Research Article: 2022 Vol: 25 Issue: 5

The influence of electronic customer relationship management (e-crm) on service quality, customer satisfaction, loyalty and trust

Shymaa Mohamed Mohamed, Helwan University

Mohamed Marie, Helwan University

Engy Yehia, Helwan University

Citation Information: Mohamed, S.M., Marie, M., & Yehia, E. (2022). The influence of electronic customer relationship

management (e-crm) on service quality, customer satisfaction, loyalty and trust. Journal of

Management Information and Decision Sciences, 25(S7), 1-11

Abstract

E-CRM is the main e-commerce approach. E-CRM is an association of management, application, and software. E-CRM aims to improve customer service, establish a relationship and retain important customers. As the literature states, E- CRM deals with technology, procedures, people, and E-CRM is intended to achieve customer loyalty. Previous researches have examined E-impact CRM's on customer satisfaction, service quality, trust, and customer loyalty. The major aim of the current study is to investigate important research on customer satisfaction, service quality, trust, and customer loyalty for E-CRM. To do that, the author has sought and reviewed in detail several corresponding journals indexed in reputable databases to collect adequate indexes. Findings give information on each source, show what can be found there and how valuable the knowledge may be. This article meets defined needs for information/resources and gives practical aid for an individual and academic who initiate an E-CRM research with customer satisfaction, service quality, trust, and loyalty. This research also offers a useful insight into E-CRM in the best possible form for the supervisors of administrative firms and adapts it to their businesses or industry cultures to raise the levels of customer loyalty and improve their organization’s profitability and revenue.

Keywords

Customer Relationship Management; Electronic Customer Relationship Management; Customer Satisfaction; Service Quality; Trust; Customer Loyalty.

Introduction

The term CRM was used since the 1990s and evolved as a corporate strategy for the selection and management of the most important customer communications. The management of customer relations needs a focus on customers and a culture to support the organization's efficient marketing, sales, and post-sales services. The customer-centric culture focuses on the simple principle of single-to-one consumer connection. In the viewpoint of a person who wants, buys, and requires, this approach applies to each customer.

E-CRM is the technology that checks customer interactions with the support of innovation. In the whole management process, the E-CRM leads to satisfied customers (Durai & Stella, 2017).

The banking sector has experienced a number of issues as a result of fast changes in the business environment. As a result, the banking industry must become more competitive in responding to client queries in order to suit customer preferences and wants. Customer Relationship Management (CRM) is a strategy that allows businesses to gather information about their present and potential customers, as well as their needs and desires, and utilize it to improve their implementation and retention (Saputra, 2019). The researchers also supported using E-CRM to mix digital marketing with customer-based marketing approaches (Al-Dmour et al., 2019).

E-CRM Definitions

E-CRM improves a company's complete purchase and sale process by increasing its efficiency over its rivals in terms of its various wants and demands and thus makes them happy and loyal to the organization. At last, associations not only increase their income, but also start to grow via the use of new E-CRM instruments (Salehi et al., 2015). It was determined that the E-CRM system better serves customers to satisfy their expectations and to achieve larger company benefits and revenues. Types of research have been carried out to support E-CRM's advantages for banks in particular. For example, (Bezovski & Hussain, 2016) found that E- CRM offers advantages to the banks such as lower branch workload, reduced administrative costs, increased cross-sales, bank profits, and the ability of bankers to understand customer requirements from prior transactions. Delicate technology use is the strategic means through which associations obtain competitive advantage regardless of their type and size. Every business in the world today seeks to achieve success via the most advanced use of technology, while simultaneously relying on customer relationship management for its success or failure (Nasruddin & Khalid, 2017).

CRM versus E-CRM

The difference between CRM and E-CRM is that the CRM, or equivalent E-CRM, is based on CRM, but the focus is on individualization, sales direct marketing technology, and the provision of a variety of services to local market. E-CRM makes this possible for consumers by making contact with the firm more efficient; it also shows its potential as a customer via this relationship, as well as the organisation and the customer benefit. E-CRM is also reliant on the CRM platform, which focuses on segmentation technologies, customer data analysis, multi-channel interactions, one-to-one interaction, and market-specific services. The application of information technology in customer interactions has resulted in the creation of the E-CRM concept. As a result, clients were able to build their own unique items using IT capabilities. It's worth noting that the "E" in E-CRM refers to a new technology, namely the Internet (Taghipourian et al., 2019):

• Implement a customization degree in which CRM was unavailable. One of the advantages of E-CRM enables every customer to provide products and services.

