Research Article: 2020 Vol: 24 Issue: 2

The Impact of Value Added Tax (VAT) On Small and Medium Enterprises in A Developing Country

Wadesango N, University of Limpopo

Gift Chirebvu, Midlands State University

Abstract

The stimulants for the the growth and spread of value-added tax (VAT) remains unclear both theoretically and empirically. small and medium enterprises (SMEs) are experiencing challenges with respect to complying with the VAT requirements. Unfortunately, there is little researches that have focused on understanding how VAT really affects the operations of SMEs. This study therefore sought to determine the factors that affect VAT compliance; identify the VAT collection methods; determine how VAT is affecting the operations and profits of the firms; and describe the status of VAT compliance among SMEs in this developed country which shall be referred to as country A. Structured survey questionnaires were distributed to conveniently sampled 50 owners and managers of the firms and a response rate of 76% was recorded. Results indicated that VAT compliance is affected mainly by characteristics of the individuals, features of the VAT system itself, and environmental factors such as political and socio-economic situation in this developed country. The non-compliance among most SMEs is a measure to survive the harsh economic conditions. The high costs of implementing such a complex system is so high for SMEs that an attempt to comply predict the folding up of that small business.

Keywords

Value Added Tax, Small and Medium Enterprises, Compliance, Developed Country.

Introduction

Small businesses are instrumental in ensuring economic growth that may lead to job creation. In this developing country, SMEs represent over 95% of enterprises that generate over 50% of private sector employment. Despite Small and Medium and Enterprises (SMEs) being an important vehicle to address the challenges of job creation and economic growth, the SMEs sector is faced with multiple challenges among them financing and heavy tax burden. The SMEs, like any other business entities are expected to be compliant to the various tax systems in this 3rd would country, Value Added Tax (VAT) among them. The research study sought to explore the impact of VAT on small and medium enterprises in one developing country.

Background to The Study

The Value Added Tax Act (Chapter 23:12) enabled the introduction of Vat Tax in the developing country under study, replacing the sales tax. The Act specifies that VAT should be charged, levied and collected on the value of the supply of goods and services by a registered operator, on the importation of any goods into the country under study, or supply of any imported services by any person. It also clearly spells out the conditions on which VAT should be and should not be charged. VAT is a consumption tax which represents tax on the value added to the product throughout its production process. VAT is currently pegged at 15%, for all goods and services, except for those that have been either exempted, zerorated or subject to Vat at special rate. The Value Added Tax (VAT) was introduced in this country in 2004 by this country’s Revenue Authority. According to the country’s Revenue Authority, it is compulsory for all traders whose taxable supplies exceed, or are likely to exceed $60 000 within a period of twelve months to register for VAT. Anyone who is registered or is required to be registered is required to charge VAT, remit to the revenue authority and keep required records thereof, failure of which the trader would attract penalties. Some scholars have pointed out that the best practice VAT model should exempt small businesses from paying VAT. However, in the prevailing economic situation, the developing country under study has been faced with closure of big companies and corporate entities, and an increasing number of Small to Medium enterprises (SMEs), some which fall in the group of those traders who are required to register for VAT.

There has been varying definitions for SMEs in country A. The country’s Policy Framework of 2004 recognizes any business with less than 100 employees as an SME. According to the SME Association of country A, SMEs covers enterprises making a turnover less than $24 000 or assets less than $100 00 whilst medium enterprises have a turnover and assets above the threshold for small enterprises but less than $1 million each. The revenue authority (RA) on the other hand, for the purposes of their operations, identifies SMEs as enterprises employing between 5 to 75 people and with a turnover and assets from as low as $50 000 to $2million. The development of small to medium scale business enterprises is greatly affected by the level of taxation, its administration and compliance; The higher the task risk of the greater the efforts to fulfil taxation requirement as well as to check how those requirements are met, the lower the initiatives for small scale businesses to work hard. Thus, maintaining the tricky balance between tax rate, compliance cost, tax administration and economic growth should be a major goal of every tax policy.

The relationship between taxation and the level of growth of small-scale enterprises has been a debatable issue over the years. The perceived relationship can be either positive or negative depending on the type of tax policy adopted by the government. However, it is generally agreed that high task rate can lead to decrease in business activities since it dampens the incentives to invest while low tax rate, on the other hand, tends to increase growth of business activities as profits are increased which lead to further investment as well as expansion of business. A high marginal tax rate lowers an investor’s willingness to invest by lowering the returns on his investment (Palacio & Harischandra, 2008). In the same vein, a reduced amount of business activities has a number of negative consequences including decreased productivity of workers and reduced output, employment and ultimately, living standard of the people.

