data or data confidentiality

The question intended to establish whether data confidentiality of theft of data is a challenge that auditors face when using data analytics.

The results obtained show that many respondents agreed that theft of data is one of the challenges encountered when using data analytics, this is because when using applications and software there might be chances of hackers. Table 8 outlines the results from the respondents. 3/10(10%) strongly disagree, 4/30(13.33%) disagree, 4/30(13.33%) neutral, 10/30(33.33%) agree and 9/30(30%) strongly agree. The modal statistic therefore shows that 19/30 (63.33%) agree that data theft is a challenge faced by auditors when performing data analytics in audit. This is supported by Earley (2015) who highlighted that since application of data analytics implies that most of the processes will be automated there is a chance that hackers might steal confidential data of clients and the tools used by auditors may be corrupted.

| Table 8 Theft of Data | |||||

| Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree | |

| Theft of data | 9 | 10 | 4 | 4 | 3 |

| Percentage response | 30% | 33.33% | 13.33% | 13.33% | 10% |

Data availability, data relevance and data integrity

The question was designed for verification on whether data availability, data relevance and data integrity is one of the challenges faced by auditors when performing data analytics during an audit.

Solutions to Challenges Faced with Data Analytics in Gathering Audit Evidence

The statement on the questionnaire was designed to substantiate the solutions to address the challenges encountered when using data analytics.

Recruitment of information technology department

This statement was for verification on whether recruitment of an information technology department which key in the firm for it to work towards alleviating the challenges highlighted.

Results shown in Table 9 clearly demystify that many respondents agreed that recruiting information technology department is a solution to the challenges encountered when using data analytics. Table 9 shows that 63.34% of the respondents were in agreement and this was the modal group of respondents. The results obtained and analysed above are supported by Appelbaum (2016) who highlights that audit firms must have a department for information technology which assists auditors to carry out their audit procedures. Furthermore, Appelbaum (2016) highlights that firms should recruit highly qualified personnel under the information technology department. Taking into consideration the results obtained from questionnaires and arguments by other scholars the researcher concluded that recruiting an information technology department is a solution to challenges faced when using data analytics.

| Table 9 Recruitment of Information Technology Department | |||||

| Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree | |

| Recruitment of an IT department | 5 | 14 | 7 | 4 | 0 |

| Percentage response | 16.67% | 46.67% | 23.33% | 13.33% | 0% |

Training and education of audit teams

This statement was meant to assess if training and education knowledge is one of the solutions to address the challenges faced when using data analytics. Table 10 below exhibits the findings which were obtained.

| Table 10 Training and Education of Audit Teams | |||||

| Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree | |

| Training of audit teams | 15 | 8 | 4 | 3 | 0 |

| Percentage response | 50% | 26.67% | 13.33% | 10% | 0% |

As shown in Table 10 above 0/30 strongly disagree, 3/30 disagree, 4/30(13.33%) neutral, 8/30(26.67%) agree and 15/30(50%) strongly agree that training and education knowledge for auditors is a solution for challenges encountered when using data analytics. Using mode, it can be denoted that many respondents agreed that training and education knowledge for auditors is a solution to the challenges encountered. This is because training and education improves auditors’ expertise thus addressing one of the challenges encountered when using data analytics which is lack of expertise. This is also supported by Earley (2015) who suggests that audit firms must train their auditors and educate them on data analytics so that they can improve on their skills.

Access to data

This statement was meant to assess if access to data is one of the solutions to address the challenges faced when using data analytics. Table 11 exhibits the findings which were obtained.

| Table 11 Access to Data | ||||||

| Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree | Total | |

| Access to data | 8 | 12 | 5 | 1 | 4 | 30 |

| Percentage response | 26.67% | 40% | 16.67% | 3.33% | 13.33% | 100% |

The Table 11 above shows that 4/30(13.33%) strongly disagree, 1/30(3.33%) disagree, 5/30(16.67%) neutral, 12/30(40%) agree and 8/30(26.67%) strongly agree that auditors access to data is one of the solutions to challenges encountered when using data analytics. The results shown above depicts that many respondents agreed that auditors access to data is a solution to challenges faced when using data analytics. This is supported by Bender (2017) who highlighted that auditors consider data extraction the biggest challenge encountered when using data analytics and this can be solved if auditors are allowed to extract data on their own and granted access to all data without the interference of the client. Considering the results obtained from the questionnaires which were distributed and arguments by other scholars the researcher deduced that auditors’ access to data is a solution to challenges faced when using data analytics.