• Reacted more quickly than customers on channels that are different from the CRM channels.

• Track each customer's behavioral trends because E-CRM was unable to do so.

• Customer empowerment increased, which is less in terms of CRM.

Service Quality Definitions

Quality of service has become important due to the increasing preparedness of services associations and the growing competition between them, where it is not enough, without the provision of good treatment and knowledge among the biggest customers, to continue to handle them and expand their customers' base and to provide services at reasonable quality and price (Alshurideh et al., 2017).

Service Quality Dimensions

The term of quality of service involves both the service results and the service execution. According to Jovovic et al. (2017) and Parasuraman et al. (1985) have proposed the five-dimension (reliability, tangibility, empathy, assurance, and responsiveness) for the measurement of service quality. The materialist resources, apparatus, and manifestations of HR are described by tangibility; the understanding and seriousness of the customer requirements are described; the empathy to provide services committed in perfect terms is strongly linked to the reliance on reliability; and responsiveness indicates that the bank's staff are compliant to support the customer and make it timely Several studies used the Seroquel methodology to assess service quality in several businesses, including banking. Different studies (Apornak, 2017; Oskooii & Albonaiemi, 2017) have joined the Servqual five dimensions model to examine the quality of services and customer satisfaction in the banking sector.

Customer Satisfaction Definitions

Customer satisfaction is used as the extent to which customers are satisfied with a company's goods, services, and skills. Satisfaction is described in the comparison between one's expectations and the products, outcomes, and perceived results, as a level of pleasure or satisfaction. When customers receive items and services of outstanding quality, their degree of satisfaction is increased (Al-Dmour et al., 2019).

Customer Loyalty Definitions

Associations succeed in today's market if they are loyal to them and may now get competitive advantages. By adopting E-CRM in their whole process, banks quickly develop customer loyalty (Abu-Shanab & Anagreh, 2015) Loyalty has strong, economical and handling costs to achieve quality, on-time delivery, and product delivery (Al-Hawary & Hussien, 2016; Alshurideh et al., 2017) Customer loyalty is essential, in the extremely competitive business banking environment (Mang'unyi et al., 2017).

Trust Definitions

Building consumer connections requires a high level of trust (Mahmoud et al., 2017). One of the most essential backdrops of strong and community relationships is commercial trust; trust is seen to be a vital component in the formation of internet commerce (Kundu & Datta, 2015). For e-commerce system administrators and information system researchers, building online trust is a critical problem (Elbeltagi & Agag, 2016). Clients may gain trust online through a variety of techniques, such as the website's thorough design or the information offered by the service provider to their customers (Mousavian & Ghasbeh, 2017).

Literature Review

The major goal of the study of Bataineh (2015) was to see how E-CRM techniques used by Jordanian banks affect Electronic word of Mouth (eWOM) on these banks' social networking sites (SNSs), such as Facebook, Twitter, and Instagram. Furthermore, an advanced survey was used to collect data from a sample of 507 customers; the findings revealed that electronic direct mail, perceived benefits, and interpersonal communication all had an impact on the eWOM of banks' SNSs. Furthermore, the function of customer satisfaction as a mediating factor was confirmed.

Hidayat et al. (2015) in his study determined how the quality of service, customer trust, and customer service affect customer satisfaction and loyalty at Islamic banks in East Java. Data collection questionnaires were used, and the results revealed that Islamic banks have a significant impact on customer satisfaction with service quality and consumer confidence. Through East Java customer satisfaction, service quality and customer trust have a direct and indirect influence on customer loyalty. Directly and indirectly, religious commitment has minimal impact on customer satisfaction and loyalty.

Kaur & Kaur (2016) examined that how E-CRM competitive advantage greatly helps to organizational financial success. Research results indicate that the financial success of E-CRM considerably adds to the success of the firm. It may also be noted that the competitive advantage of E-CRM may also influence non-financial development (such as satisfaction with the customer), improving internal business quality, and also upgrading e-services and facilities in a bank.

