Research Article: 2021 Vol: 24 Issue: 4S

The impact of the dividend policy on the market value of the shares of public shareholding companies listed on Amman stock exchange 2010-2019

Khawla Kassed Abdo, Al-Balqa Applied University

Citation Information: Abdo, K. K. (2021). The impact of the dividend policy on the market value of the shares of public shareholding companies listed on Amman stock exchange 2010-2019. Journal of Management Information and Decision Sciences, 24(S4), 1-10.

Abstract

This study aimed to explore the policies of profit distribution and how these policies affect the fluctuation in the market value of the shares of companies listed on the Amman Stock Exchange. The study followed the descriptive analytical approach. The study sample consisted of 48 joint stock companies listed on the Amman Stock Exchange from various sectors. The study highlights the importance of the policies followed in joint stock companies listed on the Amman Stock Exchange and that the share of profits has an effective relationship with the market value of the shares of these companies, while the ratio of dividends to shareholders’ equity and the payout ratio had an effective relationship in the sector service, and it did not appear to be related to the industrial sector, and the study recommended a set of recommendations, including: the boards of directors of public shareholding companies to adopt a dividend distribution policy that matches their expectations and future projects.

Keywords

Dividends policy; Market value; Common stock; Share holding companies.

Introduction

The management of the latter constantly strives to serve the interest of its shareholders by increasing their wealth, which necessitates the distribution of what satisfies them of earnings. Not only that, but management must also detain enough earnings to finance investment prospects. Due to the fact that it involves both investment and finance decisions, deciding how to share earnings may be a difficult task. Determining how these decisions interact with one another, and how they affect the value of Enterprise shares, which are intended to maximize owners' wealth, is therefore important.

Most institutions have a strategic goal of increasing profits, and investors monitor market share prices and corporate profits to make investment decisions (Baragneh, 2019). Investors also monitor companies' profit distribution policies because it provides them with a cash flow on their investments, and the retained portion of profits is the capital profit that they earn.

The market values of shares of businesses listed on the Amman Stock Exchange are subject to up and down swings, since the prices of shares of joint stock companies sold in the financial market are influenced by a variety of variables, both financial and non-financial (Shenk, 2018). These reasons include financial factors related to the company's financial performance, and they base their investment decisions on purely financial indicators such as: the ordinary share's share of profits, or its share of dividends, or the company's financial leverage, and other traditional financial indicators extracted from the company's published financial statements (Al-saraireh, 2017).

There are several profit distribution policies, each with advantages and disadvantages. Companies, for example, are eager to select a strategy that maximizes owner wealth, but the majority of investors want a dividend policy based on cash distribution and good returns (Bani Saeed, 2004).

Study Problem and Questions

The dividend policy is one of the issues that has received significant attention in the financial management literature in recent years, and continues to do so today, where there is no optimal or best dividend policy among the policies, and the reason is due to the disparity in the circumstances surrounding the companies, and decision-making by relying on Dividend distribution policy is one of the Study problem contains several questions, including the following: The Study problem contains several questions, including the following: Knowing the nature of the relationship between the dividend policy and the market prices of the shares of companies listed on the Amman Stock Exchange? And identify the most important factors and variables that determine the dividend policy pursued by companies?

The Importance of the Study

The dividend policy is one of the most significant choices made by the board of directors in every joint stock firm, and its significance stems from the fact that retained earnings are a low-cost source of funding for prospective future initiatives (Pandya, 2016).

The significance of dividend policy in various organizations is undeniable. This is the motivation for both firms and their investors to make a profit. As a result of the company's management's expertise in selecting a dividend policy that suits, they also entice investors to acquire their shares and investment.

Shareholders view dividends as containing information that may affect their expectations about the future of the company and its ability to achieve future profits. If the company increases the cash dividends distributed. It is explained by contributors signal from the management of the company improved its financial position and rise to higher levels in terms of profitability.

