Research Article: 2020 Vol: 24 Issue: 5

The Influence of Financial Literacy on Smes Performance Through Access to Finance And Financial Risk Attitude as Mediation Variables

Agung Dharmawan Buchdadi, Universitas Negeri Jakarta, Indonesia

Amelia Sholeha, Universitas Negeri Jakarta, Indonesia

Gatot Nazir Ahmad, Universitas Negeri Jakarta, Indonesia

Mukson, Universitas Muhadi Setiabudi, Indonesiaterus

Abstract

The Small and Medium-size Enterprises (SMEs) sector has the crucial role to increase economic growth in emerging countries. Then, the purpose of this study was to examine the determinant variable of the SMEs performance namely financial literacy of the manager. This study utilize acces to financial product and financial risk risk attitude as the mediation variables. This type of research uses a quantitative approach and the structural equation modeling (SEM) is used to analyse the data. The samples of this study 70 person who managed the SMEs in Brebes district in Central Java due to there are a lot of best performer SMEs in Indonesia from this area. This study found the positive impact of financial literacy, access to finance, and financial risk attitude on the MSME performance. This study also found the mediation role of access to finance and the financial risk attitude on the relationship between financial literacy on MSMEs performance. From the descriptive of statistics, it is also found that the weakness of the manager of the MSME regarding the bank and capital market product. The implication of these findings the government needs to create a program to enhance the level of financial literacy among the manager of the MSMEs especially the skills and knowledge regarding the bank product, risk management, and capital market product.

Keywords

Financial Literacy, Smes Performance, Access To Financial Product, And Financial Risk Attitudes.

Introduction

The development and role of the private sector have increased in emerging countries, including Indonesia. Business people face considerable challenges, incredibly uncertain economic conditions due to global competition, and the strengthening of the dollar against the rupiah. The business sector small and medium size enterprises (SMEs), which have the potential to increase economic growth and create new jobs, are expected to make a significant contribution to the Indonesian economy.

A large number of SMEs are scattered in each region, and their contribution to the Indonesian economy does not make SMEs a vital sector and is free from various problems. In general, SMEs often experience delays in their development. According to Abor (2016), most of the SMEs are difficult to develop due to various conventional problems that cannot be resolved entirely, such as problems with the capacity and quality of human resources, ownership, financing, marketing, finance, and various other issues related to business management, so that SMEs find it difficult to compete to biger companies.

Therefore, strategic efforts are needed to improve the performance and sustainability of SMEs. One of the ways that can be done is by enriching the knowledge of SMEs people on financial expertise so that management and accountability can be better accounted for as befits a large company (Adomako et al., 2016; Sadat & Lin, 2018).

Financial literacy is an important thing that must be owned by SMEs manager in achieving success and improving business performance. However, there are still many people, including SMEs in Indonesia, who do not understand financial literacy well. In the third National Financial Literacy Survey (SNLIK) conducted by the Financial Services Authority (OJK) in 2017, the financial literacy index reached 38.03%, and the financial inclusion index 76.19%. Based on the regional strata, for urban areas, the financial literacy index reached 41.41%, and the financial inclusion for urban communities was 83.60%. In comparison, the literacy index and financial inclusion for rural communities were 34.53% and 68.49% (OJK-RI, 2017).

Low financial literacy level makes it difficult for SMEs to access funding because they are unable to produce financial reports properly and inaccurate financial management. According to data from Bank Indonesia and the Financial Services Authority (OJK), it is stated that as many as 70% of the total of nearly 60 million Small and Medium Enterprises (SMEs) units in Indonesia have not had access to financing from banks. SMEs occupy an important position in the country's economy. OJK noted that the minimal distribution of funding to SMEs was due to administrative constraints, as well as financial and business management, which is generally still managed manually. Difficult access to finance will become one of the obstacles to the growth and development of SMEs performance because formal financial institutions are still hesitant to provide credit to business owner (Fatimah, 2011; Purwaningsih & Kusuma Damar, 2015).

Good financial literacy can minimize financial risks that occur in corporate organizations because the financial risk attitude allows entrepreneurs to identify opportunities and risks associated with business and financial decisions. It is also found that financial risk attitudes affect the organization's financial decision-making process. Financial risk attitudes affect the survival and failure rates of companies, as well as their decision making (Gärling et al., 2009).

Brebes Regency is one of the districts in Central Java, which has abundant natural resources so that it can be processed and appropriately marketed by Small, Micro, and Medium Enterprises (SMEs). Starting from the agricultural, livestock, forestry, and marine sectors. With the existence of these SMEs, it is hoped that it can improve the community's economy. This area was chosen by the government as the pilot project in developing SMEs for enhanceng the poverty and the quality of life starting in 2016. Currently, Brebes District has recorded 25,214 SMEs, consisting of 17,358 micro-enterprises, 7,244 small businesses, and 636 medium enterprises. One of the best performer association of the MSME is Guyub Rukun Saklawase UMKM forum. This association regularly provide the meeting with the government, the academician, and industry in order to improve the quality of business(Rasban, 2019).

The Rukun Saklawase Guyub Forum was formed to facilitate the coordination and guidance and empowerment of SMEs. So that it can improve product quality, marketing, technology, and other things related to improving the performance and sustainability of SMEs in Brebes Regency, not all SMEs are active. Only a few are participating in this forum. This forum often conducts training, including financial training for SMEs. Therefore, researchers will examine MSME manager who are active in this forum. How is the performance associated with the influence of financial literacy, access to finance, and financial risk attitudes.