Navimipoura & Soltani (2016) found the most effective factors for E-CRM efficiency (cost, Technology acceptance, and employees’ satisfaction) They gathered information from clients in a major UK city via a surveyor. The impact of technology acceptance on organization performance begins with infrastructure capability, ease of use, and E-learning systems, according to data from 210 employees of the Tax Administration of East Azerbaijan in Iran, and the complementarity among these factors positively influences the effectiveness of the E- CRM. The findings also revealed that customer expenses have a significant influence on customer relationship performance, increasing the usefulness of an E-CRM in the organization.

Mang'unyi et al. (2017) analysed the influence of the Electronic Customer Relationship Management features (E-CRM) on customer loyalty. Via a cross-sectional survey approach, data was obtained using self- administrated questionnaires from a convenience sample of customers of a large corporate Kenyan bank. Results from correlation analysis and other regression analyses have shown that E-CRM loyalty is a positive, substantial link between pre- service, during service, and after-service, and that pre-service and service features predict loyalty considerably. Improving E-CRM procedures might be a strategic competitive strategy to affect the bank's customer connections.

Cherapanukorn (2017) studied the factors of success of E-CRM in the hotel sector. Semi-structured questionnaires and five hoteliers were interviewed using the benefit of quality research. The exact results demonstrate that five primary factors result in the success of E-CRM; include organization readiness, customer service, knowledge management, online communication, and technology support.

Oumar et al. (2017) studied set Customer Relationship Management theory (CRM) and examined the link between electronic CRM (E-CRM) and electronic banking loyalties (e-customer). By adopting a review strategy, the data were collected using a questionnaire taken from the commodity samples of the major Kenyan commercial bank's customers. The results show that E-CRM and e-customer loyalty relate beneficially. E-CRM characteristics greatly affect e-customer loyalty in the banking sector at all three phases of an electronic transaction cycle, which include pre-service, during service, and post- service.

According to Chiguvi & Guruwo (2017) Customer satisfaction has an impact on consumer loyalty in Botswana's banking business. In addition, the impacts of demography as moderating buildings were examined in this study. A self- administered questionnaire was randomly picked from 44 respondents who visited Standard Chartered Bank using an explicatory study technique. Customer satisfaction and loyalty were found to have favourable links in the study.

Yildiz (2017) investigated the influence of service quality on customer trust and satisfaction, customer loyalty, and word-of-mouth loyalty. Questionnaires were sent to 460 customers of various freight companies. As an outcome, satisfaction and trust have been found to have a strong impact on loyalty and loyalty to have a positive impact, word of mouth.

Mang’unyi et al. (2017) by using data from clients of one of Kenya's largest retail banks in the field of Electronic Customer Relationship Management (E-CRM), this research attempts to investigate the mediation impact of Customer Satisfaction (CS) and Customer Loyalty (CL). The interaction of the E-CRM transaction and the CS was statistically significant, and the CL was forecasted, but the interaction didn't account for considerably more differences than the E-CRM characteristics and the CS, according to this study, which was conducted in survey mode. The relationship between the E-CRM transaction characteristics and the CS capabilities was also statistically significant, according to the research. The path analysis revealed that CS mediation had no significant influence on the E-CRM-CL connection.

The purpose of the study (Aldaihani & Ali, 2018) was to look at the effects of commercial banks in Kuwait providing high-quality electronic services through electronic customer relationship management. The research population consisted of all commercial bank clients in Kuwait. The descriptive-analytical strategy was used to meet the study's aims, with a questionnaire that incorporated a substantial data collection instrument created by top researchers and writers in the field of study variables (39). Following the assessment of the gathered data and assumptions, the following results were obtained: The quality of services provided by Kuwait's commercial banks has been greatly influenced by e-customer relationship management.

Mulyono & Situmorang (2018) determined the role of online transportation experience and pleasure in mediating the relationship between E-CRM and loyalty. The applicability of e-customer relationship management, customer experience, customer happiness, and customer loyalty is expanded in this article. Data was collected from 190 respondents who completed an online questionnaire while travelling. Result E-CRM shows that it has a positive and substantial confirmation that it is satisfied and loyal to its consumers in a research with direct effect. Result The relationship between E-CRM, customer happiness, and loyalty is completely mediated by customer experiences, according to direct positive research.

