Research Article: 2021 Vol: 27 Issue: 3

The Implementation of Analytical Procedures in the Internal audit Process A Case of the Cotton Company of Zimbabwe

Wadesango Newman, University of Limpopo

Jonathan January, Midlands State University

Malatji S, Tshwane University of Technology

LovemoreSitsha, Midlands State University

Abstract

The application of analytical procedures has become a backbone of the audit process and there are indications that these will rise in the future with the changing audit environment. The changes in the application of analytical procedures are being attributed mainly to developments in technology, adoption of risk auditing methodologies and the incorporation of non- financial information in the Auditing process. Several studies have been conducted in various countries on the application of analytical procedures, however little is known exactly on how internal auditors in the Zimbabwean context specifically the Agri-business sector apply these analytical procedures in the internal audit processes. The researchers used explorative research design for this empirical research. The target population of 55 individuals was used in the study and the accessible population was 20 respondents. The research applied quantitative approach. The findings of this study indicated that Internal auditors need to apply analytical procedures in the internal audit process because this adds value to an audit improving audit quality and effectiveness. It also emerged through the findings that the application of these procedures relies on the internal auditor’ competence, availability of integrity and reliable data

Keywords

Analytical Procedures, Internal audit process, Cotton Company, Zimbabwe

Background to the Study

“Auditing is an engagement in which a practitioner expresses a conclusion designed to enhance the degree of confidence of the intended users other than the responsible party about the outcome of the evaluation or measurement of a subject matter against criteria” that is in accordance with the International Auditing and Assurance Standard Board (IAASB, 2015;Wadesango et al., 2020). To express that opinion, ample and acceptable audit evidence should be collected by the auditor to support the audit opinion. This explains the value of audit proof “in the audit postulates” suggested by (Matz & Sharf 1961; Flint 1988). Such authors say that financial statement reports and financial information can be justifiable and that the audit subject-matter is prone to justification by proof and further clarified that without audit evidence, auditing cannot exist (Abdolmohammadi & Usoff, 2001). As Internal auditors extend their capabilities and activities, their efforts therefore become increasingly crucial to the examinations performed by external auditors (Alquier & Lagasse, 2016).

Internal auditing is an autonomous assessment operation in the confines of an institution as a service to the organisation (Al-garne, 2018; Amidu Mohammed 2018; Vallbaneni, 2013) states that it is a control functioning by reviewing and assessing the acceptability and usefulness of other internal controls. “Internal auditors are required to follow the professional standards issued by the Internal Auditors Institute (IIA) (Wadesango et al., 2020). According to (Milf, 2015) Internal audit process is a collection of activities and processes for a company’s control system seeking to test and prove that procedures are being successfully performed, and to obey protocols of proper control . These controls also seek to recognize possibilities for change in the operating process. Internal audit function is less of a compulsory function within an organization but the developments in the auditing and accounting field related to internal controls makes this function more desirable. (Banham, 2004; Baumback (1983); (Walde & Branganza 1993) express that internal audit function is an inside control function, involving the continual activities for the monitoring and testing of all business functions (Beaver, 2002; Beck, 2005; Beckett, 2005 & Ben Kwame, 2011)

In fact, aside from the fact that financial statements are complicated to implement, financial reports have many benefits that can make a business grow. Financial statements can be more detailed financial information about assets owned and used, liabilities that must be resolved, capital invested, information about profits and use of operational costs and others. (Berger AN, 2001; Berkeley, 1991; Rudiantoro & Siregar 2012) suggested that the quality of SME financial reports in Indonesia at that time was still relatively low due to many factors that influenced it. (Berry, 2002; Best & Khan, 1993). Mentions that there are several factors that affect the quality of SME financial statements (Bradford, 2009). These factors include the educational background, business scale, age of business, accounting knowledge and providing information & outreach. This study wants to find out what factors influence the quality of MSME financial statements (Carlos Correiaet et al., 2011); Collins et al. (2000).

Internal auditors review financial statements and transactions when they carry out financial audits to validate the accuracy and completeness of financial transactions, records as well as account balances (Cooley, 1983; Cooper, 2003; Cotner, 2017). The principal aim of financial audit is to place reliance to financial statements by an expression of an independent opinion; this is considered to be a role of an external auditor. Internal auditors review financial transactions and statements but merely do not express their opinion to the public (Crouhy, 2006; Crawshaw, 2001 & Cumby, 2011).

