Research Article: 2021 Vol: 25 Issue: 3

The Influence of Financial Socialisation Mechanisms on Young Financial Professionals Financial Literacy Levels in The Eastern Cape

Xolile Antoni, Rhodes University, South Africa

Michelle Saayman, Nelson Mandela University, South Africa

Abstract

This study investigates the influence of financial socialisation mechanisms on the levels of financial literacy of young financial professionals in the Eastern Cape. Currently, there no studies that have investigate the influence of financial socialisation mechanism on financial literacy levels of young financial professionals the Eastern Cape which is surprising since young professionals in the Eastern Cape have the lowest financial literacy levels in South Africa. A quantitative research design was adopted and closed-ended questionnaires were used in this study to collect primary data from 263 young professionals working in the financial industry in the Eastern Cape. It was found that almost half of them reported above average (61% to 80%) financial literacy levels. In terms of financial socialisation mechanisms, parental teaching and modelling and employers' financial instruction positively influenced the financial literacy of these young financial professionals, while earned allowance (pocket money) had a negative influence on their financial literacy. It was recommended that financial educators should improve parents' levels of financial knowledge and promote positive parental financial behaviour to influence young professionals. Additionally, employers should find ways to promote financial education in the workplace. This study demonstrates that parents and employers have an important role to play in assisting with the financial literacy of young professionals in the Eastern Cape. Accordingly, this study contributes to literature by providing empirical data on this topic.

Keywords

Financial Literacy, Financial Socialisation Agents, Financial Socialisation Mechanisms, Young Financial Professionals and Eastern Cape.

Introduction

Financial literacy – referring to consumers having adequate financial knowledge – is essential for all consumers to make informed financial decisions (Sohn et al., 2012:969). Consumers who have high financial literacy levels are more likely to make informed financial decisions such as paying credit card balances on time, participating in the security exchanges, and following an age-appropriate investment strategy (Fong et al., 2021:65). Financial literacy is also associated with informed decisions such as ensuring that one has adequate funding at retirement age (Zeka, 2020). However, South African consumers lack adequate financial understanding to make informed decisions (Nanziri & Leibbrandt, 2018:17). This view is supported by Rousseau & Venter (2019:254), who state that the low level of financial literacy in South Africa is a serious concern, especially in the Eastern Cape. In that province, consumers appear to have the lowest financial literacy levels (Nanziri & Leibbrandt, 2018:17). Similarly, young professionals who reside in the Eastern Cape have insufficient financial knowledge (Matchaba-hove, 2016:166). Rousseau & Venter (2019) point out that even individuals who have postgraduate qualifications may possess a level of ignorance about their financial behaviour.

In the present study, "young professionals" refers to employed individuals below the age of 35 who have a tertiary qualification (Matchaba-hove, 2016; Nkoutchou & Eiselen, 2012:39). A study by Mngadi (2020:74) investigating the levels of financial literacy of professionals in South Africa found that professionals have low levels of financial literacy. This researcher also found that medical professionals have lower financial literacy levels than accounting professionals (Mngadi, 2020:74). These results suggest that financial professional have higher levels of financial literacy than non-financial professionals even though in general, all professionals in the study were found to have low levels of financial literacy (Mngadi, 2020:77). This finding is supported by Sallie (2015:44) who indicates that 92% of individuals who work in the financial services industry regard themselves as having high levels of financial literacy. It seems that individuals who work in the financial industry or are financial professionals have higher levels of financial literacy than individuals working in other industries.

Previous studies in South Africa have mainly focused on measuring the levels of financial literacy of students (Louw et al., 2013:439). This bias towards students is also observed by Matemane (2018:1), stating that few studies in South Africa have investigated the financial literacy levels of the working class. Matemane (2018:11) reports that only 1.8% of working individuals in South Africa, specifically black working individuals, answered all the financial literacy questions correctly. This highlights the need to investigate the levels of financial literacy of working individuals in South Africa, specifically young professionals in the Eastern Cape.

In addition, little is known about the factors (apart from demographic variables) that influence financial literacy in South Africa. This is because most South African studies have focused on measuring the levels of financial literacy of students (Van Deventer & De Klerk, 2017; Fatoki, 2014; Louw et al., 2013). This trend is apart from Sallie (2015:61) who investigated the influence of financial socialisation factors on employees' financial literacy and financial security in South Africa. However, Sallie (2015:61) found that family does not influence the financial literacy of individuals working in the financial industry. This finding is surprising, since most Western researchers who use financial socialisation as a theoretical framework find that financial literacy is influenced mainly by the family (Shim et al., 2015:35; Jorgensen & Savla, 2010:474). Financial socialisation is seen as the process by which individuals acquire and develop their financial literacy levels (Danes, 1994:128). Agents such as parents, peers, teachers and employers are instrumental in influencing individuals' level of financial literacy (Xiao, 2016:66). These financial socialisation agents use mechanisms such as modelling of behaviour and parental teaching to positively influence individuals' financial literacy in Western countries (Shim et al., 2015:36-37). In addition, Antoni et al. (2019:82) found that financial socialisation mechanisms influence students' financial behaviour in the Eastern Cape. Therefore, it might be expected that these mechanisms also influence young professionals' financial literacy in the Eastern Cape. Consequently, the following questions arise: Do young financial professionals have higher levels of financial literacy in the Eastern Cape? If so, are those levels of financial literacy influenced by financial socialisation mechanisms?

This study fills the literature gap in research in the Eastern Cape by investigating the influence of financial socialisation mechanism on the financial literacy levels of young financial professionals in the province. This study also shows the relevance of using financial socialisation processes to improve financial literacy levels in the Eastern Cape.

Research Aim and Objectives of the Study

The research aim of this study was to investigate the influence of financial socialisation mechanisms on the levels of financial literacy of young financial professionals in the Eastern Cape. In achieving the research aim, the study's objectives were to discuss the agents and the financial socialisation mechanisms, and to measure the financial literacy levels and the financial socialisation mechanisms of young financial professionals in the Eastern Cape. The study also empirically tested the relationship between financial socialisation mechanisms and financial literacy.

