Research Article: 2022 Vol: 25 Issue: 4S

The Influence of Firm Performance CG Code and Tax Planning of Thailand

Wanpen Klinphanich, Rajamangala University of Technology

Kittisak Jermsittiparsert, Dhurakij Pundit University

Muhammadiyah Makassar, Universitas Muhammadiyah Sinjai

Citation Information: Klinphanich, W., Jermsittiparsert, K., & Makassar, M. (2022). The influence of firm performance CG code and tax planning of Thailand. Journal of Management Information and Decision Sciences, 25(S4), 1-11.

Keywords

Performance, Corporate Governance, Tax Planning

Abstract

This study aimed to investigate the influence of firm performance on corporate governance and tax planning of listed companies in the Stock Exchange of Thailand. The population of this study was 200 companies. Structural Equation Model (SEM) was used as an analysis model to determine parameters from the analysis of validity and reliability. The researcher prepared a paper to measure corporate governance report and corporate social responsibility disclosure. Data were collected from annual report (Form 56-1), annual financial statements, and notes to financial statements and corporate governance reports in the accounting period of 2019 to estimate the score of corporate governance report. The results of this study indicated that total debt to total assets/leverage (LEV) had a direct negative influence on Corporate Governance (CG) with an influence coefficient of -0.03 with a statistical significance level of 0.05 and had a positive direct influence on tax planning (ETR) with an influence coefficient of 0.14 with a statistical significance level of 0.05. However, leverage (LEV) had no indirect influence on a latent variable of tax planning (ETR). Return on Assets (ROA) had a direct positive influence on Corporate Governance (CG) with an influence coefficient of 0.01 with a statistical significance level of 0.05 and a negative direct influence on tax planning (ETR) with a coefficient of influence of -0.03. However, return on assets (ROA) had no indirect influence on a latent variable of tax planning (ETR). In addition, market capitalization (CAP) had a direct negative influence on Corporate Governance (CG) with an influence coefficient of -0.01 and a positive direct influence on tax planning (ETR) with a statistical significance level of 0.05 with an influence coefficient of 0.04. However, market capitalization (CAP) had no indirect influence on a latent variable of tax planning (ETR). Corporate governance (CG) had a direct negative influence on tax planning (ETR) with an influence coefficient of -0.02 with a statistical significance level of 0.01.

Introduction

Background and Significance of Study

The financial disclosure of companies has the target to present the financial statement to the stakeholders who concern with those companies, and they will use this information for making the economic decision. The external stakeholders are investors, lenders or creditors (Federation of Accounting Professions, 2015). The main stakeholders of any companies need to know the financial status and the overall operation through the report using the information of the financial statement. In the past, the stakeholders always decide to invest to any companies which have the good financial statement or which have the good overall operation and much profit; that’s why the companies give the importance to make a profit. Besides, the amount of business tax is the important cost which the executives try to decrease so that their companies will have more profit (Avi-Yonah, 2006; Erle, 2008; Lanis & Richardson, 2011; Tang & Firth, 2011).

As above-mentioned reasons, many companies are always operated without considering about the effects to the public. The executives think that the high turnover is more important than the continuous operation; therefore, the companies lack of the confidence from the investors and cannot raise funds enough. However, according to the law, any companies have the profit; they must pay the tax at the highest rate, 20% of the accounting profit. If any companies can decrease the deduction of the corporate income tax, their earnings and cash flow can be increased. So, the companies having the correct accounting system and following the tax compliance doesn’t have to pay any penalty and surcharge. Moreover, the companies which have any plans about the tax for receiving the rights of the tax reduction will have the decreasing cost and will gain a competitive advantage. However, the accounting profit has the different target from the tax profit. One is for presenting the financial status and the actual overall operation of the companies, and the financial budget will be done as Thai Financial Reporting Standard which the accrual basis will be reported. The other is for fulfilling the government taxation. The tax profit is calculated along Revenue Code which the accrual basis will be recognized. So, there is some difference between Thai Financial Reporting Standard and Revenue Code, and the executives try to make more accounting profit and to decrease the tax profit in the same accounting period (Frank et al., 2008).