Based on previous research, there is an impact ofinancial literacy and access to finance on the performance of SMEs. According to Kimani & Ntoiti (2015), financial literacy allows entrepreneurs to make projections of income and expenditure, thus concluding that debt management, budget planning. Banking services and training on record-keeping that made it easier for them to access credit had a positive effect on business performance. Also, some research (Aribawa, 2016; Dermawan, 2019; Dewi, Yurniwati, & Annisaa, 2018) obtained significant positive results between the effects of financial literacy, access to finance, and the performance of SMEs. Meanwhile, other research (Eresia-Eke & Raath, 2013; Fowowe, 2017; Kumalasari & Asandimitra, 2019; Olawale & Garwe, 2010; Sibanda, Hove-Sibanda, & Shava, 2018) show a significant negative effect of financial literacy, access to finance, and SMEs performance.

Previous research on the effect of financial literacy and financial risk attitudes on SMEs performance has also found several different results. According to Esiebugie, Richard, & Emmanuel (2018), the financial attitudes affect the performance of SMEs. However, most SMEs managers and owners have poor attitudes towards their financial activities. Their low future orientation evidence this, inability to take risks, and lack of participation in training programs that can promote their financial skills despite the knowledge of the importance of directing short-term activities towards the long-term goals of the company. Meanwhile, research by Eniola & Entebang (2017) shows that financial literacy has a significant effect on the performance and growth of SMEs. However, financial attitudes do not have a substantial impact on company performance.

With there are still differences in previous research and based on the background of the research object, it is interesting for researchers to research the effect of financial literacy on the performance of SMEs through mediating access to finance and financial risk attitudes in Brebes Regency, Central Java. This study will have contribution to make a confirmation on the impact of financial literacy on the performance of SMEs through mediating access to finance and financial risk attitudes. Moreover, this research will be the empirical evidence for the government in providing policies in enhancing the SMEs in developing countries.

Literature Review and Hypothesis Development

SMEs Performance

SMEs performance is the result of the evaluation of the company's work achieved by a person or group with the division of activities in the form of tasks and roles in a certain period with the standards of the company (Mutegi et al., 2015). Business performance at SMEs can be seen from the company's success in product quality, innovation, human resource management, and customers and finance (Fitriati et al., 2020; Mukson et al., 2021). Where this shows that the company has a development orientation and sees opportunities for continuous innovation (Mel et al., 2001).

The Impact of Financial Literacy on SMEs Performance

According to Remund (2010), financial literacy is knowledge of all the basics of finance, understanding financial concepts, and is used as an individual or individual or company decision-making. Meanwhile, Aribawa (2016) explains that financial literacy is knowledge of financial concepts, abilities, and skills related to financial concepts, skills in business management, the ability to make strategic business decisions, relatively precise and fast in certain situations. Moreover, Financial Servises Authority of Indonesia (OJK) in 2016 defines that financial literacy is not limited to the understanding the product and services in financial institutions. This financial literacy can make the ability for people to arrange the financial goals, to compile financial planning, to manage finances and be able to make a good financial decisions in using financial products and services. In addition, the aspects of financial literacy according to Chen & Volpe (1998) are divided into 4 including: (1) Basic understanding of personal finance, (2) Understanding of credit management, (3) Understanding of savings and investment, (4) Risk management.

Previous research argue that the level of personal financial literacy has an impact on their ability to make the right financial decisions. Knowledge of personal finance will affect their financial future (Chen & Volpe, 1998; Lusardi & Mitchell, 2011). The findings can also be adapted for companies. In this case, MSMEs that have good financial literacy will be able to make the right business decisions, have a business development orientation and be able to survive in their business. Furthermore, it is also found that the low level of financial literacy in financial statement will make the small business financial condition poorly (Dahmen & Rodríguez, 2014). Moreover, it is mentioned that the financial literacy will make the small business survive in the competition (Wise, 2013).

H1: The financial literacy of the manager of SMEs will have a positive impact on the SMEs perofrmance

The Impact of Access To Finance on SMEs Performance

Access to finance is defined as the ability of individuals, households, entrepreneurs, and companies to access and utilize various financial services if they choose to do so (Adomako et al., 2016). Access to Finance increases financial inclusion and contributes to the deepening of the financial sector and overall economic growth. Financial inclusion aims to attract the unbanked population into a formal financial system to enable them to access a variety of financial services including savings, payments, money transfers, credit and insurance (Hannig & Jansen, 2010). Development theory also emphasizes the importance of access to finance in overcoming income inequality and achieving a country's economic growth (Nkundabanyanga et al., 2014). Access to finance also plays an essential role in the development of Small and Medium Enterprises (SMEs) (Kimani & Ntoiti, 2015; Nkuah et al., 2013).

Moreover, the results of previous studies found that financially literacy of the SMEs increase their access to financial resources through the timely dissemination of financial information that can be used to related parties, such as bankers or lenders, thereby convincing funders. However, SMEs with low financial knowledge, they find it challenging to access finance (Mashizha & Sibanda, 2017; Van Auken & Carraher, 2013).

In addition, the result of previous studies found that financial literacy improves the physical access and feasibility of SMEs to financial resources, as well as makes finance more affordable and makes it easier to create a healthy capital structure, thereby improving business performance (Adomako et al., 2016; Cowling et al., 2014; Hussain et al., 2018; Kimani & Ntoiti, 2015).

Measurement of the variable access to finance for MSME manager in this study consists of indicators of ownership and utilization of accounts for service providers and financial services which refers to Adomako et al. (2016).

H2: The access of finance will have a positive impact on the SMEs perofrmance

H3: The financial literacy of the manager of SMEs will have a positive impact on the access of finance.

H4: The access to finance can mediate the relationship between financial literacy and SME performance.

The Impact of Financial Risk Attitude on SMEs Performance

There are two important measurements of financial risk attitudes, namely risk perception and risk propensity. Perceptions of risk play an important role in human behavior, especially in relation to decision making in uncertain situations. Perceived risk is defined as a person's assessment of a risky condition (uncertainty) which is strongly influenced by psychological factors and the decision-making situation. The degree of uncertainty will be evaluated and assessed differently by different decision makers. The tendency to risk is the tendency of a decision maker to take or avoid risks. The likelihood of risk changes as circumstances change so that it is considered an accumulated result of (Ye & Kulathunga, 2019).

