Research Article: 2021 Vol: 25 Issue: 2S

The Impact of the Existing Relationship between Real Estate Market and Stock Exchange Market on the Strategic Planning in the Jordanian Banks

Ahmad Fathi Alheet, Al-Ahliyya Amman University

Rasha A. A. Qawasmeh, Al-Ahliyya Amman University

Ahmad. Y. M. Areiqat, Al-Ahliyya Amman University

Ahmad M. A. Zamil, Prince Sattam bin Abdulaziz University

Keywords

Real Estate Market, Financial Stock Market, Investment, Micro Economic, Macroeconomic, Demand, Supply, Microeconomic, Economic Factors, Macroeconomic, Strategic Planning

Abstract

The economic performance of any country is influenced by different factors such as price levels, inflation rates, the level of national income, and GDP, and many other factors. This is in addition to other factors such as changes in foreign exchange rates, global economic crises that lead to a recession in the global economy. This article aims to highlight the impact of such factors on the performance of the Amman Stock Exchange, and the real estate market in Jordan. And by calculated the Pearson correlation coefficient, showing that the relationship between the two market in Jordan, almost non-existence.

Introduction

The relationship between the Real Estate Market (R.E.) and the financial stock market – as two investment arenas within the markets of any economy has a great importance. The changes in micro economic, and macro-economic factors across the time affect the two markets in many areas such as, prices, demand, supply, and the cost, and the rate of return, to force banks to reconsider their strategic planning.

For Jordan, the landscape or real estate in Jordan evolved transforming the face of major cities across the kingdom. The real estate industry showed significant changes during the five years expressed by a large development projects ranging from residential, commercial, tourism, and industrial estates. This booming in the real estate sector can be attribute to several factors: first is the growth of the Jordanian economy. second, investors from gulf countries with excess liquid, resulting from rising oil revenues who found profitable opportunities in the Jordanian market. Third, political unrest in Lebanon and Iraq, increased the population in Jordan who increased the demand for housing and other services. And finally, the wide base of young population in Jordan created a natural demand for housing (Jordan investment Board, 2008).

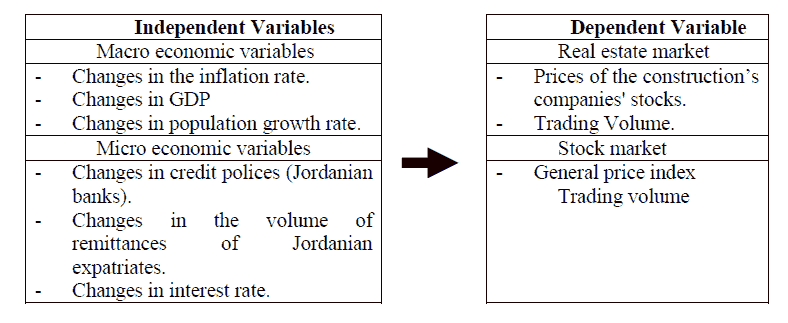

But, almost for two years the real estate market in Jordan shows a sharp regression in both demand and prices. And this regression reflected on the prices of the construction companies’ stocks in Amman stock exchange. Also, this regression resulted by many factors in both macro and micro economic. This study will focus on the impact of the change in gross domestic product, the change in the inflation rate, and the population growth on the trading volume and prices of the real estate market, as macroeconomic factors, and the impact of the funding polices in the Jordanian banks that provided to the two markets, the change of the remittances of Jordanian expatriates, and the change in the interest’s rate as microeconomic factors.

And after determination the impact of those factors on each market, the researcher can deduce the relationship between the two markets, and finally this relationship features will become as independent variables to measure their impact on the strategic planning process in the Jordanian organization.

Problem statement and questions

Because the two markets affected by the same economic factors, we can suggest the problem of this study in the form “variations in the prices and trading volume of the real estate market have a significant impact on the Amman stock exchange’s indicators”. The general price index and the trading volume, this causal relationship may affect the strategic planning process in Jordanian banks.

