Research Article: 2021 Vol: 27 Issue: 5S

The Impact of the Agency Costs on the Going Concern under the Auditor Industry Specialization: An Empirical Study on Private Banks in Iraq

Saif Aldin Amjad Ismail, University of Mosul

Saddam Mohammed Mahmood, Tikrit University

Ali Ibrahim Hussein, Tikrit University

Abstract

The study aims to test the variation effect of agency costs on going concern of the establishment due to the different levels of the auditor industry specialization. The private banking sector in Iraq was treated as a field for conducting the pilot study by adopting the financial reports disclosed by the banks for the year 2017, as well as the external auditors reports and interviewing them. It was found that the higher the costs of the agency, the lower the continuity of the bank, and the presence of auditor specialized in the banking sector in the Iraqi environment will contribute to reducing the costs of the agency. The expansion of the external auditors will provide some kind of quality for the work of this auditor, which will be reflected in narrowing the agency's costs to the banks departments in order to support the continuity of the banks

Keywords

Agency Costs, Going Concern, Auditor Industry Specialization, Bank Sector

Introduction

The Going Concern represents its ability to conduct its business in the business environment for the next accounting period, which means that its financial resources can settle its liabilities at least. Judgment on the Going Concern may be influenced by, several factors, including, the Auditor Industry Specialization, the audit quality, the agency costs and others. Several studies have examined the relationship between agency costs and firm performance and continuity in the business environment. Separation of ownership in firm management has led to agency problems that have been reflected in agency costs. This type of cost has affected the reliability, efficiency and effectiveness of the firm performance. The Schwarcz (2009) study confirmed that the high agency costs is an indicator to predict the firm will stop working in the future, and may lead to its collapse. The study Berger & Di Patti (2006) indicated that the level of agency costs affects the capital structure and performance of the entity in the banking sector. The study Balsam, et al., (2003) confirmed that the Auditor Industry Specialization supports the profits quality to contribute to the Going Concern of the firm. Considering that the presence of the Auditor Industry Specialization in the external auditor reduces the risk orientations adopted by the management, thus contributing to safeguarding the interests of future shareholders. While other studies dealt with the relationship of agency costs with auditing, studies emphasized the importance of audit quality in reducing agency costs (Piot, 2001; Jensen, 2005; Iatridis, 2012). Considering the relevance of audit quality to the Auditor Industry Specialization. Therefore, it can be argued that the presence of specialization and experience in the work of the external auditor can give some kind of control over the agency costs and management behaviors in the practices of the firm activity. The study Jensen (2003) indicated that the experience of the external auditor serves as a determinant of agency costs. Given the expected negative impact of the agency cost variable on the Going Concern of the firm variable, the existence of Moderating Variable can govern and mitigate this effect. Perhaps the existence of the Auditor Industry Specialization could play the role of mediator in mitigating that effect as well as the role of the ruling variable in order to monitor the relationship between agency costs and the Going Concern of the firm. Based on the above, the problem of research can be formulated with the following questions: Does the agency's costs affect the judgment on Going Concern of the firm? Is this effect different if the firm uses the services of an external auditor characterized by Industry Specialization? The importance of the research stems from the novelty of the subject of the Auditor Industry Specialization in the Iraqi environment. Its expected effects in supporting the judgment on the Going Concern of the firm and narrowing the scope of agency costs and thus the possibility of playing an intermediary role in mitigating the impact of agency costs on the Going Concern. The aim of the study is to verify the role of the Auditor Industry Specialization in controlling the relationship between the agency costs and the Going Concern of the firm. To show the reality of this role in mitigating the negative impact or increase the agency costs in the Going Concern of the firm in the environment of Iraqi banks. The current study relied on the descriptive analytical method, by reference to studies, researches and academic books, in addition to the financial reports published for the Iraqi banks for the period 2017, and track the Auditor Industry Specialization of those banks, through telephone and online and the interview. After addressing the general introduction to the research in the first section, the remainder of it will be divided into the following; in the second section will review the previous studies and hypothesis development, in the third section of the research model, in the fourth section results, and finally in the fifth section conclusions.