The government of country A in an attempt to widen the tax base and collect more revenues has had to levy several taxes especially on business enterprises in the state. According to the 2016 report SMEs in this country contributed 48.58 billion to the country’s GDP, and employing more than 5.9 million people. Currently 70% of RA registered tax payers are SME, but only contribute 20% to tax revenue. There have been many criticisms on the tax burden on SMEs in this country, and the worrying rate of tax compliance of these SMEs. Of concern has also been the VAT system employed in this country. Country A’s VAT system leaves a large proportion of consumption out of the tax base for merit reasons, by exempting domestic electricity, passenger transportation, health care education and postal services. Exemptions are also extended to live animals, fuel and agricultural equipment that some do not even consider being standard exemptions for merit. The VAT rate employed also has an effect on the operations of businesses entities, much impact being on the SMEs. Thus, it is a greater worthiness that the researcher is studying the impact VAT taxation on small scale enterprises in country A.

Statement of The Problem

There is a revenue mobilization drive in country A, most of which are carried out by contracted agencies that sometimes come up with various taxes and levies and impose them on business operators in the state. Various methods are then used to collect the revenue from the business operators. However, researchers observed that SMEs cry foul on the burden of taxes imposed on them and how they affect business operation. Some researchers also showed that some SME operators were not knowledgeable on the ways in which some tax systems operated, hence creating problems with authorities and affecting business. Among such tax systems is of VAT collection. SMEs are mostly likely not in a position of maximising on claiming VAT thereby living them exposed to paying more tax liabilities. This research therefore seeks to find out the extent to which the VAT system has affected the operation of SMEs in this country.

Research Questions

The study is guided by the following research questions:

1. What is the effect of the VAT system on the SMEs operations in Country A?

2. What are the effects of VAT on SMEs operations and growth in Country A?

3. To what extent has the VAT affected the growth of small and medium enterprises?

4. How does the VAT rate affect the profits and sales turnover of small and medium enterprises?

Research Methodology

In this study a more quantitative and deductive approach was used. The population in this study consisted of all registered SMEs. Attempting to include SMEs who do not pay tax would have introduced errors. Only SMEs who pay taxes or are registered as tax payers were relevant. According to MSMEs (2013), they were 12531 registered tax paying SMEs. To select a representative sample of SMEs from such a heterogenous population was not done by randomising but by carefully setting some appropriate selection criteria. Registered SMEs are made up of heterogeneous groups of people doing different trades such as manufacturing, Agriculture, retailing, consultancy, construction and services among others. Attempting to consider such as a single homogenous set of enterprises would introduce sampling errors. Furthermore, some of the registered tax payers have either left or are no longer trading such that trying to use the MSMEs sampling frame would be highly misleading. Therefore, the researchers opted to use a more cautious sampling approach by setting some criteria upon which the selection of the members would be considered.

Convenient sampling was used in which only SMEs that met criteria set by the researcher. First, only SMEs registered as tax payers were considered for sampling. Also only those that consented to participating in the study were included. The researchers also set that no two consecutive SMEs from same sector were given the questionnaire to allow for the representativeness of the sample. In addition, those identified by the researcher and who were available on the day of data collection were selected into the sample. According to Yount (2016) non-probability sampling techniques such as convenience samplign yield better results than probability sampling techniques such as simple random sampling. Situtions in which the members of the population have varied features and geographically difficult to locate usually require sampling that is carefully planned than relying on statistical formulas and guidance. The researchers’ knowledge of the population was important for decision making as to which member to select or not. Had simple random sampling or any other probability technique used to select the SMEs, the risk of selecting members of similar features leaving behind other features would have very high. Even the sampling list from MSME was outdated and less relevant to apply in the current study.

The size of the sample was defined by fulfilling certain pre-set conditions: selecting more members until saturation began to be noticed. However, following Yount (2016) propounds that for increasing the statistical significance of the sample, the sample size should be at least 30 members. The researchers in this study increaased the sample size to 50 to allow for error adjustment. Thus the sample size used was 50. Questionnairres were used to collect data.