An Analysis of the Relationship between Variables of Data Analytics and Gathering Audit Evidence

Regression analysis

The researcher employed regression analysis to test the association between data analytics and gathering audit evidence for KPMG Zimbabwe (Table 12). The model combined variables relating to data analytics and how they impact gathering of audit evidence. Data obtained from questionnaires was used for test of association using the statistical social package of social (SPSS).

| Table 12 Logistic Regression Output Table | |||||||

| β | S.E. | Wald | df | Sig. | Exp β | ||

| Step 1a | Time spent on audit | 0.14 | 0.053 | 2.6 | 1 | 0.020 | 3.533 |

| Cost of the audit | 0.029 | 0.021 | 1.45 | 1 | 0.03 | 1.853 | |

| Audit fees | 0.02 | 0.036 | 0.80 | 1 | 0.049 | 0.841 | |

| Constant | 0.001 | 0.008 | 0.125 | 1 | 0.030 | 0.000 | |

Looking first at the results for ‘time spent on audit’, there is a highly significant overall effect (Wald = 2.6, df = 1, p<0.020). The β coefficient for the time spent is significant and positive, indicating that increasing punctuality is associated with increased chances of gathering audit evidence.

The Exp(β) column (the Odds Ratio) tells us that companies with the highest audit efficiency and audit quality are four (3.533) times more likely than those with lowest audit efficiency and audit quality (our reference category) to gather adequate audit evidence.

Most importantly, controlling audit efficiency and quality has changed the associations between the adoption of data analytics and the ability to gather audit evidence. The overall association of cost of the audit and the audit fees remains highly significant on gathering audit evidence, as indicated by the overall Wald test, but the size of the β coefficient and the associated Odds ratio for audit fee has changed substantially.

Traditional audit systems have resulted in the audit efficiency being affected as time spent on audits is more than budgeted for and this affects auditor client relationships. The sampling and testing of big data has resulted in auditors at KPMG spending more time on audits and this trickles down to the quality of the audit. Resultantly the costs to both the auditor and client are increased as there is need for resources allocated to work on an engagement going above the budgeted costs.