Literature Review

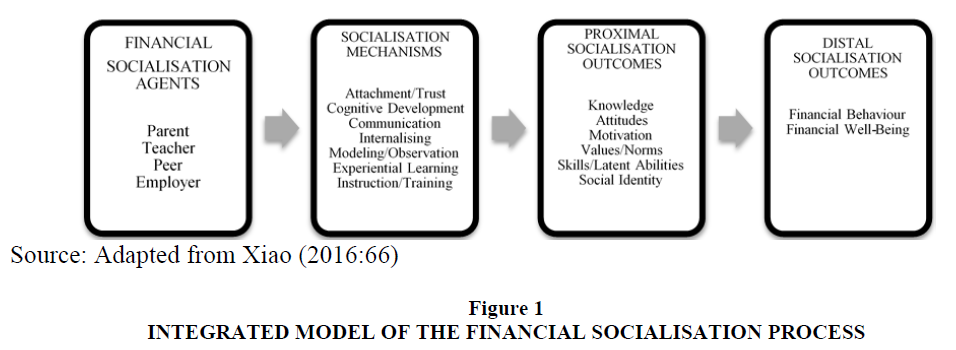

This study adopted the integrated model of financial socialisation, which was developed by Xiao (2016:66). The integrated model illustrates that financial socialisation is initiated by financial socialisation agents using different mechanisms to influence individuals' financial outcomes. See Figure 1 for the process of financial socialisation.

Financial Socialisation Agents

Socialisation agents are the "sources of influence" and in this case, the sources that influence the financial literacy of young professionals (Moschis & Churchill, 1978:599). Financial socialisation agents include parents, peers, teachers and employers (Xiao, 2016:66), but parents have the most influence on the financial outcomes of individuals. For this reason, parents are considered the primary financial socialisation agents in the lives of children (Maccoby, 1992:1006; Bowen, 2002:95; Mimura et al., 2015:73). Peers, teachers and employers are secondary financial socialisation agents since they have less influence than parents (Gutter et al., 2010:401).

Teachers socialise individuals by teaching them financial concepts or topics (Shim et al., 2009). Van Campenhout (2015:211) supports this in emphasising the importance of teachers engaging young adults on financial concepts is because this will have lasting effects on learners as they will be motivated to make sound financial decisions. There has been a steady increase in employers providing financial education as part of their employee benefits (Lusardi & Mitchell, 2014:29). Financial education is considered an important employee benefit because employees' financial literacy can increase when they participate in workplace financial education. Employees with higher levels of financial literacy are likely to have more hope for their financial futures and in turn, be more satisfied with their work and supportive of their workplace (Hira & Loibl, 2005:185-186).

Financial Socialisation Mechanisms

Individuals are socialised by financial socialisation agents using different financial socialisation mechanisms (Xiao, 2016:66). One of the mechanisms that may be used by parents is teaching financial practices (Danes, 1994:129), which is defined as parents sharing their financial knowledge about certain financial concepts while interacting with their children (Gudmunson & Danes, 2011:649, 662). Teaching financial practices may include financial discussions about family matters, informing children about the importance of saving, teaching them how to be smart shoppers, and teaching them how to use a credit card in an appropriate manner (Shim et al., 2009).

Parents may also use modelling to influence financial literacy. Modelling is the act of demonstrating both positive and negative behaviours. Children who observe these behaviours unconsciously incorporate them into their own behaviours (Cruess et al., 2008:718). Even before children can speak, they learn from their parents by observation, for example, while watching their parent's shop (Gudmunson & Danes, 2011:662). Their parents act as role models, or social models, defined by Ko?odziej et al. (2014:100) as persons of importance to a child and can include not only parents but also teachers and peers. Children observe their parents' everyday financial behaviours and then repeat them.

Parents also give their children allowances (pocket money), which is defined as cash transfers from parents to children on a regular basis for monthly expenses. Pocket money can be classified into three categories, namely earned allowance, educational allowance and entitled allowance (Miller & Yung, 1990 as cited in Alhabeeb, 1996:124). Parents usually provide earned allowance based on the completion of some chore, assignment, or compliance with behaviour deemed to be appropriate (Beutler & Dickson, 2008:113). Educational allowance is pocket money given by parents to their children to teach their children about saving, sharing, and how to budget money sensibly (Gudmunson & Danes, 2011:648). Entitled allowance is provided on a regular basis to the child based on funding the child's basic needs or wants. Entitled and earned allowances may be given on a regular basis, whereas educational allowances are only given in certain situations (Ko?odziej et al., 2014:104).

Another mechanism used by financial socialisation agents is peer communication, referring to interactions between adolescents that is focused on products and services (Moschis & Churchill, 1978:600). Young adults' communication with their peers about consumption matters influences how they see the marketplace and its offerings (Moschis & Churchill, 1978:605). In addition, teachers and employers may use financial instruction to influence financial literacy of individuals.

Financial instruction refers to the process of acquiring an understanding of financial concepts and making use of information, instruction and advice to develop skills and confidence to become more aware of financial matters. It also leads to one making better-informed decisions, seeking advice when needed and taking effective action to improve one's financial status (The Organisation for Economic Cooperation and Development 2005 as cited in Lusardi & Mitchell, 2007:1). Studies have established that financial education is needed for certain financial concepts, such as interest and taxation, which is not easily understood merely by observing (Bowen, 2002:96). Harrison et al. (2014:3) suggest that concepts such as saving and borrowing should be included in financial education. Employers may provide different types of financial education related to topics such as savings, retirement, budgeting, debt management, investments, inflation and taxation (Bernheim & Garrett, 2003:1491).