In Thailand, the accounting principles and the tax rules are involved very much. The financial statement is issued for fulfilling the tax target (Ball et al., 2003), so the executives try to make the good financial statement so that the deduction can be decreased (Coppen & Peek, 2005; Goncharov & Zimmermann, 2006). Besides, the law enforcement in Thailand isn’t strict enough (Leuz et al., 2003); thus, the companies always do the tax planning. This is consistent with the study of Tsakumis, et al., (2007) which found that the following the tax rules of many companies in Thailand is ranked at the 3rd from the last, next to Panama and Peru. The research of Chadil Rojananont (2006) about the Effective Tax Rate (ETR) of Thailand found that the ETR is lower than the corporate income tax according to the law and the average ETR of ASEAN member countries. This can show the revenue loss of the government and the wealth transferred from the government to the stakeholders.

However, at present, the investors and stakeholders of many companies give the importance to the accountability and the reliability of their companies to other investors and other stakeholders especially the government sector (the Revenue Department) which will play more important role to their companies (Tanchanpong & Bangmek, 2014). Moreover, the Stock Exchange of Thailand follows the concept of Corporate Governance Code. It controls and examines the executives by prescribing Code of Best Practices for solving the Agency Problem and diminishing the window dressing including the executives’ fraudulent act (Wysocki, 2003; Chen, et al., 2007; Liu & Lu, 2007; Henry, 2010). They will operate their companies honestly and carefully as the policy follows. Then, the operation of the companies will be accepted that their performance has the international standard.

In consequence, the researcher recognized the importance of the influence of the overall operation to the corporate governance and the tax planning of the listed companies in the Stock Exchange of Thailand because this information is useful for anyone who would like to invest in those companies. We have to look for why the overall operation can have an effect on the corporate governance and the tax planning. The result from this research can be used as the methods of the good corporate governance method and the tax planning in the future.

Objectives

- To study the influence of leverage ratio on corporate governance and tax planning of listed companies in the Stock Exchange of Thailand.

- To study the influence of return on assets on corporate governance and tax planning of listed companies in the Stock Exchange of Thailand.

- To study the influence of market capitalization on corporate governance and tax planning of listed companies in the Stock Exchange of Thailand.

Related Concepts, Theories and Researches

Firm Performance

The firm performance is the net present value or the evaluation of the future cash flows of the companies through the different perspectives. The “value” is always used for saying the value of the asset. If we do the evaluation by using the financial method, the “price” which is in the form of the cash equivalent will be called the “value”, and the “business” is always used for the reference to the organizations or the companies (Jermsittiparsert & Boonratanakittiphumi, 2019; Rittiboonchai, Pinyokul, Na-Nakorn & Jermsittiparsert, 2021).

Agency Theory

The creation of the good corporate governance mechanism can decrease the agency problem. The motivation of the good corporate governance is the agency concept. The companies or the organizations under the good corporate governance were named by the owners or the stakeholders (Srichanphet, 2017). This theory explains the connection of two sides, the principle and the agent. There will be the discrimination between the owners or the stakeholders and the executives if the owners who are the stakeholders cannot assemble for deciding anything about the daily operation of the companies. So, there needs to be the executives. As long as the representatives can work and make benefit for the owners, the relation of two sides will be smooth. If the targets and the benefit of the principle and the agent don’t conform, the agency problem may occur. Among the employees of any companies, people who have the chance to seize the benefit the most are the chief executives because they have the administrative authority, and those problems have many causes (Silpapron Srichanphet, 2008).

Corporate Governance (CG)

The good corporate governance method is used so that the executives can perform their responsible duty as the conditions of the companies. They should unstintingly work and go all out for making the advantage to the companies the most; this concept is supported by the agency theory (Jensen & Meck- ling, 1976) and the stakeholder theory (Freeman, 1984). For the good corporate governance, the assessment scores of the corporate governance are the indicator which can help everybody who wants to invest to make a decision. Most of investors would like to invest in the companies having the good corporate governance and always avoid the companies having the good corporate governance in some parts because they have to reduce the risk in the investment as the scandal of Enron Company and WorldCom Company who have the window dressing and their executives defraud.

Tax Planning

The tax planning is the action along the tax strategy which can decrease the deduction (Dyreng et al., 2006), and it can affect to the accounting profit as follows. (1) It can decrease the accounting profit, but it hasn’t an effect on the accounting profit. It can be measured by the Effective Tax Rate (ETR) and the Book-Tax Differences (BTDs). (2) It can decrease the accounting profit and the tax profit. It can be measured by the ratio of the tax and the cash flow from the operation (TAX/CFO) (Zimmerman, 1983merman, 1983) (Tanyaporn Tantiyawarong, 2552). If the ETR and the TAX/CFO are low, the tax planning will be in the high level. There were many reports about the influence of the good corporate governance to the tax planning. There are many researchers who apply and develop their researches as following.