The objective of the study by Al-Dmour et al. (2019) was to establish an integrated framework to examine the impact on customer satisfaction, consumer trust, and customer retention of electronic customer relationship management (E-CRM) success factors (process fits, customer information quality, and system support) which, in turn, have an effect on Jordan's financial performance in the city of Amman. A sample of 343 industry managers, branch assistants, and department leaders in Jordanian commercial banks responded to an autonomous questionnaire. The findings show that Customer Satisfaction, customer trust, and customer retention have been positively benefited by E-CRM success factors (process fit, Customer Information Quality, and system support). In addition, writers found that customer satisfaction and consumer trust had a strong effect on the retention of customers. Customer satisfaction, consumer trust, and customer retention were proven to have a strong influence on the financial success of the company.

Mohammad (2019) studied the effects on customer electronic loyalty of banks in Jordan of the electronic customer relations management. The survey was made up of customers who electronically make their bank transactions. A questionnaire was prepared by elite investigators and writers, in the field of study variables, to provide data collection, consisting of (26) statements and distribution and collection of 400 questionnaires. The results of this study demonstrated that electronic customer loyalty in banks operating in Jordan is positively impacted by electronic customer relations.

Abdi et al. (2019) investigated the impact the service attributes and the quality of customer-bank connections of electronic Customer Relation Management (E-CRM) and collected information using a questionnaire. Results show the impact of E-CRM on the services and quality attributes and the results of the customer relationship with the Maskan Bank. Moreover, the implementation of E-CRM also affects the quality and results of relationships indirectly through customer service attributes.

Rashwan et al. (2019) evaluated the links between E-Customer Relationship Management (E-CRM), electronic banking satisfaction as a mediator variable, and electronic customer loyalty. A questionnaire was used to obtain the data. The study indicated that the characteristics of the E-CRM (expected security) were significantly interlinked with the objectives of repeating e- mail transactions and giving other customers favorable comments; the convenience of website design and supplying customers with favorable remarks to other people were significantly correlated. Although the convenience of the website design and intentions of repeated e-dealing are not significant. And electronic banking pleasure does not operate as a mediator in affecting the link between the E-CRM dimensions (expected security) and the intention to repeat electronic transactions.

Taghipourian et al. (2019) examined E-CRM on the relationship quality and its results. Therefore, in the statistical collectivity between private banks electronic customers of 388 individuals, evidence from the Iranian private banks. Data demonstrate that the quality of connections and the implications of customers with 7 parts including communication channels, communication quality overall, confidence, satisfaction, loyalty, maintenance and the trend to compromise have a good and important impact on E-CRM and The impact on the quality dimensions and consequences with customers such as satisfaction, loyalty, and maintenance were confirmed by the outcome of the study.

Boonlertvanich (2019) provided a complete model that reflects the connections between quality of service, customer satisfaction, trust, and loyalty in retail banking. Data are gathered from 400 customers via a questionnaire. Quality of service perceived by the customer, directly and indirectly, impacts attitude and behavioral loyalty through satisfaction and trust. Customer loyalty is less affected by service quality if a customer is a major bank.

Kumar & Mokha (2020) examined the effects on customer loyalty in the banking business using E-CRM (measured using products/services, data security/privacy, alternative payment methods, problem-solving, Online feedback, and FAQs). Data are gathered from Delhi/300 NCR's customers (either 150 from the banks of the public or private sector) utilizing E-CRM. The results show that all six elements of E-CRM have a substantial positive customer loyalty relationship. This experimental outcome will have academic and management consequences as they support E-CRM managers in the decision-making process and assist them to build the current knowledge base.

Salameh et al. (2020) examined the effects of E-CRM in Saudi Arabia on customer satisfaction, customer trust, and commitment. A quantitative cross-sectional survey has been designed for this project. Study outcome the strong impact on E-CRM has been demonstrated by customer satisfaction, customer profitability, trust, and commitment. Empirical data of this survey showed the key determinants of effective E-CRM from the customer's point of view, satisfaction, customer profitability, trust, and commitment.