Financial Literacy

As previously mentioned, financial literacy refers to financial knowledge and skills necessary to make informed financial decisions. The most common component of financial literacy is mostly measured as financial knowledge as (Kimiyaghalam & Safari, 2015:82; Sohn et al., 2012:82; Remund, 2010:279). Financial knowledge refers to the understanding of the basic financial concepts needed to make everyday financial decisions (Bowen 2002:93). Similarly, Roberts et al. (2014:5) define financial knowledge as the extent to which individuals stay updated on financial matters, whether they have an understanding of key areas of their personal finances and their knowledge of financial products. Financial knowledge can be objective or subjective. Objective financial knowledge refers to the actual understanding of financial matters, whereas subjective financial knowledge is a person's belief about and understanding of financial matters (Xiaoet al., 2014a:595; Tang & Baker, 2016:165). The present study measures the objective financial knowledge of young financial professionals.

Financial Socialisation Mechanisms and Financial Literacy

Financial socialisation mechanisms have a positive influence on the financial literacy of individuals (Shim et al., 2015:36-37; Sohn et al., 2012:976). Parents, as the primary financial socialisation agent, have a positive influence on the financial knowledge of young adults, as shown in a study done by Shim et al. (2009). Kim et al. (2011:670) and Shim et al. (2009) also found that parents who model financial behaviour have children with increased levels of financial knowledge. Similarly, individuals who are given pocket money are found to have a high levels of financial knowledge (Ko?odziej et al., 2014:104; Sohn et al., 2012:976).

In terms of secondary financial socialisation agents, peers have a negative influence on financial literacy. Mimura et al. (2015:72) indicated that children who use their peers as a source of financial information about savings and investments have lower financial knowledge levels. However, Sallie (2015:61) found that peers do not influence the financial literacy of individuals. This finding is in contrast to teachers, where financial education or instruction at schools is usually found to improve children's financial knowledge (Borden et al., 2008:28). Similarly, employers are an important source of financial education to increase employees' financial knowledge (Bernheim & Garrett, 1996:17; Hira & Loibl, 2005:185). Sallie (2015:61) also found that individuals consult colleagues at the workplace about financial decisions and this has a positive influence on their levels of financial literacy. As a result, it is expected that financial socialisation mechanisms (teaching practices, modelling of behaviour, peer communication and teacher/employers' financial instructions) will increase the levels of financial literacy of young financial professionals.

Framework and Hypotheses of the Study

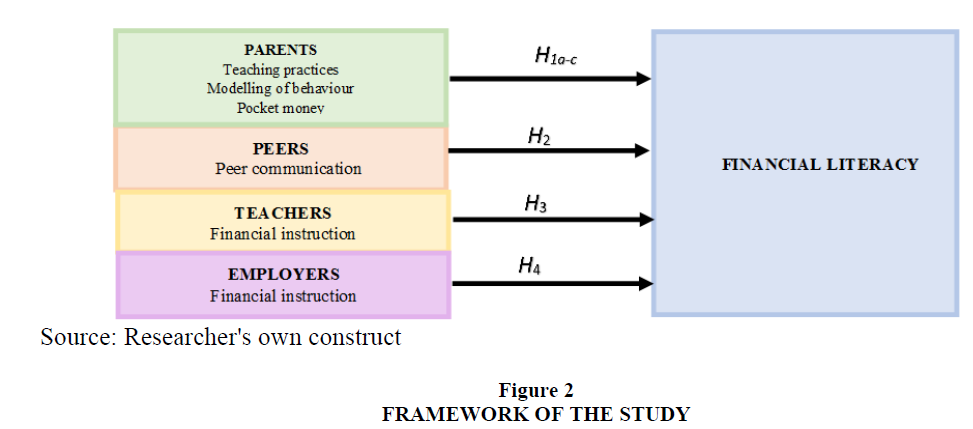

Figure 2 demonstrates the model used in the study based on the theoretical framework (integrated model of financial socialisation) and the literature review. The model illustrates the relationships between the independent (financial socialisation mechanisms) and the dependent variable (financial literacy). The hypotheses of the study are provided below.

H1a: There is a significant positive relationship between teaching practices and financial literacy.

H1b: There is a significant positive relationship between modelling of behaviour and financial literacy.

H1c: There is a significant positive relationship between pocket money and financial literacy.

H2: There is a significant positive relationship between peer communication and financial literacy.

H3: There is a significant positive relationship between teachers' financial instruction and financial literacy.

H4: There is a significant positive relationship between employers' financial instruction and financial literacy.

Research Methodology

This study adopted a positivist research paradigm and implemented a quantitative research design using cross-sectional data. This section will describe the research design employed in the study, the sampling technique, questionnaire design and data analysis.

Sampling

The study's target population was young professionals who have been working for at least one year in the finance industry. To be able to select respondents from a population, one needs to have a sample frame. The sample frame is a list of all the young professionals employed in the Nelson Mandela Metropolitan area in the Eastern Cape. However, access to the whole sample frame is unattainable because it would be expensive and time-consuming to generate. Probability and non-probability sampling methods maybe be used in these circumstances, to draw a sample (Zikmund, 2003:369). In this study, non-probability sampling with snowball and convenience sampling was used to select the sample.

Snowball sampling involves a few phases. First, a few individuals in the sample who meet the sample selection criteria are approached. These individuals then refer the researcher to other members in the sample, who could indicate to the researcher other suitable prospective participants. This process continues until the target sample has been reached (Magnani et al., 2005:69; Welman & Kruger, 2001:62). The reason for using snowball sampling is that it is challenging to contact young financial professionals. Therefore, the available network was used to obtain suitable respondents in the finance industry who would refer to other respondents who met the criteria. The second method used was convenience sampling, where respondents who are the most convenient or easily accessible, are obtained (Zikmund, 2000:344). The reason for using convenience sampling was to ensure a diverse group of respondents in the sample.