The influence of corporate governance on tax planning

The corporate governance have the positive influence on the tax planning (Desai & Dharmapala, 2006; Wang, 2010) because any companies which are accountable and have the tax avoidance try to avoid any ambiguous methods which make those companies are in trouble in the future. Their stakeholders can receive more interests. The research of Desai & Dharmapala (2006); Wang (2010); Lanis & Richardson (2011) found that the good corporate governance have the negative affect to the tax planning. Any companies which have the good corporate governance in some parts, their executives will use the high-risk methods to provide the capital and support the tax avoidance. If the companies have the better corporate governance, they may have the lower risk to the financing and decrease the tax avoidance. However, the study of Hanlon, et al., (2005) can find out that the good corporate governance hasn’t any affect to the tax planning. It means that we can’t conclude the direction of their influence clearly.

Research hypothesis

H1: Leverage ratio has a direct influence on corporate governance.

H2: Leverage ratio has a direct influence on tax planning.

H3: Return on assets has direct influence on corporate governance.

H4: Return on assets has direct influence on tax planning.

H5: Firm value has direct influence on corporate governance.

H6: Firm value has direct influence on tax planning.

Methodology

Population and sample

The population of this research was 570 listed companies in the Stock Exchange of Thailand. The researcher collected annual data for the year 2019 (as of May/0, 2020). Such number of companies excludes companies in MAI because these companies cannot clearly specify the objectives of the fundraising, affecting corporate governance reporting and data analysis (Booth et al., 2000; Sukcharoensin, 2003).

The sample of this study was analyzed based on Structural Equation Model (SEM) to determine parameters from analyzing validity and reliability. According to Hair, et al., (1998), the sample size should be at most 200.

Research format

The researcher studied related concepts, theories and research results to determine the operational definition and structure of the variables to be consistent to the conceptual framework. The researcher conducted paper-based record of corporate governance report statistics to determine level of corporate social responsibility. Data were collected from annual reports (Form 56-1), annual financial statements, and notes to financial statements, corporate social responsibility reports in the year 2019 to estimate the score of corporate governance report.

Data collection

The researcher conducted paper-based record of corporate governance report statistics to determine level of disclosure. Companies with CG disclosure shall get 1 point when they mentioned 1 CG disclosure item. The researcher then recorded individual disclosure items and summarized individual disclosure statistics. Companies without CG disclosure shall get 0 point. Companies with disclosure of data related to corporate governance reporting shall get N/A (Not Applicable) if such data is not related to the company.

The Statistics used to analyze data

Structural equation model was used for multivariate analysis to study the model of the influence of firm performance and corporate governance on tax planning of listed companies in the Stock Exchange of Thailand. Statistics used in the structural equation model were Multiple Indicators and Multiple Causes (MIMIC) Model because SEM is effective to estimate the internal relationship and multivariate relationship.

Results

Validation of measurement model

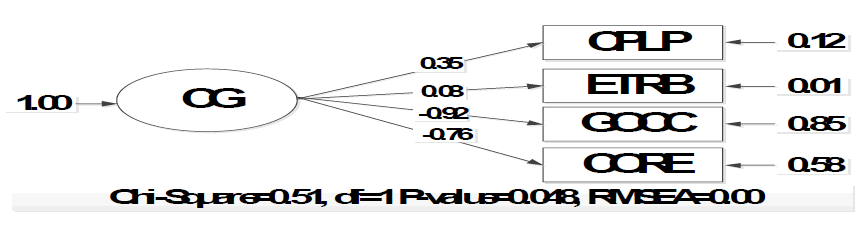

The results of analyzing measurement model by confirmatory factor analysis of Corporate Governance (CG) variables indicated that the model was consistent with the empirical data after adjusting the model without exclusion of any indicator from the measurement model. Chi-Square statistic was 0.51, probability (p) was 0.48, RMSEA was 0.00, SRMR was 0.02, GFI was 1.00, CFI was 1.00 and AGFI was 0.099 (Table 1 and Figure 1).

