Research Article: 2023 Vol: 27 Issue: 5

The importance of Auditors and Earning Quality; A Malaysian Perspective

Asaad Munshid Mohammed, University of Babylon

Citation Information: Mohammed, A.M. (2023). The importance of auditors and earning quality; a malaysian perspective. Academy of Accounting and Financial Studies Journal, 27(5), 1-19.

Abstract

The Earning quality is to be consider as the essential pillar of capital market as effective resource distribution, which is determined by such information. In the annual reports, the actual firm’s performance is neither revealed nor reflected in the earnings report, then huge losses are faced by economy, investors, different companies and individual employee. Similarly, the suggestions of claim that in annual reports there disclosed Earning quality in which stakeholders are very much concerned as their decision making is highly influence on this information, specifically Information on contracts and investments. Similar to this research, which focused on the Malaysian business market, data from Malaysia's top 100 firms were gathered. According to the findings, auditors are crucial to businesses and immediately contribute to high-quality earnings.

Keywords

Auditors, Earning Quality, Malaysian Perspective, Economy.

Introduction

There will probably be unforeseen wealth transfers as a result of awareness of subpar financial reporting. According to Cohen et al. (2004), the main responsibility of the corporate governance system is to keep a careful eye on a company's financial statements and the ability to produce superior earnings. But past studies (Beasley et al., 2000; Beasley, 1996; Carcello & Neal, 2000; Patricia et al., 2000; Klein, 2002; Krishnan, 2001) have demonstrated a substantial relationship between poor financial reporting and different corporate governance practises. Manipulation, earnings management, weaknesses in internal control systems, and financial statement frauds are some of these hot topics. The four main stakeholders who monitor a company's corporate governance are Management, the governing board, the audit committee, internal auditors, and external auditors are all involved in the audit process. The function of internal auditors in this context is still an empirical topic, despite the fact that many solid studies have been undertaken to study the issues linked to external auditors, audit/board committees, and the effect of management on earning quality.

The conflict of interest between a company's owners (principals) and management (agents) is addressed by agency theory. On the other hand, as they have a sizable investment in the firm and wish to maximize their wealth, shareholders want their shares to have a high dividend and a increased worth. These two goals are at odds with one another, which leads to conflict inside the organisation. Insufficient communication (also known as information asymmetry) between shareholders and managers results in an agency problem when managers abuse their power by making decisions that are in their own best interests rather than those of all stakeholders, according to some authors (Davis et al., 1997; Hamid et al., 2015), while others (Jensen & Mackling, 1976) disagree.

Many empirical studies (Abbott et al., 2004; Beasley, 1996; Farber, 2005; Klein, 2002; Krishnan, 2005; Vafeas, 2005) demonstrate that the effectiveness of the audit committee, financial knowledge, and board structure, which make up the mechanism of corporate governance, are crucial to the Earnings Quality System. These factors together form the mechanism of corporate governance. The internal audit function (IAF) and external audit, on the other hand, are little-recognized methods of internal monitoring.

Literature Review

Previous empirical research that was insufficient and restricted to the US has examined the value of internal audit in connection to earnings management or the accuracy of financial reporting. (Gramling et al., 2004) made the case that internal audit has an impact on business performance, the calibre of corporate governance, and the calibre of financial reporting based on prior experimental research and surveys. However, there are few studies in the literature that address the relationship between internal audit and quality financial reporting (Davidson et al., 2005; Prawitt et al., 2009). Former discovered that earning quality is what limits profits management in his analysis of 218 publicly traded US companies from 2000 to 2005. Two restrictions apply to their study, though. The majority of the information is accessible in the US context, underdeveloped nations are not taken into account, and the quality of the factors associated to audit may be restricted, therefore the study's findings cannot be generalised. Second, several aspects of the internal audit environment and activities such as coordination, grading, fieldwork quality assurance, and follow up are ignored by the internal audit measurement.

As far as the Malaysian economy is concerned, there are a number of reasons why it was chosen for this study. First, given that the Malaysian economy differs significantly from the US economy in terms of capital market maturity and economic growth, the relevance of internal audit and external audit has recently come to the attention of Malaysian policy makers and regulators. The East Asian Financial Crisis is a major focus of investigation for Malaysian publicly traded companies. It was 2000, The Malaysian Code of Corporate Governance (MCCG) specifies requirements for all Malaysian businesses, including the establishment of audit controls and the maintenance of robust internal control systems. Internal control review and declaration in the absence of an audit would be presumed to be appropriate, and control boards would explain this. In order to assure audit compliance, the Securities Commission of Malaysia established a task force and formulated rules and policies for the industry in 2001. The MCCG was altered twice, first in 2007 and then again in 2012, as a result of an increase in corporate irregularities (such as those at Nation Com Holding, Takaful Bhd, Megan Media Holdings, Tran con Group Bhd, and Southern Bank Bhd).

Many studies on the Malaysian economy have used survey designs (semi-structured interviews) to examine the issue of earning quality. For example, one study (Ali et al., 2007; Cooper et al., 1996; Ernst & Young, 2004; Hanim Fadzil et al., 2005; Leung et al., 2006; Math, Australia, and Malaysia. Ali et al. (2007) investigated the internal audit position in local government and state agencies in terms of top management support, presence, and staffing skills and discovered that only a small number of government agencies had internal and external auditors. They also show that many municipal and state agencies lack appropriate audit capabilities and neither receive enough assistance from senior management nor have trained and competent employees.

Investigating whether internal and external auditors of publicly traded companies comply with international standards of internal audit and if this compliance results in stronger internal control systems is done by (Hanim Fadzil et al., 2005). They discovered that internal audit quality relative to objectivity, internal audit management, and professional competence had a substantial impact on monitoring components of internal control. However, it should be emphasized that the conclusions of their research depend on the opinions of the business's Audit Committee, the head of the internal audit department, and the Chief Audit Executive, and do not necessarily represent how the firm operates in practice. The authors of the study (Mohamed et al., 2012) looked at two characteristics of internal audit quality, internal audit contribution and internal audit competency to financial statements audit and their relation with audit fees. The formation of external audit provides formal monitoring system to recover the financial reporting system quality which will subsequently mitigate agency problem and information irregularity as well in the organization (Ataullah et al., 2014; Fagbemi & Uadiale, 2011). They found that internal audit tenure inside the organization and past experiences of internal audit staff in accounting and auditing certifications are positively related with lower fees of audit, therefore it gives support to the relation of audit fees and internal audit quality.

Internal audit function the variable warrant for the research, prior studies suggest that Independent auditor is exceed probity or more efficient in auditor position in between financial reporting process, which ultimately effects on the reduction of the financial reporting problem (Abbott et al., 2004; Committee, 1999; Dechow et al., 1995; McMullen, 1996). Moreover, the expertise in the financial reporting might be enhanced if they have sufficient knowledge and expertise. Therefore, prior research concluded that (Committee, 1999), regarding the audit committee size, that more will be the audit committees that might enhance the efficiency of financial reporting. On the diligent dimension extensive research on that point suggested that audit committee should be diligent in the line of performing responsibilities (Abbott et al., 2004; Committee, 1999; Kalbers & Fogarty, 1993).

On the external auditor’s point of view first the large firms of audit, large audit firms are most likely to performing well because their reputation always on the stake and however they invest in expertise and guidance, and lawsuit process (Ashbaugh-Skaife et al., 2007). Second variable for testing is industry leader, industry leader auditors have the supreme concern resemblance to the lower category auditors (DeAngelo, 1981). Prior research provides suggestion that the specialized client have the enhance quality of financial reporting (Balsam et al., 2003). The third measure of audit tenure provides the evidence that long-lasting relation with clients resulting into the higher quality of Earning quality i-e, Myers et al. (2003) proven that advanced quality of financial reporting the tenure of log terms.

As a result, the current research is an extensive investigation to close the gaps by include emerging nations, in this case Malaysia. This study looked at how internal and external audit characteristics affected the Earning quality process.

Independence with Earning Quality

While there is a positive correlation between an independent audit committee and the accuracy of financial reporting (Sharma & Iselin, 2012), there is none between the quality of earnings and an independent audit committee (Agrawal & Chadha, 2005; Yang & Krishnan, 2005). Researches on the relation of audit fee and audit committee have emphasized audit committee (Hay, 2013). The current study is being performed on the relationship between independent audit committee and earning quality and assumes that there exists a positive link between them based on literature mixed results and the status of audit committee. This assumption's broad justification is that, in contrast to other disclosures, IC reporting is uncontrolled. This brings irregularities about opportunistic behavior of managers (Aboody & Lev, 2000), adverse selection, opportunities for enhanced moral hazards and information irregularity in IC information (Aboody & Lev, 2000; Holland, 2003). Insofar as managers are successfully under the control of independent directors, it is expected that independent audit committees will positively affect the standard of financial reporting. In light of this, it is possible to speculate that the results of this study will likely be more applicable to decision-makers and consistent with international attempts to improve the performance of audit committees (Committee, 1999; Smith, 2003). Studies done in the past (Abbott et al., 2003; Carmelo et al., 2002; Sharma, 2004) have mostly concentrated on the correlation between audit fees and audit committee features (such as meeting frequency, competence, and distinctiveness of the audit committee members). However, according to some academics, audit committees ought to anticipate audits of greater calibre (Abbott et al., 2003).