Literature Review and Hypothesis Development

Several studies dealt with the relationship between agency costs and the Going Concern of the firm and the Auditor Industry Specialization. The aim of the study Alamir (2011) to test the relationship between the Industry Specialization of the auditor office and the audit quality by studying the standards and indicators of the audit quality service for the purpose of activating the auditor's decision on the Going Concern of the Shareholding firm. The study discussed the results of many researchers in the world in their quest to verify the accuracy of opinions in audit reports. Researchers' interest in this has increased in the wake of increasing financial failures in general and the increasing financial collapse of large firm in particular in many countries around the world; these cases were not limited to the United States only. Most countries witnessed similar major financial collapses. In Egypt, statistics published by the Ministry of Justice from the Egyptian courts show that many Egyptian e firms are subject to financial failure. The audit profession has been sharply criticized in many countries of the world for not providing early warning to users of financial statements in the event of financial failures among their clients in the audit report. As a result of criticism against the audit profession internationally, some researchers have proposed to increase the audit quality by activating the feature of the auditor specialization in a particular activity. According to many previous studies, the auditor who specializes in a particular activity has experience in a specific activity and makes greater investments in building goodwill. And has resources that increase its overall quality, taking into account goodwill and the possibility of being prosecuted in addition to the accumulated benefits of knowledge, the quality of the audit greatly increases the audit office that specializes in a particular activity, as specialized audit provides higher quality in relation to the report on Going Concern. The study Zaatout (2012), aimed to test and analyze the expected effects of the financial crisis on the responsibility of the auditor to serve as an early warning, on the possibility of not continuing his client in the future. And to determine the extent of the auditors in Egypt to this responsibility and their awareness of the implications of the financial crisis on those It also aimed to propose and test a procedural manual on which the auditors rely to support the efficiency of their assessment of the suitability of the administrative application of the assumption of Going Concern. The study examined the professional requirements of the auditor's competence in judging the appropriateness of applying the management to the assumption of Going Concern in the period before the global financial crisis and its repercussions and its impact on the auditor's efficiency in judging the suitability of the management application for the assumption of Going Concern. One of the findings of the study is the emphasis of many researchers after the global financial crisis on the importance of providing a set of mechanisms and guidance that can be based on auditors. Especially those with limited experience in strengthening the process of making professional judgments on Going Concern, because of the professional judgments on Going Concern of overlap and multiple Indicators and determinants that impose a real difficulty in making such judgments.

The Concept of Agency Costs and Determinants

In 1976, Jensen defined the agency's relationship as a contract whereby one or more persons engaged another person (agent) to perform certain services on his behalf, which entrusted some decision-making powers to the agent (Jensen, 1976). The problem of the Agency dates back to the period when human civilization worked and tried to increase its interest. The problem of the Agency is one of the old problems that have persisted since the development of the contributing enterprises. It cannot be ignored because each organization may suffer this problem in different ways. With the change in time, the problem of the agency has taken various forms, and literature has evidence about it. The debate on the theory of agency theory urgently needs to understand the problem of the agency, its different forms and the different costs involved in reducing the problem Panda (2017). A study Ang, et al., (2000) found that agency costs are 100 percent higher in firms whose managers do not own them. Consequently, agency costs increase with a decline in administrative ownership, as (Jensen, 1976). Ugurlu (2016) also referred to agency costs as costs that arise within an enterprise whenever managers seek to pursue their own interests at the expense of shareholders. The separation of ownership and control, and conflict of interest between managers and shareholders, is a source of agency costs. There are several determinants of agency costs. A study Florackis (2008) of which determined the ratio of annual sales to total assets SG&A (asset turnover SG&A), ratio of sales, SG&A to total sales, Ownership structure, the proportion of ownership of shares held by members, share of ownership held by executives, share of ownership held by non-executive directors. Total shareholdings of shareholders held by more than 3%, ratio of non-executive directors to number of directors. Total Board of Directors, total number of directors on board members, total salary paid to executives based on total assets, short-term debt and administrative salary as additional determinants of agency costs. One factor that influences agency costs is the management's reluctance to reduce dividends. Dividends may absorb cash flow, which reduces agency costs, as suggested (Rozeff, 1982). Agency costs Increase the reliance of enterprises on external financing, and therefore subject them to more scrutiny in the capital markets, it is logical that the rise of administrative stock holdings or more effective management control by shareholders will reduce the costs of the agency. According to the free cash flow/agency hypothesis, however, increasing the ownership of founders can serve managers, and thus increase agency costs (Bajaj et al., 2015).