This study's sample is young professionals residing in the Eastern Cape area in the age group of 20 to 35 who have been working for at least one year in the financial industry. The target sample size was between 250 and 300 young professionals.

Questionnaire Design

The questionnaire consisted of a cover letter and three sections, A, B and C. The cover letter provided respondents with information about their rights in participating in the study and explained how respondents' confidentiality would be maintained. Section A collected the demographic information of respondents such as age, gender, ethnicity, highest qualification, field employed in, profession, and employment period. This section used a nominal scale where men were coded with the number one and women with the number two.

Section B used a five-point Likert-type scale. The respondents were asked to rate the statements between 1 and 5, where 1 represented "always true" and 5 represented "never true". The five-point Likert-type scale was used for the following constructs: parents (14 statements), peers (4 statements), teachers (5 statements) and employers (4 statements). The statements to measure the construct in the questionnaire were adapted from various authors (Hogarth & Hilgert, 2002:6; Gutter et al., 2010:397; Kim & Chatterjee, 2013:68; Furnham & Milner 2017:1221). Section C used a nominal scale to determine respondents' financial knowledge; it comprised six statements. These statements were adapted from two different sets of authors (Danes et al., 1999:33; Hogarth & Hilgert, 2003:2-3). The three-point nominal scale for this section was 1 = true, 2 = false, 3 = do not know. Although this section used a nominal scale, the respondents' answers were summed to represent each respondent's score. This was done to determine respondents' levels of financial literacy. Respondents who scored less than 50% were considered to have low levels of financial literacy, as suggested by various authors (Chen & Volpe, 1998:121; Mandell, 2008; Lusardi et al., 2010:28).

Data Analysis

Each completed questionnaire was scrutinised for missing data, and those that were incomplete or completed incorrectly were disregarded. The completed questionnaires were captured in Microsoft Excel and were subsequently transferred to Statistica version 12. Thereafter, the data was subjected to extensive statistical analysis, such as descriptive statistics (mean scores and standard deviation) and frequency distributions. Furthermore, to assess validity and reliability, exploratory factor analysis (EFA) was performed, and Cronbach's alpha was calculated. According to Hardy & Bryman (2009:28), factor analysis is a statistical procedure that summarises the relationships between the items/statements and the factors. In this study, items/statements with a factor loading of 0.5 were considered significant (Wiid & Diggines, 2013:242).

Furthermore, Cronbach's alpha was used to assess reliability, and a value greater than 0.6 was considered acceptable (Wiid & Diggines, 2013:238). This study's constructs were regarded as reliable if they had a Cronbach's alpha of 0.7 or above. Cronbach's alpha is used in this study to measure internal reliability (Tavakol & Dennick, 2011:53).

Multiple regression analysis was conducted to test the hypotheses of the study. Multiple regression is used to analyse the influence of two or more independent variables on a single dependent variable (Zikmund et al., 2010:584; Tredoux & Durrheim, 2002:339). In interpreting the results of multiple regression analysis, the researcher should interpret the r-squared (R2) as the percentage of variance in the dependent variable which is explained by the combination of independent variables (Gravetter & Wallnau, 2014:468). In this study, multiple regression analysis was used to test the significance levels and the beta of the relationships. A significant level of less than 0.05 and a beta score that is positive was accepted in this study. In contrast, if the significance level is more than 0.05 and the beta negative, the hypothesis was rejected.

Empirical Results

A total of 300 hundred questionnaires were distributed to businesses operating in the Nelson Mandela Metropolitan area in the Eastern Cape. All the businesses that the questionnaires were distributed to operated in the financial industry. Only 263 questionnaires were returned, but all of them were usable, resulting in an 88% response rate. All questionnaire data were captured on a Microsoft Excel spreadsheet and was then analysed using Statistica version 13.3.

Demographical Data

More than half of the respondents were female (54%), and 46% were male. In terms of population, most respondents were white (50%), and 24% coloured. Fourteen per cent were black respondents, and 9% were Asian. Only 15% of the respondents were between the ages of 20 and 25. Most of the respondents were older than 25, with 42% between the ages of 26 and 30, and 43% between the ages of 31 and 35. All the respondents had qualifications beyond a Matriculation Certificate. The majority's highest qualification was an honours degree (51%) followed by a bachelor's degree (24.5%). Only two respondents confirmed having obtained a masters degree. Many respondents (30%) are employed in investments, with 22% employed as auditors and 20% are employed in the banking sector. Twenty-one respondents indicated that they work in the field of economics and 18 in the field of accounting. In terms of professional designation, just under a third (30%) of the respondents reported that they do not have a professional designation. By contrast, the majority of the respondents reported that they are registered with a professional body.

Financial Literacy of the Respondents

Section B of the questionnaire asked respondents True/False questions about financial concepts. Respondents' financial literacy was measured by summing all the correct responses relating to financial concepts such as retirement annuity, inflation, interest, taxation, and savings questions. Table 1 shows the statements and the answers of the respondents.

| Table 1 Financial Literacy | |||||||

| Category | True | False | Don't know | ||||

| Number | Statements | Freq. | % | Freq. | % | Freq. | % |

| 1 | One must be employed to be a member of a retirement annuity (False) | 30 | 11 | 231 | 88 | 2 | 1 |

| 2 | A rand amount today is worth more than the same rand amount in the future (True) | 88 | 34 | 132 | 50 | 43 | 16 |

| 3 | Compound interest is interest earned on interest and NOT the original amount (True) | 163 | 62 | 79 | 30 | 21 | 8 |

| 4 | You may pay tax on interest earned on your savings account at a bank (True) | 234 | 89 | 26 | 10 | 3 | 2 |

| 5 | You can save in interest if you choose a mortgage bond with a term of 30 years over a term of 20 years (False) | 51 | 19 | 209 | 80 | 3 | 2 |

| False = The statement is incorrect and True = The statement is correct. | |||||||