| Table 1 Confirmatory factor analysis of corporate governance variables |

||||

|---|---|---|---|---|

| Variable | Factor | R2 | ||

| b | SE | t | ||

| INDE | 0.35 | - | - | 0.58 |

| FEMA | 0.08 | 0.37 | 1.55 | 0.85 |

| BOAR | -0.92 | 0.01 | 2.13 | 0.01 |

| DEGR | -0.76 | 0.20 | 3.24 | 0.12 |

| c2=0.51, df=1, p-value=0.48, RMSEA=0.00 | ||||

In other words, Corporate Governance (CG) consisted of 4 components, including Competitiveness and Performance with Long-Term Perspective (CPLP), Ethical and Responsible Business (ETRB), Good Corporate Citizenship (GOCC), and Corporate Resilience (CORE). The results showed that Good Corporate Citizenship (GOCC) was the most important factor, followed by Corporate Resilience (CORE), Competitiveness and Performance with Long-Term Perspective (CPLP), and Ethical and Responsible Business (ETRB) respectively.

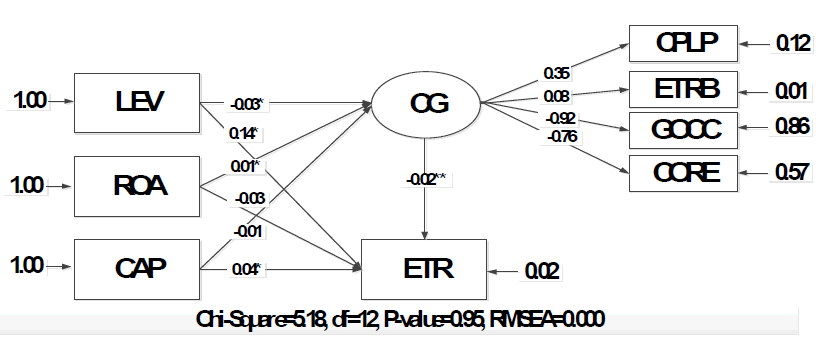

Path analysis after model adjustment

The results of testing the alignment of causal relationship model of the firm performance showed that the model was consistent with the empirical data. Chi-Square statistic was 5.18, Probability (P) was 0.95, Degree of Freedom (Df) was 12, c2/2 was 0.42, RMSEA was 0.00, SRMR was 0.04, GFI is 0.99, CFI was 1.00 and AGFI was 0.98 (Table 2 and Figure 2).

| Table 2 PATH ANALYSIS RESULTS |

||||||

|---|---|---|---|---|---|---|

| Dependent variable Independent variable |

CG | ETR | ||||

| TE | DE | IE | TE | DE | IE | |

| LEV | -0.03 * (1.18) |

-0.03 * (1.18) |

- | 0.14* (0.34) |

0.14* (0.11) |

0.00 (0.23) |

| ROA | 0.01* (0.10) |

0.01* (0.10) |

- | -0.03 (0.42) |

-0.03 (0.32) |

0.00 (0.01) |

| CAP | -0.01 (0.90) |

-0.01 (0.90) |

- | 0.04* (0.10) |

0.04* (0.10) |

0.00 (0.00) |

| CG | - | -0.02** (0.78) |

-0.02** (0.78) |

|||

| c2=5.18, c2/df=0.43, df=12, p-value=0. 95, RMSEA=0.00 | ||||||

Leverage (LEV) had a direct negative influence on corporate governance (CG) with an influence coefficient of -0.03 with a statistical significance level of 0.05 and had a positive direct influence on tax planning ( ETR) with an influence coefficient of 0.14 with a statistical significance level of 0.05. However, leverage (LEV) had no indirect influence on a latent variable of tax planning (ETR).

Return on Assets (ROA) had a direct positive influence on Corporate Governance (CG) with an influence coefficient of 0.01 with a statistical significance level of 0.05 and a negative direct influence on tax planning (ETR) with a coefficient of influence of -0.03. However, Return on Assets (ROA) had no indirect influence on a latent variable of tax planning (ETR).

In addition, market Capitalization (CAP) had a direct negative influence on Corporate Governance (CG) with an influence coefficient of -0.01 and a positive direct influence on tax planning (ETR) with a statistical significance level of 0.05 with an influence coefficient of 0.04. However, market Capitalization (CAP) had no indirect influence on a latent variable of tax planning (ETR).