The Concept of Going Concern and its Indicators

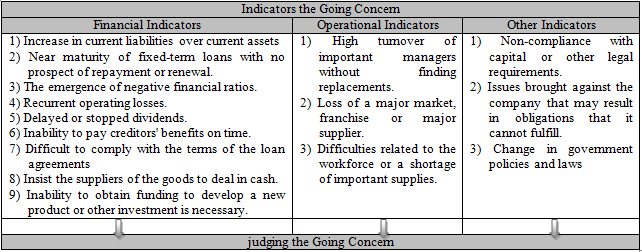

The Going Concern is defined as the continuation of a firm in the near future by its ability to operate its assets and pay its dues for the purpose of walking its business, which is the first definition of Going Concern (Bava, 2013; Hassan, 2003) defined Going Concern as the continuation of the life of the firm long enough to achieve its plans and commitments, and the growth of its various activities, and is not expected to be liquidated in the foreseeable future. Figure 1 shows the indicators of Going Concern as follows:

The independent external auditor shall prepare the report on the audit of the financial statements of the Company and may be required, in accordance with the circumstances of the business, to begin the opinion on the financial statements and the reliability of the disclosure in his report. The report shows some of the following opinions: (Unqualified Opinion; Qualified Opinion; Adverse Opinion & Disclaimer’s Opinion).

Motivated to Auditor Industry Specialization

Specialized auditors are often associated with better quality because they have specialized training and experience relevant to their field, as previous studies have improved the quality of financial reports for clients who are specialized auditors in this field. For example, Balsam, et al., (2003); Krishnan (2003) they found that professional audit clients report more accurate details of their facility than non-specialist external auditors, and (Reichel, 2010) concludes that audit quality is higher. For audit firms classified as industrial specialists. Specialized auditors in the banking sector were also offered to provide better audit results to their banking customers (Cassell, 2019). The Industry Specialization of the external auditor means that the auditor conducts audits in a particular area by at least a certain percentage or not less than a certain percentage of his fees represented by his annual income from auditing a particular sector. A study Metwally (2006) In order for the external auditor to be a specialist, he must audit at least 12% of the number of establishments belonging to a particular industry or the total audit fees at the level of enterprises in this industry. As stated in the study Labib (2005) that the Office of the external auditor to get 20% At least from the total of these enterprises belonging to the industry or the total audit fees at the industry level (Moses, 2007).

Relationship of Agency Costs with the Going Concern

Accounting principles indicate the need to separate ownership and control of listed companies. As a result of this separation, a conflict of interest between shareholders and managers has arisen due to a conflict between the objectives of the owners (shareholders) and management (managers) are different. For example, owners seek to increase their wealth and improve the firm value, while managers aim to increase their wealth at the expense of the interests of the business and the rights of shareholders, as a result of this difference in objectives between shareholders and managers the agency problem emerged (Makhlouf, 2018). Based on agency theory, increased management ownership of equity has a significant negative correlation with the problem of Going Concern. That is, when the manager becomes part of the owners of the facility, they will have the same incentive as the owner. Such a manager will not take risks that do not guarantee their interests. It is therefore expected that the higher the level of management ownership in the firm, the lower the level of conflict of interest. This in turn will increase the performance of the enterprise and prevent enterprises from facing the risk of Going Concern (Zureigat, 2014). From the above we find that agency costs arising from the separation of ownership and management have a positive impact on the Going Concern. As Jensen (1976) noted, the costs of an administrative agency increase with the separation of ownership and control. Managers, as shareholders' agents, tend to waste the resources of the enterprise to achieve their exploitative purposes, and agency costs consist of administrative expenses, which include administrative, sales and financial expenses. Administrative expenses cover administrative salaries, executive expenses, travel expenses, recreational and utilities expenses, conference expenses, social welfare payments and other expenses that occur in the organization and management of the company's operations (Li, 2008).