Business and financial risks are assumed to increase rapidly in line with economic instability in developing countries such as Indonesia. SMEs entrepreneurs must face challenging economic conditions and must be prepared to survive in the midst of global competition. This explains that SMEs in emerging markets must manage risk efficiently to ensure the survival of their organizations (Oláh et al., 2019).

Moreover, the results of previous research found a positive relationship between financial literacy and financial risk attitudes. High financial literacy can manage financial risk attitudes efficiently so that SMEs actors can solve problems and make decisions appropriately in running their business (Goswami, Hazarika, & Handique, 2017; Hsiao & Tsai, 2018).

Measurement of the variable of financial risk attitudes of SMEs players in this study consists of indicators of risk perception and risk tendency which refers to the research of Ye & Kulathunga (2019).

H5: The financial risk attitudes will have a positive impact on the SMEs perofrmance

H6: The financial literacy of the manager of SMEs will have a positive impact on the financial risk attitudes.

H7: The financial risk attitudes can mediate the relationship between financial literacy and SME performance.

Research Model

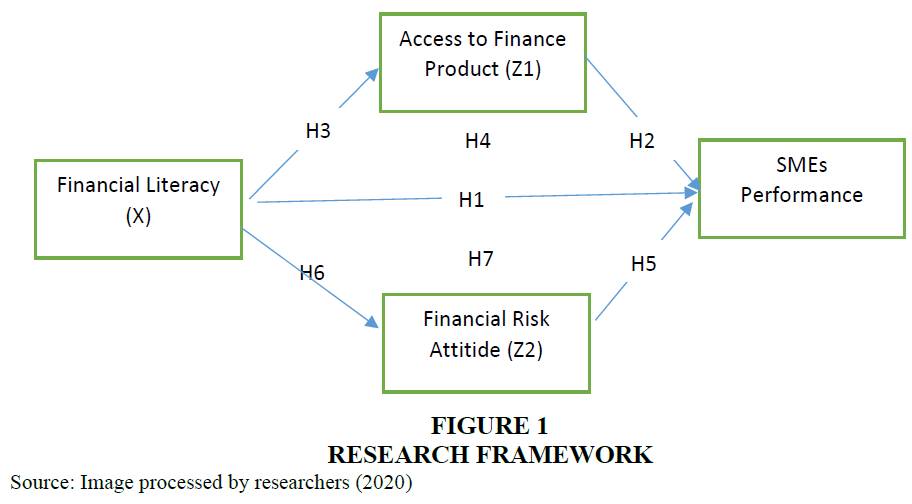

Descriptions of all variables in this study, a research model framework can be made, as shown below Figure 1:

Research Hypothesis Formulation

Based on the conceptual framework above, it describes the general relationship between the independent, dependent, and mediation variables as follows:

1. H1: There is an effect of financial literacy on the performance of SMEs.

2. H2: There is an effect of access to finance on SMEs performance.

3. H3: There is an effect of financial literacy on access to finance.

4. H4: There is an effect of financial literacy on the performance of SMEs through access to finance.

5. H5: There is an effect of financial risk attitudes that affect the performance of SMEs.

6. H6: There is an effect of financial literacy on financial risk attitudes.

7. H7: There is an effect of financial literacy on SMEs performance through financial risk attitudes.

Research Methods

Sample

The samples in this study were all SMEs who became the board of the Guyub Rukun Saklawase Forum with a total sampling technique. The complete sampling or census technique in survey research where the researcher takes all members of the population as respondents. This technique was taken because members of the community were focused on all SMEs who were active in the Guyub Rukun Saklawase Forum in Brebes Regency, as many as 250 people.

The sample size in this study is determined by the Slovin formula as follows:

n = N / 1 + N.e2

Information:

n = the number of elements / members of the sample

N = number of elements / members of the population

e = error level (error rate) (note: commonly used 1 % or 0,01, 5 % or 0,05, and 10 % or 0,1).

Based on this, the following calculations were obtained:

n = 250 / 1 + 250.(0,1)2

= 71

Based on the results of calculations with the Slovin formula, the proportional sample size is 71.43 and rounded up to 71 respondents. Thus, the number of samples in this study was determined to be 71 respondents who were active MSME manajer who were also active in the Guyub Rukun Saklawase UMKM Forum throughout Brebes Regency.

Method of Collecting Data

The primary data collection method was carried out by using an online questionnaire with respondents through the Guyub Rukun Saklawase Forum. The questionnaire consisted of structured research questions with a modified Likert-type with a scale of 5 (1 = strongly disagree, 2-disagree, 3 = neutral, 4- agree, and 5 = strongly agree). In general, the constructs and indicators used are presented in Table 1.