The Study is Going to Discuss this Problem Through the Following Questions:

1. Is there any relationship between the variations in the prices of the real estate assets and the variations in Amman stock exchange?

2. What is the role of inflation rates in the variations occurring in the two markets?

3. What is the role of the changes in (GDP) in exploring and forecasting the potential variations in the two markets?

4. How can Jordanian banks have benefited from the impacts of the micro economic factors through their strategic planning?

The Study Importance

The relationship between the two markets through discussion the impacts of the macroeconomic, and microeconomic factors on each market will provide the investors, business organizations, and decisions’ makers, and speculators a significant aid to forecast future performance in their strategic planning.

Also, the portfolio managers can be benefited from the findings of this study, while deciding their assets allocations.

The Study Objectives

This study aims to accomplish the following objectives:

1. To discern the impact of the macroeconomic factors (GDP, inflation rate, and population growth) on the volume and prices of the stocks of the constructions companies.

2. To discern the impact of the microeconomic factors (funding policies, remittances of Jordanian expatriates, and the interest rate) on the volume and prices of the stocks of the constructions companies.

3. To discern the impact of the macroeconomic factors (The same factors) on the price index and the trading volume in Amman stock exchange.

4. To discern the impact of micro economic factors (the same factors) on the price index and the trading volume in Amman stock exchange.

5. To discern the relationship between the two markets through the identification of the effects of these factors on each market unit.

6. To describe the impact of the existing relationship between the two markets on the strategic planning process in the Jordanian banks.

The Study Hypotheses

The First Major Hypothesis:

H1 There is no impact for the changes in the macroeconomic indicators on the trading volume in the real estate market in Jordan.

This Hypothesis consists of the following sub-hypotheses:

H11 There is no impact for the changes in the inflation rate on the trading volume in the real estate market in Jordan.

H12 There is no impact for the gross domestic product on the trading volume in the real estate market in Jordan.

H13 There is no impact for the changes in the population growth rate on the trading volume in the real estate market in Jordan.

The Second Major Hypothesis:

H2 There is no impact for the changes in the macroeconomic indicator on the prices of the stocks of the constriction companies in Amman Stock Exchange.

This Hypothesis Consists of the Following Sub-Hypotheses:

H21 There is no impact for the changes in the inflation rate on the changes in the prices of the stocks of the constrictions companies in Amman Stock Exchange.

H22 There is no impact for the changes in the gross domestic product on the changes in the prices of the stocks of the constriction’s companies in Amman Stock Exchange.

H23 There is no impact for the changes in the population growth rate on the changes in the prices of the stocks of the constrictions companies in Amman Stock Exchange.

The Third Major Hypothesis:

H3 There is no impact for the changes in the microeconomic indicators on the change in trading volume in Amman Shock Exchange.

This Hypothesis Consists of the Following Sub-Hypotheses:

H31 There is no impact for the changes in the credit policies applied in the Jordanian Banks and the trading volume in Amman Stock Exchange.

H32 There is no impact for the changes in the volume of remittances of the Jordanian expatriates on the trading volume in Amman Stock Exchange.

H33 There is no impact for the changes in the interest rate on the volume in Amman stock Exchange.

The Fourth Major Hypothesis:

H4 There is no impact of the change in the microeconomic indicators in the price index in Amman Stock Exchange.

This Hypothesis Consists of the Following Sub-Hypotheses:

H41 There is no impact of the change in the credit polices applied by the Jordanian Banks on the on the Jordanian organizations.

H42 There is no impact of the change in the volume of remittances of the Jordanian expatriates on the price in Amman Stock Exchange.

H43 There is no impact of the change in the interest rate in the price index in Amman Stock Exchange.

The Manner and Procedures

After the approval or disapproval of these hypotheses through computing the correlation factor (Pearson) between the variables, we can examine the relationship between the two markets and its impact in the strategic planning process in the Jordanian Banks. And this will be conducted under two assumptions:

• There is no relationship between the real estate market in Jordan and Amman stock exchange.