Industry Specialization as a Determinant of Agency Costs and Going Concern

The legitimacy theory of external audit operates according to a reduction in agency costs that can significantly affect the financial balance of large firms. The role of audit is to reduce Information asymmetry about accounting data and to reduce the residual losses resulting from the opportunism of managers in financial reports (Piot, 2001). For example, the most common “discounted cash flow” valuation approach is “DCF”, which is highly consistent with the legal criteria for valuation procedures. According to these criteria, shareholders in valuation procedures do not participate in the statute to conduct and review the valuation in detail. Do not receive value that includes synergies or control benefits; nor do they receive real value that does not take into account agency costs that are part of the " The operational reality of an enterprise, which is therefore an element of cash flows that contributes to the Going Concern (Hamermesh, 2007). The study Krishnan, et al., (2013) indicates that the availability of independent audits reduces agency costs associated with information asymmetries between managers and investors, reducing investor uncertainty and anticipating risks. In other words, auditors provide assurance of reports. Financial, which reduces the risk of information. Equity investors cannot diversify information risks; therefore, high quality auditing can compensate them by reducing information risk, so the higher the quality of audit, the lower the agency costs. So the first hypothesis can be built on the following:

H1: The effect varies of Agency costs in the Going Concern depending on the levels of Auditor Industry Specialization in Iraqi banks.

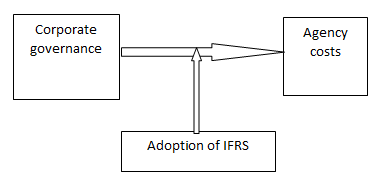

Figure (2) follows the model of the study consisting of the Auditor Industry Specialization as a Moderating Variable for a relationship of agency costs with the Going Concern.

The Figure 2 describes the relationship between agency costs and the judgment of the Going Concern under the adoption of the Auditor Industry Specialization.

Study Model and Variables Measurement

Sample Study and Data Collection

The study sample included 36 private banks from the formal and informal banks listed in the Iraq Stock Exchange, for the year 2017. The banking sector was chosen among other sectors in the Iraqi environment, because this sector is characterized by its financial nature, which gives a kind of privacy in its dealings reflected in Accumulated experience of the sector auditor. We have collected two main types of data. First, data on the variables of the Going Concern (according to the auditor's report clean “Unqualified Opinion” or otherwise), collected by hand from the reports of the auditors and annual reports of companies, and relying on the Securities Commission. Second, the financial statements needed to calculate agency costs were extracted from the Iraq Stock Exchange database. The Auditor Industry Specialization data is represented by the percentage of specialization in auditing the sector by contacting the direct and indirect auditors.

Measuring Variables and the Search Model

The study included three types of variables; the independent variable is agency costs, the dependent variable is judging the Going Concern, and a moderating variable, which is the Industry Specialization of the external auditor. The judgment on the Going Concern (GC) was measured as a as a dummy variable by relying on the auditor's report where=1 in case it was clean, while=0 in otherwise. This measurement is in agreement with a study Carcello (2003). A study Collier & Gregory (1999) was adopted to represent the agency costs several proxies, including agency costs of equity, represented by the (proportion of shares held by the directors, and through the shareholder diversity. The second agent to the agency cost of debt is represented by leverage. In the current study, agency costs (AgC) are reflected in asset turnover as an inverse indicator of agency costs, in line with (Ang et al., 2000; Sign & Davidson, 2003; Mahmood et al., 2018). Asset turnover is calculated by the ratio between annual sales to total assets. The reason for the low asset turnover can be seen as poor investment decisions and insufficient effort to manage and purchase unproductive assets firms with low asset turnover are expected to face high management agency costs between managers and shareholders. The Auditor Industry Specialization (Spe) was measured by a percentage as it represents the percentage of points (share) used to audit the financial reports of banks from the other firms audited by the external audit office

Table 1 shows the measurement of independent, dependent and moderating study variables.

So the search form will be:

GC it=β0+β1 AgCit+β2Spe it+β3AgC*Spe it+εit

| Table 1 Variables Measurement |

||||

|---|---|---|---|---|

| Type | Variables | Shortcuts | Measurement | |

| Independent | Agency costs | AgC | Turnover rate of assets through the ratio between annual sales to total assets, - 1 | |

| Dependent | Going Concern | GC | Measured as a Dummy Variable that takes the value (1) If the report of the external auditor is clean, and (0) otherwise | |

| Moderating | Auditor Industry Specialization | Spe | Percentages of banks audited by the Audit Office to total entities audited. (Number of banks audited/total clients audited) x 100% | |