Data Presentation, Analysis and Discussion

Factors that affect VAT compliance among SMEs in Ruwa

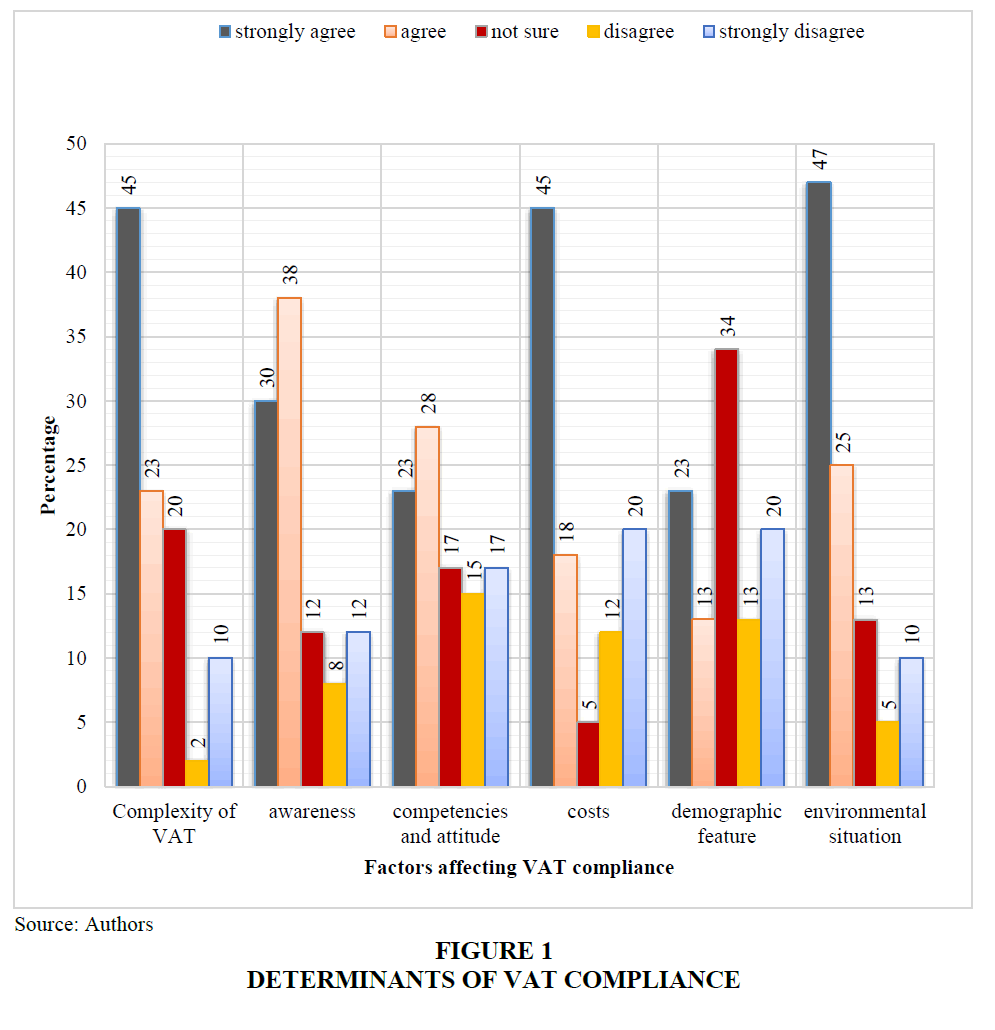

SME owners and managers were asked to identify possible factors that affected compliance of SMEs to VAT requirements. The responses were recorded and presented on a bar graph in Figure 1.

The respondents identified complexity of VAT, lack of awareness, lack of competencies, environmental factor influence and high implementation costs are major drivers behind VAT compliance issues. However, they could not ascertain whether demographic features like age and gender could affect VAT compliance. In fact, 68% of the respondents reported that they felt that lack of awareness and complexity of the VAT system are major causes of non-compliance. Furthermore 51% stated that costs of implementation were high. However, 32% thought that costs were not influencing the compliance behaviour. Environmental factors that include the socio-economic and political situation in the country were alleged to influence significantly the decision to comply with VAT requirements. While 36% reported that gender and age can affect compliance, a relatively equal percent, 32% did not agree while 34% were unsure. This indicates divergent views about the effect of demography on VAT compliance.

In summary, the results indicated that the characteristics of VAT, competencies of the personnel, cost implications and environmental influences were major factors affecting VAT compliance among SMEs in Ruwa. This is supported by Atawodi & Ojeka (2012) and Abrie & Doussy (2016) who postulate that the complexity of the VAT system and the skills and attitudes of the leadership of SMEs do indeed affect their ability to comply. VAT administration requires skills which most SMEs do not have. In fact, VAT is specialized accounting procedure under taxation which involves a lot of knowledge demands. However, the findings from this study diverged from previous findings by Schoonjans et al. (2011) and Vlachos & Bitzenis (2016) who claim that gender disparities and age differences among owners and managers of SMEs do indeed determine the SME’ tendency to comply or not. It was actually discovered that Flemish female onwers were more compliant to VAT than their male counterparts. Furthermore, the older females were even very compliant than younger generation of SME owners.