Corporate Governance (CG) had a direct negative influence on tax planning (ETR) with an influence coefficient of -0.02 with a statistical significance level of 0.01.

Analytical results based on hypothesis

| Table 3 Results of hypothetical testing |

||

|---|---|---|

| Research Hypothesis | Results Testing | Direction/Effect |

| H1: Leverage ratio has a direct influence on corporate governance. | Accepted | - |

| H2: Leverage ratio has a direct influence on tax planning. | Accepted | + |

| H3: Return on assets has direct influence on corporate governance. | Accepted | + |

| H4: Return on assets has direct influence on tax planning. | Rejected | # |

| H5: Firm value has direct influence on corporate governance. | Rejected | # |

| H6: Firm value has direct influence on tax planning. | Accepted | + |

| Note: + defines as a significantly positive effect; - defines as a significantly negative effect; # defines as an insignificant effect | ||

Research Discussion and Conclusions

The results of this research found that leverage ratio had a negative influence on corporate governance and had direct influence on tax planning with statistically significant significance. This can explain that when the company has a greater proportion of leverage, the company will have a tendency to plan more taxes as well, and the company wills less focus on the disclosure of corporate governance information. The results of this study are consistent with Tanthiwarong's research study in 2009 (Tanthiwarong, 2009) that companies with a larger debt ratio will influence tax planning and when the company has the ability to make more profits, tax planning will be reduced by using methods that reduce taxable profits Without affecting the accounting profit (measured from ETR). Moreover, the research of Ming Long, Zhi Yuan Feng & Hua Wei Huang (2013) found that when the company has a high debt burden (Considering the leverage ratio), it must consider the disclosure of social responsibility at a high level, resulting in a decrease in this disclosure as it will make the company more risky. Therefore, it can be concluded that the company should be cautious in the management of the total debt to total assets ratio to be at an appropriate level because the change in the total debt ratio to the total assets of the company will directly affect the increasing trend of tax planning and also allow the company to disclose limited corporate governance information. It may be due to the company having to bear the burden of increasing risk from indebtedness, causing investors to be more careful or strict in considering investment in the company.

In terms of return on assets, it was found that the return on assets had a direct influence on corporate governance with statistically significant results and found that the return on assets had no influence on tax planning, which was consistent with the research of Minnick & Noga (2010) that found that the rate of return on assets, the rate of dividend payment and the business size were related to corporate governance. Onokoya, et al., (2014) studied the relationship between corporate governance and the company's performance for 9 banks in Nigeria during 2006 - 2010, found that corporate governance factors in the size of the board in the company and the proportion of the number of shareholders were related with a return on equity, and Esra Ahmed & Allam Hamdan (2015) conducted a study of corporate governance factors that affected performance. The results from Esra Ahmed's research found that corporate governance factors had a significant effect on the return on assets ratio in the positive direction. From the study of the relationship between corporate governance and the operating results of the company, most of the study results showed that corporate governance has a direct relationship with the operating results. In studies of the factors of corporate governance and the relationship between the results of the study conducted by the Corporate Governance Index in Eastern Europe, Klapper & Love (2006) found that corporate governance would result in the company to have good operating results that measure values from the return on assets ratio and also resulted in a high value of the business as well, which showed that this research provided consistent results. While in the studies of the relationship between return on assets and tax planning, no influence was found, which was consistent with the study of Onokoya, et al., (2014) that found only the relationship of corporate governance. In other areas, including the aspects of tax planning, there was no influence. The results of the study can therefore conclude that the results of research on return on assets will influence the company to disclose good corporate governance information to increase interest in the company to more groups of investors.

Regarding the firm value, the study found that there was no influence on good corporate governance but had a significant influence on tax planning which was consistent with the research results of many researchers who found that the firm value and good corporate governance did not influence each other or cannot clearly be concluded the direction of influence (Price et al., 2011; Connelly et al., 2012). While tax planning and performance has a positive influence on each other (Atwood et al., 2010; Minnick & Noga, 2010; Lim, 2011) because taxes are one component of profit. The tax planning would result in lower tax expenses as well as the reduction of other expenses which result in the company having net profit and current Increase cash. While the research of Gleason & Mills (2007); Dhaliwal, et al., (2008) had found that tax planning has a negative influence on performance, although the reduction in tax expenses will increase net profit; however, the tax planning that caused the reduction of the tax expense is related to other costs such as bankruptcy costs, legal costs that may arise if government officials detect, the mistake of tax planning. If other costs are greater than the benefits derived from tax planning, it may negatively affect the performance, and tax planning positively impacts the value of the securities of the company, which makes shareholders and the board to receive more returns, including companies with different corporate governance will have different tax planning strategies. Dhaliwal, et al., (2008) research has found that the increasing of accounting income and taxable income will increase the cost of capital and negatively affect performance because accounting profit is a sign of the persistence of profit (Blaylock, Shevlin &Wilson, 2010). This explains that when the company discloses more tax expenses, it helps to reduce the inequality of information recognition between businesses and government agencies and also helps to increase the firm value.