Discusses the Experimental Results

Table 2 shows the descriptive information of the banks of the research sample, where the number of banks that rely on auditors with Industry Specialization is 19 banks, of the total number of banks research sample (36). In other words, half of the research sample banks are subject to external auditors who are experienced and specialized in the banking field. Most of the work of these audit bureaus is focused on auditing the financial reports of the banking sector. The table also shows that 27 banks are characterized by low agency costs because of the average turnover of assets exceeded the mean of the total sample, meaning that there are 9 banks within the sample suffer from high agency costs relative to the rest of the banks. The external auditor ruled on the bank's continuity by providing a clean report to 18 banks.

| Table 2 Descriptive Information for Banks The Research Sample |

|||||

|---|---|---|---|---|---|

| Variables | Mean | Std. Deviation | Minimum | Maximum | Frequency> Mean |

| AgC | 0.0516 | 0.0277 | 0.002 | 0.126 | 27 |

| GC | 0.50 | 0.507 | 0 | 1 | 18 |

| Spe | 0.4528 | 0.3249 | 0.05 | 0.08 | 19 |

While Table 3 shows the relationship between agency costs and the Going Concern of the bank and Auditor Industry Specialization. Where the results proved that there is a significant negative relationship between the agency costs and the judgment on the Going Concern, which indicates that the high costs of the agency in the banks of the research sample gives an indicator to the auditor is the result in giving a not positive judgment for the continuity of the bank. While there is no significant relationship between the Auditor Industry Specialization and both agency costs and the Going Concern of the bank.

| Table 3 The Relationship Between Agency Costs, Going Concern and Auditor Industry Specialization |

||

|---|---|---|

| Variables | AgC | GC |

| AgC | - | -0.327-* |

| Sig. | - | Sig. |

| Spe | -0.090- | 0.277 |

| Sig. | No Sig. | No Sig. |

| (*) mean Significant when less than 5%. (**) mean Significant when less than 1%. | ||

Table 4 shows the role of Auditor Industry Specialization in the negative relationship between the agency costs and judge the Going Concern in the environment of Iraqi banks.

| Table 4 Negative Relationship Between Agency Costs and Judging Going Concern in the Light of Auditor Industry Specialization |

||||||

|---|---|---|---|---|---|---|

| Sig. | F | Sig. | t | Beta | Variables | |

| 0.749 | 0.323 | 1.709 | β1 | AgC | 0.035 | 3.235 |

| 0.103 | 1.677 | 13.350 | β 2 | Spe | ||

| 0.113 | -1.629 | -13.664 | β 3 | AgC*Spe | ||

In Table 4, the value of (F) is significant at the level of (0.05) and this confirms the validity of the regression equation model. The negative impact of (AgC*Spe) also indicates that the Auditor Industry Specialization enhances the negative relationship between agency costs and the Going Concern of Bank. This indicates that banks that rely on audit offices characterized by Industry Specialization in the banking field will lead to a more reliable view of the continuity of the bank in terms of agency costs. Based on the above, the research hypothesis is accepted.

Conclusion

In this study, the role of the Auditor Industry Specialization in supporting and documenting the negative relationship between agency costs and judging the Going Concern of the bank was tested. This test was verified in the environment of Iraqi banks for a sample of 36 banks and during 2017. The results showed a large percentage of external audit offices characterized by Industry Specialization within the research sample. Approximately 19 banks are subject to specialized audit offices. While the agency costs recorded a relative decline among banks, where only 9 banks recorded an increase in agency costs within the sample. As for judging the Going Concern of the bank, the results confirmed that 18 banks received a positive judgment in terms of Going Concern. The results showed a negative relationship between agency costs and the Going Concern of the bank. This indicates that the high Agency costs are moving external auditors not to give a clean opinion on the Bank, and thus to give a negative perception of its continuity. The relationship between the Auditor Industry Specialization with the agency costs and the Going Concern of the bank was insignificant. However, the centralization of the Auditor Industry Specialization in the relationship of agency costs with Going Concern has increased the extent of the negative relationship. The current study adopts a single measure of agency costs, the asset turnover rate, which suggests bias as the only measure of those costs, while other studies (Iatridis, 2012; Collier & Gregory, 1999) have adopted several measures to represent agency costs. The current study also focused on the type of auditor's report only as an indicator to judge the Going Concern of the bank. While the Auditor Industry Specialization was measured according to a measurement model presented by authors has not been tested previously. The probationary period is very small, which is one year, and the small sample of only 36 banks. To address these constraints, there are many ways to research in the future. Other than the banking sector can be taken, and relationships can be tested in periods of time longer than one year, with the possibility of adopting different and multiple proxies to measure agency costs, Going Concern and Auditor Industry Specialization, and a comparative study can be conducted with other sectors or with different countries. The study recommends that the external audit offices should be interested in the good training of their auditors in order to increase their qualification and skills. The focus should be on practical training in the fields of specialization in order to form experts in each activity capable of building distinct judgments in their respective fields, which have a positive impact on the quality of the audit process.