Interview Responses Transcribed

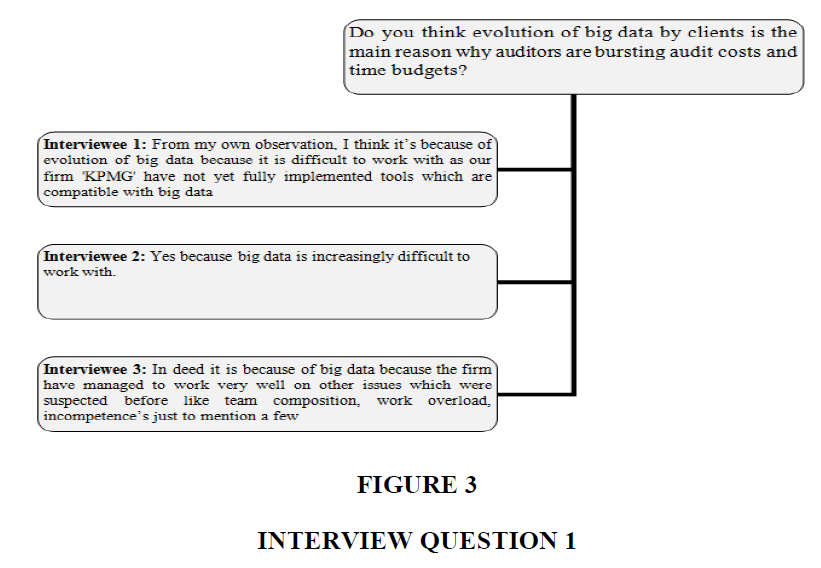

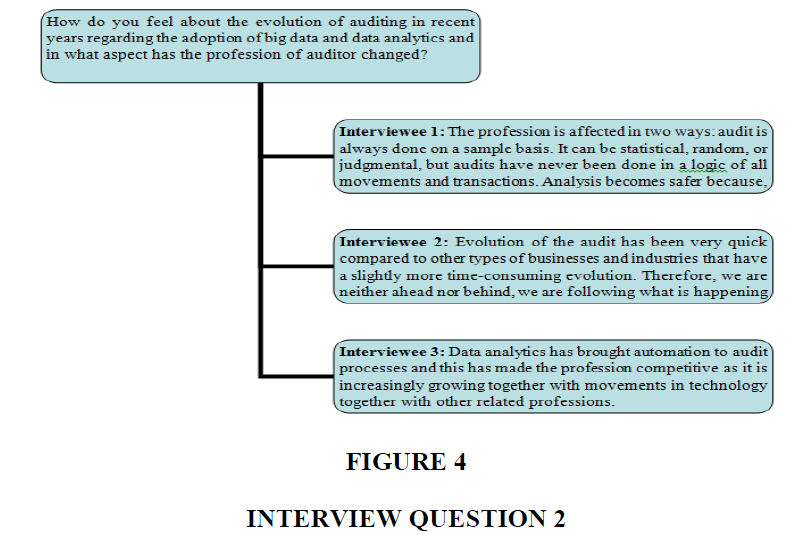

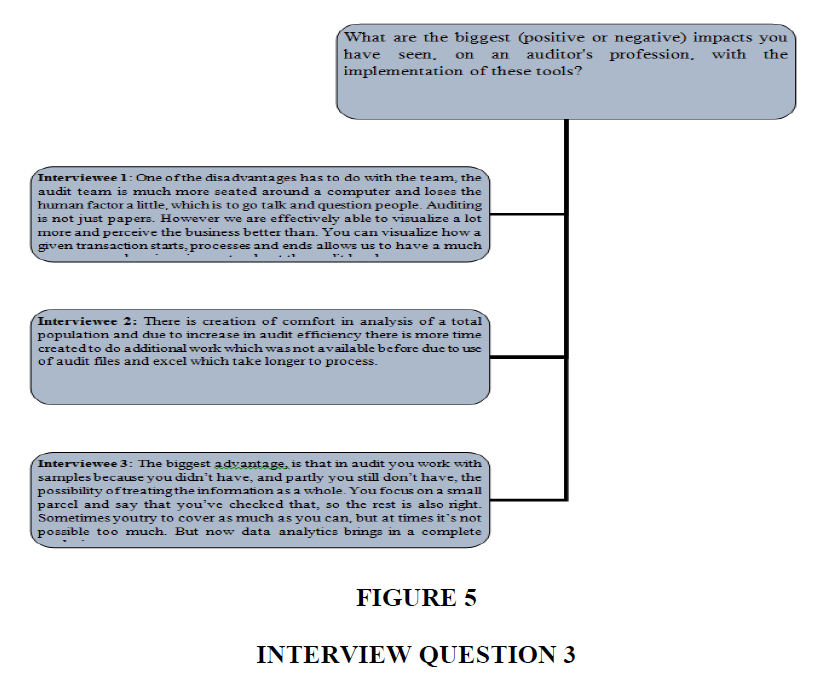

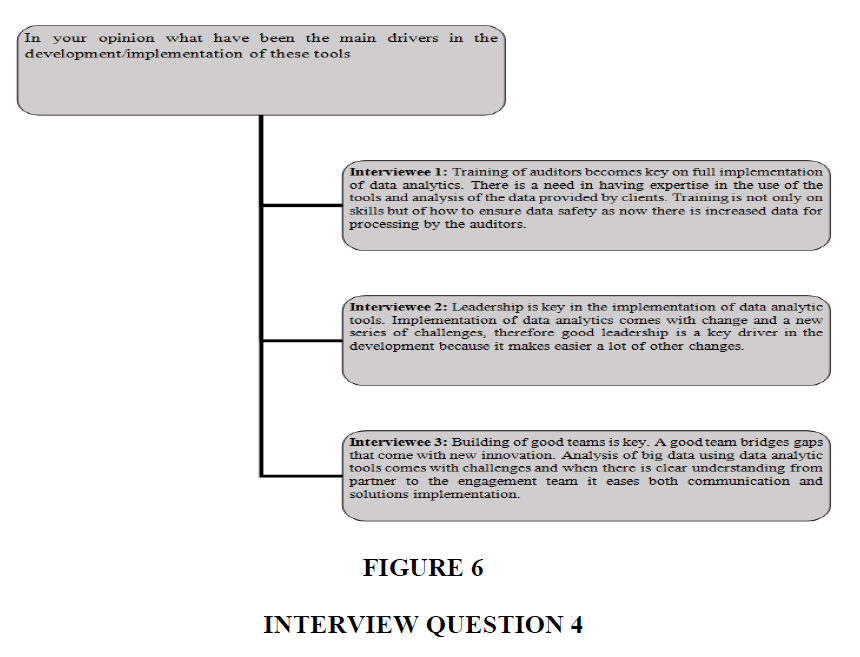

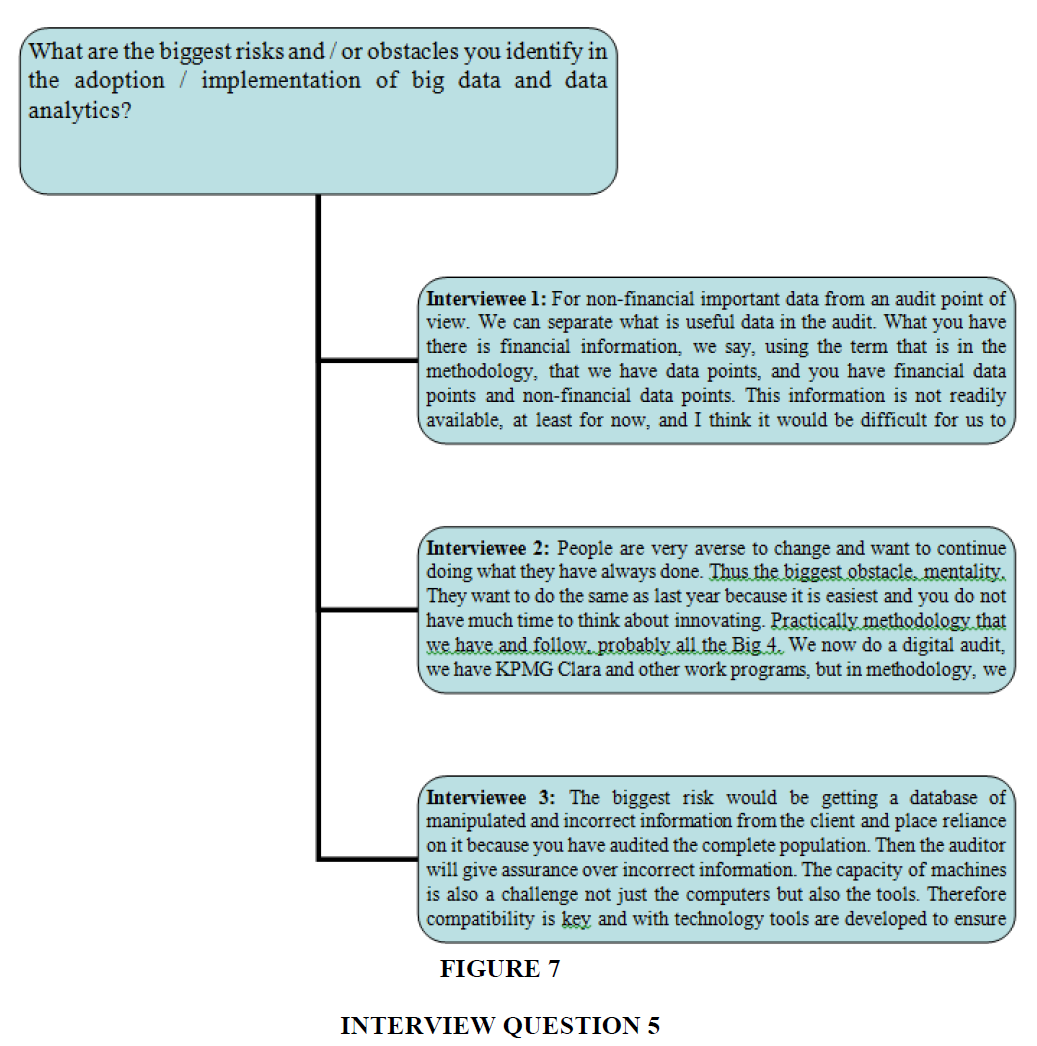

All the interview questions and responses have been transcribed in Figures 3-7.

Major Research Findings

It emerged in this study that:

• Through data analytics, auditors acquire new skills sets through trainings which are conducted for the auditors enhance auditor skills and thus better audit engagements are carried out.

• Due to the large coverage and a shift from sampling to total population audits, there is more value addition to clients being audited and more audit credibility.

• Data analytics not only improves the manner in which audit procedures are carried out. It improves audit quality, audit effectiveness and efficiency because of better analysis of the entity being audited, better analysis of exceptions noted through the embedded audit routines approach.

• Through this study, there is maximization of professional skepticism and judgment due to the use of complex audit techniques from the simpler traditional methods.

• Through the questionnaires it was discovered that auditors face challenges when using data analytics these include data availability, system breakdown, expertise of auditors, and theft of data and compatibility of hardware.

• The study also revealed through the interviews conducted that the main reason why KPMG auditors spent more time that budgeted for during audits is the evolution of big data.