• There is no impact for the existing the relationship between the two markets on the strategic planning process in the Jordanian Banks.

The Study Model

Theoretical Procedural Definition of the Study Variables:

• Real estate markets is the market where real estate assets in all its forms (Land, buildings, stocks of real estate companies) and all its uses (residential, agricultural, commercial and industrial use) are exchanged by buying and selling of these assets (Hsieh and Paterson, 2000).

• Gross Domestic Product (GDP): the market value of the goods and services produced by a country (quick MBA, 2007).

• Inflations: is an increase in the price of a basket of goods and services that is representative of the economy as a whole (Mofatt, 2009).

• Demand: is an economic principle that described a consumer’s desire and willingness to pay a price for a specific good or service (Investopedia, 2009).

Literature Review

Peskin, Doron (2009). “Jordan Real Estate Market Seeks Gov’t Aid”.

The study aimed to diagnose the reasons that caused the current regression in the real estate market.

The author pointed out that “the Jordanian real estate market is suffering from a sharp decline in demands, as part of the implications of the global financial crisis”.

According to the chairman of the real estate investments company, the decline in the Jordanian real estate market began in 2007, but the situation worsened in light of the global financial crisis in 2008, also, because the banks refraining from giving loans for the purpose of purchasing apartments. Then the author recommends that the government aid in this aspect is very necessary.

Florion, Jeff (2008). “Jordan Real Estate Sector Still Riding High”.

The study aimed to high light the factors that enhance the growth of the real estate sector in Jordan. In this area the author pointed out that “recent announcements from the growing sector include a $7bn housing projects for low-income citizens in the kingdom and the entry into the market by one of the region’s largest develop. also, the high degree of king Abdullah II care for this sector expressed by his launched the national housing initiative, which is a multi-billion-dollar project that aims to build 120000 properties throughout the kingdom for low and limited-income Jordanians.

The author indicated that UAE has a significant role in the growth of this sector, because $300m will be spent to build two residential towers in Amman.

As a result of this article, the potential success of the project will be, offering the housing units at affordable payment terms, and the project should be conduct through collaboration with the Jordan housing and urban development corporation.

Sorin A. Tuluca, and others (2004). Under the title "Dynamic of Private and Public Real Estate Markets".

The authors investigated how co-integration of capital markets affects the dynamics of public and private real estate markets. The results show that the price indices of the five assets (T-bills, bonds, stocks, and both public and private real estate) are no stationary and co integrated. Some implications for the long-term equilibrium relationship for portfolio divaricating, price discovery and prediction are discussed. The results show that the long-term equilibrium relationship establishes a feedback between the two real estate markets, but the private market seems to lead the public one. Possible explanations are also explored.

Piet M.A. Eichholtz (2005). "Does International Diversification Work Better for Real Estate than Stocks and Bonds?"

The study investigated the effectiveness of international real estate diversification relative to international diversification of stock and bond portfolios. Tests of international correlation matrixes of real estate returns, common stock returns, and bond returns indicate significantly lower correlations between national real estate returns than between common stock or bond returns. The implication is that international diversification reduces the risk of a real estate portfolio more than that of common stock and bond portfolios.

Patrick J. Wilson & John Okunev, (2007). "Long-Term Dependencies and Long Run Non-Periodic Co-Cycles Real Estate and Stock Markets".

The authors pointed out that the literature is not clear on whether there are co-dependencies domestically across real estate and stock markets, nor whether there are international co-dependencies for these asset classes, despite the importance of this question for portfolio diversification strategies. They used a non-linear technique to search for co-dependence over the long term. "We find no evidence to suggest long co-memories between stock and property markets in the United States and the United Kingdom, but some evidence of this in Australia. In an international context, if we take whole of sample period data", they found no evidence of long co-memory effects, however "if we sample on either side of the 1987 market correction, we find evidence of long co-memory".

Xiaofang & YAN Jinming (2007). In their study titled Relationships between Chinese Real Estate and Stock Market.