Hanif et al. (2020) looked at the influence of E-CRM on organizational performance. In today's corporate setting, digital technology plays a critical role, and customer happiness is predicated on its use. Random sampling was used to conduct the inquiry in Pakistan. Quantitative and qualitative approaches have been used in questionnaire research processes. A total of 220 surveys and interviews were used to create the sample. This demonstrates that, as competition grows, the electronic customer relationship has a beneficial impact due to the organization's requirement to maintain the E-CRM system. Our conclusion demonstrates that customer satisfaction results in the use of technology in mediation for E-CRM and organizational success.

Darojat (2020) examined the influence of E-CRM and e-service quality on customer satisfaction and customer loyalty as mediators. Kidang Rangga Mebel Jakarta using a sample of 160 customers. The research objective is to customer PT. Quarantine research types via disseminating surveys. IT was proven to have a good and considerable influence on PT's customer satisfaction and loyalty with E- CRM and e-service quality. Kidang Rangga Mebel Jakarta's customer loyalty has a large and good effect on satisfaction; satisfaction with the partial mediation of the effects of the E-CRM and the quality of e-services on customer loyalty PT.

Dehghanpouri et al. (2020) assessed the performance of the E-Customer Relationship Management (E-CRM) systems through the effects of trust, privacy, service quality, and customer satisfaction. A new framework is offered in this study to determine the important success elements for E- CRM systems. The proposed model is checked with partially less than squares with modeling of structural equations. 378 taxpayers in eastern Azerbaijan Province of Iran have been created and gathered with a questionnaire. The results show that the quality of service perceived mostly influences customer satisfaction.Trust seems to have a strong influence on customer satisfaction. As a response, the operation of E-CRM systems is greatly determined by customer satisfaction, service quality, trust, and privacy.

Comparison With Previous Studies

To the best of our knowledge, our proposal is the first study dedicated to the most factors (E-CRM, Service quality, trust, customer satisfaction, and loyalty), Table 1 shows the limitations of the previous researches attempted to introduce E-CRM studies.

| Table 1 The Limitations Of The Previous Studies Against The New Proposed Study |

||||||||

|---|---|---|---|---|---|---|---|---|

| Studies | Factors | |||||||

| E-CRM | Customer satisfaction | Customer loyalty | Commitment | Service Quality | Customer expectation | Perceived Price | Trust | |