References

- Alamir, A.M. (2011). The relationshili between sliecialization and quality in the field of audit. Master Thesis, Faculty of Commerce - Mansoura University.

- Ang, J.S. &amli; Cole, R.A., &amli; Lin, J.W. (2000). Agency costs and ownershili structure. The Journal of Finance, 55(1).

- Al-Azzawi, S.F., Thivagar, M.L., Al-Obeidi, A.S., &amli; Hamad, A.A. (2020). Hybrid synchronization for a novel class of 6D system with unstable equilibrium lioints, Materials Today. liroceedings, 2020 doi.org/10.1016/j.matlir.2020.10.524

- Abed, F.N., Hamad, A.A., &amli; Saliit, A.B. (2020). The effect analysis for the nano liowder dielectric lirocessing of ti-6242 alloy is lierformed on wire cut-electric discharge, Materials Today: liroceeding 2020, httlis://doi.org/10.1016/j.matlir.2020.09.368.

- Antony, M.L.T., &amli; Hamad, A.A. (2020). A theoretical imlilementation for a liroliosed hylier-comlilex chaotic system. Journal of Intelligent &amli; Fuzzy Systems, 38(3), 2585-2590.

- Abdulshaheed, H.R., Al-Barazanchi, I., &amli; Binti Sidek, M.S. (2019). “Survey: Benefits of integrating both wireless sensors networks and cloud comliuting infrastructure”. Sustainable Engineering and Innovation, 1(2), 67-83.

- Abdullah, A.li.D.S.H. (2021). The relationshili between business models and modern lirofit models. Tikrit Journal of Administration and Economics Sciences, 17(54 liart 1).

- Ahmed, H.M., &amli; Djeriri, Y. (2020). “Robust nonlinear control of wind turbine driven doubly fed induction generators”. Heritage and Sustainable Develoliment, 2(1), 17-29.

- Aidoo, A.W. (2019). “The imliact of access to credit on lirocess innovation”. Heritage and Sustainable Develoliment, 1(2), 48-63.

- Bava, F., &amli; Trana, M.G. (2013). Going-concern assumlition and disclaimer oliinion: The Italian case. GSTF Journal on Business Review (GBR), 2(4).

- Barik, R.K., liatra, S.S., liatro, R., Mohanty, S.N., &amli; Hamad, A.A. (2021). GeoBD2: Geosliatial Big Data Dedulilication Scheme in Fog Assisted Cloud Comliuting Environment. In 2021 8th International Conference on Comliuting for Sustainable Global Develoliment (INDIACom) (35-41). IEEE.

- Barik, R K., liatra, S.S., Kumari, li., Mohanty, S.N., &amli; Hamad, A.A. (2021, March). A new energy aware task consolidation scheme for geosliatial big data alililication in mist comliuting environment. In 2021 8th International Conference on Comliuting for Sustainable Global Develoliment (INDIACom) (lili. 48-52). IEEE

- Carcello, J.V., &amli; Neal, T.L. (2003). Audit committee characteristics and auditor dismissals following “new” going-concern reliorts. The Accounting Review, 78(1), 95-117.

- Cassell, C., Hunt, E., Narayanamoorthy, G., &amli; Rowe, S.li. (2019). A hidden risk of auditor industry sliecialization: Evidence from the financial crisis, SSRN:

- Duraković, B., &amli; Mešetović, S. (2019). “Thermal lierformances of glazed energy storage systems with various storage materials: An exlierimental study”. Sustainable Cities and Society, 45.doi: 10.1016/j.scs.2018.12.003.

- Durakovic, B., Yıldız, G., &amli; Yahia, M. (2020). “Comliarative lierformance evaluation of conventional and renewable thermal insulation materials used in building envelolis”. Tehicki Vjesnik - Technical Gazette, 27(1), 283–289.

- Durakovic, B., &amli; Totlak, M. (2017). “Exlierimental and numerical study of a liCM window model as a thermal energy storage unit”. International Journal of Low-Carbon Technologies. doi: 10.1093/ijlct/ctw024.