The importance of the research stems from the importance of the topic you address, where it seems clear the importance of the dividend policies pursued by companies, given the desire of each company and its investors to make profits, hence the importance of choosing a dividend policy that suits each company and does not suit the other, where the shareholder believes that the dividend policy is one of the most important decisions taken by the board of directors in any joint stock company, and its importance derives from the fact that retained earnings are the cheap source that the company uses to finance promising future projects.

Study Hypotheses

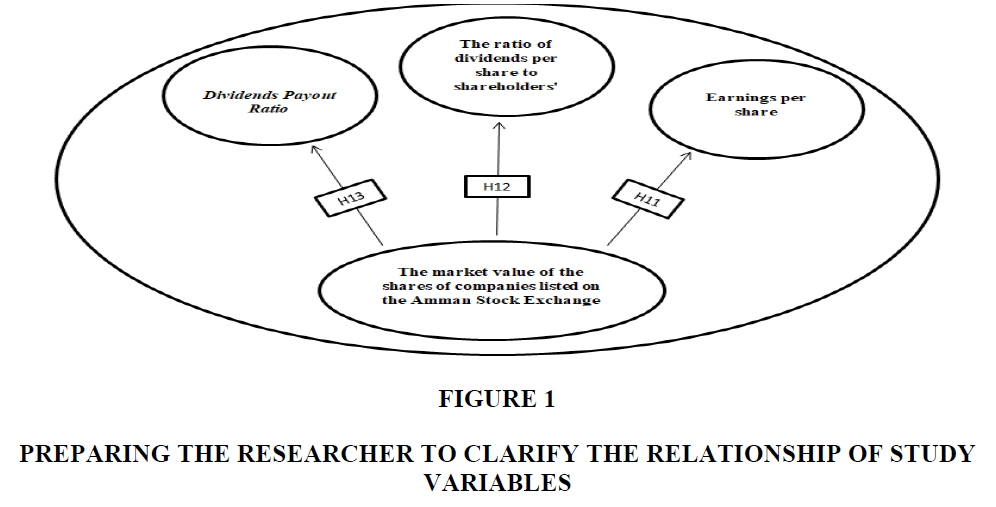

This study seeks to achieve a number of goals from them. Know The impact of the dividend policy on the market value of the shares of public shareholding companies listed on the Amman Stock Exchange for the period 2010-2019. To answer the questions of the study, the main hypothesis was formulated as follows. There is an effective relationship between the dividends and the market value of the stock. Several sub-hypotheses follow the study as follows and as the Figure 1 below:

H1: There is an effective relationship between the share of profits and the market value of the share

H2: There is an effective relationship between the dividends per share to shareholders' equity and the market value of the share.

H3: There is an effective relationship between the dividends per share to the share of profits and the market value of the share.

The above hypothesis will be tested in all its parts, at the level of the economic sector in Jordan, and at the level of the service sector and the industrial sector.

Literature Review

Attia (2020) studied the impact of the dividend policy and the impact of the capital structure on the market value of banks in the Saudi Stock Exchange, for the period from 2016-2019, and the study sample consisted From 11 banks. The study relied on the statistical method and used the simple and multiple linear regression equation to test the hypotheses of the study, and the study concluded that there is no statistically significant effect of the capital structure on the market value, showing the presence of an impact of the dividend policy on the market value. The study recommended that it is necessary to work on determining the appropriate mix of sources of financing (endogenous and external) in order to reduce the cost of capital. This study differs from Metwally's in that it includes a broad sample of industrial and service businesses listed on the Amman Stock Exchange.

Al-Qallab (2019) in his thesis studied the impact of the dividend policy and financial structure on the market value of the Islamic and Conventional banks listed in Amman Stock Exchange. Total outstanding shares represent the market value which is the dependent variable while dividends payout ratio and debt ratio are the independent variables. The thesis concluded that there is an effect of the policy on the distribution of cash profits and financial structure on the market value of the Islamic and Conventional banks listed in Amman Stock Exchange combined and for each group separately. The study recommend both kind of banks to make a trade - off between finance with debt and finance with property to select the optimal capital structure that increase the market value of the banks, also this study investigate the banks dividends policy, while our study investigate the industrial and service companies operating in the ASE.