| The proposed study | √ | √ | √ | √ | √ | |||

| Bataineh (2015) | √ | √ | ||||||

| Hidayat et al. (2015) | √ | √ | √ | √ | √ | |||

| Kaur & Kaur (2016) | √ | |||||||

| Navimipoura & Soltani (2016) | √ | √ | ||||||

| Mang'unyi et al. (2017) | √ | √ | ||||||

| Chiguvi & Guruwo, 2017 | √ | |||||||

| Oumar et al. (2017) | √ | √ | √ | |||||

| Chiguvi & Guruwo )2017) | √ | √ | ||||||

| Yildiz (2017) | √ | √ | √ | √ | ||||

| Mang’unyi et al. (2018) | √ | √ | √ | |||||

| Aldaihani & Ali (2018) | √ | √ | ||||||

| Mulyono & Situmorang (2018) | √ | √ | √ | |||||

| Al-Dmour et al. (2019) | √ | √ | √ | |||||

| Mohammad (2019) | √ | √ | ||||||

| Abdi et al. (2019) | √ | √ | ||||||

| Rashwan et al. (2019) | √ | √ | √ | |||||

| Taghipourian & Hatami (2019) | √ | √ | √ | |||||

| Boonlertvanich (2019) | √ | √ | √ | √ | ||||

| Kumar & Mokha (2020) | √ | √ | ||||||

| Salameh et al. (2020) | √ | √ | √ | √ | ||||

| Hanif et al. (2020) | √ | √ | ||||||

| Darojat (2020) | √ | √ | √ | √ | ||||

| Dehghanpouri et al. (2020) | √ | √ | √ | √ | ||||

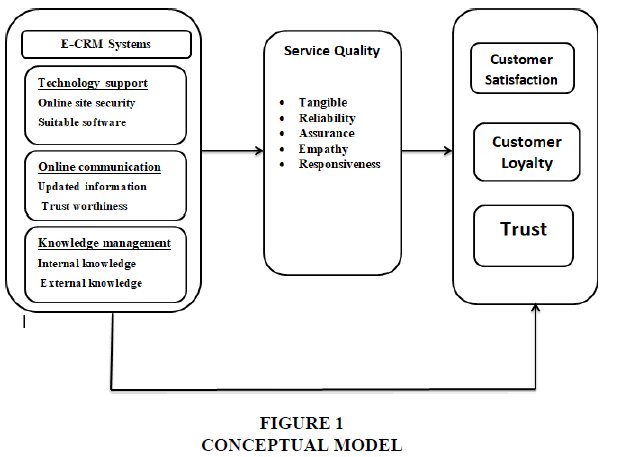

Conceptual Framework

A theoretical framework describes the link between factors that contribute to the research problem. The theoretical framework provides a clear understanding of the dynamics of the problem being investigated and thus facilitates the generation of testable hypotheses.

The direction of the links between study factors was consistent with the related literature and theoretical background in addition to the link between service quality and trust, customer satisfaction and loyalty whereas the direct relationship between E-CRM and trust, customer satisfaction and loyalty will be considered. There are seven primary components in the theoretical framework for this study (Figure 1):

1. Technology support

2. Online communication

3. Knowledge management

4. Customer satisfaction

5. Service quality

6. Customer loyalty

7. Trust

Conclusion

This review article was a first-hand analysis of the E-CRM relationship with customer satisfaction, customer loyalty, service quality, trust, and other sentences to ensure that the E-CRM is in terms of customer satisfaction and customer loyalty, which is the goal of ECRM in current marketing. The findings of investigations carried out by prior scientists show that E-CRM has a positive and substantial determination in terms of client pleasure and consumer loyalty, as discussed before in this scientific review article. by checking the association literature and E-CRM has positive and important determinations as to the dimensions of service quality and the role of trust as a variable could be determined in enhancing relations between E-CRM, customer satisfaction, and customer loyalty. The findings of previous studies are consistent and interlinked as indicated in previous studies.

References

Abdi, M.A., Hamidizadeh, M.R., & Gharache, M. (2019). Effects of e-crm on the service attributes and quality of customer-bank relationship.International Transaction Journal of Engineering, Management, & Applied Sciences & Technologies,11(4), 1-12.

Abu-Shanab, E., & Anagreh, L. (2015). Impact of electronic customer relationship management in banking sector.International Journal of Electronic Customer Relationship Management,9(4), 254-270.

Indexed at, Google Scholar, Cross ref

Aldaihani, F.M., & Ali, N.A. (2018). Effect of Electronic Customer Relationship Management on Electronic service quality provided by the commercial banks in Kuwait.International Journal of Academic Research in Accounting, Finance and Management Sciences,8(2), 143-154.

Indexed at, Google Scholar, Cross ref

Al-Dmour, H.H., Algharabat, R.S., Khawaja, R., & Al-Dmour, R.H. (2019). Investigating the impact of ECRM success factors on business performance: Jordanian commercial banks.Asia Pacific Journal of Marketing and Logistics,31(1), 105-127.

Indexed at, Google Scholar, Cross ref

Al-Hawary, S.I.S., & Hussien, A.J. (2016). The Impact of electronic banking services on the Customers Loyalty of Commercial Banks in Jordan.International Journal of Academic Research in Accounting, Finance and Management Sciences,7(1), 50-63.

Indexed at, Google Scholar, Cross ref

Alshurideh, M.T., Al-Hawary, S., Mohammad, A., Al-Hawary, A., & Al Kurdi, A. (2017). The impact of Islamic bank’s service quality perception on Jordanian customer’s loyalty.Jounal of management reseach,9, 140-159.

Indexed at, Google Scholar, Cross ref

Apornak, A. (2017). Customer satisfaction measurement using SERVQUAL model, integration Kano and QFD approach in an educational institution.International Journal of Productivity and Quality Management,21(1), 129-141.

Indexed at, Google Scholar, Cross ref

Bataineh, A.Q. (2015). The Effect of eCRM Practices on eWOM on Banks' SNSs: The Mediating Role of Customer Satisfaction.International Business Research,8(5), 230.