In terms of corporate governance and tax planning, the results of this study found that good corporate governance had a negative influence on tax planning measured by the reduction in taxable profits without affecting the accounting earning (ETR) significantly, showing that Good corporate governance helps to reduce tax planning that causes both accounting profit and taxable profit to decrease. Research results correspond to Rego's theory and research, and Wilson (2010); Lo, et al., (2010); Lanis & Richardson (2011). This may be because most listed companies in the Stock Exchange of Thailand have a concentration of holders and family companies, with this group of shareholders having a large amount of interest in the company, therefore giving importance to good corporate governance in order to maintain the reputation and success of the business for the next generation. However, even though family companies give priority to good corporate governance, most executives are family members with the power to decide on accounting policies and present information in financial reports, as well as being able to communicate through channels other than financial reports but with incentives for tax planning that make both accounting profit and taxable profit decrease.

This research found that corporate governance helps to reduce tax planning. Therefore, agencies that are involved in capital market development should focus on good corporate governance and continuously promote, including develop the survey criteria and evaluation to be suitable for the current situation as well as to be able to use in many purposes such as investors can use corporate governance scores in assessing investment risks, or tax collection agency can use as a preliminary examination that the company has the correct accounting system and comply with tax principles etc. When Thai listed companies have better corporate governance, they will lead to growth and add value to shareholders in the long term. In addition, regulators of Thai listed companies should increase tax evasion checks to help reduce inappropriate behavior of executives which may lead to damage to the company and the tax planning (ETR) and may be one indicator that will provide information to support the orientation of tax collection policies to suit the capital market.

Recommendations

- Further research should be conducted to conduct more qualitative research and expand in-depth study results to the cost that will affect tax planning.

- Further studies can be carried out by using this conceptual framework, and can be conducted a study classified by industry groups to delve into the results of the study and confirm the findings.

- The next study can extend the results of the study using this conceptual framework and study the sustainability of the company when following the results of this research to expand the research results further.

- Investors can use the information to use Assess risks and make investment decisions by observing the good corporate governance score, including the Revenue Department can be used to consider the use of good corporate governance scores as a criterion for evaluating compliance with tax laws, which may help reduce the time of government officials' examination

- Listed companies in Thailand can take considering the use of resources and investment to be suitable for the benefits received by allocating personnel and budget for corporate governance, such as the appointment of the Corporate Governance Committee, the Audit Committee, etc. to demonstrate transparency and create trust to investors.

Acknowledgement

Kittisak Jermsittiparsert, Professor of Dhurakij Pundit University, Thailand and Adjunct Professor of University of Muhammadiyah Makassar & University of Muhammadiyah Sinjai, Indonesia is the corresponding author.

References

Ahmed, E., & Hamdan, A. (2015). The impact of corporate governance on firm performance: Evidence from Bahrain bourse. Emerald group publishing limited, 11(2), 21-37.

Atwood, T.J., Drake, M.S., & Myers, L.A. (2010). Book-tax conformity, Earnings persistence and the association between earnings and future cash flows. Journal of Accounting and Economics, 50, 111-125.

Crossref, GoogleScholar, Indexed at

Avi-Yonah, (2006). Law & economics. Working papers archive 2003-2009.

Ball, R., Robin, A., & Wu, J. (2003). Incentives versus standards: Properties of accounting income in four East Asian countries. Journal of Accounting and Economics, 30(1-3), 235-270.

Crossref, GoogleScholar, Indexed at

Blaylock, B., Shevlin, T., & Wilson, R. (2012). Tax avoidance, large positive book-tax differences, and earnings persistence. The Accounting Review, 87(1), 91–120.