Conclusion

The main purpose of this study was to determine the effect of adoption of data analytics on gathering audit evidence. It was noted that adoption of data analytics has a constructive influence on the audit procedures carried out and the quality of audit evidence gathered during an audit and this was supported by the respondents of the questionnaires and all the interviewees. It also emerged that full implementation of data analytic tools by KPMG would result in better understanding of the audit approach by all auditors from junior associates to management and improved quality in all audit procedures from risk assessment and planning to completion.

Recommendation

• To improve on cost cutting measures which result from auditors spending more time than budgeted during an audit, the firm’s partnership should consider shifting from traditional audit procedures to data analytics as it increases efficiency and effectiveness of audits.

• KPMG partnership and the human resources management team should recruit more Information Technology audit specialists for them to assist in auditing Information systems of clients using data analytics

• KPMG partnership and management should also make data analytics skills one of the key performance indicators of the auditors as part of assessment on the audit growth quality matrix.

References

- Akhtar, I. (2016). Research Design. In Rata, G., Arslan, H., & Runcan, P-L. (eds.) Research in Social Science: Interdisciplinary Perspectives. Cambridge Scholars Publishing.

- Alles, M. G. (2015). Drivers of the use and facilitators and obstacles of the evolution of Big Data by the audit profession. Accounting Horizons, 29(2), 439-449.

- Appelbaum, D. (2016). Securing big data provenance for auditors: The Big Data provenance black box as reliable evidence. Journal of Emerging Technologies in Accounting, 13(1), 17-36.

- Bender, T. H. H. (2017). The effects of Data Analytics on audit efficiency. Thesis submitted to Erasmus School of Economics.

- Brown-Liburd, H., Issa, H., & Lombardi, D. (2015). Behavioral Implications of Big Data`s Impact on Audit Judgment and Decision Making and Future Research Directions. Accounting Horizons, 29(2), 451-468.

- Byrnes, P., Criste, T., Stewart, T., & Vasarhelyi, M. (2014). Remaining Auditing in a Wired World. White Paper. Retrieved from https://www.business.com/articles/big-data-big-problems-coping-with-shortage-of-talent-in-data-analysis/

- Davenport, T., & Harris, J. (2017). Competing on analytics: Updated, with a new introduction: The new science of winning. Harvard Business Press.

- Deloitte. (2013). Formula for growth: Innovation, Big Data & Data Analytics. Retrieved from https://www2.deloitte.com/content/dam/Deloitte

- Earley, C. E. (2015). Data analytics in auditing: Opportunities and Challenges. Business Horizons, 58(5), 493-500.

- Gepp, A., Linnenluecke, M. K., O’neill, T. J., & Smith, T. (2018). Big data techniques in auditing research and practice: Current trends and future opportunities. Journal of Accounting Literature, 40, 102-117.

- KPMG. (2018). Big Data Fraud. Retrieved from https://assets.kpmg/content/dam/kpmg/ca/pdf/2018/03/finding-the-evidentiary-needledemonstrating-fraud-in-the-big-data-haystack.pdf

- Liddy, J. (2015). How Data and Analytics Are Enhancing Audit Quality and Value. The CPA Journal, 85(5), 80.

- Mansour, E. (2016). Factors affecting the adoption of Computer Assisted Audit Techniques in audit process: Findings from Jordan. Business and Economic Research, 6(1), 248-271.

- Mohammad, Al-K. A., Kamil, S. B., & Noor, I. B. M. (2017). Factors affecting adoption of computer assisted audit techniques and tools (caats) among external auditors in Jordan. International Journal of Engineering Sciences & Management Research, 4(2), 28-32.

- PWC. (2018). AI will help answer the big question about data. Retrieved from https://www.pwc.com/us/en/advisory-services/assets/ai-predictions-2018-report.pdf

- Ramlukan, R. (2015). How big data and analytics are transforming the audit. EY Reporting. Retrieved from http://www.ey.com/gl/en/services/assurance/ey-reporting-issue-9-how-big-dataand-analytics-are-transforming-the-audit#

- Rosli, K., Yeow, P. H. P., & Siew, E. G. (2013). Factors influencing audit technology acceptance by audit firms: A new I-TOE adoption framework. Journal of Accounting and Auditing: Research and Practice (2012), 876814.

- Russom, P. (2011). Big data analytics. TDWI Best Practices Report, Fourth Quarter. Renton. Retrieved from http://public.dhe.ibm.com/common/ssi/ecm/en/iml14293usen/IML14293USEN.PDF

- Vanbutsele, F. (2017). The Impact of Big Data on Financial Statement Auditing. Master’s Thesis submitted at Universiteit Gent.