H1: The relationship between the independence of the audit committee and how that affects the accuracy of financial reportin.

Expertise with Earning Quality

Increasing shareholder value requires strong governance (De Fond & Francis, 2005). Since they are ultimately in charge of true financial reporting, audit committee members must be proficient in finance (Jaime & Michael, 2012). Consumers may benefit significantly from the assistance of financial experts as they can immediately spot any fraud or manipulation due to their knowledge and experience. The majority of studies have emphasized the benefits of audit committee members' financial and accounting skills and high-quality salaries (Krishnan & Vivanathan, 2008). Members of the audit committee with high levels of experience ensure fewer false reports due to effective monitoring (Raghunandan & Rama, 2007). When directors are independent and have significant accounting and financial reporting expertise, financial reporting is more reliable and of higher quality (De Zoort, 1998).

H2: The relationship between the effectiveness and quantity of the audit committee's features and the impact they have on financial reporting quality.

Diligence with Earning Quality

The following hypothesis is, therefore, tested diligence of Audit committee. Audit committees to be assiduous in order to carry their responsibilities for best practices governance and many studies are also conducted (Abbott et al., 2004). Generally, for audit committee diligence studies used proxy commonly, which is the annually held meetings of audit committee. According to the past study, the frequency of financial reporting problems can be condensed if there will be audit committee meetings happen often. For instance, the audit committee may inform the external auditor that regular meetings and communications with the auditor necessitate increased focus on a particular auditing topic on the auditor's part (Scarbrough et al., 1998). Lower external audit costs were anticipated under the risk-based approach since it was believed that an attentive audit committee might reduce financial reporting issues. OverallIf the audit committee is formed in a trustworthy manner, as the Blue-Ribbon committee (1999), the recommendations can be used to increase the audit committee's effectiveness in the oversight functions. Due to decreasing external audit fees, there will be fewer practical tests.

H3: The relation of Audit Committee Features (diligence) and its effect on the Earning quality.

External auditor (Large Audit Firms) with Earning Quality

Additionally, they claim that big businesses are more careful. Due to the possibility of legal problems, large corporations prefer to audit firms with lower accruals (Becker et al., 1998; Francis & Krishnan, 1999). Two aspects that affect an audit company's value are its age and size. Cadburybaker et al. (2008) assert that business value is positively correlated with company size. On the other side, business age has a detrimental effect on the firm value, according to (Loderer & Waelchli, 2009). The current study will examine the link between the attributes of external audit firms in terms of audit duration, audit firm size, and audit opinion and company value as determined by the ratio of price earnings, the ratio of price book value, and Tobin's Q.

H4: The effect of big audit companies' (external auditors') activities on the calibre of financial reporting.

External Auditor (Industry Leader) with Earning Quality

The auditor with the largest percentage of audit fees collected in a certain industry—that is, the amount of an auditor's fees in a particular industry divided by the total audit fees in that industry nationwide—is the sector leader. In this case, 520 enterprises were inspected by business executives in 173 countries in 2003. Leading authorities in the industry examined 173 statements, including 170 from the "Big 4" and three from non-Big 4 auditors (Grant Thornton or BDO Seidman).

H5: There is a connection between the effectiveness of the external auditor (a leader in the industry) and the caliber of financial reporting.

The aspects of internal and external audits in regard to the accuracy of financial reporting were not effectively compared in any of the aforementioned studies. Without a doubt, these adjustments show Malaysia's confidence in and significant interest in audit elements for enhancing and monitoring the Earning quality. The historical fear literature of Malaysia still has internal audit qualities and external audit traits.

Methods and Results

Descriptive Analysis

For each dependent variable and independent variable, descriptive statistics are computed. The mean and standard deviation of each variable for the whole data set make up descriptive variables. The quantity of observations, or N, is additionally determined in order to search for any missing data. The greatest and lowest values for each variable over the whole data set are also computed in order to assess the data range. The following table provides statistical information on the reliant element, which consists of the log natural of the absolute values of DAC (discretionary accruals), the initial values of DAC, and all other variables in the regression model: Table 1.

| Table 1 Descriptive Statistics |

|||||

|---|---|---|---|---|---|

| N | Mean | Standard Deviation | Maximum | Minimum | |

| DAC | 100 | -363.442 | 1667.456 | 9868.975 | -10548.1 |

| Absolute DAC | 100 | 589.7618 | 1600.782 | 10548.14 | 3.4931 |

| Ln Absolute DAC | 100 | 5.0007 | 1.5824 | 9.2637 | 1.2508 |

| ACI | 99 | 0.8114 | 0.1779 | 1 | 0.34 |

| ACE | 98 | 0.4627 | 0.193 | 0.8 | 0 |

| ACD | 99 | 5.798 | 2.5434 | 18 | 2 |

| EALAF | 100 | 0.92 | 0.2727 | 1 | 0 |

| EAIL | 100 | 0.28 | 0.4513 | 1 | 0 |

The descriptive statistics for the independent variables audit committee independence (ACI), audit committee expertise (ACE), audit committee diligence (ACD), external auditor large audit firm (EALAF), and external audit industry leader (EAIL) are shown in T for the dependent variable ln of absolute values of discretionary accruals (Ln Absolute DAC), Absolute DAC, original values of DAC, and all inclusive values.. The dependent variable, which has a mean value of 5.0007, a standard deviation of 1.5824, and a range of 8.019 (highest value to lowest value), includes data for all 100 firms. Data for ACE are available for 98 organisations, while data for ACI and ACD are unavailable for one company in both variables. ACI, ACE, ACD, EALAF, and EAIL have respective mean values of 0.8114, 0.4627, 5.7980, 0.9200, and 0.28.

Graphic Analysis

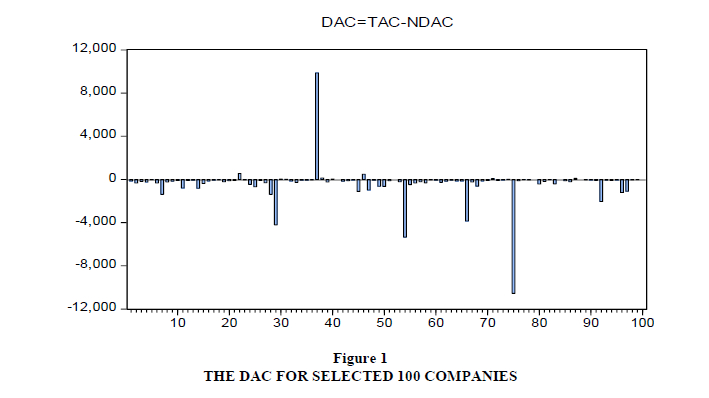

This section provides some graphic insights from the collected information of selected companies to examine some of their characteristics graphically Figure 1.

The above graph shows the DAC for selected 100 companies. It is easy to understand the pattern of discretionary accruals of the selected companies and to have a comparison from the figure is very easy and useful. The DAC are calculated by subtracting the non-discretionary accruals from total accruals. The highest DAC is for the CIMB group with a value of 9868.975 while the Petronas Chemicals has the lowest value of DAC equal to -10548.10. In the same fashion, one can make comparison of different companies for any specific variable.

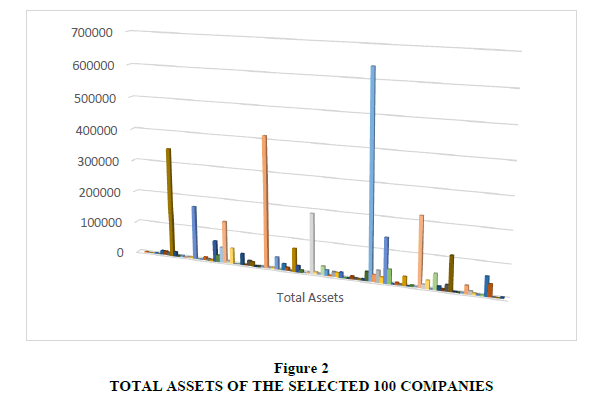

Figure 2 above demonstrates the value of total assets of selected one hundred companies. It can be seen from above graph that highest value of total assets is of Malayan Banking while lowest asset holding company in the sample is Berjaya Auto Berhad.

4 Inferential Statistics

The correlation and regression analysis of the data obtained from specific companies are discussed in this section. Correlation analysis shows the reciprocal linear relationship between variables, whereas regression analysis examines a variable's dependency on one or more explanatory factors.