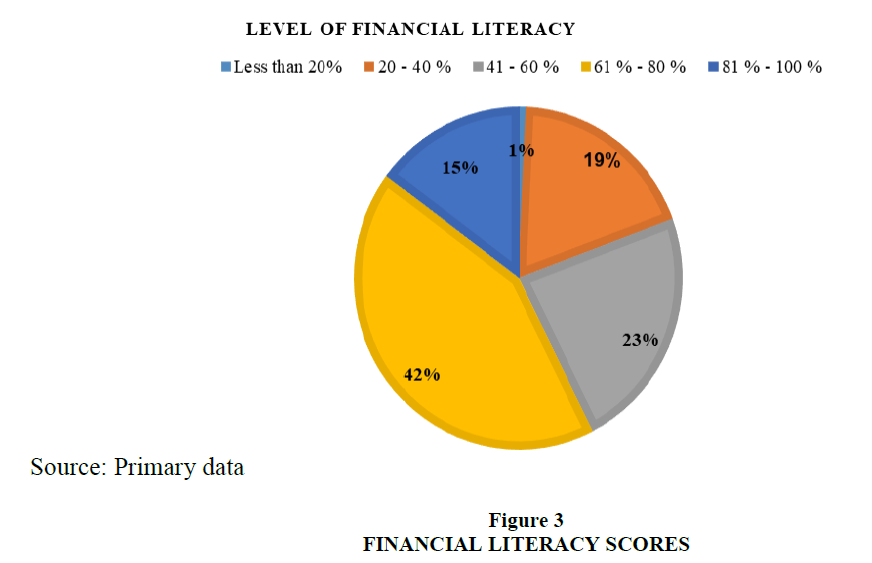

Table 1 shows that most of the respondents said that the first (88%) and the fifth (80%) statements are false, which was correct. The respondents also indicated that third (62%) and the fourth (89%) statements are true, which was also correct. Figure 3 shows the percentages scored by respondents for all the financial concepts.

Figure 3 shows that almost half (42%) of the respondents scored between 61% and 80% for financial literacy questions. Only 15% of respondents scored between 81 and 100%. This result means that most respondents have adequate levels of financial literacy. Only 1% scored less than 20% for financial literacy. The following section discuss the validity and reliability of the results.

Results of Validity and Reliability

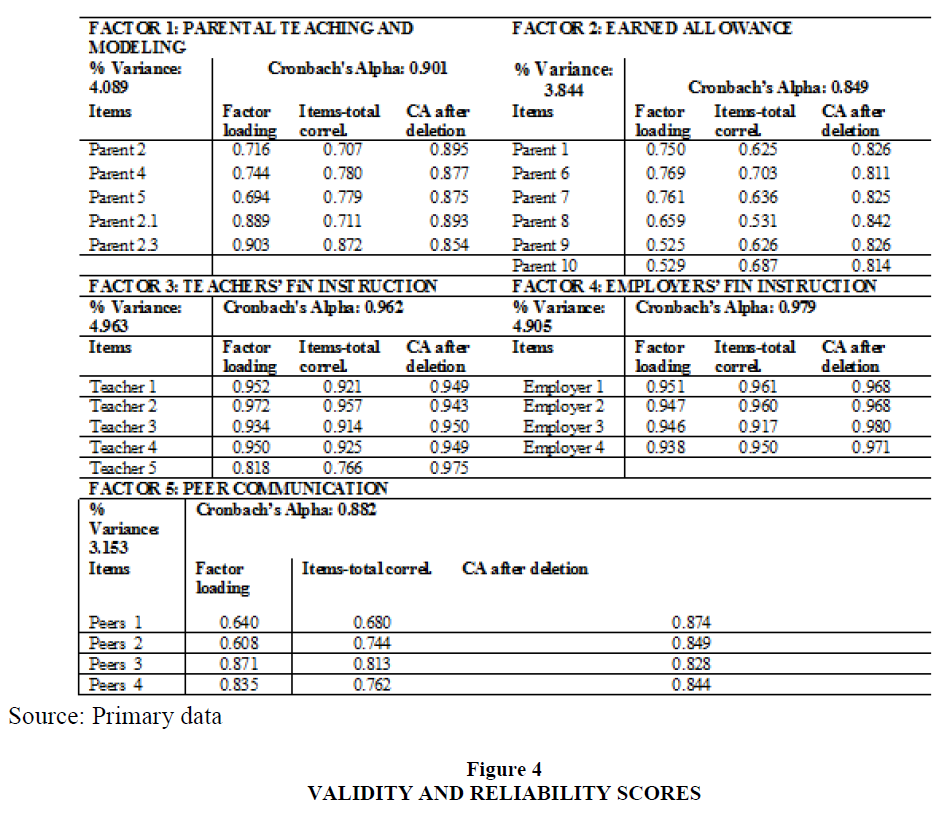

Figure 4 shows the EFA and Cronbach's Alpha results for the independent variables.

Figure 4 shows that factor 1 had five items loaded onto it. Two items (Parent 2.1 and Parent 2.3) loaded onto modelling of behaviour, together with three items (Parent 2, Parent 4 and Parent 5) intended to measure teaching practices. Factor 1 was named parental teaching and modelling and had a Cronbach's alpha of 0.901. Six items loaded onto factor 2; one item was intended to measure teaching practices (Parent 1), and four statements were intended to measure pocket money. Factor 2 was named earned allowance and had a Cronbach's alpha of 0.849. Additionally, five items (Teacher 1, Teacher 2, Teacher 3, Teacher 4 and Teacher 5) loaded onto teachers' financial instruction with Cronbach's alpha of 0.962. All four items (employer 1 to 4) were loaded onto employers' financial instruction and had Cronbach's Alpha 0.979. The last factor, namely factor 5, had four items (Friends 1, Friends 2, Friends 3 and Friends 4) loadings, and the factor was named peer communication. Peer communication had a Cronbach's alpha of 0.882.