Indexed at, Google Scholar, Cross ref

Bezovski, Z., & Hussain, F. (2016). The benefits of the electronic customer relationship management to the banks and their customers.Research Journal of Finance and Accounting,7(4), 112-116.

Boonlertvanich, K. (2019). Service quality, satisfaction, trust, and loyalty: the moderating role of main-bank and wealth status.International Journal of Bank Marketing, 37(1), 278-302.

Indexed at, Google Scholar, Cross ref

Cherapanukorn, V. (2017). Development of eCRM success: A case study of hotel industry.International Journal of Trade, Economics, and Finance,8(2), 90-95.

Indexed at, Google Scholar, Cross ref

Chiguvi, D., & Guruwo, P.T. (2017). Impact of customer satisfaction on customer loyalty in the banking sector.International Journal of Scientific Engineering and Research,5(2), 55-63.

Darojat, T.A. (2020). Analysis of E-CRM and e-Service Quality of Customer Loyalty at PT. Kidang Rangga Jakarta Mebel With Satisfaction as a Intervening Variable: Analysis of E-CRM and e-Service Quality of Customer Loyalty at PT. Kidang Rangga Jakarta Mebel With Satisfaction as a Intervening Variable.Jurnal Mantik,3(4), 671-677.

Dehghanpouri, H., Soltani, Z., & Rostamzadeh, R. (2020). The impact of trust, privacy and quality of service on the success of E-CRM: the mediating role of customer satisfaction.Journal of business & industrial marketing, 1831-1847.

Indexed at, Google Scholar, Cross ref

Durai, T., & Stella, G. (2017). A Study On The Effect Of Electronic Customer Relationship Management (ecrm) On Customer Satisfaction Of E–Commerce Websites.Journal of Marketing Strategy,5(3), 332-339.

Elbeltagi, I., & Agag, G. (2016). E-retailing ethics and its impact on customer satisfaction and repurchase intention: a cultural and commitment-trust theory perspective.Internet Research, 26, 288-310.

Indexed at, Google Scholar, Cross ref

Hanif, M.I., Ahsan, M., Bhatti, M.K., & Loghari, M.S. (2020). The Effect of Electronic Customer Relationship Management on Organizational Performance with Mediating Role of Customer Satisfaction.International Review of Management and Marketing,10(5), 138.

Indexed at, Google Scholar, Cross ref

Hidayat, R., Akhmad, S., & Machmud, M. (2015). Effects of service quality, customer trust and customer religious commitment on customers satisfaction and loyalty of Islamic banks in East Java.Al-Iqtishad: Jurnal Ilmu Ekonomi Syariah,7(2), 151-164.

Indexed at, Google Scholar, Cross ref

Jovovic, R., Draskovic, M., Delibasic, M., & Jovovic, M. (2017). The concept of sustainable regional development–institutional aspects, policies and prospects.Journal of International Studies,10(1), 255-266.

Kaur, J., & Kaur, B. (2016). The influence of e?CRM competitive advantage on e?CRM performance in the Indian banking industry.Strategic Change,25(5), 537-550.

Indexed at, Google Scholar, Cross ref

Kumar, P., & Mokha, A.K. (2020). A Study on Relationship Between Electronic Customer Relationship Management (E-CRM) and Customer Loyalty in the Banking Industry.Ramanujan International Journal of Business and Research,5, 211-226.

Indexed at, Google Scholar, Cross ref

Kundu, S., & Datta, S.K. (2015). Impact of trust on the relationship of e-service quality and customer satisfaction.EuroMed Journal of Business. EuroMed Journal of Business, 10, 21-46.

Indexed at, Google Scholar, Cross ref

Mahmoud, M.A., Hinson, R.E., & Anim, P.A. (2017). Service innovation and customer satisfaction: the role of customer value creation.European Journal of Innovation Management, 21(3), 102-125.

Mang’unyi, E.E., Khabala, O.T., & Govender, K.K. (2017). The relationship between e-CRM and customer loyalty: a Kenyan Commercial Bank case study.Banks & bank systems, 12(2), 106-115.

Indexed at, Google Scholar, Cross ref

Mang’unyi, E.E., Khabala, O.T., & Govender, K.K. (2018). Bank customer loyalty and satisfaction: the influence of virtual e-CRM.African Journal of Economic and Management Studies, 9(2), 250-265.