| Table 1 Research Constructs and Indicators | ||

| Construct | Indicator | |

| Financial Literacy | 1 | We can prepare monthly income reports |

| Chen and Volpe (1998) | 2 | We have received training on bookkeeping |

| 3 | We know the documents required to get a loan from a bank | |

| 4 | We are knowledgeable and can prepare basic accounting bookkeeping | |

| 5 | We can calculate the cost of borrowing capital | |

| 6 | I know the costs and benefits of accessing credit | |

| 7 | We have a business savings account | |

| 8 | I can calculate interest rates and loan payments correctly | |

| 9 | We have the skills to minimize losses by minimizing bad credit | |

| 10 | We can regularly analyze our finances | |

| 11 | We have the skills needed to assess a company's prospects | |

| Access to Finance | 1 | The loan products offered are as needed |

| Adomako et al. (2016) | 2 | The terms and conditions of bank loans are in our favor |

| 3 | Savings products offered by banks are safe for our business | |

| 4 | The financial services offered by the bank have led to an increase in our business | |

| 5 | We have formal insurance for our business | |

| 6 | The account opening fee charged by the bank is affordable | |

| 7 | I prefer to make loans in cooperatives rather than in banks | |

| Financial Risk Attitude | 1 | Invest 10% of revenue annually for business development |

| Ye (2019) | 2 | Invest 10% of income annually to buy stocks / mutual funds |

| 3 | Invest 20% of revenue each month in a business emergency fund | |

| 4 | High risk of investing in gambling | |

| MSME performance | 1 | The business has reached the Break Event Point (BEP) |

| Hudson et al. (2001) | 2 | Reducing operational costs |

| 3 | Increase customer satisfaction | |

| 4 | Fast confirmation of customer orders | |

| 5 | Employees feel comfortable at work | |

| 6 | Employees have the same vision and mission in improving the business | |

| 7 | Quick response to market demand | |

| 8 | Increase the amount of profit and market share with product innovation | |

Analysis Technique

The collected data were analyzed using a structural equation model based on partial least square. Descriptive analysis is used to interpret respondents' data, while structural equation modeling is used to test hypotheses.

Research Results and Discussion

Respondent Characteristics

Based on the Table 2 above, it can be seen that there are more respondents in the segment of the age 40 years to 49 years, namely, with a percentage of 41% and a frequency of 29 respondents. Followed by the part of the age 30 years to 39 years, namely with a percentage of 34% and a frequency of 24 respondents, then aged 20 years to 29 years with a percentage of 17% and a frequency of 12 respondents, and in the last order respondents are over 50 years of age, namely with a percentage of 8% and the frequency is six respondents.

| Table 2 Characteristics of Respondents Based on Age, Gender, and Education | ||

| Age | Frequency | Percentage |

| 20-29 | 12 | 17% |

| 30-39 | 24 | 34% |

| 40-49 | 29 | 41% |

| > 50 | 6 | 8% |

| Total | 71 | 100% |

| Gender | Frequency | Percentage |

| Male | 23 | 32% |

| Female | 48 | 68% |

| Total | 71 | 100% |

| Educational Background | Frequency | Percentage |

| High School | 39 | 55% |

| Bachelor to Master Degree | 32 | 45% |

| Total | 71 | 100% |

Meanwhile, more female respondents than male respondents, with a percentage of 68% and a frequency of 48 respondents, while male respondents with a percentage of 32% and a frequency of 32 respondents. Based on gender, more female respondents than male respondents, with a percentage of 68%. This shows that most women have a role in the development of SMEs.

Furthermore, the educational background of respondents from Elementary School to Senior High School is more with a percentage of 55% and a frequency of 39 respondents. In comparison, respondents with a higher education background have a frequency of 32 respondents, with a percentage of 42%. The educational background shows that most respondents have sufficient basic knowledge of finance because 32 respondents are university graduates and the rest are high school students.

Data Testing Results

Evaluate the Outer Model

Convergent Validity

Loading Factors: Convergent validity is related to the principle that the gauges (manifest variable) of a constituent should be positively correlated. The rule of thumb that is commonly used to assess convergent validity is that the loading factor value must be more than 0.7 for confirmatory research and the loading factor value between 0.6 - 0.7 for explanatory research is still acceptable (Ghozali, 2012). The results of the loading factor for each indicator can be seen below:

Based on the Table 3, it can be concluded that the loading factors for each variable have a value above 0.7 and can be used to assess convergent validity.

| Table 3 Loading Factors | ||||

| Access to Finance (Z1) | MSME Performance (Y) | Financial Literacy (X) | Financial Risk Attitude (Z2) | |

| AK1 | 0.85 | |||

| AK2 | 0.882 | |||

| AK3 | 0.821 | |||

| AK4 | 0.896 | |||

| AK5 | 0.869 | |||

| KU1 | 0.8 | |||

| KU2 | 0.91 | |||

| KU3 | 0.91 | |||

| KU4 | 0.82 | |||

| LK1 | 0.74 | |||

| LK10 | 0.785 | |||

| LK3 | 0.784 | |||

| LK4 | 0.711 | |||

| LK5 | 0.834 | |||

| LK6 | 0.879 | |||

| LK7 | 0.766 | |||

| LK8 | 0.873 | |||

| LK9 | 0.801 | |||

| SRK1 | 0.906 | |||

| SRK2 | 0.766 | |||

| SRK3 | 0.839 | |||

Average Variance Extracted (AVE): AVE describes the average variance or discriminant extracted on each indicator so that the ability of each item to share measurements with others can be known. According to Ghozali (2012), the average variance extracted (AVE) value must be greater than 0.5.

In the Table 4, the AVE value for the financial literacy variable (x) is 0.638, the MSME performance variable (Y) is 0.740, the Access to Finance variable is 0.746, and the financial risk attitude variable (Z2) is 0.704. Based on the results of the table above, the AVE value for each variable has a value above 0.5.

| Table 4 Average Variance Extracted (AVE) | |

| Average Variance Extracted (AVE) | |

| Financial Literacy (X) | 0.638 |

| MSME performance (Y) | 0.740 |

| Access to Finance (Z1) | 0.746 |

| Financial Risk Attitude (Z2) | 0.704 |

Discriminant Validity

Fornell Larcker Criterion: Discriminant validity can be seen in the Fornell Larcker Criterion test by comparing the square root of the AVE for each construct with the correlation value between the constructs in the model (Ghozali, 2012). A construct is valid if it has the square root of the highest AVE to the intended construct compared to the square root of AVE to other constructs.