Methods of VAT Collection among SMES

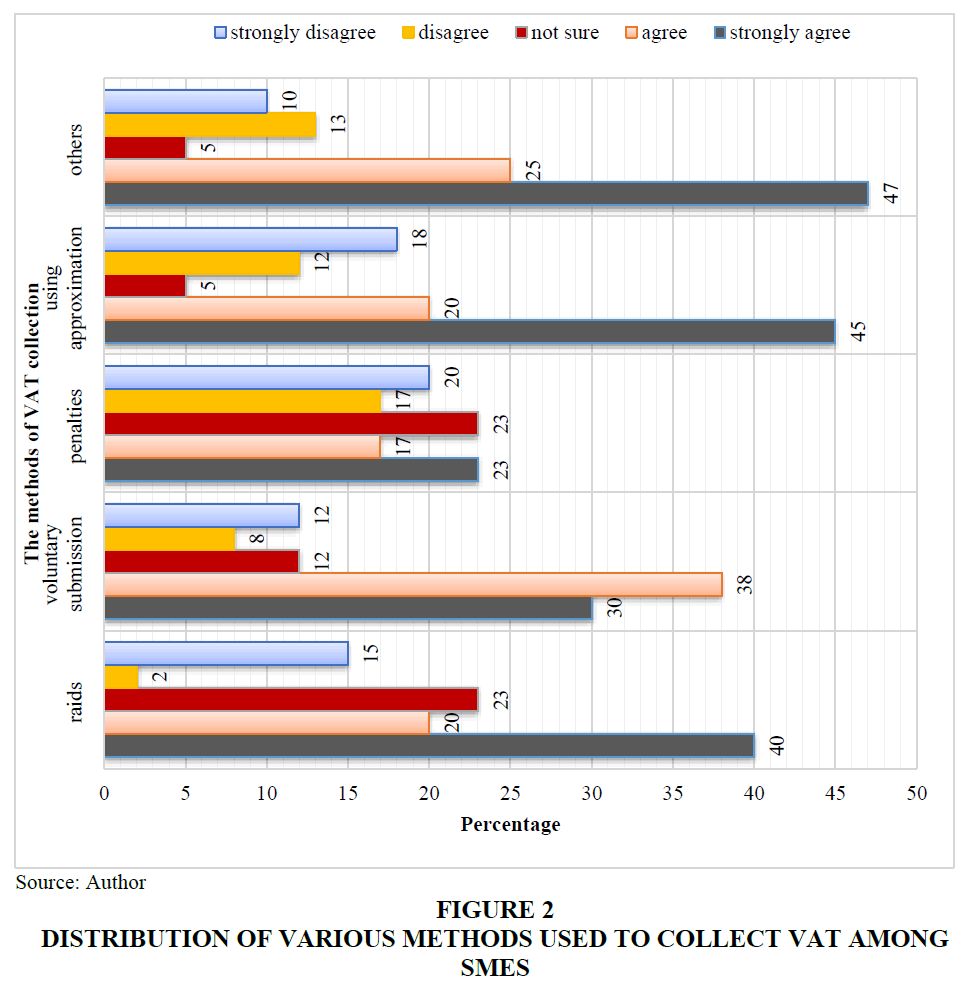

The owners and managers of SMEs were asked to provide their experiences with respect to how Country A’s Revenue Authority collects VAT from SMEs. The key issues were for the respondents to assess the applicability of the use of raids, approximations, penalties, voluntary submissions by SMEs and any other which the respondents have experienced. The responses were presented in Figure 2.

While 60% concurred that the RA usually conducts raids on non-compliant SMEs to collect VAT, a meagre 17% thought otherwise while a significant number were uncertain of the use of raids on SMEs. In addition, the 68% of SMEs revealed that the voluntarily submit their VAT returns without being raided upon or charged with penalties. However, 20% denied the use of voluntary submission of VAT to the RA. Furthermore, 65% reported that the RA uses estimates given by SMEs. This might probably suggest that SMEs do not have the proper systems to account for VAT but usually use estimates given either by consultants or from their own books. Surprisingly, 72% of the SMEs indicated that there are other methods in which VAT is being collected from their businesses. However, such methods could not readily be identified. There was uncertainty over the significance of penalties as method of VAT collection. However, 40% admitted to the RA using such techniques while a relatively equal number, 37% reported otherwise. A significant number, 23% were not even certain over the use of penalties.

In summary, the respondents concurred that the RA uses a cocktail of methods: raids, voluntary submissions, use approximations and other such techniques. However, it could not be ascertained if the penalties approach was a significant technique applied by the RA on VAT collection. The findings are not unique than what was discovered by prior studies. Lent, Casanegra, & Guerard (2013) and OECD (2017) report that VAT collection has mainly centred on computerised systems that are automatically linked to the authorities’ central databases. Thus majority of the revenue collection is more voluntary and automated. Jerene (2016) also provides insights into the use of raids and penalties especially in countries with poor taxation laws. Grigore & Gurau (2017) and HM Revenue and Customs (2018) Mach, (2018) describes VAT as one such tax that is easy to collect using estimates against sales volumes. It does not require complex calculations. However, the authors did not highlight the fact that VAT in developing countries demands some computations especially when no proper books are kept. The situation of approximations is then highlighted by (OECD, 2017).