Correlation Analysis

Correlation analysis examines the reciprocal linear relationship between variables. The simple coefficient of correlation is used to examine linear correlations between no more than two variables, whereas multiple correlation coefficients are used to examine relationships between more than two variables. The correlation coefficient's range runs from -1 to +1. Zero indicates that there is no connection between the variables, whereas minus 1 and plus 1 show, respectively, perfectly negative and positively linear correlations. The coefficient of correlation for various variables is shown in the Table 2 below.

Table 2 displays the correlation matrix, also known as the coefficient of correlation, between the variables ACI, ACE, ACD, EALAF, and EAIL and the log natural of the absolute values of the DAC, also known as Earning quality (EQ). While there is a negative correlation between EQ and EALAF, there is a positive correlation between EQ and ACI, ACE, ACD, and EAIL. For further clarity, the table also shows the coefficient of association for each of these factors.

| Table 2 Correlation Matrix |

||||||

|---|---|---|---|---|---|---|

| LN_DAC_AB | ACI | ACE | ACD | EALAF | EAIL | |

| LN_DAC_AB | 1.000000 | 0.037518 | 0.171121 | 0.161318 | -0.045044 | 0.177612 |

| ACI | 0.037518 | 1.000000 | -0.085417 | -0.074910 | -0.174527 | -0.074439 |

| ACE | 0.171121 | -0.085417 | 1.000000 | 0.019517 | 0.019466 | -0.076014 |

| ACD | 0.161318 | -0.074910 | 0.019517 | 1.000000 | 0.151181 | 0.070898 |

| EALAF | -0.045044 | -0.174527 | 0.019466 | 0.151181 | 1.000000 | 0.186201 |

| EAIL | 0.177612 | -0.074439 | -0.076014 | 0.070898 | 0.186201 | 1.000000 |

Regression Analysis

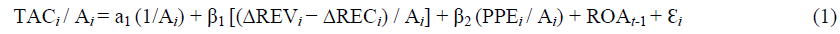

Regression analysis focuses on assessing a variable's dependence on one or more explanatory factors, and uses the known independent values of the independent variables to estimate the average value of the dependent variable. Regression models come in a variety of formats. Since the traditional linear regression model was adequate for the current investigation, we employed it. two calculated regression models are used to create the estimate. The second regression model looks at the impact of numerous explanatory factors on EQ, whereas the first model, known as the supplemental regression, concentrates on the estimation of NDAC. By keeping a track of the absolute value of discretionary accruals, earning quality may be assessed. When calculating discretionary accruals, the proxy is determined using the performance adjusted modified Jones model. Because Kothari, Leone, and Wesley (2005) asserted that the model specification below is superior for predicting non-discretionary accruals, they estimated the earning quality following regression model. (NDAC):

Where;

| Dependent Variable: TAC_A | ||||

| Method: Least Squares | ||||

| Sample: 1 100 | ||||

| Included observations: 100 | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | 0.033914 | 0.042916 | 0.870141 | 0.4919 |

| 1/A | -129.2372 | 64.80928 | -1.984124 | 0.059 |

| (?REV- ?REC)/A | -2.996668 | 0.117593 | -13.88571 | 0 |

| PPE/A | 0.081234 | 0.033085 | 2.363967 | 0.0306 |

| ROAt-1 | -0.022929 | 0.038342 | -0.858598 | 0.3827 |

| R - squared | 0.71517 | Mean dependent var | -0.166126 | |

| Adjusted R- squared | 0.705454 | S.D. dependent var | 0.722598 | |

| S.E regression | 0.438649 | Akaike info criterion | 0.760652 | |

| Sum squared reside | 11.25811 | Schwarz criterion | 0.851041 | |

| Log likelihood | -45.43846 | Hanna-Quinn critter | 0.973412 | |

| F-statistic | 112.1532 | Durbin-Watson stat | 1.709421 | |

| Prob(F-statistic) | 0 | |||

TACi, Ai, and REVi all stand for total accruals for company i, total assets for firm i, and change in revenue for firm i from the prior year, respectively. PPEi stands for company i's gross property, plant, and equipment; ROAt-1 stands for the return on assets at the end of the prior year; and i stands for the error term included in the regression model that satisfies all presumptions. RECi is the difference between the current year and last year's receivables for business I. The estimation of the aforementioned model appears as follows:

Table 2 NDAC estimation estimates from auxiliary regression Equation (1) now can be rewritten as follows:

Non-discretionary accruals (NDAC) are calculated using the ratio of total accruals to total firm assets, or TAC/A. The gross value of property, plant, and equipment (PPEi/Ai), the return on assets in the prior year ROAt-1, and the difference between the change in revenue and the change in receivables between 2014 and 2013 are divided by the company's total assets to account for variations.

The R-square value demonstrates how well the regression model fits the data. It has a value between 0 and 1. Regression line fitness is totally terrible at zero, whereas it is perfectly fit at one. The current model's R square value is 0.8141, which indicates that explanatory factors included in the regression model can explain 81 percent of variability in the dependent variable. In other words, the model's independent variables account for more than 81 percent of the variation in NDAC. The adjusted R square value, which accounts for the influence of an increasing number of explanatory factors, is another indicator of a regression model's quality of fit. It also confirms the fact that the model's included predictors account for more than 80% of the variations in the dependent variable, with a score of 0.8064.

Values for the parameters show how strongly and in which direction the explanatory and dependent variables are correlated. According to the estimate findings, PPE/Ai (at a 1% significance level), (REV- REC)/Ai (at a 5% significance level), and 1/Ai (at a 1% significance level) are significant predictors of NDAC, while return on assets with a one-year lag has no meaningful impact on the dependent variable, NDAC. It is possible to state that the reciprocal of a business's assets, the difference between change in revenue and receivables, and the ratio of a company's total assets to its gross property, plant, and equipment are the most significant predictors of the NDAC of a firm, although return on assets with a one-year lag are not.

You may also gauge the significance of the regression model as a whole by looking at the magnitude and significance of the F-statistic, a trustworthy measure of its overall relevance. The overall relevance of the model is well demonstrated by the p-value of the F-statistic (0.0000), which shows that this is significant at the 1% level of significance.

The Durbin-Watson statistic is used to examine time series data for autocorrelation and specification bias in regression models. In the current study, specification bias is being examined through the use of this statistic. The Durbin-Watson d statistic ranges from 0 to 4. The closer the value of the d statistic is to 2, the more evidence there is that specification bias does not occur. The Durbin Watson d statistic in this extra regression has a value of 1.7092 when compared to the corresponding table values, suggesting that there is no specification bias in the regression model and further demonstrating the efficacy of our model in predicting the NDAC. The expected values are identified as NDAC and derived using the aforementioned algorithm, Eq. 1. According to Kothari et al. (2005), discretionary accruals (DAC) are the difference between actual total accruals (TAC) and NDAC.DACi = TACi - NDACi.

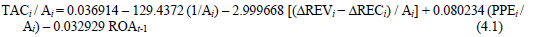

The absolute values of DAC are taken into consideration once DAC has been calculated using Equation (4.2), and the resulting number is utilized as a stand-in for the Earning quality (EQ) indicator. The audit committee's independence (ACD), expertise (ACE), diligence (ACD), and independence (ACI), as well as the external auditor large audit firm (EALAF), external auditor industrial leader (EAIL), depend on the EQ, and i is the residual term that complies with the CLRM assumptions.

The regression model in the estimated as follows;

The estimation of above stated model in Eq. (4.3) is as follows:

EQ is the dependent variable, C is the equation's constant, and the explanatory variables for the model are ACI, ACE, ACD, EALAF, and EAIL. The regression model's estimated value, as given in Eq. The same reasoning we used to explain auxiliary regression also applies to this model.

R-square, whose values range from 0 to 1, displays how well the regression model fits the data, as was already indicated. Since the explanatory factors that were considered can predict more than 80% of changes in the dependent variable EQ, the R square for this regression model is 0.8021. In other words, ACI, ACE, ACD, EALAF, and EAIL account for more than 80% of EQ variance. One such measure of a regression model's fit is the adjusted R square value, which takes into account the impact of an increasing number of explanatory variables. The included predictors in the model account for more than 77% of the variability in EQ, with a score of 0.771 in this mode.