Based on the Table 5, each variable shows a higher value compared to other variables with a diagonal assessment.

| Table 5 Fornell Larcker Criterion | ||||

| Access to Finance | MSME Performance | Financial Literacy | Financial Risk Attitude | |

| Access to Finance (Z1) | 0.864 | |||

| MSME Performance (Y) | 0.962 | 0.860 | ||

| Financial Literacy (X) | 0.900 | 0.858 | 0.799 | |

| Financial Risk Attitude (Z2) | 0.538 | 0.604 | 0.542 | 0.839 |

Cross Loading: Discriminant validity testing, reflective indicators can be seen in the cross-loading between the indicator and the construct. An indicator is declared valid if it has the highest loading factor for the intended construct compared to the loading factor for other constructs. Thus, latent constructs predict indicators in their block better than indicators in different leagues.

Based on the Table 6, it is obtained that the indicator value has the highest loading factor value for the intended construct compared to the loading factor for other constructs.

| Table 6 Cross Loading | ||||

| Access to Finance (Z1) | MSME performance (Y) | Financial Literacy (X) | Financial Risk Attitude (Z2) | |

| AK1 | 0.870 | 0.743 | 0.850 | 0.354 |

| AK2 | 0.882 | 0.791 | 0.774 | 0.479 |

| AK3 | 0.821 | 0.801 | 0.705 | 0.377 |

| AK4 | 0.906 | 0.896 | 0.780 | 0.512 |

| AK5 | 0.905 | 0.869 | 0.758 | 0.591 |

| KU1 | 0.801 | 0.821 | 0.705 | 0.377 |

| KU2 | 0.896 | 0.906 | 0.780 | 0.512 |

| KU3 | 0.869 | 0.905 | 0.758 | 0.591 |

| KU4 | 0.709 | 0.824 | 0.708 | 0.604 |

| LK1 | 0.608 | 0.620 | 0.740 | 0.525 |

| LK10 | 0.669 | 0.634 | 0.785 | 0.400 |

| LK3 | 0.680 | 0.640 | 0.784 | 0.346 |

| LK4 | 0.543 | 0.553 | 0.711 | 0.476 |

| LK5 | 0.762 | 0.711 | 0.834 | 0.401 |

| LK6 | 0.845 | 0.771 | 0.879 | 0.470 |

| LK7 | 0.663 | 0.676 | 0.766 | 0.452 |

| LK8 | 0.860 | 0.815 | 0.873 | 0.471 |

| LK9 | 0.781 | 0.709 | 0.801 | 0.368 |

| SRK1 | 0.544 | 0.595 | 0.578 | 0.906 |

| SRK2 | 0.378 | 0.412 | 0.392 | 0.766 |

| SRK3 | 0.406 | 0.487 | 0.357 | 0.839 |

Composite Reliability and Cronbach’s Alpha

The reliability test is carried out using the Composite Reliability and Cronbach's Alpha tests by looking at all latent variable values that have a Composite Reliability or Cronbachs Alpha value ≥ 0.7. It can be concluded that the construct has good reliability, or the questionnaire used as a measuring tool in this study has been reliable or consistent.

Based on Table 7, the value of composite reliability and Cronbach's Alpha is more than 7, so it can be concluded that the construct has good reliability.

| Table 7 Composite Reliability and Cronbach’s Alpha | ||

| Composite Reliability | Cronbach's Alpha | |

| Access to Finance | 0.936 | 0.915 |

| MSME performance | 0.919 | 0.882 |

| Financial Literacy | 0.941 | 0.929 |

| Financial Risk Attitude | 0.876 | 0.790 |

Inner Model Evaluation

R-Square: The value of R-square (R2) is zero to one. If the R-Square (R2) value is getting closer to one, the independent variables provide all the information needed to predict endogenous variations.

Based on the results of the Table 8 above, the financial literacy variable that affects the MSME performance variable in the structural model has an R2 value of 0.935, which indicates that the model is "moderate." Meanwhile, the financial literacy variable that affects two intervening variables, namely the Access to Finance variable, has an R2 value of 0.811, and the financial risk attitude variable has an R2 value of 0.294, which indicates that the model is "moderate”.

| Table 8 R-Square | |

| MSME performance (Y) | 0,935 |

| Access to Finance (Z1) | 0,811 |

| Financial Risk Attitude (Z2) | 0,294 |

Path Coefficients: Path coefficients are used to see the hypothesized relationship between constructs. The path coefficient values are in the range of values -1 to +1, where the path coefficient values that are close to +1 represent a strong positive relationship and the path coefficient values that are -1 indicate a robust negative relationship.

Referring to the Table 9, it is found that the path efficiency value leads to a strong positive relationship.

| Table 9 Path Coefficients | |||

| Z1 | Z2 | Y | |

| Financial Literacy (X) | 0.9 | 0.542 | |

| Access to Finance (Z1) | 0.897 | ||

| Financial Risk Attitude (Z2) | 0.121 | ||

| MSME performance (Y) | |||

Hypothesis Test

Based on the Table 10 above, it can be explained as follows:

| Table 10 Inter-Construct Testing | |||||

| original sample estimate | mean of sub samples | Standard deviation | T-Statistic | Decision | |

| Financial Literacy (X) -> MSME Performance (Y) |

0.873 | 0.874 | 0.025 | 34.600 | Received |

| Financial Literacy (X) -> Access to Finance (Z1) |

0.900 | 0.901 | 0.023 | 38.364 | Received |

| Financial Literacy (X) -> Financial Risk Attitude (Z2) |

0.542 | 0.556 | 0.107 | 5.069 | Received |

| Access to Finance (Z1) -> MSME Performance (Y) |

0.897 | 0.902 | 0.029 | 31.285 | Received |

| Financial Risk Attitude (Z2) -> MSME Performance (Y) |

0.121 | 0.114 | 0.048 | 2.548 | Received |

1. Financial literacy has a positive effect on the performance of SMEs of 0.873, and a statistical T value of 34,600, which means greater than 1.96, so that the hypothesis H1 can be declared accepted.