The Status of Vat Compliance Among SMES

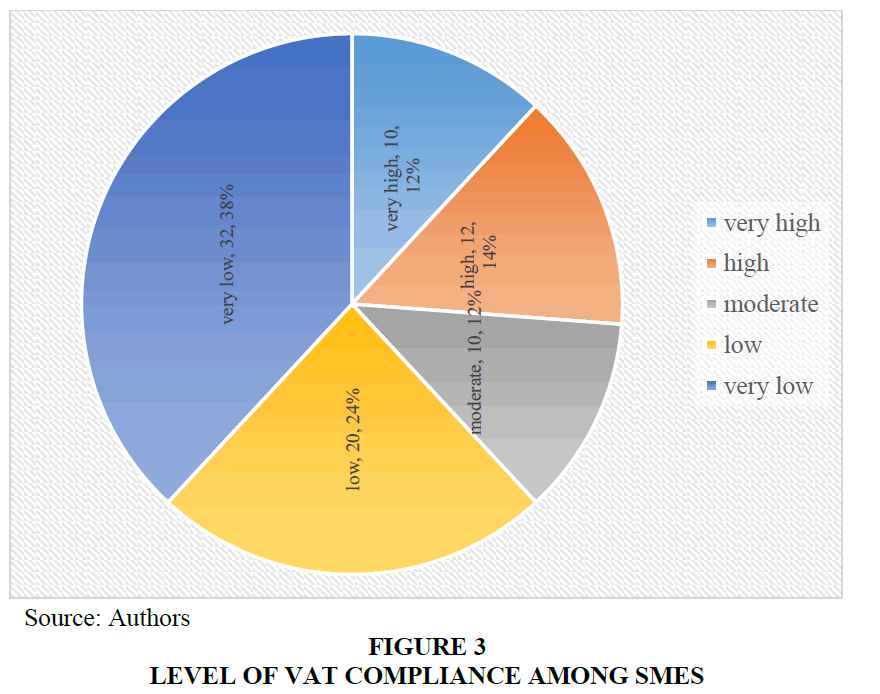

The respondents had to provide their opinion about the level of VAT compliance among SMEs and through which activities do these SMEs comply. The feedback was recorded in Figure 3 and Table 1 below:

| Table 1 VAT Compliance Distribution Among SMES | |||||||

| Status of VAT compliance among SMEs where 1 = strongly agree, 2 = agree, 3 = not sure, 4 = disagree 5 = strongly disagree |

|||||||

| Percentage of respondents | Weighted mean | Interpretation | |||||

| 1 | 2 | 3 | 4 | 5 | |||

| Most have current tax clearances | 67 | 11 | 3 | 10 | 9 | 2.46 | Agree |

| Most SMEs registered taxpayers | 34 | 30 | 20 | 4 | 12 | 2.43 | Agree |

| Most SMEs compliant | 8 | 15 | 12 | 38 | 26 | 3.84 | Disagree |

| Most SMEs not registered | 9 | 12 | 13 | 20 | 47 | 4.11 | Disagree |

The respondents indicated that they agree (mean score of 2.43) that most SMEs are registered on the RA VAT system and are managing (mean score of 2.46) to comply with the RA tax clearance certification. However, the respondents disagreed (mean score 3.84) that SMEs are in actual fact compliant with VAT requirements. In fact, they refused (mean score of 4.11) that most SMEs are registered on the RA VAT system. This was also substantiated by 62% of the respondents (In Figure 3) who concurred that the VAT compliance levels among SMEs is at least low. This suggests that SMEs in this country could be using some techniques to evade VAT and obtain tax clearance certifications.

In summary, SMEs in this part of the developing country under study have low compliance level to VAT but a significant number are registered and clearing with the RA.

The Relationship between VAT and Operations of SMEs

Researchers sought to investigate how VAT affects various aspects of the operations of the SMEs. Specifically, it was sought to understand how VAT is related to operational costs, business risk, complexity of operations, and increase in stress and burden. Pearson correlation was calculated using SPSS version 20. The results were presented in tabular form and as Pearson correlation statistics shown in Table 2.