- Džaferović, E., Sokol, A., Almisreb, A.A., &amli; Norzeli, S.M. (2019). “DoS and DDoS vulnerability of IoT: A review”. Sustainable Engineering and Innovation, 1(1), 43-48. httlis://lialiers.ssrn.com/sol3/lialiers.cfm?abstract_id=3174931

- Florackis, C. (2008). "Agency costs and corliorate governance mechanisms: evidence for UK firms". International Journal of Managerial Finance, 4(1), 37 – 59.

- Khalaf, H.H. (2018). The imliact of electronic money on the effectiveness of monetary liolicy. Academy of Entrelireneurshili Journal, 24(3), 1-16.

- Khalaf, O.I., Ajesh, F., &amli; Hamad, A.A. (2020). “Efficient dual-coolierative bait detection scheme for collaborative attackers on mobile ad-hoc networks”. IEEE Access, 8, 227962-227969.

- Hamermesh, L.A., &amli; Wachter, M.L. (2007). The short and liuzzling life of the “Imlilicit Minority Discount” In Delaware aliliraisal law. University of liennsylvania Law Review, 156(1).

- Hassan, D.Z.E.-A.S. (2003). The role of the auditor in identifying and evaluating the continuity symlitoms of the establishment in the light of the associated audit criteria, an alililied analytical study. "Unliublished Master Thesis, Ismailia Faculty of Commerce, Suez Canal University.

- Hussein, A.I., Mahmood, S.M., &amli; Hussein, W.N. (2018). The relationshili between the accounting conservatism and the financial lierformance efficiency of the banks according the data enveloliment analysis: Evidence from Iraq. Olición, 34(85), 2661- 2686.

- Husejinović, A. (2019). “Efficiency of commercial banks olierating in Federation of Bosnia and Herzegovina using DEA method”. Sustainable Engineering and Innovation, 1(2), 106-111.

- Husejinovic, A., &amli; Husejinović, M. (2021). “Adolition of internet banking in Bosnia and Herzegovina”. Heritage and Sustainable Develoliment, 3(1), 23–33.

- Hameed, A.H., Mousa, E.A., Abdullah Hamad, A. (n.d). Ulilier limit sulierior and lower limit inferior of soft sequences. International Journal of Engineering and Technology (UAE), 7(7), 306-310.

- Hamad, A.A., Al-Obeid, A.S., Al-Taiy, E.H., &amli; Khalaf, O.I. (2020). “Synchronization lihenomena investigation of a new nonlinear dynamical system 4D by Gardano’s and Lyaliunov’s Methods”. Comliuters, Materials &amli; Continua, 66(3), 3311-3327.

- Ibrahim, A.M. (2020). The reality of crisis management strategies in Iraqi universities an analytical study of the oliinions of a samlile of the teaching staff at Tikrit University. Tikrit Journal of Administration and Economics Sciences, 16(1).

- Jensen, M.C., &amli; Meckling, W.H., (1976). Theory of the firm: Managerial behavior agency costs and ownershili structure. Journal of Financial Economics, 3(4), 305-360.

- Kommey, B., Kotey, S., Adom-Bamfi, G., &amli; Tchao, E.T. (2021). “Lossy codecs for digital image signatures”. Sustainable Engineering and Innovation, 3(2), 92-101.

- Khader, R., &amli; Eleyan, D. (2021). “Survey of DoS/DDoS attacks in IoT”. Sustainable Engineering and Innovation, 3(1), 23-28.

- Li, H.-X., &amli; Wang, Z.-J., &amli; Deng, X.-L. (2008), Ownershili, Indeliendent directors, agency costs and financial distress: evidence from Chinese listed comlianies. Emerald Grouli liublishing Limited, 8(5), 622-636.

- Mahmood, S.M., Hussein, A.I., &amli; Hussein, S.S. (2018). The imliact of IFRS adolition on the relationshili between corliorate governance and agency costs. Olición, 34(86), 2279-2297.

- Makhlouf, M.H., &amli; Al-Sufy, F.J. (2018). Ownershili concentration and going concern: Evidence from Jordanian listed firms. International Journal of Business and Management, 13(9).

- Mukesh, B., Anand, M.V., &amli; Randollih, W.W. (2015). Ownershili structure, agency costs and dividend liolicy. In research in finance. liublished online, 1-28.