Yee (2017) examined the relationship between dividend policy the independent variable and firm performance as the dependent variable. The study found that there are many factors which should be taken in consideration before selecting a dividends policy, such as the economy status, the capital structure of the firm, the legislation in which corporate operates, the taxation system, corporate strategy, and equity holder expectation and preferences.

Kajola et al. (2015) studied the effect of determination of the correct mix of dividend and retained earnings on profitability by examine the relationship between the financial performance and dividend pay-out policy, with a sample of 25 non-financial company listed on the Nigerian Stock Exchange during the period 2004-2013. The study use Ordinary Least Squares (OLS) to estimate the coefficients of variables. The study used the panel data, the profitability was measured by The Return on Assets (ROA) the dependent variable, and dividend policy measured by Dividend Pay-out ratio. The firm size is the control variable. The study found that there is a positive and significant relationship between dividend pay-out policy (DPO) and firm performance (ROA) and recommended the companies to put in place robust dividend pay-out policy.

What sets this study apart from others is that it took into consideration many sectors. The majority of prior research has concentrated on the financial sector and banks, but this research focuses on the service sector and, within the financial, the industrial sector.

Distribution of dividends Police departments typically stick to a set profit distribution strategy and seldom stray from it, as doing so would be seen as a negative sign for the organization (Ross, 2016). Different types of dividend policies exist. There are two types of dividends that the firm can pay out: cash dividends and equity dividends (Pandya, 2014).

Stable Amount Dividend Policy: Under this policy, the company will pay an equal regular amount every year, whether it makes profit or not; during years when the company makes a large amount of profit, it will pay the same amount of dividends and keep the rest as retained earnings; and during years when the company suffers a loss or low profit, it will pay the same amount of dividends and keep the rest as retained earnings; and during years when the company suffers a loss or low profit, it will pay the same amount Stable ratio dividends policy: according to this policy the company will pay a stable ratio from its profit collected every ear, so the amount is different, but the ratio is fixed, this policy will give the investors a hint about the Company Business Results (Bani Saeed, 2004).

Irregular dividend policy: Companies that have unstable profits and work in a high-competition environment, where they make huge profits in some years and small profits in others, usually resort to distributing high profits to shareholders in years with high profits and high liquidity, and low profits to shareholders in years with low profits and low liquidity. In some years, it may decide not to distribute any dividends at all (Kilani & Qaddoumi, 2016).

Policy of no dividends this strategy is typically used by firms wanting to grow and enter into future projects, and it is sufficient to pay shareholders with capital earnings that are represented in the rise in market share prices as a consequence of the increase in the fair worth of the company.

Academics and practitioners agree that the price at which a stock is sold in the market is determined in light of the company's market value (Kathiravan et al., 2018), which is determined in light of two basic variables: the cash flows expected to be generated from its operations (net profit after tax plus the depreciation premium) and the rate at which the company is valued (Kathiravan et al., 2018) to arrive at its present value, which is equal to the company's market worth (Hindi, 2000).

Methodology

The study relied on the descriptive method and statistical analysis, where secondary data were collected from unpublished books and university theses, quantitative data were collected from the Jordanian Companies Directory, and the financial lists of companies listed on the Amman Stock Exchange, and the website of the Amman Stock Exchange was also relied on.

Study Population and Sample

The study population consists of all 192 Jordanian public shareholding companies listed on the Amman Financial Market. A representative sample of the study community was selected from 48 joint stock companies, from the banking and insurance sector, and the services and industry sector

Data Analysis

In order to achieve the objectives of the study, the SPSS statistical program was used to identify the degree and type of relationship between each of the independent factors and the market value of the shares listed on the Amman Stock Exchange as a dependent variable, and the stepwise regression equation was used to determine the degree of influence of the independent variables on the dependent variable, (Salamzadeh, 2020).