2. Financial literacy has a positive influence on access to finance of 0.900, and a statistical T value of 38,364, which means greater than 1.96, so that the hypothesis H2 can be declared accepted.

3. Financial literacy has a positive effect on financial risk attitudes of 0.542, and a statistical T value of 5.069, which means greater than 1.96, so that the hypothesis H3 can be declared accepted.

4. Access to finance has a positive effect on the performance of SMEs of 0.897 and a statistical T value of 31,285, which means it is more significant than 1.96 so that the hypothesis H4 can be declared accepted.

5. Financial risk attitudes have a positive influence on the performance of SMEs of 0.121, and a statistical T value of 2.548, which means greater than 1.96, so that the hypothesis H5 can be declared accepted.

Based on the Table 11, it can be explained as follows:

| Table 11 Testing Between Mediation Constructs | |||||

| original sample estimate | mean of subsamples | Standard deviation | T-Statistic | Decision | |

| Financial Literacy (X) -> Access to Finance (Z1) -> MSME performance (Y) |

0.807 | 0.812 | 0.033 | 24.620 | Received |

| Financial Literacy (X) -> Financial Risk Attitude (Z2) -> MSME Performance (Y) |

0.066 | 0.062 | 0.028 | 2.317 | Received |

1. The effect of mediating access to finance on the relationship between financial literacy and the performance of SMEs has a positive effect of 0.807, and a statistical T value of 24,620, which means it is more significant than 1.96 so that the hypothesis H6 can be declared accepted.

2. The mediating effect of financial risk attitudes on the relationship between Financial Literacy and MSME performance has a positive effect of 0.066, and a statistical T value of 2.317, which means greater than 1.96, so that the hypothesis H7 can be declared accepted.

Based on the mediation analysis above, it is known that there is a significant direct relationship, and the connection through mediation is also significant so that the mediation variable does not play a full role or as a partial mediation.

The Impact of Financial Literacy on MSMEs Performance

Based on the research results, it is known that financial literacy has a positive influence on the performance of SMEs so that the first hypothesis is suspected that there is an effect of financial literacy on the performance of SMEs in Brebes Regency to be accepted. So, this study also confirms the previous studies (Adomako et al., 2016; Dahmen & Rodríguez, 2014; Fatoki, 2014; Kimani & Ntoiti, 2015; Wise, 2013).

In addition, From the Table 12 it is noted that the MSME managers have weakness regarding the loan from the bank (LK3, LK8, LK9). Then it is implied that the government need to find the way to enhance the capability of the manager in this knowlede as it is needed to finance the firm. Moreover, from the indicator of MSME performance it also is found that the managers have difficulties in managing the cost (KU1, KU2). The results of this study serve as a warning to the Indonesian government to accelerate the SME skills and knowledge improvement program considering that this finding has been disclosed by several previous studies(Abiodun & Entebang, 2015; Tambunan & Xiangfeng, 2008).

| Table 12 Descriptive Statistic of Variables | |||||||||

| Variabel/Items | Neutral or less | Agree | Strongly Agree | Variabel/Items | Neutral or less | Agree | Strongly Agree | ||

| Financial Literacy | LK1 | 13% | 65% | 23% | Access to Finance | AK1 | 23% | 61% | 17% |

| LK2* | 27% | 56% | 17% | AK2 | 44% | 37% | 20% | ||

| LK3 | 31% | 46% | 23% | AK3 | 31% | 48% | 21% | ||

| LK4 | 18% | 56% | 25% | AK4 | 37% | 48% | 15% | ||

| LK5 | 20% | 59% | 21% | AK5 | 52% | 32% | 15% | ||

| LK6 | 28% | 51% | 21% | AK6* | 34% | 49% | 17% | ||

| LK7 | 21% | 55% | 24% | AK7* | 44% | 34% | 23% | ||

| LK8 | 34% | 49% | 17% | MSME Performance | KU1 | 41% | 38% | 21% | |

| LK9 | 31% | 46% | 23% | KU2 | 25% | 56% | 18% | ||

| LK10 | 18% | 55% | 27% | KU3 | 6% | 38% | 56% | ||

| LK11* | 11% | 68% | 21% | KU4 | 1% | 48% | 51% | ||

| Financial Risk Attitude | SRK1 | 21% | 48% | 31% | KU5* | 7% | 49% | 44% | |

| SRK2 | 44% | 35% | 21% | KU6* | 7% | 52% | 41% | ||

| SRK3 | 18% | 58% | 24% | KU7* | 10% | 55% | 35% | ||

| SRK4* | 24% | 37% | 39% | KU8* | 4% | 56% | 39% | ||

| *= drop from the model | |||||||||

The Impact of Access To Finance on SMEs performance

The findings of this study confirm the previous studies of the hypothesis. The access to finance will enhance the performance of the MSMEs (Kimani & Ntoiti, 2015; Nkuah et al., 2013). It is also found a positive impact of financial literacy on the access of finance (Mashizha & Sibanda, 2017; Van Auken & Carraher, 2013). Furthermore, this study also provide the positive impact of access to finance on the MSMEs performance (Adomako et al., 2016; Claessens, 2006; Cowling et al., 2014; Hussain et al., 2018; Kimani & Ntoiti, 2015; Yang, Chen, Gu, & Fujita, 2019).

In addition, this study also found that the manager of the SMEs has problems in access to finance as the proportion of the manager who are not familiar with the bank product are more than 30% (AK2, AK3, AK4, AK5 in Table 12). Then, this finding will invigorate the importance of financial inclusion development among the people of Indonesia as it noted in some studies (Hamidah et al., 2019; OJK-RI, 2017).