Crossref, GoogleScholar, Indexed at

Booth, T., Ainscow, M., Black-Hawkins, K., Vaughan, M., & Shaw, L. (2000). Index for Inclusion: Developing Learning and Participation in Schools. Bristol, Centre for Studies on Inclusive Education.

Crossref, GoogleScholar, Indexed at

Chen, K.Y., Elder, R.J., & Hsieh, Y.M. (2007). Corporate governance and earnings management: The implications of corporate governance best-practice principles for Taiwanese listed companies. Journal of Contemporary Accounting & Economics, 3(2), 73–105.

Crossref, GoogleScholar, Indexed at

Connelly, J.T., Limpaphayom, P., & Nagarajan, N.J. (2012). Form versus substance: The effect of ownership structure and corporate governance on firm value in Thailand. Journal of Banking & Finance, 36, 1722-1743.

Crossref, GoogleScholar, Indexed at

Coppens, L., & Peek, E. (2005). An analysis of earnings management by European private firms. Journal of International Accounting,Auditing and Taxation, 14, 1–17.

Crossref, GoogleScholar, Indexed at

Desai, M.A., Dyck, A. & Zingales, L. (2005). “Corporate governance and taxation”. Journal of Financial Economics, 84(3), 591–623.

Crossref, GoogleScholar, Indexed at

Desai, M.A., & Dharmapala, D. (2006). Corporate tax avoidance and high-powered incentives. Journal of Financial Economics, 79, 145–179.

Crossref, GoogleScholar, Indexed at

Dhaliwal, D., Gal-Or, R., Naiker, V., & Sharma, D.S. (2013). The influence of the audit committee on auditor provided tax planning services. Retrieved February 16, 2015.

Crossref, GoogleScholar, Indexed at

Dyreng, S.D., Hanlon, M., & Maydew, E.L. (2006). Long-run corporate tax avoidance.The Accounting Review, 83(1), 61–82.

Crossref, GoogleScholar, Indexed at

Erle, B. (2008). Tax risk management and board responsibility, In Drexl, J., Hilty, R.M., Schon, W., & Straus, J. (Eds.), MPI studies on Intellectual Property, Competition and Tax Law, 3(1), 357. Springer-Verlag Berlin Heidelberg.

Crossref, GoogleScholar, Indexed at

Frank, M.M., Lynch, L., & Rego, S.O. (2008). Tax reporting aggressiveness and its relation to aggressive financial reporting. The Accounting Review, 84(2), 467–496.

Crossref, GoogleScholar, Indexed at

Freeman, R. (1984). Strategic management: A stakeholder approach. Pitman publishing inc., boston.

Crossref, GoogleScholar, Indexed at

Gleason, C.A., & Mills, L.F. (2008). Evidence of differing market responses to beating targets through tax expense decreases. Review of Accounting Studies, 13, 319-326.

Crossref, GoogleScholar, Indexed at

Goncharov, I., & Zimmermann, J. (2006). Earnings management when incentives compete: The role of tax accounting in Russia. Journal of International Accounting Research, 5, 41–65.

Crossref, GoogleScholar, Indexed at

Hair, J.F., Anderson, R.E., Tatham, R.L., & Black, W.C. (1998). Multivariate data analysis (5th edition). Upper Saddle River, NJ: Prentice Hall.

Crossref, GoogleScholar, Indexed at

Ismail, H., & Yahya. (2007). Factor influencing corporate social disclosure practices in Malaysia (2nd edition). Corporate social responsibility: Our first look, Malaysia: Malaysian Institute of integrity, 58-87.

Crossref, GoogleScholar, Indexed at

Henry, D. (2010). Agency costs, ownership structure and corporate governance compliance: A private contracting perspective, Pacifi c-Basin Finance Journal, 18, 24–46.

Crossref, GoogleScholar, Indexed at

Jensen, M., & Mecking, W. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

Crossref, GoogleScholar, Indexed at

Jermsittiparsert, K., & Boonratanakittiphumi, C. (2019). The mediating role of knowledge management and the moderating role of additive manufacturing (Industry 4.0) in the relationship between knowledge management capability and firm performance: A case of KPMG Thailand. International Journal of Innovation, Creativity and Change, 8(8), 430-449.

Klapper. L., & Love. (2006). Corporate governance provisions and firm ownership: Firm-level evidence from Easter Europe.Journal of International Money and Finance, 25, 249-444.