The values of the parameters reflect the strength and direction of the correlation between the explanatory and dependent variables. This is evident from the estimate findings, which show that while ACE and ACD are significant at a 10% level of significance, the effects of EALAF on EQ are not significant, as shown by the p-value in the Table 3 above., The p-value in the table above shows that ACI, EAIL, and EALAF are significant at a 5% level of significance. It could be discovered that EALAF makes no contribution to comprehending the variance in EQ for a corporation, in contrast to ACI, ACE, ACD, and EAIL. Chewninges in Earning quality may be monitored using the audit committee intelligence, audit committee expertise, audit committee diligence, and external auditor industrial leader.

| Table 3 Estimates For Estimating Regression Eq |

||||

|---|---|---|---|---|

| Dependent Variable: EQ | ||||

| Method: Least Squares | ||||

| Sample: 1 100 | ||||

| Included observations: 97 | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | 3.563851 | 1.151342 | 3.127927 | 0.0026 |

| ACI | 0.573463 | 0.275614 | 2.151884 | 0.0326 |

| ACE | 1.487972 | 0.932252 | 1.926952 | 0.0897 |

| ACD | 0.112373 | 0.073157 | 1.518057 | 0.7089 |

| EALAF | -0.571804 | 0.721070 | -0.867721 | 0.3549 |

| EAIL | 0.826538 | 0.362206 | 1.926423 | 0.0579 |

| R-squared | 0.501096 | Mean dependent var | 5.018895 | |

| Adjusted R-squared | 0.860980 | S.D. dependent var | 1.504613 | |

| S.E. of regression | 1.471817 | Akaike info criterion | 2.687423 | |

| Sum squared reside | 324.9707 | Schwarz criterion | 2.968984 | |

| Log likelihood | -167.7980 | Hanna-Quinn critter. | 1.863810 | |

| F-statistic | 4.059465 | Durbin-Watson stat | 1.830415 | |

| Prob(F-statistic) | 0.036405 | |||

The magnitude and significance of the F-statistic, a reliable indicator of the model's overall importance, can also be used to determine the relevance of the regression model as a whole. The p-value of the F-statistic (0.0264), which is significant at the 5% level of significance and clearly supports the model's overall relevance, indicates that this model is suited for researching EQ variation in general.

The Durbin-Watson statistic is used to assess the specification bias of a regression model and the presence of autocorrelation in a time series of data. Similar to how the previous model was applied, this statistic is used to investigate specification bias. The range of the Durbin-Watson d statistic is to 4. There is greater proof against specification bias the closer 2 is near the value of the d statistic. The Durbin Watson d statistic for this auxiliary regression is 1.9206, which, when compared to the data in the accompanying table, indicates that there is no specification bias in the regression model, further confirming the effectiveness of our method for EQ predicting.

Conclusion

The agency theory has described proposed relationship between several stakeholders of organization. The agency theory portray that, for safeguarding investors interest companies provides the several practices and audit practices is considering one of them. This study has start its debit front he auditing practices and its function and then define why it is consider important in the organization. Then, in the context of Malaysia, this study has covered the theoretical framework that has covered the external auditors by the large audit firms (big4) and leading audit firm that, to the best of our knowledge, have not been taken into account in the background of Malaysia. These qualities include the members of the audit committee as well as their independence, diligence, experience, and subject matter knowledge. The proposed research's goal is to analyses the relationship between the independent variable (audit committee independence, audit committee diligence, audit committee expertise, large audit firms, and top audit firms) and the dependent variable (financial rearing quality).

The research's findings demonstrate that when all the factors that supported the inquiry were combined, the outcomes revealed conclusions that were consistent with those from earlier studies, such as those on the knowledge and objectivity of the audit committee. It has also been shown that of the five variables, four (audit committee independence, diligence, expertise, and major audit firm) have been found to have a significant relationship with earnings quality, and the fifth variable, save for one, has not been found to be inconsistent with prior findings by a reputable audit company.

The research of 100 hundred Bursa Malaysian firms has yielded some pretty fascinating results when using descriptive analysis. This study makes the claim that the independent audit committee's characteristics directly affect the quality of the earnings. This claim is backed up by a thorough examination of abnormal accruals, which is used as the main proxy for determining the relationship between the independent and dependent variables.

The descriptive analysis also revealed that among the top 100 performing Bursa Malaysia companies, the independent auditor committee had a mean score of 0.811. In order to conclude, it should be noted that 81% of the concentration has identified independence in the audit committee structure in the form of independent executive directors. Top 100 performers on the Bursa Malaysia. Additionally, according to this study, 3 of the 4 members of each corporation's audit committee were independent, which is consistent with all annual reports. The Satndar variation also showed a 17% difference, It is crucial because it shows how important the independence of the audit committee is to Malaysia's top-performing businesses. to investigate the connection between the expertise of the audit committee and how it affects the earning quality.

This study has produced significant findings that lead to the conclusion that the 100 best-performing Bursa Malaysian companies have significant audit committee expertise by carefully examining abnormal accruals and the relationship between the audit committee's expertise and financial rating quality. The findings of this study concur with a lot of those found in the Earning quality.Additional detailed information was supplied by the descriptive research, which revealed that 0.454, or 45%, of the top 100 performing organizations, have knowledge. This descriptive analysis also addresses the myth that audit committees at Top 100 companies have organizational structure knowledge, which is why half of the directors were appointed to the committee in order to ensure that they would provide a higher level of audit quality and earnings. The audit committee's standard deviation is 0.19, meaning that either less than or more than half of its members have experience in finance or are actively involved, both of which are important considerations for the audit committee board.

To look into the relationship between the audit committee's attention to detail and how it impacts earning In order to claim to have effective Earning quality, the audit committee must exercise diligence, according to the study's literature research. Numerous studies have also demonstrated that the audit committee's vigilance has an impact on the Earning quality. As shown in this study, vigilant audit committee members have an impact on the earning quality. The descriptive study has demonstrated the close connection between Earning quality and the diligence of the audit committee.

The Top 100 Companies' average mean found that at least six meetings were held throughout the year, and that the baking sector's audit committee was involved. A sampling revealed that more than 15 meetings were held annually, demonstrating that Malaysia's banking industry is more aware of the due diligence of the audit committee board. Since the standard deviation was 3, it was determined that the Top 100 Malaysian corporations held at least three meetings annually. It should be noted that the annual meeting proxy conducts a diligent audit committee examination

To investigate the connection between external auditors (large audit firms) and how that affects earning quality the study is original and innovative in the form of the variables it has chosen. Previous research has demonstrated the impact of the audit committee on the Earning quality, and this study has used external evidence to back this claim.

According to statistical findings from the descriptive studies, more than 90% of the top 100 performing firms rely on the Big 4 to audit their financial standards on average, with an average mean of 0.90. This compelling evidence supports the claim that businesses use large audit firms to examine their financial records in order to demonstrate the openness of their accounting practices only one variable in the model has a variance of less than 0.10 percent. Malaysian businesses are concentrating on auditing the Big 4 corporations to investigate the connection between the earning quality and the external auditor (an industry leader).

Only one of the model's variables, the top 100 performing businesses' leading audit firms, is not significant. Price Cooper BerHad is a market leader in the audit industry. Contrary to popular belief, top organizations don't always work with the finest vendors on the market; in this instance, the Top 100 performing companies are hesitant to use Price Cooper BerHad. Thirty firms out of a total of 100 chose Price Cooper BerHad for the audit. Other Big 4 businesses are the primary choice for other corporations looking for auditing services. According to researchers who visited the market, Price Cooper BerHad was asking a high price (almost twice as much as other top 4 competitors) in the additionally, it was shown that there is no substantial association between top audit firms and earnings quality, which is loosely driving aberrant accrual by statics terms. The sample size is too small to draw any firm conclusions from the study, which is why the significance has a low R square. The major auditing firms were not the first option for Malaysian enterprises, which is the reason why.

Findings

Aside from the many study limitations, there are multiple ways to draw conclusions from this research. First, no research has compared the characteristics of the audit committee and external auditors within the same framework. Studies have shown that audit committee independence has a positive impact on earnings, a finding that is comparable to those of other studies, but this one stands out because it is unique in that it is focused on Malaysia and does not yet show any ties to the present economy's top 100 performing businesses. Relating to the audit committee's expertise and thoroughness. Moreover, outside auditors, including large audit firms.

References

Abbott, L. J., Parker, S., & Peters, G. F. (2004). Audit committee characteristics and restatements. Auditing: A Journal of Practice & Theory, 23(1), 69–87.

Indexed at, Google Scholar, Cross Ref

Abbott, L. J., Parker, S., & Peters, G. F. (2012). Internal audit assistance and external audit timeliness. Auditing: A Journal of Practice & Theory, 31(4), 3–20.

Indexed at, Google Scholar, Cross Ref

Abbott, L. J., Parker, S., Peters, G. F., & Raghunandan, K. (2003). The association between audit committee characteristics and audit fees. Auditing: A Journal of Practice & Theory, 22(2), 17–32.

Indexed at, Google Scholar, Cross Ref

Aboody, D., & Lev, B. (2000). Information asymmetry, R&D, and insider gains. Journal of Finance, 2747–2766.

Indexed at, Google Scholar, Cross Ref

Adiguzel, H. (2013). Corporate Governance, Family Ownership and Earnings Management: Emerging Market Evidence. Accounting and Finance Research, 2(4), p17.