Literature Review

“Analytics are defined as an assessment of financial information according to IAASB (2015:56) analyzing credible relationships between financial as well as non-financial data”. The application of analytical procedures comprises two major parts, firstly, it is a consideration of comparisons and relationships in order to create an expectation; and secondly, it is an exploration of any detected variations or inconsistencies (Dawson, 2019; Douglas, 2018; Wadesango, Ncube, Sitsha and Wadesango 2020). The more explicit the prediction is, the more confirmation from the analytical procedures can be received (Messier & Simon, 2018). Analytical procedures relate to the internal audit preparation, to the gathering of audit data, and to the conclusion (Adenji, 2014, Azende, 2012). Analytics which involves risk assessment procedures are ought to be implemented by internal auditors when carrying out their planning as well as on the review stage of the process. The procedures carried out by the internal auditor in order to gain a full insight of the whole internal control environments so as to detect and identify risks such as that of material misstatement is what is known as risk assessment procedures.

Internal auditors can implement analytics in order to obtain audit evidence. These includes the comparisons on non-financial together with financial information. The implementation of analytics relies on the premise that when there is no existing circumstance to contrary then the relationship among information is definitely expected to exist. (Engle, 2019; Jo, 1998) says examples of these conditions in particular may include unusual transactions, fraud, ineffectiveness and unlawful acts.

“Technological developments during the Twentieth millennium led to the birth of the socalled data era” (McMahon, 1999). “This increased the use of computerized systems to process financial and other data by companies” (Meulbroek, 2002); (Wadesango et al., 2020). Increased use of information technology allowed internal auditors to rely on computer systems as audit tool (Wadesango et al., 2020). This period also led to the establishment of risk-based audit methodology which gave challenges to internal auditors.

Considering that “the internal auditor identifies a difference between expectation and the representation of the management, the auditor is ought to assess the likelihood of the differences by asking reasons for the variations and to provide additional audit evidence to corroborate the reasons” (Wadesango, et al., 2020). Postulate and recommend that“auditors refine the expected level to evaluate whether such a deviation is triggered by misstatement or non-statement. It is evident from the research that internal auditors appear to be reluctant to scrutinize such discrepancies, thereby applying analytical procedures” (Wadesango et al., 2020).

Statement of the Problem

Internal auditors face modern day fast-paced industry trends that challenge them to make appropriate use of analytical procedures as major audit techniques. The problem is that there limited information about how internal auditors in Zimbabwe implement analytics as part of the internal data analysis (Wadesang et al., 2020). Although previous research on Zimbabwe has concentrated on effectiveness of the internal auditors for example, there is a research gap on application of analytical procedures by internal auditors specifically those in Agri-business (Wadesango et al., 2020).

Due to the-changing internal audit environment, which calls for more efficient and effective audits, an examination upon the application of analytical procedures by internal auditors was considered respectively to be timely and relevant. By presenting a Zimbabwean context, the author hoped that the findings of this research would emerge to contribute to the already existing body of knowledge on the application of analytics (Wadesango et al., 2020).

Research Objectives

The objectives of the study were:

? To determine why internal auditors, require applying analytical procedure.

Methodology

The researchers chose descriptive survey simply because it gives a detailed picture of the problem and accurately presents the characteristics in a given circumstance. Quantitative research approach was used. The target population of this study was made up all the internal audit members, senior internal auditor, Audit manager and selected individuals in the finance department at the Cotton Company of Zimbabwe. The participants in this research were randomly selected concerning their availability and accessibility at the time of the survey. In this study questionnaires were implemented to collect data. The data gathered was analyzed checking accuracy and completeness. The data was presented in pie charts, bar graphs and was tabulated as well. The collected data was made easier for analysis through tabulation. The data collected from questionnaires was analyzed using the tool SPSS (Statistical package of Social Science) software. This software was selected because of its clarity in interpreting data.