Crossref, GoogleScholar, Indexed at

Lanis, R., & Richardson, G. (2011). The effect of board of director composition on corporate tax aggressiveness. Journal Account Public Policy, 30, 50-70.

Leuz, C., Nanda, D., & Wysocki, P.D. (2003). Earnings management and investor protection: An international comparison. Journal of Financial Economics, 69, 505–527.

Crossref, GoogleScholar, Indexed at

Liu, Q., & Lu, Z., (2007). Corporate governance and earning management in the Chines listed companies: A tunneling perspective, Journal of Corporate Finance, 13, 881–906.

Crossref, GoogleScholar, Indexed at

Lo, A.W.Y., Wong, R.M.K., & Firth, M. (2010). Can corporate governance deter management from manipulating earnings? Evidence from related party sales transactions in China. Journal of Corporate Finance, 16(1) 225–235.

Crossref, GoogleScholar, Indexed at

Ming-Long, W., Zhi-Yuan, F., & Hua-Wei, H. (2013). Corporate social responsibility and cost of equity capital: A global perspective.

Minnick, K., & Noga, T. (2010). Do corporate governance characteristics influence tax management? Journal of Corporate Finance, 16, 703-718.

Onokoya, A.B., & Fasanya, I.O., & Ofoegbu, D.I. (2014). Corporate governance as correlate for firm performance: A pooled OLS investigation of selected Nigerian banks. The IUP,Journal of Corporate Governance. 13(1), 7-16.

Price, R., Roman, F.J., & Rountree, B. (2011). The impact of governance reform on performance and transparency. Journal of Financial Economics, 99, 76-96.

Crossref, GoogleScholar, Indexed at

Rittiboonchai, W., Pinyokul, K., Na-Nakorn, N., & Jermsittiparsert, K. (2021). The moderating effect of information technology capability on the relationship of management components and firm performance of chemical industry. Journal of management information and decision sciences, 24(4), 213.

Crossref, GoogleScholar, Indexed at

SETS MART. (2014). SET marketing analysis and reporting tool.

Srijunpetch, S. (2017). Social responsibility accounting. The association of private higher education institutions of Thailand. Journal of business administration, 6(1), 25-32.

Crossref,GoogleScholar, Indexed at

Stock exchange of Thailand. (2012). The principles of good corporate governance for listed companies 2012.

Crossref, Googlescholar, Indexed at

Sukcharoensin, S. (2003). Essays on corporate governance, outside directors, and firm performance. Unpublished DBA dissertation, Thammasat University, Chulalongkorn University, and national institute development administration, Thailand.

Tang, T., & Firth, M. (2011). Can book-tax differences capture earnings management and tax management? Empirical evidence China.

Crossref, GoogleScholar, Indexed at

Thanjunpong, S. (2014). The impact of good corporate governance on tax planning of listed companies in the Stock Exchange of Thailand. Journal of Accounting Profession, 10(28), 5–18.

Thanyaporn, T. (2009). Study of factors influencing tax planning and relationships between tax planning. With the value of the business: Empirical evidence from Thailand, thesis, B.E., Chulalongkorn University, Bangkok.

Tsakumis, G.T., Curatola, A.P., & Porcano, T.M. (2007). The relation between national cultural dimensions and tax evasion. Journal of International Accounting, Auditing and Taxation, 16, 131–147.

Wilson, R. (2009). An examination of corporate tax shelter participants. The Accounting Review, 84(3), 969-999.

Wang, X. (2010). Tax avoidance, corporate transparency, and firm value.

Wysocki, P.D. (2003). Discussion of ultimate ownership, income management, and legal and extra-legal institutions.Journal of Accounting Research, 43, 172-175.

Crossref, GoogleScholar, Indexed at

Zimmerman, B.J., & Martinez-Pons, M. (1983). Construct validation of a strategy model of student self-regulated learning. Journal of Educational Psychology, 50(3), 284-298.

Crossref, GoogleScholar,Indexed at

Received: 19-Dec-2021, Manuscript No. JMIDS-21-7188; Editor assigned: 22-Dec-2021; PreQC No. JMIDS-21-7188(PQ); Reviewed: 06-Jan-2022, QC No. JMIDS-21-7188; Revised: 13-Jan-2022, Manuscript No. JMIDS-21-7188; Published: 19-Jan-2022