Indexed at, Google Scholar, Cross Ref

Afify, H. A. E. (2009). Determinants of audit report lag: Does implementing corporate governance have any impact? Empirical evidence from Egypt. Journal of Applied Accounting Research, 10(1), 56–86.

Indexed at, Google Scholar, Cross Ref

Agacer, G. (n.d.). M., and TS Doupnik.: 1991,‹ Perceptions of Auditor Independence: A Cross-Cultural Study’. International Journal of Accounting, 26, 220–237.

Indexed at, Google Scholar, Cross Ref

Aggarwal, R., Erel, I., Stulz, R. M., & Williamson, R. (2007). Do US firms have the best corporate governance? A cross-country examination of the relation between corporate governance and shareholder wealth. National Bureau of Economic Research.

Indexed at, Google Scholar, Cross Ref

Agrawal, A., & Chadha, S. (2005). Corporate governance and accounting scandals. Journal of Law and Economics, 48(2), 371–406.

Indexed at, Google Scholar, Cross Ref

Ahmad-Zaluki, N. A., & Nordin Wan-Hussin, W. (2010). Corporate governance and earnings forecasts accuracy. Asian Review of Accounting, 18(1), 50–67.

Indexed at, Google Scholar, Cross Ref

Ali, A. M., Gloeck, J. D., Ali, A., Ahmi, A., & Sahdan, M. H. (2007). Internal audit in the state and local governments of Malaysia. Southern African Journal of Accountability and Auditing Research, 7, 25–57.

Indexed at, Google Scholar, Cross Ref

Almutairi, A. R., Dunn, K. A., & Skantz, T. (2009). Auditor tenure, auditor specialization, and information asymmetry. Managerial Auditing Journal, 24(7), 600–623.

Indexed at, Google Scholar, Cross Ref

Ameer, R., Ramli, F., & Zakaria, H. (2010). A new perspective on board composition and firm performance in an emerging market. Corporate Governance: The International Journal of Business in Society, 10(5), 647–661.

Indexed at, Google Scholar, Cross Ref

Amernic, J. H., Kanungo, R., & Aranya, N. (1983). Professional and work values of accountants. The International Journal of Accounting, 18(2), 177–192.

Indexed at, Google Scholar, Cross Ref

Anderson, R. C., Mansi, S. A., & Reeb, D. M. (2004). Board characteristics, accounting report integrity, and the cost of debt. Journal of Accounting and Economics, 37(3), 315–342.

Indexed at, Google Scholar, Cross Ref

Ashbaugh, H., LaFond, R., & Mayhew, B. W. (2003). Do nonaudit services compromise auditor independence? Further evidence. The Accounting Review, 78(3), 611–639.

Indexed at, Google Scholar, Cross Ref

Ashbaugh-Skaife, H., Collins, D. W., & Kinney, W. R. (2007). The discovery and reporting of internal control deficiencies prior to SOX-mandated audits. Journal of Accounting and Economics, 44(1), 166–192.

Indexed at, Google Scholar, Cross Ref

Ataullah, A., Davidson, I., Le, H., & Wood, G. (2014). Corporate diversification, information asymmetry and insider trading. British Journal of Management, 25(2), 228–251.

Indexed at, Google Scholar, Cross Ref

Bae, G. S., Cheon, Y. S., & Kang, J.-K. (2008). Intragroup propping: Evidence from the stock-price effects of earnings announcements by Korean business groups. Review of Financial Studies, 21(5), 2015–2060.

Indexed at, Google Scholar, Cross Ref

Ball, R., & Brown, P. (1968). An empirical evaluation of accounting income numbers. Journal of Accounting Research, 159–178.

Indexed at, Google Scholar, Cross Ref

Balsam, S., Krishnan, J., & Yang, J. S. (2003). Auditor industry specialization and earnings quality. Auditing: A Journal of Practice & Theory, 22(2), 71–97.

Indexed at, Google Scholar, Cross Ref

Bame-Aldred, C. W., Brandon, D. M., Messier Jr, W. F., Rittenberg, L. E., & Stefaniak, C. M. (2012). A summary of research on external auditor reliance on the internal audit function. Auditing: A Journal of Practice & Theory, 32(sp1), 251–286.

Indexed at, Google Scholar, Cross Ref

Barth, M. E., & So, E. C. (2014). Non-diversifiable volatility risk and risk premiums at earnings announcements. The Accounting Review, 89(5), 1579–1607.

Indexed at, Google Scholar, Cross Ref

Baumeister, C., & Peersman, G. (2013). The role of time?varying price elasticities in accounting for volatility changes in the crude oil market. Journal of Applied Econometrics, 28(7), 1087–1109.

Baxter, P., & Cotter, J. (2009). Audit committees and earnings quality. Accounting & Finance, 49(2), 267–290.

Beasley, M. S. (1996). An empirical analysis of the relation between the board of director composition and financial statement fraud. Accounting Review, 443–465.

Indexed at, Google Scholar, Cross Ref

Beasley, M.S., Carcello, J.V, Hermanson, D.R., & Lapides, P.D. (2000). Fraudulent financial reporting: Consideration of industry traits and corporate governance mechanisms. Accounting Horizons, 14(4), 441–454.

Indexed at, Google Scholar, Cross Ref

Beaver, W. H. (1968). The information content of annual earnings announcements. Journal of Accounting Research, 67–92.

Indexed at, Google Scholar, Cross Ref

Becker, C. L., DeFond, M. L., Jiambalvo, J., & Subramanyam, K. R. (1998). The effect of audit quality on earnings management. INTERNATIONAL REVIEWS OF IMMUNOLOGY, 16, 1–24.

Indexed at, Google Scholar, Cross Ref

Bedard, J., Chtourou, S. M., & Courteau, L. (2004). The effect of audit committee expertise, independence, and activity on aggressive earnings management. Auditing: A Journal of Practice & Theory, 23(2), 13–35.

Indexed at, Google Scholar, Cross Ref

Bernard, V. L., & Thomas, J. K. (1989). Post-earnings-announcement drift: delayed price response or risk premium? Journal of Accounting Research, 1–36.

Indexed at, Google Scholar, Cross Ref

Bharath, S. T., Sunder, J., & Sunder, S. V. (2008). Accounting quality and debt contracting. The Accounting Review, 83(1), 1–28.

Indexed at, Google Scholar, Cross Ref

Boubaker, A., Mensi, W., & Nguyen, D. K. (2008). More on corporate diversification, firm size and value creation. Economics Bulletin, 7(3), 1–7.

Bou-Raad, G. (2000). Internal auditors and a value-added approach: the new business regime. Managerial Auditing Journal, 15(4), 182–187.

Indexed at, Google Scholar, Cross Ref

Bozzolan, S., Favotto, F., & Ricceri, F. (2003). Italian annual intellectual capital disclosure: an empirical analysis. Journal of Intellectual Capital, 4(4), 543–558.

Indexed at, Google Scholar, Cross Ref

Bradbury, M., Mak, Y. T., & Tan, S. M. (2006). Board characteristics, audit committee characteristics and abnormal accruals. Pacific Accounting Review, 18(2), 47–68.

Indexed at, Google Scholar, Cross Ref

Bradshaw, M. T., Drake, M. S., Myers, J. N., & Myers, L. A. (2012). A re-examination of analysts’ superiority over time-series forecasts of annual earnings. Review of Accounting Studies, 17(4), 944–968.

Indexed at, Google Scholar, Cross Ref

Brennan, N. (2001). Reporting intellectual capital in annual reports: evidence from Ireland. Accounting, Auditing & Accountability Journal, 14(4), 423–436.

Indexed at, Google Scholar, Cross Ref

Brown-Liburd, H. L., & Wright, A. M. (2011). The effect of past client relationship and strength of the audit committee on auditor negotiations. Auditing: A Journal of Practice & Theory, 30(4), 51–69.

Indexed at, Google Scholar, Cross Ref

Cadbury, A. (1992). The Committee on the Financial Aspects of Corporate Governance and Gee and Co. Ltd. Report, 61.

Campbell, D., & Rahman, M. R. A. (2010). A longitudinal examination of intellectual capital reporting in Marks & Spencer annual reports, 1978–2008. The British Accounting Review, 42(1), 56–70.

Indexed at, Google Scholar, Cross Ref

Carcello, J. V, & Neal, T. L. (2000). Audit committee composition and auditor reporting. The Accounting Review, 75(4), 453–467.

Indexed at, Google Scholar, Cross Ref

Carcello, J. V, & Neal, T. L. (2003). Audit committee characteristics and auditor dismissals following “new” going-concern reports. The Accounting Review, 78(1), 95–117.