Which aimed to explore the relationships between the Chinese real estate and stock market by comparing the fluctuation of stock index with that of real estate index from 1998 to 2006. The results from this study show three specific outcomes that extend the current literature on real estate finance. First, it is shown that fluctuation of real estate index lead that of stock index between 1998 and 2006. Because of financing market structural problem, Chinese real estate market is more sensitive to economy than stock market. Second, the results also indicate that wealth effect in real estate market is more than stock market in China. The reason is that the scale of stock market is small, and the fluctuation of stock price is uncertain. Finally, rising of stock price would reduce the rate of real estate price increasing. These results appear to have important implications for managing property assets in the funds management industry and also for the pricing efficiency within the Chinese property market. It is also useful for policy makers in making decisions with regard to economy safety.

Elias Oikarinen (2006). "Price Linkages between Stock, Bond and Housing Markets Evidence from Finnish Data, Elta".

Suppose that there are a number of reasons to assume that significant interdependences exist between the financial asset markets and the housing market. The purpose of this paper is to study the long- and short-term dynamic interdependences between stock, bond and housing markets using time series econometrics and utilizing a quarterly datSSEt from Finland over 1970-2005.

In addition to short-term dynamics, there also appears to be long-run interrelations between the asset prices according to co-integration analysis. There is clearly a structural break in the long-run relationship between stock and housing prices in the early 1990s.

John Okunev, Patrick Wilson & Ralf Zurbruegg (2007). In their research "The Causal Relationship between Real Estate and Stock Markets".

Tried to examine the dynamic relationship that exists between the US real estate and S&P 500 stock markets between the years of 1972 to 1998. This is achieved by conducting both linear and nonlinear causality tests. The results from these tests provide a number of interesting observations which primarily show linear relationships to be spuriously affected by structural shifts which are inherent within the data. Linear test results generally show a uni-directional relationship to exist from the real estate market to the stock market. However, these results are not consistent with financial theory and for all sub-samples of the data. In contrast, the nonlinear causality test shows a strong unidirectional relationship running from the stock market to the real estate market and is consistent in the presence of any structural breaks.

Okunev, John, Wilson, Patrick, Zurbruegg, Ralf (2005). In their research "The Causal Relationship between Real Estate and Stock Markets".

Tried to explore the relationship between the Australian real estate and equity market between 1980 and 1999. The results from this study show three specific outcomes that extend the current literature on real estate finance. First, it is shown that structural shifts in stock and property markets can lead to the emergence of an unstable linear relationship between these markets. That is, full-sample results support bi-directional Granger causality between equity and real estate returns, whereas when sub-samples are chosen that account for structural shifts the results generally show that changes within stock market prices influence real estate market returns, but not vice versa. Second, the results also indicate that non-linear causality tests show a strong unidirectional relationship running from the stock market to the real estate market. Finally, from this empirical evidence a trading strategy is developed which offers superior performance when compared to adopting a passive strategy for investing in Australian securitized property. These results appear to have important implications for managing property assets in the funds management industry and also for the pricing efficiency within the Australian property market,

Aman Ullah, Zhong-guo Zhou (2003). "In their study "Real Estate and Stock Returns".

Examined dynamic relationships among three housing market variables and a stock market index in a multivariate vector autoregressive error correction (VAREC) model. It is first found that, in the USA, sales and the median sales price of the existing single-family homes and the 30-year mortgage rate have unit roots, while the New York Stock Exchange (NYSE) value-weighted portfolio returns appear random. Moreover, it is found that not only are three real estate variables co integrated with one another but that they are also co integrated with the stock index returns. After controlling for the unit root problem and co integration, a multivariate VAREC model is further developed to examine dynamic relationships among the four variables using Johansen’s approach. It is found that the price, mortgage rate, and stock returns affect sales. It is found that the mortgage rate and stock returns affect the price. The 30-year mortgage rate is affected by sales and the stock returns. Except for the mortgage rate which is negatively correlated with the stock returns, significant evidence is not found that sales and the median sales price affect the stock returns directly.