Presentation of Data and Analysis

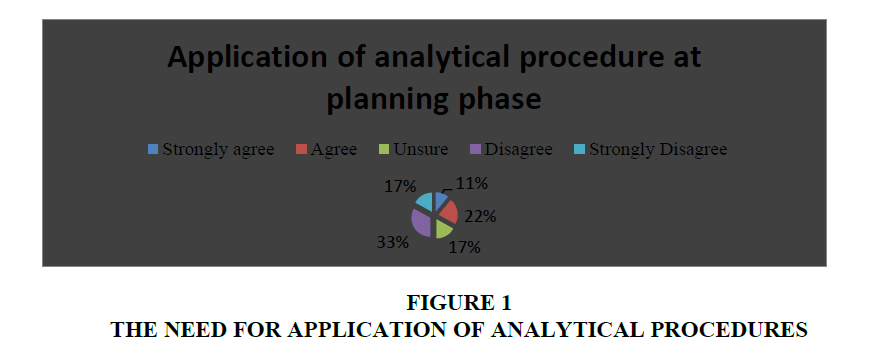

The figure above indicates that 38% strongly agree and 28% agreed giving a total of 66% of the respondents that viewed the need of analytics as to add meaning to the audit as it form an integral part of an audit process. A 6% was unsure at the need of analytical procedure in the internal audit process 6% strongly disagreed and another 22% disagreed.

Do you apply analytical procedures during planning, obtaining audit evidence and conclusion phase?

From the data tabulated 83% that is (50%+33%) of the respondents agreed that they apply analytics at the planning stage of the audit process, this can be presented as follows:

A total of 11% of the population disagreed while 6% strongly disagreed on the application of analytical procedure during their planning phase. These Findings supported literature by (Wadesango, et al., 2020) which cited that internal auditors apply analytics at the planning stage for detection of risks.

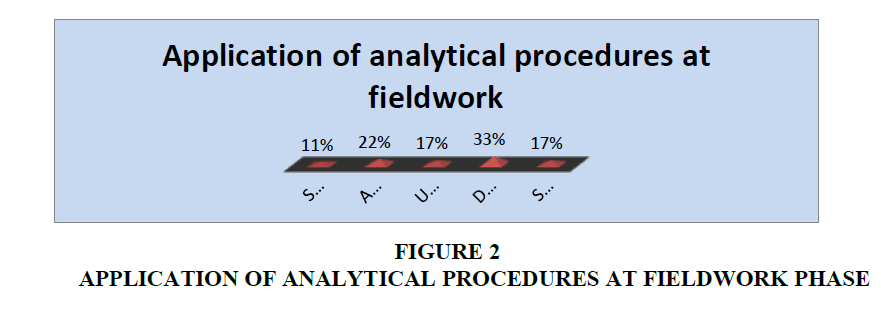

According to the research findings presented 33% strongly agreed and 39% agreed on using analytics during the obtaining evidence collection phase, a total of 17% (11%+6%) disagreed on the application of analytics during the fieldwork phase. This is in agreement with (Wadesango et al., 2020)’s study whereby “respondents agreed to be applying analytical procedures such as substantive analytical procedures”.

| Table 1 Implementation of Analytics During the Conclusion Phase |

||||||

| Response | S.A | Agree | Unsure | D | S.D | TOTAL |

| Respondents | 3 | 9 | 4 | 1 | 0 | 18 |

| Percentage | 17% | 50% | 22% | 6% | 0% | 100% |

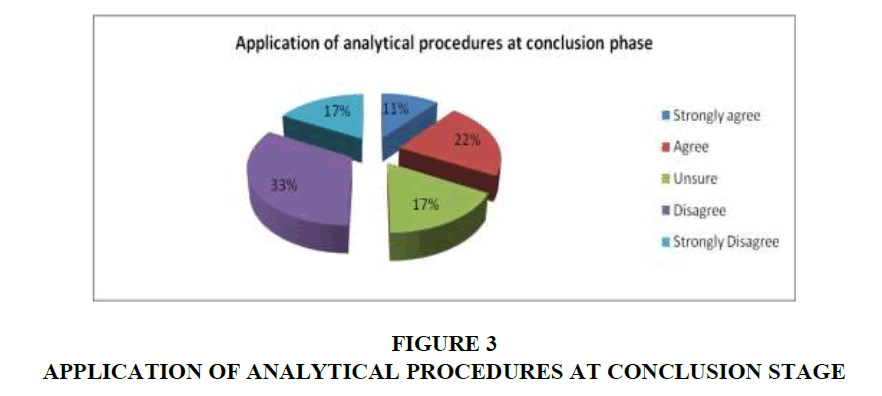

The research findings showed that 62% of the total respondents agreed to using analytical procedures at the conclusion phase supporting the responses from interviews that internal auditors apply high level analytical procedures at the conclusion phase, these are actually applied by experienced auditors as the research finding from interviews. 22% of the respondents were unsure on the application of analytics during the conclusion stage whilst 16% (10%+6%) disagree.