Indexed at, Google Scholar, Cross Ref

Carcello, J. V, Hermanson, D. R., & Ye, Z. (2011). Corporate governance research in accounting and auditing: Insights, practice implications, and future research directions. Auditing: A Journal of Practice & Theory, 30(3), 1–31.

Indexed at, Google Scholar, Cross Ref

Carcello, J. V, Hermanson, D. R., Neal, T. L., & Riley, R. A. (2002). Board Characteristics and Audit Fees. Contemporary Accounting Research, 19(3), 365–384.

Indexed at, Google Scholar, Cross Ref

Carson, E., Simnett, R., Soo, B. S., & Wright, A. M. (2012). Changes in audit market competition and the Big N premium. Auditing: A Journal of Practice & Theory, 31(3), 47–73.

Indexed at, Google Scholar, Cross Ref

Chang, H., Cheng, C. S. A., & Reichelt, K. J. (2010). Market reaction to auditor switching from Big 4 to third-tier small accounting firms. Auditing: A Journal of Practice & Theory, 29(2), 83–114.

Indexed at, Google Scholar, Cross Ref

Chen, C., Lin, C., & Lin, Y. (2008). Audit Partner Tenure, Audit Firm Tenure, and Discretionary Accruals: Does Long Auditor Tenure Impair Earnings Quality?*. Contemporary Accounting Research, 25(2), 415–445.

Indexed at, Google Scholar, Cross Ref

Cheung, D. K. C., & Sami, H. (2000). Price and trading volume reaction: the case of Hong Kong companies’ earnings announcements. Journal of International Accounting, Auditing and Taxation, 9(1), 19–42.

Indexed at, Google Scholar, Cross Ref

Chewning, E. G., Coller, M., & Tuttle, B. (2004). Do market prices reveal the decision models of sophisticated investors?: Evidence from the laboratory. Accounting, Organizations and Society, 29(8), 739–758.

Indexed at, Google Scholar, Cross Ref

Choi, J.-H., Jeon, K.-A., & Park, J.-I. (2004). The role of audit committees in decreasing earnings management: Korean evidence. International Journal of Accounting, Auditing and Performance Evaluation, 1(1), 37–60.

Indexed at, Google Scholar, Cross Ref

Chouchene, I. (2010). The determinants of the presence of independent directors in French board companies. International Journal of Business and Management, 5(5), p144.

Indexed at, Google Scholar, Cross Ref

Chung, H., & Kallapur, S. (2003). Client importance, nonaudit services, and abnormal accruals. The Accounting Review, 78(4), 931–955.

Indexed at, Google Scholar, Cross Ref

Cohen, J. R., Krishnamoorthy, G., & Wright, A. (2004). The corporate governance mosaic and Earning quality. Journal of Accounting Literature, 87–152.

Committee, B. R. (1999). Audit Committee Characteristics and Restatements: A Study of the Efficacy of Certain Blue Ribbon Committee Recommendations. New York Stock Exchange and National Association of Securities Dealers, New York, NY.

Indexed at, Google Scholar, Cross Ref

Cooper, B. J., Leung, P., & Mathews, C. M. H. (1996). Benchmarking-a comparison of internal audit in Australia, Malaysia and Hong Kong. Managerial Auditing Journal, 11(1), 23–29.

Indexed at, Google Scholar, Cross Ref

Cormier, D., & Gordon, I. M. (2001). An examination of social and environmental reporting strategies. Accounting, Auditing & Accountability Journal, 14(5), 587–617.

Indexed at, Google Scholar, Cross Ref

Cornett, M. M., McNutt, J. J., & Tehranian, H. (2009). Corporate governance and earnings management at large US bank holding companies. Journal of Corporate Finance, 15(4), 412–430.

Indexed at, Google Scholar, Cross Ref

Crabtree, A. D., Brandon, D. M., & Maher, J. J. (2006). The impact of auditor tenure on initial bond ratings. Advances in Accounting, 22, 97–121.

Indexed at, Google Scholar, Cross Ref

Craswell, A. T., Francis, J. R., & Taylor, S. L. (1995). Auditor brand name reputations and industry specializations. Journal of Accounting and Economics, 20(3), 297–322.

Indexed at, Google Scholar, Cross Ref

Dalton, D. R., Daily, C. M., Johnson, J. L., & Ellstrand, A. E. (1999). Number of directors and financial performance: A meta-analysis. Academy of Management Journal, 42(6), 674–686.

Indexed at, Google Scholar, Cross Ref

Das, S., & Shroff, P. K. (2002). Fourth quarter reversals in earnings changes and earnings management. Available at SSRN 308441

Indexed at, Google Scholar, Cross Ref

Davidson, R. A., & Neu, D. (1993). A note of the association between audit firm size and audit. Contemporary Accounting Research, 9(2), 479.

Indexed at, Google Scholar, Cross Ref

Davidson, R., Goodwin?Stewart, J., & Kent, P. (2005). Internal governance structures and earnings management. Accounting & Finance, 45(2), 241–267.

Indexed at, Google Scholar, Cross Ref

Davis, J. H., Schoorman, F. D., & Donaldson, L. (1997). Davis, Schoorman, and Donaldson reply: The distinctiveness of agency theory and stewardship theory. JSTOR.

Indexed at, Google Scholar, Cross Ref

De Jong, A., Roosenboom, P., DeJong, D. V, & Mertens, G. (2005). Royal Ahold: a failure of corporate governance. ECGI-Finance Working Paper, (67).

Indexed at, Google Scholar, Cross Ref

DeAngelo, L. E. (1981). Auditor size and audit quality. Journal of Accounting and Economics, 3(3), 183–199.

Indexed at, Google Scholar, Cross Ref

Dechow, P. M., & Dichev, I. D. (2002). The quality of accruals and earnings: The role of accrual estimation errors. The Accounting Review, 77(s-1), 35–59.

Indexed at, Google Scholar, Cross Ref

Dechow, P. M., & Skinner, D. J. (2000). Earnings management: Reconciling the views of accounting academics, practitioners, and regulators. Accounting Horizons, 14(2), 235–250.

Indexed at, Google Scholar, Cross Ref

Dechow, P. M., Sloan, R. G., & Sweeney, A. P. (1995). Detecting earnings management. The Ac-counting Review 7O (April): 193-225., and. 1996. Causes and consequences of earnings manipulation: An analysis of firms subject to enforcement actions by the SEC. Contemporary Accounting Research, 13, 1–36.

Indexed at, Google Scholar, Cross Ref

Dechow, P., Ge, W., & Schrand, C. (2010). Understanding earnings quality: A review of the proxies, their determinants and their consequences. Journal of Accounting and Economics, 50(2), 344–401.

Indexed at, Google Scholar, Cross Ref

DeFond, M. L., & Francis, J. R. (2005). Audit research after sarbanes-oxley. Auditing: A Journal of Practice & Theory, 24(s-1), 5–30.

Indexed at, Google Scholar, Cross Ref

Dellaportas, S., Leung, P., Cooper, B. J., Rochmah Ika, S., & Mohd Ghazali, N. A. (2012). Audit committee effectiveness and timeliness of reporting: Indonesian evidence. Managerial Auditing Journal, 27(4), 403–424.

Indexed at, Google Scholar, Cross Ref

Demerjian, P. R., Lev, B., Lewis, M. F., & McVay, S. E. (2012). Managerial ability and earnings quality. The Accounting Review, 88(2), 463–498.

Indexed at, Google Scholar, Cross Ref

DeZoort, F. T. (1998). An analysis of experience effects on audit committee members’ oversight judgments. Accounting, Organizations and Society, 23(1), 1–21.

Indexed at, Google Scholar, Cross Ref

Dhaliwal, D. A. N., Naiker, V. I. C., & Navissi, F. (2010). The Association Between Accruals Quality and the Characteristics of Accounting Experts and Mix of Expertise on Audit Committees. Contemporary Accounting Research, 27(3), 787–827.

Indexed at, Google Scholar, Cross Ref

Edvinsson, L., & Malone, M. S. (1997). Intellectual Capital: Realizing Your Company’s True Value by Finding Its Hidden Brainpower.

Efendi, J., Smith, L. M., & Wong, J. (2011). Longitudinal analysis of voluntary adoption of XBRL on financial reporting. International Journal of Economics and Accounting, 2(2), 173–189.

Indexed at, Google Scholar, Cross Ref

Epstein, R. A., & Epstein, R. A. (2009). Simple rules for a complex world. Harvard University Press.

Indexed at, Google Scholar, Cross Ref

Fagbemi, T. O., & Uadiale, O. M. (2011). An appraisal of the determinants of timeliness of audit report in Nigeria: Evidence from selected quoted companies. In The New Orleans International Academic Conference New Orleans, Louisiana USA.

Fama, E. F., & Jensen, M. C. (1983). Separation of ownership and control. Journal of Law and Economics, 301–325.