Methodology

In this section, the researcher will list the Jordanian economy factors that may affect the real estate market and Amman stock exchange:

| Table 1 Real GDP Growth |

||||||||

|---|---|---|---|---|---|---|---|---|

| Year | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 |

| Real GDP Growth |

5.30% | 5.80% | 4.20% | 8.60% | 8.10% | 8.00% | 8.90% | 7.90% |

| Table 2 Inflation Rate (Consumer Prices) |

||

|---|---|---|

| Year | Inflation Rate | Percent Change |

| 2003 | 3.30% | - |

| 2004 | 2.40% | - 27.27% |

| 2005 | 3.20% | 33.33% |

| 2006 | 4.5% | 40.63% |

| 2007 | 6.3% | 40% |

| 2008 | 5.4% | - 14.29 |

| 2009 estimated | 14.9% | 175.93% |

The information reflects the percent change in consumer prices.

Source: Index Mundi

The Macro and Micro Economic Factors for the Period from 2000-2008

| Table 3 The Inflation Average Consumer Prices |

||

|---|---|---|

| Year | Inflation Average, Consumer Prices | Percent Change |

| 2000 | 0.674 | 12.71% |

| 2001 | 1.768 | 162.31% |

| 2002 | 1.835 | 3.79% |

| 2003 | 1.627 | - 11.34% |

| 2004 | 3.365 | 106.82% |

| 2005 | 3.491 | 3.74% |

| 2006 | 6.255 | 79.18 |

| 2007 | 5.385 | - 13.91 |

| 2008 | 14.920 | 177.16% |

| Table 4 Amman Stock Exchange: Weighted Index And Trading Value |

||

|---|---|---|

| Year | Index | Trading Value |

| 2000 | 813.3 | 334, 724, 633 |

| 2001 | 1060.6 | 668 652 674 |

| 2002 | 1090.9 | 950 272 995 |

| 2003 | 1761.5 | 1855 176 028 |

| 2004 | 2729.1 | 3793 251 050 |

| 2005 | 4259.7 | 16871 051 948 |

| 2006 | 3013.7 | 14209 870 592 |

| 2007 | 3675.0 | 12 348 101 910 |

| 2008 | 2758.4 | 20 318 014 547 |

| Table 5 Remittances of Jordanian Expatriates |

|

|---|---|

| Year | The Volume |

| 2001 | 1283.3 |

| 2002 | 1362.3 |

| 2003 | 1404.5 |

| 2004 | 1459.6 |

| 2005 | 1544.8 |

| 2006 | 1728.7 |

| 2007 | 2123. |

| 2008 | 1793 |

| Table 6 Interest Rates for the Period 2000-2008 for the Time Deposits |

|

|---|---|

| Year | Interest Rate |

| 2000 | 6.55 |

| 2001 | 5.19 |

| 2002 | 3.07 |

| 2003 | 2.75 |

| 2004 | 2.49 |

| 2005 | 3.52 |

| 2006 | 5.13 |

| 2007 | 5.50 |

| 2008 | 5.42 |

The Relationship between the Real Estate Market in Jordan and the ASE

To determine the relationship between the real estate market in Jordan and the ASE:

To determine the relationship between the Jordanian real estate market and Amman stock exchange, the table below shows how each variable either macroeconomic or microeconomic influence the dependent variables used to represent the performance in the two markets.

| Table 7 Relationship Between The Real Estate Market In Jordan And The ASE |

||

|---|---|---|

| Independent Variables | Amman Stock Exchange | Real Estate Market |

| Macro-economic variables | Weighted price index | Construction companies’ stocks prices |

| Inflation rates GDP Changes in population growth Changes in inflation rates Changes in real GDP Changes in population |

No impact Weak impact No impact Trading volume No impact Weak impact No impact |

No impact Weak impact No impact Trading volume No impact Weak Impact No impact |

The Study Results and Findings

The main findings of this study which indicate at the relationship between the Real Estate market and the stock market in Jordan are:

1. The macroeconomic factors as independent variables have the same impact on the two markets in the prices area as follows:

• There is no relationship between the changes in inflation rates and changes in the weighted price index in Amman Stock Exchange, and the prices of the construction companies’ stocks. This means that the prices in the two market do not affect by these variables.