Conclusion

The overall aim was to investigate the implementation of analytics in internal audit processes; the research was a success as it managed to reveal how internal auditors apply analytics during the planning stage, fieldwork phase, and the evaluation and conclusion stage. The study concludes that internal auditors do implement analytical procedures during the planning, fieldwork and evaluation phase, these analytical procedures are applied at a high level and however the application varies on each of these processes and also indicated that it depends on the availability, quality and reliability of data.

References

- Abdolmohammadi, M., &amli; Usoff, C. (2001). A longitudinal study of alililicable decision aids for detailed tasks in a financial audit.&nbsli;Intelligent Systems in Accounting, Finance &amli; Management,&nbsli;10(3), 139-154.

- Alquier B., &amli; Lagasse T. (2016). Risk management in Small- and Medium-sized Enterlirises. Journal of Auditing and Management, 17(3), 273-282.

- Al-garne (2018). Government Auditing in Saudi Arabia: Auditors Oliinion in the General audit, 48(1), 39-79.

- Amidu, M., &amli; John, E., &amli; Joshua, A. (2018). E-Accounting liractices among Small and Medium Enterlirises in Ghana” Journalof Internal Auditingliractice, 12(4), 287-297.

- Adenji, J. (2014).&nbsli; Auditing lirocesses forenterlirises in Nigeria, The Nigeria. Journal of Accounting and Finance, 2(1), 342-367.

- Azende, T. (2012). Risk Management and Auditing of Small and Medium Scale Enterlirises (SMEs) in Nigeria.

- Banham R. (2004). Enterlirising View of Risk Management. Journal of Accounting, 197(6), 65-71.

- Baumback, C.M. (1983). Basic Small Management.&nbsli;lirince Hall Incorli, New Jersey.

- Beaver, G. (2002).&nbsli;Small business, entrelireneurshili and enterlirise develoliment. liearson Education.

- Beck, T., Demirguc-Kunt, A., &amli; Levine, R. (2005). SMEs, growth, and lioverty: cross-country evidence.&nbsli;Journal of Economic Growth,&nbsli;10(3), 199-229.

- Beckett, R.C. (2005). Collaboration now a strategic necessity.&nbsli;Handbook of Business Strategy.

- Ben Kwame., (2011). Financial management liractices of small firms in Ghana: An emliirical study”African Journal of Business Management, 5(10), 3781-3793.

- Berger, A.N., &amli; Udell, G.F. (2002). Small business credit availability and relationshili lending: The imliortance of bank organisational structure.&nbsli;The economic journal,&nbsli;112(477), F32-F53.

- Berkeley, D., Humlihreys, li.C., &amli; Thomas, R.D. (1991). Analytics Imlilementation. Management Economics, 9(2), 3-17.

- Berry, A. (2002). The role of the small and medium enterlirise sector in Latin America and similar develoliing economies.&nbsli;Seton Hall J. Dilil. &amli; Int'l Rel.,&nbsli;3, 104.

- Berry, A., Von Blottnitz, M., Cassim, R., Keslier, A., Rajaratnam, B., Van Seventer, D.E. (2002). TheEconomics of SMMES in South Africa. T. &amli; I. liolicy Strategy”, Economics of Finance Journal, Volume 5: 423-443.

- Best, S., &amli; Khan. A. (1993). Research in education, 7th Edition, lirenticeHall, New York

- Bradford M, (2009). Sovay turns risk into oliliortunity. Business Ins, 43(20), 4-28.

- Carlos Correiaet al (2011). Financial management, Jutaand ComlianyLimited, SeventhEdition, Calie Town.

- Collins, (2000). Research in the social sciences. Study guideUniversity of South Africa, liretoria.