Indexed at, Google Scholar, Cross Ref

Farber, D. B. (2005). Restoring trust after fraud: Does corporate governance matter? The Accounting Review, 80(2), 539–561.

Indexed at, Google Scholar, Cross Ref

Fontaine, R., & Pilote, C. (2011). Clients’ preferred relationship approach with their financial statement auditor. Current Issues in Auditing, 6(1), P1–P6.

Indexed at, Google Scholar, Cross Ref

Francis, J. R., & Krishnan, J. (1999). Accounting Accruals and Auditor Reporting Conservatism. Contemporary Accounting Research, 16(1), 135–165.

Indexed at, Google Scholar, Cross Ref

García, L. S., Barbadillo, E. R., & Pérez, M. O. (2012). Audit committee and internal audit and the quality of earnings: empirical evidence from Spanish companies. Journal of Management & Governance, 16(2), 305–331.

Indexed at, Google Scholar, Cross Ref

Geiger, M. A., & Raghunandan, K. (2002). Auditor tenure and audit reporting failures. Auditing: A Journal of Practice & Theory, 21(1), 67–78.

Indexed at, Google Scholar, Cross Ref

Ghosh, A., & Moon, D. (2005). Auditor tenure and perceptions of audit quality. The Accounting Review, 80(2), 585–612.

Indexed at, Google Scholar, Cross Ref

Goddard, A. R., & Masters, C. (2000). Audit committees, Cadbury Code and audit fees: an empirical analysis of UK companies. Managerial Auditing Journal, 15(7), 358–371.

Indexed at, Google Scholar, Cross Ref

Gramling, A. A., Maletta, M. J., Schneider, A., & Church, B. K. (2004). The role of the internal audit function in corporate governance: A synthesis of the extant internal auditing literature and directions for future research. Journal of Accounting Literature, 23, 194.

Indexed at, Google Scholar, Cross Ref

Gras-Gil, E., Marin-Hernandez, S., & Garcia-Perez de Lema, D. (2012). Internal audit and financial reporting in the Spanish banking industry. Managerial Auditing Journal, 27(8), 728–753.

Indexed at, Google Scholar, Cross Ref

Gray, R., Kouhy, R., & Lavers, S. (1995). Corporate social and environmental reporting: a review of the literature and a longitudinal study of UK disclosure. Accounting, Auditing & Accountability Journal, 8(2), 47–77.

Indexed at, Google Scholar, Cross Ref

Guthrie, J., Petty, R., & Ricceri, F. (2006). The voluntary reporting of intellectual capital: comparing evidence from Hong Kong and Australia. Journal of Intellectual Capital, 7(2), 254–271.

Hamid, K. C. A., Othman, S., & Rahim, M. A. (2015). Independence and Financial Knowledge on Audit Committee with Non-compliance of Financial Disclosure: A Study of Listed Companies Issued with Public Reprimand in Malaysia. Procedia-Social and Behavioral Sciences, 172, 754–761.

Indexed at, Google Scholar, Cross Ref

Haniffa, R., Abdul Rahman, R., & Haneem Mohamed Ali, F. (2006). Board, audit committee, culture and earnings management: Malaysian evidence. Managerial Auditing Journal, 21(7), 783–804.

Indexed at, Google Scholar, Cross Ref

Hanim Fadzil, F., Haron, H., & Jantan, M. (2005). Internal auditing practices and internal control system. Managerial Auditing Journal, 20(8), 844–866.

Indexed at, Google Scholar, Cross Ref

Hasseldine, J., Salama, A. I., & Toms, J. S. (2005). Quantity versus quality: the impact of environmental disclosures on the reputations of UK Plcs. The British Accounting Review, 37(2), 231–248.

Indexed at, Google Scholar, Cross Ref

Hay, D. (2013). Further Evidence from Meta?Analysis of Audit Fee Research. International Journal of Auditing, 17(2), 162–176.

Indexed at, Google Scholar, Cross Ref

Holland, J. (2003). Intellectual capital and the capital market-organisation and competence. Accounting, Auditing & Accountability Journal, 16(1), 39–48.

Indexed at, Google Scholar, Cross Ref

Huang, S., & Thakor, A. V. (2013). Investor heterogeneity, investor-management disagreement and share repurchases. Review of Financial Studies, 26(10), 2453–2491.

Indexed at, Google Scholar, Cross Ref

Ibrahim, A. B. (2015). Strategy Types and Small Firms’ Performance An Empirical Investigation. Journal of Small Business Strategy, 4(1), 13–22.

Ismail, N. A., & Abidin, A. Z. (2009). Perception towards the importance and knowledge of information technology among auditors in Malaysia. Journal of Accounting and Taxation, 1(4), 61–69.

Indexed at, Google Scholar, Cross Ref

Jamal, A. (2003). Retailing in a multicultural world: the interplay of retailing, ethnic identity and consumption. Journal of Retailing and Consumer Services, 10(1), 1–11.

Indexed at, Google Scholar, Cross Ref

Jenkins, D. S., & Velury, U. (2008). Does auditor tenure influence the reporting of conservative earnings? Journal of Accounting and Public Policy, 27(2), 115–132.

Indexed at, Google Scholar, Cross Ref

Jensen, H. L., & Yiu, K. (1995). Audit independence and Confucian values. In Proceedings of the Seventh Asian-Pacific Conference in International Accounting Issues, California State University, Fresno, CA.

Indexed at, Google Scholar, Cross Ref

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360.

Jones, J. J. (1991). Earnings management during import relief investigations. Journal of Accounting Research, 193–228.

Indexed at, Google Scholar, Cross Ref

Kalbers, L. P., & Fogarty, T. J. (1993). Audit committee effectiveness: An empirical investigation of the contribution of power. Auditing, 12(1), 24.

Indexed at, Google Scholar, Cross Ref

Karamanou, I., & Vafeas, N. (2005). The association between corporate boards, audit committees, and management earnings forecasts: An empirical analysis. Journal of Accounting Research, 43(3), 453–486.

Indexed at, Google Scholar, Cross Ref

Khurana, I. K., & Raman, K. K. (2004). Litigation risk and the financial reporting credibility of Big 4 versus non-Big 4 audits: Evidence from Anglo-American countries. The Accounting Review, 79(2), 473–495.

Indexed at, Google Scholar, Cross Ref

Klein, A. (2002). Audit committee, board of director characteristics, and earnings management. Journal of Accounting and Economics, 33(3), 375–400.

Indexed at, Google Scholar, Cross Ref

Krishnan, J. (2001). Corporate governance and internal control: An empirical analysis. In American Accounting Association Annual Meeting. Atlanta, Georgia.

Indexed at, Google Scholar, Cross Ref

Krishnan, J. (2005). Audit committee quality and internal control: An empirical analysis. The Accounting Review, 80(2), 649–675.

Indexed at, Google Scholar, Cross Ref

Krogstad, J. L., Ridley, A. J., & Rittenberg, L. E. (1999). Where We’re Going: How the new definition of internal auditing impacts the profession's evolution. Internal Auditor, 56, 26–33.

Lalonde, C., & Adler, C. (2015). Information asymmetry in process consultation: An empirical research on leader-client/consultant relationship in healthcare organizations. Leadership & Organization Development Journal, 36(2), 177–211.

Indexed at, Google Scholar, Cross Ref

Lang, M., & Lundholm, R. (1993). Cross-sectional determinants of analyst ratings of corporate disclosures. Journal of Accounting Research, 246–271.

Indexed at, Google Scholar, Cross Ref

Larson, R. K., Herz, P. J., & Kenny, S. Y. (2011). Academics and the development of IFRS: An invitation to participate. Journal of International Accounting Research, 10(2), 97–103.

Indexed at, Google Scholar, Cross Ref

Leung, P., Cooper, B. J., Cooper, B. J., Leung, P., & Wong, G. (2006). The Asia Pacific literature review on internal auditing. Managerial Auditing Journal, 21(8), 822–834.

Indexed at, Google Scholar, Cross Ref

Lin, J. W., Li, J. F., & Yang, J. S. (2006). The effect of audit committee performance on earnings quality. Managerial Auditing Journal, 21(9), 921–933.

Indexed at, Google Scholar, Cross Ref

Lin, S., Pizzini, M., Vargus, M., & Bardhan, I. R. (2011). The role of the internal audit function in the disclosure of material weaknesses. The Accounting Review, 86(1), 287–323.

Indexed at, Google Scholar, Cross Ref

Loderer, C., & Waelchli, U. (2009). Firm age and performance. University of Bern, Working Paper.

Indexed at, Google Scholar, Cross Ref

Magness, V. (2006). Strategic posture, financial performance and environmental disclosure: An empirical test of legitimacy theory. Accounting, Auditing & Accountability Journal, 19(4), 540–563.

Indexed at, Google Scholar, Cross Ref

Mangena, M., & Pike, R. (2005). Accounting and Business Research, 35(4), 327–349.