Multiple Regression Analysis Results

Table 2 shows the multiple regression results (MRA) for the study's independent and dependent variables.

| Table 2 Results of the Mira for Financial Literacy | ||||||

| Dependent Variable: Financial Literacy | ||||||

| Independent Variable | Standardised beta | Std. Err. | Unstandardized beta | Std. Err. | T-value(263) | P-value |

| Earned allowance | -0.543 | 0.073 | -11.417 | 1.542 | -7.407 | 0.000 |

| Parental teaching and modeling | 0.413 | 0.072 | 8.0834 | 1.399 | 5.778 | 0.000 |

| Peer communication | -0.036 | 0.075 | -0.0665 | 1.384 | -0.480 | 0.632 |

| Teachers’ financial instrucation | 0.022 | 0.060 | 0.374 | 1.033 | 0.362 | 0.718 |

| Employers’ financial instrucation | 0.143 | 0.065 | 1.849 | 0.834 | 2.217 | 0.028 |

| R2 = 19.95% | ||||||

| Red = p <0.05 (statistically significant) | ||||||

Table 2 shows that there is a significant negative relationship (b* = -0.543; p = 0.000) between earned allowance and financial literacy. This significant result suggests that young professionals exposed to earned allowance in childhood are likely to have lower levels of financial literacy in adulthood. A significant positive relationship (b* = 0.413; p = 0.000) between parental teaching and modelling, and financial literacy was found. This significant result means that young professionals who were taught and observed their parents' financial behaviour in childhood are likely to have high financial literacy levels in adulthood. Finally, a significant positive relationship (b* = 0.143; p = 0.028) between employers’ financial instruction and financial literacy was found. This significant result means that when young professionals have access to financial education at their workplace, they are likely to have high financial literacy levels. However, there were no significant relationships between peer communication and financial literacy (b* = -0.036; p = 0.632) as well as teachers’ financial instruction financial literacy (b* = 0.022; p = 0.718). These results suggest peer communication and financial instruction from teachers who young professionals were exposed to in childhood do not have a significant role in young professionals' financial literacy in adulthood. Therefore, based on these MRA results, H1 is partially accepted because earned allowance has a negative relationship with financial literacy while H4 is fully accepted. H2 and H3 are rejected as they were not significant.

Discussion of Results

The majority of respondents (57%) scored more than 61% for financial literacy questions. This result indicates that most of the young financial professionals in this study have above-average financial literacy, given that many authors have suggested that a score of less than 50% can be considered low (Chen & Volpe, 1998:121; Mandell, 2008; Lusardi et al., 2010:28). This finding is supported by Mngadi (2020:74) that financial professionals have higher levels of financial literacy.

Based on the MRA, the study identified two financial socialisation mechanisms (parental teaching and modelling and earned allowance) used by parents to influence young professionals' financial literacy. One of the mechanisms is teaching practices and modelling, which had a significant positive influence on young professionals' financial literacy level. This means that if parents discussed with their children how to save money and how to pay bills on time, the children who became young professionals were likely to have higher levels of financial literacy. Also, if young professionals during childhood had observed how their parents demonstrated positive financial behaviour such as budgeting and paying bills on time, as young professionals they were likely to have higher financial literacy levels. This result is consistent with the research findings of Shim et al. (2009) that an adult who was taught about financial concepts in childhood will have higher levels of financial knowledge in adulthood. Similarly, children who observed their parents modelling positive financial behaviour in childhood were found to have higher levels of financial knowledge in adulthood (Kim et al., 2011:670; Shim et al., 2009).

By contrast, children whose parents used earned allowance as a way to socialise them in childhood were likely to have low levels of financial literacy in adulthood. This study found that earned allowance has a significant negative influence on the financial literacy of young professionals. This result suggests if children experienced budgeting, donations and received pocket money from their parents every month, on birthdays, for performing chores and for good school performance, then as young professionals, they were likely to have lower financial literacy levels. This result is contrary to the research by Ko?odziej et al. (2014:104), who found that entitled allowance positively influences financial knowledge.

Employers who provided financial education to young professionals at their workplace are likely to increase the financial literacy levels of young professionals. This significant result is similar to the study of Hira & Loibl (2005:185) in which employees who receive financial education or financial information at the workplace were found to be more likely to have higher financial literacy levels.

However, peer communication and teachers' financial instruction were found not to have a significant relationship with young professionals' financial literacy levels. This non-significant result is in contrast to the study of Mimura et al. (2015:72) who reports that children who use their peers as a source of financial information on savings and investments have lower financial knowledge levels. Also, Shim et al. (2009) found that students who attended financial workshops at school have higher levels of financial knowledge.

Recommendations

Parental teaching is important for increasing the levels of financial literacy of young professionals in the Eastern Cape. It is recommended that parents should teach children about financial concepts as early as possible because this has an impact on financial literacy in adulthood. Shim et al. (2010) support this recommendation to enable children to have the best chance of transitioning successfully into financially independent adults. However, South African parents have low levels of financial literacy to transfer knowledge to their children (Nanziri & Leibbrandt, 2018:17). Therefore, financial educators and financial institutions should develop a financial education programme that will teach parents about financial concepts and the importance of sharing financial information with their children.

Parental modelling of behaviour is also important for improving the levels of financial literacy of young professionals in the Eastern Cape. It is recommended parents demonstrate positive financial behaviour to their children. The study by Solheim et al. (2011) shows that children learn about financial concepts by observing their parents' financial behaviour. To this end, parents need to demonstrate to their children how to save money and to budget. This finding indicates that educators should develop a financial education programme that promotes positive parental financial behaviour such as paying their bills on time. According to Shim et al. (2015:37) such educational programmes will show parents the importance of the role they play in improving the levels of financial literacy of children when they reach adulthood.