The Impact of Financial Risk Attitude on MSMEs Performance

This study found the positive impact of financial risk attitude on MSMEs performance, confirming the findings of previous studies (Gärling et al., 2009; Oláh et al., 2019; Willebrands, Lammers, & Hartog, 2012). The findings also supports the argument that people with higher level of financial literacy can manage financial risk attitudes efficiently so that MSMEs can solve problems and make decisions appropriately in running their business (Goswami et al., 2017; Hsiao & Tsai, 2018; Widdowson & Hailwood, 2007). Finally, this study also explores the mediation role of financial risk attitudes on a positive relationship between financial literacy and MSMEs performance. This result is in line with the previous research by Rooij, Lusardi & Alessie (2011).

Moreover, it is found that the manager of the MSMEs has weaknesses in capital market instruments. It means the government needs to provide the program to introduce the capital market to a business man in Indonesia as it is also important in developing the MSMEs business.

Conclusions and Recommendations

This study found the positive impact of financial literacy, access to finance, and financial risk attitude on the MSME performance. This study also found the mediation role of access to finance and the financial risk attitude on the relationship between financial literacy on MSMEs performance. From the descriptive of statistics, it is also found that the weakness of the manager of the MSME regarding the bank and capital market product. The implication of these findings the government needs to create a program to enhance the level of financial literacy among the manager of the MSMEs especially the skills and knowledge regarding the bank product, risk management, and capital market product.

The limitation of this study that it does not include the technological factors in the indicators. Perhaps it is one of the important variables especially after the MSMEs survive from the COVID19 outbreak. Moreover, perhaps it will be interesting to examine the MSME by the industry, such as food, clothes, Interior design, Handy craft, Music, and other creative industries.

References

- Abiodun, A., & Entebang, H. (2015). SME Firm Performance-Financial Innovation and Challenges. Procedia - Social and Behavioral Sciences, 195, 334–342.

- Adomako, S., Danso, A., & Ofori Damoah, J. (2016). The moderating influence of financial literacy on the relationship between access to finance and firm growth in Ghana. Venture Capital, 18(1), 43–61.

- Aribawa, D. (2016). The effect of financial literacy on the performance and sustainability of Umkm in central Java. Jurnal Siasat Bisnis, 20(1), 1–13.

- Chen, H., & Volpe, R.P. (1998). An analysis of personal financial literacy among college students. Financial Services Review, 7(2), 107–128.

- Claessens, S. (2006). Access to financial services: A review of the issues and public policy objectives. World Bank Research Observer, 21(2), 207–240.

- Cowling, M., Liu, W., Ledger, A., & Zhang, N. (2014). What really happens to small and medium-sized enterprises in a global economic recession? UK evidence on sales and job dynamics. International Small Business Journal, 33(5), 488–513.

- Dahmen, P., & Rodríguez, E. (2014). Financial literacy and the success of small businesses: an observation from a small business development center pearl. Numeracy, 7(1).

- Dermawan, T. (2019). Finance on Performance and Sustainability of Umkm (Studies in Micro-Business Actors of Brawijaya University Students). Thesis.Universitas Brawijaya.

- Dewi, W., Yurniwati. K., & Annisaa, R. (2018). The effect of financial literacy and financial access to the performance of SMEs (Small and Medium Enterprises) in the Trade Sector of Padang City. International Journal of Progressive Sciences and Technologies (Ijpsat), 10(2), 379. Retrieved from https://ijpsat.ijsht-journals.org/index.php/ijpsat/article/view/606

- Eniola, A.A., & Entebang, H. (2017). SME managers and financial literacy. Global Business Review, 18(3), 559–576.

- Eresia-Eke, C.E., & Raath, C. (2013). SMME Owners’ financial literacy and business growth. Mediterranean Journal of Social Sciences, 4(13), 397–406.

- Esiebugie, U., Richard, A.T., & Emmanuel, A.L. (2018). Financial literacy and performance of small and medium scale enterprises in Benue State, Nigeria. International Journal of Economics, Business and Management Research, 2(04), 65–79.

- Fatimah, T. (2011). Strategi Pemberdayaan Usaha Mikro, Kecil Dan Menengah (Umkm) Dalam Menghadapi Globalisasi. Jurnal Ilmiah Econosains, 9(1), 49–61.

- Fatoki, O. (2014). The financial literacy of micro entrepreneurs in South Africa. Journal of Social Sciences, 40(2), 151–158.

- Fitriati, T.K., Purwana, D., & Dharmawan, A. (2020). The role of innovation in improving small medium enterprise ( SME ) Performance. International Journal of Innovation, Creativity and Change, 11(2), 232–250.

- Fowowe, B. (2017). Access to finance and firm performance: Evidence from African countries. Review of Development Finance, 7(1), 6–17.

- Gärling, T., Kirchler, E., Lewis, A., & van Raaij, F. (2009). Psychology, financial decision making, and financial crises. Psychological Science in the Public Interest, 10(1), 1–47.

- Ghozali, I. (2012). Multivariate Analysis Applications with Programs IBM SPSS 21 (7th ed.). Semarang: Badan Penerbit Universitas Diponegoro.

- Goswami, K., Hazarika, B., & Handique, K. (2017). Determinants of financial risk attitude among the handloom micro-entrepreneurs in North East India. Asia Pacific Management Review, 22(4), 168–175.

- Hamidah, Gustiawan, D., & Buchdadi, A. D. (2019). Financial literacy and capital market literacy among students. In 1st International Conference on Education, Social Sciences and Humanities (ICESSHum 2019) Financial, 335,194–197.