| Table 2 Relationship between VAT and SME Operations | |||||||

| Correlations | |||||||

| VAT | Increases costs | Burden & stress | Business risk | Complexity | Bad reputation | ||

| VAT | Pearson Correlation | 1 | 0.725 | 0.345 | 0.237 | 0.567 | 0.234 |

| Sig. (2-tailed) | 0.00 | 0.000 | 0.010 | 0.012 | 0.002 | 0.032 | |

| N | 38 | 38 | 38 | 38 | 38 | 38 | |

| Increases costs | Pearson Correlation | 0.725 | 1 | 0.427** | 0.180* | 0.675** | 0.557** |

| Sig. (2-tailed) | 0.000 | 0.002 | 0.000 | 0.017 | 0.000 | 0.000 | |

| N | 38 | 38 | 38 | 38 | 38 | 38 | |

| Burden and stress | Pearson Correlation | 0.345 | 0.427** | 1 | 0.018 | 0.164* | 0.020 |

| Sig. (2-tailed) | 0.010 | 0.000 | 0.0816 | 0.030 | 0.025 | ||

| N | 38 | 38 | 38 | 38 | 38 | 38 | |

| Business risk | Pearson Correlation | 0.237 | 0.180* | 0.018 | 1 | 0.432** | 0.563 |

| Sig. (2-tailed) | 0.012 | 0.017 | 0.816 | 0.000 | 0.000 | 0.000 | |

| N | 38 | 38 | 38 | 38 | 38 | 38 | |

| Operation complexity | Pearson Correlation | 0.567 | 0.675** | 0.164* | 0.432** | 1 | 0.431 |

| Sig. (2-tailed) | 0.002 | 0.000 | 0.030 | 0.000 | 0.000 | 0.000 | |

| N | 38 | 38 | 38 | 38 | 38 | 38 | |

| Bad reputation | Pearson Correlation | 0.234 | 0.557** | 0.120 | 0.563 | 0.431 | 1 |

| Sig. (2-tailed) | 0.032 | 0.000 | 0.020 | 0.000 | 0.000 | ||

| N | 38 | 38 | 38 | 38 | 38 | 38 | |

| **. Correlation is significant at the 0.01 level (2-tailed). | |||||||

| *. Correlation is significant at the 0.05 level (2-tailed). | |||||||

Pearson Correlation

VAT was significantly and positively correlated with all the operational factors: costs, increases in operational burdens, business risk, complexity and bad reputation.

At 0.01 and 0.05 significance level, the relationship between VAT and operational parameters was significant and positive. There is strong positive correlation of coefficient 0.725 and 0.567 between VAT and increase in operational costs and complexity of business operations respectively. However, there is weak positive correlation of 0.345; 0.237 and 0.234 between VAT and burdensome of operations, business risk and bad reputation respectively. Increases in bad reputation, business risks and burdensome of operations is weakly predicted by VAT. However, a change in VAT is strongly associated with increases in operational costs and complexity of business operations. VAT requires businesses to reengineer in order to incorporate the computerized system of the RA. This requires expertise and investment in machinery and personnel competencies. These factors increase complexity and operational costs of the SMEs.

The Link between VAT and SMES Growth

This study intended to determine the nature of the relationship between value added tax (VAT) and the growth dimensions: expansion, sales, and future prospects of the firm. It was sought to find the influence of VAT on the SMEs’ growth prospects particularly looking at the drive to expand, and actual increase in size of the firm.

Pearson Correlation

A two-tailed test on the significance of the relationship between VAT and the growth dimensions indicated that VAT is significantly and negatively correlated with growth, business future prospects and expansion drive. The correlation between VAT and expansion was relatively strong and negative with a coefficient of -0.427. The correlation between VAT and growth was negative but weak with correlation coefficient of -0.180. However, the relationship between VAT and future business prospects was significant, strong and negative. Increases in VAT decreases the expansion, growth and future prospects of SMEs. This suggests that increases in VAT are significantly likely to stimulate change in prospects and relatively significant for expansions. However, the growth of the firm is weakly associated with VAT with a Pearson correlation coefficient of -0.180. The correlation was significant at both two-tailed test significance level of 0.01 and 0.05.

In summary, VAT is negatively correlated to correlated to expansion, growth and future prospects. It is positively and strongly correlated with operational costs and complexity of the administration. However, it is weakly correlated with business risk and reputation. Prior studies seem also to concur with the findings of the current study that VAT is related to underlying operational issues such as operational costs and complexity of administration procedures. Kiertzmann & Hermkens (2011) and Talaue et al. (2018) state that VAT administration is cumbersome resulting in firms incurring costs in recruiting experts to manage such a complex system. Furthermore, Venter & Clercq (2017) and Valkenburg et al. (2016) suggest that VAT is highly premised on the viability of the firm to pay. VAT inadvertently affects the growth and future prospects of the firm. Its effect on business future prospects has stimulated unethical business practices among SMEs who tend to avert paying taxes to government.