Analyze the impact of different dividend policies on market value

Hypothesis Examinination

H1: There is an effective relationship between the share of profits and the market value of the share

The results will be analyzed to show the degree of impact of each of the independent variables on the market value of the shares of public shareholding companies listed on the Amman Stock Exchange on two levels:

The first will study the impact of each of the independent variables on the market value of the shares of public shareholding companies listed on the Amman Stock Exchange at the level of all sectors.

Second, the impact of each of the independent variables on the market value of the shares of public shareholding companies listed on the Amman Stock Exchange will be studied at the level of two sectors: the first includes the service sector from banks, insurance companies and other service companies, and the second is the industrial sector, which includes all industrial companies.

Table 1 shows data analysis using the stepwise regression method for all economic sectors for the period 2010-2019.

| Table 1 Stepwise Regression Analysis for all Economic Sectors for the Period 2010-2019 | |||||

| Variable | Unstandardized coefficients | Standardized coefficients | T | Sig | |

| R2 | Std Error | ||||

| Constant | -2.398 | 1.265 | -1.922 | 0.056 | |

| X1 | 0.5475 | 0.321 | 0.532 | 19.762 | 0.000* |

| X2 | 0.0211 | 0.195 | -0.065 | -1.221 | 0.321 |

| X3 | 7.330E-04 | 0.018 | 0.002 | 0.073 | 0.949 |

| At the level of significance 1% | |||||

The table was prepared by the researcher, and it is a summary of the statistical analysis of the three sub-hypotheses

As we note from Table 1 When testing the first sub-hypothesis, which is we notice from Table 1 that the Probability = 0.00 at a statistical level of significance 1%, and R2 = 54% which means the independent variable explain the variation of 54% in the dependent variable the market value of the stock.

So we will accept that there is statistically significant relationship between the Earnings per share and the market value of the stock.

As for the second sub hypothesis

There is an effective relationship between the dividends per share to shareholders' equity and the market value of the stock.

As mentions in Table 1 the probability for this variable = 0.321 at a level of significance 1%, which is very high, while the R2 = 2%, meaning only of the variation are explained by the independent variable the dividends per share to shareholders' equity, so we will reject this hypothesis.

As for the third sub hypothesis

There is an effective relationship between Payout Ratio and the market value of the stock.

The independent variable does not have an effective relationship with the dependent factor, the market value, the probability = 0.949 while the independent variable explain the variation of 0.0733% of the dependent variable, so we reject the third sub hypothesis. Analyzing the degree of impact of the dividend policy on the market value of shares at the level of each sector separately.

First the services sector

Table 2 shows data analysis using the stepwise regression method for services sector for the period 2010-2019.

| Table 2 Stepwise Regression Analysis for Services Sector for the Period 2010-2019 | |||||

| Variable | Unstandardized coefficients | Standardized coefficients | T | Sig | |

| R2 | Std Error | ||||

| Constant | - 3.799 | 3.131 | - 1.219 | 0.227 | |

| X1 | 0.5969 | 0.509 | 0.533 | 11.132 | 0.00* |

| X2 | 0.5589 | 0.833 | 0.308 | 7.157 | 0.00* |

| X3 | 0.7943 | 0.439 | 0.320 | 4.987 | 0.00* |

| At the level of significance 1% | |||||

As we note from Table 2 when testing the first sub-hypothesis, which is

There is an effective relationship between the Earnings per share and the market value of the stock

As we notice from Table 2 that the Probability = 0.00 at a statistical level of significance 1%, and R2 = 59% which means that the independent variable explain the variation of 59% of the dependent variable.

So we will accept that there is statistically significant relationship between the Earnings per share and the market value of the stock, in the services sector

As for the second sub hypothesis

There is an effective relationship between the dividends per share to shareholders' equity and the market value of the stock.

As mentions in Table 2 the probability for this variable = 0.00 at a level of significance 1%, which means there is a significant relationship between the dividends per share to shareholders' equity and the market value, while the R2 = 55.89%, meaning that the independent variable explain the variation of 55% of the dependent variable, so we will accept this hypothesis

As for the third sub hypothesis

There is an effective relationship between Payout Ratio and the market value of the stock.