- Hannig, A., & Jansen, S. (2010). Financial inclusion and financial stability: Current policy issues. Financial Market Regulation and Reforms in Emerging Markets. https://doi.org/10.2139/ssrn.1729122

- Hsiao, Y., & Tsai, W. (2018). Financial literacy and participation in the derivatives markets. Journal of Banking and Finance, 88, 15–29.

- Hussain, J., Salia, S., & Karim, A. (2018). Is knowledge that powerful? Financial literacy and access to finance: An analysis of enterprises in the UK. Journal of Small Business and Enterprise Development, 25(6), 985–1003.

- Kimani, P.M., & Ntoiti, J. (2015). Effects of financial literacy on performance of youth led entreprises: A case of equity group foundation training program in kiambu county. International Journal of Social Science Management and Entrepreneurship, 2(1), 2018–2231.

- Kumalasari, B., & Asandimitra, N. (2019). Factors Affecting the Performance of MSMEs in Bojonegoro Regency. Journal of Management Science, 7(3), 784–795.

- Lusardi, A., & Mitchell, O. (2011). Financial literacy around the world - Annamaria Lusardi and Olivia S. Mitchell. Nber, 17(4), 1–14.

- Mashizha, M., & Sibanda, M. (2017). The link between financial knowledge, financial product awareness and utilization: A study among small and medium enterprises in Zimbabwe. International Journal of Economics and Financial Issues, 7(6), 97–103.

- Mel, H., Andi, S., & Mike, B. (2001). Theory and practice in SME performance measurement systems. International Journal of Operations & Production Management, 21(8), 1096–1115.

- Mukson, H., & Prabuwono, A.S. (2021). Work environment and entrepreneurship orientation towards MSME performance through organizational commitment. Management Science Letters, 11.

- Mutegi, H.K., Njeru, P.W., & Ongesa, N.T. (2015). Financial literacy and its impact on loan repayment by small and medium enterprenuers: an analysis of the effect of book keeping skills from equity group foundation’s financial literacy training program on enterpreneurs’ loan repayment performance. International Journal of Economics, Commerce and Management, 3(3), 1–28.

- Nkuah, J.K., Paul, J., & Kala, T. (2013). Financing small and medium enterprises ( SMEs ) in Ghana?: Challenges and Determinants in Accessing Bank Credit. International Journal of Research in Social Sciences, 2(3), 12–25.

- Nkundabanyanga, S.K., Kasozi, D., Nalukenge, I., & Tauringana, V. (2014). Lending terms, financial literacy and formal credit accessibility. International Journal of Social Economics, 41(5), 342–361.

- OJK-RI. (2017). Strategi Nasional Literasi Keuangan Indonesia (Revisit 2017). Otoritas Jasa Keuangan. Retrieved from https://www.ojk.go.id/id/berita-dan-kegiatan/publikasi/Pages/Strategi-Nasional-Literasi-Keuangan-Indonesia-(Revisit-2017)-.aspx

- Oláh, J., Kovács, S., Virglerova, Z., Lakner, Z., Kovacova, M., & Popp, J. (2019). Analysis and comparison of economic and financial risk sources in SMEs of the visegrad group and serbia sustainability analysis and comparison of economic and financial risk sources in SMEs of the visegrad group and Serbia. Sustainability, (March), 0–19.

- Olawale, F., & Garwe, D. (2010). Obstacles to the growth of new SMEs in South Africa: A principal component analysis approach. African Journal of Business Management, 4(5), 729–738.

- Purwaningsih, R., & Kusuma Damar, P. (2015). Analisis faktor- faktor yang mempengaruhi kinerja usaha kecil dan menengah (ukm) dengan metode structural equation modelling (studi kasus UKM berbasis industri kreatif Kota Semarang). In Prosiding SNST Fakultas Teknik Universitas Wahid Hasyim Semarang, 6, 7–12.

- Remund, D.L. (2010). Financial literacy explicated: The case for a clearer definition in an increasingly complex economy. Journal of Consumer Affairs, 44(2), 276–295.

- Rooij, M. van, Lusardi, A., & Alessie, R. (2011). Financial Literacy and Stock Market Participation. Journal of Financial E, 101(2), 449–472.

- Sadat, A.M., & Lin, M.L. (2018). Organizational amnesia: The barrier of value creation and organizational performance in small and medium sized enterprise. Journal of Business and Behavioural Entrepreneurship, 2(1), 1–8.

- Sibanda, K., Hove-Sibanda, P., & Shava, H. (2018). The impact of SME access to finance and performance on exporting behaviour at firm level: A case of furniture manufacturing SMEs in Zimbabwe. Acta Commercii, 18(1).

- Tambunan, T., & Xiangfeng, L. (2008). SME Development in Indonesia and China. Retrieved from http://www. usakti-cisbucs.com/index.php/research-papers-01/70-sme-development-in-indonesia-and-china

- Van Auken, H., & Carraher, S. (2013). Influences on Frequency of Preparation of Financial Statements Among SMEs. Journal of Innovation Management, 1(1), 143–157.

- Widdowson, D., & Hailwood, K. (2007). Financial literacy and its role in promoting a sound financial system. Reserve Bank of New Zealand Bulletin, 70(2), 37–47.

- Willebrands, D., Lammers, J., & Hartog, J. (2012). A successful businessman is not a gambler. Risk attitude and business performance among small enterprises in Nigeria. Journal of Economic Psychology, 33(2), 342–354.

- Wise, S. (2013). The impact of financial literacy on new venture survival. International Journal of Business and Management, 8(23), 30–39.

- Yang, Y., Chen, X., Gu, J., & Fujita, H. (2019). Alleviating financing constraints of SMEs through supply chain. Sustainability (Switzerland), 11(3).

- Ye, J., & Kulathunga, K.M.M.C.B. (2019). How does financial literacy promote sustainability in SMEs? A developing country perspective. Sustainability (Switzerland), 11(10), 1–21.