Indexed at, Google Scholar, Cross ref

Mohammad, A.A. (2019). Customers' Electronic Loyalty of Banks Working In Jordan: the Effect Of electronic customer relationship management. International Journal of Scientific & Technology Research, 8(12).

Mousavian, S.J., & Ghasbeh, M.J. (2017). Investigation of relationship between e-banking industry risks and electronic customer relationship management (E-CRM).MAYFEB Journal of Business and Management,2, 26-34.

Mulyono, H., & Situmorang, S. H. (2018). E-CRM and loyalty: A mediation Effect of Customer Experience and satisfaction in online transportation of Indonesia.Academic journal of Economic studies,4(3), 96-105.

Nasruddin, N.H.M., & Khalid, F.A. (2017). The Influence of Internal and External Forces in Adoption of Electronic Customer Relationship Management (ECRM) in Malaysian SMEs.The Social Sciences,12(12), 2230-2235.

Navimipour, N.J., & Soltani, Z. (2016). The impact of cost, technology acceptance and employees' satisfaction on the effectiveness of the electronic customer relationship management systems.Computers in Human Behavior,55, 1052-1066.

Indexed at, Google Scholar, Cross ref

Oskooii, N., & Albonaiemi, E. (2017). Measuring the customer satisfaction based on SERVQUAL model (case study: Mellat Bank in Tehran city).Innovative marketing,13(2), 13-22.

Indexed at, Google Scholar, Cross ref

Oumar, T.K., Mang’Unyi, E.E., Govender, K.K., & Rajkaran, S. (2017). Exploring the e-CRM–e-customer-e-loyalty nexus: a Kenyan commercial bank case study.Management & Marketing. Challenges for the Knowledge Society,12(4), 674-696.

Indexed at, Google Scholar, Cross ref

Parasuraman, A., Zeithaml, V.A., & Berry, L.L. (1985). A conceptual model of service quality and its implications for future research.Journal of Marketing,49(4), 41-50.

Indexed at, Google Scholar, Cross ref

Rashwan, H.H.M., Mansi, A.L.M., & Hassan, H.E. (2019). The impact of the E-CRM (expected security and convenience of website design) on E-loyalty field study on commercial banks.Journal of Business and Retail Management Research,14(1).

Indexed at, Google Scholar, Cross ref

Salameh, A., Hatamleh, A., Azim, M., & Kanaan, A. (2020). Customer oriented determinants of e-CRM success factors.Uncertain Supply Chain Management,8(4), 713-720.

Indexed at, Google Scholar, Cross ref

Salehi, S., Kheyrmand, M., & Faraghian, H. (2015). Evaluation of the effects of e-CRM on customer loyalty (case study: Esfahan Branch's of Sepah Bank). In2015 9th International Conference on e-Commerce in Developing Countries: With focus on e-Business (ECDC)(pp. 1-8). IEEE.

Indexed at, Google Scholar, Cross ref

Saputra, S. (2019). The Effect of Customer Relationship Management (CRM) on Bank Customer Loyalty through Satisfaction as Mediating Variable: Evidence in Batam, Indonesia.Proceedings of the International Symposium on Social Sciences, Education, and Humanities (ISSEH 2018).

Indexed at, Google Scholar, Cross ref

Taghipourian, M.J., Hatami, S., & Chalous, I. (2019). E-CRM on the Relationships Quality and Its Consequences: Evidence from Iranian Private Banks.Journal of Information Engineering and Applications,9(5), 1-14.

Indexed at, Google Scholar, Cross ref

Yildiz, E. (2017). Effects of service quality on customer satisfaction, trust, customer loyalty and word of mouth: an application on cargo companies in gümü?hane.Global Journal of Economics and Business Studies,6(12), 81-88.

Received: 16-Apr-2022, Manuscript No. JMIDS-22-11771; Editor assigned: 20-Apr-2022, PreQC No. JMIDS-22-11771(PQ); Reviewed: 04-May-2022, QC No. JMIDS-22-11771; Revised: 26-May-2022, Manuscript No. JMIDS-22-11771(R); Published: 30-May-2022