It was found in this study that earned allowance can have a significant negative relationship with young professionals' financial literacy. Accordingly, it is recommended that parents should talk to their children about the role of pocket money and how to save their money before giving them pocket money. Having such a discussion about pocket money is a way to socialise children positively about money (Kim et al., 2011).

Finally, employers' financial instruction was found to improve the financial literacy of young professionals. Therefore, employers should consider providing workshops on financial matters such as retirement planning, debt management, savings and investments, insurance, medical schemes, credit cards and vehicle assistance to young professionals in the Eastern Cape. Additionally, employers should also consider sending informative emails about financial matters regularly to their young professionals to improve levels of financial literacy in the workplace.

It is important to note that these findings and recommendations are limited to young professions in the Eastern Cape. Because young professionals in other locations in South Africa were not considered, this study's sample is not a representation of the entire population. Also, not all financial socialisation mechanisms have been identified, such as for example financial communication. Therefore, future studies should include a larger sample, more financial socialisation mechanisms and agents to investigate financial literacy. Notwithstanding its limitations, this study contributes to the literature by providing empirical data on the influence of financial socialisation mechanisms on financial literacy of young professionals in the Eastern Cape. In doing so, the study also provides empirical data on the levels of financial literacy of these young Eastern Cape professionals and offers a reliable scale with which to assess financial socialisation mechanisms, which may be used in future studies in the Eastern Cape. This study also serves as a baseline for future research on the influence of financial socialisation mechanisms on financial literacy.

In conclusion, this study has found that parents and employers play an important role in influencing the financial literacy of levels young financial professional in the Eastern Cape. It also confirms that parents are the most influential socialisation agents, followed by employers as secondary socialisation agents. Therefore, this study shows the relevance of using financial socialisation as a theoretical framework in predicting the levels of financial literacy of young financial professionals in the Eastern Cape.

References

- Alhabeeb, M.J. (1996). Teenagers' money, discretionary spending and saving. Journal of Financial Counselling and Planning, 7, 123-132.

- Beutler, I.F., & Dickson, L. (2008). Consumer economic consumer economic socialisation. In J.J. Xiao (Ed.), Handbook of consumer finance research (83-102). New York: Springer

- Bernheim, B.D., & Garrett, D.M. (2003). The effects of financial education in the workplace: evidence from a survey of households. Journal of Public Economics, 87(7), 1487-1519.

- Borden, L.M., Lee, S.A., Serido, J., & Collins, D. (2008). Changing college students' financial knowledge, attitudes and behaviour through seminar participation. Journal of Family and Economic Issues, 29(1), 23-40.

- Bowen, C.F. (2002). Financial knowledge of teens and their parents. Journal of Financial Counselling and Planning 13(2), 93-102.

- Chen, H., & Volpe, R.P. (1998). An analysis of personal financial literacy among college students. Financial Services Review, 7(2), 107-128.

- Cruess, S.R., Cruess, R.L., & Steinert, Y. (2008). Role modelling – making the most of a powerful teaching strategy. Teaching Rounds, 336, 718-721.

- Danes, S.M. (1994). Parental perceptions of children's financial socialisation. The Journal of Financial Counselling and Planning, 5, 127-149.

- Danes, S.M., Huddleston-Casas, C., & Boyce, L. (1999). Financial planning curriculum for teens: impact evaluation. Journal of Financial Counselling and Planning, 10(1), 26-39.

- Fong, J.H., Koh, B.S.K., Mitchell, O.S., & Rohwedder, S. (2021). Financial literacy and financial decision-making at older ages. Pacific Basin Finance Journal, 65.

- Furnham, A., & Milner, R. (2017). Parents' beliefs and behaviours about the economic socialisation, through allowances/pocket money, of their children. Psychology, 8(8), 1216-1223.

- Gravetter, F.J., & Wallnau, L.B. (2014). Essentials of statistics for the behavioural sciences. 8th edition. United states of America: Cengage.

- Gudmunson, C.G., & Danes, S.M. (2011). Family financial socialisation: theory and critical review. Journal of Family and Economic Issues, 32(4), 644-667.

- Gutter, M.S., Copur, Z., & Garrison, S. (2009). Which students are more likely to experience financial socialisation opportunities? Exploring the relationship between financial behaviours and financial well-being of college students. Networks Financial Institute Working Paper.

- Gutter, M.S., Garrison, Z., & Copur, Z. (2010). Social learning opportunities and the financial behaviours of college students. Journal of Family and Consumer Sciences, 38, 387-404.

- Hardy, M., & Bryman, A. (2011). The handbook of data analysis. California: Cengage.

- Harrison, T., Marchant, C., & Ho, M. (2014). Conceptualising financial socialisation. Journal of Child and Teen Consumption 9-11.

- Hira, T.K., & Loibl, C. (2005). Understanding the impact of employer-provided financial education on workplace satisfaction. Journal of Consumer Affairs, 39(1), 173-194.

- Hogarth, J.M., Beverly, S.G., & Hilgert, M.A. (2003). Patterns of financial behaviours: implications for community educators and policy makers. Federal Reserve System Community Affairs Research Conference, 1-26.

- Kim, J., & Chatterjee, S. (2013). Childhood financial socialisation and adults' financial management. Journal of Financial Counselling and Planning, 24(1), 61-79.

- Kim, J., LaTaillade, J., & Kim, H. (2011). Family processes and adolescents' financial behaviours. Journal of Family Economics, 32, 668-679.

- Ko?odziej, S., Lato, K., & Szyma?ka, M. (2014). The role of parental influences on the economic socialisation of children. Problems of Education in the 21st Century, 58, 99-107.

- Louw, J., Fouché, J., & Oberholzer, M. (2013). Financial literacy needs of South African third-year university students. International Business & Economics Research Journal, 12(4), 439-450.

- Lusardi, A., & Mitchell, O.S. (2007). Financial literacy and retirement preparedness: evidence and implications for financial education programs. Centre for Financial Studies Working Paper, 15, 1-24.