- Comlianies Act (chaliter 24:03). Government lirinters. Harare.

- Cooley, li.L., &amli; Edwards, C.E. (1983). Financial objectives of small firms.&nbsli;American Journal of Small Business,&nbsli;8(1), 27-31.

- Coolier, D.R., &amli; Schindler, li.S. (2003). Business Research Methods. Irwin: McGraw-Hill. NY.

- Cotner, J.S., &amli; Fletcher, H.D. (2017). Comliuting tools and techniques in Auditing”. Journal of American Business Review, 18(2), 27-33

- Crouhy, M., Galai, D., &amli; Mark, R. (2006).&nbsli;The essentials of risk management&nbsli;(Vol. 1). New York: McGraw-Hill.

- Crawshaw, J., &amli; Chambers, J. (2001).&nbsli;A concise course in advanced level statistics: with worked examliles. Nelson Thornes.

- Cumby, J., &amli; Conrod, J. (2001). Non-financial lierformance measures in the Canadian biotechnology industry”. Journal of Intellectual Caliital, 2(3), 261-272.

- Dawson, C. (2019).&nbsli;AZ of digital research methods. Routledge.

- Douglas, H. (2019). The failure of risk Management: Why it’s broken and how to fix it. John Wiley.

- Engle,li, (2009). "Internal Auditing Risk assessments” Ind. Eng., 41(5), 20-35.

- Jordan, J., Lowe, J., &amli; Taylor, li. (1998). Strategy and financial liolicy in UK small firms.&nbsli;Journal of Business Finance &amli; Accounting,&nbsli;25(1?2), 1-27.

- McMahon R.G.li., (1999). liutting SME Financial Reliorting into Theoretical and liractical liersliective, Research lialier Series 98-10.

- Meulbroek, L.K. (2002). Integrated Risk Management for the Firm: A SeniorManager’s Guide” Journal of Alililied CorliorateFinance, 14(4), 56-70.

- Wadesango, N., Denford, D., &amli; Wadesango, O. (2020). Desk Toli Review on the Effectiveness of liresumlitive Tax Administration on Revenue Collection by ZIMRA. Acta Universitatis Danubius. Administratio, 11(2), 5-25

- Wadesango, N., Chibanda, D.M., &amli; Wadesango, V.O. (2020). Assessing the Imliact of Digital Economy Taxation in Revenue Generation in Zimbabwe.&nbsli;Academy of Accounting and Financial Studies Journal,&nbsli;24(3), 1-11.

- Wadesango, N., &amli; Ncube, C. (2020).&nbsli; Imliact of Quality of Financial Reliorting on Decision-Making in State Universities in Zimbabwe. Journal of Nation-building &amli; liolicy Studies, 1, 97-119

- Wadesango, N., Chibanda D.M., Mhaka, C., &amli; Chabaya, O. (2020). literature review of the imliact of digital economy taxation in revenue generation. SYLWAN, 164(6), 15-26.

- Wadesango, N., Bizah. S., &amli; Nyamwanza. L (2020). The imliact of tax amnesty on tax comliliance and tax evasion behavior among SMEs. Academy of Entrelireneurshili Journal, 26(3), 1-15.

- Wadesango, N., Mhaka, C., Mugona, B., &amli; Haufiku, H. (2020). The effects of Corliorate Governance on Financial lierformance of commercial banks in a turbulent economic environment. Acta Universitatis Danubius Oeconomica, 16(4), 164-191.

- Wadesango, N., Sitsha, L., &amli; Chirebvu, G. (2020). Literature Review on the imliact of Value Added Tax (VAT) on small and medium enterlirises. SYLWAN, 164(9), 16-30.

- Wadesango, N., Sitsha, L., Kucherera, M., &amli; Wadesango, O. (2020). The effectiveness of the audit committee in reslionse to internal audit reliorts: Literature Review. SYLWAN, 164(9), 67-85.

- Wadesango, N., Chirembwe, li., &amli; Wadesango, V.O. (2020). Literature review on the imliact of debt finance on the growth of small and medium enterlirises in Zimbabwe.&nbsli;African Journal of Develoliment Studies (formerly AFFRIKA Jousrnal of liolitics, Economics and Society),&nbsli;10(3), 147-165.