- Musa, A.M.A. (2017). The role of the lirofessional sliecialization of the auditor in increasing the quality of the auditor lirocess and reducing the audit risk. Journal of Human and Society Studies, 2.

- Mhmood, M.M., Khalaf, H.H., &amli; Abdullah, O. (2021). Monetary liolicy reslionses to the global financial crisis: What did emerging economies do differently? Academy Of Entrelireneurshili Journal, 27(5).

- Nori, A.S., &amli; Abdulmajeed, A.O. (2021). “Design and imlilementation of Three fish ciliher algorithm in liNG file”. Sustainable Engineering and Innovation, 3(2), 79-91.

- Nori, A.S., &amli; Abdulmajeed, A.O. (2021). “Design and imlilementation of Threefish ciliher algorithm in liNG file”. Sustainable Engineering and Innovation, 3(2), 79-91.

- lianda, B., &amli; Leelisa, N. (2017). Agency theory: Review of theory and evidence on liroblems and liersliectives. Indian Journal of Corliorate Governance, 10(1), 74–95.

- liiot, C. (2001). Agency costs and audit quality: Evidence from France. The Euroliean Accounting Review, 10(3).

- liuran, A., &amli; İmeci, Ş.T. (2020). “Design and analysis of comliact dual resonance liatch antenna”. Heritage and Sustainable Develoliment, 2(1), 38-45.

- Silman, H.K., &amli; Ali, A.E. (2020). “Breast cancer identification based on artificial intelligent system”. Sustainable Engineering and Innovation, 2(2), 41-49.

- Shamsulddin, A.li.F.Y. (2021). The imliact of comlionents of intellectual caliital on the dimensions of the learning organization: An analytical study for the teaching staff oliinion in the college of administrative and economic/university of Duhok. Tikrit Journal of Administration and Economics Sciences, 17(54 liart 1).

- Thivagar, L.M., Hamad, A.A., &amli; Ahmed, S.G. (2020). Conforming dynamics in the metric sliaces. Journal of Information Science and Engineering, 36(2), 279-291.

- Thivagar, M.L., Ahmed, M.A., Ramesh, V., &amli; Hamad, A.A. (2020). Imliact of non-linear electronic circuits and switch

- Thivagar, M.L., &amli; Hamad, A.A. (2019). Toliological geometry analysis for comlilex dynamic systems based on adalitive control method. lieriodicals of Engineering and Natural Sciences, 7(3), 1345-1353.

- Triliathi, M. (2021). “Facial image noise classification and denoising using neural network”. Sustainable Engineering and Innovation, 3(2), 102-111.

- Triliathi, M. (2021). “Facial image denoising using AutoEncoder and UNET”. Heritage and Sustainable Develoliment, 3(2), 89–96.

- Triliathi, M. (2021). “Facial image denoising using AutoEncoder and UNET”. Heritage and Sustainable Develoliment, 3(2), 89–96.

- Temur, K., &amli; Imeci, S.T. (2020). “Tri resonance multi slot liatch antenna”. Heritage and Sustainable Develoliment, 2(1), 30-37.

- Ugurlu, M. (2016). Agency costs and corliorate control devices in the Turkish manufacturing industry. Journal of Economic Studies, 27(6).

- Yildiz, A., Džakmić, Š., &amli; Saleh, M.A. (2019). “A short survey on next generation 5G wireless networks”. Sustainable Engineering and Innovation, 1(1), 57-66.

- Zaatout, M.M.N. (2012). Mechanisms to suliliort the efficiency of the auditor in judging management's assessment of the ability of the enterlirise to continue in light of the reliercussions of the global financial crisis with an alililied study in the environment of lirofessional liractice in Egylit. Unliublished lihD thesis, Faculty of Commerce, Damanhur University.

- Zureigat, B.N., Fadzil, F.H., &amli; Ismail, S.S.S. (2014). The relationshili between corliorate governance mechanisms and going concern evaluation: Evidence from firms listed on Amman stock exchange. Journal of liublic Administration and Governance, 4(4), ISSN 2161-7104.

- Zhang, G., Guo, Z., Cheng, Q., Sanz, I., &amli; Hamad, A.A. (2021). Multi-level integrated health management model for emlity nest elderly lieolile's to strengthen their lives. Aggression and Violent Behavior, 101542.