- Lusardi, A., & Mitchell, O.S. (2014). The economic importance of financial literacy: theory and evidence. Journal of Economic Literature, 52(1), 5-44.

- Lusardi, A., Mitchell, O.S., & Curto, V. (2010). Financial literacy among the young: evidence and implications for consumer policy. Journal of Consumer Affairs, 3-35.

- Maccoby, E.E. (1992). The role of parents in the socialisation of children: a historical overview. Journal of Developmental Psychology, 28(6), 1006-1017.

- Magnani, R., Sabin, K., Saidel, T., & Heckathorn, D. (2005). Review of sampling hard to-reach and hidden populations for HIV surveillance. AIDS, 19(2), 67-72.

- Mandell, L. (2008). The financial literacy of young American adults: Results of the 2008 National Jumpstart Coalition Survey of high school seniors and college students, 4-253.

- Matchaba-hove, T. (2016). Young professionals' intentions to make use of financial planning services: A South African perspective. 3rd Business & Management Conference, 22 March 2016, Lisbon.

- Matemane, M.R. (2018). Saving for tomorrow: Does the level of financial literacy in the South African working class matter?. Southern African Business Review, 22(1).

- Mimura, Y., Koonce, J., Plunkett, S.W., & Pleskus, L. (2015). Financial information source, knowledge and practices of college students from diverse backgrounds. Journal of Financial Counselling and Planning, 26(1), 63-78.

- Mngadi, T.V. (2020). Financial capability of practicing professionals: A comparative analysis of finance and non-finance professional's financial capability. Unpublised Thesis, University of Kwazulu-natal: South Africa.

- Moschis, G.P., & Churchill, G.A. (1978). Consumer socialisation: A theoretical and empirical analysis. Journal of Marketing Research, 15(4), 599-609.

- Nanziri, E.L., & Leibbrandt, M. (2018). Measuring and profiling financial literacy in South Africa. South African Journal of Economic and Management Sciences, 21(1), 1-17.

- Nkoutchou, H., & Eiselen, R. (2012). Retirement saving behaviour of young adults in the financial services sector. Journal of Economic and Financial Sciences, 5(1), 31-48.

- Oseifuah, E.K. (2010). Financial literacy and youth entrepreneurship in South Africa. African Journal of Economic and Management Sciences, 1(2), 164-182.

- Remund, D.L. (2010). Financial literacy explicated: the case for a clearer definition in an increasingly complex economy. The Journal of Consumer Affairs, 44(2), 276-295.

- Roberts, B., Struwig, J., & Gordon, S. (2014). Financial literacy in South Africa: results from the 2013 South African social attitudes survey round [Online]. Available: https://www.alexanderforbes.co.za/download/afo/benefitsbarometer/Article%20Documents/Financial-Literacy-Report.pdf. [Accessed 18 April 2017].

- Rousseau, G.G., & Venter, D.J.L. (2016). Financial insight and behaviour of household consumers in Port Elizabeth. Southern African Business Review, 20(1), 236-258.

- Shim, S., Barber, B.L., Card, N.A., Xiao, J.J., & Serido, J. (2009). Financial socialisation of first-year college students: the roles of parents, work, and education. Journal of Youth and Adolescence, 39, 1457-1470.

- Shim, S., Serido, J., Card, N., & Tang, C. (2015). Socialisation processes and pathways to healthy financial development for emerging young professionals. Journal of Applied Developmental Psychology, 38, 29-38.

- Sallie, N. (2015). The impact of socialisation factors on financial literacy and financial security amongst employees in the financial services industry. Unpublished Master of Business Administration, University of Pretoria, South Africa.

- Solheim, C.A., Zuiker, V.S., & Levchenko, P., (2011). Financial socialisation family pathways: Reflections from college students' narratives. Family Science Review, 16(2), 97-112.

- Sohn, S.H., Joo, S.H., Grable, J.E., Lee, S., & Kim, M. (2012). Adolescents' financial literacy: The role of financial socialization agents, financial experiences, and money attitudes in shaping financial literacy among South Korean youth. Journal of Adolescence, 35(4), 969-980.

- Tang, N., & Baker, A. (2016). Self-esteem, financial knowledge and financial behaviour. Journal of Economic Psychology, 54, 164-176.

- Tavakol, M., & Dennick, R. (2011). Making sense of Cronbach's alpha. International Journal of Medical Education 2(1), 52-53.

- Tredoux, C., & Durrheim, K. (2002). Numbers, hypotheses and conclusions: A course in statistics for the social sciences. Cape Town: UCT Press.

- Van Campenhout, G. (2015). Revaluing the role of parents as financial socialisation agents in youth financial literacy programs. Journal of Consumer Affairs, 49(1), 186-222

- Welman, J.C., & Kruger, S.J. (2001). Research methodology for business and administrative science (Second edition). Cape Town: Oxford University Press.

- Wiid, J., & Diggines, C. (2013). Marketing research. 2nd edition. Cape Town: Juta.

- Xiao, J.J. (2016). Handbook of consumer finance research (Second edition). Switzerland: Springer.

- Xiao, J.J., Ahn, S.Y., Serido, J., Shim, S. (2014a). Earlier financial literacy and later financial behaviour of college students. International Journal of Consumer Studies, 38(6), 593-601.

- Xiao, J.J., Chatterjee, S., & Kim, J. (2014b). Factors associated with financial independence of young adults. International Journal of Consumer Studies, 38, 394-403.

- Zeka, B. (2020). Retirement funding adequacy in black South African townships. African Journal of Economic and

- Management Studies, 11(4), 573-585. https://doi.org/10.1108/AJEMS-09-2019-0353.

- Zikmund, W.G. (2003). Business research methods (Seventh edition). USA: Thomson South Western.

- Zikmund, W.G., Babin, B., Carr, J., & Griffin, M. (2010). Business research methods. 8th edition. Canada: Cengage Learning.