The Effects of Vat on Profits and Sales Turnover

SME owners and managers were asked to assess VAT and sales, profits and revenue. Pearson correlational analysis was conducted on the data and the research outcomes are as shown in Table 3.

| Table 3 Relationship between VAT and SME Growth | |||||

| Correlations | |||||

| VAT | Expansion | Growth | Prospects | ||

| VAT | Pearson Correlation | -1 | -0.427** | -0.180* | -0.675** |

| Sig. (2-tailed) | 0.000 | 0.001 | 0.000 | ||

| N | 38 | 38 | 38 | 38 | |

| Expansion | Pearson Correlation | -0.427** | -1 | -0.018 | -0.164* |

| Sig. (2-tailed) | 0.000 | 0.816 | 0.030 | ||

| N | 174 | 174 | 174 | 174 | |

| Growth | Pearson Correlation | -0.180* | 0.018 | -1 | -0.432** |

| Sig. (2-tailed) | 0.017 | 0.816 | 0.000 | ||

| N | 174 | 174 | 174 | 174 | |

| Prospects | Pearson Correlation | -0.675** | -0.164* | -0.432** | -1 |

| Sig. (2-tailed) | 0.000 | 0.030 | 0.000 | ||

| N | 174 | 174 | 174 | 174 | |

| **. Correlation is significant at the 0.01 level (2-tailed). | |||||

| *. Correlation is significant at the 0.05 level (2-tailed). | |||||

Pearson Correlation

SPSS version 20 was used to calculate the Pearson correlation coefficient between value added tax (VAT) and sales, profits and revenue of SMEs. The results were tabulated as shown in Table 4.

| Table 4 Error! No text of specified style in document. Relationship between VAT and SALES and Profits |

|||||

| Correlations | |||||

| VAT | Sales | Profits | Revenue | ||

| VAT | Pearson Correlation | -1 | -0.543** | -0.758* | -0.345** |

| Sig. (2-tailed) | 0.001 | 0.003 | 0.000 | ||

| N | 38 | 38 | 38 | 38 | |

| Sales | Pearson Correlation | -0.543** | -1 | -0.004 | -0.164* |

| Sig. (2-tailed) | 0.000 | 0.032 | 0.025 | ||

| N | 38 | 38 | 38 | 38 | |

| Profits | Pearson Correlation | -0.758* | -0.004 | -1 | -0.123** |

| Sig. (2-tailed) | 0.003 | 0.032 | 0.000 | ||

| N | 38 | 38 | 38 | 38 | |

| Revenue | Pearson Correlation | -0.345** | -0.164* | -0.123** | -1 |

| Sig. (2-tailed) | 0.000 | 0.025 | 0.000 | ||

| N | 38 | 38 | 38 | 38 | |

| **. Correlation is significant at the 0.01 level (2-tailed). | |||||

| *. Correlation is significant at the 0.05 level (2-tailed). | |||||

Value added tax is significantly and negatively correlated with sales of the SMEs. As the VAT is increased the sales volumes of SMEs decreases. The Pearson correlation coefficient of -0.543 was recorded. The association between VAT and sales is strong suggesting that a small change in VAT imposed on SMEs will result in a significant change in the sales of the firm. Furthermore, VAT had a strong and negative correlation with coefficient of -0.758 with profits. In other words, increases in VAT are associated with a magnified decrease in SME profit margins. VAT does indeed affect the profits of the SMEs. Furthermore, VAT is weakly correlated (correlation coefficient of -0.345) with revenue. Increases in VAT results is slight reduction in revenue. Considering the strong correlation of 0.725 between VAT and increases in operational costs, this study shows that though the direct link between revenue and VAT is weak the increases in costs are stimulating greater decline in profits made by SMEs. This suggests that VAT is affecting the financial positions of SMEs such that the viability of these firms remains questionable.

In summary, VAT is associated with reduction of sales and profits. However, it is not directly connected with revenue base of the firm. Previous studies seem also to echo same sentiments that VAT is one of the operational costs for firms and thus directly affects the profit margins (Verma & Pullman, 2014; Venter & Clercq, 2017). It also affect the firm’s ability to produce (Vlachos & Bitzenis, 2016).

Summary

The study found that of the 50 questionnaires conveniently distributed among owners and managers of SMEs, only 38 usable questionnaires were returned representing a response rate of 76%. The data indicated that most respondents were young people below the age of 52 and concentrated within the 35 18 to 35 age group. The majority (74%) have at least an undergraduate degree and more than 80% with less experience of less than 15 years in the industry. Sixty-two percent of the respondents reported low VAT compliance though a large number agreed that they have tax clearance certificates and are registered taxpayers. This situation supports the claims made that the RA resort to raids and penalties in addition to voluntary submissions and approximations for VAT collection. This situation has resulted in negative effects on the operational and financial situation of SMEs. The VAT is significantly affecting the profits and operational costs of the SMEs suggesting that tax burden for the SMEs is high and beyond just the financial liability bar. The complexity in VAT calculations is one key issue negatively affecting the compliance status of SMEs.