As we notice from Table 2 that the Probability = 0.00 at a statistical level of significance 1%, and R2 = 79% which means that the independent variable explain the variation of 79% of the dependent variable.

So we will accept that there is statistically significant relationship between the Payout Ratio and the market value of the stock, in the services sector.

Second the industrial sector

Table 3 shows data analysis using the stepwise regression method for industrial sector for the period 2010-2019.

| Table 3 Stepwise Regression Analysis for Industrial Sector for the Period 2010-2019 | |||||

| Variable | Unstandardized coefficients | Standardized coefficients | T | Sig | |

| R2 | Std Error | ||||

| Constant | 0.359 | 0.587 | 0.634 | 0.54 | |

| X1 | 0.875 | 1.152 | 0.612 | 8.767 | 0.000 |

| X2 | -8.877E-02 | 0.071 | 0.086 | -1.544 | 0.127 |

| X3 | 0.1744 | 0.006 | 0.069 | 1.237 | 0.186 |

| At the level of significance 1% | |||||

As we note from Table 3 when testing the first sub-hypothesis, which is

There is an effective relationship between the Earnings per share and the market value of the stock in the industrial sector

As we notice from Table 3 that the Probability = 0.00 at a statistical level of significance 1%, and R2 = 87% which means the independent variable explain the variation of 87% in the dependent variable the market value of the stock.

So we will accept that there is statistically significant relationship between the Earnings per share and the market value of the stock in the industrial sector

As for the second sub hypothesis

There is an effective relationship between the dividends per share to shareholders' equity and the market value of the stock.

As mentions in Table 3 the probability for this variable = 0.127 at a level of significance 1%, which is very high, while the R2 is less than 1% , meaning only less than 1% of the variation are explained by the independent variable the dividends per share to shareholders' equity in the industrial sector, so we will reject this hypothesis

As for the third sub hypothesis

There is an effective relationship between Payout Ratio and the market value of the stock in the industrial sector.

The independent variable does not have an effective relationship with the dependent factor, the market value, the probability = 0.186 while the independent variable explain the variation of 0.1744% of the dependent variable, so we reject the third sub hypothesis.

Results and Discussion

The independent variable earning per share has an effective relationship with the dependent factor whether at the level of economic sectors, or at the level of each sector separately, the service sector and the industrial sector (Endri et al., 2020). This means that investors care about the share of the profit (Earnings per share), whether those profits are distributed as dividends or held as retained earnings.

The independent variable, dividends per share to shareholders’ equity, has an effective relationship with the dependent variable only when the hypothesis was tested in the services sector and it appeared that it had no statistically significant relationship when testing the relationship at the level of all economic sectors and at the level of the industry sector (Bui, 2019). This means that investors in the service sector, consisting of banks and insurance companies, are as concerned with distributing profits as they are interested in realizing them.

The independent variable, Payout Ratio, has an effective relationship with the dependent variable only when the hypothesis was tested in the services sector and it appeared that it had no statistically significant relationship when testing the relationship at the level of all economic sectors and at the level of the industry sector (Pillay, 2020). The reason may be attributed to the fact that the service sector is smaller and less influential than the industrial sector, because the results were similar in the economic sector as a whole and the industrial sector, and different results appeared when testing the hypotheses in the service sector.

Conclusion

This study was a complement to a large group of theoretical and practical studies that agreed on the importance of studying the impact of dividend policies on stock prices. The purpose of this study is to search whether there is a relationship between those policies used and the market value for public shareholding companies of Jordan listed on the Amman Stock Exchange. In the event of such a relationship, the researcher will determine the interest of the Jordanian investor in distributed profits or retained profits. If there is a strong and influential relationship between the rate of return on equity and the ratio of debt utilization and between the market value of the stock. This indicates the investor's lack of interest in the dividend distribution policies of dividends, Retained earnings and the market value of the stock.