Indexed at, Google Scholar, Cross Ref

Mansi, S. A., Maxwell, W. F., & Miller, D. P. (2004). Does auditor quality and tenure matter to investors? Evidence from the bond market. Journal of Accounting Research, 42(4), 755–793.

Indexed at, Google Scholar, Cross Ref

Mansor, N., Che-Ahmad, A., Ahmad-Zaluki, N. A., & Osman, A. H. (2013). Corporate governance and earnings management: A study on the Malaysian family and non-family owned PLCs. Procedia Economics and Finance, 7, 221–229.

Indexed at, Google Scholar, Cross Ref

Mathews, C., Cooper, B. J., & Leung, P. (1994). A Profile of Internal Audit in Malaysia–1994. Institute of Internal Auditors–Malaysia, Kuala Lumpur.

Indexed at, Google Scholar, Cross Ref

McDaniel, L., Martin, R. D., & Maines, L. A. (2002). Evaluating Earning quality : The effects of financial expertise vs. financial literacy. The Accounting Review, 77(s-1), 139–167.

Indexed at, Google Scholar, Cross Ref

McMullen, D. A. (1996). Audit committee performance: An investigation of the consequences associated with audit committees. Auditing, 15(1), 87.

Indexed at, Google Scholar, Cross Ref

Mohamed, Z., Mat Zain, M., Subramaniam, N., Yusoff, W., & Fadzilah, W. (2012). Internal audit attributes and external audit’s reliance on internal audit: implications for audit fees. International Journal of Auditing, 16(3), 268–285.

Indexed at, Google Scholar, Cross Ref

Mohd Saleh, N., Mohd Iskandar, T., & Mohid Rahmat, M. (2007). Audit committee characteristics and earnings management: Evidence from Malaysia. Asian Review of Accounting, 15(2), 147–163.

Indexed at, Google Scholar, Cross Ref

Myers, J. N., Myers, L. A., Palmrose, Z.-V., & Scholz, S. (2003). Mandatory auditor rotation: Evidence from restatements. Academic Working.

Nurunnabi, M., Hossain, M., & Hossain, M. (2011). Intellectual capital reporting in a South Asian country: evidence from Bangladesh. Journal of Human Resource Costing & Accounting, 15(3), 196–233.

Indexed at, Google Scholar, Cross Ref

Ou, J. A., & Penman, S. H. (1989). Accounting measurement, price-earnings ratio, and the information content of security prices. Journal of Accounting Research, 111–144.

Indexed at, Google Scholar, Cross Ref

Owusu-Ansah, S., & Leventis, S. (2006). Timeliness of corporate annual financial reporting in Greece. European Accounting Review, 15(2), 273–287.

Indexed at, Google Scholar, Cross Ref

Palmrose, Z.-V. (1986). Audit fees and auditor size: Further evidence. Journal of Accounting Research, 97–110.

Indexed at, Google Scholar, Cross Ref

Pergola, T. M., & Verreault, D. A. (2009). Motivations and potential monitoring effects of large shareholders. Corporate Governance: The International Journal of Business in Society, 9(5), 551–563.

Indexed at, Google Scholar, Cross Ref

Prawitt, D. F., Smith, J. L., & Wood, D. A. (2009). Internal audit quality and earnings management. The Accounting Review, 84(4), 1255–1280.

Indexed at, Google Scholar, Cross Ref

Raghunandan, K., & Rama, D. V. (2007). Determinants of audit committee diligence. Accounting Horizons, 21(3), 265–279.

Indexed at, Google Scholar, Cross Ref

Rennie, M. D., Kopp, L. S., & Lemon, W. M. (2010). Exploring trust and the auditor-client relationship: Factors influencing the auditor’s trust of a client representative. Auditing: A Journal of Practice & Theory, 29(1), 279–293.

Indexed at, Google Scholar, Cross Ref

Riahi-Belkaoui, A. (2003). Intellectual capital and firm performance of US multinational firms: a study of the resource-based and stakeholder views. Journal of Intellectual Capital, 4(2), 215–226.

Indexed at, Google Scholar, Cross Ref

Rose, C., & Mejer, C. (2003). The Danish corporate governance system: from stakeholder orientation towards shareholder value. Corporate Governance: An International Review, 11, 335–344.

Indexed at, Google Scholar, Cross Ref

Scarbrough, D. P., Rama, D. V, & Raghunandan, K. (1998). Audit committee composition and interaction with internal auditing: Canadian. Accounting Horizons evidence., 12(1), 51.

Indexed at, Google Scholar, Cross Ref

Schipper, K., & Vincent, L. (2003). Earnings quality. Accounting Horizons, 17, 97.

Indexed at, Google Scholar, Cross Ref

Schleicher, T., Hussainey, K., & Walker, M. (2007). Loss firms’ annual report narratives and share price anticipation of earnings. The British Accounting Review, 39(2), 153–171.

Indexed at, Google Scholar, Cross Ref

Sengupta, P. (1998). Corporate disclosure quality and the cost of debt. Accounting Review, 459–474.

Sharma, V. D. (2004). Board of director characteristics, institutional ownership, and fraud: Evidence from Australia. Auditing: A Journal of Practice & Theory, 23(2), 105–117.

Indexed at, Google Scholar, Cross Ref

Sharma, V. D., & Iselin, E. R. (2012). The association between audit committee multiple-directorships, tenure, and financial misstatements. Auditing: A Journal of Practice & Theory, 31(3), 149–175.

Indexed at, Google Scholar, Cross Ref

Siagian, F. T., & Tresnaningsih, E. (2011). The impact of independent directors and independent audit committees on earnings quality reported by Indonesian firms. Asian Review of Accounting, 19(3), 192–207.

Indexed at, Google Scholar, Cross Ref

Singhvi, S. S. (1968). Characteristics and implications of inadequate disclosure: A case study of India. The International Journal of Accounting, 3(2), 29–43.

Indexed at, Google Scholar, Cross Ref

Smith, R. (2003). Audit committees combined code guidance. London: Financial Reporting Council.

Indexed at, Google Scholar, Cross Ref

Too, S. W., Wan Yusoff, W. F., & Chase, R. (2015). Exploring Intellectual Capital Disclosure as a Mediator for the Relationship between IPO Firm-Specific Characteristics and Underpricing. Journal of Intellectual Capital, 16(3).

Indexed at, Google Scholar, Cross Ref

Vafeas, N. (1999). Board meeting frequency and firm performance. Journal of Financial Economics, 53(1), 113–142.

Indexed at, Google Scholar, Cross Ref

Vafeas, N. (2005). Audit committees, boards, and the quality of reported earnings. Contemporary Accounting Research, 22(4), 1093–1122.

Indexed at, Google Scholar, Cross Ref

Vergauwen, P. G. M. C., & Van Alem, F. J. C. (2005). Annual report IC disclosures in the Netherlands, France and Germany. Journal of Intellectual Capital, 6(1), 89–104.

Indexed at, Google Scholar, Cross Ref

Walsh, J. P., & Seward, J. K. (1990). On the efficiency of internal and external corporate control mechanisms. Academy of Management Review, 15(3), 421–458.

Indexed at, Google Scholar, Cross Ref

Whiting, R. H., & Woodcock, J. (2011). Firm characteristics and intellectual capital disclosure by Australian companies. Journal of Human Resource Costing & Accounting, 15(2), 102–126.

Indexed at, Google Scholar, Cross Ref

Xie, B., Davidson, W. N., & DaDalt, P. J. (2003). Earnings management and corporate governance: the role of the board and the audit committee. Journal of Corporate Finance, 9(3), 295–316.

Indexed at, Google Scholar, Cross Ref

Yang, J. S., & Krishnan, J. (2005). Audit committees and quarterly earnings management. International Journal of Auditing, 9(3), 201–219.

Indexed at, Google Scholar, Cross Ref

Ye, P., Carson, E., & Simnett, R. (2011). Threats to auditor independence: The impact of relationship and economic bonds. Auditing: A Journal of Practice & Theory, 30(1), 121–148.

Indexed at, Google Scholar, Cross Ref

Yi, A., & Davey, H. (2010). Intellectual capital disclosure in Chinese (mainland) companies. Journal of Intellectual Capital, 11(3), 326–347.

Indexed at, Google Scholar, Cross Ref

Zhang, J. (2008). The contracting benefits of accounting conservatism to lenders and borrowers. Journal of Accounting and Economics, 45(1), 27–54.

Indexed at, Google Scholar, Cross Ref

Received: 31-May-2023 Manuscript No. AAFSJ-23-13649; Editor assigned: 01-Jun-2023, PreQC No. AAFSJ-23-13649(PQ); Reviewed: 15-Jun-2023, QC No. AAFSJ-23-13649; Revised: 19-Jun-2023, Manuscript No. AAFSJ-23-13649(R); Published: 23-Jun-2023