Literature abounds on the description of the development and trends of VAT but highly marginalized on the implications of VAT for the success and development of the small and medium enterprises (SMEs) (Keen & Lockwood, 2017). Studies show that the VAT compliance among SMEs is very poor (Grigore & Gurau, 2017; Keen & Lockwood, 2017). The major drivers of low compliance among SMEs has been labelled against a number of factors that range from individual characteristics, organisational limitations and environmental influences. For instance, Abrie & Doussy (2016) consider the complexity of the administration of the tax as major driver to the observed behaviour among SMEs. Vlachos & Bitzenis (2016) an Venter & Clercq (2017) assert that it is was not the tax systems itself that had problems but the administration and procedures involved. However, other authors (Tee et al. 2016; Twenge et al. 2018) concur that the underlying socio-economic conditions such as poor economic performance, society characterised by high corruption index, political instability and poor regulatory environment are conducive elements for SMEs to evade VAT obligations. However, Jayshingpure et al. (2016); Keen & Lockwood (2017); and HM Revenue and Customs (2018) report that VAT generally is significantly related to the revenue, profit and growth prospects of the firm. However its influence of revenue remains debatable.

Conclusion

The study concludes that VAT compliance is affected mainly by characteristics of the individuals, features of the VAT system itself, and environmental factors such as political and socio-economic situation in Zimbabwe. The non-compliance among most SMEs is a measure to survive the harsh economic conditions. The high costs of implementing such a complex system is so high for SMEs that an attempt to comply predict the folding up of that small business. VAT specifically and directly affects the costs structure, production capacity and growth prospects of the SMEs. The current VAT system is negatively affecting the behaviour of SMEs stimulating some unethical business practices such as registering as tax payers but avoiding to pay the tax.

Recommendations

Against the study results, it is recommended that:

1. VAT authorities reconsider the current VAT system with the view to either imposing a VAT relief for SMEs or installing VAT systems within the SMEs so that such costs do not directly go to the SMEs;

2. Furthermore, government might need to consider implementing VAT awareness and training programs to help build the capacity for SMEs to administer the VAT.

3. SMEs might consider to reduce business risks and penalties for non-compliance through implementing VAT administrative measures that are cost effective and easy to link with the central tax system of ZIMRA.

References

- Mach, P. (2018). VAT rates and their impact on busines and tax revenue. European research studies journal, 21 (1), 144-152.

- Abrie & Doussy (2016). Factors that influence tax compliance of SMEs in South Africa. Acta Universitatis Danubius, 10(2). 94-111.

- Atawodi, O.W., & Ojeka, S.A. (2012). Factors that affect tax compliance among small and medium enterprises (SMEs) in north central Nigeria. International Journal of Business and Management, 7(12), 87-96.

- Clercq, B.D., & Venter, J.M.P. (2009). Factors influencing a prospective chartered accountant’s level of financial literacy: An exploratory study. Meditari Accountancy Research, 17(September), 47-60.

- Grigore, M.Z., & Gur?u, M. (2017). Optimizing Tax Costs relating to a New Business. Global Economic Observer, "Nicolae Titulescu" University of Bucharest. Institute for World Economy of the Romanian Academy, 5(1).

- Jayshingpure, A.G., Khona, A.C, Narkhede, B.E., & Nagare, M.R. (2016). A conceptual framework for vendor selection. IOSR Journal of Business and Management,18(6), 127-133.

- Keen, M., & Lockwood, B. (2007). The value added tax: Its. causes and consequences Journal of Development Economics, 92(2), 138-151.

- Kiertzmann,J., Hermkens,K., McCarthy,I.P., & Silvestre, B. (2011). Social Media? Get Serious! Understanding the Functional Building Blocks of Social Media. Business Horizons 54(3), 241-251

- MSMEs. (2013). Speical visit to SMEs. Harare: Ministry of Small to Medium Enterprises (MSMEs).

- Palacios, M., & Harischandra, K. (2008). The impact of taxes on economic behavior. Retrieved from https://www.fraserinstitute.org/sites/default/files/impact-and-cost-of-taxation-in-canada-2008.pdf

- Schoonjans, B., Cauwenberge, P., Reekmans, C., & Simeons, G. (2011). A survey of compliance costs of Flemish SMEs: Magnitude and determinants. Environment and Planning C: Government and Policy, 29(4), 605-621.

- Talaue, G.M., AlSaad, A., AlRushaidan, N. & AlHugail, A. (2018). The impact of social media on academic performance of selected college students. International Journal of Advanced Information Technology, 8.

- Valkenburg, P.M., Peter, J., & Walther, J.B. (2016). Media effects: Theory and research. Annual Review of Psychology, 67, 315-338.

- Verma, R., & Pullman, M.E. (1998). An analysis of the supplier selection process. Omega, 26(6), 739-750.

- Vlachos, V.A., & Bitzenis, A. (2016). Tax compliance of small enterprises in Greece. Int. J. Entrepreneurship and Small Business, 28 (2/3), 380-389.

- Yount, R. (2016). Population and sampling. In Research Fundamentals (4th ed.).