Recommendations

The report advises public businesses and their boards of directors to research investor behavior and determine their wishes and preferences for profit distribution and retention. The research suggests that the Amman Stock Exchange conduct short investor training sessions, emphasizing the relevance of dividend distribution rules and inviting public shareholding company boards of directors to establish a dividend distribution strategy that reflects their aspirations and future plans.

Limitations

The study period was limited to the period from 2010 to 2019, and the study did not address the year 2020 due to the COVID-19 pandemic, which negatively affected the number of joint stock companies listed on the Amman Stock Exchange (the performance of the Amman Stock Exchange during the year 2020).

References

- Al-Saraireh, H. (2017). Profit distribution policies and their impact on the market value of operating joint stock companies. Master's Thesis submitted at Mua’tah University, Jordan.

- Bani Saeed, F. (2004). The Impact of Dividend Distribution Policies on the Market Value of Shares of Companies Listed in the Amman Stock Exchange for the Period (1993-2002). Unpublished Master's Thesis, Yarmouk University, Irbid, Jordan.

- Baragneh, A. (2019). Testing the relationship between dividend distribution and each of the market and book value of shares traded in the Palestine Stock Exchange. Master's Thesis, Gaza Islamic University, Palestine.

- Bui, T. N. (2019). Inflation and stock index: evidence from Vietnam. Journal of Management Information and Decision Sciences, 22(4), 408-414.

- Endri, E., Sulastri, S., Syafarudin, A., Mulyana, B., Imaningsih, E. S., & Setiawati, S. (2020). Determinants Cash Holding Of Coal Mining Companies Listed On The Indonesian Stock Exchange. Academy of Strategic Management Journal, 19(6), 1-9.

- Hindi, M. I. (2000). Commercial Banks Management: An Introduction to Decision Making. Modern Arab Office, Alexandria, Egypt.

- Kajola, S. O., Adewumi, A. A., & Oworu, O. O. (2015). Dividend pay-out policy and firm financial performance: Evidence from Nigerian listed non-financial firms. International Journal of Economics, Commerce and Management, 3(4), 1-12.

- Kathiravan, C., Selvam, M., Venkateswar, S., Lingaraja, K., Vasani, S. A., & Kannaiah, D. (2018). An empirical investigation of the inter-linkages of stock returns and the weather at the Indian stock exchange. Academy of Strategic Management Journal, 17(1), 1-14.

- Kilani, Q. (2006). The Effect Of Share's Book Value On Its Market Value - A State Of Retained Earning "An Analytical Study On The Jordanian Banks" For The Period( 1999-2003). Applied Sciences Private University.

- Pandya, B. (2014). Association of Total Shareholder Return with other value based measures of financial performance. Journal of Entrepreneurship, Business and Economics, 2(2), 26-44.

- Pandya, B. (2016). Impact of financial leverage on market value added: empirical evidence from India. Journal of Entrepreneurship, Business and Economics, 4(2), 40-58.

- Pillay, S. (2020). Determining the optimal arima model for forecasting the share price index of the johannesburg stock exchange. Journal of Management Information and Decision Sciences, 23(5), 527-538.

- Ross, S. A., Westerfield, R., Jordan, B. D., & Biktimirov, E. N. (2008). Essentials of corporate finance. McGraw-Hill/Irwin.

- Salamzadeh, A. (2020). What constitutes a theoretical contribution? Journal of Organizational Culture, Communications and Conflicts, 24(1), 1-2.

- Shenk O. (2018) Financial and Non-Financial Determints that Affect stock Market prices for Industrial Public shareholding Companies Listed At Amman Stock Exchange (Empirical Study). Master’s Thesis submitted at Middle East University, Amman, Jordan.

- Tajpour, M., & Hosseini, E. (2021). Entrepreneurial Intention and the Performance of Digital Startups: The Mediating Role of Social Media. Journal of Content, Community & Communication, 13, 2-15.

- Yee, T. C. (2017). Dividend pay-out policy and Firm Performance. Journal of Arts & Social Sciences, 1(1), 42-52.