• There is a weak relationship between changes in GDP and changes in the weighted prices index of ASE, and the prices of construction companies' stocks, which means that the prices in the two market do not respond strongly to the changes in GDP.

• There is not any relationship between the population growth and the prices in the two markets.

2. Macroeconomic variables have a similar relationship between each one of them and the trading volume in the two markets.

3. Microeconomic factors as independent variables have different impacts on the two markets either in the prices or the trading volume areas as follows.

• There is a strong positive relationship between the changes in the interest rates and the changes in the weighted price index in ASE. But there is no relationship between these changes in the interest rates and the construction companies’ stocks prices.

• There is a weak relationship between the changes in remittances of Jordanian expatriates and the prices in the two markets.

• There is no relationship between the rigid polices applied by the Jordanian banks and the prices in the two markets.

4. Microeconomic variables have different impacts also on the trading volume in both real estate and stock markets, as follows:

• There is a weak relationship between the changes in the interest rates and the trading volume in the two markets.

• There is medium relationship between the changes in the remittances and the trading volume in the two markets.

• There is a medium relationship between the changes in the loans volume provided by the Jordanian banks and the trading volume in the (ASE). But for the trading volume in the real estate market the relationship between the two variables is very weak.

From these results we can express the relationship between the two markets by the following statements:

1. The two markets are not sensitive for the changes in the macroeconomic indicators that used in this study.

2. The stock market responds more than the real estate market to microeconomic indicators.

3. According to these results, banks, especially those who own or manage portfolios have to depend on strategies that enable them to respond to the fluctuations in the interest rates and the prices of each component in their portfolios, and to have an active tool to avoid any high risk in their investment.

Recommendations

1. The government must intervene to determine the prices of the construction materials to reduce the high prices of apartments.

2. The Jordanian banks have to exercise a more active role by simplifying procedures for access the housing loans, especially for the category of staff with limited income.

3. Jordanian embassies, especially in countries where there are much of Jordanian workers, have to provide them with information needed to direct their investments towards the best investment.

4. The investors in the housing sector must take in there account the relationship between the demand and the ability of the Jordanian citizen to buy an apartment.

5. Jordan Securities Commission, and through its agencies working in the Amman Stock Exchange have to observe and hold those who call rumors harmful to the interests of the traders.

References

- Jordan Investment Board (2008).

- Smith, J. (2008). Analysis: Jordan real estate, construction becomes most active sector. UK.

- Central Bank of Jordan. Index Mundi (2009), Jordan.

- Jordan Economic & Commerce Bureau (2009).

- Hlaves, D. (2007). Commercial Real Estate, USA.

- Florian, J. (2008). Jordan's real estate sector still riding high.

- Pesking, D. (2009). Jordan real estate market seeks gov't aid. Israel business.

- Quick MBA .(2007).

- Piet, E. (2005). Review of pacific basin financial markets and polices. 20(8), 100-115.

- Wilson, P., & Okunev, J., (2007). Long-term dependencies and long run non-periodic co-cycles: Real estate and stock markets. Journal of Real Estate Research, 12(5), 210-220.

- Jinming, G., Xiaofang, G, & Yan, Y. (2007). Relationships between chinese real estate and stock market. china.

- Karinen, O.E. (2006). Price linkages between stock, bond, and housing markets. Evidence from finish data, Eita. Finland.

- Okunev, J., Wilson, P., & Zurbruegg, R. (2007). The causal relationship between Real Estate and Stock Markets.

- Zhong, A. (2003). Real Estate and Stock Returns. IMF Report (2009).

- www.ase.com.jo. Amman Chamber of Commerce Report (2007).